LPX 12.31.2014 10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

| | |

For the fiscal year ended | | Commission File Number |

December 31, 2014 | | 1-7107 |

_____________________________

Louisiana-Pacific Corporation

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 93-0609074 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

| |

414 Union Street, Suite 2000 Nashville, TN 37219 | | 615-986-5600 |

(Address of principal executive offices) | | Registrant’s telephone number (including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $1 par value | | New York Stock Exchange |

Preferred Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark if the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $2,070,534,952

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date: 142,364,326 shares of Common Stock, $1 par value, outstanding as of March 2, 2015.

Documents Incorporated by Reference

Definitive Proxy Statement for 2014 Annual Meeting: Part III

Except as otherwise specified and unless the context otherwise requires, references to “LP”, the “Company”, “we”, “us”, and “our” refer to Louisiana-Pacific Corporation and its subsidiaries.

ABOUT FORWARD-LOOKING STATEMENTS

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their businesses and other matters as long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed in the statements. This report contains, and other reports and documents filed by us with the Securities and Exchange Commission may contain, forward-looking statements. These statements are or will be based upon the beliefs and assumptions of, and on information available to, our management.

The following statements are or may constitute forward-looking statements: (1) statements preceded by, followed by or that include words like “may,” “will,” “could,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “potential,” “continue” or “future” or the negative or other variations thereof and (2) other statements regarding matters that are not historical facts, including without limitation, plans for product development, forecasts of future costs and expenditures, possible outcomes of legal proceedings, capacity expansion and other growth initiatives and the adequacy of reserves for loss contingencies.

Factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to the following:

| |

• | changes in governmental fiscal and monetary policies and levels of employment; |

| |

• | changes in general economic conditions; |

| |

• | changes in the cost and availability of capital; |

| |

• | changes in the level of home construction activity; |

| |

• | changes in competitive conditions and prices for our products; |

| |

• | changes in the relationship between supply of and demand for building products; |

| |

• | changes in the relationship between supply of and demand for raw materials, including wood fiber and resins, used in manufacturing our products; |

| |

• | changes in the cost of and availability of energy, primarily natural gas, electricity and diesel fuel; |

| |

• | changes in other significant operating expenses; |

| |

• | changes in exchange rates between the U.S. dollar and other currencies, particularly the Canadian dollar, Australian dollar, EURO, Brazilian real and the Chilean peso; |

| |

• | changes in general and industry-specific environmental laws and regulations; |

| |

• | changes in tax laws, and interpretations thereof; |

| |

• | changes in circumstances giving rise to environmental liabilities or expenditures; |

| |

• | governmental gridlock and curtailment of government services and spending; |

| |

• | the resolution of existing and future product-related litigation and other legal proceedings; and |

| |

• | acts of public authorities, war, civil unrest, natural disasters, fire, floods, earthquakes, inclement weather and other matters beyond our control. |

In addition to the foregoing and any risks and uncertainties specifically identified in the text surrounding forward-looking statements, any statements in the reports and other documents filed by us with the Commission that warn of risks or uncertainties associated with future results, events or circumstances identify important factors that could cause actual results, events and circumstances to differ materially from those reflected in the forward-looking statements.

ABOUT THIRD-PARTY INFORMATION

In this report, we rely on and refer to information regarding industry data obtained from market research, publicly available information, industry publications, U.S. government sources and other third parties. Although we believe the information is reliable, we cannot guarantee the accuracy or completeness of the information and have not independently verified it.

PART I

General

Our company, founded in 1973 and headquartered in Nashville, Tennessee, is a leading manufacturer of building products. As of December 31, 2014, we had approximately 4,500 employees. We currently own 21 modern, strategically located facilities in the U.S. and Canada, two facilities in Chile and one facility in Brazil. We also operate facilities through a joint venture, for which we are the exclusive provider of product distribution for North America. Our focus is on delivering innovative, high-quality commodity and specialty building products to retail, wholesale, home building and industrial customers. We utilize various tools, such as Lean Six Sigma, to improve operational efficiency and productivity. Our products are used primarily in new home construction, repair and remodeling, and outdoor structures.

Business Segments

We operate in four segments: North America Oriented Strand Board (OSB); Siding; Engineered Wood Products (EWP); and South America. In general, our businesses are affected by the level of housing starts; the level of home repairs; changes in industry capacity; changes in the prices we pay for raw materials and energy and changes in foreign exchange rates (primarily the Canadian dollar, Chilean Peso and Brazilian Real).

OSB

Our OSB segment manufactures and distributes OSB structural panel products.

OSB is an innovative, affordable and environmentally smart product made from wood strands arranged in layers and bonded with resin. OSB serves many of the same uses as plywood, including roof decking, sidewall sheathing and floor underlayment, but can be produced at a significantly lower cost. It is estimated for 2014 that OSB accounted for approximately 62% of the structural panel consumption in North America with plywood accounting for the remainder. We estimate that the overall North American structural panel market (based upon 2014 housing starts) was 29.0 billion square feet with the OSB market comprising an estimated 18.0 billion square feet of this market. Based upon our production in 2014 of 4.3 billion square feet (including OSB produced in our siding segment), we estimate that we account for 24% of the North American OSB market and 15% of the overall North American structural panel market. We believe we have the largest installed capacity and are one of the most efficient producers of OSB in North America.

Siding

Our siding offerings fall into two categories: SmartSide® siding products and related accessories; and CanExel siding and accessories and other related products. Our SmartSide® products consist of a full line of wood-based sidings, trim, soffit and fascia. These products have quality and performance characteristics similar to solid wood at more attractive prices due to lower raw material and production costs. Our CanExel siding and accessory product offerings include a number of pre-finished lap and trim products in a variety of patterns and textures.

Additionally, minor amounts of commodity OSB are produced and sold in this segment.

Engineered Wood Products

Our Engineered Wood Products (EWP) segment manufactures and distributes laminated veneer lumber (LVL), I-Joists, laminated strand lumber (LSL) and other related products. This segment also includes the sale of I-Joist produced by our joint venture with Resolute Forest Products and LVL sold under a contract manufacturing arrangement. We believe that in North America we are one of the top three producers (including our joint venture production) of I-Joists, LVL and LSL. A plywood mill associated with our LVL operations in British Columbia and minor amounts of commodity OSB are also included in this segment.

We believe that our engineered I-joists, which are used primarily in residential and commercial flooring and roofing systems and other structural applications, are stronger, lighter and straighter than conventional lumber joists.

Our LVL and LSL are high-grade, value-added structural products used in applications where extra strength and quality is required, such as headers and beams.

South America

Our South American segment manufactures and distributes OSB and siding products in South America and certain export markets. This segment also distributes and sells related products to augment the transition to wood frame construction. We believe we are the only producer of OSB in South America.

Other Products

Our other products category includes our remaining timber and timberlands, and other minor products, services and closed operations. Prior to their disposition during 2013, this category also included our interest in a joint venture that produced cellulose insulation and our former moulding operations.

Sales, Marketing and Distribution

Our sales and marketing efforts are primarily focused on traditional two-step distribution, professional building products dealers, home centers, third-party wholesale buying groups and other retailers. The wholesale distribution channel includes a variety of specialized and broad-line wholesale distributors and dealers focused primarily on the supply of products for use by professional builders and contractors. The retail distribution channel includes large retail chains catering to the do-it-yourself (DIY) and repair and remodeling markets as well as smaller independent retailers.

Customers

We seek to maintain a broad customer base and a balanced approach to national distribution through both wholesale and retail channels. In 2014, our top ten customers accounted for approximately 41% of our sales. Because a significant portion of our sales are from OSB, a commodity product sold primarily on the basis of price and availability, we are not dependent on any one customer. Our principal customers include the following:

| |

• | Wholesale distribution companies, which supply building materials to retailers on a regional, state or local basis; |

| |

• | Two-step distributors, who provide building materials to smaller retailers, contractors and others; |

| |

• | Building materials professional dealers, that specialize in sales to professional builders, remodeling firms and trade contractors that are involved in residential home construction and light commercial building; |

| |

• | Retail home centers, that provide access to consumer markets with a broad selection of home improvement materials and increasingly serve professional builders, remodelers and trade contractors; and |

| |

• | Shed producers, who design, construct and distribute prefabricated residential and light commercial structures, including fully manufactured, modular and panelized structures, for consumer and professional markets. |

Seasonality

Our business is subject to seasonal variances, with demand for many of our products tending to be greater during the building season, which generally occurs in the second and third quarters in North America and the fourth and first quarters in South America. From time to time, we engage in promotional activities designed to stimulate demand for our products, such as reducing our selling prices and providing extended payment terms, particularly at times when demand is otherwise relatively soft. We do this in an effort to better balance our inventory levels with demand, manage the logistics of our product shipments, allow our production facilities to run efficiently, be competitive, and/or obtain initial orders from customers.

