10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended September 27, 2015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-6227

LEE ENTERPRISES, INCORPORATED

(Exact name of Registrant as specified in its Charter) |

| |

Delaware | 42-0823980 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

201 N. Harrison Street, Suite 600, Davenport, Iowa 52801

(Address of principal executive offices)

(563) 383-2100

Registrant's telephone number, including area code |

| |

Title of Each Class | Name of Each Exchange On Which Registered |

Securities registered pursuant to Section 12(b) of the Act: | |

Common Stock - $0.01 par value | New York Stock Exchange |

Preferred Share Purchase Rights | New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this Chapter) during the preceding 12 months (or such shorter period that the Registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (S 229.405 of this Chapter) is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definition of “large accelerated filer", "accelerated filer" and "smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer (Do not check if a smaller reporting company) [ ] Smaller Reporting Company [ ]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant's most recently completed second fiscal quarter. Based on the closing price of the Registrant's Common Stock on the New York Stock Exchange on March 31, 2015, such aggregate market value is approximately $156,747,000. For purposes of the foregoing calculation only, as required, the Registrant has included in the shares owned by affiliates the beneficial ownership of Common Stock of officers and directors of the Registrant and members of their families, and such inclusion shall not be construed as an admission that any such person is an affiliate for any purpose.

Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of November 30, 2015. Common Stock, $0.01 par value, 54,649,374 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Lee Enterprises, Incorporated Definitive Proxy Statement to be filed in January 2016 are incorporated by reference in Part III of this Form 10-K.

|

| | | |

TABLE OF CONTENTS | PAGE |

| | | |

| | | |

| |

| | | |

Part I | |

| | | |

| Item 1 | | |

| | | |

| Item 1A | | |

| | | |

| Item 1B | | |

| | | |

| Item 2 | | |

| | | |

| Item 3 | | |

| | | |

| Item 4 | Mine Safety Disclosures | |

| | | |

Part II | |

| | | |

| Item 5 | | |

| | | |

| Item 6 | | |

| | | |

| Item 7 | | |

| | | |

| Item 7A | | |

| | | |

| Item 8 | | |

| | | |

| Item 9 | | |

| | | |

| Item 9A | | |

| | | |

| Item 9B | | |

| | | |

Part III | |

| | | |

| Item 10 | | |

| | | |

| Item 11 | | |

| | | |

| Item 12 | | |

| | | |

| Item 13 | | |

| | | |

| Item 14 | Principal Accounting Fees and Services | |

| | | |

Part IV | |

| | | |

| Item 15 | | |

| | | |

| |

| | | |

| |

| | | |

| |

References to “we”, “our”, “us” and the like throughout this document refer to Lee Enterprises, Incorporated and subsidiaries (the "Company"). References to "2015", "2014", "2013" and the like refer to the fiscal years ended the last Sunday in September.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. This report contains information that may be deemed forward-looking that is based largely on our current expectations, and is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those anticipated. Among such risks, trends and other uncertainties, which in some instances are beyond our control, are:

•Our ability to generate cash flows and maintain liquidity sufficient to service our debt;

•Our ability to comply with the financial covenants in our credit facilities;

•Our ability to refinance our debt as it comes due;

•That the warrants issued in our refinancing will not be exercised;

•The impact and duration of adverse conditions in certain aspects of the economy affecting our business;

•Changes in advertising and subscription demand;

•Changes in technology that impact our ability to deliver digital advertising;

•Potential changes in newsprint, other commodities and energy costs;

•Interest rates;

•Labor costs;

•Legislative and regulatory rulings;

•Our ability to achieve planned expense reductions;

•Our ability to maintain employee and customer relationships;

•Our ability to manage increased capital costs;

•Our ability to maintain our listing status on the NYSE;

•Competition; and

•Other risks detailed from time to time in our publicly filed documents.

Any statements that are not statements of historical fact (including statements containing the words “may”, “will”, “would”, “could”, “believes”, “expects”, “anticipates”, “intends”, “plans”, “projects”, “considers” and similar expressions) generally should be considered forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements, which are made as of the date of this report. We do not undertake to publicly update or revise our forward-looking statements, except as required by law.

PART I

ITEM 1. BUSINESS

Lee Enterprises, Incorporated is a leading provider of local news and information, and a major platform for advertising, in the markets we serve, which are located primarily in the Midwest, Mountain West and West regions of the United States. With the exception of St. Louis, Missouri, our 50 daily newspaper markets (including TNI Partners ("TNI") and Madison Newspapers ("MNI")), across 22 states, are principally midsize or small. Through our paid and unpaid print and digital platforms, we reach an overwhelming majority of adults in our markets.

Our products include:

| |

• | 50 daily and 38 Sunday newspapers with print and digital subscribers totaling 0.9 million and 1.3 million, respectively, for the year ended September 27, 2015, read by more than three million people in print. |

| |

• | Nearly 300 weekly newspapers and classified and niche publications. |

Our markets have established retail bases, and most are regional shopping hubs. We are located in four state capitals. Six of our top ten markets by revenue include major universities, and seven are home to major corporate headquarters. Based on data from the Bureau of Labor of Statistics as of September 2015, the unemployment rate in seven of our top ten markets by revenue was lower than the national average. We believe that all of these factors have had a positive impact on advertising revenue. Community newspapers and their associated digital media are a valuable source of local news and information to readers and an effective means for local advertisers to reach their customers.

We believe our audiences across these communities tend to be loyal readers that actively seek our content and serve as an attractive target for our advertisers.

We do not face significant competition from other local daily newspapers in most of our markets, although there is significant competition for audience in those markets from other media. In our top ten markets by revenue, only two have significant local daily print competition.

Lee Enterprises, Incorporated was founded in 1890, incorporated in 1950, and listed on the New York Stock Exchange ("NYSE") in 1978. We have acquired and divested a number of businesses since inception. The acquisition of Pulitzer Inc., the most significant recent transaction, is discussed more fully below.

On December 12, 2011, the Company and certain of its subsidiaries filed voluntary, prepackaged petitions in the U.S. Bankruptcy Court for the District of Delaware (the "Bankruptcy Court") for relief under Chapter 11 of the U.S. Bankruptcy Code (the "U.S. Bankruptcy Code") (collectively, the "Chapter 11 Proceedings"). Our interests in TNI and MNI were not included in the filings.

On January 23, 2012, the Bankruptcy Court approved our Second Amended Joint Prepackaged Plan of Reorganization (the "Plan") under the U.S. Bankruptcy Code and on January 30, 2012 (the "Effective Date"), the Company emerged from the Chapter 11 Proceedings. On the Effective Date, the Plan became effective and the transactions contemplated by the Plan were consummated. Implementation of the Plan resulted primarily in refinancing of our debt and extending the maturity. The Chapter 11 Proceedings did not adversely affect employees, vendors, contractors, customers or any aspect of Company operations. Stockholders retained their interest in the Company, subject to modest dilution.

In May 2013, we refinanced $94 million of our debt, extending its maturity to April 2017. In 2014, we completed a comprehensive refinancing of our remaining debt (the "2014 Refinancing"). Final maturities of our then outstanding debt have been extended to dates from April 2017 through December 2022. As a result, refinancing risk has been substantially reduced for the next several years.

Prior to 2015, we experienced significant net losses in all but one year since 2007 due primarily to non-cash charges for impairment of intangible and other assets in 2013, 2011, 2009 and 2008 and reorganization costs in 2012. Our ability to operate as a going concern is dependent on our ability to remain in compliance with debt covenants and to repay, refinance or amend our debt agreements as they become due, or earlier if available liquidity is consumed. We are in compliance with our debt covenants at September 27, 2015. The information included herein should be evaluated in that context. See Item 1A, “Risk Factors”, and Notes 4 and 5 of the Notes to Consolidated Financial Statements, included herein, for additional information.

