UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2016

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-6549

AMERICAN SCIENCE AND ENGINEERING, INC.

(Exact name of registrant as specified in its charter)

|

Massachusetts |

|

04-2240991 |

|

829 Middlesex Turnpike, |

|

01821 |

(978) 262-8700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock ($.66 2/3 par value) |

|

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting stock held by non-affiliates of the registrant, computed using the closing sale price of its common stock of $35.56 on September 30, 2015, was $250,549,000.

7,138,104 shares of registrant’s common stock were outstanding on July 14, 2016.

AMERICAN SCIENCE AND ENGINEERING, INC.

FORM 10-K/A

FOR THE PERIOD ENDED MARCH 31, 2016

American Science and Engineering, Inc. and its subsidiaries (referred to herein as “AS&E”, the “Company”, “we”, and “us”) is filing this Amendment No. 1 (this “Form 10-K/A”) to its Annual Report on Form 10-K for the fiscal year ended March 31, 2016 (the “Original Form 10-K”) as originally filed with the Securities and Exchange Commission (the “SEC”) on May 24, 2016. The Company is filing this Form 10-K/A solely for the purpose of including in Part III (Items 10, 11, 12, 13, and 14) which was previously omitted from the Form 10-K in reliance on General Instruction G(3) to Form 10-K. Accordingly, we hereby amend and replace in its entirety Part III of the Form 10-K as well as amend the cover page to remove the statement that information is being incorporated by reference from the Company’s definitive proxy statement.

No attempt has been made in this Form 10-K/A to modify or update the other disclosures presented in the Original Form 10-K, including, without limitation, the financial statements. This Form 10-K/A does not reflect events occurring after the filing of the Original Form 10-K or modify or update the disclosures in the Original Form 10-K, except as set forth in this Form 10-K/A, and should be read in conjunction with the Original Form 10-K and the Company’s other filings with the SEC.

In addition, pursuant to the rules of the SEC, Item 15 of Part IV has been amended to include the currently dated certifications of AS&E’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of AS&E’s principal executive officer and principal financial officer are filed with this Form 10-K/A as Exhibits 31.3 and 31.4 hereto. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. We are not including the certificate under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Form 10-K/A.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Board of Directors

The following table sets forth for each member of the Board of Directors of the Company his or her position with the Company as of July 14, 2016.

|

Name |

|

Age |

|

Positions and Offices of |

|

Date Assumed |

|

Charles P. Dougherty |

|

54 |

|

Director |

|

April 2013 |

|

Hamilton W. Helmer |

|

69 |

|

Chair Director |

|

September 2015 |

|

Don R. Kania |

|

61 |

|

Director |

|

February 2010 |

|

John P. Sanders |

|

52 |

|

Director |

|

May 2015 |

|

Robert N. Shaddock |

|

58 |

|

Director |

|

June 2014 |

|

Mark S. Thompson |

|

59 |

|

Director |

|

November 2005 |

|

Jennifer L. Vogel |

|

54 |

|

Director |

|

April 2013 |

Charles P. Dougherty has been a director of the Company since April 2013. Since April 2013, Mr. Dougherty has also held the position of president and chief executive officer of the Company. From 2010 to 2012, Mr. Dougherty served as president of the Communications and Industrial segment of TE Connectivity, Ltd., formerly Tyco Electronics Corporation, one of the world’s largest providers of connectivity solutions in the industrial, telecommunications, consumer-electronics, medical devices and solar energy markets. In 2009, Mr. Dougherty served as president of the Public Safety and Professional Communications business unit of Harris Corporation, after Harris Corporation acquired the business unit from Tyco Electronics Corporation. From 2006 to

2009, Mr. Dougherty served as president of the Wireless Systems segment of Tyco Electronics Corporation. Mr. Dougherty received a master’s degree in business administration from Villanova University and a bachelor’s degree in business administration from the Wharton School of the University of Pennsylvania.

We believe that Mr. Dougherty is qualified to serve as a director due to his position as President and Chief Executive Officer of the Company and his more than 30 years of valuable experience in building successful global technology businesses.

Mr. Hamilton W. Helmer has been a director of the Company since February 1993. Since June 2012, Mr. Helmer has served as managing partner and chief investment officer of Strategy Capital LLC (the general partner for Strategy Capital Investors, LP, an investment partnership). Since 2002, he has been the managing director of Deep Strategy LLC (a strategy consulting firm). From 1982 until 2002, Mr. Helmer served as managing partner of Helmer & Associates, Deep Strategy’s predecessor firm. Since September 2008, Mr. Helmer has taught business strategy in the Economics Department of Stanford University. Mr. Helmer is a Phi Beta Kappa graduate of Williams College and received his Ph.D. in economics from Yale University.

We believe that Mr. Helmer is qualified to serve as a director due to his background in business strategy for high technology and security companies and his knowledge of finance, corporate mergers and acquisitions and equity markets.

Dr. Don R. Kania has been a director of the Company since February 2010. Since 2006, he has been president, chief executive officer and director of FEI Company (a provider of diversified scientific instruments including electron and ion-beam microscopes and tools for nanoscale applications). From 2004 to 2006, Dr. Kania served as president and chief operating officer of Veeco Instruments Inc. (a provider of metrology and process equipment used by manufacturers in the data storage, semiconductor and compound semiconductor/wireless industries) having also been president from 2003 to 2004. Dr. Kania received his bachelors of science, master of science, and Ph.D. degrees in physics and engineering from the University of Michigan.

We believe that Dr. Kania is qualified to serve as a director due to his experience as a chief executive officer and chief operating officer in manufacturing and high technology companies and because of his knowledge of physics and engineering.

John P. Sanders has been a director of the Company since May 2015. Mr. Sanders served as assistant administrator and chief technology officer of the Transportation Security Administration from August 2012 to December 2014 and prior to that served as deputy assistant administrator since June 2010. Previously, he was co-founder and executive vice president of Reveal Imaging Technologies, Inc., (a leading threat detection products and services company with a focus on risk management, threat detection and security enhancement for the transportation industry) from January 2003 to May 2010. Mr. Sanders holds a Bachelor of Science degree in physics from the University of California San Diego and received a master of science degree in physics from San Diego State University.

We believe that Mr. Sanders is qualified to serve as a director due to his broad private and public security industry expertise and his experience as an innovator in leading the evolution of transportation security technology, as well as his expertise in business strategy, government contracts and operations.

Robert N. Shaddock has been a director of the Company since June 2014. Since January 2012, Mr. Shaddock has served as executive vice president and chief technology officer of TE Connectivity Ltd. (a manufacturer of connectivity and sensor solutions), and prior to that served as senior vice president and chief technology officer since September 2008. Previously, he was senior vice president of the Consumer Products business at Motorola from August 2007 to August 2008 and prior to that he was chief technology officer for Motorola’s Mobile Devices business since January 2004. Mr. Shaddock holds a bachelor’s degree in engineering science from the University of Oxford, UK.

