Table of Contents

As filed with the Securities and Exchange Commission on February 16, 2024

Registration Nos. 333- , 333- -01, 333- -02,

333- -03, 333- -04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| PPL Corporation | Pennsylvania | 23-2758192 | ||

| PPL Capital Funding, Inc. | Delaware | 23-2926644 | ||

| PPL Electric Utilities Corporation | Pennsylvania | 23-0959590 | ||

| (Exact name of registrant as specified in its charter) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Two North Ninth Street

Allentown, Pennsylvania 18101-1179

(610) 774-5151

(Address, including zip code, and telephone number, including area code, of each registrant’s principal executive offices)

| Louisville Gas and Electric Company | Kentucky | 61-0264150 | ||

| (Exact name of registrant as specified in its charter) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

220 West Main Street

Louisville, Kentucky 40202-1377

(502) 627-2000

(Address, including zip code, and telephone number, including area code, of each registrant’s principal executive offices)

| Kentucky Utilities Company | Kentucky and Virginia | 61-0247570 | ||

| (Exact name of registrant as specified in its charter) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

One Quality Street

Lexington, Kentucky 40507-1462

(502) 627-2000

(Address, including zip code, and telephone number, including area code, of each registrant’s principal executive offices)

Joseph P. Bergstein

Executive Vice President and Chief

Financial Officer

PPL Corporation

Two North Ninth Street

Allentown, Pennsylvania 18101-1179

(610) 774-5151

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Catherine C. Hood Bracewell LLP 31W. 52nd Street, Suite 1900 New York, New York 10019 (212) 508-6118 |

Michael Kaplan Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Peter O’Brien

Hunton Andrews Kurth LLP

200 Park Avenue, 52nd Floor

New York, New York 10166

(212) 309-1024

Approximate date of commencement of proposed sale to the public: From time to time after the registration statement becomes effective, as determined by market and other conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, please check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| PPL Corporation: | Large accelerated filer | ☒ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||

| Emerging growth company | ☐ | |||||||

| PPL Capital Funding, Inc.: | Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||

| Emerging growth company | ☐ | |||||||

| PPL Electric Utilities Corporation: | Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||

| Emerging growth company | ☐ | |||||||

| Louisville Gas and Electric Company: | Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||

| Emerging growth company | ☐ | |||||||

| Kentucky Utilities Company: | Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||

| Emerging growth company | ☐ | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

| PPL Corporation: | ☐ | |

| PPL Capital Funding, Inc.: | ☐ | |

| PPL Electric Utilities Corporation: | ☐ | |

| Louisville Gas and Electric Company: | ☐ | |

| Kentucky Utilities Company: | ☐ |

Table of Contents

PROSPECTUS

PPL Corporation

PPL Capital Funding, Inc.

PPL Electric Utilities Corporation

Two North Ninth Street

Allentown, Pennsylvania 18101-1179

(610) 774-5151

Louisville Gas and Electric Company

220 West Main Street

Louisville, Kentucky 40202

(502) 627-2000

Kentucky Utilities Company

One Quality Street

Lexington, Kentucky 40507

(502) 627-2000

PPL Corporation

Common Stock, Preferred Stock,

Stock Purchase Contracts, Stock Purchase Units and Depositary Shares

PPL Capital Funding, Inc.

Debt Securities and Subordinated Debt Securities

Guaranteed by PPL Corporation as described in a supplement to this prospectus

PPL Electric Utilities Corporation

Debt Securities

Louisville Gas and Electric Company

Debt Securities

Kentucky Utilities Company

Debt Securities

We will provide the specific terms of these securities in supplements to this prospectus. You should read this prospectus and the supplements carefully before you invest.

We may offer the securities directly or through underwriters or agents. The applicable prospectus supplement will describe the terms of any particular plan of distribution.

Investing in the securities involves certain risks. See “Risk Factors” on page 2.

PPL Corporation’s common stock is listed on the New York Stock Exchange and trades under the symbol “PPL.”

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission, nor has the Securities and Exchange Commission or any state securities commission determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 16, 2024.

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

i

Table of Contents

This prospectus is part of a registration statement that PPL Corporation, PPL Capital Funding, Inc. (“PPL Capital Funding”), PPL Electric Utilities Corporation (“PPL Electric”), Louisville Gas and Electric Company (“LG&E”) and Kentucky Utilities Company (“KU”) have each filed with the Securities and Exchange Commission, or SEC, using the “shelf” registration process. Under this shelf process, we may, from time to time, sell combinations of the securities described in this prospectus in one or more offerings. Each time we sell securities, we will provide a prospectus supplement that will contain a description of the securities we will offer and specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information described under “Where You Can Find More Information.”

We may use this prospectus to offer from time to time:

| • | shares of PPL Corporation Common Stock, par value $.01 per share (“PPL Common Stock”); |

| • | shares of PPL Corporation Preferred Stock, par value $.01 per share (“PPL Preferred Stock”); |

| • | contracts or other rights to purchase shares of PPL Common Stock or PPL Preferred Stock (“PPL Stock Purchase Contracts”); |

| • | stock purchase units, each representing (1) a PPL Stock Purchase Contract and (2) PPL Preferred Stock or debt securities or preferred trust securities of third parties (such as debt securities or subordinated debt securities of PPL Capital Funding, preferred trust securities of a subsidiary trust or United States Treasury securities) that are pledged to secure the stock purchase unit holders’ obligations to purchase PPL Common Stock or PPL Preferred Stock under the PPL Stock Purchase Contracts; |

| • | PPL Corporation’s Depositary Shares, issued under a deposit agreement and representing a fractional interest in PPL Preferred Stock; |

| • | PPL Capital Funding’s unsecured and unsubordinated debt securities (“PPL Capital Funding Debt Securities”); |

| • | PPL Capital Funding’s unsecured and subordinated debt securities (“PPL Capital Funding Subordinated Debt Securities”); |

| • | PPL Electric’s First Mortgage Bonds issued under PPL Electric’s 2001 indenture, as amended and supplemented, which will be secured by the lien of the 2001 indenture on PPL Electric’s electricity distribution and certain transmission properties, subject to certain exceptions to be described in a prospectus supplement; |

| • | LG&E’s First Mortgage Bonds issued under LG&E’s 2010 indenture, as amended and supplemented, which will be secured by the lien of the 2010 indenture on LG&E’s Kentucky electricity generation, transmission and distribution properties and natural gas distribution properties, subject to certain exceptions to be described in a prospectus supplement; and |

| • | KU’s First Mortgage Bonds issued under KU’s 2010 indenture, as amended and supplemented, which will be secured by the lien of the 2010 indenture on KU’s Kentucky electricity generation, transmission and distribution properties, subject to certain exceptions to be described in a prospectus supplement. |

We sometimes refer to the securities listed above collectively as the “Securities.”

