Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2012

Commission File Number 1-5318

KENNAMETAL INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 25-0900168 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| World Headquarters |

||

| 1600 Technology Way |

||

| P.O. Box 231 |

||

| Latrobe, Pennsylvania |

15650-0231 | |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (724) 539-5000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Capital Stock, par value $1.25 per share | New York Stock Exchange | |

| Preferred Stock Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [X] | Accelerated filer [ ] | |||||

| Non-accelerated filer [ ] (Do not check if smaller reporting company) | Smaller reporting company [ ] | |||||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of December 31, 2011, the aggregate market value of the registrant’s Capital Stock held by non-affiliates of the registrant, estimated solely for the purposes of this Form 10-K, was approximately $2,325,200,000. For purposes of the foregoing calculation only, all directors and executive officers of the registrant and each person who may be deemed to own beneficially more than 5% of the registrant’s Capital Stock have been deemed affiliates.

As of July 31, 2012, there were 80,106,781 shares of the Registrant’s Capital Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2012 Annual Meeting of Shareowners are incorporated by reference into Part III.

Table of Contents

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements that do not relate strictly to historical or current facts. For example, statements about Kennametal’s outlook for earnings, sales volumes, and cash flow for its fiscal year 2013, its expectations regarding future growth and any statements regarding future operating or financial performance or events are forward-looking. We have also included forward looking statements in this Form 10-K concerning, among other things, our strategy, goals, plans and projections regarding our financial position, liquidity and capital resources, results of operations, market position, and product development. These statements are based on current estimates that involve inherent risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should the assumptions underlying the forward-looking statements prove incorrect, our actual results could vary materially from our current expectations. There are a number of factors that could cause our actual results to differ from those indicated in the forward-looking statements. They include: economic recession; availability and cost of the raw materials we use to manufacture our products; our foreign operations and international markets, such as currency exchange rates, different regulatory environments, trade barriers, exchange controls, and social and political instability; changes in the regulatory environment in which we operate, including environmental, health and safety regulations; our ability to protect and defend our intellectual property; competition; our ability to retain our management and employees; demands on management resources; potential claims relating to our products; integrating acquisitions and achieving the expected savings and synergies; business divestitures; global or regional catastrophic events; energy costs; commodity prices; labor relations; demand for and market acceptance of new and existing products; and implementation of environmental remediation matters. We provide additional information about many of the specific risks we face in the “Risk Factors” Section of this Annual Report on Form 10-K. We can give no assurance that any goal or plan set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. We undertake no obligation to release publicly any revisions to forward-looking statements as a result of future events or development.

Table of Contents

OVERVIEW From its founding in 1938, the McKenna family incorporated Kennametal Inc. in Pennsylvania in 1943. As a global enterprise, we deliver productivity to customers seeking peak performance in demanding environments by providing innovative custom and standard wear-resistant solutions. To provide these solutions, we harness our knowledge of advanced materials and application development with a commitment to environmental sustainability. Our solutions are built around industry-essential technology platforms. These include metalworking tools, engineered components and surface technologies that are mission-critical to the performance of our customers battling extreme conditions such as fatigue wear, corrosion and high temperatures. We believe that our reputation for manufacturing excellence, as well as our technological expertise and innovation we deliver in our products and services, help us to achieve a leading position in our primary markets. End users of our products include metalworking and machinery manufacturers and suppliers across a diverse array of industries, including the aerospace, defense, transportation, machine tool, light machinery and heavy machinery, as well as producers and suppliers in a number of equipment-intensive industries such as coal mining, road construction and quarrying, as well as oil and gas exploration, refining, production and supply. Our end users’ applications range from airframes to mining operations, engines to oil wells and turbochargers to processing.

Our product offering includes a wide selection of standard and customized technologies for metalworking, such as sophisticated metal cutting tools, tooling systems and services, as well as advanced, high-performance materials, such as cemented tungsten carbide products, super alloys, coatings and investment castings to address customer demands. We offer these products through a variety of channels to meet customer-specified needs. We are a leading global supplier of tooling, engineered components and advanced materials consumed in production processes. We believe we are one of the largest global providers of consumable metal cutting tools and tooling supplies.

We specialize in developing and manufacturing metalworking tools and wear-resistant engineered components and coatings using a specialized type of powder metallurgy. Our metalworking tools are made of cemented tungsten carbides, ceramics, cermets and super-hard materials. We also manufacture and market a complete line of tool holders, tool-holding systems and rotary-cutting tools by machining and fabricating steel bars and other metal alloys. In addition, we produce specialized compacts and metallurgical powders, as well as products made from tungsten carbide or other hard materials that are used for custom-engineered and challenging applications, including mining and highway construction, among others. Further, we develop, manufacture and market engineered components and surface technology solutions with proprietary metal cladding capabilities, as well as process technology and materials that focus on component deburring, polishing and effecting controlled radii. The recent addition of the Deloro Stellite Holdings 1 Limited (Stellite) organization to our portfolio brings new capabilities in engineered components and surface technologies, extending our offering of investment casting, coatings and super alloy solutions.

Unless otherwise specified, any reference to a “year” refers to a 12-month fiscal year ending on June 30.

BUSINESS SEGMENT REVIEW Our operations are organized into two reportable operating segments; Industrial and Infrastructure. Segment determination is based upon internal organizational structure, the manner in which we organize segments for making operating decisions and assessing performance, the availability of separate financial results and materiality considerations. Sales and operating income by segment are presented in Management’s Discussion and Analysis set forth in Item 7 of this annual report on Form 10-K (MD&A). Additional segment data is provided in Note 20 of our consolidated financial statements set forth in Item 8 of this annual report on Form 10-K (Item 8) which is incorporated herein by reference.

INDUSTRIAL In the Industrial segment, we focus on customers in the aerospace, defense, transportation and general engineering market sectors, as well as the machine tool industry. Our customers in these end markets use our products and services in the manufacture of engines, airframes, automobiles, trucks, ships and other various types of industrial equipment. The technology and customization requirements we provide vary by customer, application and industry. The value we deliver to our Industrial segment customers centers on knowledge of our customers processes, application expertise and our diverse offering of products and services.

INFRASTRUCTURE In the Infrastructure segment which includes the Stellite acquisition, we focus on customers in the energy and earthworks sectors who support primary industries such as oil and gas, power generation and process industries such as food and beverage and chemicals; underground, surface and hard-rock mining; highway construction and road maintenance. Our success is determined by our associates gaining an in-depth understanding of our customers’ engineering and development needs, to be able to offer complete system solutions and high-performance capabilities to optimize and add value to their operations.

- 1 -

Table of Contents

INTERNATIONAL OPERATIONS During 2012, we generated 57 percent of our sales in markets outside of the United States of America (U.S), with principal international operations in Western Europe, Asia Pacific, India, Latin America and Canada. In addition, we operate manufacturing and distribution facilities in Israel and South Africa, while serving customers through sales offices, agents and distributors in Eastern Europe and other parts of the world. While geographic diversification helps to minimize the sales and earnings impact of respective demand changes in any one particular region, our international operations are subject to normal risks of doing business globally, including fluctuations in currency exchange rates and changes in social, political and economic environments.

Our international assets and sales are presented in Note 20 of the Company’s consolidated financial statements, set forth in Item 8 and are incorporated herein by reference. Further information about the effects and risks of currency exchange rates is presented in the Quantitative and Qualitative Disclosures About Market Risk section, as set forth in Item 7A of this annual report on Form 10-K.

GENERAL DEVELOPMENT OF BUSINESS We continue to engage in balancing our geographic footprint between North America, Western Europe, and the rest of the world markets. This strategy, together with steps to enhance the balance of our sales among our served end markets and business units, has helped to create a more diverse business base and thereby provide additional sales opportunities, as well as limit reliance on and exposure to any specific region or market sector.