STRATEGIC INITIATIVES

We are focused on several strategic initiatives:

Comprehensive Local News That Drives Frequency And Engagement

We drive frequency and engagement with our products by delivering valuable, intensely local, original news and information that, in many cases, we believe our audiences cannot otherwise readily obtain. Our large and talented news and editorial staff provide constant, real-time local news with significant breadth, depth and reliability. Our full access platforms provide our subscribers with in-depth and breaking news and information through continuous updates to our stories digitally on websites, mobile devices and tablets.

We believe the strength of our local brands is the result of the quality and size of our news gathering staff, which allow us to provide the most comprehensive coverage of local news in our markets. In most of our markets, we are the leading source of print and digital news and information. As the digital consumption of news has expanded, we have moved quickly to develop applications that address audience demands and digital advertising demands for mobile and tablet advertising platforms. As new digital technologies emerge, we expect to move rapidly to make our content available through them and monitize the audience.

We are focused on continually improving the functionality and the look and feel of all our news platforms, providing greater depth of coverage and reader engagement. We are arming our journalists with new tools to give them real-time information about audience engagement on our digital platforms, helping inform their decisions on both presentation and coverage.

We believe our journalists are at the forefront for information about the local community. We are engaging our readers by providing information that we believe stirs public awareness, advances ideas, inspires vision, creates debate and provokes action. Through our news leadership we strive to contribute to community betterment, promote education, foster commerce and help improve the quality of life in our markets.

Accelerate And Expand Digital Revenue Growth

Our digital businesses have experienced rapid growth since 2010. Digital advertising grew 6.9% in 2015 and reached 21.6% of total advertising and marketing services revenue in the 13 weeks ended September 27, 2015. Total digital revenue in 2015 increased 27.8% over the prior year, and we expect total digital revenue, which represented 19.9% of total operating revenue in the 13 weeks ended September 27, 2015, to continue to grow. We are growing revenue by offering an expansive array of digital products, including video, digital couponing, behavioral targeting, audience retargeting, banner ads and social networking.

We provide digital marketing services to small and midsized businesses ("SMBs"), including search engine marketing ("SEM"), social media, audience extension, business profiles and website hosting and design. Lee Local offers small business solutions including search engine optimization (“SEO”), local online marketing, social media marketing, video advertising and web site design. Lee Local seeks to help small businesses maximize the return on marketing dollars by increasing audiences, expanding brands, and enhancing their web presence. We believe that these innovative solutions will continue to drive meaningful new opportunities for us to grow our digital marketing revenue.

Amplified Digital, a full-service advertising agency, provides advertisers with consultation and management of a comprehensive suite of print and digital products including: SEO, SEM, web and mobile production, social media services and reputation monitoring and management. Amplified Digital also designs and supports digital marketing campaigns beyond our owned and operated products and platforms for extended audience targeting.

INN Partners, L.C. ("TownNews"), of which we own 82.5%, provides digital infrastructure and digital publishing services for nearly 1,600 daily and weekly newspapers, along with universities, television stations and niche publications, as well as for us. We believe TownNews represents a powerful opportunity for us to drive additional digital revenue. In 2015, digital services revenue, which is primarily TownNews, increased to almost $13 million, or 23.0% over 2014.

We are also a member of the Local Media Consortium (the “Consortium”). The Consortium partners with companies like Google, Yahoo! and other technology companies and service providers to increase the potential share of new revenue and audience-building programs available to consortium members, as well as the quality of information and advertising services available from, Consortium members. The Consortium currently includes more than 1,600 local newspapers and hundreds of local broadcast outlets in the United States.

Our sales force is larger than any local competitor, and we believe they are the most highly trained and proficient sales force in our markets. We also continue to expand our array of digital products to address advertisers evolving needs, while seeking to increase our share of advertising and marketing services spending from existing customers and react to competition.

In 2015, no single advertiser accounted for more than 1.9% of advertising revenue and our top 10 advertisers represented 8.7% of advertising revenue.

Grow Audience Revenue And Engagement

Based on audience research conducted by a third party on our behalf for the period January to June 2015, we reached 76% of all adults over the course of a seven-day period in 11 selected markets, which include most of our largest strategic business units. Half of the adults in these markets read our newspapers in print, with 19% being both newspaper readers and visitors to our newspaper digital platforms. Another 13% were exclusive digital users. The remaining 13% primarily used our newspapers to obtain advertising and other information.

Furthermore, our audiences strength spans across all age groups. Among the 18-29 age group, 40% read our printed newspapers, while 33% accessed our publications by web, mobile or tablet. Another 20% primarily used our newspapers to obtain advertising and other information.

As media access and delivery vehicles continue to evolve, it is clear that our audiences are evolving and increasingly moving from one delivery platform to another throughout the day and accessing our content in print, on desktops and

laptops, and on mobile devices. We seek to grow our audience and engagement on whatever platform they choose by, among other things, continually improving content and presentation to maximize the unique and evolving capabilities of each platform. Our digital audiences are massive. Unique visitors to our digital sites totaled 24.9 million in September 2015, while page views totaled 221.4 million in September 2015.

To serve our readers across all delivery platforms in 2014, we began to phase in a new subscription model, which is now in place in substantially all of our markets. This model, known as full access, provides subscribers complete access to our print and digital products available in their market for a single subscription rate.

Business Transformation And Manage Costs

We are transforming our business model and reducing our costs to maintain our margins and cash flows. We have regionalized many staff functions; consolidated and/or selectively outsourced printing and ad production; discontinued unprofitable publications; reduced newsprint volume significantly; and continually seek to improve the efficiencies of our operation and reduce costs. We have reduced personnel while protecting our strengths in news, sales and digital products. In 2015, we reduced cash costs(1) on a comparable basis 3.1%. We continue our focus on cost efficiencies while investing in revenue drivers. We believe that our operating cash flow margin(1) of almost 23% in 2015 remains among the highest in the industry.

Generate Strong Free Cash Flow With A Commitment To Reduce Our Debt

Throughout the last economic downturn and subsequent recovery, and during a time of unprecedented transition for our industry, we have posted strong free cash flow. Our operating cash flow margins(1) have improved nearly back to pre-recession levels, with modest capital expenditures and pension contributions, and we continue to make significant debt reductions each year. Since 2009, we have dedicated substantially all of our free cash flow(1) to debt repayment, and we intend to continue to use our free cash flow to reduce debt.

The principal amount of debt was reduced by $78.9 million in 2015 and totaled $725.9 million as of September 27, 2015. Since 2005, we have reduced debt by $962 million. We expect to continue to significantly reduce our debt in 2016. As a result of our debt reductions, cash interest expense was reduced by $4.9 million in 2015 compared to 2014, providing additional free cash flow available for debt service.

(1) See "Non-GAAP Financial Measures: in Item 7, included herein, for additional information.

PULITZER

In 2005, we acquired Pulitzer Inc. (“Pulitzer”). Pulitzer published 14 daily newspapers and more than 100 weekly newspapers and specialty publications. Pulitzer also owned a 50% interest in TNI, as discussed more fully below. The acquisition of Pulitzer increased our paid circulation by more than 50% and revenue by more than 60% at that time. The acquisition was financed primarily with debt.

Pulitzer newspaper operations include St. Louis, Missouri, where its subsidiary, St. Louis Post-Dispatch LLC (“PD LLC”), publishes the St. Louis Post-Dispatch, the only major daily newspaper serving the greater St. Louis metropolitan area, a variety of specialty publications, and supports its related digital products. St. Louis newspaper operations also include the Suburban Journals of Greater St. Louis, a group of weekly newspapers and niche publications that focus on separate communities within the metropolitan area.

Pulitzer and its subsidiaries and affiliates currently publish 11 daily newspapers and support the related digital products, as well as publish approximately 75 weekly newspapers, shoppers and niche publications that serve markets in the Midwest, Southwest and West.

TNI Partners

As a result of the acquisition of Pulitzer, we own a 50% interest in TNI, the Tucson, Arizona newspaper partnership. TNI, acting as agent for our subsidiary, Star Publishing Company (“Star Publishing”) and Citizen Publishing Company (“Citizen”), the owner of the remaining 50%, a subsidiary of Gannett Co., Inc., (“Gannett”). TNI is responsible for printing, delivery, advertising and subscription activities of the Arizona Daily Star and, until May 2009, the Tucson Citizen, as well as their related digital products and specialty publications. In May 2009, Citizen discontinued print publication of the Tucson Citizen and in 2014 stopped publishing its digital product.

