UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE FISCAL YEAR ENDED June 30, 2022

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from _______ to _______

Commission File Number 1-5318

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

Registrant’s telephone number, including area code: (412 ) 248-8000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of December 31, 2021, the aggregate market value of the registrant’s Capital Stock held by non-affiliates of the registrant, estimated solely for the purposes of this Form 10-K, was approximately $1,725,400,000 . For purposes of the foregoing calculation only, all directors and executive officers of the registrant and each person who may be deemed to own beneficially more than 5% of the registrant’s Capital Stock have been deemed affiliates.

As of July 29, 2022, there were 81,338,696 shares of the Registrant’s Capital Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| Item No. | Page | |||||||

| 1 | ||||||||

| 1A. | ||||||||

| 1B. | ||||||||

| 2. | ||||||||

| 3. | ||||||||

| 4. | ||||||||

| 5. | ||||||||

| 7. | ||||||||

| 7A. | ||||||||

| 8. | ||||||||

| 9. | ||||||||

| 9A. | ||||||||

| 9B. | ||||||||

| 9C. | ||||||||

| 10. | ||||||||

| 11. | ||||||||

| 12. | ||||||||

| 13. | ||||||||

| 14. | ||||||||

| 15. | ||||||||

| 16. | ||||||||

2

FORWARD-LOOKING INFORMATION

Statements and financial discussion and analysis contained herein and in the documents incorporated by reference herein that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). For example, statements about Kennametal's outlook for earnings, sales volumes, cash flow, and capital expenditures for its fiscal year 2023, its expectations regarding future growth and any statements regarding future operating or financial performance or events are forward-looking. We have also included forward-looking statements in this Annual Report on Form 10-K ("Annual Report") concerning, among other things, our strategy, goals, plans and projections regarding our financial position, liquidity and capital resources, results of operations, market position, and product development. Any forward-looking statements are based on current knowledge, expectations and estimates that involve inherent risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should the assumptions underlying the forward-looking statements prove incorrect, our actual results could vary materially from our current expectations. There are a number of factors that could cause our actual results to differ from those indicated in the forward-looking statements. They include: uncertainties related to changes in macroeconomic and/or global conditions, including as a result of increased inflation and Russia's invasion of Ukraine and the resulting sanctions on Russia; uncertainties related to the effects of the ongoing COVID-19 pandemic, including the emergence of more contagious or virulent strains of the virus, its impacts on our business operations, financial results and financial position and on the industries in which we operate and the global economy generally, including as a result of travel restrictions, business and workforce disruptions associated with the pandemic; other economic recession; our ability to achieve all anticipated benefits of restructuring, simplification and modernization initiatives; our foreign operations and international markets, such as currency exchange rates, different regulatory environments, trade barriers, exchange controls, and social and political instability, including the conflict in Ukraine; changes in the regulatory environment in which we operate, including environmental, health and safety regulations; potential for future goodwill and other intangible asset impairment charges; our ability to protect and defend our intellectual property; continuity of information technology infrastructure; competition; our ability to retain our management and employees; demands on management resources; availability and cost of the raw materials we use to manufacture our products; product liability claims; integrating acquisitions and achieving the expected savings and synergies; global or regional catastrophic events; demand for and market acceptance of our products; business divestitures; energy costs; commodity prices; labor relations; and implementation of environmental remediation matters. We provide additional information about many of the specific risks we face in the "Risk Factors" section of this Annual Report. We can give no assurance that any goal or plan set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. We undertake no obligation to release publicly any revisions to forward-looking statements as a result of future events or developments.

3

PART I

ITEM 1 - BUSINESS

OVERVIEW With more than 80 years of materials expertise, Kennametal Inc. (the Company) is a global industrial technology leader, that helps customers across the aerospace, earthworks, energy, general engineering and transportation end markets build their products with precision and efficiency. The Company was founded based on a tungsten carbide technology breakthrough in 1938 and was incorporated in Pennsylvania in 1934 as a manufacturer of tungsten carbide metal cutting tooling. In 1967, it was listed on the New York Stock Exchange (NYSE) with the stock ticker KMT.

The Company's core expertise includes the development and application of tungsten carbides, ceramics, super-hard materials and solutions used in metal cutting and extreme wear applications to keep customers up and running longer against conditions such as corrosion and high temperatures. We bring together material science, technical expertise, innovation and customer service in a way that allows us to anticipate customers' needs and help them overcome problems and achieve their manufacturing objectives.

Our standard and custom product offering spans metal cutting and wear applications including turning, milling, hole making, tooling systems and services, as well as specialized wear components and metallurgical powders. End users of the Company's metal cutting products include manufacturers engaged in a diverse array of industries including: transportation vehicles and components, machine tools and light and heavy machinery; airframe and aerospace components; and energy-related components for the oil and gas industry, as well as power generation. The Company’s wear and metallurgical powders are used by producers and suppliers in equipment-intensive operations such as road construction, mining, quarrying, and oil and gas exploration, refining, production and supply.

Unless otherwise specified, any reference to a “year” refers to our fiscal year ending on June 30. Unless the context requires otherwise, the terms “we,” “our” and “us” refer to Kennametal Inc. and its subsidiaries.

BUSINESS SEGMENT REVIEW Kennametal operates in two segments: Metal Cutting and Infrastructure. The Company's reportable operating segments have been determined in accordance with the Company's internal management structure, which is organized based on operating activities, the manner in which we organize segments for making operating decisions and assessing performance and the availability of separate financial results. Sales and operating income by segment are presented in Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 of this Annual Report (MD&A). Additional segment data is provided in Note 21 of our consolidated financial statements set forth in Item 8 of this Annual Report.

METAL CUTTING The Metal Cutting segment develops and manufactures high performance tooling and metal cutting products and services and offers an assortment of standard and custom metal cutting solutions to diverse end markets, including aerospace, general engineering, energy and transportation. The products include milling, hole making, turning, threading and toolmaking systems used in the manufacture of airframes, aero engines, trucks and automobiles, ships and various types of industrial equipment. We leverage advanced manufacturing capabilities in combination with varying levels of customization to solve our customers’ toughest challenges and deliver improved productivity for a wide range of applications. Metal Cutting markets its products under the Kennametal®, WIDIA®, WIDIA Hanita® and WIDIA GTD® brands through its direct sales force, a network of independent and national distributors, integrated supplier channels and digitally. Application engineers and technicians are critical to the sales process and directly assist our customers with specified product design, selection, application and support.

INFRASTRUCTURE Our Infrastructure segment produces engineered tungsten carbide and ceramic components, earth-cutting tools, and advanced metallurgical powders, primarily for the energy, earthworks and general engineering end markets. These wear-resistant products include compacts, nozzles, frac seats and custom components used in oil and gas and petrochemical industries; rod blanks and abrasive water jet nozzles for general industries; earth cutting tools and systems used in underground mining, trenching and foundation drilling and road milling; tungsten carbide powders for the oil and gas, aerospace and process industries; and ceramics used by the packaging industry for metallization of films and papers. We combine deep metallurgical and engineering expertise with advanced manufacturing capabilities, such as 3D printing, to deliver solutions that drive improved productivity for our customers. Infrastructure markets its products primarily under the Kennametal® brand and sells through a direct sales force as well as through distributors.

