SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| Kimberly-Clark Corporation | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials. | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

Proxy Statement

For 2020 Annual Meeting of Stockholders

|

March 6, 2020

Michael D. Hsu

Chairman of the Board and

Chief Executive Officer

FELLOW STOCKHOLDERS:

It is my pleasure to invite you to the Annual Meeting of Stockholders of Kimberly-Clark Corporation. The meeting will be held on Wednesday, April 29, 2020, at 9:00 a.m. at our World Headquarters, which is located at 351 Phelps Drive, Irving, Texas.

At the Annual Meeting, stockholders will be asked to elect eleven directors for a one-year term, ratify the selection of Kimberly-Clark’s independent auditor, approve the compensation for our named executive officers, and vote on a stockholder proposal. These matters are fully described in the accompanying Notice of Annual Meeting and proxy statement.

Your vote is important. Regardless of whether you plan to attend the meeting, I urge you to vote your shares as soon as possible. You may vote using the proxy form by completing, signing, and dating it, then returning it by mail. Also, most of our stockholders can submit their vote by telephone or through the Internet. If telephone or Internet voting is available to you, instructions will be included on your proxy form. Additional information about voting your shares is included in the proxy statement.

Sincerely,

| 2020 Proxy Statement |

|

Notice of

Annual Meeting

of Stockholders

TO BE HELD

April 29, 2020

AT

World

Headquarters

351 Phelps Drive,

Irving, Texas

The Annual Meeting of Stockholders of Kimberly-Clark Corporation will be held at our World Headquarters, which is located at 351 Phelps Drive, Irving, Texas, on Wednesday, April 29, 2020, at 9:00 a.m. for the following purposes:

| 1. | To elect as directors the eleven nominees named in the accompanying proxy statement; |

| 2. | To ratify the selection of Deloitte & Touche LLP as our independent auditor for 2020; |

| 3. | To approve the compensation for our named executive officers in an advisory vote; and |

| 4. | To vote on a stockholder proposal that may be presented at the meeting. |

Stockholders also will take action upon any other business that may properly come before the meeting.

Stockholders of record at the close of business on March 2, 2020 are entitled to notice of and to vote at the meeting or any adjournments.

It is important that your shares be represented at the meeting. I urge you to vote promptly by using the Internet or telephone or by signing, dating and returning your proxy form.

The accompanying proxy statement also is being used to solicit voting instructions for shares of Kimberly-Clark common stock that are held by the trustees of our employee benefit and share purchase plans for the benefit of the participants in the plans. It is important that participants in the plans indicate their preferences by using the Internet or telephone or by signing, dating and returning the voting instruction card, which is enclosed with the proxy statement, in the business reply envelope provided.

To attend in person, please register by following the instructions on page 9.

| By Order of the Board of Directors. | March 6, 2020 |

Grant B. McGee

Vice President –

Deputy General Counsel and

Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on April 29, 2020

The Proxy Statement and proxy card, as well as our Annual Report on

Form 10-K for the year ended December 31, 2019, are available at

http://www.kimberly-clark.com/investors.

| 2020 Proxy Statement | 1 |

|

| 2 | 2020 Proxy Statement |

|

| 2020 Proxy Statement | 3 |

|

Proxy Summary

This section contains only selected information. Stockholders should

review the entire Proxy Statement before casting their votes.

Matters for Stockholder Voting

| Proposal | Description | Board voting recommendation | ||

| 1 | Election of directors | Election of 11 directors to serve for a one-year term | FOR all nominees | |

| 2 | Ratification of auditor | Approval of the Audit Committee’s selection of Deloitte & Touche LLP as Kimberly-Clark’s independent auditor for 2020 |

FOR | |

| 3 | Say-on-pay | Advisory approval of our named executive officers’ compensation | FOR | |

| 4 | Stockholder proposal on written consent |

Proposal to permit stockholders to act by written consent | AGAINST | |

2019 Performance and Compensation Highlights

The Management Development and Compensation Committee of our Board concluded that Kimberly-Clark’s management delivered financial performance in 2019 that was above target from an overall perspective, as reflected in the financial metrics of our annual incentive program.

| Performance Measures | 2019 Results | 2019 Target | Adjusted EPS is adjusted earnings per share and Adjusted OPROS is adjusted operating profit return on sales. For details on how these measures are adjusted, see “Compensation Discussion and Analysis - Executive Compensation for 2019, 2019 Performance Goals, Performance Assessments and Payouts.” | ||||

| Net sales | $18.45 billion | $18.13 billion | |||||

| Adjusted EPS | $6.89 | $6.61 | |||||

| Adjusted OPROS improvement | +78 bps | +60 bps | |||||

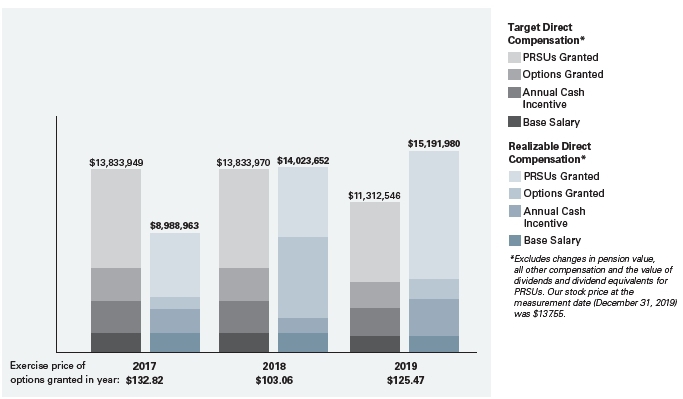

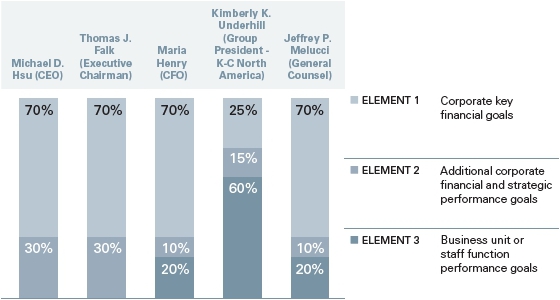

Based on this performance, the Committee approved annual cash incentives for 2019 above the target amount, including an annual incentive payout for our Chief Executive Officer of 132 percent.

|

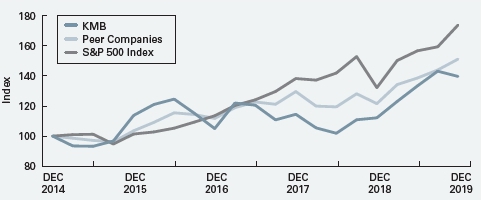

The chart at left shows the Total Shareholder Return for Kimberly-Clark, our Executive Compensation Peer Group (taken as a whole) and the S&P 500 for the previous five years, which reflects the value returned to our stockholders. |

| 4 | 2020 Proxy Statement |

|

Proxy Summary |

Corporate Governance

Board Succession Planning. In recent years the Board has demonstrated its commitment to refreshing the composition of the Board through the execution of a long-term succession plan by adding six new independent directors.

| Recently Added Independent Directors | ||

| S.Todd Maclin | Retired Chairman, Chase Commercial and Consumer Banking JPMorgan Chase |

2019 |

| Dunia A. Shive | Former Chief Executive Officer Belo Corp. |

2019 |

| Mark T. Smucker | President and CEO J.M. Smucker |

2019 |

| Sherilyn S. McCoy | Former Chief Executive Officer Avon Products |

2018 |

| Christa S. Quarles | Former Chief Executive Officer OpenTable |

2016 |

| Michael D. White | Former Chairman, President and Chief Executive Officer DIRECTV |

