8K.Exhibit 99.1 Press Release 06.30.2015 Q4 10K

Exhibit 99.1

KIMBALL INTERNATIONAL, INC. ANNOUNCES IMPROVED FOURTH QUARTER AND FISCAL YEAR 2015 RESULTS

Fourth Quarter Adjusted Earnings Per Share Reaches $0.15, Significantly Exceeding Prior Year Earnings

JASPER, IN (July 30, 2015) - Kimball International, Inc. (NASDAQ: KBAL) today announced fourth quarter fiscal year 2015 net sales of $159.1 million and income from continuing operations of $4.7 million, or $0.12 per Class B diluted share. Adjusted income from continuing operations for the fourth quarter of fiscal year 2015 was $5.8 million, or $0.15 per share, excluding charges related to a previously announced restructuring plan and the spin-off of the Company's Electronic Manufacturing Services segment.

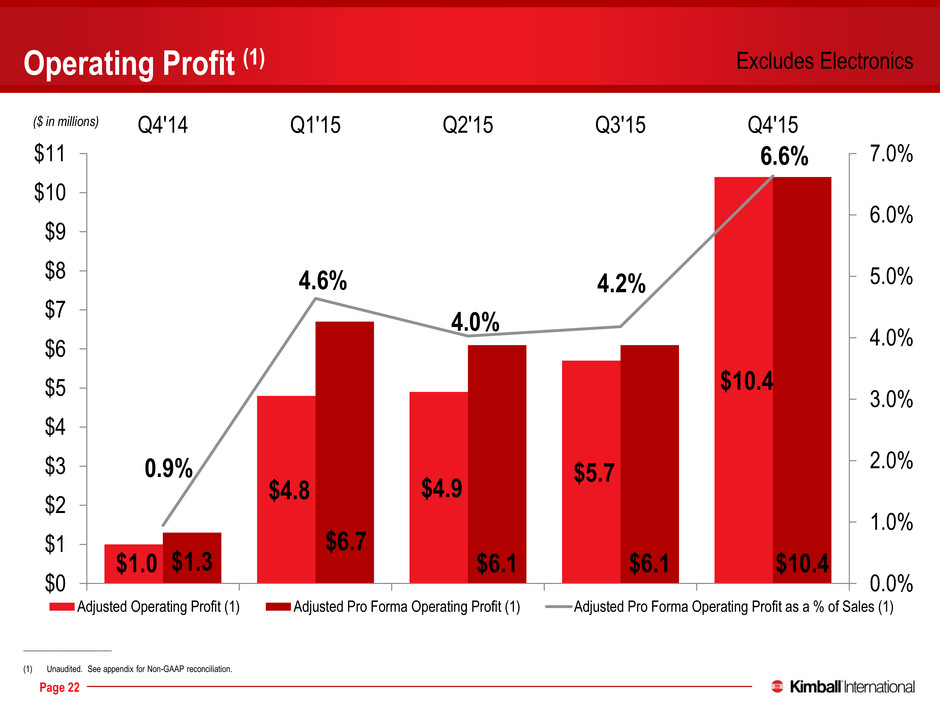

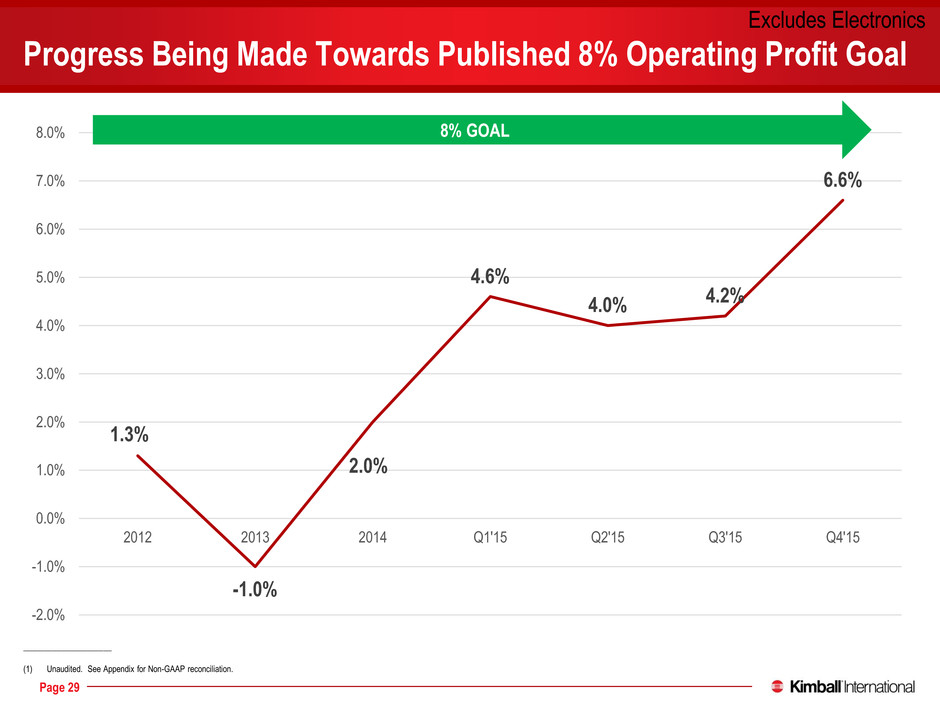

Bob Schneider, Chairman and CEO, stated, “Our turnaround is getting nice traction. Our business is growing across most verticals, with sales increasing a strong 15% compared to the prior year fourth quarter. Our profitably is up significantly, with the current quarter adjusted operating profit as a percent of net sales hitting the highest level in the last decade. It is very encouraging to see the progress and feel the excitement of our employees as we deliver on creative new product introductions and find ways to operate more efficiently. It is a tremendous team effort.”

On October 31, 2014, Kimball International spun off its Electronic Manufacturing Services segment. The following discussion excludes the results of the Electronic Manufacturing Services segment for all periods presented, except where indicated.

