UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR- 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission File Number 1-898

AMPCO-PITTSBURGH CORPORATION

| Pennsylvania | ||

| (State of Incorporation) | 25-1117717 | |

|

600 Grant Street, Suite 4600 |

I.R.S. Employer ID No. | |

| Pittsburgh, PA 15219 | ||

| (Address of principal executive offices) | (412) 456-4400 | |

| (Registrant’s telephone number) | ||

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class | Name of each exchange on which registered | |

| Common stock, $1 par value | New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act: | None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No ü

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ü]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer Accelerated Filer ü Non-accelerated Filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No ü

The aggregate market value of the voting stock of Ampco-Pittsburgh Corporation held by non-affiliates on June 30, 2012 (based upon the closing price of the Registrant’s Common Stock on the New York Stock Exchange (the “NYSE”) on that date) was approximately $157 million.

As of March 11, 2013, 10,346,090 common shares were outstanding.

Documents Incorporated by Reference: Part III of this report incorporates by reference certain information from the Proxy Statement for the 2013 Annual Meeting of Shareholders.

5

– PART I –

ITEM 1. BUSINESS

GENERAL DEVELOPMENT OF BUSINESS

Ampco-Pittsburgh Corporation (the “Corporation”) was incorporated in Pennsylvania in 1929. The Corporation, individually or together with its consolidated subsidiaries, is also referred to herein as the “Registrant”.

The Corporation classifies its businesses in two segments: Forged and Cast Rolls and Air and Liquid Processing.

FINANCIAL INFORMATION ABOUT SEGMENTS

The sales and operating profit of the Corporation’s two segments and the identifiable assets attributable to both segments for the three years ended December 31, 2012 are set forth in Note 19 (Business Segments) on page 55 of this Annual Report on Form 10-K.

NARRATIVE DESCRIPTION OF BUSINESS

Forged and Cast Rolls Segment

Union Electric Steel Corporation produces forged hardened steel rolls used in cold rolling by producers of steel, aluminum and other metals throughout the world. It is headquartered in Carnegie, Pennsylvania with three manufacturing facilities in Pennsylvania and one in Indiana. Union Electric Steel Corporation is one of the largest producers of forged hardened steel rolls in the world. In addition to several domestic competitors, several major European, South American and Asian manufacturers also compete in both the domestic and foreign markets. In 2007, a subsidiary became a 49% partner in a joint venture in China to manufacture large forged backup rolls principally in weight and size larger than those which can be made in the subsidiary’s facilities in the United States. Limited production continued in 2012.

Union Electric Steel UK Limited produces cast rolls for hot and cold strip mills, medium/heavy section mills and plate mills in a variety of iron and steel qualities. It is located in Gateshead, England and is a major supplier of cast rolls to the metalworking industry worldwide. It primarily competes with European, Asian and North and South American companies in both the domestic and foreign markets. Union Electric Steel UK is a 25% partner in a Chinese joint venture which produces cast rolls.

Air and Liquid Processing Segment

Aerofin Division of Air & Liquid Systems Corporation produces custom-engineered finned tube heat exchange coils and related heat transfer products for a variety of industries including fossil fuel and nuclear power generation, automotive, industrial process and HVAC, and is located in Lynchburg, Virginia.

Buffalo Air Handling Division of Air & Liquid Systems Corporation produces large custom air handling systems used in commercial, institutional and industrial buildings and is located in Amherst, Virginia.

Buffalo Pumps Division of Air & Liquid Systems Corporation manufactures a line of centrifugal pumps for the refrigeration, power generation and marine defense industries and is located in North Tonawanda, New York.

All three of the divisions in this segment are principally represented by a common independent sales organization and have several major competitors.

In both segments, the products are dependent on engineering, principally custom designed, and are sold to sophisticated commercial and industrial users located throughout the world.

The Forged and Cast Rolls segment has two international customers which constituted approximately 23% of its sales in 2012. The loss of both of these customers could have a material adverse effect on the segment.

For additional information on the products produced and financial information about each segment, see page 4 and Note 19 (Business Segments) on page 55 of this Annual Report on Form 10-K.

Raw Materials

Raw materials used in both segments are generally available from many sources and the Corporation is not dependent upon any single supplier for any raw material. Substantial volumes of raw materials used by the Corporation are subject to significant variations in price. The Corporation generally does not purchase or commit for the purchase of a major portion of

| ampco pittsburgh | 2012 annual report | 6 |

raw materials significantly in advance of the time it requires such materials but does make forward commitments for the supply of natural gas.

Patents

While the Corporation holds some patents, trademarks and licenses, in the opinion of management they are not material to either segment of the Corporation’s business, other than in protecting the goodwill associated with the names under which products are sold.

Backlog

The backlog of orders at December 31, 2012 was approximately $196 million compared to a backlog of $260 million at year-end 2011. Approximately 20% of the backlog is expected to be released after 2013.

Competition

The Corporation faces considerable competition from a large number of companies in both segments. The Corporation believes, however, that it is a significant factor in each of the niche markets which it serves. Competition in both segments is based on quality, service, price and delivery. For additional information, see “Narrative Description of Business” on page 6 of this Annual Report on Form 10-K.

Research and Development

As part of an overall strategy to develop new markets and maintain leadership in each of the industry niches served, the Corporation’s businesses in both segments incur expenditures for research and development. The activities that are undertaken are designed to develop new products, improve existing products and processes, enhance product quality, adapt products to meet customer specifications and reduce manufacturing costs. In the aggregate, these expenditures approximated $1.48 million in 2012, $1.70 million in 2011 and $1.71 million in 2010.

Environmental Protection Compliance Costs

Expenditures for environmental control matters were not material to either segment in 2012 and such expenditures are not expected to be material in 2013.

Employees

On December 31, 2012, the Corporation had 1,178 active employees.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

The Forged and Cast Rolls segment has a manufacturing operation in England and a small European sales and engineering support group in Belgium. For financial information relating to foreign and domestic operations see Note 19 (Business Segments) on page 55 of this Annual Report on Form 10-K.

AVAILABLE INFORMATION

The Corporation files annual, quarterly and current reports, amendments to those reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). You may access and read the Corporation’s filings without charge through the SEC’s website at www.sec.gov. You may also read and copy any document the Corporation files at the SEC’s Public Reference Room located at 100 F. Street, N.E., Room 1580, Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

The Corporation’s Internet address is www.ampcopittsburgh.com. The Corporation makes available, free of charge on its Internet website, access to these reports as soon as reasonably practicable after such material is filed with, or furnished to, the SEC. The information on the Corporation’s website is not part of this Annual Report on Form 10-K.

| 7 | ampco pittsburgh | 2012 annual report |

EXECUTIVE OFFICERS

The name, age, position with the Corporation(1) and business experience for the past five years of the Executive Officers of the Corporation are as follows:

Robert A. Paul (age 75). Mr. Paul was elected Chairman and Chief Executive Officer of the Corporation in 2004. Prior to that, he was President and Chief Executive Officer of the Corporation for more than five years. He has been a Director since 1970 and his current term expires in 2015. He is also Chairman and a director of The Louis Berkman Investment Company. Mr. Paul has been a shareholder, officer and director of the Corporation for more than forty years.

Rose Hoover (age 57). Ms. Hoover has been employed by the Corporation for more than thirty years. She has served as Executive Vice President and Chief Administrative Officer of the Corporation since May 2011; Senior Vice President of the Corporation since April 2009 and prior to that served as Vice President Administration of the Corporation since December 2006. She has also served as Secretary of the Corporation for more than five years.

Marliss D. Johnson (age 48). Ms. Johnson has been Vice President, Controller and Treasurer of the Corporation for more than ten years. Ms. Johnson is a Certified Public Accountant with fourteen years of experience with a major accounting firm prior to joining the Corporation.

