UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

For the Fiscal Year Ended December 31, 2020

OR

For the transition period from to Commission File Number: 1-7665

Lydall, Inc.

(Exact name of registrant as specified in its charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||||||||||||||

| , | , | |||||||||||||||||||

| (Address of principal executive offices) | (Zip code) | |||||||||||||||||||

Registrant’s telephone number, including area code: (860 ) 646-1233

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On June 30, 2020, the aggregate market value of the Registrant’s voting stock held by nonaffiliates was $232,958,264 based on the New York Stock Exchange closing price on that date. For purposes of this calculation, the Registrant has assumed that its directors and executive officers are affiliates. On February 12, 2021, there were 17,860,166 shares of Common Stock outstanding, exclusive of treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to the definitive Proxy Statement to be distributed in connection with the Registrant’s

Annual Meeting of Stockholders to be held on April 20, 2021.

LYDALL, INC.

TABLE OF CONTENTS

| Page Number | ||||||||

| PART I | ||||||||

| PART II | ||||||||

| PART III | ||||||||

| PART IV | ||||||||

Financial Statement Schedules, Exhibits | ||||||||

The information called for by Part III, to the extent not included in this document, is incorporated herein by reference to such information included in the Company’s definitive Proxy Statement to be filed with the Securities and Exchange Commission and distributed in connection with Lydall, Inc.’s 2021 Annual Meeting of Stockholders to be held on April 20, 2021.

i

PART I

| ITEM 1. | BUSINESS | ||||

GENERAL

Lydall, Inc. and its subsidiaries (collectively, “Lydall”, "the Company”, “we”, and “our”) design, manufacture, and market specialty filtration and advanced materials solutions that contribute to a cleaner, quieter and safer world. The Company operates in a variety of attractive end markets supported by global megatrends such as the demand for indoor air quality and lower emissions, near sourcing of supply chains, and vehicle electrification redefining safety and sound. Lydall solves our customers' problems culminating in demanding applications, including: high performance air and liquid specialty filtration, molecular filtration, engineered fiber based materials and sealing solutions, specialty insulation including high temperature and ultra-low temperature (cryogenic) insulation, needle punch nonwoven materials for industrial, geosynthetic, medical and other specialty applications; and thermal management and acoustical products and solutions to assist in the reduction of noise, vibration, and harshness.

The Company is organized into three reportable segments: Performance Materials, Technical Nonwovens, and Thermal Acoustical Solutions. The Performance Materials and Technical Nonwovens segments' products are generally sold to original equipment manufacturers ("OEM"), Tier 1, Tier 2, and Tier 3 industrial customers while the Thermal Acoustical Solutions segment's products are sold to OEMs and Tier 1 suppliers in the automotive industry. The Company differentiates itself through its superior quality, consistency, and organizational agility, as well as, its market leading materials science expertise, superior applications engineering and exceptional customer service. The Company has several domestic and foreign competitors for its products, most of whom are either privately owned or divisions of larger public companies.

AVAILABLE INFORMATION

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements are made available free of charge through the Investor Relations Section of the Company’s website at www.lydall.com after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “Commission”) and are also available on the Commission’s website at www.sec.gov. Information found on websites mentioned in this report are not part of this Annual Report on Form 10-K.

RECENT EVENTS

Coronavirus Pandemic (“COVID-19”)

In early 2020, the World Health Organization (“WHO”) characterized COVID-19 as a pandemic. In an effort to contain COVID-19 and slow its spread, governments throughout the world, including global and regional markets served by the Company, enacted various measures, including orders to close "non-essential" businesses, isolate residents in their place of residence, and practice social distancing. These actions and the global health crisis caused by COVID-19 continue to adversely impact global business activity, which could continue to have a material negative impact on our financial performance. Each region where the Company conducts business, including North America, Europe and Asia, has been impacted by the pandemic. The timing and extent of the impact related to COVID-19 varies by country and region.

In addition to impacting the Company's financial performance during 2020, the Company experienced labor shortages and operational inefficiencies, directly related to COVID-19, as customer demand increased, primarily in the Company's Hamptonville, North Carolina operations of the Thermal Acoustical Solutions segment. As a result, the Company was unable to manufacture parts timely, leading to customer production line stoppages in some instances. Early in the fourth quarter 2020, the Company invoked force majeure, or commercial impracticability, to certain customers as the basis for delayed performance of contracts and as a legal defense to any claim that may be asserted by these customers due to the unforeseen and unforeseeable nature of the COVID-19 pandemic, which is not in the Company’s control. The resurgence of cases in that same facility during the fourth quarter of 2020 caused the Company to expand its declaration of force majeure, or commercial impracticability, to other impacted customers.

1

As of the date of this report, all of our manufacturing facilities around the world are open. The Company has taken steps, at all locations, to mitigate the potential risks to employees and the Company posed by the spread, related circumstances, and economic impacts of COVID-19. As employees returned to work at various times during 2020, the Company implemented changes to help ensure the safety and health of all its employees and continues to assess and update its business continuity plans in the context of this pandemic. The Company established the Lydall Emergency Preparedness Team, which implemented strict travel restrictions, enforced rigorous hygiene protocols, increased sanitization efforts at all facilities, and implemented remote working arrangements for the majority of employees who work outside of our facilities. The Company will continue its efforts to maintain a safe and healthy work environment and continue to allow remote working arrangements, where appropriate, as long as necessary.

The COVID-19 pandemic has significantly increased worldwide and regional economic uncertainty and impacted demand for some of the Company's products in many of the markets we serve, which could continue for an unknown period-of-time. In these circumstances, there may be developments outside of our control, including the length and extent of the COVID-19 pandemic, government-imposed measures, and disruptions to the Company's supply chain, inhibiting the Company's ability to ship products and requiring it to adjust operating plans. As such, given the dynamic nature of this situation, we cannot estimate with certainty the future impacts of COVID-19 on our financial condition, results of operations or cash flows.

See Part I, Item 1A, "Risk Factors", and Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations", for further discussion regarding the impact of COVID-19 on our business financial condition and results of operations.

Goodwill and Other Long-Lived Assets Impairment Charges

During the three-month period ended March 31, 2020, the Company began to experience disruptions in some operations from lower customer demand directly attributable to the COVID-19 pandemic. Lower expected demand in automotive and other end markets due to the COVID-19 pandemic during that period resulted in a reduction in sales and cash generation projections as compared to prior projections for the Company's reporting units and a significant decrease in the Company's share price and market capitalization. As a result, the Company performed an interim quantitative impairment assessment of goodwill held at its Performance Materials and Technical Nonwovens reporting units. In addition, the Company performed an impairment assessment of a long-lived asset group of an underperforming European facility within the Performance Materials segment. As a result, the Company recorded non-cash goodwill and long-lived asset impairment charges of $48.7 million and $12.4 million, respectively, for its Performance Materials segment during the three-month period ended March 31, 2020. See "Management's Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates" in Part II, Item 7 and Note 6, "Goodwill and Other Intangible Assets", in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

Restructuring

In the third quarter of 2020, the Company’s Performance Materials segment undertook actions to discontinue production of a lower efficiency air filtration media product and, in turn, fully depreciated the supporting machinery and equipment in North America, consolidated certain product lines, and began exiting underperforming facilities in Europe. These restructuring activities, which are projected to conclude in 2021, are expected to reduce operating costs, increase production efficiency, and enhance the Company’s flexibility by better aligning its manufacturing operations with the segment's customer base. As a result, the Company expects to record total pre-tax expenses of approximately $19.0 million to $21.0 million, primarily related to severance and employee retention expenses, in connection with these restructuring activities, of which approximately $13.2 million to $15.2 million are expected to result in cash expenditures. The Company incurred a total of $15.9 million as of December 31, 2020, of which $5.8 million were non-cash expenditures, which consisted of fully depreciating and/or amortizing long-lived assets and, to a lesser extent, writing-off inventory.

