UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2013, or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

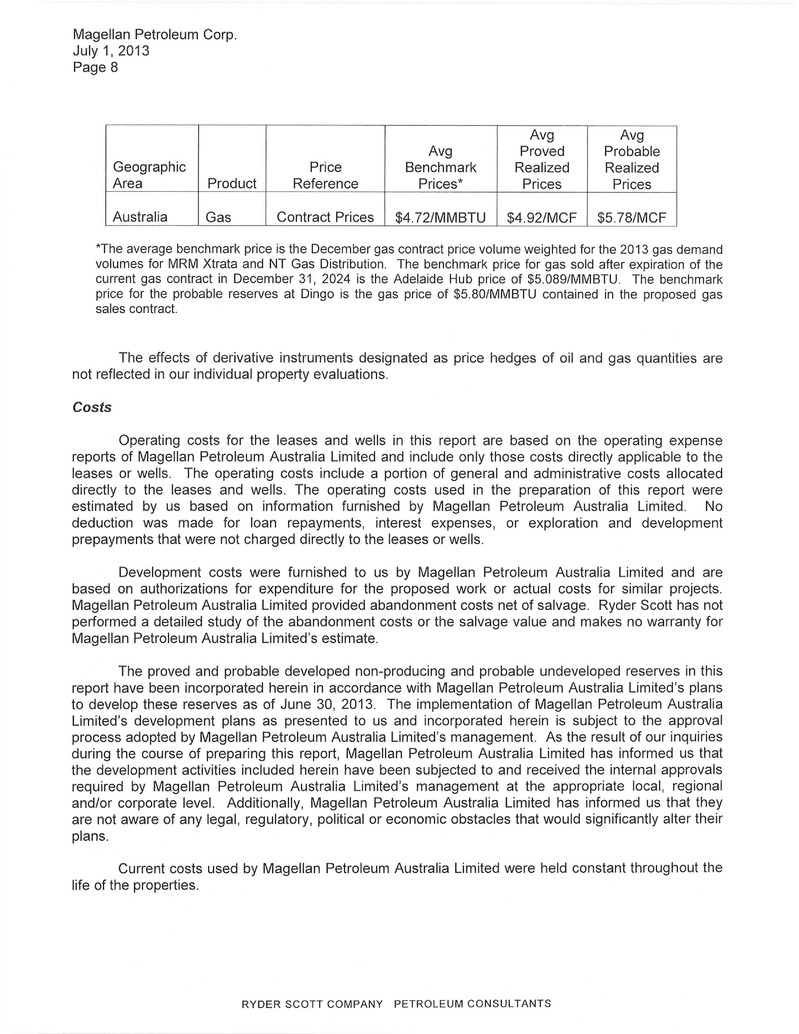

for the transition period from to

Commission file number 001-5507

Magellan Petroleum Corporation

(Exact name of registrant as specified in its charter)

Delaware | 06-0842255 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1775 Sherman Street, Suite 1950, Denver, CO | 80203 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (720) 484-2400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each exchange on which registered | |

Common stock, par value $0.01 per share | NASDAQ Capital Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.:

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company þ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common equity held by non-affiliates of the registrant, based on the $0.922 closing price per share of the registrant's common stock as reported by the NASDAQ Capital Market, as of December 31, 2012 (the last business day of the most recently completed second fiscal quarter) was $33,470,909. For the purpose of this calculation, shares of common stock held by each director and executive officer and by each person who owns ten percent or more of the outstanding shares of common stock or who is otherwise believed by the registrant to be in a control position have been excluded. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

Common stock, par value $0.01 per share, 45,359,647 shares outstanding as of September 12, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement related to the 2013 annual meeting of stockholders to be filed within 120 days after June 30, 2013, are incorporated by reference in Part III of this Form 10-K to the extent stated herein.

TABLE OF CONTENTS

ITEM | PAGE | |

PART I | ||

PART II | ||

2

PART III | ||

PART IV | ||

3

PART I

ITEMS 1 AND 2: BUSINESS AND PROPERTIES

GENERAL

Magellan Petroleum Corporation (the "Company" or "Magellan" or "we" or "us") is an independent energy company engaged in the exploration, development, production, and sale of crude oil and natural gas. The Company conducts its operations through three wholly owned subsidiaries: Nautilus Poplar LLC ("NP"), which owns and operates an oil field covering Poplar Dome ("Poplar") located in the Williston Basin in eastern Montana; Magellan Petroleum Australia Pty Ltd ("MPA"), which owns and operates onshore gas fields in Australia, and owns an offshore exploration license in Australia; and Magellan Petroleum (UK) Limited ("MPUK"), which owns a large acreage position in the Weald and Wessex Basins in southern England prospective for conventional and unconventional oil and gas production.

Magellan was founded in 1957 and incorporated in Delaware in 1967. The Company's common stock has been trading on the NASDAQ since 1972 under the ticker symbol "MPET."

Our principal offices are located at 1775 Sherman Street, Suite 1950, Denver, Colorado, 80203, and our telephone number is (720) 484-2400.

STRATEGY

Our strategy is to enhance shareholder value by maximizing the value of our existing assets. Our portfolio of operations includes several early stage oil and gas exploration and development projects, the successful development of which requires significant capital, as well as significant engineering and management resources. We are committed to investing in these projects to establish their technical and economic viability. In turn, we are focused on determining the most efficient way to create greatest value and highest returns for our shareholders.

SIGNIFICANT DEVELOPMENTS IN FISCAL YEAR 2013

During fiscal year 2013, the Company took important steps in its strategy of creating value from our existing assets. Administratively, we completed the two-year turn-around of the Magellan platform through a number of achievements, including: hiring new engineering and geologic personnel, completing the overhaul of our accounting function, voluntarily delisting from the Australian Securities Exchange ("ASX"), repurchasing 17% of our common shares plus warrants that had been pledged by an entity affiliated with a former director, and raising $23.5 million through the issue of convertible preferred equity on attractive terms. As a result, we believe we now have an organized and effective platform poised to achieve growth and the successful development of our assets.

Operationally, we made steady progress on each of our key projects such that we can continue to achieve key developmental and operational milestones in fiscal year 2014. At Poplar, our work on the CO2-enhanced oil recovery ("CO2-EOR") pilot project during fiscal year 2013 resulted in obtaining a CO2 supply contract and receiving the permits to start the drilling of our pilot wells in July and August 2013, respectively. With the drilling of CO2-EOR pilot wells now underway, we expect to be able to deliver results by the end of calendar year 2014. In parallel, we initiated a water shut-off program to increase oil production from the existing wells at Poplar and reduce our operating costs. This program has started to yield positive results, and we will continue to roll it out across the field as we gather results from each treatment. Onshore Australia, we spent most of fiscal year 2013 in discussions and contract negotiations with potential customers of gas from our properties in the Dingo field, resulting in the signing of a long term gas supply and purchase agreement (the "Dingo GSPA") with Northern Territory Power and Water Corporation ("PWC") for the sale over a 20-year period of the majority of our current estimated probable reserves at Dingo. Gas sales are expected to commence in early calendar year 2015 once surface facilities and a tie-in pipeline are constructed at Dingo. With gas sales contracts in place at both Palm Valley and Dingo, and considering the cost of Dingo's surface facilities and pipeline tie-in, we expect our Amadeus Basin assets to provide Magellan with reasonably predictable cash flows. Offshore Australia, we conducted 2-D and 3-D seismic surveys over portions of NT/P82, our 100% owned exploration license in the Bonaparte Basin. Based on the preliminary interpretation of the seismic data we acquired, we believe we can successfully execute a farmout transaction in fiscal year 2014 whereby a new partner will drill the large gas prospects that lie within our block. In the UK, together with our partner Celtique Energie Holdings Ltd ("Celtique"), we completed an extensive geological analysis of the potential prospects underlying our Weald Basin acreage. In addition, we prepared and filed applications for permits to drill exploratory wells on our acreage, which will allow us to drill and further assess the potential for conventional and unconventional oil and gas production in fiscal year 2014.

4

As a result of the achievements and improvements realized in fiscal year 2013, in fiscal year 2014 we expect to progress various operational initiatives to points that will permit us to demonstrate the potential value of our assets and develop an asset rationalization strategy to maximize Magellan's net asset value per share.

Financial Performance

Our 2013 fiscal year financial results were significantly affected by the full-year impact of events in Australia that occurred during fiscal year 2012, namely the termination of the 25-year gas sales contract between Palm Valley and PWC (the "PWC Palm Valley Contract") in January 2012 and completion of the asset swap with Santos QNT Pty Ltd ("Santos QNT") and Santos Limited (collectively "Santos") in May 2012 (the "Santos SA"). These events together resulted in a significant decline in revenue and net income. Adjusted EBITDAX, however, improved slightly as reduced expenditures offset the loss of revenue.

