lgl-ex991_8.htm

APPENDIX A

PRELIMINARY INFORMATION STATEMENT FILED BY M-TRON INDUSTRIES, INC. WITH THE

U.S. SECURITIES AND EXCHANGE COMMISSION ON MAY 11, 2022; TO BE AMENDED

PRELIMINARY AND SUBJECT TO COMPLETION

INFORMATION STATEMENT

M-tron Industries, Inc.

COMMON STOCK, PAR VALUE $0.01 PER SHARE

This information statement is being furnished by The LGL Group, Inc., a Delaware corporation (the “Company”), in connection with its spin-off (the “spin-off”) of M-tron Industries, Inc., a Delaware corporation (“Mtron,” “we,” “us” and “our”). Mtron is currently a wholly-owned subsidiary of the Company but, as described below, will become a separate, publicly-traded company as a result of the spin-off. Mtron is an operating subsidiary engaged in the manufacture of electronic components and its business includes the operations of Piezo Technology, Inc., M-tron Asia, LLC and other related subsidiaries. It has design and manufacturing facilities in Orlando, Florida and Yankton, South Dakota.

The Company will continue as a separate, publicly-traded company following the spin-off, with its business consisting of the operation of its subsidiary, Precise Time and Frequency, LLC, a Delaware limited liability company and manufacturer of time and frequency instruments. It has a design and manufacturing facility in Wakefield, Massachusetts.

To effect the spin-off, the Company will distribute shares of common stock, par value $0.01 per share, of Mtron (“Mtron Common Stock”) held by it on a pro rata basis to the Company’s stockholders (the “distribution”). As a stockholder of the Company, you will receive one share of Mtron Common Stock for each share of the Company’s common stock, par value $0.01 per share, held of record by you as of 5:00 P.M., Eastern time, on [•][•], 2022, the record date for the distribution (such date and time, the “record date”). As a result, the stockholders of the Company prior to the spin-off will become the stockholders of Mtron after the spin-off.

We expect that the distribution will occur on [•] [•], 2022 (the “distribution date”). Immediately after the distribution, Mtron will be a separate, publicly-traded company. The spin-off will not impact your holdings of the Company’s common stock, and, accordingly, your proportionate interest in the Company will not change as a result of the spin-off. The distribution is intended to be tax-free for U.S. federal income tax purposes. See “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off.”

The Board of Directors of the Company is seeking stockholder approval of the proposed spin-off in the contemplated manner. The Company intends to hold a special meeting of its stockholders (the “special meeting”), and the Company has distributed a separate proxy statement which contains information regarding the proposed spin-off and the special meeting. Completion of the spin-off is conditioned upon stockholder approval of the spin-off. You do not need to pay any consideration, exchange or surrender your existing shares of the Company’s common stock or take any other action to receive your shares of Mtron Common Stock.

Prior to the spin-off, the Company will own all of the outstanding shares of Mtron Common Stock. Accordingly, there is no current trading market for Mtron Common Stock. We intend to list Mtron Common Stock on the NYSE American, under the symbol “MPTI”. We expect that the Mtron Common Stock will be listed on the NYSE American on or promptly after the distribution date. However, there is no assurance that an active public market for Mtron Common Stock will develop or be sustained after the spin-off. If an active public market does not develop or is not sustained, it may be difficult for Mtron’s stockholders to sell their shares of Mtron Common Stock at a price that is attractive to them, or at all. It is expected that a limited trading in the over-the-counter market, commonly known as a “when-issued” trading market, for shares of Mtron Common Stock will begin one trading day before the record date and that “regular way” trading of the Mtron Common Stock will begin the first day of trading after the distribution date.

The Company’s common stock is listed on the NYSE American. It is anticipated that, beginning on the record date and continuing until the time of the distribution, there will be two markets in shares of the Company’s common stock on the NYSE American: a “regular-way” market and an “ex-distribution” market. Shares of the Company’s common Stock that trade on the “regular-way” market will trade with an entitlement to the shares of Mtron Common Stock to be distributed in the spin-off in respect thereof. Shares of the Company’s common stock that trade on the “ex-distribution” market will trade without an entitlement to shares of Mtron Common Stock. Therefore, if a stockholder sells shares of the Company’s common stock in the “regular-way” market on or prior to the time of the distribution, such stockholder will also be selling the right to receive the shares of Mtron Common Stock that such stockholder would have otherwise received in the spin-off in respect of the shares of the Company’s common stock being sold. If a stockholder owns shares of the Company’s common stock on the record date and sells those shares on the “ex-distribution” market on or prior to the time of the distribution, such stockholder will continue to be entitled to receive the shares of Mtron Common Stock which are distributed in the spin-off in respect of the shares of the Company’s common stock being sold.

You are encouraged to consult with your broker, financial and/or tax advisors regarding the specific implications of selling your shares of the Company’s common stock prior to or on the distribution date.

Mtron is an “emerging growth company” as defined under applicable U.S. federal securities laws and, as such, has provided more limited disclosures in this information statement than an issuer that would not so qualify and also intends to elect to comply with the reduced public company reporting requirements for emerging growth companies in its future filings for so long as it is permitted to do so. See “Summary—Implications of Being an Emerging Growth Company.”

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 14.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell, or the solicitation of an offer to buy, any securities.

The date of this information statement is [•] [•], 2022.

This information statement was first mailed to the Company’s stockholders on or about May [•], 2022.

Table of Contents

Summary1

Questions and Answers About the Spin-Off4

Summary of the Spin-Off10

Selected Historical Financial Information13

Risk Factors14

Cautionary Statement Regarding Forward-Looking Statements26

The Spin-Off28

Dividend Policy35

Capitalization36

Selected Historical Financial Information37

Unaudited Pro Forma Financial Statements38

Business43

Management’s Discussion and Analysis of Financial Condition and Results of Operations47

Certain Relationships and Related Party Transactions51

Management52

Executive Compensation58

Director Compensation63

Security Ownership of Certain Beneficial Owners and Management64

Description of Capital Stock65

Where You Can Find More Information69

Index to Combined Financial StatementsF-1

Report of Independent Registered Public Accounting FirmF-2

ii

Summary

The following is a summary of material information discussed in this information statement. This summary may not contain all the details concerning the spin-off or other information that may be important to you. To better understand the spin-off and Mtron’s business and financial position, you should carefully review this entire information statement. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of Mtron, assumes the completion of all the transactions referred to in this information statement in connection with the spin-off. Unless the context otherwise requires, references in this information statement to “Mtron”, “we”, “us” and “our” and “our company” refer to M-tron Industries, Inc., a Delaware corporation. References in this information statement to “the Company” refer to The LGL Group, Inc., a Delaware corporation, and its consolidated subsidiaries (other than, after the spin-off, Mtron and its consolidated subsidiaries), unless the context otherwise requires.

References in this information statement to the historical assets, liabilities, products, businesses or activities of Mtron are generally intended to refer to the historical assets, liabilities, products, businesses or activities of the businesses of Mtron as they have been conducted as part of the Company’s organization.

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except as required by law.

