form_10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 1-7677

LSB INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

(State of Incorporation)

|

|

(I.R.S. Employer)

Identification No.)

|

|

16 South Pennsylvania Avenue

Oklahoma City, Oklahoma

|

|

73107

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's Telephone Number, Including Area Code: (405) 235-4546

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Name of Each Exchange

On Which Registered

|

|

Common Stock, Par Value $.10

Preferred Share Purchase Rights

|

|

New York Stock Exchange

New York Stock Exchange

|

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). [ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [X]

Non-accelerated filer [ ] Smaller reporting company [ ]

(Do not check if a smaller reporting company)

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

The aggregate market value of the Registrant’s voting common equity held by non-affiliates of the Registrant, computed by reference to the price at which the voting common stock was last sold as of June 30, 2010, was approximately $222 million. As a result, the Registrant is an accelerated filer as of December 31, 2010. For purposes of this computation, shares of the Registrant’s common stock beneficially owned by each executive officer and director of the Registrant were deemed to be owned by affiliates of the Registrant as of June 30, 2010. Such determination should not be deemed an admission that such executive officers and directors of our common stock are, in fact, affiliates of the Registrant or affiliates as of the date of this Form 10-K.

As of February 28, 2011, the Registrant had 21,156,897 shares of common stock outstanding (excluding 4,320,462 shares of common stock held as treasury stock).

FORM 10-K OF LSB INDUSTRIES, INC.

| |

|

Page

|

|

| |

|

|

| |

PART I

|

|

| |

|

|

|

|

|

4

|

| |

|

|

|

|

|

16

|

| |

|

|

|

|

|

21

|

| |

|

|

|

|

|

21

|

| |

|

|

|

|

|

22

|

| |

|

|

|

|

|

23

|

| |

|

|

| |

|

23

|

| |

|

|

| |

PART II

|

|

| |

|

|

|

|

|

26

|

| |

|

|

|

|

|

27

|

| |

|

|

|

|

|

28

|

| |

|

|

|

|

|

57

|

| |

|

|

|

|

|

60

|

| |

|

|

|

|

|

60

|

| |

|

|

|

|

|

60

|

| |

|

|

|

|

|

62

|

| |

|

|

| |

PART III

|

|

| |

|

|

|

|

|

64

|

| |

|

|

|

|

|

69

|

| |

|

|

|

|

|

85

|

| |

|

|

|

|

|

89

|

| |

|

|

|

|

|

90

|

| |

|

|

| |

PART IV

|

|

| |

|

|

|

|

|

91

|

PART I

General

LSB Industries, Inc. (“LSB” or “Registrant”) was formed in 1968 as an Oklahoma corporation and became a Delaware corporation in 1977. LSB is a diversified holding company involved in manufacturing, marketing and engineering operations through its subsidiaries. LSB and its wholly-owned subsidiaries (the “Company”, “We”, “Us”, or “Our”) own the following core businesses:

|

·

|

Climate Control Business manufactures and sells a broad range of air conditioning and heating products in the niche markets we serve consisting of geothermal and water source heat pumps, hydronic fan coils, large custom air handlers, modular geothermal chillers and other related products used to control the environment in various structures. Our markets include commercial/institutional and residential new building construction, renovation of existing buildings and replacement of existing systems.

|

|

·

|

Chemical Business manufactures and sells nitrogen based chemical products produced from four plants located in Arkansas, Alabama, Oklahoma, and Texas for the industrial, mining and agricultural markets. Our products include high purity and commercial grade anhydrous ammonia, industrial and fertilizer grade ammonium nitrate (“AN”), urea ammonium nitrate (“UAN”), sulfuric acids, nitric acids in various concentrations, nitrogen solutions, diesel exhaust fluid (“DEF”) and various other products. During the fourth quarter of 2010, we began sustained production of anhydrous ammonia at our previously idled chemical plant located in Oklahoma.

|

We believe our Climate Control Business has developed leadership positions in certain niche markets by offering extensive product lines, customized products and improved technologies. Under this focused strategy, we have developed what we believe to be the most extensive line of geothermal and water source heat pumps and hydronic fan coils in the United States (“U.S.”). Further, we believe that we were a pioneer in the use of geothermal technology in the climate control industry and have used it to create what we believe to be the most energy efficient climate control systems commercially available today. We employ highly flexible production capabilities that allow us to custom design units for new construction as well as the retrofit and replacement markets. This flexibility positions us well for an eventual recovery in commercial/institutional and residential construction markets.

In recent years, we have put heavy emphasis on our geothermal heating, ventilation, and air conditioning (“HVAC”) products, which are considered “green” technology and a form of renewable energy. We believe our geothermal systems are among the most energy efficient systems available in the market for heating and cooling applications in commercial/institutional and single family new construction as well as replacement and renovation markets. In 2010, we captured approximately 38% of the geothermal market, based on Air-Conditioning, Heating and Refrigeration Institute (“AHRI”) reported sales of these products. Although the general construction level has been lower than some previous years in both the commercial/institutional and residential sectors, we have continued to increase our market share of the growing geothermal heating and cooling market.

Our Chemical Business engages in the manufacturing and selling of nitrogen based chemical products from four chemical production facilities located in El Dorado, Arkansas (the “El Dorado Facility”), Cherokee, Alabama (the “Cherokee Facility”), Pryor, Oklahoma (the “Pryor Facility”) and Baytown, Texas (the “Baytown Facility”). Our products include high purity and commercial grade anhydrous ammonia, industrial and fertilizer grade AN, UAN, sulfuric acids, nitric acids in various concentrations, nitrogen solutions, DEF and various other products. Our Chemical Business is a supplier to some of the world’s leading chemical and industrial companies. By focusing on specific geographic areas, we have developed freight and distribution advantages over many of our competitors, and we believe our Chemical Business has established leading regional market positions.

We sell most of our industrial and mining products to customers pursuant to contracts containing minimum volumes or cost plus a profit provision. These contractual sales stabilize the effect of commodity cost changes. Periodically we enter into forward sales commitments for agricultural products but we sell most of our agricultural products at the current spot market price in effect at time of shipment.

As discussed below under “Chemical Business - Agricultural Products,” the Pryor Facility began limited production in the first quarter of 2010 but did not reach sustained production of anhydrous ammonia until the fourth quarter of 2010. This facility’s production will be predominantly agricultural products. We expect this additional production will alter the ratio of our sales of agricultural products to our sales of industrial acids and mining products in the future.

Certain statements contained in this Part I may be deemed to be forward-looking statements. See "Special Note Regarding Forward-Looking Statements."

Current State of the Economy

Since our two core business segments serve several diverse markets, we consider market fundamentals for each market individually as we evaluate economic conditions.

Climate Control Business - Sales for 2010 were down 6% from 2009 due to a 9% reduction in commercial/institutional product sales partially offset by a 6% increase in residential product sales. The reduction in commercial/institutional sales was due to lower order levels during the latter part of 2009 and first quarter of 2010 as a result of the slowdown in commercial/institutional construction coupled with a lower product order backlog at the beginning of 2010 compared with the beginning of 2009. We have seen an increase in the level of commercial/institutional orders in the last three quarters of 2010 over the order levels in 2009. Sales and order levels of our residential products continue to increase year over year despite the slowdown in new residential construction. Based upon published reports of leading indicators, including the Construction Market Forecasting Service (“CMFS”) published by McGraw-Hill as well as the National Architecture Billings Index (“NABI”) published by American Institute of Architects (“AIA”), the overall commercial/institutional construction sector should increase modestly during 2011, where as CMFS and AIA have projected more aggressive growth in residential construction contract activity during 2011. Another factor that may affect product order rates going forward is the potential for growth in our highly energy-efficient geothermal water-source heat pumps, which could benefit significantly from government stimulus programs, including various tax incentives, although we cannot predict the impact these programs will have on our business.