PPL Corporation will fully and unconditionally guarantee the payment of principal, premium and interest on the PPL Capital Funding Debt Securities and PPL Capital Funding Subordinated Debt Securities as will be described in supplements to this prospectus. We sometimes refer to PPL Corporation’s guarantees of PPL Capital Funding Debt Securities as “PPL Guarantees” and PPL Corporation’s guarantees of PPL Capital Funding Subordinated Debt Securities as the “PPL Subordinated Guarantees.”

Table of Contents

Information contained herein relating to each registrant is filed separately by such registrant on its own behalf. No registrant makes any representation as to information relating to any other registrant or Securities or guarantees issued by any other registrant, except that information relating to PPL Capital Funding’s Securities is also attributed to PPL Corporation.

As used in this prospectus, the terms “we,” “our” and “us” generally refer to:

| • | PPL Corporation with respect to Securities, PPL Guarantees or PPL Subordinated Guarantees issued by PPL Corporation or PPL Capital Funding; |

| • | PPL Electric, with respect to Securities issued by PPL Electric; |

| • | LG&E, with respect to Securities issued by LG&E; and |

| • | KU, with respect to Securities issued by KU. |

For more detailed information about the Securities, the PPL Guarantees and the PPL Subordinated Guarantees, you can read the exhibits to the registration statement. Those exhibits have been either filed with the registration statement or incorporated by reference to earlier SEC filings listed in the registration statement.

Investing in the Securities involves certain risks. You are urged to read and consider the risk factors relating to an investment in the Securities described in the Annual Reports on Form 10-K of PPL Corporation, PPL Electric, LG&E and KU, as applicable, for the year ended December 31, 2023, and incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus. The risks and uncertainties we have described are not the only ones affecting PPL Corporation, PPL Electric, LG&E and KU. The prospectus supplement applicable to each type or series of Securities we offer and our other filings incorporated by reference herein and therein may contain a discussion of additional risks applicable to an investment in us and the particular type of Securities we are offering under that prospectus supplement.

Certain statements included or incorporated by reference in this prospectus, including statements concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are other than statements of historical fact are “forward-looking statements” within the meaning of the federal securities laws. Although we believe that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that these expectations will prove to be correct. Forward-looking statements are subject to many risks and uncertainties, and actual results may differ materially from the results discussed in forward-looking statements. In addition to the specific factors discussed in the “Risk Factors” section in this prospectus and our reports that are incorporated by reference, the following are among the important factors that could cause actual results to differ materially and adversely from the forward-looking statements:

| • | strategic acquisitions, dispositions, or similar transactions, and our ability to consummate these business transactions or realize expected benefits from them; |

| • | pandemic health events or other catastrophic events such as fires, earthquakes, explosions, floods, droughts, tornadoes, hurricanes and other extreme weather-related events (including events potentially caused or exacerbated by climate change) and their impact on economic conditions, financial markets and supply chains; |

2

Table of Contents

| • | capital market conditions, including the availability of capital, credit or insurance, changes in interest rates and certain economic indices, and decisions regarding capital structure; |

| • | volatility in or the impact of other changes in financial markets, commodity prices and economic conditions, including inflation; |

| • | weather and other conditions affecting generation, transmission and distribution operations, operating costs and customer energy use; |

| • | the outcome of rate cases or other cost recovery, revenue or regulatory proceedings; |

| • | the direct or indirect effects on PPL or its subsidiaries or business systems of cyber-based intrusion or the threat of cyberattacks; |

| • | significant changes in the demand for electricity; |

| • | expansion of alternative and distributed sources of electricity generation and storage; |

| • | the effectiveness of our risk management programs, including commodity and interest rate hedging; |

| • | defaults by counterparties or suppliers for energy, capacity, coal, natural gas or key commodities, goods or services; |

| • | a material decline in the market value of PPL’s equity; |

| • | significant decreases in the fair value of debt and equity securities and their impact on the value of assets in defined benefit plans, and the related cash funding requirements if the fair value of those assets decline; |

| • | interest rates and their effect on pension and retiree medical liabilities, asset retirement obligation liabilities, interest payable on certain debt securities, and the general economy; |

| • | the potential impact of any unrecorded commitments and liabilities of PPL and its subsidiaries; |

| • | new accounting requirements or new interpretations or applications of existing requirements; |

| • | adverse changes in the corporate credit ratings or securities analyst rankings of PPL and its securities; |

| • | any requirement to record impairment charges pursuant to Generally Accepted Accounting Principles with respect to any of our significant investments; |

| • | laws or regulations to reduce emissions of greenhouse gases or the physical effects of climate change; |

| • | continuing ability to access fuel supply for LG&E and KU, as well as the ability to recover fuel costs and environmental expenditures in a timely manner at LG&E and KU and natural gas supply costs at LG&E and Rhode Island Energy (“RIE”); |

| • | war, armed conflicts, terrorist attacks, or similar disruptive events, including the ongoing conflicts in Ukraine, the Red Sea and Gaza; |

| • | changes in political, regulatory or economic conditions in states or regions where PPL or its subsidiaries conduct business; |

| • | the ability to obtain necessary governmental permits and approvals; |

| • | changes in state or federal tax laws or regulations; |

3

Table of Contents

| • | changes in state, federal or foreign legislation or regulatory developments; |

| • | the impact of any state, federal or foreign investigations applicable to PPL and its subsidiaries and the energy industry; |

| • | our ability to attract and retain qualified employees; |

| • | the effect of changing expectations and demands of our customers, regulators, investors and stakeholders, including views on environmental, social and governance concerns; |

| • | the effect of any business or industry restructuring; |

| • | development of new projects, markets and technologies; |

| • | performance of new ventures; |

| • | collective labor bargaining negotiations and labor costs; and |

| • | the outcome of litigation involving PPL and its subsidiaries. |

Any forward-looking statements should be considered in light of these important factors and in conjunction with other documents we file with the SEC.

New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time to time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made and, we undertake no obligation to update the information contained in the statement to reflect subsequent developments or information.

4

Table of Contents

PPL Corporation, headquartered in Allentown, Pennsylvania, is a utility holding company, incorporated in 1994. PPL Corporation, through its regulated utility subsidiaries, delivers electricity to customers in Pennsylvania, Kentucky, Virginia, and Rhode Island; delivers natural gas to customers in Kentucky and Rhode Island; and generates electricity from power plants in Kentucky.

