UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-7665

Lydall, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 06-0865505 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

One Colonial Road, Manchester, Connecticut | 06042 | |

(Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (860) 646-1233

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Accelerated filer o | Smaller reporting company o | Emerging growth company o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

On June 30, 2017, the aggregate market value of the Registrant’s voting stock held by nonaffiliates was $859,559,961 based on the New York Stock Exchange closing price on that date. For purposes of this calculation, the Registrant has assumed that its directors and executive officers are affiliates.

On February 15, 2018, there were 17,354,532 shares of Common Stock outstanding, exclusive of treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to the definitive Proxy Statement to be distributed in connection with the Registrant’s

Annual Meeting of Stockholders to be held on April 27, 2018.

The exhibit index is located on pages 42 – 45.

INDEX TO ANNUAL REPORT ON FORM 10-K

Year Ended December 31, 2017

Page Number | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

The information called for by Items 10, 11, 12, 13 and 14, to the extent not included in this document, is incorporated herein by reference to such information included in the Company’s definitive Proxy Statement to be filed with the Securities and Exchange Commission and distributed in connection with Lydall, Inc.’s 2018 Annual Meeting of Stockholders to be held on April 27, 2018.

i

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Lydall, Inc. and its subsidiaries are hereafter collectively referred to as “Lydall,” the “Company” or the “Registrant.” Lydall and its subsidiaries’ names, abbreviations thereof, logos, and product and service designators are all either the registered or unregistered trademarks or trade names of Lydall and its subsidiaries.

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future operating and financial performance of the Company based on current assumptions relating to the Company’s business, the economy and future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs” and other words of similar meaning in connection with the discussion of future operating or financial performance. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, uses of cash and other measures of financial performance. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Accordingly, the Company’s actual results may differ materially from those contemplated by the forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Forward-looking statements in this Annual Report on Form 10-K include, among others, statements relating to:

• | Overall economic, business and political conditions and the effects on the Company’s markets; |

• | Outlook for the fiscal year 2018; |

• | Expected vehicle production in the North American, European or Asian markets; |

• | Growth opportunities in markets served by the Company; |

• | Expected costs and future savings associated with restructuring programs and the combination of the Thermal/Acoustical Metals and Thermal/Acoustical Fibers segments into the Lydall Thermal Acoustical Solutions segment; |

• | Expected gross margin, operating margin and working capital improvements from the application of Lean Six Sigma; |

• | Product development and new business opportunities; |

• | Future strategic transactions, including but not limited to: acquisitions, joint ventures, alliances, licensing agreements and divestitures; |

• | Pension plan funding; |

• | Future cash flow and uses of cash; |

• | Future amounts of stock-based compensation expense; |

• | Future earnings and other measurements of financial performance; |

• | Ability to meet cash operating requirements; |

• | Future levels of indebtedness and capital spending; |

• | Ability to meet financial covenants in the Company's amended revolving credit facility; |

• | Future impact of the variability of interest rates and foreign currency exchange rates; |

• | Expected future impact of recently issued accounting pronouncements upon adoption, including the new revenue recognition standard effective January 1, 2018; |

• | Future effective income tax rates, including the impact of the U.S. Tax Cuts and Jobs Act, and realization of deferred tax assets; |

• | Estimates of fair values of reporting units and long-lived assets used in assessing goodwill and long-lived assets for possible impairment; and |

• | The expected outcomes of legal proceedings and other contingencies, including environmental matters |

ii

All forward-looking statements are inherently subject to a number of risks and uncertainties that could cause the actual results of the Company to differ materially from those reflected in forward-looking statements made in this Annual Report on Form 10-K, as well as in press releases and other statements made from time to time by the Company’s authorized officers. Such risks and uncertainties include, among others, worldwide economic cycles and political changes that affect the markets which the Company’s businesses serve, which could have an effect on demand for the Company’s products and impact the Company’s profitability; challenges encountered by the Company in the integration of the Texel and Gutsche acquisitions, including execution of restructuring programs; challenges encountered in the combination of the Thermal/Acoustical Fibers and Thermal/Acoustical Metals business segments; disruptions in the global credit and financial markets, including diminished liquidity and credit availability; changes in international trade agreements including tariff regulation and trade restrictions; swings in consumer confidence and spending; unstable economic growth; volatility in foreign currency exchange rates; raw material pricing and supply issues; fluctuations in unemployment rates; retention of key employees; increases in fuel prices; changes in tax laws; and outcomes of legal proceedings, claims and investigations as well as other risks and uncertainties identified in Part I, Item 1A — Risk Factors of this Annual Report on Form 10-K. The Company does not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

iii

PART I

Item 1. | BUSINESS |

Lydall, Inc. has been incorporated in Delaware since 1987 after originally being incorporated in Connecticut in 1969. The principal executive offices are located in Manchester, Connecticut. The Company designs and manufactures specialty engineered filtration media, industrial thermal insulating solutions, automotive thermal and acoustical barriers for filtration/separation and thermal/acoustical applications.

Lydall serves a number of markets. The Company’s products are primarily sold directly to customers through an internal sales force and distributed via common carrier. The majority of products are sold to original equipment manufacturers and tier-one suppliers. The Company differentiates itself through high-quality, specialty engineered innovative products, application engineering and exceptional customer service. Lydall has a number of domestic and foreign competitors for its products, most of whom are either privately owned or divisions of larger companies.

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements are made available free of charge through the Investor Relations Section of the Company’s Internet website at www.lydall.com after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “Commission”) and are also available on the Commission’s website at www.sec.gov. Information found on these websites is not part of this Form 10-K. Additionally, the public may read and copy any materials the Company files with the Commission at the Commission’s Public Reference room located at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

SEGMENTS

During 2017, the Company’s reportable segments were Performance Materials, Technical Nonwovens, Thermal/Acoustical Metals, and Thermal/Acoustical Fibers. The Performance Materials segment reports the results of the Filtration, Thermal Insulation and Life Sciences Filtration businesses. The Technical Nonwovens segment reports the results of Lydall's Industrial Filtration and Advanced Materials products. The Thermal/Acoustical Metals segment reports the results of Lydall’s metal parts and related tooling and the Thermal/Acoustical Fibers segment reports the results of Lydall’s fiber parts and related tooling, with both used primarily in automotive applications. For additional information regarding the Company’s reportable segments, please refer to Note 12 in the Consolidated Financial Statements included in this Annual Report on Form 10-K.

During the third quarter of 2017, the Company announced its plan to combine the Thermal/Acoustical Metals and Thermal/Acoustical Fibers operating segments into a single operating segment named Thermal Acoustical Solutions ("TAS"). Combining these automotive segments into one segment is expected to allow for better customer alignment, leverage operating disciplines and realize efficiencies across the global automotive operations. Through December 31, 2017 these two segments continued to be managed separately as the Company defined the future global structure and strategies of the combined businesses.

Performance Materials Segment

The Performance Materials segment includes filtration media solutions primarily for air, fluid power, and industrial applications (“Filtration”), thermal insulation solutions for building products, appliances, and energy and industrial markets (“Thermal Insulation”) and air and liquid life science applications (“Life Sciences Filtration”). Filtration products include LydAir® MG (Micro-Glass) Air Filtration Media, LydAir® MB (Melt Blown) Air Filtration Media, LydAir® SC (Synthetic Composite) Air Filtration Media, and Arioso™ Membrane Composite Media. These products constitute the critical media component of clean-air systems for applications in clean-space, commercial, industrial and residential HVAC, power generation, and industrial processes. Lydall has leveraged its extensive technical expertise and applications knowledge into a suite of media products covering the vast liquid filtration landscape across the engine and industrial fields. The LyPore® Liquid Filtration Media series addresses a variety of application needs in fluid power including hydraulic filters, air-water and air-oil coalescing, industrial fluid processes and diesel fuel filtration.

