QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

For the fiscal year ended December 31, 2019

or

For the transition period from _____________ to _____________

Commission file number 0-1402

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices) (Zip Code)

(216 ) 481-8100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | |||

Emerging growth company | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common shares held by non-affiliates as of June 28, 2019 was $5,236,546,343 (affiliates, for this purpose, have been deemed to be Directors and Executive Officers of the Company and certain significant shareholders).

The number of shares outstanding of the registrant's common shares as of January 31, 2020 was 60,364,079 .

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the registrant's definitive proxy statement with respect to the registrant's 2020 Annual Meeting of Shareholders.

PART I

ITEM 1. BUSINESS

General

As used in this Annual Report on Form 10-K, the term "Company," except as otherwise indicated by the context, means Lincoln Electric Holdings, Inc. and its wholly-owned and majority-owned subsidiaries for which it has a controlling interest. The Lincoln Electric Company began operations in 1895 and was incorporated under the laws of the State of Ohio in 1906. During 1998, The Lincoln Electric Company reorganized into a holding company structure, and Lincoln Electric Holdings, Inc. became the publicly-held parent of Lincoln Electric subsidiaries worldwide, including The Lincoln Electric Company.

The Company is one of only a few worldwide broad-line manufacturers of welding, cutting and brazing products. The Company is the world leader in the design, development and manufacture of arc welding products, automated joining, assembly and cutting systems, plasma and oxy-fuel cutting equipment. The Company also has a leading global position in brazing and soldering alloys.

The Company's products include arc welding power sources, plasma cutters, wire feeding systems, robotic welding packages, integrated automation systems, fume extraction equipment, consumable electrodes, fluxes and welding accessories and specialty welding consumables and fabrication. The Company's product offering also includes computer numeric controlled ("CNC") plasma and oxy-fuel cutting systems and regulators and torches used in oxy-fuel welding, cutting and brazing.

The arc welding power sources and wire feeding systems manufactured by the Company range in technology from basic units used for light manufacturing and maintenance to highly sophisticated robotic applications for high volume production welding and fabrication. Three primary types of arc welding electrodes are produced: (1) coated manual or stick electrodes; (2) solid electrodes produced in coil, reel or drum forms for continuous feeding in mechanized welding; and (3) cored electrodes produced in coil form for continuous feeding in mechanized welding.

The Company has, through wholly-owned subsidiaries, manufacturing facilities located in the United States, Australia, Brazil, Canada, China, Colombia, France, Germany, India, Italy, Mexico, the Netherlands, Poland, Romania, Russia, Spain, Turkey and the United Kingdom.

The Company's business units are aligned into three operating segments. The operating segments consist of Americas Welding, International Welding and The Harris Products Group. The Americas Welding segment includes welding operations in North and South America. The International Welding segment includes welding operations in Europe, Africa, Asia and Australia. The Harris Products Group includes the Company's global cutting, soldering and brazing businesses, as well as the retail business in the United States.

Customers

The Company's products are sold in both domestic and international markets. In the Americas, products are sold principally through industrial distributors, retailers and also directly to users of welding products. Outside of the Americas, the Company has an international sales organization comprised of Company employees and agents who sell products from the Company's various manufacturing sites to distributors and product users.

The Company's major end-user markets include:

• | general fabrication, |

• | energy and process industries, |

• | heavy industries (heavy fabrication, ship building and maintenance and repair), |

• | automotive and transportation, and |

• | construction and infrastructure. |

The Company is not dependent on a single customer or a few customers and no individual customer currently accounts for more than ten percent of total Net sales. However, the loss of a large customer could have an adverse effect on the Company's business. The Company's operating results are sensitive to changes in general economic conditions. The arc welding and cutting industry is generally a mature industry in developed markets such as North America and Western Europe and is cyclical in nature. Overall demand for arc welding and cutting products is largely determined by economic cycles and the level of capital spending in manufacturing and other industrial sectors. The Company experiences some variability in reported period-to-period results as demand for the Company's products are mildly seasonal with generally higher demand in the second and third quarters. See "Item 1A. Risk Factors" for further discussion regarding risks associated with customers, general economic conditions and demand.

1

Competition

Conditions in the arc welding and cutting industry are highly competitive. The Company believes it is the world's largest manufacturer of consumables and equipment with relatively few major broad-line competitors worldwide, but numerous smaller competitors in specific geographic markets. The Company continues to pursue strategies to heighten its competitiveness in domestic and international markets, which includes positioning low cost manufacturing facilities in most geographical markets. Competition in the arc welding and cutting industry is based on brand preference, product quality, price, performance, warranty, delivery, service and technical support. The Company believes its performance against these factors has contributed to the Company's position as the leader in the industry.

Most of the Company's products may be classified as standard commercial articles and are manufactured for stock. The Company believes it has a competitive advantage in the marketplace because of its highly trained technical sales force and the support of its welding research and development staff to assist customers in optimizing their welding applications. This allows the Company to introduce its products to new users and to establish and maintain close relationships with its customers. This close relationship between the technical sales force and the direct customers, together with its supportive relationship with its distributors, who are particularly interested in handling the broad range of the Company's products, is an important element of the Company's market success and a valuable asset of the Company.

Raw Materials

The principal raw materials essential to the Company's business are steel, electronic components, engines, brass, copper, silver, aluminum alloys, robotic components and various chemicals, all of which are normally available for purchase in the open market.

Patents and Trademarks

The Company holds many valuable patents, primarily in arc welding, and actively protects its innovations as research and development has progressed in both the United States and major international jurisdictions. The Company believes its trademarks are an important asset and aggressively pursues brand management.

Environmental Regulations

The Company's facilities are subject to environmental regulations. To date, compliance with these environmental regulations has not had a material adverse effect on the Company's earnings. The Company is ISO 14001 certified at most significant manufacturing facilities in North America and Europe and is progressing towards certification at its remaining facilities worldwide. In addition, the Company is ISO 9001 certified at 47 facilities worldwide.

International Operations

The Company conducts a significant amount of its business and has a number of operating facilities in countries outside the United States. As a result, the Company is subject to business risks inherent to non-U.S. activities, including political uncertainty, import and export limitations, exchange controls and currency fluctuations.

Employees

The number of persons employed by the Company worldwide at December 31, 2019 was approximately 11,000. See "Part I, Item 1C" for information regarding the Company's executive officers, which is incorporated herein by reference.

2

Website Access

The Company's website, www.lincolnelectric.com, is used as a channel for routine dissemination of important information, including news releases and financial information. The Company posts its filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission ("SEC"), including annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K; proxy statements; and any amendments to those reports or statements. The Company also posts its Code of Corporate Conduct and Ethics on its website. All such postings and filings are available on the Company's website free of charge. In addition, this website allows investors and other interested persons to sign up to automatically receive e-mail alerts when news releases and financial information is posted on the website. The SEC also maintains a website, www.sec.gov, that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

ITEM 1A. RISK FACTORS

From time to time, information we provide, statements by our employees or information included in our filings with the SEC may contain forward-looking statements that are not historical facts. Those statements are "forward-looking" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the use of words such as "may," "will," "expect," "intend," "estimate," "anticipate," "believe," "forecast," "guidance" or words of similar meaning. Actual results may differ materially from such statements due to a variety of factors that could adversely affect the Company's operating results. Forward-looking statements, and our future performance, operating results, financial position and liquidity, are subject to a variety of factors that could materially affect results, including those risks described below. Forward-looking statements made in this report speak only as of the date of the statement, and, except as required by law, we undertake no obligation to update those statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

In the ordinary course of our business, we face various strategic, operating, compliance and financial risks. These risks could have a material impact on our business, financial condition, operating results and cash flows. Our Enterprise Risk Management ("ERM") process seeks to identify and address significant risks. Our ERM process is a company-wide initiative that is designed with the intent of prioritizing risks and allocating appropriate resources to address such risks. We use the integrated risk framework of the Committee of Sponsoring Organizations to assess, manage and monitor risks.