Robert F. Schultz (age 65). Mr. Schultz has been with the Corporation for more than thirty years, twenty-one of which he has served as Vice President Industrial Relations and Senior Counsel. Prior to joining the Corporation, Mr. Schultz practiced law in a private practice law firm.

| (1) | Officers serve at the discretion of the Board of Directors and none of the listed individuals serves as a director of a public company, except that Mr. Paul is a director of the Corporation. |

ITEM 1A. RISK FACTORS

From time to time, important factors may cause actual results to differ materially from any future expected results based on performance expressed or implied by any forward-looking statements made by us, including known and unknown risks, uncertainties and other factors, many of which are not possible to predict or control. Several of these factors are described from time to time in our filings with the Securities and Exchange Commission, but the factors described in filings are not the only risks that are faced.

Cyclical Demand for Products/Economic Downturns

A significant portion of our sales consists of rolling mill rolls to customers in the global steel industry which can be periodically impacted by economic or cyclical downturns. Such downturns, the timing and length of which are difficult to predict, may reduce the demand for, and sales of, our forged and cast steel rolls both in the United States and the rest of the world. Lower demand for rolls may also adversely impact profitability as other roll producers, which compete with us, lower selling prices in the market place in order to fill their manufacturing capacity. Cancellation of orders or deferral of delivery of rolls may occur and produce an adverse impact on financial results.

Steel Industry Consolidation

Globally, the steel industry has undergone structural change by way of consolidation and mergers. In certain markets, the resultant reduction in the number of steel plants and the increased buying power of the enlarged steel producing companies may put pressure on the selling prices and profit margins of rolls.

Export Sales

Exports are a significant proportion of our sales. Historically, changes in foreign exchange rates, particularly in respect of the U.S. dollar and the Euro, have impacted the export of our products and may do so again in the future. Other factors which may adversely impact export sales and operating results include political and economic instability, export controls, changes in tax laws and tariffs and new indigenous producers in overseas markets. A reduction in the level of export sales may have an adverse impact on our financial results. In addition, exchange rate changes may allow foreign roll suppliers to compete in our home markets.

Capital Spending

Each of our businesses is susceptible to the general level of economic activity, particularly as it impacts industrial and construction capital spending. A downturn in capital spending in the United States and elsewhere may reduce demand for and

| ampco pittsburgh | 2012 annual report | 8 |

sales of our air handling, power generation and refrigeration equipment, and rolling mill rolls. Lower demand may also reduce profit margins due to our competitors and us striving to maximize manufacturing capacity by lowering prices.

Prices and Availability of Commodities

We use certain commodities in the manufacture of our products. These include steel scrap, ferroalloys and energy. Any sudden price increase may cause a reduction in profit margins or losses where fixed-priced contracts have been accepted or increases cannot be obtained in future selling prices. In addition, there may be curtailment in electricity or gas supply which would adversely impact production. Shortage of critical materials while driving up costs may be of such severity as to disrupt production, all of which may impact sales and profitability.

Labor Agreements

We have several key operations which are subject to multi-year collective bargaining agreements with our hourly work force. While we believe we have excellent relations with our unions, there is the risk of industrial action at the expiration of an agreement if contract negotiations break down, which may disrupt manufacturing and impact results of operations.

Dependence on Certain Equipment

Our principal business relies on certain unique equipment such as an electric arc furnace and a spin cast work roll machine. Although a comprehensive critical spare inventory of key components for this equipment is maintained, if any such unique equipment is out of operation for an extended period, it may result in a significant reduction in our sales and earnings.

Asbestos Litigation

Our subsidiaries, and in some cases, we, are defendants in numerous claims alleging personal injury from exposure to asbestos-containing components historically used in certain products of our subsidiaries. Through year-end 2012, our insurance has covered a substantial majority of our settlement and defense costs. We believe that the estimated costs net of anticipated insurance recoveries of our pending and future asbestos legal proceedings for the next ten years will not have a material adverse effect on our consolidated financial condition or liquidity. However, there can be no assurance that our subsidiaries or we will not be subject to significant additional claims in the future or that our subsidiaries’ ultimate liability with respect to asbestos claims will not present significantly greater and longer lasting financial exposure than provided for in our consolidated financial statements. Similarly, although the Corporation believes that the assumptions employed in valuing its insurance coverage were reasonable, there are other assumptions that could have been employed that would have resulted in materially lower insurance recovery projections. The ultimate net liability with respect to such pending and any unasserted claims is subject to various uncertainties, including the following:

| • | the number of claims that are brought in the future; |

| • | the costs of defending and settling these claims; |

| • | insolvencies among our insurance carriers and the risk of future insolvencies; |

| • | the possibility that adverse jury verdicts could require damage payments in amounts greater than the amounts for which we have historically settled claims; |

| • | possible changes in the litigation environment or federal and state law governing the compensation of asbestos claimants; |

| • | the risk that the bankruptcies of other asbestos defendants may increase our costs; and |

| • | the risk that our insurance will not cover as much of our asbestos liabilities as anticipated. |

Because of the uncertainties related to such claims, it is possible that the ultimate liability could have a material adverse effect on our consolidated financial condition or liquidity in the future.

Environmental Matters

We are subject to various domestic and international environmental laws and regulations that govern the discharge of pollutants and disposal of wastes and which may require that we investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. We could incur substantial cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims as a result of violations or liabilities under these laws or non-compliance with environmental permits required at our facilities.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

The Corporation has no unresolved staff comments.

| 9 | ampco pittsburgh | 2012 annual report |

ITEM 2. PROPERTIES

The location and general character of the principal locations in each segment, all of which are owned unless otherwise noted, are as follows:

| Company and Location | Principal Use | Approximate Square Footage |

Type of Construction | |||

| FORGED AND CAST ROLLS SEGMENT | ||||||

| Union Electric Steel Corporation Route 18 Burgettstown, PA 15021 |

Manufacturing facilities |

296,800 on 55 acres |

Metal and steel | |||

| 726 Bell Avenue Carnegie, PA 15106 |

Manufacturing facilities and offices | 165,900 on 8.7 acres | Metal and steel | |||

| U.S. Highway 30 Valparaiso, IN 46383 |

Manufacturing facilities | 88,000 on 20 acres | Metal and steel | |||

| 1712 Greengarden Road Erie, PA 16501 |

Manufacturing facilities | 40,000* | Metal and steel | |||

| Bosstraat 54 3560 Lummen Belgium |

Sales and engineering | 4,500* | Cement block | |||

| Union Electric Steel UK Limited Coulthards Lane Gateshead, England |

Manufacturing facilities and offices | 274,000 on 10 acres | Steel framed, metal and brick | |||

|

AIR AND LIQUID PROCESSING SEGMENT |

||||||

| Air & Liquid Systems Corporation | ||||||

|

Aerofin Division 4621 Murray Place Lynchburg, VA 24506 |

Manufacturing facilities and offices |

146,000 on 15.3 acres |

Brick, concrete and steel | |||

| Buffalo Air Handling Division |

||||||

| Zane Snead Drive Amherst, VA 24531 |

Manufacturing facilities and offices | 89,000 on 19.5 acres | Metal and steel | |||

| Buffalo Pump Division | ||||||

| 874 Oliver Street N. Tonawanda, NY 14120 |

Manufacturing facilities and offices | 94,000 on 9 acres | Metal, brick and cement block | |||

| * | Facility is leased. |

The Corporation’s office space and the Air & Liquid Systems headquarter’s office space is leased. All of the owned facilities are adequate and suitable for their respective purposes.

The Forged and Cast Rolls segment’s facilities were operated within 75% to 80% of their normal capacity during 2012. The facilities of the Air and Liquid Processing segment were operated within 60% to 70% of their normal capacity. Normal capacity is defined as capacity under approximately normal conditions with allowances made for unavoidable interruptions, such as lost time for repairs, maintenance, breakdowns, set-up, failure, supply delays, labor shortages and absences, Sundays, holidays, vacation, inventory taking, etc. The number of work shifts is also taken into consideration.

| ampco pittsburgh | 2012 annual report | 10 |

ITEM 3. LEGAL PROCEEDINGS

LITIGATION

The Corporation and its subsidiaries are involved in various claims and lawsuits incidental to their businesses. In addition, it is also subject to asbestos litigation as described below.