4

INTERNATIONAL OPERATIONS During 2022, we generated 60 percent of our consolidated sales in markets outside of the United States of America (U.S.), with principal international operations in Western Europe, China and India. We also operate manufacturing and distribution facilities in Israel, Latin America, South Africa and Vietnam, while serving customers through sales offices, agents and distributors in Europe and other parts of the world. While geographic diversification helps to minimize the sales and earnings effect of demand changes in any one particular region, our international operations are subject to normal risks of doing business globally, including fluctuations in currency exchange rates and changes in social, political and economic environments.

Our international sales and long-lived assets are presented in Note 21 of the Company’s consolidated financial statements, set forth in Item 8 of this Annual Report. Further information about the effects and risks of currency exchange rates are presented in the Quantitative and Qualitative Disclosures About Market Risk section, set forth in Item 7A of this Annual Report.

STRATEGY AND GENERAL DEVELOPMENT OF BUSINESS We continued to make progress on our growth initiatives in the following areas in fiscal 2022.

Growth

•We launched more than 20 new products, including Infrastructure's PCD Roof Tool and Road King Diamond Flex, and Metal Cutting's new 4-flute solid carbide endmill and product line extensions for KOR5 and H1TE.

•We further cemented our position as a technology and commercial leader in tungsten carbide additive manufacturing through the introduction of new powder grades for component production, and strategic industry partnerships to advance tungsten carbide binder jet printing.

Sales in 2022 of $2,012.5 million increased from $1,841.4 million in 2021, reflecting a 9 percent increase of which 11 percent was due to organic sales growth, partially offset by 2 percent from an unfavorable currency exchange effect.

ACQUISITIONS AND DIVESTITURES We continually evaluate new opportunities to expand into new market areas, and to introduce new and/or complementary product offerings into new or existing areas where appropriate. We expect to continue to grow our business and further enhance our market position through the investment opportunities that exist within our core businesses, including potential acquisitions in the near term.

RAW MATERIALS AND SUPPLIES Our major metallurgical raw materials consist of tungsten ore concentrates and scrap carbide, which are used to make tungsten oxide, as well as compounds and secondary materials such as cobalt. Although an adequate supply of these raw materials currently exists, our major sources for raw materials are located abroad and prices fluctuate at times. We exercise great care in selecting, purchasing and managing the availability of raw materials utilizing a mix of long-term supply agreements coupled with spot purchases. Additionally, our internal tungsten recycling capability provides us access to additional sources of tungsten, and therefore, helps to mitigate our reliance on third parties. We also purchase steel bars and forgings for making toolholders and other tool parts, as well as for producing mining tools, rotary cutting tools and accessories. We purchase products for use in manufacturing processes and for resale from thousands of suppliers located in the U.S. and abroad.

RESEARCH AND DEVELOPMENT (R&D) Our R&D efforts focus on delivering innovations to our customers from both new product and process technology development. New product development provides solutions to our customers’ manufacturing challenges and productivity requirements. New process technology is developed and implemented in support of operational excellence to enhance product quality and efficiency at our plant sites. We use a disciplined framework, and have established “stage-gates,” or sequential tests to remove inefficiencies and accelerate commercial success. This framework is designed to accelerate and streamline development into a series of actions and decision points, integrating resource tasks to implement new and enhanced products and process technologies faster. Our stage-gate process ensures a strong linkage between verified customer requirements and corporate strategy, and enables us to gain the full benefits of our investment in development work.

We hold a number of patents and trademarks which, in the aggregate, are material to the operation of our businesses. The duration of our patent protection varies throughout the world by jurisdiction.

SEASONALITY Our business is affected by seasonal variations to varying degrees by summer road construction, traditional summer vacation shutdowns of customers’ plants and holiday shutdowns that affect our sales levels during the first and second quarters of our fiscal year.

BACKLOG Our backlog of standard orders generally is not significant to our operations.

5

COMPETITION As one of the world’s leading producers of tooling and metal cutting products, specialty wear-resistant components and ceramics, earth cutting tools and advanced metallurgical powders, we maintain a leading competitive position in major markets worldwide. We actively compete in the sale of all our products with several large global competitors and with many smaller niche businesses offering various capabilities to customers around the world. While several of our competitors are divisions of larger corporations, our industry remains largely fragmented, containing several hundred fabricators, toolmakers and niche specialty coating businesses. Many of our competitors operate relatively small facilities, producing a limited selection of tools while buying cemented tungsten carbide components from original producers of cemented tungsten carbide products, including Kennametal. We also supply coated solutions and other engineered wear-resistant products to both larger corporations and smaller niche businesses. Given the fragmentation, opportunities for consolidation exist from both U.S.-based and internationally-based firms, as well as among thousands of industrial supply distributors.

The principal competitive differentiators in our businesses include customer focused support and application expertise, custom and standard product innovation, product performance and quality and our brand recognition. We derive competitive advantage from our premium brand positions, global presence, application expertise and ability to address unique customer needs with new and improved tools, innovative surface and wear-resistant solutions, highly engineered components, consistent quality, traditional and digital customer service and technical assistance capabilities, state-of-the-art manufacturing and multiple sales channels. With these strengths, we are able to sell products based on the value-added productivity we deliver to our customers, rather than competing solely on price.

REGULATION From time to time, we are a party to legal claims and proceedings that arise in the ordinary course of business, which may relate to our operations or assets, including real, tangible, or intellectual property assets. While we currently believe that the amount of ultimate liability, if any, we may face with respect to these actions will not materially affect our financial position, results of operations or liquidity, the ultimate outcome of any litigation is uncertain. Were an unfavorable outcome to occur or if protracted litigation were to ensue, the effect on us could be material.

Compliance with government laws and regulations pertaining to the discharge of materials or pollutants into the environment or otherwise relating to the protection of the environment did not have a material effect on our capital expenditures or competitive position for the years covered by this Annual Report, nor is such compliance expected to have a material effect on us in the future.

The operation of our business has exposed us to certain liabilities and compliance costs related to environmental matters. We are involved in various environmental cleanup and remediation activities at certain sites associated with our current or former operations.

We establish and maintain accruals for certain potential environmental obligations. At June 30, 2022 and 2021, the balances of these accruals were $12.5 million and $14.7 million, respectively. These accruals represent anticipated costs associated with the remediation of these issues and are generally not discounted.