Management has identified and prioritized critical risks based on the severity and likelihood of each risk and assigned an executive to address each major identified risk area and lead action plans to monitor and mitigate risks, where possible. Our Board of Directors provides oversight of the ERM process and systematically reviews identified critical risks. The Audit Committee also reviews major financial risk exposures and the steps management has taken to monitor and control them.

Our goal is to pro-actively manage risks in a structured approach and in conjunction with the strategic planning process, with the intent to preserve and enhance shareholder value. However, these and other risks and uncertainties could cause our results to vary materially from recent results or from our anticipated future results. The risk factors and uncertainties described below, together with information incorporated by reference or otherwise included elsewhere in this Annual Report on Form 10-K, should be carefully considered. Additional risks and uncertainties of which we are currently unaware or that we currently believe to be immaterial may also adversely affect our business.

General economic, financial and market conditions may adversely affect our financial condition, results of operations and access to capital markets.

Our operating results are sensitive to changes in general economic conditions. Recessionary economic cycles, higher interest rates, inflation, higher labor costs, trade barriers in the world markets, financial turmoil related to sovereign debt and changes in tax laws or trade laws or other economic factors affecting the countries and industries in which we do business could adversely affect demand for our products. An adverse change in demand could impact our results of operations, collection of accounts receivable and our expected cash flow generation from current and acquired businesses, which may adversely impact our financial condition and access to capital markets.

In July 2017, the United Kingdom Financial Conduct Authority, which regulates The London Interbank Offered Rate (“LIBOR”), has announced that it intends to phase out LIBOR by the end of 2021. We may need to amend our revolving line of credit and interest rate swap agreements that use LIBOR as a benchmark and we cannot predict what alternative index or other amendments may be negotiated with our counterparties. As a result, the uncertainty regarding the future of LIBOR as well as the transition from LIBOR could have adverse impacts on our financial condition.

3

Economic and supply disruptions associated with events beyond our control, such as war, acts of terror, political unrest, pandemic, labor disputes or natural disasters could adversely affect our supply chain and distribution channels or result in loss of sales and customers.

Our facilities and operations, and the facilities and operations of our suppliers and customers, could be disrupted by events beyond our control, such as war, political unrest, pandemic, labor disputes or natural disasters. Any such disruption could cause delays in the production and distribution of our products and the loss of sales and customers. Insurance proceeds may not adequately compensate the Company for the losses.

Availability of and volatility in energy costs or raw material prices may adversely affect our performance.

In the normal course of business, we are exposed to market risks related to the availability of and price fluctuations in the purchase of energy and commodities used in the manufacture of our products (primarily steel, brass, copper, silver, aluminum alloys, electronic components, electricity and natural gas). The availability and prices for energy costs and raw materials, including steel, nonferrous metals and chemicals, are subject to volatility and are influenced by worldwide economic conditions. They are also influenced by import duties and tariffs (including the Section 232 steel and aluminum tariffs initiated by the U.S. government in 2018), speculative action, world supply and demand balances, inventory levels, availability of substitute materials, currency exchange rates, anticipated or perceived shortages, government trade practices and regulations and other factors.

Increases in the cost of raw materials and components may adversely affect our profitability if we are unable to pass along to our customers these cost increases in the form of price increases or otherwise reduce our cost of goods sold. Although most of the raw materials and components used in our products are commercially available from a number of sources and in adequate supply, any disruption in the availability of such raw materials and components, our inability to timely or otherwise obtain substitutes for such items, or any deterioration in our relationships with or the financial viability of our suppliers could adversely affect our business.

We are a co-defendant in litigation alleging asbestos induced illness. Liabilities relating to such litigation could reduce our profitability and impair our financial condition.

As of December 31, 2019, we were a co-defendant in cases alleging asbestos induced illness involving claims by approximately 3,233 plaintiffs. In each instance, we are one of a large number of defendants. The asbestos claimants allege that exposure to asbestos contained in welding consumables caused the plaintiffs to develop adverse pulmonary diseases, including mesothelioma and other lung cancers.

Since January 1, 1995, we have been a co-defendant in asbestos cases that have been resolved as follows: 55,114 of those claims were dismissed, 23 were tried to defense verdicts, 7 were tried to plaintiff verdicts (which were reversed or resolved after appeal), 1 was resolved by agreement for an immaterial amount and 900 were decided in favor of the Company following summary judgment motions.

The long-term impact of the asbestos loss contingency, in the aggregate, on operating results, operating cash flows and access to capital markets is difficult to assess, particularly since claims are in many different stages of development and we benefit significantly from cost-sharing with co-defendants and insurance carriers. While we intend to contest these lawsuits vigorously, and believe we have applicable insurance relating to these claims, there are several risks and uncertainties that may affect our liability for personal injury claims relating to exposure to asbestos, including the future impact of changing cost sharing arrangements or a change in our overall trial experience.

Asbestos use in welding consumables in the U.S. ceased in 1981.

We may incur material losses and costs as a result of product liability claims that may be brought against us or failure to meet contractual performance commitments.

Our business exposes us to potential product liability risks that are inherent in the design, manufacture, sale and application of our products and the products of third-party suppliers that we utilize or resell. Our products are used in a variety of applications, including infrastructure projects such as oil and gas pipelines and platforms, buildings, bridges and power generation facilities, the manufacture of transportation and heavy equipment and machinery and various other construction projects. We face risk of exposure to product liability claims in the event that accidents or failures on these projects result, or are alleged to result, in bodily injury or property damage. Further, our products are designed for use in specific applications, and if a product is used inappropriately, personal injury or property damage may result. In certain cases, we design automated welding systems for use in a customer’s production facilities (including automotive production facilities), which could expose us to financial losses or professional liability.

4

The occurrence of defects in or failures of our products, or the misuse of our products in specific applications, could cause termination of customer contracts, increased costs and losses to us, our customers and other end users. We cannot be assured that we will not experience any material product liability losses in the future or that we will not incur significant costs to defend those claims. Further, we cannot be assured that our product liability insurance coverage will be adequate for any liabilities that we may ultimately incur or that product liability insurance will continue to be available on terms acceptable to us. Even if we are successful defending such claims or product liability coverage is adequate, claims of this nature could cause customers to lose confidence in our products and our Company. Warranty claims are not generally covered by insurance and we may incur significant warranty costs in the future for which we would not be reimbursed.

We may incur losses if we do not achieve contractual commitments, including project performance requirements or project schedules. Project performance can be affected by a number of factors, including but not limited to, availability of materials, changes in the project scope of services, environmental conditions or labor disruptions. In addition, our backlog consists of the expected revenue from projects for which we have an executed contract or commitment with a customer. Project cancellations, scope adjustments, deferrals or changes in cost estimates may reduce the dollar amount of revenue and profits that we actually earn.

The cyclical nature and maturity of the arc welding and cutting industry in developed markets may adversely affect our performance.

The arc welding and cutting industry is generally a mature industry in developed markets such as North America and Western Europe and is cyclical in nature. Overall demand for arc welding and cutting products is largely determined by the level of capital spending in manufacturing and other industrial sectors, and the welding industry has historically experienced contraction during periods of slowing industrial activity. If economic, business and industry conditions deteriorate, capital spending in those sectors may be substantially decreased, which could reduce demand for our products and have an adverse impact on our revenues and results of operations.

We may not be able to complete our acquisition or divestiture strategies, successfully integrate acquired businesses and in certain cases we may be required to retain liabilities for certain matters.

