0000062234DEF 14AFALSE00000622342022-12-302023-12-28iso4217:USD00000622342021-12-312022-12-2900000622342021-01-012021-12-3000000622342019-12-272020-12-310000062234ecd:PeoMembermcs:DeductionForAmountsReportedInStockAwardsMember2019-12-272020-12-310000062234ecd:PeoMembermcs:DeductionForAmountsReportedInStockAwardsMember2021-01-012021-12-300000062234ecd:PeoMembermcs:DeductionForAmountsReportedInStockAwardsMember2021-12-312022-12-290000062234ecd:PeoMembermcs:DeductionForAmountsReportedInStockAwardsMember2022-12-302023-12-280000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:PeoMember2019-12-272020-12-310000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:PeoMember2021-01-012021-12-300000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:PeoMember2021-12-312022-12-290000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:PeoMember2022-12-302023-12-280000062234ecd:PeoMembermcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2019-12-272020-12-310000062234ecd:PeoMembermcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2021-01-012021-12-300000062234ecd:PeoMembermcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2021-12-312022-12-290000062234ecd:PeoMembermcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMember2022-12-302023-12-280000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:PeoMember2019-12-272020-12-310000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:PeoMember2021-01-012021-12-300000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:PeoMember2021-12-312022-12-290000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:PeoMember2022-12-302023-12-280000062234ecd:PeoMembermcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2019-12-272020-12-310000062234ecd:PeoMembermcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2021-01-012021-12-300000062234ecd:PeoMembermcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2021-12-312022-12-290000062234ecd:PeoMembermcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2022-12-302023-12-280000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2019-12-272020-12-310000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2021-01-012021-12-300000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2021-12-312022-12-290000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2022-12-302023-12-280000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:PeoMember2019-12-272020-12-310000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:PeoMember2021-01-012021-12-300000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:PeoMember2021-12-312022-12-290000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:PeoMember2022-12-302023-12-280000062234mcs:DeductionForAmountsReportedInStockAwardsMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:DeductionForAmountsReportedInStockAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:DeductionForAmountsReportedInStockAwardsMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:DeductionForAmountsReportedInStockAwardsMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:DeductionForAmountsReportedInOptionAwardsMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:ReductionForValuesReportedInChangeInPensionValueAndNonqualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:EquityChangeInFairValueYearEndFairValueOfCurrentYearEquityAwardMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:EquityChangeInFairValueYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2022-12-302023-12-280000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2019-12-272020-12-310000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2021-01-012021-12-300000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2021-12-312022-12-290000062234mcs:IncreaseForServiceCostAndPriorServiceCostForPensionPlansMemberecd:NonPeoNeoMember2022-12-302023-12-28000006223412022-12-302023-12-28000006223422022-12-302023-12-28000006223432022-12-302023-12-28000006223442022-12-302023-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | |

| o | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material Pursuant to § 240.14a-12 |

THE MARCUS CORPORATION

(Name of Registrant as Specified in its Charter)

_______________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

THE MARCUS CORPORATION

100 East Wisconsin Avenue, Suite 1900

Milwaukee, Wisconsin 53202-4125

___________________________

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

To Be Held Thursday, May 23, 2024

___________________________

To the Shareholders of

THE MARCUS CORPORATION

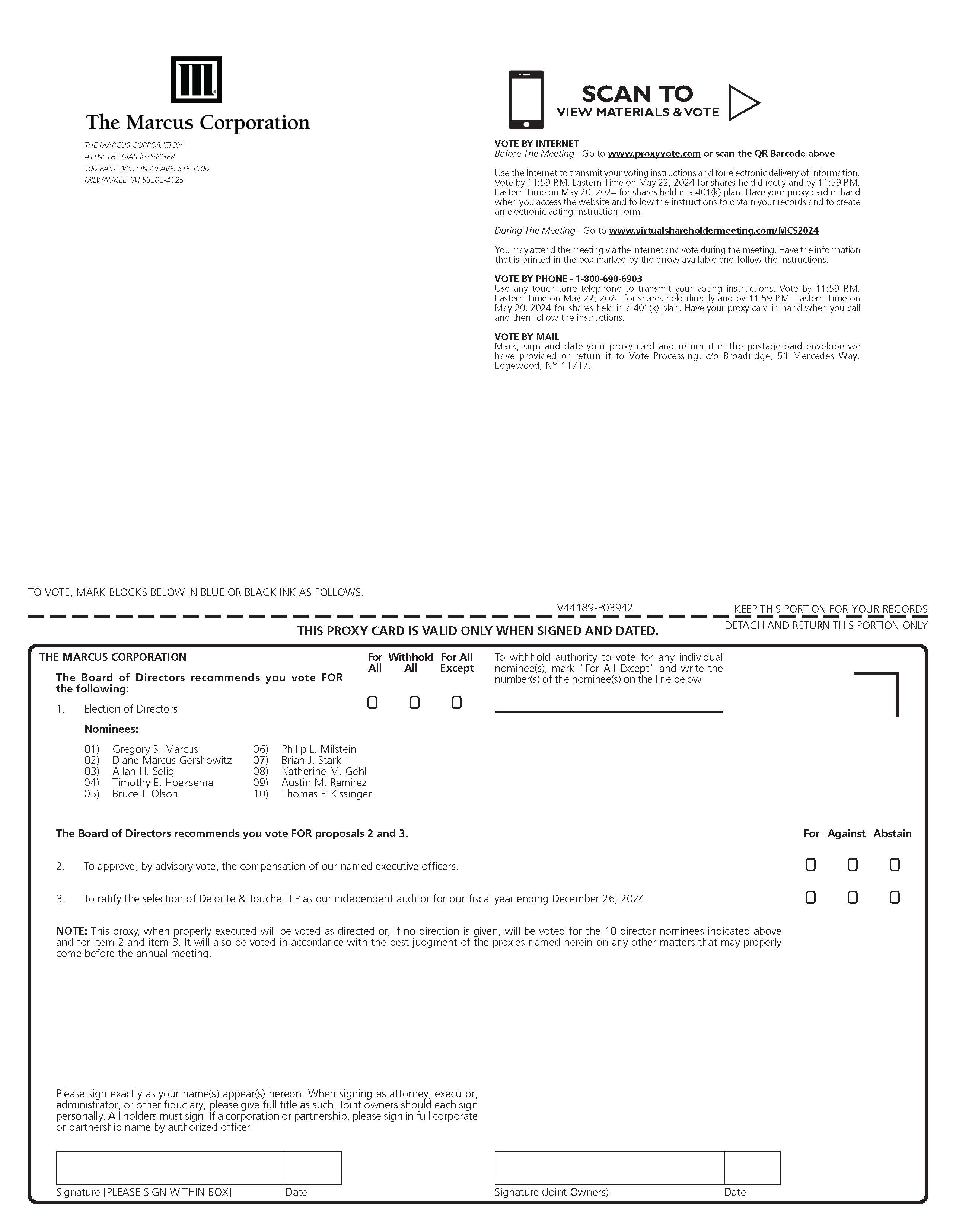

NOTICE IS HEREBY GIVEN THAT the 2024 Annual Meeting of Shareholders of THE MARCUS CORPORATION will be held on Thursday, May 23, 2024, at 9:00 A.M., Central Time, online via live webcast, in which you can submit questions and vote online, at www.virtualshareholdermeeting.com/MCS2024 for the following purposes:

1.to elect as directors the ten nominees named in the attached proxy statement;

2.to approve, by advisory vote, the compensation of our named executive officers as disclosed in the attached proxy statement;

3.to ratify the selection of Deloitte & Touche LLP as our independent auditor for our fiscal year ending December 26, 2024; and

4.to consider and act upon any other business that may be properly brought before the meeting or any postponement or adjournment thereof.