Thermal Insulation products are high performance nonwoven veils, papers, mats and specialty composites for the building products, appliance, and energy and industrial markets. The Manniglas® Thermal Insulation brand is diverse in its product application ranging from high temperature seals and gaskets in ovens and ranges to specialty veils for HVAC and cavity wall insulation. The appLY® Mat Needled Glass Mats have been developed to expand Lydall’s high

1

temperature technology portfolio for broad application into the appliance market and supplements the Lytherm® Insulation Media product brand, traditionally utilized in the industrial market for kilns and furnaces used in metal processing. Lydall’s Cryotherm® Super-Insulating Media, CRS-Wrap® Super-Insulating Media and Cryo-Lite™ Cryogenic Insulation products are industry standards for state-of-the-art cryogenic insulation designs used by manufacturers of cryogenic equipment for liquid gas storage, piping, and transportation.

Life Sciences is comprised of products which have been designed to meet the stringent requirements of critical applications including biopharmaceutical pre-filtration and clarification, lateral flow diagnostic and analytical testing, respiratory protection, potable water filtration and high purity process filtration such as that found in food and beverage and medical applications. Lydall also offers ultra-high molecular weight polyethylene membranes under the Solupor® trade name. These specialty microporous membranes are utilized in various markets and applications including air and liquid filtration and transdermal drug delivery. Solupor® membranes incorporate a unique combination of high mechanical strength, chemical inertness, gamma stability and very high porosity making them ideal for many applications.

Net sales from the Performance Materials segment represented 16.7% of Lydall’s net sales in 2017 compared with 19.6% in 2016 and 19.3% in 2015. Net sales generated by the foreign operations of the Performance Materials segment accounted for 34.2%, 35.3% and 33.9% of segment net sales in 2017, 2016, and 2015, respectively.

Technical Nonwovens Segment

The Technical Nonwovens segment primarily produces needle punch nonwoven solutions for myriad industries and applications. Products are manufactured and sold globally under the leading brands of Lydall Industrial Filtration, Southern Felt, Gutsche, and Texel. Industrial Filtration products include nonwoven rolled-good felt media and filter bags used primarily in industrial air and liquid filtration applications. Nonwoven filter media is an effective solution to satisfy increasing emission control regulations in a wide range of industries, including power, cement, steel, asphalt, incineration, mining, food, and pharmaceutical. Advanced Materials products include nonwoven rolled-good media used in commercial applications and predominantly serves the geosynthetics, automotive, industrial, medical, and safety apparel markets. Automotive media is provided to Tier I/II suppliers and as well as the Company's Thermal/Acoustical Fibers segment.

Technical Nonwovens segment products include air and liquid filtration media sold under the brand names Fiberlox® high performance filtration felts, Checkstatic™ conductive filtration felts, Microfelt® high efficiency filtration felts, Pleatlox® pleatable filtration felts, Ultratech™ PTFE filtration felts, Powertech® and Powerlox® power generation filtration felts, Microcap® high efficiency liquid filtration felts, Duotech membrane composite filtration felts, along with our porotex® family of high temperature filtration felts including microvel® and optivel® products. Technical Nonwovens Advanced Materials products are sold under the brand names Thermofit® thermo-formable products, Ecoduo® recycled content materials, Duotex® floor protection products, and Versaflex® composite molding materials. Technical Nonwovens also offers extensive finishing and coating capabilities which provide custom engineered properties tailored to meet the most demanding applications. The business leverages a wide range of fiber types and extensive technical capabilities to provide products that meet our customers’ needs across a variety of applications providing both high performance and durability.

On July 7, 2016, the Company completed an acquisition of the nonwoven and coating materials businesses primarily operating under the Texel brand (“Texel”) from ADS, Inc. (“ADS”), a Canadian based corporation. The Texel operations manufacture nonwoven needle punch materials and predominantly serve the geosynthetic, liquid filtration, and other industrial markets.

On December 31, 2016, the Company completed an acquisition of the nonwoven needle punch materials businesses, operating under the Gutsche (“Gutsche”) brand, a German based corporation. The Gutsche operations manufacture nonwoven needle punch materials and predominantly serve the industrial filtration and high performance nonwoven markets.

Technical Nonwovens segment net sales represented 38.5% of the Company's net sales in 2017, 27.4% in 2016 and 26.5% in 2015. Net sales generated by foreign operations of the Technical Nonwovens segment accounted for 69.5%, 55.4% and 40.9% of segment net sales in 2017, 2016, and 2015 respectively.

2

Thermal/Acoustical Metals Segment

The Thermal/Acoustical Metals segment offers a full range of innovative engineered products tailored for the transportation sector to thermally shield sensitive components from high heat, improve exhaust gas treatment and lower harmful emissions as well as assist in the reduction of powertrain and road noise. The segment's products are found in the underbody (tunnel, fuel tank, rear muffler, spare tire) and underhood (outer dash, powertrain, catalytic converter, turbo charger, manifolds) of cars, trucks, SUVs, heavy duty trucks and recreational vehicles.

Thermal/Acoustical Metals segment products are formed on production lines capable of efficiently combining multiple layers of metal and thermal - acoustical insulation media to provide an engineered thermal and acoustical shielding solution for an array of application areas in the global automotive and truck markets. The flux® product family in Thermal/Acoustical Metals includes several patented or IP-rich products that address applications which include: Direct Exhaust Mount heat shields, which are assembled to high temperature components like catalytic converters, turbochargers or exhaust manifolds using aluminized and stainless steel and high performance and high temperature heat insulating materials; Powertrain heat shields that absorb noise at the source and do not contribute to the engine's noise budget; and durable, thermally robust solutions for temperature sensitive plastic components such as fuel tanks that are in proximity to high temperature heat sources.

Thermal/Acoustical Metals segment net sales represented 27.0% of the Company’s net sales in 2017, 30.9% in 2016 and 30.7% in 2015. Net sales generated by foreign operations of the Thermal/Acoustical Metals segment accounted for 50.6%, 49.8% and 54.9% of segment net sales in 2017, 2016 and 2015, respectively.

The operating results include allocations of certain costs shared between the Thermal/Acoustical Metals and Thermal/Acoustical Fibers segments.

Thermal/Acoustical Fibers Segment

The Thermal/Acoustical Fibers segment offers innovative engineered products to assist primarily in noise vibration and harshness (NVH) abatement and thermal protection within the transportation sector. The segment's products are found in the interior (dash insulators, cabin flooring), underbody (wheel well, aerodynamic belly pan, fuel tank, exhaust) and under hood (engine compartment) of cars, trucks, SUVs, heavy duty trucks and recreational vehicles.