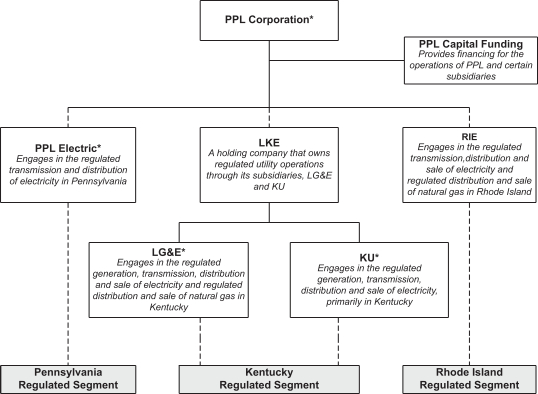

PPL Corporation’s principal subsidiaries are shown below (* denotes a registrant hereunder):

PPL Corporation conducts its operations through the following segments:

Kentucky Regulated

The Kentucky Regulated segment consists primarily of the regulated electricity generation, transmission and distribution operations conducted by LG&E and KU, as well as LG&E’s regulated distribution and sale of natural gas. As of December 31, 2023, LG&E provided electric service to approximately 436,000 customers and provided natural gas service to approximately 335,000 customers in Kentucky, and KU delivered electricity to approximately 573,000 customers in Kentucky and Virginia. See “Louisville Gas and Electric Company” and “Kentucky Utilities Company,” respectively, for more information.

Pennsylvania Regulated

The Pennsylvania Regulated segment includes the regulated electricity transmission and distribution operations of PPL Electric. As of December 31, 2023, PPL Electric delivered electricity to approximately 1.5 million customers in eastern and central Pennsylvania. See “PPL Electric Utilities Corporation” below for more information.

Rhode Island Regulated

The Rhode Island Regulated segment consists primarily of the regulated electricity transmission and distribution operations and regulated distribution and sale of natural gas conducted by RIE. As of December 31, 2023, RIE delivered electric service to approximately 500,000 customers and natural gas service to approximately 270,000 customers in Rhode Island.

5

Table of Contents

PPL Corporation’s subsidiaries, including PPL Electric, LG&E, KU and RIE, are separate legal entities and are not liable for the debts of PPL Corporation, and PPL Corporation is not liable for the debts of its subsidiaries (other than under the PPL Guarantees of PPL Capital Funding Debt Securities and PPL Subordinated Guarantees of PPL Capital Funding Subordinated Debt Securities). None of PPL Electric, LG&E, KU or RIE will guarantee or provide other credit or funding support for the Securities to be offered by PPL Corporation pursuant to this prospectus.

PPL Capital Funding is a Delaware corporation and wholly owned subsidiary of PPL Corporation. PPL Capital Funding’s primary business is to provide PPL Corporation with financing for its operations. PPL Corporation will fully and unconditionally guarantee the payment of principal, premium and interest on the PPL Capital Funding Debt Securities pursuant to the PPL Guarantees and the PPL Capital Funding Subordinated Debt Securities pursuant to the PPL Subordinated Guarantees, as will be described in supplements to this prospectus.

PPL ELECTRIC UTILITIES CORPORATION

PPL Electric, headquartered in Allentown, Pennsylvania, is a wholly owned subsidiary of PPL Corporation, incorporated in Pennsylvania in 1920 and a regulated public utility that is an electricity transmission and distribution service provider in eastern and central Pennsylvania. As of December 31, 2023, PPL Electric delivered electricity to approximately 1.5 million customers in a 10,000 square mile territory in 29 counties of eastern and central Pennsylvania. PPL Electric also provides electricity to retail customers in this area as a provider of last resort under the Pennsylvania Electricity Generation Customer Choice and Competition Act.

PPL Electric is subject to regulation as a public utility by the Pennsylvania Public Utility Commission, and certain of its transmission activities are subject to the jurisdiction of the Federal Energy Regulatory Commission (“FERC”) under the Federal Power Act.

Neither PPL Corporation nor any of its subsidiaries or affiliates will guarantee or provide other credit or funding support for the Securities to be offered by PPL Electric pursuant to this prospectus.

LOUISVILLE GAS AND ELECTRIC COMPANY

LG&E, headquartered in Louisville, Kentucky, is a wholly owned subsidiary of LG&E and KU Energy LLC (“LKE”) and a regulated utility engaged in the generation, transmission, distribution and sale of electricity and distribution and sale of natural gas in Kentucky.

As of December 31, 2023, LG&E provided electric service to approximately 436,000 customers in Louisville and adjacent areas in Kentucky, covering approximately 700 square miles in nine counties and provided natural gas service to approximately 335,000 customers in its electric service area and eight additional counties in Kentucky.

LG&E is subject to regulation as a public utility by the Kentucky Public Service Commission (“KPSC”), and certain of its transmission activities are subject to the jurisdiction of the FERC under the Federal Power Act. LG&E was incorporated in 1913.

Neither PPL Corporation nor any of its subsidiaries or affiliates will guarantee or provide other credit or funding support for the Securities to be offered by LG&E pursuant to this prospectus.

KU, headquartered in Lexington, Kentucky, is a wholly owned subsidiary of LKE and a regulated utility engaged in the generation, transmission, distribution and sale of electricity in Kentucky and Virginia.

As of December 31, 2023, KU provided electric service to approximately 545,000 customers in 77 counties in central, southeastern and western Kentucky, approximately 28,000 customers in five counties in southwestern Virginia, covering approximately 4,800 non-contiguous square miles. As of December 31, 2023, KU also sold wholesale electricity to two municipalities in Kentucky under load following contracts. In Virginia, KU operates under the Old Dominion Power name.

6

Table of Contents

KU is subject to regulation as a public utility by the KPSC and the Virginia State Corporation Commission, and certain of its transmission and wholesale power activities are subject to the jurisdiction of the FERC under the Federal Power Act. KU was incorporated in Kentucky in 1912 and in Virginia in 1991.

Neither PPL Corporation nor any of its subsidiaries or affiliates will guarantee or provide other credit or funding support for the Securities to be offered by KU pursuant to this prospectus.

The offices of PPL Corporation, PPL Capital Funding and PPL Electric are located at Two North Ninth Street, Allentown, Pennsylvania 18101-1179 (Telephone number (610) 774-5151).

The offices of LG&E are located at 220 West Main Street, Louisville, Kentucky 40202 (Telephone number (502) 627-2000).

The offices of KU are located at One Quality Street, Lexington, Kentucky 40507 (Telephone number (502) 627-2000).