We expect fiscal year 2013 to be a "trough" year in terms of revenues and earnings, with greater hydrocarbon production expected from our operating assets in fiscal years 2014 and 2015. At Poplar, the results of ongoing work-overs and water shut-off treatments, as well as production from the CO2-EOR pilot project, are expected to increase production from Poplar over the next twelve months. Gas reserves at Palm Valley are currently contracted to Santos through the Palm Valley GSPA (as defined below), and gas sales volumes are expected to increase under this contract to an annualized rate of 1.3 Bcf by the end of fiscal year 2014 and 1.5 Bcf by the end of fiscal year 2015. In addition, in September 2013, the Company signed the Dingo GSPA, a long term, inflation-indexed contract with PWC, for the sale of Dingo gas reserves, under which gas sales are expected to commence in early calendar year 2015.

Revenues. For the fiscal year ended June 30, 2013, revenues totaled $7.1 million compared to $13.7 million in the prior year, a decrease of 48%. This decrease was primarily the result of the termination of the PWC Palm Valley Contract in January 2012 and the sale of Magellan's interests in the Mereenie oil and gas field to Santos in May 2012 as part of the Santos SA.

Under Palm Valley's current gas supply and purchase agreement with Santos (the "Palm Valley GSPA"), gas sales volumes and revenues are currently expected to increase materially in the second half of fiscal year 2014. Under the terms of the Dingo GSPA signed in September 2013, new gas sales volumes and revenues from Dingo are expected to commence in early calendar year 2015.

Net Income and Earnings per Share. For the fiscal year ended June 30, 2013, net loss was $19.8 million ($(0.41)/basic share), compared to net income of $26.5 million ($0.49/basic share) for the prior fiscal year. The decrease in net income was primarily the result of non-recurring gains on sales of assets of $40.4 million recorded in fiscal year 2012 related to the Santos SA in May 2012, and the farmout of an interest in Poplar to VAALCO in September 2011 (the "VAALCO Farmout").

Adjusted EBITDAX. For the fiscal year ended June 30, 2013, Adjusted EBITDAX (see Non-GAAP Financial Measures and Reconciliation under Part I, Items 1 and 2: Business and Properties) was negative $10.9 million, compared to negative $11.2 million in the prior fiscal year, a positive change of 2%. The slight improvement in Adjusted EBITDAX resulted from a decrease in revenues offset by a corresponding decrease in lease operating expense, both primarily due to the sale of the Company's interest in Mereenie in May 2012 as part of the Santos SA and a decrease in general and administrative expense.

Cash. As of June 30, 2013, Magellan had $32.5 million in cash and cash equivalents as compared to $41.2 million at the end of the prior fiscal year. The decrease of $8.7 million was primarily the result of investment in work-overs and water shut-off treatments at Poplar, the cost of the 2-D and 3-D seismic surveys over NT/P82 (as defined below), our offshore block in Australia, and the repurchase of shares and warrants from Sopak AG (as defined below) in January 2013. These cash outflows were partially offset by $23.0 million in net proceeds from the issuance of convertible preferred stock in May 2013. We believe that our cash balance will permit us to determine the most efficient way to enhance shareholder value through assessing the potential value of our existing assets.

Operational Progress on Our Key Projects

In fiscal year 2013, management diligently pursued its strategy of proving up the value of the Company's existing assets as the most economic way of increasing shareholder value. Towards that end, management made steady progress on the development of all our key projects and has laid the groundwork for the achievement of key milestones in fiscal year 2014.

CO2-EOR at Poplar. On the basis of reservoir modeling and lab testing performed in the prior year, in fiscal year 2013, management focused heavily on furthering plans for a CO2-EOR program in the Charles formation at Poplar. In particular, the Company prepared for a five-well CO2-EOR pilot project planned for fiscal year 2014. Specifically, the Company worked to fulfill the various regulatory requirements necessary to obtain permits to drill the pilot wells. These permits were obtained in August 2013. In addition, the Company held extensive discussions with various CO2 suppliers. These efforts led to a two-year CO2 supply contract with Air Liquide Industrial U.S. LP ("Air Liquide") in July 2013. Air Liquide is the world leader in gases

5

for industry, health, and the environment. The Company also began dialogues with large-scale CO2 producers regarding the long term supply of CO2 for a full field CO2-EOR program at Poplar, which would follow the completion of the CO2-EOR pilot project if it proves successful.

NT/P82. During fiscal year 2013, Magellan focused on conducting a seismic survey over portions of its NT/P82 Exploration Permit ("NT/P82") in the Bonaparte Basin, offshore Northern Territory, Australia. In December 2012, the Company successfully conducted, via a third-party contractor, a 2-D and 3-D seismic survey over portions of the block. The seismic recording vessel Voyager Explorer, operated by Seabird Exploration FZ-LLC, acquired a total of 76 square miles of 3-D full fold data and 65 miles of 2-D full fold data. Between January and August 2013, the seismic data was undergoing processing and interpretation, the results of which were received in August 2013. We believe that the results of the seismic survey will allow the Company to begin a farmout process during the second quarter of fiscal year 2014. Through this process, the Company expects to identify a partner to drill exploratory wells over the large gas prospects that lie in our permit area in exchange for an ownership interest in and operatorship of the license.

Dingo. In fiscal year 2013, the Company undertook marketing efforts to identify and attract long term customers for Dingo's gas resources. These efforts resulted in the signing of the Dingo GSPA with PWC in September 2013 for the supply of up to 31 petajoules ("PJ") (30 billion cubic feet ("Bcf")) of gas over a 20-year period at a fixed price escalating with Australian CPI. In parallel to the marketing efforts, during the fiscal year Magellan completed a pre-front-end engineering and design ("pre-FEED") study to evaluate the cost and logistics of installing gas treatment facilities and laying a pipeline to tie the Dingo field into the existing pipeline infrastructure at Brewer Estate, south of Alice Springs, where PWC will take delivery of the gas. This study will serve as the basis for bringing Dingo to operational capability at the beginning of calendar year 2015.

United Kingdom. In fiscal year 2013, Magellan focused primarily on carrying out extensive geological analysis and planning for the exploration of three of the Production Exploration and Development Licenses ("PEDLs") it co-owns 50% with its partner Celtique (PEDLs 231, 234, and 243) in the Weald Basin in southern England. These licenses are prospective for unconventional oil production from the Kimmeridge Clay and Liassic formations. The Company, in conjunction with Celtique, which operates the licenses, worked toward permitting well site locations and evaluating the prospects for drilling exploratory wells, the first of which the Company expects to spud in the third quarter of fiscal year 2014.

Also in fiscal year 2013, it appears that the macro environment in the UK underwent favorable developments that positively impact the outlook on the development of unconventional resources. In December 2012, the UK government announced that exploratory hydraulic fracturing activities could resume in the UK following a moratorium on the practice. In February 2013, the government also announced plans to better exploit its unconventional hydrocarbon resources. Tax incentives and other favorable changes in UK laws and regulations with respect to onshore drilling in the UK are expected to be introduced in the coming months.

Realignment of Shareholder Base and Preferred Equity Issuance

During fiscal year 2013, the Company effected two major changes in its shareholder base. In January 2013, it repurchased 17% of its common stock and related warrants representing up to an incremental 7% dilution overhang from Sopak AG, a Swiss subsidiary of Glencore International plc ("Sopak"), which aquired the stock and warrants through a pledge by an entity affiliated with a former director. Later in the fiscal year, the Company issued convertible preferred stock to a new single investor, thereby replenishing its cash balances and gaining a new long term strategic and financial partner.

Series A Convertible Preferred Stock Financing Agreement with One Stone. On May 10, 2013, the Company entered into a Series A Convertible Preferred Stock Purchase Agreement (the "Series A Purchase Agreement") with an affiliate of One Stone Energy Partners, L.P., a New York based private equity firm focused on investments in the oil and gas industry (both the private equity firm and its affiliate are hereinafter referred to collectively as "One Stone"). Pursuant to the terms of the Series A Purchase Agreement, on the closing date of May 17, 2013, the Company issued and sold to One Stone 19,239,734 shares of Series A Convertible Preferred Stock, par value $0.01 per share (the "Series A Preferred Stock"), at a purchase price of $1.22149381 per share, for aggregate net proceeds of approximately $23.0 million. Each share of Series A Preferred Stock will be entitled to a dividend equivalent to 7.0% per annum. Subject to certain conditions, each share of Series A Preferred Stock and any related unpaid accumulated dividends will be convertible into one share of the Company's common stock at an initial conversion price of $1.22149381 per share.

Management believes that this Series A Preferred Stock financing was a critical milestone in the path to delivering value to shareholders because the proceeds of this transaction, together with the proceeds from potential asset sales or farmout arrangements, in addition to the Company's existing cash resources, will provide the Company with sufficient liquid capital resources to fund (i) the CO2-EOR pilot project at Poplar, including the purchase of necessary CO2 volumes; (ii) the current negative cash flow from operations, which is expected to be partially mitigated by the planned ramp up of gas sales from our onshore Australian assets in calendar year 2014; and (iii) the Company's efforts to further establish the value of our UK acreage

6

through the participation in one or more exploratory wells in calendar year 2014.