The accruals we have established for environmental obligations represent our best current estimate of the probable and reasonably estimable costs of addressing identified environmental situations, based on our review of currently available evidence, and taking into consideration our prior experience in remediation and that of other companies, as well as public information released by the United States Environmental Protection Agency (USEPA), other governmental agencies and by the Potentially Responsible Party (PRP) groups in which we are participating. Although the accruals currently appear to be sufficient to cover these environmental obligations, there are uncertainties associated with environmental liabilities, and we can give no assurance that our estimate of any environmental liability will not increase or decrease in the future. The recorded and unrecorded liabilities for all environmental concerns could change substantially due to factors such as the nature and extent of contamination, changes in remedial requirements, technological changes, discovery of new information, the financial strength of other PRPs, the identification of new PRPs and the involvement of and direction taken by the government on these matters.

Among other environmental laws, we are subject to the Comprehensive Environmental Response Compensation and Liability Act of 1980, under which we have been identified by the USEPA or other third party as a PRP with respect to environmental remedial costs at certain sites. We have evaluated our claims and potential liability associated with these sites based upon the best information currently available to us. We believe our environmental accruals will be adequate to cover our portion of the environmental remedial costs at those sites where we have been designated a PRP, to the extent these expenses are probable and reasonably estimable.

HUMAN CAPITAL RESOURCES

Employee Profile

We employed 8,732 people, including approximately 8,600 full-time employees, as of June 30, 2022. Approximately 2,900 employees were located in the U.S. and 5,800 were located in other parts of the world, principally Germany, India and China. At June 30, 2022, approximately 2,500 of our employees were represented by labor unions. We consider our labor relations to be generally good.

6

Diversity and Inclusion

We value diversity in all forms and are fully committed to inclusion in the workplace.

We continue to deploy our strategy and supporting infrastructure to elevate and advance diversity and inclusion (D&I) across our global organization and instill accountability for our performance. The enhanced D&I strategy focuses on four strategic pillars – awareness, acquisition, development and community. To drive action and accountability, each pillar is led by a senior Kennametal executive who is known as an accountability partner and is responsible for developing strategic initiatives in partnership with our People & Culture team.

Our Global Inclusion Council, which consists of cross-functional global leaders, champions the strategic initiatives and provides guidance and support. Four regional inclusion councils covering the Americas, Asia Pacific, EMEA and India execute the strategies and provide a global perspective.

As part of our awareness initiatives in 2022, we continued to enhance the D&I sections of the Company’s intranet and our external website. We expanded our Employee Resource Groups (ERGs) to foster communication and mentorship among diverse groups within the Company, such as the APAC Women’s Club, U.S. Women’s Mentoring, and U.S. Young Professionals groups. Our facilities around the world held events in March 2022 to celebrate International Women’s Day and recognize the achievements of female colleagues and participate in activities and discussions.

The tables below show the percentage of our employees who are women and the percentage of leadership roles at the Company held by women as of the dates indicated.

| Number of Employees | |||||||||||||||||

| Female | Male | ||||||||||||||||

| As of June 30 | Number | Percent | Number | Percent | Total | ||||||||||||

| 2022 | 1,582 | 18.1 | % | 7,150 | 81.9 | % | 8,732 | ||||||||||

| 2021 | 1,485 | 17.2 | 7,150 | 82.8 | 8,635 | ||||||||||||

| Women in Leadership Roles (in percentages) | ||||||||||||||

| As of June 30 | Board of Directors | Executive | Leadership | Senior Management | ||||||||||

| 2022 | 22.2 | % | 42.9 | % | 27.3 | % | 12.4 | % | ||||||

| 2021 | 22.2 | 42.9 | 24.0 | 11.5 | ||||||||||

Health and Safety

Safety, including the health of our employees, is one of our core values and a priority across our global operations. We are committed to developing a world-class health and safety culture to target zero injuries and illnesses. Our health and safety strategy is designed to focus all employees on proactively identifying, mitigating and eliminating high-risk conditions that could result in a serious injury or fatality. The strategy consists of three pillars – fatality and serious injury (FSI) prevention, incident prevention, and leadership development and compliance culture.

Our recordable cases and total recordable incident rate (TRIR) decreased 14 percent to 0.32 in 2022 compared to 0.37 in 2021.

In fiscal 2022, we launched an enhanced electronic Environmental, Health and Safety (EHS) Management System, including an extensive list of apps to enable streamlined collection, tracking and dissemination of key data. The apps include incident management, internal corporate EHS verification/audit and self-assessment, action tracking, compliance calendar, inspection tool, job safety analysis, FSI risk assessment, industrial hygiene and sustainability data collection. There are additional apps planned for fiscal 2023 including management of change and document control.

As part of our commitment to continuous improvement of our EHS programs, Kennametal has focused on the creation of new company-wide Global EHS Standards to strengthen our compliance management across the organization. These standards include:

•FSI prevention;

•Contractor safety;

•Powered industrial vehicles;

•Molten metal personal protective equipment (PPE);

•Lock/tag/verify;

•Fall control;

7

•Machine guarding and robotics safety; and

•Electrical safety.

Along with each standard, we have developed a self-assessment used to evaluate performance and develop action plans needed to meet tier levels aligning with the EHS roadmap. As discussed above, in 2022 we launched a new app as part of our EHS Management System to process electronic self-assessments, which capture each location’s level of compliance and create action plans.

Employee Development and Training

For the Company to grow, our employees must grow and develop continuously. We offer learning and development opportunities for all employees. In 2022, this included training for senior, mid-level and emerging leaders in role- and function-specific skills, such as project management, process improvement and sales effectiveness. We also offered our operational employees technical training through the Kennametal Knowledge Center.

Supporting our learning and development efforts is our OneTeam learning management system. Available in multiple languages, OneTeam offers more than 10,000 online courses in an easy-to-use interface. While this is not the only training delivery platform we use, our employees completed over 4,000 hours of training using this system in 2022.

We also continue to design and deliver development programs, focusing on the following:

•Individual development;

•Leadership development;

•Business- and operations-focused content;

•Sales-focused content; and

•Diversity and inclusion content.

Employee Engagement

As a follow up to the June 2021 employee engagement survey, targeted action plans were put in place focusing on one or two important team engagement goals. We conducted three short pulses during 2022 to check on progress. We then conducted another employee engagement survey that was launched in May 2022. With a response rate of 75 percent, the May 2022 survey indicated that we continue to make progress in employee engagement, with an increased average engagement score of 68, while our percent favorable increased to 63 percent.

