As filed with the Securities and Exchange Commission on April 22, 2011

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Kentucky Utilities Company

(Exact name of registrant issuer as specified in its charter)

|

Kentucky and Virginia |

|

4911 |

|

61-0247570 |

|

(State or other jurisdiction |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

|

of incorporation) |

|

Classification Code Number) |

|

Identification Number) |

One Quality Street

Lexington, Kentucky 40507

(502) 627-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John R. McCall

Executive Vice President, General Counsel, Corporate Secretary

and Chief Compliance Officer

220 West Main Street

Louisville, Kentucky 40202

(502) 627-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of communications to:

Catherine C. Hood

Dewey & LeBoeuf LLP

1301 Avenue of the Americas

New York, New York 10019

(212) 259-8000

Approximate date of commencement of proposed exchange offers: As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer x |

|

Smaller reporting company o | |

|

|

|

|

(Do not check if a smaller reporting company) | ||||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to |

|

Amount to be |

|

Proposed Maximum |

|

Proposed Maximum |

|

Amount of Registration |

|

|

1.625% First Mortgage Bonds due 2015 |

|

$250,000,000 |

|

100% |

|

$250,000,000 |

|

$29,025.00 |

|

|

3.250% First Mortgage Bonds due 2020 |

|

$500,000,000 |

|

100% |

|

$500,000,000 |

|

$58,050.00 |

|

|

5.125% First Mortgage Bonds due 2040 |

|

$750,000,000 |

|

100% |

|

$750,000,000 |

|

$87,075.00 |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not complete the exchange offers or sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2011

PRELIMINARY PROSPECTUS

KENTUCKY UTILITIES COMPANY

Offers to Exchange

$250,000,000 aggregate principal amount of its 1.625% First Mortgage Bonds due 2015,

$500,000,000 aggregate principal amount of its 3.250% First Mortgage Bonds due 2020 and

$750,000,000 aggregate principal amount of its 5.125% First Mortgage Bonds due 2040

(together, the Exchange Bonds), each of which have been registered under the Securities Act of 1933, as amended,

for any and all of its outstanding

1.625% First Mortgage Bonds due 2015, 3.250% First Mortgage Bonds due 2020 and

5.125% First Mortgage Bonds due 2040 (together, the Outstanding Bonds), respectively

(such transactions, collectively, the Exchange Offers)

We are conducting the Exchange Offers in order to provide you with an opportunity to exchange your unregistered Outstanding Bonds for the Exchange Bonds that have been registered under the Securities Act.

The Exchange Offers

· We will exchange all Outstanding Bonds that are validly tendered and not validly withdrawn for an equal principal amount of Exchange Bonds that are registered under the Securities Act.

· You may withdraw tenders of Outstanding Bonds at any time prior to the expiration of the Exchange Offers.

· The Exchange Offers expire at 5:00 p.m., New York City time, on , 2011, unless extended. We do not currently intend to extend the Expiration Date.

· The exchange of Outstanding Bonds for Exchange Bonds in the Exchange Offers will not be a taxable event for US federal tax purposes.

· The terms of the Exchange Bonds to be issued in the Exchange Offers are substantially identical to the Outstanding Bonds of the respective series, except that the Exchange Bonds will be registered under the Securities Act, and do not have any transfer restrictions, registration rights or liquidated damages provisions.

Results of the Exchange Offers

· Except as prohibited by applicable law, the Exchange Bonds may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. There is no existing market for the Exchange Bonds to be issued, and we do not plan to list the Exchange Bonds on a national securities exchange or market.

· We will not receive any proceeds from the Exchange Offers.

All untendered Outstanding Bonds will remain outstanding and continue to be subject to the restrictions on transfer set forth in the Outstanding Bonds and in the indenture governing the Outstanding Bonds. In general, the Outstanding Bonds may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the Exchange Offers, we do not currently anticipate that we will register the Outstanding Bonds under the Securities Act.

Each broker-dealer that receives Exchange Bonds for its own account in the Exchange Offers must acknowledge that it will deliver a prospectus in connection with any resale of those Exchange Bonds. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act.

This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Bonds received in exchange for Outstanding Bonds where the broker-dealer acquired such Outstanding Bonds as a result of market-making or other trading activities. We have agreed that, for a period of 180 days after the Expiration Date, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

See “Risk Factors” beginning on page 9 for a discussion of certain risks that you should consider before participating in the Exchange Offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Exchange Bonds to be distributed in the Exchange Offers or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011.

In making your investment decision, you should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer of the Exchange Bonds in any jurisdiction where the offer thereof is not permitted. The information contained in this prospectus speaks only as of the date of this prospectus.

References to the “Company,” “we,” “us” and “our” in this prospectus are references to Kentucky Utilities Company.

|

|

1 | |

|

|

9 | |

|

|

15 | |

|

|

17 | |

|

|

17 | |

|

|

18 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

19 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

41 |

|

|

41 | |

|

|

42 | |

|

|

53 | |

|

|

55 | |

|

|

90 | |

|

|

91 | |

|

|

102 | |

|

|

118 | |

|

|

122 | |

|

|

122 | |

|

|

122 | |

|

|

122 | |

|

|

124 |

This summary highlights certain information concerning the Company, the Exchange Offers and the Exchange Bonds that may be contained elsewhere in this prospectus. This summary is not complete and does not contain all the information that may be important to you. You should read this prospectus in its entirety before making an investment decision.

Kentucky Utilities Company

Kentucky Utilities Company, incorporated in Kentucky in 1912 and Virginia in 1991, is a regulated public utility engaged in the generation, transmission, distribution and sale of electric energy in Kentucky, Virginia and Tennessee. We provide electric service to approximately 514,000 customers in 77 counties in central, southeastern and western Kentucky, to approximately 30,000 customers in five counties in southwestern Virginia and to fewer than 10 customers in Tennessee. Our service area covers approximately 6,600 noncontiguous square miles. During 2010, approximately 98% of the electricity we generated was produced by our coal-fired electric generating stations. The remainder was generated by natural gas and oil fueled combustion turbines, or CTs, and a hydroelectric power plant. In Virginia, we operate under the name Old Dominion Power Company. We also sell wholesale electric energy to 12 municipalities.

Our principal executive offices are located at One Quality Street, Lexington, Kentucky 40507 (Telephone number (502) 627-2000).

Recent Developments

Kentucky Rate Case

In January 2010, we filed an application with the Kentucky Public Service Commission, or the Kentucky Commission, requesting an increase in electric base rates of approximately 12%, or $135 million annually. A number of intervenors entered the rate case, including the office of the Attorney General of Kentucky, certain representatives of industrial and low-income groups and other third parties, and submitted filings challenging our requested rate increases, in whole or in part. In June 2010, we and all of the intervenors except for the Kentucky Attorney General agreed to stipulations providing for an increase in our electric base rates of $98 million annually, and jointly filed a request with the Kentucky Commission to approve such settlement. An order in the proceeding was issued in July 2010, approving all provisions in the stipulation, including a return on equity range of 9.75-10.75%. The new rates became effective on August 1, 2010.