In pursuing this financing, the Company considered a number of alternatives, including equity issuances via a PIPE or secondary offering to the institutional investor markets, conventional bank debt, and mezzanine loans from a bank and alternative investment markets. The Company also considered the sale of non-core assets, but determined that this alternative would have been premature at the time, as the UK acreage remained highly prospective, 3-D seismic data over NT/P82 was still undergoing processing and interpretation, and the onshore Australian assets were not yet fully contracted.

Ultimately, the Company determined this Series A Preferred Stock financing to be the most attractive financing option available. Through this financing, the Company (i) gained a long term strategic and financial partner in One Stone; (ii) received approximately $23.0 million in net proceeds convertible at a 20% premium to the common share price prior to the transaction, without issuing any warrants; and (iii) maintained certain protections in the form of forced conversion and redemption rights. Management believes that, in spite of potential ownership dilution to existing shareholders, this transaction represented the most timely and efficient path to increasing net asset value per share.

The Series A Purchase Agreement and the related Certificate of Designations of the Series A Preferred Stock and Registration Rights Agreement have been previously filed as exhibits to the Company's US Securities and Exchange Commission ("SEC") reports, and are incorporated by reference in the exhibits under Part IV, Item 15 of this report. For a more detailed summary of the key terms of the Series A Purchase Agreement, please see Note 8 to the consolidated financial statements included in Item 8: Financial Statements and Supplementary Data of this report.

Sopak, YEP, and Nikolay V. Bogachev; Share and Warrant Repurchases. On January 14, 2013, the Company entered into a Collateral Purchase Agreement with Sopak. Under the terms of this agreement, Magellan paid $10.0 million to Sopak for 9,264,637 shares of Magellan common stock, a warrant granting Sopak the right to purchase an additional 4,347,826 shares of Magellan common stock at an exercise price of $1.15 per share, and a registration rights agreement related to the repurchased shares and warrant. In addition, the Company obtained from both Nikolay V. Bogachev, who served as a director of the Company until his resignation effective January 16, 2013, and Young Energy Prize S.A. ("YEP"), a Luxembourg entity affiliated with Mr. Bogachev, a release from all claims by those parties against Magellan or its assets. Sopak originally obtained its shares and warrant in September 2012 by exercising its rights under a pledge and security agreement between Sopak and YEP.

As a result of this transaction, the Company repurchased 17% of its outstanding common stock and eliminated the significant potential dilutive impact of the related warrant at a price and at a time that the Company believes was attractive.

For further details on this transaction, see Note 9 to the consolidated financial statements included in Item 8: Financial Statements and Supplementary Data of this report.

OUTLOOK FOR FISCAL YEAR 2014

During fiscal year 2014, Magellan intends to execute on its strategy of proving the potential of its existing assets. We are particularly focused on the four projects below, which we intend to fund through the Company's cash resources comprised of cash on hand and proceeds from asset sales or farmout arrangements, which include the proceeds from the Series A Preferred Stock issuance in May 2013:

• | implementing a CO2-EOR pilot project at Poplar; |

• | drilling one and possibly two wells in the UK to evaluate the potential of the various formations in our licenses in the UK; |

• | contracting most of Dingo's gas reserves under a long term agreement, which was achieved in September 2013 through the Dingo GSPA and conducting the engineering, design, and construction of the pipeline and surface facilities to make Dingo ready for gas production in fiscal year 2015; |

• | completing the processing and interpretation of seismic data for NT/P82 and identifying a farm-in partner to drill one or more exploration wells on the exploration permit in Australia in fiscal year 2015. |

Management believes that each of these projects has significant potential that, if realized, could materially impact the Company's reserves and the underlying net asset value per share and eventually allow the Company to generate positive cash flow from operations. Specific steps and milestones for each of these key areas are discussed below. By pursuing these courses of action in parallel, management expects that, over the next 12 to 15 months, the Company will be able to validate the value potential of these assets and will be able to determine the most appropriate course of action with respect to each asset to achieve the best value for its shareholders.

7

CO2-EOR Pilot Project

In fiscal year 2014, the Company intends to implement a CO2-EOR pilot project in the Charles formation at Poplar to validate the reserves potential of this tertiary recovery technique on a full-field basis. In July 2013, the Company signed an approximately two-year CO2 supply contract with Air Liquide for the CO2 necessary to complete the CO2-EOR pilot project. In August 2013, the Company obtained permits from the US Bureau of Land Management to drill the five wells necessary for the pilot project. Drilling began in August 2013 and is expected to continue through November of this year. Currently we plan for the five pilot wells to be arranged in a "five-spot" pattern, with a single CO2 injection well in the center surrounded by four producing wells. CO2 injection is expected to commence in October 2013. From the time of first injection, it will take between 12 and 15 months to evaluate the effectiveness of the CO2-EOR technique and announce results from the pilot project. The cash cost of the pilot project, including capital and certain operating expenditures including the cost of the supply of CO2 over two years, will total approximately $20.0 million, with most of these expenditures incurred by March 2014.

With the results of the CO2-EOR pilot project expected to be received by the end of calendar year 2014, the Company hopes to demonstrate that the implementation of a full-field CO2-EOR program at Poplar could result in the recovery of approximately an additional 50 million barrels of oil. Based on our own work, the production history of the field to date, and reference to analogous CO2-EOR projects in the Williston Basin, management believes that the Charles formation at Poplar has 500 to 600 million barrels of oil in place and the recovery of an incremental 10% of this amount is an achievable objective.

United Kingdom Exploration Wells

In fiscal year 2014, the Company will focus on evaluating the potential of its conventional and unconventional prospects in the Weald Basin in southern England, which are primarily contained within the license areas of PEDLs 231, 234, and 243, which the Company co-owns 50% with Celtique. These licenses are prospective for unconventional oil production. The PEDLs are due to expire at the end of June 2014 and are subject to customary "drill or drop" work commitment and a 50% relinquishment rule. These PEDLs will be extended for an additional 5-year period if work commitments are met. We and our partner, Celtique, are planning to drill the first exploration well in PEDL 234, the location of which may meet our work commitments for both PEDLs 234 and 243. We expect to spud this well in the third quarter of fiscal year 2014. In addition, we are in the process of permitting a well in PEDL 231 to fulfill our commitments for this lease area, and will apply for a 12-month extension to our current PEDL to allow additional time to receive planning approval. In PEDL 234, we are also awaiting final planning approval to drill a well in the center of the Basin, which may spud in the fourth quarter of fiscal year 2014. The purpose of these wells is to test and evaluate the Kimmeridge Clay and Liassic formations in order to substantiate the unconventional oil and gas production potential of our acreage and to test and evaluate the conventional prospects in the Triassic formation. Under the terms of our joint operating agreement with Celtique, we are required to participate in these commitment wells to maintain our working interest in the PEDLs. We intend to participate in the drilling of these wells and expect to fund our share of the costs through either our cash reserves, the farmout of a portion of our interests, or the proceeds from other asset sales.

With regards to PEDL 137, of which the Company owns 100%, we expect to finalize the terms of a farmout agreement with a partner to drill the Horse Hill prospect, which targets Jurassic and Triassic formations with oil and gas potential, respectively. With regards to the various PEDLs (PEDLs 126, 155, 240, 256, and P1916) the Company owns along with Northern Petroleum Plc ("Northern"), we do not anticipate any significant activity in fiscal year 2014.

Dingo Development

In September 2013, the Company signed the Dingo GSPA with PWC for the sale of up to 31 PJ (30 Bcf) of gas over a 20-year period to PWC, commencing early in calendar year 2015. With a long term contract now in place, the Company will use the intervening time period to design, construct, and commission the surface facilities and tie-in pipeline necessary for the production and delivery of Dingo's gas. Gas volumes are expected to be produced from three wells drilled at Dingo in the 1980s and 1990s, of which two wells have since been temporarily shut-in but are expected to be capable of producing gas volumes sufficient to meet the initial delivery requirements under the Dingo GSPA. Currently, the Company is undertaking the front-end engineering and design ("FEED") of the facilities and pipeline, which is a continuation of work performed during the pre-FEED stage in fiscal year 2013, and which is expected to take approximately six months to complete. Based on engineering and design work already done, the Company is planning to run Dingo as a remote operation, with only wellheads and gathering lines to be located at the field itself. Production from the wells will flow through a pipeline approximately 30 miles in length to a processing facility to be located at Brewer Estate, an industrial facility located just south of Alice Springs, where the gas will be processed and where PWC will take delivery of the gas.