2015 |

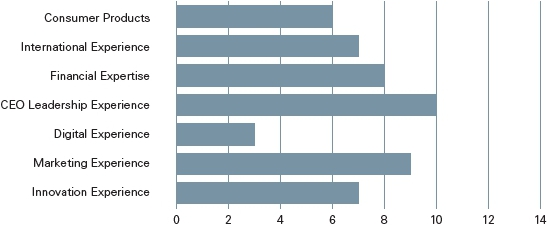

| DIRECTOR NOMINEE EXPERIENCE IN PRIORITY AREAS | GENDER DIVERSITY | |

|

| |

| ETHNIC DIVERSITY | ||

|

Governance Highlights. The Corporate Governance section beginning on page 10 describes our governance framework, which includes:

| Our Corporate Governance Profile | |

| Independent Lead Director | Stockholders Have Right to Call Special Meetings |

| Independent Board Committees | Proxy Access Rights |

| Annual Board and Committee Evaluations | Stockholder Engagement Policy and Outreach Program |

| Annually Elected Directors | Anti-Hedging and Pledging Policy |

| Independent Directors Meet Without Management Present | Stock Ownership Guidelines for Directors and Executive Officers |

| Board and Management Succession Planning | Outside Director Equity Awards Not Paid Out Until Retirement |

| Robust Oversight of Strategy and Risk | Majority Voting in Director Elections |

In 2019, our Management Development and Compensation Committee enhanced our compensation clawback policy to address situations involving significant financial or reputational harm. For details, see “Compensation Discussion and Analysis - Additional Information about Our Compensation Practices - Compensation Clawback Policy.”

| 2020 Proxy Statement | 5 |

|

Proxy Summary |

Our Board Nominees

We believe our director nominees collectively possess the necessary experience and attributes to effectively guide our company and reflect the diversity of our global consumers.

| Name Main Occupation |

Independent | Audit Committee | MDC Committee | NCG Committee | Executive Committee |

| Michael D. Hsu Chairman of the Board and CEO Kimberly-Clark Corporation |

✓ | ||||

| Abelardo E. Bru Retired Vice Chairman PepsiCo, Inc. |

✓ | Chair | ✓ | ||

| Robert W. Decherd Chairman, President and CEO A.H. Belo Corporation |

✓ | ✓ | |||

| Mae C. Jemison, M.D. President The Jemison Group |

✓ | ✓ | ✓ | ||

| S.Todd Maclin Retired Chairman, Chase Commercial and Consumer Banking JPMorgan Chase & Co. |

✓ | ✓ | |||

| Sherilyn S. McCoy Former CEO Avon Products, Inc. |

✓ | ✓ | ✓ | ||

| Christa S. Quarles Former CEO OpenTable, Inc. |

✓ | ✓ | |||

| Ian C. Read Former Chairman and CEO Pfizer, Inc. |

✓ | Chair | |||

| Dunia A. Shive Former CEO and President Belo Corp. |

✓ | ✓ | |||

| Mark T. Smucker President and CEO The J.M. Smucker Company |

✓ | ✓ | |||

| Michael D. White Former Chairman, President and CEO DIRECTV |

✓ | Chair | ✓ |

Nancy J. Karch and Marc J. Shapiro will not stand for re-election to the Board of Directors when their terms expire at this year’s Annual Meeting. Ms. Karch currently serves as Chair of the Nominating and Corporate Governance Committee and a member of the Executive Committee and Mr. Shapiro currently serves as a member of the Management Development and Compensation Committee and the Nominating and Corporate Governance Committee.

| 6 | 2020 Proxy Statement |

|

Information About Our

Annual Meeting

| ► | FOR the election of directors named in this proxy statement |

| ► | FOR ratification of the selection of our independent auditor |

| ► | FOR approval of the compensation of our named executive officers |

| ► | AGAINST the stockholder proposal requesting stockholders be permitted to act by written consent |

| 2020 Proxy Statement | 7 |

|

Information About Our Annual Meeting Effect of Not Instructing Your Broker |

| ► | Mail a revised proxy form to the Corporate Secretary of Kimberly-Clark (the form must be received before the meeting starts). Use the following address: 351 Phelps Drive, Irving, TX 75038 |

| ► | Use the Internet voting website |

| ► | Use the telephone voting procedures |

| ► | Attend the meeting and vote in person |

Election of Directors. A director nominee will be elected if he or she receives a majority of the votes cast at the meeting in person or by proxy. If any nominee does not receive a majority of the votes cast, then that nominee will be subject to the Board’s policy regarding resignations by directors who do not receive a majority of “for” votes.

Election of Directors. Abstentions will have no impact on the outcome of the vote. They will not be counted for the purpose of determining the number of votes cast or as votes “for” or “against” a nominee.

Other Proposals. Abstentions will be counted:

| ► | as present in determining whether we have a quorum |

| ► | in determining the total number of shares entitled to vote on a proposal |

| ► | as votes against a proposal |

Routine Matters. If your shares are held through a broker and you do not instruct the broker on how to vote your shares, your broker may choose to leave your shares unvoted or to vote your shares on routine matters. “Proposal 2. Ratification of Auditor” is the only routine matter on the agenda at this year’s Annual Meeting.

| 8 | 2020 Proxy Statement |

|

Information About Our Annual Meeting Costs of Solicitation |

Preregistration. In order to attend the Annual Meeting, you must preregister by emailing stockholders@kcc.com by 5:00 p.m. Central Time on April 24, 2020 to confirm that you or your proxy holder or representative plan to attend. If you hold your shares in street name, your preregistration email must include proof of ownership as of the record date. Acceptable forms of proof of ownership include your Notice of Internet Availability of Proxy Materials, your proxy card or voting instruction form if you received one, or an account or brokerage statement showing share ownership as of the record date. If your proxy holder or representative will attend, your preregistration email must also include the name of the proxy holder or representative and a valid proxy authorizing the proxy holder or representative to act on your behalf.

Kimberly-Clark will bear all costs of this proxy solicitation, including the cost of preparing, printing and delivering materials, the cost of the proxy solicitation and the expenses of brokers, fiduciaries and other nominees who forward proxy materials to stockholders. In addition to mail and electronic means, our employees may solicit proxies by telephone or otherwise. We have retained D. F. King & Co., Inc. to aid in the solicitation at a cost of approximately $20,000 plus reimbursement of out-of-pocket expenses.

| 2020 Proxy Statement | 9 |

|

Our governance structure and processes are based on a number of important governance documents including our Code of Conduct, Certificate of Incorporation, Corporate By-Laws, Corporate Governance Policies and our Board Committee Charters. These documents, which are available in the Investors section of our website at www.kimberly-clark.com, guide the Board and our management in the execution of their responsibilities.

Consistent with this leadership structure, at least once a quarter our Lead Director, who is an independent director, chairs executive sessions of our non-management directors. Members of our senior management team do not attend these sessions.

Chairman and Chief Executive Officer Positions

The Board’s current view is that a combined Chairman and CEO position, coupled with a predominantly independent board and a proactive, independent Lead Director, promotes candid discourse and responsible corporate governance. Mr. Hsu serves as Chairman of the Board and CEO. The Board believes Mr. Hsu has demonstrated the leadership and vision necessary to lead the Board and Kimberly-Clark. Accordingly, Mr. Hsu serves in this combined role at the pleasure of the Board without an employment contract. As Mr. Hsu is not an independent director, the Board continues to believe it is appropriate for the independent directors to elect an Independent Lead Director.

Lead Director

Mr. Read has served as Independent Lead Director since 2017. Our Corporate Governance Policies outline the significant role and responsibilities of the Lead Director, which include:

| ► | Chairing the Executive Committee |

| ► | Chairing executive sessions at which non-management directors meet outside management’s presence, and providing feedback from such sessions to the Chief Executive Officer |

| ► | Coordinating the activities of the Independent Directors |

| ► | Providing input on and approving the agendas and schedules for Board meetings |

| ► |

Leading (with the Chairman of the Nominating and Corporate Governance Committee) the annual Board evaluation |

| 10 | 2020 Proxy Statement |

|

Corporate Governance Board Meetings |

| ► | Leading (with the Chairman of the Management Development and Compensation Committee) the Board’s review and discussion of the Chief Executive Officer’s performance |

| ► | Providing feedback to individual directors following their individual evaluations |

| ► | Speaking on behalf of the Board and chairing Board meetings when the Executive Chairman of the Board is unable to do so |

| ► | Acting as a direct conduit to the Board for stockholders, employees and others according to the Board’s policies |

Our Corporate Governance Policies, as adopted by the Board, provide independence standards consistent with the rules and regulations of the SEC and the listing standards of the New York Stock Exchange (“NYSE”). Our independence standards can be found in Section 7 of our Corporate Governance Policies.

