Exhibit 99.1

Cybex International, Inc.

Fair Disclosure

This presentation includes “forward-looking statements”. Forward-looking statements relate to future events or our future financial performance and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those expressed or implied by these forward-looking statements for a number of important factors. These factors include, among others, the successful development and introduction of new products, potential delays and uncertain market acceptance, fluctuations in raw material costs, reliance on third party suppliers, ability to protect intellectual property and possible infringement claims. Additional information regarding these and other factors may be contained in the Company’s SEC filings. We cannot assure you that the assumptions upon which forward-looking statements are based will prove to be correct. We cannot guarantee any future results, levels of activity, performance or achievements. We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in, or implied by, these forward-looking statements, even if new information becomes available in the future.

| 2 |

|

Thumbnail Description

Sales $147M

Strong brand globally

Innovative products

Focused on premium market segment

Full line fitness equipment manufacturer (Strength, Cross Trainer, Treadmill, etc.)

| 3 |

|

Key Business Strategies

Continue to introduce compelling and innovative new cardiovascular and strength fitness products.

Develop extensions and enhancements of existing products, especially the Arc Trainer.

Significantly expand presence in light commercial and high-end home markets.

Increase market share in North America and international markets.

Increase operating efficiencies through automation and flexible, lean manufacturing.

| 4 |

|

Cybex Sales by Product

Strength Bikes Treadmills Steppers Arcs Home Arc Other

27%

2%

5%

39%

1%

20%

6%

| 5 |

|

Customers

CUSTOMER SEGMENTS

COMMERCIAL MARKET (over 90% of Cybex’s 2007 revenue with approximately 160 products)

– Fitness clubs

– YMCAs and JCCs

– Military

LIGHT COMMERCIAL “VERTICAL” MARKET (9 products)

– Hotels, resorts and spas

– Corporate fitness centers

– Schools

HIGH-END HOME MARKET (1 product)

| 6 |

|

Product Lineup

Cardiovascular Equipment

CROSS TRAINERS

Arc Trainer

Total Body Arc Trainer

“One size fits all”… for the first-time exerciser to the pro athlete

Patented advanced stride technology

Superior biomechanics and impact free

Broad resistance range

Gaining market share versus elliptical trainer

| 8 |

|

Home Arc & 425A Arc Trainer

Compact Footprint and design for home use

11 levels of incline

20 levels of resistance

Two water bottle holders

Combines elements of a climber, hiker and skier for more workout versatility

The compact footprint and elegant design.

Delivers balanced loading allowing you to work harder without feeling it for better results in less time.

The adjustable incline lets you have the ultimate in variety.

A resistance range that lets you train as easy as you like or as hard as you need to.

Exceptional programming choices.