See Note 14, “Restructuring”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

2

STRATEGY

The Company’s strategy is focused on reshaping the portfolio by successfully deploying capital in the highest returning opportunities, driving improvements across the organization in areas within our control, and partnering with our customers by bringing the Company's decades of materials science and applications engineering expertise to solve unique problems with a particular focus on specialty filtration and advanced materials solutions. This will be accomplished by:

•Fixing the core businesses and optimizing the product portfolio to improve margins and cash generation,

•Focusing the resources of the Company's optimized portfolio to further expand into attractive markets where the Company is well positioned to be highly competitive; and

•Accelerating value creation by continuing to reshape the Company's product portfolio and driving new product innovation in higher margin Specialty Filtration and Advanced Materials Solutions to deliver enhanced shareholder returns over the long term.

The strategy is focused on three pillars:

| Fix and Focus | •Disciplined capital deployment to drive improved operating margins and cash flow •Energizing our culture under “One Lydall” to apply best practices and standardization to drive efficiencies throughout the organization •Decisively address under-performing assets | ||||

| Grow and Differentiate | •Continue investing in Lydall’s technological leadership •Extract full value from recent investments in specialty filtration •Extend our product portfolio into market adjacencies •Grow in attractive advanced material solutions end markets through commercialization of innovative products | ||||

| Accelerate Value Creation | •Continuing to optimize the portfolio, when appropriate •Leveraging best in class operational processes and a strong, unified culture to drive cash flow generation and enhance profitability •Delivering long-term, attractive returns to shareholders | ||||

The Company's strong brands, market position, agility, global footprint and industry recognized materials science and applications engineering expertise all help enable us to further capture and execute on growth opportunities and allow the Company to continue to strengthen its position as a market leader.

DESCRIPTION OF SEGMENTS

The Company’s reportable segments are Performance Materials, Technical Nonwovens and Thermal Acoustical Solutions. The Performance Materials segment includes filtration and sealing and advanced solutions products. The Technical Nonwovens segment includes industrial filtration and advanced materials products. The Thermal Acoustical Solutions segment includes parts and tooling. For additional information regarding the Company’s reportable segments, see Note 15, “Segment Information”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

3

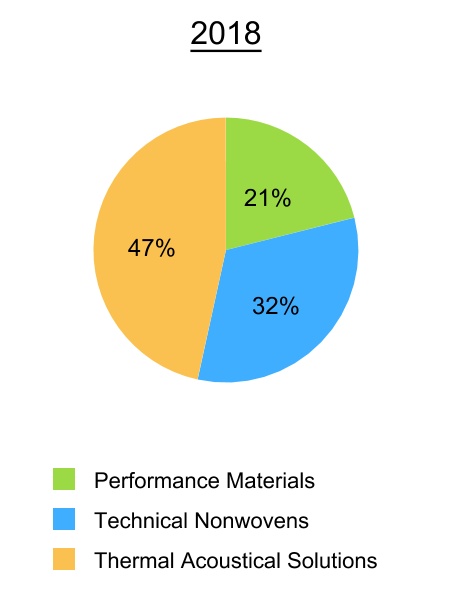

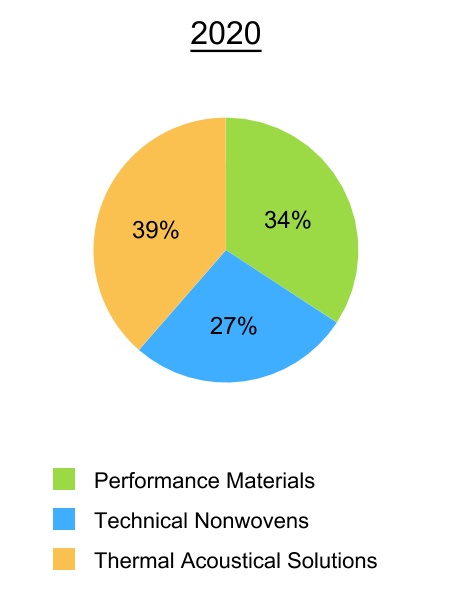

Segment Sales (as a percentage of Consolidated Sales)(1)

(1) Segment sales as a percentage of consolidated net sales excludes intercompany sales between segments.

Performance Materials Segment

The Performance Materials segment is a worldwide leader in delivering innovative specialty filtration, sealing and advanced materials solutions for demanding applications. Specifically, the segment’s offerings include: (1) specialty filtration media solutions for a variety of applications in the global air and liquid filtration market such as personal protective equipment (“PPE”), indoor air quality, life sciences, transportation, and industrial applications; (2) gasket materials and parts for a broad range of applications in the global sealing market for parts in large/heavy duty equipment for commercial, industrial, agriculture and construction end markets; and, (3) advanced materials that include highly engineered insulation solutions for cryogenic storage of liquid hydrogen/nitrogen, energy storage, and advanced composite materials for aerospace and defense applications

Filtration Products. The filtration portfolio is comprised of well-known brands such as: LydAir® MG Air Filtration Media (Micro-Glass) used for a variety of air filters including specialty HEPA/ULPA filtration; LydAir® MB Air Filtration Media (fine fiber meltblown) used for high performance air filtration including N95 respirator masks, surgical facemasks, and MERV 8 to MERV 14 filters in commercial, industrial and residential indoor air quality applications; and LydAir® SC (Synthetic Composite) air filtration media for a variety of specialty indoor air quality filters. These media are the critical filtration component of clean-air filter systems for clean-space, commercial, industrial and residential HVAC, power generation, respiratory protection, and industrial processes. In addition, the Company has leveraged its decades of technical expertise and applications knowledge into a suite of media products covering the vast liquid filtration landscape across the transportation and industrial fields. The LyPore® liquid filtration media series enable filtration performance in a variety of fluid power hydraulic filters, air-water and air-oil coalescing, industrial fluid processes and diesel fuel filtration. Finally, LyPore® media and Solupor® UHMWPE membranes serve critical liquid filtration/separation applications in the biopharmaceutical diagnostic and analytical testing, potable water filtration and high purity process filtration in food, beverage and medical applications.