The Board has determined that all directors and nominees, except for Michael D. Hsu, are Independent Directors and meet the independence standards in our Corporate Governance Policies. In addition, the Board previously reviewed the independence of former directors John F. Bergstrom and James M. Jenness, who did not stand for re-election at our 2019 Annual Meeting, and found that Mr. Bergstrom and Mr. Jenness were also independent. Thomas J. Falk, who served as our Executive Chairman throughout 2019, was not independent. In making these determinations, the Board considered the following:

| ► | Companies majority-owned by Mr. Bergstrom paid us approximately $57,000 in 2017, 2018 and 2019 to lease excess hangar space at an airport near Appleton, Wisconsin, and approximately $240,000 in 2017, $240,000 in 2018 and $248,000 in 2019 for pilot services pursuant to a pilot sharing contract. In addition, these companies paid us approximately $198,000 in 2017, $197,000 in 2018 and $202,000 in 2019 for scheduling and aircraft services for their airplane. |

| ► | We paid approximately $11,000 in 2017, $6,000 in 2018 and $1,000 in 2019 for automobiles and related services to car dealerships in the Neenah, Wisconsin area that are majority-owned by Mr. Bergstrom. |

The NYSE listing standards and our own Corporate Governance Policies establish certain levels at which transactions are considered to have the potential to affect a director’s independence. The transactions listed above all fall below these levels. Under our Corporate Governance Policies, certain relationships were considered immaterial and therefore were not considered by the Board in determining independence.

The Board of Directors met seven times in 2019. All of the directors attended in excess of 75 percent of the total number of meetings of the Board and the committees on which they served.

All of our directors are encouraged to attend our annual meeting of stockholders. All of our directors attended the 2019 Annual Meeting.

| 2020 Proxy Statement | 11 |

|

Corporate Governance Board Meetings |

Our Committee charters are available in the Investors section of our website at www.kimberly-clark.com.

As set forth in our Corporate Governance Policies, the Audit, Management Development and Compensation, and Nominating and Corporate Governance Committees all have the authority to retain independent advisors and consultants, with all costs paid by Kimberly-Clark.

Audit Committee

|

Chairman: Michael D. White Other members: Robert W. Decherd, S. Todd Maclin, Christa S. Quarles, Dunia A. Shive and Mark T. Smucker |

The Board has determined that each Audit Committee member is an “audit committee financial expert” under SEC rules and regulations. In addition, all Audit Committee members satisfy the NYSE’s financial literacy requirements and qualify as Independent Directors under the rules of the SEC and the NYSE, as well as under our Corporate Governance Policies. See “Corporate Governance - Director Independence” for additional information on Independent Directors.

No member of the Audit Committee serves on the audit committees of more than three public companies and under our Audit Committee Charter, no Committee member is permitted to do so.

During 2019 the Committee met eight times.

The Committee’s principal functions, as specified in its charter, include:

| ► | Overseeing: |

| ➢ | the quality and integrity of our financial statements |

| ➢ | our compliance programs |

| ➢ | the independence, qualification and performance of our independent auditor |

| ➢ | the performance of our internal auditor |

| ► | Selecting and engaging our independent auditor, subject to stockholder ratification |

| ► | Pre-approving all audit and non-audit services that our independent auditor provides |

| ► | Reviewing the scope of audits and audit findings, including any comments or recommendations of our independent auditor |

| ► | Establishing policies for our internal audit programs |

| ► | Overseeing the company’s risk management program (including risks related to data privacy and cybersecurity) and receiving periodic reports from management on risk assessments, the risk management process, and issues related to the risks of managing our business |

Committee Report

For additional information about the Audit Committee’s oversight activities in 2019, see “Proposal 2. Ratification of Auditor - Audit Committee Report.”

| 12 | 2020 Proxy Statement |

|

Corporate Governance Board Committees |

|

Chairman: Abelardo E. Bru Other members: Mae C. Jemison, M.D., Sherilyn S. McCoy and Marc J. Shapiro |

Each member of this Committee is an Independent Director under the rules of the SEC and the NYSE, as well as under our Corporate Governance Policies. The Committee met five times in 2019.

The Committee’s principal functions, as specified in its charter, include:

| ► | Establishing and administering the policies governing annual compensation and long-term compensation, including stock option awards, restricted stock awards and restricted share unit awards, such that the policies are designed to align compensation with our overall business strategy and performance | |

| ► | Setting, after an evaluation of his overall performance, the compensation level of the Chief Executive Officer | |

| ► | Approving, in consultation with the Chief Executive Officer, compensation levels and performance targets for the senior executive team | |

| ► | Overseeing: | |

| ➢ | leadership development for senior management and future senior management candidates | |

| ➢ | a periodic review of our long-term and emergency succession planning for the Chief Executive Officer and other key officer positions, in conjunction with our Board | |

| ➢ | key organizational effectiveness and engagement policies | |

| ► | Reviewing diversity and inclusion programs and related metrics | |

| ► | Annually reviewing our compensation policies and practices for the purpose of mitigating risks arising from these policies and practices that could reasonably have a material adverse effect | |

Roles of the Committee and the CEO in Compensation Decisions

Each year, the Committee reviews and sets the compensation of the officers that are elected by the Board (our “elected officers”), including our Chief Executive Officer and our other executive officers. The Committee’s charter does not permit the Committee to delegate to anyone the authority to establish any compensation policies or programs for elected officers, including our executive officers. With respect to officers that have been appointed to their position (our “non-elected officers”), our Chief Executive Officer has the authority to establish compensation programs and to approve equity grants. However, only the Committee may make grants to elected officers, including our executive officers.

| 2020 Proxy Statement | 13 |

|

Corporate Governance Board Committees |

Use of Compensation Consultants

The Committee’s charter authorizes it to retain advisors, including compensation consultants, to assist it in its work. The Committee believes that compensation consultants can provide important market information and perspectives that can help it determine compensation programs that best meet the objectives of our compensation policies. In selecting a consultant, the Committee evaluates the independence of the firm as a whole and of the individual advisors who will be working with the Committee.

Independent Committee Consultant. In 2019, the Committee retained Semler Brossy Consulting Group as its independent executive compensation consultant. According to the Committee’s written policy, the independent Committee consultant provides services solely to the Committee and not to Kimberly-Clark. Semler Brossy has no other business relationship with Kimberly-Clark and receives no payments from us other than fees for services to the Committee. Semler Brossy reports directly to the Committee, and the Committee may replace it or hire additional consultants at any time. A representative of Semler Brossy attends Committee meetings and communicates with the Chairman of the Committee between meetings from time to time.

The scope of Semler Brossy’s engagement in 2019 included:

| ► | Conducting a review of the competitive market data (including base salary, annual incentive targets and long-term incentive targets) for our executive officers, including our Chief Executive Officer and Executive Chairman |

| ► | Reviewing and commenting, as requested by the Committee, on recommendations by management and Mercer Human Resource Consulting (“Mercer”) concerning executive compensation programs, including program changes and redesign, special awards, change-of-control provisions, our executive compensation peer group, any executive contract provisions, promotions, retirement and related items |

| ► | Reviewing and commenting on the Committee’s report for the proxy statement |

| ► | Attending Committee meetings |

| ► | Periodically consulting with the Chairman of the Committee |

During 2019, at the request of the Committee, a representative of Semler Brossy attended all Committee meetings.