Asbestos Litigation

Claims have been asserted alleging personal injury from exposure to asbestos-containing components historically used in some products of predecessors of the Corporation’s Air & Liquid Systems Corporation subsidiary (“Asbestos Liability”) and of an inactive subsidiary in dissolution. Those subsidiaries, and in some cases the Corporation, are defendants (among a number of defendants, often in excess of 50) in cases filed in various state and federal courts.

Asbestos Claims

The following table reflects approximate information about the claims for Asbestos Liability against the subsidiaries and the Corporation, along with certain asbestos claims asserted against the inactive subsidiary in dissolution, for the two years ended December 31, 2012 and 2011:

| 2012 | 2011 | |||||||||

| Total claims pending at the beginning of the period |

8,145 | (1) | 8,081 | |||||||

| New claims served |

1,538 | 1,565 | ||||||||

| Claims dismissed |

(1,420 | ) | (1,225 | ) | ||||||

| Claims settled |

(256 | ) | (276 | ) | ||||||

| Total claims pending at the end of the period (1) |

8,007 | 8,145 | ||||||||

| Gross settlement and defense costs (in 000’s) |

$ | 23,589 | $ | 22,767 | ||||||

| Average gross settlement and defense costs per claim resolved (in 000’s) |

$ | 14.07 | $ | 15.17 | ||||||

| (1) | Included as “open claims” are approximately 1,632 claims and 1,668 claims in 2012 and 2011, respectively, classified in various jurisdictions as “inactive” or transferred to a state or federal judicial panel on multi-district litigation, commonly referred to as the MDL. |

A substantial majority of the settlement and defense costs reflected in the above table was reported and paid by insurers. Because claims are often filed and can be settled or dismissed in large groups, the amount and timing of settlements, as well as the number of open claims, can fluctuate significantly from period to period.

Asbestos Insurance

The Corporation and its Air & Liquid Systems Corporation (“Air & Liquid”) subsidiary are parties to a series of settlement agreements (“Settlement Agreements”) with insurers that have coverage obligations for Asbestos Liability (the “Settling Insurers”). The Settlement Agreements include agreements with insurers encompassing all known solvent primary policies and solvent first-layer excess policies with responsibilities for Asbestos Liability. The Settlement Agreements also include an agreement, effective on October 8, 2012, with insurers responsible for the majority of the solvent second-layer and above excess insurance policies issued to the Corporation from 1981 through 1984. Under the Settlement Agreements, the Settling Insurers accept financial responsibility, subject to the terms and conditions of the respective agreements, including overall coverage limits, for pending and future claims for Asbestos Liability. The claims against the Corporation’s inactive subsidiary in dissolution, numbering approximately 300 as of December 31, 2012, are not included within the Settlement Agreements. The Corporation believes that the claims against the inactive subsidiary in dissolution are immaterial.

The Settlement Agreements include acknowledgements that Howden North America, Inc. (“Howden”) is entitled to coverage under policies covering Asbestos Liability for claims arising out of the historical products manufactured or distributed by Buffalo Forge, a former subsidiary of the Corporation (the “Products”). The Settlement Agreements do not provide for any prioritization on access to the applicable policies or any sub limits of liability as to Howden or the Corporation and Air & Liquid, and, accordingly, Howden may access the coverage afforded by the Settling Insurers for any covered claim arising out of a Product. In general, access by Howden to the coverage afforded by the Settling Insurers for the Products will erode coverage under the Settlement Agreements available to the Corporation and Air & Liquid for Asbestos Liability.

On February 24, 2011, the Corporation and Air & Liquid filed a lawsuit in the United States District Court for the Western District of Pennsylvania against thirteen domestic insurance companies, certain underwriters at Lloyd’s, London and certain London market insurance companies, and Howden. The lawsuit seeks a declaratory judgment regarding the respective rights and obligations of the parties under excess insurance policies that were issued to the Corporation from 1981 through 1984 as

| 11 | ampco pittsburgh | 2012 annual report |

respects claims against the Corporation and its subsidiary for Asbestos Liability and as respects asbestos bodily-injury claims against Howden arising from the Products. The Corporation and Air & Liquid entered into an agreement, effective October 8, 2012, as described above, with eight of the domestic defendant insurers in the action. That agreement specifies the terms and conditions upon which the insurer parties would contribute to defense and indemnity costs for claims for Asbestos Liability. Howden also reached an agreement with such insurers, effective the same day, addressing asbestos-related bodily injury claims arising from the Products. On October 16, 2012, the Court entered Orders dismissing all claims filed by the Corporation and Air & Liquid, Howden and the eight settling excess insurers against each other in the litigation. Various counterclaims, cross claims and third party claims have been filed in the litigation and remain pending as to non-settled parties.

Asbestos Valuations

In 2006, the Corporation retained Hamilton, Rabinovitz & Associates, Inc. (“HR&A”), a nationally recognized expert in the valuation of asbestos liabilities, to assist the Corporation in estimating the potential liability for pending and unasserted future claims for Asbestos Liability. HR&A was not requested to estimate asbestos claims against the inactive subsidiary in dissolution, which the Corporation believes are immaterial. Based on this analysis, the Corporation recorded a reserve for Asbestos Liability claims pending or projected to be asserted through 2013 as at December 31, 2006. HR&A’s analysis has been periodically updated since that time. Most recently, the HR&A analysis was updated in 2012, and additional reserves were established by the Corporation as at December 31, 2012 for Asbestos Liability claims pending or projected to be asserted through 2022. The methodology used by HR&A in its projection in 2012 of the operating subsidiaries’ liability for pending and unasserted potential future claims for Asbestos Liability, which is substantially the same as the methodology employed by HR&A in prior estimates, relied upon and included the following factors:

| • | HR&A’s interpretation of a widely accepted forecast of the population likely to have been exposed to asbestos; |

| • | epidemiological studies estimating the number of people likely to develop asbestos-related diseases; |

| • | HR&A’s analysis of the number of people likely to file an asbestos-related injury claim against the subsidiaries and the Corporation based on such epidemiological data and relevant claims history from January 1, 2010 to December 20, 2012; |

| • | an analysis of pending cases, by type of injury claimed and jurisdiction where the claim is filed; |

| • | an analysis of claims resolution history from January 1, 2010 to December 20, 2012 to determine the average settlement value of claims, by type of injury claimed and jurisdiction of filing; and |

| • | an adjustment for inflation in the future average settlement value of claims, at an annual inflation rate based on the Congressional Budget Office’s ten year forecast of inflation. |

Using this information, HR&A estimated in 2012 the number of future claims for Asbestos Liability that would be filed through the year 2022, as well as the settlement or indemnity costs that would be incurred to resolve both pending and future unasserted claims through 2022. This methodology has been accepted by numerous courts.