Competitors / Competition

The building products industry is highly competitive. We compete internationally with several thousand forest and building products firms, ranging from very large, fully integrated firms to smaller enterprises that may manufacture only one or a few items. We also compete less directly with firms that manufacture substitutes for wood building products. Some competitors have substantially greater financial and other resources than we do that could, in some instances, give them a competitive advantage over us.

In terms of our commodity OSB, we compete based upon price, quality and availability of products. In terms of our specialty products, including EWP, siding and various value added OSB products, we compete based upon price, quality, and availability of products as well as performance features offered.

Raw Materials

Wood fiber is the primary raw material used in most of our operations, and the primary source of wood fiber is timber. The primary end-markets for timber harvested in the U.S. are manufacturers who supply: (1) the housing market, where it is used in the construction of new housing and the repair and remodeling of existing housing; (2) the pulp and paper market; (3) commercial and industrial markets; (4) export markets; and (5) emerging biomass energy production markets. The supply of timber is limited by access to timber and by the availability of timberlands. The availability of timberlands, in turn, is limited by several factors, including forest management policies, alternate uses of land, and loss to urban or suburban real estate development.

In Canada, we harvest enough timber annually under long-term harvest rights with various Canadian governments and other third parties to support our Canadian production facilities.

We purchase approximately 80% of our wood fiber requirements on the open market, through either private cutting contracts or purchased wood arrangements. Our remaining wood fiber requirements (20%) are fulfilled through government contracts, principally in Canada. Because wood fiber is subject to commodity pricing, the cost of various types of timber that we purchase in the market has at times fluctuated greatly due to weather, governmental, economic or other industry conditions. However, our mills are generally in close proximity to large and diverse supplies of timber and have the ability to procure wood fiber at competitive prices.

In addition to wood fiber, we use a significant quantity of various resins in our manufacturing processes. Resin product costs are influenced by changes in the prices of raw materials used to produce resin, primarily petroleum products, as well as competing demand for resin products. Currently, we purchase the majority of our resin from three major suppliers and believe our relationships with those suppliers to be good. However there can be no assurance that pricing or availability of resins will not be impacted based upon competing demand.

While a portion of our energy requirements are generated at our plants through the conversion of wood waste, we also purchase substantial amounts of energy in our operations, primarily electricity and natural gas. Energy prices have experienced significant volatility in recent years, particularly in deregulated markets. We attempt to mitigate our exposure to energy price changes through the selective use of long-term supply agreements.

Environmental Compliance

Our operations are subject to many environmental laws and regulations governing, among other things, discharges of pollutants and other emissions on or into land, water and air, the disposal of hazardous substances or other contaminants, the remediation of contamination and the restoration and reforestation of timberlands. In addition, certain environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. Compliance with environmental laws and regulations can significantly increase the costs of our operations. In some cases, plant closures can result in more onerous compliance requirements becoming applicable to a facility or a site. Violations of environmental laws and regulations can subject us to additional costs and expenses, including defense costs and expenses and civil and criminal penalties.

We cannot assure you that the environmental laws and regulations to which we are subject will not become more stringent, or be more stringently implemented or enforced, in the future.

During 2012, the U.S. Environmental Protection Agency (EPA) finalized the Clean Air Act pollution standards. We estimate that we will be required to make capital expenditures in the range of $3 million to $13 million over the next five years to comply with such standards.

Our policy is to comply fully with all applicable environmental laws and regulations. We devote significant management attention to achieving full compliance. In addition, from time to time, we undertake construction projects for environmental control equipment or incur other environmental costs that extend an asset’s useful life, improve its efficiency or improve the marketability of certain properties.

Additional information concerning environmental matters is set forth under item 3, Legal Proceedings, and in Note 18 of the Notes to the consolidated financial statements included in item 8 of this report.

Employees

We employ approximately 4,500 people, about 800 of whom are members of unions, primarily in Canada, Chile and Brazil. We consider our relationship with our employees generally to be good. While we do not currently anticipate any work stoppage, there can be no assurance that work stoppages will not occur.

Available Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available to the public over the internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room at 100 F Street, NE., Washington, D.C. 20549. You may obtain information on the operation of the SEC’s public reference room in Washington, D.C. by calling the SEC at 1-800-SEC-0330.

In addition, we will make available our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act through our internet website at http://www.lpcorp.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Segment and Price Trend Data

The following table sets forth, for each of the last three years: (1) our production volumes; (2) the estimated average wholesale price of OSB sold in the United States; and (3) our logs procured by source. In addition, information concerning our: (1) consolidated net sales by business segment; (2) consolidated profit (loss) by business segment; (3) identifiable assets by segment; (4) depreciation, amortization and cost of timber harvested; (5) capital expenditures; and (6) geographic segment information is included at Note 24 of the Notes to the consolidated financial statements included in item 8 of this report and information concerning our sales by product line is included in item 7 of this report.

Product Information Summary

For Years Ended December 31

(Dollar amounts in millions, except per unit)

|

| | | | | | | | | | | |

| 2014 | | 2013 | | 2012 |

PRODUCTION VOLUMES(1) | | | | | |

OSB,3/8” basis, million square feet(2) | 4,294 |

| | 4,096 |

| | 3,660 |

|

South America OSB, million cubic meters | 485 |

| | 458 |

| | 458 |

|

Wood-based siding,3/8” basis, million square feet | 1,103 |

| | 1,011 |

| | 923 |

|

Engineered I-joists, million lineal feet | 76 |

| | 74 |

| | 63 |

|

Laminated veneer lumber and laminated strand lumber, thousand cubic feet | 9,015 |

| | 7,783 |

| | 6,633 |

|

COMMODITY PRODUCT PRICE TRENDS(3) | | | | | |

OSB, MSF, 7/16” span rating (North Central price) | $ | 218 |

| | $ | 315 |

| | $ | 271 |

|

OSB, MSF, 7/16” span rating (Western Canada price) | $ | 197 |

| | $ | 300 |

| | $ | 269 |

|

OSB, MSF, 7/16” span rating (Southwest price) | $ | 208 |

| | $ | 293 |

| | $ | 260 |

|

% LOGS BY SOURCES(4) | | | | | |

Private cutting contracts | 4 | % | | 6 | % | | 8 | % |

Government contracts | 20 | % | | 29 | % | | 26 | % |

Purchased logs | 76 | % | | 65 | % | | 67 | % |

| |

(1) | Includes purchases of products from joint ventures or purchased under contract manufacturing arrangements. |

| |

(2) | Includes production at both our commodity and specialty mills in North America. |

| |

(3) | Prices represent yearly averages stated in dollars per thousand square feet (MSF). Source: Random Lengths. |

| |

(4) | Stated as a percentage of total log volume. |

You should be aware that the occurrence of any of the events described in this Risk Factors section and elsewhere in this report or in any other of our filings with the SEC could have a material adverse effect on our business, financial position, results of operations and cash flows. In evaluating us, you should consider carefully, among other things, the risks described below and the matters described in “About Forward-Looking Statements.”