Part of our business strategy is to pursue targeted business acquisition opportunities, including foreign investment opportunities. We cannot be certain that we will be successful in pursuing potential acquisition candidates or that the consequences of any acquisition would be beneficial to us. Future acquisitions may expose us to unexpected liabilities and involve the expenditure of significant funds and management time. Further, we may not be able to successfully integrate an acquired business with our existing businesses or recognize the expected benefits from any completed acquisition. Integration efforts may include significant rationalization activities that could be disruptive to the business. Our current operational cash flow is sufficient to fund our acquisition plans, but a significant acquisition could require access to the capital markets.

Additionally, from time to time we may identify assets for strategic divestitures that would increase capital resources available for other activities and create organizational and operational efficiencies. Various factors could materially affect our ability to dispose of such assets or complete announced divestitures, including the receipt of approvals of governmental agencies or third parties and the availability of purchasers willing to acquire the interests or purchase the assets on terms and at prices acceptable to us.

Sellers typically retain certain liabilities or indemnify buyers for certain matters. The magnitude of any such retained liability or indemnification obligation may be difficult to quantify at the time of the transaction and ultimately may be material. Also, as is typical in divestitures, third parties may be unwilling to release us from guarantees or other credit support provided prior to the sale of the divested assets. As a result, after a divestiture, we may remain secondarily liable for the obligations guaranteed or supported to the extent that the buyer of the assets fails to perform these obligations.

If we cannot continue to develop, manufacture and market products that meet customer demands, continue to enforce the intellectual property rights on which our business depends or if third parties assert that we violate their intellectual property rights, our revenues, gross margins and results of operations may suffer.

Our continued success depends, in part, on our ability to continue to meet our customers' needs for welding and cutting products through the introduction of innovative new products and the enhancement of existing product design and performance characteristics. We must remain committed to product research and development and customer service in order to remain competitive. We cannot be assured that new products or product improvements, once developed, will meet with customer acceptance and contribute positively to our operating results, or that we will be able to continue our product development efforts at a pace to sustain future growth. Further, we may lose customers to our competitors if they demonstrate product design, development or manufacturing capabilities superior to ours.

5

We rely upon patent, trademark, copyright and trade secret laws in the United States and similar laws in foreign countries, as well as agreements with our employees, customers, suppliers and other third parties, to establish and maintain our intellectual property rights. However, any of our intellectual property rights could be challenged, invalidated or circumvented, or our intellectual property rights may not be sufficient to provide a competitive advantage. Further, the laws and their application in certain foreign countries do not protect our proprietary rights to the same extent as U.S. laws. Accordingly, in certain countries, we may be unable to protect our proprietary rights against unauthorized third-party copying or use, which could impact our competitive position.

Further, third parties may claim that we or our customers are infringing upon their intellectual property rights. Even if we believe that those claims are without merit, defending those claims and contesting the validity of patents can be time consuming and costly. Claims of intellectual property infringement also might require us to redesign affected products, enter into costly settlements or license agreements, pay costly damage awards or face a temporary or permanent injunction prohibiting us from manufacturing, marketing or selling certain of our products.

The competitive pressures we face could harm our revenue, gross margins and prospects.

We operate in a highly competitive global environment and compete in each of our businesses with other broad-line manufacturers and numerous smaller competitors specializing in particular products. We compete primarily on the basis of brand, product quality, price, performance, warranty, delivery, service and technical support. We have previously initiated, and may in the future initiate significant rationalization activities to align our business to market conditions and improve our overall competitiveness, including with respect to the integration of acquired businesses. Such rationalization activities could fail to deliver the desired competitive cost structure and could result in disruptions in customer service. If our products, services, support and cost structure do not enable us to compete successfully based on any of the criteria listed above, our operations, results and prospects could suffer.

Further, in the past decade, the arc welding industry in the United States and other developed countries has been subject to increased levels of foreign competition as low cost imports have become more readily available. Our competitive position could be harmed if new or emerging competitors become more active in the arc welding business. For example, while steel manufacturers traditionally have not been significant competitors in the domestic arc welding industry, some foreign integrated steel producers manufacture selected consumable arc welding products and robotic arm manufacturers compete in the automated welding and cutting space. In addition, in certain markets of the world, distributors manufacture and sell arc welding products. Our sales and results of operations, as well as our plans to expand in some foreign countries, could be adversely affected by this practice.

We conduct our sales and distribution operations on a worldwide basis and maintain manufacturing facilities in a number of foreign countries, which subjects us to risks associated with doing business outside the United States.

As a growing global enterprise, the share of sales and profits we derive from our international operations and exports from the United States is significant. This trend increases our exposure to the performance of many developing economies in addition to the developed economies outside of the United States. If international economies were to experience significant slowdowns, it could adversely affect our financial condition, results of operations and cash flows. There are a number of risks in doing business internationally, which may impede our ability to achieve our strategic objectives relating to our foreign operations, including:

• | Political and economic uncertainty and social turmoil; |

• | Corporate governance and management challenges in consideration of the numerous U.S. and foreign laws and regulations, including regulations relating to import-export control, technology transfer restrictions, repatriation of earnings and funds, exchange controls, labor regulations, nationalization, tariffs, data protection and privacy requirements, anti-boycott provisions and anti-bribery laws (such as the Foreign Corrupt Practices Act and the Organization for Economic Cooperation and Development Convention); |

• | International terrorism and hostilities; |

• | Changes in the global regulatory environment, including revised or newly created laws, regulations or standards relating to the Company, our products or the markets in which we operate; and |

• | Significant fluctuations in relative currency values; in particular, an increase in the value of the U.S. dollar against foreign currencies could have an adverse effect on our profitability and financial condition, as well as the imposition of exchange controls, currency devaluations and hyperinflation. |

6

Our operations depend on maintaining a skilled workforce, and any interruption in our workforce could negatively impact our results of operations and financial condition.

Our success depends in part on the efforts and abilities of our management team and key employees. Their skills, experience and industry knowledge significantly benefit our operations and performance. Our future success will also depend on our ability to identify, attract and retain highly qualified managerial and technical (including research and development) personnel. Competition for these individuals is intense, and we may not succeed in identifying, attracting or retaining qualified personnel. With our strategy to expand internationally into developing markets, we may incur additional risks as some developing economies lack a sufficiently trained labor pool.

Any interruption of our workforce, including rationalization efforts related to the integration of acquired businesses, interruptions due to unionization efforts, changes in labor relations or shortages of appropriately skilled individuals could impact our results of operations and financial condition.

Our defined benefit pension plans are subject to financial market trends, such as changes in discount rates and actual investment return on pension assets, which could adversely affect our results of operations and cash flows.

The performance of the financial markets and interest rates impact our funding obligations under our defined benefit pension plans. Significant changes in discount rates, decreases in the fair value of plan assets and investment losses on plan assets may increase our benefit obligations and adversely impact our results of operations, shareholders' equity and cash flows through our annual measurement of plan assets and liabilities.

Changes in tax rates or exposure to additional income tax liabilities could affect profitability.

Our business is subject to income taxes in the United States and various foreign jurisdictions. Domestic and international tax liabilities are subject to the allocation of income among various tax jurisdictions. Our effective tax rate could be adversely affected by changes in the mix among earnings in countries with differing statutory tax rates, changes in the valuation allowances of deferred tax assets or changes in tax laws.

The amount of income taxes paid is subject to ongoing audits by United States federal, state and local tax authorities and by foreign tax authorities. If these audits result in assessments different from amounts reserved, future financial results may include unfavorable adjustments which could have a material adverse effect on our results of operations.

We are subject to risks relating to our information technology systems.

