formdef14a123111.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| |

|

| |

Filed by the Registrant [ X ]

|

| |

Filed by a Party other than the Registrant [ ]

|

| |

|

| |

Check the appropriate box:

|

| |

|

| |

[ ] Preliminary Proxy Statement

|

| |

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

[ X ] Definitive Proxy Statement

|

| |

[ ] Definitive Additional Materials

|

| |

[ ] Soliciting Material Pursuant to §240.14a-12

|

|

4Kids Entertainment, Inc.

(Name of Registrant as Specified in its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| |

|

| |

[ X ] No fee required.

|

| |

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| |

|

| |

1) Title of each class of securities to which transaction applies:

|

| |

|

| |

2) Aggregate number of securities to which transaction applies:

|

| |

|

| |

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

| |

4) Proposed maximum aggregate value of transaction:

|

| |

|

| |

[ ] Fee paid previously with preliminary materials.

|

| |

|

| |

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

|

| |

1) Amount Previously Paid:

|

| |

|

| |

2) Form, Schedule or Registration Statement No.:

|

4KIDS ENTERTAINMENT, INC.

53 West 23rd Street

New York, New York 10010

(212) 590-2100

April 26, 2012

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of 4Kids Entertainment, Inc. (“4Kids” or the “Company”) to be held at 10:00 am (Eastern Time) on Monday, May 21, 2012, at UBS Financial Services, Inc., 15th Floor, 1285 Avenue of the Americas, New York, New York.

The purposes of the Annual Meeting are to (i) elect directors, (ii) ratify the appointment of auditors and (iii) transact such other business as may properly come before the meeting and any adjournment or postponements thereof. These matters are described in the formal Notice of the 2012 Annual Meeting of Shareholders and the accompanying Proxy Statement.

Included with the Proxy Statement is a copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2011. We encourage you to read the Annual Report. It includes information on the Company’s business, markets and products as well as the Company’s audited financial statements.

Your vote is very important. We hope you will find it convenient to attend the Annual Meeting in person. Whether or not you are personally able to attend, it is important that your shares be represented at the meeting. Accordingly, you are requested to sign, date and return the enclosed proxy promptly. If you do attend the Annual Meeting you may revoke your proxy and vote in person. Your cooperation is greatly appreciated.

Sincerely,

MICHAEL GOLDSTEIN

Interim Chairman of the Board of Directors

TABLE OF CONTENTS

| |

Page

|

| |

|

|

General Information

|

2

|

| |

|

|

Proposal 1 – Election of Directors

|

3

|

| |

|

|

Management

|

5

|

|

Director Qualifications

|

7

|

|

Leadership Structure

|

7

|

|

Meetings of the Board of Directors

|

8

|

|

Committees of the Board of Directors

|

8

|

|

Independence of Directors

|

10

|

|

Communications with the Board of Directors

|

10

|

|

Attendance at Annual Meetings

|

10

|

|

Executive Sessions of Non-Employee, Non-Management Directors

|

10

|

|

Corporate Governance Guidelines

|

11

|

|

Code of Ethics

|

11

|

|

Compensation of Named Executive Officers

|

11

|

|

Equity Compensation Plan Information

|

17

|

|

Compensation of Directors

|

18

|

|

Compensation Committee Interlocks and Insider Participation

|

18

|

|

Report of the Audit Committee of the Board of Directors

|

19

|

|

Certain Transactions Involving Management

|

20

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

22

|

|

Principal Shareholders

|

24

|

| |

|

|

Proposal 2 – Selection of Auditors

|

25

|

| |

|

|

Pre-Approval Policy for Services of Independent Registered Public Accounting Firm

|

25

|

| |

|

|

Other Matters

|

26

|

| |

|

|

Shareholder Proposals

|

27

|

| |

|

4KIDS ENTERTAINMENT, INC.

53 West 23rd Street

New York, New York 10010

NOTICE OF 2012 ANNUAL MEETING OF SHAREHOLDERS

to be held on May 21, 2012

NOTICE IS HEREBY GIVEN that the 2012 Annual Meeting of Shareholders (the “Annual Meeting”) of 4Kids Entertainment, Inc. (“4Kids” or the “Company”), a New York corporation, will be held at UBS Financial Services, Inc., 15th Floor, 1285 Avenue of the Americas, New York, New York, on Monday, May 21, 2012, at 10:00 am (Eastern Time) for the purpose of considering and acting upon the following matters set forth in the accompanying Proxy Statement:

|

1.

|

Election of five directors to serve until the next Annual Meeting and until their successors are duly elected and qualified;

|

|

2.

|

Ratification of the appointment of EisnerAmper LLP as auditors for 4Kids for the fiscal year ending December 31, 2012; and

|

|

3.

|

The transaction of such other business as may properly come before the meeting and any adjournment or postponements thereof.

|

The Board of Directors has fixed the close of business on April 18, 2012 as the record date for the Annual Meeting and only holders of shares of record at that time are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponements thereof.

By Order of the Board of Directors,

MICHAEL GOLDSTEIN

Interim Chairman of the Board of Directors

THIS PROXY STATEMENT AND THE ACCOMPANYING PROXY ARE BEING DISTRIBUTED TO SHAREHOLDERS ON OR ABOUT APRIL 26, 2012.

ALL SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU INTEND TO BE PRESENT, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE STAMPED AND ADDRESSED ENVELOPE ENCLOSED FOR YOUR CONVENIENCE. SHAREHOLDERS CAN HELP 4KIDS AVOID UNNECESSARY EXPENSE AND DELAY BY PROMPTLY RETURNING THE ENCLOSED PROXY CARD. THE BUSINESS OF THE MEETING TO BE ACTED UPON BY THE SHAREHOLDERS CANNOT BE TRANSACTED UNLESS ONE-THIRD OF THE OUTSTANDING SHARES OF 4KIDS’ COMMON STOCK ARE REPRESENTED AT THE ANNUAL MEETING.

PROXY STATEMENT

This Proxy Statement (the “Proxy Statement”) is being furnished to the shareholders of 4Kids Entertainment, Inc. (“4Kids” or the “Company”), a New York corporation, in connection with the Annual Meeting of Shareholders of 4Kids (the “Annual Meeting”) to be held at 10:00 am (Eastern Time) on Monday, May 21, 2012, at UBS Financial Services, Inc., 15th Floor, 1285 Avenue of the Americas, New York, New York.

Accompanying this Proxy Statement is a notice of such Annual Meeting, a form of proxy solicited by the 4Kids Board of Directors and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2011 (the “Annual Report”). This Proxy Statement, the accompanying proxy and the Annual Report were first mailed to shareholders on or about April 26, 2012. Audited financial statements of 4Kids for the fiscal year ended December 31, 2011 are contained in the Annual Report. The Annual Report is not incorporated in this Proxy Statement and is not deemed to be a part of the proxy solicitation material.