This information statement describes our business, our relationship with the Company, and how this transaction affects the Company’s stockholders, and provides other information to assist you in evaluating the benefits and risks of the spin-off and holding or disposing of the shares of Mtron Common Stock received in connection with the spin-off.

|

|

|

The Company |

The Company is The LGL Group, Inc., a Delaware corporation. The Company was incorporated in 1928 under the laws of the State of Indiana and reincorporated under the laws of the State of Delaware in 2007, and is a diversified holding company with subsidiaries engaged in the design, manufacturing and marketing of highly-engineered, high reliability frequency and spectrum control products used to control the frequency or timing of signals in electronic circuits and in the design of high performance frequency and time reference standards that form the basis for timing and synchronization in various applications. The Company operates through its two principal subsidiaries, (1) M-tron Industries, Inc., which includes the operations of Piezo Technology, Inc., M-tron Asia, LLC and other subsidiaries (collectively, referred to herein as “Mtron”), which represents its electronic components segment, and (2) Precise Time and Frequency, LLC, a Delaware limited liability company, which represents its electronics instruments segment.

The Company is a publicly-traded company. Its common stock is listed on the NYSE American under the ticker symbol “LGL.” The Company will own all of the shares of Mtron Common Stock issued and outstanding prior to the distribution. Immediately following the distribution, the Company will not own any shares of Mtron Common Stock. Instead, the stockholders of the Company prior to the spin-off will become the stockholders of Mtron after the spin-off. |

|

Mtron |

Originally founded in 1965, Mtron designs, manufactures and markets highly-engineered, high reliability frequency and spectrum control products.

These component-level devices are used extensively in electronic systems for applications in defense, aerospace, earth-orbiting satellites, down-hole drilling, medical devices, instrumentation, industrial devices and global positioning systems as well as in infrastructure equipment for the telecommunications and network equipment industries. As an engineering-centric company, Mtron provides close support to the customer throughout its products’ entire life cycle, including product design, prototyping, production and subsequent product upgrades. This collaborative approach has resulted in the development of long-standing business relationships with its blue-chip customer base.

All of Mtron’s production facilities are ISO 9001:2008 certified, ITAR registered and Restriction of Hazardous Substances (“RoHS”) compliant. In addition, its U.S. production facilities in Orlando, Florida and Yankton, South Dakota are AS9100 Rev D and MIL-STD-790 certified.

Mtron also has design and manufacturing facilities in Orlando, Florida and Yankton, South Dakota. |

|

|

|

The Spin-Off |

On August 12, 2021, the Company announced that its Board of Directors had authorized its management to explore a potential spin-off of Mtron’s business into a newly created and separately traded public Company. In connection with the contemplated spin-off, Mtron will enter into a number of agreements with the Company, including a Separation and Distribution Agreement, a Transitional Administrative and Management Services Agreement, and a Tax Indemnity and Sharing Agreement. These agreements will provide the terms and conditions of the separation of the Company’s businesses between the Company and Mtron and will govern various ongoing arrangements between the Company and Mtron upon completion of the spin-off.

As described in further detail below, completion of the spin-off is subject to a number of conditions, including approval of the distribution and all related transactions by the Company’s Board of Directors (and such approval not having been withdrawn) and approval by the Company’s stockholders of the proposed spin-off, to permit the distribution in the manner contemplated herein. Subject to the satisfaction of the conditions to completion of the spin-off, we expect that the distribution will occur on [•] [•], 2022. Immediately after the distribution, Mtron will be a separate, publicly-traded company and the Company will not own any shares of Mtron Common Stock.

We intend to list Mtron Common Stock on the NYSE American under the symbol “MPTI”. We expect that the Mtron Common Stock will be listed on the NYSE American on or promptly after the distribution date.

The distribution is intended to be tax-free for U.S. federal income tax purposes. See “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off.” |

|

Risk Factors |

You should carefully read the section of this information statement entitled “Risk Factors” for an explanation of the risks and uncertainties associated with the business and investments of Mtron, as well as the risks and uncertainties related to the spin-off and to ownership of Mtron Common Stock. |

|

Implications of Being an Emerging Growth Company |

Mtron qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, it may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies, including reduced financial disclosure and reduced disclosure about its executive compensation arrangements. In addition, as an emerging growth company, Mtron is exempt from the requirements to hold non-binding advisory votes on executive compensation and golden parachute payments, and from the auditor attestation requirement in the assessment of its internal control over financial reporting. Mtron is permitted to, and intends to, take advantage of these exemptions until it no longer qualifies for such exemptions. It will cease to be an emerging growth company upon the earliest of:

•the last day of the fiscal year in which it has $1.07 billion or more in annual revenues;

•the last day of the fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”);

•the date on which it has issued more than $1.0 billion in non-convertible debt securities during the previous three-year period; and

•the date on which it is deemed to be a “large accelerated filer” (which is the last day of the fiscal year during which the total market value of common equity securities held by non-affiliates is $700 million or more, calculated as of the end of the second quarter (June 30) of such fiscal year).

Mtron may choose to take advantage of some, but not all, of the exemptions available to it. Mtron has taken advantage of certain reduced reporting obligations in this information statement. Accordingly, the information contained herein may be different than the information you receive from other public companies.

In addition, Section 107 of the JOBS Act provides that an emerging growth company may take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. Mtron has decided at this time to take advantage of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards. |

|

|

|

Corporate Information |

M-tron Industries, Inc. is a Delaware corporation. Its principal executive offices are located at 2525 Shader Road, Orlando, Florida 32804. Its telephone number is (407) 298-2000. Its corporate website is www.mtronpti.com. Information contained on, or connected to, Mtron’s website or the Company’s website does not and will not constitute part of this information statement or the registration statement on Form 10, of which this information statement is a part. |

Questions and Answers About the Spin-Off

The following provides a summary of certain of the terms of the spin-off. For a more detailed description of the matters described below, see “The Spin-Off.”

|

|

|

Q: What is the spin-off?

|

A: The spin-off is the method by which Mtron will separate from the Company. To complete the spin-off, the Company will distribute to its stockholders all of the shares of Mtron Common Stock. We refer to this as the “distribution.” Following the spin-off, Mtron will be a separate company from the Company, and the Company will not retain any ownership interest in Mtron. The separation of Mtron from the Company and the distribution of Mtron Common Stock are intended to provide you with equity investments in two separate companies, each able to focus on its own respective business and distinct business strategy and capital allocation policy. The two separate companies will be (i) Mtron, which, as described in further detail below, is engaged in the manufacture of electronic components and its business includes the operations of Piezo Technology, Inc., M-tron Asia, LLC, and other subsidiaries of Mtron and (ii) the Company, which continues to own and operate its subsidiary, Precise Time and Frequency, LLC, a Delaware limited liability company and manufacturer of time and frequency instruments. |

|

Q: What is Mtron?

|

A: Mtron is currently a wholly-owned subsidiary of the Company. Originally founded in 1965, Mtron designs, manufactures and markets highly-engineered, high reliability frequency and spectrum control products. These component-level devices are used extensively in electronic systems for applications in defense, aerospace, earth-orbiting satellites, down-hole drilling, medical devices, instrumentation, industrial devices and global positioning systems as well as in infrastructure equipment for the telecommunications and network equipment industries. |

|

Q: What will I receive in the spin-off? |

A: As a stockholder of the Company, in connection with the spin-off, you will receive one share of Mtron Common Stock for each share of the Company’s common stock that you own as of the record date. See “Description of Capital Stock”.

The spin-off will not impact your holdings of the Company’s common stock and, accordingly, your proportionate interest in the Company will not change as a result of the spin-off.