Only holders of record of our Common Stock and Class B Common Stock as of the close of business on March 27, 2024, will be entitled to notice of, and to vote at, the annual meeting and any postponement or adjournment thereof. Shareholders may vote online or by proxy. The holders of our Common Stock will be entitled to one vote per share and the holders of our Class B Common Stock will be entitled to ten votes per share on each matter submitted for shareholder consideration. If you are a shareholder and wish to access the virtual 2024 Annual Meeting of Shareholders, please visit: www.virtualshareholdermeeting.com/MCS2024. To participate and submit questions in writing during the virtual annual meeting, you will need the 16-digit control number included in your Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting, voting instruction form or proxy card.

Shareholders are cordially invited to attend the annual meeting online via live webcast. You should have already received an Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting with instructions on how to access the proxy materials and vote. As indicated in that Notice, you may view the proxy materials online at www.proxyvote.com and you may also access and complete the proxy card online at www.proxyvote.com. Or if you prefer, you may request a copy of the proxy materials, free of charge, including a hard copy of the proxy card, through the website www.proxyvote.com, by phone at 1-800-690-6903 or by email at sendmaterial@proxyvote.com. Whether or not you expect to attend the annual meeting, you are requested to properly complete the proxy card online at www.proxyvote.com or to obtain, complete, date, sign and promptly return a hard copy of the proxy card, which can be obtained by request through the website, toll free number or email address noted above.

Accompanying this Notice of 2024 Annual Meeting of Shareholders is a proxy statement and form of proxy.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on May 23, 2024

We encourage you to access and review all of the information contained in the proxy statement and accompanying materials before voting. The proxy statement and our 2023 annual report to shareholders are available at www.proxyvote.com. If you want to receive a paper or email copy of these documents, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy as instructed above on or before May 9, 2024 to facilitate timely delivery.

IMPORTANT: If you hold your shares in a brokerage account, you should be aware that your broker is not permitted to vote your shares for the election of directors or approval, by advisory vote, of the compensation of our named executive officers if you do not instruct your broker how to vote within 10 days prior to our Annual Meeting. Therefore, you must affirmatively take action to vote your shares at our Annual Meeting. If you do not, your shares will not be voted with respect to such matters.

| | | | | |

| On Behalf of the Board of Directors |

Milwaukee, Wisconsin April 12, 2024 | Thomas F. Kissinger Senior Executive Vice President, General Counsel and Secretary |

THE MARCUS CORPORATION

_________________________

PROXY STATEMENT

_________________________

For

2024 Annual Meeting of Shareholders

To Be Held Thursday, May 23, 2024

This proxy statement and accompanying form of proxy are being furnished to our shareholders beginning on or about April 12, 2024, in connection with the solicitation of proxies by our board of directors for use at our 2024 Annual Meeting of Shareholders to be held on Thursday, May 23, 2024, at 9:00 A.M., Central Time, online via live webcast, in which our shareholders can submit questions and vote online, at www.virtualshareholdermeeting.com/MCS2024 and at any postponement or adjournment thereof (collectively, the “Meeting”), for the purposes set forth in the attached Notice of 2024 Annual Meeting of Shareholders and as described herein.

Execution of a proxy will not affect your right to attend the Meeting and to vote online, nor will your presence revoke a previously submitted proxy. You may revoke a previously submitted proxy at any time before it is exercised by giving written notice of your intention to revoke the proxy to our Secretary, by notifying the appropriate personnel at the Meeting in writing or by voting online at the Meeting. Unless revoked, the shares represented by proxies received by our board of directors will be voted at the Meeting in accordance with the instructions thereon. If no instructions are specified on a proxy, the votes represented thereby will be voted: (1) for the board’s ten director nominees set forth below; (2) for the approval, by advisory vote, of the compensation of our named executive officers; (3) for the ratification of the selection of Deloitte & Touche LLP as our independent auditor for our fiscal year ending December 26, 2024; and (4) on such other matters that may properly come before the Meeting and at any postponement or adjournment thereof in accordance with the best judgment of the persons named as proxies.

Only holders of record of shares of our Common Stock (“Common Shares”) and our Class B Common Stock (“Class B Shares”) as of the close of business on March 27, 2024 (the “Record Date”) are entitled to vote at the Meeting. As of the Record Date, we had 25,170,317 Common Shares and 6,984,584 Class B Shares outstanding and entitled to vote. The record holder of each outstanding Common Share on the Record Date is entitled to one vote per share and the record holder of each outstanding Class B Share on the Record Date is entitled to ten votes per share on each matter submitted for shareholder consideration at the Meeting. The holders of our Common Shares and the holders of our Class B Shares will vote together as a single class on all matters subject to shareholder consideration at the Meeting. The total number of votes represented by outstanding Common Shares and Class B Shares as of the Record Date was 95,016,157, consisting of 25,170,317 votes represented by outstanding Common Shares and 69,845,840 votes represented by outstanding Class B Shares.

IMPORTANT: If you hold your shares in a brokerage account, you should be aware that your broker is not permitted to vote your shares for the election of directors or the approval, by advisory vote, of the compensation of our named executive officers if you do not instruct your broker how to vote within 10 days prior to the Meeting. Therefore, you must affirmatively take action to vote your shares at the Meeting. If you do not, your shares will not be voted with respect to such matters.

TRIBUTE TO STEPHEN H. MARCUS

After more than 60 years of company leadership, Stephen H. Marcus retired as our chairman in May 2023. Mr. Marcus had been a director of the company since 1969, was chief executive officer from 1988 to 2009, and served as chairman of the board since 1991. As a result, we want to formally extend our thanks and gratitude to Mr. Marcus for his years of dedicated service and contributions to our company, our board of directors and our shareholders. We extend to Mr. Marcus our sincere appreciation for his valued service, guidance, advice and dedication to our company as he continues to serve as our chairman emeritus.

PROPOSAL 1 — ELECTION OF DIRECTORS

At the Meeting, our shareholders will elect all ten members of our board of directors. The directors elected at the Meeting will hold office until our 2025 Annual Meeting of Shareholders and until their successors are duly qualified and elected. If, prior to the Meeting, one or more of the board’s nominees becomes unable to serve as a director for any reason, the votes represented by proxies granting authority to vote for all of the board’s nominees, or containing no voting instructions, will be voted for a replacement nominee selected by the board of directors. Under Wisconsin law, if a quorum of shareholders is present, directors are elected by a plurality of the votes cast by the shareholders entitled to vote in the election. This means that the individuals receiving the largest number of votes will be elected as directors, up to the maximum number of directors to be chosen at the election. Therefore, any shares that are not voted on this matter at the Meeting, whether by abstention, broker nonvote or otherwise, will have no effect on the election of directors at the Meeting.

All of our director nominees have been elected by our shareholders and have served continuously as directors since the date indicated below. The names of the director nominees, together with certain information about each of them as of the Record Date, are set forth below. Unless otherwise indicated, all of our director nominees have held the same principal occupation indicated below for at least the last five years.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Current Principal Occupation | | Age | | Director Since |

| | | | | | | |

| Gregory S. Marcus | | Our chairman since 2023, chief executive officer since January 2009 and our president since January 2008. Prior thereto, he was our senior vice president — corporate development. Mr. Marcus’ experience with our Company since 1999 in various positions, including his current role as our chairman and chief executive officer, led to our conclusion that he should serve as a director of the Company.(1)(2)(3) | | 59 | | 2005 |

| | | | | | | |

| Diane Marcus Gershowitz | | Real estate management and investments. Ms. Gershowitz’s long-standing service on our board and her expertise in real estate matters led to our conclusion that she should serve as a director of the Company.(1)(2) | | 85 | | 1985 |

| | | | | | | |

| Allan H. Selig | | Chief executive officer of Selig Leasing Co., Inc. (automobile leasing agency) and Commissioner Emeritus of Major League Baseball. Mr. Selig’s long-standing service on our board and his experience as commissioner of Major League Baseball has led to our conclusion that he should serve as a director of the Company.(4) | | 89 | | 1995 |