The Chemical Business - Our Chemical Business’ primary markets are industrial, mining and agricultural. During 2010, approximately 61% of our Chemical Business’ sales were into industrial and mining markets of which approximately 69% of these sales are to customers that have contractual obligations to purchase a minimum quantity or allow us to recover our cost plus a profit, irrespective of the volume of product sold. During 2010, customer demand for our industrial and mining products increased over 2009. We believe that such demand will continue to increase in 2011 as the industrial markets in the United States continue to recover based on the American Chemistry Council’s Chemistry and Economic Report.

The remaining 39% of our Chemical Business’ sales in 2010 were made into the agricultural fertilizer markets to customers that primarily purchase at spot market prices and not pursuant to contractual arrangements. Our agricultural sales volumes and margins depend upon the supply of and the demand for fertilizer, which in turn depends on the market fundamentals for crops including corn, wheat and forage. The current outlook according to most market indicators, including reports in Green Markets, Fertilizer Week and the USDA’s World Agricultural Supply and Regional Estimates, point to positive supply and demand fundamentals for the types of nitrogen fertilizer products we produce and sell. However, it is possible that the fertilizer outlook could change if there are unanticipated changes in commodity prices, acres planted or unfavorable weather conditions. During 2010, the anhydrous ammonia market price increased while natural gas costs generally declined. Our Cherokee and Pryor Facilities produce anhydrous ammonia and UAN from natural gas and have benefited from increased margins. On the other hand, our El Dorado Facility is at a current cost disadvantage for their agricultural grade AN, which is produced from purchased ammonia, compared to their competitors that produce from natural gas.

See further discussion relating to the economy under various risk factors under Item 1A of this Part 1 and “Overview-Economic Conditions” of the Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) contained in this report.

Website Access to Company's Reports

Our internet website address is www.lsb-okc.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act are available free of charge through our website within a reasonable amount of time after they are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”).

Segment Information and Foreign and Domestic Operations and Export Sales

Schedules of the amounts of net sales, gross profit, operating income (loss) and identifiable assets attributable to each of our lines of business and of the amount of our export sales in the aggregate and by major geographic area for each of the last three years appear in Note 21 of the Notes to Consolidated Financial Statements included elsewhere in this report.

Climate Control Business

General

Our Climate Control Business manufactures and sells a broad range of standard and custom designed geothermal and water source heat pumps and hydronic fan coils as well as large custom air handlers and modular chiller systems, including modular geothermal chillers. These products are for use in commercial/institutional and residential HVAC systems. Our products are installed in some of the most recognizable commercial/institutional developments in the United States, including the Prudential Tower, Rockefeller Plaza, Trump Tower, Time Warner Center and many others. In addition, we have a significant presence in the lodging sector with installations in numerous Hyatt, Marriott, Four Seasons, Starwood, Ritz Carlton and Hilton hotels. During 2009 and 2010, our Climate Control Business saw a significant decline in sales associated with the multi-family residential and lodging sectors due to the economic downturn.

The following table summarizes net sales information relating to our products of the Climate Control Business:

|

Percentage of net sales of the Climate Control Business:

|

|

|

|

|

|

|

|

|

|

|

Geothermal and water source heat pumps

|

|

69

|

%

|

|

68

|

%

|

|

61

|

%

|

|

Hydronic fan coils

|

|

15

|

%

|

|

17

|

%

|

|

27

|

%

|

|

Other HVAC products

|

|

16

|

%

|

|

15

|

%

|

|

12

|

%

|

| |

|

100

|

%

|

|

100

|

%

|

|

100

|

%

|

|

Percentage of LSB’s consolidated net sales:

|

|

|

|

|

|

|

|

|

|

|

Geothermal and water source heat pumps

|

|

28

|

%

|

|

34

|

%

|

|

25

|

%

|

|

Hydronic fan coils

|

|

6

|

%

|

|

9

|

%

|

|

11

|

%

|

|

Other HVAC products

|

|

7

|

%

|

|

7

|

%

|

|

5

|

%

|

| |

|

41

|

%

|

|

50

|

%

|

|

41

|

%

|

Market Conditions - Climate Control Business

As discussed above, based upon published reports of leading indicators, including CMFS as well as AIA, the overall commercial/institutional construction sector should increase modestly during 2011, where as CMFS and AIA have projected more aggressive growth in residential construction contract activity during 2011.

In addition, we believe that tax credits and incentives, and certain planned direct spending by the federal government contained in the American Reinvestment and Recovery Act of 2009, have and could continue to stimulate sales of our geothermal heat pump products, as well as other “green” products.

Geothermal and Water Source Heat Pumps

We believe our Climate Control Business is a leading provider of geothermal and water source heat pumps to the commercial/institutional construction and renovation markets in the United States. Water source heat pumps are highly efficient heating and cooling products, which enable individual room climate control through the transfer of heat using a water pipe system connected to a centralized cooling tower or heat injector. Water source heat pumps enjoy a broad range of commercial/institutional applications, particularly in medium to large sized buildings with many small, individually controlled spaces. We believe the market share for commercial/institutional water source heat pumps relative to other types of heating and air-conditioning systems will continue to grow due to the relative efficiency and longevity of such systems, as well as due to the emergence of the replacement market for those systems.

We have also developed the use of geothermal heat pumps in residential and commercial/institutional applications. Geothermal systems, which circulate water or a combination of water and antifreeze through an underground heat exchanger, are among the most energy efficient systems currently available in the market. We believe the energy efficiency, longer life, and relatively short payback periods of geothermal systems, as compared with other systems, as well as tax incentives that are available to homeowners and businesses when installing geothermal systems, will continue to increase demand for our geothermal products. Our products are sold to the commercial/institutional markets, as well as single and multi-family residential new construction, renovation and replacements.

Hydronic Fan Coils

We believe that our Climate Control Business is a leading provider of hydronic fan coils targeting the commercial/institutional markets. Hydronic fan coils use heated or chilled water provided by a centralized chiller or boiler, through a water pipe system, to condition the air and allow individual room control. Hydronic fan coil systems are quieter, have longer lives and lower maintenance costs than other comparable systems used where individual room control is required. Important components of our strategy for competing in the commercial/institutional renovation and replacement markets include the breadth of our product line coupled with customization capability provided by a flexible manufacturing process. Hydronic fan coils enjoy a broad range of commercial/institutional applications, particularly in medium to large sized buildings with many small, individually controlled spaces.

Production, Capital Investments and Backlog - Climate Control Business

We manufacture our products in many sizes and configurations, as required by the purchaser, to fit the space and capacity requirements of hotels, motels, schools, hospitals, apartment buildings, office buildings and other commercial/institutional or residential structures. In addition, most customer product orders are placed well in advance of required delivery dates.

During 2010, we invested approximately $7.2 million in additional property, plant and equipment (“PP&E”) primarily relating to the exercise of an option, pursuant to the terms of the underlying operating lease, to purchase a portion of a production facility. Our investment also included production equipment and other upgrades for additional capacity relating to our Climate Control Business.