2011 Virginia Rate Case

In April 2011, we filed an application with the Virginia State Corporation Commission, or the Virginia Commission, requesting an increase in base rates of approximately 14%, or $9 million annually. The requested rate increase is based on an 11% return on equity, inclusion of expenditures to complete Trimble County Unit 2, or TC2, all new flue gas desulfurization controls in rate base, recovery of a 2009 regulatory asset and various other adjustments to revenue and expenses for the test year ended December 31, 2010. We cannot predict the outcome of this proceeding.

PPL Acquisition

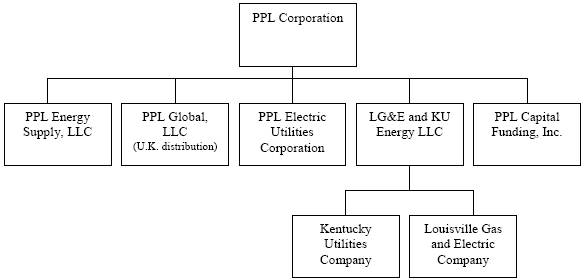

On November 1, 2010, we became an indirect wholly owned subsidiary of PPL Corporation when PPL acquired all of the outstanding limited liability company interests in our direct parent, LG&E and KU Energy LLC, or Parent (formerly E.ON U.S. LLC), from E.ON US Investments Corp. Our Parent, a Kentucky limited liability company, also owns our affiliate, Louisville Gas and Electric Company, or LG&E, a regulated public utility engaged in the generation, transmission, distribution and sale of electric energy and distribution and sale of natural gas in Kentucky. Following the acquisition, our business has not changed and we and LG&E are continuing as subsidiaries of our Parent, which is now an intermediary holding company in the PPL group of companies. An abridged structure of the PPL group of companies, including us, is shown below:

PPL, incorporated in 1994 and headquartered in Allentown, Pennsylvania, is an energy and utility holding company. Through its subsidiaries, PPL Corporation owns or controls about 19,000 megawatts, or Mw, of generating capacity in the United States, sells energy in key U.S. markets, and delivers electricity and natural gas to about 10 million customers in the United States and the United Kingdom.

Neither PPL nor any of its other subsidiaries, including our Parent or LG&E, will be obligated to make payments on, or provide any credit support for, the Exchange Bonds.

PPL Acquisition Approvals

In September 2010, the Kentucky Commission approved a settlement agreement among PPL, joint applicants and all of the intervening parties to PPL’s joint application to the Kentucky Commission for approval of its acquisition of ownership and control of our Parent, the Company and LG&E. In the settlement, the parties agreed that we and LG&E would commit that no base rate increases would take effect before January 1, 2013. Our rate increase that took effect on August 1, 2010 (See “Business — Rates and Regulation”) will not be impacted by the settlement. Under the terms of the settlement, we retain the right to seek approval for the deferral of “extraordinary and uncontrollable costs.” Interim rate adjustments will continue to be permissible during that period for existing fuel, environmental and demand-side management, or DSM, cost trackers. The agreement also substituted an acquisition savings shared deferral mechanism for the requirement that we file a synergies plan with the Kentucky Commission. This mechanism, which will be in place until the earlier of five years or the first day of the year in which a base rate increase becomes effective, permits us to earn up to a 10.75% return on equity. Any earnings above a 10.75% return on equity will be shared with customers on a 50%/50% basis. In October 2010, both the Virginia Commission, and the Tennessee Regulatory Authority approved the transfer of control of the Company from E.ON US Investments Corp. to PPL. The orders of the commissions contained a number of other commitments with regards to operations, workforce, community involvement and other matters.

In October 2010, the Federal Energy Regulatory Commission, or FERC, approved a September 2010 settlement agreement among the Company, LG&E, other applicants and protesting parties, and such protests have been withdrawn. The settlement agreement includes various conditional commitments, such as a continuation of certain existing undertakings with protesters in prior cases, an agreement not to terminate certain of our municipal customer contracts prior to January 2017, an exclusion of any transaction-related costs from wholesale energy and tariff customer rates to the extent that we have agreed to not seek the same transaction-related cost from retail customers and agreements to coordinate with protesters in certain open or on-going matters.

The Exchange Offers

In November 2010, we issued the Outstanding Bonds in transactions not subject to the registration requirements of the Securities Act of 1933, as amended, or Securities Act. The term “2015 Exchange Bonds” refers to the 1.625% First Mortgage Bonds due 2015; the term “2020 Exchange Bonds” refers to the 3.250% First Mortgage Bonds due 2020 and the term “2040 Exchange Bonds” refers to the 5.125% First Mortgage Bonds due 2040, each as registered under the Securities Act, and all of which collectively are referred to as the “Exchange Bonds.” The term “Bonds” collectively refers to the Outstanding Bonds and the Exchange Bonds.

|

General |

|

In connection with the issuance of the Outstanding Bonds, we entered into a registration rights agreement with the initial purchasers pursuant to which we agreed, among other things, to deliver this prospectus to you and to use commercially reasonable efforts to complete the Exchange Offers within 315 days after the date of original issuance of the Outstanding Bonds. You are entitled to exchange in the Exchange Offers your Outstanding Bonds for the respective series of Exchange Bonds that are identical in all material respects to the Outstanding Bonds except: |

|

|

|

|

|

|

|

· the Exchange Bonds have been registered under the Securities Act and, therefore, will not be subject to the restrictions on transfer applicable to the Outstanding Bonds (except as described in “The Exchange Offers — Resale of Exchange Bonds” and “Description of the Exchange Bonds — Form; Transfers; Exchanges”); |

|

|

|

|

|

|

|

· the Exchange Bonds are not entitled to any registration rights which are applicable to the Outstanding Bonds under the registration rights agreement, including any rights to liquidated damages for failure to comply with the registration rights agreement; and |

|

|

|

|

|

|

|

· the Exchange Bonds will bear different CUSIP numbers. |

|

|

|

|

|

The Exchange Offers |

|

We are offering to exchange: |

|

|

|

|

|

|

|

· $250,000,000 aggregate principal amount of 1.625% First Mortgage Bonds due 2015 that have been registered under the Securities Act for any and all of our existing 1.625% First Mortgage Bonds due 2015; |

|

|

|

|

|

|

|

· $500,000,000 aggregate principal amount of 3.250% First Mortgage Bonds due 2020 that have been registered under the Securities Act for any and all of our existing 3.250% First Mortgage Bonds due 2020 and |