In fiscal 2012, we experienced year-over-year quarterly sales growth in every quarter. Our sales for the year ended June 30, 2012 were $2,736.2 million, 46 percent of which were in North America, 28 percent in Western Europe and 26 percent in the rest of the world. Our restructuring programs completed in fiscal 2011 are delivering annual ongoing pre-tax savings of approximately $170 million.

For fiscal 2012, global industrial production increased by 2.9 percent, demonstrating that a number of end markets continued to grow. While the global economy continues to improve, we remain confident in our ability to respond quickly to changes in global markets while continuing to serve our customers and preserve our competitive strengths. At the same time, we continue to focus on maximizing cash flow and priority uses of cash. Further discussion and analysis of the developments in our business is set forth in MD&A.

ACQUISITIONS AND DIVESTITURES During 2012, we completed the acquisition of Deloro Stellite Holdings 1 Limited (Stellite) in the Infrastructure segment for a purchase price of approximately $383 million, net of cash acquired. The Stellite acquisition resulted in approximately $243 million of goodwill, based on the final purchase price allocations, which is not deductible for tax purposes and is attributable to the operating synergies we expect to gain from the acquisition.

We continue to evaluate new opportunities for the expansion of existing product lines into new market areas where appropriate. We also continue to evaluate opportunities for the introduction of new and/or complementary product offerings into new and/or existing market areas where appropriate. We expect to continue to evaluate potential acquisitions to continue to grow our business and further enhance our market position.

MARKETING AND DISTRIBUTION We sell our products through the following, distinct sales channels: (i) a direct sales force; (ii) a network of independent distributors and sales agents in North America, Europe, Latin America, Asia Pacific and other markets around the world; (iii) integrated supply chain channels; and (iv) via the Internet. Application engineers and technicians directly assist our customers with specified product design, selection, application and support.

To market our products, we maintain two premium brands: Kennametal and Widia. These master brands also include sub-categories with various trademarks and trade names combining the Kennametal master brand with identifying categorical names such as: Kennametal Conforma Clad; Kennametal Tricon; Kennametal Extrude Hone; Kennametal Sintec; Kennametal International Specialty Alloys; and Kennametal Camco. Similarly, we combine the Widia master brand with other identifying names, such as: Widia GTD; Widia Ruebig; Widia Circle; Widia Manchester; Widia Hanita; Widia Clappdico; Widia Metal Removal; and Widia Metcut; as well as select product names such as ToolBoss, Kyon, Fix-Perfect and Mill1™. We own these names and trademarks via Kennametal Inc. or Kennametal subsidiaries. On a very limited basis, we offer certain products to customers for resale under their own names or private labels.

RAW MATERIALS AND SUPPLIES Major metallurgical raw materials consist of ore concentrates, compounds and secondary materials containing tungsten, tantalum, titanium, niobium and cobalt. Although an adequate supply of these raw materials currently exists, our major sources for raw materials are located abroad and prices fluctuate at times. We have entered into extended raw material supply agreements and will implement product price increases as deemed necessary to mitigate rising costs. For these reasons, we exercise great care in selecting, purchasing and managing availability of raw materials. We also purchase steel bars and forgings for making toolholders and other tool parts, as well as for producing rotary cutting tools and accessories. We obtain products purchased for use in manufacturing processes and for resale from thousands of suppliers located in the U.S. and abroad.

- 2 -

Table of Contents

RESEARCH AND DEVELOPMENT Our product development efforts focus on providing solutions to our customers’ manufacturing challenges and productivity requirements. Our product development program provides discipline and focus for the product development process by establishing “gateways,” or sequential tests, during the development process to remove inefficiencies and accelerate improvements. This program speeds and streamlines development into a series of actions and decision points, combining efforts and resources to produce new and enhanced products faster. This program is designed to assure a strong link between customer requirements and corporate strategy, and to enable us to gain full benefit from our investment in new product development. We hold a number of patents which, in the aggregate, are material to the operation of our businesses.

Research and development expenses included in operating expense totaled $38.3 million, $33.3 million and $28.0 million in 2012, 2011 and 2010, respectively.

SEASONALITY Our business is not materially affected by seasonal variations. However, to varying degrees, traditional summer vacation shutdowns of customers’ plants and holiday shutdowns often affect our sales levels during the first and second quarters of our fiscal year.

BACKLOG Our backlog of orders generally is not significant to our operations.

COMPETITION As one of the world’s leading producers of engineered cemented carbide products and solutions, we maintain a leading competitive position in major markets worldwide. Our recent acquisition of Stellite further strengthens our competitive position providing innovative surface and wear solutions, while also adding super-alloy materials and investment casting capabilities. We actively compete in the sale of all our products with approximately 30 companies in the United States, with many more offering similar capabilities to customers in 60 countries around the world. While several of our competitors are divisions of larger corporations, our industry remains largely fragmented, with several hundred fabricators and toolmakers. Many of our competitors operate relatively small shops, producing a limited selection of tools while buying cemented tungsten carbide components from original producers of cemented tungsten carbide products, including Kennametal. We also supply coating solutions and other engineered wear-resistant products to such shops. Given the fragmentation, significant competition and opportunities for consolidation exist from both U.S.-based and internationally-based firms, as well as among thousands of industrial supply distributors.

The principal competitive differentiators in our businesses include service, product innovation, performance, quality, selection and availability, pricing and productivity ascribed to our brands. We derive competitive advantage from our premium brands; global presence; application expertise and ability to address customer needs with new and improved tools; innovative surface and wear solutions; highly engineered components; consistent quality; integrated customer service capabilities; state-of-the-art manufacturing; and multiple sales channels. With these strengths, we are able to sell products based on the value-added productivity we deliver to our customers, rather than competing on price.

REGULATION From time to time, we are a party to legal claims and proceedings that arise in the ordinary course of business, which may relate to our operations or assets, including real, tangible, or intellectual property. While we currently believe that the amount of ultimate liability, if any, with respect to these actions will not materially affect our financial position, results of operations or liquidity, the ultimate outcome of any litigation is uncertain. Were an unfavorable outcome to occur or if protracted litigation were to ensue, the impact could be material to us.

Compliance with government laws and regulations pertaining to the discharge of materials or pollutants into the environment or otherwise relating to the protection of the environment did not have a material effect on our capital expenditures or competitive position for the years covered by this report, nor is such compliance expected to have a material effect in the future.

We are involved as a potentially responsible party (PRP) at various sites designated by the United States Environmental Protection Agency (USEPA) as Superfund sites. For certain of these sites, we have evaluated the claims and potential liabilities and have determined that neither are material, individually or in the aggregate. For certain other sites, proceedings are in the very early stages and have not yet progressed to a point where it is possible to estimate the ultimate cost of remediation, the timing and extent of remedial action that may be required by governmental authorities or the amount of our liability alone or in relation to that of any other PRPs.

- 3 -

Table of Contents

Reserves for other potential environmental issues at June 30, 2012 and 2011 were $5.1 million and $5.4 million, respectively. The reserves that we have established for environmental liabilities represent our best current estimate of the costs of addressing all identified environmental situations, based on our review of currently available evidence, and take into consideration our prior experience in remediation and that of other companies, as well as public information released by the USEPA, other governmental agencies, and by the PRP groups in which we are participating. Although the reserves currently appear to be sufficient to cover these environmental liabilities, there are uncertainties associated with environmental liabilities, and we can give no assurance that our estimate of any environmental liability will not increase or decrease in the future. The reserved and unreserved liabilities for all environmental concerns could change substantially due to factors such as the nature and extent of contamination, changes in remedial requirements, technological changes, discovery of new information, the financial strength of other PRPs, the identification of new PRPs and the involvement of and direction taken by the U.S. government on these matters.

