UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-00802 | |||||||

|

| ||||||||

|

Mairs and Power Growth Fund, Inc. | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

332 Minnesota Street, Suite W1520, St. Paul, MN |

|

55101 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

William B. Frels, President, 332 Minnesota Street, Suite W1520, St. Paul, MN 55101 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

651-222-8478 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

December 31, 2011 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

December 31, 2011 |

| ||||||

Item 1. Reports to Stockholders.

Mairs and Power

Growth Fund, Inc.

Annual Report

December 31, 2011

W1520 First National Bank Building

332 Minnesota Street

St. Paul, Minnesota 55101

TO OUR SHAREHOLDERS

February 8, 2012

Fourth Quarter Results

With the possibility of a "double dip" recession, together with various concerns regarding the European debt crises showing signs of diminishing, investor confidence returned to lead the stock market to a significant fourth quarter recovery. The Growth Fund fully participated in this turnaround, showing a total investment return of 13.5%, which compared favorably with fourth quarter returns of 12.8% for the Dow Jones Industrial Average and 11.8% for the benchmark Standard & Poor's 500 Index. A peer group universe of similar multi-cap core funds shown in the Wall Street Journal experienced a lesser 10.8% average return.

Recently reported fourth quarter Gross Domestic Product figures showed an improved 2.8% gain (preliminary basis) although inventory spending accounted for a significant portion of the gain. Consumer spending showed an encouraging 2.0% increase along with a 4.7% boost in exports. Government spending continued to be a drag on the economy, experiencing a 4.6% rate of decline. Inflation remained well contained with government figures showing only a modest 0.7% rise in a price index for personal consumption expenditures. Corporate profits continued to increase with a better than expected "high single digit" rate indicated by reported results for S&P 500 companies.

With inflation seemingly well under control, the Federal Reserve has continued to aggressively pursue a stimulative monetary policy in an attempt to "jump start" the economy. As a result, interest rates at both the short and long end of the rate curve have remained at historically low levels during the quarter. Moreover, credit spreads have also generally narrowed because of a shortage of new financing supply.

The strength in the stock market during the final quarter reflected a growing level of confidence in future earnings growth along with historically low interest rates and reasonable valuation levels. This combination of factors resulted in a willingness on the part of investors to take on more risk by buying issues more cyclical in nature as well as issues of more volatile small-cap companies. Conversely, the more stable, lower risk issues in sectors such as consumer staples, health care and utilities underperformed by comparison. Among individual holdings in the Fund, Stratasys (+64.0%), SurModics (+61.1%), MTS Systems (+33.0%), Fastenal (+31.0%) and H. B. Fuller (+26.8%) performed the best, while Baxter Int'l (-11.9%), NVE Corp. (-8.5%), St. Jude Medical (-5.2%), Zimmer Holdings (-0.1%) and Techne (+0.4%) fared the worst.

1

TO OUR SHAREHOLDERS (continued)

2011 in Review

Over the past year, the stock market was characterized by high volatility with alternating periods of both strength and weakness, depending on changing investor perceptions of the European financial crisis and its effect on the U. S. economy. The Growth Fund ended the year with a modestly positive investment return of 0.7% compared to higher returns of 8.4% for the DJIA and 2.1% for the benchmark S&P 500. However, the Fund performed somewhat better than most of its peers, as shown by an average negative return of -2.7% for a universe of comparable multi-cap core funds in the Wall Street Journal.

Even though the economy showed some pick-up in the fourth quarter, the year as a whole proved to be quite disappointing with only a 1.7% (preliminary basis) rate of growth. This represented a slippage from a 3.0% rate of growth in 2010. Like the fourth quarter, most of the full year strength came from consumer spending and export growth partially offset by a weakness in government spending. Corporate profits are believed to have again increased at a "double digit " rate similar to the previous year, in response to such factors as continuing productivity improvement, higher foreign profits and currency translation gains.

Future Outlook

While some of the fourth quarter economic strength seems likely to spillover into 2012, the outlook for the full year appears anything but clear. Such factors as the presidential election, continuing uncertainties in Europe and rising tensions in the Middle East should all serve to temper one's optimism for the coming twelve month period. Moreover, historically high debt levels will continue to restrain government spending again during the coming year and beyond. On the other hand, prospects for consumer spending may be somewhat brighter if the employment situation continues to improve. In addition, any improvement in the long-depressed housing picture could increase confidence and further help the outlook for consumer spending. However, even with an improved outlook for consumer spending, it seems difficult to build a case for economic growth much beyond 2% over the foreseeable future, barring a major change in the outlook for such issues as taxes, health care costs and the trend in government regulation.

The outlook for corporate profit growth seems likely to be somewhat better than that for the overall economy in light of such factors as cost cutting, productivity improvement programs and participation in faster growing foreign markets. Also, earnings on a per share basis should continue to benefit from significant corporate buyback programs arising from record cash flow and balance sheet liquidity.

2

TO OUR SHAREHOLDERS (continued)

Because of such factors as election year politics, a low rate of inflation and slow economic growth, the Federal Reserve seems unlikely to change its very stimulative monetary policy any time soon, resulting in a continuation of historically low interest rate levels. In fact, the Fed has recently suggested that its accommodative policy could remain in place for as long as two or more years. This seems to imply that the Fed is also looking for a period of continuing below normal growth over the immediate future.

Finally, prospects for the stock market appear to be somewhat better than the overall outlook for the U. S. economy. Because of relatively low valuation levels (13x estimated 2012 earnings for the S&P 500) along with historically low interest rates, the stock market seems to be already discounting many of the challenges now facing the economy. In addition, relatively high and rising dividend yields continue to make stocks look more attractive relative to fixed income investment alternatives.

William B. Frels

President and Lead Manager

Mark L. Henneman

Co-Manager

Past performance is no guarantee of future results.

The Fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary prospectus or full prospectus contains this and other important information about the Fund, and they may be obtained by calling Shareholder Services at (800) 304-7404, or visiting www.mairsandpower.com. Read the summary prospectus or full prospectus carefully before investing.