|

|

|

|

|

|

|

· $750,000,000 aggregate principal amount of 5.125% First Mortgage Bonds due 2040 that have been registered under the Securities Act for any and all of our existing 5.125% First Mortgage Bonds due 2040. |

|

|

|

|

|

|

|

You may only exchange Outstanding Bonds in minimum denominations of $2,000 and in multiples of $1,000 in excess thereof. Any untendered Outstanding Bonds must also be in a minimum denomination of $2,000. |

|

|

|

|

|

Resale |

|

Based on an interpretation by the staff of the Securities and Exchange Commission, or SEC, set forth in no-action letters issued to third parties, we believe that the Exchange Bonds issued pursuant to the Exchange Offers in exchange for the Outstanding Bonds may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

|

|

|

· you are acquiring the Exchange Bonds in the ordinary course of your business; and |

|

|

|

|

|

|

|

· you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the Exchange Bonds. |

|

|

|

|

|

|

|

Any holder of Outstanding Bonds who: |

|

|

|

|

|

|

|

· is our affiliate; |

|

|

|

|

|

|

|

· does not acquire Exchange Bonds in the ordinary course of its business; or |

|

|

|

|

|

|

|

· tenders its Outstanding Bonds in the Exchange Offers with the intention to participate, or for the purpose of participating, in a distribution of Exchange Bonds |

|

|

|

|

|

|

|

cannot rely on the position of the staff of the SEC enunciated in Morgan Stanley & Co. Incorporated (available June 5, 1991) and Exxon Capital Holdings Corporation (available May 13, 1988), as interpreted in Shearman & Sterling (available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the Exchange Bonds. |

|

|

|

|

|

|

|

If you are a broker-dealer and receive Exchange Bonds for your own account in exchange for Outstanding Bonds that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the Exchange Bonds and that you are not our affiliate and did not purchase your Outstanding Bonds from us or any of our affiliates. See “Plan of Distribution.” |

|

|

|

|

|

|

|

Our belief that the Exchange Bonds may be offered for resale without compliance with the registration or prospectus delivery provisions of the Securities Act is based on interpretations of the SEC for other exchange offers that the SEC expressed in some of its no-action letters to other issuers in exchange offers like ours. We have not sought a no-action letter in connection with the Exchange Offers, and we cannot guarantee that the SEC would make a similar decision about our Exchange Offers. If our belief is wrong, or if you cannot truthfully make the representations mentioned above, and you transfer any Exchange Bond issued to you in the Exchange Offers without meeting the registration and prospectus delivery requirements of the Securities Act, or without an exemption from such requirements, you could incur liability under the Securities Act. We are not indemnifying you for any such liability. |

|

|

|

|

|

Expiration Date |

|

The Exchange Offers will expire at 5:00 p.m., New York City time, on , 2011, unless extended by us. We do not currently intend to extend the Expiration Date. |

|

|

|

|

|

Withdrawal |

|

You may withdraw the tender of your Outstanding Bonds at any time prior to the expiration of the Exchange Offers. We will return to you any of your Outstanding Bonds that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the Exchange Offers. |

|

|

|

|

|

Conditions to the Exchange Offers |

|

Each Exchange Offer is subject to customary conditions. We reserve the right to waive any defects, irregularities or conditions to exchange as to particular |

|

|

|

Outstanding Bonds. See “The Exchange Offers — Conditions to the Exchange Offers.” |

|

|

|

|

|

Procedures for Tendering Outstanding Bonds |

|

If you wish to participate in any of the Exchange Offers, you must either: |

|

|

|

|

|

|

|

· complete, sign and date the applicable accompanying letter of transmittal, or a facsimile of the letter of transmittal, in accordance with the instructions contained in this prospectus and the letter of transmittal, and mail or deliver such letter of transmittal or facsimile thereof, together with the Outstanding Bonds to be exchanged for Exchange Bonds, to the exchange agent at the address set forth on the cover page of the letter of transmittal; or |

|

|

|

|

|

|

|

· if you hold Outstanding Bonds through The Depository Trust Company, or DTC, comply with DTC’s Automated Tender Offer Program procedures described in this prospectus, by which you will agree to be bound by the letter of transmittal. |

|

|

|

|

|

|

|

By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

|

|

|

|

|

|

|

· any Exchange Bonds received by you will be acquired in the ordinary course of your business, |

|

|

|

|

|

|

|

· you have no arrangements or understanding with any person to participate in the distribution of the Exchange Bonds within the meaning of the Securities Act; |

|

|

|

|

|

|

|

· you are not an “affiliate,” as defined in Rule 405 of the Securities Act, of the Company or, if you are an affiliate, you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; |

|

|

|

|

|

|

|

· if you are not a broker-dealer, that you are not engaged in, and do not intend to engage in, the distribution of the Exchange Bonds and; |

|

|

|

|

|

|

|

· if you are a broker-dealer, you will receive Exchange Bonds for your own account in exchange for Outstanding Bonds that were acquired as a result of market-making activities or other trading activities, and you will deliver a prospectus in connection with any resale of such Exchange Bonds. |

|

|

|

|

|

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner of Outstanding Bonds that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those Outstanding Bonds in any of the Exchange Offers, you should contact the registered holder promptly and instruct the registered holder to tender those Outstanding Bonds on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your Outstanding Bonds, either make appropriate arrangements to register ownership of the Outstanding Bonds in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the Expiration Date. |

|

|

|

|

|

Guaranteed Delivery Procedures |

|

If you wish to tender your Outstanding Bonds and your Outstanding Bonds are not immediately available, or you cannot deliver your Outstanding Bonds, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests prior to the Expiration Date, you must tender your Outstanding Bonds according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offers — Guaranteed Delivery |

|

|

|

Procedures.” |

|

|

|

|

|

Effect on Holders of Outstanding Bonds |

|

As a result of the making of, and upon acceptance for exchange of all validly tendered Outstanding Bonds pursuant to the terms of, the Exchange Offers, we will have fulfilled a covenant under the registration rights agreement. Accordingly, we will not be required to pay liquidated damages on the Outstanding Bonds under the circumstances described in the registration rights agreement. If you do not tender your Outstanding Bonds in any of the Exchange Offers, you will continue to be entitled to all the rights and limitations applicable to the Outstanding Bonds as set forth in the Indenture (as defined below), except we will not have any further obligation to you to provide for the exchange and registration of untendered Outstanding Bonds under the registration rights agreement. To the extent that Outstanding Bonds are tendered and accepted in the Exchange Offers, the trading market for Outstanding Bonds that are not so tendered and accepted could be adversely affected. |

|

|

|

|

|

Consequences of Failure to Exchange |

|

All untendered Outstanding Bonds will remain outstanding and continue to be subject to the restrictions on transfer set forth in the Outstanding Bonds and in the Indenture. In general, the Outstanding Bonds may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the Exchange Offers, we do not currently anticipate that we will register the Outstanding Bonds under the Securities Act. |

|

|

|

|

|

United States Federal Income Tax Consequences |

|

The exchange of Outstanding Bonds in the Exchange Offers will not be a taxable event for US federal income tax purposes. See “Material U.S. Federal Income Tax Consequences.” |

|

|

|

|

|

Use of Proceeds |

|

We will not receive any proceeds from the issuance of the Exchange Bonds in the Exchange Offers. See “Use of Proceeds.” |

|

|

|

|

|

Exchange Agent |

|

The Bank of New York Mellon is the exchange agent for the Exchange Offers. Any questions and requests for assistance with respect to accepting or withdrawing from the Exchange Offers, requests for additional copies of this prospectus or of the letter of transmittal and requests for the notice of guaranteed delivery should be directed to the exchange agent. The address and telephone number of the exchange agent are set forth in the section captioned “The Exchange Offers — Exchange Agent.” |