TNI collects all receipts and income and pays substantially all operating expenses incident to the partnership's operations and publication of the newspaper and other media. Under the amended and restated operating agreement between Star Publishing and Citizen, the Arizona Daily Star remains the separate property of Star Publishing. Results of TNI are accounted for using the equity method. Income or loss of TNI (before income taxes) is allocated equally to Star Publishing and Citizen. TNI makes monthly distributions to Star Publishing and Citizen of all available cash.

Until the May 2009 discontinuation of print publication of the Tucson Citizen, TNI was subject to the provisions of the Newspaper Preservation Act of 1970, which permits joint operating agreements between newspapers under certain circumstances without violation of the Federal antitrust laws. Agency agreements generally allow newspapers operating in the same market to share certain printing and other facilities and to pool certain revenue and expenses in order to decrease aggregate expenses and thereby allow the continuing operation of multiple newspapers in the same market.

The TNI agency agreement (“Agency Agreement”), which remains in effect, has governed the operation since 1940. Both the Company and Citizen incur certain administrative costs and capital expenditures that are reported by their individual companies. The Agency Agreement expires in 2040, but contains an option, which may be exercised by either party, to renew the agreement for successive periods of 25 years each. Star Publishing and Citizen also have a reciprocal right of first refusal to acquire the 50% interest in TNI owned by Citizen and Star Publishing, respectively, under certain circumstances.

MADISON NEWSPAPERS

We own 50% of the capital stock of MNI and 17% of the non-voting common stock of The Capital Times Company (“TCT”). TCT owns the remaining 50% of the capital stock of MNI. MNI publishes daily and Sunday newspapers, and other publications in Madison, Wisconsin, and other Wisconsin locations, and supports their related digital products. MNI conducts business under the trade name Capital Newspapers. We have a contract to furnish the editorial and news content for the Wisconsin State Journal, which is published by MNI, and periodically provide other services to MNI. Results of MNI are accounted for using the equity method. Net income or loss of MNI (after income taxes) is allocated equally to the Company and TCT. MNI makes quarter dividend payments to the Company.

ADVERTISING AND MARKETING SERVICES

Approximately 64% of our 2015 revenue was derived from advertising and marketing services.

The following broadly define major categories of advertising and marketing services revenue:

Retail advertising is print or digital revenue earned from sales of display advertising space in the publication, or for preprinted advertising inserted in the publication, to local accounts or regional and national businesses with local retail operations.

Classified advertising, which includes employment, automotive, real estate for sale or rent, legal, obituaries and other categories, is revenue earned from sales of advertising space in these categories or from publications consisting primarily of such advertising. Classified publications offer advertisers a cost-effective local advertising vehicle and are particularly effective in larger markets with higher media fragmentation.

National advertising is revenue earned from print or digital display advertising space, or for preprinted advertising inserted in the publication for national accounts that do not have a local retailer representing the account in the market.

Digital advertising consists of display, banner, behavioral targeting, search, rich media, directories, classified or other advertising on websites or mobile devices associated and integrated with our print publications, other digital applications, or on third party affiliated websites, such as Yahoo! Inc. (“Yahoo!”). Digital advertising is reported in combination with print advertising in the retail, classified and national categories.

Niche publications are specialty publications, such as lifestyle, business, health or home improvement publications that contain significant amounts of advertising.

Marketing services includes a robust suite of custom digital marketing services that include: SEO, SEM, web and mobile production, social media services and reputation monitoring and management. Our services

also include media buying in audience extension networks (outside of those owned and operated by us) such as Centro Ad Lift, Google Ad Exchange and Facebook.

The advertising environment is influenced by the state of the overall economy, including retail sales, unemployment rates, inflation, energy prices and consumer interest rates. Our enterprises are primarily located in midsize and small markets. Historically these markets have been more stable than major metropolitan markets during downturns in advertising spending but may not experience increases in such spending as significant as those in major metropolitan markets in periods of economic improvement.

Several of our businesses operate in geographic groups of publications, or “clusters,” which provide operational efficiencies, extend sales penetration and provide broader audiences for advertisers. Operational efficiencies are obtained through consolidation of sales forces, back office operations such as finance, human resources, management and/or production of the publications. A table under the caption “Daily Newspapers and Markets” in Item 1, included herein, identifies those groups of our newspapers operating in clusters.

Our newspapers, classified and specialty publications, and digital products compete with newspapers having national or regional circulation, magazines, radio, network, cable and satellite television, other advertising media such as outdoor, mobile, and movie theater promotions, other classified and specialty publications, direct mail, directories, as well as national, regional and local advertising websites and content providers. Competition for advertising is based on audience size and composition, subscription levels, readership demographics, distribution and display mechanisms, price and advertiser results. In addition, several of our daily and Sunday newspapers compete with other local daily or weekly newspapers. We believe we capture a substantial share of the total advertising dollars spent in each of our markets.

The number of competitors in any given market varies. However, all of the forms of competition noted above exist to some degree in our markets, including those listed in the table under the caption “Daily Newspapers and Markets” in Item 1, included herein.

SUBSCRIPTION

Approximately 30% of our 2015 revenue was derived from subscriptions to our printed and digital products.

Subscription revenue is derived from the delivery of our leading local news, information and advertising content in print and digitally, via mobile devices and tablets. In 2014, we began the rollout of our full access subscription model that provides subscribers access to both the print and digital editions of our newspapers for one price. Digital only options are also available to subscribers.

AUDIENCES

Based on independent research, we estimate that, in an average week, our newspapers and digital products reach approximately 76% of adults in our larger markets. We also measure use of our daily newspapers for advertising, sports scores and entertainment listings ("print users").

Audience reach is summarized as follows:

|

| | | | | | | | | | |

| All Adults | |

(Percent, Past Seven Days) | 2015 |

| 2014 |

| 2013 |

| 2012 |

| 2011 |

|

| | | | | |

Print only | 31.3 |

| 33.1 |

| 36.9 |

| 37.8 |

| 43.4 |

|

Print and digital | 19.3 |

| 20.0 |

| 17.8 |

| 19.6 |

| 16.4 |

|

Digital only | 12.5 |

| 12.1 |

| 10.5 |

| 9.4 |

| 7.9 |

|

Total readership | 63.1 |

| 65.2 |

| 65.2 |

| 66.8 |

| 67.7 |

|

Print users | 12.8 |

| 13.0 |

| 13.9 |

| 14.7 |

| 14.5 |

|

Total reach | 75.9 |

| 78.2 |

| 79.1 |

| 81.5 |

| 82.2 |

|

| | |

|

|

|

|

|

|

Total print reach | 63.4 |

| 66.1 |

| 68.6 |

| 72.1 |

| 74.3 |

|

Total digital reach | 31.8 |

| 32.1 |

| 28.3 |

| 29.0 |

| 24.3 |

|

|

| | | | | | | | | | |

| Age 18-29 | |

(Percent, Past Seven Days) | 2015 |

| 2014 |

| 2013 |

| 2012 |

| 2011 |

|

| | | | | |

Print only | 19.5 |

| 20.3 |

| 30.7 |

| 29.4 |

| 33.0 |

|

Print and digital | 20.2 |

| 18.3 |

| 15.6 |

| 20.5 |

| 13.7 |

|

Digital only | 12.7 |

| 15.3 |

| 10.5 |

| 10.7 |

| 11.6 |

|

Total readership | 52.4 |

| 53.9 |

| 56.8 |

| 60.6 |

| 58.3 |

|

Print users | 19.5 |

| 19.5 |

| 22.0 |

| 23.7 |

| 21.1 |

|

Total reach | 71.9 |

| 73.4 |

| 78.8 |

| 84.3 |

| 79.4 |

|

| | |

|

|

|

|

|

|

Total print reach | 59.2 |

| 58.1 |

| 68.3 |

| 73.6 |

| 67.8 |

|

Total digital reach | 32.9 |

| 33.6 |

| 26.1 |

| 31.2 |

| 25.3 |

|

|

| |

Source: | Lee Enterprises Audience Report, Thoroughbred Research. January-June 2011-2015. |

Markets: | 11 largest markets in 2011-2015. |

Margin of Error: | Total sample +/- 1.1%, Total digital sample +/- 1.3% |

After advertising, subscriptions and single copy sales are our largest source of revenue. For the 13 weeks ended September 2015, our daily circulation units, which include TNI and MNI, as measured by the Alliance for Audited Media ("AAM") were 0.9 million and Sunday circulation units were 1.3 million.