The conduct and management of our business relies extensively on information technology systems, which contain confidential information related to our customers, suppliers and employees and other proprietary business information. We maintain some of these systems and are also dependent on a number of critical corporate infrastructure services provided by third parties relating to, among other things, human resources, electronic communication services and finance functions. Like many multinational companies, our systems are subject to regular cyber attacks and other malicious efforts to cause cyber security incidents. To date, these attacks have not had a material impact on our business or operations. However, if as a result of future attacks, our systems are significantly damaged, cease to function properly or are subject to a significant cyber security breach, we may suffer an interruption in our ability to manage and operate the business, and our results of operations and financial condition could be adversely affected. The Company continues to invest in cyber security, including maintaining and improving cyber security resilience, and the Company’s cyber security risks are monitored by the Audit Committee of our Board of Directors. Nevertheless, due to the nature of cyber threats, there can be no assurance that our preventive efforts can fully mitigate the risks of all cyber incidents, and a significant a security breach could result in financial loss, unfavorable publicity, damage to our reputation, loss of our trade secrets and other competitive information, allegations by our customers that we have not performed our contractual obligations, litigation by affected parties and fines and other sanctions resulting from any related breaches of data privacy regulations. Any of these could have an adverse effect on our results of operations and financial condition.

Our global operations are subject to increasingly complex environmental regulatory requirements.

We are subject to increasingly complex environmental regulations affecting international manufacturers, including those related to air and water emissions, waste management and climate change. Some environmental laws impose strict, retroactive and joint and several liability for the remediation of the release of hazardous substances, even for conduct that was lawful at the time it occurred, or for the conduct of or conditions caused by prior operators, predecessors or third parties. Failure to comply with environmental laws could expose us to penalties or clean-up costs, civil or criminal liability and sanctions on certain of our activities, as well as damage to property or natural resources. These liabilities, sanctions, damages and remediation efforts related to any non-compliance with such laws and regulations could negatively impact our ability to conduct our operations and our financial condition and results of operations. In addition, there can be no assurances that we will not be adversely affected by costs, liabilities or claims with respect to existing or subsequently acquired operations or under present laws and regulations or those that may be adopted or imposed in the future.

7

Changes in environmental laws or regulations could result in higher expenses and payments, and uncertainty relating to environmental laws or regulations may also affect how we conduct our operations and structure our investments and could limit our ability to enforce our rights. Changes in environmental and climate change laws or regulations, including laws relating to greenhouse gas emissions, could subject us to additional costs and restrictions, including increased energy and raw material costs. If environmental laws or regulations are either changed or adopted and impose significant operational restrictions and compliance requirements upon us or our products, they could negatively impact our business, capital expenditures, results of operations, financial condition and competitive position.

It is our policy to apply strict standards for environmental protection to all of our operations inside and outside of the United States, even when we are not subject to local government regulations. We may incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, liabilities resulting from third-party property damage or personal injury claims, or our products could be prohibited from entering certain jurisdictions, if we were to violate or become liable under environmental laws, if our products become non-compliant with environmental laws or if we were to undertake environmental protection actions voluntarily.

We also face increasing complexity in our products design and procurement operations as we adjust to new and future requirements relating to the design, production and labeling of our products that are sold worldwide in multiple jurisdictions. The ultimate costs under environmental laws and the timing of these costs are difficult to predict.

We may incur additional restructuring charges as we continue to contemplate rationalization actions in an effort to optimize our cost structure and may not achieve the anticipated savings and benefits of these actions.

We may take additional actions in the future to further optimize our cost structure and improve the efficiency of our operations, which will reduce our profitability in the periods incurred. As a result of these actions, we will likely continue to incur charges, which may include but are not be limited to asset impairments, employee severance costs, charges for pension and other postretirement contractual benefits and pension settlements, any of which could be significant, and could adversely affect our financial condition and results of operations. In addition, we may not realize anticipated savings or benefits from past or future rationalization plans in full or in part or within the time periods we expect. Failure to realize anticipated savings or benefits from our cost reduction actions could have a material adverse effect on our business, financial condition, liquidity, results of operations and cash flows. For more information regarding rationalization plans, refer to the rationalization and asset impairment related disclosure under Note 7 to the Company's consolidated financial statements.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

8

ITEM 1C. INFORMATION ABOUT OUR EXECUTIVE OFFICERS

EXECUTIVE OFFICERS OF THE REGISTRANT

Name | Age | Position | |||

Christopher L. Mapes | 58 | Chairman of the Board effective December 21, 2013. President and Chief Executive Officer effective December 31, 2012; Chief Operating Officer from September 1, 2011 to December 31, 2012; Director since February 2010. Prior to his service with the Company, Mr. Mapes was an Executive Vice President of A.O. Smith Corporation (a global manufacturer with a water heating and water treatment technologies business), a position he held from 2004 through August 2011, and the President of its former Electrical Products unit, a position he held from September 2004 through August 2011. | |||

Vincent K. Petrella | 59 | Executive Vice President, Chief Financial Officer and Treasurer since February 19, 2014; Senior Vice President, Chief Financial Officer and Treasurer from October 7, 2005 to February 19, 2014; Vice President, Chief Financial Officer and Treasurer from February 4, 2004 to October 7, 2005. | |||

Jennifer I. Ansberry | 46 | Executive Vice President, General Counsel and Secretary since April 20, 2017; Vice President, Deputy General Counsel from August 1, 2014 to April 20, 2017; Deputy General Counsel from 2004 to August 1, 2014. | |||

George D. Blankenship | 57 | Executive Vice President, President, Americas Welding since February 18, 2016; Executive Vice President, President, Lincoln Electric North America from February 19, 2014 to February 18, 2016; Senior Vice President; President, Lincoln Electric North America from July 30, 2009 to February 19, 2014; Senior Vice President, Global Engineering from October 7, 2005 to July 30, 2009; Senior Vice President; President, Lincoln Cleveland of The Lincoln Electric Company from January 8, 2008 to July 30, 2009; Senior Vice President, U.S. Operations of The Lincoln Electric Company from October 7, 2005 to January 8, 2008. | |||

Gabriel Bruno | 52 | Executive Vice President, Finance since January 1, 2019; Executive Vice President, Chief Human Resources Officer from July 1, 2016 to January 1, 2019; Executive Vice President, Chief Human Resources Officer and Chief Information Officer from February 18, 2016 to July 1, 2016; Executive Vice President, Chief Information Officer and Interim Chief Human Resources Officer from March 7, 2015 to February 18, 2016; Executive Vice President, Chief Information Officer from February 19, 2014 to March 7, 2015; Vice President, Chief Information Officer from May 1, 2012 to February 19, 2014; Vice President, Corporate Controller from 2005 to May 1, 2012. | |||

Steven B. Hedlund | 53 | Executive Vice President and President, International Welding since June 1, 2017; Senior Vice President and President, Global Automation from January 22, 2015 to June 1, 2017; Senior Vice President, Strategy & Business Development from February 19, 2014 to January 22, 2015; Vice President, Strategy and Business Development from September 15, 2008 to February 19, 2014. Prior to his service with the Company, Mr. Hedlund was the Vice President, Growth and Innovations with Master Lock, LLC (a security products company) from June 1, 2005 to July 1, 2008. | |||

Michele R. Kuhrt | 53 | Executive Vice President, Chief Human Resources Officer since February 25, 2019; Executive Vice President, Chief Information Officer from July 1, 2016 to February 24, 2019; Senior Vice President, Tax from 2006 to July 1, 2016. | |||

David J. Nangle | 63 | Executive Vice President, President, Harris Products Group since July 27, 2018; Senior Vice President, President, Harris Products Group from February 19, 2014 to July 27, 2018; Vice President, Group President of Brazing, Cutting and Retail Subsidiaries from January 12, 2006 to February 19, 2014. | |||

Geoffrey P. Allman | 49 | Senior Vice President, Strategy and Business Development since January 1, 2019; Senior Vice President, Corporate Controller from January 14, 2014 to December 31, 2018; Corporate Controller from July 1, 2012 to January 14, 2014; Director, Regional Finance North America from October 1, 2009 to June 30, 2012. | |||

