Exhibit 99.1

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Bob Dineen

President and CEO

Lincoln Financial Network

President and CEO

Lincoln Financial Network

LFD and LFN

Successfully Affecting Outcomes

Successfully Affecting Outcomes

Will Fuller

President and CEO

Lincoln Financial Distributors

President and CEO

Lincoln Financial Distributors

Lincoln’s Distribution Franchise

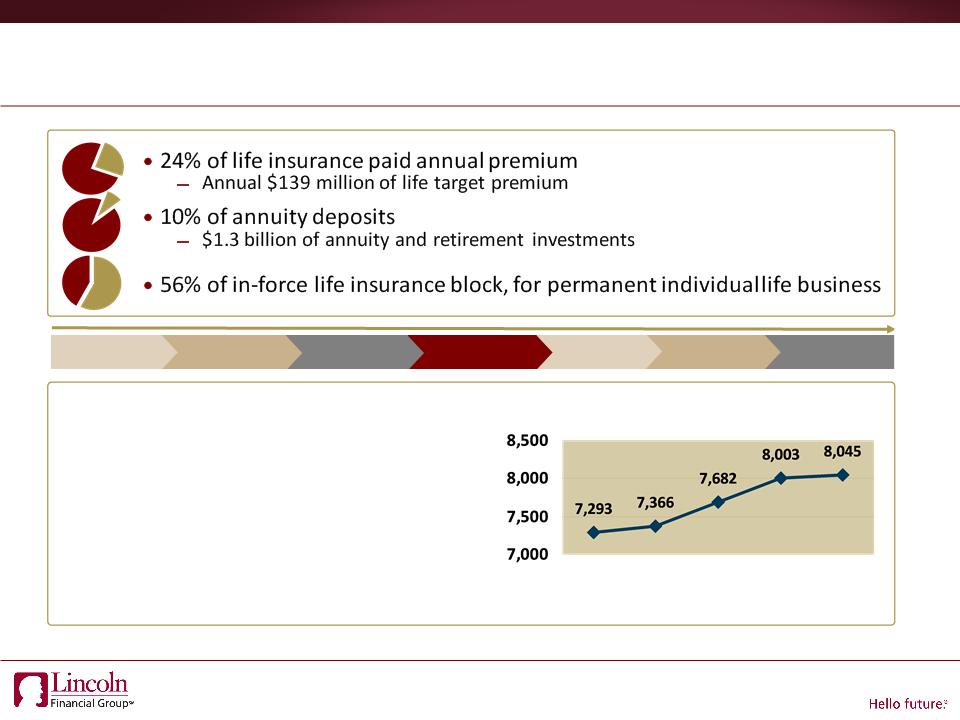

568 Wholesalers

LFN

8,045 Advisors

311 Worksite

Consultants

Consultants

Group Protection

148 Wholesalers

Disciplined

Powerful

• Dedicated to consumer driven products

• Focused on growing market segments where advice and

planning are highly valued

planning are highly valued

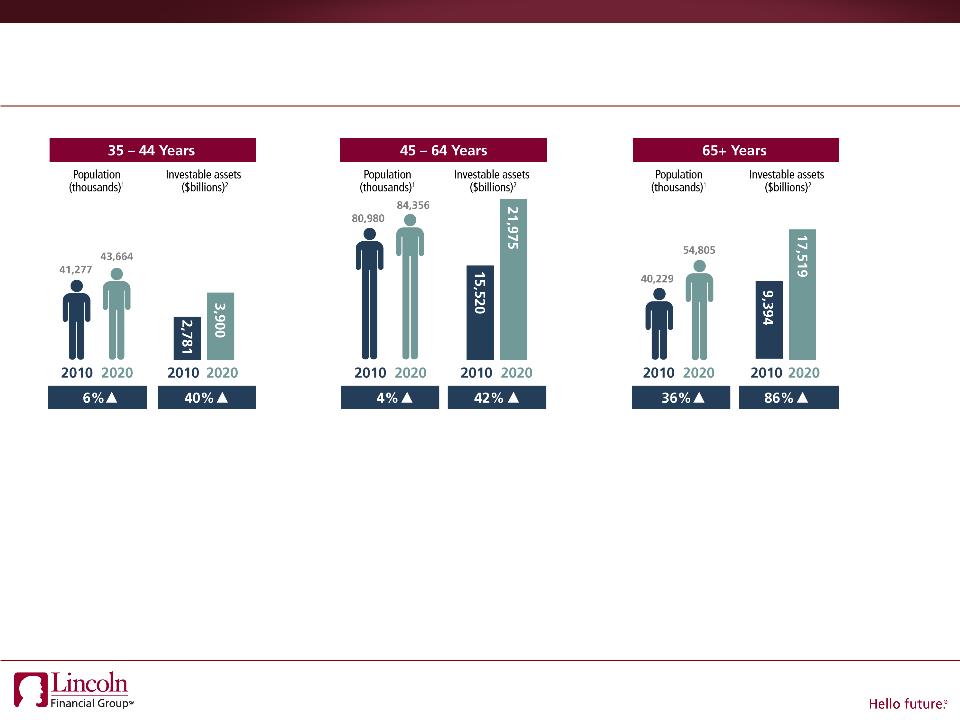

Consumer Trends

• Focus on safety (guarantees)

• Tempered expectations on

returns

returns

• Concern regarding taxes

• Need for advice

1 Source: US Census Bureau Projections

2 Source: Federal Reserve Flow of Funds Report April 2010, 10-year Treasury Note maturity 2/15/2021, interest rate 3.625%.

Company estimates regarding wealth transfer, excludes future savings

Company estimates regarding wealth transfer, excludes future savings

Daily

Registered

14,769

Registered

14,769

RIA Only

18,582

18,582

Regional

B/Ds

B/Ds

35,994

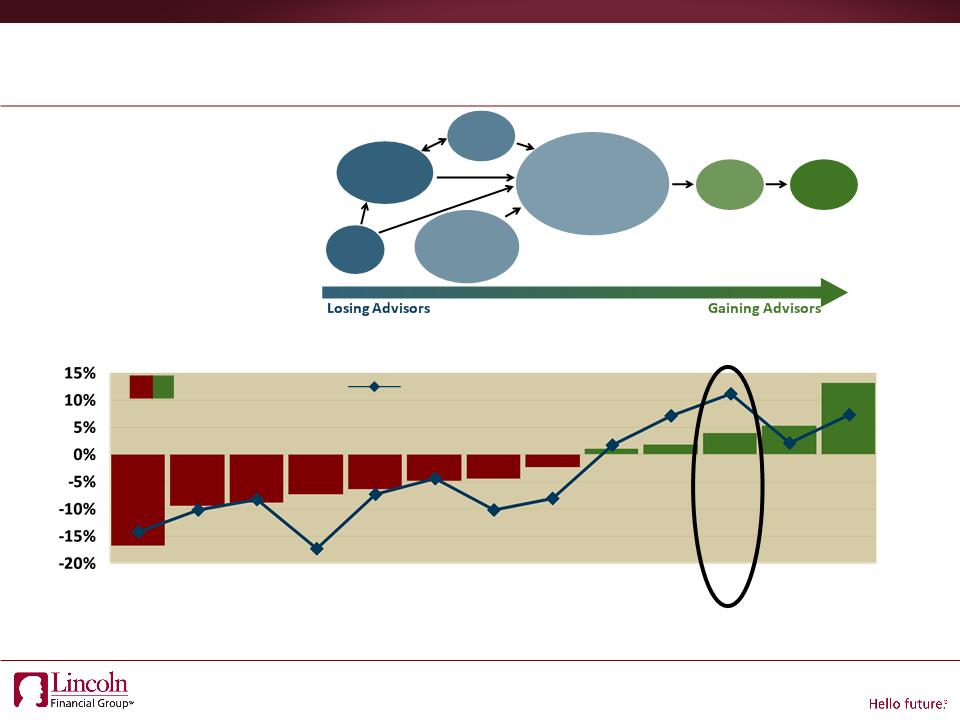

Industry Trends and Advisor Flows

• Environmental

conditions

accelerating migration

from wirehouse and

regionals to

independent

conditions

accelerating migration

from wirehouse and

regionals to

independent

Sources: Securities Industry Association, Investment News, Financial Planning, Bank Insurance Market Research Group, National Regulatory

Services, Standard & Poors, Money Market Directories, Cerulli Associates; Consolidated Industry Surveys (Financial Planning Magazine, June

2010; Investment News, April 2010; Financial Advisor, April 2010)

Services, Standard & Poors, Money Market Directories, Cerulli Associates; Consolidated Industry Surveys (Financial Planning Magazine, June

2010; Investment News, April 2010; Financial Advisor, April 2010)

400

300

200

100

0

-100

-200

-300

-400

-500

-16.7%

-9.4%

-8.9%

-7.4%

-6.3%

-4.9%

-4.5%

-2.4%

1.0%

1.7%

3.8%

5.4%

13.0%

Sage

Point

Point

ING

New

England

England

Axa

Advisors

Advisors

Princor

John

Hancock

Hancock

MML

Ameriprise

NWM

LPL

LFN

Common

wealth

wealth

Cambridge

% Change vs. 2009

# Change vs. 2009

Advisor Headcount Changes 2010 vs. 2009

Banks

B/Ds

16,406

B/Ds

16,406

Wirehouse

54,865

Insurance

B/Ds

B/Ds

70,405

Independent

B/Ds

B/Ds

98,706

LFN: Delivering Shareholder Value to Lincoln

Wirehouse Regionals Insurance BD LFA/Sagemark ABGA GA Independent

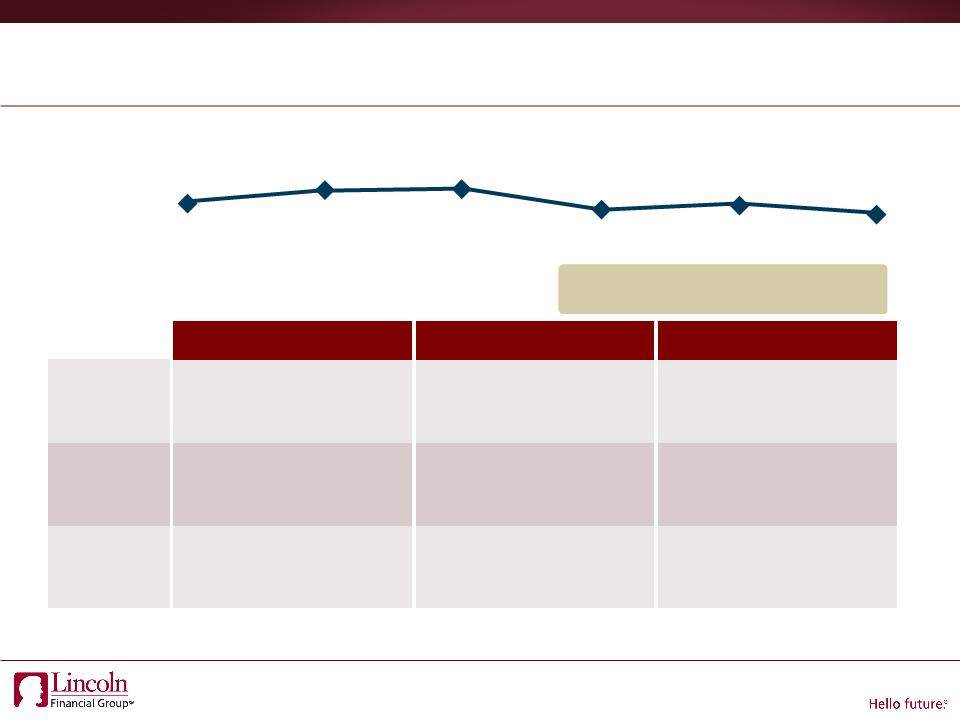

LFN: Keys to Sustained Growth

• Independence

– Open architecture and affiliation choice

• National Recruiting Platform

– Growing number of productive, process driven advisors

• Retention of top-tier advisors remains strong

• Recruiting of productive advisors very strong

• Advice

– Deep financial planning expertise

• National Planning Center

• Advisory process helps insulate from margin compression

2007

2008

2009

2010

Sept

2011

2011

Sustained Growth Trend

Number of Active LFN Advisors

Number of Active LFN Advisors

1 Investment News, January 26, 2011

2nd Largest Independent Broker-Dealer1

LFD: A History of Consistent Achievement

49,743

Producers

Producers

55,029

Producers

Producers

57,264

Producers

Producers

58,000

Producers

Producers

Across different business cycles, consistent

new business levels and growing producer levels

new business levels and growing producer levels

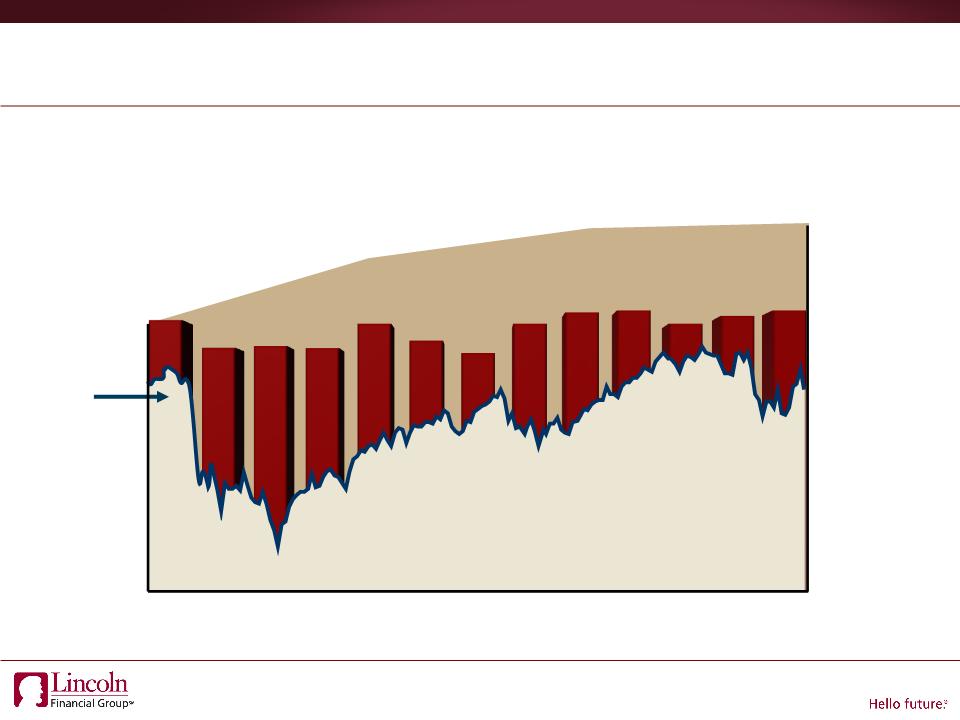

S&P

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q08

3Q08

$5

$2

$1

$4

$3

Consolidated Deposits ($ billions)

