UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended:

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to ______________________

Commission file number:

The LGL Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

☒ |

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant, based upon the $12.98 per share closing price of the registrant's common stock on June 30, 2022, the last business day of the registrant's most recently completed second fiscal quarter, was $

The number of outstanding shares of the registrant's common stock was

DOCUMENTS INCORPORATED BY REFERENCE

None.

THE LGL GROUP, INC.

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

9 |

|

|

Item 1B. |

|

|

27 |

|

|

Item 2. |

|

|

27 |

|

|

Item 3. |

|

|

27 |

|

|

Item 4. |

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

28 |

|

|

Item 6. |

|

|

28 |

|

|

Item 7. |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations. |

|

29 |

|

Item 7A. |

|

|

35 |

|

|

Item 8. |

|

|

35 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. |

|

35 |

|

Item 9A. |

|

|

35 |

|

|

Item 9B. |

|

|

35 |

|

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

36 |

|

|

Item 11. |

|

|

38 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

|

40 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence. |

|

41 |

|

Item 14. |

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

43 |

|

|

Item 16. |

|

|

45 |

PART I

Caution Concerning Forward-Looking Statements

This annual report on Form 10-K (this "Report") and the Company's (as defined below) other communications and statements may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements about the Company's beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond the Company's control. The words "may," "could," "should," "would," "believe," "anticipate," "estimate," "expect," "intend," "plan," "target," "goal," and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. The Company's actual future results may differ materially from those set forth in the Company's forward-looking statements. For information concerning these factors and related matters, see "Risk Factors" in Part I, Item 1A in this Report, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7 in this Report. However, other factors besides those referenced could adversely affect the Company's results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this Report. The Company does not undertake to update any forward-looking statement, except as required by law. As a result, you should not place undue reliance on these forward-looking statements.

Item 1.Business.

General

The LGL Group, Inc. (the "Company," "LGL," "we," "us," or "our") is a holding company engaged in services, investment and manufacturing business activities. Since 1985, the Company has acquired 32 businesses, sold 11, and spun off 3, culminating this year with the spin-off of M-tron Industries, Inc. The Company was incorporated in 1928 under the laws of the State of Indiana, and in 2007, the Company was reincorporated under the laws of the State of Delaware as The LGL Group, Inc. We maintain our executive offices at 2525 Shader Road, Orlando, Florida 32804. Our telephone number is (407) 298-2000. Our Internet address is www.lglgroup.com. Our common stock and warrants are traded on the NYSE American (“NYSE”) under the symbols "LGL" and “LGL WS”, respectively.

LGL’s business strategy is primarily focused on growth through expanding new and existing operations across diversified industries. The LGL Group Inc.'s engineering and design origins date back to the early part of the last century. In 1917, Lynch Glass Machinery Company, the predecessor of LGL, was formed, and emerged in the late twenties as a successful manufacturer of glass-forming machinery. The company was then renamed Lynch Corporation and was incorporated in 1928 under the laws of the State of Indiana. In 1946, Lynch was listed on the “New York Curb Exchange,” the predecessor to the NYSE American. The company has had a long history of owning and operating various businesses in the precision engineering, manufacturing and services sectors.

Manufacturing Business

We operate our manufacturing business currently through our subsidiary, Precise Time and Frequency, LLC ("PTF"), a globally-positioned producer of industrial Electronic Instruments and commercial products and services. Founded in 2002, PTF operates from our design and manufacturing facility in Wakefield, Massachusetts. In addition, we operated an Electronic Components segment, M-tron Industries, Inc. (“MtronPTI”), until its Spin-off to all shareholders on October 7, 2022 when Mtron became an independent, publicly traded company trading on the NYSE American under the stock symbol ”MPTI”. The Separation was achieved through LGL’s distribution (the “Distribution”) of 100% of the shares of MtronPTI's common stock to holders of LGL's common stock as of the close of business on the record date of September 30, 2022. LGL's stockholders of record received one-half share of MtronPTI's common stock for every share of LGL's common stock For more information regarding the Spin-off of MtronPTI, please see Note A – Basis of Presentation Transactions to the Consolidated Financial Statements included in Item 8. Financial Statements and Supplementary Data of this Report.

1

PTF is our sole wholly owned manufacturing operation following the Spin-off of MtronPTI, PTF is focused on the design and manufacture of high-performance Frequency and Time reference standards that form the basis for timing and synchronization in various applications including satellite communication, time transfer systems, network synchronization, electricity distribution and metrology. PTF offers customers frequency reference and time standard synchronization solutions tailored to meeting performance requirements. PTF is housed in a well-equipped, modern, facility and staffed by a highly dedicated and experienced team of time and frequency professionals. Although the company offers a wide range of standard instruments and options, new requirements are enthusiastically embraced, resulting in an ever expanding capability. Products include NTP Servers, broadband amplifiers, RF distribution, 1PPS distribution, and fiber optic distribution. PTF has developed a comprehensive portfolio of time and frequency instrumentation including frequency standards, time standards, and time code generators, complemented by a wide range of ancillary products such as RF distribution amplifiers, Digital distribution amplifiers, Time Code distribution amplifiers, and redundancy switches. Thousands of instruments have been delivered to a broad range of applications worldwide, from simple network time servers to synchronize local computers and instruments, to fully redundant and highly sophisticated Satellite Communications and Broadcast systems. Military applications include synchronization of mobile Satcom terminals, high performance sources for calibration, a unique SAASM solution, and test equipment providing the ultimate in frequency stability and phase noise performance.

Investment Business

Our Investment business is comprised of various private investment funds (“Investment Funds”) in which we have shareholding, or partner interests, and through which we invest our proprietary capital. As shareholder or partner, LGL will provide advisory and certain administrative and back-office services to such Investment Funds but will not provide such services to any other entities, individuals or accounts. To the extent possible, interests in the Investment Funds are generally not offered to outside investors.

The LGL investment business is comprised of various investment vehicles in which LGL is either shareholder, partner, or has general partner interests, and through which LGL invests its capital. The Company seeks to invest available cash and cash equivalents in liquid investments with a view to enhancing returns as we continue to assess further acquisitions of, or investments in, operating businesses broadly. LGL may provide consulting, advisory, and certain administrative and back-office services to the investment vehicles in which LGL is invested. LGL core strengths include identifying and acquiring undervalued assets and businesses, often through the purchase of securities, increasing value through management, financial or other operational changes, and managing complex legal, regulatory or financial issues, which may include technical, engineering, environmental, zoning, permitting and licensing issues among others.