Sealing and Advanced Solutions Products. Sealing products include fiber-reinforced gasket materials and parts for heavy-duty vehicles in agricultural, construction and industrial, automotive, small engine, transmission, specialty vehicle and compressor markets sold directly to OEMs and aftermarket. These products handle high pressure and high temperature challenges of sealing engines, transmissions, and drive systems. Select-a-Seal® is an example of rubber-edged composite (REC) technology that provides robust sealing, compression, adhesion, and shear strength for driveline applications. Advanced solutions products include highly engineered materials for extreme applications in cryogenic storage/transportation of liquid hydrogen/nitrogen and light weight advanced composite materials for aerospace and defense applications. Advanced solutions’ nonwoven veils, papers, and advanced composite solutions include Manniglas® Thermal Insulation Papers, and Lytherm® Insulation Media for high temperature

4

technology applications. The Company's Cryotherm® Super-Insulating Media, CRS-Wrap® Super-Insulating Media and Cryo-Lite® Cryogenic Insulation products are industry standards for state-of-the-art cryogenic insulation designs used by manufacturers of cryogenic equipment for liquid hydrogen/nitrogen storage, piping, and transportation.

Technical Nonwovens Segment

The Technical Nonwovens segment is a global leader in engineered nonwoven materials for industrial filtration applications and advanced materials products. The primary industrial filtration markets include air pollution and emissions control, power generation, and liquid filtration solutions. Advanced materials products include geotextile felts for separation, reinforcement, filtration, drainage, and protection; thermal and acoustic insulation for transportation and automotive applications, and highly customized and technical solutions for acoustic media, medical, building & construction, and safety apparel. Specifically, the segment’s offerings include needle punched nonwoven and highly engineered felts made from a variety of synthetic fibers.

Industrial Filtration Products. Industrial filtration products include nonwoven rolled-good felt media and filter bags used primarily in industrial air and liquid filtration applications. Nonwoven filter media is an effective solution to satisfy increasing emissions control regulations in a wide range of industries, including power, cement, steel, asphalt, incineration, mining, food, and pharmaceutical. Industrial filtration products are manufactured and sold globally under the Company’s brands including: Southern Felt, Gutsche, Texel and Lydall Industrial Filtration. The air and liquid filtration media are sold under the brand names Fiberlox® high performance filtration felts, Checkstatic™ conductive filtration felts, Microfelt® high efficiency filtration felts, Pleatlox® pleatable filtration felts, Ultratech™ PTFE filtration felts, Powertech® and Powerlox® power generation filtration felts, Microcap® high efficiency liquid filtration felts, Duotech membrane composite filtration felts, along with our Porotex® family of high temperature filtration felts including Microvel® and Optivel® products.

Advanced Materials Products. Advanced materials products include nonwoven rolled-good media used in commercial applications and predominantly serves the geosynthetics, automotive, industrial, medical, and safety apparel markets. Automotive media is provided to Tier 1 and Tier 2 suppliers as well as the Company's Thermal Acoustical Solutions segment. Technical Nonwovens advanced materials products are sold under the brand names Thermofit® thermo-formable products, Ecoduo® recycled content materials, Duotex® floor protection products, and Versaflex® composite molding materials. Technical Nonwovens also offers extensive finishing and coating capabilities which provide custom engineered properties tailored to meet the most demanding applications. The business leverages a wide range of fiber types and extensive technical capabilities to provide products that meet our customers’ needs across a variety of applications providing both high performance and durability.

Thermal Acoustical Solutions Segment

The Thermal Acoustical Solutions segment designs, manufactures and distributes a full range of innovative engineered products tailored for the transportation and industrial sectors. These products shield sensitive components from high temperature environments, assist in the reduction of harmful emissions and reduce noise and vibration. Within the transportation sector, the Company's products are found in the interior, underbody, and underhood of cars, trucks, SUVs, heavy duty trucks and recreational vehicles.

The Thermal Acoustical Solutions segment’s product portfolio is balanced across the traditional transportation sector and play a critical role by treating thermal and acoustical problems at their source. Engineered thermal solutions such as ZeroClearance® and the flux® product family provide lightweight, efficient and highly effective thermal shielding in the most aggressive thermal environments. The engineered acoustical product portfolio is comprised of lightweight fiber composites that leverage absorbing properties to reduce noise in the passenger compartment as well as drive-by noise. dBCore® and dBLyte® are two product platforms that can be tailored to specific customer requirements and achieve the desired in-vehicle sound.

The product portfolio is also in-step with the trend towards hybrid and electric vehicles. The metal and fiber components of high temperature heat shielding are readily adapted through proper engineering to xEV batteries and electrical systems for thermal and electromagnetic insulation. The requirements of core acoustical products are increasing in parallel as less traditional noise paths become more problematic with electric battery and drivetrains.

5

INTELLECTUAL PROPERTY

The Company holds a number of patents, trademarks and licenses. While no single patent, trademark, or license is critical to the Company's success, together these intangible assets are of considerable value to the Company.

SEASONALITY

Typically, the Company’s business can be slightly stronger in the first half of the calendar year given the timing of customer order patterns and planned customer shutdowns in North America and Europe that typically occur in the third and fourth quarters of each year.

BACKLOG

The majority of the Company’s unfulfilled performance obligations, or backlog, are generally expected to be satisfied within twelve months.

Backlog at December 31, 2020, 2019, and 2018 was $157.7 million, $119.1 million, and $114.4 million, respectively. The performance obligations may be impacted by various assumptions, including future automotive production volume estimates, changes in customer program launch timing, and changes in customer development plans.

No significant portion of the Company’s business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of any governmental body.

GOVERNMENT REGULATION

The Company is required to comply, and it is our policy to comply, with numerous regulations that are normal and customary to businesses in the regions, industries, and markets in which the Company operates. These regulations include, but are not limited to, tax, employment, privacy, governmental contracts and defense, imports/exports, healthcare, environmental protection, antitrust, anti-corruption, marketing, fraud and abuse, product safety and efficacy, and other areas.

Environmental Regulation

The Company’s operations are subject to various federal, state, local, and foreign environmental regulations relating to the use, storage, handling and disposal of regulated materials, chemicals, and certain waste products. In the United States, the Company is subject to the federal regulation and control of the Environmental Protection Agency and similar agencies in various states in which we operate. In the foreign locations in which the Company operates, we are subject to similar or comparable authorities. The Company’s policy is that all operations shall, at a minimum, meet all applicable legal and regulatory environmental requirements. The Company believes that compliance with those regulations will not have a material adverse effect on our results of operations, operating cash flows, capital expenditures and financial position; or our ability to compete in the industries in which the Company operates.

Although the Company believes our safety procedures for using, handling, storing, and disposing of such regulated materials, chemicals, and certain waste products comply with the standards required by federal and state laws and regulations, we cannot completely eliminate the risk of contamination or injury from these regulated materials. In the event of contamination involving such regulated materials, the Company could be liable for damages and such liability could exceed the amount of our liability insurance coverage and the resources of our business.

Regulatory Compliance

The Company has certain contracts with U.S. government agencies and entities or with entities whose projects are funded by or products sold to these agencies. At times, the Company contracts with similar government authorities outside of the U.S. and is subject, in all cases, to the applicable law. Consequently, the Company must comply with and is affected by regulations relating to the formation, administration, and performance of such U.S. government and other contracts governing such matters.

The Company is subject to laws concerning our business operations and marketing activities in foreign countries where we conduct business. For example, the Company is subject to the U.S. Foreign Corrupt Practices Act (the

6

"FCPA"), U.S. export control and trade sanction laws, and similar anti-corruption and international trade laws in certain foreign countries, such as the U.K. Bribery Act.