In conjunction with developing the aggregate liability estimate referenced above, the Corporation also developed an estimate of probable insurance recoveries for its Asbestos Liabilities. In developing the estimate, the Corporation considered HR&A’s projection for settlement or indemnity costs for Asbestos Liability and management’s projection of associated defense costs (based on the current defense to indemnity cost ratio), as well as a number of additional factors. These additional factors included the Settlement Agreements then in effect, policy exclusions, policy limits, policy provisions regarding coverage for defense costs, attachment points, prior impairment of policies and gaps in the coverage, policy exhaustions, insolvencies among certain of the insurance carriers, the nature of the underlying claims for Asbestos Liability asserted against the subsidiaries and the Corporation as reflected in the Corporation’s asbestos claims database, and the status of negotiations with insurers not party to the Settlement Agreements, as well as estimated erosion of insurance limits on account of claims against Howden arising out of the Products. In addition to consulting with the Corporation’s outside legal counsel on these insurance matters, the Corporation consulted with a nationally-recognized insurance consulting firm it retained to assist the Corporation with certain policy allocation matters that also are among the several factors considered by the Corporation when analyzing potential recoveries from relevant historical insurance for Asbestos Liabilities. Based upon all of the factors considered by the Corporation, and taking into account the Corporation’s analysis of publicly available information regarding the credit-worthiness of various insurers, the Corporation estimated the probable insurance recoveries for Asbestos Liability and defense costs through 2022. Although the Corporation believes that the assumptions employed in the insurance valuation were reasonable and previously consulted with its outside legal counsel and insurance consultant regarding those assumptions, there are other assumptions that could have been employed that would have resulted in materially lower insurance recovery projections.

| ampco pittsburgh | 2012 annual report | 12 |

Based on the analyses described above, the Corporation’s reserve at December 31, 2012 for the total costs, including defense costs, for Asbestos Liability claims pending or projected to be asserted through 2022 was $181 million, of which approximately 73% was attributable to settlement costs for unasserted claims projected to be filed through 2022 and future defense costs. While it is reasonably possible that the Corporation will incur additional charges for Asbestos Liability and defense costs in excess of the amounts currently reserved, the Corporation believes that there is too much uncertainty to provide for reasonable estimation of the number of future claims, the nature of such claims and the cost to resolve them beyond 2022. Accordingly, no reserve has been recorded for any costs that may be incurred after 2022.

The Corporation’s receivable at December 31, 2012 for insurance recoveries attributable to the claims for which the Corporation’s Asbestos Liability reserve has been established, including the portion of incurred defense costs covered by the Settlement Agreements in effect through December 31, 2012, and the probable payments and reimbursements relating to the estimated indemnity and defense costs for pending and unasserted future Asbestos Liability claims, was $118 million. The insurance receivable recorded by the Corporation does not assume any recovery from insolvent carriers, and a substantial majority of the insurance recoveries deemed probable was from insurance companies rated A – (excellent) or better by A.M. Best Corporation. There can be no assurance, however, that there will not be further insolvencies among the relevant insurance carriers, or that the assumed percentage recoveries for certain carriers will prove correct. The difference between insurance recoveries and projected costs is not due to exhaustion of all insurance coverage for Asbestos Liability. The Corporation and the subsidiaries have substantial additional insurance coverage which the Corporation expects to be available for Asbestos Liability claims and defense costs the subsidiaries and it may incur after 2022. However, this insurance coverage also can be expected to have gaps creating significant shortfalls of insurance recoveries as against claims expense, which could be material in future years.

The amounts recorded by the Corporation for Asbestos Liabilities and insurance receivables rely on assumptions that are based on currently known facts and strategy. The Corporation’s actual expenses or insurance recoveries could be significantly higher or lower than those recorded if assumptions used in the Corporation’s or HR&A’s calculations vary significantly from actual results. Key variables in these assumptions are identified above and include the number and type of new claims to be filed each year, the average cost of disposing of each such new claim, average annual defense costs, the resolution of coverage issues with insurance carriers, and the solvency risk with respect to the relevant insurance carriers. Other factors that may affect the Corporation’s Asbestos Liability and ability to recover under its insurance policies include uncertainties surrounding the litigation process from jurisdiction to jurisdiction and from case to case, reforms that may be made by state and federal courts, and the passage of state or federal tort reform legislation.

The Corporation intends to evaluate its estimated Asbestos Liability and related insurance receivables as well as the underlying assumptions on a regular basis to determine whether any adjustments to the estimates are required. Due to the uncertainties surrounding asbestos litigation and insurance, these regular reviews may result in the Corporation incurring future charges; however, the Corporation is currently unable to estimate such future charges. Adjustments, if any, to the Corporation’s estimate of its recorded Asbestos Liability and/or insurance receivables could be material to operating results for the periods in which the adjustments to the liability or receivable are recorded, and to the Corporation’s liquidity and consolidated financial position.

ENVIRONMENTAL

The Corporation is currently performing certain remedial actions in connection with the sale of real estate previously owned.

| 13 | ampco pittsburgh | 2012 annual report |

– PART II –

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The shares of common stock of Ampco-Pittsburgh Corporation are traded on the New York Stock Exchange (symbol AP). Cash dividends have been paid on common shares in every year since 1965.

| 2012 Per Share | 2011 Per Share | |||||||||||||||||

|

Common Stock Price |

Common Stock Price |

|||||||||||||||||

| Quarter | High | Low | Dividends Declared |

High | Low | Dividends Declared | ||||||||||||

| First |

$ 23.71 | $ 19.30 | $ 0.18 | $ 28.55 | $ 23.50 | $ 0.18 | ||||||||||||

| Second |

20.22 | 15.20 | 0.18 | 27.81 | 21.96 | 0.18 | ||||||||||||

| Third |

19.86 | 15.65 | 0.18 | 27.73 | 17.77 | 0.18 | ||||||||||||

| Fourth |

19.90 | 16.14 | 0.18 | 23.78 | 16.45 | 0.18 | ||||||||||||

| Year |

23.71 | 15.20 | 0.72 | 28.55 | 16.45 | 0.72 | ||||||||||||

The number of shareholders at December 31, 2012 and 2011 equaled 454 and 487, respectively.

| ampco pittsburgh | 2012 annual report | 14 |

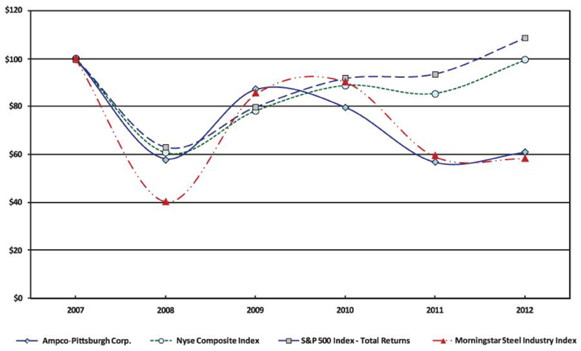

STOCK PERFORMANCE GRAPH

Comparison of FiveYear Cumulative Total Return

Standard & Poors 500, NYSE Composite and Morningstar’s Steel Industry

(Performance results through December 31, 2012)

Assumes $100 invested at the close of trading on the last trading day preceding January 1, 2007 in Ampco-Pittsburgh Corporation common stock, Standard & Poors 500 Index, NYSE Composite Index and Morningstar’s Steel Industry group.

*Cumulative total return assumes reinvestment of dividends.

In the above graph, the Corporation has used Morningstar’s Steel Industry group for its peer comparison. The diversity of products produced by subsidiaries of the Corporation made it difficult to match to any one product-based peer group. Although not totally comparable, the Steel Industry group was chosen because the largest percentage of the Corporation’s sales is to the global steel industry.