We maintain a Corporate Environmental, Health and Safety (EHS) Department to monitor compliance with environmental regulations and to oversee remediation activities. In addition, we have designated EHS coordinators who are responsible for each of our global manufacturing facilities. Our financial management team periodically meets with members of the Corporate EHS Department and the Corporate Legal Department to review and evaluate the status of environmental projects and contingencies. On a quarterly basis, we review financial provisions and reserves for environmental contingencies and adjust these reserves when appropriate.

EMPLOYEES We employed approximately 12,900 persons at June 30, 2012, of which approximately 4,700 were located in the U.S. and 8,200 in other parts of the world, principally Europe, Asia Pacific and India. At June 30, 2012, approximately 3,700 of the above employees were represented by labor unions. We consider our labor relations to be generally good.

AVAILABLE INFORMATION Our Internet address is www.kennametal.com. On the SEC Filings page of our Web Site, which is accessible under the Investor Relations tab, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (SEC): our annual report on Form 10-K, our annual proxy statement, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act). Our SEC Filings Web page also includes Forms 3, 4 and 5 filed pursuant to Section 16(a) of the Exchange Act. All filings posted on our SEC Filings Web page are available to be viewed on the Web page free of charge. On the Corporate Governance page of our Web site, which is under the Investor Relations tab, we post the following charters and guidelines: Audit Committee Charter, Compensation Committee Charter, Nominating/Corporate Governance Committee Charter, Kennametal Inc. Corporate Governance Guidelines and Kennametal Inc. Stock Ownership Guidelines. On the Ethics and Compliance page of our Web site, which is under Company Profile tab, we post the Code of Business Ethics and Conduct. All charters and guidelines posted on our Web pages are available to be viewed on our Web page free of charge. Information contained on our Web site is not part of this annual report on Form 10-K or our other filings with the SEC.

Kennametal’s business, financial condition or results of operations may be materially affected by a number of factors. Our management regularly monitors the risks inherent in our business, with input and assistance from our Enterprise Risk Management department. In addition to real time monitoring, we conduct a formal, annual, enterprise-wide risk assessment to identify factors and circumstances that might present significant risk to the company. Many of these factors are discussed throughout this report. In addition, the following list details some of the important factors and uncertainties that we believe could cause Kennametal’s actual results to differ materially from those projected in any forward-looking statements:

Downturns in the business cycle could adversely affect our sales and profitability. Our business has historically been cyclical and subject to significant impact from economic downturns. The recent global economic downturn that occurred, coupled with the global financial and credit market disruptions has had a negative impact on our sales and profitability. These events contributed to weak end markets, a sharp drop in demand and higher costs of borrowing and/or diminished credit availability. While the economy has recovered from the crisis of the economic downturn and we believe that the long-term prospects for our business remain positive, we are unable to predict the future course of industry variables or the strength, pace or sustainability of the economic recovery and the effects of government intervention. We implemented restructuring and other actions to reduce our manufacturing costs and operating expenses over the past several years. However, there is no assurance that these actions, or any others that we have taken or may take, will be sufficient to counter any future economic or industry disruptions.

- 4 -

Table of Contents

Our international operations pose certain risks that may adversely impact sales and earnings. We have manufacturing operations and assets located outside of the U.S., including those in Brazil, Canada, China, Europe, India, Israel and South Africa. We also sell our products to customers and distributors located outside of the U.S. During the year ended June 30, 2012, 57 percent of our consolidated sales were derived from non-U.S. markets. A key part of our long-term strategy is to increase our manufacturing, distribution and sales presence in international markets. These international operations are subject to a number of special risks, in addition to the risks of our domestic business, including currency exchange rate fluctuations, differing protections of intellectual property, trade barriers, exchange controls, regional economic uncertainty, differing (and possibly more stringent) labor regulation, labor unrest, risk of governmental expropriation, domestic and foreign customs and tariffs, current and changing regulatory environments (including, but not limited to, the risks associated with the importation and exportation of products and raw materials), risk of failure of our foreign employees to comply with both U.S. and foreign laws, including antitrust laws, trade regulations and the Foreign Corrupt Practices Act, difficulty in obtaining distribution support, difficulty in staffing and managing widespread operations, differences in the availability and terms of financing, political instability and unrest and risks of increases in taxes. Also, in some foreign jurisdictions, we may be subject to laws limiting the right and ability of entities organized or operating therein to pay dividends or remit earnings to affiliated companies unless specified conditions are met. To the extent we are unable to effectively manage our international operations and these risks, our international sales may be adversely affected, we may be subject to additional and unanticipated costs, and we may be subject to litigation or regulatory action. As a consequence, our business, financial condition and results of operations could be seriously harmed.

Changes in the regulatory environment, including environmental, health and safety regulations, could subject us to increased compliance and manufacturing costs, which could have a material adverse effect on our business.

Health and Safety Regulations. Certain of our products contain hard metals, including tungsten and cobalt. Hard metal dust is being studied for potential adverse health effects by organizations in several regions throughout the world, including the U.S., Europe and Japan. Future studies on the health effects of hard metals may result in our products being classified as hazardous to human health, which could lead to new regulations in countries in which we operate that may restrict or prohibit the use of, and/or exposure to, hard metal dust. New regulation of hard metals could require us to change our operations, and these changes could affect the quality of our products and materially increase our costs.

Environmental Regulations. We are subject to various environmental laws, and any violation of, or our liabilities under, these laws could adversely affect us. Our operations necessitate the use and handling of hazardous materials and, as a result, we are subject to various federal, state, local and foreign laws, regulations and ordinances relating to the protection of the environment, including those governing discharges to air and water, handling and disposal practices for solid and hazardous wastes, the cleanup of contaminated sites and the maintenance of a safe workplace. These laws impose penalties, fines and other sanctions for noncompliance and liability for response costs, property damages and personal injury resulting from past and current spills, disposals or other releases of, or exposure to, hazardous materials. We could incur substantial costs as a result of noncompliance with or liability for cleanup or other costs or damages under these laws. We may be subject to more stringent environmental laws in the future. If more stringent environmental laws are enacted in the future, these laws could have a material adverse effect on our business, financial condition and results of operations.

Regulations affecting the mining and drilling industries or utilities industry. Some of our principal customers are mining and drilling and utility companies. Many of these customers supply coal, oil, gas or other fuels as a source for the production of utilities in the U.S. and other industrialized regions. The operations of these mining and drilling companies are geographically diverse and are subject to or affected by a wide array of regulations in the jurisdictions where they operate, such as applicable environmental laws and regulations governing the operations of utilities. As a result of changes in regulations and laws relating to such industries, our customers’ operations could be disrupted or curtailed by governmental authorities. The high cost of compliance with mining, drilling and environmental regulations may also induce customers to discontinue or limit their operations, and may discourage companies from developing new opportunities. As a result of these factors, demand for our mining- and drilling-related products could be substantially affected by regulations adversely impacting the mining and drilling industries or altering the consumption patterns of utilities.

- 5 -

Table of Contents

Our continued success depends on our ability to protect and defend our intellectual property. Our future success depends in part upon our ability to protect and defend our intellectual property. We rely principally on nondisclosure agreements and other contractual arrangements and trade secret law and, to a lesser extent, trademark and patent law, to protect our intellectual property. However, these measures may be inadequate to protect our intellectual property from infringement by others or prevent misappropriation of our proprietary rights. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do U.S. laws. If one of our patents is infringed upon by a third party, we may need to devote significant time and financial resources to attempt to halt the infringement. We may not be successful in defending the patents involved in such a dispute. Similarly, while we do not knowingly infringe on patents, copyrights or other intellectual property rights owned by other parties, we may be required to spend a significant amount of time and financial resources to resolve any infringement claims against us. We may not be successful in defending our position or negotiating an alternative remedy. Our inability to protect our proprietary information and enforce or defend our intellectual property rights in proceedings initiated by or against us could have a material adverse effect on our business, financial condition and results of operations.