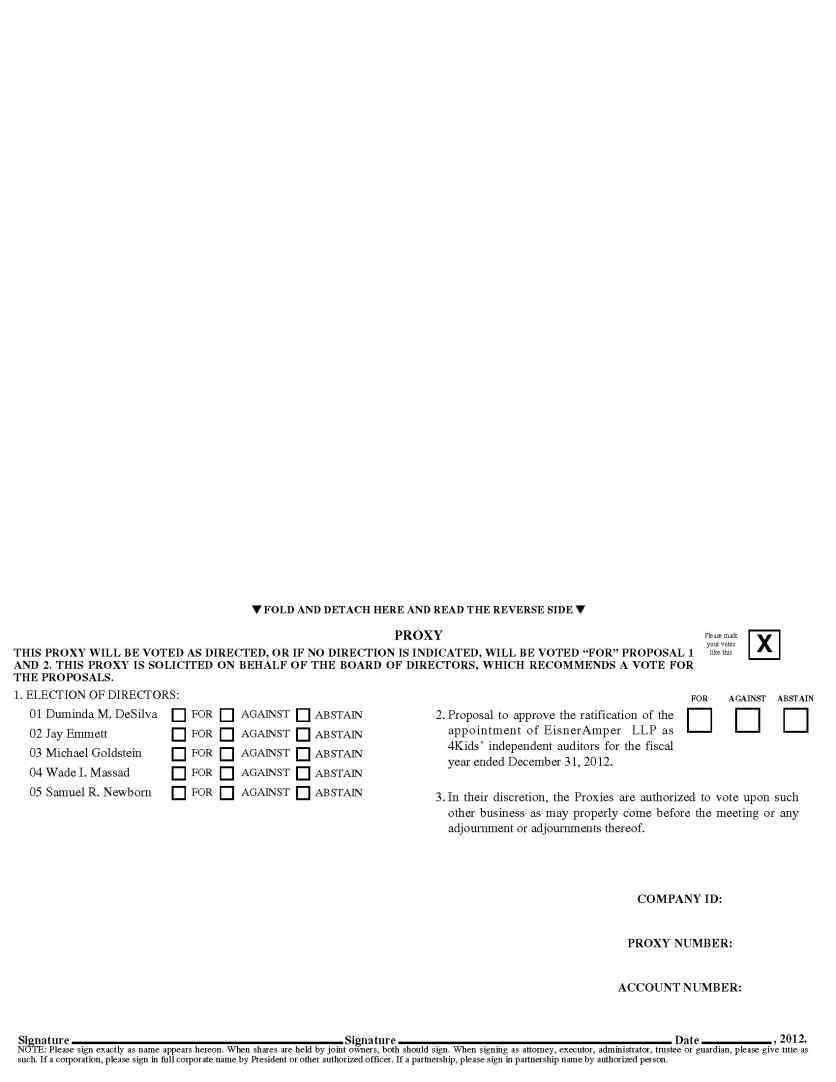

VOTING RIGHTS AND SOLICITATION OF PROXIES

Proxies in the accompanying form which are properly executed and duly returned to 4Kids and not revoked prior to the voting at the Annual Meeting will be voted as specified. If no contrary specification is made, and if not designated as broker non-votes, the shares of common stock of 4Kids, par value $.01 per share, represented by the enclosed proxy will be voted FOR the election of the nominees for director (Proposal 1) and FOR the ratification of the appointment of EisnerAmper LLP as auditors (Proposal 2). In addition, the shares of common stock represented by the enclosed proxy will be voted by either of the persons named therein, in such person’s discretion, with respect to any other business which may properly come before the Annual Meeting or any adjournment or postponements thereof. Any shareholder giving a proxy has the power to revoke it at any time prior to the voting by filing with the Secretary of 4Kids a written notice of revocation or a duly executed proxy bearing a later date or by voting in person at the Annual Meeting.

The Board of Directors has fixed the close of business on April 18, 2012 as the record date for the determination of the shareholders entitled to receive notice of, and to vote at, the Annual Meeting. The holders of one-third of the voting power of all issued and outstanding shares of common stock present in person, or represented by proxy, shall constitute a quorum at the Annual Meeting. Assuming the presence of a quorum:

|

·

|

To elect the directors — In an uncontested election, a director will be elected if the votes cast “FOR” such director exceed the votes "WITHHELD" or cast “AGAINST” such director; provided that, if the number of nominees for director exceeds the number of directors to be elected, directors will be elected by a plurality of votes cast.

|

|

·

|

To ratify the selection of the independent registered public accounting firm — An affirmative vote of a majority of the votes cast is required to ratify the selection of the independent registered public accounting firm.

|

On April 18, 2012, the record date for the Annual Meeting, 4Kids had 13,653,824 shares of common stock outstanding. Each share of common stock is entitled to one vote on each matter to come before the Annual Meeting. There is no cumulative voting. Votes shall be counted by 4Kids’ transfer agent.

Shares represented by proxies designated as broker non-votes will be counted for purposes of determining a quorum, but not for purposes of determining the outcome of a vote on any matter. Broker non-votes occur when a broker nominee does not vote on one or more other matters at a meeting because it has not received instructions to so vote from the beneficial owner and is prohibited from exercising discretionary authority to so vote. Shares represented by proxies marked as abstentions will also be treated as present for purposes of determining a quorum and for purposes of determining the outcome of a vote on any matter, but will not serve as a vote “for” or “against” any matter. Broker non-votes and abstentions will have no effect on the election of directors but abstaining will have the practical effect of voting against the ratification of the selection of the independent registered public accounting firm.

Expenses

All expenses in connection with solicitation of proxies will be borne by 4Kids. Officers and regular employees of 4Kids may solicit proxies by personal interview, telephone and telegraph. Brokerage houses, banks and custodians, nominees and fiduciaries will be reimbursed for out-of-pocket and reasonable expenses incurred in forwarding proxies and the Proxy Statement. Georgeson Inc. has been engaged to assist in the solicitation of proxies, brokers, nominees, fiduciaries and other custodians. 4Kids will pay Georgeson Inc. approximately $7,500 for its services and reimburse its out-of-pocket expenses.

PROPOSAL 1 - ELECTION OF DIRECTORS

The directors are elected annually by the shareholders of 4Kids. The 4Kids By-laws provide that the number of directors shall not be less than three nor more than nine, the exact number of directors to be determined from time to time by the affirmative vote of a majority of the entire Board of Directors. On April 10, 2012, the Board of Directors established the number of directors of 4Kids at five. In accordance therewith, a total of five persons have been designated by the Board of Directors upon the recommendation of its Nominating and Corporate Governance Committee (the “Nominating Committee”) as nominees and are being presented to the shareholders for election at the Annual Meeting. A director will be elected if the votes cast “FOR” such director exceed the votes "WITHHELD" or cast “AGAINST” such director; provided that, if the number of nominees for director exceeds the number of directors to be elected, directors will be elected by a plurality of votes cast.

The five persons named below have been nominated for election to serve as directors until the next Annual Meeting and until their respective successors have been duly elected and qualified, each of whom is currently a director.

|

· Duminda M. DeSilva

|

· Michael Goldstein

|

· Samuel R. Newborn

|

|

· Jay Emmett

|

· Wade I. Massad

|

|

All of the nominees have consented to serve as directors, if elected. If, at the time of the Annual Meeting, any nominee is unable or declines to serve, the proxies may be voted for the election of such other person or persons as the remaining members of the Board of Directors may recommend.