As of December 31, 2010, we have committed to spend an additional $1.8 million primarily for production equipment and facility upgrades. Additional investments will depend upon our long-term outlook for the economic conditions that might affect our markets. These investments have and will continue to increase our capacity to produce and distribute our Climate Control products. See discussions under “Liquidity and Capital Resources-Capital Expenditures” of Item 7 of Part II of this report, including Advanced Manufacturing Energy Credits awarded to two subsidiaries of the Climate Control Business.

As of December 31, 2010 and 2009, the backlog of confirmed customer product orders (purchase orders from customers that have been accepted and received credit approval) for our Climate Control Business was approximately $47.6 million and $32.2 million, respectively. The increase in our backlog is primarily the result of increased order levels for our commercial/institutional products, which typically have longer lead times for production scheduling. The backlog of product orders generally does not include amounts relating to shipping and

handling charges, service orders or service contract orders and exclude contracts related to our engineering and construction business due to the relative size of individual projects and, in some cases, extended timeframe for completion beyond a twelve-month period.

Historically, we have not experienced significant cancellations relating to our backlog of confirmed customer product orders and we expect to ship substantially all of these orders within the next twelve months; however, it is possible that some of our customers could cancel a portion of our backlog or extend the shipment terms.

Distribution - Climate Control Business

Our Climate Control Business sells its products primarily to mechanical contractors, original equipment manufacturers (“OEMs”) and distributors. Our sales to mechanical contractors primarily occur through independent manufacturers' representatives, who also represent complementary product lines not manufactured by us. OEMs generally consist of other air conditioning and heating equipment manufacturers who resell under their own brand name the products purchased from our Climate Control Business in competition with us. The following table summarizes net sales to OEMs relating to our products of the Climate Control Business:

|

Net sales to OEMs as a percentage of:

|

|

|

|

|

|

|

|

|

|

|

Net sales of the Climate Control Business

|

|

24

|

%

|

|

23

|

%

|

|

20

|

%

|

|

LSB’s consolidated net sales

|

|

10

|

%

|

|

11

|

%

|

|

9

|

%

|

Market - Climate Control Business

Our Climate Control Business market includes commercial/institutional and residential new building construction, renovation of existing buildings and replacement of existing systems.

Raw Materials and Components - Climate Control Business

Numerous domestic and foreign sources exist for the materials and components used by our Climate Control Business, which include compressors, copper, steel, electric motors, aluminum, and valves. Periodically, our Climate Control Business enters into futures contracts for copper. We do not anticipate any difficulties in obtaining necessary materials and components for our Climate Control Business. Although we believe we will be able to pass to our customers the majority of any cost increases in the form of higher prices, the timing of these price increases could lag the increases in the cost of materials and components. While we believe we will have sufficient sources for materials and components, a shortage could impact production of our Climate Control products.

Regulatory Matters - Climate Control Business

The American Reinvestment and Recovery Act of 2009 contains significant incentives for the installation of our geothermal products. Also see discussion concerning Advanced Manufacturing Energy Credits awarded to two subsidiaries under “Liquidity and Capital Resources - Capital Expenditures” of Item 7 of Part II of this report.

Competition - Climate Control Business

Our Climate Control Business competes primarily with several companies, such as Carrier, Trane, Florida Heat Pump, and McQuay, some of whom are also our customers. Some of our competitors serve other markets and have greater financial and other resources than we do. We believe our Climate Control Business manufactures a broader line of geothermal and water source heat pump and fan coil products than any other manufacturer in the United States and that we are competitive as to price, service, warranty and product performance.

Continue to Introduce New Products - Climate Control Business

Based on business plans and key objectives submitted by subsidiaries within our Climate Control Business, we expect to continue to launch new products and product upgrades in an effort to maintain and increase our current market position and to establish a presence in new markets served by the Climate Control Business.

Chemical Business

General

Our Chemical Business manufactures products for three principal markets:

|

·

|

anhydrous ammonia, fertilizer grade AN, UAN, and ammonium nitrate ammonia solution (“ANA”) for agricultural applications,

|

|

·

|

high purity and commercial grade anhydrous ammonia, high purity AN, sulfuric acids, concentrated, blended and regular nitric acid, mixed nitrating acids, and DEF for industrial applications, and

|

|

·

|

industrial grade AN and solutions for the mining industry.

|

The following table summarizes net sales information relating to our products of the Chemical Business:

|

Percentage of net sales of the Chemical Business:

|

|

|

|

|

|

|

|

|

|

|

Agricultural products

|

|

39

|

%

|

|

41

|

%

|

|

36

|

%

|

|

Industrial acids and other chemical products

|

|

36

|

%

|

|

37

|

%

|

|

38

|

%

|

|

Mining products

|

|

25

|

%

|

|

22

|

%

|

|

26

|

%

|

| |

|

100

|

%

|

|

100

|

%

|

|

100

|

%

|

|

Percentage of LSB’s consolidated net sales:

|

|

|

|

|

|

|

|

|

|

|

Agricultural products

|

|

22

|

%

|

|

20

|

%

|

|

20

|

%

|

|

Industrial acids and other chemical products

|

|

21

|

%

|

|

18

|

%

|

|

22

|

%

|

|

Mining products

|

|

15

|

%

|

|

11

|

%

|

|

15

|

%

|

| |

|

58

|

%

|

|

49

|

%

|

|

57

|

%

|

Market Conditions - Chemical Business

We discuss below certain details of our agricultural products, industrial acids and other chemical products, mining products, major customers, raw materials and other sales and industry issues affecting our Chemical Business.

As discussed above and in more detail under “Overview-Economic Conditions” of the MD&A contained in this report, it appears that customer demand for our industrial, mining and agricultural products will be sufficiently strong to allow us to run the four chemical plants at optimal production rates, which is an important operating characteristic in chemical process plants. The industrial and mining customer demand is predominantly driven by contractual arrangements with certain large customers. The fertilizer outlook could be affected by significant changes in commodity prices, acres planted or weather conditions.

Agricultural Products

Our Chemical Business produces agricultural grade AN at the El Dorado Facility, anhydrous ammonia and UAN at the Pryor Facility, and anhydrous ammonia, UAN, and ANA at the Cherokee Facility; all of which are nitrogen based fertilizers. Farmers and ranchers decide which type of nitrogen-based fertilizer to apply based on the crop planted, soil and weather conditions, regional farming practices and relative nitrogen fertilizer prices. Our agricultural markets include a high concentration of pastureland and row crops, which favor our products. We sell these agricultural products to farmers, ranchers, fertilizer dealers and distributors primarily in the ranch land and grain production markets in the United States. We develop our market position in these areas by emphasizing high quality products, customer service and technical advice. During the past few years, we have been successful in expanding outside our traditional markets by barging to distributors on the Tennessee and Ohio rivers, and by railing

into certain Western States. The El Dorado Facility produces a high performance AN fertilizer that, because of its uniform size, is easier to apply than many competing nitrogen-based fertilizer products.

Our subsidiary, El Dorado Chemical Company (“EDC”) establishes long-term relationships with end-users through its network of wholesale and retail distribution centers and our subsidiary, Cherokee Nitrogen Company (“CNC”) sells directly to agricultural customers. Our subsidiary, Pryor Chemical Company (“PCC”), which owns the Pryor Facility, is primarily selling anhydrous ammonia for the agricultural market and is also a party to an UAN purchase and sale agreement (the “UAN Agreement”) with Koch Nitrogen Company (“Koch”) under which Koch agrees to purchase and distribute substantially all of the UAN at market prices produced at the Pryor Facility. The term of the UAN Agreement is through June 2014, but may be terminated earlier by either party pursuant to the terms of the agreement.