Thermal/Acoustical Fibers segment products offer thermal and acoustical insulating solutions comprised of organic and inorganic fiber composites for the automotive and truck markets primarily in North America. Lydall’s dBCore® is a lightweight acoustical composite that emphasizes absorption principles over heavy-mass type systems. Lydall’s dBLyte® is a high-performance acoustical barrier with sound absorption and blocking properties and can be used throughout a vehicle’s interior to minimize intrusive noise from an engine compartment and road. Lydall’s ZeroClearance® is an innovative thermal solution that utilizes an adhesive backing for attachment and is used to protect vehicle components from excessive heat. Lydall’s specially engineered products provide a solution that provides weight reduction, superior noise suppression, and increased durability over conventional designs.

Thermal/Acoustical Fibers segment net sales represented 22.6% of the Company’s net sales in 2017, 26.4% in 2016 and 26.5% in 2015. There are no net sales generated by foreign operations, as the Thermal/Acoustical Fibers segment only produces domestically.

The operating results include allocations of certain costs shared between the Thermal/Acoustical Fibers and Thermal/Acoustical Metals segments.

GENERAL BUSINESS INFORMATION

Lydall holds a number of patents, trademarks and licenses. While no single patent, trademark or license is critical to the success of Lydall, together these intangible assets are of considerable value to the Company.

Typically, the Company’s business can be slightly stronger in the first half of the calendar year given the timing of customer order patterns and planned customer shutdowns in North America and Europe that typically occur in the third and fourth quarters of each year. Lydall maintains levels of inventory and grants credit terms that are normal within the industries it serves. The Company uses a wide range of raw materials in the manufacturing of its products, including aluminum and other metals to manufacture most of its automotive heat shields and various glass and

3

petroleum derived fibers in its Performance Materials, Technical Nonwovens, and Thermal/Acoustical Fibers segments. The majority of raw materials used are generally available from a variety of suppliers.

Sales to Ford Motor Company accounted for 17.3%, 19.6% and 18.2% of Lydall’s net sales in the years ended December 31, 2017, 2016 and 2015, respectively. No other customers accounted for more than 10% of Lydall's net sales in such years. Foreign and export sales were 54.2% of net sales in 2017, 46.9% in 2016, and 44.2% in 2015. Foreign sales were $322.2 million, $212.5 million and $179.6 million for the years ended December 31, 2017, 2016 and 2015, respectively. Export sales primarily to Canada, Mexico, Asia and Europe were $55.9 million, $53.2 million, and $52.5 million in 2017, 2016 and 2015, respectively. The increase in foreign sales during 2017, compared to 2016, was primarily related to the acquisitions of Texel on July 7, 2016 and Gutsche on December 31, 2017.

Foreign operations generated operating income of $15.6 million, $4.9 million, and $6.4 million for the years ended December 31, 2017, 2016 and 2015, respectively. Total foreign assets were $342.8 million, $317.8 million, and $144.2 million at December 31, 2017, 2016 and 2015, respectively. The increase in foreign operating income in 2017 compared to 2016 was primarily due to the acquisitions of Texel and Gutsche. For further detail regarding revenue and financial information about the Company’s geographic areas, see Note 12 to the Consolidated Financial Statements.

The Company invested $10.8 million in 2017, $9.0 million in 2016, and $8.5 million in 2015, or approximately 2% of net sales in 2017, 2016 and 2015, in research and development to create new products and to improve existing products. All amounts were expensed as incurred. Most of the investment in research and development is application specific. There were no customer-sponsored research and development activities during the past three years.

Backlog at January 31, 2018 was $116.6 million. Lydall’s backlog was $109.0 million at December 31, 2017, $94.9 million at December 31, 2016, and $72.2 million at December 31, 2015. The increase in backlog at year-end 2017 compared to year-end 2016 was primarily driven by the Technical Nonwovens segment. Thermal/Acoustical Metals and Thermal/Acoustical Fibers segment backlog, which comprises the majority of total backlog, may be impacted by various assumptions, including future automotive production volume estimates, changes in program launch timing and changes in customer development plans. The Company believes that global automotive orders are typically fulfilled within a two month period and therefore represent a reasonable timeframe to be included as Thermal/Acoustical Metals and Thermal/Acoustical Fibers segment backlog.

No material portion of Lydall’s business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of any governmental body.

Lydall believes that its plants and equipment are overall, in substantial compliance with applicable federal, state and local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment (See Item 3, Legal Proceedings).

As of December 31, 2017, Lydall employed approximately 2,600 people. Three unions with contracts expiring on September 30, 2020 represent approximately 50 employees in the United States. All employees at the facilities in France and the Netherlands are covered under a National Collective Bargaining Agreement. Certain salaried and all hourly employees in Germany, the United Kingdom, China and Canada are also covered under some form of a National Collective Bargaining Agreement. Lydall considers its employee relationships to be satisfactory.

There are no significant anticipated operating risks related to foreign investment law, expropriation, or availability of material, labor or energy. The foreign and domestic operations attempt to limit foreign currency exchange transaction risk by completing transactions in functional currencies whenever practical or through the use of foreign currency forward exchange contracts when deemed appropriate.

4

Item 1A. | RISK FACTORS |

The reader should carefully review and consider the risk factors discussed below. Any and all of these risk factors could materially affect the Company’s business, financial condition, future results of operations or cash flows and possibly lead to a decline in Lydall’s stock price. The risks, uncertainties and other factors described below constitute all material risk factors known to management as of the date of this report.

Global political or economic changes may negatively impact Lydall’s business - Ongoing instability or changes in a country's or region's economic or political conditions could adversely affect demand for the Company’s products and impact profitability. Among other factors, political conflicts or changes, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, including tariffs regulation and trade restrictions, swings in consumer confidence and spending, unstable economic growth and fluctuations in unemployment rates causing economic instability could have a negative impact on the Company’s results of operations, financial condition and liquidity. These factors also make it difficult to accurately forecast and plan future business activities.

The Company’s foreign and export sales were 54.2% of net sales in 2017, 46.9% in 2016, and 44.2% in 2015. If the global economy were to take a significant downturn, depending on the length, duration and severity of such downturn, the Company’s business and financial statements could be adversely affected.

The Company’s Thermal/Acoustical Metals and Thermal/Acoustical Fibers segments are tied primarily to general economic and automotive industry conditions - The Company’s Thermal/Acoustical Metals and Thermal/Acoustical Fibers segments are suppliers in the automotive market. Sales to the automotive market accounted for 48.3% of the Company’s net sales in 2017, 56.2% in 2016, and 56.6% in 2015. The segments' net sales from products manufactured in North America were 72.3%, 73.1%, and 70.6% in 2017, 2016, and 2015, respectively, with the remainder manufactured in Europe and Asia. These segments are closely tied to general economic and automotive industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit, the cost of fuel, legislative and regulatory oversight and trade agreements. These factors have had, and could continue to have, a substantial impact on these segments. Adverse developments could reduce demand for new vehicles, causing Lydall’s customers to reduce their vehicle production in North America, Europe and Asia and, as a result, demand for Company products would be adversely affected.

The Company’s quarterly operating results may fluctuate; as a result, the Company may fail to meet or exceed the expectations of research analysts or investors, which could cause Lydall’s stock price to decline - The Company’s quarterly results are subject to significant fluctuations. Operating results have fluctuated as a result of many factors, including size and timing of orders and shipments, loss of significant customers, product mix, reductions in customer pricing, customer or company shut-downs, technological change, operational efficiencies and inefficiencies, competition, changes in tax laws and deferred tax asset valuation allowances, strategic initiatives, severance and recruiting charges, asset impairment, penalties or fines and general economic conditions. In addition, lower revenues may cause asset utilization to decrease, resulting in the under absorption of the Company’s fixed costs, which could negatively impact gross margins. Additionally, the Company’s gross margins vary among its product groups and have fluctuated from quarter to quarter as a result of shifts in product mix. Any and all of these factors could affect the Company’s business, financial condition, future results of operations or cash flows and possibly lead to a decline in Lydall’s stock price.