Cyclical industry conditions and commodity pricing have and may continue to adversely affect our financial condition and results of operations. Our operating results reflect the general cyclical pattern of the building products industry. Demand for our products correlates to a significant degree to the level of residential construction activity in North America, which historically has been characterized by significant cyclicality. This cyclicality is influenced by a number of factors, including the supply of new and existing homes on the market, the level of unemployment, longer-term interest rates, and mortgage foreclosure rates. The cyclicality is also influenced by the availability of mortgage financing, which is currently more restrictive than normal and which could be adversely affected by the implementation of one or more proposals to eliminate or reduce the mortgage market roles of or levels of support for government-sponsored enterprises such as Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. A significant increase in longer-term interest rates, a prolonged decline in the availability of mortgage financing, or the occurrence of other events that reduce levels of residential construction activity could have a material adverse effect on our financial condition, results of operations and cash flows. Our primary product, OSB, and a significant portion of our raw materials are globally traded commodity products. In addition, our products are subject to competition from manufacturers worldwide. Historical prices for our products have been volatile, and we, like other participants in the building products industry, have limited influence over the timing and extent of price changes for our products. Product pricing is significantly affected by the relationship between supply and demand in the building products industry. Product supply is influenced primarily by fluctuations in available manufacturing capacity. Demand is affected by the state of the economy in general and a variety of other factors, including the level of new residential construction activity and home repair and remodeling activity, changes in the availability and cost of mortgage financing and weather conditions. We are not able to predict with certainty market conditions and selling prices for our products. In this competitive environment with so many variables which we do not control, we cannot assure you that prices for our products will not decline from current levels. A prolonged and severe weakness in the markets for one or more of our principal products, particularly OSB, could seriously harm our financial condition and results of operations and our ability to satisfy our cash requirements, including the payment of interest and principal on our debt.

We have a high degree of product concentration. OSB accounted for about 48%, 59% and 57% of our North American sales in 2014, 2013 and 2012 and we expect OSB sales to continue to account for a substantial portion of our revenues and profits in the future. Concentration of our business in the OSB market further increases our sensitivity to commodity pricing and price volatility. In this competitive environment with so many variables for which we do not control, we cannot assure you that pricing for OSB or our other products will not decline from current levels.

Intense competition in the building products industry could prevent us from increasing or sustaining our net sales and profitability. The markets for our products are highly competitive. Our competitors range from very large, fully integrated forest and building products firms to smaller firms that may manufacture only one or a few types of products. We also compete less directly with firms that manufacture substitutes for wood building products. Many of our competitors have greater financial and other resources than we do, and certain of the mills operated by our competitors may be lower-cost producers than the mills operated by us.

Our results of operations may be harmed by potential shortages of raw materials and increases in raw material costs. The most significant raw material used in our operations is wood fiber. We currently obtain about 80% of our wood fiber requirements in the open market. Wood fiber is subject to commodity pricing, which fluctuates on the basis of market factors over which we have no control. In addition, the cost of various types of wood fiber that we purchase in the market has at times fluctuated greatly because of governmental, economic or industry conditions, and may be affected by increased demand resulting from initiatives to increase the use of

biomass materials in the production of heat, power, biobased products and biofuels. In addition to wood fiber, we also use a significant quantity of various resins in our manufacturing processes. Resin product costs are influenced by changes in the prices or availability of raw materials used to produce resins, primarily petroleum products, as well as demand for and availability of resin products. Selling prices of our products have not always increased in response to raw material cost increases. We are unable to determine to what extent, if any, we will be able to pass any future raw material cost increases through to our customers through product price increases. Our inability to pass increased costs through to our customers could have a material adverse effect on our financial condition, results of operations and cash flows.

Many of the Canadian forestlands from which we obtain wood fiber also are subject to the constitutionally protected treaty or common-law rights of the aboriginal peoples of Canada. Most of British Columbia is not covered by treaties and, as a result, the claims of British Columbia’s aboriginal peoples relating to forest resources are largely unresolved, although many aboriginal groups are actively engaged in treaty discussions with the governments of British Columbia and Canada. Final or interim resolution of claims brought by aboriginal groups are expected to result in additional restrictions on the sale or harvest of timber and may increase operating costs and affect timber supply and prices in Canada.

We depend on our senior management team and other key employees, and significant attrition within our management team could adversely affect our business. Our success depends in part on our ability to attract, retain and motivate senior management and other key employees. Achieving this objective may be difficult due to many factors, including fluctuations in global economic and industry conditions, competitors’ hiring practices, cost reduction activities, and the effectiveness of our compensation programs. Competition for qualified personnel can be very intense. We must continue to recruit, retain and motivate senior management and other key employees sufficient to maintain our current business and support our future projects. A loss of any such personnel, or the inability to recruit and retain qualified personnel in the future, could have an adverse effect on our business, financial condition and results of operations.

Our operations require substantial capital. Capital expenditures for expansion or replacement of existing facilities or equipment or to comply with future changes in environmental laws and regulations may be substantial. Although we maintain our production equipment with regular periodic and scheduled maintenance, we cannot assure you that key pieces of equipment in our various production processes will not need to be repaired or replaced or that we will not incur significant additional costs associated with environmental compliance. The costs of repairing or replacing such equipment and the associated downtime of the affected production line could have a material adverse effect on our financial condition, results of operations and cash flow. If for any reason we are unable to provide for our operating needs, capital expenditures and other cash requirements on economic terms, we could experience a material adverse effect on our business, financial condition, results of operations and cash flows.

Our pension and health care costs are subject to numerous factors which could cause these costs to change. We have defined benefit pension plans covering substantially all U.S. and Canadian employees. We provide retiree health care benefits to certain of our U.S. salaried and certain hourly employees. Our pension costs are dependent upon numerous pension plan provisions that are subject to interpretations and factors resulting from actual plan experience and assumptions of future experience. Pension plan assets are primarily made up of equity and fixed income investments. Fluctuations in actual equity market returns; changes in general interest rates and changes in the number of retirees may result in increased pension costs in future periods. Likewise, changes in assumptions regarding current discount rates and expected rates of return on plan assets could also change pension and health care costs. We are subject to market risk on pension plan assets as well as discount rates on long-term obligations. Significant adverse changes in the factors affecting our pension and health care costs could adversely affect our cash flows, financial condition and results of operations.

Our pension plans are currently underfunded, and over time we may be required to make cash payments to the plans, reducing the cash available for our business. We record a liability associated with our pension plans equal to the excess of the benefit obligation over the fair value of plan assets. The benefit liability recorded under the provisions of Accounting Standards Codification (ASC) 715, “Compensation—Retirement Benefits,” at December 31, 2014 was $96.1 million. Although we expect to contribute $2.0 million to $5.0 million to our plans in

2015, we continually reassess the amount and timing of any discretionary contributions. Over the next several years we may make significant contributions to the plans. The amount of such contributions will depend upon a number of factors, principally the actual earnings and changes in values of plan assets and changes in interest rates.

We depend on third parties for transportation services and increases in costs and the availability of transportation could materially and adversely affect our business and operations. Our business depends on the transportation of a large number of products, both domestically and internationally. We rely primarily on third parties for transportation of the products we manufacture and/or distribute as well as for delivery of our raw materials. In particular, a significant portion of the goods we manufacture and raw materials we use are transported by railroad or trucks, which are highly regulated. If any of our third-party transportation providers were to fail to deliver the goods we manufacture or distribute in a timely manner, we may be unable to sell those products at full value or at all. Similarly, if any of these providers were to fail to deliver raw materials to us in a timely manner, we may be unable to manufacture our products in response to customer demand. In addition, if any of these third parties were to cease operations or cease doing business with us, we may be unable to replace them at reasonable cost. Any failure of a third-party transportation provider to deliver raw materials or finished products in a timely manner could harm our reputation, negatively affect our customer relationships and have a material adverse effect on our financial condition and results of operations. In addition, an increase in transportation rates or fuel surcharges could materially and adversely affect our sales and profitability.

We are subject to significant environmental regulation and environmental compliance expenditures and liabilities. Our businesses are subject to many environmental laws and regulations, particularly with respect to discharges of pollutants and other emissions on or into land, water and air, and the disposal and remediation of hazardous substances or other contaminants and the restoration and reforestation of timberlands. Compliance with these laws and regulations is a significant factor in our business. We have incurred and expect to continue to incur significant expenditures to comply with applicable environmental laws and regulations. Moreover, some or all of the environmental laws and regulations to which we are subject could become more stringent in the future. Our failure to comply with applicable environmental laws and regulations and permit requirements could result in civil or criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, installation of pollution control equipment or remedial actions.