In addition, holders of unvested restricted stock awards of the Company’s common stock that are outstanding on the distribution date will retain such restricted stock awards and receive one restricted share of Mtron Common Stock for each share of the Company’s common stock subject to such restricted stock awards held on the record date. The restricted shares of Mtron Common Stock will be subject to the same terms and conditions, including, without limitation, vesting conditions, as contained in the Company’s restricted stock award agreement relating to the shares of the Company’s common stock in respect of which the restricted shares of Mtron were received. As of May 6, 2022, a total of 26,283 shares of the Company’s common stock are subject to outstanding restricted stock awards, all of which are held by the Company’s executive officers or by the Company on behalf of the executive officers until vesting. |

|

Q: What will be the voting rights of the Mtron stock I receive in the spin-off?

|

A: The shares of Mtron Common Stock that you will receive in the spin-off will have the same voting rights as the respective shares of the Company’s common stock that you currently hold. As a general matter, holders of Mtron Common Stock will vote as one class on the election of directors and most other matters submitted to a vote of Mtron’s stockholders. In addition, the holders of Mtron Common Stock will each be entitled to a separate class vote under limited circumstances provided by Delaware law. See “Description of Capital Stock” for additional information. |

|

|

|

Q: What is the record date for the distribution? |

A: The record date for the distribution will be 5:00 p.m. Eastern Time on [•] [•], 2022, which date and time we refer to as the “record date.” |

|

Q: When will the distribution occur? |

A: We expect that shares of Mtron Common Stock will be distributed on or about [•] [•], 2022, which we refer to as the “distribution date.” It is expected that the distribution agent, acting on behalf of the Company, may require up to one week after the distribution date to fully distribute the shares of Mtron Common Stock to the Company’s stockholders. |

|

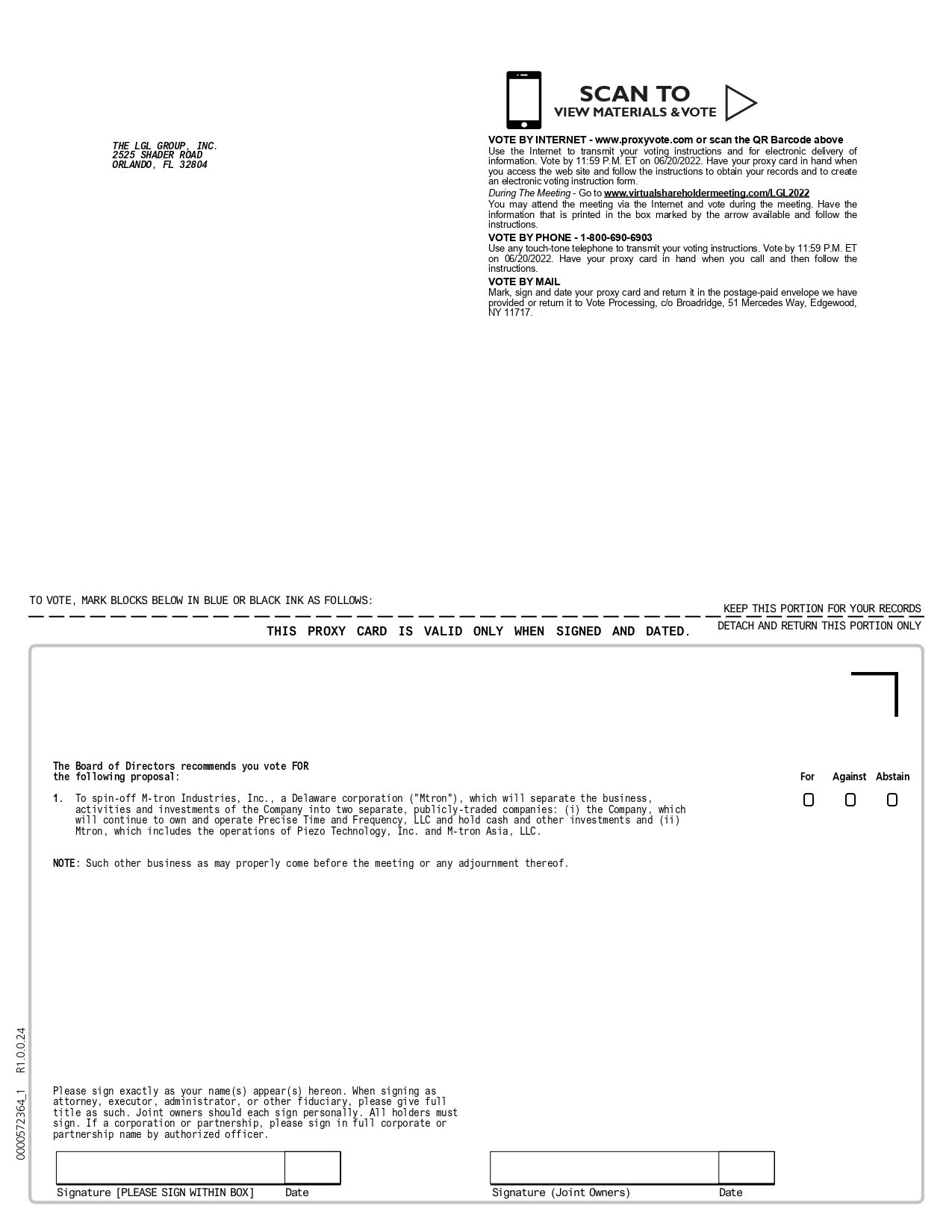

Q: Is stockholder approval required for the spin-off? |

A: Yes. Stockholder approval of the spin-off itself is required by Delaware law. It will involve a transfer of substantially all assets of the Company. |

|

Q: What do stockholders need to do to participate in the distribution? |

A: You do not need to take any action to receive your shares of Mtron Common Stock in the spin-off, but you are encouraged to read this entire information statement carefully. You will not be required make any payment to the Company for the new shares or to surrender any shares of the Company’s common stock that you currently own in order to participate in the spin-off. However, your receipt of shares of Mtron Common Stock in connection with the spin-off is intended to be tax-free for U.S. federal income tax purposes. |

|

Q: Will fractional shares be distributed in the spin-off? |

A: Because the distribution ratio is one share of Mtron Common Stock for each share of the Company’s common stock, no fractional shares will result from, or be distributed in, the spin-off. |

|

Q: What are the U.S. federal income tax consequences of the distribution to the Company’s stockholders? |

A: The distribution is intended to be tax-free for U.S. federal income tax purposes. We believe that the Company’s stockholders should not recognize gain or loss as a result of the distribution and no amount should be included in their income as a result of the distribution. The Company’s stockholders are urged to consult with their tax advisors with respect to the U.S. federal, state and local or foreign tax consequences, as applicable, of the distribution. See “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off.” |

|

Q: Why has the Company decided to spin-off Mtron? |

A: The Company’s Board of Directors has determined that the separation of Mtron from its other business is in the best interests of the Company’s stockholders. The Board believes that separating Mtron from the Company will, among other things:

•allow each company to pursue its own distinct business strategy and optimal capital allocation policy, independent of the other, which would better position each company to maximize value over the long-term;

•permit each company to tailor its strategic plans and pursue growth opportunities consistent with the key commercial markets served by each company, respectively;

•enable each company to more efficiently raise and allocate capital, including through debt or equity offerings, based on the fundamentals of their separate businesses;

•provide each company with greater flexibility to use stock as a currency for mergers, acquisitions and joint ventures;

•provide the Company’s current stockholders with equity investments in two separate, publicly traded companies, including that reflect risks and prospects of their underlying respective businesses; and

•enable investors to make investment decisions based on each company’s individual performance and potential, and enhance the likelihood that the market will value each company appropriately. |

|

|

|

Q: Are there risks associated with the spin-off and ownership of Mtron Common Stock? |

A: Yes. There are a number of risks associated with the spin-off of Mtron and ownership of Mtron Common Stock. We discuss these risks under “Risk Factors.” |

|

Q: Are there conditions to completion of the spin-off? |

A: Yes. Completion of the spin-off is subject to the following conditions:

•The Company’s Board of Directors, in its sole and absolute discretion, shall have authorized and approved the spin-off (and such authorization and approval shall not have been withdrawn, as described below);

•The approval of the Company’s stockholders of the spin-off in the contemplated manner;

•Mtron’s registration statement on Form 10, of which this information statement is a part, shall have been declared effective by the U.S. Securities and Exchange Commission (the “SEC”) and shall not be the subject of any stop order or proceedings seeking a stop order, and this information statement shall have been sent to the Company’s stockholders as of the close of business on the record date, all necessary permits and authorizations under the Securities Act and the Exchange Act relating to the issuance and trading of shares of Mtron Common Stock shall have been obtained and be in effect, and such shares shall have been approved for listing on the NYSE American, subject to official notice of issuance; and

•No court or other governmental authority having jurisdiction over the Company or Mtron shall have issued or entered any order, and no applicable law shall have been enacted or promulgated, in each case, that is then in effect and has the effect of permanently restraining, enjoining or otherwise prohibiting the consummation of the spin-off.

We are not aware of any material regulatory requirements that must be complied with or any material regulatory or third party approvals that must be obtained, other than compliance with SEC rules and regulations, including the SEC’s declaration of effectiveness of Mtron’s registration statement on Form 10, and the approval for listing of Mtron Common Stock the NYSE American, subject to official notice of issuance. |

|

Q: Can the Company’s Board of Directors decide to terminate the spin-off even if all of the conditions have been satisfied? |

A: Yes. Until the distribution has occurred, the Company’s Board of Directors has the right to terminate the spin-off, even if all of the other conditions have been satisfied, if the Company’s Board of Directors determines, in its sole and absolute discretion, that the spin-off is not in the best interests of the Company and its stockholders or that market conditions or other circumstances are such that the separation of Mtron and the Company is otherwise no longer advisable at that time. |

|

Q: When will I be able to trade my shares of Mtron Common Stock? What will the market price be? |

A: Prior to the spin-off, the Company will own all of the outstanding shares of Mtron Common Stock. Accordingly, there is no current trading market for Mtron Common Stock. We intend to list Mtron Common Stock on the NYSE American under the symbol “MPTI”. We expect that the Mtron Common Stock will be listed on the NYSE American on or promptly after the distribution date. However, there is no assurance that an active public market for Mtron Common Stock will develop or be sustained after the spin-off. If an active public market does not develop or is not sustained, it may be difficult for Mtron’s stockholders to sell their shares of Mtron Common Stock at a price that is attractive to them, or at all. It is expected that limited trading in the over-the-counter market, commonly known as a “when-issued” trading market, for shares of Mtron Common Stock will begin one trading day before the record date and that “regular way” trading of the Mtron Common Stock will begin the first day of trading after the distribution date.

We cannot predict what the market price will be for Mtron Common Stock prior to, on or after the distribution date. It is possible that some of the Company’s stockholders may sell the shares received in connection with the spin-off because, among other things, Mtron’s business or strategies do not fit their investment objectives or because Mtron Common Stock may not be included in certain indices. The market price of Mtron Common Stock may fluctuate significantly, including during the period before the market has analyzed fully the business and financial characteristics of Mtron separate from the Company. |

|

|

|

Q: Does Mtron expect to pay dividends after the spin-off? |

A: No. It is not anticipated that Mtron will pay cash dividends on its common stock following the spin-off. Mtron currently intends to retain any earnings for use in the operation of its business. |

|

Q: Will my shares of the Company’s common stock continue to trade after the spin-off? |

A: Subject to continued compliance with applicable listing standards and requirements, it is expected that, following the spin-off, the Company’s common stock will continue to trade on the NYSE American. |

|

Q: If I sell my shares of the Company’s common stock prior to the distribution, will I still be entitled to receive shares of Mtron in the distribution? |

A: It is anticipated that, beginning on the record date and continuing until the time of the distribution, there will be two markets in shares of the Company’s common stock on the NYSE American: a “regular-way” market and an “ex-distribution” market. Shares of the Company’s common stock that trade on the “regular-way” market will trade with an entitlement to the shares of Mtron Common Stock to be distributed in the spin-off in respect thereof. Shares of the Company’s common stock that trade on the “ex-distribution” market will trade without an entitlement to shares of Mtron Common Stock. Therefore, if a stockholder sells shares of the Company’s common stock in the “regular-way” market on or prior to the time of the distribution, such stockholder will also be selling the right to receive the shares of Mtron Common Stock that such stockholder would have otherwise received in the spin-off in respect of the shares of the Company’s common stock being sold. If a stockholder owns shares of the Company’s common stock on the record date and sells those shares on the “ex-distribution” market on or prior to the time of the distribution, such stockholder will continue to be entitled to receive the shares of Mtron Common Stock which are distributed in the spin-off in respect of the shares of the Company’s common stock being sold.

You are encouraged to consult with your broker or financial advisor regarding the specific implications of selling your shares of the Company’s common stock prior to or on the distribution date. |

|

Q: Will the spin-off affect the market price of the Company’s common stock?

|

A: It is possible that the market price of the Company’s common stock will be affected by the spin-off because such stock will no longer reflect the benefits, risks or rewards associated with Mtron and its subsidiaries. There is no assurance as to how the market will respond to the spin-off, including the agreements entered into in connection with the spin-off and the relationship between the Company and Mtron following the spin-off. We cannot provide you with any assurance as to the price at which shares of the Company’s common stock or shares of Mtron Common Stock will trade following the spin-off. |

|

Q: What will be the relationship between the Company and Mtron after the spin-off? |

A: Immediately following the spin-off, Mtron will be a separate, publicly-traded company, and the Company will have no continuing stock ownership interest in Mtron. In connection with the spin-off, Mtron will enter into a Separation and Distribution Agreement and several other agreements with the Company which will provide the terms and conditions of the separation of the businesses and will govern various ongoing arrangements between the Company and Mtron after completion of the spin-off.

Following the spin-off, there will be limited overlap between executive management of the Company and Mtron. It is expected that following the Spin-off, the following executive officers of the Company will resign and be appointed to serve as executive officers of Mtron. Michael J. Ferrantino will serve as chief executive officer, James W. Tivy will serve as chief financial officer and Linda M. Biles will serve as vice-president, controller of Mtron. To replace these positions, Marc J. Gabelli will be appointed and serve as the Company’s chief executive officer, Ivan Arteaga will be its chief financial officer, and James W. Tivy will be its chief accounting officer.

It is currently anticipated that in connection with the Spin-off, two members of the Board of Directors of the Company, Bel Lazar and John S. Mega, will resign as directors and will be appointed to serve as directors of Mtron. It is also anticipated that the Company’s chairman of the board, Marc J. Gabelli, will be appointed to serve as a director and as non-executive chairman of the board of Mtron, and that Michael J. Ferrantino will also be appointed to serve as a director of Mtron. As a result of the anticipated resignations, the Company’s Board of Directors will consist of Marc J. Gabelli, as chairman of the board, Timothy J. Foufas, Donald H. Hunter, Manjit Kalha, Ivan Arteaga, and Michael J. Ferrantino. See “Management” for additional information. |

|

|

|

Q: How will the Company’s indebtedness and cash be allocated, paid or transferred in connection with the spin-off? |

A: Mtron will assume the indebtedness of or related to it and its subsidiaries in connection with the spin-off, which had no outstanding indebtedness of as of December 31, 2021.