We believe that Mr. Shaddock is qualified to serve as a director due to his expertise in technology strategy and product development, as well as executive senior management experience with global companies.

Dr. Mark S. Thompson has been a director of the Company since November 2005. Since May 2008, Dr. Thompson has been chairman of the board of Fairchild Semiconductor International, Inc. (a supplier of high performance power and mobile products semiconductors) having also served as president and chief executive officer since 2005. From 2001 to 2004, Dr. Thompson held the position of chief executive officer of Big Bear Networks, Inc., (a designer and manufacturer of optoelectronic network solutions). Dr. Thompson holds a bachelor of arts degree in chemistry from State University of New York and a Ph.D. in inorganic chemistry from the University of North Carolina.

We believe that Dr. Thompson is qualified to serve as a director due to his experience as a chief executive officer in manufacturing and high technology companies.

Jennifer L. Vogel has been a director of the Company since April 2013. Ms. Vogel served as senior vice president, general counsel, secretary and chief compliance officer of Continental Airlines, Inc. from 2003 to 2010, when it merged with United Airlines, Inc., having been general counsel and chief compliance officer from 2001 to 2003. Ms. Vogel currently serves on the board of directors of Virgin America and AAR Corp. (commercial airline companies). Ms. Vogel was a member of the board of Clearwire Corporation from April 2011 until its acquisition by Sprint in July 2013. Ms. Vogel holds a bachelor’s degree in business administration from the University of Iowa and holds a juris doctorate from the University of Texas at Austin.

We believe that Ms. Vogel is qualified to serve as a director due to her significant experience in advising boards on best governance practices and executive compensation, as well as her experience in international business and regulatory issues, corporate finance, mergers and acquisitions, and ethics and compliance matters.

Executive Officers (who are not also Directors)

The names of, and certain information with respect to, each person serving as an executive officer of the Company as of July 14, 2016 (other than Mr. Dougherty, whose information appears above) are as follows:

|

Name |

|

Age |

|

Positions and Offices of Company Held |

|

Date Assumed |

|

Diane J. Basile |

|

54 |

|

Senior Vice President, Chief Financial Officer and Treasurer |

|

January 2016 |

|

Laura Berman |

|

55 |

|

Vice President, Corporate Communications |

|

January, 2014 |

|

David P. Hack |

|

48 |

|

Senior Vice President, General Manager Detection Services |

|

May 2016 |

|

Lanning L. Levine |

|

62 |

|

Senior Vice President, Human Resources |

|

May 2013 |

|

Michael J. Muscatello |

|

57 |

|

Vice President, General Counsel and Secretary |

|

March 2014 |

|

Michael N. Tropeano |

|

46 |

|

Senior Vice President, General Manager Detection Products |

|

June 2015 |

Diane J. Basile was appointed senior vice president, chief financial officer and treasurer of the Company in January 2016. Ms. Basile was most recently the chief financial officer of Intronis, a provider of online backup and recovery solutions. From 2009 to 2015, Ms. Basile served as vice president of finance of the Healthcare Division of Nuance Communications, a global provider of health information technology. Previously, Ms. Basile held various positions in finance and investments at Fidelity Investments, Merrill Lynch & Co., Inc., Mercury Computer Systems Inc., PerkinElmer Inc., and Staples Inc. Ms. Basile received a master’s degree in finance from Boston College and a bachelor’s degree in economics from the Wharton School of the University of Pennsylvania.

Laura B. Berman was appointed vice president, corporate communications in January 2014, with responsibility for the Company’s internal and external communications. Ms. Berman has held various key positions including director of corporate communications from 2001 to 2014, overseeing all external and marketing communications effort for the Company. Ms. Berman holds a bachelor’s degree from Tufts University.

David P. Hack was appointed senior vice president, general manager detection services in May of 2016. Prior to appointment to his current position, Mr. Hack held the position of vice president, general manager detection services from June 2015 to May 2016, vice president, worldwide services from 2013 to 2015 and director, worldwide services business development from 2007 to 2013, having held several other services positions since first joining the Company in 1991. Mr. Hack received a master’s degree and bachelor’s degree in business administration from the University of Massachusetts.

Lanning L. Levine was appointed senior vice president, human resources in May 2013. Prior to appointment to his current position, Mr. Levine held the position of vice president, human resources from March 2013 to May 2013, having been director, human resources from 2012 to 2013 and manager, compensation and benefits from 2011 to 2012. Prior to joining the Company in 2011, Mr. Levine served as a human resources management consultant and held management positions in human resources organizations at various companies including Brooks Automation and C.R. Bard. Mr. Levine holds a bachelor’s degree in

business administration from Boston University.

Michael J. Muscatello was appointed general counsel, vice president and secretary in March 2014. Prior to joining the Company, Mr. Muscatello served as a consultant to a mobile app and cloud storage start-up from 2013 until 2014 and held the position of associate general counsel with Biogen Idec Inc. from 2011 to 2013. Previously, Mr. Muscatello served as division general counsel at Harris Corporation, successor to Tyco Electronics Professional Communications Division, from 2009 to 2011. Mr. Muscatello served in various other positions at Tyco Electronics, Tyco International, Aspen Technology, Inc., Motorola, Inc. and General Instrument Corporation. Mr. Muscatello earned a J.D. from Villanova University School of Law and holds a bachelor’s degree from Yale University.

Michael N. Tropeano was appointed senior vice president, general manager detection products in June 2015. Prior to appointment to his current position, Mr. Tropeano held key management positions with the Company including serving as senior vice president, customer development and support from 2014 to 2015, vice president, customer development and support from 2013 to 2014, vice president, product management from 2012 to 2013, senior vice president, product management from 2010 to 2012 and vice president, standard products from 2007 to 2010. Prior to joining the Company in 1998, Mr. Tropeano served in various positions related to the defense industry at General Electric, Lockheed Martin and General Dynamics. Mr. Tropeano received a master’s degree in mechanical engineering from Rensselaer Polytechnic Institute and holds a bachelor’s degree in mechanical engineering from the Florida Institute of Technology.

Audit Committee

The Audit Committee, established in accordance with the applicable securities regulations and NASDAQ Stock Market Listing Rules, currently consists of Dr. Don Kania (chair), Mr. Robert Shaddock and Dr. Mark Thompson. In the opinion of the Board of Directors, all members of the Audit Committee are “independent” as such term is defined in the applicable NASDAQ Stock Market Listing Rules, the applicable securities regulations and the Audit Committee charter and all members of the Audit Committee are independent of management and free of any relationship that would interfere with the exercise of independent judgment as members of the Audit Committee. The Board believes that the members of the Audit Committee have sufficient knowledge and experience with financial and accounting matters to perform their duties as members of the Audit Committee and has determined that Dr. Kania qualifies as an “audit committee financial expert” as such term is defined under applicable securities regulations.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires certain persons, including the Company’s directors, executive officers and beneficial holders of more than 10% of the Company’s common stock, to file initial reports of beneficial ownership of the Company’s securities and reports of changes in beneficial ownership with the Securities and Exchange Commission. Based on the Company’s review of these filings and representations from certain reporting persons, we believe that during fiscal year 2016 such persons have complied with their filing requirements, except for one report for each of the members of the Board of Directors (seven reports/transactions total) for their annual restricted stock grants which were filed one day late.