Overview

|

| | | | | | | | | | |

Financial Highlights (Amounts in Thousands, Except Per Share Data) | Three Months Ended | | |

| June 30,

2015 | June 30,

2014 | Percent Change |

Net Sales | $ | 159,061 |

| | $ | 137,858 |

| | 15 | % |

Gross Profit | $ | 51,079 |

| | $ | 42,056 |

| | 21 | % |

Gross Profit % | 32.1 | % | | 30.5 | % | | |

Selling and Administrative Expenses | $ | 40,818 |

| | $ | 42,175 |

| | (3 | %) |

Selling and Administrative Expenses % | 25.6 | % | | 30.6 | % | | |

Restructuring Expense | $ | 1,567 |

| | $ | 0 |

| |

|

Operating Income (Loss) | $ | 8,694 |

| | $ | (119 | ) | |

|

Operating Income (Loss) % | 5.5 | % | | (0.1 | %) | | |

Adjusted Operating Income (Loss) * | $ | 10,384 |

| | $ | (759 | ) | | 1,468 | % |

Adjusted Operating Income (Loss) % * | 6.5 | % | | (0.6 | %) | | |

Income from Continuing Operations | $ | 4,745 |

| | $ | 359 |

| |

|

Adjusted Income from Continuing Operations* | $ | 5,812 |

| | $ | 230 |

| | 2,427 | % |

Diluted Earnings Per Share from Continuing Operations | $ | 0.12 |

| | $ | 0.01 |

| |

|

Adjusted Diluted Earnings Per Share from Continuing Operations * | $ | 0.15 |

| | $ | 0.00 |

| |

|

* Items indicated represent Non-GAAP measurements. See “Reconciliation of Non-GAAP Financial Measures” below.