Kimberly-Clark Consultant. To assist management and the Committee in assessing our compensation programs and determining appropriate, competitive compensation for our executive officers, Kimberly-Clark annually engages an outside compensation consultant. In 2019, it retained Mercer for this purpose. Mercer has provided consulting services to Kimberly-Clark on a wide variety of human resources and compensation matters, both at the officer and non-officer levels. During 2019, Mercer provided advice and counsel on various matters relating to executive and director remuneration, including the following services:

| ► | Assessing our executive compensation peer group and recommending changes as necessary |

| ► | Assessing compensation levels within our peer group for executive officer positions and other selected positions |

| 14 | 2020 Proxy Statement |

|

Corporate Governance Board Committees |

| ► | Reviewing historic and projected performance for peer group companies under the metrics we use in our annual and long-term incentive plans |

| ► | Assisting in incentive plan design and modifications, as requested |

| ► | Providing market research on various issues as requested by management |

| ► | Preparing for and participating in Committee meetings, as requested |

| ► | Reviewing the Compensation Discussion and Analysis section of the proxy statement and other disclosures, as requested |

| ► |

Consulting with management on compensation matters |

Committee Assessment of Consultant Conflicts of Interest. The Committee has reviewed whether the work provided by Semler Brossy and Mercer represents any conflict of interest. Factors considered by the Committee include: (1) other services provided to Kimberly-Clark by the consultant; (2) what percentage of the consultant’s total revenue is made up of fees from Kimberly-Clark; (3) policies or procedures of the consultant that are designed to prevent a conflict of interest; (4) any business or personal relationships between individual consultants involved in the engagement and Committee members; (5) any shares of Kimberly-Clark stock owned by individual consultants involved in the engagement; and (6) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. Based on its review, the Committee does not believe that any of the compensation consultants that performed services in 2019 has a conflict of interest with respect to the work performed for Kimberly-Clark or the Committee.

Committee Report

The Committee has reviewed the “Compensation Discussion and Analysis” section of this proxy statement and has recommended that it be included in this proxy statement. The Committee’s report is located at “Compensation Discussion and Analysis — Management Development and Compensation Committee Report.”

Nominating and Corporate Governance Committee

|

Chair: Nancy J. Karch Other Members: Mae C. Jemison, M.D., Sherilyn S. McCoy and Marc J. Shapiro |

Each member of this Committee is an Independent Director under the rules of the SEC and the NYSE, as well as under our Corporate Governance Policies. The Committee met four times in 2019.

The Committee’s principal functions, as specified in its charter, include the following:

| ► | Maintaining and reviewing a Board succession plan | |

| ► | Overseeing the process for Board nominations | |

| ► | Advising the Board on: | |

| ➢ |

Board organization, membership, function, performance and compensation | |

| ➢ | committee structure and membership | |

| ➢ | policies and positions regarding significant stockholder relations issues | |

| ► | Overseeing corporate governance matters, including developing and recommending to the Board changes to our Corporate Governance Policies | |

| 2020 Proxy Statement | 15 |

|

Corporate Governance Stockholder Rights |

| ► | Reviewing director independence standards and making recommendations to the Board with respect to the determination of director independence |

| ► | Monitoring and recommending improvements to the Board’s practices and procedures |

| ► | Reviewing stockholder proposals and considering how to respond to them |

| ► | Overseeing matters relating to Kimberly-Clark’s corporate social responsibility and sustainability activities and providing input to management on these programs and their effectiveness |

The Committee, in accordance with its charter and our Certificate of Incorporation, has established criteria and processes for director nominations, including those proposed by stockholders. Those criteria and processes are described in “Proposal 1. Election of Directors - Process and Criteria for Nominating Directors,” “Other Information - Stockholder Director Nominees for Inclusion in Next Year’s Proxy Statement” and “Other Information - Stockholder Director Nominees Not Included in Next Year’s Proxy Statement.”

Executive Committee

|

Chairman: Ian C. Read (Lead Independent Director) Other Members: Abelardo E. Bru, Michael D. Hsu, Nancy J. Karch and Michael D. White |

The Committee did not meet in 2019.

The Committee’s principal function is to exercise, when necessary between Board meetings, the Board’s powers to direct our business and affairs.

None of the members of the Management Development and Compensation Committee is a current or former officer or employee of Kimberly-Clark. No interlocking relationship exists between the members of our Board of Directors or the Management Development and Compensation Committee and the board of directors or compensation committee of any other company.

Proxy Access By-Law. Eligible stockholders may nominate candidates for election to the Board under our “proxy access” By-Law. Proxy access candidates will be included in our proxy materials. The proxy access By-Law permits a stockholder, or a group of up to 20 stockholders, owning three percent or more of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials directors constituting up to two individuals or 20 percent of the Board (whichever is greater).

Stockholders who wish to nominate directors under our proxy access By-Law should follow the instructions under “Other Information - Stockholder Director Nominees for Inclusion in Next Year’s Proxy Statement.”

| 16 | 2020 Proxy Statement |

|

Corporate Governance Our Approach to Sustainability |

Board Policy on Stockholder Rights Plans. We do not have a “poison pill” or stockholder rights plan. If we were to adopt a stockholder rights plan, the Board would seek prior stockholder approval of the plan unless, due to timing constraints or other reasons, a majority of Independent Directors of the Board determines that it would be in the best interests of stockholders to adopt a plan before obtaining stockholder approval. If a stockholder rights plan is adopted without prior stockholder approval, the plan must either be ratified by stockholders or must expire, without being renewed or replaced, within one year. The Nominating and Corporate Governance Committee reviews this policy statement periodically and reports to the Board on any recommendations it may have concerning the policy.

Simple Majority Voting Provisions. Our Certificate of Incorporation does not include supermajority voting provisions.

The Board has established a process by which stockholders and other interested parties may communicate with the Board, including the Lead Director. That process can be found in the Investors section of our website at www.kimberly-clark.com.

Each year we meet with investors on corporate governance matters, including executive compensation, board composition and refreshment and corporate social responsibility and sustainability. This process ensures that management and the Board understand and consider the issues that matter most to our stockholders and enables the company to address them effectively. During 2019, we offered meetings to stockholders representing more than 50 percent of our common stock and held numerous discussions. Our executive compensation programs and corporate governance profile reflect the input of stockholders from our outreach efforts.

Everything we do at Kimberly-Clark is connected to our vision to lead the world in essentials for a better life. We strive to deliver on our value of caring for the communities where we live and work -so the environment around us and the people we serve will have a brighter future.

| 2020 Proxy Statement | 17 |

|

Corporate Governance Our Approach to Sustainability |

| Priority | What We’re Doing | 2022 Goal |

Forests & Fiber |

Innovating our tissue products to reduce their natural forest footprint. | 50% reduction in natural forest fiber use. |

Waste & Recycling |

Delivering innovation to help keep product and packaging material out of landfills. | Identify and deploy solutions that avoid and/or divert 150,000 MT of materials to higher value alternatives. |

Energy & Climate |

Increasing our energy efficiency while seeking lower carbon solutions. | 20% reduction of greenhouse gas emissions. |

Supply Chain |

Creating value from source to shelf with a sustainable supply chain. | Set sustainable water use targets. |

Social Impact |

Improving lives through social and community investments that increase access to sanitation, help children thrive and empower women and girls. | Improve the lives of 25 million people in need. |

Our sustainability program is not only good for our communities and the environment, but it is also good for our business. Our sustainability program provides cost savings, provides us with a more resilient supply chain for the long-term, grows brand equity and provides opportunities for more meaningful employee and consumer engagement.

Board Oversight and Governance. Our Board has established and approved the framework for our sustainability-related policies and procedures, including environmental stewardship, energy and climate, fiber sourcing, product safety, charitable contributions, human rights, labor, and diversity and inclusion in employment. As part of their oversight roles, the Board and the Nominating and Corporate Governance Committee receive regular reports from management on these topics, our goals and our progress toward achieving them.

Our Board oversees risk management, including risks related to environmental and social issues. The Board is focused on our long-term business strategy, including fostering sustainability-driven innovations, and incorporates our sustainability risks and opportunities into its overall strategic decision-making. Sustainability risk areas for our company include shifting consumer preferences toward sustainable choices, supply chain risks related to water security and deforestation and the cost of energy we use to make and market our products.

| 18 | 2020 Proxy Statement |

|

Corporate Governance Our Approach to Sustainability |

Recent Results. In 2019, we published our progress three years into our Sustainability 2022 program through 2018, which included significant progress against our goals. Highlights from 2018 include:

| ► | Co-founded the Alliance for Period Supplies to help women and girls in need access period supplies |

| ► | Met absolute greenhouse gas (GHG) reduction goals four years early, down 27% from 2005 |

| ► | Reduced use of fiber from natural forest landscapes by 30% since 2011 |

| ► | Diverted more than 21,000 metric tons of material to higher value alternatives |

| ► | Reduced our water use at our facilities in high-stress regions by 24% |

| ► | Introduced alternative energy sources across six manufacturing sites, including wind, solar and cogeneration projects |

Our energy and climate goals were accelerated by a combination of conservation and alternative energy projects. Over the past three years, we have executed more than 400 energy conservation projects and deployed lean energy projects at 37 sites. We also implemented six alternative energy projects around biomass boilers, lower GHG emitting fuels and cogeneration. The electricity produced because of the company’s virtual power purchase agreements with two wind farms offset 99% of the electricity purchased by its Kimberly-Clark Professional manufacturing sites in the United States.