Implementation of the Company’s strategic initiatives may not be successful - As part of Lydall’s business strategy, the Company continues to review various strategic and business opportunities to grow the business and to assess the profitability and growth potential for each of its existing businesses. The Company may incur significant professional services expenses associated with the review and potential implementation of strategic business opportunities. The Company cannot predict with certainty whether any recent or future strategic transactions will be beneficial to the Company. Among other things, future performance could be impacted by the Company’s ability to:

• | Identify and effectively complete strategic transactions; |

• | Obtain adequate financing to fund strategic initiatives; |

5

• | Successfully integrate and manage acquired businesses that involve numerous operational and financial risks, including difficulties in the integration of acquired operations, diversion of management's attention from other business concerns, managing assets in multiple geographic regions and potential loss of key employees and key customers of acquired operations; |

• | Improve operating margins through its Lean Six Sigma initiatives which are intended to improve processes and work flow, improve customer service, reduce costs and leverage synergies across the Company; and |

• | Successfully invest and deploy capital investments to support our business and commitments to our customers. |

In order to meet its strategic objectives, the Company may also divest assets and/or businesses. Successfully executing such a strategy depends on various factors, including effectively transferring assets, liabilities, contracts, facilities and employees to any purchaser, identifying and separating the intellectual property to be divested from the intellectual property that the Company wishes to retain, reducing or eliminating fixed costs previously associated with the divested assets or business, and collecting the proceeds from any divestitures.

The Company may not have adequate cash to fund its operating requirements - The principal source of the Company’s liquidity is operating cash flows. Other significant factors that affect the overall management of liquidity include capital expenditures, investments in businesses, acquisitions, income tax payments, pension funding, share repurchases, outcomes of contingencies and availability of lines of credit and long-term financing. The Company’s liquidity can be impacted by the Company’s ability to:

• | Manage working capital and the level of future profitability. The consolidated cash balance is impacted by capital equipment and inventory investments that may be made in response to changing market conditions; |

• | Satisfy covenants and other obligations under its existing credit facility, which could limit or prohibit Lydall’s ability to borrow funds. Additionally, these debt covenants and other obligations could limit the Company’s ability to make acquisitions, incur additional debt, make investments, or consummate asset sales and obtain additional financing from other sources. |

Incurring a substantial amount of indebtedness could have an adverse effect on the Company’s financial health and make it more difficult for Lydall to obtain additional financing in the future - Incurring additional debt to fund the acquisitions' purchase price may have an adverse effect on the Company’s financial condition and may limit Lydall’s ability to obtain any necessary financing in the future for working capital, capital expenditures, future acquisitions, debt service requirements or other purposes. Additionally, the Company may not be able to generate sufficient cash flow or otherwise obtain funds necessary to meet the additional debt obligations. Any default under the Amended Credit Facility would likely result in the acceleration of the repayment obligations to our lenders.

The Company is subject to the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws, which impose restrictions on the Company and violations of which may carry substantial fines and penalties and result in criminal sanctions - The U.S. Foreign Corrupt Practices Act and anti-bribery laws in other jurisdictions, including anti-bribery legislation in the United Kingdom, generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business or other commercial advantage. The Company’s policies mandate compliance with these anti-bribery laws, violations of which often carry substantial fines and penalties and could result in criminal sanctions against the Company, Lydall’s officers or employees. The Company cannot assure that its internal control policies and procedures always will protect it from reckless or other inappropriate acts committed by the Company’s affiliates, employees or agents. Violations of these laws, or allegations of such violations, could have a material adverse effect on Lydall’s business, or financial statements and could possibly lead to a decline in Lydall's stock price.

Raw material pricing, supply issues, and disruptions in transportation networks could affect all of the Company’s businesses - The Thermal/Acoustical Metals segment uses aluminum and other metals to manufacture most of its automotive heat shields. The Thermal/Acoustical Fibers and Technical Nonwovens segments use various petroleum-derivative fibers in manufacturing products, and the Performance Materials segment uses various glass-derivative fibers in manufacturing products. If the prices and duties of these raw materials, or any other raw materials used in the Company’s businesses increase, the Company may not have the ability to pass incremental cost increases on to its customers. In addition, an interruption in the ability of the Company to source such materials could negatively impact operations and sales.

6

Impairment of the Company’s goodwill or other long-lived assets has required, and may in the future require recording significant charges to earnings - The Company reviews its long-lived assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is also tested by the Company for impairment during the fourth quarter of each year. Factors that may be considered a change in circumstances, indicating that the carrying value of goodwill or other long-lived assets may not be recoverable, include, but are not limited to, a decline in the Company’s stock price and market capitalization, reduced future cash flow estimates, and slower growth rates.

Volatility in the securities markets, interest rates, actuarial assumptions and other factors could substantially increase the Company’s costs and funding for its domestic defined benefit pension plan - The Company’s domestic defined benefit pension plan is funded with trust assets invested in a diversified portfolio of securities. Changes in interest rates, mortality rates, investment returns, and the market value of plan assets may affect the funded status and cause volatility in the net periodic benefit cost and future funding requirements of such plan. A significant increase in benefit plan liabilities or future funding requirements could have a negative impact on the Company’s financial statements.

The Company is involved in certain legal proceedings and may become involved in future legal proceedings all of which could give rise to liability - The Company is involved in legal proceedings that, from time to time, may be material. These proceedings may include, without limitation, commercial or contractual disputes, intellectual property matters, personal injury claims, stockholder claims, and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s financial statements.

The Company is subject to legal and compliance risks and oversight on a global basis and developments in these risks and related matters could have a material adverse effect on Lydall's consolidated financial position, results of operations or liquidity - The Company is subject to a variety of laws and regulations that govern our business both in the United States and internationally, including antitrust laws. Violations of these laws and regulations can result in significant fines, penalties or other damages being imposed by regulatory authorities. Expenses and fines arising out of or related to these investigations and related claims can also be significant. Despite meaningful measures that we undertake to seek to ensure lawful conduct, which include training and internal control policies, these measures may not always prevent our employees or agents from violating the laws and regulations. As a result, we could be subject to criminal and civil penalties, disgorgement, further changes or enhancements to our procedures, policies and controls, personnel changes or other remedial actions. For example, in July 2017, Lydall Gerhardi entered into a formal settlement agreement with the German Cartel Office and paid a settlement amount in August 2017 of €3.3 million (approximately $3.9 million U.S. Dollars) in connection the conclusion of an investigation relating to violations of German anti-trust laws by and among certain European automotive heat shield manufacturers, including Lydall Gerhardi. Violations of laws, or allegations of such violations, could disrupt our operations, involve significant management distraction and result in a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

Changes in Accounting Standards - The Company’s accounting and financial reporting policies conform to U.S. generally accepted accounting principles (“U.S. GAAP”), which are periodically revised and/or expanded. The application of accounting principles is also subject to varying interpretations over time. Accordingly, the Company is required to adopt new or revised accounting standards or comply with revised interpretations that are issued from time to time by various parties, including accounting standard setters and those who interpret the standards, such as the FASB and the SEC. Such new financial accounting standards may change the financial accounting or reporting standards that govern the preparation of the Company’s Consolidated Financial Statements. In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers, which provides for comprehensive changes in revenue recognition and supersedes nearly all existing U.S. GAAP, and is applicable to the Company beginning in Q1 2018. In February 2016, the FASB issued ASU 2016-02, Leases, which is a wide-ranging change to lease accounting that is applicable to the Company beginning in 2019. Implementing changes required by new standards, requirements or laws require interpretation of rules and development of new accounting policies and internal controls that if not appropriately applied could result in financial statement errors and deficiencies in internal control.