| |

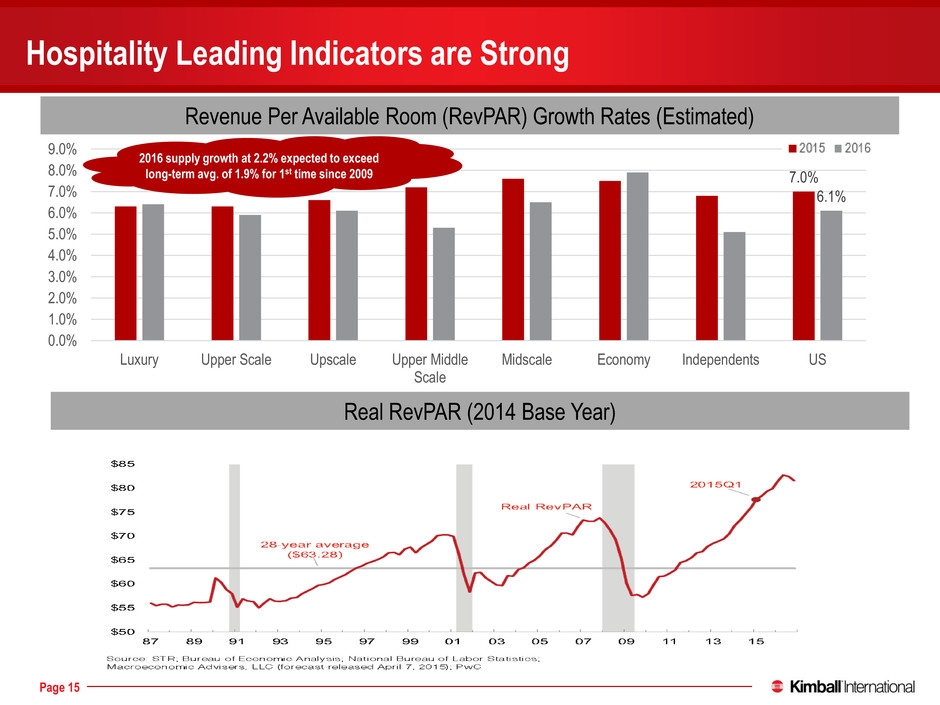

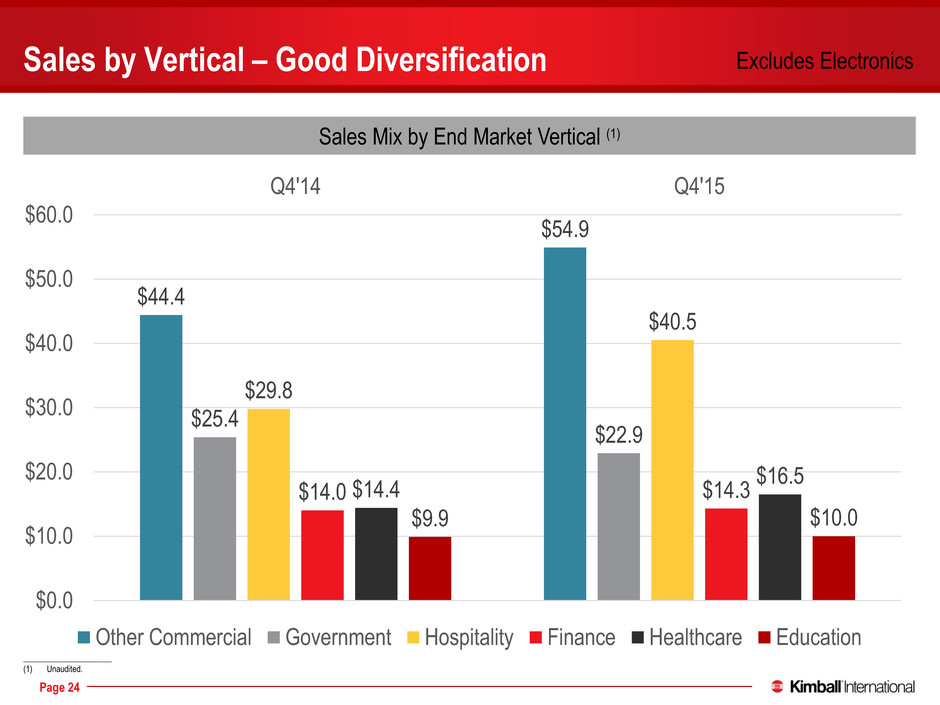

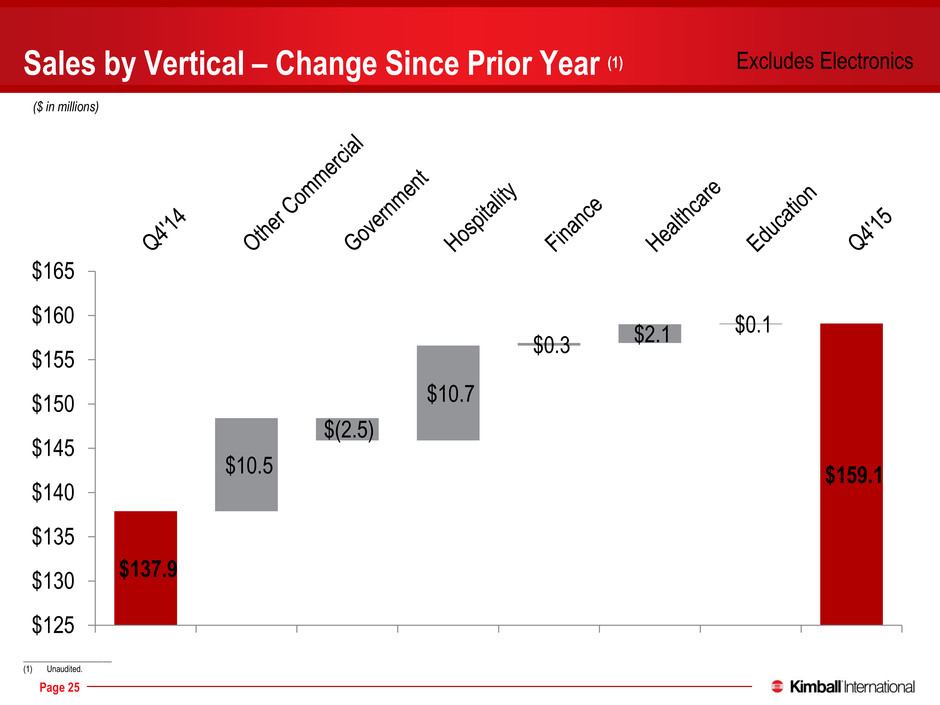

• | Net sales in the fourth quarter of fiscal year 2015 increased 15% from the prior year fourth quarter, primarily driven by increases in the hospitality and other commercial vertical markets. Net sales for the hospitality vertical increased 36% over the prior year, driven by strong sales of both custom and non-custom hospitality furniture. The other commercial vertical, which is the largest portion of our business focused on a broad variety of customers, increased 24% over the prior year fourth quarter, boosted by new product sales and the positive impact of marketing initiatives. |

| |

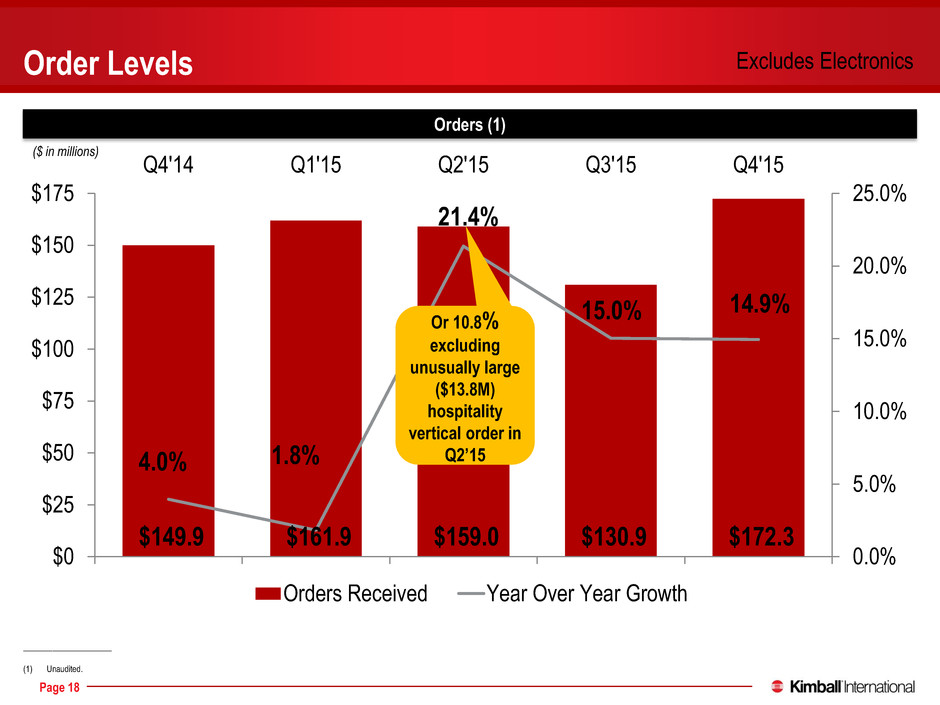

• | Orders received during the fiscal year 2015 fourth quarter increased 15% over the prior year fourth quarter. Orders in all market verticals increased with the exception of the education vertical. The hospitality and other |

commercial vertical markets in particular are experiencing significant growth, with hospitality orders growing in both custom and non-custom furniture, and other commercial orders benefiting from many new products which have been well received.