The information above concerning PPL Corporation, PPL Capital Funding, PPL Electric, LG&E and KU and, if applicable, their respective subsidiaries is only a summary and does not purport to be comprehensive. For additional information about these companies, including certain assumptions, risks and uncertainties involved in the forward-looking statements contained or incorporated by reference in this prospectus, you should refer to the information described in “Where You Can Find More Information.”

7

Table of Contents

Except as otherwise described in a prospectus supplement, the net proceeds from the sale of the PPL Capital Funding Debt Securities and the PPL Capital Funding Subordinated Debt Securities will be loaned to PPL Corporation and/or its subsidiaries, and PPL Corporation and/or its subsidiaries are expected to use the proceeds of such loans, and the proceeds of the other Securities issued by PPL Corporation, for general corporate purposes, including repayment of debt. Except as otherwise described in a prospectus supplement, each of PPL Electric, LG&E and KU is expected to use the proceeds of the Securities it issues for general corporate purposes, including repayment of debt and for capital expenditures.

8

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

Available Information

PPL Corporation, PPL Electric, LG&E and KU each file reports and other information with the SEC. The SEC maintains an Internet site that contains information PPL Corporation, PPL Electric, LG&E and KU have filed electronically with the SEC, which you can access over the Internet at http://www.sec.gov.

PPL Corporation’s Internet Web site is www.pplweb.com. Under the “Investors” heading of that website, PPL Corporation provides access to all SEC filings of PPL Corporation, PPL Electric, LG&E and KU free of charge, as soon as reasonably practicable after filing with the SEC. The information at PPL Corporation’s Internet Web site is not incorporated in this prospectus by reference, and you should not consider it a part of this prospectus.

In addition, reports, proxy statements and other information concerning PPL Corporation, PPL Electric, LG&E and KU, as applicable, can be inspected at Two North Ninth Street, Allentown, Pennsylvania 18101-1179.

Incorporation by Reference

Each of PPL Corporation, PPL Electric, LG&E and KU will “incorporate by reference” information into this prospectus by disclosing important information to you by referring you to another document that it files separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and later information that we file with the SEC will automatically update and supersede that information. This prospectus incorporates by reference the documents set forth below that have been previously filed with the SEC. These documents contain important information about the registrants.

PPL Corporation

| SEC Filings (File No. 1-11459) |

Period/Date | |

| Annual Report on Form 10-K | Year ended December 31, 2023 | |

| PPL Corporation’s 2023 Notice of Annual Meeting and Proxy Statement (portions thereof incorporated by reference into PPL Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022) | Filed on April 4, 2023 | |

| Current Reports on Form 8-K | Filed on January 5, 2024 | |

PPL Electric

| SEC Filings (File No. 1-905) |

Period/Date | |

| Annual Report on Form 10-K | Year ended December 31, 2023 | |

| Current Reports on Form 8-K | Filed on January 5, 2024 | |

LG&E

| SEC Filings (File No. 1-2893) |

Period/Date | |

| Annual Report on Form 10-K | Year ended December 31, 2023 |

KU

| SEC Filings (File No. 1-3464) |

Period/Date | |

| Annual Report on Form 10-K | Year ended December 31, 2023 |

Additional documents that PPL Corporation, PPL Electric, LG&E and KU file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, between the date of this prospectus and the termination of the offering of the Securities are also incorporated herein by reference. In addition, any additional documents that PPL Corporation, PPL Electric, LG&E or KU file with the SEC pursuant to these sections of the Exchange Act after the date of the filing of the registration statement containing this prospectus, and prior to the effectiveness of the registration statement, are also

9

Table of Contents

incorporated herein by reference. Unless specifically stated to the contrary, none of the information that PPL Corporation, PPL Electric, LG&E or KU files or discloses under Items 2.02 or 7.01 of any Current Report on Form 8-K that have been furnished or may from time to time be furnished with the SEC is or will be incorporated by reference into, or otherwise included in, this prospectus.

Each of PPL Corporation, PPL Electric, LG&E and KU will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered, a copy of any and all of its filings with the SEC. You may request a copy of these filings by writing or telephoning the appropriate registrant at:

Two North Ninth Street

Allentown, Pennsylvania 18101-1179

Attention: Treasurer

Telephone: 1-800-345-3085

No separate financial statements of PPL Capital Funding are included herein or incorporated herein by reference. PPL Corporation and PPL Capital Funding do not consider those financial statements to be material to holders of the PPL Capital Funding Debt Securities or PPL Capital Funding Subordinated Debt Securities because (1) PPL Capital Funding is a wholly owned subsidiary that was formed for the primary purpose of providing financing for PPL Corporation and its subsidiaries, (2) PPL Capital Funding does not currently engage in any independent operations and (3) PPL Capital Funding is a finance subsidiary and does not currently plan to engage, in the future, in more than minimal independent operations. See “PPL Capital Funding.” Accordingly, PPL Corporation and PPL Capital Funding do not expect PPL Capital Funding to file such reports.

10

Table of Contents

The consolidated financial statements of PPL Corporation and PPL Electric Utilities Corporation and the financial statements of Louisville Gas and Electric Company and Kentucky Utilities Company incorporated by reference in this Prospectus by reference to their Annual Reports on Form 10-K for the year ended December 31, 2023, and the effectiveness of PPL Corporation’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

VALIDITY OF THE SECURITIES AND THE PPL GUARANTEES

Davis Polk & Wardwell LLP, New York, New York, and W. Eric Marr, Esq., Senior Counsel of PPL Services Corporation will pass upon the validity of the Securities, the PPL Guarantees and the PPL Subordinated Guarantees for PPL Corporation and PPL Capital Funding. Bracewell LLP, New York, New York and Mr. Marr will pass upon the validity of any PPL Electric Securities for PPL Electric. Bracewell LLP and John P. Fendig, Esq., Senior Counsel of PPL Services Corporation will pass upon the validity of any LG&E and KU Securities for those issuers. Hunton Andrews Kurth LLP, New York, New York will pass upon the validity of the Securities, the PPL Guarantees and the PPL Subordinated Guarantees for any underwriters or agents. Bracewell LLP, Davis Polk & Wardwell LLP and Hunton Andrews Kurth LLP will rely on the opinion of Mr. Marr as to matters involving the law of the Commonwealth of Pennsylvania and on the opinion of Mr. Fendig as to matters involving the laws of the Commonwealths of Kentucky and Virginia.

11

Table of Contents

PART II.