AVAILABLE INFORMATION Our internet address is www.kennametal.com. On the SEC Filings page of our Website, which is accessible under the "About Us" tab, under Investor Relations and then the "Financials" tab, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (SEC): our annual reports on Form 10-K, our annual proxy statements, our annual conflict minerals disclosure and reports on Form SD, our annual reports on Form 11-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. The SEC Filings page of our Website also includes Forms 3, 4 and 5 filed pursuant to Section 16(a) of the Exchange Act. All filings posted on our SEC Filings page are available to be viewed on our Website free of charge. On the Corporate Governance page of our Website, which is accessible under the "About Us" tab, under Investor Relations, we post the following charters and guidelines: Audit Committee Charter, Compensation Committee Charter, Nominating/Corporate Governance Committee Charter, Kennametal Inc. Corporate Governance Guidelines and Kennametal Inc. Stock Ownership Guidelines. On the Ethics and Compliance page of our Website, which is under the "About Us" tab, we post our Code of Conduct. All charters and guidelines posted on our Website are available to be viewed free of charge. Information contained on our Website is not part of this Annual Report or our other filings with the SEC. Copies of this Annual Report and those items disclosed on the Corporate Governance and Ethics and Compliance pages of our Website are available without charge upon written request to: Investor Relations, Kennametal Inc., 525 William Penn Place, Suite 3300, Pittsburgh, Pennsylvania 15219-2706. The SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers, including Kennametal that file electronically with the SEC.

8

RISK FACTORS

This section describes material risks to our business that are currently known to us. Our business, financial condition or results of operations may be materially affected by a number of factors. Our management regularly monitors the risks inherent in our business, with input from our Enterprise Risk Management process. In addition to real time monitoring, we periodically conduct a formal enterprise-wide risk assessment to identify factors and circumstances that might present significant risk to the Company. Many of these risks are discussed throughout this report. The risks below, however, are not exhaustive. We operate in a rapidly changing environment. Other risks that we currently believe to be immaterial could become material in the future. We are also subject to legal and regulatory changes. New factors could emerge, and it is not possible to predict the outcome of all such risk factors on our business, financial condition or results of operations. The following discussion details the material risk factors and uncertainties that we believe could cause Kennametal’s actual results to differ materially from those projected in any forward-looking statements.

Global Operational Risks:

Russia’s invasion of Ukraine, the sanctions and actions taken against Russia and Russia's response to such actions could adversely affect our business. While our sales in Russia and Ukraine are not material to our overall business, the Russian invasion of Ukraine and the resulting sanctions and actions taken against Russia by the United States, the United Kingdom, the European Union, Switzerland and others have restricted our ability to sell certain products in Russia and Ukraine. It is also unclear what actions Russia may take in responding to these sanctions and actions. A significant escalation or expansion of the conflict beyond its current geographic, political and economic scope and scale could have a material adverse effect on our business, results of operations and financial condition and could exacerbate other risks. Such risks include, but are not limited to: an energy shortage in Europe as Russia has begun to limit natural gas and other supplies into Europe, an increase in the frequency and severity of the cybersecurity threats we and various third parties with whom we do business experience, unfavorable changes in exchange rates, further shortages, delivery delays and price inflation in a wide variety of raw materials and components, widespread reductions in customer demand and increased logistical challenges. In 2022, the Company ceased operations in Russia and subsequently decided to liquidate its legal entity in Russia.

Public health threats or outbreaks of communicable diseases could have a material adverse effect on our operations and financial results. We face risks related to public health threats or outbreaks of communicable diseases. A widespread healthcare crisis, such as an outbreak of a communicable disease could adversely affect the global economy and our business, our suppliers and our customers’ ability to conduct business for an indefinite period of time. For example, the ongoing global Coronavirus Disease 2019 (COVID-19) pandemic has negatively affected the global economy, disrupted financial markets and international trade and significantly affected global supply chains since its emergence in 2019, all of which have and may continue to have an effect on the Company and our end markets. The extent to which the COVID-19 pandemic may affect our business, operating results, financial condition, or liquidity in the future will depend on future developments, including the duration of the pandemic, the emergence of more contagious or virulent strains of the virus, travel restrictions, business and workforce disruptions, the availability, uptake and efficacy of vaccines, and the effectiveness of actions taken to contain and treat the disease. It is not possible to accurately predict with any degree of certainty the impact COVID-19 will have on our operations going forward and it could have a material adverse effect on our results of operations, financial condition, and liquidity. In particular, the continued spread of COVID-19 and any existing or future variants and efforts to contain them may:

•continue to affect customer demand across our end markets and geographical regions;

•affect our ability to conduct business in certain jurisdictions in which we operate where nationwide, regional or local lockdowns are currently implemented or may be implemented in the future;

•cause us to experience an increase in costs related to the emergency measures we have taken, delayed payments from customers and uncollectible accounts;

•cause delays and disruptions in our supply chain resulting in disruptions in the commencement dates of certain planned projects;

•affect the availability of qualified personnel;

•affect our ability to fund operations and maintain covenant compliance;

•affect our access to financial markets;

•affect our ability to accurately forecast; and

•cause other unpredictable events.

9

Downturns in the business cycle could adversely affect our sales and profitability. Our business has historically been cyclical and subject to significant effect from economic downturns. Global economic downturns coupled with global financial and credit market disruptions have had a negative effect on our sales and profitability historically. These events could contribute to weak end markets, a sharp drop in demand for our products and services, higher energy costs and commodity prices, and higher costs of borrowing and/or diminished credit availability. Although we believe that the long-term prospects for our business remain positive, we are unable to predict the future course of industry variables or the strength and pace or sustainability of economic development.

Our international operations pose certain risks that may adversely affect sales and earnings. We have manufacturing operations and assets located outside of the U.S., including but not limited to those in Western Europe, Brazil, Canada, China, India, Israel, South Africa and Vietnam. We also sell our products to customers and distributors located outside of the U.S. During the year ended June 30, 2022, 60 percent of our consolidated sales were derived from non-U.S. markets. These international operations are subject to a number of special risks, in addition to the risks that affect our domestic operations, including currency exchange rate fluctuations, differing protections of intellectual property, trade barriers, exchange controls, regional economic uncertainty, overlap of different tax regimens, differing (and possibly more stringent) labor regulations, labor unrest, risk of governmental expropriation, domestic and foreign customs and tariffs, current and changing regulatory environments (including, but not limited to, the risks associated with the importation and exportation of products and raw materials), risk of failure of our foreign employees to comply with both U.S. and foreign laws, including antitrust laws, trade regulations and the Foreign Corrupt Practices Act, difficulty in obtaining distribution support, difficulty in staffing and managing widespread operations, differences in the availability and terms of financing, social and political instability and unrest and risks of increased taxes and/or adverse tax consequences. Also, in some foreign jurisdictions, we may be subject to laws limiting the right and ability of entities organized or operating therein to pay dividends or remit earnings to affiliated companies unless specified conditions are met. To the extent we are unable to effectively manage our international operations and these risks, our international sales may be adversely affected, we may be subject to additional and unanticipated costs, and we may be subject to litigation or regulatory action. As a consequence, our business, financial condition and results of operations could be seriously harmed.

Additional tax expense or exposures could affect our financial condition and results of operations. We are subject to various taxes in the U.S. and numerous other jurisdictions. Our future results of operations could be adversely affected by changes in our effective tax rate as a result of a change in the mix of earnings between U.S. and non-U.S. jurisdictions or among jurisdictions with differing statutory tax rates, changes in tax laws or treaties or in their application or interpretation, changes in generally accepted accounting principles, changes in the valuation of deferred tax assets and liabilities, changes in the amount of earnings indefinitely reinvested in certain non-U.S. jurisdictions, and the results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures.