As of December 31, 2021, the Company had approximately $29.0 million of cash and cash equivalents. In connection with the spin-off, the Company will contribute to Mtron $1.7 million of cash and cash equivalents, other than $27.3 million of cash and cash equivalents and marketable securities with a current value of approximately $16.2 million which will be retained by the Company for use in the operation of its business. |

|

Q: What will Mario J. Gabelli’s and Marc J. Gabelli’s ownership and voting percentage of Mtron be immediately following the distribution? |

Mario J. Gabelli and Marc J. Gabelli will have the same beneficial ownership and voting interest in Mtron immediately following the spin-off as they have with respect to the Company immediately prior to the spin-off, or 1,042,612 and 844,883 shares, respectively. In the aggregate, these shares currently represent approximately 35.2% of the Company’s total outstanding common stock. As a result, they will have the same voting power with respect to Mtron and will have a significant influence in the election of directors and the vote on any other matter presented for approval by Mtron’s stockholders. |

|

Q: Do the Company’s executive officers and directors have interests in the spin-off that may be different from or in addition to the interests of the Company’s other stockholders? |

Yes. You should be aware that the executive officers and directors of the Company have interests in the spin-off that may differ from, or may be in addition to, the interests of the Company’s stockholders generally. As previously described, following the spin-off, there will be an overlap between directors of the Company and Mtron. Marc J. Gabelli will serve as a chief executive officer and as a director and chairman of the Company and as a director and non-executive chairman of Mtron. Michael J. Ferrantino will also serve as a director of the Company and as a director and chief executive officer of Mtron. James W. Tivy will serve as chief accounting officer of the Company and chief financial officer of Mtron. The Company’s directors currently receive annual cash fees and stock awards for their service on the Company’s Board, and it is anticipated that those who will also serve on the Mtron’s board of directors and receive fees for doing so as determined by the compensation committee of Mtron’s board. |

|

|

|

Q: Will I have appraisal rights in connection with the spin-off? |

A: No. Stockholders of the Company will not have any appraisal rights in connection with the spin-off. |

|

Q: Who will be the transfer agent for Mtron’s Common stock after the spin-off? |

A: It is expected that Computershare Inc. will be the transfer agent for Mtron’s Common stock after the spin-off. |

|

Q: Who is the distribution agent for the spin-off? |

A: Computershare Inc. will be the distribution agent for the spin-off. |

|

Q: Where can I get more information? |

A: If you have any questions relating to the spin-off, you should contact the distribution agent at:

Computershare

211 Quality Circle, Suite 210

College Station, TX 77845

Toll free number: (877) 868-8027

TDD Hearing Impaired: (800) 952-9245

Foreign Stockholders: (201) 680-6578

TDD Foreign Stockholders: (781) 575-4592 |

Summary of the Spin-Off

|

Distributing Company |

The LGL Group, Inc., a Delaware corporation. Immediately after the distribution, the Company will not own any shares of Mtron Common Stock. |

|

Distributed/Spin-Off Company |

M-tron Industries, Inc., a Delaware corporation, which is currently a wholly-owned subsidiary of the Company. Such corporation will become a separate, publicly-traded company as a result of the spin-off. |

|

Separation of Businesses |

In connection with the spin-off, the Company will continue to own and operate its subsidiary, Precise Time and Frequency, LLC, and will hold cash and other investments.

If the spin-off is completed, Mtron will be a separate, publicly-traded company engaged in the manufacture and marketing of frequency and spectrum control products directly and through its Piezo Technology, Inc., M-tron Asia, LLC and related subsidiaries. |

|

Distributed Securities |

The shares of Mtron Common Stock to be distributed in the spin-off will constitute all of the issued and outstanding shares of Mtron Common Stock immediately following the distribution.

Based on the number of shares of the Company’s common stock expected outstanding as of the record date, Mtron expects that 5,360,470 shares of Mtron Common Stock will be distributed in the spin-off. However, the actual number of shares of Mtron Common Stock to be distributed in the spin-off will be determined based on the actual number of shares of the Company’s common stock outstanding as of the record date. |

|

Record Date |

5:00 P.M., Eastern time, on [•] [•], 2022. |

|

Distribution Date |

[•], [•], 2022. |

|

Distribution Ratio |

Each stockholder of the Company will receive one share of Mtron Common Stock for each share of the Company’s common stock held by such stockholder as of the record date. |

|

The Distribution |

On or before the distribution date, the Company will release the shares of Mtron Common Stock to the distribution agent to distribute to the Company’s stockholders. The shares will be distributed in book-entry form, which means that no physical share certificates will be issued. We expect that it may take the distribution agent up to one week following the distribution date to electronically issue shares of Mtron Common Stock to you or to your bank or brokerage firm on your behalf by way of direct registration in book-entry form.

You will not be required to make any payment, surrender or exchange of your shares of the Company’s common stock or take any other action to receive your shares of Mtron Common Stock.

However, the Company is seeking the approval of its stockholders in order to effect the spin-off in the contemplated manner. The Company intends to hold a special meeting of its stockholders to approve these actions and has distributed a separate proxy statement which contains information regarding the proposed spin-off and name change and the special meeting. Completion of the spin-off is conditioned upon stockholder approval of the spin-off and certain other conditions described below. |

|

No Fractional Shares |

Because the distribution ratio is one share of Mtron Common Stock for each share of the Company’s common stock, no fractional shares will result from, or be distributed in, the spin-off. |

|

Conditions to the Spin-Off |

Completion of the spin-off is subject to the following conditions:

•the Company’s Board of Directors of, in its sole and absolute discretion, shall have authorized and approved the spin-off (and such authorization and approval shall not have been withdrawn, as described below);

•the approval of the Company’s stockholders of the spin-off in the manner contemplated;

•Mtron’s registration statement on Form 10, of which this information statement is a part, shall have been declared effective by the SEC and shall not be the subject of any stop order or proceedings seeking a stop order, and this information statement shall have been sent to the Company’s stockholders as of the close of business on the record date, all necessary permits and authorizations under the Securities Act and the Exchange Act relating to the issuance and trading of shares of Mtron Common Stock shall have been obtained and be in effect, and such shares shall have been approved for listing on the NYSE American, subject to official notice of issuance; and

•No court or other governmental authority having jurisdiction over the Company or Mtron shall have issued or entered any order, and no applicable law shall have been enacted or promulgated, in each case, that is then in effect and has the effect of permanently restraining, enjoining or otherwise prohibiting the consummation of the spin-off.

We are not aware of any material regulatory requirements that must be complied with or any material regulatory or third party approvals that must be obtained, other than compliance with SEC rules and regulations, including the SEC’s declaration of effectiveness of Mtron’s registration statement on Form 10, and the approval for listing of Mtron Common Stock on the NYSE American. |

|

Trading of Shares |

We intend to list Mtron Common Stock on the NYSE American under the symbol “MPTI”. We expect that the Mtron Common Stock will be listed on the NYSE American on or promptly after the distribution date.

It is expected that a limited trading in the over-the-counter market, commonly known as a “when-issued” trading market, for shares of Mtron Common Stock will begin one trading day before the record date and that “regular way” trading of the Mtron Common Stock will begin the first day of trading after the distribution date.