3

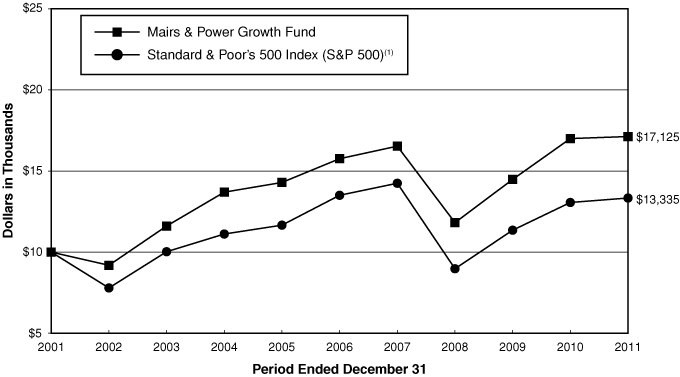

PERFORMANCE INFORMATION (unaudited) December 31, 2011

Ten years of investment performance (through December 31, 2011)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended December 31, 2011

| 1 year | 5 years | 10 years | 20 years | ||||||||||||||||

| Mairs and Power Growth Fund | 0.74 | % | 1.68 | % | 5.53 | % | 11.25 | % | |||||||||||

| S&P 500(1) | 2.11 | % | -0.25 | % | 2.92 | % | 7.81 | % | |||||||||||

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404.

(1) The S&P 500 is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

4

FUND INFORMATION (unaudited) December 31, 2011

Portfolio Managers

William B. Frels, lead manager since 2004

Co-manager since 1999

University of Wisconsin, BBA Finance 1962

Mark L. Henneman, co-manager since 2006

University of Minnesota, MBA Finance 1990

General Information

| Fund Symbol | MPGFX | ||||||

| Net Asset Value (NAV) Per Share | $ | 70.78 | |||||

| Expense Ratio | 0.72 | % | |||||

| Portfolio Turnover Rate | 2.78 | % | |||||

| Sales Charge | None1 | ||||||

| Fund Inception Year | 1958 | ||||||

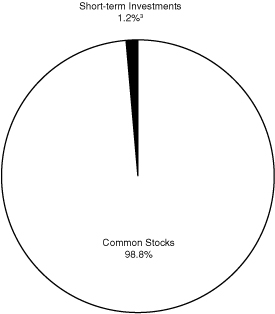

Portfolio Composition

Top Ten Portfolio Holdings

(Percent of Total Net Assets) 2

| 3M Co. | 4.8 | % | |||||

| Donaldson Co., Inc. | 4.7 | ||||||

| Valspar Corp. | 4.6 | ||||||

| Target Corp. | 4.4 | ||||||

| Ecolab, Inc. | 4.3 | ||||||

| Medtronic, Inc. | 4.3 | ||||||

| Honeywell International Inc. | 4.3 | ||||||

| U.S. Bancorp | 4.0 | ||||||

| Emerson Electric Co. | 4.0 | ||||||

| Graco, Inc. | 3.9 | ||||||

Portfolio Diversification

(Percent of Total Net Assets)