Concurrently with the FEED work, the Company will be applying for various regulatory permits and licenses to allow for the commercial production and sale of gas from Dingo, including (i) the grant of a production license over the area of the

8

current Dingo retention license, (ii) the grant of a pipeline license over the approximately 30-mile pipeline route connecting the Dingo field to Brewer Estate, and (iii) the grant of planning approval for the use of land at Brewer Estate for the installation and operation of a gas processing facilities. The Company expects that it will take approximately twelve months to receive all required permits and licenses to be able to start the construction phase of the surface facilities and pipeline necessary to commission the production of gas from Dingo. We began preliminary permitting work in July 2013 and expect the construction phase of the project to commence in early fiscal year 2015.

The Company currently intends to fund the development of Dingo primarily through the issuance of new project finance debt facilities, which it will service with cash flow generated by the Dingo GSPA once production commences. The Company also expects to supplement the project financing from its own cash resources. If project finance debt is not available under satisfactory terms, Magellan may seek to find a third party to build and own the pipeline, which third party would in turn charge the Company a tariff for the use of the pipeline over the life of the Dingo GSPA. Finally, the Company also intends to review strategic alternatives for its Amadeus Basin assets, Palm Valley and Dingo, over the course of the upcoming year.

NT/P82, Offshore Australia

In the first quarter of fiscal year 2014, the Company expects it will complete the processing and interpretation of 3-D and 2-D seismic surveys that the Company shot over part of NT/P82 in the Bonaparte Basin in December 2012. From preliminary results of the 2-D and 3-D seismic interpretation the Company expects to engage in a farmout process to identify a partner experienced in offshore drilling. In completing a farmout, the Company expects to relinquish a portion of its working interest in, and operatorship of NT/P82, in exchange for a commitment from the partner to drill exploration wells over the large gas prospects identified in the block by fiscal year 2015. Given the high level of offshore drilling activity in the Bonaparte Basin, the network of installed gas infrastructure in the relative vicinity of our block, and the relatively shallow depths of water in the license, the Company believes it is well positioned to successfully complete a farmout.

OPERATIONS

Magellan operates in the single industry segment of oil and gas exploration and production. We have three reportable geographic segments, NP, MPA, and MPUK, corresponding to our operations in the United States, Australia, and the UK, respectively. NP's oil and gas assets consist of its interests in Poplar in the Williston Basin. MPA's oil and gas assets consist of interests in the Palm Valley, Dingo, and Mereenie (prior to May 25, 2012) fields in the Amadeus Basin, onshore Australia; and NT/P82, an exploration block in the Bonaparte Basin, offshore Australia. MPUK's oil and gas assets consist of various exploration licenses in the Weald and Wessex Basins located onshore and offshore southern England. The locations of the Company's key oil and gas properties are presented in the map below. For certain additional information about the Company's reportable segments, see Note 11 to the consolidated financial statements included in Item 8: Financial Statements and Supplementary Data of this report.

9

Magellan's Areas of Operations

United States - Poplar

In the US, Magellan owns Poplar, an oil field located in Roosevelt County, Montana. Our acreage position covers substantially all of Poplar Dome, the largest geologic structure in the western Williston Basin with multiple stacked formations with hydrocarbon resource potential.

The field was discovered in the 1950s by Murphy Oil, who actively explored and developed the Charles formation for two decades. By the time Magellan acquired Poplar in 2009, technological advances in oil and gas exploration allowed us to reevaluate Poplar's known formations and to discover new ones.

Poplar, as the Company defines it, is composed of a 100% working interest in the oil and gas leases within the East Poplar Unit ("EPU"), a federal exploratory unit in Roosevelt County, Montana, totaling approximately 18,000 net acres, and the working interests in various oil and gas leases that are adjacent to or near EPU ("Northwest Poplar" or "NWP") totaling approximately 4,000 net acres.

Our interests within EPU (also referred to herein as "Poplar") include a 100% operated working interest in the interval from the surface to the top of the Bakken/Three Forks formation (the "Shallow Intervals") and an operated working interest below those intervals ranging from 50% to 65%, which include the Bakken/Three Forks, Nisku, and Red River formations (the "Deep Intervals"). VAALCO Energy (USA), Inc. ("VAALCO") owns the remaining working interest in the Deep Intervals. Our interests within NWP are all operated and are the same as within EPU, except in certain leases in which the Company and VAALCO collectively own less than 100% of the working interest.

Shallow Intervals. Magellan's primary objective in the Shallow Intervals is to establish the technical and economic viability of a CO2-EOR project in the Charles formation, in which the substantial volume of oil in place offers Magellan a chance to significantly increase its oil reserves. Secondarily, the Company intends to explore other formations within the Shallow Intervals prospectively for oil and gas production, including the Tyler and Amsden formations, as well as the Piper and Judith River formations.

Deep Intervals. Pursuant to the terms of the VAALCO Farmout entered into in September 2011, VAALCO drilled and completed three wells in the Deep Intervals in fiscal year 2012 and 2013 to ultimately earn a 50% non-operated working interest in the Deep Intervals. The original agreement with VAALCO granted a 65% working interest upon the drilling of three wells and was re-negotiated in March 2013 to grant VAALCO a 50% working interest in the Deep Intervals, subject to other

10

terms and conditions further discussed in Part II, Item 7 : Management's Discussion and Analysis of Financial Condition and Results of Operations of this report. Through this process, the Company was able to start evaluating the potential of various formations, including the Bakken/Three Forks, Nisku, and Red River. Although commercial quantities of oil and gas were not encountered with these three wells, the results of cores and logs are encouraging, and the Company may engage in further exploration of these formations at a later date.

Australia - Amadeus Basin

In the Amadeus Basin, located near Alice Springs in central Australia, Magellan owns 100% operated working interests in two gas fields, Palm Valley and Dingo.

Palm Valley. Palm Valley was discovered in 1965 and has been reliably producing natural gas since 1983. As of June 2013, the field has produced a cumulative total of 158 Bcf of gas. Through its direct connection to the Amadeus-Darwin Gas Pipeline, Palm Valley is able to meet the needs of its potential customers in Darwin, Northern Territory, and the mining operations adjacent to this pipeline. In 2011, Magellan entered into the Palm Valley GSPA with Santos whereby the Company has the ability to sell up to approximately 23 Bcf of natural gas, representing the majority of what the Company believes are the field's remaining gas reserves, over a 17-year period which began on May 25, 2012 to Santos, which onsells to third party customers. To date Santos has future sale commitments estimated at 11 Bcf of this gas. The deliverability of gas from existing wells and the firm sale commitments are crucial elements in determining the reserves that can be booked as proved reserves.

Dingo. Dingo is a gas field discovered in 1981. Four appraisal wells drilled between 1981 and 1991 established the field's resource and production potential. Magellan maintains its interest in Dingo through Retention License No. 2, which expires in February 2014, and is subject to renewal for a further five years. The Company has initiated the application process for an operating license that will allows us to maintain production for a 20-year period once received. Until recently, Northern Territory gas market dynamics have prevented the development of Dingo as a producing field. However, Magellan has entered into the Dingo GSPA with PWC for the sale of up to 31 PJ of gas (30 Bcf) over a 20-year period. Sales under the Dingo GSPA are expected to commence early in calendar year 2015. In the intervening time, Magellan will be focused on obtaining permits and licenses to commission Dingo for commercial production, completing the design, engineering, and construction of the surface facilities and the 30 mile tie-in to existing pipeline infrastructure. As of the date of this report, the Company has initiated the various permitting processes and expects the construction phase of the project to commence at the beginning of fiscal year 2015.

Australia - NT/P82

In the Timor Sea, offshore Northern Territory, Australia, Magellan holds a 100% interest in the exploration permit NT/P82, which covers 2,500 square miles of the Bonaparte Basin in water ranging in depth from 30 to 500 feet. The Company conducted 3-D and 2-D seismic surveys over portions of the license area in December 2012 and is currently in the final stages of interpreting this data. Under the terms of the permit, which is due to expire in May 2016, the Company is required to drill one exploratory well by May 2015. The Company currently intends to meet its work commitment through a farmout to another company.

United Kingdom

In the Weald and Wessex Basins, Magellan has interests in 10 PEDLs and one Seaward Production License (P1916), representing a total of approximately 200,000 net acres onshore and offering both oil and gas prospects through conventional and unconventional development.

Magellan's acreage position is composed of three groups of licenses: (i) four PEDLs co-owned 50% with, and operated by, Celtique; (ii) five licenses (four PEDLs and P1916) with varying ownership operated by Northern; and (iii) two licenses wholly owned and operated by Magellan. To date in the UK, Magellan has participated in conventional wells, the most recent being the Markwells Wood-1, which was drilled and operated by Northern in PEDL 126. In addition, Magellan has contributed, along with its partners, to the exploration of its other licenses in accordance with the terms of each PEDL.