Growth in audiences can, over time, also positively impact advertising revenue. Our strategies to improve audiences include continuous improvement of content and promotional efforts to expand our audience. Content can include focus on local news, features, scope of coverage, accuracy, presentation, writing style, tone and type style. Promotional efforts include advertising, contests and other initiatives to increase awareness of our products. Customer service can also influence subscriptions. The introduction in 2010, and continued improvement since, of new mobile and tablet applications has positively impacted our digital audiences.

We have historically experienced higher retention of customers using credit cards or bank account withdrawals, ("easy pay"). Accordingly we focus on our enterprises on increasing the number of easy pay subscribers. Other initiatives vary from location to location and are determined principally by our centralized consumer sales and marketing group in collaboration with local management. Competition for subscriptions is generally based on the content, journalistic quality and price of the publication.

Audience competition exists in all markets, from unpaid print and digital products, but is most significant in markets with competing local daily newspapers. These markets tend to be near major metropolitan areas, where the size of the population may be sufficient to support more than one daily newspaper.

Our subscription sales channels continue to evolve through an emphasis on targeted direct mail and email to acquire new subscribers and retain current subscribers.

DAILY NEWSPAPERS AND MARKETS

The Company, TNI and MNI publish the following daily newspapers and maintain the following primary digital sites: |

| | | | | | | | |

| | | Average Units (1) | | |

Newspaper | Primary Website | Location | Daily (2) |

| | Sunday |

| |

| | | | | | |

St. Louis Post-Dispatch (3) | stltoday.com | St. Louis, MO | 124,712 |

| | 405,843 |

| |

Capital Newspapers (4) | | | | | | |

Wisconsin State Journal | madison.com | Madison, WI | 67,965 |

| | 88,367 |

| |

Daily Citizen | wiscnews.com/bdc | Beaver Dam, WI | 6,564 |

| | — |

| |

Portage Daily Register | wiscnews.com/pdr | Portage, WI | 3,350 |

| | — |

| |

Baraboo News Republic | wiscnews.com/bnr | Baraboo, WI | 2,903 |

| | — |

| |

The Times | nwitimes.com | Munster, Valparaiso, and Crown Point, IN | 66,523 |

| | 77,082 |

| |

Arizona Daily Star (5) (3) | azstarnet.com | Tucson, AZ | 57,735 |

| | 102,595 |

| |

Lincoln Group | | | | | | |

Lincoln Journal Star | journalstar.com | Lincoln, NE | 47,831 |

| | 55,637 |

| |

Columbus Telegram | columbustelegram.com | Columbus, NE | 5,829 |

| | 6,984 |

| |

Fremont Tribune | fremonttribune.com | Fremont, NE | 5,430 |

| | — |

| |

Beatrice Daily Sun | beatricedailysun.com | Beatrice, NE | 3,989 |

| | — |

| |

Billings Gazette | billingsgazette.com | Billings, MT | 31,826 |

| | 35,798 |

| |

Central Illinois Newspaper Group | | | | | | |

The Pantagraph (3) | pantagraph.com | Bloomington, IL | 29,920 |

| | 32,577 |

| |

Herald & Review | herald-review.com | Decatur, IL | 21,869 |

| | 26,776 |

| |

Journal Gazette & Times-Courier | jg-tc.com | Mattoon/Charleston, IL | 9,660 |

| | — |

| |

Quad-Cities Group | | | | | | |

Quad-City Times | qctimes.com | Davenport, IA | 36,144 |

| | 46,339 |

| |

Muscatine Journal | muscatinejournal.com | Muscatine, IA | 5,980 |

| | — |

| |

The Courier | wcfcourier.com | Waterloo and Cedar Falls, IA | 35,179 |

| | 34,826 |

| |

Sioux City Journal | siouxcityjournal.com | Sioux City, IA | 23,486 |

| | 26,221 |

| |

The Post-Star | poststar.com | Glens Falls, NY | 21,608 |

| | 26,101 |

| |

The Bismarck Tribune | bismarcktribune.com | Bismarck, ND | 20,762 |

| | 23,790 |

| |

River Valley Newspaper Group | | | | | | |

La Crosse Tribune | lacrossetribune.com | La Crosse, WI | 20,347 |

| | 28,904 |

| |

Winona Daily News | winonadailynews.com | Winona, MN | 7,274 |

| | 8,445 |

| |

The Chippewa Herald | chippewa.com | Chippewa Falls, WI | 4,049 |

| | 3,946 |

| |

Missoula Group | | | | | | |

Missoulian | missoulian.com | Missoula, MT | 19,404 |

| | 23,350 |

|

|

Ravalli Republic | ravallinews.com | Hamilton, MT | 2,775 |

| (6) | 2,680 |

| (6) |

The Journal Times | journaltimes.com | Racine, WI | 19,343 |

| | 22,154 |

| |

Rapid City Journal | rapidcityjournal.com | Rapid City, SD | 18,644 |

| | 22,728 |

| |

Casper Star-Tribune | trib.com | Casper, WY | 17,053 |

| | 19,013 |

| |

The Daily News | tdn.com | Longview, WA | 16,572 |

| | 14,135 |

| |

Magic Valley Group | | | | | | |

The Times-News | magicvalley.com | Twin Falls, ID | 18,912 |

| | 16,289 |

| |

Elko Daily Free Press | elkodaily.com | Elko, NV | 4,344 |

| (6) | — |

| |

The Southern Illinoisan | thesouthern.com | Carbondale, IL | 16,336 |

| | 24,440 |

| |

The Daily Herald (3) | heraldextra.com | Provo, UT | 17,530 |

| | 32,125 |

| |

|

| | | | | | | | |

| Average Units (1) | | |

Newspaper | Primary Website | Location | Daily (2) |

| | Sunday |

| |

| | | | | | |

Helena/Butte Group | | | | | | |

Independent Record | helenair.com | Helena, MT | 12,016 |

| | 12,428 |

| |

The Montana Standard | mtstandard.com | Butte, MT | 9,995 |

| | 10,146 |

| |

The Sentinel | cumberlink.com | Carlisle, PA | 11,566 |

| | 9,107 |

| |

Globe Gazette | globegazette.com | Mason City, IA | 11,444 |

| | 14,381 |

| |

Mid-Valley News Group | | | | | | |

Albany Democrat-Herald | democratherald.com | Albany, OR | 10,514 |

| | 10,835 |

| |

Corvallis Gazette-Times | gazettetimes.com | Corvallis, OR | 8,176 |

| | 8,217 |

| |

Napa Valley Register (3) | napavalleyregister.com | Napa, CA | 10,000 |

| | 10,441 |

| |

Central Coast Newspapers | | | | | | |

Santa Maria Times (3) | santamariatimes.com | Santa Maria, CA | 10,780 |

| | 14,504 |

| |

The Lompoc Record (3) | lompocrecord.com | Lompoc, CA | 2,687 |

| | 2,665 |

| |

The Times and Democrat | thetandd.com | Orangeburg, SC | 7,948 |

| | 8,749 |

| |

Arizona Daily Sun (3) | azdailysun.com | Flagstaff, AZ | 8,443 |

| | 8,827 |

| |

The World (3) | theworldlink.com | Coos Bay, OR | 6,082 |

| | — |

| |

The Sentinel (3) | hanfordsentinel.com | Hanford, CA | 6,209 |

| | — |

| |

The Citizen | auburnpub.com | Auburn, NY | 6,403 |

| | 7,994 |

| |

The Ledger Independent | maysville-online.com | Maysville, KY | 4,864 |

| | — |

| |

Daily Journal (3) | dailyjournalonline.com | Park Hills, MO | 4,731 |

| | — |

| |

| | | 943,706 |

| | 1,325,439 |

| |

|

| |

(1) | Source: AAM: September 2015 Quarterly Data Report, unless otherwise noted. |