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is a statement of the estimated expenses (other than underwriting compensation) to be incurred by PPL Corporation and subsidiaries in connection with a distribution of the securities registered under this registration statement.

| Securities and Exchange Commission registration fee |

$ | * | ||

| Printing expenses |

* | * | ||

| Trustee fees and expenses |

* | * | ||

| Legal fees and expenses |

* | * | ||

| Accounting fees and expenses |

* | * | ||

| Blue Sky fees and expenses |

* | * | ||

| Rating Agency fees |

* | * | ||

| Miscellaneous |

* | * | ||

| Total |

$ | * | * |

| * | To be deferred pursuant to Rule 456(b) and calculated in connection with the offering of securities under this registration statement pursuant to Rule 457(r). |

| ** | Estimated expenses not presently known. |

Item 15. Indemnification of Directors and Officers.

PPL Corporation

Chapter 17, Subchapter D of the Pennsylvania Business Corporation Law of 1988, as amended (the “PBCL”), contains provisions permitting indemnification of officers and directors of a business corporation incorporated in Pennsylvania. Sections 1741 and 1742 of the PBCL provide that a business corporation may indemnify directors and officers against liabilities and expenses he or she may incur in connection with any threatened, pending or completed civil, criminal, administrative or investigative proceeding initiated by a third party or any threatened, pending or completed action by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he or she is or was a representative of the corporation or was serving at the request of the corporation as a representative of another enterprise, provided that the particular person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful. In general, the power to indemnify under these sections does not exist in the case of actions against a director or officer by or in the right of the corporation if the person otherwise entitled to indemnification shall have been adjudged to be liable to the corporation, unless it is judicially determined that, despite the adjudication of liability but in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnification for the expenses the court deems proper. Section 1743 of the PBCL provides that the corporation is required to indemnify directors and officers against expenses they may incur in defending these actions if they are successful on the merits or otherwise in the defense of such actions.

Section 1746 of the PBCL provides that indemnification under the other sections of Subchapter D is not exclusive of other rights that a person seeking indemnification may have under any by-law, agreement, vote of shareholders or disinterested directors or otherwise, whether or not the corporation would have the power to indemnify the person under any other provision of law. However, Section 1746 prohibits indemnification in circumstances where the act or failure to act giving rise to the claim for indemnification is determined by a court to have constituted willful misconduct or recklessness.

Section 1747 of the PBCL permits a corporation to purchase and maintain insurance on behalf of any person who is or was a director or officer of the corporation, or is or was serving at the request of the corporation as a representative of another enterprise, against any liability asserted against such person and incurred by him or her in that capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify the person against such liability under Subchapter D.

II-1

Table of Contents

PPL Corporation’s Bylaws provide that it is obligated to indemnify directors and officers and other persons designated by the board of directors against reasonable expense and any liability paid or incurred by such person in connection with any actual or threatened claim, action, suit or proceeding, civil, criminal, administrative, investigative or other, whether brought by or in the right of the corporation or otherwise, in which he or she may be involved, as a party or otherwise, by reason of such person being or having been a director or officer of the corporation or by reason of the fact that such person is or was serving at the request of the corporation as a director, officer, employee, fiduciary or other representative of another corporation, partnership, joint venture, trust, employee benefit plan or other entity (such claim, action, suit or proceeding hereinafter being referred to as “action”). Such indemnification shall include the right to have expenses incurred by such person in connection with an action paid in advance by the corporation prior to final disposition of such action, subject to such conditions as may be prescribed by law. Furthermore, PPL Corporation, as well as its directors and officers, may be entitled to indemnification by any underwriters named in a prospectus supplement against certain civil liabilities under the Securities Act of 1933 under agreements entered into between PPL Corporation and such underwriters.

PPL Corporation presently has insurance policies which, among other things, include liability insurance coverage for officers and directors and officers and directors of PPL Corporation’s subsidiaries, including PPL Capital Funding, Inc., under which such officers and directors are covered against any “loss” by reason of payment of damages, judgments, settlements and costs, as well as charges and expenses incurred in the defense of actions, suits or proceedings. “Loss” is specifically defined to exclude fines and penalties, as well as matters deemed uninsurable under the law pursuant to which the insurance policy shall be construed. The policies also contain other specific exclusions, including illegally obtained personal profit or advantage, and dishonesty.

PPL Capital Funding, Inc.

Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”) allows a corporation to provide in its certificate of incorporation that a director or officer of the corporation will not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, except where the director or officer breached the duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit or for an officer in any action by or in the right of the corporation. The Certificate of Incorporation of PPL Capital Funding, Inc. provides for this limitation of liability for directors.

Section 145 of the DGCL, or Section 145, provides, among other things, that a Delaware corporation may indemnify any person who was, is or is threatened to be made, party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was an officer, director, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was unlawful. A Delaware corporation may indemnify any persons who were or are a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason of the fact that such person is or was a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit, provided such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests, provided further that no indemnification is permitted without judicial approval if the officer, director, employee or agent is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses (including attorneys’ fees) which such officer or director has actually and reasonably incurred.

II-2

Table of Contents

Section 145 further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his or her status as such, whether or not the corporation would otherwise have the power to indemnify such person under Section 145.

The By-Laws of PPL Capital Funding, Inc. provide that PPL Capital Funding, Inc. shall indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently exists or may hereafter be amended, any person (an “Indemnitee”) who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he, or a person for whom he is the legal representative, is or was a director or officer of the corporation or, while a director or officer of the corporation, is or was serving at the written request of the corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust, enterprise or nonprofit entity, including service with respect to employee benefit plans, against all liability and loss suffered and expenses (including attorneys’ fees) reasonably incurred by such Indemnitee. Notwithstanding the preceding sentence, except with respect to certain proceedings for unpaid claims, PPL Capital Funding shall be required to indemnify an Indemnitee in connection with a proceeding (or part thereof) commenced by such Indemnitee only if the commencement of such proceeding (or part thereof) by the Indemnitee was authorized by the board of directors. The By-Laws also provide that PPL Capital Funding, Inc. shall pay the expenses (including attorneys’ fees) incurred by an Indemnitee in defending any proceeding in advance of its final disposition; provided, however, that, to the extent required by law, such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt of an undertaking by the Indemnitee to repay all amounts advanced if it should be ultimately determined that the Indemnitee is not entitled to be indemnified under the By-Laws or otherwise.

The indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of the certificate of incorporation, the by-laws, agreement, vote of stockholders or disinterested directors or otherwise.

Section 174 of the DGCL provides, among other things, that a director, who willfully or negligently approves of an unlawful payment of dividends or an unlawful stock purchase or redemption, may be held jointly and severally liable for such actions. A director who was either absent when the unlawful actions were approved or dissented at the time may avoid liability by causing his or her dissent to such actions to be entered in the books containing the minutes of the meetings of the board of directors at the time such action occurred or immediately after such absent director receives notice of the unlawful acts. Furthermore, PPL Capital Funding, Inc., as well as its directors and officers, may be entitled to indemnification by any underwriters named in a prospectus supplement against certain civil liabilities under the Securities Act of 1933 under agreements entered into between PPL Capital Funding, Inc. and such underwriters.