The Exchange Bonds

The summary below describes the principal terms of the Exchange Bonds. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Exchange Bonds” section of this prospectus contains more detailed descriptions of the terms and conditions of the Outstanding Bonds and Exchange Bonds. The Exchange Bonds will have terms identical in all material respects to the respective series of Outstanding Bonds, except that the Exchange Bonds will not contain certain terms with respect to transfer restrictions, registration rights and liquidated damages for failure to observe certain obligations in the registration rights agreement.

|

Issuer |

|

Kentucky Utilities Company, a Kentucky and Virginia corporation. |

|

|

|

|

|

Securities Offered |

|

$250,000,000 of 2015 Exchange Bonds |

|

|

|

|

|

|

|

$500,000,000 of 2020 Exchange Bonds |

|

|

|

|

|

|

|

$750,000,000 of 2040 Exchange Bonds |

|

|

|

|

|

Maturity Date |

|

The 2015 Exchange Bonds will mature on November 1, 2015. |

|

|

|

|

|

|

|

The 2020 Exchange Bonds will mature on November 1, 2020. |

|

|

|

|

|

|

|

The 2040 Exchange Bonds will mature on November 1, 2040. |

|

|

|

|

|

Interest Rate and Payment Dates |

|

The 2015 Exchange Bonds will bear interest at the rate of 1.625% per annum, payable semi-annually in arrears on each May 1 and November 1, commencing 1, 2011. |

|

|

|

|

|

|

|

The 2020 Exchange Bonds will bear interest at the rate of 3.250% per annum, payable semi-annually in arrears on each May 1 and November 1, commencing 1, 2011 |

|

|

|

|

|

|

|

The 2040 Exchange Bonds will bear interest at the rate of 5.125% per annum, payable semi-annually in arrears on each May 1 and November 1, commencing 1, 2011 |

|

|

|

|

|

|

|

Interest will accrue on the Exchange Bonds of each series from the most recent date to which interest has been paid or, if no interest has been paid, from November 16, 2010. |

|

|

|

|

|

Optional Redemption |

|

We may redeem the Exchange Bonds at our option, in whole at any time or in part from time to time, on not less than 30 nor more than 60 days’ notice, at the redemption prices described under “Description of the Exchange Bonds — Redemption.” |

|

|

|

|

|

|

|

We may redeem, in whole or in part, Exchange Bonds of any or all series. |

|

|

|

|

|

Ranking |

|

Each series of Exchange Bonds will be our senior secured indebtedness and will rank equally in right of payment with our existing and future first mortgage bonds issued under our Mortgage. |

|

|

|

|

|

Security |

|

Each series of Exchange Bonds will be secured, equally and ratably, by the lien of the Mortgage, which constitutes a first mortgage lien on substantially all of our real and tangible personal property located in Kentucky and used in the generation, transmission and distribution of electricity (other than property duly released from the lien of the Mortgage in accordance with the provisions |

|

|

|

thereof and certain other excepted property, and subject to certain Permitted Liens), as described under “Description of the Bonds — Security; Lien of the Mortgage.” |

|

|

|

|

|

Events of Default |

|

For a discussion of events that will permit acceleration of the payment of the principal of and accrued interest on the Exchange Bonds, see “Description of the Exchange Bonds — Events of Default.” |

|

|

|

|

|

Further Issuances |

|

Subject to compliance with certain issuance conditions contained in the Mortgage, we may, without the consent of the holders of a series of the Exchange Bonds, increase the principal amount of the series and issue additional bonds of such series having the same ranking, interest rate, maturity and other terms (other than the date of issuance and, in some circumstances, the initial interest accrual date and initial interest payment date) as the Exchange Bonds. Any such additional bonds would, together with the existing Exchange Bonds of such series, constitute a single series of securities under the Mortgage and may be treated as a single class for all purposes under the Mortgage, including, without limitation, voting, waivers and amendments. |

|

|

|

|

|

Company Obligations |

|

Our obligations to pay the principal of, premium, if any, and interest on the Exchange Bonds are solely obligations of the Company and none of our direct or indirect parent companies nor any of their subsidiaries or affiliates will guarantee or provide any credit support for our obligations on the Exchange Bonds. |

|

|

|

|

|

Denominations |

|

Minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

|

|

|

|

|

Form of Bonds |

|

The Exchange Bonds will be issued in fully registered book-entry form and each series of Exchange Bonds will be represented by one or more global certificates, which will be deposited with or on behalf of DTC and registered in the name of DTC’s nominee. Beneficial interests in global certificates will be shown on, and transfers thereof will be effected only through, records maintained by DTC and its direct and indirect participants, and your interest in any global certificate may not be exchanged for certificated bonds, except in limited circumstances described herein. See “Description of the Exchange Bonds — Book-Entry Only Issuance — The Depository Trust Company.” |

|

|

|

|

|

Trustee |

|

The Bank of New York Mellon |

|

|

|

|

|

Absence of Established Market for the Exchange Bonds |

|

We do not plan to have the Exchange Bonds listed on any securities exchange or included in any automated quotation system. There is no existing trading market for the Exchange Bonds. If no active trading market develops, you may not be able to resell your Exchange Bonds at their fair market value or at all. Future trading prices of the Exchange Bonds will depend on many factors including, among other things, prevailing interest rates, our operating results and the market for similar securities. No assurance can be given as to the liquidity of or trading market for the Exchange Bonds. |

|

|

|

|

|

Risk Factors |

|

You should refer to the section entitled “Risk Factors” beginning on page 9 for a discussion of material risks you should carefully consider before deciding to exchange your Outstanding Bonds. |

An investment in the Bonds, including a decision to tender your Outstanding Bonds in the Exchange Offers, involves a number of risks. Risks described below should be carefully considered together with the other information included in this prospectus. Any of the events or circumstances described as risks below could result in a significant or material adverse effect on our business, results of operations, cash flows or financial condition, and a corresponding decline in the market price of, or our ability to repay, the Bonds. The risks and uncertainties described below may not be the only risks and uncertainties that we face. Additional risks and uncertainties not currently known may also result in a significant or material adverse effect on our business, results of operations, cash flow or financial condition.