We operate in a highly competitive environment. Our domestic and foreign operations are subject to significant competitive pressures. We compete directly and indirectly with other manufacturers and suppliers of metalworking tools, engineered components and advanced materials. Some of our competitors are larger than we are and may have greater access to financial resources or be less leveraged than us. In addition, the industry in which our products are used is a large, fragmented industry that is highly competitive.

If we are unable to retain our qualified management and employees, our business may be negatively affected. Our ability to provide high quality products and services depends in part on our ability to retain our skilled personnel in the areas of management, product engineering, servicing and sales. Competition for such personnel is intense, and our competitors can be expected to attempt to hire our management and skilled employees from time to time. In addition, our restructuring activities and strategies for growth have placed, and are expected to continue to place, increased demands on our management’s skills and resources. If we are unable to retain our management team and professional personnel, our customer relationships and level of technical expertise could be negatively affected, which may materially and adversely affect our business.

Our future operating results may be affected by fluctuations in the prices and availability of raw materials. The raw materials we use for our products include ore concentrates, compounds and secondary materials containing tungsten, tantalum, titanium, niobium and cobalt. A significant portion of our raw materials is supplied by sources outside the U.S. The raw materials industry as a whole is highly cyclical and at times pricing and supply can be volatile due to a number of factors beyond our control, including natural disasters, general economic and political conditions, labor costs, competition, import duties, tariffs and currency exchange rates. This volatility can significantly affect our raw material costs. In an environment of increasing raw material prices, competitive conditions can affect how much of the price increases in raw materials that we can recover in the form of higher sales prices for our products. To the extent we are unable to pass on any raw material price increases to our customers, our profitability could be adversely affected. Furthermore, restrictions in the supply of tungsten, cobalt and other raw materials could adversely affect our operating results. If the prices for our raw materials increase or we are unable to secure adequate supplies of raw materials on favorable terms, our profitability could be impaired.

Product liability claims could have a material adverse effect on our business. The sale of metalworking, mining, highway construction and other tools and related products as well as engineered components and advanced materials entails an inherent risk of product liability claims. We cannot give assurance that the coverage limits of our insurance policies will be adequate or that our policies will cover any particular loss. Insurance can be expensive, and we may not always be able to purchase insurance on commercially acceptable terms, if at all. Claims brought against us that are not covered by insurance or that result in recoveries in excess of our insurance coverage could have a material adverse affect on our business, financial condition and results of operations.

Natural disasters or other global or regional catastrophic events could disrupt our operations and adversely affect results. Despite our concerted effort to minimize risk to our production capabilities and corporate information systems and to reduce the effect of unforeseen interruptions to us through business continuity planning, we still may be exposed to interruptions due to catastrophe, natural disaster, pandemic, terrorism or acts of war, which are beyond our control. Disruptions to our facilities or systems, or to those of our key suppliers, could also interrupt operational processes and adversely impact our ability to manufacture our products and provide services and support to our customers. As a result, our business, our results of operations, financial position, cash flows and stock price could be adversely affected.

ITEM 1B – UNRESOLVED STAFF COMMENTS

No unresolved comments from the Securities and Exchange Commission Staff.

- 6 -

Table of Contents

Our principal executive offices are located at 1600 Technology Way, P.O. Box 231, Latrobe, Pennsylvania, 15650. A summary of our principal manufacturing facilities and other materially important properties is as follows:

| Location | Owned/Leased | Principal Products | Segment | |||

| United States: | ||||||

| Irondale, Alabama | Owned | Custom Fabricated Wear Plate Solutions and Pins | Infrastructure | |||

| Rogers, Arkansas | Owned/Leased | Carbide Products and Pelletizing Die Plates | Infrastructure | |||

| University Park, Illinois | Owned | Custom Fabricated Wear Plate Solutions | Infrastructure | |||

| Rockford, Illinois | Owned | Indexable Tooling | Industrial | |||

| Goshen, Indiana | Leased | Powders, Welding Rods and Wires and PTA Machines | Infrastructure | |||

| New Albany, Indiana | Leased | High Wear Coating for Steel Parts | Infrastructure | |||

| Greenfield, Massachusetts | Owned | High-Speed Steel Taps | Industrial | |||

| Shelby Township, Michigan | Leased | Thermal Deburring and High Energy Finishing | Industrial | |||

| Traverse City, Michigan | Owned | Wear Parts | Industrial | |||

| Walker, Michigan | Leased | Thermal Energy Machining | Industrial | |||

| Elko, Nevada | Owned | Custom Fabricated Wear Plate Solutions | Infrastructure | |||

| Fallon, Nevada | Owned | Metallurgical Powders | Infrastructure | |||

| Asheboro, North Carolina | Owned | High-Speed Steel and Carbide Round Tools | Industrial | |||

| Henderson, North Carolina | Owned | Metallurgical Powders | Infrastructure | |||

| Roanoke Rapids, North Carolina | Owned | Metalworking Inserts | Industrial | |||

| Cleveland, Ohio | Leased | Distribution | Industrial | |||

| Orwell, Ohio | Owned | Metalworking Inserts | Industrial | |||

| Solon, Ohio | Owned | Metalworking Toolholders | Industrial | |||

| Whitehouse, Ohio | Owned | Metalworking Inserts and Round Tools | Industrial | |||

| Bedford, Pennsylvania | Owned/Leased | Mining and Construction Tools and Wear Parts and Distribution |

Infrastructure | |||

| Irwin, Pennsylvania | Owned/Leased | Carbide Wear Parts and Abrasive Flow Machining | Industrial | |||

| Latrobe, Pennsylvania | Owned | Metallurgical Powders | Infrastructure | |||

| New Castle, Pennsylvania | Owned/Leased | Specialty Metals and Alloys | Industrial | |||

| Johnson City, Tennessee | Owned | Metalworking Inserts | Industrial | |||

| Lyndonville, Vermont | Owned | High-Speed Steel Taps | Industrial | |||

| Chilhowie, Virginia | Owned | Mining and Construction Tools and Wear Parts | Infrastructure | |||

| New Market, Virginia | Owned | Metalworking Toolholders | Industrial | |||

| International: | ||||||

| Indaiatuba, Brazil | Leased | Metalworking Carbide Drills and Toolholders | Industrial | |||

| Belleville, Canada | Owned | Casting Components, Coatings and Powder Metallurgy Components |

Infrastructure | |||

| Victoria, Canada | Owned | Wear Parts | Industrial | |||

| Baotou, China | Leased | Mining Tools | Infrastructure | |||

| Fengpu, China | Owned | Intermetallic Composite Ceramic Powders and Parts | Infrastructure | |||

| Shanghai, China | Owned | Powders, Welding Rods and Wires and Casting Components |

Infrastructure | |||

| Tianjin, China | Owned | Metalworking Inserts and Carbide Round Tools | Industrial | |||

| Xuzhou, China | Leased | Mining Tools | Infrastructure | |||

| Kingswinford, England | Leased | Distribution | Industrial | |||

| Ebermannstadt, Germany | Owned | Metalworking Inserts | Industrial | |||

| Essen, Germany | Owned | Metallurgical Powders and Wear Parts | Industrial | |||

| Koblenz, Germany | Owned | Casting Components and Coatings | Infrastruture | |||

| Koenigsee, Germany | Leased | Metalworking Carbide Drills | Industrial | |||

| Lichtenau, Germany | Owned | Metalworking Toolholders | Industrial | |||

| Mistelgau, Germany | Owned | Metallurgical Powders, Metalworking Inserts and Wear Parts | Infrastructure | |||

| Nabburg, Germany | Owned | Metalworking Toolholders and Metalworking Round Tools, Drills and Mills |