| Common Stocks 98.8% | |||||||

| Health Care | 18.3 | % | |||||

| Capital Goods | 16.8 | ||||||

| Basic Industries | 15.8 | ||||||

| Technology | 12.2 | ||||||

| Financial | 11.5 | ||||||

| Consumer Cyclical | 9.1 | ||||||

| Diversified | 7.3 | ||||||

| Consumer Staple | 6.3 | ||||||

| Transportation | 1.5 | ||||||

| Short-term Investments 1.2%3 | 1.2 | ||||||

| 100.0 | % | ||||||

1 Although the Fund is no-load, investment management fees and other expenses still apply.

2 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

5

SCHEDULE OF INVESTMENTS December 31, 2011

| Shares | Security Description | Fair Value | |||||||||

| COMMON STOCKS 98.8% | |||||||||||

| BASIC INDUSTRIES 15.8% | |||||||||||

| 2,185,000 | Bemis Co., Inc. | $ | 65,724,800 | ||||||||

| 1,485,153 | Ecolab, Inc. | 85,856,695 | |||||||||

| 2,980,000 | H.B. Fuller Co. (a) | 68,867,800 | |||||||||

| 2,340,000 | Valspar Corp. | 91,189,800 | |||||||||

| 311,639,095 | |||||||||||

| CAPITAL GOODS 16.8% | |||||||||||

| 327,000 | Badger Meter, Inc. | 9,623,610 | |||||||||

| 1,350,000 | Donaldson Co., Inc. | 91,908,000 | |||||||||

| 730,000 | Fastenal Co. | 31,835,300 | |||||||||

| 1,870,000 | Graco, Inc. | 76,464,300 | |||||||||

| 1,200,000 | MTS Systems Corp. (a) | 48,900,000 | |||||||||

| 2,190,000 | Pentair, Inc. | 72,905,100 | |||||||||

| 331,636,310 | |||||||||||

| CONSUMER CYCLICAL 9.1% | |||||||||||

| 500,000 | G&K Services, Inc., Class A | 14,555,000 | |||||||||

| 1,700,000 | Target Corp. | 87,074,000 | |||||||||

| 1,220,000 | Toro Co. | 74,005,200 | |||||||||

| 130,000 | The Walt Disney Company | 4,875,000 | |||||||||

| 180,509,200 | |||||||||||

| CONSUMER STAPLE 6.3% | |||||||||||

| 1,450,000 | General Mills, Inc. | 58,594,500 | |||||||||

| 2,240,000 | Hormel Foods Corp. | 65,609,600 | |||||||||

| 124,204,100 | |||||||||||

| DIVERSIFIED 7.3% | |||||||||||

| 1,160,000 | 3M Co. | 94,806,800 | |||||||||

| 2,700,000 | General Electric Co. | 48,357,000 | |||||||||

| 143,163,800 | |||||||||||

6

SCHEDULE OF INVESTMENTS (continued) December 31, 2011

| Shares | Security Description | Fair Value | |||||||||

| COMMON STOCKS (continued) | |||||||||||

| FINANCIAL 11.5% | |||||||||||

| 810,000 | Associated Banc-Corp. | $ | 9,047,700 | ||||||||

| 1,090,000 | Principal Financial Group | 26,814,000 | |||||||||

| 3,060,000 | TCF Financial Corp. | 31,579,200 | |||||||||

| 300,000 | The Travelers Cos., Inc. | 17,751,000 | |||||||||

| 2,910,000 | U.S. Bancorp | 78,715,500 | |||||||||

| 1,920,000 | Wells Fargo & Co. | 52,915,200 | |||||||||

| 500,000 | Western Union Co. | 9,130,000 | |||||||||

| 225,952,600 | |||||||||||

| HEALTH CARE 18.3% | |||||||||||

| 1,000,000 | Baxter International Inc. | 49,480,000 | |||||||||

| 1,090,000 | Johnson & Johnson | 71,482,200 | |||||||||

| 522,500 | MEDTOX Scientific, Inc. (a) (b) | 7,341,125 | |||||||||

| 2,230,000 | Medtronic, Inc. | 85,297,500 | |||||||||

| 970,000 | Patterson Cos., Inc. | 28,634,400 | |||||||||

| 1,550,000 | Pfizer Inc. | 33,542,000 | |||||||||

| 1,240,000 | St. Jude Medical, Inc. | 42,532,000 | |||||||||

| 628,800 | SurModics, Inc. (b) | 9,218,208 | |||||||||

| 160,000 | Techne Corp. | 10,921,600 | |||||||||

| 430,000 | Zimmer Holdings, Inc. (b) | 22,970,600 | |||||||||

| 361,419,633 | |||||||||||

| TECHNOLOGY 12.2% | |||||||||||

| 1,950,000 | Corning Inc. | 25,311,000 | |||||||||

| 1,430,000 | Daktronics, Inc. | 13,685,100 | |||||||||

| 1,675,000 | Emerson Electric Co. | 78,038,250 | |||||||||

| 170,000 | Fiserv, Inc. (b) | 9,985,800 | |||||||||

| 1,550,000 | Honeywell International Inc. | 84,242,500 | |||||||||

| 780,000 | Intel Corp. | 18,915,000 | |||||||||

7

SCHEDULE OF INVESTMENTS (continued) December 31, 2011

| Shares | Security Description | Fair Value | |||||||||

| COMMON STOCKS (continued) | |||||||||||

| TECHNOLOGY (continued) | |||||||||||

| 143,900 | NVE Corporation (b) | $ | 7,990,767 | ||||||||

| 100,000 | Stratasys, Inc. (b) | 3,041,000 | |||||||||

| 241,209,417 | |||||||||||

| TRANSPORTATION 1.5% | |||||||||||

| 110,000 | C.H. Robinson Worldwide, Inc. | 7,675,800 | |||||||||

| 310,000 | United Parcel Service, Inc., Class B | 22,688,900 | |||||||||

| 30,364,700 | |||||||||||

|

TOTAL COMMON STOCKS (cost $1,331,018,501) |

$ |

1,950,098,855 |

|||||||||

| SHORT-TERM INVESTMENTS 1.2% | |||||||||||

|

24,461,357 |

First American Prime Obligations Fund, Class Z, 0.03% (c) (cost $24,461,357) |

$ | 24,461,357 | ||||||||

|

TOTAL INVESTMENTS 100.0% (cost $1,355,479,858) |

$ | 1,974,560,212 | |||||||||

| OTHER ASSETS AND LIABILITIES (NET) 0.0% | 567,267 | ||||||||||

| TOTAL NET ASSETS 100.0% | $ | 1,975,127,479 | |||||||||

(a) Affiliated company (Note 5).

(b) Non-income producing.

(c) The rate quoted is the annualized seven-day effective yield as of December 31, 2011.

See accompanying Notes to Financial Statements.

8

STATEMENT OF ASSETS AND LIABILITIES December 31, 2011

| ASSETS | |||||||

| Investments, at fair value (Note 1): | |||||||

| Unaffiliated securities (cost $1,294,193,883) | $ | 1,849,451,287 | |||||

| Affiliated securities (cost $61,285,975) (Note 5) | 125,108,925 | ||||||

| 1,974,560,212 | |||||||

| Receivable for Fund shares sold | 426,036 | ||||||

| Dividends receivable | 2,870,726 | ||||||

| Prepaid expenses | 93,225 | ||||||

| 1,977,950,199 | |||||||

| LIABILITIES | |||||||

| Payable for Fund shares redeemed | 1,406,801 | ||||||

| Accrued investment management fees (Note 2) | 998,558 | ||||||

| Accrued Fund administration fees (Note 2) | 35,860 | ||||||

| Accrued transfer agent fees | 151,129 | ||||||

| Accrued expenses and other liabilities | 230,372 | ||||||

| 2,822,720 | |||||||

| NET ASSETS | $ | 1,975,127,479 | |||||

| NET ASSETS CONSIST OF | |||||||

| Portfolio capital | $ | 1,356,192,247 | |||||

| Undistributed net investment income | 376,379 | ||||||

| Undistributed net realized loss on investments | (521,501 | ) | |||||

| Net unrealized appreciation of investments | 619,080,354 | ||||||

| TOTAL NET ASSETS | $ | 1,975,127,479 | |||||

|

Fund shares issued and outstanding (par value $0.01 per share; 100,000,000 authorized) |

27,907,033 | ||||||

| Net asset value per share | $ | 70.78 | |||||

See accompanying Notes to Financial Statements.

9

STATEMENT OF OPERATIONS December 31, 2011

| INVESTMENT INCOME | |||||||||||

| Income: | |||||||||||

| Dividends from unaffiliated securities | $ | 40,782,787 | |||||||||

| Dividends from affiliated securities (Note 5) | 1,959,100 | ||||||||||

| TOTAL INCOME | $ | 42,741,887 | |||||||||

| Expenses: | |||||||||||

| Investment management fees (Note 2) | 12,136,326 | ||||||||||

| Fund administration fees (Note 2) | 275,245 | ||||||||||

| Fund accounting | 222,857 | ||||||||||

| Directors' compensation (Note 2) | 180,010 | ||||||||||

| Transfer agent fees | 1,017,275 | ||||||||||

| Custodian fees | 142,033 | ||||||||||

| Legal and audit fees | 110,650 | ||||||||||

| Other expenses | 380,397 | ||||||||||

| TOTAL EXPENSES | 14,464,793 | ||||||||||

| NET INVESTMENT INCOME | 28,277,094 | ||||||||||

|

NET REALIZED GAIN AND NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) OF INVESTMENTS (Note 4) |

|||||||||||

| Net realized gain on: | |||||||||||

| Unaffiliated investments sold | 25,608,835 | ||||||||||

| Affiliated investments sold (Note 5) | - | ||||||||||

| 25,608,835 | |||||||||||

|

Net change in unrealized appreciation/(depreciation) of investments |

(40,724,935 | ) | |||||||||

|

NET REALIZED GAIN AND NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) OF INVESTMENTS |

(15,116,100 | ) | |||||||||

| NET INCREASE IN NET ASSETS FROM OPERATIONS | $ | 13,160,994 | |||||||||

See accompanying Notes to Financial Statements.