Risks related to Our Operations

The following risks apply to the Outstanding Bonds and will apply equally to the Exchange Bonds.

Our business is subject to significant and complex governmental regulation.

Various federal and state entities, including, but not limited to, the FERC, the Kentucky Commission, the Virginia Commission and the Tennessee Regulatory Authority, regulate many aspects of our utility operations, including the following:

· the rates that we may charge and the terms and conditions of our service and operations;

· financial and capital structure matters;

· siting and construction of facilities;

· mandatory reliability and safety standards and other standards of conduct;

· accounting, depreciation and cost allocation methodologies;

· tax matters;

· affiliate restrictions;

· acquisition and disposal of utility assets and securities; and

· various other matters.

Such regulations or changes thereto may subject us to higher operating costs or increased capital expenditures and failure to comply could result in sanctions or possible penalties. In any rate-setting proceedings, federal or state agencies, intervenors and other permitted parties may challenge our rate requests, and ultimately reduce, alter or limit the rates we seek.

Our profitability is highly dependent on our ability to recover the costs of providing energy and utility services to our customers and earn an adequate return on our capital investments. We currently provide services to our retail customers at rates approved by one or more federal or state regulatory commissions, including those commissions referred to above. While these rates are generally regulated based on an analysis of their costs incurred in a base year, the rates we are allowed to charge may or may not match our costs at any given time. While rate regulation is premised on providing a reasonable opportunity to earn a reasonable rate of return on invested capital, there can be no assurance that the applicable regulatory commissions will consider all of our costs to have been prudently incurred or that the regulatory process in which rates are determined will always result in rates that will produce full recovery of our costs or an adequate return on our capital investments. If our costs are not adequately recovered through rates, it could have an adverse affect on our business, results of operations, cash flows or financial condition.

In connection with the PPL acquisition, we have agreed, subject to certain limited exceptions such as fuel and environmental cost recoveries, that no base rate increase would take effect for our Kentucky retail customers before January 1, 2013. See “Summary — Recent Developments — PPL Acquisition Approvals.”

Our transmission and interstate market activities, as well as other aspects of our business, are subject to significant FERC regulation.

Our business is subject to extensive regulation by the FERC covering matters including rates charged to transmission users, market-based or cost-based rates applicable to wholesale customers; interstate power market structure; construction and operation of transmission facilities; mandatory reliability standards; standards of conduct and affiliate restrictions and other matters. Existing FERC regulation, changes thereto or issuances of new rules or situations of non-compliance, including, but not limited to, the areas of market-based tariff authority, revenue sufficiency guarantee resettlements in the Midwest Independent Transmission System Operator, Inc. market, mandatory reliability standards and natural gas transportation regulation can affect our earnings, operations or other activities.

Changes in transmission and wholesale power market structures could increase costs or reduce revenues.

Wholesale sales fluctuate with regional demand, fuel prices and contracted capacity. Changes to transmission and wholesale power market structures and prices may occur in the future, are not estimable and may result in unforeseen effects on energy purchases and sales, transmission and related costs or revenues. These can include commercial or regulatory changes affecting power pools, exchanges or markets in which we participate.

We undertake significant capital projects and these activities are subject to unforeseen costs, delays or failures, as well as risk of inadequate recovery of resulting costs.

Our business is capital intensive and requires significant investments in energy generation and distribution and other infrastructure projects, such as projects for environmental compliance. The completion of these projects without delays or cost overruns is subject to risks in many areas, including the following:

· approval, licensing and permitting;

· land acquisition and the availability of suitable land;

· skilled labor or equipment shortages;

· construction problems or delays, including disputes with third party intervenors;

· increases in commodity prices or labor rates;

· contractor performance;

· environmental considerations and regulations;

· weather and geological issues; and

· political, labor and regulatory developments.

Failure to complete our capital projects on schedule or on budget, or at all, could adversely affect our financial performance, operations and future growth.

Our costs of compliance with, and liabilities under, environmental laws are significant and are subject to continual changes.

Extensive federal, state and local environmental laws and regulations are applicable to our air emissions, water discharges and the management of hazardous and solid waste, among other areas; and the costs of compliance or alleged non-

compliance cannot be predicted with certainty but could be material. In addition, our costs may increase significantly if the requirements or scope of environmental laws or regulations, or similar rules, are expanded or changed from prior versions by the relevant agencies. Costs may take the form of increased capital or operating and maintenance expenses; monetary fines, penalties or forfeitures or other restrictions. Many of these environmental law considerations are also applicable to the operations of our key suppliers, or customers, such as coal producers, industrial power users, etc., and may impact the costs of their products or their demand for our services.

We are subject to operational and financial risks regarding certain on-going developments concerning environmental regulation.

A number of regulatory initiatives have been implemented or are under development which could have the effect of significantly increasing the environmental regulation or operational or compliance costs related to a number of emissions or operating activities which are associated with the combustion of coal as occurs at our generating stations. Such developments could include potential new or revised federal or state legislation or regulation regarding emissions of NOx, SO2, mercury and other particulates generally and regarding storage of coal combustion byproducts. Additional regulatory initiatives may occur in other areas involving our operations, including revision of limitations on water discharge or intake activities or increased standards relating to polychlorinated biphenyl, or PCB, usage. Compliance with any new laws or regulations in these matters could result in significant changes to our operations, significant capital expenditures or significant increases in the cost of conducting business.

Our operating results are affected by weather conditions, including storms and seasonal temperature variations, as well as by significant man-made or accidental disturbances, including terrorism or natural disasters.

These weather or other factors can significantly affect our finances or operations by changing demand levels; causing outages; damaging infrastructure or requiring significant repair costs; affecting capital markets and general economic conditions or impacting future growth.

We are subject to operational and financial risks regarding potential developments concerning global climate change.

Various regulatory and industry initiatives have been implemented or are under development to regulate or otherwise reduce emissions of greenhouse gases, or GHGs, which are emitted from the combustion of fossil fuels such as coal and natural gas, as occurs at our generating stations. Such developments could include potential federal or state legislation or regulations limiting GHG emissions; establishing costs or charges on GHG emissions or on fuels relating to such emissions; requiring GHG capture and sequestration or other mitigation measures; establishing renewable portfolio standards or generation fleet-diversification requirements to address GHG emissions; promoting energy efficiency and conservation; mandating changes in transmission grid construction, operation or pricing to accommodate GHG-related initiatives; or requiring other measures. Our generation fleet is predominantly coal-fired and may be highly impacted by developments in this area. Compliance with any new laws or regulations regarding the reduction of GHG emissions could result in significant changes to our operations, significant capital expenditures and a significant increase in our cost of conducting business. We may face strong competition for, or difficulty in obtaining, required GHG-compliance related goods and services, including construction services, emissions allowances and financing, insurance and other inputs relating thereto. Increases in our costs or prices of producing or selling electric power due to GHG-related developments could materially reduce or otherwise affect the demand, revenue or margin levels applicable to our power, thus adversely affecting our financial condition or results of operations.