The PEDL licensing regime in the UK, which is administered by the Department of Energy and Climate Change ("DECC"), allows for a 6-year initial exploration phase, which can be extended by an additional five years so long as pre-agreed work commitments have been met, for a maximum of an 11-year exploration phase from the original award date of a PEDL. Following the exploration phase, a PEDL will either convert into a production license with a term of approximately 20 years or transfer to the government and be made available for a new round of licensing. The licensing regime also requires that

11

50% of the acreage of a PEDL be relinquished at the end of the first six-year exploration period. This 50% relinquishment is expected to occur for most of Magellan's licenses in June 2014.

RESERVES

Estimates of reserves are inherently imprecise and continually subject to revision based on production history, results of additional exploration and development, price changes, and other factors.

The below table presents a summary of our proved and probable reserves as of June 30, 2013.

Oil (Mbbls) | Gas (Bcf) | Total (Mboe)(1) | ||||||

Proved developed producing (PDP): | ||||||||

United States | 1,081 | — | 1,081 | |||||

Australia | — | 6 | 1,000 | |||||

Total | 1,081 | 6 | 2,081 | |||||

Proved developed not producing (PDNP): | ||||||||

United States | 500 | — | 500 | |||||

Australia | — | 5 | 833 | |||||

Total | 500 | 5 | 1,333 | |||||

Proved undeveloped (PUD): | ||||||||

United States | 5,787 | — | 5,787 | |||||

Total | 5,787 | — | 5,787 | |||||

Total proved reserves | 7,368 | 11 | 9,201 | |||||

PDP% | 15 | % | 55 | % | 23 | % | ||

PDNP% | 7 | % | 45 | % | 14 | % | ||

PUD% | 78 | % | — | % | 63 | % | ||

Probable: | ||||||||

Developed | — | 13 | 2,167 | |||||

Undeveloped | 1,950 | 29 | 6,783 | |||||

Total | 1,950 | 42 | 8,950 | |||||

Total proved and probable reserves | 9,318 | 53 | 18,151 | |||||

Proved % | 79 | % | 21 | % | 51 | % | ||

Probable % | 21 | % | 79 | % | 49 | % | ||

(1) Gas volumes are converted to Mboe at a rate of 6 MMcf of gas per Mbbl of oil based upon the approximate relative energy content of each fuel.

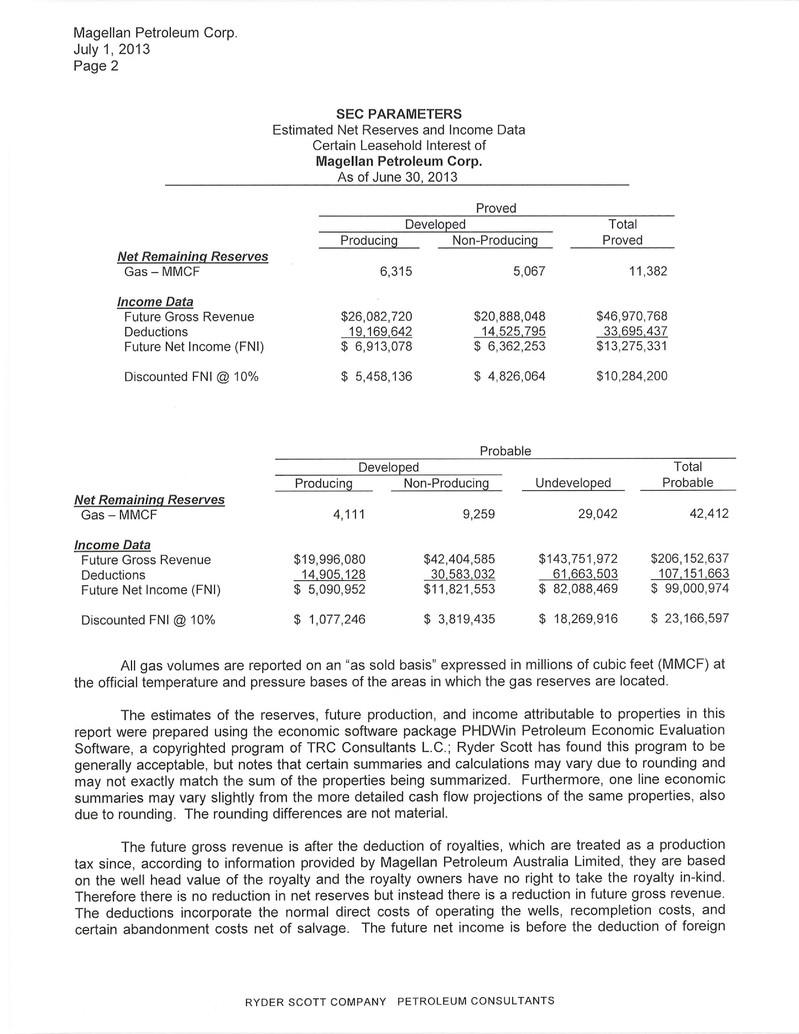

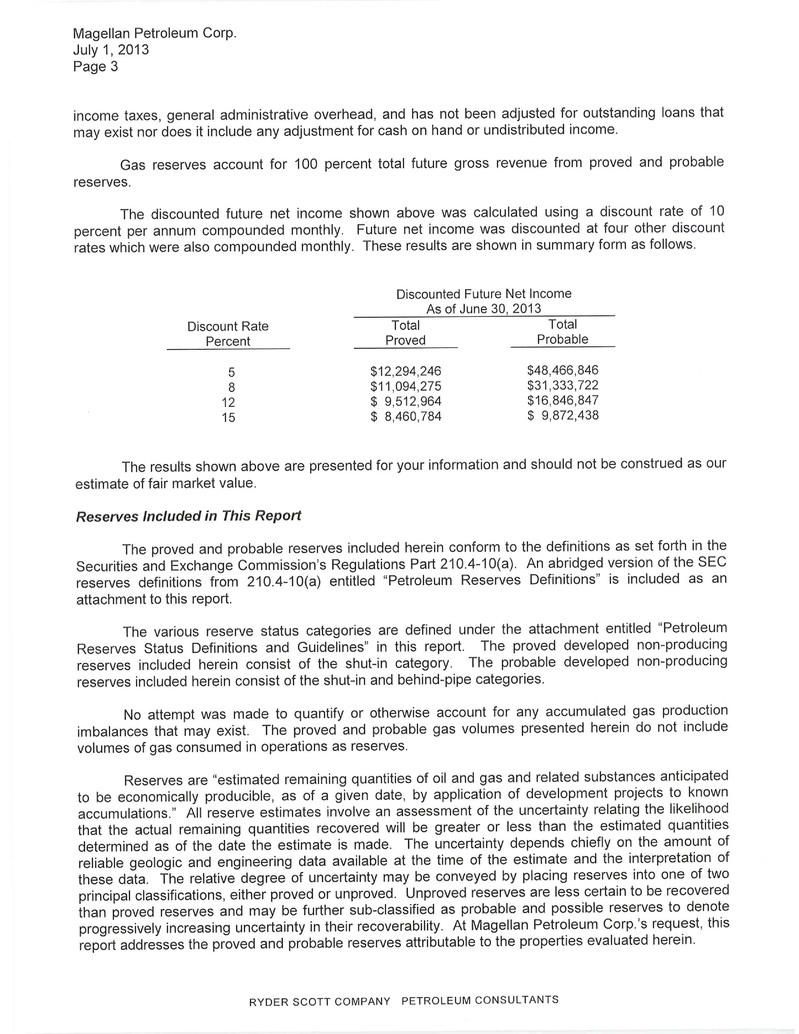

As of June 30, 2013, our consolidated total proved reserves amounted to 9,201 Mboe, comprised of 7,368 Mbbls (79%) of proved oil reserves and 11 Bcf (21%) of proved gas reserves. All of our proved and probable oil reserves relate to our interest in Poplar, Montana. Of the 7,368 Mbbls of proved oil reserves, approximately 7,328 Mbbls (99%), 35 Mbbls (0%), and 5 Mbbls (0%) were derived from the Charles, Tyler, and Amsden formations, respectively. All of the probable oil reserves were derived from the Tyler formation.

The Company's proved undeveloped reserves in the US consist of twenty infill drilling locations within EPU at Poplar targeting the Charles formation. These proved undeveloped reserves were identified and recorded in fiscal year 2010. In light of the Company's focus on CO2-EOR and the fact that none of these infill locations have been drilled to date, the Company decided to reduce this drilling program from 20 locations to 16 locations over the next two fiscal years. In their place, the Company will be drilling four producing wells as part of the CO2-EOR pilot project. To be conservative and due to the lack of

12

technical data available, we have decided not to include these wells in the Company's reserves estimates. The Company expects to conduct a similar review of its drilling program and impact on proved undeveloped reserves at the end of fiscal year 2014.