Doing Business on Our Terms

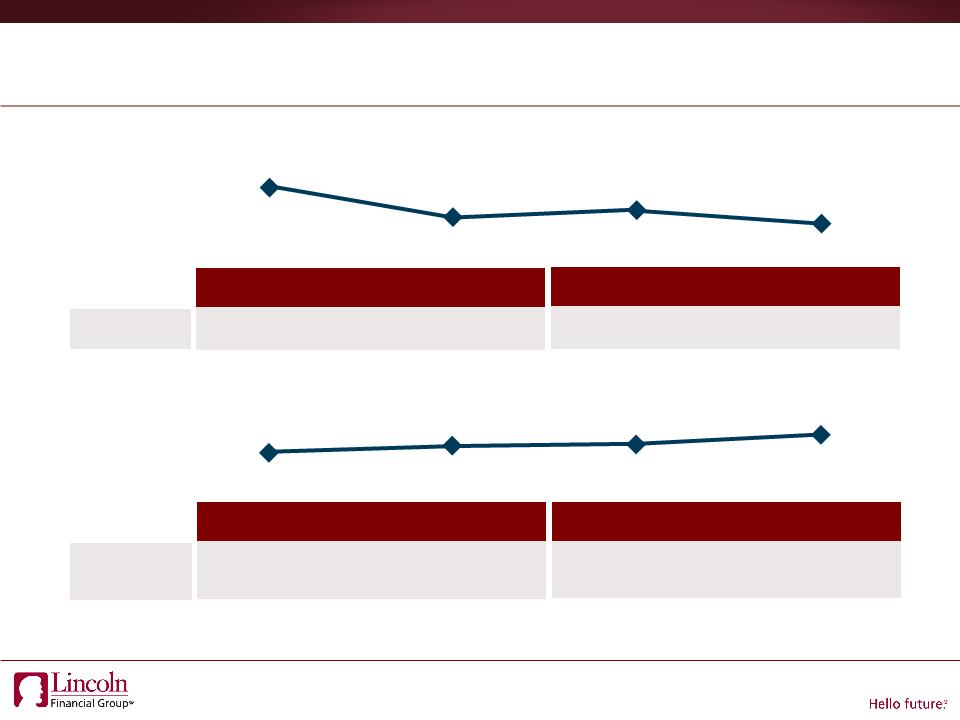

Variable Annuities Market Share and Rankings1

Core Life Market Share and Rankings2

1 Rankings based on MARC YTD sales as of June 30, 2011

2 Rankings based on LIMRA YTD sales as of June 30, 2011. Core Life includes UL, VUL and term

|

2008

|

2009

|

|

• De-risking and re-pricing of VA portfolio

|

|

|

Variable

Annuities |

|

2010

|

2Q 2011

|

|

• Risk mitigation built into products and further

re-pricing |

|

|

2008

|

2009

|

|

• Increased Term focus

• Continued expansion of MoneyGuard franchise

|

|

|

Life

|

|

2010

|

2Q 2011

|

|

• Re-pricing of SG UL and MoneyGuard products

• Increased focus on non-interest rate sensitive

products (VUL, Term, Indexed UL) |

|

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

7.2%

6.4%

6.6%

6.2%

Ranked

#1

#1

Ranked

#2

#2

Ranked

#2

#2

Ranked

#1

#1

8.0%

8.2%

8.2%

8.6%

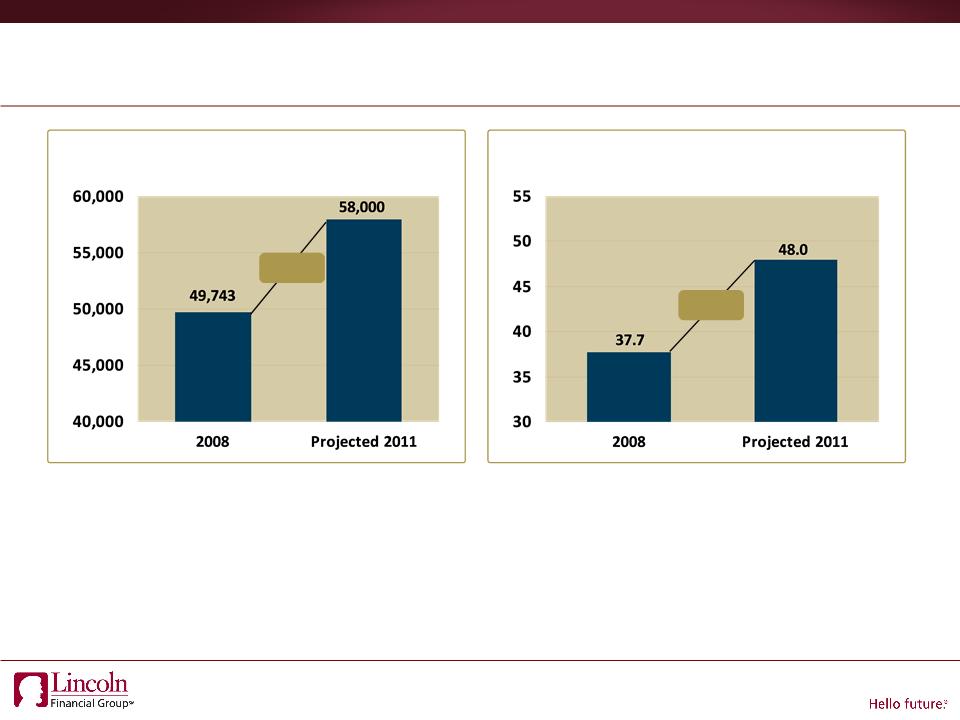

Growth On: LFD Creating Value for Lincoln

1 Excludes 2011 Defined Contribution expansion

Growing Active Producers

+17%

Growing Wholesaler Productivity

+27%

1

• Increasing producers across products

– 8,000+ new producers

– 10,000+ producers selling multiple

Lincoln products

Lincoln products

• Winning the war for talent

– Success in attracting top talent from

industry

industry

– Record high retention

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Life Insurance

Protecting Margins / Leveraging Franchise

Protecting Margins / Leveraging Franchise

Mark Konen

President, Insurance and Retirement Solutions

President, Insurance and Retirement Solutions

Tailwinds

• Renewed consumer interest in

protection; favorable demographics

protection; favorable demographics

• Innovation to meet changing needs

• Risk management track record

• Advice-driven model

The Life Insurance Industry Today

Headwinds

• Macro economic

environment

environment

• Resetting expectations

to “new normal”

to “new normal”

Life insurance remains an important solution

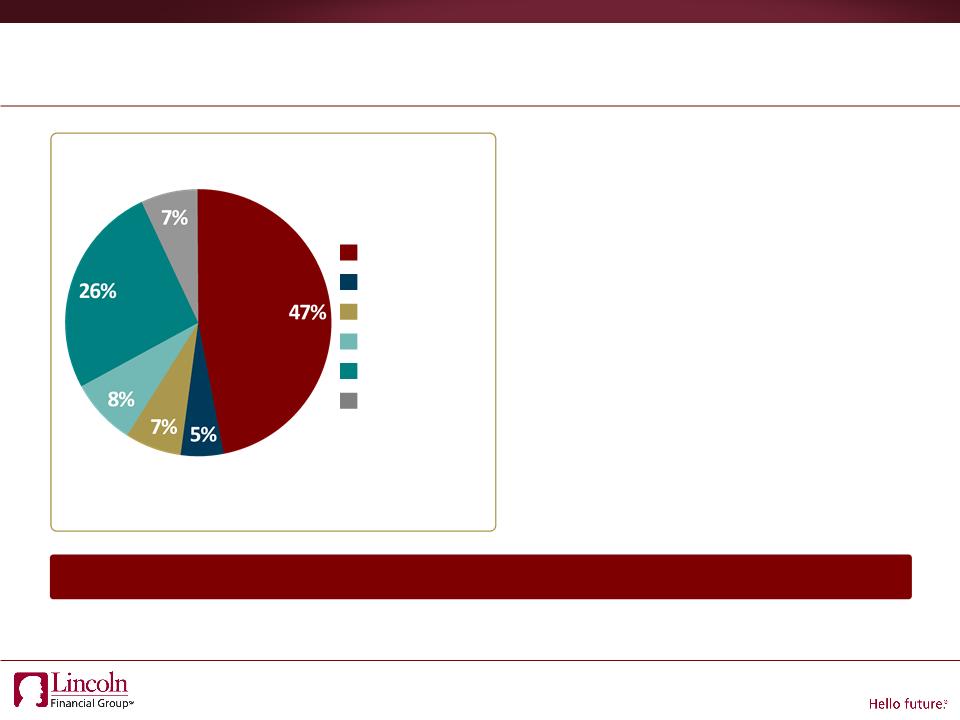

Diverse Product Portfolio

• Secondary Guarantee Universal Life

(SG UL) now less than 50% of sales

(SG UL) now less than 50% of sales

• Sales of products other than SG UL

up 19% year-over-year

up 19% year-over-year

Sales1 by Product

1 Sales as defined on page ii of our quarterly statistical report

2 Non-SG UL includes Indexed UL sales

3Q 2011 YTD sales: $471 million

Comprehensive portfolio: relevant and adaptable to market conditions

SG UL

Non-SG UL2

VUL

Term

MoneyGuard

Executive

Benefits

Benefits

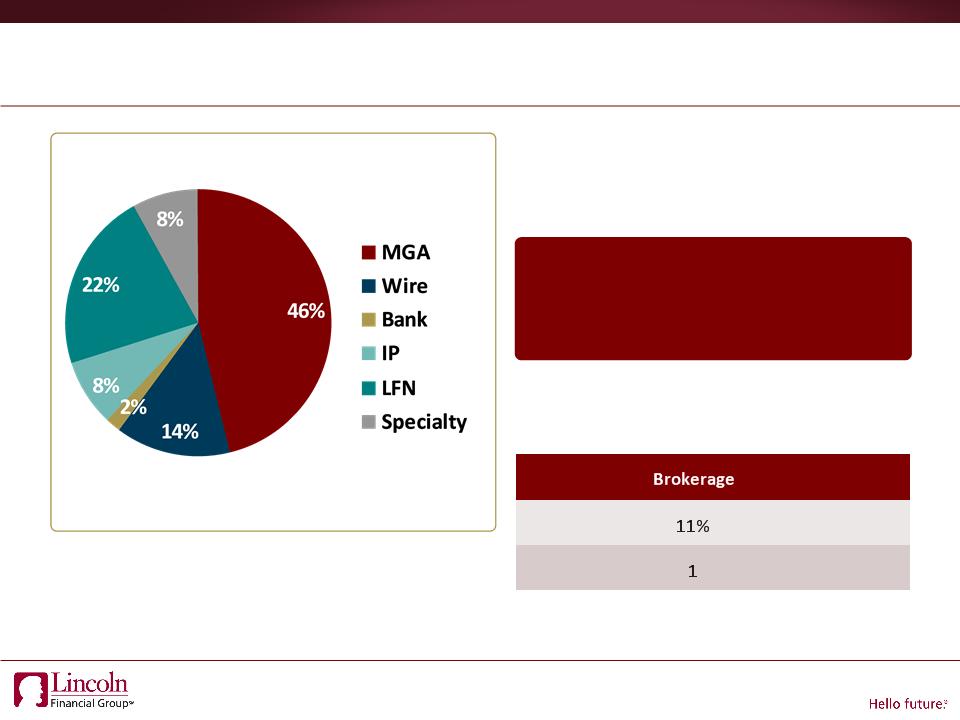

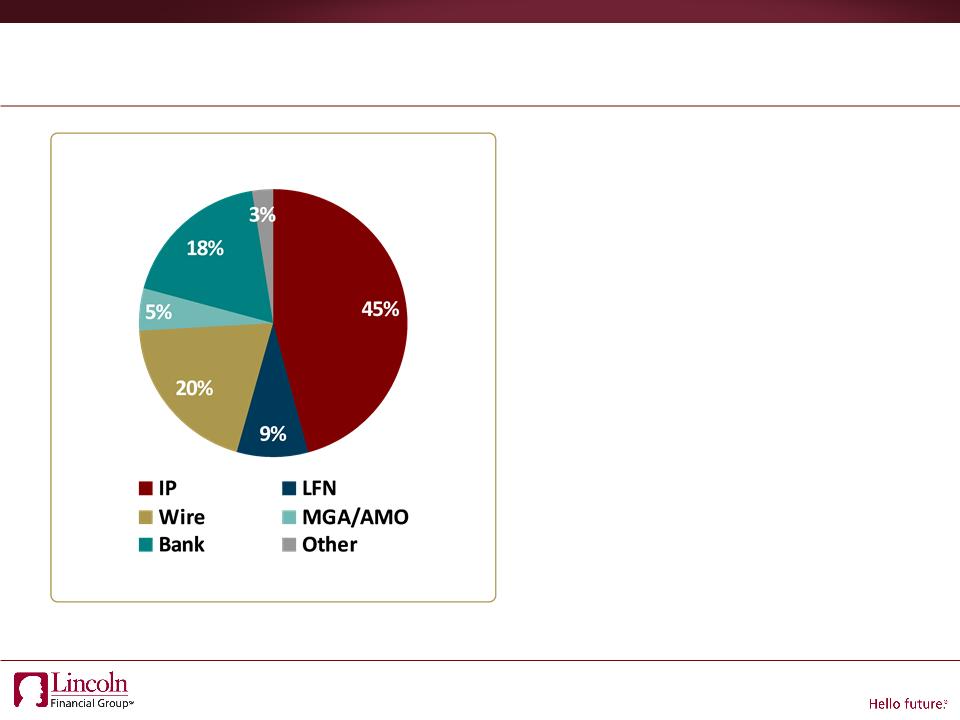

Multi-Channel Distribution Strategy

• Significant scale in each channel

• Lincoln ranks #1 in Top 10 accounts2

Sales by Channel1

Source: LIMRA; core life sales (excluding whole life)