As of December 31, 2022, LGL had investments (currently classified as Cash and Cash Equivalents and Marketable securities) with a fair value of approximately $38.1 million. The Company accounts for its Marketable securities under ASC 321 and as such, its Marketable securities are reported at fair value on its consolidated balance sheets.

Business Strategy

Across all of our businesses, our success is based on a simple formula: we seek to find undervalued companies in the Graham & Dodd tradition, a methodology for valuing companies that primarily looks for deeply depressed prices. Today, we are a diversified holding company owning subsidiaries engaged in manufacturing and investments. Several of our operating businesses started out as investment positions in debt or equity securities, held directly by us. Those positions ultimately resulted in control or complete ownership of the target company. For example, in 2004, we acquired a controlling interest in PTI which started out as an investment position and ultimately became an operating subsidiary before the Spin-off. The acquisition of PTI, like our other operating subsidiaries, reflects our opportunistic approach to value creation, through which returns may be obtained by, among other things, promoting change through minority positions at targeted companies in our Investment segment or by acquiring control of those target companies that we believe we could run more profitably ourselves.

In appropriate circumstances, we or our subsidiaries may become the buyer of target companies, adding them to our portfolio of operating subsidiaries, thereby expanding our operations through such opportunistic acquisitions.

It is our belief that our strategy will continue to produce strong results into the future.

2

Our manufacturing business, PTF, employs a market-based approach of designing and offering new products to our customers through both organic research and development, and through strategic partnerships, joint ventures, acquisitions or mergers. We seek to leverage our core strength as an engineering leader to expand client access, add new capabilities and continue to diversify our product offerings. Our focus is on investments that will differentiate us, broaden our portfolio and lead toward higher levels of integration organically and through joint venture, merger and acquisition opportunities. We believe that successful execution of this strategy will lead to a transformation of our product portfolio towards multi-component integrated offerings, longer product life cycles, better margins and improved competitive position.

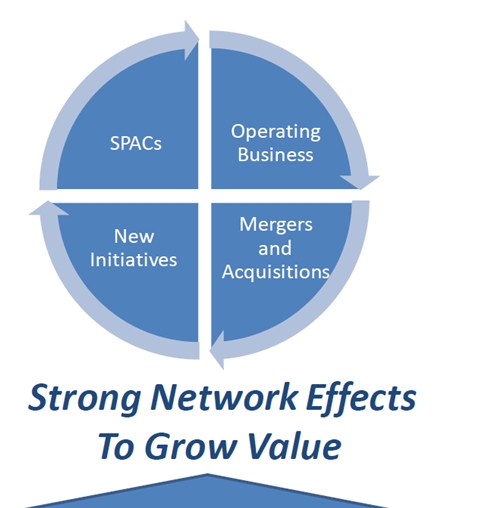

A key driver of value is the direct investing business which utilizes various structures and vehicles to build shareholder value, including certain Special Purpose Vehicles which may be syndicated for investment, and involve certain fee generating activities. The company could act as the financial and management sponsor, raise capital from external nonaffiliated investors, and may receive management fees and success-based incentives in accordance with market practice.

This direct investment effort includes the development of various vehicles of designed to leverage the Company’s broad investment network. LGL Systems Acquisition Holding Company, LLC, a partially owned subsidiary of the Company, serves as the sponsor (the “SponsorCo”) of certain direct investing efforts. SponsorCo’s first vehicle, LGL Systems Acquisition Corp., was a special purpose acquisition company, commonly referred to as a “SPAC” or blank check company, formed for the purpose of effecting a business combination in the aerospace, defense and communications industries (the “SPAC”). This SPAC was a publicly traded company on the NYSE American under the ticker symbol “DFNS.” The Company invested $3.35 million for its partial ownership in the Sponsor, holding 20% of the total common shares (Class A and Class B) in the SPAC along with 5,200,000 private warrants. The SponsorCo and any related activity was accounted for under the equity method of accounting in the Company’s financial statements. The Company through SponsorCo offered a SPAC related franchise to investors and formed LGL Systems Acquisition Corp II and LGL Systems Acquisition Corp III with the purpose of enhancing the Company’s investment business through acquisitions. The Company and several of its management and directors are, or have been, partners in SponsorCo. SponsorCo’s activities include broad investments and acquisitions, the development of additional special purpose vehicles or funds to serve as the base for the growth of the investment business.

An anthology of the Company’s activities underscores the path ahead.

LGL history of Investments and reorganization

|

|

• |

Lynch Glass Machinery Company, predecessor of Lynch Corporation, was organized in 1917. The Company emerged in the late twenties as a successful manufacturer of glass-forming machinery. In 1928, Lynch Corporation was incorporated in the State of Indiana |

|

|

• |

In 1946, Lynch was listed on the “New York Curb Exchange” the predecessor to the American Stock Exchange. |

|

|

• |

In 1964, Curtiss-Wright Corporation purchased a controlling interest in Lynch. |

|

|

• |

In 1976, M-tron Industries, Inc., a manufacturer of quartz crystals was acquired. |

|

|

• |

In 1985, companies affiliated with Gabelli Funds, Inc. acquired a majority interest in Lynch’s Common Stock, including the entire interest of Curtiss-Wright Corporation. |

|

|

• |

In July 1986, Lynch issued $23 million of 8% Convertible Subordinated Debentures as the first step in an acquisition program designed to broaden Lynch’s business base. |

|

|

• |

In 1987, Lynch expanded the scope of its operations into the financial services and entertainment industries with the start-up of Lynch Capital Corporation, a securities broker dealer, and Lynch Entertainment Corporation, a joint venture partner with a 20% interest in WHBF-TV, the CBS television network affiliate in Rock Island, Illinois. Later in the year, the Company acquired Tremont Partners, Inc., a Connecticut-based investment management-consulting firm. In December, Lynch added to its manufacturing sector with the acquisition of an 83% interest in Safety Railway Service Corporation. |

|

|

• |

In 1988, Lynch entered the service sector with the acquisition of Morgan Drive Away. |

|

|

• |

1989 was highlighted by Lynch’s entry into the telecommunications industry with the acquisition of Western New Mexico Telephone Company. |