Industrial | |||

| Nuenkirchen, Germany | Owned | Distribution | Industrial | |||

| Vohenstrauss, Germany | Owned | Metalworking Carbide Drills | Industrial |

- 7 -

Table of Contents

| Location | Owned/Leased | Principal Products | Segment | |||

| Bangalore, India | Owned | Metalworking Inserts and Toolholders and Wear Parts | Industrial | |||

| Gurgaon, India | Leased | Coatings | Infrastructure | |||

| Shlomi, Israel | Owned | High-Speed Steel and Carbide Round Tools | Industrial | |||

| Milan, Italy | Owned | Investment Castings Components and Metalworking Cutting Tools |

Infrastructure/ Industrial | |||

| Zory, Poland | Leased | Mining and Construction Conicals | Infrastructure | |||

| Barcelona, Spain | Leased | Metalworking Cutting Tools | Industrial | |||

| Newport, United Kingdom | Owned | Intermetallic Composite Powders | Infrastructure |

We also have a network of warehouses and customer service centers located throughout North America, Europe, India, Asia Pacific and Latin America, a significant portion of which are leased. The majority of our research and development efforts are conducted in a corporate technology center located adjacent to our world headquarters in Latrobe, Pennsylvania, U.S., as well as in our facilities in Rogers, Arkansas, U.S.; Fuerth, Germany and Essen, Germany.

We use all of our significant properties in the businesses of powder metallurgy, tools, tooling systems, engineered components and advanced materials. Our production capacity is adequate for our present needs. We believe that our properties have been adequately maintained, are generally in good condition and are suitable for our business as presently conducted.

The information set forth in Part I, Item 1, of this annual report on Form 10-K under the caption “Regulation” is incorporated into this Item 3. From time to time, we are party to legal claims and proceedings that arise in the ordinary course of business, which may relate to our operations or assets, including real, tangible, or intellectual property. Although certain of these actions are currently pending, we do not believe that any individual proceeding is material or that our pending legal proceedings in the aggregate are material to Kennametal.

ITEM 4 - MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Incorporated by reference into this Part I is the information set forth in Part III, Item 10 under the caption “Executive Officers of the Registrant” of this annual report on Form 10-K.

ITEM 5 - MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our capital stock is traded on the New York Stock Exchange (symbol KMT). The number of Shareowners of record as of July 31, 2012 was 2,106. Stock price ranges and dividends declared and paid were as follows:

| Quarter ended | September 30 | December 31 | March 31 | June 30 | ||||||||||||

| Fiscal 2012 |

||||||||||||||||

| High |

$ | 45.66 | $ | 41.15 | $ | 47.82 | $ | 46.24 | ||||||||

| Low |

30.53 | 29.30 | 37.04 | 30.65 | ||||||||||||

| Dividends |

0.12 | 0.14 | 0.14 | 0.14 | ||||||||||||

| Fiscal 2011 |

||||||||||||||||

| High |

$ | 31.80 | $ | 39.81 | $ | 44.11 | $ | 43.48 | ||||||||

| Low |

24.08 | 30.35 | 36.57 | 37.38 | ||||||||||||

| Dividends |

0.12 | 0.12 | 0.12 | 0.12 | ||||||||||||

The information incorporated by reference in Part III, Item 12 of this annual report on Form 10-K from our 2012 Proxy Statement under the heading “Equity Compensation Plans – Equity Compensation Plan Information” is hereby incorporated by reference into this Item 5.

- 8 -

Table of Contents

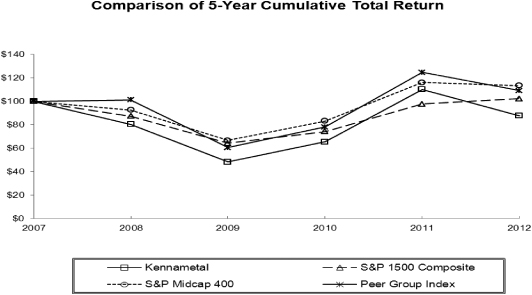

PERFORMANCE GRAPH

The following graph compares cumulative total shareowner return on our capital stock with the cumulative total shareowner return on the common equity of the companies in the Standard & Poor’s Mid-Cap 400 Market Index (S&P Mid-Cap 400), the Standard & Poor’s Composite 1500 Market Index (S&P Composite), and the peer group of companies determined by us for the period from July 1, 2007 to June 30, 2012.

The Peer Group consists of the following companies: Allegheny Technologies Incorporated; Ametek Inc.; Barnes Group Inc.; Carpenter Technology Corporation; Crane Co.; Donaldson Company, Inc.; Dresser-Rand Group Inc.; Flowserve Corp.; Greif Inc.; Harsco Corporation; Joy Global Inc.; Lincoln Electric Holdings, Inc.; Pall Corporation.; Parker-Hannifin Corporation; Pentair Inc.; Sauer-Danfoss, Inc.; Teleflex, Incorporated; and The Timken Co.

Assumes $100 Invested on July 1, 2007 and All Dividends Reinvested

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| Kennametal |

$100.00 | $80.37 | $48.44 | $65.50 | $110.24 | $87.76 | ||||||||||||||||||

| Peer Group Index |

100.00 | 101.18 | 60.66 | 78.11 | 124.67 | 109.15 | ||||||||||||||||||

| S&P Mid-Cap 400 |

100.00 | 92.66 | 66.70 | 83.32 | 116.14 | 113.43 | ||||||||||||||||||

| S&P 1500 Composite |

100.00 | 87.28 | 64.29 | 74.30 | 97.81 | 102.34 | ||||||||||||||||||

- 9 -

Table of Contents

ISSUER PURCHASES OF EQUITY SECURITIES

| Period | Total Number of Shares Purchased (1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (2) |

||||||||||||

| April 1 through April 30, 2012 |

- | $ - | - | 4,505,100 | ||||||||||||

| May 1 through May 31, 2012 |

2,557 | 35.12 | - | 4,505,100 | ||||||||||||

| June 1 through June 30, 2012 |

160 | 33.99 | - | 4,505,100 | ||||||||||||

| Total |

2,717 | $35.05 | - | |||||||||||||

| (1) | During the current period, 2,552 shares were purchased on the open market on behalf of Kennametal to fund the Company's dividend reinvestment program. Also, during the current period employees delivered 165 shares of restricted stock to Kennametal, upon vesting, to satisfy tax withholding requirements. |

| (2) | On July 26, 2012, the Company publicly announced an amended repurchase program for up to 12 million shares of its outstanding capital stock. As of the amendment date, there were approximately 8.5 million shares available to be purchased under the amended authorization. |