Code of Conduct

The Company has adopted a Code of Business Conduct and Ethics that applies to our Board of Directors, Chief Executive Officer (principal executive officer), Chief Financial Officer (principal financial and accounting officer), and all employees of the Company. The Company’s Code of Business Conduct and Ethics is posted on our website at www.as-e.com and may be accessed in the Corporate Governance section of the Investor Information page. The Company intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K, regarding an amendment to, or waiver from, our Code of Conduct, by posting such information on our website at the location specified above.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis section discusses the compensation of our “named executive officers”, who for fiscal year 2016 were:

|

Name |

|

Title |

|

Charles P. Dougherty |

|

President and Chief Executive Officer |

|

Diane J. Basile |

|

Senior Vice President, Chief Financial Officer and Treasurer |

|

Kenneth J. Galaznik |

|

Former Senior Vice President, Chief Financial Officer and Treasurer (1) |

|

Michael N. Tropeano |

|

Senior Vice President, General Manager of Detection Products |

|

Lanning L. Levine |

|

Senior Vice President, Human Resources |

|

Michael J. Muscatello |

|

Vice President, General Counsel and Secretary |

(1) Mr. Galaznik ceased to serve as the Company’s Senior Vice President, Chief Financial Officer and Treasurer upon the hire of Ms. Basile. However, he continued to serve as a Senior Vice President of the Company and worked as an advisor to ensure a seamless transition, until his retirement effective March 31, 2016.

Key Compensation Plan Changes

· New FY2016 Performance and Time-Based Long-Term Incentive Plan (“LTIP”): We adopted a new FY2016 LTIP that is based on restricted stock units only (50% time-based and 50% performance-based). The reduced reliance on cash (as a long-term incentive award) and use of free cash flow as a performance metric is better aligned with the Company’s long-term strategic plan and vision.

· New FY2017 Annual Incentive Bonus Plan (“FY2017 STIP”): We adopted a new STIP for implementation in FY2017. Key changes include:

· Capping payouts at 150% of the target award, compared to 200% for FY2016.

· Individual’s performance may be used to reduce (but not increase) bonus payouts.

· The bonus payout for FY2017 may be “recouped” to the extent there is a restatement due to errors and omissions or fraud.

Our incentive compensation plan payouts for fiscal year 2016 align with our commitment to performance.

|

FY2016 Short-Term Incentive Bonus Plan |

Long-Term Incentive Plans |

|

|

|

|

0% |

FY2012-FY2016 plan: 50% FY2014-FY2018 plan: 11.1% FY2016-FY18 plan: 18.7% |

|

|

|

|

We did not pay out any bonus since the threshold corporate financial performance for FY2016 was not met. |

The FY2012-FY2016 plan paid out under the time-based provision of the award at 50% of the award. Two of the four other outstanding plans paid out a portion of the target awards based on partial performance achieved. |

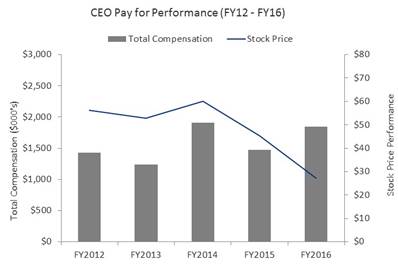

Our Chief Executive Officer’s compensation continued to be aligned with our performance.

(1) Total compensation for our Chief Executive Officer for each fiscal year consists of base salary, earned annual and long-term cash incentives with performance periods ending in that fiscal year, time- and performance-based stock/unit awards valued at grant date and all other compensation as disclosed in the Summary Compensation Table. Stock price reflects closing price adjusted for dividend impact on the date of each respective fiscal year end. Note that fiscal year 2013 reflects the impact of the retirement of the Company’s former Chief Executive Officer and the reversal of his unvested stock based compensation in that year.

(2) The Chief Executive Officer’s compensation for FY2016 is higher than his compensation for fiscal year 2015 as a result of the change in the Company’s LTIP grant practice. In prior years, a part of the LTIP was cash-based, the value of which is only shown in the chart above to the extent it was earned. Beginning in FY2016, the Company started to grant 50% of LTIP in the form of performance share units (“PSUs”). The value of PSUs is included in the table above at target. This artificially inflates Chief Executive Officer compensation as it includes compensation granted at target, not earned as yet.

The structure of our compensation plans and the level of compensation that our executives receive are heavily reliant on short- and long-term performance-based factors. We believe that our programs deliver a level of compensation that is appropriate for the financial and operational results achieved.

Key Program Elements and Objectives

We believe that the compensation programs for our executive officers, including our named executive officers as defined below under “Summary Compensation Table,” allow our Compensation Committee and Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to produce long-term business success. The executive compensation programs discussed in the following pages include a combination of financial performance goals. A significant portion of the target compensation under our executive compensation plan in fiscal year 2016 was contingent upon achieving these financial performance goals. We believe that the structure of our compensation programs aligns the financial interests of executives with the interests of shareholders by linking rewards with the financial and business results that build long-term shareholder value.

It is our intent that the various elements of the Company’s executive compensation program accomplish two goals:

· provide a competitive compensation package adequate to attract, motivate and retain the caliber of executive necessary to manage growth in a competitive and dynamic marketplace; and

· create a “pay-for-performance” culture that aligns the executive’s interests with those of shareholders through both short- and long-term increase in Company value.

The table below describes the key elements of our compensation program for our named executive officers. In addition to the more specific objectives summarized below, all elements of our program are intended to help us attract and retain talented individuals.

Summary of Major Elements of FY2016 Compensation

|

Compensation Element |

|

Purpose |

|

Key Features |

|

Base Salary |

|

Provided a conservative but competitive fixed annual salary. |

|

Designed to retain key executive officers by being competitive but is not considered to be the primary means of rewarding performance.