4Kids' By-laws include a policy requiring that an incumbent director who does not receive a majority of the votes cast for his or her re-election will be required to tender his or her resignation. The Board of Directors must then decide, through a process managed by the Nominating Committee and excluding the nominee in question, whether to accept the resignation. In making its decision, the Board of Directors may consider any factors or information that it considers appropriate or relevant. The decision of the Board of Directors must be completed within 90 days from the date of the certification of the election results and disclosed promptly thereafter in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”).

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE DIRECTOR NOMINEES NAMED ABOVE, AND, UNLESS A SHAREHOLDER GIVES INSTRUCTIONS ON THE PROXY CARD TO THE CONTRARY OR SUCH PROXY CARD IS IN RESPECT OF A BROKER NON-VOTE, THE APPOINTEES NAMED THEREON INTEND SO TO VOTE.

MANAGEMENT

The following table sets forth information concerning the five nominees for director (including five current directors standing for re-election at the Annual Meeting), followed by information concerning our executive officers, as of the date of this Proxy Statement. Each of our directors serves until the Annual Meeting or until his successor is elected and qualifies and all executive officers hold office until their successors are appointed.

|

Name

|

Age

|

Position

|

| |

|

|

|

Michael Goldstein

|

70

|

Interim Chairman of the Board of Directors

|

|

Duminda M. DeSilva

|

44

|

Director

|

|

Jay Emmett

|

83

|

Director

|

|

Wade I. Massad

|

44

|

Director

|

|

Samuel R. Newborn, Esq.

|

57

|

Executive Vice President, General Counsel, Director

|

|

Bruce R. Foster

|

52

|

Executive Vice President, Chief Financial Officer,

|

|

Daniel Barnathan

|

57

|

President of 4Kids Ad Sales, Inc.

|

|

Brian Lacey

|

61

|

Executive Vice President, International

|

Michael Goldstein, 70, has been a director since March 2003 and is currently the interim Chairman of the Board of Directors. Mr. Goldstein was a member of the Board of Directors of Toys “R” Us, Inc., a global toy retailer, from 1994 to 2003, its Chairman from 1997 to 2001, its Vice Chairman and Chief Executive Officer from 1994 to 1998 and its Chief Financial Officer from 1984 to 1994. Mr. Goldstein was employed by Ernst & Young LLP, an international public accounting firm (and its predecessor firms) from 1963 to 1979, including six years as an audit partner. Mr. Goldstein currently serves on the Board of Directors of the following companies having securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the reporting requirements of Section 15(d) of such Act (in either case, a “public company”): Charming Shoppes since 2008; and Pacific Sunwear of California, Inc since 2004. Mr. Goldstein also serves as a director of various private companies and not-for-profit charitable organizations. He has also served on the boards of each of the following other public companies within the last five years: Bear Stearns and Co. from 2007 to 2008; Martha Stewart Living Omnimedia, Inc. from 2004 to 2010; and United Retail Group from 1999 to 2007; Medco Health Solutions, Inc. from 2003 to April 2012. Mr. Goldstein is nominated because he has extensive experience in governance and leadership roles on the boards of the other public companies on which he has and/or continues to serve, as well as extensive background in finance, both as an audit partner and then as a finance executive and chief executive officer at Toys “R” Us.

Duminda M. DeSilva, 44, has been a director since May 2010. Mr. DeSilva has been a Managing Director at Prescott Group Capital Management, a registered investment advisory firm and the largest shareholder of 4Kids as of April 20, 2011, since 2005. Previously, Mr. DeSilva was President and Chief Operating Officer of WorldTelemetry Inc., a company providing asset management solutions for the oil, gas and petrochemical industries, from 2001 to 2005. Prior thereto, Mr. DeSilva served as General Manager & Senior Vice President of Dean & Deluca, from 1998 to 2001, and before that in a variety of senior positions at Koch Industries, Inc. from 1991 to 1998. Additionally, Mr. DeSilva has consulted for government agencies as well as private sector companies and served on the boards of several non-profit firms. Mr. DeSilva is a graduate of the University of Kansas and the Strategic Management Program at Harvard University. Mr. DeSilva is nominated because of his financial expertise and diverse domestic and international business experience.

Jay Emmett, 83, has been a director since August 1999. Mr. Emmett served as the President of the International Special Olympics from 2007 to 2008 and has been a member of the International Special Olympics Board of Directors for more than 30 years. Mr. Emmett has had a long and distinguished career in the entertainment industry. Mr. Emmett also has extensive experience in television and film, licensing and sports. Mr. Emmett is nominated because of his extensive business experience in entertainment and licensing.

Wade I. Massad, 44, has been a director since May 2010. Mr. Massad is the Co-Founder and Co-Managing Member of Cleveland Capital Management, L.L.C., a registered investment advisor and General Partner of Cleveland Capital L.P., a private investment fund focused on micro-cap public and private equity securities, since October 1996. Previously, Mr. Massad was an investment banker with Keybanc Capital Markets and RBC Capital Markets where he managed the U.S. Capital Markets business from 1997-2003. Mr. Massad has served on the board of directors of Cleveland Pacific Equity Ventures and currently serves on the advisory board of Attevo, a global information technology consulting firm. Mr. Massad is a graduate of Baldwin-Wallace College and currently serves on its Board of Trustees. Mr. Massad is nominated because of his extensive experience in finance, investing and capital markets.

Samuel R. Newborn, Esq., 57, has been a director of 4Kids since 2005 and Executive Vice President and General Counsel since January 2000. Prior to joining 4Kids, Mr. Newborn was a partner in the law firm of Janklow, Newborn & Ashley for more than five years. Mr. Newborn is nominated because of his knowledge of legal practice and regulatory procedures.

Bruce R. Foster, 52, has been the Chief Financial Officer (“CFO”) and Executive Vice President of 4Kids since December 2005. Prior thereto, Mr. Foster had served as the Senior Vice President of Finance since joining 4Kids in August 2002. From 1998 to 2002, Mr. Foster held various positions with Deloitte & Touche LLP, an international public accounting firm, most recently as an Audit Director.

Daniel Barnathan, 55, has been President of 4Kids Ad Sales, Inc. since May 2006. Prior to such time, Mr. Barnathan served as Executive Vice President of Sales, Marketing and Promotions of 4Kids Ad Sales, Inc. since 2001. Prior to 2001, Mr. Barnathan worked at ABC-TV for more than 23 years in various positions such as Senior Vice President of ABC-TV/Disney Kids Network and senior management positions in the sales and marketing departments of the children’s, daytime and news day-parts at the ABC-TV Network. From 2001 to 2002, Mr. Barnathan served as Executive Vice President of Sales and Marketing at CBS HealthWatch/Medscape, an online health information network. He began his career with the CBS-TV Network Research Department in 1977.

Brian Lacey, 61, has been Executive Vice President of International for 4Kids since July 2003. Prior to joining 4Kids, Mr. Lacey was the President and founder of Lacey Entertainment, a New York-based worldwide television marketing, production, and distribution company, specializing in innovative and creative approaches in the packaging, production and launching of television series in the U.S. and around the world. Prior to forming Lacey Entertainment, he was co-founder and principal of Zodiac Entertainment, a television program and marketing co-venture formed with Central Independent Television of the UK (now Carlton Television).