It is anticipated that, beginning on the record date and continuing until the time of the distribution, there will be two markets in shares of the Company’s common stock on the NYSE American: a “regular-way” market and an “ex-distribution” market. Shares of the Company’s common Stock that trade on the “regular-way” market will trade with an entitlement to the shares of Mtron Common Stock to be distributed in the spin-off in respect thereof. Shares of the Company’s common stock that trade on the “ex-distribution” market will trade without an entitlement to shares of Mtron Common Stock. Therefore, if a stockholder sells shares of the Company’s common stock in the “regular-way” market on or prior to the time of the distribution, such stockholder will also be selling the right to receive the shares of Mtron Common Stock that such stockholder would have otherwise received in the spin-off in respect of the shares of the Company’s common stock being sold. If a stockholder owns shares of the Company’s common stock on the record date and sells those shares on the “ex-distribution” market on or prior to the time of the distribution, such stockholder will continue to be entitled to receive the shares of Mtron Common Stock which are distributed in the spin-off in respect of the shares of the Company’s common stock being sold.

You are encouraged to consult with your broker or financial advisor regarding the specific implications of selling your shares of the Company’s Common Stock prior to or on the distribution date. |

|

Material U.S. Federal Income Tax Consequences |

The distribution is intended to be tax-free under Section 355 of the Internal Revenue Code of 1986, as amended. We believe that the Company’s stockholders should not recognize gain or loss as a result of the distribution and no amount should be included in their income as a result of the distribution for U.S. federal income tax purposes. The Company has not obtained a tax opinion with respect to the tax consequences of the spin-off. Neither the Company nor Mtron has applied for a private letter ruling from the Internal Revenue Service (the “IRS”) with respect to the tax consequences of the distribution. Accordingly, there can be no assurance that the IRS or another taxing authority will not assert that the distribution is taxable to the Company, Mtron or the Company’s stockholders. The Company’s stockholders are urged to consult with their tax advisors with respect to the U.S. federal, state and local or foreign tax consequences, as applicable, of the distribution.

For a more detailed discussion of the federal income tax consequences of the spin-off, see “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off” and “Risk Factors—Risks Relating to the Spin-Off—The distribution of our common stock may not qualify for tax-free treatment.” |

|

Separation and Distribution Agreement and other Spin-Off Documents |

In connection with the spin-off, Mtron will enter into a Separation and Distribution Agreement and several other agreements with the Company, which will provide the terms and conditions of the separation of the businesses of the Company between the Company and Mtron and will govern various ongoing arrangements between the Company and Mtron upon completion of the spin-off. The Separation and Distribution Agreement and other agreements expected to be entered into with the Company in connection with the spin-off are described in further detail under “The Spin-Off—Relationship Between Mtron and the Company.” |

|

Dividend Policy |

It is not anticipated that Mtron will pay cash dividends on its common stock following the spin-off. Mtron currently intends to retain any earnings for use in the operation of its business. |

|

Distribution Agent |

Computershare, Inc. will be the distribution agent for the spin-off. |

|

Risk Factors |

There are a number of risks and uncertainties related to the spin-off of Mtron (including its business and investments and it being a separate, publicly-traded company following the spin-off) and ownership of Mtron Common Stock. You should carefully read the factors set forth in the section of this information statement entitled “Risk Factors.” |

SELECTED Historical COMBINED Financial Information

Selected Historical Combined Financial Data

The following tables present the selected historical combined financial data of Mtron. We derived the statements of operations data for the year ended December 31, 2021 and 2020 and the balance sheets data as of December 31, 2021 and 2020 from our audited combined financial statements included elsewhere in this information statement.

The historical statements of operations reflect allocations of general corporate expenses from the Company, including, but not limited to, executive management, accounting, and other shared services. These expenses have been allocated to Mtron on the basis of direct usage when identifiable, while the remainder of the expenses, including costs related to executive compensation, were allocated primarily on a pro-rata basis based on segment revenues. The allocations may not, however, reflect the expenses Mtron would have incurred as a stand-alone public company for the periods presented. The financial statements included in this information statement may not necessarily reflect our financial position, results of operations and cash flows as if Mtron had operated as a stand-alone public company during all periods presented.

The selected historical combined financial data presented below should be read in conjunction with our audited historical combined financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

Fiscal Year Ended |

|

|

|

|

December 31,

2021 |

|

|

December 31,

2020 |

|

|

Summary of Operations |

|

(in thousands, except for percentage

of revenues) |

|

|

Revenues |

|

$ |

26,694 |

|

|

$ |

29,984 |

|

|

Gross Margin |

|

|

9,336 |

|

|

|

10,296 |

|

|

Gross Margin % of revenues |

|

|

35.0 |

% |

|

|

34.3 |

% |

|

Operating Income |

|

|

2,114 |

|

|

|

3,030 |

|

|

Net Income |

|

|

1,582 |

|

|

|

2,310 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial Information |

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

2,635 |

|

|

$ |

2,456 |

|

|

Total Assets |

|

|

20,006 |

|

|

|

17,918 |

|

|

Working Capital |

|

|

9,081 |

|

|

|

8,930 |

|

|

Net Cash Provided by Operating Activities |

|

|

2,960 |

|

|

|

3,906 |

|

|

Capital Expenditures |

|

|

1,099 |

|

|

|

407 |

|

|

Equity |

|

|

16,849 |

|

|

|

14,974 |

|

Risk Factors

You should carefully consider each of the following risks and uncertainties, which we believe are the principal risks that Mtron faces and of which we are currently aware, and all of the other information in this information statement. Some of the risks and uncertainties described below relate to Mtron’s business. Other risks relate principally to the spin-off, the securities markets and the ownership of Mtron Common Stock. If any of the following events actually occur, Mtron’s business, financial condition or results of operations, and the liquidity and trading price of Mtron Common Stock, could be materially adversely affected. Additional risks and uncertainties that we do not presently know about or currently believe are not material may also adversely affect Mtron’s business, financial condition and results of operations.

Risks Relating to Our Business

We are dependent on a single line of business.

We are engaged only in the design, manufacture and marketing of standard and custom-engineered electronic components that are used primarily for the control of frequency and spectrum of signals in electronic circuits. Until we diversify our product offerings, we will remain dependent on our single electronic components line of business.

Given our reliance on this single line of business, any decline in demand for this product line or failure to achieve continued market acceptance of existing and new versions of this product line may harm our business and financial condition. Additionally, unfavorable market conditions affecting this line of business would likely have a disproportionate impact on us in comparison with certain competitors, who have more diversified operations and multiple lines of business. Should this line of business fail to generate sufficient sales to support ongoing operations, there can be no assurance that we will be able to develop or acquire alternate business lines.

Our operating results vary significantly from period to period.

We experience fluctuations in our operating results. Some of the principal factors that contribute to these fluctuations include changes in demand for our products; our effectiveness in managing manufacturing processes, costs and inventory; our effectiveness in engineering and qualifying new product designs with our OEM customers and in managing the risks associated with offering those new products into production; changes in the cost and availability of raw materials, which often occur in the electronics manufacturing industry and which affect our margins and our ability to meet delivery schedules; macroeconomic and served industry conditions; and events that may affect our production capabilities, such as labor conditions and political instability. In addition, due to the prevailing economic climate and competitive differences between the various market segments which we serve, the mix of sales between our communications, networking, aerospace, defense, industrial and instrumentation market segments may affect our operating results from period to period.

Our acquisitions may reduce earnings, require it to obtain additional financing and expose it to additional risks.