3

|

|

• |

Lynch’s second telecommunications acquisition, Inter-Community Telephone Company of Nome, North Dakota, was completed in April 1991, followed in October of that year with the acquisitions of Cuba City Telephone Exchange Company and Belmont Telephone Company. |

|

|

• |

During 1992, Lynch acquired Bretton Woods Telephone Company of New Hampshire; and completed a rights offering to its shareholders, which resulted in the Tremont investment advisory firm becoming a publicly traded company. |

|

|

• |

1993 saw the launching of The Morgan Group, Inc., as a public company with an initial public offering of 1.1 million Class A Common Shares. Lynch also acquired J.B.N. Telephone Company in Kansas from GTE Corporation. |

|

|

• |

1994 saw the rebirth of Safety Railway Service Corporation into Spinnaker Industries • In 1995 in multimedia, we partnered with CLR Video, a cable operator in Kansas, bought 340 telephone lines from Sprint and commercialized DirectTV. |

|

|

• |

In 1996 on the telephony front, we consummated the affiliation with the Maytum family and Dunkirk & Fredonia and completed the purchase of 1,400 lines from U.S. West. Morgan closed on Transit Homes of America, Inc. We organized and bid on Personal Communications Services licenses in the so-called “C” block and “F” block auctions. |

|

|

• |

In 1997, acquired Upper Peninsula Telephone Company. Spun-off East/West Communications, Inc., a F-Block PCS licensee with 20 million “POPs.” |

|

|

• |

In 1999, Lynch acquired Central Scott Telephone Company, a 6,000 ILEC in Iowa, an area where we would like to grow significantly. This became part of the Lynch Interactive spin-off (see below). |

|

|

• |

In 1999, Spinnaker refocused its efforts in the adhesive-backed paper industry and sold its industrial tape operations, also significantly deleveraging itself. |

|

|

• |

On September 1, 1999, Lynch Interactive Corporation was born via a tax-free spin-off from Lynch Corporation. Interactive consists of Lynch Corporation’s cable, telecommunications, PCS and broad casting operations as well as The Morgan Group, Inc. |

|

|

• |

In the latter part of 1999, and early 2000, Spinnaker continued deleveraging by buying back a significant amount of its senior debt at a gain. |

|

|

• |

In 2000 MTron Industries was preparing for an IPO, but was held back due to changing stock market conditions. |

|

|

• |

In 2001 Company spins off The Morgan Group and Tremont Advisors to shareholders. Tremont later acquired by Oppenheimer. |

|

|

• |

In 2002 company sells remaining stake in Spinnaker Industries. M-tron Industries purchases assets of Champion Technologies (formerly Motorola), expanding their product line to include VCXO, TCXO and timing solutions. |

|

|

• |

In 2004 Venator Merchant Fund LLC., funds affiliated with Marc Gabelli the LGL Chairman, financed the acquisition of Piezo Technologies PTI, based in Orlando FL, to re-direct M-tron Industries strategic direction. This acquisition set the stage for the development of the company’s orientation toward avionics, space, and defense industries. |

|

|

• |

In 2007 the business assets of Lynch Systems were sold. |

|

|

• |

In 2008 the company develops and expands its Delhi India facilities. |

|

|

• |

In 2014 assets of Trilithic are acquired. |

|

|

• |

In 2016 establishes PTF, by acquiring the assets of Precise Time and Frequency, Inc. |

|

|

• |

In 2019 the LGL direct investing segment started. |

|

|

• |

In 2021 the LGL SPAC completes its business combination. |

|

|

• |

In 2022 M-tron Industries is spun off. |

Business Description

As a diversified holding company, we believe that the cash flow and asset coverage from our operating subsidiaries will allow us to maintain a strong balance sheet and ample liquidity over time. We seek to invest available cash and cash equivalents and marketable securities in liquid investments with a view to enhancing returns as we continue to assess further acquisitions of, or investments in, operating businesses. As of December 31, 2022, we had cash and cash equivalents and marketable securities with a fair market value of approximately $38.1 million.

4

The LGL approach is to establish long term partnerships utilizing the resources of our organization to facilitate a full cycle of advice and investment to augment investments in conjunction with broader capital syndication. This approach allows for LGL to be creative and nimble with no pre-determined exit time table. We focus on businesses with existing growth potential which through helping improve their capabilities, teaming up portfolio companies for strategic expansions and transforming the businesses through merger and acquisition opportunities.

The Company’s objective is to deliver long-term investment growth to our shareholders, maximizing shareholder value. This includes developing businesses and positioning them as independent entities to enhance shareholder value and alignment.

With the exception of our Investment business, our operating segment(s) have and currently comprise independently operated business(es) that we have obtained a controlling interest in through execution of our business strategy. Our Investment business derives revenues from gains and losses from investment transactions. Our operating segments derive revenues principally from net sales of various products.

Electronic Instruments Segment

Overview of PTF

PTF designs, manufactures, and markets for sale time and frequency instruments. The industries PTF serves include computer networking, satellite ground stations, electric utilities, broadcasting, telecommunication systems, and metrology. PTF was originally founded in 2002 and its assets were acquired by LGL in September 2016 through a business acquisition, reinforcing our position as a broad-based supplier of highly engineered products for the generation of time and frequency references for synchronization and control. Since its inception, PTF has developed a comprehensive portfolio of time and frequency instruments complemented by a wide range of ancillary products such as distribution amplifiers and redundancy auto switches.

PTF Products

PTF's products range from simple, low-cost time and frequency solutions to premium products designed to deliver maximum performance for the most demanding applications. PTF's products include Frequency and Time Reference Standards, RF, digital, and optical time code distribution amplifiers, redundancy auto switches and NTP servers, all of which are used in a wide range of applications worldwide.

PTF's Frequency and Time Reference Standards include quartz Frequency Standards, GPS/GNS Frequency and Time Standards and rubidium atomic Frequency Standards. The de facto standard for many highly demanding applications, such as satellite communications, is PTF's range of GPS/GNS disciplined quartz frequency and time standards. The MtronPTI high-quality quartz oscillators utilized within the PTF instruments deliver outstanding phase noise and short-term stability performance for applications where low noise is paramount. This outstanding short-term performance, coupled with the long-term stability and accuracy of the external GNS reference signals, which can be from GPS, Galileo, Glonass or QZSS, provides the user excellent all-around performance that is highly cost-effective.

When two or more computers are involved, accurate time keeping is a challenge especially when the computers are in different locations. PTF's range of GNS Time and Frequency References and Network Time Servers deliver a high level of performance that allows customers to synchronize to Universal Time Coordinated (UTC), in several cost-effective forms to meet a multitude of time and frequency reference requirements. Applications range from low phase noise, highly stable and accurate system frequency references for Sat-Com and Digital Broadcasting applications, to computer networks, shipboard time code references and e-commerce time stamping applications. With respect to Universal Coordinated Time, the Company has developed long-term real time synchronization capability of less than 10 nanoseconds of which to date multiple systems have been delivered.