| |

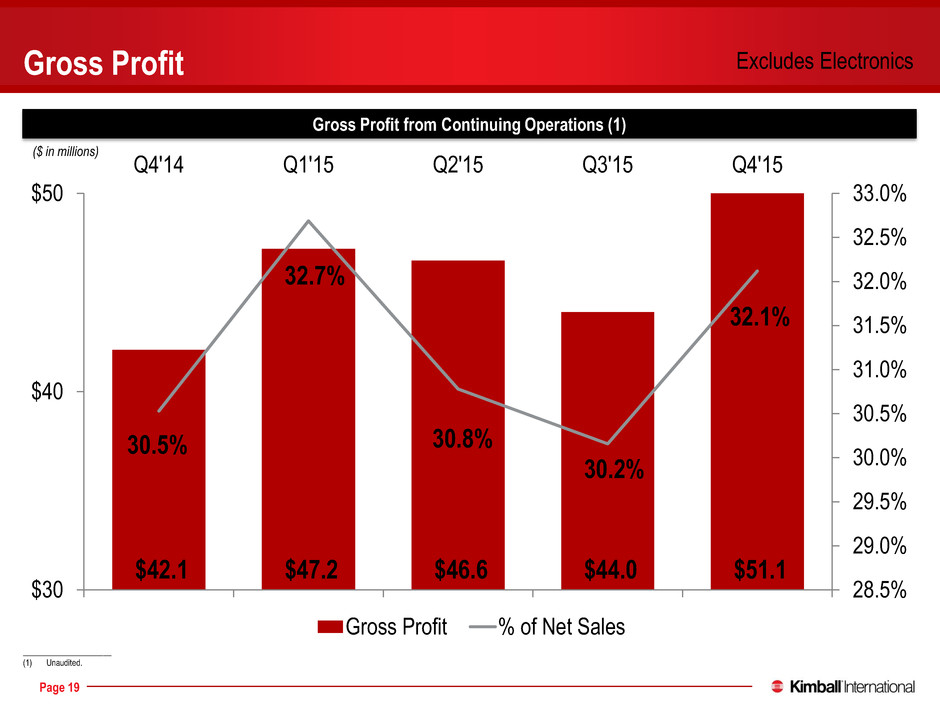

• | Fourth quarter gross profit as a percent of net sales increased 1.6 percentage points from the prior year fourth quarter. The margin improvement was driven by price increases, lower sales price discounting, cost reduction efforts, and the leverage gained on increased sales volumes. |

| |

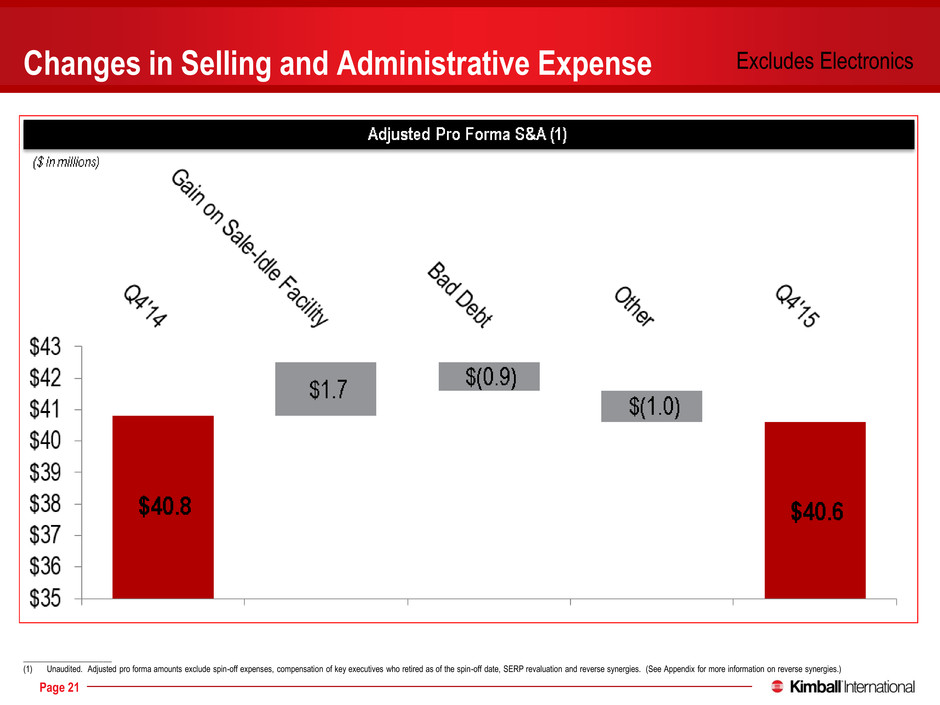

• | Selling and administrative expenses in the fourth quarter of fiscal year 2015 declined as a percent of sales by 5.0 percentage points on leverage from higher sales volumes, and decreased 3% in absolute dollars compared to the prior year. The lower selling and administrative expense was driven by declines in spin-off expenses, bad debt expenses, and the elimination of compensation and incentive pay related to executives who retired in conjunction with the spin-off. The year-over-year comparison was also impacted by a large gain on the sale of an idled manufacturing facility which occurred in the prior year fourth quarter. |

| |

• | Pre-tax restructuring costs in the fourth quarter of fiscal year 2015 totaled $1.6 million and were related to the Company's previously announced restructuring plan to consolidate its metal fabrication production from an operation located in Post Falls, Idaho, into existing production facilities in Indiana. The restructuring plan remains on track for completion by September 30, 2016. |

| |

• | The Company's 45.9% effective tax rate for the fourth quarter of fiscal year 2015 was higher than the prior year fourth quarter effective tax rate of 21.6%. The prior year fourth quarter effective tax rate was favorably impacted by a decrease in a foreign deferred tax asset valuation allowance coupled with relatively low pre-tax income. |