10

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended December 31 | |||||||||||

| 2011 | 2010 | ||||||||||

| OPERATIONS | |||||||||||

| Net investment income | $ | 28,277,094 | $ | 24,053,553 | |||||||

| Net realized gain on investments sold | 25,608,835 | 26,676,299 | |||||||||

|

Net change in unrealized appreciation/(depreciation) of investments |

(40,724,935 | ) | 265,798,244 | ||||||||

| NET INCREASE IN NET ASSETS FROM OPERATIONS | 13,160,994 | 316,528,096 | |||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |||||||||||

| Net investment income | (27,830,878 | ) | (23,956,406 | ) | |||||||

| Net realized gain on investments sold | (25,685,385 | ) | (26,917,941 | ) | |||||||

| Contribution from adviser (Note 2) | - | (1,201,007 | ) | ||||||||

| TOTAL DISTRIBUTIONS TO SHAREHOLDERS | (53,516,263 | ) | (52,075,354 | ) | |||||||

| CAPITAL TRANSACTIONS | |||||||||||

| Proceeds from shares sold | 125,601,510 | 125,571,015 | |||||||||

| Contribution from adviser (Note 2) | - | 1,201,007 | |||||||||

|

Reinvestment of distributions from net investment income and net realized gains |

49,290,789 | 48,072,038 | |||||||||

| Cost of shares redeemed | (200,118,859 | ) | (333,904,916 | ) | |||||||

|

DECREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS |

(25,226,560 | ) | (159,060,856 | ) | |||||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (65,581,829 | ) | 105,391,886 | ||||||||

| NET ASSETS | |||||||||||

| Beginning of year | 2,040,709,308 | 1,935,317,422 | |||||||||

|

End of year (including undistributed net investment income of $376,379, and $97,147, respectively) |

$ | 1,975,127,479 | $ | 2,040,709,308 | |||||||

| FUND SHARE TRANSACTIONS | |||||||||||

| Shares sold | 1,725,807 | 1,870,148 | |||||||||

| Shares issued for reinvested distributions | 683,471 | 688,287 | |||||||||

| Shares redeemed | (2,783,784 | ) | (4,939,071 | ) | |||||||

| NET DECREASE IN FUND SHARES | (374,506 | ) | (2,380,636 | ) | |||||||

See accompanying Notes to Financial Statements.

11

NOTES TO FINANCIAL STATEMENTS December 31, 2011

Note 1 – Organization and Significant Accounting Policies

The Mairs and Power Growth Fund, Inc. (the Fund) is registered under the Investment Company Act of 1940 (as amended) as a diversified, no-load, open-end management investment company. The objective of the Fund is to provide shareholders with a diversified portfolio of common stocks, which have the potential for above-average, long-term appreciation. Effective January 1, 2012, the Fund completed a reorganization into a newly formed series of the Mairs and Power Funds Trust, a Delaware statutory trust (the Trust), which is known as the Mairs and Power Growth Fund series of the Trust.

Significant accounting policies of the Fund are as follows:

Security Valuations

Security valuations for Fund investments are furnished by independent pricing services that have been approved by the Fund's Board of Directors (the Board). Investments in equity securities are valued at the NASDAQ Official Closing Price if readily available for such securities on each business day. Other equity securities traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost, which approximates fair value.

Securities for which prices are not available from an independent pricing service, but where an active market exists, are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely used quotation system. When market quotations are not readily available, or where the last quoted sale price is not considered representative of the value of the security if it were to be sold on that day, the security will be valued at fair value as determined in good faith by the Fair Value Committee appointed by the Board, pursuant to procedures approved by the Board. Factors that may be considered in determining the fair value of a security are fundamental analytical data relating to the security, the nature and duration of any restrictions on the disposition of the security, and the forces influencing the market in which the security is purchased or sold. As of December 31, 2011, no securities in the Fund were valued using this method.

Fair Valuation Measurements

The Fund has adopted authoritative fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the

12

NOTES TO FINANCIAL STATEMENTS (continued) December 31, 2011

Note 1 – Organization and Significant Accounting Policies (continued)

measurements of fair value and changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

• Level 1 – Quoted prices in active markets for identical securities.

• Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

• Level 3 – Significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. All of the inputs used to value the Fund's investments as of December 31, 2011 were classified as Level 1. For detail of investments by major industry classification, please refer to the Schedule of Investments. There were no transfers between levels during the period. The Fund did not hold any Level 3 investments at either December 31, 2011 or December 31, 2010, therefore, a rollforward of Level 3 investments is not required.

On May 12, 2011, the Financial Accounting Standards Board (FASB) issued an Accounting Standard Update (ASU) No. 2011-04 modifying FASB Accounting Standards Codification (ASC) Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (IASB) issued International Financial Reporting Standard (IFRS) 13, Fair Value Measurement. The objective by the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to disclose i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, ii) for Level 3 fair value measurements, a) quantitative information about significant unobservable inputs used, b) a description of the valuation processes used by the reporting entity and c) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of the ASU is for interim and annual periods beginning after December 15, 2011. At this time, management is evaluating the implications of this guidance and the impact it will have on the financial statement amounts and footnote disclosures, if any.

Security Transactions and Investment Income

Security transactions are recorded on the date on which securities are purchased or sold. Dividend income and corporate action transactions are recorded on the ex-dividend date and

13

NOTES TO FINANCIAL STATEMENTS (continued) December 31, 2011

Note 1 – Organization and Significant Accounting Policies (continued)

interest income is recorded on an accrual basis. Realized gains and losses are reported on an identified cost basis.

Income Taxes

The Fund is a "regulated investment company" as defined in Subtitle A, Chapter 1, Subchapter M of the Internal Revenue Code (the Code), as amended. No provision has been made for federal income taxes as it is the intention of the Fund to comply with the provisions of the Code applicable to regulated investment companies and to make distributions of income and realized gains sufficient to relieve it from all or substantially all excise and income taxes.

As of December 31, 2011, the Fund did not have any tax positions that did not meet the "more-likely-than-not" threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all tax returns filed for the last three years.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the Act) was enacted, which changed various technical rules governing the tax treatment of regulated investment companies. The changes are generally effective for taxable years beginning after the date of enactment. One of the more prominent changes addresses capital loss carryforwards. Under the Act, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after the date of enactment for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years, which carry an expiration date. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered all short-term as permitted under previous regulation. As of December 31, 2011, the Fund does not have any capital loss carryforwards.