In establishing base salaries, the Compensation Committee considers market studies conducted biennially by an independent compensation consultant reporting directly to the Chairman of the Compensation Committee of the Board of Directors. |

|

|

|

|

|

|

|

FY2016 Short-Term Incentive Bonus Plan |

|

Provided annual incentive awards upon achievement of predetermined financial performance. |

|

This is a performance-contingent plan that is governed by Company performance based on a determined threshold of operating income. If minimum threshold levels of performance are not met, there is no payout. |

|

|

|

|

|

|

|

Performance and Time Based Long-Term Incentive Plan |

|

Provided incentive awards upon achievement of long-term financial goals that are designed to increase long-term shareholder value and to retain our executives. |

|

The performance-vesting of this award reinforces our pay-for-performance objectives and the time vest aspect provides retention of key executives. |

|

|

|

|

| |

|

|

|

|

The Company adopted a new FY2016 LTIP. Under this new plan awards are granted in the form of restricted stock units (“RSUs”).

50% of the award for FY2016 were (PSUs:

Performance metric was cumulative cash flow and aligns with the Company’s business plan.

Performance period extends over multiple fiscal years (2016, 2017 and 2018); approximately one-third of the award becomes eligible to be earned in each of the periods, with amounts not earned in each period to be forfeited.

Earned only to the extent the performance criteria are achieved. Award is then subject to a service based requirement and are not vested until March 31, 2018 subject to continuous employment with the |

|

|

|

|

|

Company.

The LTIP agreements contain a clawback provision whereby, upon a financial restatement as a result of errors, omissions, or fraud, the Committee may direct that the Company recover all or a portion of the amount of income recognized upon the distribution of and any additional gain realized upon any sale of shares granted under the LTIP with respect to any fiscal year of the Company the financial results of which are negatively affected by such restatement.

50% of the award for 2016 is time-based “RSUs.”

Vests in three substantially equal annual installments over the three years following the date of grant if the executive remains employed by the Company on the vest date. |

|

|

|

|

|

|

|

Severance and Change in Control Agreements |

|

Provides competitive benefits to attract motivate and retain key talent in the face of long-term uncertainties.

Aligns executive actions in connection with a Change in Control with the shareholders’ best interests by providing market appropriate income protection. |

|

The agreement provides for compensation in the event of a defined qualifying termination of an executive during the period of 24 months following a change in control, as well as termination (i) by us for any reason other than cause, or (ii) by the executive for good reason, each as defined in the agreement.

Does not include any tax “gross-up” provision for the executive. |

|

|

|

|

|

|

|

Health and Welfare Benefits |

|

Provides competitive levels of employee health and welfare benefits. |

|

Benefits do not vary substantially from general employee benefits. |

|

|

|

|

|

|

|

401(k) Defined Contribution Benefit Plan |

|

Provides tax favored retirement savings. |

|

Same program provided to general employee population. |

|

What We Do |

|

What We Don’t Do | ||||

|

o |

|

Pay for Performance. Our short- and long-term incentive compensation is tied directly to achievement of objective, Board-approved performance metrics based on core business goals. |

|

x |

|

Golden Parachute Tax Gross-ups. We do not provide change in control excise tax gross-ups. |

|

|

|

|

|

|

|

|

|

o |

|

Annual Incentive Plan. The amounts our executives can earn under our annual corporate performance-based incentive plans are capped. Accordingly, amounts earned under the annual plan are predictable and performance above incentive plan targets benefits shareholders. |

|

x |

|

Single-Trigger Severance following Change in control. Severance benefits are payable to our named executive officers following a change in control only upon involuntary termination of employment or termination by the executive for “good reason.” |

|

o |

|

Performance-Based Equity Awards. Our performance-based equity award has performance measures that span up to three years with awards earned not fully vested and distributed until the end of the plan period. |

|

x |

|

Hedging or Pledging of Company Stock. Our policies do not allow our executives to hedge or pledge Company securities. |

|

|

|

|

|

|

|

|

|

o |

|

Time-Based Equity Awards: Our time-based equity awards provide a retention capability. Awards vest in three substantially equal annual installments over three years following the date of grant if the executive remains employed by the Company on the vest date. |

|

x |

|

Repricing or Exchange of Underwater Stock Options. Our Equity and Incentive Plans do not allow repricing of stock options and stock appreciation rights without shareholder approval. |

|

|

|

|

|

|

|

|

|

o |

|

Stock Ownership Guidelines. We have stock ownership guidelines for our Chief Executive Officer, other executive officers and non-employee directors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

Clawback Policy. We have clawback provisions under our equity long-term incentive plan for recovery of incentive compensation that applies to all executive officers. |

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

Independent Compensation Consultant. The independent compensation consultant directly reports to our Compensation Committee. |

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

Annual Compensation Risk Assessment. We conduct a risk assessment of our compensation programs on an annual basis. |

|

|

|

|

Shareholder Response

Our shareholders have shown strong approval of our executive compensation program. We received more than 98% of support on our advisory “say on pay” proposal in 2015. The Compensation Committee believes that the result reflects our shareholders’ support for our approach to executive compensation, including the focus on incentive components linked to our performance, and has been mindful of this shareholder support when acting on compensation matters.

How We Determine Compensation

The Role of the Compensation Committee

The Compensation Committee of the Board of Directors has the responsibility for, among other matters, establishing executive compensation programs, overseeing compensation of executive officers (including employment offers and termination arrangements for executive officers), monitoring all general compensation programs applicable to the Company’s employees and overseeing regulatory compliance with respect to compensation matters.

In the case of compensation for the Chief Executive Officer, the Compensation Committee reviews the goals and objectives established for the Chief Executive Officer, evaluates his performance with respect to such goals and objectives, as well as other factors which may comprise appropriate measures of his performance overall, and, based on such evaluation, makes recommendations to the Board of Directors. This evaluation and determination is made and reviewed annually by the full Board of Directors (acting through its independent directors).

In evaluating the compensation of the Chief Executive Officer, the Board of Directors considers several factors, including:

· achievement of short- and long-term financial and strategic targets and objectives, considering factors such as revenue, bookings and earnings per share;

· the Company’s position within the industry in which it competes;

· overall Company financial and operational performance;

· overall economic climate;

· individual contribution to the Company; and

· such other qualitative and quantitative factors as the Board of Directors, upon recommendation of the Compensation Committee, may deem appropriate.

The Chief Executive Officer makes annual recommendations to the Compensation Committee with respect to executive compensation, other than his own. The Committee reviews his proposals and makes a final determination concerning the scope and nature of such compensation arrangements.

Independent Compensation Consultant

The Compensation Committee typically retains the services of an independent compensation consultant every two years, reporting directly to the Committee, to evaluate the Company’s executive compensation packages for marketplace competitiveness and soundness of design.

In fiscal year 2015, the Committee requested that our compensation consultant, Pearl Meyer & Partners, LLC (“Pearl Meyer”), review the base salaries, annual incentives, total cash compensation, long-term incentive awards and all other compensation programs for our five named executive officers as well as other executive officers reporting to the Chief Executive Officer. Pearl Meyer compared these elements of compensation with data from the peer group and broader survey data from its executive and senior management total compensation survey for companies with similar revenues, number of employees, and industries (the “2015 Pearl Meyer Study”).