(2) | Not all newspapers are published Monday through Saturday |

(3) | Owned by Pulitzer, Inc. |

(4) | Owned by MNI. |

(5) | Owned by Star Publishing and published through TNI. |

(6) | Source: Company statistics. |

NEWSPRINT

The basic raw material of newspapers, and our other print publications, is newsprint. We purchase newsprint from U.S. and Canadian producers. We believe we will continue to receive a supply of newsprint adequate for our needs and consider our relationships with newsprint producers to be good. Newsprint purchase prices can be volatile and fluctuate based upon factors that include foreign currency exchange rates and both foreign and domestic production capacity and consumption. Price fluctuations can have a significant effect on our results of operations. We have not entered into derivative contracts for newsprint. For the quantitative impacts of these fluctuations, see Item 7A, “Quantitative and Qualitative Disclosures about Market Risk”, included herein.

EXECUTIVE TEAM

The following table lists our current executive team members:

|

| | | | |

Name | Age | Service With The Company | Named To Current Position | Current Position |

| | | | |

Mary E. Junck | 68 | June 1999 | January 2002 | Chairman, President and Chief Executive Officer |

| | | | |

Nathan E. Bekke | 46 | January 1992 | February 2015 | Vice President - Consumer Sales and Marketing |

| | | | |

Paul M. Farrell | 60 | October 2013 | October 2015 | Vice President - Sales and Marketing |

| | | | |

Suzanna M. Frank | 45 | December 2003 | March 2008 | Vice President - Audience |

| | | | |

Astrid J. Garcia | 65 | December 2006 | December 2013 | Vice President - Human Resources |

| | | | |

James A. Green | 49 | March 2013 | March 2013 | Vice President - Digital |

| | | | |

Michael R. Gulledge | 55 | October 1982 | October 2015 | Vice President - Advertising Sales Leadership |

| | | | |

John M. Humenik | 52 | December 1998 | February 2015 | Vice President - News |

| | | | |

Ronald A. Mayo | 54 | May 2015 | June 2015 | Vice President - Chief Financial Officer and Treasurer |

| | | | |

Kevin D. Mowbray | 53 | September 1986 | April 2015 | Executive Vice President and Chief Operating Officer |

| | | | |

Gregory P. Schermer | 61 | February 1989 | October 2012 | Vice President - Strategy |

| | | | |

Michele Fennelly White | 53 | June 1994 | June 2011 | Vice President - Information Technology and Chief Information Officer |

Mary E. Junck was elected Chairman, President and Chief Executive Officer in 2002. She was elected to the Board of Directors of the Company in 1999.

Nathan E. Bekke was appointed Vice President - Consumer Sales and Marketing in February 2015. From 2003 to February 2015, he served as Publisher of the Casper Star-Tribune.

Paul M. Farrell was appointed Vice President - Sales in October 2015. From October 2013 to October 2015, he served as Vice President - Digital Sales. From September 2012 to October 2013, he served as Publisher of the Connecticut Media Group of Hearst Media Services. From May 2007 to August 2012, he served as Vice President - Sales and Marketing of the Company.

Suzanna M. Frank was appointed Vice President - Audience in March 2008. From 2003 to March 2008 she served as Director of Research and Marketing of the Company.

Astrid J. Garcia was appointed Vice President - Human Resources in December 2013. From 2006 to November 2013 she served as Vice President of Human Resources, Labor Relations and Operations of the St. Louis Post-Dispatch.

James A. Green was appointed Vice President - Digital in March 2013. From June 2011 to March 2013, he served as Executive Vice President and General Manager of Travidia, Inc., a developer of newspaper digital shopping media and marketing programs. From 2004 to June 2011 he served as Chief Marketing Officer of Travidia, Inc.

Michael R. Gulledge was elected Vice President - Sales and Marketing in September 2012 and named Publisher of the Billings Gazette in 2000. From 2005 to September 2012 he served as a Vice President - Publishing.

John M. Humenik was appointed Vice President - News in February 2015. He is also president and publisher of the Wisconsin State Journal and president of Madison Newspapers Inc., a role he has held since 2013. He was publisher and editor of the Arizona Daily Star from 2005 to 2010 and additionally served president of Tucson Newspapers Inc until 2013.

Ronald A. Mayo was elected Vice President, Chief Financial Officer and Treasurer in June 2015. Prior to joining the Company, he was Chief Financial Officer of Halifax Media Group from July 2014 to January 2015 and previously served MediaNews Group, Inc, most recently as Vice President and Chief Financial Officer.

Kevin D. Mowbray was elected Executive Vice President and Chief Operating Officer in April 2015. From May 2013 to April 2015 he served as Vice President and Chief Operating Officer. From 2004 to May 2013 he served as a Vice President - Publishing and was Publisher of the St. Louis Post-Dispatch from 2006 until May 2013.

Gregory P. Schermer was elected Vice President - Strategy in October 2012. From 1997 to October 2012 he served as Vice-President - Interactive Media. He was elected to the Board of Directors of the Company in 1999.

Michele Fennelly White was appointed Vice President - Information Technology and Chief Information Officer in June 2011. From 1999 to June 2011, she served as Director of Technical Support.

Ms. Junck and Messrs. Farrell, Green, Gulledge, Mayo, Mowbray and Schermer have been designated by the Board of Directors as executive officers for United States Securities and Exchange Commission ("SEC") reporting purposes.

EMPLOYEES

At September 27, 2015, we had approximately 4,500 employees, including approximately 1,200 part-time employees, exclusive of TNI and MNI. Full-time equivalent employees in 2015 totaled approximately 4,200. We consider our relationships with our employees to be good.

Bargaining units represent 385, or 69%, of the total employees of the St. Louis Post-Dispatch, which has six contracts with bargaining units with expiration dates through September 2018.

Approximately 37 employees in three additional locations are represented by collective bargaining units.

CORPORATE GOVERNANCE AND PUBLIC INFORMATION

We have a long, substantial history of sound corporate governance practices. Our Board of Directors has a lead independent director, and has had one for many years. Currently, eight of ten members of our Board of Directors are independent, as are all members of the Board's Audit, Executive Compensation and Nominating and Corporate Governance committees. The Audit Committee approves all services to be provided by our independent registered public accounting firm and its affiliates.

At www.lee.net, one may access a wide variety of information, including news releases, SEC filings, financial statistics, annual reports, investor presentations, governance documents, newspaper profiles and digital links. We make available via our website all filings made by the Company under the Securities Exchange Act of 1934 (the "Exchange Act"), including Forms 10-K, 10-Q and 8-K, and related amendments, as soon as reasonably practicable after they are filed with, or furnished to, the SEC. All such filings are available free of charge. The content of any website referred to in this Annual Report is not incorporated by reference unless expressly noted.

ITEM 1A. RISK FACTORS

Risk exists that our past results may not be indicative of future results. A discussion of our risk factors follows. See also, “Forward-Looking Statements”, included herein. In addition, a number of other factors (those identified elsewhere in this document) may cause actual results to differ materially from expectations.

DEBT AND LIQUIDITY

We May Have Insufficient Earnings Or Liquidity To Meet Our Future Debt Obligations

We have a substantial amount of debt, as discussed more fully (and certain capitalized terms used below defined) in Item 7,"Liquidity" and Note 5 of the Notes to Consolidated Financial Statements, included herein. Since February 2009, we have satisfied all interest payments and substantially all principal payments due under our debt facilities with our cash flows and asset sales.