In response to meeting our energy and climate goals early, we determined to double our GHG reduction target from 20% to 40% reduction by 2022.

Sustainability Reporting. Each year, Kimberly-Clark publishes our Global Sustainability Report outlining our strategies and results in greater detail. Our report is organized and presented in accordance with the Global Reporting Initiative (GRI) Sustainability Reporting Standards, and can be found on our website at www.kimberly-clark.com. We continue to monitor best practices on reporting frameworks including the emerging trend towards reporting aligned with standards of the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). We regularly engage with key stakeholders on this issue.

Stakeholder Engagement and Recognition. In setting our sustainability priorities and implementing our program, we continue to engage key external stakeholders. We maintain an independent Sustainability Advisory Board with external members to provide guidance on key governance, social and environmental issues to inform our sustainability priories and programs.

We also routinely engage our stockholders on the topic of sustainability through our governance engagement program and regular investor meetings. In these meetings, we often discuss sustainability topics relevant to our business, our priorities and the impact to our business.

External partnerships also play an important role in our sustainability results. In 2018, Kimberly-Clark’s consumer and professional businesses signed on to Wrap UK’s Plastics Pact, and the company joined Ocean Conservancy’s Trash Free Seas Alliance as members of the steering committee. In addition, the company continued to foster strong relationships with World Wildlife Fund (WWF) and the Forest Stewardship Council® (FSC®) and used the partnership to build consumer awareness of responsible forestry practices.

| 2020 Proxy Statement | 19 |

|

Corporate Governance Other Corporate Governance Policies and Practices |

Our sustainability program continues to receive strong recognition from our external stakeholders. 2019 highlights included:

| ► | CDP (formerly Carbon Disclosure Project) Leadership category for Supply Chain |

| ► | FTSE4Good Index Series - 16th consecutive year - for excellence in environmental, social, and governance |

| ► | MSCI “AA” ranking for environmental, social, and governance |

| ► | Ethibel Sustainability Index Excellence Global |

| ► | Forbes’ The JUST 100: America’s Most JUST Companies, America’s Best Corporate Citizens, Best Employers List and Best Employers for Diversity |

| ► | US Environmental Protection Agency’s SmartWay Excellence Award (6th consecutive year) for freight supply chain energy and environmental performance |

| ► | Perfect score on 2018 Human Rights Campaign Foundation’s Corporate Equality Index for policies and practices pertinent to lesbian, gay, bisexual and transgender (LGBT) employees |

| ► | Corporate Reputation Magazine’s 100 Best Corporate Citizens |

| ► | EcoVadis Gold rating covering environment, fair labor practices, ethics/fair business practices, and supply chain |

Board and Committee Evaluations. The Board conducts annual self-evaluations to determine whether it and its committees are functioning effectively and whether its governing documents continue to remain appropriate. Each Board member is periodically evaluated on an individual basis. The process is designed and overseen by our Lead Director and our Nominating and Corporate Governance Committee, and the results of the evaluations are discussed by the full Board.

Each committee annually reviews its own performance and assesses the adequacy of its charter, and reports the results and any recommendations to the Board. The Nominating and Corporate Governance Committee oversees and reports annually to the Board its assessment of each committee’s performance evaluation process.

Board Succession Planning. Our Nominating and Corporate Governance Committee maintains and reviews a succession plan for the Board, as described in “Proposal 1. Election of Directors -Process and Criteria for Nominating Directors.”

Code of Conduct. Kimberly-Clark has a Code of Conduct that applies to all of our directors, executive officers and employees, including our Chief Executive Officer, Chief Financial Officer and Vice President and Controller. It is available in the Investors section of our website at www.kimberly-clark. com. Any amendments to or waivers of our Code of Conduct applicable to our Chief Executive Officer, Chief Financial Officer or Vice President and Controller will also be posted at that location.

| 20 | 2020 Proxy Statement |

|

Corporate Governance Other Corporate Governance Policies and Practices |

Board and Management Roles in Risk Oversight. The Board is responsible for providing risk oversight with respect to our operations. In connection with this oversight, the Board particularly focuses on our strategic and operational risks, as well as related risk mitigation. In addition, the Board reviews and oversees management’s response to key risks facing Kimberly-Clark.

The Board’s committees review particular risk areas to assist the Board in its overall risk oversight of Kimberly-Clark:

| ► | The Audit Committee oversees our risk management program, with a particular focus on our internal controls, compliance programs, financial statement integrity and fraud risks, data privacy and cybersecurity, and related risk mitigation. In connection with this oversight, the Audit Committee receives regular reports from management on risk assessments, the risk management process, and issues related to the risks of managing our business. The Audit Committee also receives an annual enterprise risk management update, which describes our key financial, strategic, operational and compliance risks. |

| ► | The Management Development and Compensation Committee reviews the risk profile of our compensation policies and practices. This process includes a review of an assessment of our compensation programs, as described in “Compensation Discussion and Analysis — Analysis of Compensation-Related Risks.” |

| ► | The Nominating and Corporate Governance Committee monitors risks relating to governance matters and recommends appropriate actions in response to those risks. In addition, it provides oversight of our Corporate Social Responsibility programs and sustainability activities and receives regular updates on the effectiveness of these programs. |

Complementing the Board’s overall risk oversight, our senior executive team identifies and monitors key enterprise-wide and business unit risks, providing the basis for the Board’s risk review and oversight process. We have a Global Risk Oversight Committee, consisting of management members from core business units and from our finance, treasury, global risk management, legal, internal audit, human resources and supply chain functions. This committee identifies significant risks for review and updates our policies for risk management in areas such as hedging, foreign currency and country risks, product liability, property and casualty risks, data privacy and cybersecurity risks, and supplier and customer risks. The Board believes the allocation of risk management responsibilities described above supplements the Board’s leadership structure by allocating risk areas to an appropriate committee for oversight, allows for an orderly escalation of issues as necessary, and helps the Board satisfy its risk oversight responsibilities.

Whistleblower Procedures. The Audit Committee has established procedures for receiving, recording and addressing any complaints we receive regarding accounting, internal accounting controls or auditing matters, and for the confidential and anonymous submission, by our employees or others, of any concerns about our accounting or auditing practices. We also maintain a toll-free Code of Conduct telephone helpline and a website, each allowing our employees and others to voice their concerns anonymously.

Chief Ethics and Compliance Officer. Our Vice President and Chief Ethics and Compliance Officer oversees our compliance programs. His duties include: regularly updating the Audit Committee on the effectiveness of our compliance programs, providing periodic reports to the Board, and working closely with our various compliance functions to promote coordination and sharing of best practices across these functions.

Management Succession Planning. In conjunction with the Board, the Management Development and Compensation Committee is responsible for periodically reviewing the long-term management development plans and succession plans for the Chief Executive Officer and other key officers, as well as the emergency succession plan for the Chief Executive Officer and other key officers if any of these officers unexpectedly becomes unable to perform his or her duties.

| 2020 Proxy Statement | 21 |

|

Corporate Governance Other Corporate Governance Policies and Practices |

Disclosure Committee. We have established a Disclosure Committee to assist in fulfilling our obligations to maintain disclosure controls and procedures and to coordinate and oversee the process of preparing our periodic securities filings with the SEC. This committee is composed of members of management and is chaired by our Vice President and Controller.

No Executive Loans. We do not extend loans to our executive officers or directors, and, therefore, do not have any such loans outstanding.

Charitable Contributions. The Nominating and Corporate Governance Committee has adopted guidelines for the review and approval of charitable contributions by Kimberly-Clark (or any foundation under the common control of Kimberly-Clark) to organizations or entities with which a director or an executive officer may be affiliated. We will disclose in the Investors section of our website at www.kimberly-clark.com any contributions made by us to a tax-exempt organization under the following circumstances:

| ► | An Independent Director serves as an executive officer of the tax-exempt organization; and |

| ► | If within the preceding three years, contributions in any single year from Kimberly-Clark to the organization exceeded the greater of $1 million or 2 percent of the tax-exempt organization’s consolidated gross revenues. |

| 22 | 2020 Proxy Statement |

|

Proposal 1.