Implementation of tariffs and changes to or uncertainties related to tariffs and trade agreements could adversely affect our business. The U.S. government has imposed tariffs on certain foreign goods from a variety of countries and regions, most notably China, that it perceives as engaging in unfair trade practices, and previously raised the possibility of imposing significant, additional tariff increases or expanding the tariffs to capture other types of goods from other countries. In response, many of these foreign governments have imposed retaliatory tariffs on goods that their countries import from the U.S. Uncertainties with respect to tariffs, trade agreements or any potential trade wars could negatively affect the global economy and could affect demand for our products and could have a material adverse effect on our financial condition, results of operations and cash flows. Changes in tariffs and trade barriers could also result in adverse changes in the cost and availability of our raw materials, and our ability to manufacture globally to support global sales which could lead to increased costs that we may not be able to effectively pass on to customers, each of which could materially adversely affect our operating margins, results of operations and cash flows.

Natural disasters or other global or regional catastrophic events could disrupt our operations and adversely affect results. Despite our concerted effort to minimize risk to our production capabilities and corporate information systems and to reduce the effect of unforeseen interruptions to us through business continuity planning, we still may be exposed to interruptions due to catastrophe, natural disaster, pandemic, terrorism or acts of war, which are beyond our control. Disruptions to our facilities or systems, or to those of our key suppliers, could also interrupt operational processes and adversely affect our ability to manufacture our products and provide services and support to our customers. As a result, our business, our results of operations, financial position, cash flows and stock price could be adversely affected.

10

Changes in the regulatory environment, including environmental, health and safety regulations, could subject us to increased compliance and manufacturing costs, which could have a material adverse effect on our business.

Health and safety regulations. Certain of our products contain hard metals, including tungsten and cobalt. Hard metal dust is being studied for potential adverse health effects by organizations in several regions throughout the world, including the U.S., Europe and Japan. Future studies on the health effects of hard metals may result in our products being classified as hazardous to human health, which could lead to new regulations in countries in which we operate that may restrict or prohibit the use of, and/or exposure to, hard metal dust. New regulation of hard metals could require us to change our operations, and these changes could affect the quality of our products and materially increase our costs.

Environmental regulations. We are subject to various environmental laws, and any violation of, or our liabilities under, these laws could adversely affect us. Our operations necessitate the use and handling of hazardous materials and, as a result, we are subject to various federal, state, local and foreign laws, regulations and ordinances relating to the protection of the environment, including those governing discharges to air and water, handling and disposal practices for solid and hazardous wastes, the cleanup of contaminated sites and the maintenance of a safe workplace. These laws impose penalties, fines and other sanctions for noncompliance and liability for response costs, property damages and personal injury resulting from past and current spills, disposals or other releases of, or exposure to, hazardous materials. We could incur substantial costs as a result of noncompliance with or liability for cleanup or other costs or damages under these laws. We may be subject to more stringent environmental laws in the future. If more stringent environmental laws are enacted in the future, these laws could have a material adverse effect on our business, financial condition and results of operations.

Regulations affecting the mining and drilling industries, utilities industry or the use of fossil fuels. Some of our principal customers are mining and drilling companies that supply coal, oil, gas or other fuels as a source of energy to utility companies or for transportation. The operations of these mining and drilling companies are geographically diverse and are subject to or affected by a wide array of regulations in the jurisdictions where they operate. As a result of changes in regulations and laws relating to these industries, including, without limitation, actions to limit or reduce greenhouse gas emissions from the use of fossil fuels, our customers’ operations could be disrupted or curtailed by governmental authorities. The high cost of compliance with these regulations may also induce customers to discontinue or limit their operations and may discourage companies from developing new opportunities. As a result of these factors, demand for our mining- and drilling-related products could be substantially affected by regulations adversely affecting the mining and drilling industries or altering the fuel choices of utilities or in transportation. Our principal customers also include transportation original equipment manufacturers and tier suppliers engaged in the production of internal combustion engines. As a result of breakthrough technologies, changing consumer preferences or regulations designed to limit or reduce greenhouse gas emissions from the use of fossil fuels in transportation, demand for our products could be negatively affected.

Climate change and resulting legal or regulatory responses. There is growing concern that a gradual increase in global average temperatures may cause significant changes in weather patterns around the globe and an increase in the frequency and severity of natural disasters. Such climate change may impair our production capabilities, disrupt our supply chain or impact demand for our products. Growing concern over climate change also may result in additional legal or regulatory requirements designed to reduce or mitigate the effects of carbon dioxide and other greenhouse gas emissions on the environment. Increased energy or compliance costs and expenses as a result of increased legal or regulatory requirements may cause disruptions in, or an increase in the costs associated with, the manufacturing and distribution of our products. The impacts of climate change and legal or regulatory initiatives to address climate change could have a long-term adverse impact on our business and results of operations.

Product liability claims could have a material adverse effect on our business. The sale of metal cutting, mining, highway construction and other tools and related products as well as engineered components and advanced materials entails an inherent risk of product liability claims. We cannot give any assurances that the coverage limits of our insurance policies will be adequate or that our policies will cover any particular loss. Insurance can be expensive, and we may not always be able to purchase insurance on commercially acceptable terms, if at all. Claims brought against us that are not covered by insurance or that result in recoveries in excess of our insurance coverage could have a material adverse effect on our business, financial condition and results of operations.

Business Strategy Risks:

Our restructuring efforts may not have the intended effects. From time to time, we implement restructuring and other actions to reduce structural costs, improve operational efficiency and position the Company for long-term profitable growth. However, there is no assurance that these efforts, or that any other actions that we have taken or may take in the future, will be sufficient to counter any future economic or industry disruptions. We cannot provide assurance that we will not incur future restructuring charges or impairment charges, or that we will achieve all of the anticipated benefits from the restructuring actions we have taken or plan to take in the future.

11

We may not be able to complete, manage or integrate acquisitions successfully. We may evaluate acquisition opportunities that have the potential to strengthen or expand our business. We can give no assurances, however, that any acquisition opportunities will arise or if they do, that they will be consummated, or that additional financing, if needed, will be available on satisfactory terms. In addition, acquisitions involve inherent risks that the businesses acquired will not perform in accordance with our expectations. We may not be able to achieve the synergies and other benefits we expect from the integration of acquisitions as successfully or rapidly as projected, if at all. Our failure to consummate an acquisition or effectively integrate newly acquired operations could prevent us from realizing our expected strategic growth and rate of return on an acquired business and could have a material and adverse effect on our results of operations and financial condition.