Thomas A. Flohn | 59 | Senior Vice President, President, Asia Pacific Region since February 19, 2014; Vice President, Regional President, Lincoln Electric Asia Pacific Region from November 4, 2013 to February 19, 2014. Vice President; President, Lincoln Electric Europe, Middle East & Africa (EMEA) from July 1, 2010 to November 4, 2013; Vice President; President, Lincoln Asia Pacific from January 1, 2005 to June 30, 2010. | |||

Douglas S. Lance | 52 | Senior Vice President, President, Cleveland Operations since September 1, 2016; Senior Vice President, North American Operations from February 19, 2014 to September 1, 2016; Vice President, Operations from January 1, 2012 to February 19, 2014. | |||

Michael Mintun | 57 | Senior Vice President, Sales and Marketing, North America since February 19, 2014; Vice President, Sales and Marketing, North America from January 1, 2013 to February 19, 2014; Vice President, Sales, North America from January 1, 2008 to January 1, 2013. | |||

9

Michael J. Whitehead | 46 | Senior Vice President, President, Global Automation, Cutting and Additive Businesses since January 1, 2019; Senior Vice President, Strategy and Business Development from August 1, 2016 to January 1, 2019; President, Lincoln Canada from January 1, 2015 to August 1, 2016; Director, New Product Development, Consumables R&D from January 1, 2012 to January 1, 2015. | |||

The Company has been advised that there is no arrangement or understanding among any one of the officers listed and any other persons pursuant to which he or she was elected as an officer. The executive officers are elected by the Board of Directors normally for a term of one year and/or until the election of their successors.

10

ITEM 2. PROPERTIES

The Company's corporate headquarters and principal United States manufacturing facilities are located in the Cleveland, Ohio area. Total Cleveland area property consists of 244 acres, of which present manufacturing facilities comprise an area of approximately 3,017,090 square feet.

The Company has 59 manufacturing facilities, including operations and joint ventures in 18 countries, the significant locations (grouped by operating segment) of which are as follows:

Americas Welding: | ||

United States | Cleveland, Columbus, Coldwater and Fort Loramie, Ohio; San Diego and Anaheim, California; Reno, Nevada; Ladson, South Carolina; Chattanooga, Tennessee; Detroit, Michigan; Fort Collins, Colorado; Bettendorf, Iowa; Churubusco, Indiana. | |

Brazil | Guarulhos; Indaiatuba. | |

Canada | Toronto; Mississauga; Hamilton; Montreal; Hawkesbury; Vankleek Hill. | |

Colombia | Bogota. | |

Mexico | Mexico City; Torreon. | |

International Welding: | ||

Australia | Newcastle; Gladstone. | |

China | Shanghai; Nanjing; Zhengzhou; Luan County. | |

France | Grand-Quevilly; Partheny. | |

Germany | Essen; Eisenberg; Frankfurt. | |

India | Chennai. | |

Italy | Corsalone; Due Carrere; Verona; Storo. | |

Netherlands | Nijmegen. | |

Poland | Bielawa; Dzierzoniow. | |

Romania | Buzau. | |

Russia | Mtsensk. | |

Spain | Zaragoza. | |

Turkey | Istanbul. | |

United Kingdom | Sheffield, England; Port Talbot, Wales. | |

The Harris Products Group: | ||

United States | Mason, Ohio; Gainesville, Georgia; Winston Salem, North Carolina. | |

Brazil | Maua. | |

Poland | Dzierzoniow. | |

All properties relating to the Company's Cleveland, Ohio headquarters and manufacturing facilities are owned by the Company. Most of the Company's foreign subsidiaries own manufacturing facilities in the country where they are located. The Company believes that its existing properties are in good condition and are suitable for the conduct of its business.

In addition, the Company maintains operating leases for some manufacturing facilities, distribution centers and sales offices throughout the world. Refer to Note 18 to the consolidated financial statements for information regarding the Company's lease commitments.

11

ITEM 3. LEGAL PROCEEDINGS

The Company is subject, from time to time, to a variety of civil and administrative proceedings arising out of its normal operations, including, without limitation, product liability claims, regulatory claims and health, safety and environmental claims. Among such proceedings are the cases described below.

As of December 31, 2019, the Company was a co-defendant in cases alleging asbestos induced illness involving claims by approximately 3,233 plaintiffs, which is a net decrease of 50 claims from those previously reported. In each instance, the Company is one of a large number of defendants. The asbestos claimants seek compensatory and punitive damages, in most cases for unspecified sums. Since January 1, 1995, the Company has been a co-defendant in other similar cases that have been resolved as follows: 55,114 of those claims were dismissed, 23 were tried to defense verdicts, 7 were tried to plaintiff verdicts (which were reversed or resolved after appeal), 1 was resolved by agreement for an immaterial amount and 900 were decided in favor of the Company following summary judgment motions.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

12

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company's common shares are traded on The NASDAQ Global Select Market under the symbol "LECO." The number of record holders of common shares at December 31, 2019 was 1,957.

Issuer purchases of equity securities for the fourth quarter 2019 were:

Period | Total Number of Shares Repurchased | Average Price Paid Per Share | Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs (2) (3) | |||||||||

October 1-31, 2019 | 255 | (1) | $ | 86.83 | — | 3,563,635 | |||||||

November 1-30, 2019 | 298,353 | 91.93 | 298,353 | 3,265,282 | |||||||||

December 1-31, 2019 | 457,429 | (1) | 94.66 | 457,389 | 2,807,893 | ||||||||

Total | 756,037 | 93.58 | 755,742 | ||||||||||

(1) | The above share repurchases include the surrender of the Company's common shares in connection with the vesting of restricted awards. |

(2) | On April 20, 2016, the Company announced that the Board of Directors authorized a new share repurchase program, which increased the total number of the Company’s common shares authorized to be repurchased to 55 million shares. Total shares purchased through the share repurchase program were 52.2 million shares at a cost of $2.2 billion for a weighted average cost of $41.55 per share through December 31, 2019. |

(3) | On February 12, 2020, the Company's Board of Directors authorized a new share repurchase program for up to an additional 10 million shares of the Company's common stock. |

13

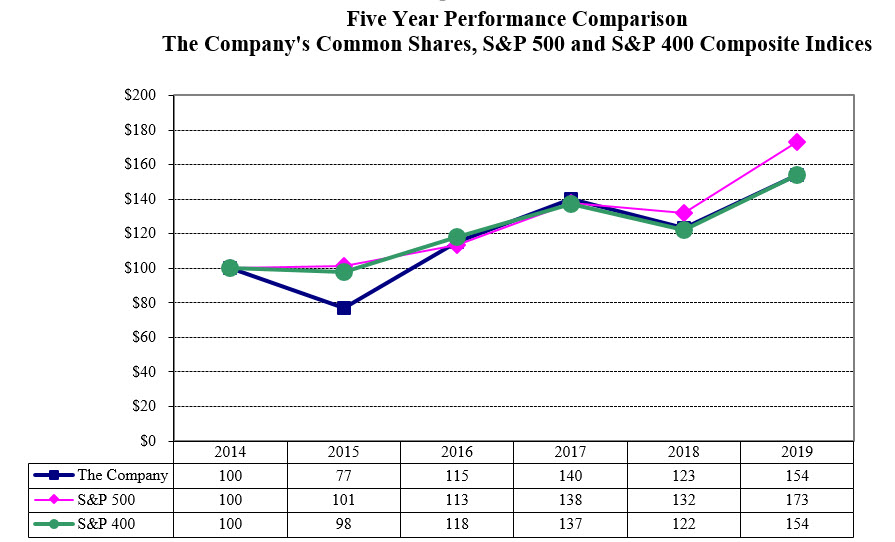

The following line graph compares the yearly percentage change in the cumulative total shareholder return on the Company's common stock against the cumulative total return of the S&P Composite 500 Stock Index ("S&P 500") and the S&P 400 MidCap Index ("S&P 400") for the five-year calendar period commencing January 1, 2015 and ending December 31, 2019. This graph assumes that $100 was invested on December 31, 2014 in each of the Company's common shares, the S&P 500 and the S&P 400. A peer-group index for the welding industry, in general, is not readily available because the industry is comprised of a large number of privately held competitors and competitors that are smaller parts of large publicly traded companies.