Changes in tax rates and exposure to additional income tax liabilities - The Company is subject to risks with respect to changes in tax law and rates, changes in rules related to accounting for income taxes, or adverse outcomes from tax audits that are in process or future tax audits in various jurisdictions in which the Company operates. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Reform Act”). The changes included in the Tax Reform Act are broad and complex. The final transition impacts of the Tax Reform Act may differ from the estimates provided elsewhere in this report, possibly materially, due to, among other things, changes in interpretations of the Tax Reform Act, any legislative action to address questions

7

that arise because of the Tax Reform Act, any changes in accounting standards for income taxes or related interpretations in response to the Tax Reform Act, or any updates or changes to estimates the company has utilized to calculate the transition impacts, including impacts from changes to current year earnings estimates and foreign exchange rates of foreign subsidiaries. In addition, certain jurisdictions in which the Company operates have statutory rates greater than or less than the United States statutory rate. Changes in the mix and source of earnings between jurisdictions could have a significant impact on the Company’s overall effective tax rate.

Realization of deferred tax assets is not assured - The Company maintains valuation allowances against certain deferred tax assets where realization is not reasonably assured. The Company evaluates the likelihood of the realization of all deferred tax assets and reduces the carrying amount to the extent it believes a portion will not be realized. Changes in these assessments can result in an increase or reduction to valuation allowances on deferred tax assets and could have a significant impact on the Company’s overall effective tax rate.

The Company’s future success depends upon its ability to continue to innovate, improve its existing products, develop and market new products, and identify and enter new markets - Improved performance and growth are partially dependent on improvements to existing products and new product introductions planned for the future. Delays in improving or developing products and long customer qualification cycles may impact the success of new product programs. The degree of success of new product programs could impact the Company’s future results. Developments by other companies of new or improved products, processes or technologies may make our products or proposed products obsolete or less competitive and may negatively impact our net sales. Accordingly, our ability to compete is in part dependent on our ability to continually offer enhanced and improved products that meet the changing requirements of our customers. If we fail to develop new products or enhance existing products, it could have a material adverse effect on our business, financial condition or results of operations.

The Company’s foreign operations expose it to business, economic, political, legal, regulatory and other risks - The Company believes that in order to be competitive and grow its businesses, it needs to maintain significant foreign operations. Foreign sales were $322.2 million, $212.5 million and $179.6 million for the years ended December 31, 2017, 2016, and 2015, respectively. Foreign operations are subject to inherent risks including political and economic conditions in various countries, unexpected changes in regulatory requirements (including tariff regulations and trade restrictions), longer accounts receivable collection cycles and potentially adverse tax consequences. The Company has little control over most of these risks and may be unable to anticipate changes in international economic and political conditions and, therefore, unable to alter its business practices in time to avoid the adverse effect of any of these possible changes.

Foreign currency exchange rate fluctuations and limitations on repatriation of earnings may affect the Company’s results of operations - The Company’s financial results are exposed to currency exchange rate fluctuations and an increased proportion of its assets, liabilities and expenses are denominated in non-U.S. dollar currencies. During 2017 and 2016, there was significant volatility in foreign currencies that impacted the Company, primarily the British Pound Sterling, Euro, Chinese Yuan and Canadian Dollar. The Company’s foreign and domestic operations seek to limit foreign currency exchange transaction risk by completing transactions in functional currencies whenever practical or through the use of foreign currency forward exchange contracts when deemed appropriate. If the Company does not successfully hedge its currency exposure, changes in the rate of exchange between these currencies and the U.S. dollar may negatively impact the Company. Translation of the results of operations and financial condition of its foreign operations into U.S. dollars may be affected by exchange rate fluctuations. Additionally, limitations on the repatriation of earnings, including imposition or increase of withholding and other taxes on remittances, may limit or negatively impact the Company’s ability to redeploy or distribute cash. The Company receives a material portion of its revenue from foreign operations. Foreign operations generated approximately 46.1%, 37.5% and 34.2% of total net sales in 2017, 2016, and 2015, respectively.

The Company’s manufacturing processes are subject to inherent risk - The Company operates a number of manufacturing facilities and relies upon an effective workforce and properly performing machinery and equipment. The workforce may experience a relatively high turnover rate, causing inefficiencies associated with retraining and rehiring. The equipment and systems necessary for such operations may break down, perform poorly or fail, and possibly cause higher manufacturing costs. Manufacturing processes affect the Company’s ability to deliver quality products on a timely basis, and delays in delivering products to customers could result in the Company incurring penalties from customers.

8

Increases in energy pricing can affect all of the Company’s businesses - Higher energy costs at the Company’s manufacturing plants or higher energy costs passed on from the Company’s vendors could impact the Company’s profitability.

The Company’s resources are limited and may impair its ability to capitalize on changes in technology, competition and pricing - The industries in which the Company sells its products are highly competitive and many of the competitors are affiliated with entities that are substantially larger and that have greater financial, technical and marketing resources. The Company’s more limited resources and relatively diverse product mix may limit or impair its ability to capitalize on changes in technology, competition and pricing.

The Company’s products may fail to perform as expected, subjecting it to warranty or other claims from its customers -If such failure results in, or is alleged to result in, bodily injury and/or property damage or other losses, the Company may be subject to product liability lawsuits, U.S. Food and Drug Administration product recalls and other claims, any of which could have a material adverse impact on results of operations and cash flows.

If the Company does not retain its key employees, the Company’s ability to execute its business strategy could be adversely affected - The Company’s success, in part, depends on key managerial, engineering, sales and marketing and technical personnel and its ability to continue to attract and retain additional personnel. The loss of certain key personnel could have a material, adverse effect upon the Company’s business and results of operations. There is no assurance that the Company can retain its key employees or that it can attract competent and effective new or replacement personnel in the future.

The Company’s current reserve levels may not be adequate to cover potential exposures - Estimates and assumptions may affect the reserves that the Company has established to cover uncollectible accounts receivable, excess or obsolete inventory, income tax valuation and fair market value write downs of certain assets and various liabilities. Actual results could differ from those estimates.

The Company is subject to environmental laws and regulations that could increase its expense and affect operating results - The Company is subject to federal, state, local, and foreign environmental, health and safety laws and regulations that affect operations. New and changing environmental laws and regulations may impact the products manufactured and sold to customers. In order to maintain compliance with such laws and regulations, the Company must devote significant resources and maintain and administer adequate policies, procedures and oversight. Should the Company fail to do these things, it could be negatively impacted by lower net sales, fines, legal costs, and clean-up requirements.