The Pryor Facility began limited production of anhydrous ammonia and UAN in the first quarter of 2010. The Pryor Facility did not reach sustained production of anhydrous ammonia until the fourth quarter of 2010. Throughout November and December, market demand for ammonia was strong and most ammonia produced at the Pryor Facility was sold, rather than converted to UAN. During November and December 2010, the Pryor Facility produced a total of approximately 33,000 tons of anhydrous ammonia. Approximately 4,700 tons of the ammonia were converted into 11,500 tons of UAN and most of the balance was sold as ammonia. We expect to begin to convert more anhydrous ammonia to UAN, which will be sold to Koch as discussed above. Currently, the products sold from the Pryor Facility are predominantly agricultural fertilizer.

Industrial Acids and Other Chemical Products

Our Chemical Business manufactures and sells industrial acids and other chemical products primarily to the polyurethane, paper, fibers, fuel additives, emission control, and electronics industries. We are a major supplier of concentrated nitric acid and mixed nitrating acids, specialty products used in the manufacture of fibers, gaskets, fuel additives, ordnance, and other chemical products. In addition, at the El Dorado Facility, we produce and sell blended and regular nitric acid and we are a niche market supplier of sulfuric acid, primarily to the region’s key paper and related chemical manufacturers. At the Cherokee Facility, we are also a niche market supplier of industrial and high purity ammonia for many specialty applications, including the reduction of air emissions from power plants. As discussed below under “Introduction of New Product” of this Item 1, in January 2010, the Cherokee Facility began producing and selling DEF. In addition, the Pryor Facility is a supplier of anhydrous ammonia to industrial markets for use in a number of industrial manufacturing applications.

We believe the Baytown Facility is one of the largest nitric acid manufacturing units in the United States, with demonstrated capacity exceeding 1,350 short tons per day. The majority of the Baytown Facility’s production is sold to Bayer pursuant to a long-term contract (the “Bayer Agreement”) that provides for a pass-through of certain costs, including the anhydrous ammonia costs, plus a profit. The initial term of the Bayer Agreement is through June 2014, with certain renewal options.

We compete based upon service, price, location of production and distribution sites, product quality and performance. We also believe we are one of the largest domestic merchant marketers of concentrated and blended nitric acids and provide inventory management as part of the value-added services offered to certain customers.

Mining Products

Our Chemical Business manufactures industrial grade AN at the El Dorado Facility and 83% AN solution at the Cherokee Facility for the mining industry. Effective January 1, 2010, EDC is a party to a long-term cost-plus supply agreement (the “Orica Agreement”). Under the Orica Agreement, EDC supplies Orica International Pte Ltd. with a significant volume of industrial grade AN per year for a term through December 2014. The Orica Agreement replaced EDC’s previous agreement to supply industrial grade AN to Orica USA, Inc.

Major Customers - Chemical Business

The following summarizes net sales to our major customers relating to our products of the Chemical Business:

|

Net sales to Orica as a percentage of:

|

|

|

|

|

|

|

|

|

|

Net sales of the Chemical Business

|

18

|

%

|

|

14

|

%

|

|

19

|

%

|

|

LSB’s consolidated net sales

|

11

|

%

|

|

7

|

%

|

|

11

|

%

|

| |

|

|

|

|

|

|

|

|

|

Net sales to Bayer as a percentage of:

|

|

|

|

|

|

|

|

|

|

Net sales of the Chemical Business

|

13

|

%

|

|

14

|

%

|

|

19

|

%

|

|

LSB’s consolidated net sales

|

8

|

%

|

|

7

|

%

|

|

11

|

%

|

Raw Materials - Chemical Business

The products our Chemical Business manufactures are primarily derived from the following raw material feedstocks: anhydrous ammonia, natural gas and sulfur. These raw material feedstocks are commodities, subject to price fluctuations.

The El Dorado Facility purchases approximately 200,000 tons of anhydrous ammonia and 55,000 tons of sulfur annually and produces and sells approximately 470,000 tons of nitrogen-based products and approximately 165,000 tons of sulfuric acid per year. Although anhydrous ammonia is produced from natural gas, the price does not necessarily follow the spot price of natural gas in the U.S. because anhydrous ammonia is an internationally traded commodity and the relative price is set in the world market while natural gas is primarily a nationally traded commodity. The ammonia supply to the El Dorado Facility is transported from the Gulf of Mexico by pipeline. Under an agreement with its principal supplier of anhydrous ammonia, EDC purchases a majority of its anhydrous ammonia requirements for its El Dorado Facility through December 2012 from this supplier. Periodically, we will enter into futures/forward contracts to economically hedge the cost of certain of the anhydrous ammonia requirements. We believe that we can obtain anhydrous ammonia from other sources in the event of an interruption of service under the above-referenced contract. Prices for anhydrous ammonia during 2010 ranged from $300 to $470 per metric ton. During 2010, the average prices for sulfur ranged from $90 to $160 per long ton.

The Cherokee Facility normally consumes 5 to 6 million MMBtu’s of natural gas to produce and sell approximately 300,000 to 370,000 tons of nitrogen-based products per year. Natural gas is a primary raw material for producing anhydrous ammonia and UAN. The Cherokee Facility’s natural gas feedstock requirements are generally purchased at spot market price. Periodically, we will enter into futures/forward contracts to economically hedge the cost of certain of the natural gas requirements. In 2010, daily spot prices per MMBtu, excluding transportation, ranged from $3.11 to $7.37. Periodically, the Cherokee Facility purchases anhydrous ammonia to supplement its annual production capacity of approximately 175,000 tons. Anhydrous ammonia can be delivered to Cherokee Facility by truck, rail or barge.

The Baytown Facility typically consumes more than 100,000 tons of purchased anhydrous ammonia per year; however, the majority of the Baytown Facility’s production is sold to Bayer pursuant to the Bayer Agreement that provides for a pass-through of certain costs, including the anhydrous ammonia costs, plus a profit.

At the Pryor Facility, natural gas is a primary raw material for producing anhydrous ammonia and UAN. The Pryor Facility’s natural gas feedstock requirements are generally purchased at spot market price. Periodically, we will enter into futures/forward contracts to economically hedge the cost of certain of the natural gas requirements. We plan to produce and sell approximately 325,000 tons of UAN annually. In addition to the UAN production, we believe we have excess ammonia capacity which, if achievable, would allow us to sell up to 90,000 tons of ammonia annually. At these rates, the Pryor Facility would consume approximately 6.9 million MMBtu’s of natural gas annually.

Spot anhydrous ammonia, natural gas and sulfur costs have fluctuated dramatically in recent years. The following table shows, for the periods indicated, the high and low published prices for:

|

·

|

ammonia based upon the low Tampa metric price per ton as published by Fertecon and FMB Ammonia reports,

|

|

·

|

natural gas based upon the daily spot price at the Tennessee 500 pipeline pricing point, and

|

|

·

|

sulfur based upon the average quarterly Tampa price per long ton as published in Green Markets.

|

| |

Ammonia Price

Per Metric Ton

|

|

Natural Gas

Prices Per MMBtu

|

|

Sulfur Price

Per Long Ton

|

| |

High

|

|

Low

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

2010

|

$470

|

|

$300

|

|

$ 7.37

|

|

$3.11

|

|

$160

|

|

$ 90

|

|

2009

|

$355

|

|

$125

|

|

$ 6.08

|

|

$1.87

|

|

$ 30

|

|

minimal

|

|

2008

|

$931

|

|

$125

|

|

$13.16

|

|

$5.36

|

|

$617

|

|

$150

|

As of February 28, 2011, the published price, as described above, for ammonia was $515 per metric ton and natural gas was $3.75 per MMBtu. The price per long ton for sulfur was $185 per long ton.