14

ITEM 6. SELECTED FINANCIAL DATA

(Dollars in thousands, except per share amounts)

Year Ended December 31, | ||||||||||||||||||||

2019 (1) | 2018 (2) | 2017 (3) | 2016 (4) | 2015 (5) | ||||||||||||||||

Net sales | $ | 3,003,272 | $ | 3,028,674 | $ | 2,624,431 | $ | 2,274,614 | $ | 2,535,791 | ||||||||||

Net income | 293,109 | 287,066 | 247,503 | 198,399 | 127,478 | |||||||||||||||

Basic earnings per share | 4.73 | 4.42 | 3.76 | 2.94 | 1.72 | |||||||||||||||

Diluted earnings per share | 4.68 | 4.37 | 3.71 | 2.91 | 1.70 | |||||||||||||||

Cash dividends declared per share | 1.90 | 1.64 | 1.44 | 1.31 | 1.19 | |||||||||||||||

Total assets | 2,371,213 | 2,349,825 | 2,406,547 | 1,943,437 | 1,784,171 | |||||||||||||||

Long-term debt, less current portion | 712,302 | 702,549 | 704,136 | 703,704 | 350,347 | |||||||||||||||

(1) | Results for 2019 include $15,188 ($12,275 after-tax) in Rationalization and asset impairment charges, $1,804 ($1,565 after-tax) of acquisition transaction and integration costs related to the acquisition of Air Liquide Welding, $1,399 ($1,049 after-tax) of amortization of step up in value of acquired inventories in Cost of goods sold related to the acquisition of Baker Industries and $1,609 of amortization of step up in value of acquired inventories in Cost of goods sold related to the acquisition of Askaynak. Results also include gains of $7,601 on change in control related to the acquisition of Askaynak and $3,554 ($2,586 after-tax) on disposal of assets related to the sale of properties. Results also include $4,852 in tax benefits in Income taxes for the settlement of a tax item as well as tax deductions associated with an investment in a subsidiary. |

(2) | Results for 2018 include $25,285 ($19,966 after-tax) in Rationalization and asset impairment charges and gains or losses on the disposal of assets, $6,686 ($5,017 after-tax) in pension settlement charges and $4,498 ($3,682 after-tax) of acquisition transaction and integration costs related to the acquisition of Air Liquide Welding. Results also include charges of $399 related to the net impact of the U.S. Tax Act (as defined in Item 7). |

(3) | Results for 2017 include charges related to the acquisition of Air Liquide Welding, including $15,002 ($11,559 after-tax) of acquisition transaction and integration costs, $4,578 ($3,453 after-tax) in amortization of step up in value of acquired inventories and a $49,650 bargain purchase gain. Results also include $8,150 ($5,030 after-tax) in pension settlement charges, $6,590 ($6,198 after-tax) in Rationalization and asset impairment charges and charges of $28,616 related to the net impact of the U.S. Tax Act. |

(4) | Results for 2016 include a loss of $34,348 ($33,251 after-tax) on the deconsolidation of the Company's Venezuelan subsidiary, partially offset by a $7,196 income tax valuation allowance reversal related to a legal entity change to realign the Company’s tax structure. Long-term debt includes the issuance in 2016 of additional Senior Unsecured Notes in the aggregate principal amount of $350,000 through a private placement. |

(5) | Results for 2015 include $13,719 ($11,943 after-tax) of rationalizaton charges and non-cash net impairment charges of $6,239. Results also include pension settlement charges of $142,738 ($87,310 after-tax) and charges of $27,214 related to Venezuelan remeasurement losses. Long-term debt includes the issuance of Senior Unsecured Notes in 2015 in the aggregate principal amount of $350,000 through a private placement. |

15

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Dollars in thousands, except per share amounts)

This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read together with "Selected Financial Data," the Company's consolidated financial statements and other financial information included elsewhere in this Annual Report on Form 10-K. This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in the forward-looking statements. See "Item 1A. Risk Factors" for more information regarding forward-looking statements.

General

The Company is the world's largest designer and manufacturer of arc welding and cutting products, manufacturing a broad line of arc welding equipment, consumable welding products and other welding and cutting products.

The Company is one of only a few worldwide broad-line manufacturers of welding, cutting and brazing products. The Company is the world leader in the design, development and manufacture of arc welding products, automated joining, assembly and cutting systems, plasma and oxy-fuel cutting equipment. The Company also has a leading global position in brazing and soldering alloys.

The Company's products include arc welding power sources, plasma cutters, wire feeding systems, robotic welding packages, integrated automation systems, fume extraction equipment, consumable electrodes, fluxes and welding accessories and specialty welding consumables and fabrication. The Company's product offering also includes computer numeric controlled ("CNC") plasma and oxy-fuel cutting systems and regulators and torches used in oxy-fuel welding, cutting and brazing.

The Company invests in the research and development of arc welding products in order to continue its market leading product offering. The Company continues to invest in technologies that improve the quality and productivity of welding products. In addition, the Company actively protects its innovations as research and development has progressed in both the United States and other major international jurisdictions. The Company believes its significant investment in research and development and its highly trained technical sales force coupled with its extensive distributor network provide a competitive advantage in the marketplace.

The Company's products are sold in both domestic and international markets. In the Americas, products are sold principally through industrial distributors, retailers and also directly to users of welding products. Outside of the Americas, the Company has an international sales organization comprised of Company employees and agents who sell products from the Company's various manufacturing sites to distributors and product users.

The Company's major end-user markets include:

• | general fabrication, |

• | energy and process industries, |

• | heavy industries (heavy fabrication, ship building and maintenance and repair), |

• | automotive and transportation, and |

• | construction and infrastructure. |

The Company has, through wholly-owned subsidiaries, manufacturing facilities located in the United States, Australia, Brazil, Canada, China, Colombia, France, Germany, India, Italy, Mexico, the Netherlands, Poland, Romania, Russia, Spain, Turkey and the United Kingdom.

The principal raw materials essential to the Company's business are steel, electronic components, engines, brass, copper, silver, aluminum alloys, robotic components and various chemicals, all of which are normally available for purchase in the open market.

The Company's facilities are subject to environmental regulations. To date, compliance with these environmental regulations has not had a material adverse effect on the Company's earnings. The Company is ISO 14001 certified at most significant manufacturing facilities in North America and Europe and is progressing towards certification at its remaining facilities worldwide. In addition, the Company is ISO 9001 certified at 47 facilities worldwide.

Key Indicators

Key economic measures relevant to the Company include industrial production trends, steel consumption, purchasing manager indices, capacity utilization within durable goods manufacturers and consumer confidence indicators. Key industries which provide a relative indication of demand drivers to the Company include steel, farm machinery and equipment, construction and transportation, fabricated metals, electrical equipment, ship and boat building, defense, truck manufacturing, energy and railroad equipment. Although these measures provide key information on trends relevant to the Company, the Company does

16

not have available a more direct correlation of leading indicators which can provide a forward-looking view of demand levels in the markets which ultimately use the Company's welding products.

Key operating measures utilized by the operating units to manage the Company include orders, sales, inventory and fill-rates, all of which provide key indicators of business trends. These measures are reported on various cycles including daily, weekly and monthly depending on the needs established by operating management.