Director Qualifications

The Nominating Committee seeks independent individuals who represent a mix of backgrounds and experiences that will enhance the quality of the Board of Directors’ deliberations and decisions. Board members should display the personal attributes necessary to be an effective director, including integrity, sound judgment, independence, the ability to operate collaboratively and a commitment to 4Kids’ shareholders.

The Nominating Committee values diversity as a factor in selecting individuals nominated to serve on the Board of Directors. Although the Board of Directors prefers a mix of backgrounds and experience among its members, it does not follow any ratio or formula to determine the appropriate mix, nor is there a specific policy on diversity. The Nominating Committee uses its judgment to identify nominees whose backgrounds, attributes and experiences, taken as a whole, will contribute to a high standard of service for the Board of Directors.

Leadership Structure

Mr. Michael Goldstein is currently the interim Chairman of the Board of Directors. Mr. Goldstein has served on our Board of Directors since 2003 and has extensive experience in, and knowledge of, the toy and children's entertainment businesses. The position of Chief Executive Officer is currently vacant and Samuel R. Newborn acts as the principal executive officer. Based on its most recent review of its structure, the Board of Directors has determined not to appoint a Chief Executive Officer. The Board of Directors believes that the current leadership structure is optimal for the Company and that the Company, at this time of cost-cutting and restructuring, cannot afford an additional executive salary. In making its determination, the Board of Directors has also taken into account a number of additional factors. First, the Board of Directors, which consists of a majority of independent directors who are highly qualified and experienced, exercises its independent oversight function on a continuous basis as evidenced by the 41 board meetings held in the fiscal year ended December 31, 2011. Second, all of the Board of Directors’ key committees (Audit, Compensation, Nominating and Corporate Governance) are comprised entirely of independent directors. Third, the Board of Directors has designated Michael Goldstein as lead independent director and Interim Chairman of the Board of Directors. Finally, the independent, non-management directors conduct regular executive sessions during which the independent directors review and provide substantial oversight of our officer’s performance.

It is management’s responsibility to assess and manage the various risks the Company faces. It is the Board of Directors’ responsibility to oversee management in this effort. In exercising its oversight, the Board of Directors review the strategic, operational, financial and compliance risks that affect the Company. The Board of Directors as a whole has oversight responsibility for the Company’s strategic and operational risks (e.g., major initiatives, competitive markets and products and sales and marketing). Oversight responsibility for compliance risk is shared among the committees of the Board of Directors. For example, the Audit Committee of the Board of Directors (the “Audit Committee”) oversees risk in the areas of accounting, finance, internal controls and tax strategy as well as compliance with related laws and policies. The Compensation Committee of the Board of Directors (the “Compensation Committee”) oversees risk in connection with the Company’s compensation programs and policies as well as compliance with compensation related laws and policies. The Nominating Committee oversees compliance with governance related laws and policies, including the Company’s corporate governance guidelines.

Meetings of the Board of Directors

The Board of Directors of 4Kids met 41 times during the fiscal year ended December 31, 2011 and 9 times subsequent to December 31, 2011, but before the filing of the 4Kids’ Annual Report on Form 10-K. Each of the directors attended at least 75% of the total number of meetings of the Board of Directors and committees on which he serves during the fiscal year ended December 31, 2011.

Committees of the Board of Directors

The Audit Committee currently consists of Mr. Goldstein, who serves as the Chairman, and Messrs. Emmett and Massad. The Audit Committee provides assistance to the Board of Directors in fulfilling the Board of Directors oversight responsibilities with respect to the following:

|

(i)

|

the quality and integrity of 4Kids’ financial reports;

|

|

(ii)

|

the performance of 4Kids’ internal audit function; and

|

|

(iii)

|

4Kids’ compliance with legal and regulatory requirements.

|

In addition, the Audit Committee:

|

(i)

|

has sole authority to appoint or replace 4Kids’ independent auditors;

|

|

(ii)

|

oversees the independent auditors’ qualifications, independence and performance;

|

|

(iii)

|

discusses with 4Kids’ management, the internal auditors and the independent auditors the scope of the annual audit; and

|

|

(iv)

|

determines the compensation for audit and permissible non-audit services to be provided by the independent auditors.

|

The Board of Directors has determined that one of the Committee’s members, Mr. Goldstein, qualifies as an “audit committee financial expert” as defined by the SEC. The Company’s Board of Directors has determined that Mr. Goldstein’s service on the other audit committees does not impair his ability to serve effectively on the Company’s Audit Committee. The Audit Committee met four times during the fiscal year ended December 31, 2011 and one time subsequent to December 31, 2011, but before filing of the 4Kids’ Annual Report on Form 10-K. The Audit Committee’s report is included on pages 19 to 20 of this Proxy Statement.

The Compensation Committee currently consists of Mr. Emmett, who serves as the Chairman, and Messrs. DeSilva and Massad. The Compensation Committee:

|

(i)

|

reviews 4Kids’ goals and objectives with respect to executive compensation;

|

|

(ii)

|

sets and administers 4Kids’ policies which govern annual and long-term compensation of executives;

|

|

(iii)

|

evaluates the CEO’s performance in light of 4Kids’ goals and objectives;

|

|

(iv)

|

determines and approves compensation for the CEO, other executive officers and directors of 4Kids; and

|

|

(v)

|

grants and administers equity incentive compensation pursuant to 4Kids stock option plans and long-term incentive compensation plans.

|

The Compensation Committee may form and delegate authority to subcommittees when appropriate. The Compensation Committee currently does not have any subcommittees. The Compensation Committee met one time during the fiscal year ended December 31, 2011 and did not meet subsequent to December 31, 2011.

The Nominating Committee currently consists of Mr. Massad, who serves as the Chairman, and Messrs. DeSilva, Emmett and Goldstein. The Nominating Committee assists the Board of Directors in:

|

(i)

|

identifying individuals qualified to become members of the Board of Directors;

|

|

(ii)

|

assessing the skills, background and abilities of each candidate;

|

|

(iii)

|

assisting in assessing the independence of members of the Board of Directors; and

|

|

(iv)

|

recommending the director nominees to be proposed for election at the annual meeting of shareholders.

|

The Nominating Committee has not adopted specific minimum qualifications with respect to its nominees, but assesses the overall qualifications of nominees including, among other things, the employment and other professional experience of the candidate, the candidate’s past expertise and involvement in areas which are of relevance to the Company’s business, the candidate’s business ethics and professional reputation and independence. The Nominating Committee evaluates candidates using these criteria and such other criteria it deems appropriate in recommending qualified candidates for nomination to the Board of Directors.

The Nominating Committee met once during the fiscal year ended December 31, 2011 and once subsequent to December 31, 2011, but before the filing of 4Kids’ Annual Report on Form 10-K. Pursuant to its policy, the Nominating Committee does not solicit director nominations, but will consider recommendations by shareholders sent to the Secretary of 4Kids Entertainment, Inc. at 53 West 23rd Street, New York, New York 10010. No formal procedures are required to be followed by shareholders in submitting such recommendations. Candidates proposed by shareholders will be considered by the Nominating Committee in substantially the same manner as other nominees.

Independence of Directors

The Company continues to employ the New York Stock Exchange (“NYSE”) standards in determining the independence of its directors. These standards require a majority of our Board of Directors to be independent and every member of our Audit Committee, Compensation Committee, and Nominating Committee to be independent. A director is considered independent only if our Board of Directors affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder, or officer) or with another company (either directly or as a partner, stockholder, or officer) that has a relationship with the Company.