Basis of Presentation

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the reported amount of net assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported results of operations during the reporting period. Actual results could differ from those estimates.

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were available to be

14

NOTES TO FINANCIAL STATEMENTS (continued) December 31, 2011

Note 1 – Organization and Significant Accounting Policies (continued)

issued. This evaluation did not result in any subsequent events that necessitated recognition or disclosures.

Note 2 – Related-Party Transactions

Investment Management and Fund Administration Fees

Mairs and Power, Inc. (the Adviser) provides investment management and fund administration services to the Fund under written agreements approved by the Board. The Fund is charged an investment management fee paid to the Adviser computed at an annual rate of 0.60% of daily net assets up to $2.5 billion and 0.50% of daily net assets in excess of $2.5 billion. The fund administration fee paid to the Adviser is computed at an annual rate of 0.00375% of daily net assets. For the year ended December 31, 2011, the Fund incurred $75,852 in administration fees from the Adviser, and as of December 31, 2011, had an accrued liability of $6,241 for administration fees payable to the Adviser. Effective January 1, 2012, the fund administration fee paid to the Adviser will be computed at an annual rate of 0.00281% of daily net assets.

Pursuant to a sub-administration agreement between the Fund and U.S. Bancorp Fund Services, LLC (USBFS), the Fund is charged a sub-administration fee paid to USBFS. For the year ended December 31, 2011, the Fund incurred $199,393 in sub-administration fees from USBFS, and as of December 31, 2011, had an accrued liability of $29,619 for sub-administration fees payable to USBFS.

Directors' Compensation

Directors' compensation is paid to individuals who are disinterested directors of the Fund. No compensation is paid to the owners of the Adviser, including principal officers who are not directors of the Fund, and William B. Frels, who is an interested director and officer of the Fund.

Contributions from Adviser

During the year ended December 31, 2010, the Fund received two contributions from the Adviser related to prospect services and other expenses paid by the Fund from 1980 to 2009, which were in violation of the Investment Company Act of 1940. The contribution amounts, which included imputed interest, as disclosed in the Statement of Changes in Net Assets, were $1,192,736 or $0.04 per share based upon shares outstanding as of May 21, 2010, and $8,271 or $0.0003 per share based upon shares outstanding as of September 24, 2010.

15

NOTES TO FINANCIAL STATEMENTS (continued) December 31, 2011

Note 3 – Indemnifications

In the normal course of business, the Fund enters into contracts that contain general indemnifications to other parties. The Fund's maximum exposure under these contracts is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Note 4 – Distributions Paid, Distributable Earnings and Investment Transactions

Net investment income and net realized gains (losses) may differ for financial reporting and tax purposes because of temporary or permanent book/tax differences. To the extent these differences are permanent, reclassifications are made to the appropriate equity accounts in the period that the difference arises.

Additionally, GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. On the Statement of Assets and Liabilities, the following reclassifications were made for the year ended December 31, 2011:

|

Undistributed Net Investment Income |

Undistributed Net Realized Gain (Loss) |

||||||

| ($166,984 | ) | $ | 166,984 | ||||

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. In addition, due to the timing of dividend distributions, the fiscal year in which the amounts are distributed may differ from the year that the income or realized gains (losses) were recorded by the Fund.

The tax character of distributions paid during the years ended December 31, 2011 and December 31, 2010, were as follows:

| 2011 | 2010 | ||||||||||

| Distributions paid from: | |||||||||||

| Ordinary income | $ | 27,997,862 | $ | 25,157,413 | |||||||

| Long-term capital gains | 25,518,401 | 26,917,941 | |||||||||

| $ | 53,516,263 | $ | 52,075,354 | ||||||||

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended December 31, 2011.

16

NOTES TO FINANCIAL STATEMENTS (continued) December 31, 2011

Note 4 – Distributions Paid, Distributable Earnings and Investment Transactions (continued)

At December 31, 2011, the components of accumulated earnings (losses) on a tax basis was as follows:

| Cost of investments | $ | 1,356,190,122 | |||||

| Gross unrealized appreciation | $ | 766,509,980 | |||||

| Gross unrealized depreciation | (148,139,890 | ) | |||||

| Net unrealized appreciation | $ | 618,370,090 | |||||

| Undistributed ordinary income | $ | 376,379 | |||||

| Undistributed long-term capital gains | 188,763 | ||||||

| Total distributable earnings | $ | 565,142 | |||||

| Total accumulated earnings | $ | 618,935,232 | |||||

The difference between book basis and tax basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales.

Purchases and sales of investment securities, excluding government securities, short-term securities and temporary cash investments, during the year ended December 31, 2011, aggregated $55,675,201 and $93,130,892, respectively. No purchases and sales of government securities occurred during the period.

Note 5 – Transactions With Affiliated Companies

The Fund owned 5% or more of the voting securities of the following companies during the year ended December 31, 2011. As a result, these companies are deemed to be affiliates of the Fund as defined by the Investment Company Act of 1940. Transactions during the period in these securities of affiliated companies were as follows:

| Share Activity | |||||||||||||||||||||||||||

| Security Name |

Balance 12/31/10 |

Purchases | Sales |

Balance 12/31/11 |

Dividend Income |

Fair Value at 12/31/11 |

|||||||||||||||||||||

| H.B. Fuller Co. | 2,980,000 | - | - | 2,980,000 | $ | 879,100 | $ | 68,867,800 | |||||||||||||||||||

| MEDTOX Scientific, Inc. | 522,500 | - | - | 522,500 | - | 7,341,125 | |||||||||||||||||||||

| MTS Systems Corp. | 1,200,000 | - | - | 1,200,000 | 1,080,000 | 48,900,000 | |||||||||||||||||||||

| $ | 1,959,100 | $ | 125,108,925 | ||||||||||||||||||||||||

17

FINANCIAL HIGHLIGHTS

SELECTED DATA AND RATIOS

(for a share outstanding throughout each year)

| Year Ended December 31, | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

| Per share | |||||||||||||||||||||||

| Net asset value, beginning of year | $ | 72.16 | $ | 63.12 | $ | 52.51 | $ | 76.30 | $ | 77.10 | |||||||||||||

| Income from investment operations: | |||||||||||||||||||||||

| Net investment income | 1.01 | 0.86 | 0.89 | 1.22 | 1.04 | ||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(0.45 | ) | 10.01 | 10.85 | (22.93 | ) | 2.79 | ||||||||||||||||