As of June 30, 2013, all of our proved gas reserves and 13 Bcf (45%) of our probable gas reserves related to our interest in Palm Valley in Australia. Under the terms of the Palm Valley GSPA, we are entitled to sell up to approximately 23 Bcf of gas from Palm Valley to Santos, who on-sells the gas to third-party customers. As of June 30, 2013, proved gas reserves totaled 11 Bcf, corresponding to gas sales volumes committed to third-party customers under the Palm Valley GSPA. The 42 Bcf of probable gas reserves correspond to the remaining volumes to be sold under the Palm Valley GSPA plus additional volumes of gas estimated to be economically recoverable from Dingo.

As of June 30, 2013, 29 Bcf (55%) of our probable gas reserves related to our interest in Dingo in Australia. In September 2013, Magellan entered into the Dingo GSPA with PWC for the sale of 31 PJ (30 Bcf) of gas over a 20-year period. Sales under the Dingo GSPA are expected to commence early in calendar year 2015. As a result of this contract, we believe that some of the probable reserves related to Dingo could be converted from probable to proved reserves as of June 30, 2014.

Proved Undeveloped Reserves

As of June 30, 2013, we had 5,787 Mboe of proved undeveloped reserves, representing a decrease of 1,471 Mboe, or 20%, over the prior year figure. During the fiscal year, we did not convert any proved undeveloped reserves to proved developed reserves.

As of June 30, 2013, we had no proved undeveloped reserves that had been on our books in excess of five years, and we had no material proved undeveloped locations that were more than one direct offset from an existing producing well.

Probable Reserves

Estimates of probable developed and undeveloped reserves are inherently imprecise. When estimating the amount of oil and gas that is recoverable from a particular reservoir, an estimated quantity of probable reserves is an estimate that more likely than not will not achieved. Estimates of probable reserves are continually subject to revision based on production history, results of additional exploration and development, price changes, and other factors.

We use deterministic methods to estimate probable reserve quantities, and when deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir. Probable reserves estimates also include potential incremental quantities associated with a lower percentage recovery of the hydrocarbons in place than assumed for proved reserves.

Internal Controls Over Reserve Estimates

Our internal controls over the recording of proved reserves are structured to objectively and accurately estimate our reserve quantities and values in compliance with regulations established by the SEC. The Company relies upon a combination of internal technical staff and third party consulting arrangements for reserve estimation and review.

In the US, the responsibility for reserves estimation is delegated to Blaine Spies, Magellan's Operations Manager since December 2011. Mr. Spies has over 20 years of operation and technical engineering experience in the oil and gas industry. Prior to his appointment with Magellan, Mr. Spies was the Operations Manager at American Oil & Gas, responsible for drilling and completion operations in North Dakota. Mr. Spies also has experience in the Rocky Mountain and Gulf Coast regions. He received his Bachelors of Science in Petroleum Engineering from the Colorado School of Mines and his Masters in Business Administration from the Colorado Technical University.

In Australia, reserve estimates were prepared by the Ryder Scott Company ("RS"), an independent petroleum engineering firm, in accordance with the Company's internal control procedures, which include the verification of input data used by RS, and management review and approval.

Third Party Reserve Audit

In the US, reserve estimates were audited by Allen & Crouch Petroleum Engineers ("A&C"), an independent petroleum engineering firm. A copy of the summary reserve report of A&C is provided as Exhibit 99.1 to this Annual Report on Form 10-

13

K. A&C does not own an interest in any of Magellan's oil and gas properties and is not employed by Magellan on a contingent basis. In addition, A&C served as the reserves auditor for Jonah Bank of Wyoming with respect to NP's loan currently outstanding with Jonah Bank of Wyoming.

In Australia, reserve estimates were prepared by RS, an independent petroleum engineering firm. A copy of the summary reserve report of RS is provided as Exhibit 99.2 to this Annual Report on Form 10-K. RS does not own an interest in any of Magellan's oil and gas properties and is not employed by Magellan on a contingent basis.

Detailed information regarding reserves, costs of oil and gas activities, capitalized costs, discounted future net cash flows, and results of operations is disclosed in the supplemental information (see Note 16) to the consolidated financial statements of this Form 10-K.

VOLUMES AND REALIZED PRICES

The following table summarizes volumes and prices realized from the sale of oil and gas from properties in which we owned an interest during the periods stated. The table also summarizes operational costs per barrel of oil equivalent.

Volumes | Average realized price (2) | Production costs (3) (Per boe)(1) | ||||||||||||||||||||||

Oil (Mbbls) | Gas (MMcf) | Total (Mboe)(1) | Oil (Per bbl) | Gas (Per Mcf) | Total (Per boe)(1) | |||||||||||||||||||

Fiscal year ended June 30, 2013 | ||||||||||||||||||||||||

United States | 72 | — | 72 | $ | 84.91 | $ | — | $ | 84.91 | $ | 67.17 | |||||||||||||

Australia | — | 191 | 32 | $ | — | $ | 4.93 | $ | 29.56 | $ | 68.86 | |||||||||||||

Total | 72 | 191 | 104 | $ | 84.91 | $ | 4.93 | $ | 68.01 | $ | 67.62 | |||||||||||||

Fiscal year ended June 30, 2012 | ||||||||||||||||||||||||

United States | 75 | — | 75 | $ | 82.66 | $ | — | $ | 82.66 | $ | 70.06 | |||||||||||||

Australia | 45 | 434 | 119 | $ | 137.21 | $ | 3.11 | $ | 64.40 | $ | 65.13 | |||||||||||||

All other areas | 2 | — | 2 | * | * | * | * | |||||||||||||||||

Total | 122 | 434 | 196 | $ | 101.64 | $ | 3.11 | $ | 70.95 | $ | 66.47 | |||||||||||||

Fiscal year ended June 30, 2011 | ||||||||||||||||||||||||

United States | 68 | — | 68 | $ | 77.96 | $ | — | $ | 77.96 | $ | 43.85 | |||||||||||||

Australia | 55 | 712 | 174 | $ | 98.60 | $ | 2.26 | $ | 47.27 | $ | 36.10 | |||||||||||||

Total | 123 | 712 | 242 | $ | 96.11 | $ | 2.26 | $ | 56.27 | $ | 38.28 | |||||||||||||

(*) Not meaningful.

(1) Gas volumes are converted to Mboe at a rate of 6 MMcf of gas per Mbbl of oil based upon the approximate relative energy content of each fuel.

(2) Prices per bbl or per Mcf are reported net of royalties. However, it should be noted that current period prices may be influenced by prior period royalty adjustments arising from annual royalty audits.

(3) Production cost excludes severance taxes.

Total production declined from 196 Mboe in fiscal year 2012 to 104 Mboe in fiscal year 2013, primarily as a result of the termination of the PWC Palm Valley Contract in January 2012 and the impact of the Santos SA completed in May 2012. Production cost on a $/boe basis increased in Australia from $65.13/boe to $68.86/boe primarily due to decreased production, and decreased in the US from $70.06/boe to $67.17/boe primarily due to a fewer amount of work-overs in fiscal year 2013. These factors combined to increase production costs from $66.47/boe to $67.62/boe in the US and Australia, collectively.

14

PRODUCTIVE WELLS

Productive wells include producing wells and wells mechanically capable of production. In the US, all wells were located at Poplar and, in Australia, all gas wells were located at Palm Valley. The following table presents a summary of our productive wells by geography as of June 30, 2013.

Oil Wells | Gas Wells | Total Wells | |||||||||||||||

Gross (1) | Net (2) | Gross (1) | Net (2) | Gross (1) | Net (2) | ||||||||||||

United States | 42.0 | 40.4 | — | — | 42.0 | 40.4 | |||||||||||

Australia | — | — | 4.0 | 4.0 | 4.0 | 4.0 | |||||||||||

Total | 42.0 | 40.4 | 4.0 | 4.0 | 46.0 | 44.4 | |||||||||||

(1) A gross well is a well in which the Company owns a working interest. Wells with one or more completions in the same bore hole are considered to be one well.

(2) The number of net wells is the sum of the fractional working interests owned in gross wells.

DRILLING ACTIVITY

The following table summarizes the results of our development and exploratory drilling during the years ended:

June 30, | |||||||||||||||||

2013 | 2012 | 2011 | |||||||||||||||

Productive (2) | Dry (3) | Productive (2) | Dry (3) | Productive (2) | Dry (3) | ||||||||||||

Development wells, net (1): | |||||||||||||||||

United States | — | — | 4.0 | 1.0 | 1.0 | — | |||||||||||

Total | — | — | 4.0 | 1.0 | 1.0 | — | |||||||||||

Exploratory wells, net (1): | |||||||||||||||||

United States | — | — | 1.0 | — | — | — | |||||||||||

Total | — | — | 1.0 | — | — | — | |||||||||||

Total net wells | — | — | 5.0 | 1.0 | 1.0 | — | |||||||||||

(1) The number of net wells is the sum of the fractional working interests owned in gross wells. The number of wells drilled refers to the number of wells completed at any time during the fiscal year, regardless of when drilling was initiated.