Impairment of goodwill and other intangible assets with indefinite lives could result in a negative effect on our financial condition and results of operations. At June 30, 2022, goodwill and other indefinite-lived intangible assets totaled $274.6 million, or 11 percent of our total assets. Goodwill results from acquisitions, representing the excess of cost over the fair value of the net tangible and other identifiable intangible assets we have acquired. We assess at least annually whether there has been impairment in the value of our goodwill and indefinite-lived intangible asset. If future operating performance at our Metal Cutting reporting unit were to fall significantly below current levels, we could record, under current applicable accounting rules, a non-cash impairment charge for goodwill. Any determination requiring the impairment of a significant portion of goodwill or other intangible assets would negatively affect our financial condition and results of operations.

Our continued success depends on our ability to protect and defend our intellectual property. Our future success depends in part upon our ability to protect and defend our intellectual property. We rely principally on nondisclosure agreements and other contractual arrangements and trade secret laws and, to a lesser extent, trademark and patent laws, to protect our intellectual property. However, these measures may be inadequate to protect our intellectual property from infringement by others or prevent misappropriation of our proprietary rights. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do U.S. laws. If one of our patents is infringed upon by a third party, we may need to devote significant time and financial resources to defend our rights with respect to such patent. We may not be successful in defending our patents. Similarly, while we do not knowingly infringe on the patents, copyrights or other intellectual property rights of others, we may be required to spend a significant amount of time and financial resources to resolve any infringement claims against us, and we may not be successful in defending our position or negotiating alternative remedies. Our inability to protect our proprietary information and enforce or defend our intellectual property rights in proceedings initiated by us or brought against us could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to retain our qualified management and employees, our business may be negatively affected. Our ability to provide high quality products and services depends in part on our ability to retain our skilled personnel in the areas of management, product engineering, servicing and sales. Competition for such personnel is intense, and our competitors can be expected to attempt to hire our management and skilled employees from time to time. In addition, our restructuring activities and strategies for growth have placed, and are expected to continue to place, increased demands on our management’s skills and resources. If we are unable to retain our management team and professional personnel, our customer relationships and level of technical expertise could be negatively affected, which may materially and adversely affect our business.

Any interruption of our workforce, including interruptions due to our restructuring initiatives, unionization efforts, changes in labor relations or shortages of appropriately skilled individuals could affect our business.

We operate in a highly competitive environment. Our domestic and foreign operations are subject to significant competitive pressures. We compete directly and indirectly with other manufacturers and suppliers of metal cutting tools, engineered components and advanced materials. Some of our competitors are larger than we are and may have greater access to financial resources or be less leveraged than us. In addition, the industry in which our products are used is a large, fragmented industry that is highly competitive.

Cybersecurity Risks:

Failure of, or a breach in security of, our information technology systems could adversely affect our business. We rely on information technology infrastructure (both on-premises and third-party managed) to achieve our business objectives. Despite security measures taken by us, our information technology systems may be vulnerable to computer viruses or attacks by hackers or breached due to employee error, supplier error, programming errors, malfeasance or other disruptions. Any disruption of our infrastructure could negatively affect our ability to record or process orders, manufacture and ship in a timely manner, or otherwise carry on business in the normal course. Any disruption could cause us to lose customers or revenue and could require us to incur significant expense to remediate. Increased global information technology threats, vulnerabilities, and a rise in sophisticated and targeted international computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. Any such breach in security could expose the Company and its employees, customers and suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes, litigation and operational disruptions, which in turn could adversely affect the Company's reputation, competitive position, business or results of operations.

12

In addition, we could be subject to liability if confidential information relating to customers, employees, vendors and the extended supply chain or other parties is misappropriated from our computer system. We cannot assure that our ongoing focus on system improvements will be sufficient to prevent or limit the damage from any cyber attack or network disruption. We do not believe we have been the target of a material successful cyber attack.

Raw Material Risks:

Our future operating results may be affected by fluctuations in the prices and availability of raw materials. The raw materials we use for our products include tungsten ore concentrates and scrap carbide, which are used to make tungsten oxide, as well as compounds and secondary materials such as cobalt. We also purchase steel bars and forgings for making toolholders and other tool parts, as well as for producing mining tools, rotary cutting tools and accessories. A significant portion of our raw materials is supplied by sources outside of the U.S. The raw materials extraction industry is highly cyclical and at times pricing and supply can be volatile due to a number of factors beyond our control, including natural disasters, pandemics or public health issues, general economic and political conditions, labor costs, competition, import duties, tariffs and currency exchange rate fluctuations. This volatility can significantly affect our raw material costs. In an environment of increasing raw material prices, competitive conditions can affect how much of these price increases we can recover in the form of higher sales prices for our products. To the extent we are unable to pass on any raw material price increases to our customers, our profitability could be adversely affected. Furthermore, restrictions in the supply of tungsten, cobalt and other raw materials could adversely affect our operating results. If the prices for our raw materials increase or we are unable to secure adequate supplies of raw materials on favorable terms, our profitability could be impaired. If the prices for our raw materials decrease, we could face product pricing challenges.

Capital and Credit-Related Risks:

Restrictions contained in our revolving credit facility and other debt agreements may limit our ability to incur additional indebtedness. Our existing revolving credit facility and other debt agreements (each a “Debt Facility” and collectively, “Debt Facilities”) contain restrictive covenants, including restrictions on our ability to incur indebtedness. These restrictions could limit our ability to effectuate future acquisitions, limit our ability to pay dividends, limit our ability to make capital expenditures or restrict our financial flexibility. Our revolving credit facility contains covenants requiring us to achieve certain financial and operating results and maintain compliance with a specified financial ratio. Our ability to meet the financial covenant or requirements in our revolving credit facility may be affected by events beyond our control, and we may not be able to satisfy such covenants and requirements. A breach of these covenants or our inability to comply with the financial ratio, tests or other restrictions contained in a Debt Facility could result in an event of default under one or more of our other Debt Facilities. Upon the occurrence of an event of default under a Debt Facility, and the expiration of any grace periods, the lenders could elect to declare all amounts outstanding under one or more of our other Debt Facilities, together with accrued interest, to be immediately due and payable. If this were to occur, our assets may not be sufficient to fully repay the amounts due under our Debt Facilities or our other indebtedness.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