| Total from investment operations | 0.56 | 10.87 | 11.74 | (21.71 | ) | 3.83 | |||||||||||||||||

| Distributions to shareholders from: | |||||||||||||||||||||||

| Net investment income | (1.00 | ) | (0.86 | ) | (0.89 | ) | (1.22 | ) | (1.04 | ) | |||||||||||||

|

Net realized gains on unaffiliated investments sold |

(0.94 | ) | (0.97 | ) | (0.24 | ) | (0.86 | ) | (3.59 | ) | |||||||||||||

| Contribution from Adviser (Note 2) | - | (0.04 | ) | - | - | - | |||||||||||||||||

| Total distributions | (1.94 | ) | (1.87 | ) | (1.13 | ) | (2.08 | ) | (4.63 | ) | |||||||||||||

| Contribution from Adviser (Note 2) | - | 0.04 | - | - | - | ||||||||||||||||||

| Net asset value, end of year | $ | 70.78 | $ | 72.16 | $ | 63.12 | $ | 52.51 | $ | 76.30 | |||||||||||||

| Total investment return | 0.74 | % | 17.40 | %(1) | 22.52 | % | -28.51 | % | 4.90 | % | |||||||||||||

|

Net assets, end of year, in thousands |

$ | 1,975,127 | $ | 2,040,709 | $ | 1,935,317 | $ | 1,681,717 | $ | 2,612,139 | |||||||||||||

| Ratios/supplemental data: | |||||||||||||||||||||||

|

Ratio of expenses to average net assets |

0.72 | % | 0.71 | % | 0.71 | % | 0.70 | % | 0.68 | % | |||||||||||||

|

Ratio of net investment income to average net assets |

1.40 | 1.26 | 1.61 | 1.75 | 1.26 | ||||||||||||||||||

| Portfolio turnover rate | 2.78 | 1.81 | 3.21 | 2.42 | 4.44 | ||||||||||||||||||

(1) For the year ended December 31, 2010, 0.08% of the Fund's total return was a result of contributions as described in Note 2 to the financial statements by the Adviser related to prospect services and other expenses paid by the Fund. Excluding the contributions, total investment return would have been 17.32%.

See accompanying Notes to Financial Statements.

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

Mairs and Power Growth Fund, Inc.

We have audited the accompanying statement of assets and liabilities of the Mairs and Power Growth Fund, Inc. (the Fund), including the schedule of investments, as of December 31, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Mairs and Power Growth Fund, Inc. at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Minneapolis, Minnesota

February 17, 2012

19

FUND EXPENSES (unaudited)

As a shareholder of the Fund, you incur ongoing expenses for the operation of the Fund (e.g., asset-based charges, such as investment management fees). The Fund is a "no-load" mutual fund. As a result, shareholders pay no commissions, fees, or expenses associated with sales representatives or sales charges.

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The table below reports the Fund's expenses during the period July 1, 2011 through December 31, 2011 and includes the costs associated with a $1,000 investment.

Actual Expenses

The first line in the table below may be used to estimate the actual expenses you paid over the reporting period. You can do this by dividing your account value by $1,000 and multiplying the result by the expense shown in the table below. For example, if your account value is $8,600, divided by $1,000 = $8.60. Multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period." By doing this you can estimate the expenses you paid on your account during this period.

Hypothetical Example

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expenses and an assumed return of 5% per year before expenses, which is not the Fund's actual return. The results may be used to provide you with a basis for comparing the ongoing costs of investing in the Fund with the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that this hypothetical example may not be used to estimate the actual ending account balance or expenses you paid during the period.

|

Beginning Account Value 07/01/2011 |

Ending Account Value 12/31/2011 |

Expenses Paid During Period * |

|||||||||||||

| Actual return | $ | 1,000.00 | $ | 952.40 | $ | 3.59 | |||||||||

| Hypothetical assumed 5% return | $ | 1,000.00 | $ | 1,021.53 | $ | 3.72 | |||||||||

* The Fund's expenses are equal to the Fund's annualized expense ratio for the most recent six-month period of 0.73%, multiplied by the average account value over the Fund's second fiscal half-year, multiplied by the number of days in the Fund's second fiscal half-year (184 days), divided by 365 days.

20

PROXY VOTING (unaudited)

Proxy Voting Policies and Procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling Shareholder Services at (800) 304-7404 and requesting a copy of the Statement of Additional Information (SAI) and (ii) on the Securities and Exchange Commission's (SEC's) website at www.sec.gov (access Form N-1A).

Information on how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available at www.mairsandpower.com and on the SEC's website at www.sec.gov.

DISCLOSURE OF PORTFOLIO HOLDINGS (unaudited)

The Fund files a complete schedule of portfolio holdings on Form N-Q for the first and third quarter-ends and on Form N-CSR for the second and fourth quarter-ends with the SEC. The Fund's Forms N-Q and N-CSR are available on the SEC's website at www.sec.gov. Forms N-Q and N-CSR may also be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

The schedule of portfolio holdings is also printed in the Fund's semi-annual and annual reports to shareholders, which is available without charge by calling Shareholder Services at (800) 304-7404 or by visiting www.mairsandpower.com.

A complete copy of the Fund's portfolio holdings will also be available on or about 15 days following each quarter-end on the Fund's website at www.mairsandpower.com.

HOUSEHOLDING (unaudited)

In an effort to decrease costs, the Fund intends to reduce the number of duplicate Summary Prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders reasonably believed to be from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call Shareholder Services at 800-304-7404 to request individual copies of these documents. Once notification to stop householding is received, the Fund will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

21

REPORT OF THE FUND'S SPECIAL SHAREHOLDER MEETING (unaudited)

A Special Meeting of Shareholders of the Mairs and Power Growth Fund, Inc. took place on December 16, 2011, to approve the reorganization of the Fund into a newly formed series of the Mairs and Power Funds Trust, to approve revisions to the Fund's fundamental and non-fundamental investment restrictions and to approve the election of the Board of Directors of the Trust. All Fund shareholders of record at the close of business on October 20, 2011 were entitled to vote. As of the record date, the Fund had 27,741,416 shares outstanding.

| Proposal | In Favor | % | Against | % | Abstain | % | |||||||||||||||||||||

| To approve the proposed Agreement and Plan of Reorganization | 14,409,656 | 95 | 545,287 | 4 | 198,599 | 1 | |||||||||||||||||||||

| To revise the policy regarding issuer diversification | 14,245,661 | 94 | 700,802 | 5 | 207,077 | 1 | |||||||||||||||||||||

|

To eliminate the policy regarding purchases of securities of other investment companies |