Sales Strategy - Chemical Business

Our Chemical Business has pursued a strategy of developing customers that purchase substantial quantities of products pursuant to sales agreements and/or pricing arrangements that provide for the pass through of raw material costs in order to minimize the impact of the uncertainty of the sales prices of our products in relation to the cost of raw materials (anhydrous ammonia, natural gas and sulfur). These pricing arrangements help mitigate the volatility risk inherent in the raw material feedstocks. For 2010, approximately 61% of the Chemical Business’ sales were into industrial and mining markets of which approximately 69% of these sales were made pursuant to these types of arrangements. The remaining 39% of our 2010 sales were into agricultural markets primarily at the price in effect at time of shipment. We enter into futures/forward contracts to economically hedge the cost of natural gas and anhydrous ammonia for the purpose of securing the profit margin on a certain portion of our sales commitments with firm sales prices in our Chemical Business. During 2011, we expect that the agricultural sales as a percent of total sales will increase significantly as a result of the planned annual production of 325,000 ton of UAN at the Pryor Facility.

The sales prices of our agricultural products have only a moderate correlation to the anhydrous ammonia and natural gas feedstock costs and reflect market conditions for like and competing nitrogen sources. This can compromise our ability to recover our full cost to produce the product in this market. Additionally, the lack of sufficient non-seasonal sales volume to operate our manufacturing facilities at optimum levels can preclude the Chemical Business from reaching full performance potential. Our primary efforts to improve the results of our Chemical Business include maximizing the production at our chemical facilities and emphasizing our marketing efforts to customers that will accept the volatility risk inherent with natural gas and anhydrous ammonia, while maintaining a strong presence in the agricultural sector.

Introduction of New Product - Chemical Business

As part of the Clean Air Act, the United States Environmental Protection Agency (“EPA”) enacted emissions standards, which became effective in 2010, that require the further reduction of nitrogen oxide emissions from diesel engines, starting with heavy-duty vehicles. CNC has developed DEF under the trade name, EarthPure DEFTM, specifically for this application. CNC began production of DEF in January 2010. The production of DEF is currently relatively small as the market is in the early stage of development. We expect this market to grow as the domestic heavy-duty truck fleet is replaced in future years.

Seasonality - Chemical Business

We believe that the only significant seasonal products that we market are fertilizer and related chemical products sold by our Chemical Business to the agricultural industry. The selling seasons for those products are primarily during the spring and fall planting seasons, which typically extend from March through June and from September through November in the geographical markets in which the majority of our agricultural products are distributed. As

a result, our Chemical Business typically increases its inventory of AN and UAN prior to the beginning of each planting season. In addition, the amount and timing of sales to the agricultural markets depend upon weather conditions and other circumstances beyond our control.

Regulatory Matters - Chemical Business

Our Chemical Business is subject to extensive federal, state and local environmental laws, rules and regulations as discussed under “Environmental Matters" of this Item 1 and various risk factors under Item 1A.

Competition - Chemical Business

Our Chemical Business competes with several chemical companies in our markets, such as Agrium, CF Industries, Dyno Nobel, Koch, Potash Corporation of Saskatchewan, and Yara International, many of whom have greater financial and other resources than we do. We believe that competition within the markets served by our Chemical Business is primarily based upon service, price, location of production and distribution sites, and product quality and performance.

In addition, see discussion concerning potential increase of imported fertilizer grade AN and UAN under Item 1A of this Part 1.

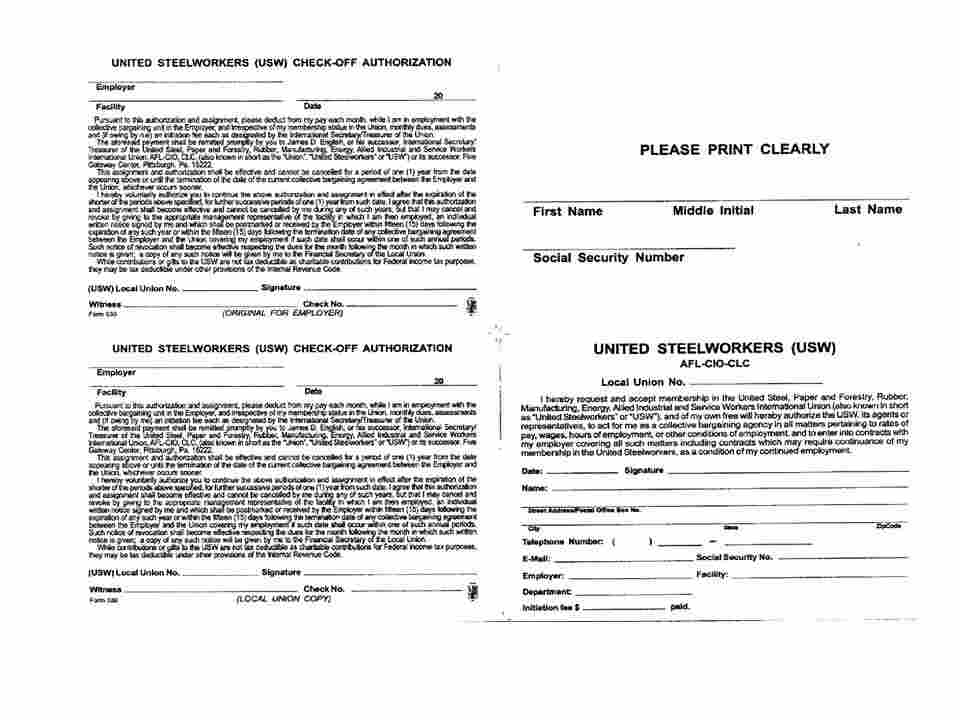

Employees

As of December 31, 2010, we employed 1,780 persons. As of that date, our Climate Control Business employed 1,233 persons, none of whom were represented by a union, and our Chemical Business employed 480 persons, with 148 represented by unions under agreements that expire in July through November of 2013.

Environmental Matters

Our operations are subject to numerous environmental laws (“Environmental Laws”) and to other federal, state and local laws regarding health and safety matters (“Health Laws”). In particular, the manufacture and distribution of chemical products are activities which entail environmental risks and impose obligations under the Environmental Laws and the Health Laws, many of which provide for certain performance obligations, substantial fines and criminal sanctions for violations. There can be no assurance that we will not incur material costs or liabilities in complying with such laws or in paying fines or penalties for violation of such laws. The Environmental Laws and Health Laws and enforcement policies thereunder relating to our Chemical Business have in the past resulted, and could in the future result, in compliance expenses, cleanup costs, penalties or other liabilities relating to the handling, manufacture, use, emission, discharge or disposal of effluents at or from our facilities or the use or disposal of certain of its chemical products. Historically, significant expenditures have been incurred by subsidiaries within our Chemical Business in order to comply with the Environmental Laws and Health Laws and are reasonably expected to be incurred in the future.