| |

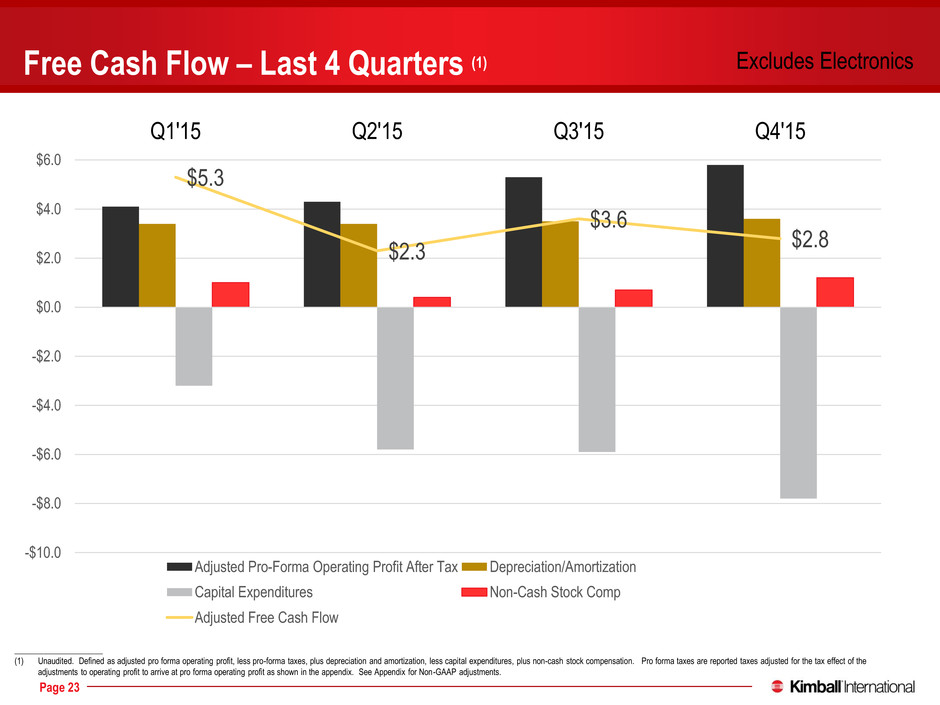

• | Operating cash flow for the fourth quarter of fiscal year 2015 was a positive cash flow of $1.8 million compared to a positive cash flow of $5.0 million in the fourth quarter of the prior year. The prior year figures include Kimball Electronics' operating cash flows, as cash management was centralized prior to the spin-off. |

| |

• | The Company's cash and cash equivalents declined to $34.7 million at June 30, 2015, compared to June 30, 2014 cash and cash equivalents of $136.6 million (inclusive of Kimball Electronics). The decline was primarily due to the transfer of $63.0 million of cash to the Kimball Electronics subsidiary as of the October 31, 2014 spin-off date, at which time Kimball Electronics began operation as an independent company. Additionally, the Company expended $33.1 million for capital investments during fiscal year 2015, with the largest items being building renovation costs related to the spin-off and manufacturing equipment purchases related to the transition of metal fabrication production from the Post Falls facility to production facilities in Indiana. |

| |

• | During fiscal year 2015, the Company acquired 1.0 million shares of its common stock at an aggregate purchase price of $11.3 million. Additionally the Company has paid $7.7 million of dividends to shareholders during fiscal year 2015, for a total year-to-date capital return to shareholders of $19.0 million. The Company repurchased its common stock pursuant to a previously announced stock repurchase program which allows for the repurchase of up to 2.0 million shares. |

Fiscal year 2015 net sales of $600.9 million increased 10% from fiscal year 2014 net sales of $543.8 million. Income from continuing operations for fiscal year 2015 was $11.1 million, or $0.29 per diluted share, compared to income from continuing operations for fiscal year 2014 of $3.4 million, or $0.09 per diluted share. Excluding charges related to a previously announced restructuring plan and the spin-off of the Company's Electronic Manufacturing Services segment, adjusted income from continuing operations for fiscal year 2015 was $17.6 million, or $0.45 per share. Excluding the gain on the sale of an idle manufacturing facility, and excluding charges related to the spin-off of the Company's Electronic Manufacturing Services segment, adjusted income from continuing operations for fiscal year 2014 was $3.7 million, or $0.10 per share.

Guidance

There is no change to the Company's previously announced guidance for periods following the expected completion of consolidation of the Company's Idaho manufacturing facility into other operations in southern Indiana. The consolidation continues to progress according to plan with completion of the plan anticipated by September 2016. Estimated savings resulting from the consolidation activities are expected to be approximately $5 million annually thereafter. When the restructuring is complete and the savings are fully realized beginning in the quarter ending December 31, 2016, the Company expects operating income as a percent of net sales to be in the range of

7% to 8% for that quarter. Net sales in that quarter are expected to be in the range of $170 million to $180 million; operating income is expected in the range of $12 million to $14 million; the effective tax rate is expected to range from 35% to 38%; and earnings per diluted share are expected to range from $0.20 to $0.24. At 8% operating income, return on capital would approach 20%, which is among the best in the office furniture industry.

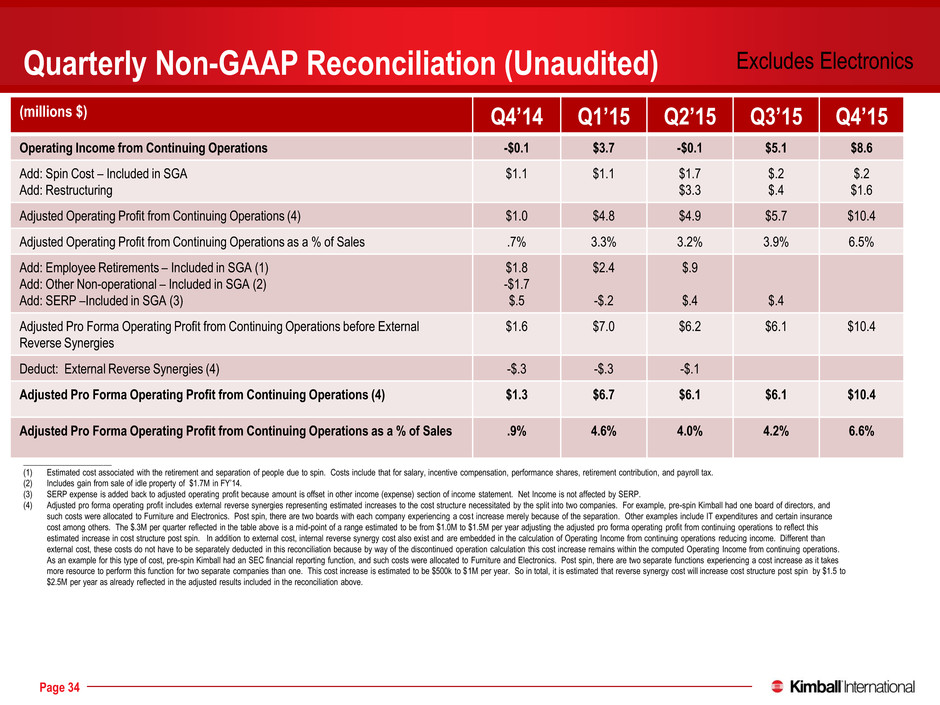

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States in the statement of income, statement of comprehensive income, balance sheet, or statement of cash flows of the Company. The non-GAAP financial measures used within this release include (1) operating income (loss) excluding spin-off expenses, restructuring charges, and the gain on sale of an idle facility; (2) income from continuing operations excluding spin-off expenses, restructuring charges, and the gain on sale of an idle facility; and (3) diluted earnings per share from continuing operations excluding spin-off expenses, restructuring charges, and the gain on sale of an idle facility. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included in the Financial Highlights table below. Management believes it is useful for investors to understand how its core operations performed without spin-off expenses, costs incurred in executing its restructuring plans, and the gain on sale of an idle facility. Excluding these amounts allows investors to meaningfully trend, analyze, and benchmark the performance of the Company's core operations. Many of the Company's internal performance measures that management uses to make certain operating decisions exclude these charges to enable meaningful trending of core operating metrics.