14,180,572 | 94 | 775,192 | 5 | 197,776 | 1 | |||||||||||||||||||||

| To revise the policy regarding industry concentration | 14,201,755 | 94 | 727,778 | 5 | 224,007 | 1 | |||||||||||||||||||||

| To revise the policy regarding investments in real estate | 14,177,424 | 94 | 768,144 | 5 | 207,973 | 1 | |||||||||||||||||||||

| To eliminate the policy regarding the use of put and call options | 14,035,100 | 92 | 882,961 | 6 | 235,480 | 2 | |||||||||||||||||||||

| To revise the policy regarding the making of loans by the Funds | 13,955,317 | 92 | 967,069 | 6 | 231,154 | 2 | |||||||||||||||||||||

|

To eliminate the policy regarding the purchase of securities on margin or short sales |

14,058,261 | 92 | 867,260 | 6 | 228,018 | 2 | |||||||||||||||||||||

| To revise the policy regarding borrowing by the Funds | 14,051,818 | 93 | 880,253 | 6 | 221,469 | 1 | |||||||||||||||||||||

| To eliminate the policy regarding pledges by the Funds | 14,019,446 | 92 | 887,273 | 6 | 246,822 | 2 | |||||||||||||||||||||

|

To eliminate the policy regarding Fund participation in joint trading accounts |

14,140,467 | 93 | 748,639 | 5 | 264,436 | 2 | |||||||||||||||||||||

|

To eliminate the policy regarding investing for the purpose of control |

14,172,205 | 93 | 738,271 | 5 | 243,066 | 2 | |||||||||||||||||||||

| To revise the policies regarding acting as an underwriter | 14,176,013 | 93 | 722,961 | 5 | 254,567 | 2 | |||||||||||||||||||||

|

To eliminate the policy regarding the purchase of securities also owned by certain related persons |

13,998,607 | 93 | 937,973 | 6 | 216,960 | 1 | |||||||||||||||||||||

| To revise the policy regarding investments in commodities | 14,082,316 | 92 | 843,092 | 6 | 228,133 | 2 | |||||||||||||||||||||

| To elect Norbert J. Conzemius (Independent Director) | 17,939,467 | 97 | 403,367 | 2 | 164,683 | 1 | |||||||||||||||||||||

| To elect Mary Schmid Daugherty (Independent Director) | 17,918,500 | 97 | 435,716 | 2 | 153,301 | 1 | |||||||||||||||||||||

| To elect Bert J. McKasy (Independent Director) | 17,887,680 | 97 | 455,693 | 2 | 164,143 | 1 | |||||||||||||||||||||

| To elect Charles M. Osborne (Independent Director) | 17,962,216 | 97 | 378,469 | 2 | 166,831 | 1 | |||||||||||||||||||||

| To elect William B. Frels (Interested Director) | 17,963,163 | 97 | 381,523 | 2 | 162,831 | 1 | |||||||||||||||||||||

22

PRIVACY POLICY (unaudited)

Your right to privacy is important to us. We understand that the privacy and security of your nonpublic personal information is important to you; therefore, we maintain various safeguards designed to protect your information from unauthorized access.

Information we collect is either required or necessary to provide the following services for you:

• Service your account;

• Complete transactions or account changes;

• Prevent unauthorized access of your account;

• Improve customer service; and

• Comply with legal and regulatory requirements.

The types of personal information we collect and share with third parties that perform everyday services for the Funds may include:

• Personal information the Funds receive from you on or in applications or other forms, correspondence, or conversations, including, but not limited to, your name, address, phone number, social security number, net-worth, assets, income and date of birth; and

• Information about your transactions with the Funds, their affiliates or others, such as your account number and balance, payment history, parties to transactions, cost basis information, and other financial information.

We do not sell information about current or former shareholders to third parties, nor is it our practice to disclose such information to third parties unless requested or permitted to do so by you or your representative or, if necessary, in order to process a transaction, service an account or as permitted by law. We may, however, share information about you with our affiliates. Additionally, we may share information with outside companies that perform administrative services for us. However, our arrangements with these service providers require them to treat your information as confidential.

We maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information. Our compliance policies and procedures restrict the use of shareholder information and require that it be held in strict confidence. We do not disclose any information, public or nonpublic, about our present or former shareholders to third parties for the purpose of marketing.

In the event that you hold shares of the Fund(s) through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of such financial intermediary governs how nonpublic personal information may be shared with nonaffiliated third parties.

23

PRIVACY POLICY (unaudited) (continued)

We are required by law to annually provide a notice describing our privacy policy. In addition, we will inform you promptly if there are changes to our policy. Please do not hesitate to contact us with questions about this notice or to correct, update or confirm your personal information. The accuracy of your personal information is important. You may contact us anytime by calling (800) 304-7404.

24

DIRECTORS AND OFFICERS (unaudited) December 31, 2011

Information pertaining to the Directors and Officers of the Fund is set forth below. The Statement of Additional Information includes additional information about the Fund's Directors and is available without charge, upon request, by calling Shareholder Services at (800) 304-7404.

|

Name (age) and address1 |

Position(s) held with the Fund and length of time served2 |

Principal occupation(s) during past five years |

Number of portfolios in Fund complex overseen by Director |

Other directorships held by directors and officers |

|||||||||||||||

| INTERESTED PRINCIPAL OFFICER WHO IS A DIRECTOR | |||||||||||||||||||

| William B. Frels (72) | President since June 2004 and Director since 1992 |

• Chairman and CEO of the Investment Adviser (2007 to present). • President of the Investment Adviser (2002 to 2007). • Treasurer of the Investment Adviser (1996 to 2007). |

3 | N/A | |||||||||||||||

| INTERESTED PRINCIPAL OFFICERS WHO ARE NOT DIRECTORS | |||||||||||||||||||

| Mark L. Henneman (50) | Vice President since 2009 | • Vice President of the Investment Adviser (2004 to present). | N/A | N/A | |||||||||||||||

| Jon A. Theobald (66) | Secretary since 2003; Chief Compliance Officer since 2004 |

• President and Chief Operating Officer of the Investment Adviser (2007 to present). • Chief Compliance Officer of the Investment Adviser (2004 to present). • Executive Vice President and Chief Administrative Officer of the Investment Adviser (2002 to 2007). |