Aspects of the Company’s operations and businesses are subject to privacy, data security, and data protection regulations, which impact the way we use and handle data and operate our products and services.

See Note 17, "Commitments and Contingencies", in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

The Company is not aware of any regulatory compliance matters that are expected to have a material adverse effect on the Company’s business, competitive position, financial position, results of operations, capital expenditures or cash flows.

COMPETITION

Competitors include public and private companies, some of which are much larger than the Company. The Company expects the markets for our products to remain competitive. The Company believes our competitive differentiators for our products and the markets we serve include our deep materials science and applications engineering expertise; flexible, customized production assets with precision quality; and our global footprint, which is optimized to meet near sourced requirements.

The Company's businesses generally require specialized technical expertise and proprietary manufacturing know-how. In addition, the Company has long-standing and deeply embedded customer relationships and it is important to our customers that we have a global manufacturing footprint. Each of these factors contribute to a barrier to entry for prospective new competitors.

AVAILABILITY OF RAW MATERIALS

While the Company believes it has sufficient sources for the materials, components, services, and supplies used in its manufacturing activities, the Company is highly dependent on the availability of essential materials, parts, and tooling from its suppliers and subcontractors. The Thermal Acoustical Solutions, Technical Nonwovens and Performance Materials segments use various petroleum-derivative fibers in manufacturing products and the Performance Materials segment uses various glass-derivative fibers in manufacturing products. The Thermal Acoustical Solutions segment also uses a wide range of raw material metal alloys in the manufacturing of its products, including aluminum, aluminized steel, and stainless steel to manufacture most of its products.

Many major parts and tooling items are procured from or subcontracted on a sole-source basis with a number of domestic and non-U.S. companies. Although alternative sources generally exist for these raw materials, qualification of the sources could take a year or more.

The Company is dependent upon the ability of a large number of suppliers and subcontractors to meet performance specifications, quality standards and delivery schedules at anticipated costs. While the Company maintains an extensive qualification system to control risk associated with such reliance on third parties, failure of suppliers or subcontractors to meet commitments could adversely affect production schedules and contract profitability, while jeopardizing the Company's ability to fulfill commitments to its customers. From time to time, the Company has experienced shortages in supplied materials which has impacted its near term results; however, the Company does not foresee any near term unavailability of materials, components or supplies that would have a material adverse effect on its business. For further discussion on the possible effects of changes in the cost or availability of raw materials on the Company's business, see Part I, Item 1A, "Risk Factors" of this Annual Report on Form 10-K.

HUMAN CAPITAL

Our employees are the foundation of the Company's business success and are the creative, strategic, and operational engine of the Company. The Company seeks to support and maintain a culture of inclusion and innovation, creativity and collaboration, and superior service to all customers, recognizing that the Company succeeds when our customers succeed. We are proud to invest in our people through competitive pay and benefits, flexibility and support in order to balance work and personal demands, and professional and personal learning and development programs. The Company's human capital is governed by various federal, state, and local regulations.

7

The Company monitors key employment activities, such as hiring, termination and pay practices to help ensure compliance with established regulations across the world.

As of December 31, 2020, the Company employed approximately 3,500 people globally, composed of roughly 825 Performance Materials employees, 940 Technical Nonwovens employees, 1,680 Thermal Acoustical Solutions employees, and 55 corporate employees. The Company’s headcount was primarily composed of manufacturing employees, including direct and indirect labor and contract employees, which accounted for approximately 85% of the global workforce as of December 31, 2020. The remaining 15% included Selling, Product Development, and Administration employees. During the year, as customer demand increased, the Company experienced a growing number of COVID-19 cases in its workforce commensurate with the increase in the communities where we operate, primarily in its Thermal Acoustical Solutions segment, causing higher overtime costs and the need for higher levels of temporary labor.

The Company has approximately 225 employees in the United States under union contracts expiring between May 2021 through September 2022. All employees at facilities in France are covered under a National Collective Bargaining Agreement. Additionally, certain salaried and all hourly employees in Germany, the United Kingdom, China, and Canada are also covered under a form of a National Collective Bargaining Agreement.

Diversity

We value employee diversity from gender and race to interests, languages, and beliefs and the Company encourages employees to leverage their varied life experiences to contribute to our strong organization.

Training and Professional Development

Training is an integral part of developing and retaining our employees and creating a culture of leadership within the Company. As part of our standard onboarding program, employees complete training courses covering our commitment to leadership, diversity, ethics, Company policies, safety, preventing unconscious biases and Company values. The Company also trains employees on important environmental health and safety topics to help ensure our people, and the environment in which the Company operates, are protected. The Company further encourages employees to obtain additional training and formal education, which will assist them in their current positions and prepare them for advancement opportunities. In order to support such endeavors, the Company offers an Educational Assistance Program in which eligible employees are reimbursed for tuition and related costs.

Compensation and Benefits

The Company's commitment to employees starts with benefit and compensation programs that value the contributions made by employees and offers physical, financial, and personal health programs to employees and their families. The Company recognizes financial stability is a critical component to an employee's well-being. In addition to competitive pay, the Company's benefit plan in the U.S. offers a 401(k) match and performance-based financial programs. Additionally, physical health programs and medical and dental coverage, help employees to feel their best on the job and at home. Full-time and part-time employees in the U.S. working 20+ hours per week are eligible for various insurance benefits, including, but not limited to, medical, dental, vision, and disability, in addition to wellness plans such as a fitness reimbursement program and a matching donation program.

Workplace Safety

The health and safety of our employees is a top priority for the Company. We offer an Environmental, Health and Safety program that focuses on implementing related policies and training programs, and the Company monitors workplace safety regularly. During 2020, in response to the COVID-19 pandemic and in an effort to safeguard our employees from exposure, the Company implemented measures based on guidelines established by the Centers for Disease Control, the World Health Organization, and our own safety standards. These measures consist of policies, procedures, protocols, and guidance related to, among other things, COVID-19 symptom awareness, effective hygiene practices, travel restrictions, social distancing, face covering requirements, temperature and health screening, work-from-home requirements, contact tracing, and enhanced workplace cleaning.

8

INFORMATION ABOUT THE COMPANY'S EXECUTIVE OFFICERS

The Company's executive officers and segment presidents as of the date of this report, their business experience since January 1, 2016, and their age as of February 23, 2021, the record date of the Company’s 2021 Annual Meeting, are as follows:

| Name | Age | Current Position | Experience Since 2016 | |||||||||||||||||

| Sara A. Greenstein | 46 | President and Chief Executive Officer | Ms. Greenstein was appointed President and Chief Executive Officer effective November 18, 2019. Prior to joining the Company, Ms. Greenstein was Senior Vice President of Consumer Solutions of United States Steel Corporation, an integrated steel producer, since 2014. Ms. Greenstein also served as a Director of Briggs & Stratton Corporation, a leading manufacturer of power generation products, from August 2018 through December 2020. | |||||||||||||||||