Forward-Looking Statements

Certain statements contained within this release are considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, the risk that any projections or guidance, including revenues, margins, earnings, or any other financial results are not realized, the successful completion of the restructuring plan, our ability to fully realize the expected benefits of the spin-off and restructuring plan, adverse changes in the global economic conditions, significant volume reductions from key contract customers, significant reduction in customer order patterns, financial stability of key customers and suppliers, and availability or cost of raw materials. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of the Company are contained in the Company's Form 10-K filing for the fiscal year ended June 30, 2014 and other filings with the Securities and Exchange Commission.

|

| | |

Conference Call / Webcast |

| | |

Date: | | July 31, 2015 |

Time: | | 11:00 AM Eastern Time |

Dial-In #: | | 877-415-3185 (International Calls - 857-244-7328) |

Pass Code: | | Kimball |

A webcast of the live conference call may be accessed by visiting Kimball's Investor Relations website at www.ir.kimball.com.

For those unable to participate in the live webcast, the call will be archived at www.ir.kimball.com within two hours of the conclusion of the live call.

About Kimball International, Inc.

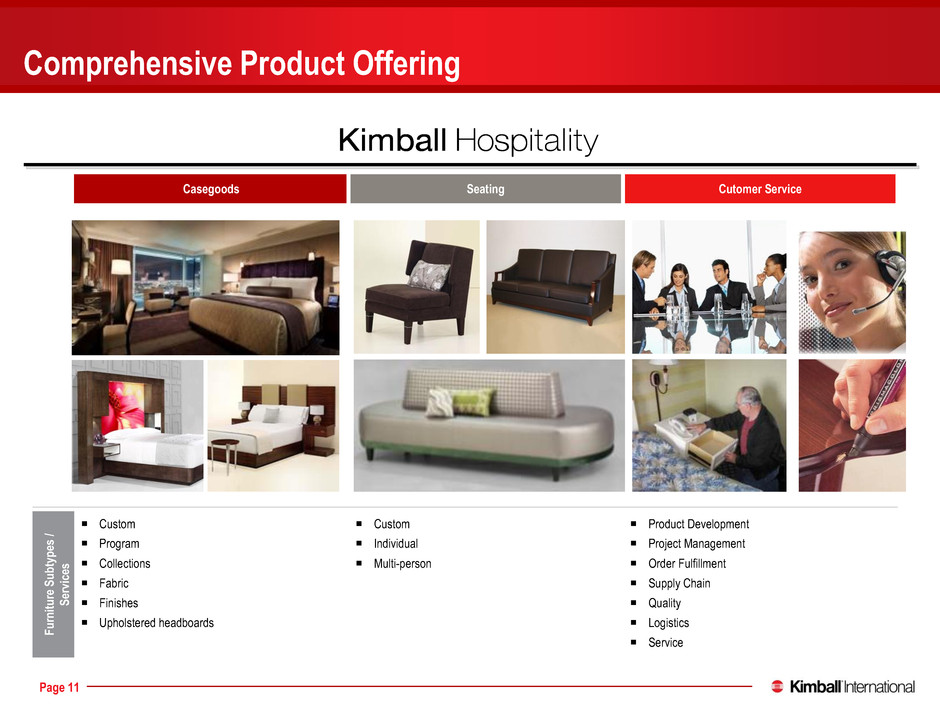

Kimball International, Inc. is a leading manufacturer of design driven, technology savvy, high quality furnishings sold under the Company’s family of brands: National Office Furniture, Kimball Office and Kimball Hospitality. Our diverse portfolio provides solutions for the workplace, learning, healing and hospitality environments. Customers can access our products globally through a variety of distribution channels. Recognized with a reputation for excellence as a trustworthy company and recognized with the Great Place to Work® designation, Kimball International is committed to a high performance culture with a foundation of sound ethics, continuous improvement and social responsibility. To learn more about Kimball International, Inc. (NASDAQ: KBAL) visit www.kimball.com.

"We Build Success"

Financial highlights for the fourth quarter and fiscal year ended June 30, 2015 are as follows:

|

| | | | | | | | | | | | | |

Condensed Consolidated Statements of Income | | | | | | |

(Unaudited) | Three Months Ended |

(Amounts in Thousands, except per share data) | June 30, 2015 | | June 30, 2014 |