Some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. In addition, we occasionally evaluate various alternatives with respect to our facilities, including possible dispositions or closures. Investigations undertaken in connection with these activities may lead to discoveries of contamination that must be remediated, and closures of facilities may trigger compliance requirements that are not applicable to operating facilities. Consequently, we cannot assure you that existing or future circumstances or developments with respect to contamination will not require significant expenditures by us.

We are involved in various environmental matters, product liability and other legal proceedings. The outcome of these matters and proceedings and the magnitude of related costs and liabilities are subject to uncertainties. The conduct of our business involves the use of hazardous substances and the generation of contaminants and pollutants. In addition, the end-users of many of our products are members of the general public. We currently are or from time to time in the future may be involved in a number of environmental matters and legal proceedings, including legal proceedings involving anti-trust, warranty or non-warranty product liability claims, negligence and other claims, including claims for wrongful death, personal injury and property damage alleged to have arisen out of the use by others of our or our predecessors’ products or the release by us or our predecessors of hazardous substances. Environmental matters and legal matters and proceedings, including class action settlements relating to certain of our products, have in the past caused and in the future may cause us to incur substantial costs. We have established contingency reserves in our consolidated financial statements with respect to the estimated costs of existing environmental matters and legal proceedings to the extent that our management has determined that such costs are both probable and reasonably estimable as to amount. However, such reserves are based upon various estimates and assumptions relating to future events and circumstances, all of which are subject to inherent uncertainties. We regularly monitor our estimated exposure to environmental and litigation loss contingencies and, as additional information becomes known, may change our estimates significantly. However, no estimate of the range of any such

change can be made at this time. We may incur costs in respect of existing and future environmental matters and legal proceedings as to which no contingency reserves have been established. We cannot assure you that we will have sufficient resources available to satisfy the related costs and expenses associated with these matters and proceedings.

Settlements of tax exposures may exceed the amounts we have established for known estimated tax exposures. We maintain reserves for known estimated tax exposures in federal, state and international jurisdictions and uncertain tax positions. Significant income tax exposures may include potential challenges to intercompany pricing and loans, the treatment of financing, acquisition and disposition transactions, the use of hybrid entities and other matters. These exposures are settled primarily through the closure of audits with the taxing jurisdictions and, on occasion, through the judicial process, either of which may produce a result inconsistent with past estimates. We believe that we have established appropriate reserves for estimated exposures; however, if actual results differ materially from our estimates we could experience a material adverse effect on our financial condition, results of operations and cash flows. In addition, our deferred tax liabilities include substantial amounts related to installment sales of timber lands in 1998 and 2003 for which we have previously monetized most of the installment receivable. As a result of these monetizations, we will be required to fund these liabilities from sources other than such installments, potentially including such tax loss and credit carryovers as may then be available.

Fluctuations in foreign currency exchange rates could result in currency exchange losses and reductions in stockholders' equity. A significant portion of our operations are conducted through foreign subsidiaries. The functional currency for our Canadian subsidiary is the U.S. dollar. The financial statements of this foreign subsidiary are remeasured into U.S. dollars using the historical exchange rate for property, plant and equipment, timber and timberlands, equity and certain other non-monetary assets and liabilities and related depreciation and amortization on these assets and liabilities. These transaction and translation gains or losses are recorded in foreign exchange gains (losses) in the income statement. The functional currency of our Chilean subsidiary is the Chilean peso and the functional currency of our Brazilian subsidiary is the Brazilian real. Translation adjustments, which are based upon the exchange rate at the balance sheet date for assets and liabilities and the weighted average rate for the income statement, are recorded in the Accumulated Comprehensive Income (Loss) section of Stockholders’ Equity. Therefore, changes in the Canadian dollar, the Chilean peso or the Brazilian real relative to the U.S. dollar may have a material adverse effect on our financial condition and results of operations.

Our ability to service our indebtedness, to refinance our indebtedness or to fund our other liquidity needs is subject to various risks. Our ability to make scheduled payments on and to refinance our indebtedness depends on and is subject to our financial and operating performance, which in turn is affected by general and regional economic, financial, competitive, business and other factors, including the availability of financing in the banking and capital markets as well as the other risks described herein. In particular, demand for our products correlates to a significant degree to the level of residential construction activity in North America, which historically has been characterized by significant cyclicality. Over the last several years, housing starts remained below “normal” levels. There can be no assurance as to when, or if the housing market, will rebound to “normal levels”. Accordingly, we cannot assure you that our business will generate sufficient cash flows from operations or that future borrowings will be available to us in an amount sufficient to enable us to service our debt, to refinance our debt or to fund our other liquidity needs. If we are unable to service our debt obligations or to fund our other liquidity needs, we could be forced to curtail our operations, reorganize our capital structure or liquidate some or all of our assets in a manner that could cause the holders of our securities to experience a partial or total loss of their investment in us.

We have not independently verified the results of third-party research or confirmed assumptions or judgments upon which it may be based, and the forecasted and other forward-looking information contained therein is subject to inherent uncertainties. We refer in this report and other documents that we file with the SEC to historical, forecasted and other forward-looking information published by sources such as RISI (Resource Information Systems, Inc.), FEA (Forest Economic Advisors, LLC), Random Lengths and the U.S. Census Bureau that we believe to be reliable. However, we have not independently verified this information and, with respect to the forecasted and forward-looking information, have not independently confirmed the assumptions and judgments upon which it is based. Forecasted and other forward looking information is necessarily based on assumptions regarding future occurrences, events, conditions and circumstances and subjective judgments relating to various matters, and is

subject to inherent uncertainties. Actual results may differ materially from the results expressed or implied by, or based upon, such forecasted and forward-looking information.

Initiatives to upgrade our information technology infrastructure involve many risks. We regularly implement business process improvement initiatives to optimize our performance. Our current initiatives include plans to further standardize the business processes and technology that support our strategies through implementation of further upgrades to our software solution over the next few years. We may experience difficulties as we transition to these new or upgraded systems and processes, including loss of data and decreases in productivity as our personnel become familiar with new systems. In addition, transitioning to these new or upgraded systems requires significant capital investments and personnel resources. Difficulties in implementing new or upgraded information systems or significant system failures could disrupt our operations and have a material adverse effect on our business, financial condition, results of operations or cash flows. In addition, we will experience significant changes in our internal controls over financial reporting as our implementation progresses. If we are unable to manage these changes successfully, our ability to timely and accurately process transactions and report our results of operations could be adversely affected.

| |

ITEM 1B. | Unresolved Staff Comments |

None.

ITEM 2. Properties

Information regarding our principal properties and facilities is set forth in the following tables. Information regarding production capacities is based on normal operating rates and normal production mixes under current market conditions, taking into account known constraints such as log supply. Market conditions, fluctuations in log supply, and the nature of current orders may cause actual production rates and mixes to vary significantly from the production rates and mixes shown.

ORIENTED STRAND BOARD

Oriented Strand Board Panel Plants

11 plants—5,885 million square feet annual capacity, 3/8” basis

|

| | |

| Square feet in millions |

Carthage, TX | 500 |

|

Chambord, Quebec, Canada1 | 470 |

|

Dawson Creek, BC, Canada | 380 |

|

Ft. St. John, British Columbia, Canada | 820 |

|

Hanceville, AL | 410 |

|

Jasper, TX | 475 |

|

Maniwaki, Quebec, Canada | 650 |

|

Roxboro, NC | 500 |

|

Sagola, MI | 410 |

|

Swan Valley, Manitoba, Canada3 | 520 |

|

Thomasville, AL | 750 |

|

SIDING

Siding and Specialty Plants

6 plants—1,445 million square feet annual capacity, 3/8” basis

|

| | |

| Square feet in millions |

Newberry, MI | 150 |

|

Hayward, WI2 | 475 |

|

Tomahawk, WI | 230 |

|

Two Harbors, MN | 190 |

|

Roaring River, NC | 300 |

|

East River, Nova Scotia, Canada | 100 |

|

ENGINEERED WOOD PRODUCTS

I-joist Plants4

1 plant—80 million lineal feet annual capacity

|

| | |

| Lineal feet in millions |

Red Bluff, CA | 80 |

|

LVL Plants

2 plants—9,400 thousand cubic feet annual capacity

|

| | |

| Cubic feet in thousands |

Golden, BC, Canada | 4,800 |

|

Wilmington, NC | 4,600 |

|

LSL Plant

1 plant—7,000 thousand cubic feet annual capacity

|

| | |

| Cubic feet in thousands |

Houlton, ME | 7,000 |

|

SOUTH AMERICAN OPERATIONS

3 plants—680 million square feet annual capacity. 3/8” basis

|

| | |

| Square feet in millions |

Panguipulli, Chile | 130 |

|

Lautaro, Chile | 160 |

|

Ponta Grossa, Brazil | 390 |

|

_______________

| |

1 | Facility indefinitely curtailed as of December 31, 2014. |

| |

2 | The Hayward, WI siding facility can produce both commodity OSB and SmartSide siding. |