We are subject to physical, market and economic risks relating to potential effects of climate change.

Climate change may produce changes in weather or other environmental conditions, including temperature or precipitation changes, such as warming, floods or drought. These changes may affect farm and agriculturally-dependent businesses and activities, which are an important part of Kentucky’s economy, and thus may impact consumer demand for electric power. Temperature increases could result in increased overall electricity volumes or peaks and precipitation changes could result in droughts reducing the availability of water for plant cooling operations or floods interfering with facility operations. These or other meteorological changes could lead to increased operating costs, capital expenses or power purchase costs. Conversely, climate change could have a number of potential impacts tending to reduce demand. Changes may entail more frequent or more intense storm activity, which, if severe, could temporarily disrupt regional economic conditions and adversely affect electricity demand levels. As discussed in other risk factors, storm outages and damage often

directly decrease revenues or increase expenses, due to reduced usage and higher restoration charges, respectively. GHG regulation could increase the cost of electric power, particularly power generated by fossil fuels, and such increases could have a depressive effect on the regional economy. Reduced economic and consumer activity in our service area both in general and specific to certain industries and consumers accustomed to previously low-cost power, could reduce demand for our electricity. Also, demand for our services could be similarly lowered should consumers’ preferences or market factors move toward favoring energy efficiency, low-carbon power sources or reduced electric usage generally.

Our business is subject to risks associated with local, national and worldwide economic conditions.

The consequences of prolonged recessionary conditions may include a lower level of economic activity and uncertainty or volatility regarding energy prices and the capital and commodity markets. A lower level of economic activity might result in a decline in energy consumption, unfavorable changes in energy and commodity prices, and slower customer growth, which may adversely affect our future revenues and growth. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital. A deterioration of economic conditions may lead to decreased production by our industrial customers and, therefore, lower consumption of electricity. Decreased economic activity may also lead to fewer commercial and industrial customers and increased unemployment, which may in turn impact residential customers’ ability to pay. Further, worldwide economic activity has an impact on the demand for basic commodities needed for utility infrastructure. Changes in global demand may impact the ability to acquire sufficient supplies and the cost of those commodities may be higher than expected.

Our business is concentrated in the Midwest United States, specifically Kentucky.

Although we also operate in Virginia and Tennessee, the majority of our operations are concentrated in Kentucky. Local and regional economic conditions, such as population growth, industrial growth, expansion and economic development or employment levels, as well as the operational or financial performance of major industries or customers, can affect the demand for energy and our results of operations. Significant industries and activities in our service area include aluminum and steel smelting and fabrication; chemical processing; coal, mineral and ceramic-related activities; educational institutions; health care facilities; paper and pulp processing and water and sewer utilities. Any significant downturn in these industries or activities or in local and regional economic conditions in our service area may adversely affect the demand for electricity in our service area.

We are subject to operational risks relating to our generating plants, transmission facilities, distribution equipment, information technology systems and other assets and activities.

Operation of power plants, transmission and distribution facilities, information technology systems and other assets and activities subjects us to many risks, including the breakdown or failure of equipment; accidents; security breaches, viruses or outages affecting information technology systems; labor disputes; obsolescence; delivery/transportation problems and disruptions of fuel supply and performance below expected levels. Occurrences of these events may impact our ability to conduct our business efficiently or lead to increased costs, expenses or losses.

Although we maintain customary insurance coverage for certain of these risks common to utilities, we do not have insurance covering our transmission and distribution systems, other than substations, because we have found the cost of such insurance to be prohibitive. If we are unable to recover the costs incurred in restoring our transmission and distribution properties following damage as a result of ice storms, tornados or other natural disasters or to recover the costs of other liabilities arising from the risks of our business, through a change in our rates or otherwise, or if such recovery is not received on a timely basis, we may not be able to restore losses or damages to our properties without an adverse effect on our financial condition, results of operations or our reputation.

We are subject to liability risks relating to our generating, transmission, distribution and retail businesses.

The conduct of our physical and commercial operations subjects us to many risks, including risks of potential physical injury, property damage or other financial affects, caused to or caused by employees, customers, contractors, vendors, contractual or financial counterparties and other third parties.

We could be negatively affected by rising interest rates, downgrades to our bond credit ratings or other negative developments in our ability to access capital markets.

In the ordinary course of business, we are reliant upon adequate long-term and short-term financing means to fund our significant capital expenditures, debt interest or maturities and operating needs. As a capital-intensive business, we are sensitive to developments in interest rate levels; credit rating considerations; insurance, security or collateral requirements; market liquidity and credit availability and refinancing steps necessary or advisable to respond to credit market changes. Changes in these conditions could result in increased costs and decreased liquidity available to the Company.

We are subject to commodity price risk and counterparty credit risk associated with the energy business.

General market or pricing developments or failures by counterparties to perform their obligations relating to energy, fuels, other commodities, goods, services or payments could result in potential increased costs to the Company. We have regulatory cost recovery mechanisms in place to mitigate negative fluctuations in commodity supply prices, and credit policies to limit our exposure to counterparty credit, but there can be no assurances that our financial performance will not be negatively impacted by price fluctuations or failure of counterparties with whom we contract to perform their contractual obligations.

We are subject to risks associated with defined benefit retirement plans, health care plans, wages and other employee-related matters.

We sponsor pension and postretirement benefit plans for our employees. Risks with respect to these plans include adverse developments in legislation or regulation, future costs or funding levels, returns on investments, market fluctuations, interest rates and actuarial matters. Changes in health care rules, market practices or cost structures can affect our current or future funding requirements or liabilities. Without sustained growth in our investments over time to increase the value of our plan assets, we could be required to fund our plans with significant amounts of cash. We are also subject to risks related to changing wage levels, whether related to collective bargaining agreements or employment market conditions, ability to attract and retain key personnel and changing costs of providing health care benefits.

We are subject to risks associated with federal and state tax regulations.

Changes in taxation as well as the inherent difficulty in quantifying potential tax effects of business decisions could negatively impact our results of operations. We are required to make judgments in order to estimate our obligations to taxing authorities. These tax obligations include income, property, sales and use and employment-related taxes. We also estimate our ability to utilize tax benefits and tax credits. Due to the revenue needs of the states and jurisdictions in which we operate, various tax and fee increases may be proposed or considered. We cannot predict whether legislation or regulation will be introduced or the effect on the Company of any such changes. If enacted, any changes could increase tax expense and could have a negative impact on our results of operations and cash flows.