| | | | | | | |

| Timothy E. Hoeksema | | Retired chairman of the board, president and chief executive officer of Midwest Air Group, Inc. (commercial airline carrier). Mr. Hoeksema’s long-standing service on our board and his experience as the chief executive officer for many years at one of the nation’s most recognized service-oriented national travel carriers and his experience in the travel industry led to our conclusion that he should serve as a director of the Company. | | 77 | | 1995 |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Current Principal Occupation | | Age | | Director Since |

| Bruce J. Olson | | Our retired senior vice president and retired president of Marcus Theatres Corporation. Mr. Olson’s long-standing service on our board and extensive experience gained while leading our theatre division led to our conclusion that he should serve as a director of the Company. | | 74 | | 1996 |

| | | | | | | |

| Philip L. Milstein | | Principal of Ogden CAP Properties, LLC (real estate and investments) and former co-chairman of Emigrant Savings Bank (savings bank). Mr. Milstein’s long-standing service on our board of directors and his financial expertise and experience led to our conclusion that he should serve as a director of the Company. | | 74 | | 1996 |

| | | | | | | |

| Brian J. Stark | | Former founding principal, chief executive officer and chief investment officer of Stark Investments (global alternative investment firm). Mr. Stark’s extensive executive level experience in the investment industry and financial markets led to our conclusion that he should serve as a director of the Company.(5) | | 69 | | 2012 |

| | | | | | | |

| Katherine M. Gehl | | President and chief executive officer of Gehl Foods, Inc. from September 2011 to March 2015, and director of Gehl Foods, Inc. from 2005 to September 2011. Ms. Gehl’s extensive executive-level experience in the food service and hospitality industries and board of directors experience led to our conclusion that she should serve as a director of the Company. | | 57 | | 2015 |

| | | | | | | |

| Austin M. Ramirez | | President and CEO of HUSCO International (global engineering and manufacturing company) since 2017, and White House Fellow on the National Economic Council in Washington D.C from 2016 to 2017. Mr. Ramirez’ extensive experience in executive leadership, board membership and community engagement led to our conclusion that he should serve as a director of the Company.(6) | | 45 | | 2023 |

| | | | | | | |

| Thomas F. Kissinger | | Our senior executive vice president, general counsel and secretary since August 2013. Prior thereto, he was our secretary and director of legal affairs from August 1993 until being promoted to general counsel and secretary in August 1995. He was promoted to vice president, general counsel and secretary in 2004. He also formerly served as our interim president of Marcus Hotels & Resorts. Mr. Kissinger’s experience with our Company since 1993 in various positions, including his current role as our senior executive vice president, general counsel and secretary, led to our conclusion that he should serve as a director of the Company. | | 63 | | 2023 |

_____________________

(1)Gregory S. Marcus is the son of Stephen H. Marcus, our Chairman Emeritus. Stephen H. Marcus and Diane Marcus Gershowitz are siblings.

(2)Gregory S. Marcus and Diane Marcus Gershowitz may be deemed to share in the control of the Company as a result of their beneficial ownership of Common Shares and Class B Shares and the ownership of Common Shares and Class B Shares by members of their family, including Stephen H. Marcus. See “Stock Ownership of Management and Others.”

(3)Gregory S. Marcus is also an officer of certain of our subsidiaries.

(4)Allan H. Selig is a director of Oil-Dri Corporation of America.

(5)Brian J. Stark is a director of Black Maple Capital Corporation.

(6)Austin M. Ramirez is a director of Old National Bancorp.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE BOARD’S NOMINEES. COMMON SHARES OR CLASS B SHARES REPRESENTED AT THE MEETING BY EXECUTED BUT UNMARKED PROXIES WILL BE VOTED “FOR” EACH OF THE BOARD’S NOMINEES.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of Directors

Based on a review by our board of directors of the direct and indirect relationships that each of the ten directors currently serving on the board of directors has with the Company, including the relationships between the Company and Selig Leasing Co., Inc. and Major League Baseball, the board of directors has determined that each of Messrs. Selig, Hoeksema, Milstein, Stark and Ramirez and Ms. Gehl are “independent directors” as defined by the rules of the New York Stock Exchange (“NYSE”) and the Securities and Exchange Commission (“SEC”).

Board Leadership Structure

Currently, Mr. Gregory S. Marcus serves as our chief executive officer and as our chairman of the board of directors. Mr. Stephen H. Marcus serves as our chairman emeritus. Our board of directors does not have a policy on whether or not the roles of chief executive officer and chairman of the board should be separate. Instead, our Corporate Governance Policy Guidelines provide that our board of directors has the authority to choose its chairman in any way it deems best for the Company and its shareholders at any given point in time. Since Mr. Stephen Marcus’ retirement as our chairman of the board of directors and Mr. Gregory Marcus’ appointment as chairman of the board of directors in 2023, our board of directors has determined that the current combination of these roles most appropriately suits our Company because of Mr. Gregory Marcus’ long history with our Company, including his current role as our chief executive officer, and his skills and experience within the industries in which we operate. Further, our board of directors believes that this combination of roles allows Mr. Gregory Marcus’ experience as our chief executive officer to assist the board of directors in implementing our strategic plan, creates streamlined accountability for our performance and benefits the board in its preparation and decision making. Our board of directors believes that there is no single board of directors leadership structure that would be most effective in all circumstances, and therefore retains the authority to modify this structure to best address our Company’s and our board of directors’ then current circumstances as and when appropriate. Additionally, our Corporate Governance Policy Guidelines provide that, if the chairman of the board of directors is an employee director or is otherwise not an independent director, then the Corporate Governance and Nominating Committee will recommend to the board of directors, and the board of directors will appoint, an independent director to serve as Lead Independent Director. Currently, Philip L. Milstein serves as our Lead Independent Director. The Lead Independent Director’s responsibilities include:

•calling and presiding over all meetings of the board of directors at which the chairman of the board of directors is not present, including executive sessions of independent directors, and communicating feedback on executive sessions to the chairman of the board of directors;

•providing input as necessary to the chairman of the board and secretary on preparation of agendas for board of directors meetings;

•facilitating the board of directors’ approval of the number and frequency of board of directors meetings, as well as the schedule of such meetings to ensure sufficient time for discussion of agenda items;

•serving as principal liaison between the independent directors and the chairman of the board of directors;

•ensuring that there is open communication between the independent directors, on the one hand, and the chairman of the board of directors and our management, on the other; and

•conferring with the chairman of the board of directors on other issues of corporate importance, as appropriate.

Our board of directors and, in particular, the Audit Committee are involved on an ongoing basis in the general oversight of our material identified enterprise-related risks. Each of our chief executive officer, chief financial officer and general counsel, with input as appropriate from other management members, report and provide relevant information directly to our board of directors or the Audit Committee on various types of identified material financial, reputational, legal, environmental, cyber and business risks to which we are or may be subject, as well as mitigation strategies for certain key identified material risks. These reports, information and strategies are then reviewed, approved and monitored on an ongoing basis by our board of directors and the Audit Committee. Our board of directors’ and Audit Committee’s roles in our risk oversight process have not affected our board of directors leadership structure.

Code of Conduct

The board of directors has adopted The Marcus Corporation Code of Conduct that applies to all of our directors, officers and employees. The Code of Conduct is available under the “Governance” section of our investor relations website, investors.marcuscorp.com. If you would like us to mail you a copy of our Code of Conduct, free of charge, please contact Thomas F. Kissinger, Senior Executive Vice President, General Counsel and Secretary, The Marcus Corporation, 100 East Wisconsin Avenue, Suite 1900, Milwaukee, Wisconsin 53202-4125.