PTF's portfolio of distribution amplifiers covers multiple signal types including HF, RF, digital, time code, optical, and custom configured units. The distribution range is designed to complement the high quality of the frequency and time references and provide the most effective cost/performance solution for the application, including options for full remote monitoring/control (including RF analog signal monitoring) and optional level control.

5

The distribution product range includes standard units with either 12 or 16 channels together with more flexible units that allow the user to define specific configurations including different types of input/output signals combined into a convenient 1U or 2U package with up to 36 output channels.

PTF's series of redundancy auto switches range from simple level detection to highly sophisticated sensing capability, extremely fast switching options and full Ethernet connectivity, to provide remote monitoring/control, and including integration with SNMP management systems. The most recent model includes multi-channel input capability as well as the ability to switch up to three input types of signals.

Customers

PTF primarily works directly with original equipment manufacturers (“OEMs”) to define the right solutions for their unique applications, including the design of custom parts with unique part numbers. Sales of products may be directly to the OEM, through franchised representatives or distributors, or direct to end customers. Our franchised representatives/distributors have highly skilled sales engineers who work directly with designers and program managers providing a high-level of engineering support at all points within the process.

In 2022, our largest customer, accounted for 18.9%, of the Company's total revenues. The Company’s second largest customer in 2022 accounted for 11.8%, of the Company's total revenues. The next five largest customers accounted for an additional 34.3% of 2022 revenue, resulting in approximately 65% of the company’s revenue spread amongst the top seven customers, and the remaining 35% of revenue spread amongst the rest of the company’s customers.

This spread of revenue over a broad customer base reduces the vulnerability of the company to any customer suffering from a market downturn, or other debilitating issue including insolvency.

Competition

We design, manufacture and market products for the generation, synchronization and control of time and frequency in many cases insuring optimal utilization of allocated spectrum. There are a number of domestic and international manufacturers who are capable of providing custom-designed products comparable in quality and performance to our products. Our competitive strategy begins with our focus on niche markets where precise specification, the ability to provide custom configurations, and reliability are the major requirements.

Product Development

For new products, the company focuses on developing products targeted at relatively new, albeit established, markets, minimizing the need for market pioneering and education. The latest product developments target the new but rapidly growing Precision Time Protocol (PTP) market utilizing ethernet networks for transmission of highly accurate time and frequency reference signals.

Marketing and Sales

Marketing efforts are supported by outsourcing to independent contractors and include the company web site, targeted monthly marketing emails, and exhibiting at relevant shows and conferences. We have a highly skilled team of domestic sales representatives and international distributors who market and sell our products. Where possible, the sales team endeavors to gain qualification of specific products from Systems Integrators, confirming suitability for use in a specific system design. Through direct contact with our clients and through our representative network, we are able to understand the needs of the customers, and then provide custom configurations to meet those requirements in a highly cost-efficient solution.

International Revenues

Our international revenues were $460,000 in 2022, or 27.8% of total consolidated revenues, compared to $308,000, or 21.3% of total consolidated revenues, in 2021. In each of 2022 and 2021, these revenues were derived mainly from customers in Europe and Asia, with significant sales in Canada. We avoid significant currency exchange risk by transacting and settling substantially all of our international sales in United States dollars.

6

Seasonality

Our business is not seasonal, although shipment schedules may be affected by the production schedules of our customers, or their contract manufacturers based on regional practices or customs.

Order Backlog

Our order backlog was $360,000 and $358,000 as of December 31, 2022 and 2021, respectively. The backlog of unfilled orders includes amounts based on purchase orders. Although backlog represents only firm orders that are considered likely to be fulfilled primarily within the 12 months following receipt of the order, cancellations or scope adjustments may and do occur.

Order backlog is adjusted quarterly to reflect project cancellations, deferrals, revised project scope and cost. We expect to fill substantially all of our 2022 order backlog in 2023, but cannot provide assurances as to what portion of the order backlog will be fulfilled in a given year.

Raw Materials

Generally, most raw materials used in the production of our products are available in adequate supply from a number of sources and the prices of these raw materials are relatively stable. However, some raw materials, including printed circuit boards, integrated circuits and certain metals including steel and aluminum are subject to greater supply fluctuations and price volatility, as experienced in recent years. In general, we have been able to include some cost increases in our pricing, but in some cases our margins were adversely impacted.

Changes in global economic and geopolitical conditions and the outbreak of the novel coronavirus (“COVID-19”) pandemic has caused disrupted supply chains and the ability to obtain components and raw materials around the world for most companies, including us. On occasion, one or more of the components used in our products have become unavailable resulting in unanticipated redesign and/or delays in shipments. Continued identification of alternative supply sources or other mitigations are important in minimizing disruption to our supply chain.

Intellectual Property

We have no patents, trademarks or licenses that are considered to be significant to our business or operations. Rather, we believe that our technological position depends primarily on the technical competence and creative ability of our engineering and technical staff in areas of product design and manufacturing processes, including our staff’s ability to customize products to meet difficult specifications, as well as proprietary know-how and information.

Government Regulations

As a supplier to certain U.S. Government defense contractors, we must comply with certain procurement regulations and other requirements. Maintaining registration under the System for Award Management (SAM) is critical in order to receive US Government contracts. As a small business we obtain preferential treatment for awards from tier one Government contractors however to maintain this position we are required to submit annually “Representation and Certification” documents attesting to our size, revenue, and internal controls for anti-discrimination, avoidance of counterfeit components, and a number of other federally mandated issues.

From time to time, we may also be subject to U.S. Government investigations relating to our or our customers' operations. In particular, for international business, we are required to submit a request for Automated Export System (AES) validation used by US Government agencies to measure the compliance of U.S. exports with U.S export control laws.