Risks Related to the Exchange Offers

There may be adverse consequences if you do not exchange your Outstanding Bonds.

If you do not exchange your Outstanding Bonds for Exchange Bonds in the Exchange Offers, you will continue to be subject to restrictions on transfer of your Outstanding Bonds as set forth in the offering memorandum distributed in connection with the private offering of the Outstanding Bonds. In general, the Outstanding Bonds may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the Outstanding Bonds under the Securities Act. You should refer to “Prospectus Summary — The Exchange Offers” and “The Exchange Offers” for information about how to tender your Outstanding Bonds.

The tender of Outstanding Bonds under the Exchange Offers will reduce the outstanding amount of the Outstanding Bonds, which may have an adverse effect upon, and increase the volatility of, the market prices of the Outstanding Bonds due to a reduction in liquidity.

Your ability to transfer the Exchange Bonds may be limited if there is no active trading market, and there is no assurance that any active trading market will develop for the Exchange Bonds.

We are offering the Exchange Bonds to the holders of the Outstanding Bonds. We do not intend to list the Exchange Bonds on any securities exchange. There is currently no established market for the Exchange Bonds. If no active trading market develops, you may not be able to resell your Exchange Bonds at their fair market value or at all. Future trading prices of the Exchange Bonds will depend on many factors including, among other things, prevailing interest rates, our operating results and the market for similar securities. No assurance can be given as to the liquidity of or trading market for the Exchange Bonds.

Certain persons who participate in the Exchange Offers must deliver a prospectus in connection with resales of the Exchange Bonds.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), we believe that you may offer for resale, resell or otherwise transfer the Exchange Bonds without compliance with the registration and prospectus delivery requirements of the Securities Act. We cannot guarantee that the SEC would make a similar decision about our Exchange Offers. If our belief is wrong, or if you cannot truthfully make the representations mentioned above, and you transfer any Exchange Bond issued to you in the Exchange Offers without meeting the registration and prospectus delivery requirements of the Securities Act, or without an exemption from such requirements, you could incur liability under the Securities Act. Additionally, in some instances described in this prospectus under “Plan of Distribution,” certain holders of Exchange Bonds will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer the Exchange Bonds. If such a holder transfers any Exchange Bonds without delivering a prospectus meeting the requirements of the Securities Act or without an applicable exemption from registration under the Securities Act, such a holder may incur liability under the Securities Act. We do not and will not assume, or indemnify such a holder against, this liability.

Risks Related to the Bonds

The following risks apply to the Outstanding Bonds and will apply equally to the Exchange Bonds.

If the ratings of the Bonds are lowered or withdrawn, the market value of the Bonds could decrease.

A rating is not a recommendation to purchase, hold or sell the Bonds, inasmuch as the rating does not comment as to market price or suitability for a particular investor. The ratings of the Bonds address the rating agencies’ views as to the likelihood of the timely payment of interest and the ultimate repayment of principal of the Bonds pursuant to their respective terms. There is no assurance that a rating will remain for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if in their judgment circumstances in the future so warrant. In the event that any of the ratings initially assigned to the Bonds is subsequently lowered or withdrawn for any reason, the market price of the Bonds may be adversely affected.

A WARNING ABOUT FORWARD-LOOKING STATEMENTS

We use forward-looking statements in this prospectus. Statements that are not historical facts are forward-looking statements, and are based on beliefs and assumptions of our management, and on information currently available to management. Forward-looking statements include statements preceded by, followed by or using such words as “believe,” “expect,” “anticipate,” “plan,” “estimate” or similar expressions. Actual results may materially differ from those implied by forward-looking statements due to known and unknown risks and uncertainties. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

· fuel supply availability;

· weather conditions affecting generation production, customer energy use and operating costs;

· operation, availability and operating costs of existing generation facilities;

· transmission and distribution system conditions and operating costs;

· collective labor bargaining negotiations;

· the outcome of litigation against us;

· potential effects of threatened or actual terrorism or war or other hostilities;

· our commitments and liabilities;

· market demand and prices for energy, capacity, transmission services, emission allowances and delivered fuel;

· competition in retail and wholesale power markets;

· liquidity of wholesale power markets;

· defaults by our counterparties under our energy, fuel or other power product contracts;

· market prices of commodity inputs for ongoing capital expenditures;

· capital market conditions, including the availability of capital or credit, changes in interest rates, and decisions regarding capital structure;

· the fair value of debt and equity securities and the impact on defined benefit costs and resultant cash funding requirements for defined benefit plans;

· interest rates and their effect on pension and retiree medical liabilities;

· volatility in or the impact of changes in financial or commodity markets and economic conditions;

· profitability and liquidity, including access to capital markets and credit facilities;

· new accounting requirements or new interpretations or applications of existing requirements;

· securities and credit ratings;

· current and future environmental conditions and requirements and the related costs of compliance, including environmental capital expenditures, emission allowance costs and other expenses;

· political, regulatory or economic conditions in states, regions or countries where we conduct business;

· receipt of necessary governmental permits, approvals and rate relief;

· new state or federal legislation, including new tax, environmental, health care or pension-related legislation;

· state or federal regulatory developments;

· the impact of any state or federal investigations applicable to us and the energy industry;

· the effect of any business or industry restructuring;

· development of new projects, markets and technologies;

· performance of new ventures; and

· asset acquisitions and dispositions.

In light of these risks and uncertainties, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. For additional details regarding these and other risks and uncertainties, see “Risk Factors” on page 9 of this prospectus.

We will not receive any cash proceeds from the issuance of the Exchange Bonds pursuant to the Exchange Offers. In consideration for issuing the Exchange Bonds as contemplated in this prospectus, we will receive in exchange a like principal amount of Outstanding Bonds, the terms of which are identical in all material respects to the Exchange Bonds of the related series, except that the Exchange Bonds will not contain terms with respect to transfer restrictions, registration rights and liquidated damages for failure to observe certain obligations in the registration rights agreement. The Outstanding Bonds surrendered in exchange for the Exchange Bonds will be retired and cancelled, and will not be reissued. Accordingly, the issuance of the Exchange Bonds will not result in any increase in our outstanding debt or the receipt of any additional proceeds.

The following table sets forth our capitalization as of December 31, 2010. You should read the data set forth below in conjunction with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Financial Statements as of December 31, 2010 and 2009 and for the Years Ended December 31, 2010, 2009 and 2008 included elsewhere in this prospectus (the “2010 Annual Financial Statements”).