- 10 -

Table of Contents

ITEM 6 - SELECTED FINANCIAL DATA

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||

| OPERATING RESULTS (in thousands) |

||||||||||||||||||||||||

| Sales |

$ | 2,736,246 | $ | 2,403,493 | $ | 1,884,067 | $ | 1,999,859 | $ | 2,589,786 | ||||||||||||||

| Cost of goods sold |

1,741,996 | 1,519,102 | 1,256,339 | 1,423,320 | 1,682,715 | |||||||||||||||||||

| Operating expense |

561,490 | 538,530 | 477,487 | 489,567 | 594,187 | |||||||||||||||||||

| Restructuring and asset impairment charges |

(1) | - | 12,586 | 43,923 | 173,656 | 39,891 | ||||||||||||||||||

| Interest expense |

27,215 | 22,760 | 25,203 | 27,244 | 31,586 | |||||||||||||||||||

| Provision (benefit) for income taxes |

79,136 | 63,856 | 26,977 | (11,205 | ) | 62,754 | ||||||||||||||||||

| Income (loss) from continuing operations attributable |

307,230 | 229,727 | 47,842 | (102,402 | ) | 163,666 | ||||||||||||||||||

| Net income (loss) attributable to Kennametal |

(2 | ) | 307,230 | 229,727 | 46,419 | (119,742 | ) | 167,775 | ||||||||||||||||

| FINANCIAL POSITION (in thousands) |

||||||||||||||||||||||||

| Working capital |

$ | 704,340 | $ | 446,064 | $ | 522,926 | $ | 469,935 | $ | 630,675 | ||||||||||||||

| Total assets |

3,034,188 | 2,754,469 | 2,267,823 | 2,346,974 | 2,784,349 | |||||||||||||||||||

| Long-term debt, including capital leases, excluding |

490,608 | 1,919 | 314,675 | 436,592 | 313,052 | |||||||||||||||||||

| Total debt, including capital leases and notes payable |

565,745 | 312,882 | 337,668 | 485,957 | 346,652 | |||||||||||||||||||

| Total Kennametal shareowners’ equity |

1,643,850 | 1,638,072 | 1,315,500 | 1,247,443 | 1,647,907 | |||||||||||||||||||

| PER SHARE DATA ATTRIBUTABLE TO KENNAMETAL |

|

|||||||||||||||||||||||

| Basic earnings (loss) from continuing operations |

$ | 3.83 | $ | 2.80 | $ | 0.59 | $ | (1.40 | ) | $ | 2.13 | |||||||||||||

| Basic earnings (loss) |

(3) | 3.83 | 2.80 | 0.57 | (1.64 | ) | 2.18 | |||||||||||||||||

| Diluted earnings (loss) from continuing operations |

3.77 | 2.76 | 0.59 | (1.40 | ) | 2.10 | ||||||||||||||||||

| Diluted earnings (loss) |

(4) | 3.77 | 2.76 | 0.57 | (1.64 | ) | 2.15 | |||||||||||||||||

| Dividends |

0.54 | 0.48 | 0.48 | 0.48 | 0.47 | |||||||||||||||||||

| Book value (at June 30) |

20.53 | 20.19 | 16.06 | 17.03 | 21.44 | |||||||||||||||||||

| Market Price (at June 30) |

33.15 | 42.21 | 25.43 | 19.18 | 32.55 | |||||||||||||||||||

| OTHER DATA (in thousands, except number of employees) |

||||||||||||||||||||||||

| Capital expenditures |

$ | 103,036 | $ | 83,442 | $ | 56,679 | $ | 104,842 | $ | 163,489 | ||||||||||||||

| Number of employees (at June 30) |

12,932 | 11,612 | 11,047 | 11,584 | 13,673 | |||||||||||||||||||

| Basic weighted average shares outstanding |

80,216 | 82,063 | 80,966 | 73,122 | 76,811 | |||||||||||||||||||

| Diluted weighted average shares outstanding |

81,439 | 83,173 | 81,690 | 73,122 | 78,201 | |||||||||||||||||||

| KEY RATIOS |

||||||||||||||||||||||||

| Sales growth |

13.8% | 27.6% | (5.8% | ) | (22.8% | ) | 14.3% | |||||||||||||||||

| Gross profit margin |

36.3 | 36.8 | 33.3 | 28.8 | 35.0 | |||||||||||||||||||

| Operating profit (loss) margin |

15.2 | 13.4 | 4.9 | (5.0 | ) | 10.0 | ||||||||||||||||||

| (1) | In 2011 and 2010, charges related to restructuring activity. In 2009, the charges related to an impairment of $111.0 million for Industrial goodwill and an Industrial indefinite-lived trademark as well as restructuring charges of $62.6 million. In 2008, the charges related to an Industrial goodwill impairment of $35.0 million as well as restructuring charges of $4.9 million. |

| (2) | Net income (loss) attributable to Kennametal includes (loss) income from discontinued operations of ($1.4) million, ($17.3) million and $4.1 million for 2010, 2009 and 2008, respectively. |

| (3) | Basic earnings (loss) per share includes basic (loss) earnings from discontinued operations per share of ($0.02), ($0.24) and $0.05 for 2010, 2009 and 2008, respectively. |

| (4) | Diluted earnings (loss) per share includes diluted (loss) earnings from discontinued operations per share of ($0.02), ($0.24) and $0.05 for 2010, 2009 and 2008, respectively. |

- 11 -

Table of Contents

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in connection with the consolidated financial statements of Kennametal Inc. and the related financial statement notes. Unless otherwise specified, any reference to a “year” is to a fiscal year ended June 30. Additionally, when used in this annual report on Form 10-K, unless the context requires otherwise, the terms “we,” “our” and “us” refer to Kennametal Inc. and its subsidiaries.

OVERVIEW Kennametal Inc. delivers productivity to customers seeking peak performance in demanding environments by providing innovative custom and standard wear-resistant solutions. To provide these solutions, we harness our knowledge of advanced materials and application development with a commitment to environmental sustainability. Our solutions are built around industry-essential technology platforms. These include metalworking tools, engineered components and surface technologies that are mission-critical to the performance of our customers battling extreme conditions such as fatigue wear, corrosion and high temperatures. We believe that our reputation for manufacturing excellence, as well as our technological expertise and innovation we deliver in our products and services, help us to achieve a leading position in our primary markets. We believe that we are one of the largest global providers of consumable metalcutting tools and tooling supplies.

In 2012, the Company achieved year-over-year sales growth each quarter, with an organic sales increase of 9 percent for the year. Organic sales growth includes both volume and price. The Company had strong earnings per diluted share (EPS) of $3.77 as a result of sales growth and solid operating margins due to price realization and operating expense control. We have also reduced our cost structure by approximately $170 million annually, due to our previous restructuring programs.

For 2012, sales were $2,736.2 million, an increase of 14 percent compared to prior year sales of $2,403.5 million. Operating income was $416.4 million, an increase of $94.7 million compared to operating income of $321.7 million in 2011. The increase in operating income was driven by higher sales volume, pricing and lower employment and restructuring costs, partially offset by higher raw material costs and acquisition-related costs. Operating income included $5.5 million of net acquisition-related costs.

We consumed higher cost raw materials in 2012, as raw material costs significantly increased during the first half of the year. The price of raw materials has remained stable throughout the second half of the fiscal year. We executed appropriate pricing earlier in the year and have continued to maintain our cost discipline throughout 2012. Realized raw materials costs generally lag the fluctuation in market prices by a quarter. We continue to monitor changes in raw materials costs to ensure appropriate pricing.

In March 2012 we acquired all of the shares of Deloro Stellite Holdings 1 Limited (Stellite) for a purchase price of approximately $383 million, net of cash acquired. The United Kingdom based Stellite is a global manufacturer and provider of alloy-based critical wear solutions for extreme environments involving high temperature, corrosion and abrasion. Stellite’s proprietary metal alloys, materials expertise, engineering design and fabrication capabilities complement Kennametal’s current business in the oil and gas, power generation, transportation and aerospace end markets. The Stellite acquisition generated approximately $243 million of goodwill, based on the final purchase price allocations, which is not deductible for tax purposes and is attributable to the operating synergies we expect to gain from the acquisition. This acquisition is in alignment with our growth strategy and positions us to further achieve geographic and end market balance.

The Company’s restructuring programs completed in fiscal 2011 are delivering annual ongoing pre-tax savings of approximately $170 million.

We generated cash flow from operating activities of $289.6 million in the current year. We have actively managed our business portfolio by investing approximately $383 million in the Stellite acquisition, returning over $110 million to shareholders through share repurchases and dividends, repurchasing approximately 2 million shares, and increasing our dividend by 17 percent in October 2011. In addition we made capital expenditures of $103.0 million during the year.