9

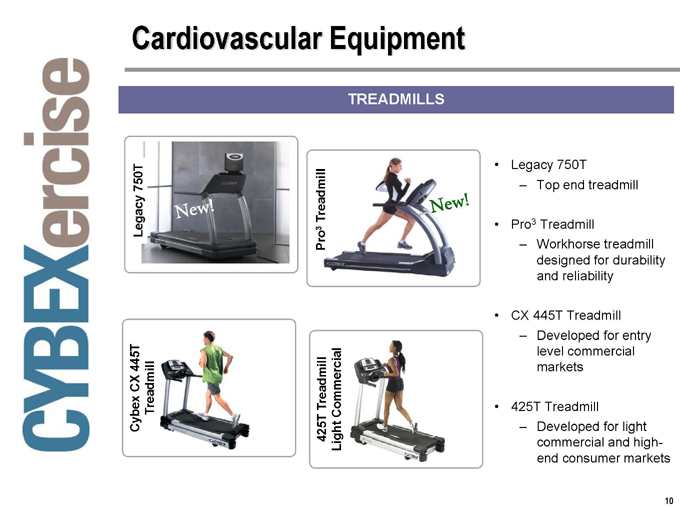

Cardiovascular Equipment

TREADMILLS

Legacy 750T

Cybex CX 445T

Treadmill

Pro3 Treadmill

425T Treadmill Light Commercial

Legacy 750T

– Top end treadmill

Pro3 Treadmill

– Workhorse treadmill designed for durability and reliability

CX 445T Treadmill

– Developed for entry level commercial markets

425T Treadmill

– Developed for light commercial and high-end consumer markets

10

Cardiovascular Equipment

STEPPER & BIKES

Cyclone S- Stepper

Cyclone Upright Bike

Cyclone Recumbent Bike

Cyclone S-Stepper

– Cable drive presents incredibly smooth feel

– Patented braking system provides virtually silent operation

– Welded, heavy-duty steel frame provides exceptional stability

– 29 levels and a speed range from 10–150 feet per minute

– The Heart Rate Control Program keeps you at your desired target heart rate

Upright Bike

– Three modes of operation: bike mode, constant power and isokinetic mode

Recumbent Bike

– Proprietary programs

– For rehabilitation patient to professional athletes

11

Strength Equipment

EAGLE LINE – 20 PIECES – HIGHEST PRICE POINT

Eagle Abdominal

Eagle Leg Press

Eagle Chest Press

Eagle Strength Line

– Group of single-station equipment covers complete scope of a workout

– “Selectorized”, meaning user inserts pin to select the appropriate level of stacked weights

– Fully enclosed weight stacks for safety and aesthetics

– Easy to use and meets needs of performance-based users

– Dual axis technology: unique forced motion or free weight effects

12

Strength Equipment

VR3 LINE –23 PIECES – MIDDLE PRICE POINT

Sales up 42% in 2007!

13

Strength Equipment

NEW VR1 LINE – ENTRY LEVEL PRICE POINT – 15 Pieces –

Sales up 50% Q4 2007!

14

Strength Equipment

NEW VR1 LINE – DUALS – LIGHT COMMERCIAL

15

Product Portfolio

TIMELINE OF NEW PRODUCT INTRODUCTIONS

2002/2003

Arc Trainer

Eagle Strength

Pro+ Treadmill

2004

Total Body Arc Trainer

Recumbent Bike

Upright Bike

Q4 2005/2006

VR3 Strength

425T Treadmill

Trazer

Eagle Strength

445T

425A Arc

350 Home Arc

2007

VR1

AV Solution

750T

REVENUE MIX BY PRODUCT SEGMENT ($ in millions) $127 $115 $103 $90 $82 $147

$125 $100 $75 $50 $25 $0

2002

$11 $40 $31

2003

$11 $41 $38

2004

$11 $43 $49

2005

$13 $41 $61

2006

$12 $47 $68

2007

Commercial

22%

Light Commercial

6%

$12 $56 $79

Cardlovascular

Strength

Other

16

Existing Products

COMMERCIAL

LIGHT COMMERCIAL

CONSUMER

VR3 Strength Eagle Strength Arc Trainer Pro3 Treadmill NEW! 445T Treadmill 750T NEW!

Cyclone Bikes Steppers VR1 Strength NEW!

425 Treadmill 425 Arc Trainer Duals Strength NEW! VR1 Strength NEW!

Home Arc

17

New Product Pipeline

COMMERCIAL

LIGHT COMMERCIAL

CONSUMER

2008

Arc 2

Plate Loaded Line Bike Line

2009

eNova Line 760 Treadmill New Audio/Visual Display Package

2009

Light Commercial Bike Line

2008

Multi-Gym Strength New Home Arc

2009

Another Cardio Product

18

Market Opportunity & Dynamics

CYBEX’S CURRENT PRIMARY MARKET

CYBEX’S EXPANDED MARKET OPPORTUNITY

Commercial

Commercial Light Commercial Premium Home $6 BILLION GLOBAL FITNESS EQUIPMENT MARKET