1 Based on YTD sales as of September 30, 2011; specialty represents COLI/BOLI

2 As of August 30, 2011

3Q 2011 YTD sales: $471 million

Multi-channel distribution

drives ability to “pivot”

across products

drives ability to “pivot”

across products

Lincoln vs. Industry by

Distribution Channel

Distribution Channel

|

|

Retail

|

Banks/

Wires |

|

|

2Q11 Market

Share % |

5.5%

|

34%

|

|

|

Rank

|

8

|

2

|

Responding to Market Conditions

Core Life Market Share and Rankings1

1 Rankings based on LIMRA YTD sales as of June 30, 2011. Core Life includes UL, VUL and term

|

2006 - 2007

|

|

• Merger with Jefferson-Pilot

|

|

• Integration of product portfolio,

underwriting standards, and distribution platform by year- end 2007 • MoneyGuard franchise

repositioned in the marketplace |

|

2008 - 2009

|

|

• The Great Recession

– Capital markets frozen

– Consumer and marketplace

turmoil |

|

• Increased diversification focus of

business mix – Increased Term focus

– Expansion of MoneyGuard

franchise • Repricing of SG UL products

|

|

2010 - 2Q 2011

|

|

• Sustained low interest rates

|

|

• Repricing of SG UL products

• Repricing of MoneyGuard

product • Increased focus on remainder of

portfolio (VUL, Term, Indexed UL) |

|

Challenge

|

|

Response

|

Ranked #2

Ranked

#1

#1

Ranked

#2

#2

Ranked

#2

#2

Ranked

#2

#2

Ranked

#1

#1

7.6%

8.3%

8.0%

8.2%

8.2%

8.6%

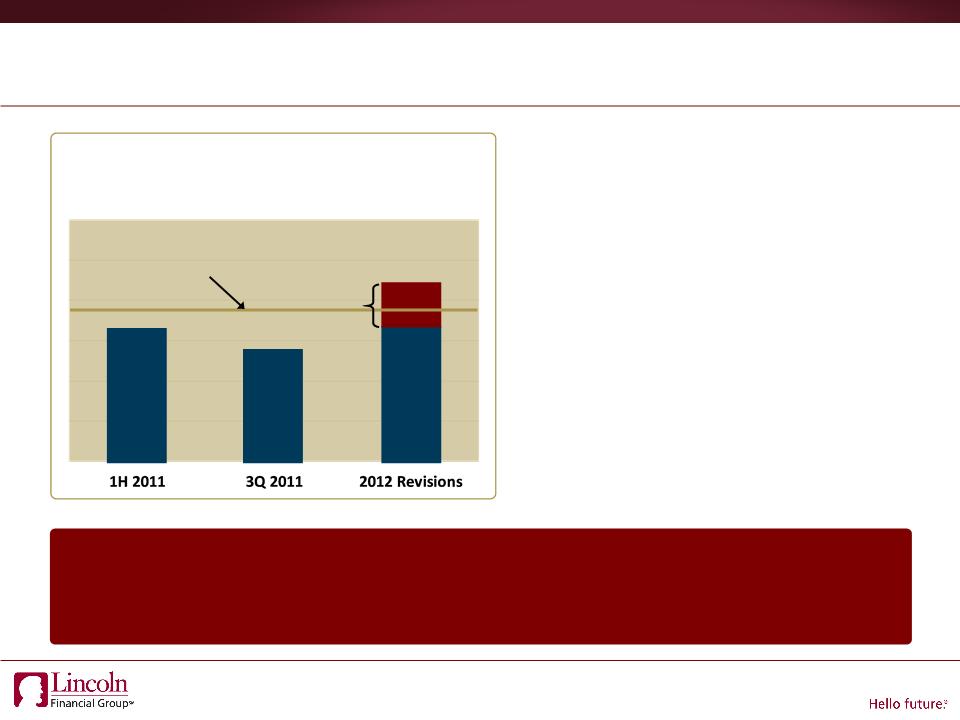

Product Actions to Improve Margins

Life Product Portfolio

(Combined Pricing IRR)

(Combined Pricing IRR)

Long-term

Target Return

Projected

Range

Range

Improve IRR

• Increased SG UL prices by 5-15%

• MoneyGuard changes:

– New business operating efficiencies

– Benefit payout reduced 10-20%

• Additional changes - 1st Half 2012

– SG UL price increase

– MoneyGuard changes

Promote product portfolio diversity

• VUL repositioning/marketing

enhancements

enhancements

• Term product improvements

• Enhanced Indexed UL

Potential sales decline until:

• Competition adjusts • Consumers reset expectations

Offset is potential for capital redeployment

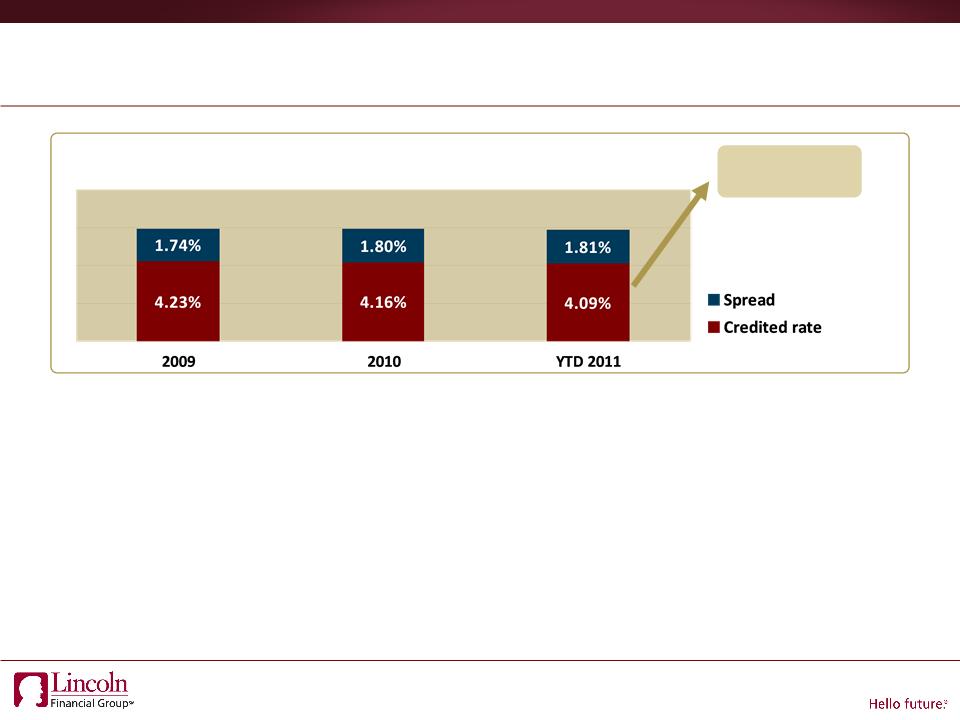

Effectively Managing Spread Compression

Yield and Spread History1

8 bps spread to

guarantee

guarantee

Yield = 5.97%

5.96%

5.90%

1 Yields and spreads exclude alternative investments and are gross of default charges

2 As of September 30, 2011

Investment Strategies

• Long duration investment portfolio - average SG UL portfolio maturity: 24 years

• Pre-investments improve portfolio yields: $1.3B with 6.45% projected yield

• 10-year Treasury stays at 2%: spreads decline ~ 10 bps per year

Crediting Rate

• Responsive credited rate actions

2

Effectively Managing Mortality Risk and Lapses

1 A/E ratios and Lapses are YTD as of September 30, 2011

Mortality risk expertise

• Industry-leading underwriting

• Experience better than pricing

|

Actual to expected

mortality ratios |

2010

|

YTD1

2011 |

|

Business written 1999 forward

(expected = pricing) |

90%

|

94%

|

|

Lapses (% Based on

Face Amounts) |

2010

|

YTD1

2011 |

|

SG UL

|

4.3%

|

3.8%

|

|

Non-SG UL

|

5.4%

|

4.7%

|

|

Total UL

|

4.8%

|

4.2%

|

• Recent lapses running at 4% - higher

than pricing (positive for SG UL)

than pricing (positive for SG UL)

• Lapses consistent with pricing

These key product risks are realizing better than planned results

Strong Franchise Enables Responsible Product Actions

While Maintaining Long-Term Growth

While Maintaining Long-Term Growth

• Protecting Margins

– Repricing secondary guarantee

products

products

– MoneyGuard benefit reduction

and other changes

and other changes

– Credited rate reductions

– ALM and other risk management

expertise

expertise

• While Growing the Business

– Diversification of product portfolio

– Leveraging power of distribution

platform

platform

– Continued innovation

• “Non-traditional” distribution

expansion - financial advisors

expansion - financial advisors

• Penetration of underinsured

and uninsured high net worth

market

and uninsured high net worth

market

• Mass affluent/middle market

innovation

innovation

Leading the market on our terms

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Group Protection

Investing for Growth

Investing for Growth

Mark Konen

President, Insurance and Retirement Solutions

President, Insurance and Retirement Solutions

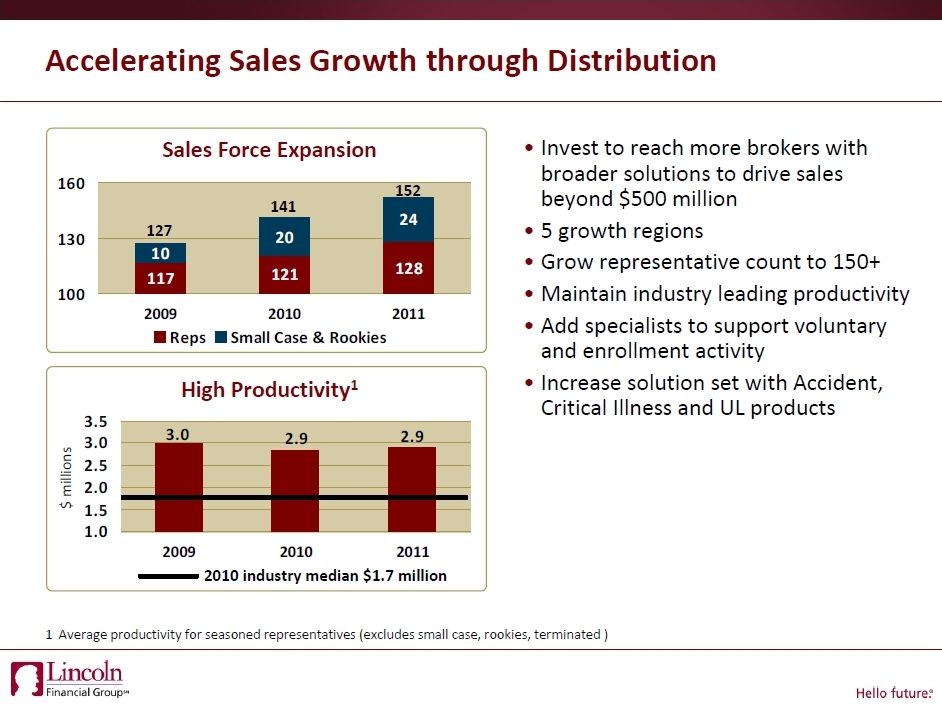

More Brokers -

More Solutions

More Solutions

• Increased group representatives and

territory management

territory management

• Broadened suite of solutions

• Comprehensive enrollment support

Investing for Growth through Distribution and Service

Seamless Employer/

Employee Experience

Employee Experience

• Focused investments in distribution

fueled sales growth

fueled sales growth

• 2010 ranked 8th in new premium for

core lines

core lines

• Maintain focus on the small case

market

market

– Top 5 or better in primary lines;

6th overall

6th overall

– Opportunistic expansion down market

and into middle-market

and into middle-market

|

Sales Ranking1

|

2008

|

2009

|

2010

|

|

LTD

|

4

|

2

|

3

|

|

STD

|

3

|

3

|

4

|

|

Life /ADD

|

6

|

5

|

5

|

|

Dental

|

14

|

12

|

12

|

|

Total

|

6

|

8

|

6

|

• Focus on growing voluntary market

with promising early results

with promising early results

– 35% of premium and ranked 11th

today

today

– 2014 goal: top 5 approaching 50%

of premium

of premium

– Investment in people, product and

systems

systems

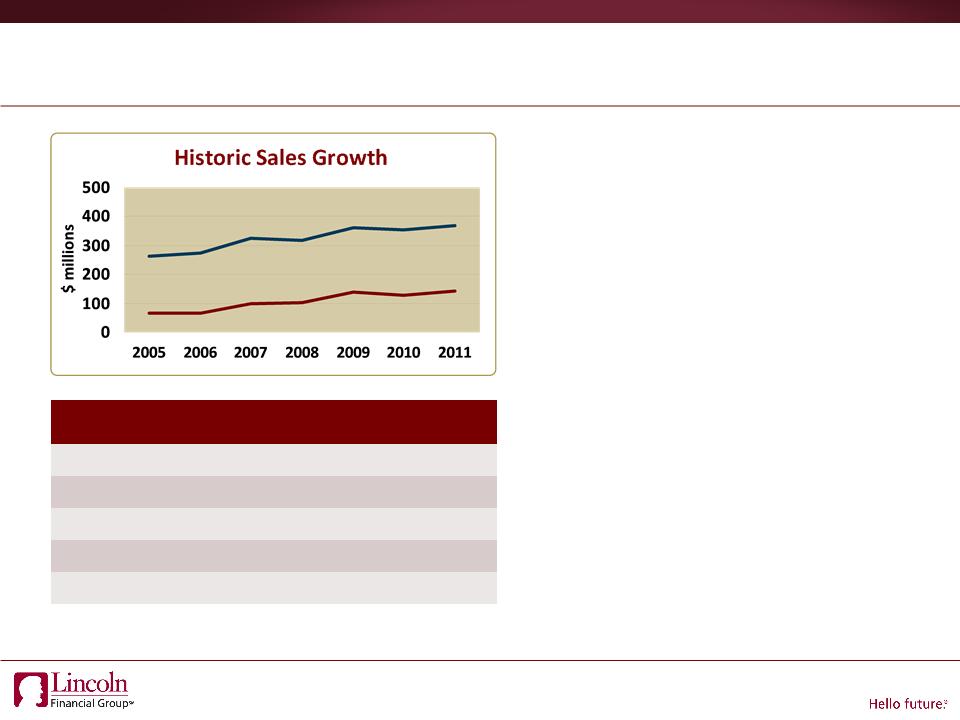

Strong Sales Growth with a Consistent Market Focus

1 By coverages sold, Source: LIMRA

14.3%

CAGR

CAGR

6.2%

CAGR

CAGR

Total

Voluntary

Effective Profitability Management

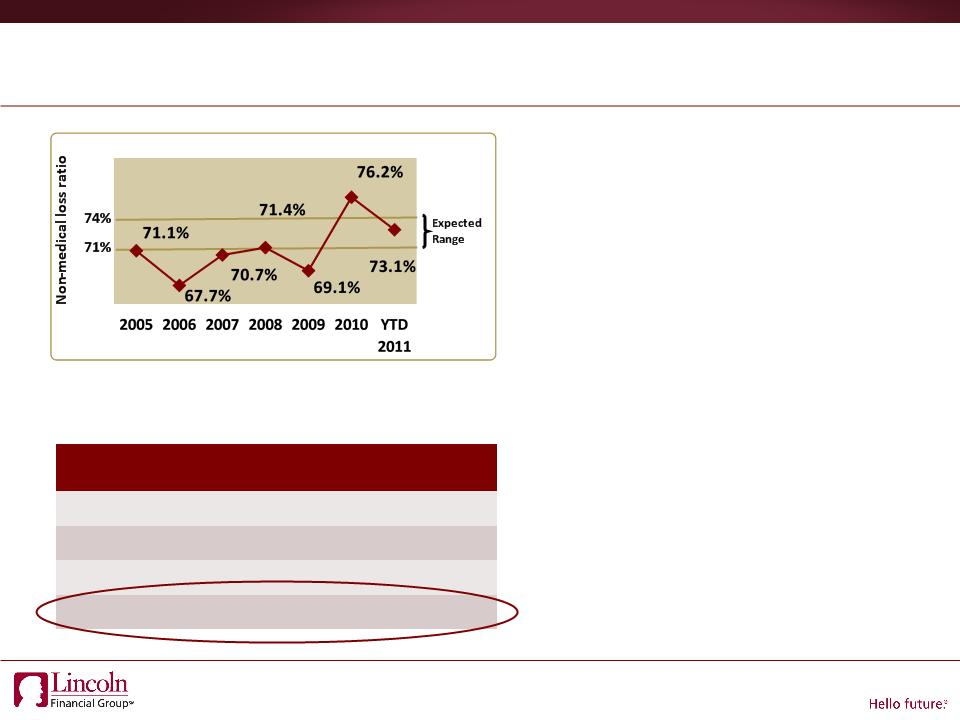

• Successful actions bring loss ratios

back in line:

back in line:

– Achieved good renewal results

– Higher loss ratio cases leaving

– Enhanced claims management actions

Balance among new sales, persistency

and renewal rate actions leads to

profitable growth

and renewal rate actions leads to

profitable growth

Non-medical Premium Growth

Over Prior Year’s Quarter

Over Prior Year’s Quarter

|

Premium Impacts

by Source |

3Q

2008 |

3Q

2009 |

3Q

2010 |

3Q

2011 |

|

New Sales

|

18.5%

|

16.5%

|

18.5%

|

15.5%

|

|

Lapses

|

-14.5%

|

-14.0%

|

-13.0%

|

-13.5%

|

|

In-force Change

|

6.5%

|

0.5%

|

3.5%

|

5.0%

|

|

TOTAL

|

10.5%

|

3.0%

|

9.0%

|

7.0%

|

Strategic Investments

Positioning Group Protection for Growth

Positioning Group Protection for Growth

Strategic Spend

2011

2012

2013

$20M

$40M

$60M

|

|

Sales

Growth |

Retention

|

Cost

Effectiveness |

Profitability

Management |

|

Technology & Service

|

P

|

P

|

P

|

P

|

|

Distribution

|

P

|

|

P

|

|

|

Employee Education & Advice

|

P

|

P

|

|

|

|

Employer Solutions

|

P

|

P

|

|

P

|

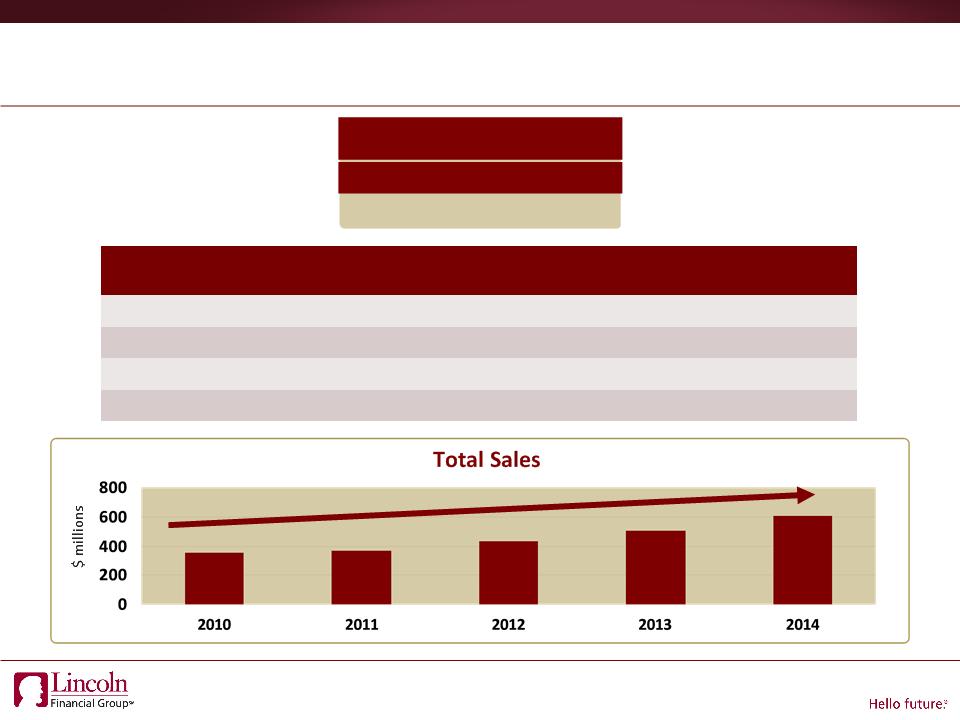

Results

• Top 5 in Voluntary sales

Accelerate Growth and Enhance Service

Investments

• Distribution to accelerate

growth

growth

– 2012 sales growth outpacing

the industry

the industry

– $500 million + of new sales

by 2014

by 2014

• Service to enhance ease of

doing business and improve

efficiency

doing business and improve

efficiency

– Employee focused services

and systems

and systems

– “Hassle-free” support for

employers

employers

– Reduced manual effort

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Lincoln Retirement Plan Services

Executing for Growth

Executing for Growth

Chuck Cornelio

President, Lincoln Retirement Plan Services

President, Lincoln Retirement Plan Services

Retirement Plan Services

Consistent Strategy - Focused on Execution

Consistent Strategy - Focused on Execution

Focus: Target markets with the fastest asset growth characteristics

|

Market

|

AUM

|

Takeover

|

Asset Growth

|

|

Small Market ($0 - $10M)

|

$520B

|

$40B

|

7.5%

|

|

Mid-Large Market ($10M - $500M)

|

$725B

|

$53B

|

7.5%

|

|

Healthcare

|

$130B

|

$14B

|

6.0%

|

1 LIMRA not-for-profit survey as of June 30, 2011

2 As of September 30, 2011

Deposits by Market

Mid-Large Market

Small Market

Multi-Fund and Other

Snapshot:

• Ranked #3 in Healthcare (by AUM)1

• 1.4M participants2

• 23,000 Plan Sponsors2

• $37B in AUM2

Source: Spark 2010

Retirement Plan Services

Actions to Capture Market Share

Actions to Capture Market Share

• New Platform LIVE with New Business

• Wholesaler Expansion completed

• Leveraging strong worksite presence to

improve asset retention and rollover

capabilities

improve asset retention and rollover

capabilities

• Expanding solutions (product and services)

for both plan sponsors and participants

for both plan sponsors and participants

Recordkeeping

& Web

& Web

Participant &

Plan Sponsor

Experience

Plan Sponsor

Experience

Distribution

Expansion

Expansion

Product

Expansion

Expansion

Marketing and

Communications

Communications

Strategic Investments

Positioning Retirement Plan Services for Growth

Positioning Retirement Plan Services for Growth

|

|

Sales

Growth |

Asset

Retention |

Expense

Efficiencies |

|

Recordkeeping Platform & Web

|

P

|

P

|

P

|

|

Distribution

|

P

|

P

|

|

|

Product

|

P

|

P

|

|

|

Participant & Plan Sponsor Experience

|

P

|

P

|

P

|

Strategic Spend

2011

2012

2013

$30M

$35M

$15M

Improving Sales

Focused Execution Translating to Growth

Focused Execution Translating to Growth

Total Deposits

Growth through new sales AND improved retention on existing block

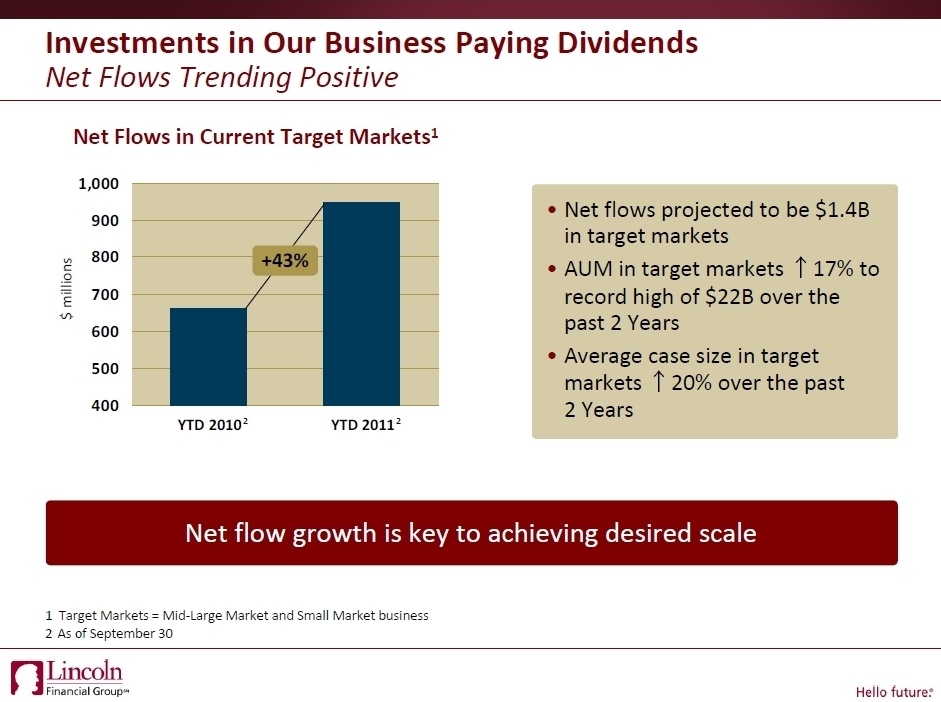

GOAL: Reach $9B in Sales by 2014

$6B

$7B

• 50% of wholesalers hired within

last 15 months; not yet at target

productivity

last 15 months; not yet at target

productivity

• Upgraded technology solution

has gone live for new sales since

October

has gone live for new sales since

October

• Product offering expansion

increasing Lincoln’s

competitiveness

increasing Lincoln’s

competitiveness

Bifocal Vision

Short-term Results AND Long-term Market Success

Short-term Results AND Long-term Market Success

• Implementing strategy focused on targeted growth markets

• Executing on strategic investments to increase competitiveness

and deliver cost efficiencies

and deliver cost efficiencies

• Capitalizing on competitive advantages to continue to win new

business

business

• Adding diversity to Lincoln business mix with lower capital

requirements and lower risks

requirements and lower risks

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Individual Annuities

Growth on Our Terms

Growth on Our Terms

Mark Konen

President, Insurance and Retirement Solutions

President, Insurance and Retirement Solutions

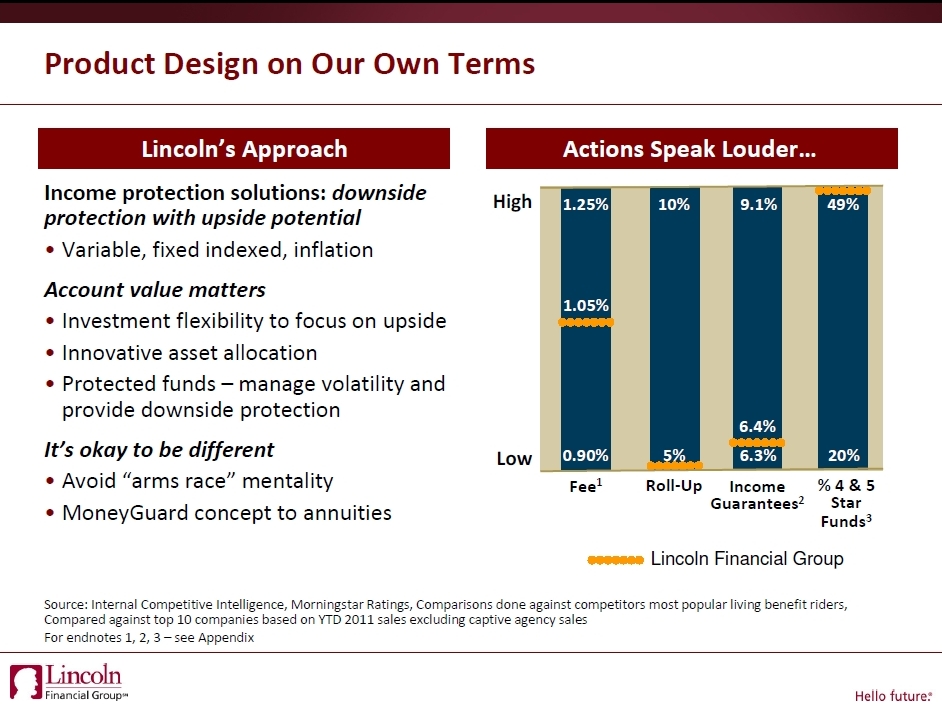

Growing the Business while Protecting Margins

Growth

Diverse solutions

Multi-channel distribution

Multi-channel distribution

Disciplined

approach

approach

Balanced, proactive

and consistent

and consistent

Managing risk

Proven track record

Diverse Products and

Multi-Channel Distribution Strategy

Multi-Channel Distribution Strategy

• Consistent product offerings

• Multi-channel distribution strategy

• Continued expansion

– Primerica

– Fee-based advisors

– Partner-specific solutions

Annuity Sales by Channel

1 As of September 30, 2011

YTD 20111 - $8.3 Billion ($6.7B VA, $1.6B FA)

Responding to Market Conditions

Variable Annuities Market Share and Rankings1

1 Morningstar VARDS as of June 30, 2011; Rankings and Market Share based upon Total Flow

2 Morningstar VARDS reported sales YTD 2011 versus YTD 2009 as of June 30

|

2006 - 2Q 2008

|

|

Calm and Growing Market

Growing S&P Index

Low Volatility

|

|

Escalating Roll-ups: 5% to 7-10%

Step-up Frequency:

Annual to Daily |

|

Our First GLWB

5% Roll-up

Investment Requirements

|

|

3Q 2008 - 2009

|

|

Subprime Crisis - Capital Markets

Frozen Significant S&P Drop

High Volatility

|

|

Firms Exit VA Market

Raised Fees / Reduced Roll-ups

Asset Transfer Programs

|

|

Consistent Market Presence

De-risked GLWB

Enforced Investment

Requirements Retroactively |

|

2010 - 2011

|

|

Europe Sovereign Debt Crisis

Sustained Low Interest Rates

Elevated Volatility

|

|

Rising Roll-ups

Funds with Volatility Management

Wide Adoption of Asset Transfer

Programs |

|

Simplified Products / More

Capital Efficient Design Raised Fees

4Q 2011 Risk Managed Funds

|

|

Market

|

|

Industry

|

|

Lincoln

|

30% sales2 growth since 2009

6.6%

7.1%

7.2%

6.4%

6.6%

6.2%

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

Ranked

#5

#5

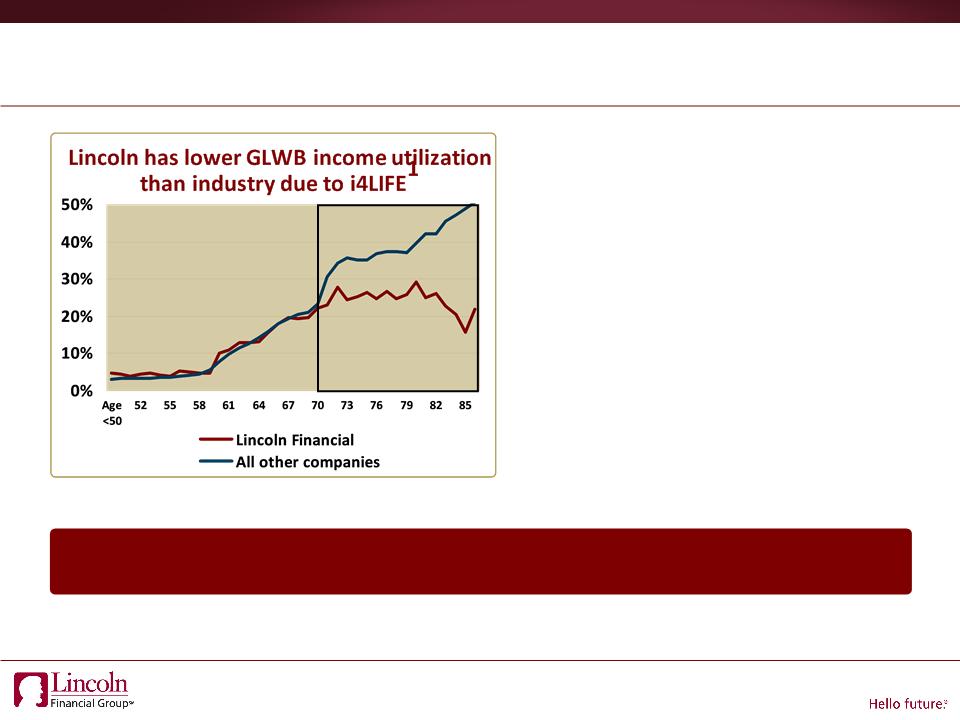

Product Design Mitigates Policyholder Behavior Risk

i4LIFE is a Compelling Solution for Clients

• Guaranteed income with strong upside

potential

potential

• Tax advantaged income for non-qualified

• Flexibility, control, and death benefit

Risk Management Advantages

• Fewer immediate income buyers in GLWB

• i4LIFE has less policyholder behavior risk,

more certainty around assumptions

more certainty around assumptions

– Known income start time

– Known income start amount

– Stable persistency

Source: Guaranteed Living Benefit Utilization Study - 2009 Data, LIMRA 2011

1 Based on 1,278,546 variable annuity contracts with a guaranteed lifetime withdrawal benefit (GLWB) rider still in force at the end of 2009. The

number of contracts from Lincoln Financial accounted for 9 percent of all GLWB in-force contracts in the study, in which 19 companies participated.

number of contracts from Lincoln Financial accounted for 9 percent of all GLWB in-force contracts in the study, in which 19 companies participated.

Better product design and positioning leads to better risk management

i4LIFE designed and positioned as

immediate income solution

immediate income solution

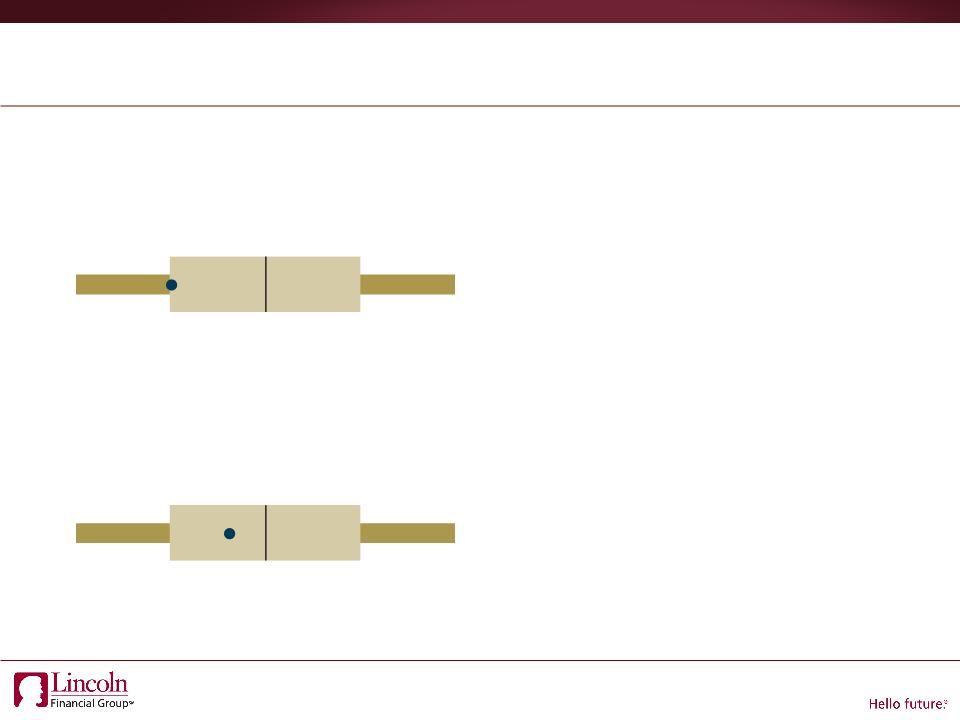

Oliver Wyman Industry Study Agrees

• Manage behavior risk through prudent

product design

product design

• Lincoln’s GLWB economics are less

sensitive than most peers to changes in

policyholder behavior

sensitive than most peers to changes in

policyholder behavior

• Lower sensitivity supports more

predictable financial results

predictable financial results

Source: Oliver Wyman analysis of 19 GLWB and GMIB designs based on September 30, 2011 market conditions.

Note: Figures based on a normalized measure of the sensitivity of total contract economic value to adverse behavior assumptions. All peer products

are weighted equally.

are weighted equally.

Least

Sensitive

Sensitive

25%

Percentile

Percentile

Average

75%

Percentile

Percentile

Most

Sensitive

Sensitive

Sensitivity to Utilization Behavior

Least

Sensitive

Sensitive

25%

Percentile

Percentile

Average

75%

Percentile

Percentile

Most

Sensitive

Sensitive

Sensitivity to Dynamic Lapse

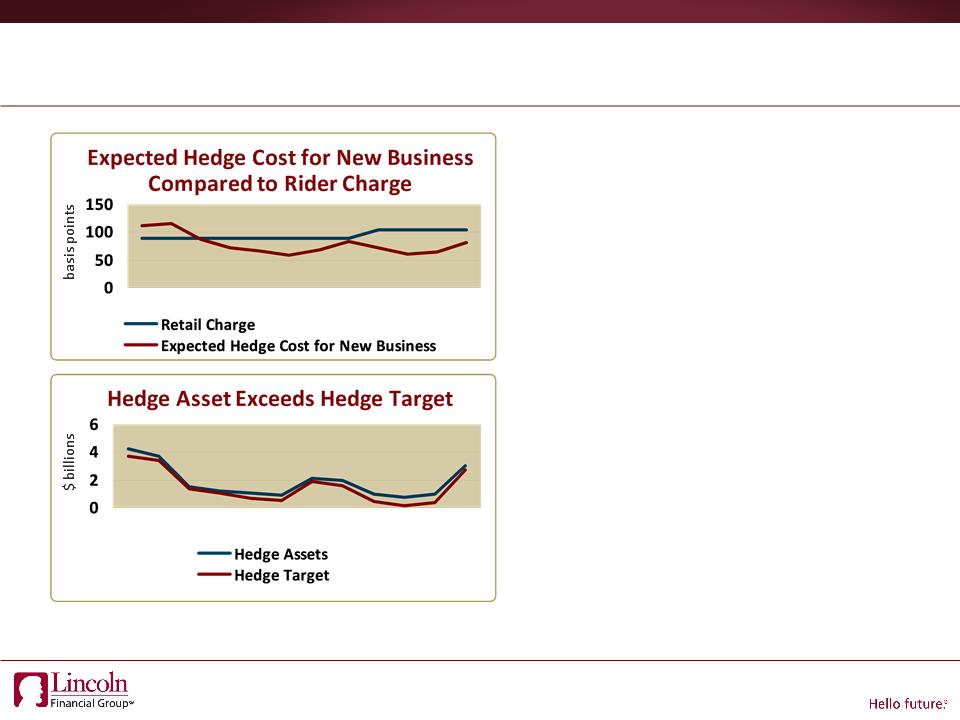

Effective Equity Risk Management

Strong Linkage Between Pricing and

Hedging

Hedging

• All living and death benefit riders hedged

• Hedging strategy established and validated

prior to all living benefit launches

prior to all living benefit launches

• Strategy is regularly monitored and

changed with updates in actuarial

assumptions and capital markets

changed with updates in actuarial

assumptions and capital markets

Hedge Program Focused on Economics

• Recognized by Moody’s as a strong hedge

program

program

– 3-Greek (market, rates, implied volatilities)

• Consistent performance through economic

cycles

cycles

– In 3Q 2011 the hedge program was over

90% effective

90% effective

4Q 2008

2Q 2009

4Q 2009

2Q 2010

4Q 2010

2Q 2011

4Q 2008

2Q 2009

4Q 2009

2Q 2010

4Q 2010

2Q 2011

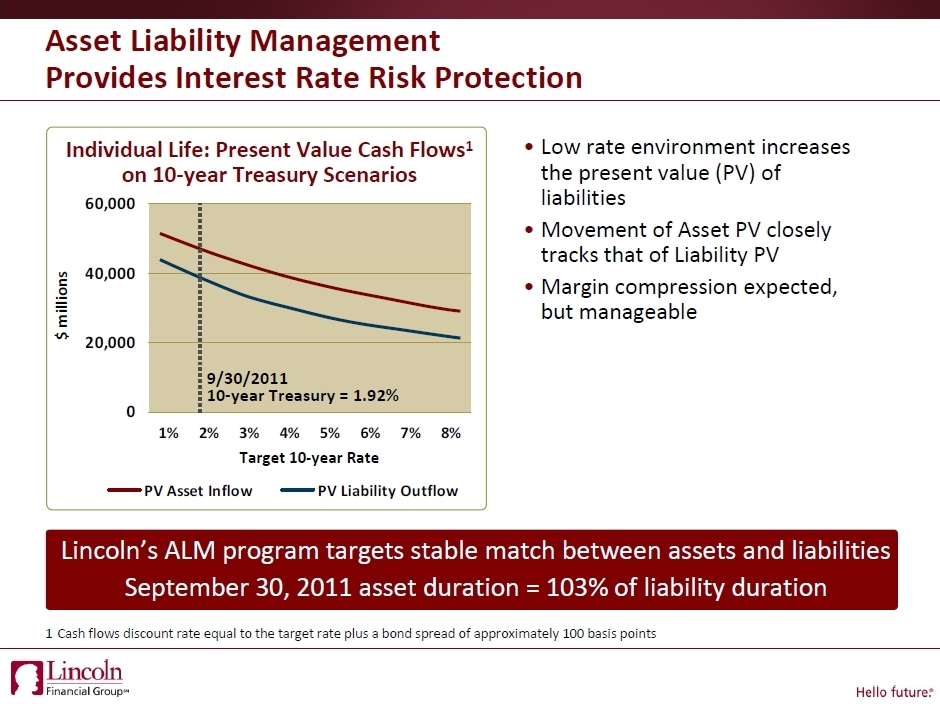

• New business rate setting based on

new money rates not portfolio rates

new money rates not portfolio rates

• Earnings impact from prolonged low

interest rates mitigated by

interest rates mitigated by

– Proactive renewal rate actions

– In-force crediting rate cushion to

guarantee ~ 105bps

guarantee ~ 105bps

– Effective asset liability matching

– Pricing based on new money rate with

low guarantee (1.00%)

low guarantee (1.00%)

• Upcoming changes in 1Q 2012

• Interest rate caps mitigate risk of rising

interest rates

interest rates

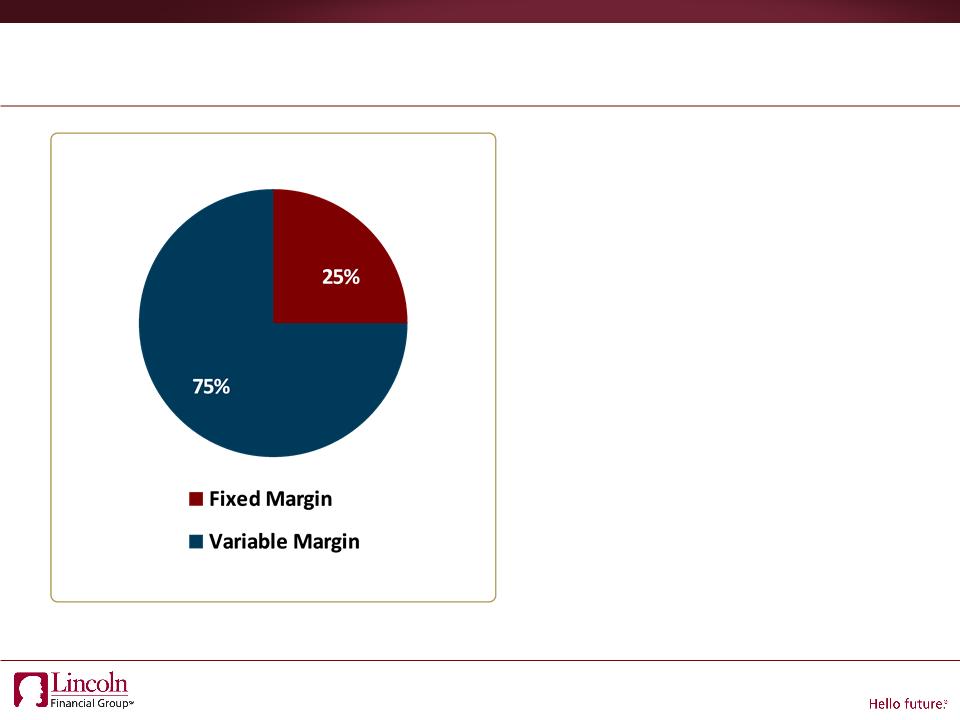

Annuity Revenue Mix1

Actions to Protect Margins

Effective Interest Rate Risk Management

1 As of September 30, 2011

Quality Business with Quality Earnings

In-force ROE

|

2007

|

2008

|

2009

|

2010

|

2011

YTD1 |

|

20%

|

8%

|

15%

|

19%

|

23%

|

|

Average = 17%

|

||||

VA New Business ROE

|

1Q 2011

|

2Q 2011

|

3Q 2011

|

|

21%

|

20%

|

14%

|

|

YTD = 18%

|

||

• Consistently strong ROE on in-force

business

business

• Healthy VA new business ROE

throughout 2011

throughout 2011

– Writing business on our terms

– Solid 3Q ROE despite capital markets

Actions to Protect Margins

• 1Q 2011 launched LINC2.0 and

simplified i4LIFE

simplified i4LIFE

• Increased M&E on L-share

• Upcoming changes in 1Q 2012

1 As of September 30, 2011. Reflects reported un-leveraged returns excluding goodwill.

Growth on Our Terms

Income protection solutions that

resonate with consumers

resonate with consumers

Multi-channel distribution

Effective protection of margins

• Variable Annuity i4LIFE

• Fixed Index Annuity GLWB (LINC Edge)