In fiscal year 2016 and 2017, Pearl Meyer reviewed and provided input on the Company’s Compensation Discussion and Analysis. The Compensation Committee regularly reviews the services provided to the Compensation Committee by outside consultants and believes that Pearl Meyer is independent in providing executive compensation consulting services.

Peer Group

The Compensation Committee uses a peer group to provide context for its compensation decision-making for our named executive officers. The Compensation Committee periodically assesses this peer group and considers revisions. The Compensation Committee determined that the 2015 peer group remained appropriate for the Company for fiscal year 2016 based on certain criteria that included the following:

· industry similarity, targeting companies in Aerospace & Defense, Electronic Equipment, Instruments and Components and other like industries;

· revenues and market capitalization within a reasonable range of the Company, ranging from approximately one-third to three times our annual revenue and market capitalization at the time of the analysis;

· comparability of business model, including levels of operational complexity such as international operations / presence and highly engineered products;

· financial metrics such as profit margin and growth outlook that reflects the business and operational characteristics;

· customer base such as government agencies, defense contractors, commercial companies, or a mix;

· other factors such as companies that named the Company as a peer, peers identified by proxy advisory services (i.e., ISS and Glass Lewis).

The following table reflects the peer group which was reviewed and approved by the Compensation Committee:

|

Aerovironment Inc. |

Analogic Corp. |

API Technologies Corp |

|

|

|

|

|

Astronics Corp. |

FARO Technologies, Inc. |

GSI Group Inc. |

|

|

|

|

|

iROBOT Corp |

LMI Aerospace, Inc. |

Measurement Specialties, Inc., |

|

|

|

|

|

Mercury Computer Systems, Inc. |

Sparton Corporation |

TASER International |

|

|

|

|

|

KEYW Holding Corp. |

|

|

Executive Compensation Program

Base Salary. The salary levels for the Company’s executive officers are reviewed against broad-based compensation surveys and compensation levels of the peer companies as described above, to assess whether such compensation remains at competitive market levels. The Compensation Committee annually reviews the base salaries of the Chief Executive Officer and the executive officers reporting to the Chief Executive Officer. In addition, the Compensation Committee also reviews the recommendations of the Chief Executive Officer for merit-based increases for the other executive officers. Each executive’s performance for the year is measured against predetermined financial and non-financial objectives, such as successful implementation of management processes, policies and business strategies, and these results are among the factors used as a guide for any salary increase or decrease.

The Compensation Committee concluded after reviewing the 2015 Pearl Meyer study that the base salaries of its executive officers were broadly competitive with those executive officers having equivalent responsibilities of the companies included in the 2015 Pearl Meyer Study and no base salary increases were approved for fiscal year 2016 for the executive officers.

Performance-Based Annual Incentive Bonus Plan.

FY2016 Short Term Incentive Bonus Plan (“FY2016 STIP”)

Performance-based annual bonus compensation is an important element to reward and motivate executives by making a

significant portion of their compensation dependent on the Company’s financial performance. A description of the FY2016 STIP is set forth below.

The target bonuses (i.e., amount paid for 100% performance) are calculated as a percentage of base salary. In fiscal year 2016 the target bonuses, expressed as a percentage of base salary, were:

|

Position |

|

Target Cash Bonus as |

|

|

Chief Executive Officer |

|

100 |

% |

|

Chief Financial Officer |

|

65 |

% |

|

All other Executive Officers |

|

50 |

% |

The annual bonus plan for the Chief Executive Officer and executive officers required that a predetermined threshold level of financial performance (“Corporate Performance Factor”) be met before any bonus was paid for fiscal year 2016.

|

Corporate Performance Factor |

|

Potential Payout of Target Bonus |

|

|

Threshold (1) |

|

50 |

% |

|

Target |

|

100 |

% |

|

Over Target |

|

200 |

%(2) |

(1) The threshold was defined to be 50% of the target Corporate Performance Factor, which for fiscal year 2016 was the target Corporate Performance Factor of operating income of $14.4 million for the year.

(2) Percent of Corporate Performance Factor is capped at 200%. Any awards above this amount are at the sole discretion of the Board of Directors.

The Company had an operating loss for fiscal year 2016 of $5.3 million. Because the threshold corporate performance factor related to operating income was not achieved for fiscal year 2016, the named executive officers did not receive an annual performance-based bonus.

FY2017 Annual Incentive Bonus Plan (“FY2017 STIP”)

In May 2016, the Company’s Board of Directors approved the adoption of the Company’s FY2017 Annual Incentive Bonus Plan (“FY2017 STIP”). The objective of the FY2017 STIP is to reward employees for achieving the Company’s FY2017 management objectives and business goals and payment of the bonus is contingent on the Company’s meeting pre-determined operating profit goals. This plan reflects a slight adjustment to the performance and payout slope under the FY2016 STIP while maintaining operating income as its Corporate Performance Factor.

The target bonuses (i.e., amount paid for 100% performance) are calculated as a percentage of base salary. For fiscal year 2017 the target bonuses, expressed as a percentage of base salary, are:

|

Position |

|

Target Cash Bonus as |

|

|

Chief Executive Officer |

|

100 |

% |

|

Chief Financial Officer |

|

60 |

% |

|

All other Executive Officers |

|

50 |

% |

Similar to the FY2016 STIP, the annual bonus plan for the Chief Executive Officer and executive officers required that a “Corporate Performance Factor” be met before any bonus is paid for fiscal year 2017.

|

Corporate Performance Factor |

|

Potential Payout of Target Bonus |

|

|

Threshold (1) |

|

25 |

% |

|

Target |

|

100 |

% |

|

Over Target |

|

150 |

%(2) |

(1) The threshold is defined to be 42% of the target Corporate Performance Factor.

(2) Percent of Corporate Performance Factor is capped at 150%. The Company reserves the right to reduce (but not increase) the result of the Bonus calculation based on individual performance.

In addition, the FY2017 STIP includes a “clawback” provision, whereby, the Compensation Committee may direct the Company to recover a portion of the bonus paid with respect to FY2017 if its financial results of were negatively affected by a restatement, or fraud.

2016 Performance and Time-Based Long-Term Incentive Compensation. The purpose of our long-term incentive compensation is to:

· Provide greater management alignment with shareholder interests and directly link incentives to shareholder value creation.

· Foster a stronger pay-for-performance culture and retain key executives and employees.

· Facilitate long-term executive stock ownership.

FY2016 LTIP

In July 2015, the Company implemented a new FY2016 LTIP consisting of granting long-term incentives in the form of restricted stock units.

50% of the award for fiscal year 2016 is performance-based

Performance Measure. Cumulative free cash flow (defined as cash provided by (used for) operations as reported in the Company’s Annual Report on Form 10-K less cash used for purchases of property and equipment as reported on the Company’s consolidated statement of cash flows) was selected as the performance measure for the FY2016 LTIP due to the importance of this to our strategic plan and long-term success of our business. In order to motivate superior performance, we also provided upside earning potential for significant outperformance (capped at 150% of the target PSU grant).