Key financial measures utilized by the Company's executive management and operating units in order to evaluate the results of its business and in understanding key variables impacting the current and future results of the Company include: sales; gross profit; selling, general and administrative expenses; operating income; earnings before interest and taxes; earnings before interest, taxes and bonus; net income; adjusted operating income; adjusted earnings before interest and income taxes; adjusted earnings before interest, taxes and bonus; adjusted net income; adjusted diluted earnings per share; operating cash flows; and capital expenditures, as well as applicable ratios such as return on invested capital and average operating working capital to sales. These measures are reviewed at monthly, quarterly and annual intervals and compared with historical periods, as well as objectives established by the Board of Directors of the Company.

17

The discussion that follows includes a comparison of our results of operations, liquidity and capital resources for fiscal years ended December 31, 2019 and 2018. For a comparison of the Company's results of operations, liquidity and capital resources for the fiscal years ended December 31, 2018 and 2017, see Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in the Company's Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 27, 2019.

Results of Operations

The following table shows the Company's results of operations:

Year Ended December 31, | ||||||||||||||||||||

2019 | 2018 | Favorable (Unfavorable) 2019 vs. 2018 | ||||||||||||||||||

Amount | % of Sales | Amount | % of Sales | $ | % | |||||||||||||||

Net sales | $ | 3,003,272 | $ | 3,028,674 | $ | (25,402 | ) | (0.8 | %) | |||||||||||

Cost of goods sold | 1,995,685 | 2,000,153 | 4,468 | 0.2 | % | |||||||||||||||

Gross profit | 1,007,587 | 33.5 | % | 1,028,521 | 34.0 | % | (20,934 | ) | (2.0 | %) | ||||||||||

Selling, general & administrative expenses | 621,489 | 20.7 | % | 627,697 | 20.7 | % | 6,208 | 1.0 | % | |||||||||||

Rationalization and asset impairment charges | 15,188 | 25,285 | 10,097 | 39.9 | % | |||||||||||||||

Operating income | 370,910 | 12.4 | % | 375,539 | 12.4 | % | (4,629 | ) | (1.2 | %) | ||||||||||

Interest expense, net | 23,415 | 17,565 | (5,850 | ) | (33.3 | %) | ||||||||||||||

Other income (expense) | 20,998 | 10,686 | 10,312 | 96.5 | % | |||||||||||||||

Income before income taxes | 368,493 | 12.3 | % | 368,660 | 12.2 | % | (167 | ) | — | |||||||||||

Income taxes | 75,410 | 81,667 | 6,257 | 7.7 | % | |||||||||||||||

Effective tax rate | 20.5 | % | 22.2 | % | 1.7 | % | ||||||||||||||

Net income including non-controlling interests | 293,083 | 286,993 | 6,090 | 2.1 | % | |||||||||||||||

Non-controlling interests in subsidiaries' loss | (26 | ) | (73 | ) | 47 | 64.4 | % | |||||||||||||

Net income | $ | 293,109 | 9.8 | % | $ | 287,066 | 9.5 | % | $ | 6,043 | 2.1 | % | ||||||||

Diluted earnings per share | $ | 4.68 | $ | 4.37 | $ | 0.31 | ||||||||||||||

Net Sales:

The following table summarizes the impacts of volume, acquisitions, price and foreign currency exchange rates on Net sales for the twelve months ended December 31, 2019 on a consolidated basis:

Change in Net Sales due to: | ||||||||||||||||||||||||

Net Sales 2018 | Volume | Acquisitions | Price | Foreign Exchange | Net Sales 2019 | |||||||||||||||||||

Lincoln Electric Holdings, Inc. | $ | 3,028,674 | $ | (140,896 | ) | $ | 129,155 | $ | 37,716 | $ | (51,377 | ) | $ | 3,003,272 | ||||||||||

% Change | ||||||||||||||||||||||||

Lincoln Electric Holdings, Inc. | (4.7 | %) | 4.3 | % | 1.2 | % | (1.7 | %) | (0.8 | %) | ||||||||||||||

Net sales decreased primarily as a result of lower organic sales and unfavorable foreign exchange, offset by acquisitions. The increase in Net sales from acquisitions was driven by the acquisitions of Coldwater, Pro Systems, Inovatech and Baker within Americas Welding, Worthington within The Harris Products Group and Askaynak within International Welding. Refer to Note 4 to the consolidated financial statements for details.

Gross Profit:

Gross profit for 2019 decreased, as a percent of sales, compared to the prior year due to product mix, lower volumes and acquisitions. The year ended December 31, 2019 includes a last-in, first-out ("LIFO") credit of $4,340, as compared with a LIFO charge of $10,990 in the prior year.

Selling, General & Administrative ("SG&A") Expenses:

The decrease in SG&A expense in 2019 as compared to 2018 was due to lower compensation costs and favorable foreign exchange, offset by higher expense from acquisitions.

18

Rationalization and Asset Impairment Charges:

In 2019, the Company recorded $15,188 ($12,275 after-tax) in charges primarily related to employee severance, asset impairment charges and gains or losses on the disposal of assets.

In 2018, the Company recorded $25,285 ($19,966 after-tax) in charges primarily related to employee severance, asset impairment charges and gains or losses on the disposal of assets.

Refer to Note 7 to the consolidated financial statements for additional details.

Interest Expense, Net:

The increase in 2019 as compared to 2018 was due to lower interest income in 2019.

Other Income (Expense):

The increase in 2019 as compared to 2018 was primarily due to the gain on change in control of $7,601 related to the acquisition of Askaynak and lower net periodic pension cost.

Income Taxes:

The 2019 effective tax rate was lower than 2018 primarily due to income tax benefits for the settlement of tax items as well as tax deductions associated with excess tax benefits resulting from exercises of stock based compensation, offset by the geographic mix of earnings and taxes at higher rates in foreign jurisdictions.

Net Income:

As compared to the prior year, reported Net income for 2019 increased primarily due to lower rationalization and asset impairment charges and a gain on change in control related to the acquisition of Askaynak.

19

Segment Results

Net Sales:

The table below summarizes the impacts of volume, acquisitions, price and foreign currency exchange rates on Net sales for the twelve months ended December 31, 2019:

Change in Net Sales due to: | ||||||||||||||||||||||||

Net Sales 2018 | Volume (1) | Acquisitions (2) | Price (3) | Foreign Exchange (4) | Net Sales 2019 | |||||||||||||||||||

Operating Segments | ||||||||||||||||||||||||

Americas Welding | $ | 1,806,514 | $ | (79,285 | ) | $ | 71,062 | $ | 25,705 | $ | (8,250 | ) | $ | 1,815,746 | ||||||||||

International Welding | 919,771 | (71,509 | ) | 37,061 | 9,159 | (40,106 | ) | 854,376 | ||||||||||||||||

The Harris Products Group | 302,389 | 9,898 | 21,032 | 2,852 | (3,021 | ) | 333,150 | |||||||||||||||||

% Change | ||||||||||||||||||||||||

Americas Welding | (4.4 | %) | 3.9 | % | 1.4 | % | (0.5 | %) | 0.5 | % | ||||||||||||||

International Welding | (7.8 | %) | 4.0 | % | 1.0 | % | (4.4 | %) | (7.1 | %) | ||||||||||||||

The Harris Products Group | 3.3 | % | 7.0 | % | 0.9 | % | (1.0 | %) | 10.2 | % | ||||||||||||||

(1) Decrease for Americas Welding due to softer demand associated with the current economic environment. Decrease for International Welding due to integration activities and softer demand in the European and Asian markets. Increase for The Harris Products Group driven primarily by higher consumables volume.

(2) Increase due to the acquisition of Coldwater, Pro Systems, Inovatech and Baker within Americas Welding, Worthington within The Harris Products Group and Askaynak within International Welding. Refer to Note 4 to the consolidated financial statements for details.