N/A | N/A | |||||||||||||||

| Andrea C. Stimmel (44) | Treasurer since 2011 |

• Director of Operations and Treasurer of the Investment Adviser (2008 to present). • Accounting Manager of the Investment Adviser (2004 to 2008). |

N/A | N/A | |||||||||||||||

25

DIRECTORS AND OFFICERS (unaudited) (continued) December 31, 2011

|

Name (age) and address1 |

Position(s) held with the Fund and length of time served2 |

Principal occupation(s) during past five years |

Number of portfolios in Fund complex overseen by Director |

Other directorships held by directors and officers |

|||||||||||||||

| DISINTERESTED DIRECTORS | |||||||||||||||||||

| Norbert J. Conzemius (70) | Board Chair since February 2006; Director since 2000 | • Retired Chief Executive Officer, Road Rescue Incorporated. | 3 | N/A | |||||||||||||||

| Charles M. Osborne (58) | Audit Committee Chair since February 2006; Director since 2001 | • Retired Chief Financial Officer, Fair Isaac Corporation (2004 to 2009). | 3 | N/A | |||||||||||||||

| Bert J. McKasy (69) | Director since September 2006 | • Attorney, Lindquist & Vennum, P.L.L.P. (1994 to present). | 3 | N/A | |||||||||||||||

| Mary Schmid Daugherty (53) | Director since December 2010 | • Associate Professor, Department of Finance, University of St. Thomas (1987 to present). | 3 | N/A | |||||||||||||||

1 Unless otherwise indicated, the mailing address of each officer and director is: W1520 First National Bank Building, 332 Minnesota Street, Saint Paul, MN 55101-1363.

2 Each Director serves until his or her resignation or mandatory retirement age. Each officer is elected annually and serves until his or her successor has been duly elected and qualified.

26

MAIRS AND POWER GROWTH FUND, INC.

Established 1958

A No-Load Fund

For Shareholder Services

Call (800) 304-7404

Or write to:

|

(via Regular Mail) c/o U.S. Bancorp Fund Services, LLC 615 East Michigan Street P. O. Box 701 Milwaukee, WI 53201-0701 |

(via Overnight or Express Mail) c/o U.S. Bancorp Fund Services, LLC 3rd Floor 615 East Michigan Street Milwaukee, WI 53202-0701 |

||||||

For Fund literature and information, visit the Fund's website at:

www.mairsandpower.com

Investment Manager

Mairs and Power, Inc.

W1520 First National Bank Building

332 Minnesota Street

Saint Paul, MN 55101

Custodian

U.S. Bank, N.A.

Custody Operations

1555 North River Center Drive, Suite 302

Milwaukee, WI 53212

Item 2. Code of Ethics.

The registrant adopted its Code of Ethics for Principal Executive Officer and Principal Financial Officer on April 15, 2003. The Code of Ethics is attached as exhibit 12(a)(1) to this form.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Charles M. Osborne and Dr. Mary Schmid Daugherty, members of the registrant’s Audit Committee, are “audit committee financial experts” as defined in Item 3 of Form N-CSR. Mr. Osborne and Dr. Daugherty are “independent” under the standards set forth in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

|

Year Ended |

|

(a) |

|

(b) |

|

(c) |

|

(d) |

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

2010 |

|

$ |

39,000 |

|

None |

|

$ |

6,500 |

|

None |

|

|

2011 |

|

$ |

40,500 |

|

None |

|

$ |

6,750 |

|

None |

|

(a) Audit fees include amounts related to the audit of registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings.

(c) Tax fees include amounts related to tax advice and tax return preparation, compliance and reviews.

(e)(1) The registrant’s Audit Committee approves the engagement of the accountant before the accountant is engaged by the registrant to render audit and non-audit services. The Audit Committee pre-approved tax-related non-audit services in an amount not to exceed $10,000 for the fiscal year ending December 31, 2011. No such tax related non-audit services were performed in the fiscal year ending December 31, 2011.

(e)(2) All of the services described in columns (b) through (d) in the table above, were approved in advance by the registrant’s Audit Committee. None of such services was subject to a waiver of the pre-approval requirement pursuant to paragraph (c)(7)(i)(c) of Rule 2-01 of Regulation S-X.

(f) Not applicable

(g) The aggregate fees for non-audit services rendered by the registrant’s accountant to the registrant were $6,500 for the fiscal year ended December 31, 2010 and $6,750 for the fiscal year ended December 31, 2011. The aggregate fees for non-audit services rendered by the registrant’s accountant to the registrant’s investment adviser were $13,000 for the fiscal year ended December 31, 2010 and $24,900 for the fiscal year ended December 31, 2011.

(h) The registrant’s Audit Committee has considered whether the provision of non-audit services by the registrant’s accountant to the registrant’s investment adviser is compatible with maintaining the account’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

(a) Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

(b) Not Applicable

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There has been no material change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures as of a date within 90 days of the filing of this report and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized and reported within the time period specified by the SEC’s rules and forms.

(b) There was no change in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a) (1) Code of Ethics

Mairs and Power Growth Fund, Inc. Code of Ethics for Principal Executive Officer and Principal Financial Officer.

Attached as exhibits 12(a)(1) to this form.

(2) Certifications required by Rule 30a-2(a) under the Investment Company Act of 1940.

Attached as exhibits 12(a)(2).1 and 12(a)(2).2 to this form.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Attached as exhibit 12(b) to this form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

(Registrant) |

Mairs and Power Growth Fund, Inc. |

|

| |||

|

|

|

|

| |||

|

By (Signature and Title)* |

/s/ William B. Frels |

|

| |||

|

|

William B. Frels, President |

|

| |||

|

|

|

|

| |||

|

|

|

|

| |||

|

Date |

3/5/12 |

|

|

|

| |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By (Signature and Title)* |

/s/ William B. Frels |

|

| ||

|

|

William B. Frels, President |

|

| ||

|

|

Principal Executive Officer |

|

| ||

|

|

|

|

| ||

|

Date |

3/5/12 |

|

|

|

|

|

|

|

|

| ||

|

|

|

|

| ||

|

By (Signature and Title)* |

/s/ Andrea C. Stimmel |

|

| ||

|

|

Andrea C. Stimmel, Treasurer |

| |||

|

|

Principal Financial Officer |

| |||

|

|

|

|

| ||

|

Date |

3/5/12 |

|

|

|

|

* Print the name and title of each signing officer under his or her signature.