Historical stock price performance shown on the above graph is not necessarily indicative of future price performance.

| 15 | ampco pittsburgh | 2012 annual report |

ITEM 6. SELECTED FINANCIAL DATA

| Year Ended December 31, | ||||||||||||||||||||

| (dollars, except per share amounts, and shares outstanding in thousands) |

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

| Net sales |

$ 292,905 | $ 344,816 | $ 326,886 | $ 299,177 | $ 394,513 | |||||||||||||||

| Net income(1) |

8,355 | 21,309 | 15,456 | 27,677 | 12,575 | |||||||||||||||

| Total assets |

533,179 | 531,632 | 526,963 | 471,825 | 488,981 | |||||||||||||||

| Shareholders’ equity |

192,093 | 192,872 | 196,777 | 179,202 | 144,987 | |||||||||||||||

| Net income per common share: |

||||||||||||||||||||

|

Basic(1) |

0.81 | 2.07 | 1.51 | 2.71 | 1.24 | |||||||||||||||

| Diluted |

0.80 | 2.05 | 1.50 | 2.71 | 1.24 | |||||||||||||||

| Per common share: |

||||||||||||||||||||

| Cash dividends declared |

0.72 | 0.72 | 0.72 | 0.72 | 0.72 | |||||||||||||||

| Shareholders’ equity |

18.57 | 18.68 | 19.10 | 17.49 | 14.25 | |||||||||||||||

| Market price at year end |

19.98 | 19.34 | 28.05 | 31.53 | 21.70 | |||||||||||||||

| Weighted average common shares outstanding |

10,338 | 10,319 | 10,254 | 10,200 | 10,177 | |||||||||||||||

| Number of shareholders |

454 | 487 | 507 | 545 | 566 | |||||||||||||||

| Number of employees |

1,178 | 1,240 | 1,264 | 1,231 | 1,306 | |||||||||||||||

| (1) | Net income includes: |

2010 – An after-tax charge of $12,931 or $1.26 per common share for estimated costs of asbestos-related litigation through 2020 net of estimated insurance recoveries (see Note 17 to Consolidated Financial Statements).

2009 – An after-tax charge of $2,831 or $0.28 per common share associated with the write-off of goodwill deemed to be impaired at one of the divisions of the Air and Liquid Processing segment and a reduction in the effective state income tax rate for which certain net deferred income tax assets will be realized.

2008 – An after-tax charge of $31,006 for estimated costs of asbestos-related litigation through 2018 net of estimated insurance recoveries (see Note 17 to Consolidated Financial Statements) offset by the release of $411 of tax-related valuation allowances associated with capital loss carryforwards for a net decrease to net income of $30,595 or $3.01 per common share.

| ampco pittsburgh | 2012 annual report | 16 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(in thousands, except per share amounts)

EXECUTIVE OVERVIEW

Ampco-Pittsburgh Corporation operates in two business segments – the Forged and Cast Rolls segment and the Air and Liquid Processing segment. The Forged and Cast Rolls segment consists of Union Electric Steel Corporation (“Union Electric Steel” or “UES”) and Union Electric Steel UK Limited (“UES-UK”). Union Electric Steel is one of the world’s largest manufacturers of forged hardened steel rolls with principal operations in Pennsylvania and Indiana whereas UES-UK produces cast iron and steel rolls in England. Rolls are supplied to manufacturers of steel and aluminum throughout the world. The Air and Liquid Processing segment includes Aerofin, Buffalo Air Handling and Buffalo Pumps, all divisions of Air & Liquid Systems Corporation, a wholly-owned subsidiary of the Corporation. Aerofin produces custom-engineered finned tube heat exchange coils and related heat transfer products for a variety of industries including fossil fuel and nuclear power generation, automotive, industrial process and HVAC. Buffalo Air Handling makes custom-designed air handling systems for commercial, institutional and industrial building markets. Buffalo Pumps manufactures centrifugal pumps for the defense, refrigeration and power generation industries. The segment has operations in Virginia and New York with headquarters in Pennsylvania. The segment distributes a significant portion of its products through a common independent group of sales offices located throughout the U.S. and Canada.

In 2012, the Forged and Cast Rolls group was adversely affected by stagnant demand worldwide and competitive pricing. Order backlog and profit in backlog also eroded as the year progressed. Lower production levels of our customers in Europe, excess roll inventories in Asia, particularly China, and the emergence of indigenous roll supply in China, South Korea and India each contributed to the falloff in demand. Price discounting has been necessary to obtain business and protect market share. For 2013, demand for rolling mill rolls is expected to recover modestly. Roll requirements by our customers in North America are anticipated to improve slightly as a result of a stronger automotive industry and a timid but positive housing market. New mill projects in Asia will partially offset the effects of excess roll inventories and competitive pricing pressures in that region. European sales, however, will remain generally weak as steel producers continue to rationalize capacity. Additionally, competitive pricing pressures will likely continue as most roll producers are expected to operate below capacity. Fluctuation in the strength of the Euro, as compared to the U.S. dollar and British pound, could result in diminished volumes and reduced margins for exports.

Union Electric Steel MG Roll Co., Ltd (“UES-MG”), the Chinese joint venture company in which a subsidiary of UES holds a 49% interest, principally manufactures and sells high quality forged hardened steel backup rolls of a size and weight not within UES’s capacity. This is a start-up business which began limited production at the end of 2010 and has been adversely impacted by the global economic slowdown and reduced demand as a result of the excess roll inventories of potential steel industry customers, particularly in China, including our steel company partner which has been unable to purchase the anticipated quantity of rolls. Contractually, the partner will acquire a significant portion of UES-MG capacity when inventories are depleted which is not expected for at least two years. Consequently, in 2012, the joint venture incurred an operating loss and an operating loss is expected for 2013. Losses to date and expected in 2013 are largely the result of non-cash expenses. Whilst not contemplated at this time, if conditions deteriorate or other impairment indicators arise, our future earnings could be adversely affected by an impairment charge.

For the Air and Liquid Processing segment, a strong level of orders during the first half of 2012 from most markets served provided for a steady and profitable workflow throughout the year. Orders slowed in the second half of the year due to a reduction in spending by the institutional markets and for new ships by the U.S. Navy. As a result of the slower second half of the year, backlog at the beginning of 2013 is approximately 10% below that of the past two years. Our ongoing focus for this segment is developing new product lines and improving related distribution networks for the sale of such.

| 17 | ampco pittsburgh | 2012 annual report |

CONSOLIDATED RESULTS OF OPERATIONS OVERVIEW

The Corporation

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| Net Sales: |

||||||||||||||||||||||||

| Forged and Cast Rolls |

$ | 189,470 | 65% | $ | 248,380 | 72% | $ | 240,345 | 74% | |||||||||||||||

| Air and Liquid Processing |

103,435 | 35% | 96,436 | 28% | 86,541 | 26% | ||||||||||||||||||

| Consolidated |

$ | 292,905 | 100% | $ | 344,816 | 100% | $ | 326,886 | 100% | |||||||||||||||

| Income (Loss) from Operations: |

||||||||||||||||||||||||

| Forged and Cast Rolls |

$ | 18,415 | $ | 38,761 | $ | 48,674 | ||||||||||||||||||

| Air and Liquid Processing(1) |

7,267 | 8,155 | (12,605) | |||||||||||||||||||||

| Corporate costs |

(9,390) | (10,442) | (11,342) | |||||||||||||||||||||

| Consolidated |

$ | 16,292 | $ | 36,474 | $ | 24,727 | ||||||||||||||||||

| Backlog: |

||||||||||||||||||||||||

| Forged and Cast Rolls |

$ | 154,527 | 79% | $ | 214,449 | 82% | $ | 350,978 | 88% | |||||||||||||||

| Air and Liquid Processing |

41,277 | 21% | 45,552 | 18% | 46,052 | 12% | ||||||||||||||||||

| Consolidated |

$ | 195,804 | 100% | $ | 260,001 | 100% | $ | 397,030 | 100% | |||||||||||||||

| (1) | Income (loss) from operations for the Air and Liquid Processing segment for 2010 includes a pre-tax charge of $19,980 for estimated costs of asbestos-related litigation net of estimated insurance recoveries (see Note 17 to Consolidated Financial Statements). |

Consolidated net sales for 2012 declined when compared to 2011 and 2010 due to a lower demand and depressed pricing for the Forged and Cast Rolls segment while net sales for each of the divisions of the Air and Liquid Processing segment improved. Consolidated income from operations for 2012 deteriorated when compared to 2011 and 2010 (which included a pre-tax charge of $19,980 for asbestos-related costs). A lower volume of shipments, weaker pricing, reduced margins and differences in product mix contributed to the shortfall. A more detailed review by segment is included below. The variance in corporate costs between the years is primarily attributable to lower stock-based compensation costs.