PPL Capital Funding, Inc. presently has insurance policies which, among other things, include liability insurance coverage for officers and directors of PPL Capital Funding, Inc., under which such officers and directors are covered against any “loss” by reason of payment of damages, judgments, settlements and costs, as well as charges and expenses incurred in the defense of actions, suits or proceedings. “Loss” is specifically defined to exclude fines and penalties, as well as matters deemed uninsurable under the law pursuant to which the insurance policy shall be construed. The policies also contain other specific exclusions, including illegally obtained personal profit or advantage, and dishonesty.

PPL Electric Utilities Corporation

Chapter 17, Subchapter D of the PBCL, contains provisions permitting indemnification of officers and directors of a business corporation incorporated in Pennsylvania. Sections 1741 and 1742 of the PBCL provide that a business corporation may indemnify directors and officers against liabilities and expenses he or she may incur in connection with any threatened, pending or completed civil, criminal, administrative or investigative proceeding initiated by a third party or any threatened, pending or completed action by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he or she is or was a representative of the corporation or was serving at the request of the corporation as a representative of another enterprise, provided that the particular person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful. In

II-3

Table of Contents

general, the power to indemnify under these sections does not exist in the case of actions against a director or officer by or in the right of the corporation if the person otherwise entitled to indemnification shall have been adjudged to be liable to the corporation, unless it is judicially determined that, despite the adjudication of liability but in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnification for the expenses the court deems proper. Section 1743 of the PBCL provides that the corporation is required to indemnify directors and officers against expenses they may incur in defending these actions if they are successful on the merits or otherwise in the defense of such actions.

Section 1746 of the PBCL provides that indemnification under the other sections of Subchapter D is not exclusive of other rights that a person seeking indemnification may have under any by-law, agreement, vote of shareholders or disinterested directors or otherwise, whether or not the corporation would have the power to indemnify the person under any other provision of law. However, Section 1746 prohibits indemnification in circumstances where the act or failure to act giving rise to the claim for indemnification is determined by a court to have constituted willful misconduct or recklessness.

Section 1747 of the PBCL permits a corporation to purchase and maintain insurance on behalf of any person who is or was a director or officer of the corporation, or is or was serving at the request of the corporation as a representative of another enterprise, against any liability asserted against such person and incurred by him or her in that capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify the person against such liability under Subchapter D.

PPL Electric Utilities Corporation’s Bylaws provide that it is obligated to indemnify directors and officers and other persons designated by the board of directors against reasonable expense and any liability paid or incurred by such person in connection with any actual or threatened claim, action, suit or proceeding, civil, criminal, administrative, investigative or other, whether brought by or in the right of the corporation or otherwise, in which he or she may be involved, as a party or otherwise, by reason of such person being or having been a director or officer of the corporation or by reason of the fact that such person is or was serving at the request of the corporation as a director, officer, employee, fiduciary or other representative of another corporation, partnership, joint venture, trust, employee benefit plan or other entity (such claim, action, suit or proceeding hereinafter being referred to as “action”). Such indemnification shall include the right to have expenses incurred by such person in connection with an action paid in advance by the corporation prior to final disposition of such action, subject to such conditions as may be prescribed by law. In addition, PPL Electric Utilities Corporation, as well as its directors and officers, may be entitled to indemnification by any underwriters named in a prospectus supplement against certain civil liabilities under the Securities Act of 1933 under agreements entered into between PPL Electric Utilities Corporation and such underwriters.

PPL Electric Utilities Corporation presently has insurance policies which, among other things, include liability insurance coverage for officers and directors of PPL Electric Utilities Corporation, under which such officers and directors are covered against any “loss” by reason of payment of damages, judgments, settlements and costs, as well as charges and expenses incurred in the defense of actions, suits or proceedings. “Loss” is specifically defined to exclude fines and penalties, as well as matters deemed uninsurable under the law pursuant to which the insurance policy shall be construed. The policies also contain other specific exclusions, including illegally obtained personal profit or advantage, and dishonesty.

Louisville Gas and Electric Company

Louisville Gas and Electric Company is a corporation incorporated under the Kentucky Business Corporation Act, or the KBCA. LG&E’s Amended and Restated Articles of Incorporation and By-laws provide, in general, for mandatory indemnification of directors and officers by the registrant to the fullest extent permitted by law.

Sections 271B.8-500 to 271B.8-580 of the KBCA provide that a corporation may indemnify an individual made a party to any threatened, pending, or completed action, suit or proceeding, whether civil, criminal, administrative or investigative and whether formal or informal, because he is or was a director of a corporation or an individual who, while a director, officer, employee or agent of a corporation, is or was serving at the corporation’s request as a director, officer, partner, trustee, employee or agent of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, against liability incurred in the proceeding if he conducted himself in good faith and he honestly believed (a) in the case of conduct in his official capacity with the corporation that his conduct was in its best interests and (b) in all other cases, that his

II-4

Table of Contents

conduct was at least not opposed to its best interests. In the case of any criminal proceeding, he must have had no reasonable cause to believe his conduct was unlawful. A corporation may not indemnify such individual (i) in connection with a proceeding by or in the right of the corporation in which such individual was adjudged liable to the corporation or (ii) in connection with any other proceeding charging improper personal benefit to him, whether or not involving action in his official capacity, in which he was adjudged liable on the basis that personal benefit was improperly received by him. Indemnification permitted in connection with a proceeding by or in the right of the corporation is limited to reasonable expenses incurred in connection with the proceeding.

Section 271B.8-520 of the KBCA provides that, unless limited by its articles of incorporation, a corporation shall indemnify a director who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which he was a party because he is or was a director of the corporation against reasonable expenses incurred by him in connection with the proceeding.

Under Section 271B.2-020(2)(d) of the KBCA, a corporation’s articles of organization may eliminate or limit the personal liability of a director to the corporation or its shareholders for monetary damages for breach of his duties as a director, provided that such provision shall not eliminate or limit the liability of a director (1) for any transaction in which the director’s personal financial interest is in conflict with the financial interests of the corporation or its shareholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or are known to the director to be a violation of law, (3) for any vote for or assent to an unlawful distribution to shareholders as prohibited under Section 271B.8-330 or (4) for any transaction from which the director derived an improper personal benefit.

In addition, LG&E, as well as its directors and officers, may be entitled to indemnification by any underwriters named in a prospectus supplement against certain civil liabilities under the Securities Act of 1933 under agreements entered into between LG&E and such underwriters.