Our Board of Directors has determined that the following directors are independent: Duminda M. DeSilva, Jay Emmett, Michael Goldstein, and Wade I. Massad. Our Board of Directors has determined that each of the members of the Audit, Compensation and Nominating Committees are “independent”.

Our Audit, Compensation and Nominating Committees each operate under written charters adopted by the Board of Directors. These charters are available for review, free of charge, on 4Kids’ website at www.4kidsentertainment.com. In addition, a printed copy of the charters of the Board Committees will be provided to any of our shareholders who submit a request therefor to the Secretary of 4Kids Entertainment, Inc. at 53 West 23rd Street, New York, New York 10010.

Communications with the Board of Directors

Shareholders or other interested parties may communicate directly with any director, committee member or the non-management directors as a group by writing to the Secretary of 4Kids Entertainment, Inc., at 53 West 23rd Street, New York, New York 10010. The Secretary has been directed to forward all relevant correspondence to the relevant director, committee member or group of directors.

Attendance at Annual Meetings

4Kids encourages all incumbent directors and nominees for election as director to attend the Annual Meeting. Each of Messrs. DeSilva, Emmett, Goldstein, Massad and Newborn attended the Annual Meeting in May 2011.

Executive Sessions of Non-Employee, Non-Management Directors

Non-employee, non-management board members meet without management present at each regularly scheduled board meeting. During the non-management director sessions, the presiding director is determined by the committee session under which the meeting is being held or the agenda item being discussed. Accordingly, the chairman of the Audit Committee presides at the Audit Committee non-management director sessions, the chairman of the Compensation Committee presides at the Compensation Committee non-management director sessions and the chairman of the Nominating/Corporate Governance presides at the Nominating/Corporate Governance non-management director sessions.

Corporate Governance Guidelines

4Kids has adopted corporate governance guidelines which are available for review, free of charge, on 4Kids’ website at www.4kidsentertainment.com. In addition, a printed copy of our corporate governance guidelines will be provided to any of our shareholders who submit a request therefor to the Secretary of 4Kids Entertainment, Inc. at 53 West 23rd Street, New York, New York 10010.

Code of Ethics

We have a code of ethics that applies to all of our employees, including our principal executive officer, principal financial officer and principal accounting officer. A copy of our Code of Ethics and Business Conduct is available for review, free of charge, on our website at www.4kidsentertainment.com. In addition, a printed copy of our Code of Ethics and Business Conduct will be provided to any of our shareholders who submit a request therefor to the Secretary of 4Kids Entertainment, Inc. at 53 West 23rd Street, New York, New York 10010.

COMPENSATION OF NAMED EXECUTIVE OFFICERS

Our Compensation Committee (for purposes of this discussion, the “Committee”) is responsible for establishing, implementing and continually monitoring the compensation structure of our Company. The Committee’s goal is to ensure that the total compensation packages for our named executive officers (“NEOs”) are fair, reasonable and competitive.

The compensation arrangements for our NEOs are designed to satisfy two core objectives:

• retain, motivate and attract executives of the highest quality in key positions in the various business segments of our company; and

• align the interests of the NEOs with those of our stockholders by rewarding performance above our established goals, with the ultimate objective of improving stockholder value.

Our NEO compensation packages currently consist of base salary, discretionary cash bonuses and other benefits which are intended to provide our NEOs with aggregate compensation packages that satisfy the core objectives set forth above. The payment of discretionary cash bonuses is based principally on achieving or exceeding our financial objectives along with successful implementation of initiatives that position us for future growth and increased stockholder value. At this time, we do not provide NEOs with any supplemental retirement benefits, qualified pension plans or deferred compensation plans other than the 401(k) plan to which the NEOs may contribute.

Our compensation philosophy is driven in large part by the fact that we are in the highly competitive entertainment industry where we must compete with companies that have substantially greater financial resources. We recognize that our need to provide executive compensation packages which are competitive with other firms in our industry must be balanced with the interests of our shareholders. We strive to meet this balance and arrive at appropriate compensation packages by carefully weighing both the marketplace realities that dictate the levels of compensation for entertainment company executives and the financial positions of companies of a similar size and global scope.

We also believe that, despite our current financial and operational issues, the long-term success of our Company requires that our NEOs make decisions that in the short-term may not contribute to our financial performance, but will prepare our Company for the future and position us to participate in the changing trends of the children’s entertainment industry. We, therefore, do not look solely at short-term financial achievements in determining appropriate compensation for our NEOs but take into account their long-range planning.

Our senior executive officers assist the Committee in analyzing our general compensation policies. This process assists the Committee in determining how to utilize the elements of the compensation package to best motivate our NEOs and to ensure the satisfaction of our short and long-term business goals. Our senior executive officers also assist the Committee in identifying a set of financial goals and strategic objectives for the upcoming year, which are selected to assess the performance of our executive officers.

The discussion below addresses the principal elements of our NEO compensation. Please also consult the compensation tables beginning on page 15 for more detailed information.

Base Salary

We establish base salaries that are sufficient, in the Committee’s judgment, to retain and motivate our NEOs. In determining appropriate salaries, the Committee considers each NEO’s scope of responsibility and accountability within our Company and reviews the NEO’s compensation, individually and relative to other officers.

Discretionary Cash Bonuses

The Committee believes that discretionary cash bonus compensation designed to retain and motivate NEOs should be directly linked to our overall corporate financial performance, individual performance and our success in achieving both our short-term and long-term strategic goals. In assessing the performance of our Company and our NEOs during the fiscal year ended December 31, 2011, the Committee considered our performance in the following areas:

• Sustaining the performance of our core properties;

• Identifying and developing future properties;

• Distributing our content across additional channels of distribution;

• Continuing to reduce operating costs across our Company's various business segments;

• Developing new initiatives to respond to changing trends in the children's entertainment world; and

• Maintaining our reputation for integrity.

Our bonuses are structured to be deductible under Section 162(m) of the Internal Revenue Code which denies publicly-held corporations a federal income tax deduction for compensation in excess of $1 million paid to the four most highly compensated officers during a fiscal year unless the compensation is “performance-based.” We believe that our process of awarding cash bonuses satisfies this requirement; however, there can be no assurance that any amounts paid as discretionary cash bonuses will be deductible.

Despite the continued efforts and the achievement by some of the various individual objectives of our NEOs during the fiscal year ended December 31, 2011, we did not pay discretionary cash bonuses to them as a result of our lackluster financial performance during the fiscal year ended December 31, 2011 or grant any equity incentives. We do not expect to pay discretionary cash bonuses to our NEOs with respect to the fiscal year ended December 31, 2012 unless our financial performance significantly improves or there are other performance related factors for individual NEOs that merit payment of a discretionary cash bonus for such individuals.

We maintain a 401(k) plan for our NEOs and other employees. Our Company currently matches twenty-five percent of the first six percent of the employees’ contribution of salary to the 401(k) plan. For the fiscal year ended December 31, 2011, we contributed matching contributions of an aggregate amount of $10,350 to the 401(k) plan accounts of our NEOs.