ITEM 2 – PROPERTIES

Our principal executive offices are located at 525 William Penn Place, Suite 3300, Pittsburgh, Pennsylvania, 15219. We also have corporate offices in Neuhausen, Switzerland, Bangalore, India and Singapore. Our technology center is located at 1600 Technology Way, P.O. Box 231, Latrobe, Pennsylvania, 15650. A summary of our principal manufacturing facilities and other materially important properties is as follows:

| Primary Segment | |||||||||||||||||

| Location | Owned/Leased | Principal Products | MC(1) | INF(2) | |||||||||||||

| United States: | |||||||||||||||||

| Gurley, Alabama | Owned | Metallurgical Powders | X | ||||||||||||||

| Huntsville, Alabama | Owned | Metallurgical Powders | X | ||||||||||||||

| Rogers, Arkansas | Owned/Leased | Carbide Products, Pelletizing Die Plates and Downhole Drilling Carbide Components | X | ||||||||||||||

| Goshen, Indiana | Leased | Powders; Welding Rods, Wires and Machines | X | ||||||||||||||

| New Albany, Indiana | Leased | High Wear Coating for Steel Parts | X | ||||||||||||||

| Greenfield, Massachusetts | Owned | High-Speed Steel Taps | X | ||||||||||||||

13

| Primary Segment | |||||||||||||||||

| Location | Owned/Leased | Principal Products | MC(1) | INF(2) | |||||||||||||

| Traverse City, Michigan | Owned | Wear Parts | X | ||||||||||||||

| Fallon, Nevada | Owned | Metallurgical Powders | X | ||||||||||||||

| Asheboro, North Carolina | Owned | Carbide Round Tools | X | ||||||||||||||

| Henderson, North Carolina | Owned | Metallurgical Powders | X | ||||||||||||||

| Roanoke Rapids, North Carolina | Owned | Metal Cutting Inserts | X | ||||||||||||||

| Cleveland, Ohio | Leased | Distribution | X | ||||||||||||||

| Orwell, Ohio | Owned | Metal Cutting Inserts | X | ||||||||||||||

| Solon, Ohio | Owned | Metal Cutting Toolholders | X | ||||||||||||||

| Whitehouse, Ohio | Owned/Leased | Metal Cutting Inserts and Round Tools | X | ||||||||||||||

| Bedford, Pennsylvania | Owned/Leased | Mining and Construction Tools, Wear Parts and Distribution | X | ||||||||||||||

| La Vergne, Tennessee | Owned | Metal Cutting Inserts | X | ||||||||||||||

| New Market, Virginia | Owned | Metal Cutting Toolholders | X | ||||||||||||||

| International: | |||||||||||||||||

| La Paz, Bolivia | Owned | Tungsten Concentrate | X | ||||||||||||||

| Indaiatuba, Brazil | Leased | Metal Cutting Carbide Drills and Toolholders | X | ||||||||||||||

| Belleville, Canada | Owned | Casting Components, Coatings and Powder Metallurgy Components | X | ||||||||||||||

| Victoria, Canada | Owned | Wear Parts | X | ||||||||||||||

| Fengpu, China | Owned | Intermetallic Composite Ceramic Powders and Parts | X | ||||||||||||||

| Shanghai, China | Owned | Powders, Welding Rods and Wires and Cast Components | X | ||||||||||||||

| Shanghai, China | Leased | Distribution | X | ||||||||||||||

| Tianjin, China | Owned | Metal Cutting Inserts, Carbide Round Tools and Metallurgical Powders | X | X | |||||||||||||

| Xuzhou, China | Leased | Mining Tools | X | ||||||||||||||

| Ebermannstadt, Germany | Owned | Metal Cutting Inserts | X | ||||||||||||||

| Essen, Germany | Owned/Leased | Metal Cutting Inserts | X | ||||||||||||||

| Königsee, Germany | Leased | Metal Cutting Carbide Drills | X | ||||||||||||||

| Mistelgau, Germany | Owned | Wear Parts and Metallurgical Powders | X | ||||||||||||||

| Nabburg, Germany | Owned | Metal Cutting Toolholders and Metal Cutting Round Tools, Drills and Mills | X | ||||||||||||||

| Schongau, Germany | Owned | Ceramic Vaporizer Boats | X | ||||||||||||||

| Vohenstrauss, Germany | Owned | Metal Cutting Carbide Drills | X | ||||||||||||||

| Bangalore, India | Owned | Metal Cutting Inserts, Toolholders and Wear Parts | X | X | |||||||||||||

| Shlomi, Israel | Owned | High-Speed Steel and Carbide Round Tools | X | ||||||||||||||

| Zory, Poland | Leased | Metal Cutting Carbide Drills | X | ||||||||||||||

| Boksburg, South Africa | Leased | Mining and Construction Conicals | X | ||||||||||||||

| Barcelona, Spain | Leased | Metal Cutting Tools | X | ||||||||||||||

| Kingswinford, United Kingdom | Leased | Distribution | X | ||||||||||||||

| Newport, United Kingdom | Owned | Intermetallic Composite Powders | X | ||||||||||||||

| Hanoi, Vietnam | Owned/Leased | Carbide and PCD Round Tools | X | ||||||||||||||

(1)Metal Cutting segment

(2)Infrastructure segment

14

We also have a network of customer service centers located throughout North America, Europe, India, Asia Pacific and Latin America, a significant portion of which are leased. The majority of our research and development efforts are conducted at our technology center located in Latrobe, Pennsylvania, U.S., as well as at our facilities in Rogers, Arkansas, U.S.; Fürth, Germany and Bangalore, India.

We use all of our significant properties in the businesses of powder metallurgy, tools, tooling systems, engineered components and advanced materials. Our production capacity is adequate for our present needs. We believe that our properties have been adequately maintained, are generally in good condition and are suitable for our business as presently conducted.

ITEM 3 - LEGAL PROCEEDINGS

The information set forth in Part I, Item 1, of this Annual Report under the caption “Regulation” is incorporated by reference into this Item 3. From time to time, we are party to legal claims and proceedings that arise in the ordinary course of business, which may relate to our operations or assets, including real, tangible or intellectual property assets. Although we currently believe that the amount of ultimate liability, if any, we may face with respect to these actions will not materially affect our financial position, results of operations or liquidity, the ultimate outcome of any litigation is uncertain. Were an unfavorable outcome to occur or if protracted litigation were to ensue, the effect on us could be material.

ITEM 4 - MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Incorporated by reference into this Part I is the information set forth in Part III, Item 10 of this Annual Report under the caption “Information About Our Executive Officers.”

PART II

ITEM 5 - MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our capital stock is traded on the New York Stock Exchange under the symbol "KMT." The number of shareholders of record as of July 29, 2022 was 1,333.

The information incorporated by reference into Part III, Item 12 of this Annual Report from our 2022 Proxy Statement under the heading “Equity Compensation Plans – Equity Compensation Plan Information” is hereby incorporated by reference into this Item 5.