Three Performance Measurement Periods. The three performance periods for the performance-based equity are:

Measurement Period 1 = FY2016

Measurement Period 2 = FY2016 – FY2017

Measurement Period 3 = FY2016 – FY2018

Portion of Award Eligible to be earned in Each Measurement Period. One-third of the target “PSUs” granted, plus up to an additional 50% of such amount, can be earned for each of the three measurement periods. The PSUs will be “banked” upon achievement of each of the cumulative free cash flow performance targets, and shall become exercisable at the end of the three (3) year performance period, to the extent the performance goal is met. If and to the extent the performance goal is not satisfied for a particular fiscal year, a proportionate number of the PSUs (with respect to such fiscal year) will be immediately forfeited upon the date of the Compensation Committee meeting at which the certification of the achievement of the performance goals is determined.

2016 Performance-Based Equity Design

|

|

|

Performance as a % of Plan |

|

% of Target PSUs Earned(1) |

|

|

Below Threshold |

|

<50% of Target |

|

0 |

% |

|

Threshold |

|

50% of Target |

|

50 |

% |

|

Target |

|

100% of Target |

|

100 |

% |

|

Maximum |

|

150% of Target |

|

150 |

% |

(1) Payout is interpolated between threshold and target, target and maximum)

50% of the award for FY2016 is time-based “RSUs”

Awards vest in three substantially equal annual installments over the three years following the date of grant if the executive remains employed by the Company on the vest date.

While the Compensation Committee updated the FY2016 LTIP as summarized above, the Compensation Committee maintained the FY2016 LTIP with compensation target values for fiscal year 2016, expressed as a percentage of base salary, as follows:

|

Position |

|

Value of Award as a |

|

|

Chief Executive Officer |

|

200 |

% |

|

Chief Financial Officer |

|

200 |

% |

|

Other Executive Officers |

|

120 |

% |

As of the end of fiscal year 2016, there are five outstanding long-term incentive plans. The corporate goals for the long-term incentive plans to date were met within the following time frames:

|

Plan Performance |

|

Form of Award |

|

Performance Goals |

|

Portion of Award |

|

Portion of Award |

|

|

FY2012-FY2016 |

|

Cash |

|

1. Revenue 2. Return on net assets (“RONA”) |

|

50 |

% |

50 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

FY2013-FY2017 (1) |

|

Cash |

|

1. Revenue 2. RONA |

|

0 |

% |

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

FY2014-FY2018(2) |

|

Restricted Stock Units/Cash |

|

1. Revenue 2. RONA 3. New products |

|

11.11 |

% |

44.44 |

%(2) |

|

|

|

|

|

|

|

|

|

|

|

|

FY2015-FY2019 |

|

Restricted Stock Units/Cash |

|

1. Revenue 2. RONA 3. New products |

|

0 |

% |

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

FY2016-FY18 (3) |

|

Performance Stock Units |

|

1. Cumulative free cash flow |

|

18.67 |

|

18.67 |

|

(1) This plan is frozen since there are no participants remaining in this plan

(2) As of fiscal year ending March 31, 2016, four of the nine milestone goals have been met in this plan.

(3) The Company achieved 56% of its target cumulative free cash flow goal for FY2016, and upon certification resulting in 56% of the participant’s respective award being credited ‘and banked’, with 44% of the award being forfeited. This banked award is then subject to a service based requirement and will not fully vest until March 31, 2018.

Clawback Provisions

The FY2016 and FY2017 LTIPs and the new FY2017 STIP each contain a “clawback” provision that reverses the bonus payout, the vesting of stock, option or cash awards in the event as a result of a financial restatement as a result of errors, omissions, or fraud. The Committee may direct that the Company recover all or a portion of the amount of income recognized upon the distribution of and any additional gain realized upon any sale of shares granted under the LTIP with respect to any fiscal year of the Company the financial results of which are negatively affected by such restatement. The conditions to the “clawback” provision have not been triggered to date.

Stock Ownership Guidelines. The members of the Board of Directors, the Chief Executive Officer, the Chief Financial Officer and other executive officers have historically been expected to build and maintain ownership of the Company’s common stock according to the following guidelines that were updated on July 1, 2015:

|

Position |

|

Value of Stock Owned as a |

|

|

Members of the Board of Directors |

|

400% |

|

|

|

|

(Target based upon cash retainer) |

|

|

Chief Executive Officer |

|

300% |

|

|

Chief Financial Officer |

|

150% |

|

|

Other Executive Officers |

|

100% |

|

Executive officers are given a four year period and non-employee Directors are given a five year period, measured from their date of hire, initial date of service on the Board of Directors, or increase in compensation, as applicable, to achieve these targets. If, after the end of the applicable accumulation period, any individual subject to these guidelines falls below his or her individual stock ownership guidelines, that individual will be required to hold all then currently owned stock until the guidelines are met or termination of employment, whichever occurs first.

As of March 31, 2016, all executive officers and members of the Board of Directors were on track to achieving these guidelines within each of their respective compliance periods.

Change in Control and Severance Benefits. To ensure that our compensation package remains competitive with industry practice and that the incentives of the executives are further aligned with the best interests of the shareholders in the event of a change in control of the Company, the Company provides change in control and severance benefits to each of its executive officers. These benefits are governed by a change in control and severance benefit agreement (in each case the “CIC Agreement”) for each of our named executive officers.

A more detailed description of these agreements is included in the section below entitled “Employment, Change in Control and Severance Agreements.” For additional information on potential payments to named executive officers in the event of a change in control, please see below in the section entitled “Potential Payments upon Termination or Change in Control.”

In summary, the CIC Agreements that apply to our named executive officers provide for the following benefits contingent upon the executive providing a release of claims as a condition to their payment:

|

Termination without cause outside of a Change in Control |

|

Two times the highest base salary of the prior 12 months for the Chief Executive Officer and one times the highest base salary of the prior 12 months for all other named executive officers. |

|

|

|

|

|

Termination following a Change in Control |

|

Two times the sum of the highest base salary of the prior 12 months plus target bonus, plus full vesting of all equity awards then held by the executive; plus full vesting of all performance-based cash long-term incentive awards. |

|

|

|

|

|

Change in Control Protection Period |

|

24 months following a change in control. |

Tax Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), generally disallows a tax deduction to public companies for compensation in excess of $1.0 million paid to a company’s chief executive officer and its other three officers (other than the chief financial officer) whose compensation is required to be disclosed to our shareholders under the Exchange Act by reason of being among the most highly compensated officers. Qualified performance-based compensation is not subject to the deduction limitation if specified requirements are met. Although the Committee has designed the executive compensation program with tax considerations in mind, the Committee does not believe that it would be in the best interests of the Company to adopt a policy that would preclude compensation arrangements subject to deduction limitations. Current outstanding cash and equity-based awards do not qualify as performance-based compensation.