| Randall B. Gonzales | 49 | Executive Vice President and Chief Financial Officer and Treasurer | Mr. Gonzales was appointed Chief Financial Officer effective March 12, 2018 and appointed Chief Financial Officer and Treasurer effective February 14, 2020. Prior to joining the Company, Mr. Gonzales was Senior Vice President, Chief Financial Officer and Treasurer of Progress Rail Services Corporation, a wholly-owned subsidiary of Caterpillar Inc. and a diversified global supplier of railroad and transit system products and services, since 2014. | |||||||||||||||||

| Chad A. McDaniel | 47 | Executive Vice President, General Counsel and Chief Administrative Officer | Mr. McDaniel was appointed Senior Vice President, General Counsel and Chief Administrative Officer effective May 13, 2015. Effective October 15, 2019, Mr. McDaniel was appointed executive Vice President, General Counsel and Chief Administrative Officer. Mr. McDaniel serves as a Director of Chase Corporation, a manufacturer of protective materials for high reliability applications since 2016. | |||||||||||||||||

| Dr. Ashish Diwanji | 57 | President, Lydall Performance Materials | Dr. Diwanji was appointed President of the Company's Performance Materials segment effective May 26, 2020. Previously, Dr. Diwanji was the Company's Senior Vice President, Innovation and Chief Technology Officer upon joining the Company on April 20, 2020. Previously, Dr. Diwanji was the Chief Technology Officer for Consumer Solutions and General Manager of Strategic Investments of United States Steel Corporation since January 2016. | |||||||||||||||||

| David D. Glenn | 41 | President, Lydall Thermal Acoustical Solutions | Mr. Glenn was appointed President of the Company's Thermal Acoustical Solutions segment effective December 10, 2020. Mr. Glenn served as Vice President, Finance and Strategic Planning for the Company's Thermal Acoustical Solutions since September 2017. Prior to this, Mr. Glenn held the role of the Vice President, Corporate Development and Investor Relations of Lydall, Inc. since 2010. | |||||||||||||||||

| Robert B. Junker | 52 | President, Lydall Technical Nonwovens | Mr. Junker was appointed President of the Company's Technical Nonwovens segment effective October 14, 2019. Prior to joining the Company, Mr. Junker was Vice President Process Filtration Operations of Parker Hannifin, a global leader in motion and control technologies, since March 2017, and President, Purolator Advanced Filtration Group, Clarcor, a manufacturer of Aerospace and Industrial filtration systems, from January 2016 through February 2017. | |||||||||||||||||

| Anthony N. Justice | 59 | Vice President & Chief Human Resources Officer | Mr. Justice was appointed Vice President and Chief Human Resources Officer effective January 11, 2021. Prior to joining the Company, Mr. Justice was General Manager, Human Resources of United States Steel Corporation since March 2020, and Human Resources Director from September 2017 to March 2020. Prior to that, he was Assistant Vice President, Human Resources of Ascena Retail Group, Inc., a retail company, from January 2014 to October 2016. | |||||||||||||||||

| John J. Tedone | 56 | Vice President, Finance and Chief Accounting Officer | Mr. Tedone was appointed Vice President, Finance and Chief Accounting Officer effective May 4, 2020. Prior to joining the Company, Mr. Tedone served as Vice President, Finance and Chief Accounting Officer of Kaman Corporation, a producer of components servicing the aerospace and defense, industrial and medical markets, from April 2007 through April 2020. | |||||||||||||||||

There is no family relationship among any of the Company’s directors or executive officers.

9

| ITEM 1A. | RISK FACTORS | ||||

The reader should carefully review and consider the risk factors discussed below. Any and all of these risk factors could materially affect the Company’s business, financial condition, future results of operations or cash flows and possibly lead to a decline in the Company’s stock price. The risks, uncertainties and other factors described below constitute all material risk factors known to management as of the date of this report. These risks factors are not necessarily in the order of importance or probability of occurrence. Additional risks and uncertainties that are not currently known to the Company or that are not currently believed by the Company to be material may also harm the Company’s business, financial condition and results of operations.

CORONAVIRUS (“COVID-19”) PANDEMIC RISKS

The Company’s financial condition and results of operations have been, and are expected to continue to be, adversely affected by the COVID-19 pandemic.

The global outbreak of COVID-19 has caused a material adverse effect on the level of economic activity around the world, including in all markets served by the Company. In response to this outbreak, the governments of many countries, states, cities, and other geographic regions have taken preventative or protective actions, such as imposing restrictions on travel and business operations. The Company has implemented numerous measures attempting to manage and mitigate the effects of the virus. While the Company has implemented programs to mitigate the impact of these measures on its results of operations, there can be no assurance that these programs will be successful. The Company cannot predict the degree to, or the time period over which, its sales and operations will be affected by the COVID-19 pandemic and governmental preventative measures, and the effects could be material. During 2020, the Company's sales declined 8.8% compared to 2019 due in large part to impacts of the COVID-19 pandemic.

The COVID-19 pandemic poses the risk that we or the Company’s affiliates, employees, suppliers, customers and others may be restricted or prevented from conducting business activities for indefinite or intermittent periods of time, including as a result of employee health and safety concerns, social distancing protocols, temporary shutdowns, shelter in place orders, travel restrictions and other actions and restrictions that may be requested or mandated by governmental authorities. For example, in early 2020 the Company experienced a temporary reduction of its manufacturing and operating capacity in China as a result of government-mandated actions to control the spread of COVID-19. Additionally, in the first half of 2020, the Company experienced the ramp-down of its automotive manufacturing facilities in the Americas and European regions coinciding with the temporary shutdown of its major automotive customer facilities in these regions. While many of the Company’s other facilities have been designated as essential businesses in jurisdictions in which facility closures have otherwise been mandated, the Company can give no assurance that this will not change in the future or that its businesses will continue to be classified as essential in each of the jurisdictions in which it operates.

In addition, restrictions on the Company’s access to its manufacturing facilities, support operations and workforce, or similar limitations for its distributors and suppliers, could continue to limit customer demand and/or the Company’s capacity to meet customer demand and have a material adverse effect on its business, financial condition and results of operations. The Company has modified its business practices (including employee travel, employee work locations, limited/restricted third-party access to the Company's facilities, and cancellation of physical participation in meetings, events and conferences), and may take further actions as may be required by government authorities, for the continued health and safety of its employees, or that the Company otherwise determines are in the best interests of its employees, customers, partners, and suppliers. Furthermore, the Company has experienced disruptions and operational inefficiencies from COVID-19 related illnesses and workforce shortages, causing higher production and logistic costs, and may continue to experience such disruptions and operational inefficiencies in the future. The Company may experience delays in its supply chain, which is likely to result in higher supply chain costs to the Company in order to maintain the supply of materials and components for its products.

Managing the impact of COVID-19 on the Company has and will continue to require significant investment of time from management and employees, as well as resources across the Company's global enterprise. The focus on managing and mitigating the impacts of COVID-19 on the Company’s business may cause it to divert or delay the application of its resources toward other or new initiatives or investments, which may cause a material adverse impact on its results of operations.

10

The Company has and may also continue to experience impacts from market downturns and changes in consumer behavior related to pandemic fears and impacts on its workforce as a result of COVID-19. The Company has experienced a significant decline in demand from certain customers as a result of COVID-19. In addition, the Company’s customers may choose to delay or abandon projects for which the Company provides products and/or services in response to the adverse impact of COVID-19 and the measures to contain its spread have had on the global economy.