Committees of the Board of Directors

Our board of directors has an Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee and Finance Committee. Each committee operates under a written charter and the charters of our Audit, Compensation and Corporate Governance and Nominating Committees are available under the “Governance” section of our website, www.marcuscorp.com. Our board of directors and each committee also operate under our Corporate Governance Policy Guidelines, which are available under the “Corporate Governance and Nominating Committee” tab of the “Governance” section of our website. If you would like us to mail you a copy of our Corporate Governance Policy Guidelines or a committee charter, free of charge, please contact Mr. Kissinger at the above address.

Audit Committee. Our board of directors has an Audit Committee whose principal functions are to: (1) appoint and establish the compensation for and oversee our independent auditors; (2) review annual audit plans with management and our independent auditors; (3) preapprove all audit and non-audit services provided by our independent auditors; (4) oversee management’s evaluation of the adequacy of our internal and business controls, disclosure controls and procedures, and risk assessment and management; (5) review areas of financial risk that could have a material adverse effect on our results of operations and financial condition with management and our independent auditors; (6) evaluate the independence of our independent auditors; (7) review, in consultation with management and our independent auditors, financial reporting and accounting practices of comparable companies that differ from our own; (8) receive, retain and address complaints (including employees’ confidential, anonymous submission of concerns) regarding financial disclosure and accounting and auditing matters; and (9) review and provide guidance regarding the Company’s risk management policies, including with respect to enterprise risks relating to cybersecurity,technology, privacy and data management. Our Audit Committee consists of Brian J. Stark (Chairman), Katherine M. Gehl and Timothy E. Hoeksema. Each member of our Audit Committee is an independent, non-employee director as defined by the rules of the NYSE and the SEC. In addition, the board of directors has determined that Messrs. Stark and Hoeksema and Ms. Gehl are each “audit committee financial experts,” as that term is defined by the rules and regulations of the SEC. The Audit Committee met four times during fiscal 2023. See “Audit Committee Report.”

Compensation Committee. Our board of directors also has a Compensation Committee whose principal functions are to: (1) evaluate and establish the compensation, bonuses and benefits of our officers and other key employees and of the officers and other key employees of our subsidiaries; and (2) administer our executive compensation plans, programs and arrangements. See “Compensation Discussion and Analysis.” Our Compensation Committee consists of Allan H. Selig (Chairman), Philip L. Milstein and Brian J. Stark. Each member of our Compensation Committee is an independent, non-employee director as defined by the rules of the NYSE and the SEC. The Compensation Committee met three times during fiscal 2023. See “Compensation Discussion and Analysis.”

Corporate Governance and Nominating Committee. Our board of directors also has a Corporate Governance and Nominating Committee whose principal functions are to: (1) develop and maintain our Corporate Governance Policy Guidelines; (2) develop and maintain our Code of Conduct; (3) oversee the interpretation and enforcement of our Code of Conduct; (4) receive and review matters brought to the committee’s attention pursuant to our Code of Conduct; (5) evaluate the performance of our board of directors, its committees and committee chairmen and our directors; and (6) recommend individuals to be elected to our board of directors. Our Corporate Governance and Nominating Committee consists of Philip L. Milstein (Chairman), Timothy E. Hoeksema and Katherine M. Gehl. Each member of our Corporate Governance and Nominating Committee is an independent, non-employee director as defined by the rules of the NYSE and the SEC. The Corporate Governance and Nominating Committee met twice during fiscal 2023.

The Corporate Governance and Nominating Committee performs evaluations of the board of directors as a whole, the non-management directors as a group, and each director individually. In addition, the Corporate Governance and Nominating Committee regularly assesses the appropriate size of our board of directors and whether any vacancies on the board of directors are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise or the board decides to increase the size of our board of directors, the Corporate Governance and Nominating Committee will identify prospective nominees, including those nominated by management, members of our board of directors and shareholders, and will evaluate such prospective nominees against the standards and qualifications set out in the Corporate

Governance and Nominating Committee Charter, including the individual’s range of experience, wisdom, integrity, ability to make independent analytical inquiries, business experience and acumen, understanding of our business and ability and willingness to devote adequate time to board and committee duties. While the Corporate Governance and Nominating Committee does not specifically have a formal policy relating to the consideration of diversity in its process to select and evaluate director nominees, our Corporate Governance Policy Guidelines provide that the board of directors shall be committed to a diversified membership. Accordingly, the Corporate Governance and Nominating Committee seeks to have our board of directors represent a diversity of backgrounds, experience, gender and race.

The Corporate Governance and Nominating Committee does not evaluate shareholder nominees differently from any other nominee. Pursuant to procedures set forth in our By-laws, the Corporate Governance and Nominating Committee will consider shareholder nominations for directors if we receive timely written notice, in proper form, of the intent to make a nomination at a meeting of shareholders. We did not receive any shareholder nominations for directors to be considered at the Meeting. To be timely for the 2024 Annual Meeting of Shareholders, any shareholder director nominations must be received by the date identified under the heading “Other Matters.” To be in proper form, the nomination must, among other things, include each nominee’s written consent to serve as a director if elected, a description of all arrangements or understandings between the nominating shareholder and each nominee, and information about the nominating shareholder and each nominee. These requirements are detailed in our By-laws, which are attached as an exhibit to our Current Report on Form 8-K, filed with the SEC on February 27, 2024, which is accessible at www.sec.gov. A copy of our By-laws will be provided upon written request to Mr. Kissinger at the above address.

Finance Committee. Our board of directors also has a Finance Committee whose principal functions are to, upon the request of Company management, provide preliminary review, advice, direction, guidance and consultation with respect to potential transactions. Our Finance Committee consists of Gregory S. Marcus, Philip L. Milstein, Brian J. Stark and Allan H. Selig. The Finance Committee did not meet during fiscal 2023.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the board of directors or compensation committee of any other company that has one or more executive officers serving as a member of our board of directors or Compensation Committee.

Board Meetings, Director Attendance, Executive Sessions and Presiding Director

Our board of directors met four times during fiscal 2023. Each of our directors attended at least 75% of the aggregate of the number of board meetings and number of meetings of the committees on which he or she served during fiscal 2023. Our non-management directors meet periodically in executive sessions without management present. The Lead Independent Director serves as the chairman of all meetings of our non-management directors.

Directors are expected to attend our annual meeting of shareholders each year. At the 2023 annual meeting of shareholders, seven of our then-serving directors were in attendance.

Environmental, Social and Governance

Our focus on “People Pleasing People” is at the heart of how we care for our guests, customers and employees. We recognize that prioritizing our responsibility to make a positive environmental and social impact across our business and the communities in which we operate is an integral part of our success. This sections provides a brief overview of our corporate responsibility oversight and initiatives.

Environment

We are committed to being responsible stewards of our environmental resources in order to maintain and support the communities in which we operate.

Particular areas of focus and highlights are:

• Climate and Water Conservation: Our board and management strive to minimize the environmental impact of our operations and continue to review ways to enhance efficiency across our businesses.

•Limiting Waste: In both our theatre and hotel businesses, we are focused on reducing waste, including food-waste and the use of single-use items, and enhancing efforts to increase recycling and composting.

•Responsible Sourcing: We collaborate with suppliers to increase responsible sourcing of the products and services used in our businesses.

Social Impact

We recognize our success is dependent on our employees’ commitment to delivering quality service to our guests and customers. Therefore, our strategic priorities include continuing to develop a committed team dedicated to service and fostering a diverse and inclusive culture that prioritizes well-being and emphasizes development and growth for all employees.

Particular areas of focus and highlights are:

• Employee Retention and Satisfaction: We focus significant attention on attracting and retaining talented and experienced individuals to manage and support our operations, and our management team routinely reviews employee turnover rates at various levels of the organization. Management also reviews employee engagement and satisfaction surveys to monitor employee morale and receive feedback on a variety of issues. We pay our employees competitively and offer a broad range of company-paid benefits, which we believe are competitive with others in our industry.