• Funds with volatility management and

capital protection

capital protection

• LTC combination products

• Breadth and depth of current platform

• Continued expansion

– Primerica

– Fee-based advisors

• Product design

• Equity risk management

• Interest rate risk management

Appendix

Disclosures/Endnotes

Source: Internal Competitive Intelligence, Morningstar Ratings, Comparisons done against competitors most

popular living benefit riders, Compared against top 10 companies based on YTD 2011 sales excluding

captive agency sales

popular living benefit riders, Compared against top 10 companies based on YTD 2011 sales excluding

captive agency sales

1 Fee reflects cost for single life version of living benefit riders

2 Income calculation based upon living benefit rider issue at 60, and beginning income at age 65

3 Based upon Morningstar Ratings of investment choices offered within variable annuity products; for each

subaccount whose underlying investment has at least a three-year history, Morningstar calculates a

Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation

in a subaccount’s monthly performance, placing more emphasis on downward variation and rewarding

consistent performance. The top 10% of subaccounts in each category receive 5 stars, the next 22.5%

receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive

1 star.

subaccount whose underlying investment has at least a three-year history, Morningstar calculates a

Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation

in a subaccount’s monthly performance, placing more emphasis on downward variation and rewarding

consistent performance. The top 10% of subaccounts in each category receive 5 stars, the next 22.5%

receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive

1 star.

The Overall Morningstar Rating for a subaccount is derived from a weighted average of the performance

figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. As of

September 30, 2011, 17,618 U.S.-domiciled subaccounts received a Morningstar Rating of 5 stars, and

47,498 subaccounts received a Morningstar Rating of 4 stars. Past performance is no guarantee of future

results.

figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. As of

September 30, 2011, 17,618 U.S.-domiciled subaccounts received a Morningstar Rating of 5 stars, and

47,498 subaccounts received a Morningstar Rating of 4 stars. Past performance is no guarantee of future

results.

2011 Conference for

Analysts, Investors

and Bankers

Analysts, Investors

and Bankers

November 15, 2011 l New York, NY

Financial Overview

Randy Freitag

Executive Vice President and Chief Financial Officer

Executive Vice President and Chief Financial Officer

Confidence in the Future

• Strong business fundamentals driving top and bottom

line growth

line growth

• Capital well protected in low rate environment

• Defensively positioned around key risks

• Solid balance sheet well positioned for stressed environments

ROE1

10%

20%

Strong Momentum Across Businesses

1 Adjusted for notable items. See appendix at the end of this presentation for a definition and reconciliation of operating revenues to revenues,

income from operations to net income, a reconciliation of return on average equity and schedules of notable items

income from operations to net income, a reconciliation of return on average equity and schedules of notable items

• YTD operating revenues up 7%

• In-force Life Insurance up 3% to

$574 billion

$574 billion

• 3Q Group net earned premium up

7% to $410 million

7% to $410 million

• 3Q Retirement deposits: VA up 7%

and DC up 15%

and DC up 15%

• YTD expense growth less than

revenue growth

revenue growth

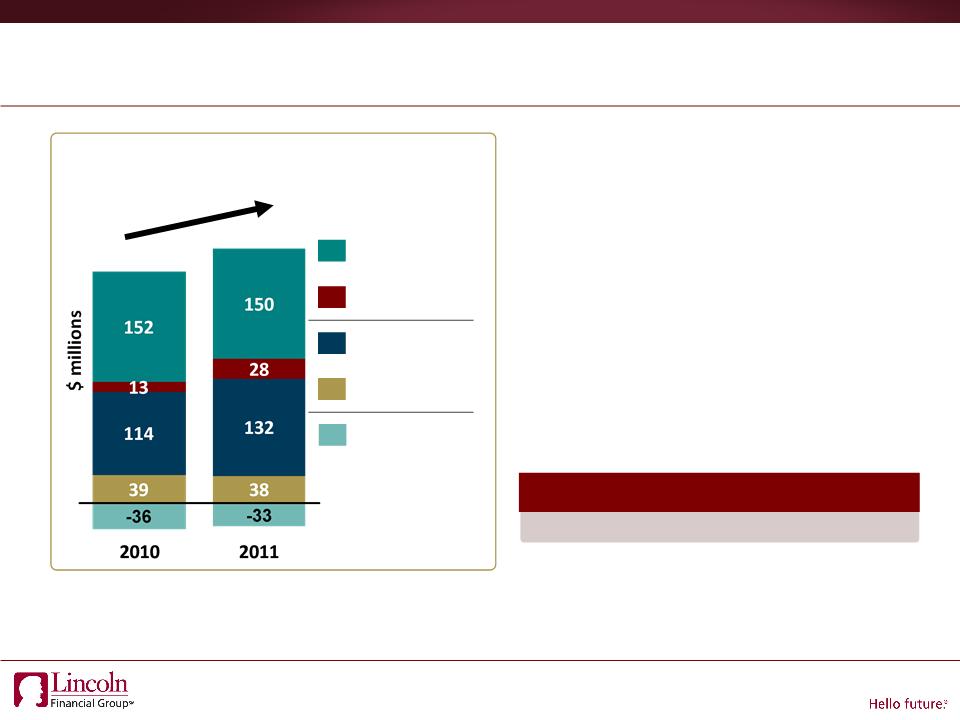

3Q Income From Operations1

Earnings Drivers

$282

$315

Life Insurance

Group Protection

Annuities

Defined

Contribution

Contribution

Other Operations

15%

Life

Annuities

GP

DC

YTD 2011

11%

+12%

|

Earnings Impact

|

|

|

2012

|

$50M

|

|

2013

|

$100M

|

|

2014

|

$150M

|

|

Earnings growth rate reduced by 3-4%

|

|

Manageable Impact to GAAP Results from Low Rates

• Minimal reserve impact absent

changes to long-term earned rate

assumption (reflected in earnings

impact)

changes to long-term earned rate

assumption (reflected in earnings

impact)

• 100 bps long-term earned rate

assumption reduction, has an

estimated $200-250 million impact

assumption reduction, has an

estimated $200-250 million impact

Impact of 10-year Treasury at 2.0% for 10 years on

GAAP Results

GAAP Results

Earnings growth continues despite low rate environment

Strong Statutory Reserve Adequacy

Impact of 10-year Treasury at 2.0% for 10 years on

Statutory Reserve Adequacy

Statutory Reserve Adequacy

|

Cash Flow Testing Reserve Adequacy ($ billions)