| |

3 | The Swan Valley, Manitoba, Canada OSB mill is planned to be converted to a siding plant in 2015. |

| |

4 | In addition to the plants described, our 50/50 joint venture with Resolute Forest Products owns and operates a plant in St. Prime, Quebec, Canada and a plant in La Rouche, Quebec, Canada. The combined annual production capacity of these facilities is 140 million lineal feet. |

CANADIAN TIMBERLAND LICENSE AGREEMENTS

|

| | |

Location | Acres |

British Columbia | 20,700,000 |

|

Manitoba | 8,900,000 |

|

Nova Scotia | 600,000 |

|

Quebec | 27,700,000 |

|

Total timberlands under license agreements in Canada | 57,900,000 |

|

We also have timber-cutting rights on 12,874 acres on government and privately owned timberlands in the U.S.

Our Canadian subsidiary has arrangements with four Canadian provincial governments which give our subsidiary the right to harvest a volume of wood off public land from defined forest areas under supply and forest management agreements, long-term pulpwood agreements, and various other timber licenses. The acreage noted above is the gross amount of the licenses and is not reflective of the amount of timber acreage that we currently manage. We also obtain wood from private parties in certain cases where the provincial governments require us to obtain logs from private parties prior to harvesting from the licenses to meet our raw materials needs.

ITEM 3. Legal Proceedings

Certain environmental matters and legal proceedings are discussed below.

ENVIRONMENTAL MATTERS

We are involved in a number of environmental proceedings and activities, and may be wholly or partially responsible for known or unknown contamination existing at a number of other sites at which we have conducted operations or disposed of wastes. Based on the information currently available, management believes that any fines, penalties or other costs or losses resulting from these matters will not have a material adverse effect on our financial position, results of operations, cash flows or liquidity.

ARS LITIGATION

On July 31, 2009, LP filed suit in the United States District Court for the Northern District of California captioned Louisiana Pacific Corporation v. Money Market 1 Institutional Investment Dealer ("MM1"); Merrill Lynch & Co., Inc.; Merrill Lynch, Pierce, Fenner & Smith Incorporated; and Deutsche Bank Securities Inc. (Civil Action No.09cv3529). Merrill Lynch caused this case to be transferred to the United States District Court for the Southern District of New York (Civil Action No. 09 MD 2030) where Merrill Lynch had multiple similar cases pending as a result of a Multi-District Litigation Panel ruling. This matter arose out of LP's acquisition of certain ARS structured and underwritten by Merrill Lynch and Deutsche Bank with an approximate par value of $145.9 million. In the lawsuit, LP alleges that the defendants made misrepresentations and omissions of material facts in connection with the issuance of and the auctions for the ARS which constitute a violation of both state and federal securities laws, as well as common law fraud. LP seeks recovery of compensatory damages, rescission of the purchase of the securities at par value, consequential damages, punitive damages, attorneys' fees and any other damages the court deems appropriate under the circumstances.

On February 15, 2012, the Court granted Merrill Lynch's motion to dismiss the case against Merrill Lynch. Cases against MM1 remain pending in the Northern District of California and the Southern District of New York. LP is seeking default judgment against MM1 in both cases.

On November 30, 2012, we entered into a settlement agreement and mutual release with Deutsche Bank Securities Inc, (DBSI) relating to the case against DBSI. Pursuant to the agreement, DBSI, without admitting any liability or wrong-doing, paid to us the sum of $20 million, we dismissed the legal proceedings against DBSI with prejudice, and we and DBSI released the other from all claims and liabilities arising out of the sale and purchase of the auction rate securities and the related legal proceedings.

HARDBOARD TRIM LITIGATION

We were named in four putative class action lawsuits filed against us in United States District Courts during the first quarter of 2012 related to non-treated hardboard trim product formerly manufactured at our Roaring River, North Carolina hardboard plant: Brown v. Louisiana-Pacific Corporation., Case No. 4:12-CV-00102-RP-TJS (S.D. Iowa) (filed March 8, 2012, as a state-wide putative class); Holbrook v. Louisiana-Pacific Corporation, et al., Case No. 3:12-CV-00484-JGC (N.D. Ohio) (filed February 28, 2012, as a state-wide putative class); Bristol Village Inc. v. Louisiana-Pacific Corporation, et al., Case No. 1:12-CV-00263 (W.D.N.Y.) (filed March 30, 2012, as a state-wide putative class or, alternatively, as a nation-wide putative class) and Prevett v. Louisiana-Pacific, Case No. 6:12-CV-348-ORL-18-KRS (M.D. Fla) (filed March 5, 2012, as a state-wide putative class). A fifth lawsuit, Eugene Lipov v. Louisiana-Pacific, Case 1:12-CV-00439- JTN (W.D. Mich) (filed May 3, 2012) was filed as a statewide putative class action in the second quarter of 2012. These lawsuits follow two state-wide putative class action lawsuits previously filed against LP in United States District Courts: Hart, et al. v. Louisiana-Pacific Corp., Case No. 2:08-CV-00047 (E.D.N.C.). and Ellis, et al. v. Louisiana-Pacific Corp., Case No. 3:11-CV-191 (W.D.N.C.) The Hart case was certified by the District Court as a class action on July 15, 2011.

The Holbrook case was dismissed by the District Court on August 29, 2012 and appealed by the plaintiffs to the United States Court of Appeals for the Sixth Circuit. The Court of Appeals upheld the dismissal on all counts except the express warranty. The Ellis case was dismissed in its entirety by the District Court which dismissal was affirmed by the United States Court of Appeals for the Fourth Circuit on November 2, 2012. The Prevett case was voluntarily dismissed by the plaintiffs on May 31, 2012 and replaced by Riley v. Louisiana-Pacific, Case No. 6:12-CV-00837-18 (M.D. Fla) (filed June 4, 2012 as a state-wide putative class). The Riley case was voluntarily dismissed by the plaintiffs on December 17, 2013. The Lipov case was voluntarily dismissed by the plaintiffs on November 27, 2013. On August 30, 2013, the District Court in the Hart case decertified the class and granted summary judgment on the claims brought by the individual plaintiff’s dismissing the entire case. The plaintiffs have appealed the dismissal and decertification to the United States Court of Appeals for the Fourth Circuit.

On October 4, 2013, another lawsuit, Harbison v. Louisiana-Pacific Corporation, Case No. 2:13-CV-00814 (W.D. Pa.) was filed as a putative class action. On February 17, 2014, the U.S. District Court granted, in part, LP’s motion to dismiss and on March 20, 2014, the court granted summary judgment in favor of LP on the breach of express warranty claim. This matter is being appealed by the plaintiffs to the United States Court of Appeals for the Third Circuit.

On September 18, 2014, the district court in Brown v. Louisiana-Pacific Corporation., Case No. 4:12-CV-00102-RP-TJS (S.D. Iowa) (filed March 8, 2012, as a state-wide putative class) granted LP’s motion for summary judgment and denied as moot Plaintiff’s motion for class certification. Plaintiff has moved for reconsideration of the court’s order.