In addition, we invested further in technology and innovation to continue delivering a high level of new products to our customers. Research and development expenses included in operating expense totaled $38.3 million for 2012. In 2012, we generated approximately 40 percent of our sales from new products.

RESULTS OF CONTINUING OPERATIONS

SALES Sales of $2,736.2 million in 2012 increased 14 percent from $2,403.5 million in 2011 as a result of strong organic growth of 9 percent, business acquisition contribution of 4 percent and 1 percent more business days in 2012. Organic sales increased in both segments and across most regions. Organic sales growth drivers were energy markets of 13 percent, aerospace and defense of 13 percent, earthworks of 10 percent, general engineering of 8 percent and transportation of 6 percent.

- 12 -

Table of Contents

Sales of $2,403.5 million in 2011 increased 27.6 percent from $1,884.1 million in 2010 as a result of strong organic growth. Organic sales increased in both segments and across all regions. Organic sales growth drivers were general engineering of 40 percent, transportation of 30 percent and energy of 26 percent.

GROSS PROFIT Gross profit increased $109.9 million to $994.3 million in 2012 from $884.4 million in 2011. This increase was primarily due to an organic sales increase of $218.4 million, $17.8 million related to the Stellite acquisition and cost reduction benefits, partially offset by higher raw material costs and unfavorable business segment mix. The gross profit margin for 2012 decreased to 36.3 percent from 36.8 percent in 2011 due primarily to the Stellite acquisition.

Gross profit increased $256.7 million to $884.4 million in 2011 from $627.7 million in 2010. The increase was primarily due to increased organic sales of $523.9 million, improved absorption of manufacturing costs due to higher production levels, cost reduction benefits, favorable business mix and favorable foreign currency effects of $3.5 million. The impact of these items was partially offset by higher raw material costs and one-time benefits in the prior year from certain labor negotiations in Europe that did not occur in the current period. The gross profit margin for 2011 increased to 36.8 percent from 33.3 percent in 2010.

OPERATING EXPENSE Operating expense in 2012 was $561.5 million, an increase of $23.0 million, or 4.3 percent, compared to $538.5 million in 2011. The increase is primarily due to additional operating expenditures related to the Stellite acquisition of $11.6 million, acquisition-related costs of $8.9 million, and higher depreciation of $4.1 million due to a full year of depreciation related to the enterprise resource planning (ERP) system upgrade in 2011, partially offset by a decrease in restructuring related charges of $3.4 million and lower employment costs.

Operating expense in 2011 was $538.5 million, an increase of $61.0 million, or 12.8 percent, compared to $477.5 million in 2010. The increase is primarily driven by higher employment costs of $31.9 million due to the reinstatement of salaries and other temporary employment cost reductions and a higher provision for incentive compensation of $18.7 million, as a result of better operating performance. Foreign currency unfavorably impacted operating expense by $2.1 million.

RESTRUCTURING CHARGES During 2012, there were no restructuring charges.

During 2011, we completed our restructuring programs to reduce costs and improve operating efficiencies. These programs related to the rationalization of certain manufacturing and service facilities, as well as other employment and cost reduction programs. We recognized $21.5 million, which included $13.7 million of restructuring charges of which $1.1 million were related to inventory disposals and recorded as cost of goods sold. Restructuring related charges of $4.4 million were recorded in cost of goods sold and $3.4 million in operating expense during 2011. We realized pre-tax benefits from these restructuring programs of approximately $165 million during 2011.

During 2010, we continued to implement restructuring actions and recognized $48.9 million of restructuring charges of which $44.3 million were recorded as restructuring charges including $0.4 million related to inventory disposals and recorded in cost of goods sold.

AMORTIZATION OF INTANGIBLES Amortization expense was $16.4 million, $11.6 million and $13.1 million in 2012, 2011 and 2010, respectively. The increase of amortization expense in 2012 of $4.8 million or 40.9 percent was primarily due to the Stellite acquisition.

INTEREST EXPENSE Interest expense increased $4.4 million to $27.2 million in 2012, compared with $22.8 million in 2011 due to increased borrowings to fund the Stellite acquisition, primarily under our revolving credit facility, as well as the new $300 million bond issuance in February 2012 which overlapped the maturity date of June 2012 for the old bond issuance. The portion of our debt subject to variable rates of interest was approximately 46 percent and 2 percent at June 30, 2012 and 2011, respectively.

Interest expense decreased $2.4 million to $22.8 million in 2011, compared with $25.2 million in 2010. This decrease was due to a decrease in the average interest rates on domestic borrowings to 4.8 percent, compared to 5.0 percent in 2010, partially offset by higher borrowings. The portion of our debt subject to variable rates of interest was approximately 2 percent and 6 percent at June 30, 2011 and 2010, respectively.

OTHER (INCOME) EXPENSE, NET In 2012, other income, net was $0.8 million compared to other expense, net of $2.8 million in 2011. The change was primarily due to favorable foreign currency transactions gains of $3.9 million.

In 2011, other expense, net decreased by $11.4 million to other expense, net of $2.8 million compared to other income, net of $8.6 million in 2010. The decrease was primarily due to a $10.2 million unfavorable change in foreign currency transaction results, primarily driven by the euro.

- 13 -

Table of Contents

INCOME TAXES The effective tax rate from continuing operations for 2012 was 20.3 percent compared to 21.6 percent for 2011. The change in the effective rate from 2011 to 2012 was primarily driven by the release of a valuation allowance in the Netherlands and effective settlement of uncertain tax positions in the U.S., Europe and Asia. The effect of these items was partially offset by increased income in the U.S. where the tax rate is higher than most international locations and non-deductible acquisition-related costs.

The effective tax rate from continuing operations for 2011 was 21.6 percent compared to 35.2 percent for 2010. The change in the effective rate from 2010 to 2011was primarily driven by increased income in international locations where the tax rate is lower than the U.S. as well as restructuring charges in the prior year in jurisdictions where no tax benefit could be recognized. The 2011 effective rate was favorably impacted by a $21.5 million release of a valuation allowance in the United Kingdom, but that impact was offset by the tax cost of approximately $22.0 million, predominately U.S., associated with dividends of current year net income from some of our international subsidiaries. The 2010 effective rate was unfavorably impacted by the expiration of the research, development and experimental tax credit as well as the impact of restructuring charges in jurisdictions where no tax benefit could be recognized.

During 2011, we generated taxable income in other jurisdictions where we have valuation allowances recorded against our net deferred tax assets. The corresponding impact on the 2011 effective tax rate was immaterial. In conjunction with our annual planning process during the fourth quarter of 2011, we determined that sustainability of future income in the United Kingdom is likely, and as a result, we believe that it is more likely than not that we will be able to realize the net deferred tax assets in this jurisdiction. Accordingly, we recorded a valuation allowance adjustment of $21.5 million that reduced tax expense. With respect to the other jurisdictions, we believe sustainability of future income remains uncertain. We therefore have not adjusted the valuation allowance in these jurisdictions. We will continue to monitor our ability to realize the net deferred tax assets in these jurisdictions, and if appropriate, will adjust the valuation allowance. Such an adjustment would likely result in a material reduction to tax expense in the period the adjustment occurs.

INCOME FROM CONTINUING OPERATIONS ATTRIBUTABLE TO KENNAMETAL SHAREOWNERS Income from continuing operations attributable to Kennametal Shareowners was $307.2 million or $3.77 per diluted share in 2012, compared to $229.7 million, or $2.76 per diluted share, in 2011. The increase in income from continuing operations was a result of the factors previously discussed.

Income from continuing operations attributable to Kennametal Shareowners was $229.7 million, or $2.76 per diluted share in 2011, compared to $47.8 million, or $0.59 per diluted share, in 2010. The increase in income from continuing operations was a result of the factors previously discussed.