The Company may incur liabilities under various government statutes for the investigation and cleanup of contaminants previously released into the environment. We do not anticipate that compliance with current provisions relating to the protection of the environment or that any payments we may be required to make for cleanup liabilities will have a material adverse effect upon our cash flows, competitive position, financial condition or results of operations. Current and on-going environmental matters are further addressed in Item 3, Legal Proceedings, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 14 to the Consolidated Financial Statements in our 2017 Annual Report on Form 10-K.

The Company may be unable to adequately protect its intellectual property, which may limit its ability to compete effectively - The Company owns intellectual property, including patents and trademarks, which play an important role in helping the Company to maintain its competitive position in a number of markets. The Company is subject to risks with respect to (i) changes in the intellectual property landscape of markets in which it competes; (ii) the potential assertion of intellectual property-related claims against the Company; (iii) the failure to maximize or successfully assert its intellectual property rights; and (iv) significant technological developments by others.

Disruptions may occur to the Company’s operations relating to information technology - The capacity, reliability and security of the Company’s information technology (“IT”) hardware and software infrastructure and the ability to expand and update this infrastructure in response to the Company’s changing needs are important to the operation of the businesses. Also, any inadequacy, interruption, loss of data, integration failure or security failure of the Company’s IT technology could harm its ability to effectively operate its business, which could adversely impact the Company’s results of operations and cash flows.

Increased cybersecurity requirements, vulnerabilities, threats and more sophisticated and targeted computer crime could pose a risk to the Company’s systems, networks, and data - Increased global cybersecurity vulnerabilities, threats

9

and more sophisticated and targeted cyber-related attacks pose a risk to the security of the Company’s systems and networks and the confidentiality, availability and integrity of the Company’s data. While the Company attempts to mitigate these risks by employing a number of measures, including employee training, monitoring and testing, and maintenance of protective systems and contingency plans, the Company remains vulnerable to additional known or unknown threats. The Company also may have access to sensitive, confidential or personal data or information in certain of Lydall’s businesses that is subject to privacy and security laws, regulations and customer-imposed controls. Despite efforts made by the Company to protect sensitive, confidential or personal data or information, the Company may be vulnerable to security breaches, ransomware, theft, misplaced or lost data, programming errors, employee errors and/or malfeasance that could potentially lead to the compromising or loss of sensitive, confidential or personal data or information and could adversely impact the Company's results of operations and cash flows. Although the Company carries cybersecurity insurance, in the event of a cyber incident, that insurance may not be extensive enough or adequate in scope of coverage or amount to cover damages the Company may incur. In addition, a cyber-related attack could result in other negative consequences, including loss of information, damage to the Company’s reputation or competitiveness, remediation or increased protection costs, litigation or regulatory action.

The Company could be subject to work stoppages or other business interruptions as a result of its unionized work force - A portion of the Company’s hourly employees are represented by various union locals and covered by collective bargaining agreements. These agreements contain various expiration dates and must be renegotiated upon expiration. Specifically, three union contracts expiring on September 30, 2020 represent approximately 50 employees in the United States. If the Company is unable to negotiate any of its collective bargaining agreements on satisfactory terms prior to expiration, the Company could experience disruptions in its operations which could have a material adverse effect on operations.

The Company could be negatively affected as a result of the actions of activist stockholders - Over the last few years, proxy contests and other forms of stockholder activism have been directed against numerous public companies. The Company could become engaged in a solicitation, or proxy contest, or experience other stockholder activism, in the future. Activist stockholders may advocate for certain governance and strategic changes at the Company. In the event of stockholder activism, particularly with respect to matters which our Board of Directors, in exercising their fiduciary duties, disagree with or have determined not to pursue, our business could be adversely affected because responding to actions by activist stockholders can be costly and time-consuming, disrupting our operations and diverting the attention of management, and perceived uncertainties as to our future direction may result in the loss of potential business opportunities and may make it more difficult to attract and retain qualified personnel, business partners and customers.

The Company may be unable to realize expected benefits from cost reduction, restructuring and consolidation efforts and profitability may be hurt or business otherwise might be adversely affected - In order to operate more efficiently and control costs, the Company announces from time to time restructuring or consolidation plans, which include workforce reductions as well as facility consolidations and other cost reduction initiatives. These plans are intended to generate operating expense savings through direct cost and indirect overhead expense reductions as well as other savings. The Company may undertake workforce reductions or restructuring actions in the future. These types of cost reduction and restructuring activities are complex. If the Company does not successfully manage current restructuring activities, or any other restructuring activities that it may undertake in the future, expected efficiencies and benefits might be delayed or not realized, and our operations and business could be disrupted. Risks associated with these actions and other workforce management issues include unforeseen delays in implementation of anticipated workforce reductions, additional unexpected costs, adverse effects on employee morale and the failure to meet operational targets due to the loss of employees, any of which may impair our ability to achieve anticipated cost reductions or may otherwise harm the business, which could have a material adverse effect on competitive position, results of operations, cash flows or financial condition.

10

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

Item 2. | PROPERTIES |

The principal properties of the Company as of December 31, 2017 are situated at the following locations and have the following characteristics:

Location | Primary Business Segment/General Description | Type of Interest | ||

Hamptonville, North Carolina | Thermal/Acoustical Metals and Fibers – Product Manufacturing | Owned | ||

Yadkinville, North Carolina | Thermal/Acoustical Fibers – Product Manufacturing | Leased | ||

Meinerzhagen, Germany | Thermal/Acoustical Metals – Product Manufacturing | Owned | ||

Saint-Nazaire, France | Thermal/Acoustical Metals – Product Manufacturing | Owned | ||

Taicang, China | Thermal/Acoustical Metals – Product Manufacturing | Leased | ||

Green Island, New York | Performance Materials – Specialty Media Manufacturing | Owned | ||

Rochester, New Hampshire | Performance Materials – Specialty Media Manufacturing | Owned | ||

Saint-Rivalain, France | Performance Materials – Specialty Media Manufacturing | Owned | ||

St. Elzear, Quebec, Canada | Technical Nonwovens - Filtration Media Manufacturing | Owned | ||

St. Marie, Quebec, Canada | Technical Nonwovens - Filtration Media Manufacturing | Owned | ||

Rossendale, United Kingdom | Technical Nonwovens - Filtration Media Manufacturing | Owned | ||

Shanghai, China | Technical Nonwovens - Filtration Media Manufacturing | Leased | ||

North Augusta, South Carolina | Technical Nonwovens - Filtration Media Manufacturing | Owned | ||

Fulda, Germany | Technical Nonwovens - Filtration Media Manufacturing | Leased | ||

Manchester, Connecticut | Corporate Office | Owned | ||

For additional information regarding lease obligations, see Note 14 to the Consolidated Financial Statements. The Company considers its properties to be in good operating condition and suitable and adequate for its present needs. In addition to the properties listed above, the Company has several leases for sales offices and warehouses in the United States, Europe and Asia, which the Company believes are immaterial individually and in the aggregate.

11

Item 3. | LEGAL PROCEEDINGS |

The Company is subject to legal proceedings, claims, investigations and inquiries that arise in the ordinary course of business such as, but not limited to, actions with respect to commercial, intellectual property, employment, personal injury, and environmental matters. The Company believes that it has meritorious defenses against the claims currently asserted against it and intends to defend them vigorously. While the outcome of litigation is inherently uncertain and the Company cannot be sure that it will prevail in any of the cases, subject to the matter referenced below, the Company is not aware of any matters pending that are expected to have a material adverse effect on the Company’s business, financial position, results of operations or cash flows.