(3) Increase for Americas Welding and International Welding segments due to increased product pricing as a result of higher input costs.

(4) Decrease in the International Welding segment due to a stronger U.S. dollar.

20

Adjusted Earnings Before Interest and Income Taxes (“Adjusted EBIT”):

Segment performance is measured and resources are allocated based on a number of factors, the primary measure being the Adjusted EBIT profit measure. EBIT is defined as Operating income plus Equity earnings in affiliates and Other income. EBIT is adjusted for special items as determined by management such as the impact of rationalization activities, certain asset impairment charges and gains or losses on disposals of assets.

The following table presents Adjusted EBIT by segment:

December 31, | Favorable (Unfavorable) 2019 vs. 2018 | |||||||||||||

2019 | 2018 | $ | % | |||||||||||

Americas Welding: | ||||||||||||||

Net sales | $ | 1,815,746 | $ | 1,806,514 | $ | 9,232 | 0.5 | % | ||||||

Inter-segment sales | 123,342 | 118,936 | 4,406 | 3.7 | % | |||||||||

Total Sales | $ | 1,939,088 | $ | 1,925,450 | $ | 13,638 | 0.7 | % | ||||||

Adjusted EBIT (4) | $ | 315,719 | $ | 340,744 | $ | (25,025 | ) | (7.3 | %) | |||||

As a percent of total sales (1) | 16.3 | % | 17.7 | % | (1.4 | %) | ||||||||

International Welding: | ||||||||||||||

Net sales | $ | 854,376 | $ | 919,771 | $ | (65,395 | ) | (7.1 | %) | |||||

Inter-segment sales | 17,691 | 18,576 | (885 | ) | (4.8 | %) | ||||||||

Total Sales | $ | 872,067 | $ | 938,347 | $ | (66,280 | ) | (7.1 | %) | |||||

Adjusted EBIT (5) | $ | 50,281 | $ | 54,273 | $ | (3,992 | ) | (7.4 | %) | |||||

As a percent of total sales (2) | 5.8 | % | 5.8 | % | — | |||||||||

The Harris Products Group: | ||||||||||||||

Net sales | $ | 333,150 | $ | 302,389 | $ | 30,761 | 10.2 | % | ||||||

Inter-segment sales | 7,487 | 6,969 | 518 | 7.4 | % | |||||||||

Total Sales | $ | 340,637 | $ | 309,358 | $ | 31,279 | 10.1 | % | ||||||

Adjusted EBIT (6) | $ | 45,701 | $ | 36,564 | $ | 9,137 | 25.0 | % | ||||||

As a percent of total sales (3) | 13.4 | % | 11.8 | % | 1.6 | % | ||||||||

Corporate / Eliminations: | ||||||||||||||

Inter-segment sales | $ | (148,520 | ) | $ | (144,481 | ) | $ | 4,039 | 2.8 | % | ||||

Adjusted EBIT (7) | (10,948 | ) | (8,887 | ) | (2,061 | ) | (23.2 | %) | ||||||

Consolidated: | ||||||||||||||

Net sales | $ | 3,003,272 | $ | 3,028,674 | $ | (25,402 | ) | (0.8 | %) | |||||

Net income | $ | 293,109 | $ | 287,066 | $ | 6,043 | 2.1 | % | ||||||

As a percent of total sales | 9.8 | % | 9.5 | % | 0.3 | % | ||||||||

Adjusted EBIT (8) | $ | 400,753 | $ | 422,694 | $ | (21,941 | ) | (5.2 | %) | |||||

As a percent of total sales | 13.3 | % | 14.0 | % | (0.7 | %) | ||||||||

(1) | 2019 decrease as compared to 2018 driven by the dilutive impact of recent acquisitions and lower Net sales volumes. |

(2) | 2019 was flat as compared to 2018 driven by lower compensation costs, partially offset by lower Net sales volumes. |

(3) | 2019 increase as compared to 2018 driven by consumables volume increases. |

(4) | 2019 excludes Rationalization and asset impairment charges of $1,716, as discussed in Note 7 to the consolidated financial statements and the amortization of step up in value of acquired inventories of $1,399 related to the Baker acquisition. |

2018 excludes pension settlement charges of $6,686 related to lump sum pension payments.

21

(5) | 2019 excludes Rationalization and asset impairment charges of $11,702, respectively, related to severance, asset impairments and gains or losses on the disposal of assets as discussed in Note 7 to the consolidated financial statements, the amortization of step up in value of acquired inventories of $1,609, gains on disposals of assets of $3,554 and a gain on change in control of $7,601 related to the Askaynak acquisition. |

2018 excludes charges of $25,285 related to employee severance, asset impairments and other related costs.

(6) | 2019 excludes Rationalization and asset impairment charges of $1,770, as discussed in Note 7 to the consolidated financial statements. |

(7) | 2019 and 2018 exclude acquisition transaction and integration costs of $1,804 and $4,498, respectively, related to the Air Liquide Welding acquisition as discussed in Note 4 to the consolidated financial statements. |

(8) | See non-GAAP Financial Measures for a reconciliation of Net income as reported and Adjusted EBIT. |

Non-GAAP Financial Measures

The Company reviews Adjusted operating income, Adjusted EBIT, Adjusted net income, Adjusted effective tax rate, Adjusted diluted earnings per share and Return on invested capital, all non-GAAP financial measures, in assessing and evaluating the Company's underlying operating performance. These non-GAAP financial measures exclude the impact of special items on the Company's reported financial results. Non-GAAP financial measures should be read in conjunction with the generally accepted accounting principles in the United States ("GAAP") financial measures, as non-GAAP measures are a supplement to, and not a replacement for, GAAP financial measures. From time to time, management evaluates and discloses to investors the following non-GAAP measures: Free cash flow ("FCF"), defined as Net cash provided by operating activities less Capital expenditures (the Company considers FCF to be a liquidity measure that provides useful information to management and investors about how the amount of cash generated by our business, after the purchase of property and equipment, can be used for debt service, acquisitions, paying dividends and repurchasing our common shares); Cash conversion, defined as FCF divided by Adjusted net income; Organic sales, defined as sales excluding the effects of foreign currency and acquisitions.

The following table presents a reconciliation of Operating income as reported to Adjusted operating income:

Year Ended December 31, | ||||||||

2019 | 2018 | |||||||

Operating income as reported | $ | 370,910 | $ | 375,539 | ||||

Special items (pre-tax): | ||||||||

Rationalization and asset impairment charges (1) | 15,188 | 25,285 | ||||||

Acquisition transaction and integration costs (2) | 1,804 | 4,498 | ||||||

Amortization of step up in value of acquired inventories (3) | 3,008 | — | ||||||

Gains on asset disposals (4) | (3,045 | ) | — | |||||

Adjusted operating income | $ | 387,865 | $ | 405,322 | ||||

(1) Charges primarily consist of employee severance, gains or losses on the disposal of assets and non-cash asset impairment charges.

(2) Acquisition-related costs included in Selling, general & administrative expenses related to the Air Liquide Welding acquisition as discussed in Note 4 to the consolidated financial statements.

(3) Charges represent the step up in value of acquired inventories related to the acquisitions of Baker and Askaynak and are included in Cost of goods sold.

(4) Gains related to the sale of properties and are primarily included in Cost of goods sold.

22

The following table presents the reconciliations of Net income as reported to Adjusted net income and Adjusted EBIT, Effective tax rate as reported to Adjusted effective tax rate and Diluted earnings per share as reported to Adjusted diluted earnings per share:

Year Ended December 31, | ||||||||

2019 | 2018 | |||||||

Net income as reported | $ | 293,109 | $ | 287,066 | ||||

Special items: | ||||||||

Rationalization and asset impairment charges (1) | 15,188 | 25,285 | ||||||

Acquisition transaction and integration costs (2) | 1,804 | 4,498 | ||||||