(2) A productive well is an exploratory, development, or extension well that is not a dry well.

(3) A dry well is an exploratory, development, or extension well that proves to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. Completion refers to installation of permanent equipment for production of oil or gas, or, in the case of a dry well, to reporting to the appropriate authority that the well has been plugged and abandoned.

The following table summarizes the results, as of September 16, 2013, of our wells that were still in progress as of June 30, 2013.

Still in Progress | |||||

Gross (1) | Net (2) | ||||

United States (3) | 4.0 | 3.4 | |||

Total | 4.0 | 3.4 | |||

(1) A gross well is a well in which the Company owns a working interest. Wells with one or more completions in the same bore hole are considered to be one well.

(2) The number of net wells is the sum of the fractional working interests owned in gross wells.

(3) The four work in progress wells consist of the three wells drilled by VAALCO in the Deep Intervals, EPU 120, EPU 133-H, EPU 125, and the EPU 119, which remains under evaluation following a water shut-off treatment in January 2013.

15

ACREAGE

The following table summarizes gross and net developed and undeveloped acreage by geographic area at June 30, 2013.

Developed (1) | Undeveloped (4) | Total | |||||||||||||||

Gross (2) | Net (3) | Gross (2) | Net (3) | Gross (2) | Net (3) | ||||||||||||

United States: | |||||||||||||||||

Poplar | 22,913 | 21,997 | — | — | 22,913 | 21,997 | |||||||||||

Australia: | |||||||||||||||||

Palm Valley | 41,644 | 41,644 | 116,288 | 116,288 | 157,932 | 157,932 | |||||||||||

Dingo | — | — | 116,139 | 116,139 | 116,139 | 116,139 | |||||||||||

NT/P82 | — | — | 1,566,647 | 1,566,647 | 1,566,647 | 1,566,647 | |||||||||||

United Kingdom | 80 | 32 | 373,137 | 195,203 | 373,217 | 195,235 | |||||||||||

Total | 64,637 | 63,673 | 2,172,211 | 1,994,277 | 2,236,848 | 2,057,950 | |||||||||||

(1) Developed acreage encompasses those leased acres assignable to productive wells. Our developed acreage that includes multiple formations may be considered undeveloped for certain formations but have been included as developed acreage in the presentation above.

(2) A gross acre is an acre in which the registrant owns a working interest.

(3) The number of net acres is the sum of the fractional working interests owned in gross acres.

(4) Undeveloped acreage encompasses those leased acres on which wells have not been drilled or completed to a point that would permit the production of economic quantities of oil or gas regardless of whether such acreage contains proved reserves.

Of our 22,913 gross acres at Poplar, approximately 18,000 acres (79%) form a federal exploratory unit which is held by economic production from any one well within the unit. Currently, Poplar contains 42 producing wells.

TITLES TO PROPERTY, PERMITS, AND LICENSES

Magellan maintains interests in its oil and gas properties through various contractual arrangements customary to the oil and gas industry and relevant to the local jurisdictions of its assets.

United States

In the US, Magellan maintains its working interests in oil and gas properties pursuant to leases from third parties. We have either commissioned title opinions or conducted title reviews on substantially all of our properties and believe we have title to them. Magellan obtains title opinions to a drill site prior to commencing initial drilling operations. In accordance with industry practice, we perform only minimal title review work at the time of acquiring undeveloped properties.

Australia

In Australia, all of Magellan's onshore permits are issued by the Northern Territory and are subject to the Petroleum (Prospecting and Mining) Act and the Petroleum Act of the Northern Territory. Lessees have the exclusive right to produce petroleum from the land subject to payment of a rental and a royalty at the rate of 10% of the wellhead value of the petroleum produced. Rental payments may be offset against the royalty paid. The term of a petroleum lease is typically 21 years, and leases may be renewed for successive terms of 21 years each.

The below table summarizes the permits we maintain in Australia as of June 30, 2013.

Permit | Geologic basin | Expiration date | Operator | Ownership interest | Gross acres (1) | Net acres (2) | ||||||||

Petroleum Lease No. 3 (Palm Valley) | Amadeus | 11/7/2024 | Magellan | 100% | 157,932 | 157,932 | ||||||||

Retention License No. 2 (Dingo) | Amadeus | 2/3/2014 | Magellan | 100% | 116,139 | 116,139 | ||||||||

NT/P82 (Timor Sea) | Bonaparte | 5/12/2016 | Magellan | 100% | 1,566,647 | 1,566,647 | ||||||||

Total | 1,840,718 | 1,840,718 | ||||||||||||

(1) A gross acre is an acre in which the registrant owns a working interest.

(2) The number of net acres is the sum of the fractional working interests owned by registrant in gross acres.

16

United Kingdom

In the UK, Petroleum Exploration and Development Licenses ("PEDLs") and Seaward Production Licenses (denoted by a "P") issued by the government are subject to the Petroleum Act. A licensee has the exclusive right to produce, explore, and develop petroleum from the land subject to the payment of a rental payments to the UK government's Department of Energy and Climate Change ("DECC"). The maximum term of the license is 31 years. Licenses expire after the initial exploration term of 6 years if a well is not drilled and after 11 years if a well is drilled but no development program is approved by the Secretary of State for Energy and Climate Change.

The below table summarizes the permits we maintain in the UK as of June 30, 2013.

License | Geologic basin | Expiration date | Operator | Ownership interest | Gross acres (1) | Net acres (2) | ||||||||

PEDL 126 | Weald | 6/30/2014 | Northern | 40% | 30,124 | 12,050 | ||||||||

PEDL 137 | Weald | 9/30/2013 | Magellan | 100% | 24,525 | 24,525 | ||||||||

PEDL 155 | Weald | 9/30/2015 | Northern | 40% | 13,029 | 5,212 | ||||||||

PEDL 231 | Weald | 6/30/2014 | Celtique | 50% | 98,800 | 49,400 | ||||||||

PEDL 232 | Weald | 6/30/2014 | Celtique | 50% | 23,342 | 11,671 | ||||||||

PEDL 234 | Weald | 6/30/2014 | Celtique | 50% | 74,100 | 37,050 | ||||||||

PEDL 240 | Wessex | 6/30/2014 | Northern | 23% | 1,778 | 409 | ||||||||

PEDL 243 | Weald | 6/30/2014 | Celtique | 50% | 74,100 | 37,050 | ||||||||

PEDL 246 | Weald | 6/30/2014 | Magellan | 100% | 10,769 | 10,769 | ||||||||

PEDL 256 | Weald | 4/30/2015 | Northern | 40% | 11,115 | 4,446 | ||||||||

P 1916 | Wessex | 1/31/2016 | Northern | 23% | 11,535 | 2,653 | ||||||||

Total | 373,217 | 195,235 | ||||||||||||

(1) A gross acre is an acre in which the registrant owns a working interest.

(2) The number of net acres is the sum of the fractional working interests owned by registrant in gross acres.

The PEDL 137 license, representing 24,525 gross and net acres, is due to expire in September 2013, however, pending our application to the UK Government is likely to be renewed for an additional 12 month period. The expiration of PEDL 137 would reduce our gross and net acres in the UK to 348,692 and 170,710 acres, respectively.

MARKETING ACTIVITIES AND CUSTOMERS

Customers

United States. In the US, the Company has a sole customer who accounted for 87% and 45%, of the consolidated revenues during the fiscal years ended June 30, 2013, and 2012, respectively.

Australia. In Australia, revenue from one customer accounted for approximately 13% and 0%, revenue from a second customer accounted for approximately 0%, and 45% of consolidated oil and gas production revenue for the years ended June 30, 2013, and 2012, respectively.

Delivery Commitments

Our production sales agreements contain customary terms and conditions with various parties that require us to deliver a fixed determinable quantity of product. In May 2012, Magellan commenced the Palm Valley GSPA with Santos, the terms of which provide for the sale by Magellan to Santos of a total contract gas quantity of 25.65 Petajoules over the 17 year term of the agreement, subject to certain limitations regarding deliverability into the Amadeus Pipeline. We are not obliged to deliver fixed quantities of gas under the Palm Valley GSPA other than that which we forecast for delivery over the ensuing 12 months. We can re-forecast quantities of gas every three months for the remainder of the contract year. If a shortfall in delivery of more than 10% occurs on any daily nomination by Santos, and confirmed for delivery by us, we incur a shortfall. If we shortfall on deliveries we can provide make-up gas in years 16 and 17 of the contract term. We will be required to make periodic deficiency payments for any shortfalls in delivering the minimum volume commitments. If a shortfall in the minimum volume commitment for natural gas is projected, we have certain rights to arrange for third party gas to be delivered into the gathering lines and such volume will count towards our minimum commitment. We believe our production and reserves are adequate to meet these delivery commitments.