As of September 27, 2015, our debt consists of the following:

| |

• | $400,000,000 aggregate principal amount of 9.5% Senior Secured Notes (the “Notes”), pursuant to an Indenture dated as of March 31, 2014 (the “Indenture”); |

| |

• | $250,000,000 first lien term loan (the "1st Lien Term Loan") and $40,000,000 revolving facility (the "Revolving Facility") under a First Lien Credit Agreement dated as of March 31, 2014 (together, the “1st Lien Credit Facility”), of which $180,872,000 is outstanding at September 27, 2015; and |

| |

• | $150,000,000 second lien term loan under a Second Lien Loan Agreement dated as of March 31, 2014 (the “ 2nd Lien Term Loan”), of which $145,000,000 is outstanding at September 27, 2015. |

Our ability to make payments on our indebtedness will depend on our ability to generate future cash flows from operations. Cash generated from future asset sales could serve as an additional source of repayment. This ability, to a certain extent, is subject to general economic, financial, competitive, business, legislative, regulatory and other factors that are beyond our control.

At September 27, 2015, after consideration of letters of credit, we have approximately $32,935,000 available for future use under our Revolving Facility. Including cash, our liquidity at September 27, 2015 totals $44,069,000. This liquidity amount excludes any future cash flows. Our unlevered free cash flow(1) has been strong for the last seven years and has exceeded $149,000,000 in each year from 2011 through 2015, but there can be no assurance that such cash flows will continue. We expect all interest and principal payments due in the next twelve months will be satisfied by our continuing cash flows and certain asset sales, which will allow us to maintain an adequate level of liquidity.

At September 27, 2015, the principal amount of our outstanding debt totals $725,872,000. At September 27, 2015, our debt, net of cash, is 4.4 times our 2015 adjusted EBITDA(1), compared to a ratio of 4.7 times at September 28, 2014.

Final maturities of our debt are March 2019 through December 2022. As a result, refinancing risk has been substantially reduced for the next several years.

There are numerous potential consequences under the Notes, 1st Lien Credit Facility, 2nd Lien Term Loan, if an event of default, as defined, occurs and is not remedied. Many of those consequences are beyond our control. The occurrence of one or more events of default would give rise to the right of the applicable lenders to exercise their remedies under the Notes, 1st Lien Credit Facility, 2nd Lien Term Loan, respectively, including, without limitation, the right to accelerate all outstanding debt and take actions authorized in such circumstances under applicable collateral security documents.

(1) See "Non-GAAP Financial Measures: in Item 7, included herein, for additional information.

Our ability to operate as a going concern is dependent on our ability to remain in compliance with debt covenants and to refinance or amend our debt agreements as they become due, if necessary. The Notes, 1st Lien Credit Facility and 2nd Lien Term Loan have only limited affirmative covenants with which we are required to maintain compliance. We are in compliance with our debt covenants at September 27, 2015.

ECONOMIC CONDITIONS

General Economic Conditions May Continue To Impact Our Revenue And Operating Results

According to the National Bureau of Economic Research, the United States economy was in a recession from December 2007 until June 2009. Our revenue, operating results and cash flows were significantly impacted by the recession and

its aftermath. The duration and depth of an economic recession, and pace of economic recovery, in markets in which we operate, may influence our future results.

OPERATING REVENUE

Our Revenue May Not Return To Historical Levels

A significant portion of our revenue is derived from advertising. The demand for advertising is sensitive to the overall level of economic activity, both locally and nationally. Newspaper publishing is both capital and labor intensive and, as a result, newspapers may not be able to quickly reduce cost. Accordingly, changes in advertising and circulation revenue could have a disproportionate effect on our results of operations.

Operating revenue in most categories has decreased since 2007 and may decrease in the future. Such decreases may not be offset by growth in advertising in other categories, such as digital revenue which has been rising since 2010. Historically, newspaper publishing has been viewed as a cost-effective method of delivering various forms of advertising. There can be no guarantee that this historical perception will guide future decisions on the part of advertisers. Web sites and applications for mobile devices distributing news and other content continue to gain popularity. As a result, audience attention and advertising spending are shifting and may continue to shift from traditional media to digital media. As media audiences fragment, we expect that advertisers will allocate greater portions of their future budgets to digital media, which can offer more measurable returns than traditional print media through pay for performance and keyword-targeted advertising. If our efforts to adapt to evolving technological developments in the media industry are unsuccessful, or if we fail to correctly anticipate shifts in audience demand and digital media trends, we may be unable to provide the services, media and content that audiences and potential audiences in our markets prefer and we may be unable to provide the returns on ad spending that our advertisers seek. This increased competition has had, and may continue to have, an adverse effect on our business and financial results. The digital media industry experiences additional competitive challenges because barriers to entry can be low and geographic location is less relevant.

Technological developments also pose other challenges that could adversely affect our revenue and competitive position. New delivery platforms may lead to pricing restrictions and the loss of a direct relationship with consumers. We may also be adversely affected if the use of technology developed to block the display of advertising on websites and other digital platforms proliferates.

The rates we charge for advertising are, in part, related to the size of the audience of our publications and digital products. There is significant competition for readers and viewers from other media. Our business may be adversely affected to the extent individuals decide to obtain news, entertainment, classified listings and local shopping information from digital or other media, to the exclusion of our outlets for such information.

Retail Advertising

Many advertisers, including major retail store chains, automobile manufacturers and dealers, banks and telecommunications companies, have experienced significant merger and acquisition activity over the last several years, and some have gone out of business, effectively reducing the number of brand names under which the merged entities operate. Changes in the economy and consumer shopping habits such as the increasing use of online shopping, drive advertising spending and retailers approach to advertising and marketing their goods and services.

Classified Advertising

Classified advertising is the category that has been most significantly impacted by changing advertising trends and the increase in digital/classified advertising competitors. All categories of classified advertising have generally declined since 2007.

See "Advertising and Marketing Services” in Item 1, included herein, for additional information on the risks associated with advertising revenue.

Subscription Revenue

Advertising and subscription revenue is affected by readership of our print publications and digital products. Although our aggregate print and digital audience is relatively stable, subscription sales have nonetheless been declining for

many years, reflecting general trends in the newspaper industry, including consumer migration toward digital platforms and other media for news and information. The possibility exists that future subscription price increases may be difficult to accomplish or maintain as a result of future declines in subscription sales, and that price decreases may be necessary to retain or grow subscription volume. We are maintaining our share of audience through digital audience growth and strong print newspaper readership.

In addition, as audience attention increasingly focuses on digital media, print circulation of our newspapers may be adversely affected, which may decrease subscription revenue and exacerbate declines in print advertising. We face increasing competition from other digital sources for subscription revenue. This competition has intensified as a result of the continued development of digital media technologies. To maintain our subscription base, we may be required to incur additional costs that we may not be able to recover through subscription and advertising revenue. We may not be able to achieve a profitable balance between subscription levels and advertising revenue. In addition, if we are not successful in growing our digital businesses, including digital subscription revenue, to offset declines in revenue from our print products, our business, financial condition and prospects will be adversely affected.

In 2011, we began introducing charges for access to digital content using a metered model in certain of our markets and ended free, unlimited access to those newspapers’ websites. In 2014, we began the transition of our subscriptions to full access, including the printed edition, desktop, mobile and tablet. Our ability to build a subscriber base on our digital platforms through these packages depends on market acceptance, consumer habits, pricing, an adequate digital infrastructure, terms of delivery platforms and other factors. In addition, the metered model and/or the price increases may result in fewer page views or unique visitors to our digital platforms if viewers are unwilling to pay to gain access to our digital content. Stagnation, or a decline in traffic levels, may adversely affect our advertiser base and advertising rates and result in a decline in digital revenue.

See "Audiences” in Item 1, included herein, for additional information on the risks associated with subscription revenue.