Investment Business

In 2019 LGL management pursued the development of special purpose acquisition corporation (SPAC) vehicles. These vehicles allowed for the LGL team to use the capital markets to raise capital and form a vehicle to pursue acquisitions of significant scale. Each vehicle required $5-8 million of initial IPO capital and $5-10 million of secondary issue (PIPE) capital. While these funds could be partially syndicated, typically up to 35%, the capital is required to “backstop” an offering prior to launch. LGL commenced a program to launch 3 SPAC vehicles requiring

7

an estimated $35-45 million to be successful. The business initially developed LGL Systems Acquisition Corp., a $172.5 million vehicle listed on the NYSE with the symbol “DFNS”. LGL committed approximately $6 million of initial at-risk investment capital in August 2019 to commence the DFNS IPO process and raise outside capital. LGL then further committed nearly $10 million of incremental capital for the DFNS business combination with IronNet Cybersecurity, a $1.3 billion acquisition, negotiated in February of 2021 and completed in September of 2021. The Business combination was completed and IRNT was listed on the NYSE. LGL shareholders benefited with a stronger balance sheet. The process of SPAC formation and acquisition allowed LGL Group to form a team with extensive management and acquisition experience which brought residual cluster benefits to the LGL shareholders. The LGL deal team and its related pipeline of deals was significant and competitive. New opportunities for acquisitions required additional vehicles for team incentive alignment, and capital, and SPACs provided a path to accelerate the development of a business division. The blank check corporations, or SPACs, offered that opportunity via syndicated capital raises of $150-$200 million with the prospect of transacting in the $1-$3 billion range per SPAC vehicle. This new division attracted and retained talent with the ability to acquire and manage business of significant size for the benefit of the LGL shareholder.

In 2020 and 2021, the LGL II and LGL III SPAC vehicles were then formed between Nov 2020 and March of 2021, each seeking to raise $200 million, and were beginning their plans for IPO.

In 2020 and 2021, the LGL II and LGL III SPAC vehicles were then formed between Nov 2020 and March of 2021, each seeking to raise $200 million, and were beginning their plans for IPO.

SPACs and direct investments would become an integral division with LGL and would become a part of shareholder value creation. The balance sheet strategic positioning for transactions of scale outside of the Electronic business was increasing. The objective is to broaden the franchise utilizing direct investment across several differentiated industry verticals, to pursue innovative investments, and to leverage management expertise in the capital markets.

While these SPAC vehicles (LGL II and LGL III) are readied for IPO, this effort has been delayed due to market pressures on the SPAC product. The Company continues to believe the SPAC vehicle, when utilized appropriately, is a value-added component of capital formation and growth for American businesses in the capital markets.

In 2022, LGL management began plans to form new direct investment vehicles (“investment funds”) that would replace the loss of SPACS. These vehicles relative to SPACs, required more time, upward of one year, to launch. LGL Group is continuing its focus on developing new businesses through investment with an emphasis on the manufacturing sector of the economy, which currently provides fertile opportunities for growing the intrinsic value of the enterprise.

We conduct and plan to continue to conduct our activities in such a manner as not to be deemed an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Therefore, no more than 40% of our total assets can be invested in investment securities, as such term is defined in the Investment Company Act. In addition, we do not invest or intend to invest in securities as our primary business.

The Company’s one reported business segment Electronic Components includes all products manufactured and sold by PTF. We operate our manufacturing business through PTF which has a design and manufacturing facility in Wakefield, Massachusetts.

Government Regulations

As a supplier to certain U.S. Government defense contractors, we must comply with certain procurement regulations and other requirements. Maintaining registration under the System for Award Management (SAM) is critical in order to receive US Government contracts. As a small business we obtain preferential treatment for awards from tier one Government contractors however to maintain this position we are required to submit annually “Representation and Certification” documents attesting to our size, revenue, and internal controls for anti-discrimination, avoidance of counterfeit components, and a number of other federally mandated issues.

8

From time to time, we may also be subject to U.S. Government investigations relating to our or our customers' operations. In particular for international business we are required to submit a request for Automated Export System (AES) validation used by US Government agencies to measure the compliance of U.S. exports with U.S export control laws.

Employees

As of December 31, 2022, the Company’s executives were based in Orlando Florida, and Greenwich Connecticut. We employed five full-time manufacturing and engineering employees located in Wakefield, Massachusetts and one investment employee located in Greenwich, Connecticut. The company’s Co-Chief Executives, Chief Accounting Officer, and Vice President are employed through certain service level agreements in place. None of the Company's employees are represented by a labor union and the Company considers its relationships with employees to be good.

|

Item 1A. |

Risk Factors. |

Investing in our securities involves risks. Before making an investment decision, you should carefully consider the risks described below. Any of these risks could result in a material adverse effect on our business, financial condition, results of operations, or prospects, and could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. The risks and uncertainties described below are not the only ones we face but represent those risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Summary Risk Factors

Risks Relating to Our Structure

|

|

• |

We may, in the future, engage in transactions with our affiliates; |

|

|

• |

We are subject to the risk of becoming an investment company; |

|

|

• |

We may structure transactions in a less advantageous manner to avoid becoming subject to the Investment Company Act; |

Risks Relating to Liquidity and Capital Requirements

|

|

• |

We are a holding company and depend on the businesses of our subsidiaries to satisfy our obligations; |

|

|

• |

We have made significant investments in the Investment business and negative performance of the Investment business may result in a significant decline in the value of our investments |

Risks Relating to Our Investment Business

|

|

• |

The Company has made and may make material investments in special purpose acquisition companies that may not be successful. |

|

|

• |

Our investments may be subject to significant uncertainties; |

|

|

• |

The historical financial information for the Investment Funds is not necessarily indicative of its future performance; |

|

|

• |

The Investment business’s investment strategy involves numerous and significant risks, including the risk that we may lose some or all of our investments in the Investment business. This risk may be magnified due to concentration of investments and investments in undervalued securities; |

|

|

• |

We may not be able to identify suitable investments, and our investments may not result in favorable returns or may result in losses; |

|

|

• |

Successful execution of our activist investment activities involves many risks, certain of which are outside of our control; |

|

|

• |

The Investment business may make investments in companies we do not control; |

|

|

• |

The use of leverage in investments by the Investment business may pose a significant degree of risk and may enhance the possibility of significant loss in the value of the investments in the Investment business; |

|

|

• |

The possibility of increased regulation could result in additional burdens on our Investment business; |

|

|

• |

The ability to hedge investments successfully is subject to numerous risks; |

9

|

|

• |

The Investment business may invest in distressed securities, as well as bank loans, asset backed securities and mortgage-backed securities; and |

|

|

• |

The Investment business may invest in companies that are based outside of the United States, which may expose the Investment Funds to additional risks not typically associated with investing in companies that are based in the United States. |