The plaintiffs in these lawsuits seek to certify classes consisting of all persons that own structures within the respective states in which the lawsuits were filed (or, in some cases, within the United States) on which the hardboard trim in question is installed. The plaintiffs seek unspecified damages and injunctive and other relief under various state law theories, including negligence, violations of consumer protection laws, and breaches of implied and express warranties, fraud, and unjust enrichment. While some individual owners of structures within the putative classes may have valid warranty claims, we believe that the claims asserted on a class basis are without merit and we intend to defend these matters vigorously. We have established warranty reserves for the hardboard trim in question pursuant to our normal business practices, and we do not believe that the resolution of these lawsuits will have a material effect on our financial condition, results of operations, cash flows or liquidity.

OTHER PROCEEDINGS

LP is party to other legal proceedings. Based on the information currently available, LP believes that the resolution of such proceedings will not have a material adverse effect on its financial position, results of operations, cash flows or liquidity.

CONTINGENCY RESERVES

We maintain reserves for the estimated cost of the legal and environmental matters referred to above. However, as with any estimate, there is uncertainty of predicting the outcomes of claims and litigation and environmental investigations and remediation efforts that could cause actual costs to vary materially from current estimates. Due to various uncertainties, we cannot predict to what degree actual payments will exceed the recorded liabilities related to these matters. However, it is possible that, in either the near term or the longer term, revised estimates or actual payments will significantly exceed the recorded liabilities.

For information regarding our financial statement reserves for the estimated costs of the environmental and legal matters referred to above, see Note 18 of the Notes to financial statements included in item 8 in this report.

ITEM 4. Mine Safety Disclosures

N/A

PART II

| |

ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The common stock of LP is listed on the New York Stock Exchange with the ticker symbol “LPX.” The Dow-Jones newspaper quotations symbol for the common stock is “LaPac.” Information regarding the high and low sales prices for the common stock for each quarter of the last two years is as follows:

|

| | | | | | | | | | | | | | | |

| 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR |

HIGH AND LOW STOCK PRICES | | | | | | | |

2014 High | $ | 18.88 |

| | $ | 17.55 |

| | $ | 15.45 |

| | $ | 17.66 |

|

Low | $ | 15.85 |

| | $ | 13.73 |

| | $ | 12.71 |

| | $ | 12.46 |

|

2013 High | $ | 22.55 |

| | $ | 21.70 |

| | $ | 18.50 |

| | $ | 18.96 |

|

Low | $ | 18.93 |

| | $ | 14.51 |

| | $ | 14.73 |

| | $ | 15.40 |

|

As of March 2, 2015, there were approximately 6,881 holders of record of our common stock. No dividends were paid in 2014 or 2013. Our ability to pay dividends in the future is subject to limitations set forth in the agreement governing our bank credit facility and the indenture governing our Senior Notes due in 2020.

ISSUER PURCHASES OF EQUITY SECURITIES

On October 31, 2014, LP’s Board of Directors authorized LP to repurchase up to $100 million of LP’s common stock. LP may initiate, discontinue or resume purchases of its common stock under this authorization in the open market, in privately negotiated transactions or otherwise at any time or from time to time without prior notice. As of March 2, 2015, no purchases have occurred under this authorization.

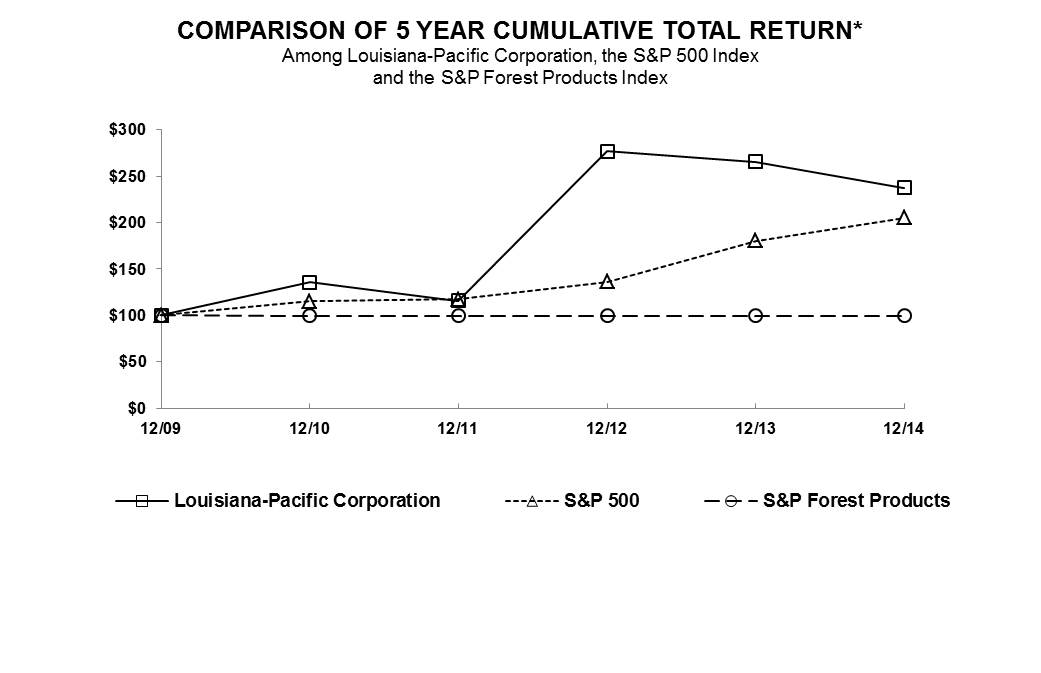

PERFORMANCE GRAPH

The following graph compares the total cumulative return to investors, including dividends paid (assuming reinvestment of dividends) and appreciation or depreciation in stock price, from an investment in LP Common Stock for the period December 31, 2009 through December 31, 2014, to the total cumulative return to investors from the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Paper and Forest Products Index for the same period. Stockholders are cautioned that the graph shows the returns to investors only as of the dates noted and may not be representative of the returns for any other past or future period.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Dec-09 | | Dec-10 | | Dec-11 | | Dec-12 | | Dec-13 | | Dec-14 |

LOUISIANA-PACIFIC CORPORATION | $ | 100 |

| | $ | 136 |

| | $ | 116 |

| | $ | 277 |

| | $ | 265 |

| | $ | 237 |

|

S&P 500 INDEX | $ | 100 |

| | $ | 115 |

| | $ | 117 |

| | $ | 136 |

| | $ | 180 |

| | $ | 205 |

|

PAPER & FOREST PRODUCTS | $ | 100 |

| | $ | 100 |

| | $ | 100 |

| | $ | 100 |

| | $ | 100 |

| | $ | 100 |

|

ITEM 6. Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | |

Dollar amounts in millions, except per share | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Year ended December 31 | | | | |

SUMMARY INCOME STATEMENT DATA | | | | | | | | | |

Net sales | $ | 1,934.8 |

| | $ | 2,085.2 |

| | $ | 1,691.2 |

| | $ | 1,328.7 |

| | $ | 1,351.4 |

|

Income (loss) from continuing operations | (73.4 | ) | | 177.4 |

| | 29.5 |

| | (175.5 | ) | | (37.4 | ) |

Loss from discontinued operations | (2.0 | ) | | (0.3 | ) | | (0.7 | ) | | (5.6 | ) | | (1.2 | ) |