Compensation Committee Report

The Compensation Committee has discussed and reviewed the Compensation Discussion and Analysis as required by the applicable securities regulations with management. Based upon this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Annual Report on Form 10-K for the fiscal year ended March 31, 2016.

This Compensation Committee Report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Company specifically incorporates this Report.

Report Submitted By: Dr. Mark Thompson (Chairman), Ms. Jennifer Vogel, Mr. John Sanders

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended March 31, 2016, the Compensation Committee consisted of Dr. Mark Thompson, Ms. Jennifer Vogel and Mr. John Sanders. None of the Compensation Committee’s current members has at any time been an officer or employee of the Company. None of the Company’s executive officers serve or in the past fiscal year has served as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving on the Company’s Board of Directors or Compensation Committee.

Summary Compensation Table

The table below shows the annual compensation for the fiscal years indicated of our named executive officers.

|

Name and Principal |

|

Fiscal |

|

Salary |

|

Bonus |

|

Stock |

|

Non-Equity |

|

All Other |

|

Total |

|

|

Diane J. Basile (4) |

|

2016 |

|

70,000 |

|

— |

|

— |

|

— |

|

— |

|

70,000 |

|

|

Charles P. Dougherty |

|

2016 |

|

588,000 |

|

— |

|

1,133,000 |

|

49,000 |

|

162,000 |

|

1,932,000 |

|

|

|

2015 |

|

566,000 |

|

— |

|

680,000 |

|

49,000 |

|

176,000 |

|

1,471,000 |

| |

|

|

2014 |

|

518,000 |

|

— |

|

658,000 |

|

648,000 |

|

86,000 |

|

1,910,000 |

| |

|

Kenneth J. Galaznik (5) |

|

2016 |

|

319,000 |

|

— |

|

615,000 |

|

350,000 |

|

9,000 |

|

1,293,000 |

|

|

|

2015 |

|

307,000 |

|

— |

|

369,000 |

|

129,000 |

|

8,000 |

|

814,000 |

| |

|

|

2014 |

|

300,000 |

|

— |

|

359,000 |

|

356,000 |

|

8,000 |

|

1,023,000 |

| |

|

Lanning L. Levine |

|

2016 |

|

267,000 |

|

— |

|

298,000 |

|

13,000 |

|

2,000 |

|

580,000 |

|

|

Michael J. Muscatello |

|

2016 |

|

254,000 |

|

— |

|

288,000 |

|

— |

|

8,000 |

|

550,000 |

|

|

Michael N. Tropeano |

|

2016 |

|

283,000 |

|

— |

|

318,000 |

|

138,000 |

|

10,000 |

|

749,000 |

|

|

|

2015 |

|

275,000 |

|

22,000 |

(6) |

191,000 |

|

12,000 |

|

12,000 |

|

512,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The Stock Awards column represents the grant date fair value of restricted stock units awarded during the fiscal year indicated, computed in accordance with the Financial Accounting Standards Board Accounting Standards Codification 718 Compensation — Stock Compensation. The assumptions used to calculate the value of stock awards are set forth under Note 6 of the Notes to Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for fiscal year 2016 filed with the SEC on May 24, 2016. Certain of these awards are subject to performance conditions. The value reported in the table for these performance based awards is based upon the probable achievement of the target amounts of the award at date of grant.

(2) Non-Equity Incentive Plan Compensation represents incentive compensation earned for the indicated fiscal year under the Company’s performance-based long-term incentive compensation plan and/or under the Company’s performance-based short term incentive bonus plan. In fiscal years 2015 and 2016, no payments were made under the Company’s performance-based short term incentive bonus plan. In fiscal year 2015 and 2016, certain of the executive officers received payments for vesting of a portion of performance-based long-term incentive compensation award granted in prior periods. In addition in fiscal years 2015 and 2016, certain executive officers received payment for the time-vesting portion of long-term compensation awards granted in fiscal years 2010 and 2011. In fiscal year 2014, certain executive officers received payments for vesting of long-term incentive compensation awards granted in prior and the then current fiscal year. In addition, in fiscal year 2014, the Chief Executive Officer received the full value of his short term incentive bonus as stipulated in his offer letter and the other named executive officers received short-term incentive bonuses at the threshold level. For additional information on these programs, please see the section herein named “Compensation Discussion and Analysis — Executive Compensation Program.”

(3) All Other Compensation includes payments by the Company for life insurance premiums, matching contributions to the employee’s 401(k) account, and costs for temporary living expense and commuting expenses for Mr. Dougherty.

(4) Ms. Basile commenced employment with the Company on January 11, 2016.

(5) Mr. Galaznik terminated employment with the Company effective March 31, 2016.

(6) Bonus compensation for Mr. Tropeano represented the value received under a time vested bonus award granted in fiscal year 2013.

Grants of Plan-Based Awards in Fiscal Year 2016

The following table provides information on all plan-based awards granted in the fiscal year ended March 31, 2016 to the named executive officers.