Risks Related to Our Business and Industry

|

|

• |

Macroeconomic fluctuations may harm our business, results of operations and stock price. |

|

|

• |

Inflation and rising interest rates may adversely affect our financial condition and results of operations. |

|

|

• |

The effects of the COVID-19 pandemic on our business are uncertain and may adversely affect our results of operations and cash flows. |

|

|

• |

We are currently dependent on a single line of manufacturing business. |

|

|

• |

Our financial results vary significantly from period to period. |

|

|

• |

Our order backlog may not be indicative of future revenues. |

|

|

• |

Our future rate of growth and profitability are highly dependent on the development and growth of the communications, networking, aerospace, defense, instrumentation and industrial markets, which are cyclical. |

|

|

• |

The market share of our customers in the communications, networking, aerospace, defense, instrumentation and industrial markets may change over time, reducing the potential value of our relationships with our existing customer base. |

|

|

• |

We may make acquisitions that are not successful, or we may fail to integrate acquired businesses into our operations properly. |

|

|

• |

If we are unable to introduce innovative products, demand for our products may decrease. |

|

|

• |

Our markets are highly competitive, and we may lose business to larger and better-financed competitors. |

|

|

• |

Our success depends on our ability to retain key management and technical personnel and attracting, retaining, and training new technical personnel. |

|

|

• |

We purchase certain key components and raw materials from single or limited sources and could lose sales if these sources fail to fulfill our needs for any reason, including the inability to obtain these key components or raw materials due to the COVID-19 outbreak. |

|

|

• |

As a supplier to U.S. Government defense contractors, we are subject to a number of procurement regulations and other requirements and could be adversely affected by changes in regulations or any negative findings from a U.S. Government audit or investigation. |

|

|

• |

Our products are complex and may contain errors or design flaws, which could be costly to correct. |

|

|

• |

Communications and network infrastructure equipment manufacturers increasingly rely upon contract manufacturers, thereby diminishing our ability to sell our products directly to those equipment manufacturers. |

|

|

• |

Future changes in our environmental liability and compliance obligations may increase costs and decrease profitability. |

|

|

• |

We rely on information technology systems to conduct our business, and disruption, failure or security breaches of these systems could adversely affect our business and results of operations. |

|

|

• |

Cybersecurity risks and cyber incidents may adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information, and/or damage to our business relationships, all of which could negatively impact our financial results. |

10

|

|

|

|

• |

If we fail to correct any material weakness that we identify in our internal control over financial reporting or otherwise fail to maintain effective internal control over financial reporting, we may not be able to report our financial results accurately and timely, in which case our business may be harmed, investors may lose confidence in the accuracy and completeness of our financial reports and the price of our common stock may decline. |

Risks Related to Our Securities

|

|

• |

The price of our common stock has fluctuated considerably and is likely to remain volatile, in part due to the limited market for our common stock. |

|

|

• |

Our officers, directors and 10% or greater stockholders have significant voting power and may vote their shares in a manner that is not in the best interest of other stockholders. |

|

|

• |

Provisions in our corporate charter documents and under Delaware law could make an acquisition of the Company more difficult, which acquisition may be beneficial to our stockholders. |

|

|

• |

The warrants to purchase shares of our common stock may not have any value. |

|

|

• |

An active trading market for the warrants to purchase shares of our common stock may not develop. |

|

|

• |

Holders of the warrants to purchase shares of our common stock will have no rights as a common stockholder until such holders exercise their warrants and acquire shares of our common stock. |

|

|

• |

Adjustments to the exercise price of the warrants, or the number of shares of common stock for which the warrants are exercisable, following certain corporate events may not fully compensate warrant holders for the value they would have received if they held the common stock underlying the warrants at the time of such events. |

Risks Related to the Separation

|

|

• |

We may be unable to achieve some or all of the expected benefits of the Spin-Off, and the Spin-Off may adversely affect our business. |

|

|

• |

The Separation could result in substantial tax liability to us and our stockholders. |

|

|

• |

The distribution of MtronPTI common stock may not qualify for tax-free treatment. |

|

|

• |

As a result of the Separation, certain of our directors and officers may have actual or potential conflicts of interest because of their positions or relationships with MtronPTI. |

Risks Related to our Structure

We have engaged, and in the future may engage, in transactions with our affiliates.

We may in the future invest in entities in which Mr. Marc Gabelli also invests. We also have purchased and may in the future purchase entities or investments from him or his affiliates.

Mr. Gabelli may pursue other business opportunities in industries in which we compete and there is no requirement that any additional business opportunities be presented to us. We continuously identify, evaluate and engage in discussions concerning potential investments and acquisitions, including potential investments in and acquisitions of affiliates of Mr. Gabelli. There cannot be any assurance that any potential transactions that we consider will be completed.

We are subject to the risk of becoming an investment company.

Because we are a holding company and a significant portion of our assets may, from time to time, consist of investments in companies in which we own less than a 50% interest, we run the risk of inadvertently becoming an investment company that is required to register under the Investment Company Act. Events beyond our control, including significant appreciation or depreciation in the market value of certain of our publicly traded holdings or adverse developments with respect to our ownership of certain of our subsidiaries, could result in our inadvertently becoming an investment company that is required to register under the Investment Company Act. Transactions

11

involving the sale of certain assets could result in our being considered an investment company. Following such events or transactions, an exemption under the Investment Company Act would provide us up to one year to take steps to avoid becoming classified as an investment company. We expect to take steps to avoid becoming classified as an investment company, but no assurance can be made that we will successfully be able to take the steps necessary to avoid becoming classified as an investment company.

If we are unsuccessful, then we will be required to register as a registered investment company and will be subject to extensive, restrictive and potentially adverse regulations relating to, among other things, operating methods, management, capital structure, dividends and transactions with affiliates. Registered investment companies are not permitted to operate their business in the manner in which we currently operate our business, nor are registered investment companies permitted to have many of the relationships that we have with our affiliated companies. In addition, if we become required to register under the Investment Company Act, it is likely that we would be treated as a corporation for U.S. federal income tax purposes and would be subject to the tax consequences described below under the caption, “We may become taxable as a corporation if we are no longer treated as a partnership for U.S. federal income tax purposes.”

If it were established that we were an investment company and did not register as an investment company when required to do so, there would be a risk, among other material adverse consequences, that we could become subject to monetary penalties or injunctive relief, or both, in an action brought by the SEC, that we would be unable to enforce contracts with third parties or that third parties could seek to obtain rescission of transactions with us undertaken during the period it was established that we were an unregistered investment company.

We may structure transactions in a less advantageous manner to avoid becoming subject to the Investment Company Act.

In order not to become an investment company required to register under the Investment Company Act, we monitor the value of our investments and structure transactions with an eye toward the Investment Company Act. As a result, we may structure transactions in a less advantageous manner than if we did not have Investment Company Act concerns, or we may avoid otherwise economically desirable transactions due to those concerns.

Risks Relating to Liquidity and Capital Requirements

We are a holding company and depend on the businesses of our subsidiaries to satisfy our obligations.