Our business strategy includes future acquisitions of operating companies. Some of these acquisitions may be material. While we seek to make acquisitions in companies that provide opportunities for growth, our investments or acquisitions may not prove to be successful or, even if successful, may not initially generate income, or may generate income on an irregular basis or over a long time period. Accordingly, our results of operations may vary significantly on a quarterly basis and from year to year as a result of acquisitions. Acquisitions will also expose us to the risks of the businesses acquired. Acquisitions entail numerous risks, including those involving:

|

|

• |

Difficulties in integrating business operations and assimilating the acquired businesses’ management; |

|

|

• |

Unforeseen expenses or liabilities, which may lead losses; |

|

|

• |

Challenges associated with entering new markets in which we have no or limited prior experience; |

|

|

• |

Delays in achieving anticipated synergies and profitability; |

|

|

• |

The potential loss of key employees of acquired businesses; |

|

|

• |

The incurrence of significant due diligence expenses relating to acquisitions, including with respect to those that are not completed. |

In addition, to the extent that operating businesses are acquired outside the United States or the State of Florida, there will be additional risks related to compliance with foreign regulations and laws including tax laws, labor laws, currency fluctuations and geographic economic conditions.

In addition, there may be significant competition for investments and acquisitions, which could increase the costs associated with the investments or acquisitions. Substantial costs are incurred in connection with the evaluation of potential acquisition and investment opportunities whether or not the acquisitions or investments are ultimately consummated. Further, funding of such investments or acquisitions may require additional debt or equity financing, which will subject us to the risks and uncertainties described in these risk factors with respect to those activities in the immediately following risk factors. If we require additional financing in the future, the financing may not be available when needed or on favorable terms, if at all.

We have a large customer that accounts for a significant portion of our revenues, and the loss of this customer, or decrease in the customer’s demand for our products, could have a material adverse effect on our results of operations.

In 2021, our largest customer, a commercial aerospace and defense company, accounted for $7,838,000, or 29.4%, of our total revenues, compared to $7,802,000, or 26.0%, of the Company’s total revenues in 2020. Our second largest customer in 2021, a defense contractor, accounted for $3,138,000, or 11.8%, of the Company's total revenues, compared to $5,550,000, or 18.5%, of the Company’s total revenues in 2020. The loss of either of these customers, or a decrease in their demand for our products, could have a material adverse effect on our results.

A relatively small number of customers account for a significant portion of our accounts receivable, and the insolvency of any of these customers could have a material adverse impact on our liquidity.

As of December 31, 2021, four of our largest customers accounted for approximately $2,568,000, or 62.3% of accounts receivable. The insolvency of any of these customers could have a material adverse impact on our liquidity.

Our order backlog may not be indicative of future revenues.

Our order backlog is comprised of orders that are subject to specific production release, orders under written contracts, oral and written orders from customers with which we have had long-standing relationships and written purchase orders from sales representatives. Our customers may order products from multiple sources to ensure timely delivery when backlog is particularly long and may cancel or defer orders without significant penalty. They also may cancel orders when business is weak and inventories are excessive. As a result, we cannot provide assurances as to the portion of backlog orders to be filled in a given year, and our order backlog as of any particular date may not be representative of actual revenues for any subsequent period.

Our future rate of growth and profitability are highly dependent on the development and growth of the communications, networking, aerospace, defense, instrumentation and industrial markets, which are cyclical.

In 2021, the majority of our revenues were derived from sales to manufacturers of equipment for the defense, aerospace, instrumentation and industrial markets for frequency and spectrum control devices, including indirect sales through distributors and contract manufacturers. During 2022 and 2023, we expect a significant portion of our revenues to continue to be derived from sales to these manufacturers. Often OEMs and other service providers within these markets have experienced periods of capacity shortage and periods of excess capacity, as well as periods of either high or low demand for their products. In periods of excess capacity or low demand, purchases of capital equipment may be curtailed, including equipment that incorporates our products. A reduction in demand for the manufacture and purchase of equipment for these markets, whether due to cyclical, macroeconomic or other factors, or due to our reduced ability to compete based on cost or technical factors, could substantially reduce our net sales and operating results and adversely affect our financial condition. Moreover, if these markets fail to grow as expected, we may be unable to maintain or grow our revenues. The multiple variables which affect the communications, networking, aerospace, defense, instrumentation and industrial markets for our products, as well as the number of parties involved in the supply chain and manufacturing process, can impact inventory levels and lead to supply chain inefficiencies. As a result of these complexities, we have limited visibility to forecast revenue projections accurately for the near and medium-term timeframes.

The market share of our customers in the communications, networking, aerospace, defense, instrumentation and industrial markets may change over time, reducing the potential value of our relationships with our existing customer base.

We have developed long-term relationships with our existing customers, including pricing contracts, custom designs and approved vendor status. If these customers lose market share to other equipment manufacturers in the communications, networking, aerospace, defense, instrumentation and industrial markets with whom we do not have similar relationships, our ability to maintain revenue, margin or operating performance may be adversely affected.

If we are unable to introduce innovative products, demand for our products may decrease.

Our future operating results are dependent on our ability to develop, introduce and market innovative products continually, to modify existing products, to respond to technological change and to customize some of our products to meet customer requirements. There are numerous risks inherent in this process, including the risks that we will be unable to anticipate the direction of technological change or that it will be unable to develop and market new products and applications in a timely or cost-effective manner to satisfy customer demand.

Our markets are highly competitive, and we may lose business to larger and better-financed competitors.

Our markets are highly competitive worldwide, with low transportation costs and few import barriers. We compete principally on the basis of product quality and reliability, availability, customer service, technological innovation, timely delivery and price. Within the industries in which we compete, competition has become increasingly concentrated and global in recent years.

Many of our major competitors, some of which are larger than us, and potential competitors have substantially greater financial resources and more extensive engineering, manufacturing, marketing and customer support capabilities. If we are unable to successfully compete against current and future competitors, our operating results will be adversely affected.

Our success depends on our ability to retain key management and technical personnel and attracting, retaining, and training new technical personnel.

Our future growth and success will depend in large part upon our ability to recruit highly-skilled technical personnel, including engineers, and to retain our existing management and technical personnel. The labor markets in which we operate are highly competitive and some of our operations are not located in highly populated areas. As a result, we may not be able to recruit and retain key personnel. Our failure to hire, retain or adequately train key personnel could have a negative impact on our performance.

We purchase certain key components and raw materials from single or limited sources and could lose sales if these sources fail to fulfill our needs for any reason, including the inability to obtain these key components or raw materials due to the COVID-19 outbreak.

If single-source components or key raw materials were to become unavailable on satisfactory terms, and we could not obtain comparable replacement components or raw materials from other sources in a timely manner, our business, results of operations and financial condition could be harmed. On occasion, one or more of the components used in our products have become unavailable, resulting in unanticipated redesign and related delays in shipments. The COVID-19 outbreak has caused a global pandemic that has disrupted supply chains and the ability to obtain components and raw materials around the world for all companies, including Mtron. We cannot give assurance that we will be able to obtain the necessary components and raw materials necessary to conduct our business during the COVID-19 pandemic, and we also cannot give assurance that similar delays will not occur in the future. In addition, our suppliers may be impacted by compliance with environmental regulations including RoHS and Waste Electrical and Electronic Equipment (“WEEE”), which could disrupt the supply of components or raw materials or cause additional costs for us to implement new components or raw materials into our manufacturing processes.

As a supplier to U.S. Government defense contractors, we are subject to a number of procurement regulations and other requirements and could be adversely affected by changes in regulations or any negative findings from a U.S. Government audit or investigation.