If the COVID-19 pandemic becomes more pronounced in the markets in which the Company or its automotive industry customers operate, or there is a resurgence in the virus in markets currently recovering from the spread of COVID-19, then its operations in areas impacted by such events could experience further materially adverse financial impacts due to market changes and other resulting events and circumstances.

The extent to which the COVID-19 pandemic will continue to impact the Company’s financial condition depends on future developments that are highly uncertain and are difficult to predict, including new government actions or restrictions, new information that may emerge concerning the severity, the longevity and the impact of COVID-19 on economic activity. To the extent the COVID-19 pandemic materially adversely affects the Company’s business and financial results, it may also have the effect of significantly heightening many of the other risks associated with the Company's business and indebtedness. See "Management's Discussion and Analysis of Financial Condition and Results of Operations - Overview of Business" in Part II, Item 7 of this Annual Report on Form 10-K.

Our invocation due to the COVID-19 pandemic of the force majeure provisions contained in certain contracts may expose us to claims from customers and lead to reputational damage.

In the three-month period ended September 30, 2020, labor shortages and operational inefficiencies directly related to COVID-19 affecting the Thermal Acoustical Solutions segment caused the Company to invoke force majeure (or excusable delay) with its customers. The events leading up to the invocation of force majeure caused interruption of a customer’s production line. A resurgence of cases in late 2020 at that same facility caused the Company to expand its declaration of force majeure (or excusable delay) to cover most of its automotive customers. Although the Company believes it has a strong legal basis for asserting force majeure or commercial impracticability as a result of COVID-19, it is reasonably possible customers may assert claims against the Company, and the Company could be subject to financial damages to customers, which could have a material effect on the Company’s consolidated results of operations and cash flows or its reputation.

The COVID-19 pandemic presents significant challenges to the Company’s liquidity and ability to comply with its financial covenants.

The Company’s continued access to affordable sources of liquidity and its ability to comply with its financial covenants set forth in the 2018 Amended and Restated Credit Agreement, as amended (“Amended Credit Agreement”), depends on multiple factors, including global economic conditions, the COVID-19 pandemic’s effects on its customers and their production rates, the condition of global financial markets, the availability of sufficient amounts of financing, its operating performance, and its credit worthiness. The Company relies on the credit markets to provide it with liquidity to operate and grow its businesses beyond the liquidity that operating cash flows provide. In March 2020, the Company drew down an incremental $20.0 million under its Amended Credit Agreement to provide liquidity as it addressed critical issues related to the COVID-19 pandemic. In addition, on May 11, 2020, the Company amended its Amended Credit Agreement, which, among other changes, decreased available borrowings from $450.0 million to $314.0 million and modified certain financial covenants, at least one of which the Company expected to fail under the Amended Credit Agreement during the second quarter of 2020. On October 14, 2020, the Company further amended its Amended Credit Agreement to allow certain restructuring and other charges, as defined by the agreement, to be excluded from EBITDA in the calculation of the Company’s financial covenants. As a result of the impacts of the COVID-19 pandemic, the Company's access to and cost of financing will depend on, among other things, global economic conditions, conditions in the global financing markets, the availability of sufficient amounts of financing, its prospects and its credit ratings. The Company believes that its liquidity resources, including available funds under the Amended Credit Agreement, are sufficient to meet its working capital needs and other cash requirements. The Company was in compliance with its financial covenants as of December 31, 2020, and management does not anticipate noncompliance in the foreseeable future. See Note 7, “Long-Term Debt and Financing Arrangements”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

11

The Company may not be able to collect amounts owed to it or sell its inventory due to customers becoming significantly impacted by the COVID-19 pandemic.

The Company experienced an increase in uncollectible receivables during 2020, which may continue if customers continue to be significantly impacted by COVID-19 and are unable to pay. Additionally, the Company may experience an increase in inventory write-off charges for those inventory items that have no alternative use for customers that are severely impacted by COVID-19.

GLOBAL POLITICAL AND ECONOMIC RISKS

Global political or economic changes may negatively impact the Company’s business.

Ongoing instability or changes in a country's or region's economic or political conditions could adversely affect demand for the Company’s products and impact profitability. Among other factors, political conflicts or changes, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, swings in consumer confidence and spending, unstable economic growth and fluctuations in unemployment rates causing economic instability could have a negative impact on the Company’s results of operations, financial condition and liquidity. These factors also make it difficult to accurately forecast and plan future business activities.

Furthermore, the implementation of more restrictive trade policies, including the imposition of tariffs, or the renegotiation of existing trade agreements by the U.S. or by countries where the Company sells products or procures materials incorporated into our products could negatively impact the Company's business, results of operations, and financial condition. For example, a government's adoption of "buy national" policies or retaliation by another government against such policies, could have a negative impact on the Company's results of operations by decreasing the demand for Company products in certain countries and/or increase the prices on raw materials that are critical to the Company's businesses.

On January 31, 2020, the United Kingdom withdrew from the European Union ("EU") (generally referred to as “BREXIT”). On December 24, 2020, the U.K. and EU reached an agreement ("Brexit Agreement") which contains new rules for how the U.K. and EU will live, work, and trade together. The Company has operations in the U.K. Changes resulting from Brexit and the Brexit Agreement could subject the Company to increased risk, including among other things, regulatory oversight, disruptions to supply, increases in prices, fees, taxes, or tariffs on goods that are sold between the E.U. and the U.K., inspections or barriers on goods sold between the U.K. and the E.U., extra charges, and/or difficulty with hiring employees. The Company is in the process of evaluating the potential impact of the Brexit Agreement.

Brexit may also cause fluctuations in the value of the U.K. pound sterling and E.U. euro. Fluctuations in exchange rates between the U.S. dollar and foreign currencies may adversely affect the Company's expenses, earnings, cash flows, results of operations, and revenues. Although the Company may attempt to mitigate some of its exposure to foreign currency exchange risks through hedging arrangements, the Company's hedging arrangements may not target the potential impacts associated with fluctuations in currency resulting from Brexit or otherwise effectively offset the adverse financial impacts.

The Company’s foreign sales, including U.S. and non-U.S. customers, and U.S. export sales were 55.3% of net sales in 2020, 53.1% in 2019, and 53.5% in 2018. If the global economy were to take a significant downturn, depending on the length, duration and severity of such downturn, the Company’s business and financial statements could be materially adversely affected.

The Company’s foreign operations expose it to business, economic, political, legal, regulatory and other risks.

The Company believes that in order to be competitive and grow its businesses, it needs to maintain significant foreign operations. Foreign sales were $343.9 million, $358.7 million and $363.7 million for the fiscal years ended December 31, 2020, 2019, and 2018, respectively. Foreign operations are subject to inherent risks including political and economic conditions in various countries, unexpected changes in regulatory requirements (including tariff regulations and trade restrictions), longer accounts receivable collection cycles and potentially adverse tax consequences. In addition, COVID-19 has resulted in travel restrictions and extended temporary shutdowns of certain businesses outside the U.S. The Company has little control over most of these risks and may be unable to

12

anticipate changes in international economic and political conditions and, therefore, unable to alter its business practices in time to avoid the adverse effect of any of these possible changes.