As previously disclosed, Lydall Gerhardi GmbH Co. & KG (“Lydall Gerhardi”), an indirect wholly-owned subsidiary of Lydall, Inc. and part of Lydall’s Thermal/Acoustical Metals reporting segment, cooperated with the German Federal Cartel Office, Bundeskartellamt (“German Cartel Office”) in connection with an investigation relating to violations of German anti-trust laws by and among certain European automotive heat shield manufacturers, including Lydall Gerhardi.

In December 2016, Lydall Gerhardi agreed in principle with the German Cartel Office to pay a settlement amount of €3.3 million. The Company recorded the expense of €3.3 million (approximately $3.5 million U.S. Dollars) in December 2016. In July 2017, Lydall Gerhardi entered into a formal settlement agreement with the German Cartel Office, and remitted payment in full in August 2017 of €3.3 million (approximately $3.9 million U.S. Dollars), definitively concluding this matter.

In the fourth quarter of 2016, as part of a groundwater discharging permitting process, water samples collected from wells and process water basins at the Company’s Rochester New Hampshire manufacturing facility, within the Performance Materials segment, showed concentrations of Perfluorinated Compounds (“PFCs”) in excess of state ambient groundwater quality standards.

In January 2017, the Company received a notification from the State of New Hampshire Department of Environmental Services (“NHDES”) naming Lydall Performance Materials, Inc. a responsible party with respect to the discharge of regulated contaminants and, as such, is required to take action to investigate and remediate the impacts in accordance with standards established by the NHDES. The Company conducted a site investigation, the scope of which was reviewed by the NHDES, in order to assess the extent of potential soil and groundwater contamination and develop a remedial action. Based on input received from NHDES in March 2017 with regard to the scope of the site investigation, the Company recorded $0.2 million of expense in the first quarter of 2017 associated with the expected costs of conducting this site investigation.

In the fourth quarter of 2017, the Company completed its state-approved site investigation report and submitted it to the NHDES. The Company does not know the scope or extent of its future obligations, if any, that may arise from the NHDES review of the site investigation report and therefore is unable to estimate the cost of any required future corrective actions. The Company expects a response from the NHDES to the site investigation report in the first quarter of 2018. During the year ended December 31, 2017, the environmental liability of $0.2 million recorded in the first quarter of 2017 has been reduced by $0.2 million reflecting payments made to vendors, resulting in no balance at December 31, 2017.

While the site investigation is complete, the Company cannot be sure that additional costs will not be incurred until a response is received from the NHDES nor that any future corrective action at this location would not have a material effect on the Company’s financial condition, results of operations or liquidity. Provisions for such matters are charged to expense when it is probable that a liability has been incurred and reasonable estimates of the liability can be made. Estimates of environmental liabilities are based on a variety of matters, including, but not limited to, the stage of investigation, the stage of the remedial design, evaluation of existing remediation technologies, and presently enacted laws and regulations. In future periods, a number of factors could significantly impact any estimates of environmental remediation costs.

12

Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

13

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of Lydall, Inc. or its subsidiaries, together with the offices presently held by them, their business experience since January 1, 2013, and their age as of March 2, 2018, the record date of the Company’s 2018 Annual Meeting, are as follows:

Name | Age | Position and Date of Appointment | Other Business Experience Since 2013 | |||

Dale G. Barnhart | 65 | President, Chief Executive Officer (August 27, 2007) | Not applicable | |||

Scott M. Deakin | 51 | President, Lydall Thermal / Acoustical Solutions (August 30, 2017); Executive Vice President and Chief Financial Officer (September 8, 2015) | Executive Vice President and Chief Financial Officer, Ensign-Bickford Industries, Inc. (2009 – 2015), a diversified global manufacturer with operating segments that serve the aerospace & defense, life science, specialty chemicals (divested in 2016) and food & flavoring industries. | |||

Joseph A. Abbruzzi | 59 | President, Technical Nonwovens, (February 20, 2014); formerly Sr. Vice President, General Manager, Lydall Thermal/Acoustical Fibers (March 14, 2011) | Not applicable | |||

James V. Laughlan | 45 | Vice President, Chief Accounting Officer and Treasurer (March 26, 2013); formerly Chief Accounting Officer, Controller and Treasurer (July 27, 2012); formerly Chief Accounting Officer and Controller (March 29, 2010) | Not applicable | |||

Paul A. Marold | 56 | President, Performance Materials (February 15, 2016) | Chief Operating Officer, Sontara, a division of Jacob Holm & Sons (2014-2016), a global manufacturer of spunlace nonwoven fabrics and finished goods; Senior Vice President, Growth & Innovation, Clarcor, Inc. (2013-2014), a global manufacturer of filtration products; President, Clarcor Air Filtration Products (2011-2013), a manufacturer of air filtration products. | |||

Chad A. McDaniel | 44 | Senior Vice President, Chief Administrative Officer and General Counsel (May 13, 2015); formerly Vice President, General Counsel and Secretary (May 10, 2013) | Director, Chase Corporation (2016), NYSE: CCF, a manufacturer of protective materials for high reliability applications; Associate General Counsel, United Technologies Corporation (“UTC”), Sikorsky Aircraft division (2012 – 2013),UTC is a manufacturer of high-technology products and services for the global aerospace and building systems industries. | |||

There is no family relationship among any of the Company’s directors or executive officers.

14

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

PRICE RANGE OF COMMON STOCK AND DIVIDEND HISTORY

The Company’s Common Stock is traded on the New York Stock Exchange (“NYSE”) under the symbol LDL. The table below shows the range of reported sale prices on the NYSE Composite Tape for the Company’s Common Stock for the periods indicated. As of December 31, 2017, 10,214 stockholders of record held 17,343,839 shares of Lydall’s Common Stock, $0.01 par value.

High | Low | Close | ||||||||||

2017 | ||||||||||||

First Quarter | $ | 63.80 | $ | 49.21 | $ | 53.60 | ||||||

Second Quarter | 60.00 | 47.60 | 51.70 | |||||||||

Third Quarter | 58.65 | 45.45 | 57.30 | |||||||||

Fourth Quarter | 60.00 | 49.55 | 50.75 | |||||||||

2016 | ||||||||||||

First Quarter | $ | 35.10 | $ | 25.41 | $ | 32.52 | ||||||

Second Quarter | 40.22 | 32.01 | 38.56 | |||||||||

Third Quarter | 53.30 | 37.96 | 51.13 | |||||||||

Fourth Quarter | 64.85 | 44.14 | 61.85 | |||||||||

The Company does not pay a cash dividend on its Common Stock. The Company’s Amended Credit Facility entered into on July 7, 2016, places no restrictions on cash dividend payments, so long as the payments do not place the Company in default.