Net income (loss) | (75.4 | ) | | 177.1 |

| | 28.8 |

| | (181.1 | ) | | (38.6 | ) |

Net income (loss) attributed to Louisiana-Pacific Corporation | (75.4 | ) | | 177.1 |

| | 28.8 |

| | (181.3 | ) | | (39.0 | ) |

Income (loss) from continuing operations per share—basic | $ | (0.52 | ) | | $ | 1.27 |

| | $ | 0.22 |

| | $ | (1.32 | ) | | $ | (0.29 | ) |

Net income (loss) per share—basic | $ | (0.53 | ) | | $ | 1.27 |

| | $ | 0.21 |

| | $ | (1.36 | ) | | $ | (0.30 | ) |

Income (loss) from continuing operations per share—diluted | $ | (0.52 | ) | | $ | 1.23 |

| | $ | 0.20 |

| | $ | (1.32 | ) | | $ | (0.29 | ) |

Net income (loss) per share—diluted | $ | (0.53 | ) | | $ | 1.23 |

| | $ | 0.20 |

| | $ | (1.36 | ) | | $ | (0.30 | ) |

Average shares of common stock outstanding (millions) | | | | | | | | | |

Basic | 141.1 |

| | 139.6 |

| | 137.1 |

| | 133.2 |

| | 129.1 |

|

Diluted | 141.1 |

| | 144.3 |

| | 142.6 |

| | 133.2 |

| | 129.1 |

|

SUMMARY BALANCE SHEET INFORMATION | | | | | | | | | |

Total assets | $ | 2,353.5 |

| | $ | 2,493.3 |

| | $ | 2,331.0 |

| | $ | 2,139.9 |

| | $ | 2,410.6 |

|

Long-term debt, excluding current portion | $ | 759.5 |

| | $ | 762.7 |

| | $ | 782.7 |

| | $ | 715.9 |

| | $ | 714.5 |

|

Contingency reserves, excluding current portion | $ | 12.2 |

| | $ | 13.3 |

| | $ | 12.8 |

| | $ | 17.2 |

| | $ | 25.9 |

|

Stockholders’ equity | $ | 1,115.8 |

| | $ | 1,226.3 |

| | $ | 1,033.8 |

| | $ | 1,000.9 |

| | $ | 1,217.8 |

|

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

General

Our products are used primarily in new home construction, repair and remodeling, and outdoor structures. We also market and sell our products in light industrial and commercial construction and we have a modest export business. Our manufacturing facilities are primarily located in the U.S. and Canada, but we also operate two facilities in Chile and one facility in Brazil.

To serve these markets, we operate in four segments: North America Oriented Strand Board (OSB); Siding; Engineered Wood Products (EWP); and South America. OSB is the most significant segment, accounting for 44% of continuing sales in 2014, 51% in 2013 and 48% in 2012.

OSB is sold as a commodity for which sales prices fluctuate daily based on market factors over which we have little or no control. We cannot predict whether the prices of our products will remain at current levels, increase or decrease in the future.

Factors Affecting Our Results

Revenues and Operating Costs.

We derive our revenues from sales of our products. The unit volumes of products sold and the prices at which sales are made determine the amount of our revenues. These volumes and prices are affected by the overall level of demand for, and supply of, products of the type we sell and comparable or substitute products, and by competitive conditions.

Our operating results reflect the relationship between the amount of our revenues and our costs of production and other operating costs and expenses. Our costs of production are affected by, among other factors, costs of raw materials (primarily wood fiber and various petroleum-based resins) and energy costs, which in turn are affected by the overall market supply of and demand for these manufacturing inputs.

Demand for Building Products

Demand for our products correlates to a significant degree to the level of residential construction activity in North America, which historically has been characterized by significant cyclicality. This activity can be further delineated into three areas: (1) new home construction; (2) repair and remodeling; and (3) outdoor structures.

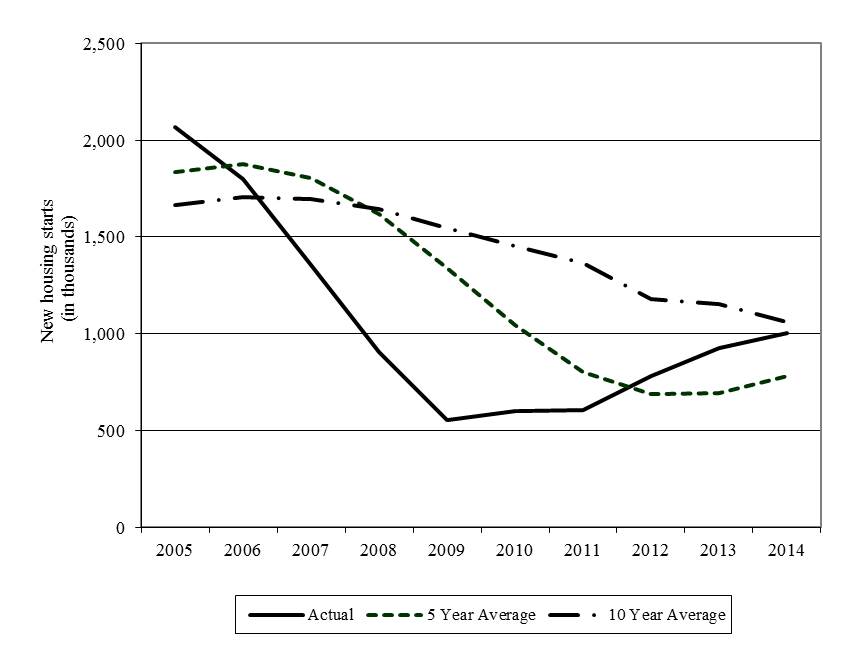

New Home Construction. Demand for our products correlates to a significant degree to the level of new home construction activity in North America, which historically has been characterized by significant cyclicality. The U.S. Census Bureau reported that actual single and multi-family housing starts in 2014 were about 9% higher than 2013, which were about 19% higher than such housing starts in 2012. We believe that the level of building continues to be impacted by delayed household formations due to the sluggish economy and a more restrictive mortgage market.

While near term residential construction is constrained in the U.S., positive long-term fundamentals exist. Increased immigration, the changing age distribution of the population, the high number of adults living with their parents and historically low interest rates are expected to lead to more household formations. The chart below, which is based on data published by U.S. Census Bureau, provides a graphical summary of new housing starts for single and multi-family in the U.S. showing actual and rolling five and ten year averages for housing starts.

Repair and Remodeling. Demand for building materials to support home improvement projects is largely tied to the size and age of the existing housing stock in North America and consumer confidence. In this regard, the 1970s and 1980s had some of the highest levels of building activity. This puts these homes at an age of approximately 30-40 years, which has been shown to be consistent with the highest per home expenditure rate on repair and remodeling. With the rise in the number and scale of home improvement stores in North America, individuals now have ready and convenient access to obtain the building materials needed for repair and remodeling, as well as increased access to installation services.

Supply of Building Products

OSB is a commodity product, and it is, along with all of our products, subject to competition from manufacturers worldwide. Product supply is influenced primarily by fluctuations in available manufacturing capacity and imports. According to FEA (Forest Economic Advisors, LLC), total North American OSB annual production capacity is projected to increase by approximately 1.6 billion square feet in the period from 2015 to 2018 while plywood production capacity is projected to increase by 0.2 billion square feet for the same period. According to FEA, OSB accounted for approximately 66% of North American structural panel production capacity in 2014, with plywood accounting for the remainder.

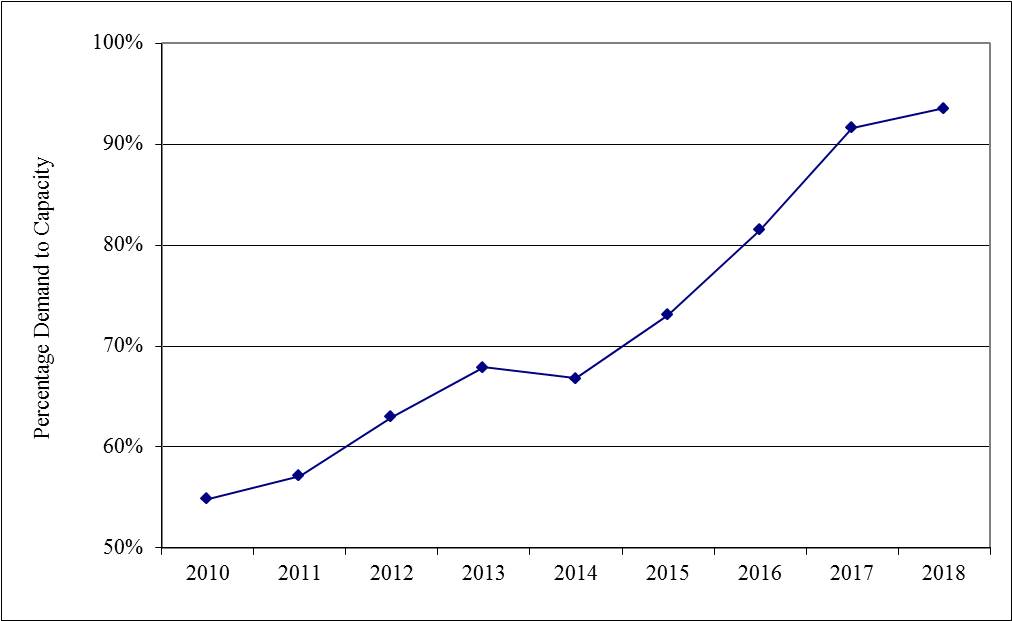

Putting Demand and Supply Together

As noted above, demand for building products is influenced by the general economy, demographics and need for housing. In the case of OSB, generally, lower demand coupled with higher production capacity will result in lower pricing. The chart below, as calculated by FEA (as of December 2014), shows the demand capacity ratio (demand divided by supply) for OSB in 2010 through 2014 as well as FEA’s forecast through 2018 based upon estimated future demand and supply.