Gross margin, excluding depreciation, as a percentage of net sales, was 22.9%, 25.7%, and 29.8% for 2012, 2011 and 2010, respectively. The ongoing decrease is attributable to price discounting necessary to remain competitive and higher raw material costs as a percentage of sales and increasing employee benefit expenses.

Selling and administrative expenses totaled $40,530 (13.8% of net sales), $41,887 (12.1% of net sales) and $44,168 (13.5% of net sales) for 2012, 2011 and 2010, respectively. The decrease in 2012 from 2011 and in 2011 from 2010 is primarily due to lower stock-based compensation costs of $696 and $1,313, respectively, and a decrease in commission expense of $2,283 and $1,442, respectively, for the Forged and Cast Rolls group related to the reduction in sales.

The increase in depreciation expense over the years is attributable to completion of a significant capital investment program for the Forged and Cast Rolls group in mid-2010 and subsequent acquisitions. Depreciation expense includes a partial year of depreciation when assets are placed in service and a full year of depreciation thereafter.

The (credit) charge for asbestos litigation in 2012 includes a pre-tax credit of $540 representing an adjustment to previously-provided charges for asbestos-related litigation net of estimated insurance recoveries and 2010 includes a pre-tax charge of $19,980 for estimated costs of asbestos-related litigation net of estimated insurance recoveries. The claims result from alleged personal injury from exposure to asbestos-containing components historically used in some products manufactured by certain of our former subsidiary companies (now operated as divisions of the Air and Liquid Processing segment). See Note 17 to the Consolidated Financial Statements.

Investment-related income for 2010 includes a dividend from our Chinese cast roll joint venture of $1,084. No dividend was declared or received in 2012 or 2011.

Other income (expense) fluctuated primarily as a result of changes in foreign exchange gains and losses and charges related to operations discontinued years ago. Gains (losses) on foreign exchange transactions approximated $107, $(371) and $655 for 2012, 2011 and 2010, respectively, and charges related to operations discontinued years ago equaled $(1,054), $(1,219) and $(1,631), respectively.

| ampco pittsburgh | 2012 annual report | 18 |

Our statutory income tax rate equals 35% which compares to an effective income tax rate of 34.4%, 37.2% and 35.3% for 2012, 2011 and 2010, respectively. The effective income tax rate for 2011 was adversely impacted by the revaluation of net deferred income tax assets associated with a reduction in the statutory income tax rate for the U.K. operation and adjustments to deferred income tax assets, partially offset by benefits associated with changes in uncertain tax positions.

Equity losses in the Chinese joint venture represent Union Electric Steel’s share (49%) of the losses of UES-MG (see Note 2 to Consolidated Financial Statements). Since production by the joint venture has been limited, as explained in the Executive Overview, operating losses have been incurred and are expected for 2013. While losses to date are largely the result of non-cash expenses, if conditions deteriorate or other impairment indicators arise, future earnings may be adversely affected by an impairment charge.

As a result of the above, we earned $8,355 or $0.81 per common share for 2012, $21,309 or $2.07 per common share for 2011, and $15,456 or $1.51 per common share for 2010. Net income for 2010 includes an after-tax charge of $12,931 or $1.26 per common share for estimated costs of asbestos-related litigation through 2020 net of estimated insurance recoveries. See Note 17 to Consolidated Financial Statements.

Forged and Cast Rolls

| 2012 | 2011 | 2010 | ||||||||||

| Net sales |

$ | 189,470 | $ | 248,380 | $ | 240,345 | ||||||

| Operating income |

$ | 18,415 | $ | 38,761 | $ | 48,674 | ||||||

| Backlog |

$ | 154,527 | $ | 214,449 | $ | 350,978 | ||||||

For 2012, the decrease in net sales from 2011 is due to a reduction in the level of shipments and selling prices which adversely affected operating results by approximately $12,500 and $9,000, respectively. Lower freight and commission expense offset the impact to operating income. For 2011, the increase in net sales from 2010 is attributable to a higher level of sales from our cast roll operations. The additional volume added approximately $2,606 of operating income. Increases in the cost of raw materials, fuels and employee-related expenses of approximately $12,900 adversely affected operating income in 2011 when compared to 2010.

The decrease in backlog is a reflective of weak demand resulting in shipments outpacing new orders. Additionally, profitability in backlog has deteriorated over the years. As of December 31, 2012, approximately $32,315 of the backlog is expected to be released after 2013.

Air and Liquid Processing

| 2012 | 2011 | 2010 | ||||||||||

| Net sales |

$ | 103,435 | $ | 96,436 | $ | 86,541 | ||||||

| Operating income (loss) |

$ | 7,267 | $ | 8,155 | $ | (12,605 | ) | |||||

| Backlog |

$ | 41,277 | $ | 45,552 | $ | 46,052 | ||||||

Although sales for the segment improved in the current year against the prior two years, operating income decreased when compared to 2011 but improved when compared to 2010. For 2012, operating income (loss) includes a credit of $540 representing an adjustment to previously-provided charges for asbestos-related litigation net of estimated insurance recoveries. For 2010, operating income (loss) includes a charge of $19,980 for asbestos litigation relating to claims resulting from alleged personal injury from exposure to asbestos-containing components historically used in some products (see Note 17 to Consolidated Financial Statements). In addition, operating income (loss) includes uninsured legal and case management and valuation costs associated with asbestos litigation of approximately $1,737, $918 and $173 for 2012, 2011 and 2010, respectively.

For Aerofin, sales and operating income benefited from a higher volume of coil shipments to customers in the nuclear power generation market; such shipments having a better profit margin. When compared to 2010, sales and operating income improved in the current year as a result of a higher volume of shipments to the nuclear power generation and general industrial markets. For Buffalo Pumps, although sales increased from additional business activity with its power generation customers, operating income was unfavorably impacted by lower margins on certain projects for U.S. Navy shipbuilders. For Buffalo Air Handling, in 2010, the division received a large order for a customer in medical research. Portions of the order shipped in 2012 and 2011 thereby improving sales and operating results.

Backlog for Aerofin at December 31, 2012 continued to improve when compared to the previous two years due to additional orders for replacement coils for customers in the power generation market. Backlog for Buffalo Pumps was comparable at

| 19 | ampco pittsburgh | 2012 annual report |

December 31, 2012 and 2010; a higher level of orders for power generation customers increased its backlog at the end of 2011. Backlog for Buffalo Air Handling declined against the prior years which included a large order for a customer in medical research. The order has completely shipped as of December 31, 2012. The majority of the year-end backlog is scheduled to ship in 2013.

LIQUIDITY AND CAPITAL RESOURCES

Net cash flows provided by operating activities for 2012 equaled $25,444 compared to $22,287 and $42,951 for 2011 and 2010, respectively. While the credit for asbestos litigation recorded in 2012 improved earnings and the charge for asbestos litigation recorded in 2010 reduced earnings, they did not affect cash flows by those amounts. Instead, the asbestos liability, net of insurance recoveries, will be paid over a number of years and will generate tax benefits. Net asbestos-related payments equaled $7,932, $5,061 and $5,129 in 2012, 2011 and 2010, respectively, and are expected to approximate $5,100 in 2013. Contributions to our pension and other postretirement plans approximated $2,500 in 2012, $9,400 in 2011 (of which $7,000 were voluntary contributions) and $7,100 in 2010 (of which $5,000 were voluntary contributions). In 2012, Moving Ahead for Progress in the 21st Century (“MAP-21”) was signed into law. MAP-21 reduces funding requirements for single-employer defined benefit plans. As a result, no minimum contributions are expected for 2013; however, voluntarily contributions may be made.