We are a holding company. In addition to cash and cash equivalents, U.S. government and agency obligations, marketable equity and debt securities and other short-term investments, our assets consist primarily of investments in our subsidiaries. Moreover, if we make significant investments in new operating businesses, it is likely that we will reduce our liquid assets in order to fund those investments and the ongoing operations of our subsidiaries. Consequently, our cash flow and our ability to meet our debt service obligations and make distributions with respect to depositary units likely will depend on the cash flow of our subsidiaries and the payment of funds to us by our subsidiaries in the form of dividends, distributions, loans or otherwise.

The operating results of our subsidiaries may not be sufficient to make distributions to us. In addition, our subsidiaries are not obligated to make funds available to us and distributions and intercompany transfers from our subsidiaries to us may be restricted by applicable law or covenants contained in debt agreements and other agreements to which these subsidiaries may be subject or enter into in the future.

We have made significant investments in the Investment business and negative performance of the Investment business may result in a significant decline in the value of our investments.

As of December 31, 2022, we had investments in Cash and Marketable securities with a fair market value of approximately $38.1 million, which may be accessed on short notice to satisfy our liquidity needs. However, if the Investments experience negative performance, the value of these investments will be negatively impacted, which could have a material adverse effect on our operating results, cash flows and financial position.

12

Risks Relating to Our Investment Business

The Company has made and may make material investments in special purpose acquisition companies that may not be successful.

The Company invested $6.1 million in LGL Systems Acquisition Holdings, LLC, the Sponsor of LGL Systems Acquisition Corp., a NYSE-listed SPAC trading under the symbol “DFNS” which later completed a business combination with IronNet Cybersecurity, Inc. and began trading on the NYSE under the symbol “IRNT”.

The Company is a partner in LGL Systems Acquisition Holdings, LLC, which has formed two new SPAC vehicles yet to be issued. If the SPACs are launched to complete a business combination, this action may be material to the Company. There is no assurance that such activity may occur, that the Company will have appropriate insurance for such an occurrence, or that its ’Board will endorse such activity. There is no assurance that the SPAC will be successful with IPO, complete a business combination, or that any business combination will be successful. If invested, the Company can lose its entire investment in the SPAC if a business combination is not completed within 24 months of the SPAC’s IPO or if the business combination is not successful, which may adversely impact the Company’s stockholder value.

Our investments may be subject to significant uncertainties.

Our investments may not be successful for many reasons, including, but not limited to:

|

|

• |

fluctuations of or sustained increases in interest rates; |

|

|

• |

lack of control in minority investments; |

|

|

• |

worsening of general economic and market conditions; |

|

|

• |

lack of diversification; |

|

|

• |

lack of success of the Investment business’s strategies; |

|

|

• |

inflationary conditions; |

|

|

• |

fluctuations of U.S. dollar exchange rates; and |

|

|

• |

adverse legal and regulatory developments that may affect particular businesses. |

The historical financial information for our Investment business is not necessarily indicative of our future performance.

Our Investment business’s financial information is driven by the amount of funds allocated to the Investment business and the performance of the underlying investments. Future funds allocated to the Investment business may increase or decrease based on the contributions and redemptions by our Holding Company and Mr. Marc Gabelli. Additionally, historical performance results of the Investment business are not indicative of future results as past market conditions, investment opportunities and investment decisions may not occur in the future. Changes in general market conditions coupled with changes in exposure to short and long positions have significant impact on our Investment business results of operations and the comparability of results of operations year over year and as such, future results of operations will be impacted by our future exposures and future market conditions, which may not be consistent with prior trends. Additionally, future returns may be affected by additional risks, including risks of the industries and businesses in which a particular fund invests.

The Investment business’s investment strategy involves numerous and significant risks, including the risk that we may lose some or all of our investments in the Investment business. This risk may be magnified due to concentration of investments and investments in undervalued securities.

Our Investment business’s revenue depends on the investments made by the Investment business. There are numerous and significant risks associated with these investments, certain of which are described in this risk factor and in other risk factors set forth herein. Certain investment positions held by the Investment business may be illiquid. The Investment business may own restricted or non-publicly traded securities and securities traded on foreign exchanges. We may also have significant influence with respect to certain companies owned by the Investment business, including representation on the board of directors of certain companies, and may be subject to trading restrictions with respect to specific positions in the Investment business at any particular time. These investments and trading restrictions could prevent the Investment business from liquidating unfavorable positions promptly and subject the Investment business to substantial losses.

13

At any given time, the Investment business’s assets may become highly concentrated within a particular company, industry, asset category, trading style or financial or economic market. In that event, the Investment business’s investment portfolio will be more susceptible to fluctuations in value resulting from adverse events, developments or economic conditions affecting the performance of that particular company, industry, asset category, trading style or economic market than a less concentrated portfolio would be. As a result, the Investment business’s investment portfolio’s aggregate returns may be volatile and may be affected substantially by the performance of only one or a few holdings.

The Investment business seek to invest in securities that are undervalued. The identification of investment opportunities in undervalued securities is challenging, and there are no assurances that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer the opportunity for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses. Returns generated from the Investment business’s investments may not adequately compensate for the business and financial risks assumed.

From time to time, the Investment business may invest in bonds or other fixed income securities, such as commercial paper and higher yielding (and, therefore, higher risk) debt securities. It is likely that a major economic recession could severely disrupt the market for such securities and may have a material adverse impact on the value of such securities. In addition, it is likely that any such economic downturn could adversely affect the ability of the issuers of such securities to repay principal and pay interest thereon and increase the incidence of default for such securities.

For reasons not necessarily attributable to any of the risks set forth in this Report (e.g., supply/demand imbalances or other market forces), the prices of the securities in which the Investment business invest may decline substantially. In particular, purchasing assets at what may appear to be undervalued levels is no guarantee that these assets will not be trading at even more undervalued or otherwise lower levels at a future time of valuation or at the time of sale.

The prices of financial instruments in which the Investment business may invest can be highly volatile. Price movements of forward and other derivative contracts in which the Investment business’s assets may be invested are influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments, and national and international political and economic events and policies. The Investment business are subject to the risk of failure of any of the exchanges on which their positions trade or of their clearinghouses.

We may not be able to identify suitable investments, and our investments may not result in favorable returns or may result in losses.