|

||

|

|

Base Case

|

Low Rate

Scenario |

|

Life1

|

$4

|

$3

|

|

Annuity

|

$4

|

$3

|

|

Total1

|

$8

|

$6

|

Statutory Reserves

• Prescribed conservative assumptions that

are fixed at issue

are fixed at issue

• Adequacy tested annually with cash flow

testing

testing

• Increased if cash flow testing deficiency exists

Results of Cash Flow Testing

• $8 billion of reserve sufficiency

• $6 billion in low rate scenario

– Potential for up to $500 million reserve

increase from standalone analysis of SG UL

in ‘out’ years

increase from standalone analysis of SG UL

in ‘out’ years

1 Excludes financed reserves

Significant statutory reserve adequacy in low rate environment

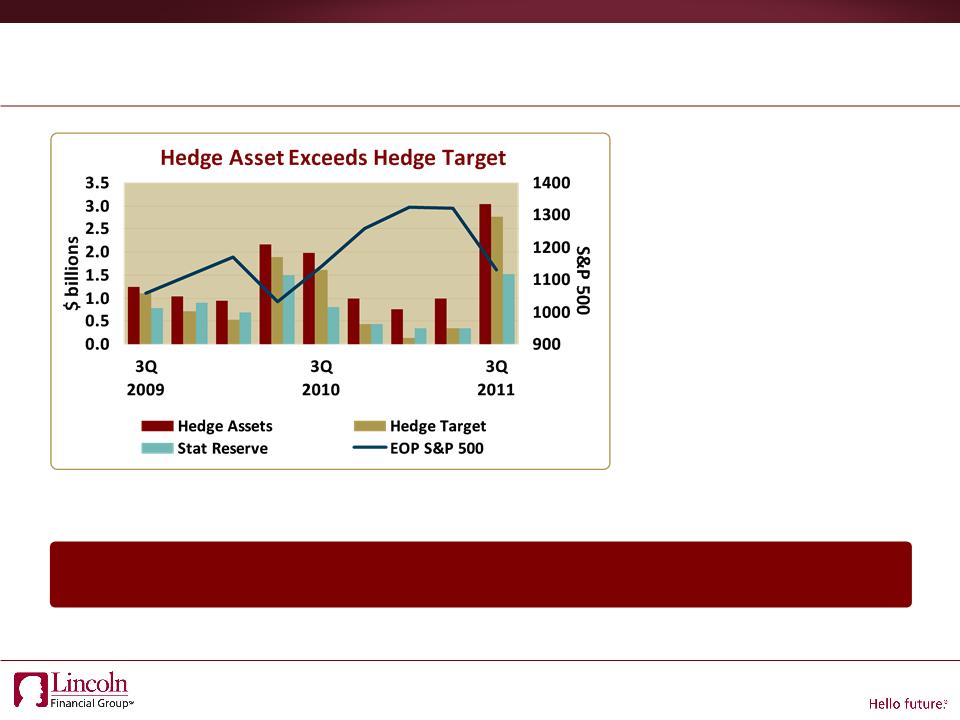

VA Hedge Program Protects Capital

• Hedge assets have

exceeded economic and

statutory reserves at all

points

exceeded economic and

statutory reserves at all

points

• Hedge program focused

on economics

on economics

• All guaranteed living and

death benefits covered

by hedge program

death benefits covered

by hedge program

• No additional capital has

been required in these

volatile markets

been required in these

volatile markets

Hedge assets in excess of statutory requirements at all points

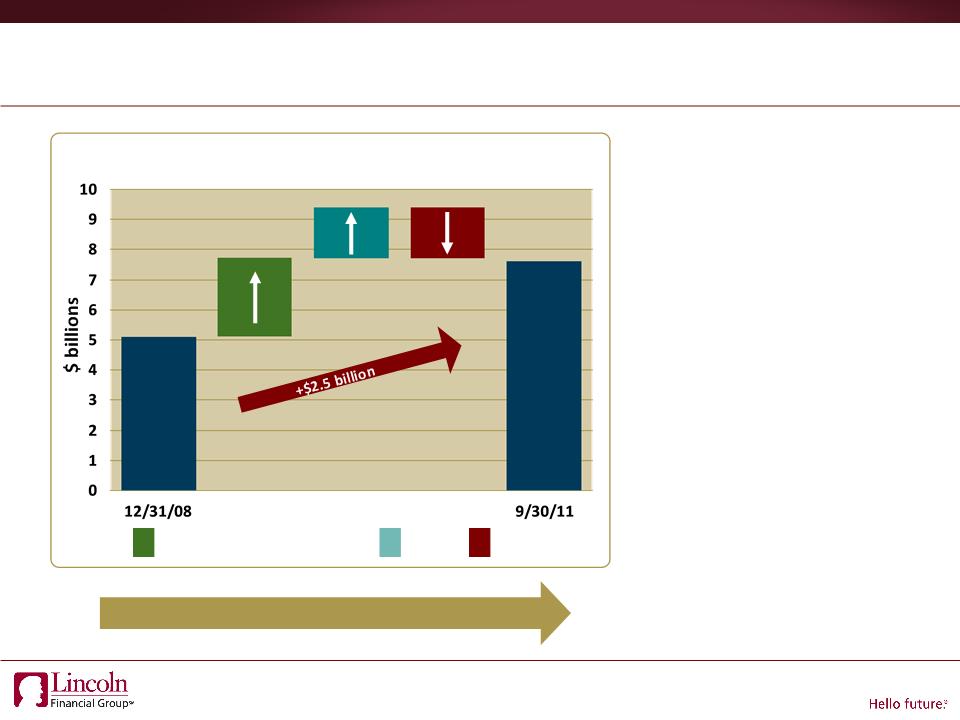

Strong Statutory Capital and

Holding Company Liquidity Positions

Holding Company Liquidity Positions

• Strong statutory earnings

generation

generation

• Upstreamed $1.7 billion to

HoldCo after funding new

business needs

HoldCo after funding new

business needs

• Strong liquidity position at

HoldCo

HoldCo

– $770 million at 9/30/11

– $1.5 billion increase since

12/31/08

12/31/08

Statutory Capital

Stat Op Income/ Res Financing

Dividends

Other

$5.1

$7.6

~500%

RBC

393%

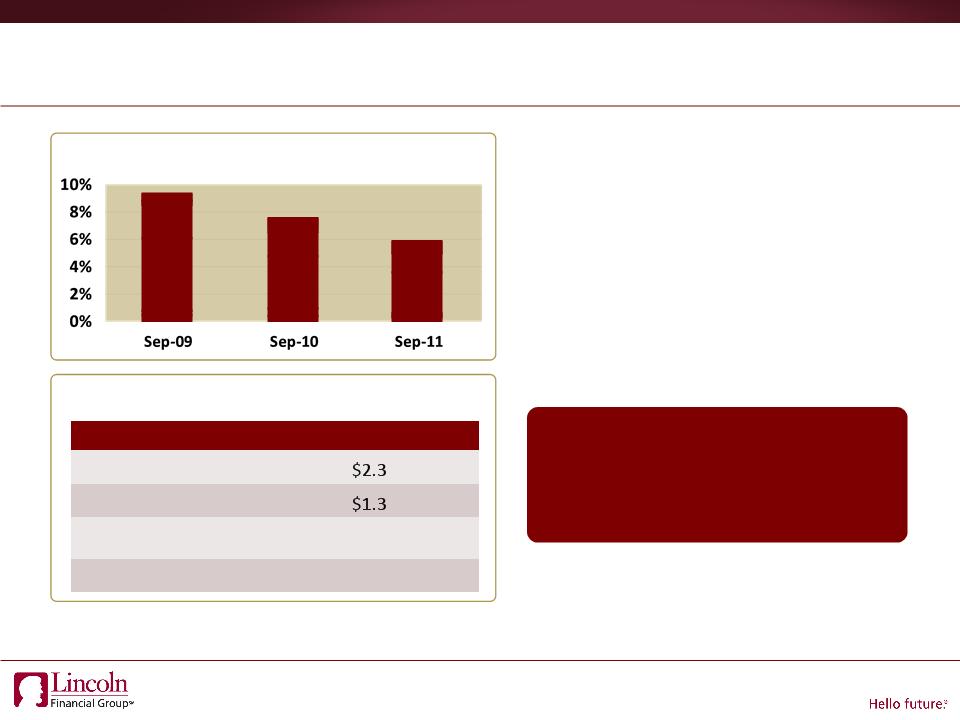

General Account Strategy

A “Risk-Off” Position Since 2008

A “Risk-Off” Position Since 2008

• Purchases biased towards higher quality

securities - 70% of purchases NAIC 1

securities - 70% of purchases NAIC 1

• Reduced Risk Assets2 by over $2 billion

• Sold $400 million of European holdings

exposed to risk of contagion

exposed to risk of contagion

– Recently reduced EU banking exposure

by $92 million and added $50 million of

CDS protection

by $92 million and added $50 million of

CDS protection

Net unrealized gains/losses ($ billions)

Below Investment Grade1 Trends

9.2%

7.5%

5.8%

|

Product

|

Sep-08

|

Sep-09

|

Sep-10

|

Sep-11

|

|

Life

|

-$2.2

|

$0.2

|

$3.4

|

|

|

Annuities

|

-$0.7

|

$0.2

|

$1.2

|

|

|

Surplus

& Other |

-$1.4

|

-$0.3

|

$1.5

|

$1.7

|

|

Total

|

-$4.3

|

$0.1

|

$5.1

|

$6.3

|

C1 capital down 20% since

2009 on $6 billion increase

in invested assets

30% reduction in risk profile

2009 on $6 billion increase

in invested assets

30% reduction in risk profile

1 AFS & Trading based on NAIC ratings, GAAP book values, and includes CLNs

2 Includes Corporate High Yield, alternative investments, 05’-07’ vintage RMBS, leveraged CMBS, common and preferred equity, CDO and real

estate equity

estate equity

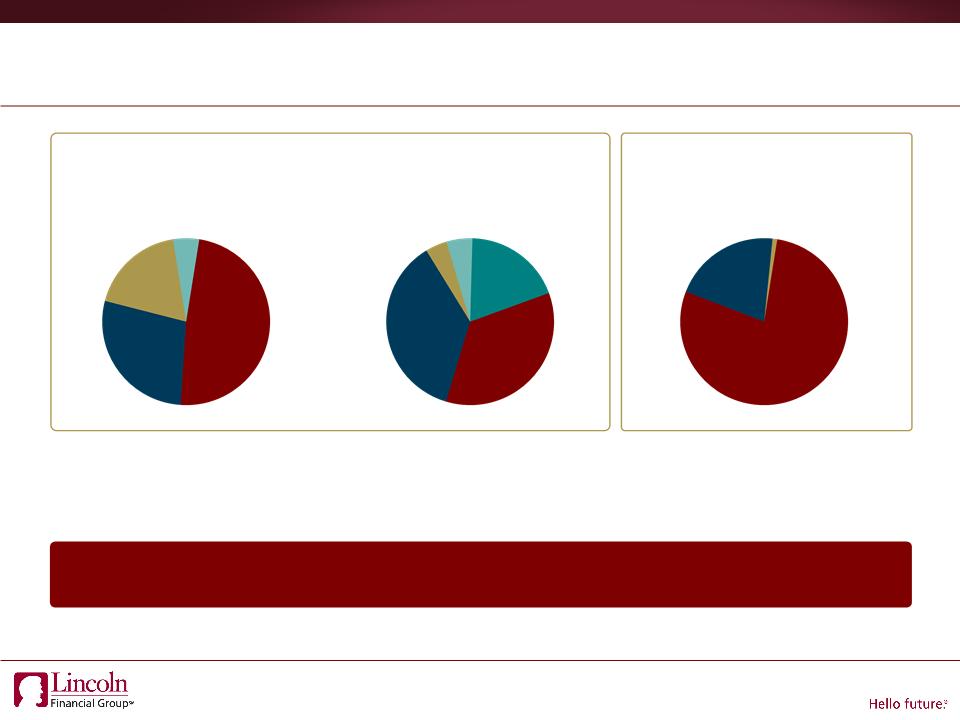

European Exposure Reduced & Well-Positioned

1 Defined as sovereign and banking exposure to Portugal, Ireland, Italy, Greece and Spain

2 Debt and preferred stock issued by companies domiciled in EU member countries

$84 million of direct EU peripheral1 exposure,

mostly non-European subsidiaries of large Spanish Banks

mostly non-European subsidiaries of large Spanish Banks

$775M Indirect Exposure to Peripheral EU

Sector Exposure

Spain

48%

48%

Ireland

28%

Italy

19%

Portugal

5%

Greece

0%

Capital

Goods

35%

Goods

35%

Utility

37%

37%

Financial

Institutions

4%

Institutions

4%

Transportation

5%

5%

Communications

19%

19%

Country Composition

$6.6B of EU Exposure2

Utilities &

Industrials

78%

Industrials

78%

Financials

21%

21%

Sovereigns

1%

• $775M indirect exposure in a net gain position

• 96% in defensive sectors / 4% financial

• Approximately 80% in

diversified defensive sectors

diversified defensive sectors

• Net unrealized gain of $500M

Strong Capital Margin Above Rigorous Threshold

|

Assumptions

(2012/2013/2014) |

Moderate Stress

|

Severe Stress

|

|

GDP Growth

|

2% / 2% / 2%

|

-2% / -1% / 0%

|

|

Unemployment

|

9% / 9% / 9%

|

10% / 11% / 10%

|

|

Housing Price Change

|

-3% / -3% / -3%

|

-5% / -5% / -5%

|

|

Interest Rates (10-year Treasury)

|

2.0% / 2.5% / 3.0%

|

1.5% / 1.75% / 2.0%

|

|

S&P 500

(YE2011 / 2012 / 2013 / 2014) |

1135 / 1175 / 1225 / 1275

|

1135 / 800 / 825 / 875

|

|

Cumulative Credit Related Impacts ($B)

|

$0.6

|

$1.7

|

|

Projected Capital Margin ($B)

>400% RBC

>$500M HoldCo cash

|

$1.5 / $1.7 / $1.9

|

$0.8 / $0.8 / $0.7

|

Confidence in the Future

• Strong balance sheet and capital generation

• Well positioned to withstand low interest rate environment

from both Statutory and GAAP perspective

from both Statutory and GAAP perspective

• Effective risk management reduces exposure to credit and

equity markets risks

equity markets risks

• Strong capital margin positions Lincoln for economic stress and

continued return of capital to shareholders

continued return of capital to shareholders

– 60% increase in dividend

– $375 million of share repurchases year-to-date

Appendix

Income (loss) from operations and ROE are non-GAAP financial measures and are not substitutes for net income (loss) and ROE,

calculated using GAAP measures. We exclude the after-tax effects of the following items from GAAP net income (loss) to arrive at

income (loss) from operations: realized gains and losses associated with the following ("excluded realized gain (loss)"): sale or

disposal of securities; impairments of securities; change in the fair value of derivative investments; embedded derivatives within

certain reinsurance arrangements; trading securities; change in the fair value of the derivatives we own to hedge our guaranteed

death benefit ("GDB") riders within our variable annuities, which is referred to as "GDB derivatives results"; change in the fair

value of the embedded derivatives of our guaranteed living benefit (“GLB”) riders within our variable annuities accounted for

under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the FASB ASC (“embedded

derivative reserves”), net of the change in the fair value of the derivatives we own to hedge the changes in the embedded

derivative reserves, the net of which is referred to as “GLB net derivative results”; and changes in the fair value of the embedded

derivative liabilities related to index call options we may purchase in the future to hedge contract holder index allocations

applicable to future reset periods for our indexed annuity products accounted for under the Derivatives and Hedging and the Fair

Value Measurements and Disclosures Topics of the FASB ASC (“indexed annuity forward-starting option”); change in reserves

accounted for under the Financial Services - Insurance - Claim Costs and Liabilities for Future Policy Benefits Subtopic of the FASB

ASC resulting from benefit ratio unlocking on our GDB and GLB riders ("benefit ratio unlocking"); income (loss) from the initial

adoption of new accounting standards; income (loss) from reserve changes (net of related amortization) on business sold through

reinsurance; gain (loss) on early extinguishment of debt; losses from the impairment of intangible assets; and income (loss) from

discontinued operations.

calculated using GAAP measures. We exclude the after-tax effects of the following items from GAAP net income (loss) to arrive at

income (loss) from operations: realized gains and losses associated with the following ("excluded realized gain (loss)"): sale or

disposal of securities; impairments of securities; change in the fair value of derivative investments; embedded derivatives within

certain reinsurance arrangements; trading securities; change in the fair value of the derivatives we own to hedge our guaranteed

death benefit ("GDB") riders within our variable annuities, which is referred to as "GDB derivatives results"; change in the fair

value of the embedded derivatives of our guaranteed living benefit (“GLB”) riders within our variable annuities accounted for

under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the FASB ASC (“embedded

derivative reserves”), net of the change in the fair value of the derivatives we own to hedge the changes in the embedded

derivative reserves, the net of which is referred to as “GLB net derivative results”; and changes in the fair value of the embedded

derivative liabilities related to index call options we may purchase in the future to hedge contract holder index allocations

applicable to future reset periods for our indexed annuity products accounted for under the Derivatives and Hedging and the Fair

Value Measurements and Disclosures Topics of the FASB ASC (“indexed annuity forward-starting option”); change in reserves

accounted for under the Financial Services - Insurance - Claim Costs and Liabilities for Future Policy Benefits Subtopic of the FASB

ASC resulting from benefit ratio unlocking on our GDB and GLB riders ("benefit ratio unlocking"); income (loss) from the initial

adoption of new accounting standards; income (loss) from reserve changes (net of related amortization) on business sold through

reinsurance; gain (loss) on early extinguishment of debt; losses from the impairment of intangible assets; and income (loss) from

discontinued operations.

The earnings used to calculate ROE are income (loss) from operations. Income (loss) from operations is an internal measure used

by the company in the management of its operations. Management believes that this performance measure explains the results

of the company's ongoing businesses in a manner that allows for a better understanding of the underlying trends in the company's

current business because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals

or future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate

to the operations of the individual segments.

by the company in the management of its operations. Management believes that this performance measure explains the results

of the company's ongoing businesses in a manner that allows for a better understanding of the underlying trends in the company's

current business because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals

or future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate

to the operations of the individual segments.

The company uses its prevailing corporate federal income tax rate of 35% while taking into account any permanent differences for

events recognized differently in its financial statements and federal income tax returns when reconciling non-GAAP measures to

the most comparable GAAP measure.

events recognized differently in its financial statements and federal income tax returns when reconciling non-GAAP measures to

the most comparable GAAP measure.