We are obligated to monitor certain discharge water outlets at our Chemical Business facilities should we discontinue the operations of a facility. We also have certain facilities in our Chemical Business that contain asbestos insulation around certain piping and heated surfaces, which we plan to maintain or replace, as needed, with non-asbestos insulation through our standard repair and maintenance activities to prevent deterioration.

1. Discharge Water Matters

The El Dorado Facility owned by EDC generates process wastewater, which includes cooling tower and boiler blowdowns, contact storm water and miscellaneous spills and leaks from process equipment. The process water discharge, storm-water runoff and miscellaneous spills and leaks are governed by a state National Pollutant Discharge Elimination System (“NPDES”) discharge water permit issued by the Arkansas Department of Environmental Quality (“ADEQ”), which permit is generally required to be renewed every five years. The El Dorado Facility is currently operating under a NPDES discharge water permit (“2004 NPDES permit”), which became effective in 2004. In November 2010, a preliminary draft of a discharge water permit renewal, which contains more restrictive ammonia limits, was issued by the ADEQ for EDC’s review. EDC submitted comments to

the ADEQ on the draft permit in December 2010. The preliminary draft is subject to approval by the EPA of the rule change.

The El Dorado Facility has generally demonstrated its ability to comply with applicable ammonia and nitrate permit limits, and believes that if it is required to meet the more restrictive dissolved minerals permit levels, it should be able to do so. However, as part of our long-term compliance plan, EDC is pursuing a rulemaking and permit modification with the ADEQ. The ADEQ approved a rule change, subject to certification by the Arkansas Secretary of State and approval by the EPA. The ADEQ incorporated the revised dissolved minerals limits in the preliminary draft permit received in November 2010.

During January 2010, EDC received an Administrative Order from the EPA noting certain violations of the 2004 NPDES permit and requesting EDC to demonstrate compliance with the permit or provide a plan and schedule for returning to compliance. EDC has provided the EPA a response which states that the El Dorado Facility is now in compliance with the permit, that the El Dorado Facility expects to maintain compliance and that a majority of the alleged violations were resolved through a consent administrative order with the ADEQ. During the meeting with the EPA prior to the issuance of the Administrative Order, the EPA advised EDC that its primary objective was to bring the El Dorado Facility into compliance with the 2004 NPDES permit requirements, but reserved the right to assess penalties for past and continuing violations of the permit. As a result, it is unknown whether the EPA might elect to pursue civil penalties against EDC. Therefore, no liability has been established at December 31, 2010 as a result of the Administrative Order.

In conjunction with our long-term compliance plan, the city of El Dorado, Arkansas received approval to construct a pipeline for disposal of wastewater generated by the city and by certain companies in the El Dorado area. The companies intending to use the pipeline will contribute to the cost of construction and operation of the pipeline. Although EDC believes it can comply with the more restrictive permit limits, EDC intends to participate in the construction of the pipeline that will be owned by the city in order to ensure that EDC will be able to comply with future permit limits. EDC anticipates its cost in connection with the construction of the pipeline for EDC’s right to use the pipeline to dispose of its wastewater will be approximately $4.0 million. The city plans to complete the construction of the pipeline in 2013.

In addition, the El Dorado Facility is currently operating under a consent administrative order (“2006 CAO”) that recognizes the presence of nitrate contamination in the shallow groundwater. The 2006 CAO requires EDC to continue semi-annual groundwater monitoring, to continue operation of a groundwater recovery system and to submit a human health and ecological risk assessment to the ADEQ relating to the El Dorado Facility. The final remedy for shallow groundwater contamination, should any remediation be required, will be selected pursuant to a new consent administrative order and based upon the risk assessment. The cost of any additional remediation that may be required will be determined based on the results of the investigation and risk assessment, which costs (or range of costs) cannot currently be reasonably estimated. Therefore, no liability has been established at December 31, 2010, in connection with this matter.

2. Air Matters

The EPA has sent information requests to most, if not all, of the nitric acid plants in the United States, including to us relating to our El Dorado and Cherokee Facilities and the Baytown Facility. The EPA is requesting information under Section 114 of the Clean Air Act as to construction and modification activities at each of these facilities over a period of years to enable the EPA to determine whether these facilities are in compliance with certain provisions of the Clean Air Act. In connection with a review by our Chemical Business of these facilities in obtaining information for the EPA pursuant to the EPA’s request, our Chemical Business management believes, subject to further review, investigation and discussion with the EPA, that certain facilities within our Chemical Business may be required to make certain capital improvements to certain emission equipment in order to comply with the requirements of the Clean Air Act. If changes to the production equipment at these facilities are required in order to bring this equipment into compliance with the Clean Air Act, the type of emission control equipment that might be imposed is unknown and, as a result, the amount of capital expenditures necessary in order to bring the equipment into compliance is unknown at this time but could be substantial.

Further, if it is determined that the equipment at any of our chemical facilities have not met the requirements of the Clean Air Act, our Chemical Business could be subject to penalties in an amount not to exceed $27,500 per day as to each facility not in compliance and be required to retrofit each facility with the “best available control technology.” We are currently unable to determine the amount (or range of amounts) of any penalties that may be assessed by the EPA. Therefore no liability has been established at December 31, 2010, in connection with this matter.

3. Other Environmental Matters

In December 2002, two subsidiaries within our Chemical Business, sold substantially all of their operating assets relating to a Kansas chemical facility (“Hallowell Facility”) but retained ownership of the real property. At December 31, 2002, even though we continued to own the real property, we did not assess our continuing involvement with our former Hallowell Facility to be significant and therefore accounted for the sale as discontinued operations. In connection with this sale, our subsidiary leased the real property to the buyer under a triple net long-term lease agreement. However, our subsidiary retained the obligation to be responsible for, and perform the activities under, a previously executed consent order to investigate the surface and subsurface contamination at the real property and a corrective action strategy based on the investigation. In addition, certain of our subsidiaries agreed to indemnify the buyer of such assets for these environmental matters. The successor (“Chevron”) of a prior owner of the Hallowell Facility has agreed in writing, within certain limitations, to pay and has been paying one-half of the costs of the interim measures relating to this matter as approved by the Kansas Department of Environmental Quality, subject to reallocation.

Our subsidiary and Chevron are pursuing a course with the state of Kansas of long-term surface and groundwater monitoring to track the natural decline in contamination. Currently, our subsidiary and Chevron are in the process of performing additional surface and groundwater testing. We have accrued for our allocable portion of costs for the additional testing, monitoring and risk assessments that could be reasonably estimated. The ultimate required remediation, if any, is unknown.

In addition, the Kansas Department of Health and Environment (“KDHE”) notified our subsidiary and Chevron that this site has been referred to the KDHE’s Natural Resources Trustee, who is to consider and recommend restoration, replacement and/or whether to seek compensation. KDHE will consider the recommendations in their evaluation. Currently, it is unknown what damages, if any, the KDHE will claim. The nature and extent of a portion of the requirements are not currently defined and the associated costs (or range of costs) are not reasonably estimable.

At December 31, 2010, our estimated allocable portion of the total estimated liability (which is included in current accrued and other liabilities) related to the Hallowell Facility is $178,000. The estimated amount is not discounted to its present value. It is reasonably possible that a change in the estimate of our liability could occur in the near term.