The equity securities in which we may invest may include common stock, preferred stock and securities convertible into common stock, as well as warrants to purchase these securities. The debt securities in which we may invest may include bonds, debentures, notes or non-rated mortgage-related securities, municipal obligations, bank debt and mezzanine loans. Certain of these securities may include lower rated or non-rated securities, which may provide the potential for higher yields and therefore may entail higher risk and may include the securities of bankrupt or distressed companies. In addition, we may engage in various investment techniques, including derivatives, options and futures transactions, foreign currency transactions, “short” sales and leveraging for either hedging or other purposes. We may concentrate our activities by owning significant or controlling interests in certain investments. We may not be successful in finding suitable opportunities to invest our cash and our strategy of investing in undervalued assets may expose us to numerous risks.

The Investment business may make investments in companies we do not control.

Investments by the Investment business may include investments in debt or equity securities of publicly traded companies that we do not control. Such investments may be acquired by the Investment business through open market trading activities or through purchases of securities from the issuer. These investments will be subject to the risk that the company in which the investment is made may make business, financial or management decisions with which our Investment business disagree or that the majority of stakeholders or the management of the company may take risks or otherwise act in a manner that does not serve the best interests of the Investment business. In addition, the Investment business may make investments in which it shares control over the investment with co-investors, which may make it more difficult for it to implement its investment approach or exit the investment when it otherwise would. If any of the foregoing were to occur, the values of the investments by the Investment business could decrease and our Investment business revenues could suffer as a result.

14

The use of leverage in investments by the Investment Business may pose a significant degree of risk and may enhance the possibility of significant loss in the value of the investments.

The Investment business may leverage their capital if management believes that the use of leverage may enable the Investment business to achieve a higher rate of return. Accordingly, the Investment business may pledge their securities in order to borrow additional funds for investment purposes. The Investment business may also leverage their investment return with options, short sales, swaps, forwards and other derivative instruments. The amount of borrowings that the Investment business may have outstanding at any time may be substantial in relation to their capital. While leverage may present opportunities for increasing the Investment business’s total return, leverage may increase losses as well. Accordingly, any event that adversely affects the value of an investment by the Investment business would be magnified to the extent such fund is leveraged. The cumulative effect of the use of leverage by the Investment business in a market that moves adversely to the Investment business’s investments could result in a substantial loss to the Investment business that would be greater than if the Investment business were not leveraged. There is no assurance that leverage will be available on acceptable terms, if at all.

In general, the use of short-term margin borrowings results in certain additional risks to the Investment business. For example, should the securities pledged to brokers to secure any Investment business’s margin accounts decline in value, the Investment business could be subject to a “margin call,” pursuant to which it must either deposit additional funds or securities with the broker, or suffer mandatory liquidation of the pledged securities to compensate for the decline in value. In the event of a sudden drop in the value of any of the Investment business’s assets, the Investment business might not be able to liquidate assets quickly enough to satisfy its margin requirements.

The Investment business may enter into repurchase and reverse repurchase agreements. When the Investment business enters into a repurchase agreement, it “sells” securities issued by the U.S. or a non-U.S. government, or agencies thereof, to a broker-dealer or financial institution, and agrees to repurchase such securities for the price paid by the broker-dealer or financial institution, plus interest at a negotiated rate. In a reverse repurchase transaction, the Investment business “buys” securities issued by the U.S. or a non-U.S. government, or agencies thereof, from a broker-dealer or financial institution, subject to the obligation of the broker-dealer or financial institution to repurchase such securities at the price paid by the Investment business, plus interest at a negotiated rate. The use of repurchase and reverse repurchase agreements by any of the Investment business involves certain risks. For example, if the seller of securities to the Investment business under a reverse repurchase agreement defaults on its obligation to repurchase the underlying securities, as a result of its bankruptcy or otherwise, the Investment business will seek to dispose of such securities, which action could involve costs or delays. If the seller becomes insolvent and subject to liquidation or reorganization under applicable bankruptcy or other laws, the Investment business’s ability to dispose of the underlying securities may be restricted. Finally, if a seller defaults on its obligation to repurchase securities under a reverse repurchase agreement, the Investment business may suffer a loss to the extent it is forced to liquidate its position in the market, and proceeds from the sale of the underlying securities are less than the repurchase price agreed to by the defaulting seller.

The financing used by the Investment business to leverage its portfolio will be extended by securities brokers and dealers in the marketplace in which the Investment business invest. While the Investment business will attempt to negotiate the terms of these financing arrangements with such brokers and dealers, its ability to do so will be limited. The Investment business are therefore subject to changes in the value that the broker-dealer ascribes to a given security or position, the amount of margin required to support such security or position, the borrowing rate to finance such security or position and/or such broker-dealer’s willingness to continue to provide any such credit to the Investment business. Because the Investment business currently have no alternative credit facility which could be used to finance its portfolio in the absence of financing from broker-dealers, it could be forced to liquidate its portfolio on short notice to meet its financing obligations. The forced liquidation of all or a portion of the Investment business’s portfolios at distressed prices could result in significant losses to the Investment business.

The possibility of increased regulation could result in additional burdens on our Investment business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”), enacted into law in July 2010, resulted in regulations affecting almost every part of the financial services industry.

The regulatory environment in which our Investment business operates is subject to further regulation in addition to the rules already promulgated, including the Reform Act. Our Investment business may be adversely affected by the enactment of new or revised regulations, or changes in the interpretation or enforcement of rules and regulations

15

imposed by the SEC, other U.S. or foreign governmental regulatory authorities or self-regulatory organizations that supervise the financial markets. Such changes may limit the scope of investment activities that may be undertaken by the Investment business’s managers. Any such changes could increase the cost of our Investment business doing business and/or materially adversely impact its profitability. Additionally, the securities and futures markets are subject to comprehensive statutes, regulations and margin requirements. The SEC, other regulators and self-regulatory organizations and exchanges have taken and are authorized to take extraordinary actions in the event of market emergencies. The regulation of derivatives transactions and funds that engage in such transactions is an evolving area of law and is subject to modification by government and judicial action. The effect of any future regulatory change on the Investment business and the Investment business could be substantial and adverse.

The ability to hedge investments successfully is subject to numerous risks.

The Investment business may utilize financial instruments, both for investment purposes and for risk management purposes in order to (i) protect against possible changes in the market value of the Investment business’s investment portfolios resulting from fluctuations in the securities markets and changes in interest rates; (ii) protect the Investment business’s unrealized gains in the value of its investment portfolios; (iii) facilitate the sale of any such investments; (iv) enhance or preserve returns, spreads or gains on any investment in the Investment business’s portfolio; (v) hedge the interest rate or currency exchange rate on any of the Investment business’s liabilities or assets; (vi) protect against any increase in the price of any securities our Investment business anticipate purchasing at a later date; or (vii) for any other reason that our Investment business deems appropriate.