Election of Directors

Nancy J. Karch and Marc J. Shapiro are not standing for re-election as they have reached our mandatory retirement age. Ms. Karch and Mr. Shapiro will continue to serve as directors until the Annual Meeting. We would like to thank Ms. Karch and Mr. Shapiro for their many years of service and substantial contributions to the Board, Kimberly-Clark and our stockholders.

Under our succession planning policy, the Nominating and Corporate Governance Committee maintains and reviews a Board succession plan, taking into account current composition and qualifications, Kimberly-Clark’s current and expected needs, director tenure, the effectiveness of the Board and any planned or unplanned vacancies. In consultation with the Executive Chairman of the Board and the Lead Director, the Committee screens and recruits director candidates and recommends to the Board any new appointments and nominees for election as directors at our annual meeting of stockholders. It also recommends nominees to fill any vacancies. As provided in our Certificate of Incorporation, the Board of Directors has the authority to determine the size of the Board and to fill any vacancies that occur between annual meetings of stockholders.

| 2020 Proxy Statement | 23 |

|

Proposal 1. Election of Directors Diversity of Directors |

The Committee believes that the criteria for director nominees should foster effective corporate governance, support our strategies and businesses and ensure that our directors, as a group, both have an overall mix of the attributes needed for an effective Board and reflect diversity of background and viewpoint. The criteria should also support the successful recruitment of qualified candidates.

Qualified candidates for director are those who, in the judgment of the Committee, possess a sufficient mix of the experience attributes listed below to ensure effective service on the Board. In addition, all nominees must possess high standards for ethical behavior, good interpersonal skills and a proactive and solution-oriented leadership style.

EXPERIENCE ATTRIBUTES

| Leadership experience as a chief or senior executive officer | Marketing, e-commerce and digital experience | |||

| Industry experience | Compensation, governance and public company board experience | |||

| International experience | Diversity of background or viewpoint | |||

| Financial expertise | ||||

For details about each nominee’s specific experience attributes, see “The Nominees” below.

| 24 | 2020 Proxy Statement |

|

Proposal 1. Election of Directors The Nominees |

Director since 2005 |

Abelardo E. Bru Retired Vice Chairman, PepsiCo, Inc. Mr. Bru retired as Vice Chairman of PepsiCo, a food and beverage company, in 2005. He joined PepsiCo in 1976. Mr. Bru served from 1999 to 2003 as President and Chief Executive Officer and in 2003 to 2004 as Chief Executive Officer and Chairman of Frito-Lay Inc., a division of PepsiCo. Prior to leading Frito-Lay, Mr. Bru led PepsiCo’s largest international business, Sabritas Mexico, as President and General Manager from 1992 to 1999. Mr. Bru is a member of the board of directors of the Education is Freedom Foundation. Other public company boards served on since 2015: DIRECTV (through July 2015) and Kraft Foods Group, Inc. (through July 2015).

Experience attributes: Mr. Bru satisfies the financial literacy requirements of the NYSE, has leadership experience as a chief executive officer, has knowledge about our industries, provides diversity of background and viewpoint, has international experience and experience with branded consumer packaged goods, and has marketing, compensation, governance and public company board experience. |

Director since 1996 |

Robert W. Decherd Chairman, President and Chief Executive Officer, A. H. Belo Corporation Mr. Decherd was elected Chairman, President and Chief Executive Officer of A. H. Belo Corporation, a newspaper publishing and Internet company, in 2018. He previously served as Chairman, President and Chief Executive Officer of A. H. Belo Corporation from 2008 to 2013 and served as Vice Chairman of the Board from 2013 to 2016. Mr. Decherd was Chief Executive Officer of Belo Corp., a broadcasting and newspaper publishing company, from 1987 to 2008, when the company split its newspaper and television businesses into two publicly-held entities. Mr. Decherd is presently Chairman of Parks for Downtown Dallas, a civic organization. He has previously served as a member of the Advisory Council of the Harvard University Center for Ethics and the Board of Visitors of the Columbia Graduate School of Journalism. Other public company boards served on since 2015: A. H. Belo Corporation

Experience attributes: Mr. Decherd has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, and has marketing, compensation, governance and public company board experience. |

| 2020 Proxy Statement | 25 |

|

Proposal 1. Election of Directors Diversity of Directors |

Director since 2017 |

Michael D. Hsu Chairman of the Board and Chief Executive Officer Mr. Hsu was elected Chairman of the Board in January 2020 and Chief Executive Officer in January 2019. Prior to that, he served as President and Chief Operating Officer since 2017, where he was responsible for the day-to-day operations of our business units, along with our global innovation, marketing and supply chain functions. He served as Group President, K-C North America from 2013 to 2016, where he was responsible for our consumer business in North America, as well as leading the development of new business strategies for global nonwovens. From 2012 to 2013, his title was Group President, North America Consumer Products. Prior to joining Kimberly-Clark, Mr. Hsu served as Executive Vice President and Chief Commercial Officer of Kraft Foods, Inc., from January 2012 to July 2012, as President of Sales, Customer Marketing and Logistics from 2010 to 2012 and as President of its grocery business unit from 2008 to 2010. Prior to that, Mr. Hsu served as President and Chief Operating Officer, Foodservice at H. J. Heinz Company. Other public company boards served on since 2015: Mr. Hsu has been elected to the board of Texas Instruments Incorporated effective April 1, 2020.

Experience attributes: Mr. Hsu satisfies the financial literacy requirements of the NYSE, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, has knowledge about our industries, has international experience and experience with branded consumer packaged goods, and has marketing experience. |

Director since 2002 |

Mae C. Jemison, M.D. President, The Jemison Group, Inc. Dr. Jemison is founder and President of The Jemison Group, Inc., a science, technology and innovation consulting company, and is also the Principal for the 100 Year Starship Project, an initiative started through competitive seed funding from DARPA that promotes science, technological and human systems breakthroughs and innovations by seeking to ensure that the capability required for human space travel to another star exists within 100 years. Dr. Jemison founded the Dorothy Jemison Foundation for Excellence and developed The Earth We Share international science camp and STEM programs. She was president and founder of BioSentient medical devices company from 2000 to 2012. Dr. Jemison was professor of Environmental Studies at Dartmouth College from 1995 to 2002 and is currently an adjunct professor at Dartmouth’s medical school. From 1987 to 1993 she served as a National Aeronautics and Space Administration (NASA) astronaut. Dr. Jemison is a member of the National Academy of Medicine and currently chairs its new study on increasing representation of women in science, technology, engineering, mathematics and medicine for the National Academies. She serves on the National Board of Professional Teaching Standards. She was founding chair of the State of Texas Product Development and Small Business Incubator Board and was a member of the National Advisory Council for Biomedical Imaging and Bioengineering. Other public company boards served on since 2015: Scholastic Corporation (through September 2015) and Valspar Corporation (through June 2017).

Experience attributes: Dr. Jemison satisfies the financial literacy requirements of the NYSE, has international experience and leadership experience of entrepreneurial start-up enterprises and non-profit organizations, provides diversity of background and viewpoint, and has compensation, governance and public company board experience. |

| 26 | 2020 Proxy Statement |

|

Proposal 1. Election of Directors Diversity of Directors |

Director since May 2019 |

S. Todd Maclin Retired Chairman, Chase Commercial and Consumer Banking, JPMorgan Chase & Co. Mr. Maclin retired in 2016 from a 37-year career at JPMorgan Chase & Co., and its predecessor banks, where he rose to Chairman, Chase Commercial and Consumer Banking in 2013, and served on the company's Operating Committee. Prior to that, he held a variety of leadership roles, including Regional Executive for Texas and the Southwest U.S., and Global Executive for Energy Investment Banking. Mr. Maclin serves as a director of The University of Texas Development Board, as a member of the Advisory Council for McCombs Graduate School of Business, on the Executive Committee of The University of Texas Chancellor's Council, on the Board of Visitors of UT Southwestern Health System, on the Steering Committee for the O'Donnell Brain Institute for UT Southwestern, and on the Board of Southwestern Medical Foundation and a member of its Investment Committee. Mr. Maclin also serves on the Board of The University of Texas Ex-Students' Alumni Association (Texas Exes) and served as its Interim Co-Executive Director during 2017. Mr. Maclin is President of Texas Exes for the term of June 2019-2020. He is also a lifetime member of Texas Exes and the UT President's Associates. In 2017, Mr. Maclin was inducted into the UT McCombs Texas Business Hall of Fame. Mr. Maclin also serves on the Board of Directors of RRH Corporation, the parent company of Hunt Consolidated, Inc.; is a Board Advisor for Cyber Defense Labs; and is an Advisory Director of BancAffiliated, Inc. Other public company boards served on since 2015: None.