The Outstanding Bonds that are surrendered in exchange for the Exchange Bonds will be retired and cancelled and cannot be reissued. As a result, the issuance of the Exchange Bonds will not result in any change in our capitalization.

|

|

|

As of December 31, 2010 |

| |

|

Cash and cash equivalents |

|

$ |

3 |

|

|

Long-term debt, including current portion |

|

1,851 |

| |

|

Total equity |

|

2,691 |

| |

|

Total capitalization |

|

$ |

4,542 |

|

The selected financial data presented below for the five fiscal years ended December 31, 2010, and as of December 31 for each of those years, have been derived from our audited financial statements. Our audited financial statements for the three fiscal years ended December 31, 2010, and as of December 31, 2010 for each of those years, are included in this prospectus. Historical results are not necessarily indicative of future results. Our financial statements and related financial and operating data include the periods before and after PPL’s acquisition of our Parent on November 1, 2010, and are labeled as Predecessor or Successor. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview” for additional information.

You should read the data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited financial statements and related notes included elsewhere in this prospectus.

Dollars are in millions unless otherwise noted.

|

|

|

Successor |

|

Predecessor |

| ||||||||||||||

|

|

|

November 1, 2010 |

|

January 1, 2010 |

|

Year Ended |

| ||||||||||||

|

|

|

through |

|

through October |

|

December 31, |

| ||||||||||||

|

|

|

December 31, 2010 |

|

31, 2010 |

|

2009 |

|

2008 |

|

2007 |

|

2006 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Operating revenues |

|

$ |

263 |

|

$ |

1,248 |

|

$ |

1,355 |

|

$ |

1,405 |

|

$ |

1,272 |

|

$ |

1,210 |

|

|

Operating income |

|

$ |

65 |

|

$ |

285 |

|

$ |

269 |

|

$ |

260 |

|

$ |

267 |

|

$ |

235 |

|

|

Net Income |

|

$ |

35 |

|

$ |

140 |

|

$ |

133 |

|

$ |

158 |

|

$ |

167 |

|

$ |

152 |

|

|

Total assets |

|

$ |

6,059 |

|

$ |

5,145 |

|

$ |

4,956 |

|

$ |

4,518 |

|

$ |

3,796 |

|

$ |

3,148 |

|

|

Long-term debt obligations (including amounts due within one year) |

|

$ |

1,841 |

|

$ |

1,682 |

|

$ |

1,682 |

|

$ |

1,532 |

|

$ |

1,264 |

|

$ |

843 |

|

|

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Ratio of Earnings to Fixed Charges(1) |

|

6.00 |

|

4.01 |

|

3.68 |

|

3.92 |

|

5.05 |

|

6.46 |

| ||||||

(1) For purposes of calculating the ratio of earnings to fixed charges, earnings consist of earnings from continuing operations plus fixed charges. Fixed charges consist of all interest on indebtedness, amortization of debt discount and expense and the portion of rental expense that represents an imputed interest component. Earnings from continuing operations consist of income before taxes, undistributed income of Electric Energy, Inc. and the mark-to-market impact of derivative instruments.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a regulated utility engaged in the generation, transmission, distribution and sale of electric energy in Kentucky, Virginia and Tennessee. See “Business” for a description of the business. The rates we charge our customers require approval of the appropriate regulatory government agency. See Note 3 to our 2010 Annual Financial Statements for information regarding rate cases, regulatory assets and liabilities and other regulatory matters.

The Company and its affiliate, LG&E, are wholly owned subsidiaries of our Parent, a Kentucky limited liability company. PPL Corporation acquired our Parent on November 1, 2010. Headquartered in Allentown, Pennsylvania, PPL is an energy and utility holding company that was incorporated in 1994. Through its subsidiaries, PPL owns or controls about 19,000 Mw of generating capacity in the U.S., sells energy in key U.S. markets and delivers electricity and natural gas to about 10 million customers in the U.S. and the U.K. Following the acquisition, both the Company and LG&E continue operating as subsidiaries of our Parent, which is now an intermediary holding company in the PPL group of companies. See Note 2 to our 2010 Annual Financial Statements for further information regarding the acquisition.

The following discussion and analysis by management focuses on those factors that had a material effect on our results of operations and financial condition during the periods presented and should be read in connection with the Financial Statements and Notes included elsewhere in this prospectus. The discussion also provides information with respect to our material risks and challenges and contains certain forward-looking statements that involve risk and uncertainties. See “Risk Factors” and “A Warning about Forward-Looking Statements” for further information. Specifically:

· “Results of Operations” provides a description of our operating results in 2010, 2009 and 2008, including a review of earnings and a brief outlook for 2011.

· “Financial Condition — Liquidity and Capital Resources” provides an analysis of our liquidity position and credit profile, including our sources of cash (including bank credit facilities and sources of operating cash flow) and uses of cash (including contractual obligations and capital expenditure requirements) and the key risks and uncertainties that impact our past and future liquidity position and financial condition. This subsection also includes a discussion of rating agency action on our credit ratings.

· “Financial Condition — Risk Management” provides an explanation of our risk management activities relating to market risk and credit risk.

· “Application of Critical Accounting Policies and Estimates” provides an overview of the accounting policies that are particularly important to our results of operations and our financial condition and that require our management to make significant estimates, assumptions and other judgments.

Predecessor and Successor Financial Presentation

Our financial statements and related financial and operating data include the periods before and after PPL’s acquisition of our Parent on November 1, 2010, and are labeled as Predecessor or Successor. We applied push-down accounting to account for the acquisition. For accounting purposes only, push-down accounting is considered to create a new entity due to new cost basis assigned to assets, liabilities and equity as of the acquisition date. Consequently, our results of operations and cash flows for the Predecessor and Successor periods in 2010 are shown separately, rather than combined, in our audited financial statements.

In the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of “Results of Operations” and “Financial Condition,” we have included disclosure of the combined Predecessor and Successor results of operations and cash flows. Such presentation is considered to be a non-GAAP disclosure. We have included such disclosure because we believe it facilitates the comparison of 2010 operating and financial performance to 2009 and 2008, and because our core operations have not changed as a result of the acquisition.

Competition

See the Business section for information concerning competition.

Environmental Matters

General

Protection of the environment is a major priority for us and a significant element of our business activities. Extensive federal, state and local environmental laws and regulations are applicable to our air emissions, water discharges and the management of hazardous and solid waste, among other areas; and the costs of compliance or alleged non-compliance cannot be predicted with certainty but could be material. In addition, costs may increase significantly if the requirements or scope of environmental laws or regulations, or similar rules, are expanded or changed from prior versions by the relevant agencies. Costs may take the form of increased capital or operating and maintenance expenses; monetary fines, penalties or forfeitures or other restrictions. Many of these environmental law considerations are also applicable to the operations of key suppliers, or customers, such as coal producers, industrial power users, etc., and may impact the costs of their products or their demand for our services.

Climate Change