CYBEX TARGET MARKET

Other Home 58%

Premium Home 14%

Commercial $1.5 billion Light Commercial .3 billion Premium Home .7 billion Total $2.5 billion

Source: Sporting Goods Manufacturers Association, International Health, Racquet & Sportsclub Association and Cybex estimates

19

Distribution and Marketing

Sales and distribution network

– Direct sales force

» Highest incentive-driven compensation in industry

» Includes trainers, exercise scientists and physiologists

– Independent authorized dealers and distributors

– Internet site – www.cybexinternational.com

Cybex Capital arranges leasing and financing with third parties

Cybex Hospitality focuses on hotel, spa and resort market

2007 REVENUE BY SEGMENT

North American Sales 72%

International Sales 28%

Dealer & Distributor Sales 52%

Direct Sales 48%

20

Precision Manufacturing

Vertically integrated manufacturing facilities emphasizing flexibility, consistency and efficiency Operations include fabrication, machining, welding, grinding, assembly and finishing of products Flexibility enables customization of product color and upholstery Products principally “built-to-order”

Medway, Massachusetts

– Treadmills, bikes and Trazer

– 120,000 square feet Owatonna, Minnesota

– Arc Trainer and strength equipment

– New 340,000 square feet facility in Q3 2007

21

Custom Colorization

160 different types of equipment can be customized—colors to coordinate with the customer’s decor as well as upholstery imprinted with customer’s name & logo

22

Customers

SELECTED CUSTOMERS

23

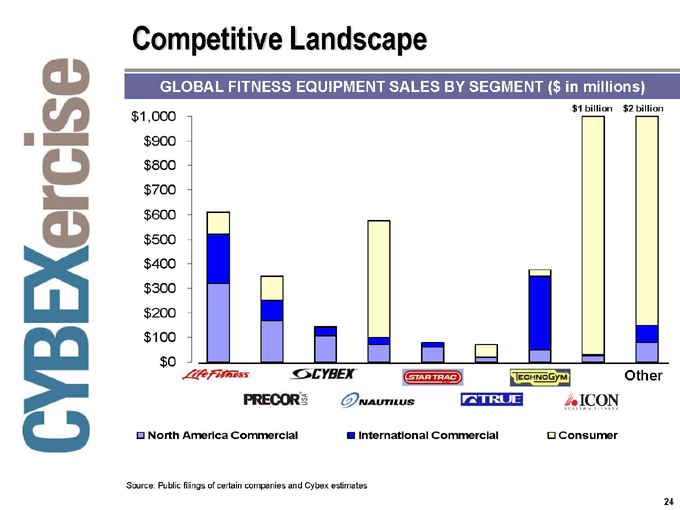

Competitive Landscape

GLOBAL FITNESS EQUIPMENT SALES BY SEGMENT ($ in millions)

$1 billion $2 billion

$1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0

Other

North America Commercial International Commercial Consumer

Source: Public filings of certain companies and Cybex estimates

24

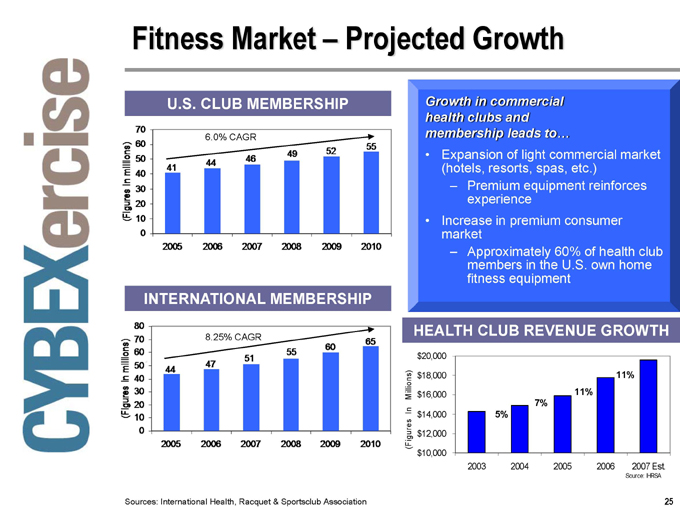

Fitness Market – Projected Growth

U.S. CLUB MEMBERSHIP

6.0% CAGR

INTERNATIONAL MEMBERSHIP

6.0% CAGR

(Figures In Millions)