•Diversity and Inclusion: We are committed to hiring, developing and supporting a diverse and inclusive workplace. Our management teams and all of our employees are expected to exhibit and promote honest, ethical and respectful conduct in the workplace. All of our employees must adhere to a Code of Conduct that sets standards for appropriate behavior and includes required annual training on preventing, identifying, reporting and stopping any type of unlawful discrimination.

•Giving Back: We strive to develop and maintain deep connections with the communities in which we operate and to contribute to making them stronger, healthier and happier places to live, work, and gather. We manage a range of charitable and volunteer programs in support of these communities, including providing on-air screen time and other resources to support the United Way, supporting various local arts and culture organizations such as United Performing Arts Fund, and supporting other community-focused organizations and educational institutions.

Governance

Our board and management are committed to ensuring our businesses are operated and governed in an ethical and responsible manner. As a company dedicated to “People Pleasing People,” we strive to ensure that our guests, customers and employees are valued and cared for. This commitment to all stakeholders drives all we do and how we work. We understand that this commitment means demonstrating integrity, communicating honestly and acting responsibly. Our Code of Conduct reflects these commitments and provides a framework for making ethical business decisions. As discussed above, our Corporate Governance and Nominating Committee is tasked with reviewing and ensuring compliance with our Code of Conduct and ensuring we have effective governance procedures in place.

Involvement in Certain Legal Proceedings

None of our officers or directors have, during the last ten years: (i) been convicted in or is currently subject to a pending criminal proceeding; (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to any federal or state securities or banking laws including, without limitation, in any way limiting involvement in any business activity, or finding any violation with respect to such law; nor (iii) has any bankruptcy petition been filed by or against the business of which such person was an executive officer or a general partner, whether at the time of the bankruptcy or for the two years prior thereto or been subject to any of the items set forth under Item 401(f) of Regulation S-K, other than Chad M. Paris, our Chief Financial Officer and Treasurer, who was formerly the Senior Vice President and Chief Financial Officer at Jason Industries, Inc. from August 2017 until April 2021. In June 2020, while Mr. Paris was acting as its Senior Vice President and Chief Financial Officer, Jason Industries, Inc. and certain of its subsidiaries each filed voluntary bankruptcy petitions in the United States Bankruptcy Court for the Southern District of New York and, in August 2020, emerged pursuant to a prepackaged plan of reorganization.

Contacting the Board

Interested parties may contact our board of directors, a group of directors (including our non-management directors), or a specific director by sending a letter, regular or express mail, addressed to our board of directors or the specific director

in care of Mr. Kissinger at the above address. Mr. Kissinger will promptly forward appropriate communications from interested parties to the board of directors or the applicable director.

STOCK OWNERSHIP OF MANAGEMENT AND OTHERS

The following table sets forth information as of the Record Date as to our Common Shares and Class B Shares beneficially owned by: (1) each of our directors and nominees for director; (2) each of our executive officers named in the Summary Compensation Table set forth below under “Compensation Discussion and Analysis;” (3) all such directors and executive officers as a group; and (4) all other persons or entities known by us to be the beneficial owner of more than 5% of either class of our outstanding capital stock. A row for Class B Share ownership is not included for individuals or entities who do not beneficially own any Class B Shares.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Individual or Group/Class of Stock | | Sole Voting and Investment Power(1) | | Shared Voting and Investment Power(1) | | Total Share Ownership and Percentage of Class(1) | | Percentage of Aggregate Voting Power(1) |

| Directors and Named Executive Officers |

Stephen H. Marcus(2)(3) | | | | | | | | | | |

| Common Shares | | 21,895 | | | | 6,003 | | | 27,898 | | | | |

| | | | | | | * | | | 46.0 | % |

| Class B Shares | | 4,315,192 | | | | 52,070 | | | 4,367,262 | | | | |

| | | | | | | 62.5 | % | | | |

Diane Marcus Gershowitz(2) | | | | | | | | | | |

| Common Shares | | 245,772 | | (4) | | — | | | 245,772 | | (4) | | |

| | | | | | | * | | | 22.6 | % |

| Class B Shares | | 1,943,221 | | | | 182,351 | | | 2,125,572 | | | | |

| | | | | | | 30.4 | % | | | |

| Gregory S. Marcus | | | | | | | | | | |

| Common Shares | | 1,160,258 | | (5)(6) | | 75 | | | 1,160,333 | | (5)(6) | | |

| | | | | | | 4.5 | % | | | 3.6 | % |

| Class B Shares | | 210,230 | | | | 18,233 | | | 228,463 | | | | |

| | | | | | | 3.3 | % | | | |

| Allan H. Selig | | | | | | | | | | |

| Common Shares | | 63,328 | | (4) | | — | | | 63,328 | | (4) | | |

| | | | | | | * | | | * |

| Timothy E. Hoeksema | | | | | | | | | | |

| Common Shares | | 48,569 | | (4) | | 15,002 | | | 63,571 | | (4) | | |

| | | | | | | * | | | * |

| Philip L. Milstein | | | | | | | | | | |

| Common Shares | | 77,162 | | (4)(7) | | — | | | 77,162 | | (4)(7) | | |

| | | | | | | * | | | * |

| Brian J. Stark | | | | | | | | | | |

| Common Shares | | 45,219 | | (4) | | — | | | 45,219 | | (4) | | |

| | | | | | | * | | | * |

| Bruce J. Olson | | | | | | | | | | |

| Common Shares | | 28,679 | | (4) | | 4,478 | | | 33,157 | | (4) | | |

| | | | | | | * | | | * |

| Katherine M. Gehl | | | | | | | | | | |

| Common Shares | | 38,519 | | (4) | | — | | | 38,519 | | (4) | | |

| | | | | | | * | | | * |

| Austin M. Ramirez | | | | | | | | | | |

| Common Shares | | 7,078 | | (4) | | — | | | 7,078 | | (4) | | |

| | | | | | | * | | | * |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Individual or Group/Class of Stock | | Sole Voting and Investment Power(1) | | Shared Voting and Investment Power(1) | | Total Share Ownership and Percentage of Class(1) | | Percentage of Aggregate Voting Power(1) |

| Directors and Named Executive Officers |

| Thomas F. Kissinger | | | | | | | | | | |

| Common Shares | | 424,050 | | (5)(6) | | — | | | 424,050 | | (5)(6) | | |

| | | | | | | 1.7 | % | | | * |

| Chad M. Paris | | | | | | | | | | |

| Common Shares | | 54,529 | | (5)(6) | | — | | | 54,529 | | (5)(6) | | |

| | | | | | | * | | | * |

| Michael R. Evans | | | | | | | | | | |

| Common Shares | | 131,684 | | (5)(6) | | — | | | 131,684 | | (6) | | |

| | | | | | | * | | | * |

| Mark A. Gramz | | | | | | | | | | |

| Common Shares | | 56,194 | | (5)(6) | | — | | | 56,194 | | (6) | | |

| | | | | | | | | | |

| | | | | | | | | | |

All directors and executive officers as a group (13 persons)(3) | | 2,381,041 | | (8) | | 19,555 | | | 2,400,596 | | (8) | | |

| | | | | | | 9.1 | % | | | 26.9 | % |

| Class B Shares | | 2,153,451 | | | | 200,584 | | | 2,354,035 | | | | |

| | | | | | | 33.7 | % | | | |

| Other Five Percent Shareholders |

BlackRock, Inc.(9) | | | | | | | | | | |

Common Shares(10) | | 4,165,289 | | | | — | | | 4,165,289 | | | | |

| | | | | | | 16.5 | % | | | 4.4 | % |

Lazard Asset Management LLC(11) | | | | | | | | | | |

Common Shares(12) | | 2,198,458 | | | | — | | | 2,198,458 | | | | |

| | | | | | | 8.7 | % | | | 2.3 | % |

Dimensional Fund Advisors LP(13) | | | | | | | | | | |

Common Shares(14) | | 1,911,190 | | | | — | | | 1,911,190 | | | | |

| | | | | | | 7.6 | % | | | 2.0 | % |

The Vanguard Group(15) | | | | | | | | | | |

Common Shares(16) | | 1,789,970 | | | | 41,650 | | | 1,831,620 | | | | |

| | | | | | | 7.3 | % | | | 1.9 | % |

Bank of Montreal(17) | | | | | | | | | | |

Common Shares(18) | | 1,575,091 | | | | — | | | 1,575,091 | | | | |

| | | | | | | 6.3 | % | | | 1.7 | % |

JPMorgan Chase & Co.(19) | | | | | | | | | | |

Common Shares(20) | | 1,346,025 | | | | — | | | 1,346,025 | | | | |

| | | | | | | 5.3 | % | | | 1.4 | % |

UBS Group AG(21) | | | | | | | | | | |

Common Shares(22) | | — | | | | 1,299,728 | | | 1,299,728 | | | | |

| | | | | | | 5.2 | % | | | 1.4 | % |

_____________________

* Less than 1%.