ISSUER PURCHASES OF EQUITY SECURITIES

The Company acquired 48,288 shares through withholding during 2017, pursuant to provisions in agreements with recipients of restricted stock granted under the Company’s equity compensation plans, which allow the Company to withhold the number of shares having fair value equal to each recipient’s tax withholding due. The following table details the activity for the fourth quarter ended December 31, 2017.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs | ||||||||

Activity October 1, 2017 - October 31, 2017 | — | $ | — | — | — | |||||||

Activity November 1, 2017 - November 30, 2017 | — | $ | — | — | — | |||||||

Activity December 1, 2017 - December 31, 2017 | 3,936 | $ | 52.73 | — | — | |||||||

Total | 3,936 | $ | 52.73 | — | — | |||||||

15

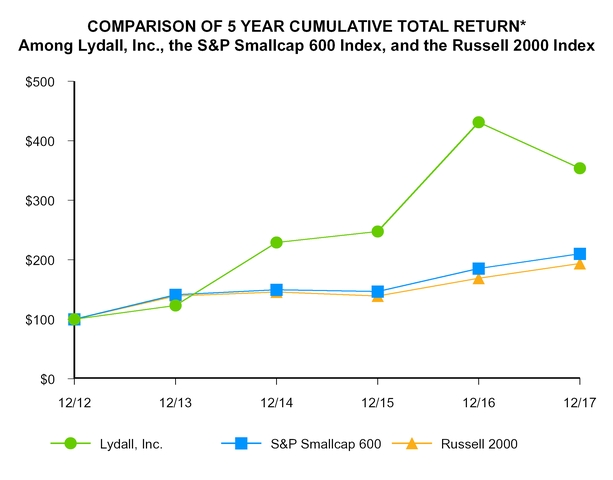

PERFORMANCE GRAPH

The following performance graph and related information shall not be deemed to be “soliciting material” or “filed” for purposes of Section 18 of the Exchange Act, nor shall such information be incorporated by reference into any filing of Lydall, Inc. under the Exchange Act, except to the extent that the Company specifically incorporates it by reference in such filing.

The following graph compares the cumulative total return on Lydall’s shares over the past five years with the cumulative total return on shares of companies comprising the Standard & Poor’s Smallcap 600 Index and the Russell 2000 Index. Cumulative total return is measured assuming an initial investment of $100 on December 31, 2012, including reinvestment of dividends, if any. Due to the diversity of niche businesses that the Company participates in, it is difficult to identify a reasonable peer group or one industry or line-of-business index for comparison purposes. Thus, Lydall has chosen to compare its performance to the Standard & Poor’s Smallcap 600 Index and to the Russell 2000 Index, which are comprised of issuers with generally similar market capitalizations to that of the Company.

12/12 | 12/13 | 12/14 | 12/15 | 12/16 | 12/17 | |||||||||||||

Lydall, Inc. | 100.00 | 122.87 | 228.87 | 247.42 | 431.31 | 353.91 | ||||||||||||

S&P Smallcap 600 | 100.00 | 141.31 | 149.45 | 146.50 | 185.40 | 209.94 | ||||||||||||

Russell 2000 | 100.00 | 138.82 | 145.62 | 139.19 | 168.85 | 193.58 | ||||||||||||

* | $100 invested on 12/31/12 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

16

Item 6. | SELECTED FINANCIAL DATA |

FIVE-YEAR SUMMARY

In thousands except per share amounts and ratio data | 2017 | 2016 (1) | 2015 (2) | 2014 (3) | 2013 | ||||||||||||||

Financial results for the year | |||||||||||||||||||

Net sales | $ | 698,437 | $ | 566,852 | $ | 524,505 | $ | 535,829 | $ | 397,969 | |||||||||

Gross margin | 23.3 | % | 24.4 | % | 23.4 | % | 21.5 | % | 21.4 | % | |||||||||

Operating margin | 9.4 | % | 9.7 | % | 10.0 | % | 6.4 | % | 7.2 | % | |||||||||

Net income | $ | 49,317 | $ | 37,187 | $ | 46,259 | $ | 21,847 | $ | 19,155 | |||||||||

Depreciation and amortization | $ | 26,130 | $ | 19,559 | $ | 17,275 | $ | 17,646 | $ | 12,703 | |||||||||

Capital expenditures | $ | 24,915 | $ | 28,159 | $ | 21,555 | $ | 19,001 | $ | 13,826 | |||||||||

Common stock per share data | |||||||||||||||||||

Basic net income | $ | 2.89 | $ | 2.20 | $ | 2.76 | $ | 1.31 | $ | 1.16 | |||||||||

Diluted net income | $ | 2.85 | $ | 2.16 | $ | 2.71 | $ | 1.28 | $ | 1.14 | |||||||||

Financial position | |||||||||||||||||||

Working capital | $ | 171,389 | $ | 165,162 | $ | 158,303 | $ | 140,229 | $ | 123,577 | |||||||||

Property, plant and equipment, net | $ | 170,332 | $ | 160,795 | $ | 114,433 | $ | 115,357 | $ | 78,863 | |||||||||

Goodwill | $ | 68,969 | $ | 63,606 | $ | 16,841 | $ | 21,943 | $ | 18,589 | |||||||||

Other intangible assets, net | $ | 40,543 | $ | 41,447 | $ | 5,399 | $ | 7,841 | $ | 3,510 | |||||||||

Total assets | $ | 560,871 | $ | 527,029 | $ | 358,260 | $ | 361,770 | $ | 274,685 | |||||||||

Long-term debt, net of current maturities | $ | 76,913 | $ | 128,141 | $ | 20,156 | $ | 40,315 | $ | 1,051 | |||||||||

Total stockholders’ equity | $ | 353,396 | $ | 273,456 | $ | 245,225 | $ | 212,599 | $ | 200,087 | |||||||||

Total debt to total capitalization | 17.9 | % | 32.0 | % | 7.7 | % | 16.1 | % | 0.8 | % | |||||||||

Please read Part II, Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) of this Annual Report on Form 10-K and the Notes to the Consolidated Financial Statements for specific changes in the Company and its markets that provide context to the above data for the years 2015 through 2017 including, without limitation, discussions concerning (i) how global economic uncertainties have affected the Company’s results; (ii) the impact of the acquisitions and divestitures; (iii) the impact of foreign currency translation; (iv) asset impairment charges; (v) consolidation and restructuring charges (vi) the German Cartel settlement and (vii) the Company’s effective tax rate.

(1) During 2016, the Company completed the acquisitions of the Texel and Gutsche businesses. The results of Texel and Gutsche, from their respective acquisition dates on July 7, 2016 and December 31, 2016, have been included within the Company's Consolidated Financial Statements as of and for the year ended December 31, 2016 and contributed to the increase in the balance sheet line items above.

(2) On January 30, 2015, the Company sold all of the outstanding shares of common stock of its Life Sciences Vital Fluids business, reported as Other Products and Services. As a result, the Company recognized a gain on the sale of $18.6 million, reported as non-operating income, and net income of $11.8 million, or $0.69 per diluted share, for the year ended December 31, 2015.

(3) During 2014, the Company completed the acquisition of the filtration businesses of Andrews Industries, Limited on February 20, 2014. The results of these businesses were included within the Company's Consolidated Financial Statements as of and for the year ended December 31, 2014.

17

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview and Outlook

Lydall, Inc. and its subsidiaries (collectively, the “Company” or “Lydall”) designs and manufactures specialty engineered nonwoven filtration media, industrial thermal insulating solutions, and thermal and acoustical barriers for filtration/separation and heat abatement and sound dampening applications. Lydall principally conducts its business through four reportable segments: Performance Materials, Technical Nonwovens, Thermal/Acoustical Metals and Thermal/Acoustical Fibers, with sales globally. Effective January 1, 2018, the Thermal/Acoustical Metals and Thermal/Acoustical Fibers operating segments were combined into a single operating segment named Thermal Acoustical Solutions.