Experience attributes: Mr. Maclin has been determined by our Board to qualify as an “audit committee financial expert” under the SEC’s rules and regulations and has a banking and finance background, has leadership experience as a senior executive, and provides diversity of background and viewpoint. |

Director since 2018 |

Sherilyn S. McCoy Former Chief Executive Officer, Avon Products, Inc. Ms. McCoy served as Chief Executive Officer and Director of Avon Products, Inc., a personal care products company, from 2012 to 2018. Prior to joining Avon, Ms. McCoy had a 30-year career at Johnson & Johnson, where she rose to Vice Chairman in 2011. Most recently at Johnson & Johnson, Ms. McCoy oversaw Pharmaceutical, Consumer, Corporate Office of Science & Technology, and Information Technology divisions. Prior to that, she served in a number of leadership roles, including Worldwide Chairman, Pharmaceuticals Group from 2009 to 2011; Worldwide Chairman, Surgical Care Group from 2008 to 2009; and Company Group Chairman and Worldwide Franchise Chairman of Ethicon, Inc., a subsidiary of Johnson & Johnson, from 2005 to 2008. Earlier in her career, Ms. McCoy was Global President of the Baby and Wound Care franchise; Vice President, Marketing for a variety of global brands; and Vice President, Research & Development for the Personal Products Worldwide Division. Other public company boards served on since 2015: AstraZeneca PLC (since October 2017), Avon Products, Inc. (through February 2018), NovoCure Limited (since May 2018) and Stryker Corporation (since May 2018).

Experience attributes: Ms. McCoy satisfies the financial literacy requirements of the NYSE, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, has knowledge about our industries, has international experience and experience with branded consumer packaged goods, and has marketing, compensation, governance and public company board experience. |

| 2020 Proxy Statement | 27 |

|

Proposal 1. Election of Directors Diversity of Directors |

Director since 2016 |

Christa S. Quarles Former Chief Executive Officer, OpenTable, Inc. Ms. Quarles served as Chief Executive Officer of OpenTable, Inc., a provider of online restaurant reservations and part of The Priceline Group, Inc. from November 2015 to 2018. Ms. Quarles served as the Chief Financial Officer of OpenTable from May 2015 to November 2015, when she was appointed Chief Executive Officer. Prior to joining OpenTable, Ms. Quarles served as Chief Business Officer of Nextdoor, Inc. from 2014 to May 2015. From 2010 to 2014, Ms. Quarles held positions of increasing responsibility with The Walt Disney Company, including Senior Vice President, General Manager Mobile and Social Games; General Manager, Disney Mobile Games; and Chief Financial Officer and Head of Business Operations, Mobile and Social Games. Prior to that, she was Chief Financial Officer of Playdom Inc., which was acquired by The Walt Disney Company in 2010. Other public company boards served on since 2015: None Experience attributes: Ms. Quarles has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations and has a background in finance, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, and has marketing, digital marketing and e-commerce experience. |

Director since 2007 |

Ian C. Read Former Chairman of the Board and Chief Executive Officer, Pfizer, Inc. Mr. Read served as Executive Chairman of Pfizer, Inc., a drug manufacturer, from January 2019 to December 2019. Prior to that, he served as Chairman of the Board and Chief Executive Officer since 2011 and President and Chief Executive Officer since 2010. Mr. Read joined Pfizer in 1978 in its financial organization. He worked in Latin America through 1995, holding positions of increasing responsibility, and was appointed President of the Pfizer International Pharmaceuticals Group, Latin America/Canada in 1996. In 2000, Mr. Read was named Executive Vice President of Europe/Canada and was named a corporate Vice President in 2001. In 2006, he was named Senior Vice President of Pfizer, as well as Group President of its Worldwide Biopharmaceutical Businesses. Other public company boards served on since 2015: Pfizer, Inc. (through December 2019) Experience attributes: Mr. Read satisfies the financial literacy requirements of the NYSE and has a background in finance, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, has international experience, and has marketing, compensation, governance and public company board experience. |

| 28 | 2020 Proxy Statement |

|

Proposal 1. Election of Directors Diversity of Directors |

Director since May 2019 |

Dunia A. Shive Former President and Chief Executive Officer, Belo Corp. Ms. Shive served as Senior Vice President of TEGNA Inc., formerly Gannett Co., Inc., a broadcast and digital media company, from 2013 to 2017. She previously served as President and Chief Executive Officer of Belo Corp. from 2008 to 2013, which was acquired by Gannett in 2013. She joined Belo Corp. in 1993 and served as Chief Financial Officer and various other leadership positions prior to her election as President and Chief Executive Officer. She serves as a Trustee of Parks for Downtown Dallas. Other public company boards served on since 2015: Dr Pepper Snapple Group, Inc. (through July 2018), Main Street Capital Corporation (since March 2019) and Trinity Industries, Inc. Experience attributes: Ms. Shive has been determined by our Board to qualify as an “audit committee financial expert” under the SEC’s rules and regulations and has an accounting and finance background, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, and has marketing, compensation, governance and public company board experience. |

Director since |

Mark T. Smucker President and Chief Executive Officer, The J.M. Smucker Company Mr. Smucker has served as President and Chief Executive Officer of The J.M. Smucker Company, a manufacturer and marketer of food and beverage products, since 2016. Prior to that time, he served as its President and President, Consumer and Natural Foods, from 2015 to 2016; President, U.S. Retail Coffee, from 2011 to 2015; President, Special Markets, from 2008 to 2011; Vice President, International, from 2007 to 2008; and Vice President, International and Managing Director, Canada, from 2006 to 2007. Other public company boards served on since 2015: The J.M. Smucker Company Experience attributes: Mr. Smucker has been determined by our Board to qualify as an “audit committee financial expert” under the SEC’s rules and regulations, has leadership experience as a chief executive officer, has knowledge about our industries, has experience with branded consumer packaged goods, and has marketing, compensation, governance and public company board experience. |

| 2020 Proxy Statement | 29 |

|

Proposal 1. Election of Directors Diversity of Directors |

Director since 2015 |

Michael D. White Former Chairman of the Board, President and Chief Executive Officer of DIRECTV Mr. White served as Chairman of the Board, President and Chief Executive Officer of DIRECTV, a leading provider of digital television entertainment services, from 2010 to July 2015. From 2003 until 2009, Mr. White was Chief Executive Officer of PepsiCo International and Vice Chairman, PepsiCo, Inc. after holding positions of increasing importance with PepsiCo since 1990. Mr. White is a member of the Boston College Board of Trustees and is Vice Chairman of The Partnership to End Addiction. Other public company boards served on since 2015: Bank of America Corporation (since June 2016), DIRECTV (through July 2015) and Whirlpool Corporation. Experience attributes: Mr. White has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations, has leadership experience as a chief executive officer, provides diversity of background and viewpoint, has international experience, and has marketing, digital marketing, e-commerce, compensation, governance and public company board experience. |

| The Board of Directors unanimously recommends a vote FOR the election of each of the eleven nominees for director. |

| 30 | 2020 Proxy Statement |

|

Proposal 1. Election of Directors Director Compensation |

Our objectives for Outside Director Compensation are:

| ► |

to remain competitive with the median compensation paid to outside directors of comparable companies |

| ► |

to keep pace with changes in practices in director compensation |

| ► |

to attract qualified candidates for Board service |

| ► |

to reinforce our practice of encouraging stock ownership by our directors |

In 2018, the Nominating and Corporate Governance Committee assessed our Outside Director compensation against the median non-management director compensation for our peers. Based on this review, the Committee recommended no change to Outside Director compensation for 2019, and the Board agreed with the Committee’s recommendation.