If We Are Not Successful In Growing Our Digital Business, Our Business, Financial Condition, Results Of Operations And Prospects Could Be Adversely Affected

Our future performance depends to a significant degree upon the development and management of our digital business. The growth of our digital business over the long term depends on various factors, including, among other things, the ability to:

| |

• | Continue to increase digital audiences; |

| |

• | Attract advertisers to our digital platforms; |

| |

• | Maintain or increase the advertising rates on our digital platforms; |

| |

• | Exploit new and existing technologies to distinguish our products and services from those of competitors and develop new content, products and services; |

| |

• | Invest funds and resources in digital opportunities; and |

| |

• | Partner with, or use services from, providers that can assist us in effectively growing our digital business. |

In addition, we expect that our digital business will continue to increase as a percentage of our total revenue. In 2015, total digital revenue (including revenue from digital subscriptions) comprised 18.0% of total revenue, as compared to 13.8% in 2014. As our digital business becomes a greater portion of our overall business, we will face a number of increased risks from managing our digital operations, including, but not limited, to the following:

| |

• | Continuing training of our sales force to more effectively sell advertising in the digital advertising arena versus our historical print advertising business; |

| |

• | Attracting and retaining employees with skill sets and the knowledge base needed to successfully operate our digital business; and |

| |

• | Managing the transition to a digital business from a historically print-focused business. |

OPERATING EXPENSES

We May Not Be Able To Reduce Future Expenses To Offset Potential Revenue Declines

We reduced cash costs of our continuing operations (compensation, newsprint and ink, other operating expenses and workforce adjustments) significantly since 2011. Such expense reductions are not expected to significantly impact our ability to deliver advertising, news or other content to our customers. As a result of the significantly reduced cost structure to date, future cost reductions may not be as significant.

Newsprint comprises a significant amount of our operating costs. See “Newsprint” in Item 1, and “Commodities” in Item 7A, included herein, for additional information on the risks associated with changes in newsprint costs.

In addition, technological developments and changes we need to make to our business, may require significant capital investments. We may be limited in our ability to invest funds and resources in digital products, services or opportunities, and we may incur costs of research and development in building and maintaining the necessary and continually evolving technology infrastructure. As a result, our digital business could suffer if we are unable to make the investments.

We May Incur Additional Non-Cash Impairment Charges

We have significant amounts of goodwill and identified intangible assets. Since 2007 we have recorded impairment charges totaling almost $1.3 billion to reduce the value of certain of these assets. Should general economic, market or business conditions decline, and have a negative impact on our stock price or projected future cash flows, we may be required to record additional impairment charges in the future. Such charges would not impact our cash flows or debt covenant compliance. See “Critical Accounting Policies” in Item 7, included herein, for additional information on the risks associated with such assets.

Sustained Increases In Funding Requirements Of Our Pension and Postretirement Obligations

May Reduce The Cash Available For Our Business

Pension liabilities, net of plan assets, totaled $52.5 million at September 27, 2015. Contributions to pension plans are expected to total $5.8 million in 2016. At September 27, 2015 the assets of our postretirement plans exceeded plan liabilities by $13.4 million.

Our pension and postretirement plans invest in a variety of equity and debt securities. Future volatility and disruption in the securities markets could cause declines in the values of our pension assets. In addition, a decrease in the discount rates used to determine the liability for obligations could result in increased future contributions. If either occurs, we may need to make additional cash contributions above what is currently estimated, which could reduce the cash available for our business. Moreover, under the Pension Protection Act of 2006 (the "PPA"), future losses of asset value may necessitate accelerated funding of pension plans in the future to meet minimum federal statutory requirements. Legislation passed in 2012, 2014 and 2015 temporarily reduced funding requirements for our pension plans, but those payments will eventually need to be restored unless discount rates and/or plan assets increase.

We used new mortality assumptions to value our pension and postretirement liabilities at September 28, 2014, which increased such liabilities, in total, by approximately $18.5 million, with a corresponding decrease in accumulated other comprehensive income in our Consolidated Balance Sheet as of that date.

We Expect To Be Subject To Withdrawal Liability In Connection With One Multiemployer Pension Plan And May Be Subject To Additional Withdrawal Liabilities In Connection With Other Multiemployer Pension Plans, Which May Reduce The Cash Available For Our Business

Pursuant to our collective bargaining obligations, we contribute to three multiemployer pension plans on behalf of certain of our employees. Based on the most recent communications from the plans’ administrators, two of these plans are currently in “critical” status, as that term is used in relation to such plans under the PPA. For plans that are in critical status, benefit reductions may apply and/or we could be required to make additional contributions.

One of our enterprise's bargaining units withdrew from representation, and as a result we will be subject to a future claim from the multiemployer pension plan for a withdrawal liability. The amount of such liability, if any, will be dependent

on actions taken, or not taken, by the Company and the pension plan, as well as the future investment performance and funding status of the pension plan. The withdrawal liability is expected to be funded over a 20 year period.

If, we were to withdraw from one of these plans or trigger a partial withdrawal due to declines in contribution base units, and the plan had unfunded vested benefits at the time of our withdrawal or partial withdrawal, we could incur a significant plan withdrawal liability, which could reduce the cash available for our business.

EQUITY CAPITAL

A Decrease In Our Stock Price May Limit The Ability To Trade Our Stock

Or For The Company To Raise Equity Capital

Under the NYSE listing standards, if our common stock fails to maintain an adequate per share price and our total market capitalization falls below $50.0 million, our common stock could be removed from the NYSE and traded in the over the counter market. In July 2011, the NYSE notified us that our common stock did not meet the NYSE continued listing standards due to the failure to maintain an adequate share price. Under the NYSE rules, our common stock was allowed to continue to be listed during a cure period. In February 2012, after completing our debt refinancing, the NYSE notified us that we were again in compliance with the minimum closing price standard. In January 2013, the NYSE notified us that we had returned to full compliance with all continued listing standards. However, there can be no assurance that we will continue to be able to meet these listing standards, and the removal of our common stock from the NYSE could adversely affect our ability to raise equity capital.

OTHER

Cybersecurity Risks Could Harm Our Ability To Operate Effectively

In the 13-weeks ended September 27, 2015, 19.9% of our revenue was obtained from digital sources, including advertising, subscriptions and one of our businesses, TownNews.com, that provides digital infrastructure and digital publishing services for us and other companies.

We use computers and digital technology in substantially all aspects of our business operations. Such uses give rise to cybersecurity risks, including the misappropriation of personally identifiable information that we store and manage and disabling or taking over of our websites. We have preventive systems and processes in place to protect against the risk of cyber incidents. However, the techniques used to obtain unauthorized access and to disable systems and websites change frequently and may be difficult to detect for long periods of time. There can be no assurance that we, or the security systems we implement, will protect against all of these rapidly changing risks. Prolonged system outages or a cyber incident that goes undetected could reduce our print and/or digital revenue, increase our operating costs, disrupt our operations, harm our reputation, lead to legal exposure to customers and/or subject us to liability under laws and regulations that protect personal data. We maintain insurance coverage against certain of such risks, but cannot guarantee that such coverage will be applicable or sufficient with respect to any given incident.

We May Not Be Able To Protect Our Intellectual Property Rights, Which May Adversely Affect Our Business

Our business depends on our intellectual property, including our valuable brands and content. We believe our proprietary trademarks and other intellectual property rights are important to our continued success and our competitive position.

Unauthorized parties may attempt to copy or otherwise obtain and use our content or infringe upon, dilute, reproduce, misappropriate or otherwise violate our intellectual property. There can be no assurance that the steps we have taken to protect our proprietary rights will be successful in any given case.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our executive offices are located in leased facilities at 201 North Harrison Street, Suite 600, Davenport, Iowa. The initial lease term expires in 2019.

All of our principal printing facilities are owned, except Madison, Wisconsin (which is owned by MNI), Tucson (which is jointly owned by Star Publishing and Citizen), St. Louis (as described below) and leased land for the Helena, Montana plant. All facilities are well maintained, in good condition, suitable for existing office and publishing operations, as applicable, and adequately equipped. With the exception of St. Louis, none of our facilities is individually significant to our business.