70 60 50 40 30 20 10 0

41 44 46 49 52 55

2005 2006 2007 2008 2009 2010

8.25% CAGR

80 70 60 50 40 30 20 10 0

44 47 51 55 60 65

2005 2006 2007 2008 2009 2010

(Figures In Millions)

HEALTH CLUB REVENUE GROWTH

$20,000

$18,000 11% $16,000 11% 7%

$14,000 5%

(Figures In Millions) $12,000

$10,000

2003 2004 2005 2006 2007 Est.

Source: IHRSA

Growth in commercial health clubs and membership leads to…

Expansion of light commercial market (hotels, resorts, spas, etc.)

– Premium equipment reinforces experience

Increase in premium consumer market

– Approximately 60% of health club members in the U.S. own home fitness equipment

Sources: International Health, Racquet & Sportsclub Association

25

Financial Overview

Quarterly Sales Growth

22 Consecutive Quarters

50

44.5 45

40 38.2 36.0 34.7 34.7 35 32.6

30.0 29.8 29.9

30 28.9

27.2 26.7 26.6 24.8 25.0 24.4 24.1 25 21.9 20.6 21.1 20

15

10

| 5 |

|

0

‘03 ‘04 ‘05 ‘06 ‘07 ‘03 ‘04 ‘05 ‘06 ‘07 ‘03 ‘04 ‘05 ‘06 07 ‘03 ‘04 ‘05 ‘06 ‘07

First Quarter Second Quarter Third Quarter Fourth Quarter

27

Financial Performance

Trailing 12 months (in thousands, except per share data)

December 31, December 31,

Change

2007 2006

Sales $ 146,503 $ 126,924 15%

Gross Margin % 34.7% 36.8% (2.1%)

Operating Income $ 8,596 $ 9,962 (13%)

Operating Margin % 5.9% 7.8% (1.9%)

Net Income $ 9,754 $ 20,054

EPS $.56 $1.22

28

Solid Balance Sheet

DEBT BALANCE ($MM)

$35.0

$30.0

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

$29.0 $27.1 $24.1 $20.6 $20.0 $18.9

$13.7

$3.8

2002 2003 2004 2005 2006 Q2 2007 Q3 2007 Q4 2007

60 50 40 30 20 10 0

51

47 47

41 40

6.54 7.04 7.00 7.37 6.68

2003 2004 2005 2006 2007

INVENTORY TURNS

7.60 7.40 7.20 7.00 6.80 6.60 6.40 6.20 6.00

7.37

7.04 7.00

6.68 6.54

2003 2004 2005 2006 2007

2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0

CURRENT RATIO

1.8X

1.5X

1.2X 1.1X

0.8X

0.5X

2002 2003 2004 2005 2006 2007

29

Unusual Income Statement Items

2007 2006

Reduction of Deferred Tax Valuation Allowance $ 5,244,000 $ 14,421,000

(After-Tax Income)

SGA:

eNova Investment (net) $ 650,000

Old Treadmill Repair $ 600,000

Home Arc Re-design $ 230,000

Settlement of Licensing Agreement $ (325,000)

$ 1,155,000

Cost of Goods:

Relocation of Owatonna Facility $ 550,000

Home Arc Inventory Reserve $ 250,000

$ 800,000

Interest Expense:

Interest Rate Swap $ 506,000

Total Pre-Tax Charges (net) $ 1,955,000 $ 506,000

30

Financial Goals

Sales Growth Over 10%

Increase in Net Income at Least on Pace with Sales Growth

Strong Balance Sheet

Higher Operating Margins

31

Questions & Answers

Cybex International, Inc.