17

CURRENT MARKET CONDITIONS AND COMPETITION

Seasonality of Business

Demand and prices for oil and gas can be impacted by seasonal factors. Increased demand for heating oil in the winter and gasoline during the summer driving season can positively impact the price of oil during those times. Increased demand for heating during the winter and air conditioning during the summer months can positively impact the price of natural gas. Unusual weather patterns can increase or dampen normal price levels. Our ability to carry out drilling activities can be adversely affected by weather conditions during winter months at Poplar. In general, the Company's working capital balances are not materially impacted by seasonal factors. In Australia, gas supply contracts are generally long term fixed price contracts and, as such, are unaffected by seasonality.

Competitive Conditions in the Business

The oil and gas industry is highly competitive. We face competition from numerous major and independent oil and gas companies, many of whom have greater technical, operational, and financial resources, or who have vertically integrated operations in areas such as pipelines and refining. Our ability to compete in this industry depends upon such factors as our ability to identify and economically acquire prospective oil and gas properties; the geological, geophysical, and engineering capabilities of management; the financial strength and resources of the Company; and our ability to secure drilling rigs and other oil field services in a timely and cost-effective manner. We believe our acreage positions, our management's technical and operational expertise, and the strength of our balance sheet allow us to effectively compete in the exploration and development of oil and gas projects.

The oil and gas industry itself faces competition from alternative fuel sources, which include other fossil fuels, such as coal and renewable energy sources.

EMPLOYEES AND OFFICE SPACE

As of June 30, 2013, the Company had a total of 39 full-time employees. We maintain approximately 6,000 square feet of functional office space in Denver, Colorado for our executive and administrative headquarters, and 4,435 square feet of office space in Brisbane, Australia.

GOVERNMENT REGULATIONS

Our business is extensively regulated by numerous foreign, US federal, state, and local laws and governmental regulations. These laws and regulations may be changed from time to time in response to economic or political conditions, or other developments, and our regulatory burden may increase in the future. Laws and regulations have the potential of increasing our cost of doing business and, consequently, could affect our results of operations. However, we do not believe that we are affected to a materially greater or lesser extent than others in our industry.

Regulations Applicable to Foreign Operations

Several of the properties in which we have interests are located outside of the US, and are subject to foreign laws, regulations, and related risks involved in the ownership, development, and operation of foreign property interests. Foreign laws and regulations may result in possible nationalization of assets, expropriation of assets, confiscatory taxation, changes in foreign exchange controls, currency revaluations, price controls or excessive royalties, export sales restrictions, and limitations on the transfer of interests in exploration licenses. Foreign laws and regulations may also limit our ability to transfer funds or proceeds from operations. In addition, foreign laws and regulations providing for conservation, proration, curtailment, cessation, or other limitations or controls on the production of or exploration for hydrocarbons may increase the costs or have other adverse effects on our foreign operations. As a result, an investment in us is subject to foreign legal and regulatory risks in addition to those risks inherent in US domestic oil and gas exploration and production company investments.

Our Australian operations are subject to stringent Australian laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations, which include the Environment Protection and Biodiversity Conservation Act 1999, require approval before seismic acquisition or drilling commences, restrict the types, quantities, and concentration of substances that can be released into the environment in connection with drilling and production activities, limit or prohibit seismic or drilling activities in protected areas, and impose substantial liabilities for pollution resulting from oil and gas operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil, and criminal penalties, incurrence of investigatory or remedial obligations, or

18

the imposition of injunctive relief. Changes in Australian environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transport, disposal, or cleanup requirements could require us to make significant expenditures to maintain compliance, and may otherwise have a material adverse effect on our results of operations, competitive position, or financial condition as well. Under these environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination, regardless of whether we were responsible for the release of such materials or if our operations were standard in the industry at the time they were performed.

Oil and gas exploration and production operations in the UK are subject to numerous UK and European Union ("EU") laws and regulations relating to environmental matters, health, and safety. Environmental matters are addressed before oil and gas production activities commence and during the exploration and production activities. Before a UK licensing round begins, the DECC will consult with various public bodies that have responsibility for the environment. Applicants for production licenses are required to submit a summary of their management systems and how those systems will be applied to the proposed work program. In addition, the Offshore Petroleum Production and Pipelines (Assessment of Environmental Effects) Regulations 1999 require the Secretary of State to exercise the Secretary's licensing powers under the UK Petroleum Act in such a way as to ensure that an environmental assessment is undertaken and considered before consent is given to certain projects. Further, depending on the scale of operations, production facilities may be subject to compliance obligations under the EU emissions trading system. Compliance with the above regulations may cause us to incur additional costs with respect to UK operations.

Energy Regulations

States in which we operate have adopted laws and regulations governing the exploration for, and production of, oil and gas, including laws and regulations that require (i) permits for the drilling of wells; (ii) impose bonding requirements in order to drill or operate wells; and (iii) govern the timing of drilling and location of wells, the method of drilling and casing wells, the surface use and restoration of properties upon which wells are drilled, and the plugging and abandonment of wells. Many of our operations are also subject to various state conservation laws and regulations, including regulations governing the size of drilling and spacing units or proration units, the number of wells that may be drilled in an area, the spacing of wells, and the unitization or pooling of oil and gas properties. In addition, state conservation laws sometimes establish maximum rates of production from oil and gas wells, generally prohibit the venting or flaring of gas, and may impose certain requirements regarding the ratability or fair apportionment of production from fields and individual wells.

Some of our operations are conducted on federal lands pursuant to oil and gas leases administered by the Bureau of Land Management ("BLM") and/or the Bureau of Indian Affairs ("BIA"). These leases contain relatively standardized terms and require compliance with detailed regulations and orders, that are subject to change. In addition to permits required from other regulatory agencies, lessees, such as Magellan, must obtain a permit from the BLM before drilling and must comply with regulations governing, among other things, engineering and construction specifications for production facilities, safety procedures, the valuation of production and payment of royalties, the removal of facilities, and the posting of bonds to ensure that lessee obligations are met. Under certain circumstances, the BLM or the BIA may suspend or terminate our operations on federal or Indian leases.

In May 2010, the BLM adopted changes to its oil and gas leasing program that require, among other things, a more detailed environmental review prior to leasing oil and natural gas resources, increased public engagement in the development of master leasing and development plans prior to leasing areas where intensive new oil and gas development is anticipated, and a comprehensive parcel review process. These changes have increased the amount of time and regulatory costs necessary to obtain oil and gas leases administered by the BLM.

Our sales of natural gas are affected by the availability, terms, and cost of gas pipeline transportation. The Federal Energy Regulatory Commission ("FERC") has jurisdiction over the transportation and sale for resale of natural gas in interstate commerce. FERC's current regulatory framework generally provides for a competitive and open access market for sales and transportation of natural gas. However, FERC regulations continue to affect the midstream and transportation segments of the industry, and thus can indirectly affect the sales prices we receive for natural gas production. In addition, the less stringent regulatory approach currently pursued by FERC and the US Congress may not continue indefinitely.

19

Environmental, Health, and Safety Matters

General. Our operations are subject to stringent and complex federal, state, tribal, and local laws and regulations governing protection of the environment and worker health and safety as well as the discharge of materials into the environment. These laws and regulations may, among other things:

• | require the acquisition of various permits before drilling commences; |

• | restrict the types, quantities, and concentration of various substances that can be released into the environment in connection with oil and natural gas drilling and production and saltwater disposal activities; |

• | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands, and other protected areas, including areas containing certain wildlife or threatened and endangered plant and animal species; and |

• | require remedial measures to mitigate pollution from former and ongoing operations, such as requirements to close pits and plug abandoned wells. |

These laws, rules, and regulations may also restrict our ability to produce oil or gas a rate of oil and natural gas production that is lower than the rate that is otherwise possible. The regulatory burden on the oil and natural gas industry increases the cost of doing business in the industry and consequently affects profitability. Additionally, environmental laws and regulations are revised frequently, and any changes that result in more stringent and costly permitting, waste handling, disposal, and cleanup requirements for the oil and natural gas industry could have a significant impact on our operating costs.

The following is a summary of some of the existing laws, rules, and regulations to which our business is subject:

Waste handling. The Resource Conservation and Recovery Act (the "RCRA") and comparable state statutes regulate the generation, transportation, treatment, storage, disposal, and cleanup of hazardous and non-hazardous wastes. Under the auspices of the federal Environmental Protection Agency (the "EPA"), the individual states administer some or all of the provisions of the RCRA, sometimes in conjunction with their own, more stringent requirements. Drilling fluids, produced waters, and most of the other wastes associated with the exploration, development, and production of oil or natural gas are currently regulated under the RCRA's non-hazardous waste provisions. However, it is possible that certain oil and natural gas exploration and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. Any such change could result in an increase in our costs to manage and dispose of wastes, which could have a material adverse effect on our results of operations and financial position.