Net cash flows used in investing activities were $9,369, $15,372 and $33,163 in 2012, 2011 and 2010, respectively, the majority of which represents capital expenditures for the Forged and Cast Rolls group. In 2010, UES-UK was awarded a government grant of up to $1,325 (£850) toward the purchase and installation of certain machinery and equipment of which $1,083 (£680) has been received. As of December 31, 2012, anticipated future capital expenditures are expected to approximate $8,797, the majority of which will be spent in 2013. Additionally, money is held in escrow which serves as collateral for the outstanding foreign currency sales contracts of UES-UK. A portion of this money was returned in 2010 in connection with diminishing exposure and no further deposits have been required to date.

Net cash outflows from financing activities represent primarily the payment of dividends of $0.72 per common share during each of the years. Additionally, stock options were exercised each year resulting in proceeds from the issuance of common stock and excess tax benefits.

The effect of exchange rate changes on cash and cash equivalents is primarily attributable to the fluctuation of the British pound against the U.S. dollar.

As a result of the above, cash and cash equivalents increased by $9,001 in 2012 and ended the year at $78,889 (of which approximately $8,600 is held by foreign operations) in comparison to $69,888 and $70,021 at December 31, 2011 and 2010, respectively. Repatriation of foreign funds may result in the Corporation accruing and paying additional income tax; however, the majority of foreign funds is currently deemed to be permanently reinvested and no additional provision for income tax has been made. Funds on hand and funds generated from future operations are expected to be sufficient to finance our operational and capital expenditure requirements. We also maintain short-term lines of credit in excess of the cash needs of our businesses. The total available at December 31, 2012 was approximately $9,400 (including £3,000 in the U.K. and €400 in Belgium).

| ampco pittsburgh | 2012 annual report | 20 |

We had the following contractual obligations outstanding as of December 31, 2012:

| Payments Due by Period | ||||||||||||||||||||||||

| Total | <1 year | 1–3 years | 3–5 years | >5 years | Other | |||||||||||||||||||

| Industrial Revenue Bond Debt(1) |

$ | 13,311 | $ | 0 | $ | 0 | $ | 0 | $ | 13,311 | $ | 0 | ||||||||||||

| Operating Lease Obligations |

2,454 | 997 | 1,284 | 156 | 17 | 0 | ||||||||||||||||||

| Capital Expenditures |

8,797 | 8,797 | 0 | 0 | 0 | 0 | ||||||||||||||||||

| Pension and Other Postretirement |

||||||||||||||||||||||||

| Benefit Obligations(2) |

66,509 | 2,614 | 20,577 | 23,790 | 19,528 | 0 | ||||||||||||||||||

| Purchase Obligations(3) |

9,371 | 4,481 | 4,890 | 0 | 0 | 0 | ||||||||||||||||||

| Unrecognized Tax Benefits(4) |

442 | 152 | 0 | 0 | 0 | 290 | ||||||||||||||||||

| Total |

$ | 100,884 | $ | 17,041 | $ | 26,751 | $ | 23,946 | $ | 32,856 | $ | 290 | ||||||||||||

| (1) | Represents principal only. Interest is not included since it is variable; interest rates averaged less than 1% in the current year. The Industrial Revenue Bonds begin to mature in 2020; however, if the bonds are unable to be remarketed they will be refinanced under a separate facility. See Note 6 to Consolidated Financial Statements. |

| (2) | Represents estimated contributions to our pension and other postretirement plans. Actual required contributions are contingent on a number of variables including future investment performance of the plans’ assets and may differ from these estimates. See Note 7 to Consolidated Financial Statements. Contributions to the U.S. defined benefit plan are based on the projected funded status of the plan including anticipated normal costs, amortization of unfunded liabilities and an 8% expected return on plan assets. With respect to the U.K. defined benefit plan, the Trustees and UES-UK have agreed to a recovery plan that estimates the amount of employer contributions, based on U.K. regulations, necessary to eliminate the funding deficit of the plan over an agreed period. |

| (3) | Represents primarily commitments by one of our Forged and Cast Rolls subsidiaries for the purchase of natural gas through 2015 covering approximately 46% of anticipated needs to meet orders in backlog. See Note 11 to Consolidated Financial Statements. |

| (4) | Represents uncertain tax positions. Amount included as “Other” represents portion for which the period of cash settlement cannot be reasonably estimated. See Note 13 to Consolidated Financial Statements. |

With respect to environmental matters, we are currently performing certain remedial actions in connection with the sale of real estate previously owned. Environmental exposures are difficult to assess and estimate for numerous reasons including lack of reliable data, the multiplicity of possible solutions, the years of remedial and monitoring activity required and the identification of new sites. However, we believe the potential liability for all environmental proceedings of approximately $1,174 accrued at December 31, 2012 is considered adequate based on information known to date (see Note 18 to Consolidated Financial Statements).

The nature and scope of our business brings us into regular contact with a variety of persons, businesses and government agencies in the ordinary course of business. Consequently, we and certain of our subsidiaries from time to time are named in various legal actions. Generally, we do not anticipate that our financial condition or liquidity will be materially affected by the costs of known, pending or threatened litigation. However, claims have been asserted alleging personal injury from exposure to asbestos-containing components historically used in some products and there can be no assurance that future claims will not present significantly greater and longer lasting financial exposure than presently contemplated (see Note 17 to Consolidated Financial Statements).

OFF-BALANCE SHEET ARRANGEMENTS

Our off-balance sheet arrangements include the operating lease, capital expenditures and purchase obligations disclosed in the contractual obligations table and the letters of credit unrelated to the Industrial Revenue Bonds as discussed in Note 8 to the Consolidated Financial Statements.

EFFECTS OF INFLATION

While inflationary and market pressures on costs are likely to be experienced, it is anticipated that ongoing improvements in manufacturing efficiencies and cost savings efforts will mitigate the effects of inflation on 2013 operating results. The ability to pass on increases in the price of commodities to the customer is contingent upon current market conditions with us potentially having to absorb some portion of such increase. Product pricing for the Forged and Cast Rolls segment is reflective of current costs with a majority of orders subject to a variable-index surcharge program which helps to protect the segment and its customers against the volatility in the cost of certain raw materials. Long-term labor agreements exist at each of the key locations (see Note 8 to Consolidated Financial Statements). Additionally, commitments have been executed for natural gas usage and for certain commodities (copper and aluminum) to cover a portion of orders in the backlog (see Note 11 to Consolidated Financial Statements).

| 21 | ampco pittsburgh | 2012 annual report |

APPLICATION OF CRITICAL ACCOUNTING POLICIES

We have identified critical accounting policies that are important to the presentation of our financial condition, changes in financial condition and results of operations and involve the most complex or subjective assessments. Critical accounting policies relate to accounting for pension and other postretirement benefits, assessing recoverability of long-lived assets, litigation, income taxes and stock-based compensation.

Accounting for pension and other postretirement benefits involves estimating the cost of benefits to be provided well into the future and attributing that cost over the time period each employee works. To accomplish this, input from our actuary is evaluated and extensive use is made of assumptions about inflation, long-term rate of return on plan assets, mortality, rates of increases in compensation, employee turnover and discount rates.

The expected long-term rate of return on plan assets is an estimate of average rates of earnings expected to be earned on funds invested or to be invested to provide for the benefits included in the projected benefit obligation. Since these benefits will be paid over many years, the expected long-term rate of return is reflective of current investment returns and investment returns over a longer period. Also, consideration is given to target and actual asset allocations, inflation and real risk-free return. We believe the expected long-term rate of return of 8% for our domestic plan and 5.61% for our foreign plan to be reasonable. Actual returns on plan assets for 2012 and 2011, respectively, approximated 10.98% and (1.90)% for our domestic plan and 9.61% and 2.80% for our foreign plan.

The discount rates used in determining future pension obligations and other postretirement benefits for each of our plans are based on rates of return on high-quality fixed-income investments currently available and expected to be available during the period to maturity of the pension and other postretirement benefits. High-quality fixed-income investments are defined as those investments which have received one of the two highest ratings given by a recognized rating agency with maturities of 10+ years. We believe the assumed discount rates of 4.25% and 4.50% as of December 31, 2012 for our domestic and foreign plans, respectively, to be reasonable.