(1)The outstanding Class B Shares are convertible on a share-for-share basis into Common Shares at any time at the discretion of each holder. As a result, a holder of Class B Shares is deemed to beneficially own an equal number of Common Shares. However, to avoid overstatement of the aggregate beneficial ownership of both classes of our outstanding capital stock, the Common Shares listed in the table do not include Common Shares that may be acquired upon the conversion of outstanding Class B Shares. Similarly, the percentage of outstanding Common Shares beneficially owned is determined with respect to the total number of outstanding Common Shares, excluding Common Shares that may be issued upon conversion of outstanding Class B Shares. The total number of votes represented by outstanding Common Shares and Class B Shares as of the Record Date was 95,016,157, consisting of 25,170,317 votes represented by outstanding Common Shares and 69,845,840 votes represented by outstanding Class B Shares.

(2)The address of Stephen H. Marcus and Diane Marcus Gershowitz is c/o 100 East Wisconsin Avenue, Suite 1900, Milwaukee, Wisconsin 53202-4125.

(3)Mr. Stephen H. Marcus retired from his position as chairman of our board of directors May 23, 2023. Due to Mr. Stephen Marcus’ retirement, his ownership of our Common Shares and Class B Shares is not included in the total ownership of all directors and executive officers listed as a group.

(4)Includes 10,226 Common Shares subject to acquisition by each of Diane Marcus Gershowitz, Allan H. Selig, Philip L. Milstein and Brian J. Stark, Katherine M. Gehl, Timothy E. Hoeksema and Bruce J. Olson and 2,455 Common Shares subject to acquisition by Austin M. Ramirez, in each case, pursuant to the exercise of stock options held on the Record Date that were then vested or that will vest within 60 days thereafter.

(5)Includes 7,295, 383, 1,561, 4,933 and 935 Common Shares held for the respective accounts of Gregory S. Marcus, Chad M. Paris, Thomas F. Kissinger, Mark A. Gramz and Michael R. Evans in our Pension Plus Plan as of December 28, 2023. See “Compensation Discussion and Analysis — Other Benefits — Qualified Retirement Plan.”

(6)Includes 687,275, 231,408, 16,500, 91,873 and 26,890 Common Shares subject to acquisition by Gregory S. Marcus, Thomas F. Kissinger, Chad M. Paris, Michael R. Evans and Mark A. Gramz, respectively, pursuant to the exercise of stock options held on the Record Date that were then vested or that will vest within 60 days thereafter. See “Compensation Discussion and Analysis — Grants of Plan-Based Awards.”

(7)Excludes the following shares, as to which Mr. Milstein disclaims beneficial interest: (a) 10,244 Common Shares held by PLM Foundation, of which Mr. Milstein is co-trustee; (b) 2,000 Common Shares held by Mr. Milstein’s wife; (c) 8,100 Common Shares held by Mr. Milstein’s children; and (d) 124,111 Common Shares held by the SVM Foundation, of which Mr. Milstein is co-trustee.

(8)Includes 1,127,983 Common Shares subject to acquisition pursuant to the exercise of stock options held by our named executive officers and non-employee directors on the Record Date that were then vested or that will vest within 60 days thereafter. See “Compensation Discussion and Analysis — Grants of Plan Based Awards” and “Compensation Discussion and Analysis — Non-Employee Director Compensation.”

(9)The address of BlackRock, Inc. (“BlackRock”) is 50 Hudson Yards, New York, New York 10001.

(10)Other than share ownership percentage information, the information set forth is as of December 31, 2023, as reported by BlackRock in its Schedule 13G/A filed with us and the SEC on January 22, 2024. BlackRock has sole voting power with respect to 4,109,474 shares and sole dispositive power with respect to 4,165,289 shares.

(11)The address of Lazard Asset Management LLC (“Lazard”) is 30 Rockefeller Plaza, New York, NY 10112.

(12)Other than share ownership percentage information, the information set forth is as of December 31, 2023, as reported by Lazard in its Schedule 13G/A filed with us and the SEC on February 14, 2024. Lazard has sole voting power with respect to 1,059,815 and sole dispositive power with respect to 2,198,458 shares.

(13)The address of Dimensional Fund Advisors LP (“DFA”) is Building One, 6300 Bee Cave Road, Austin, Texas 78746.

(14)Other than share ownership percentage information, the information set forth is as of December 29, 2023, as reported by DFA in its Schedule 13G/A filed with us and the SEC on February 9, 2024. DFA has sole voting power with respect to 1,878,435 shares and sole dispositive power with respect to 1,911,190 shares.

(15)The address of The Vanguard Group (“Vanguard”) is 100 Vanguard Blvd, Malvern, PA 19355.

(16)Other than share ownership percentage information, the information set forth is as of December 29 , 2023, as reported by Vanguard in its Schedule 13G/A filed with us and the SEC on February 13, 2024. Vanguard has sole voting power with respect to 0 shares and sole dispositive power with respect to 1,789,970 shares. Vangaurd has shared voting power with respect to 21,395 shares and shared dispositive power with respect to 41,650 shares.

(17)The address of Bank of Montreal (“BMO”) is 100 King Street West, 21st Floor, Toronto, Ontario, M5X 1A1, Canada.

(18)Other than share ownership percentage information, the information set forth is as of December 31, 2023, as reported by BMO in its Schedule 13G filed with us and the SEC on February 9, 2024. BMO has sole voting power with respect to 1,575,091 shares and sole dispositive power with respect to 1,575,091 shares.

(19)The address of JPMorgan Chase & Co. (“JPM”) is 383 Madison Avenue, New York, NY 10179.

(20)Other than share ownership percentage information, the information set forth is as of December 29, 2023, as reported by JPM in its Schedule 13G filed with us and the SEC on February 6, 2024. JPM has sole voting power with respect to 1,346,025 shares and sole dispositive power with respect to 1,346,025 shares.

(21)The address of UBS Group AG (“UBS”) is Bahnhofstrasse 45 PO Box CH-8021, Zurich, Switzerland.

(22)Other than share ownership percentage information, the information set forth is as of December 29, 2023, as reported by UBS in its Schedule 13G filed with us and the SEC on February 6, 2024. UBS does not have sole voting power or sole dispositive power with respect to its shares. UBS has shared voting power with respect to 1,299,728 shares and shared dispositive power with respect to 1,299,728 shares.

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis, or “CD&A,” provides information about our compensation philosophy, principles and processes for our chairman of the board and chief executive officer, our chief financial officer and our three other most highly compensated executive officers for fiscal 2023, as well Stephen H. Marcus, who retired as Chairman of our Board of Directors effective May 23, 2023. We sometimes collectively refer to these executive officers in this CD&A as our “named executive officers.”