LG&E presently has insurance policies which, among other things, include liability insurance coverage for officers and directors of LG&E, under which such officers and directors are covered against any “loss” by reason of payment of damages, judgments, settlements and costs, as well as charges and expenses incurred in the defense of actions, suits or proceedings. “Loss” is specifically defined to exclude fines and penalties, as well as matters deemed uninsurable under the law pursuant to which the insurance policy shall be construed. The policies also contain other specific exclusions, including illegally obtained personal profit or advantage, and dishonesty.

Kentucky Utilities Company

Kentucky Utilities Company is a corporation incorporated under the Kentucky Business Corporation Act, or the KBCA, and the Virginia Stock Corporation Act, or VSCA. KU’s Amended and Restated Articles of Incorporation and By-laws provide, in general, for mandatory indemnification of directors and officers by the registrant to the fullest extent permitted by law.

Sections 271B.8-500 to 271B.8-580 of the KBCA provide that a corporation may indemnify an individual made a party to any threatened, pending, or completed action, suit or proceeding, whether civil, criminal, administrative or investigative and whether formal or informal, because he is or was a director of a corporation or an individual who, while a director, officer, employee or agent of a corporation, is or was serving at the corporation’s request as a director, officer, partner, trustee, employee or agent of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, against liability incurred in the proceeding if he conducted himself in good faith and he honestly believed (a) in the case of conduct in his official capacity with the corporation that his conduct was in its best interests and (b) in all other cases, that his conduct was at least not opposed to its best interests. In the case of any criminal proceeding, he must have had no reasonable cause to believe his conduct was unlawful. A corporation may not indemnify such individual (i) in connection with a proceeding by or in the right of the corporation in which such individual was adjudged liable to the corporation or (ii) in connection with any other proceeding charging improper personal benefit to him, whether or not involving action in his official capacity, in which he was adjudged liable on the basis that personal benefit was improperly received by him. Indemnification permitted in connection with a proceeding by or in the right of the corporation is limited to reasonable expenses incurred in connection with the proceeding.

II-5

Table of Contents

Section 271B.8-520 of the KBCA provides that, unless limited by its articles of incorporation, a corporation shall indemnify a director who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which he was a party because he is or was a director of the corporation against reasonable expenses incurred by him in connection with the proceeding.

Under Section 271B.2-020(2)(d) of the KBCA, a corporation’s articles of organization may eliminate or limit the personal liability of a director to the corporation or its shareholders for monetary damages for breach of his duties as a director, provided that such provision shall not eliminate or limit the liability of a director (1) for any transaction in which the director’s personal financial interest is in conflict with the financial interests of the corporation or its shareholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or are known to the director to be a violation of law, (3) for any vote for or assent to an unlawful distribution to shareholders as prohibited under Section 271B.8-330 or (4) for any transaction from which the director derived an improper personal benefit.

The Virginia Stock Corporation Act Section 13.1-697 empowers a corporation to indemnify an individual made a party to a proceeding because he is or was a director against liability incurred in the proceeding if: the director (1) conducted himself in good faith; and (2) believed (i) in the case of conduct in his official capacity with the corporation, that his conduct was in its best interests; and (ii) in all other cases, that his conduct was at least not opposed to its best interests; and (3) in the case of any criminal proceeding, he had no reasonable cause to believe his conduct was unlawful; or (4) he engaged in conduct for which broader indemnification has been made permissible or obligatory as authorized by subsection C of Section 13.1-704. A corporation may not indemnify a director (1) in connection with a proceeding by or in the right of the corporation except for reasonable expenses incurred in connection with the proceeding if it is determined that the director has met the relevant standard in the preceding sentence; or (2) in connection with any other proceeding charging improper personal benefit to the director, whether or not involving action in his official capacity, in which he was adjudged liable on the basis that personal benefit was improperly received by him. Unless limited by its articles of incorporation, a corporation must indemnify a director who entirely prevails in the defense of any proceeding to which he was a party because he is or was a director of the corporation against reasonable expenses incurred by him in connection with the proceeding. Under the VSCA Section 13.1-699, a corporation may pay for or reimburse the reasonable expenses incurred by a director who is a party to a proceeding in advance of the final disposition of the proceeding if the director furnishes the corporation an undertaking, executed personally or on his behalf, to repay the advance if the director is not entitled to mandatory indemnification under Section 13.1-698 of the VSCA and it is ultimately determined that he did not meet the relevant standard of conduct. Unless a corporation’s articles of incorporation provide otherwise, the corporation may indemnify and advance expenses to an officer of the corporation to the same extent as to a director. A corporation may also purchase and maintain on behalf of a director or officer insurance against liabilities incurred in such capacities, whether or not the corporation would have the power to indemnify him against the same liability under the VSCA.

In addition, KU, as well as its directors and officers, may be entitled to indemnification by any underwriters named in a prospectus supplement against certain civil liabilities under the Securities Act of 1933 under agreements entered into between KU and such underwriters.

KU presently has insurance policies which, among other things, include liability insurance coverage for officers and directors of KU, under which such officers and directors are covered against any “loss” by reason of payment of damages, judgments, settlements and costs, as well as charges and expenses incurred in the defense of actions, suits or proceedings. “Loss” is specifically defined to exclude fines and penalties, as well as matters deemed uninsurable under the law pursuant to which the insurance policy shall be construed. The policies also contain other specific exclusions, including illegally obtained personal profit or advantage, and dishonesty.

Item 16. Exhibits.

Reference is made to the Exhibit Index filed herewith at page II-9, such Exhibit Index being incorporated in this Item 16 by reference. Instruments with respect to long-term debt of the undersigned registrants and their consolidated subsidiaries other than those instruments listed in the Exhibit Index are omitted pursuant to Item 601(b)(4)(iii) of Regulation S-K, as the total amount authorized under each such omitted instrument does not exceed 10 percent of the total assets of the undersigned registrants and their subsidiaries on a consolidated basis. The undersigned registrants hereby agrees to furnish a copy of any such instrument to the Securities and Exchange Commission upon request.

II-6

Table of Contents

Item 17. Undertakings.

| (a) | The undersigned registrants hereby undertake: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective Registration Statement; and |

| (iii) | to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the registration statement; |

provided, however, that (i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrants pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | Each prospectus filed by the registrants pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering |

II-7

Table of Contents

| thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

| (5) | That, for the purpose of determining liability of the registrants under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrants undertake that in a primary offering of securities of the undersigned registrants pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrants will be sellers to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrants relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrants or used or referred to by the undersigned registrants; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrants or their securities provided by or on behalf of the undersigned registrants; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrants to the purchaser. |

| (b) | The undersigned registrants hereby undertake that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrants’ annual reports pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrants have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrants will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

II-8

Table of Contents

PPL CORPORATION

PPL CAPITAL FUNDING, INC.