Foreign currency exchange rate fluctuations and limitations on repatriation of earnings may affect the Company’s results of operations.

The Company’s financial results are exposed to currency exchange rate fluctuations and an increased proportion of its assets, liabilities and expenses are denominated in non-U.S. dollar currencies. There can be significant volatility in foreign currencies that impact the Company, primarily the British Pound Sterling, Euro, Chinese Yuan, and Canadian Dollar. The Company’s foreign and domestic operations seek to limit foreign currency exchange transaction risk by completing transactions in functional currencies whenever practical or through the use of foreign currency forward exchange contracts when deemed appropriate. If the Company does not successfully hedge its currency exposure, changes in the rate of exchange between these currencies and the U.S. dollar may negatively impact the Company. Translation of the results of operations and financial condition of its foreign operations into U.S. dollars may be affected by exchange rate fluctuations. Additionally, limitations on the repatriation of earnings, including imposition or increase of withholding and other taxes on remittances, may limit or negatively impact the Company’s ability to redeploy or distribute cash. The Company receives a material portion of its revenue from foreign operations. Foreign operations generated approximately 45.0%, 42.8% and 46.3% of total net sales for fiscal years ended December 31, 2020, 2019, and 2018, respectively.

COMPANY AND OPERATIONAL RISKS

The Company’s Thermal Acoustical Solutions segment, and to a lesser extent, Technical Nonwovens and Performance Materials segments, are tied primarily to general economic and automotive industry conditions.

Consolidated sales to the automotive market accounted for 38.5%, 42.9% and 46.3% of the Company’s net sales for fiscal years ended December 31, 2020, 2019, and 2018, respectively. The Thermal Acoustical Solutions segment net sales from products manufactured in North America were 68.3%, 69.9%, and 69.6% for fiscal years ended December 31, 2020, 2019, and 2018, respectively, with the remainder manufactured in Europe and Asia. This segment is closely tied to general economic and automotive industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit, the cost of fuel, legislative and regulatory oversight and trade agreements. These factors have had, and could continue to have, a substantial impact on the segment. Adverse developments could reduce demand for new vehicles, causing the Company’s customers to reduce their vehicle production in North America, Europe and Asia and, as a result, demand for Company products would be adversely affected.

Implementation of the Company’s strategic initiatives may not be successful.

As part of its business strategy, the Company continues to review various strategic and business opportunities to grow the business and to assess the profitability and growth potential for each of its existing businesses. The Company may incur significant professional services expenses associated with the review and potential implementation of strategic business opportunities. The Company cannot predict with certainty whether any recent or future strategic transactions will be beneficial to the Company. Among other things, future performance could be impacted by the Company’s ability to:

•Identify and effectively complete strategic transactions;

•Obtain adequate financing to fund strategic initiatives;

•Successfully integrate and manage acquired businesses that involve numerous operational and financial risks, including difficulties in the integration of acquired operations, diversion of management's attention from other business concerns, managing assets in multiple geographic regions and potential loss of key employees and key customers of acquired operations;

•Improve operating margins through its Lean Six Sigma initiatives which are intended to improve processes and workflow, improve customer service, reduce costs and leverage synergies across the Company; and

•Successfully invest and deploy capital investments to support our business and commitments to our customers.

13

In order to meet its strategic objectives, the Company may also divest assets and/or businesses. Successfully executing such a strategy depends on various factors, including effectively transferring assets, liabilities, contracts, facilities, and employees to any purchaser, identifying and separating the intellectual property to be divested from the intellectual property that the Company wishes to retain, reducing or eliminating fixed costs previously associated with the divested assets or business, and collecting the proceeds from any divestitures.

The Company may be unable to realize expected benefits from cost reduction, restructuring and consolidation efforts; and profitability, specifically, or our business, generally, may otherwise be adversely affected.

From time to time, the Company announces restructuring or consolidation plans, which include workforce reductions, facility consolidations and/or closures, and other cost reduction initiatives in order to operate more efficiently and control costs. These plans are intended to generate operating expense savings through direct cost and indirect overhead expense reductions as well as other savings. The Company may undertake workforce reductions or restructuring actions in the future. These types of cost reduction and restructuring activities are complex. If the Company does not successfully manage current restructuring activities, or any other restructuring activities that it may undertake in the future, expected efficiencies and benefits might be delayed or not realized, and our operations and business could be disrupted. Risks associated with these actions and other workforce management issues include unforeseen delays in implementation of anticipated workforce reductions, additional unexpected costs, adverse effects on employee morale and the failure to meet operational targets due to the loss of employees, any of which may impair our ability to achieve anticipated cost reductions or may otherwise harm the business, which could have a material adverse effect on competitive position, results of operations, cash flows or financial condition.

The Company’s future success depends upon its ability to continue to innovate, improve its existing products, develop and market new products, and identify and enter new markets.

Improved performance and growth are partially dependent on future improvements to existing products and new product introductions. Delays in improving or developing products and long customer qualification cycles may impact the success of new product programs. The degree of success of new product programs could impact the Company’s future results. Developments by other companies of new, improved, or disruptive products, processes or technologies may make the Company's products or proposed products obsolete or less competitive and may negatively impact the Company's net sales. As such, the ability to compete is, in part, dependent on the Company's ability to continually offer enhanced and improved products that meet the changing requirements of the Company's customers. If the Company fails to develop new products or enhance existing products, it could have a material adverse effect on the Company's business, financial condition or results of operations.

Raw material pricing, supply issues, and disruptions in transportation networks could affect all of the Company’s businesses.

The Thermal Acoustical Solutions segment uses aluminum and other metals to manufacture most of its automotive heat shields. The Thermal Acoustical Solutions, Technical Nonwovens and Performance Materials segments use various petroleum-derivative fibers in manufacturing products, and the Performance Materials segment uses various glass-derivative fibers in manufacturing products. If the prices and duties of these raw materials, or any other raw materials used in the Company’s businesses increase, the Company may not have the ability to pass all of the incremental cost increases on to its customers. In addition, an interruption in the ability of the Company to source such materials, including government trade restrictions, could negatively impact operations and sales.

The Company could be subject to work stoppages or other business interruptions as a result of its unionized work force.

A portion of the Company’s hourly employees are represented by various union locals and are covered by collective bargaining agreements. These agreements contain various expiration dates and must be renegotiated upon expiration. If the Company is unable to negotiate any of its collective bargaining agreements on satisfactory terms prior to expiration, the Company could experience disruptions in its operations which could have a material adverse effect on operations.

14

The Company’s manufacturing processes are subject to inherent risk.

The Company operates a number of manufacturing facilities and relies upon an effective workforce and properly performing machinery and equipment. The workforce may experience a relatively high turnover rate, causing inefficiencies associated with retraining and rehiring. The equipment and systems necessary for such operations may break down, perform poorly or fail, and possibly cause higher manufacturing and delivery costs. Manufacturing processes affect the Company’s ability to deliver quality products on a timely basis, and delays in delivering products to customers could result in the Company incurring increased freight costs and penalties from customers.

The Company’s resources are limited and may impair its ability to capitalize on changes in technology, competition and pricing.