This CD&A is intended to provide you with a better understanding of why and how we make our executive compensation decisions and facilitate your reading of the information contained in the tables and descriptions that follow this discussion. This CD&A is organized as follows:

•Overview of Our Executive Compensation Philosophy. In this section, we describe our executive compensation philosophy and the core principles underlying our executive compensation programs and decisions.

•Role of Our Compensation Committee. This section describes the process and procedures that our Compensation Committee followed to arrive at its executive compensation decisions.

•Total Compensation. In this section, we describe our named executive officers’ total compensation.

•Elements of Compensation. This section includes a description of the types of compensation paid and payable to our named executive officers.

•Executive Stock Ownership. This section describes the stock ownership of our named executive officers.

Overview of Our Executive Compensation Philosophy

Our executive compensation and benefit programs are designed to advance the following core compensation philosophies and principles:

•We strive to compensate our executives at competitive levels to ensure that we attract, retain and motivate our key management employees who we expect will contribute significantly to our long-term success and value creation.

•We link our executives’ compensation to the achievement of pre-established financial and individual performance goals that are focused on the creation of long-term shareholder value.

•Our executive compensation policies are designed to foster an ownership mentality and an entrepreneurial spirit in our management team. We try to do this by providing our executives with a substantial long-term incentive compensation component that helps to more closely align our management’s financial interests with those of our shareholders over an extended performance period, and that otherwise encourages our management team to take appropriate market-responsive risk-taking actions that will facilitate our long-term growth and success.

At our 2023 annual meeting of shareholders, our shareholders were asked to approve, by advisory vote, the compensation of our named executive officers during fiscal 2022 as disclosed in the proxy statement for our 2023 annual meeting. At our 2023 annual meeting, over 98% of the votes cast and over 97% of all shares entitled to vote at the meeting were voted in favor of the compensation of our named executive officers. In developing our executive compensation and benefit programs that were in effect for fiscal 2023, we considered our shareholders’ resounding approval of our executive compensation and benefit programs for fiscal 2022 at our 2023 annual meeting. As a result, and as we describe in this CD&A, we maintained during fiscal 2023 many of the same executive compensation and benefit programs that were overwhelmingly approved by our shareholders at our 2023 annual meeting.

Role of Our Compensation Committee

Our Compensation Committee, or “Committee,” attempts to ensure that our executive compensation and benefit programs are consistent with our core compensation philosophies and principles by:

•Analyzing aggregated composite survey and benchmark data from external compensation consultants about the compensation levels of similarly situated executives at equivalently-sized companies in various industry sectors.

•Reviewing on an annual basis the performance of our company and our named executive officers, with assistance and recommendations from our chief executive officer (other than with respect to himself), and determining their total direct compensation based on competitive levels as measured against our surveyed sectors, our company’s financial performance, each executive’s individual performance and other factors described below.

•Reviewing the performance and determining the total compensation earned by, or paid or awarded to, our chairman and chief executive officer independent of input from him.

•Maintaining the practice of holding executive sessions (without management present) at every meeting of our Committee.

•Taking into account the long-term interests of our shareholders in developing and implementing our executive compensation plans and in making our executive compensation decisions.

Our Compensation Committee annually engages the services of external compensation consultants, including Aon Hewitt and Willis Towers Watson, to provide the Committee with then current survey and benchmarking compensation data on a position-by-position basis for each of our named executive officers on a composite aggregated basis for various selected industry sectors. Specifically, Aon Hewitt and Willis Towers Watson have provided our Committee with composite aggregated data respecting the base salary and total cash compensation (i.e., base salary and bonuses) for similarly situated executives at other companies with comparable annual revenue levels in the following sectors: (1) all organizations; (2) all non-manufacturing organizations; and (3) service organizations. The Committee chose these sectors so as to provide it with both a broad scope of applicable executive compensation data to consider, as well as more specific information at similarly-sized companies in comparable sectors. Neither Aon Hewitt nor Willis Towers Watson have provided, and our Compensation Committee has not received, reviewed or considered, the individual identities of the companies which comprised these general sector categories of benchmarked organizations. For each of these sectors, our Committee has been provided with aggregated compiled data and identified the 25th percentile, median and 75th percentile amounts for the base salary and total cash compensation amounts for executives similarly situated to the named executive officers in each sector. In particular, when reviewing this survey data, our Committee pays particular attention to the composite benchmark salary and cash compensation data related to the service organizations (when available for a given position), because our Committee believes that they are the most similar to our hotels and resorts and theatre divisions. In connection with our Committee’s long-term equity-based incentive award grants, Willis Towers Watson provided our Committee with composite aggregated data regarding the value of competitive long-term incentive plans for similarly situated executives at other companies with comparable revenue levels, identifying the 25th percentile, median and 75th percentile amounts.

Our Compensation Committee has the final authority to engage and terminate any compensation consultant and is responsible for periodically evaluating any compensation consultant that it engages. Our Compensation Committee also has the responsibility to consider the independence of any compensation consultant before engaging the consultant. Prior to each consultant’s appointment for fiscal 2023, our Compensation Committee reviewed the independence of such consultant and its individual representatives who serve as consultants to the Committee in light of SEC rules and NYSE listing standards regarding the independence of compensation committee members and the specific factors set forth therein and concluded that Aon Hewitt’s and Willis Towers Watson’s work for the Committee does not raise any conflict of interest.

In addition to Willis Towers Watson’s work for our Compensation Committee, a different division of Willis Towers Watson provides us with actuarial services, pension plan and consulting services limited in scope to only our new disclosure regarding the Company’s pay of named executive officers compared to the Company’s performance. In fiscal 2023, we paid such division approximately $49,800 for such actuarial, pension plan and consulting services which, given the relative sizes of both our organizations, we believe to be a relatively immaterial amount. As a result, our Compensation Committee concluded that Willis Towers Watson’s provision of such actuarial, pension plan and consulting services does not raise any conflict of interest.

In February 2024, our Compensation Committee conducted a thorough risk assessment of our compensation policies and practices. Our Committee evaluated the levels of risk-taking that could be potentially encouraged by each of our material compensation arrangements, after taking into account any relevant risk-mitigation features. As a result of this review, our Committee concluded that our compensation policies and practices do not encourage excessive or unnecessary risk-taking.

Total Compensation

The compensation paid to our named executive officers for fiscal 2023 consists of four main elements: (1) salary; (2) an annual incentive cash bonus; (3) a long-term incentive compensation award, which included an annual stock option grant, an annual restricted stock award and an annual long-term performance cash award; and (4) other benefits, including those made available under our employee benefit plans. The combination of these elements is intended to provide our named executive officers with fair and competitive compensation that rewards corporate and individual performance and helps attract, retain and motivate highly qualified individuals who contribute to our long-term success and value creation. Additionally, these compensation elements, particularly our annual incentive cash bonus and long-term incentive awards, tie the compensation of our executive officers to strong performance metrics and therefore foster a shareholder mentality and the continuation of our entrepreneurial spirit by aligning executive officers’ cash and equity incentives with sustained growth in long-term shareholder value and encouraging our executives to take appropriate market-responsive risk-taking actions that help create long-term shareholder value.

While the relative amounts of salaries and benefits provided to our named executive officers are intended to be set at competitive levels compared to our surveyed group of benchmarked sectors, we provide our executives with the opportunity to earn significant additional amounts through performance-based annual cash bonuses and long-term incentive compensation programs.