PPL ELECTRIC UTILITIES CORPORATION

LOUISVILLE GAS AND ELECTRIC COMPANY

KENTUCKY UTILITIES COMPANY

REGISTRATION STATEMENT ON FORM S-3

EXHIBIT INDEX

| Exhibit |

Description |

Method of Filing | ||

| 1.1 | Form of Underwriting Agreement with respect to Securities | A form of underwriting agreement with respect to any securities will be filed as an Exhibit to a report on Form 8-K, as contemplated by Item 601(b)(1) of Regulation S-K under the Securities Act. | ||

| 3.1 | *Amended and Restated Articles of Incorporation of PPL Corporation | Exhibit 3(i) to PPL Corporation Form 8-K (File No. 1-11459) dated May 26, 2016. | ||

| 3.2 | *Amended and Restated Articles of Incorporation of PPL Electric Utilities Corporation | Exhibit 3(a) to PPL Electric Utilities Corporation Quarterly Report on Form 10-Q (File No. 1-905) for the quarter ended September 30, 2013. | ||

| 3.3.1 | *Certificate of Incorporation of PPL Capital Funding, Inc. | Exhibit 3.3 to PPL Corporation and PPL Capital Funding, Inc. Registration Statement on Form S-3 (File Nos. 333-38003 and 333-38003-01) dated October 16, 1997. | ||

| 3.3.2 | *Amended Certificate of Incorporation of PPL Capital Funding, Inc. | Exhibit 3.5 to PPL Corporation, PPL Capital Funding, Inc. and PPL Capital Funding Trust I Registration Statement on Form S-3 (File Nos. 333-54504, 333-54504-1 and 333-54504-2) dated January 29, 2001. | ||

| 3.4.1 | *Amended and Restated Articles of Incorporation of Louisville Gas and Electric Company | Exhibit 3(a) to Louisville Gas and Electric Company Registration Statement filed on Form S-4 (File No. 333-173676) dated April 22, 2011. | ||

| 3.4.2 | *Articles of Amendment to Articles of Incorporation of Louisville Gas and Electric Company | Exhibit 3(b) to Louisville Gas and Electric Company Registration Statement filed on Form S-4 (File No. 333-173676) dated April 22, 2011. | ||

| 3.5.1 | *Amended and Restated Articles of Incorporation of Kentucky Utilities Company | Exhibit 3(a) to Kentucky Utilities Company Registration Statement filed on Form S-4 (File No. 333-173675) dated April 22, 2011. | ||

| 3.5.2 | *Articles of Amendment to Articles of Incorporation of Kentucky Utilities Company | Exhibit 3(b) to Kentucky Utilities Company Registration Statement filed on Form S-4 (File No. 333-173675) dated April 22, 2011. | ||

| 3.6 | *Bylaws of PPL Corporation | Exhibit 3(ii) to PPL Corporation Form 8-K (File No. 1-11459) dated December 19, 2022. | ||

| 3.7 | *Bylaws of PPL Electric Utilities Corporation | Exhibit 3(a) to PPL Electric Utilities Corporation Quarterly Report on Form 10-Q (File No. 1-905) for the quarter ended September 30, 2015. | ||

| 3.8 | *By-Laws of PPL Capital Funding, Inc. | Exhibit 3.4 to PPL Corporation and PPL Capital Funding, Inc. Registration Statement Nos. 333-38003 and 333-38003-01. | ||

| 3.9 | *Bylaws of Louisville Gas and Electric Company | Exhibit 3(c) to Louisville Gas and Electric Company Registration Statement filed on Form S-4 (File No. 333-173676) dated April 22, 2011. | ||

| 3.10 | *Bylaws of Kentucky Utilities Company | Exhibit 3(c) to Kentucky Utilities Company Registration Statement filed on Form S-4 (File No. 333-173675) dated April 22, 2011. | ||

II-9

Table of Contents

| Exhibit |

Description |

Method of Filing | ||

| 4.1 | *Form of PPL Corporation Common Stock Certificate | Exhibit 4.1 to PPL Corporation Registration Statement filed on Form S-3 (File No. 333-158200) dated March 25, 2009. | ||

| 4.2 | [Reserved] | |||

| 4.3 | [Reserved] | |||

| 4.4.1 | *Indenture dated as of November 1, 1997, among PPL Corporation, PPL Capital Funding, Inc. and The Bank of New York Mellon (as successor trustee to JPMorgan Chase Bank, N.A. (formerly known as The Chase Manhattan Bank)), as Trustee | Exhibit 4.1 to PPL Corporation Form 8-K (File No. 1-11459) dated November 17, 1997. | ||

| 4.4.2 | *Supplemental Indenture No. 8, dated as of June 14, 2012, to said Indenture | Exhibit 4(b) to PPL Corporation Form 8-K (File No. 1-11459) dated June 14, 2012. | ||

| 4.4.3 | *Supplemental Indenture No. 9, dated as of October 15, 2012, to said Indenture | Exhibit 4(b) to PPL Corporation Form 8-K (File No. 1-11459) dated October 15, 2012. | ||

| 4.4.4 | *Supplemental Indenture No. 10, dated as of May 24, 2013, to said Indenture | Exhibit 4.2 to PPL Corporation Form 8-K (File No. 1-11459) dated May 24, 2013. | ||

| 4.4.5 | *Supplemental Indenture No. 11, dated as of May 24, 2013, to said Indenture | Exhibit 4.3 to PPL Corporation Form 8-K (File No. 1-11459) dated May 24, 2013. | ||

| 4.4.6 | *Supplemental Indenture No. 12, dated as of May 24, 2013, to said Indenture | Exhibit 4.4 to PPL Corporation Form 8-K (File No. 1-11459) dated May 24, 2013. | ||

| 4.4.7 | *Supplemental Indenture No. 13, dated as of March 10, 2014, to said Indenture | Exhibit 4.2 to PPL Corporation Form 8-K (File No. 1-11459) dated March 10, 2014. | ||

| 4.4.8 | *Supplemental Indenture No. 14, dated as of March 10, 2014, to said Indenture | Exhibit 4.3 to PPL Corporation Form 8-K (File No. 1-11459) dated March 10, 2014. | ||

| 4.4.9 | *Supplemental Indenture No. 15, dated as of May 17, 2016, to said Indenture | Exhibit 4(b) to PPL Corporation Form 8-K (File No. 1-11459) dated May 17, 2016. | ||