During 2010, EDC became aware that certain personnel at its Whitewright, Texas agricultural distribution site, which personnel had been previously terminated by EDC, disposed of chemicals and debris at the site without authorization. Upon learning of these acts by the former employees, EDC contracted with an environmental company to analyze the areas of such disposal and dispose of any chemicals and contaminated soils. Upon completion of testing, it was determined that the area contained contaminants above state action levels. As a result, EDC notified the appropriate authorities in the state of Texas of the contamination. EDC has installed numerous monitoring wells in coordination with the state. We have incurred costs totaling $208,000 associated with this project, which includes an estimated $50,000 in current accrued and other liabilities at December 31, 2010. The estimated amount is not discounted to its present value. It is reasonably possible that a change in the estimate of our liability could occur in the near term.

Risks Related to Us and Our Business

Our Climate Control and Chemical Businesses and their customers are sensitive to adverse economic cycles.

Our Climate Control Business can be affected by cyclical factors, such as interest rates, inflation and economic downturns. Our Climate Control Business depends on sales to customers in the construction and renovation industries, which are particularly sensitive to these factors. Due to the recession, we have experienced and could continue to experience a decline in both commercial/institutional and residential construction and, therefore, demand for our Climate Control Business products. A decline in the economic activity in the United States has in the past, and could in the future, have a material adverse effect on us and our customers in the construction and renovation industries in which our Climate Control Business sells a substantial amount of its products. Such a decline could result in a decrease in revenues and profits, and an increase in bad debts, in our Climate Control Business and could have a material adverse effect on our operating results, financial condition and liquidity.

Our Chemical Business also can be affected by cyclical factors such as inflation, global energy policy and costs, global market conditions and economic downturns in specific industries. Certain sales of our Chemical Business are sensitive to the level of activity in the agricultural, mining, automotive and housing industries. A substantial decline in the activity of our Chemical Business has in the past, and could in the future, have a material adverse effect on the results of our Chemical Business and on our liquidity and capital resources.

Weather conditions adversely affect our Chemical Business.

The agricultural products produced and sold by our Chemical Business have in the past, and could in the future, be materially affected by adverse weather conditions (such as excessive rains or drought) in the primary markets for our fertilizer and related agricultural products. If any of these unusual weather events occur during the primary seasons for sales of our agricultural products (March-June and September-November), this could have a material adverse effect on the agricultural sales of our Chemical Business and our financial condition and results of operations.

Terrorist attacks and other acts of violence or war, and natural disasters (such as hurricanes, pandemic health crisis, etc.), have and could negatively impact U.S. and foreign companies, the financial markets, the industries where we operate, our operations and profitability.

Terrorist attacks and natural disasters (such as hurricanes) have in the past, and can in the future, negatively affect our operations. We cannot predict further terrorist attacks and natural disasters in the U.S. and elsewhere. These attacks or natural disasters have contributed to economic instability in the U.S. and elsewhere, and further acts of terrorism, violence, war or natural disasters could further affect the industries where we operate, our ability to purchase raw materials, our business, results of operations and financial condition. In addition, terrorist attacks and natural disasters may directly impact our physical facilities, especially our chemical facilities, or those of our suppliers or customers and could impact our sales, our production capability and our ability to deliver products to our customers. In the past, hurricanes affecting the Gulf Coast of the U.S. have negatively impacted our operations and those of our customers. The consequences of any terrorist attacks or hostilities or natural disasters are unpredictable, and we may not be able to foresee events that could have an adverse effect on our operations.

Environmental and regulatory matters entail significant risk for us.

Our businesses are subject to numerous environmental laws and regulations, primarily relating to our Chemical Business. The manufacture and distribution of chemical products are activities, which entail environmental risks and impose obligations under environmental laws and regulations, many of which provide for substantial fines and potential criminal sanctions for violations. Although we have established processes to monitor, review and manage our businesses to comply with the numerous environmental laws and regulations, our Chemical Business has in the past, and may in the future, be subject to fines, penalties and sanctions for violations and substantial expenditures for cleanup costs and other liabilities relating to the handling, manufacture, use, emission, discharge or disposal of effluents at or from the Chemical Business’ facilities. Further, a number of our Chemical Business’ facilities are dependent on environmental permits to operate, the loss or modification of which could have a material adverse effect on their operations and our financial condition.

If changes to the production equipment at our chemical facilities are required in order to comply with environmental regulations, the amount of capital expenditures necessary to bring the equipment into compliance is unknown at this time and could be substantial.

We may be required to expand our security procedures and install additional security equipment for our Chemical Business in order to comply with current and possible future government regulations, including the Homeland Security Act of 2002.

The chemical industry in general, and producers and distributors of anhydrous ammonia and AN specifically, are scrutinized by the government, industry and public on security issues. Under current and proposed regulations, including the Homeland Security Act of 2002, we may be required to incur substantial additional costs relating to security at our chemical facilities and distribution centers, as well as in the transportation of our products. These costs could have a material impact on our financial condition, results of operations, and liquidity. The cost of such regulatory changes, if significant enough, could lead some of our customers to choose alternate products to anhydrous ammonia and AN, which would have a significant impact on our Chemical Business.

Proposed governmental laws and regulations relating to greenhouse gas emissions may subject certain of our Chemical Business’ facilities to significant new costs and restrictions on their operations.

The manufacturing facilities within our Chemical Business use significant amounts of electricity, natural gas and other raw materials necessary for the production of their chemical products that result, or could result, in certain greenhouse gas emissions into the environment. Federal and state courts and administrative agencies, including the EPA, are considering the scope and scale of greenhouse gas emission regulation. There are bills pending or that have been proposed in Congress that would regulate greenhouse gas emissions through a cap-and-trade system under which emitters would be required to either install abatement systems where feasible or buy allowances for offsets of emissions of greenhouse gas. The EPA has instituted a mandatory greenhouse gas reporting requirement that began in 2010, which impacts all of our chemical manufacturing sites. Greenhouse gas regulation could increase the price of the electricity and other energy sources purchased by our chemical facilities; increase costs for natural gas and other raw materials (such as anhydrous ammonia); potentially restrict access to or the use of certain raw materials necessary to produce of our chemical products; and require us to incur substantial expenditures to retrofit our chemical facilities to comply with the proposed new laws and regulations regulating greenhouse gas emissions, if adopted. Federal, state and local governments may also pass laws mandating the use of alternative energy sources, such as wind power and solar energy, which may increase the cost of energy use in certain of our chemical and other manufacturing operations. While future emission regulations or new laws appear possible, it is too early to predict how these regulations, if and when adopted, will affect our businesses, operations, liquidity or financial results.

There is intense competition in the Climate Control and Chemical industries.

Substantially all of the markets in which we participate are highly competitive with respect to product quality, price, design innovations, distribution, service, warranties, reliability and efficiency. We compete with a number of companies that have greater financial, marketing and other resources. Competitive factors could require us to reduce prices or increase spending on product development, marketing and sales that would have a material adverse effect on our business, results of operation and financial condition.

A substantial portion of our sales is dependent upon a limited number of customers.

For 2010, five customers of our Chemical Business accounted for approximately 45% of its net sales and 26% of our consolidated sales, and our Climate Control Business had three customers (including affiliates and their distributors) that accounted for approximately 24% of its net sales and 10% of our consolidated sales. The loss of, or a material reduction in purchase levels by, one or more of these customers could have a material adverse effect on our business and our results of operations, financial condition and liquidity if we are unable to replace a customer on substantially similar terms.

Cost and the lack of availability of raw materials could materially affect our profitability and liquidity.