Employment and Severance Agreements

Our employment agreements with Messrs. Foster, Newborn and Lacey expired on December 31, 2009. The Committee has determined that we would not renew any of our employment agreements with our executive employees that expired or enter into new agreements. The following is a summary of our arrangements with our former Chief Executive Officer and the severance agreements with our other NEOs.

CEO Employment and Separation Agreement

On December 15, 2006, Alfred R. Kahn entered into a Second Amended and Restated Employment Agreement pertaining to Mr. Kahn’s service as our Chairman of the Board of

Directors and CEO (the “Kahn Agreement”). Under the Kahn Agreement, Mr. Kahn’s employment would have continued until December 31, 2012. Thereafter, the term would have been automatically extended for one year periods unless either our Company or Mr. Kahn provided written notice at least six months prior to the expiration of the then-current term that such party did not want to extend the term. Pursuant to a letter agreement between the Company and Mr. Kahn, dated December 31, 2009, as of January 1, 2010, Mr. Kahn’s annual base salary of $900,000 was reduced to an annual rate of $765,000 for the remainder of the term.

The Kahn Agreement also contained a covenant not to compete which provided that he would not engage in competition with our Company for a period of 24 months following the date of termination of his employment as well as other customary covenants concerning non-disclosure of confidential information.

On January 11, 2011, the Company announced that Mr. Kahn had retired and resigned from his position as Chief Executive Officer of the Company, as Chairman of the Company’s Board of Directors, and as a member of the Company’s Board of Directors, effective on January 10, 2011.

In connection with his retirement and resignation, Mr. Kahn entered into a Separation Agreement with the Company, dated as of January 10, 2011, providing for the payment to Mr. Kahn of an aggregate amount of $250,000, payable in six equal monthly installments commencing on February 1, 2011 and certain other benefits. Under the terms of the Separation Agreement, Mr. Kahn and the Company provided a general release of all claims, damages, rights, remedies and liabilities against each other, including all payment obligations of the Company under the Kahn Agreement. Mr. Kahn remains subject to the non-competition and confidentiality obligations provided in the Kahn Agreement. As of April 6, 2011, the date on which the Company and all of its domestic wholly-owned subsidiaries filed voluntary petition for relief under Title 11 of Chapter 11 of the United States Code in the United States Bankruptcy Court for the Southern District of New York, Mr. Kahn had received $125,000 of the $250,000 payable pursuant to the Separation Agreement.

Severance Agreements

Bruce Foster is employed as our Executive Vice President and Chief Financial Officer at an annual base salary of $500,000. He is eligible to receive salary increases, cash bonuses, and grants of equity compensation, determined at the sole discretion of the Committee.

On October 14, 2009, Mr Foster entered into a severance agreement, which was amended on December 31, 2009. Under the agreement, if we terminate Mr. Foster without “cause” or if he resigns for “good reason” (each as defined in his severance agreement), he will be entitled to receive a severance payment in an amount equal to $500,000 as well as medical benefits for a period of 18 months following termination. Such payment shall be made in a lump sum payment within ten days after the date that Mr. Foster is terminated without cause or voluntarily terminates his employment for good reason, subject to section 409A of the IRC.

Samuel R. Newborn is employed as our Executive Vice President and General Counsel at an annual base salary of $600,000. He is eligible to receive salary increases, cash bonuses, and grants of equity compensation, determined at the sole discretion of the Committee.

On October 14, 2009, Mr Newborn entered into a severance agreement, which was amended on December 31, 2009. Under the agreement, if we terminate Mr. Newborn without “cause” or if he resigns for “good reason” (each as defined in his severance agreement), he will be entitled to receive a severance payment in an amount equal to $1,000,000 as well as medical benefits for a period of 18 months following termination. Such payment shall be made in a lump sum payment within ten days after the date that Mr. Newborn is terminated without cause or voluntarily terminates his employment for good reason, subject to section 409A of the IRC.

Brian Lacey is employed as our Executive Vice President of International at an annual base salary of $500,000. He is eligible to receive salary increases, cash bonuses, and grants of equity compensation, determined at the sole discretion of the Committee.

On November 24, 2009, Mr Lacey entered into a severance agreement. Under the agreement, if we terminated Mr. Lacey without “cause” or if he resigns for “good reason” (each as defined in his severance agreement), he will be entitled to receive a severance payment equal to two weeks of his annual salary for each year of service in an amount equal to approximately $173,000 as well as medical benefits for that period following termination. In the event that a “change of control” (as defined in his severance agreement), Mr. Lacey had the right to terminate his agreement within twelve months after the occurrence of the change of control, and receive a payment equal to three weeks of his annual salary for each year of service in an amount equal to approximately $260,000. Such payment shall be made in a lump sum payment within ten days after the date that Mr. Lacey is terminated without cause or voluntarily terminates his employment for good reason, subject to section 409A of the IRC.

Summary Compensation Table

The following table shows compensation paid, accrued or expensed with respect to our NEOs for the fiscal year ended December 31, 2011 and 2010, respectively:

|

Name and

Principal Position

|

Year

|

|

Salary

|

|

Bonus

|

|

Stock

Awards

|

|

Option Awards

|

|

All Other

Compensation (1)

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred R. Kahn, Former Chairman of the Board of Directors, Chief Executive Officer

|

|

2011 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

265,519 |

|

$ |

265,519 |

|

| |

2010 |

|

$ |

765,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

21,979 |

|

$ |

786,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce R. Foster, Executive Vice President, Chief Financial Officer

|

|

2011 |

|

$ |

500,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

21,081 |

|

$ |

521,081 |

|

| |

2010 |

|

|

500,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

19,979 |

|

$ |

519,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Samuel R. Newborn, Esq., Executive Vice President, General Counsel

|

|

2011 |

|

$ |

600,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

21,081 |

|

$ |

621,081 |

|

| |

2010 |

|

|

600,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

19,979 |

|

$ |

619,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lacey, Executive Vice President, International

|

|

2011 |

|

$ |

500,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

21,081 |

|

$ |

521,081 |

|

| |

2010 |

|

|

500,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

19,979 |

|

|

519,979 |

|

(1) The following table lists all amounts included in the “All Other Compensation” column for each NEO:

|

Name

|

Year

|

|

|

Medical Premium

|

|

|

Life Insurance Premium

|

|

|

Matching Contributions

|

|

|

Gym Reimbursement

|

|

|

Severance

|

|

|

Total

|

|

| |

|

2011 |

|

|

$ |

15,519 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

250,000 |

|

|

$ |

265,519 |

|

|

Alfred R. Kahn (1)

|

|

2010 |

|

|

$ |

15,789 |

|

|

$ |

740 |

|

|

$ |

3,450 |

|

|

$ |

2,000 |

|

|

$ |

— |

|

|

$ |

21,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2011 |

|

|

$ |

16,861 |

|

|

$ |

770 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

21,081 |

|

| Bruce R. Foster |

|

2010 |

|

|

$ |

15,789 |

|

|

$ |

740 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

19,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2011 |

|

|

$ |

16,861 |

|

|

$ |

770 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

21,081 |

|

| Samuel R. Newborn |

|

2010 |

|

|

$ |

15,789 |

|

|

$ |

740 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

19,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2011 |

|

|

$ |

16,861 |

|

|

$ |

770 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

21,081 |

|

| Brian Lacey |

|

2010 |

|

|

$ |

15,789 |

|

|

$ |

740 |

|

|

$ |

3,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

19,979 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Payments to Alfred Kahn in 2011 were based on his Separation Agreement. $10,150 and $125,000, respectively of medical and severance were not paid due to the Company’s Bankruptcy filing on April 6, 2011 and are listed as a pre-petition claim.