Net Sales | $ | 159,061 |

| | 100.0 | % | | $ | 137,858 |

| | 100.0 | % |

Cost of Sales | 107,982 |

| | 67.9 | % | | 95,802 |

| | 69.5 | % |

Gross Profit | 51,079 |

| | 32.1 | % | | 42,056 |

| | 30.5 | % |

Selling and Administrative Expenses | 40,818 |

| | 25.6 | % | | 42,175 |

| | 30.6 | % |

Restructuring Expense | 1,567 |

| | 1.0 | % | | 0 |

| | 0.0 | % |

Operating Income (Loss) | 8,694 |

| | 5.5 | % | | (119 | ) | | (0.1 | %) |

Other Income, net | 84 |

| | 0.0 | % | | 577 |

| | 0.4 | % |

Income from Continuing Operations Before Taxes on Income | 8,778 |

| | 5.5 | % | | 458 |

| | 0.3 | % |

Provision for Income Taxes | 4,033 |

| | 2.5 | % | | 99 |

| | 0.0 | % |

Income from Continuing Operations | 4,745 |

| | 3.0 | % | | 359 |

| | 0.3 | % |

Income from Discontinued Operations, Net of Tax | 0 |

| | 0.0 | % | | 7,489 |

| | 5.4 | % |

Net Income | $ | 4,745 |

| | 3.0 | % | | $ | 7,848 |

| | 5.7 | % |

| | | | | | | |

Earnings Per Share of Common Stock: | | | | | | | |

Basic from Continuing Operations | $ | 0.12 |

| | | | $ | 0.01 |

| | |

Diluted from Continuing Operations | $ | 0.12 |

| | | | $ | 0.01 |

| | |

Basic | $ | 0.12 |

| | | | $ | 0.21 |

| | |

Diluted | $ | 0.12 |

| | | | $ | 0.20 |

| | |

| | | | | | | |

Average Number of Total Shares Outstanding | | | | | | | |

Basic | 38,258 |

| | | | 38,438 |

| | |

Diluted | 38,565 |

| | | | 39,045 |

| | |

|

| | | | | | | | | | | | | |

| | | | | | | |

(Unaudited) | Fiscal Year Ended |

(Amounts in Thousands, except per share data) | June 30, 2015 | | June 30, 2014 |

Net Sales | $ | 600,868 |

| | 100.0 | % | | $ | 543,817 |

| | 100.0 | % |

Cost of Sales | 412,003 |

| | 68.6 | % | | 377,092 |

| | 69.3 | % |

Gross Profit | 188,865 |

| | 31.4 | % | | 166,725 |

| | 30.7 | % |

Selling and Administrative Expenses | 166,253 |

| | 27.6 | % | | 164,781 |

| | 30.3 | % |

Restructuring Expense | 5,290 |

| | 0.9 | % | | 0 |

| | 0.0 | % |

Operating Income | 17,322 |

| | 2.9 | % | | 1,944 |

| | 0.4 | % |

Other Income, net | 357 |

| | 0.0 | % | | 2,268 |

| | 0.4 | % |

Income from Continuing Operations Before Taxes on Income | 17,679 |

| | 2.9 | % | | 4,212 |

| | 0.8 | % |

Provision for Income Taxes | 6,536 |

| | 1.0 | % | | 793 |

| | 0.2 | % |

Income from Continuing Operations | 11,143 |

| | 1.9 | % | | 3,419 |

| | 0.6 | % |

Income from Discontinued Operations, Net of Tax | 9,157 |

| | 1.5 | % | | 30,042 |

| | 5.6 | % |

Net Income | $ | 20,300 |

| | 3.4 | % | | $ | 33,461 |

| | 6.2 | % |

| | | | | | | |

Earnings Per Share of Common Stock: | | | | | | | |

Basic from Continuing Operations | $ | 0.29 |

| | | | $ | 0.09 |

| | |

Diluted from Continuing Operations | $ | 0.29 |

| | | | $ | 0.09 |

| | |

Basic | $ | 0.53 |

| | | | $ | 0.88 |

| | |

Diluted | $ | 0.52 |

| | | | $ | 0.86 |

| | |

| | | | | | | |

Average Number of Total Shares Outstanding | | | | | | | |

Basic | 38,645 |

| | | | 38,404 |

| | |

Diluted | 38,971 |

| | | | 39,037 |

| | |

|

| | | | | | | |

Condensed Consolidated Statements of Cash Flows | Fiscal Year Ended |

(Unaudited) | June 30, |

(Amounts in Thousands) | 2015 | | 2014 |

Net Cash Flow provided by Operating Activities | $ | 13,843 |

| | $ | 69,871 |

|

Net Cash Flow used for Investing Activities | (30,657 | ) | | (27,546 | ) |

Net Cash Flow used for Financing Activities | (83,895 | ) | | (9,441 | ) |

Effect of Exchange Rate Change on Cash and Cash Equivalents | (1,254 | ) | | 140 |

|

Net (Decrease) Increase in Cash and Cash Equivalents | (101,963 | ) | | 33,024 |

|

Cash and Cash Equivalents at Beginning of Year | 136,624 |

| | 103,600 |

|

Cash and Cash Equivalents at End of Year | $ | 34,661 |

| | $ | 136,624 |

|

The above figures include Kimball Electronics cash flows through the October 31, 2014 spin-off date, as cash management was centralized prior to the spin-off.

|

| | | | | | | |

| (Unaudited) | | |

Condensed Consolidated Balance Sheets | June 30,

2015 | | June 30,

2014 |

(Amounts in Thousands) | |

ASSETS | | | |

Cash and cash equivalents | $ | 34,661 |

| | $ | 136,624 |

|

Receivables, net | 55,710 |

| | 175,695 |

|

Inventories | 37,634 |

| | 140,475 |

|

Prepaid expenses and other current assets | 23,548 |

| | 46,998 |

|

Property and Equipment, net | 97,163 |

| | 188,833 |

|

Goodwill | 0 |

| | 2,564 |

|

Other Intangible Assets, net | 2,669 |

| | 4,191 |

|

Other Assets | 14,744 |

| | 26,766 |

|

Total Assets | $ | 266,129 |

| | $ | 722,146 |

|

| | | |

LIABILITIES AND SHARE OWNERS' EQUITY | | | |

Current maturities of long-term debt | $ | 27 |

| | $ | 25 |

|

Accounts payable | 41,170 |

| | 160,306 |

|

Customer deposits | 18,618 |

| | 14,130 |

|

Dividends payable | 1,921 |

| | 1,883 |

|

Accrued expenses | 45,425 |

| | 77,256 |

|

Long-term debt, less current maturities | 241 |

| | 268 |

|

Other | 17,222 |

| | 26,745 |

|

Share Owners' Equity | 141,505 |

| | 441,533 |

|

Total Liabilities and Share Owners' Equity | $ | 266,129 |

| | $ | 722,146 |

|

The June 30, 2014 balance sheet includes Kimball Electronics. The June 30, 2015 balance sheet represents continuing operations only.