|

|

|

|

|

Estimated possible payouts under non- |

|

Estimated future payouts under |

|

All Other |

|

Exercise |

|

Grant |

| ||||||||||||

|

Name |

|

Grant |

|

Threshold |

|

Target |

|

Maximum |

|

Threshold |

|

Target |

|

Maximum |

|

(3) |

|

awards |

|

awards(3) |

| ||||

|

Charles P. Dougherty |

|

(1) |

|

$ |

284,000 |

|

$ |

567,000 |

|

$ |

1,134,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

8/1/2016 |

|

|

|

|

|

|

|

— |

|

12,679 |

|

19,019 |

|

|

|

— |

|

$ |

567,000 |

| |||

|

|

|

8/1/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12,678 |

|

— |

|

$ |

567,000 |

| |||

|

Diane J. Basile |

|

|

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

| ||||

|

Kenneth J. Galaznik |

|

(1) |

|

$ |

100,000 |

|

$ |

200,000 |

|

$ |

400,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

7/31/16 |

|

|

|

|

|

|

|

— |

|

6,884 |

|

10,326 |

|

|

|

— |

|

$ |

308,000 |

| |||

|

|

|

7/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6,883 |

|

— |

|

$ |

308,000 |

| |||

|

Lanning L. Levine |

|

(1) |

|

$ |

62,000 |

|

$ |

124,000 |

|

$ |

248,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

7/31/16 |

|

|

|

|

|

|

|

— |

|

3,336 |

|

5,004 |

|

|

|

— |

|

$ |

149,000 |

| |||

|

|

|

7/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,335 |

|

— |

|

$ |

149,000 |

| |||

|

Michael J. Muscatello |

|

(1) |

|

$ |

60,000 |

|

$ |

120,000 |

|

$ |

240,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

7/31/16 |

|

|

|

|

|

|

|

— |

|

3,223 |

|

4,835 |

|

|

|

— |

|

$ |

144,000 |

| |||

|

|

|

7/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,222 |

|

— |

|

$ |

144,000 |

| |||

|

Michael N. Tropeano |

|

(1) |

|

$ |

66,000 |

|

$ |

132,000 |

|

$ |

264,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

7/31/16 |

|

|

|

|

|

|

|

— |

|

3,558 |

|

5,337 |

|

|

|

— |

|

$ |

159,000 |

| |||

|

|

|

7/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,558 |

|

— |

|

$ |

159,000 |

| |||

(1) Amounts shown are estimated possible cash payouts for fiscal year 2016 for the named executive officers under the performance-based short term incentive bonus plan. Threshold amounts represent the minimum amount that could be earned for meeting the minimum operating income metrics. Target amounts are based on a percentage of the individual’s 2016 base salary as outlined in the Compensation Discussion and Analysis above. Maximum amounts are based on 200% of the named executive officers’ applicable target amount for fiscal year 2016 and represent the maximum payout under the plan. Due to the fact that the Company did not meet the threshold financial performance targets required under the plan in fiscal year 2016, performance-based annual incentive awards at the threshold amounts were not paid for fiscal year 2016.

(2) Amounts shown are estimated possible payouts representing the value of restricted stock unit awards granted under the long-term incentive plan outlined in the Compensation Discussion and Analysis. Awards contain performance criteria set forth at the grant date for each of the following three fiscal years and a time-based condition requiring continued employment through the vesting date of March 31, 2018.

(3) One-third of the shares subject to the stock award vest each year from the date of grant. Vesting is contingent upon continued service with the Company.

Outstanding Equity Awards at 2016 Fiscal Year End

The following table sets forth information regarding the number of equity awards held by the named executive officers at March 31, 2016.

|

|

|

Option |

|

Stock Awards |

| |||||||||||

|

Name |

|

Number of |

|

Number of |

|

Equity |

|

Option |

|

Option |

|

Equity |

|

Equity Incentive |

| |

|

Charles P. Dougherty |

|

|

|

|

|

|

|

|

|

|

|

17,616 |

(3) |

488,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

12,679 |

(4) |

351,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

12,678 |

(5) |

351,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Diane J. Basile |

|

|

|

|

|

|

|

|

|

|

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Kenneth J. Galaznik |

|

1,793 |

(1) |

— |

|

— |

|

$ |

61.45 |

|

8/15/17 |

|

|

|

|

|

|

|

|

289 |

(1) |

— |

|

— |

|

$ |

60.66 |

|

9/14/17 |

|

|

|

|

|

|

|

|

1,886 |

(2) |

— |

|

— |

|

$ |

61.40 |

|

5/15/19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,582 |

(3) |

265,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

6,884 |

(4) |

191,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

6,883 |

(5) |

191,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Lanning L. Levine |

|

|

|

|

|

|

|

|

|

|

|

4,628 |

(3) |

128,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,336 |

(4) |

92,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,335 |

(5) |

92,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Michael J. Muscatello |

|

|

|

|

|

|

|

|

|

|

|

2,658 |

(3) |

74,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,223 |

(4) |

89,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,222 |

(5) |

89,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Michael N. Tropeano |

|

|

|

|

|

|

|

|

|

|

|

4,743 |

(3) |

131,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,558 |

(4) |

99,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,558 |

(5) |

99,000 |

| |

(1) Options are part of performance-based awards one-third of which vested 3/31/09 and two-thirds of which vested 3/31/10 upon achievement of performance goals

(2) Options are part of performance-based awards, two-thirds of which vested 3/31/11 upon achievement of performance goals. 50% of the remaining one-third vested at the fifth anniversary of the date of grant, the remainder was forfeited in accordance with the award terms.

(3) Awards vest upon attainment of performance-based goals over a five year period. If performance goals are not met within the five year period at a level sufficient to at least vest 50% of the initial award, additional units will be vested to bring the total vested to 50% of the original number. The figures above are based upon the assumption that all performance goals will be met, and therefore all shares subject to the awards will vest within the five year period.

(4) Awards vest upon achievement of performance-based goals established over a three year period. At the end of each of the three fiscal years, achievement against the performance goal for that fiscal year is measured and the proportionate number of performance based awards for that year is adjusted based upon achievement of that goal. Awards are then subject to a time-based condition through the end of the third fiscal year.

(5) Awards vest in three annual installments from date of grant.

(6) Market value of stock awards is calculated by multiplying the closing price of the Company’s common stock on March 31, 2016, the last trading day of the Company’s fiscal year 2016, by the number of shares of stock constituting the award.

Option Exercises and Stock Vested in Fiscal Year 2016

The following table sets forth information regarding the number of shares acquired and value realized for stock awards vested for all named executive officers during fiscal year 2016. No stock options were exercised by the named executive officers during fiscal year 2016.

|

|

|

Option Awards |

|

Stock Awards |

| ||||

|

Name |

|

Number of |

|

Value |

|

Number of |

|

Value |

|

|

Charles P. Dougherty |

|

— |

|

— |

|

1,194 |

|

73,000 |

|

|

Diane J. Basile |

|

— |

|

— |

|

— |

|

— |

|

|

Kenneth J. Galaznik |

|

— |

|

— |

|

651 |

|

40,000 |

|

|

Lanning L. Levine |

|

— |

|

— |

|

313 |

|

19,000 |

|

|

Michael J. Muscatello |

|

— |

|

— |

|

500 |

|

12,000 |

|

|

Michael N. Tropeano |

|

— |

|

— |

|

302 |

|

19,000 |

|

(1) The amounts shown in this column represent the number of shares vested multiplied by the closing market price on the date of vesting.

Employment, Change in Control and Severance Agreements

Employment Agreement with Charles P. Dougherty

On March 13, 2013, the Board elected Charles P. Dougherty, to serve as the Company’s President and Chief Executive

Officer, effective as of April 8, 2013.

On March 13, 2013, the Company entered into an employment agreement with Mr. Dougherty, effective April 8, 2013. This agreement, as amended, includes the following elements:

· an initial annual base salary of $550,000, subject to possible increase by the Company’s Board of Directors from time to time at its sole discretion, which currently stands at $567,000;

· eligibility to participate in the Company’s performance-based annual incentive compensation plan for the Company’s senior executives, with a target bonus equal to 100% of his base salary;

· incentive awards, under the Company’s long term incentive plan, equal to 200% of his base salary. Such awards could be in the form of restricted stock, restricted stock units, stock options and/or cash as determined by the Board’s Compensation Committee;

· travel expenses between his non-Boston residence and Boston up to a maximum of $100,000 per annum; and

· vacation benefits of five weeks per calendar year.