Equity Exercised or Vested and Year-End Equity Values

The following tables show information regarding the value of options exercised and restricted stock vested during the fiscal year ended December 31, 2011 and certain information about unexercised options and unvested restricted stock at December 31, 2011:

| |

|

|

Option Awards

|

|

|

Stock Awards

|

|

|

Name

|

|

|

Number of Shares acquired on Exercise

(#)

|

|

|

Value realized on Exercise

($)(1)

|

|

|

Number of Shares acquired on Vesting

(#)

|

|

|

Value realized on Vesting

($)(2)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred R. Kahn

|

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce R. Foster

|

|

|

|

— |

|

|

$ |

— |

|

|

|

13,250 |

|

|

$ |

2,289 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Samuel R. Newborn

|

|

|

|

— |

|

|

$ |

— |

|

|

|

13,250 |

|

|

$ |

2,289 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lacey

|

|

|

|

— |

|

|

$ |

— |

|

|

|

8,999 |

|

|

$ |

1,552 |

|

(1) Value represents market value at exercise less the exercise price.

(2) Value realized on vesting of stock awards is based on the average trade price on the vesting date.

Outstanding Equity Awards as of December 31, 2011

| |

|

Option Awards

|

|

|

Stock Awards

|

|

|

Name

|

|

Number of Securities Underlying Unexercised Options

(#)Exercisable

|

|

|

Number of Securities Underlying Unexercised Options

(#)Unexercisable

|

|

|

Option Exercise Price ($)

|

|

|

Option Expiration Date

|

|

|

Number of Shares or Units of Stock That Have Not Vested

(#)

|

|

|

Market Value of the Share or Units of Stock That Have Not Vested (1)

|

|

|

Alfred R. Kahn

|

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

$ |

— |

|

|

Bruce R. Foster

|

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

6,250 |

|

|

|

(2 |

) |

|

$ |

875 |

|

|

Samuel R. Newborn

|

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

6,250 |

|

|

|

(2 |

) |

|

$ |

875 |

|

|

Brian Lacey

|

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

4,166 |

|

|

|

(2 |

) |

|

$ |

583 |

|

(1) Value represents the market value of the Company’s Common Stock on December 31, 2011 (based on closing price of $0.14 per share on December 31, 2011).

(2) The shares vest on May 22, 2012.

Potential Payments Upon Termination or Change of Control

The table below reflects the amount of compensation payable to each NEO upon voluntary termination, early retirement, involuntary not-for-cause termination, for cause termination, termination following a change of control and in the event of disability or death of the NEO. The amounts shown assume that such termination was effective as of December 31, 2011, and thus include amounts earned through such time and are estimates of what would be paid out to these NEOs. The actual amounts to be paid out can only be determined at the time of such NEO’s separation from our Company. For details of the amounts payable, please refer to the “Employment Agreement” section included above.

|

Name

|

|

Voluntary/ Normal Termination

|

|

Involuntary Not For Cause Termination

|

|

For Cause Termination

|

|

Involuntary or Good Reason Termination (Change-of-Control) (4)

|

|

Death

|

|

Disability

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Alfred R. Kahn

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce R. Foster

|

|

—

|

|

526,099 (1)

|

|

—

|

|

526,974 (1)

|

|

—

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Samuel R. Newborn

|

|

—

|

|

1,026,099 (1)

|

|

—

|

|

1,026,974 (1)

|

|

—

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Brian Lacey

|

|

—

|

|

178,877 (2)

|

|

—

|

|

270,348 (3)

|

|

—

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Included in this calculation are benefits consisting of $26,099 for health benefits.

(2) Included in this calculation are benefits consisting of $5,800 for health benefits.

(3) Included in this calculation are benefits consisting of $10,150 for health benefits.

(4) Included in this calculation is the immediate vesting of unvested shares of restricted stock awards at the closing price on December 31, 2011 of $0.14.

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes 4Kids’ existing equity compensation plans as of December 31, 2011:

|

Plan Category

|

(a) Number of

Securities to Be Issued Under Outstanding Options / Restricted Stock Awards

|

(b) Weighted Average Exercise Price of Outstanding Options

|

(c) Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

|

| |

|

|

|

|

Equity compensation plans

|

|

|

|

|

approved by security holders:

|

|

|

|

|

Stock Options

|

—

|

—

|

1,973,000

|

| |

|

|

|

|

Restricted Stock

|

60,833

|

N/A

|

351,613 (1)

|

| |

|

|

|

|

Equity compensation plans not

|

|

|

|

|

approved by security holders

|

N/A

|

N/A

|

N/A

|

(1) Under the 2008, 2007, 2006 and 2005 Long-Term Incentive Compensation Plans, the Company can issue either 700,000, 800,000, 600,000 and 600,000 stock options, respectively, or 350,000, 400,000, 150,000 and 150,000 restricted shares, respectively.

Compensation of Directors

The form and amount of director compensation is determined by our Board of Directors upon the recommendation of the Committee. Each member of the Board of Directors who is not an employee of our Company (a “Non-Employee Director”) receives $45,000 annually for his service on the Board of Directors. The chairmen of the Audit and Compensation Committees each receive an additional $15,000 annually. The chairman of the Nominating Committee receives an additional $5,000 annually. At the discretion of the Board of Directors, the Non-Employee Directors are eligible to receive grants of restricted stock or options to purchase shares of our common stock at an exercise price equal to the fair market value of a share of common stock on the date of grant. All directors are reimbursed for their out-of-pocket expenses incurred in connection with their service as directors.

The following chart represents the compensation amount we paid or awarded with respect to our Non-Employee Directors for their services for the fiscal year ended December 31, 2011:

|

Director(1)

|

|

|

Fees Earned

|

|

|

Grant Date Fair Value of Stock Awards

|

|

|

All Other Compensation

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Duminda M. DeSilva

|

|

|

$ |

45,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

45,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jay Emmett

|

|

|

$ |

60,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

60,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Goldstein

|

|

|

$ |

60,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

60,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wade I. Massad (2)

|

|

|

$ |

50,000 |

|

|

$ |

— |

|

|

$ |

41,667 |

|

|

$ |

91,667 |

|

(1) Alfred Kahn and Samuel Newborn are omitted from this table because they did not receive any additional compensation for service as director.

(2) Wade Massad was paid an additional $41,667 to actively investigate and pursue potential strategic alternatives for the Company and to oversee operational matters on behalf of the Board of Directors.