A number of our customers are U.S. Government contractors. As one of their suppliers, we must comply with significant procurement regulations and other requirements. Under applicable federal regulations for defense contractors, we are required to

comply with the Cybersecurity Maturity Model Certification (“CMMC”) program in the next several years and other similar cybersecurity requirements. We also maintain registration under the International Traffic in Arms Regulations for all of our production facilities. One of those production facilities must comply with additional requirements and regulations for our production processes and for selected personnel in order to maintain the security of classified information. These requirements, although customary within these markets, increase our performance and compliance costs. If any of these various requirements change, our costs of complying with them could increase and reduce our operating margins. To the extent that we are unable to comply with the CMMC or other requirements, our business with the Department of Defense or our prime customers could be at risk.

We operate in a highly regulated environment and are routinely audited and reviewed by the U.S. Government and its agencies such as the Defense Contract Audit Agency and Defense Contract Management Agency. These agencies review our performance under our contracts, our cost structure and our compliance with applicable laws, regulations, and standards, as well as the adequacy of, and our compliance with, our internal control systems and policies. Systems that are subject to review include our purchasing systems, billing systems, property management and control systems, cost estimating systems, compensation systems and management information systems.

Any costs found to be improperly allocated to a specific contract will not be reimbursed or must be refunded if already reimbursed. If an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, which may include termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or prohibition from doing business as a supplier to contractors who sell products and services to the U.S. Government. In addition, our reputation could be adversely affected if allegations of impropriety were made against us.

From time to time, we may also be subject to U.S. Government investigations relating to our or our customers’ operations and products, and we and our customers are expected to perform in compliance with a vast array of federal laws, including the Truth in Negotiations Act, the False Claims Act, the International Traffic in Arms Regulations promulgated under the Arms Export Control Act, and the Foreign Corrupt Practices Act. We or our customers may be subject to reductions of the value of contracts, contract modifications or termination, and the assessment of penalties and fines, which could negatively impact our results of operations and financial condition, or result in a diminution in revenue from our customers, if we or our customers are found to have violated the law or are indicted or convicted for violations of federal laws related to government security regulations, employment practices or protection of the environment, or are found not to have acted responsibly as defined by the law. Such convictions could also result in suspension or debarment from serving as a supplier to government contractors for some period of time. Such convictions or actions could have a material adverse effect on us and our operating results. The costs of cooperating or complying with such audits or investigations may also adversely impact our financial results.

Our products are complex and may contain errors or design flaws, which could be costly to correct.

When we release new products, or new versions of existing products, they may contain undetected or unresolved errors or defects. The vast majority of our products are custom designed for requirements of specific OEM systems. The expected business life of these products ranges from less than one year to more than 10 years depending on the application. Some of the customizations are modest changes to existing product designs while others are major product redesigns or new product platforms.

Despite testing, errors or defects may be found in new products or upgrades after the commencement of commercial shipments. Undetected errors and design flaws have occurred in the past and could occur in the future. These errors could result in delays, loss of market acceptance and sales, diversion of development resources, damage to our reputation, product liability claims and legal action by our customers and third parties, failure to attract new customers and increased service costs.

Communications and network infrastructure equipment manufacturers increasingly rely upon contract manufacturers, thereby diminishing our ability to sell our products directly to those equipment manufacturers.

There is a continuing trend among communications and network infrastructure equipment manufacturers to outsource the manufacturing of their equipment or components. As a result, our ability to persuade these OEMs to utilize our products in customer designs could be reduced and, in the absence of a manufacturer’s specification of our products, the prices that we can charge for them may be subject to greater competition.

Future changes in our environmental liability and compliance obligations may increase costs and decrease profitability.

Our present and past manufacturing operations, products, and/or product packaging are subject to environmental laws and regulations governing air emissions, wastewater discharges, and the handling, disposal and remediation of hazardous substances, wastes and other chemicals. In addition, more stringent environmental regulations may be enacted in the future, and we cannot presently determine the modifications, if any, in our operations that any future regulations might require, or the cost of compliance that would be associated with such regulations.

Environmental laws and regulations may cause us to change our manufacturing processes, redesign some of our products, and change components to eliminate some substances in our products in order to be able to continue to offer them for sale.

We have significant international operations and sales to customers outside of the United States that subject us to certain business, economic and political risks.

We have office and manufacturing space in Noida, India, and a sales office in Hong Kong. Additionally, foreign revenues for 2021 (primarily relating to Malaysia) accounted for 10.3% of our 2021 combined revenues. We anticipate that sales to customers located outside of the United States will continue to be a significant part of our revenues for the foreseeable future. Our international operations and sales to customers outside of the United States subject our operating results and financial condition to certain business, economic, political, health, regulatory and other risks, including but not limited to:

|

|

• |

Political and economic instability in countries in which our products are manufactured and sold; |

|

|

• |

Expropriation or the imposition of government controls; |

|

|

• |

Responsibility to comply with anti-bribery laws such as the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws in other jurisdictions; |

|

|

• |

Sanctions or restrictions on trade imposed by the United States Government; |

|

|

• |

Export license requirements; |

|

|

• |

Currency controls or fluctuations in exchange rates; |

|

|

• |

High levels of inflation or deflation; |

|

|

• |

Difficulty in staffing and managing non-U.S. operations; |

|

|

• |

Greater difficulty in collecting accounts receivable and longer payment cycles; |

|

|

• |

Changes in labor conditions and difficulties in staffing and managing international operations; |

|

|

• |

The impact of the current COVID-19 outbreak; and |

|

|

• |

Limitations on insurance coverage against geopolitical risks, natural disasters and business operations. |

Additionally, to date, very few of our international revenue and cost obligations have been denominated in foreign currencies. As a result, changes in the value of the United States dollar relative to foreign currencies may affect our competitiveness in foreign markets. We do not currently engage in foreign currency hedging activities, but may do so in the future to the extent that we incur a significant amount of foreign-currency denominated assets or liabilities.

We rely on information technology systems to conduct our business, and disruption, failure or security breaches of these systems could adversely affect our business and results of operations.

We rely on information technology (“IT”) systems in order to achieve our business objectives. We also rely upon industry accepted security measures and technology to securely maintain confidential information maintained on our IT systems. However, our portfolio of hardware and software products, solutions and services and our enterprise IT systems may be vulnerable to damage or disruption caused by circumstances beyond our control such as catastrophic events, power outages, natural disasters, computer system or network failures, computer viruses, cyber-attacks or other malicious software programs. The failure or disruption of our IT systems to perform as anticipated for any reason could disrupt our business and result in decreased performance, significant remediation costs,

transaction errors, loss of data, processing inefficiencies, downtime, litigation and the loss of suppliers or customers. A significant disruption or failure could have a material adverse effect on our business operations, financial performance and financial condition.

Cybersecurity risks and cyber incidents may adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information, and/or damage to our business relationships, all of which could negatively impact our financial results.

A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of our information resources. These incidents may be an intentional attack or an unintentional event and could involve gaining unauthorized access to our information systems for purposes of misappropriating assets, stealing confidential information, corrupting data or causing operational disruption. The result of these incidents may include disrupted operations, misstated or unreliable financial data, liability for stolen assets or information, increased cybersecurity protection and insurance costs, litigation and damage to customer relationships. As our reliance on technology increases, so will the risks posed to our information systems, both internal and those we outsource. There is no guarantee that any processes, procedures and internal controls we have implemented or will implement will prevent cyber intrusions, which could have a negative impact on our financial results, operations, business relationships or confidential information.

If we fail to correct any material weakness that our independent registered public accounting firm identifies in our internal control over financial reporting or otherwise fail to maintain effective internal control over financial reporting, we may not be able to report our financial results accurately and timely, in which case our business may be harmed, investors may lose confidence in the accuracy and completeness of our financial reports and the price of our common stock may decline.