We believe that the amounts recorded in the accompanying consolidated financial statements related to pension and other postretirement benefits are based on appropriate assumptions although actual outcomes could differ. A percentage point decrease in the expected long-term rate of return would increase annual pension expense by approximately $1,600. A 1/4 percentage point decrease in the discount rate would increase projected and accumulated benefit obligations by approximately $8,000. Conversely, an increase in the expected long-term rate of return would decrease annual pension expense and an increase in the discount rate would decrease projected and accumulated benefit obligations (see Note 7 to Consolidated Financial Statements).

Property, plant and equipment are reviewed for recoverability whenever events or circumstances indicate the carrying amount of the long-lived assets may not be recoverable. If the undiscounted cash flows generated from the use and eventual disposition of the assets are less than their carrying value, then the asset value may not be fully recoverable potentially resulting in a write-down of the asset value. Estimates of future cash flows are based on expected market conditions over the remaining useful life of the primary asset(s). Accordingly, assumptions are made about pricing, volume and asset-resale values. Actual results may differ from these assumptions. We believe the amounts recorded in the accompanying consolidated financial statements for property, plant and equipment are recoverable and are not impaired as of December 31, 2012.

Litigation and loss contingency accruals are made when it is determined that it is probable that a liability has been incurred and the amount can be reasonably estimated. Specifically, we and certain of our subsidiaries are involved in various claims and lawsuits incidental to their businesses. In addition, claims have been asserted alleging personal injury from exposure to asbestos-containing components historically used in some products manufactured by certain of our former subsidiary companies (now operated as divisions of Air & Liquid) and of an inactive subsidiary in dissolution. To assist us in determining whether an estimate could be made of the potential liability for pending and unasserted future claims for Asbestos Liability along with applicable insurance coverage, and the amounts of any estimates, we hired a nationally-recognized asbestos-liability expert and insurance consultants. The asbestos-liability expert was not requested to estimate asbestos claims against the inactive subsidiary in dissolution, which we believe are immaterial. Based on their analyses, reserves for probable and reasonably estimable costs of Asbestos Liabilities including defense costs and receivables for the insurance recoveries that are deemed probable have been established. These amounts relied on assumptions which were based on currently known facts and strategy.

In 2012, we undertook another review of our Asbestos Liability claims, defense costs and the likelihood for insurance recoveries. Key variables in these assumptions are summarized in Note 17 to the Consolidated Financial Statements and include the number and type of new claims to be filed each year, the average cost of disposing of each new claim, average

| ampco pittsburgh | 2012 annual report | 22 |

annual defense costs, the resolution of coverage issues with insurance carriers, and the solvency risk with respect to the relevant insurance carriers. Other factors that may affect our Asbestos Liability and ability to recover under our insurance policies include uncertainties surrounding the litigation process from jurisdiction to jurisdiction and from case to case, reforms that may be made by state and federal courts, and the passage of state or federal tort reform legislation. Actual expenses or insurance recoveries could be significantly higher or lower than those recorded if assumptions used in the calculations vary significantly from actual results.

We intend to evaluate our estimated Asbestos Liability and related insurance receivables as well as the underlying assumptions on a regular basis to determine whether any adjustments to the estimates are required. Due to the uncertainties surrounding asbestos litigation and insurance, these regular reviews may result in the incurrence of future charges; however, we are currently unable to estimate such future charges. Adjustments, if any, to our estimate of our recorded Asbestos Liability and/or insurance receivables could be material to the operating results for the periods in which the adjustments to the liability or receivable are recorded, and to our liquidity and consolidated financial position.

Accounting for income taxes includes management’s evaluation of the underlying accounts, permanent and temporary differences, our tax filing positions and interpretations of existing tax law. A valuation allowance is recorded against deferred income tax assets to reduce them to the amount that is “more likely than not” to be realized. In doing so, assumptions are made about the future profitability of our operations and the nature of that profitability. Actual results may differ from these assumptions. If we determined we would not be able to realize all or part of the deferred income tax assets in the future, an adjustment to the valuation allowance would be established resulting in a charge to net income. Likewise, if we determined we would be able to realize deferred income tax assets in excess of the net amount recorded, we would release a portion of the existing valuation allowance resulting in an increase in net income. As of December 31, 2012, we have deferred income tax assets approximating $69,235 and a valuation allowance of $2,887.

We do not recognize a tax benefit in the financial statements related to a tax position taken or expected to be taken in a tax return unless it is “more likely than not” that the tax authorities will sustain the tax position solely on the basis of the position’s technical merits. Consideration is given primarily to legislation and statutes, legislative intent, regulations, rulings and case law as well as their applicability to the facts and circumstances of the tax position when assessing the sustainability of the tax position. In the event a tax position no longer meets the “more likely than not” criteria, we would reverse the tax benefit by recognizing a liability and recording a charge to earnings. Conversely, if we subsequently determined that a tax position meets the “more likely than not” criteria, we would recognize the tax benefit by reducing the liability and recording a credit to earnings. As of December 31, 2012, based on information known to date, we believe the amount of unrecognized tax benefits of $442 for tax positions taken or expected to be taken in a tax return which may be challenged by the tax authorities is adequate.

See Note 13 to the Consolidated Financial Statements.

Accounting for stock-based compensation is based on the fair value of the stock options on the date of grant. The fair value is affected by our stock price and various assumptions including assumptions about the expected term of the options, volatility, dividends and the risk-free interest rate. If the fair value of granted stock options was re-determined, on a date other than the date of grant, the resulting fair value would differ. Accordingly, the fair value of stock options granted to date is not indicative of the fair value of stock options to be granted in the future (see Note 9 to Consolidated Financial Statements).

RECENTLY IMPLEMENTED ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued ASU 2011-04, Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. ASU 2011-04 was effective for us beginning in 2012. The guidance primarily changes the wording used to describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements. It does not change the application of existing accounting principles and, accordingly, did not impact our operating results, financial position or liquidity.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income, which eliminates the option to present other comprehensive income and its components as part of the statement of shareholders’ equity. All non-owner changes in shareholders’ equity are presented either in a single continuous statement along with net income or in a separate statement immediately following net income. ASU 2011-05 was effective for us beginning in 2012. The guidance did not change whether items are reported in net income or other comprehensive income or when items in other comprehensive income are reclassified to net income; accordingly, ASU 2011-05 did not impact our operating results, financial position or liquidity. We elected to present other comprehensive income and its components as a separate statement immediately following our consolidated statements of operations.

| 23 | ampco pittsburgh | 2012 annual report |

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In February 2013, the FASB issued ASU 2013-02, Comprehensive Income: Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, which requires entities to report the effect of significant reclassifications out of accumulated other comprehensive income (loss) on the respective line items in net income if the amount being reclassified is required to be reclassified in its entirety to net income. Information may be reported either on the face of the income statement or in the footnotes to the financial statements. For other amounts that are not required to be reclassified in their entirety to net income in the same reporting period, an entity is required to cross-reference to other disclosures. The guidance is effective for reporting periods beginning after January 1, 2013 and is to be applied prospectively. The new guidance affects disclosures only. It does not change whether items are reported in net income or other comprehensive income or when items in other comprehensive income are reclassified to net income; accordingly, ASU 2013-02 will not impact our operating results, financial position or liquidity.

In December 2011, the FASB issued ASU 2011-11, Disclosures about Offsetting Assets and Liabilities, which requires expanded disclosures, including gross and net information, about financial and derivative instruments that are either offset in the balance sheet or are subject to an enforceable master netting arrangement or similar agreement. The guidance is effective for reporting periods beginning on or after January 1, 2013 and is to be applied retrospectively. The new guidance affects disclosures only and will not impact our operating results, financial position or liquidity.

FORWARD-LOOKING STATEMENTS