|

| | | | | | | | | | | | | | | |

Supplementary Information | | | | | | | |

Components of Other Income, net | Three Months Ended | | Fiscal Year Ended |

(Unaudited) | June 30, | | June 30, |

(Amounts in Thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Interest Income | $ | 62 |

| | $ | 35 |

| | $ | 213 |

| | $ | 179 |

|

Interest Expense | (6 | ) | | (7 | ) | | (24 | ) | | (26 | ) |

Foreign Currency/Derivative Loss | (8 | ) | | (3 | ) | | (48 | ) | | (59 | ) |

Gain on Supplemental Employee Retirement Plan Investment | 84 |

| | 538 |

| | 603 |

| | 2,579 |

|

Other Non-Operating Income (Expense) | (48 | ) | | 14 |

| | (387 | ) | | (405 | ) |

Other Income, net | $ | 84 |

| | $ | 577 |

| | $ | 357 |

| | $ | 2,268 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

Net Sales by End Market Vertical | | | | | | |

| Three Months Ended | | | | Fiscal Year Ended | | |

(Unaudited) | June 30, | | | | June 30, | | |

(Amounts in Millions) | 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

Education | $ | 10.0 |

| | $ | 9.9 |

| | 1 | % | | $ | 38.5 |

| | $ | 39.9 |

| | (4 | %) |

Finance | 14.3 |

| | 14.0 |

| | 2 | % | | 56.3 |

| | 62.2 |

| | (9 | %) |

Government | 22.9 |

| | 25.4 |

| | (10 | %) | | 96.0 |

| | 90.5 |

| | 6 | % |

Healthcare | 16.5 |

| | 14.4 |

| | 15 | % | | 60.4 |

| | 59.3 |

| | 2 | % |

Hospitality | 40.5 |

| | 29.8 |

| | 36 | % | | 143.2 |

| | 118.1 |

| | 21 | % |

Other Commercial | 54.9 |

| | 44.4 |

| | 24 | % | | 206.5 |

| | 173.8 |

| | 19 | % |

Total Net Sales | $ | 159.1 |

| | $ | 137.9 |

| | 15 | % | | $ | 600.9 |

| | $ | 543.8 |

| | 11 | % |

|

| | | | | | | | | | | | | | | | | | | | | |

Orders Received by End Market Vertical | | | | | | |

| Three Months Ended | | | | Fiscal Year Ended | | |

(Unaudited) | June 30, | | | | June 30, | | |

(Amounts in Millions) | 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

Education | $ | 13.4 |

| | $ | 14.8 |

| | (9 | %) | | $ | 39.9 |

| | $ | 37.9 |

| | 5 | % |

Finance | 17.1 |

| | 15.5 |

| | 10 | % | | 59.3 |

| | 64.2 |

| | (8 | %) |

Government | 29.6 |

| | 28.5 |

| | 4 | % | | 100.7 |

| | 95.1 |

| | 6 | % |

Healthcare | 17.5 |

| | 16.0 |

| | 9 | % | | 63.4 |

| | 58.7 |

| | 8 | % |

Hospitality | 38.7 |

| | 25.0 |

| | 55 | % | | 144.2 |

| | 114.6 |

| | 26 | % |

Other Commercial | 56.0 |

| | 50.1 |

| | 12 | % | | 216.7 |

| | 183.3 |

| | 18 | % |

Total Orders Received | $ | 172.3 |

| | $ | 149.9 |

| | 15 | % | | $ | 624.2 |

| | $ | 553.8 |

| | 13 | % |

|

| | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP Financial Measures | | | | | | | |

(Unaudited) | | | | | | | |

(Amounts in Thousands, except per share data) | | | | | | | |

| | | | | | | |

Operating Income (Loss) excluding Spin-off Expenses, Restructuring Charges, and Gain on Sale of Idle Facility | | | | |

| Three Months Ended | | | | |

| June 30, | | | | |

| 2015 | | 2014 | | | | |

Operating Income (Loss), as reported | $ | 8,694 |

| | $ | (119 | ) | | | | |

Add: Pre-tax Spin-off Expenses | 123 |

| | 1,109 |

| | | | |

Add: Pre-tax Restructuring Charges | 1,567 |

| | 0 |

| | | | |

Less: Pre-tax Gain on Sale of Idle Facility | 0 |

| | 1,749 |

| | | | |

Adjusted Operating Income (Loss) | $ | 10,384 |

| | $ | (759 | ) | | | | |

| | | | | | | |

Income from Continuing Operations excluding Spin-off Expenses, Restructuring Charges, and Gain on Sale of Idle Facility | | | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Income from Continuing Operations, as reported | $ | 4,745 |

| | $ | 359 |

| | $ | 11,143 |

| | $ | 3,419 |

|

Add: After-tax Spin-off Expenses | 107 |

| | 940 |

| | 3,193 |

| | 1,353 |

|

Add: After-tax Restructuring Charges | 960 |

| | 0 |

| | 3,235 |

| | 0 |

|

Less: After-tax Gain on Sale of Idle Facility | 0 |

| | 1,069 |

| | 0 |

| | 1,069 |

|

Adjusted Income from Continuing Operations | $ | 5,812 |

| | $ | 230 |

| | $ | 17,571 |

| | $ | 3,703 |

|

| | | | | | | |

Diluted Earnings Per Share from Continuing Operations excluding Spin-off Expenses, Restructuring Charges, and Gain on Sale of Idle Facility | | | | |

| Three Months Ended | | Fiscal Year Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Diluted Earnings Per Share from Continuing Operations, as reported | $ | 0.12 |

| | $ | 0.01 |

| | $ | 0.29 |

| | $ | 0.09 |

|

Add: Impact of Spin-off Expenses | 0.00 |

| | 0.02 |

| | 0.08 |

| | 0.04 |

|

Add: Impact of Restructuring Charges | 0.03 |

| | 0.00 |

| | 0.08 |

| | 0.00 |

|

Less: Impact of Gain on Sale of Idle Facility | 0.00 |

| | 0.03 |

| | 0.00 |

| | 0.03 |

|

Adjusted Diluted Earnings Per Share from Continuing Operations | $ | 0.15 |

| | $ | 0.00 |

| | $ | 0.45 |

| | $ | 0.10 |

|