Our sales and profits are heavily affected by the costs and availability of primary raw materials. These primary raw materials, which are purchased from unrelated third parties, are subject to considerable price volatility. Historically, when there have been rapid increases in the cost of these primary raw materials, we have sometimes been unable to timely increase our sales prices to cover all of the higher costs incurred. While we periodically enter into futures/forward contracts to economically hedge against price increases in certain of these raw materials, there can be no assurance that we will effectively manage against price fluctuations in those raw materials.

Anhydrous ammonia, natural gas and sulfur represent the primary raw material feedstocks in the production of most of the products of the Chemical Business. Although our Chemical Business has a program to enter into contracts with certain customers that provide for the pass-through of raw material costs, we have a substantial amount of sales that do not provide for the pass-through of raw material costs. In addition, the Climate Control Business depends on raw materials such as copper and steel, which have shown considerable price volatility. As a result, in the future, we may not be able to pass along to all of our customers the full amount of any increases in raw material costs. There can be no assurance that future price fluctuations in our raw materials will not have an adverse effect on our financial condition, liquidity and results of operations.

Since we source certain of our raw materials and components on a global basis, we may experience long lead times in procuring those raw materials and components purchased overseas, as well as being subject to tariff controls and other international trade barriers, which may increase the uncertainty of raw material and component availability and pricing volatility.

Additionally, we depend on certain vendors to deliver the primary raw materials and other key components that are required in the production of our products. Any disruption in the supply of the primary raw materials and other key components could result in lost production or delayed shipments. We have suspended in the past, and could suspend in the future, production at our chemical facilities due to, among other things, the high cost or lack of availability of such primary raw materials, which could adversely impact our competitiveness in the markets we serve. Accordingly, our financial condition, liquidity and results of operations could be materially affected in the future by the lack of availability of primary raw materials and other key components.

Potential increase of imported ammonium nitrate from Russia.

In 2000, the U.S. and Russia entered into a suspension agreement limiting the quantity of, and setting the minimum prices for, fertilizer grade AN sold from Russia into the U.S.

The Russians have requested that the suspension agreement be changed to only require that the prices of its imported AN reflect the Russian producers full production costs, plus profit. The Russian producers of AN could benefit from state set prices of natural gas, the principal raw material for AN, which could be less than what U.S. producers are required to pay for their natural gas. Other factors, however, such as transportation costs may partially offset natural gas and production cost advantages. This change, if accepted by the U.S., could result in a substantial increase in the amount of AN imported into the U.S. from Russia at prices that could be less than the cost to produce AN by U.S. producers plus a profit. Russia is the world’s largest producer of fertilizer grade AN, and we are led to believe that it has substantial excess AN production capacity.

For 2010, net sales of fertilizer grade AN accounted for 16% and 9% of our Chemical Business net sales and consolidated net sales, respectively. If the suspension agreement is changed, as discussed above, this change could result in Russia substantially increasing the amount of AN sold in the U.S. at prices less than the U.S. producers are required to charge in order to cover their cost plus a profit, and could have an adverse effect on our revenues and operating results.

Potential increase of imported urea ammonium nitrate (UAN).

A large percentage of the domestic UAN market is supplied by imports. Significant additional UAN production began in the Caribbean during 2010, and we believe that some of this additional UAN production could be marketed in the U.S. Generally, foreign production of UAN is produced at a lower cost than UAN produced in the U.S., and

could have an adverse impact on the domestic UAN market, and the domestic fertilizer market in general, including the UAN and fertilizer markets of our Chemical Business, by foreign producers increasing supply and possibly reducing prices.

For 2010, net sales of UAN accounted for 11% and 6% of our Chemical Business net sales and consolidated net sales, respectively. Additionally, UAN is the primary product to be produced and sold by the Pryor Facility. This potential additional import of UAN could have an adverse impact on our revenues and operating results.

Our previously idled Pryor Facility has a limited operating history.

The Pryor Facility reached sustained production of anhydrous ammonia in the fourth quarter of 2010. The nitric acid, neutralizer, and urea plants at the Pryor Facility were reactivated to produce UAN. However, our ability to operate the Pryor Facility for extended periods is unknown due to our limited operating history at this facility.

Our previously utilized net operating loss carryforwards are subject to certain limitations and examination.

We had generated significant net operating loss (“NOL”) carryforwards from certain historical losses. During recent years, we have utilized all of the remaining federal NOL carryforwards and a portion of our state NOL carryforwards. The utilization of these NOL carryforwards has reduced our income tax liabilities. The federal tax returns for 1999 through 2006 remain subject to examination for the purpose of determining the amount of remaining tax NOL and other carryforwards. With few exceptions, the 2007-2009 years remain open for all purposes of examination by the U.S. Internal Revenue Service (“IRS”) and other major tax jurisdictions. During 2011, we were notified that we will be under examination by the IRS and certain state tax authorities for the tax years 2007-2009.

We may have inadequate insurance.

While we maintain liability insurance, including certain coverage for environmental contamination, it is subject to coverage limits and policies may exclude coverage for some types of damages (which may include warranty and product liability claims). Although there may currently be sources from which such coverage may be obtained, it may not continue to be available to us on commercially reasonable terms or the possible types of liabilities that may be incurred by us may not be covered by our insurance. In addition, our insurance carriers may not be able to meet their obligations under the policies or the dollar amount of the liabilities may exceed our policy limits. Even a partially uninsured claim, if successful and of significant magnitude, could have a material adverse effect on our business, results of operations, financial condition and liquidity.

LSB is a holding company and depends, in large part, on receiving funds from its subsidiaries to fund our indebtedness.

Because LSB is a holding company and operations are conducted through its subsidiaries, including ThermaClime, LLC (“ThermaClime”) and its subsidiaries, LSB’s ability to make scheduled payments of principal and interest on its indebtedness depends, in large part, on the operating performance and cash flows of its subsidiaries and the ability of its subsidiaries to make distributions and pay dividends to LSB. Under its loan agreements, ThermaClime and its subsidiaries may only make distributions and pay dividends to LSB under limited circumstances and in limited amounts.

Loss of key personnel could negatively affect our business.

We believe that our performance has been and will continue to be dependent upon the efforts of our principal executive officers. We cannot promise that our principal executive officers will continue to be available. Jack E. Golsen has an employment agreement with us. No other principal executive has an employment agreement with us. The loss of some of our principal executive officers could have a material adverse effect on us. We believe that our future success will depend in large part on our continued ability to attract and retain highly skilled and qualified personnel.

We are effectively controlled by the Golsen Group.

Jack E. Golsen, our Chairman of the Board and Chief Executive Officer (“CEO”), members of his immediate family (spouse and children), including Barry H. Golsen, our Vice Chairman and President, entities owned by them and trusts for which they possess voting or dispositive power as trustee (collectively, the “Golsen Group”) owned as of February 28, 2011, an aggregate of 3,506,093 shares of our common stock and 1,020,000 shares of our voting preferred stock (1,000,000 of which shares have .875 votes per share, or 875,000 votes), which together votes as a class and represents approximately 20% of the voting power of our issued and outstanding voting securities as of that date. In addition, the Golsen Group also beneficially owned options and other convertible securities that allowed its members to acquire an additional 197,250 shares of our common stock within 60 days of February 28, 2011. Thus, the Golsen Group may be considered to effectively control us. As a result, the ability of other stockholders to influence our management and policies could be limited.

We have not paid dividends on our outstanding common stock in many years.