DISCONTINUED OPERATIONS We had no discontinued operations in 2012 or 2011.

On June 30, 2009, we divested our high speed steel business (HSS) from our Industrial segment as part of our continuing focus to shape our business portfolio and rationalize our manufacturing footprint. This divestiture was accounted for as discontinued operations. Cash proceeds from this divestiture amounted to $28.5 million. We incurred pre-tax charges related to the divestiture of $2.3 million during 2010.

BUSINESS SEGMENT REVIEW We operate two reportable operating segments consisting of Industrial and Infrastructure. Corporate expenses that are not allocated are reported in Corporate. Segment determination is based upon internal organizational structure, the manner in which we organize segments for making operating decisions and assessing performance, the availability of separate financial results and materiality considerations.

INDUSTRIAL

| (in thousands) | 2012 | 2011 | 2010 | |||||||||

| External sales |

$ | 1,667,434 | $ | 1,528,672 | $ | 1,166,793 | ||||||

| Operating income |

283,233 | 209,663 | 31,210 | |||||||||

- 14 -

Table of Contents

External sales of $1,667.4 million in 2012 increased by $138.8 million, or 9 percent, from 2011. The increase in sales was attributed to an organic sales increase of 9 percent and the impact of more business days of 1 percent, offset by unfavorable foreign currency effects of 1 percent. On an organic basis, sales increased in all served market sectors led by strong growth in aerospace and defense, general engineering and transportation sales of 13 percent, 8 percent and 6 percent, respectively. The aerospace and defense end markets’ sales growth is due to a significant increase in commercial aircraft production. Sales growth in the general engineering end markets is attributable to new orders for industrial machinery as manufacturers have increased their capital spending, as well as increased metalworking machinery production driven by a reaccelerating economy. The transportation end markets sales growth was due to an overall increase in vehicle sales and production in the U.S. While we still saw growth in European transportation sales, many European markets have begun to decline due to the recent economic environment in Europe. On a regional basis, sales increased by approximately 12 percent in Europe and 12 percent in the Americas and were relatively flat in Asia due to strong comparisons to the prior year. The sales increase in Europe and the Americas was driven by growth in the general engineering and transportation end markets.

In 2012, Industrial operating income was $283.2 million and reflects an increase in operating performance of $73.6 million from 2011. The primary drivers of the increase in operating income were higher organic sales of $134.8 million, operating expense control and lower restructuring costs, partially offset by higher raw material costs. Industrial operating margin increased to 17.0 percent from 13.7 percent in the prior year.

External sales of $1,528.7 million in 2011 increased by $361.9 million, or 31.0 percent, from 2010. The increase in sales was attributed to an organic sales increase of 32 percent and favorable foreign currency effects of 1 percent, offset by the impact of fewer business days. On an organic basis, sales increased in all served market sectors led by strong growth in general engineering and transportation sales of 40 percent and 30 percent, respectively. Sales growth in general engineering end markets was due to increased metalworking activities and manufacturers increased capital spending. In the transportation market sales growth increased due to strong production volumes in North America, globally light vehicle sales increased and there was growth in the mass transit market as new railroad infrastructure was built or expanded maintenance occurred. On a regional basis, sales increased by approximately 40 percent in Asia, 29 percent in Europe and 28 percent in the Americas. The increase in Asia was fairly evenly split between growth in the transportation markets and general engineering. The growth in Europe and the Americas was driven by general engineering.

Operating income for 2011 was $209.7 million and reflects an increase in operating performance of $178.5 million from 2010. The primary drivers of the increase in operating income were higher organic sales of $369.7 million, improved capacity utilization and incremental restructuring benefits. These benefits were partially offset by higher raw material costs. Industrial operating income included restructuring and related charges of $12.9 million and $35.5 million in 2011 and 2010, respectively. Industrial operating margin increased to 13.7 percent from 2.7 percent in the prior year.

INFRASTRUCTURE

| (in thousands) | 2012 | 2011 | 2010 | |||||||||

| External sales |

$ | 1,068,812 | $ | 874,821 | $ | 717,274 | ||||||

| Operating income |

141,640 | 121,733 | 79,899 | |||||||||

External sales of $1,068.8 million in 2012 increased by $194.0 million, or 22 percent, from 2011. The increase in sales was attributed to organic sales increase of 11 percent, acquisition growth of 10 percent and the impact of more business days of 1 percent. The organic increase was driven by higher sales in the energy and earthworks markets of 13 percent and 10 percent, respectively. Sales in the earthworks end markets increased due to strong mining demand from Asia in the first half of 2012, increased road maintenance in parts of Europe and Asia, and price actions partially offset by softening mining and construction market conditions in North America. Energy related product sales grew due to increased shale production and increased natural gas production, partially offset by a decline in natural gas prices and reduced drilling activity. On a regional basis, sales excluding acquisition increased by approximately 21 percent in Asia, 14 percent in Europe and 9 percent in the Americas. The sales increase in Asia was driven by performance in the earthworks markets, while the growth in Europe and the Americas was driven by earthworks markets and to a slightly lesser degree, the energy markets.

In 2012, Infrastructure operating income increased $19.9 million. The primary drivers of the increase in operating income were higher organic sales of $99.4 million, operating expense control and lower restructuring costs, partially offset by higher raw material costs. Operating income included $8.9 million of acquisition related charges. Infrastructure operating margin decreased to 13.2 percent from 13.9 percent in the prior year due to the recent Stellite business acquisition.

- 15 -

Table of Contents

External sales of $874.8 million in 2011 increased by $157.5 million, or 22.0 percent, from 2010. The increase in sales was attributed to organic sales increase of 21 percent and favorable foreign currency effects of 1 percent. The organic increase was driven by higher sales in the energy and earthworks markets of 26 percent and 18 percent, respectively. The sales growth in the energy related products market was due to globally increased oil rig counts as well as high natural gas storage. Sales increased in the earthworks end markets due to mining capacity expansion, while construction activity varies by region. In developed economies construction varies as it is governed by available funding, while in the emerging markets construction activity grew. On a regional basis, sales increased by approximately 27 percent in Asia, 22 percent in the Americas and 13 percent in Europe. The sales growth in all regions was driven by earthworks markets.

Operating income for 2011 was $121.7 million and reflected an increase of $41.8 million from 2010. Operating income improved primarily due to higher organic sales of $153.1 million, increased capacity utilization and incremental restructuring benefits, partially offset by higher raw material costs. Infrastructure operating income included restructuring and related charges of $6.2 million and $13.4 million in 2011 and 2010, respectively. Infrastructure operating margin increased from the prior year to 13.9 percent from 11.1 percent.

CORPORATE

| (in thousands) | 2012 | 2011 | 2010 | |||||||||

| Corporate unallocated expense |

$ | (8,464 | ) | $ | (9,723 | ) | $ | (17,881 | ) | |||

In 2012, unallocated expense decreased $1.3 million, or 12.9 percent from 2011. The decrease was driven by $6.0 million of lower strategic project spending, partially offset by $1.2 million of lower foreign government subsidy income for certain research projects and the impact of a non-recurring reversal of an environmental liability in 2011.

In 2011, unallocated expense decreased $8.2 million, or 45.6 percent from 2010. The decrease was driven by $4.2 million of lower strategic project spending, $4.1 million higher allocation of Corporate expense to the segments than in the prior year, $1.2 million of higher foreign government subsidy income for certain research projects and a $1.1 million reversal of an international environmental liability, partially offset by a charge of $2.4 million recorded to write-off our pre-existing ERP system.

LIQUIDITY AND CAPITAL RESOURCES Cash flow from operations is our primary source of funding for capital expenditures. During the year ended June 30, 2012, cash flow provided by operating activities was $289.6 million, driven by our operating performance.