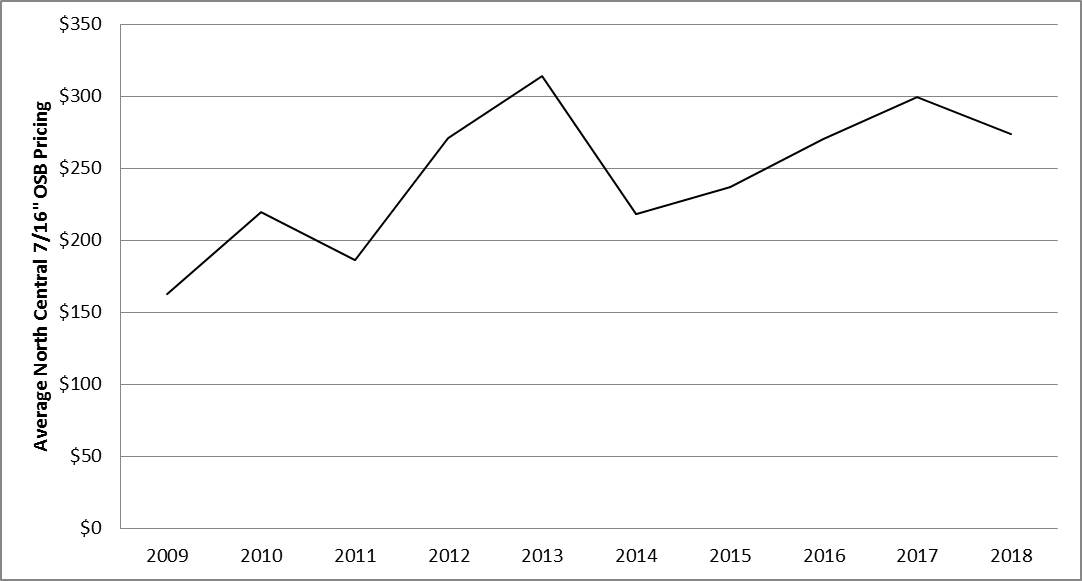

Product Pricing.

Historical prices for our products have been volatile, and we, like other participants in the building products industry, have limited influence over the timing and extent of price changes for our products. The estimated average North Central wholesale price for OSB (per thousand square feet 7/16” basis) from 2007 through 2014, as published by Random Lengths, an industry publication, is presented below. FEA’s forecast (as of December 2014) for average North Central wholesale pricing for OSB (per thousand square feet 7/16” basis) through 2018 is also shown.

CRITICAL ACCOUNTING POLICIES AND SIGNIFICANT ESTIMATES

A discussion of our significant accounting policies and significant accounting estimates and judgments is presented in Note 1 of the Notes to the financial statements in item 8 of this report. Throughout the preparation of the financial statements, we employ significant judgments in the application of accounting principles and methods. These judgments are primarily related to the assumptions used to arrive at various estimates. For 2014, these significant accounting estimates and judgments include:

Legal Contingencies. Our estimates of loss contingencies for legal proceedings are based on various judgments and assumptions regarding the potential resolution or disposition of the underlying claims and associated costs. In making judgments and assumptions regarding legal contingencies for ongoing class action settlements, we consider, among other things, discernible trends in the rate of claims asserted and related damage estimates and information obtained through consultation with statisticians and economists, including statistical analysis of potential outcomes based on experience to date and the experience of third parties who have been subject to product-related claims judged to be comparable. Due to the numerous variables associated with these judgments and assumptions, both the precision and reliability of the resulting estimates of the related loss contingencies are subject to substantial uncertainties. We regularly monitor our estimated exposure to these contingencies and, as additional information becomes known, may change our estimates significantly.

Environmental Contingencies. Our estimates of loss contingencies for environmental matters are based on various judgments and assumptions. These estimates typically reflect judgments and assumptions relating to the probable nature, magnitude and timing of required investigation, remediation and/or monitoring activities and the probable cost of these activities, and in some cases reflect judgments and assumptions relating to the obligation or willingness and ability of third parties to bear a proportionate or allocated share of the cost of these activities, including third parties who purchased assets from us subject to environmental liabilities. We consider the ability of third parties to pay their apportioned cost when developing our estimates. In making these judgments and assumptions related to the development of our loss contingencies, we consider, among other things, the activity to date at particular sites, information obtained through consultation with applicable regulatory authorities and third-party consultants and contractors and our historical experience at other sites that are judged to be comparable. Due to the numerous variables associated with these judgments and assumptions, and the effects of changes in governmental regulation and environmental technologies, both the precision and reliability of the resulting estimates of the related contingencies are subject to substantial uncertainties. We regularly monitor our estimated exposure to environmental loss contingencies and, as additional information becomes known, may change our estimates significantly. At December 31, 2014, we excluded from our estimates approximately $2.3 million of potential environmental liabilities that we estimate will be allocated to third parties pursuant to existing and anticipated future cost sharing arrangements.

Impairment of Long-Lived Assets. We review the long-lived assets held and used by us (primarily property, plant and equipment and timber and timberlands) for impairment when events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. We consider the necessity of undertaking such a review at least quarterly, and also when certain events or changes in circumstances occur. Events and changes in circumstances that may necessitate such a review include, but are not limited to: a significant decrease in the market price of a long-lived asset or group of long-lived assets; a significant adverse change in the extent or manner in which a long-lived asset or group of long-lived assets is being used or in its physical condition; a significant adverse change in legal factors or in the business climate that could affect the value of a long-lived asset or group of long-lived assets, including an adverse action or assessment by a regulator; an accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset or group of long-lived assets; current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset or group of long-lived assets; and current expectation that, more likely than not, a long-lived asset or group of long-lived assets will be sold or otherwise disposed of significantly before the end of its previously estimated useful life. Identifying these events and changes in circumstances, and assessing their impact on the appropriate valuation of the affected assets under accounting principles generally accepted in the U.S., requires us to make judgments, assumptions and estimates.

In general, for assets held and used in our operations, impairments are recognized when the carrying amount of the long-lived asset or groups of long-lived assets is not recoverable and exceeds the fair value of the asset or group of assets. The carrying amount of a long-lived asset or groups of long-lived assets is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the assets or group of assets. The key assumptions in estimating these cash flows relate to future production volumes, pricing of commodity or specialty products and future estimates of expenses to be incurred as reflected in our long-range internal planning models. Our assumptions regarding pricing are based upon the average pricing over the commodity cycle (generally five years) due to the inherent volatility of commodity product pricing, and reflect our assessment of information gathered from industry research firms, research reports published by investment analysts and other published forecasts. Our assumptions regarding expenses reflect our expectation that we will continue to reduce production costs to offset inflationary impacts.

When impairment is indicated for assets held and used in our operations, the book values of the affected assets are written down to their estimated fair value, which is generally based upon discounted future cash flows associated with the affected assets. When impairment is indicated for assets to be disposed of, the book values of the affected assets are written down to their estimated fair value, less estimated selling costs. Consequently, a determination to dispose of particular assets can require us to estimate the net sales proceeds expected to be realized upon such disposition, which may be less than the estimated undiscounted future net cash flows associated with such assets prior to such determination, and thus require an impairment charge. In situations where we have experience in selling assets of a similar nature, we may estimate net sales proceeds on the basis of that experience. In other situations, we hire independent appraisers to estimate net sales proceeds.