As of December 31, 2011, our Non-Employee Directors held the following number of unexercised stock options and the following number of unvested shares of restricted stock:

|

Director

|

|

Unexercised Options

|

|

Unvested Shares of Restricted Stock

|

|

Duminda M. DeSilva

|

|

—

|

|

—

|

| |

|

|

|

|

|

Jay Emmett

|

|

—

|

|

4,000

|

| |

|

|

|

|

|

Michael Goldstein

|

|

—

|

|

4,000

|

| |

|

|

|

|

|

Wade I. Massad

|

|

—

|

|

—

|

| |

|

|

|

|

Compensation Committee Interlocks and Insider Participation

As described in “Election of Directors - Committees of the Board of Directors” above, the Compensation Committee consists of Messrs. Emmett, DeSilva, Goldstein and Massad, none of whom has ever been an officer or employee of the Company or any of its subsidiaries. During the fiscal year ended December 31, 2011, no executive officer of the Company served as a member of the Compensation Committee or board of directors of another entity, one of whose executive officers served on our Board of Directors.

Report of the Audit Committee of the Board of Directors

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the following report shall not be deemed to be incorporated by reference into any such filing.

Membership and Role of the Audit Committee

4Kids’ Audit Committee currently consists of Mr. Goldstein, who serves as the Chairman, and Messrs. Emmett and Massad. The Audit Committee provides assistance to the Board of Directors in fulfilling the Board of Directors’ oversight responsibilities with respect to the quality and integrity of 4Kids’ financial reports, the independence and qualifications of 4Kids’ independent auditors, the performance of 4Kids’ internal audit function and 4Kids’ compliance with legal and regulatory requirements. The Audit Committee has the sole authority to appoint or replace 4Kids’ independent auditors and is directly responsible for determining the compensation and for overseeing the work of 4Kids’ independent auditors. The Audit Committee met with management periodically during the year to consider the adequacy of 4Kids’ internal controls and the objectivity of its financial reporting. The Audit Committee also discussed with 4Kids’ independent auditors and with the appropriate financial personnel their evaluations of 4Kids’ internal accounting controls and the overall quality of 4Kids’ financial reporting. The Audit Committee also discussed with 4Kids’ senior management and independent auditors the process used for certifications by 4Kids’ principal executive officer and principal financial officer which is required by the SEC for certain of 4Kids’ filings with the SEC. During the fiscal year ended December 31, 2011, the Audit Committee met privately with the independent auditors, whom have unrestricted access to the Audit Committee.

The Board of Directors has determined that one of the Audit Committee’s members, Mr. Goldstein, qualifies as an “audit committee financial expert” as defined by the SEC. The Audit Committee operates under a written charter adopted by the Board of Directors. All of the Audit Committee members are independent as defined in the NYSE listing standards.

Review of the Company’s Audited Financial Statements for the Fiscal Year Ended December 31, 2011

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2011 with the Company’s management. The Audit Committee has discussed with EisnerAmper LLP, the Company’s independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380).

The Audit Committee has also received the written disclosures and the letter from EisnerAmper LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communication with the Audit Committee concerning independence and the Audit Committee has discussed with EisnerAmper LLP such firm’s independence.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, for filing with the Securities and Exchange Commission.

Audit Committee

Michael Goldstein

Jay Emmett

Wade I. Massad

Certain Transactions Involving Management

We have adopted a written policy that states that if any director or executive officer or any business organizations or individuals associated with them have transacted business with our Company during the year, such transactions must be reported initially to the Corporate Secretary. The information may be reported in the written questionnaire submitted by directors and executive officers annually or on an as needed basis. The Corporate Secretary then advises the Board of Directors of any such transactions for their review and determination as to whether or not to approve such transactions. In making such determinations, the Board of Directors will take into account factors such as whether the goods and services in question are available from an unrelated third party on similar or more favorable terms.

Chaotic USA Entertainment Group, Inc. (“CUSA”) - On December 11, 2006, 4Kids Digital Games, Inc. (“4Kids Digital”) and CUSA Digital Games LLC (“CUSA LLC”) formed TC Digital Games LLC (“TC Digital”) as a joint venture, with 4Kids Digital now owning 55% of TC Digital’s membership interests and CUSA LLC now owning 45% of TC Digital’s membership interests. TC Digital is treated as a consolidated subsidiary of the Company as a result of its majority ownership in TC Digital and its right to break any dead-locks within the TC Digital Management Committee. Effective September 30, 2010, the Company terminated the operations of TC Digital and TC Websites LLC (“TC Websites”) due to their continued lack of profitability. The termination of the business of TC Digital and TC Websites will enable the Company to further reduce costs and focus on its core businesses. As a consequence of the termination of their operations, TC Digital and TC Websites ceased supporting the Chaotic trading card game and website, effective October 1, 2010. The results of operations of TC Digital and TC Websites are reported in the Company’s consolidated financial statements as discontinued operations, subject to a noncontrolling interest. Bryan Gannon (“Gannon”), President and Chief Executive Officer of CUSA and John Milito (“Milito”), Executive Vice President and Chief Operating Officer of CUSA, each own an interest of approximately 32% in CUSA and became officers of TC Digital in 2006. Milito’s employment with TC Digital was terminated on December 31, 2009. Gannon’s employment with TC Digital was terminated on October 15, 2010.

As of December 31, 2011, the Company had entered into the following transactions with CUSA and CUSA LLC, or parties related to Gannon and Milito that are summarized below:

|

|

°

|

Chaotic Property Representation Agreement - On December 11, 2006, 4Kids Entertainment Licensing, Inc. (“4Kids Licensing”), CUSA and Apex Marketing, Inc. (“Apex”), a corporation in which Gannon holds 60% of the outstanding capital stock and Milito owns 39% of the outstanding capital stock, entered into an amended and restated Chaotic Property Representation Agreement (“CPRA”) replacing the original Chaotic Property Representation Agreement entered into by the parties in April 2005. Under the terms of the CPRA, 4Kids Licensing is granted exclusive television broadcast and production, merchandising licensing, and home video rights to the “Chaotic” Property worldwide in perpetuity, subject to certain limited exceptions. Under the terms of the CPRA, all “Chaotic” related income less approved merchandising and other expenses shall be distributed 50% to the Company and 50% to CUSA and Apex, excluding trading card royalties which are distributed 55% to 4Kids Digital and 45% to CUSA. Additionally, all approved production expenses for television episodes based on the “Chaotic” property are allocated 50% to 4Kids Licensing and 50% to CUSA and Apex. As of December 31, 2011 and 2010 there were no distributions and approximately $8,364,000 and $8,583,000, respectively, of production, merchandising and other general expenses were owed to 4Kids Licensing by CUSA and Apex, collectively, which were fully reserved on the Company’s consolidated financial statements.

|

|

|

°

|

Patent License Agreements - On December 11, 2006, TC Digital and TC Websites each entered into an agreement (the “Patent License Agreements”) with Cornerstone Patent Technologies, LLC (“Cornerstone”), a limited liability company, in which Gannon and Milito each hold a 25% membership interest. Pursuant to the Patent License Agreements, TC Digital and TC Websites obtained exclusive licenses (subject to certain exceptions) to use certain patent rights in connection with “Chaotic” and other trading card games which are uploaded to websites owned and operated by each such entity. Additionally, each of TC Digital and TC Websites agreed to pay Cornerstone a royalty of 1.5% of the Manufacturers Suggested Retail Price for the sale of trading cards. On September 10, 2007, the Company purchased a 25% interest in such patents from Cornerstone for $750,000. During the years ended December 31, 2011 and 2010, the Company earned no royalties, associated with its portion of the patents, related to the sales of “Chaotic” trading cards.

|

|

|

°

|