Definition of Income (Loss) From Operations and ROE

Reconciliation of Net Income to Income from Operations

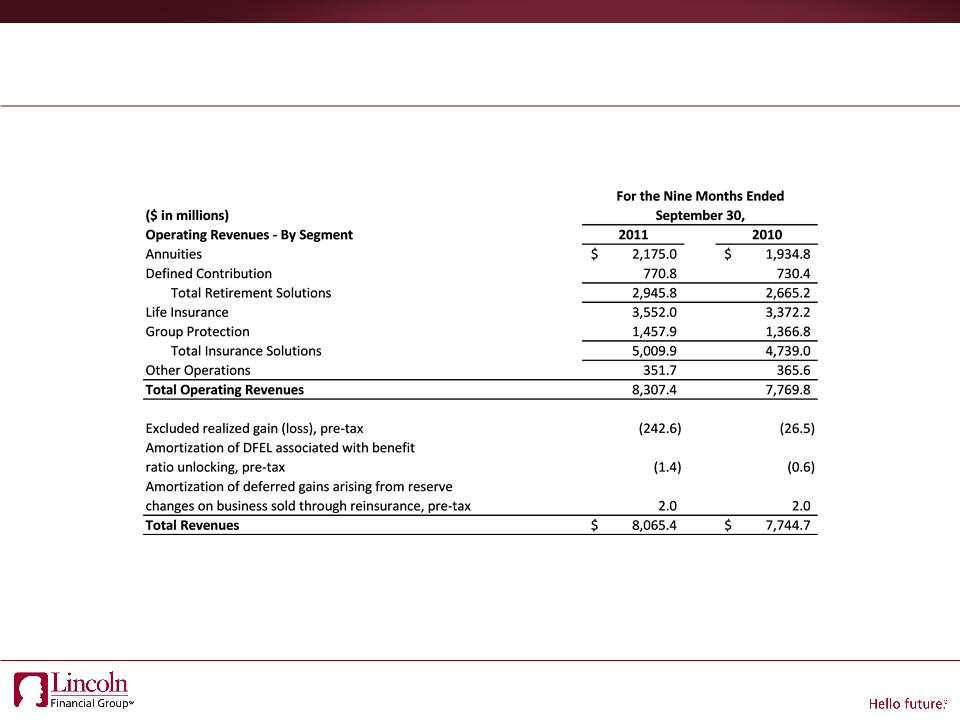

Reconciliation of Operating Revenues to Revenues

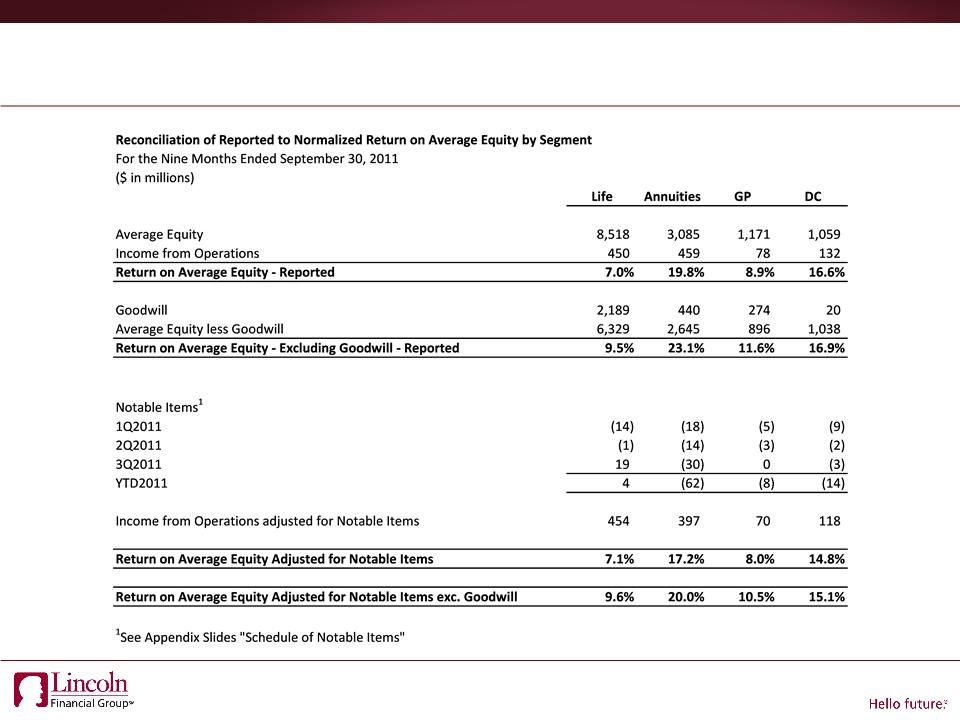

Reconciliation of Return on Average Equity

For the Nine Months Ended September 30, 2011

For the Nine Months Ended September 30, 2011

|

$ millions

|

Retirement Solutions

|

Insurance Solutions

|

Other

Operations |

||

|

Annuities

|

Group

Protection |

||||

|

Reported

|

162

|

41

|

132

|

28

|

(45)

|

|

DAC Unlocking

|

(8)

|

(4)

|

8

|

|

|

|

Mortality

|

|

|

10

|

|

|

|

Traditional Reserves

|

|

|

4

|

|

|

|

Tax-related items

|

(22)

|

|

(5)

|

|

3

|

|

Guaranty Association

Assessments |

|

|

|

|

9

|

|

Other (net)

|

|

1

|

1

|

|

|

|

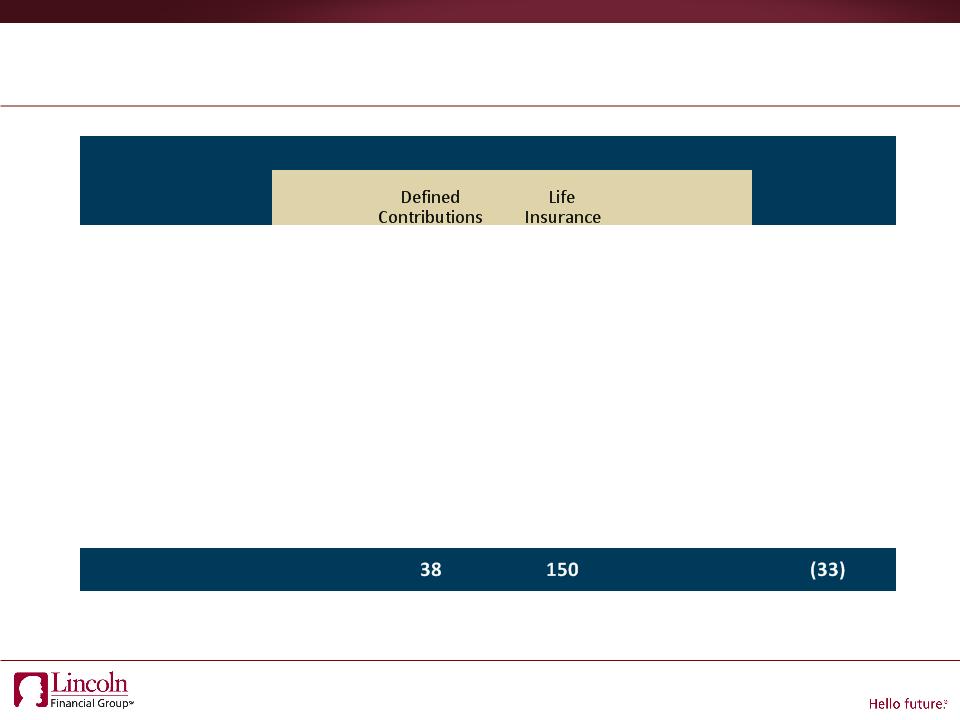

Total

|

132

|

38

|

150

|

28

|

(33)

|

3Q 2011 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

|

$ millions

|

Retirement Solutions

|

Insurance Solutions

|

Other

Operations |

||

|

Annuities

|

Defined

Contributions |

Group Protection

|

|||

|

Reported

|

150

|

42

|

152

|

26

|

(22)

|

|

Net Investment Income

|

(4)

|

(4)

|

(5)

|

(1)

|

(1)

|

|

DAC Unlocking

|

(8)

|

|

(6)

|

(1)

|

|

|

Mortality/Morbidity

|

|

|

6

|

|

(2)

|

|

Expense

|

|

2

|

|

(1)

|

(9)

|

|

Tax-related items

|

(2)

|

|

|

|

(2)

|

|

Other (net)

|

|

|

4

|

|

|

|

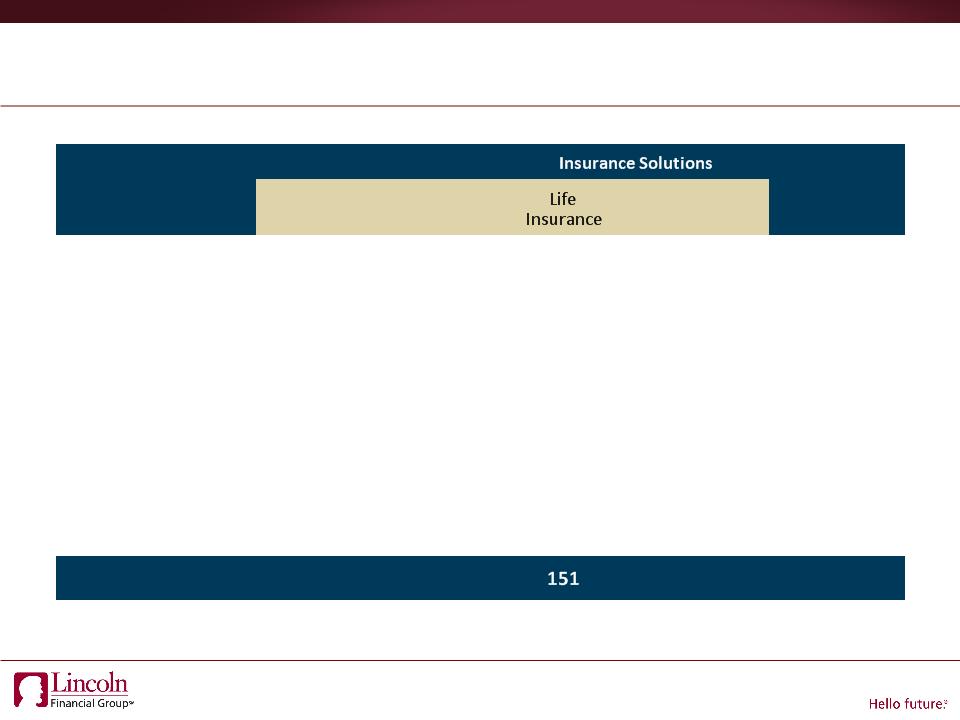

Total

|

136

|

40

|

151

|

23

|

(36)

|

2Q 2011 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

|

$ millions

|

Retirement Solutions

|

Insurance Solutions

|

Other

Operations |

||

|

Annuities

|

Defined

Contributions |

Group Protection

|

|||

|

Reported

|

147

|

49

|

166

|

24

|

(37)

|

|

Net Investment Income

|

(6)

|

(7)

|

(8)

|

(2)

|

(4)

|

|

DAC Unlocking

|

(5)

|

(2)

|

|

(1)

|

|

|

Mortality/Morbidity

|

(7)

|

|

(6)

|

|

|

|

Expense

|

|

|

|

(2)

|

4

|

|

Tax-related items

|

|

|

|

|

|

|

Other (net)

|

|

|

|

|

|

|

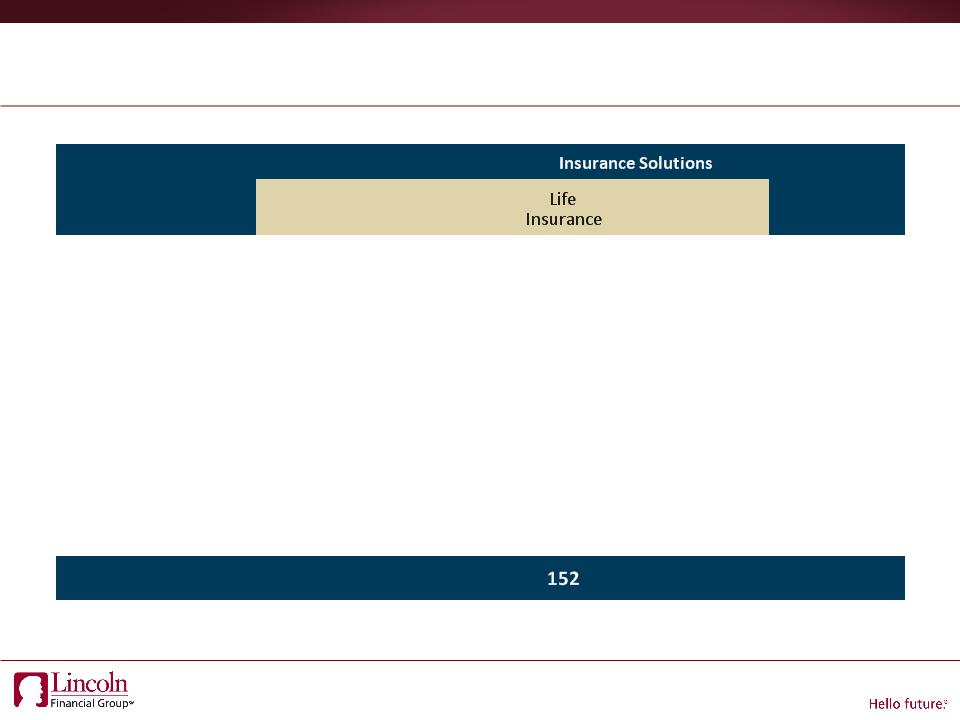

Total

|

129

|

40

|

152

|

19

|

(37)

|

1Q 2011 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

|

$ millions

|

Retirement Solutions

|

Insurance Solutions

|

Other

operations |

||

|

Annuities

|

Defined

Contributions |

Group

Protection1 |

|||

|

Reported

|

126

|

50

|

60

|

10

|

(40)

|

|

DAC Unlocking

|

(2)

|

11

|

(82)

|

|

|

|

Mortality

|

|

|

(10)

|

|

|

|

Expense

|

|

|

|

|

(2)

|

|

Tax-related items

|

14

|

|

|

|

(2)

|

|

Other (net)

|

|

|

|

(3)

|

|

|

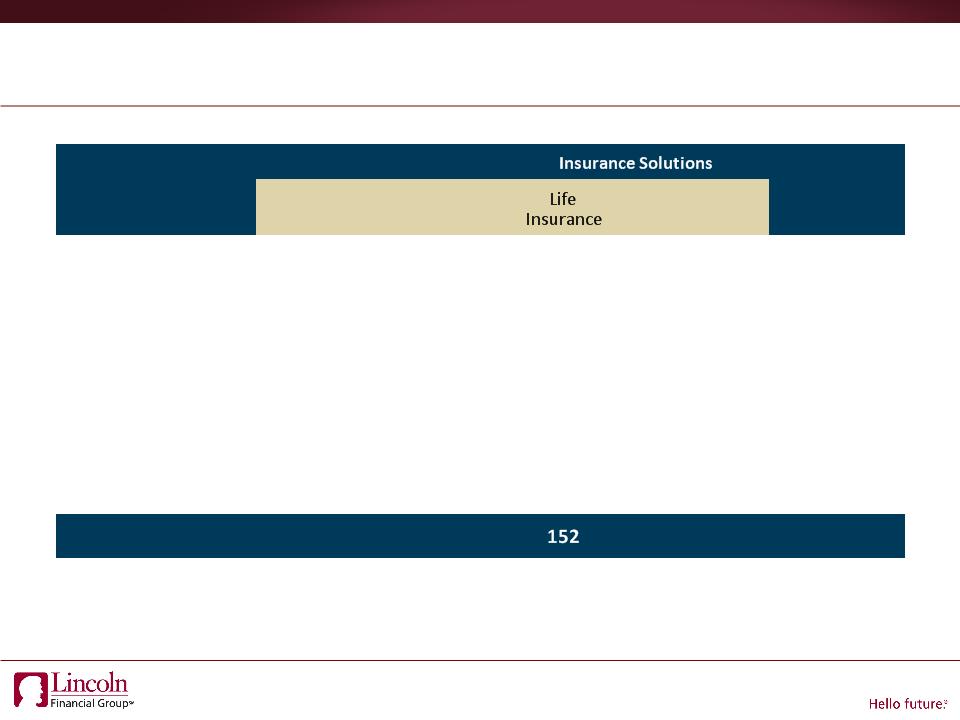

Total

|

114

|

39

|

152

|

13

|

(36)

|

1 Group Protection results do not include adjustment to normalize loss ratios

3Q 2010 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

EITF 09-G Estimated Impact

• Retrospective adoption on 1/1/2012

• Reduces GAAP equity, but no impact on

statutory surplus

statutory surplus

• Pro forma impact on YTD 2011 earnings:

5% to 7%

5% to 7%

EITF 09-G: Estimated Impact

|

|

Low

|

High

|

|

Pretax DAC

Reduction

|

$1.45b

|

$1.75

|

|

% DAC Balance

|

16%

|

19%

|

|

AT Impact to

Equity |

$950m

|

$1.15b

|

|

Impact on

BV/Share |

($3.15)

|

($3.81)

|