The industries in which the Company sells its products are highly competitive and many of our competitors are affiliated with entities that are substantially larger and have greater financial, technical, and marketing resources. The Company’s more limited resources and relatively diverse product mix may limit or impair its ability to capitalize on changes in technology, competition, or pricing.

The Company’s products may fail to perform as expected, subjecting it to warranty or other claims from its customers.

If failure of the Company's products results in, or is alleged to result in, bodily injury and/or property damage or other losses, the Company may be subject to product liability lawsuits, product recalls and other claims, any of which could have a material adverse impact on results of operations and cash flows.

If the Company does not retain its key employees, the Company’s ability to execute its business strategy could be adversely affected.

The Company’s success, in part, depends on key managerial, engineering, sales, marketing, and technical personnel and its ability to continue to attract and retain additional personnel. The loss of certain key personnel could have a material, adverse effect upon the Company’s business and results of operations. There is no assurance that the Company can retain its key employees or that it can attract competent and effective new or replacement personnel in the future.

The Company may be unable to adequately protect its intellectual property, which may limit its ability to compete effectively.

The Company owns intellectual property, including patents, trademarks, and trade secrets, which play an important role in helping the Company to maintain its competitive position in a number of markets. The Company is subject to risks with respect to (i) changes in the intellectual property landscape of markets in which it competes; (ii) the potential assertion of intellectual property-related claims against the Company; (iii) the misappropriation by third parties of our intellectual property (e.g., disclosure of trade secrets by former employees); (iv) the failure to maximize or successfully assert its intellectual property rights; and (iv) significant technological developments by others.

Impairment of the Company’s goodwill or other long-lived assets has required, and may in the future require, recording significant charges to earnings.

The Company reviews its finite long-lived assets for impairment at the asset group level at least annually in the fourth quarter or when events or changes in circumstances indicate the carrying value may not be recoverable. Factors that may be considered a change in circumstances, indicating that the carrying value of goodwill or other long-lived assets may not be recoverable, include, but are not limited to, a decline in the Company’s stock price and market capitalization, a reduction in future cash flow estimates, and slower future growth rates. Certain factors led to an impairment of the Performance Materials segment goodwill and other long-lived assets amounting to total charges of $61.1 million during the three-month period ended March 31, 2020 and $64.2 million in fiscal year ended December 31, 2019. See Note 6, “Goodwill and Other Intangible Assets”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

15

REGULATORY, COMPLIANCE, LEGAL AND ENVIRONMENTAL RISKS

The Company is subject to the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws, which impose restrictions on the Company and violations of which may carry substantial fines and penalties and result in criminal sanctions.

The U.S. Foreign Corrupt Practices Act and anti-bribery laws in other jurisdictions, including anti-bribery legislation in the U.K., generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business or other commercial advantage. The Company’s policies mandate compliance with these anti-bribery laws, violations of which often carry substantial fines and penalties and could result in criminal sanctions against the Company, its officers, or its employees. The Company cannot assure that its internal control policies and procedures always will protect it from reckless or other inappropriate acts committed by the Company’s affiliates, employees, or agents. Violations of these laws, or allegations of such violations, could have a material adverse effect on the Company's business or financial condition and could possibly lead to a decline in the Company's stock price.

The Company is subject to legal and compliance risks and oversight on a global basis and developments in these risks and related matters could have a material adverse effect on the Company's consolidated financial position, results of operations or liquidity.

The Company is subject to a variety of laws and regulations that govern our business both in the United States and internationally, including antitrust laws. Violations of these laws and regulations can result in significant fines, penalties or other damages being imposed by regulatory authorities. Expenses and fines arising out of or related to these investigations and related claims can also be significant. Despite meaningful measures that the Company undertakes to seek to ensure lawful conduct, which include training and internal control policies, these measures may not always prevent the Company's employees or agents from violating the laws and regulations. As a result, the Company could be subject to criminal and civil penalties, disgorgement, further changes or enhancements to our procedures, policies and controls, personnel changes or other remedial actions. Violations of laws, or allegations of such violations, could disrupt operations, involve significant management distraction and result in a material adverse effect on the Company's competitive position, results of operations, cash flows or financial condition.

The Company is involved in certain legal proceedings and may become involved in future legal proceedings all of which could give rise to liability.

The Company is involved in legal proceedings that, from time to time, may be material. These proceedings may include, without limitation, commercial or contractual disputes, intellectual property matters, personal injury claims, stockholder claims, and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s financial statements.

The Company is subject to environmental laws and regulations that could increase its expense and affect operating results.

The Company is subject to federal, state, local, and foreign environmental, health and safety laws and regulations that affect operations. New and changing environmental laws and regulations may impact the products manufactured and sold to customers. In order to maintain compliance with such laws and regulations, the Company must devote significant resources and maintain and administer adequate policies, procedures, and oversight. Should the Company fail to do these things, it could be negatively impacted by lower net sales, fines, legal costs, and clean-up requirements.

The Company may incur liabilities under various government statutes for the investigation and cleanup of contaminants previously released into the environment. Although there is no certainty, the Company does not anticipate that compliance with current provisions relating to the protection of the environment or that any payments the Company may be required to make for cleanup liabilities will have a material adverse effect upon the Company's cash flows, competitive position, financial condition or results of operations. Current and on-going environmental matters are further addressed in Note 17, “Commitments and Contingencies”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

16

DEBT COMPLIANCE AND OTHER FINANCIAL RISKS

Incurring a substantial amount of indebtedness could have an adverse effect on the Company’s financial health and make it more difficult for the Company to obtain additional financing in the future.

The Company incurred a substantial amount of debt to fund the purchase price of Interface Performance Materials in August 2018. Incurring this additional debt may have an adverse effect on the Company’s financial condition and may limit the Company’s ability to obtain any necessary financing in the future for working capital, capital expenditures, future acquisitions, debt service requirements or other purposes. In addition, the Company may not be able to generate sufficient cash flow or otherwise obtain funds necessary to meet the additional debt obligations. On May 11, 2020, the Company amended its Amended Credit Agreement, which, among other changes, decreased available borrowings from $450.0 million to $314.0 million and modified certain financial covenants, at least one of which the Company expected to fail under the Amended Credit Agreement during the second quarter of 2020. The Amended Credit Agreement was further amended on October 14, 2020 to allow certain restructuring and other charges, as defined by the amendment, to be excluded from EBITDA in the calculation of the Company's financial covenants as the Company anticipated it would have failed to satisfy one of the financial covenants prior to the amendment. For further information, see Note 7, “Long-Term Debt and Financing Arrangements”, in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K. Any default under the Amended Credit Agreement would likely result in the acceleration of the repayment obligations to our lenders.

The Company may not have adequate cash to fund its operating requirements.

The principal source of the Company’s liquidity is operating cash flows. Other significant factors that affect the overall management of liquidity include capital expenditures, investments in businesses, acquisitions, income tax payments, pension funding, outcomes of contingencies, and availability of lines of credit and long-term financing. The Company believes that its liquidity resources, including available funds under the Amended Credit Agreement, are sufficient to meet its working capital needs and other cash requirements, however the Company’s liquidity can be impacted by its ability to:

•Manage working capital and the level of future profitability. The consolidated cash balance is impacted by the Company's ability to collect accounts receivables balances and capital equipment and inventory investments that may be made in response to changing market conditions; and