Information related to St. Louis facilities at September 27, 2015 is as follows:

|

| | | | |

(Square Feet) | Owned |

| Leased |

|

| | |

PD LLC | 726,000 |

| 6,000 |

|

Suburban Journals | 9,000 |

| 4,000 |

|

Nearly 42% of our daily newspapers, as well as many of our nearly 300 other publications, are printed at other Company facilities, or such printing is outsourced, to enhance operating efficiency. We are continuing to evaluate additional insourcing and outsourcing opportunities in order to more effectively manage our operating and capital costs.

Our newspapers and other publications have formal or informal backup arrangements for printing in the event of a disruption in production capability.

ITEM 3. LEGAL PROCEEDINGS

We are involved in a variety of other legal actions that arise in the normal course of business. Insurance coverage mitigates potential loss for certain of these other matters. While we are unable to predict the ultimate outcome of these other legal actions, it is our opinion that the disposition of these matters will not have a material adverse effect on our Consolidated Financial Statements, taken as a whole.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock is listed on the NYSE. In March 2011, in accordance with sunset provisions established in 1986, we effected conversion of all outstanding shares of Class B Common Stock to Common Stock. The table below includes the high and low prices of Common Stock for each calendar quarter during the past three years and the closing price at the end of each quarter.

|

| | | | | | | | | | | |

| Quarter Ended | |

(Dollars) | December |

| | March |

| | June |

| | September |

|

| | | | | | | |

2015 | | | | | | | |

High | 3.93 |

| | 3.73 |

| | 3.55 |

| | 3.40 |

|

Low | 3.07 |

| | 2.74 |

| | 2.78 |

| | 1.36 |

|

Closing | 3.68 |

| | 3.17 |

| | 3.33 |

| | 2.08 |

|

| | | | | | | |

2014 | | | | | | | |

High | 3.92 |

| | 5.42 |

| | 4.78 |

| | 4.72 |

|

Low | 2.60 |

| | 3.30 |

| | 3.81 |

| | 3.24 |

|

Closing | 3.47 |

| | 4.47 |

| | 4.45 |

| | 3.38 |

|

| | | | | | | |

2013 | | | | | | | |

High | 1.75 |

| | 1.48 |

| | 2.18 |

| | 3.20 |

|

Low | 1.10 |

| | 1.15 |

| | 1.21 |

| | 2.03 |

|

Closing | 1.14 |

| | 1.27 |

| | 2.04 |

| | 2.70 |

|

Under the NYSE listing standards, if our Common Stock fails to maintain an adequate per share price and total market capitalization of less than $50,000,000, our Common Stock could be removed from the NYSE and traded in the over the counter market. In July 2011, the NYSE notified us that our Common Stock did not meet the NYSE continued listing standards due to the failure to maintain an adequate share price. Under the NYSE rules, our Common Stock was allowed to continue to be listed during a cure period. In February 2012, after completing our debt refinancing, the NYSE notified us that we were again in compliance with the minimum closing price standard. In January 2013, the NYSE notified us that we had returned to full compliance with all continued listing standards.

At September 27, 2015, we had 6,444 holders of record of our Common Stock.

Our debt agreements generally limit our ability to pay dividends and repurchase Common Stock unless in each case no default has occurred and we have satisfied certain financial measurements. See Note 5 of the Notes to Consolidated Financial Statements, included herein.

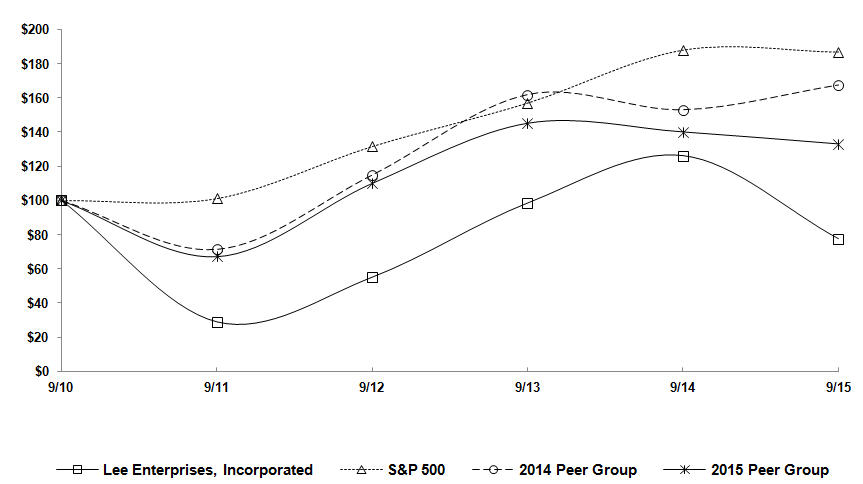

PERFORMANCE PRESENTATION

The following graph compares the percentage change in the cumulative total return of the Company, the Standard & Poor's ("S&P") 500 Stock Index, and a peer group index, in each case for the five years ended September 30, 2015 (with September 30, 2010 as the measurement point). Total return is measured by dividing (a) the sum of (i) the cumulative amount of dividends declared for the measurement period, assuming dividend reinvestment and (ii) the difference between the issuer's share price at the end and the beginning of the measurement period, by (b) the share price at the beginning of the measurement period.

Copyright©: 2015 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

The value of $100 invested on September 30, 2010 in stock of the Company, the Old Peer Group Index, New Peer Group Index and in the S&P 500 Stock Index, including reinvestment of dividends, is summarized in the table below.

|

| | | | | | | | | | | | | | | | | |

| September 30 | |

(Dollars) | 2010 |

| | 2011 |

| | 2012 |

| | 2013 |

| | 2014 |

| | 2015 |

|

| | | | | | | | | | | |

Lee Enterprises, Incorporated | 100.00 |

| | 29.10 |

| | 55.22 |

| | 98.51 |

| | 126.12 |

| | 77.61 |

|

Old Peer Group Index | 100.00 |

| | 71.47 |

| | 114.97 |

| | 161.90 |

| | 153.06 |

| | 167.52 |

|

New Peer Group Index | 100.00 |

| | 67.23 |

| | 110.16 |

| | 145.34 |

| | 140.23 |

| | 133.23 |

|

S&P 500 Stock Index | 100.00 |

| | 101.14 |

| | 131.69 |

| | 157.17 |

| | 188.18 |

| | 187.02 |

|

The S&P 500 Stock Index includes 500 U.S. companies in the industrial, transportation, utilities and financial sectors and is weighted by market capitalization. The New Peer Group Index is comprised of three U.S. publicly traded companies with significant newspaper publishing operations (excluding the Company) and is weighted by market capitalization. The New Peer Group Index includes A.H. Belo Corp., The McClatchy Company and The New York Times Company, all of which were included in the Old Peer Group Index. The E.W. Scripps Company which is included in the Old Peer Group Index, has been excluded from the New Peer Group Index due to the spin-off of its newspaper publishing business in 2015.

ITEM 6. SELECTED FINANCIAL DATA

Selected financial data is as follows:

|

| | | | | | | | | | | | | | |

(Thousands of Dollars and Shares, Except Per Common Share Data) | 2015 |

| | 2014 |

| | 2013 |

| | 2012 |

| | 2011 |

|

| | | |

| | |

| | |

| | |

|

OPERATING RESULTS (1) (2) | | | |

| | |

| | |

| | |

|

| | | | | | | | | |

Operating revenue | 648,543 |

| | 660,877 |

| | 677,774 |

| | 709,580 |

| | 726,032 |

|

Operating expenses, excluding depreciation, amortization, and impairment of intangible and other assets | 501,760 |

| | 505,822 |

| | 517,047 |

| | 546,863 |

| | 563,540 |

|

Depreciation and amortization | 45,563 |

| | 48,511 |

| | 55,527 |

| | 65,191 |

| | 69,244 |

|

Loss (gain) on sales of assets, net | 106 |

| | (1,338 | ) | | 110 |

| | (52 | ) | | 252 |

|

Impairment of intangible and other assets (3) | — |

| | 2,980 |

| | 171,094 |

| | 1,388 |

| | 204,289 |

|

Curtailment gains | — |

| | — |

| | — |

| | — |

| | 16,137 |

|