For fiscal 2023, the total cash compensation (i.e., salary and annual cash bonus) paid to our named executive officers generally fell between the 25th and 75th percentile of the total cash compensation amounts paid to executives holding equivalent positions at our surveyed group of benchmarked sectors. In establishing these relative levels of compensation, our Committee first established the relative level of each of our named executive officer’s base salary at between the 50th and 75th percentile of the salary paid to similarly situated executives at our surveyed group of benchmarked sectors. These decisions were based on the considerations discussed in more detail below under “Elements of Compensation — Base Salaries.” Then, our Committee established the relative level of each of our named executive officer’s targeted annual cash bonus award that, if earned, would result in our payment of total cash compensation amounts that would generally fall between the 50th and 75th percentile of the total cash compensation paid to similarly situated executives at our surveyed group of benchmarked sectors. These decisions were based on the considerations discussed in more detail below under “Elements of Compensation — Annual Cash Bonuses.” Our Committee subjectively believed that the targeted relative levels of total cash compensation to our named executive officers resulting from this process generally reflected the highly experienced nature of our senior executive team and was generally consistent with our historical corporate financial performance, the individual performance of our named executive officers and our prior shareholder return. Our Committee also believed that these total cash compensation levels were reasonable in their totality and supported our core compensation philosophies and principles. However, in establishing these relative compensation levels, our Committee did not specifically compare any of the criteria listed in the prior two sentences to our surveyed group of benchmarked sectors. For fiscal 2023, our Committee established the range of potential total cash compensation payable to our named executive officers at the same relative levels compared to updated recent information for our benchmarked sectors.

Mr. Gregory S. Marcus, as our chief executive officer and chairman, and Mark A. Gramz and Michael R. Evans, as our division presidents, had a higher percentage of their total compensation based on achieving incentive bonus targets, because our Committee believes that they had the most potential to impact our corporate financial performance. Our Committee believes that this emphasis and allocation most effectively links pay-for-performance.

Due to changes adopted by our Committee in February 2024, our long-term incentive compensation award for fiscal 2024 includes an annual long-term performance cash award, an annual performance stock unit award and an annual restricted stock award.

Elements of Compensation

Base Salary

Our Compensation Committee, in consultation with our chief executive officer (other than with respect to decisions affecting himself), strives to establish competitive base salaries for our named executive officers set at between the 50th and

75th percentile of the salaries paid to similarly situated executives at our surveyed group of benchmarked sectors. Each executive officer’s salary is initially based on the level of his responsibilities, the relationship of such responsibilities to those of our other executive officers and his tenure at our company. We evaluate and adjust the base salaries of our named executive officers annually as of March 1 of each fiscal year. When evaluating and adjusting the salaries of our named executive officers (other than our chairman and chief executive officer), we consider the recommendations of our chief executive officer. In making his recommendations, our chief executive officer generally takes into account: (1) our corporate financial performance as a whole and on a divisional basis, when appropriate, for the most recent fiscal year compared to our historical and budgeted performance; (2) general economic conditions (including inflation) and the impact such conditions had on our operations and results; (3) each executive officer’s past, and anticipated future, contributions to our performance; (4) each executive officer’s compensation history with our company and the past levels of each element of total compensation; (5) how each executive officer’s salary compares to the range of salaries of similarly situated executives at our surveyed group of benchmarked companies; (6) new responsibilities, if any, recently delegated, or to be delegated, to such officer; and (7) the executive’s participation in significant corporate achievements during the prior fiscal year. Our Compensation Committee, while looking to our chief executive officer for his recommendations as to the salaries of our other named executive officers (other than with respect to himself), also engages in its own independent review and judgment concerning such base salary adjustments based on the foregoing factors. When evaluating and adjusting our chief executive officer’s salary, our Compensation Committee independently, and without input from our chief executive officer, considers the factors cited above, as well as their respective ability to inspire subordinates with the vision of our company, and makes decisions accordingly. The seven factors listed above are only generally, and not individually or separately, analyzed, assessed and weighted by our Committee in its determination of the amount of base salary of each individual named executive officer. Our Committee subjectively assesses these factors in the aggregate based on the recommendations of our chief executive officer for all named executive officers other than himself and, in the case of our chairman and chief executive officer, by our Committee on its own accord.

As a result of the process described above, for fiscal 2023, Chad M. Paris, Thomas F. Kissinger, Mark A. Gramz and Michael R. Evans received increases of 8.0%, 4.3%, 4.7% and 5.0%, respectively, in their base salaries; Stephen H. Marcus and Gregory S. Marcus did not receive increases in their respective annual base salaries. In fiscal 2023, the base salaries paid to Messrs. Stephen Marcus, Greg Marcus, Paris, Kissinger, Gramz and Evans represented 46%, 20%, 46%, 29%, 42% and 40%, respectively, of their respective total compensation for the fiscal 2023 as set forth below in the Summary Compensation Table. Based upon our analyzing similar factors earlier this calendar year, for fiscal 2024, Messrs. Paris, Kissinger, Gramz and Evans received an increase in their annual base salary of, 8.2%, 2.0%, 4.5% and 4.1%, respectively; Mr. Greg Marcus did not receive an increase in his annual base salary.

Annual Cash Bonuses

We establish targeted potential annual cash bonus awards at the beginning of each fiscal year pursuant to our variable incentive plan, which our Compensation Committee administers. Our variable incentive plan allows our Committee to select from a variety of appropriate financial metrics upon which to base the financial targets for achieving a corresponding annual incentive bonus. Under our variable incentive plan, our Committee may choose from one or more of the following financial metrics, either in absolute terms or in comparison to prior year performance or publicly available industry standards or indices: revenues; gross operating profit; operating income; pre-tax earnings; net earnings; earnings per share; earnings before interest, taxes, depreciation and amortization (“EBITDA”); economic profit; operating margins and statistics; financial return and leverage ratios; total shareholder return metrics; or a company-specific financial metric (such as Adjusted EBITDA, adjusted consolidated pre-tax income (“API”) or adjusted division pre-tax income (“ADI”)). Additional financial measures not specified in the variable incentive plan may be considered if our Committee determines that the specific measure contributes to achieving the primary goal of our incentive plan — sustained growth in long-term shareholder value. Our Committee retains the ability to consider whether an adjustment of the selected financial goals for any year is necessitated by exceptional circumstances. This ability is intended to be narrowly and infrequently used.

Targeted annual bonus awards under the variable incentive plan may be based on our relative achievement of the selected consolidated financial targets and/or divisional financial targets, as well as on discretionary individual performance measures that help enhance shareholder value as subjectively determined by our Compensation Committee. Our Committee also from time to time has granted special compensation awards to our named executive officers and other key employees to reward their integral involvement in significant corporate achievements or events. Our Committee did not grant any special compensation awards to any of our named executive officers in fiscal 2023.

Historically, at the beginning of each fiscal year, our Committee establishes applicable financial targets for such fiscal year for purposes of granting our named executive officers’ target incentive cash bonus opportunities for that fiscal year. For each selected applicable financial target, our Committee also establishes a threshold minimum level of financial performance and a maximum level of financial performance relative to such target. If our actual financial performance

equals our targeted financial metric, then the portion of our incentive bonus payouts based on achieving that financial target will be equal to 100% of the targeted bonus amount. If we do not achieve the specified minimum threshold level of financial performance, then no incentive bonus payouts based on financial performance will be paid. If we equal or exceed the specified maximum level of financial performance, then we will pay out up to 320% of the targeted amount of the incentive bonuses based on the level that we exceed the selected financial performance metric. Financial performance between the threshold and target levels and between the target and maximum levels will result in a prorated portion of the financial-based bonus being paid.

Our Committee also retains the ability to consider whether an adjustment of the selected financial goals for any year is necessitated by exceptional circumstances. This ability is intended to be narrowly and infrequently used. We have historically established these financial targets for each fiscal year based on a consistent methodology that encourages growth over an average of prior years’ performance for our company and both of our divisions. We establish these targets with the belief that the level of achievability of the targets would likely be consistent with the relative level of achievement of our historical financial targets. Since the implementation of our incentive plan, we have achieved between 0%-218% of the applicable bonus based upon our consolidated financial targets and 0%-379% of the applicable bonus based upon our division financial targets.