The table below shows how we structured Outside Director compensation in 2019:

| Board Members |

Cash retainer: $100,000 annually, paid in four quarterly payments at the beginning of each quarter. Restricted share units: Annual grant with a value of $180,000, awarded and valued on the first business day of the year | |

| Committee Chairs | Additional annual grant of restricted share units with a value of $20,000, awarded and valued on the first business day of the year | |

| Lead Director | Additional annual grant of restricted share units with a value of $30,000, awarded and valued on the first business day of the year | |

| Stockholder Alignment |

Restricted share units are not paid out until retirement or other termination of Board service |

New Outside Directors receive the full quarterly amount of the annual retainer for the quarter in which they join the Board. Their annual grant of restricted share units is pro-rated based on the date when they joined.

We also reimburse Outside Directors for expenses incurred in attending Board or committee meetings.

| 2020 Proxy Statement | 31 |

|

Proposal 1. Election of Directors 2019 Outside Director Compensation |

| Name(1) | Fees Earned or Paid in Cash($) |

Stock Awards ($)(2)(3)(4) |

All Other Compensation ($)(5) |

Total($)(6) |

| John F. Bergstrom | 50,000 | 180,000 | 20,000 | 250,000 |

| Abelardo E. Bru | 100,000 | 200,000 | 10,000 | 310,000 |

| Robert W. Decherd | 100,000 | 180,000 | 30,000 | 310,000 |

| Fabian T. Garcia | 100,000 | 180,000 | — | 280,000 |

| Mae C. Jemison, M.D. | 100,000 | 180,000 | — | 280,000 |

| James M. Jenness | 50,000 | 180,000 | — | 230,000 |

| Nancy J. Karch | 100,000 | 200,000 | 10,000 | 310,000 |

| S. Todd Maclin | 75,000 | 120,000 | — | 195,000 |

| Sherilyn S. McCoy | 100,000 | 180,000 | — | 280,000 |

| Christa S. Quarles | 100,000 | 180,000 | 5,000 | 285,000 |

| Ian C. Read | 100,000 | 210,000 | 10,000 | 320,000 |

| Marc J. Shapiro | 100,000 | 180,000 | — | 280,000 |

| Dunia A. Shive | 75,000 | 120,000 | — | 195,000 |

| Mark T. Smucker | 50,000 | 60,000 | — | 110,000 |

| Michael D. White | 100,000 | 200,000 | — | 300,000 |

| (1) | Messrs. Bergstrom and Jenness served as directors until their retirement on May 2, 2019 and received fees for two quarters. Mr. Maclin and Ms. Shive joined the Board on May 2, 2019 and received a pro-rated stock award as well as fees for three quarters. Mr. Smucker joined the Board on September 18, 2019 and received a pro-rated stock award as well as fees for two quarters. |

| (2) | Amounts shown reflect the grant date fair value of those grants, determined in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 — Stock Compensation (“ASC Topic 718”) for restricted share unit awards granted pursuant to our 2011 Outside Directors’ Compensation Plan. See Note 5 to our audited consolidated financial statements included in our Annual Report on Form 10-K for 2019 for the assumptions used in valuing these restricted share units. |

| (3) | Restricted share unit awards were granted to the Outside Directors on January 2, 2019, except for Mr. Maclin and Ms. Shive who joined the Board and received a grant on May 2, 2019 and Mr. Smucker who joined the Board and received a grant on September 18, 2019. The number of restricted share units granted is set forth below: |

| Name | Restricted Share Unit Grants in 2019(#) |

| John F. Bergstrom | 1,610 |

| Abelardo E. Bru | 1,789 |

| Robert W. Decherd | 1,610 |

| Fabian T. Garcia | 1,610 |

| Mae C. Jemison, M.D. | 1,610 |

| James M. Jenness | 1,610 |

| Nancy J. Karch | 1,789 |

| S. Todd Maclin | 943 |

| Sherilyn S. McCoy | 1,610 |

| Christa S. Quarles | 1,610 |

| Ian C. Read | 1,879 |

| Marc J. Shapiro | 1,610 |

| Dunia A. Shive | 943 |

| Mark T. Smucker | 451 |

| Michael D. White | 1,789 |

| 32 | 2020 Proxy Statement |

|

Proposal 1. Election of Directors 2019 Outside Director Compensation |

| (4) | As of December 31, 2019, Outside Directors had the following stock awards outstanding: |

| Name | Restricted Stock(#) | Restricted Share Units(#) | |

| John F. Bergstrom | — | — | |

| Abelardo E. Bru | — | 37,139 | |

| Robert W. Decherd | 3,000 | 47,034 | |

| Fabian T. Garcia | — | — | |

| Mae C. Jemison, M.D. | — | 43,388 | |

| James M. Jenness | — | — | |

| Nancy J. Karch | — | 20,546 | |

| S. Todd Maclin | — | 957 | |

| Sherilyn S. McCoy | — | 2,181 | |

| Christa S. Quarles | — | 5,785 | |

| Ian C. Read | — | 30,859 | |

| Marc J. Shapiro | — | 48,089 | |

| Dunia A. Shive | — | 957 | |

| Mark T. Smucker | — | 451 | |

| Michael D. White | — | 7,412 |

| (5) | Reflects charitable matching gifts paid in 2019 under the Kimberly-Clark Foundation’s Matching Gifts Program to a charity designated by the director. This program is available to all our employees and directors. Under the program, the Kimberly-Clark Foundation matches employees’ and directors’ financial contributions to qualified educational and charitable organizations in the United States on a dollar-for-dollar basis, up to $10,000 per person per calendar year. Amounts paid in 2019 in connection with certain matching gifts for Messrs. Bergstrom, Decherd and Read and Mmes. Karch and Quarles reflect donations made in 2018. In addition, $10,000 of the amount shown for Mr. Decherd was paid in 2019 in connection with a donation made in 2017. Not included in this column is the value of retirement gifts to each of Mr. Bergstrom and Mr. Jenness, which had a value of less than $1,000. In addition, we made a charitable contribution of $50,000 in honor of each of Mr. Bergstrom and Mr. Jenness. These contributions were made directly by Kimberly-Clark to charitable organizations selected by Kimberly-Clark and were not made in the name or at the direction of Mr. Bergstrom or Mr. Jenness. Mr. Bergstrom and Mr. Jenness did not receive any personal benefit from these contributions and accordingly, the amount of the contribution has been excluded from the Director Compensation table. |

| (6) | During 2019, Outside Directors received credit for cash dividends on restricted stock held by them. These dividends are credited to interest bearing accounts maintained by us on behalf of those Outside Directors with restricted stock. Earnings on those accounts are not included in the Outside Director Compensation Table because the earnings were not above market or preferential. Also in 2019, Outside Directors received additional restricted share units with a value equal to the cash dividends paid during the year on our common stock on the restricted share units held by them. Because we factor the value of the right to receive dividends into the grant date fair value of the restricted stock and restricted share units awards, the dividends and dividend equivalents received by Outside Directors are not included in the Outside Director Compensation table. The dividends and other amounts credited on restricted stock and additional restricted share units credited in 2019 were as follows: |

| Name | Dividends Credited on Restricted Stock($) |

Number of Restricted Share Units Credited in 2019(#) |

Grant Date Fair Value of Restricted Share Units Credited($) | |

| John F. Bergstrom | 6,090 | 721.29 | 84,079 | |

| Abelardo E. Bru | — | 1,162.33 | 147,222 | |

| Robert W. Decherd | 12,270 | 1,477.90 | 187,098 | |

| Fabian T. Garcia | — | 486.13 | 61,696 | |

| Mae C. Jemison, M.D. | — | 1,362.23 | 172,472 | |

| James M. Jenness | — | 568.09 | 66,239 | |

| Nancy J. Karch | — | 635.87 | 80,654 | |

| S. Todd Maclin | — | 14.14 | 1,950 | |

| Sherilyn S. McCoy | — | 54.77 | 7,153 | |

| Christa S. Quarles | — | 169.12 | 21,611 | |

| Ian C. Read | — | 962.28 | 121,940 | |