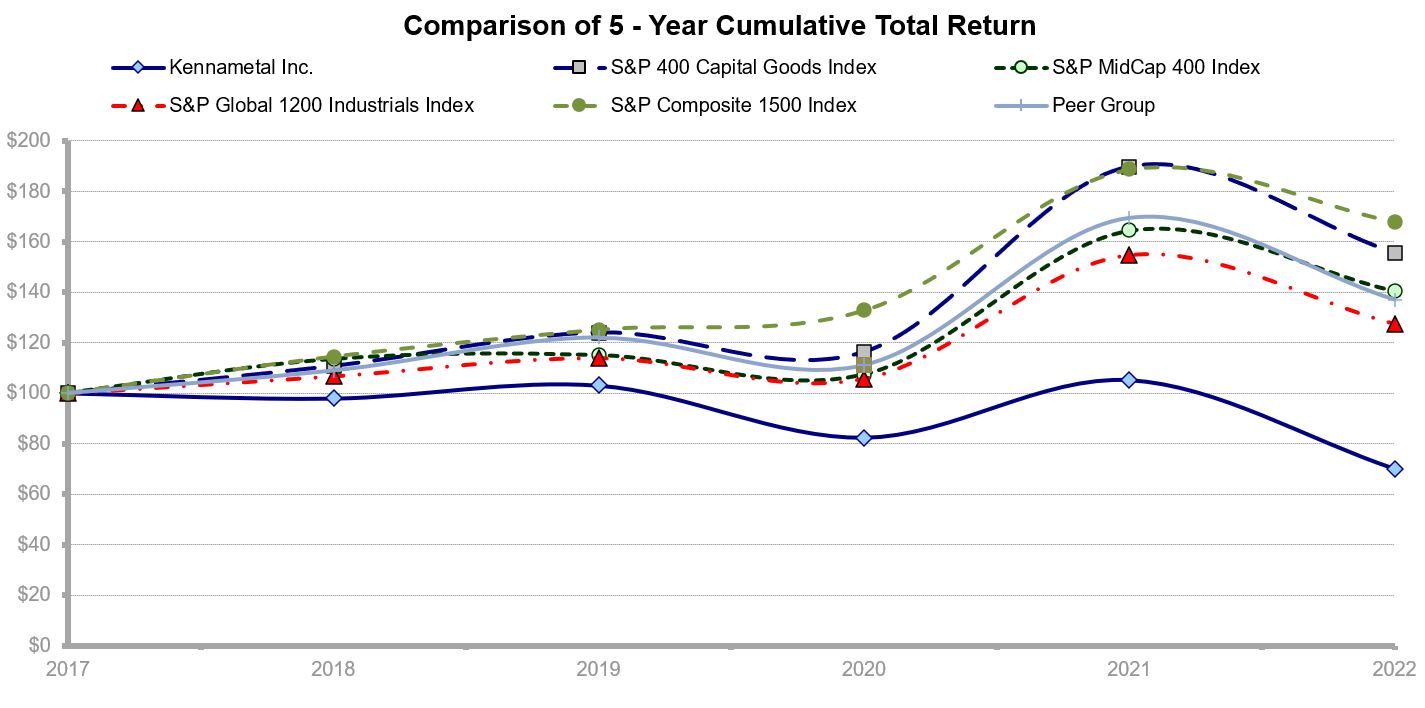

PERFORMANCE GRAPH

The following graph compares cumulative total shareholder return on our capital stock with the cumulative total shareholder return on the common stock of the companies in the Standard & Poor’s Mid-Cap 400 Market Index (S&P Midcap 400), the Standard & Poor’s 400 Capital Goods (S&P 400 Capital Goods), the Standard & Poor's Global 1200 Industrials Index (S&P Global 1200 Industrials) and the peer group of companies determined by us (Peer Group) for the period from June 30, 2017 to June 30, 2022.

The Peer Group consists of the following companies: Altra Industrial Motion Corp.; Barnes Group Inc.; Crane Co.; Curtiss-Wright Corporation; Enovis Corp.; EnPro Industries, Inc.; Flowserve Corporation; Graco Inc.; ITT Inc.; Lincoln Electric Holdings, Inc.; Nordson Corporation; Simpson Manufacturing Co., Inc.; SPX Corporation; The Timken Company; Watts Water Technologies, Inc.; Woodward, Inc.; and Zurn Water Solutions Corporation.

15

Assumes $100 Invested on July 1, 2017 and All Dividends Reinvested

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||||

| Kennametal | $ | 100.00 | $ | 97.90 | $ | 103.08 | $ | 82.25 | $ | 105.29 | $ | 69.76 | ||||||||

| Peer Group Index | 100.00 | 108.92 | 122.08 | 111.17 | 169.45 | 137.00 | ||||||||||||||

| S&P Composite 1500 Index | 100.00 | 114.50 | 125.16 | 132.77 | 188.70 | 167.91 | ||||||||||||||

| S&P Midcap 400 | 100.00 | 113.50 | 115.05 | 107.35 | 164.49 | 140.41 | ||||||||||||||

| S&P 400 Capital Goods | 100.00 | 110.74 | 124.01 | 116.34 | 189.71 | 155.47 | ||||||||||||||

| S&P Global 1200 Industrials | 100.00 | 106.73 | 113.97 | 105.78 | 154.66 | 127.45 | ||||||||||||||

16

ISSUER PURCHASES OF EQUITY SECURITIES

| Period | Total Number of Shares Purchased(1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (2) | |||||||||||||||||||

| April 1 through April 30, 2022 | 142 | $ | 28.21 | — | $ | 149,700,000 | |||||||||||||||||

| May 1 through May 31, 2022 | 676,647 | 26.29 | 672,333 | 132,000,000 | |||||||||||||||||||

| June 1 through June 30, 2022 | 639,385 | 27.09 | 638,580 | 114,700,000 | |||||||||||||||||||

| Total | 1,316,174 | $ | 26.68 | 1,310,913 | |||||||||||||||||||

(1)During the current period, 1,786 shares were purchased on the open market on behalf of Kennametal to fund the Company’s dividend reinvestment program. Also, during the current period, employees delivered 3,475 shares of restricted stock to Kennametal, upon vesting, to satisfy tax withholding requirements.

(2)On July 27, 2021, the Board of Directors of the Company approved a share repurchase program authorizing the Company to purchase up to $200 million of the Company's common stock over a three-year period outside of the Company's dividend reinvestment program.

UNREGISTERED SALES OF EQUITY SECURITIES

None.

17

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in connection with the consolidated financial statements of Kennametal Inc. and the related financial statement notes included in Item 8 of this Annual Report. Unless otherwise specified, any reference to a “year” is to our fiscal year ended June 30. Additionally, when used in this Annual Report, unless the context requires otherwise, the terms “we,” “our” and “us” refer to Kennametal Inc. and its subsidiaries.

OVERVIEW Kennametal Inc. was founded based on a tungsten carbide technology breakthrough in 1938. The Company was incorporated in Pennsylvania in 1943 as a manufacturer of tungsten carbide metal cutting tooling, and was listed on the New York Stock Exchange (NYSE) in 1967. With more than 80 years of materials expertise, the Company is a global industrial technology leader, helping customers across the aerospace, earthworks, energy, general engineering and transportation industries manufacture with precision and efficiency. This expertise includes the development and application of tungsten carbides, ceramics, super-hard materials and solutions used in metal cutting and extreme wear applications to keep customers up and running longer against conditions such as corrosion and high temperatures.

Our standard and custom product offering spans metal cutting and wear applications including turning, milling, hole making, tooling systems and services, as well as specialized wear components and metallurgical powders. End users of the Company's metal cutting products include manufacturers engaged in a diverse array of industries including: the manufacturers of transportation vehicles and components, machine tools and light and heavy machinery; airframe and aerospace components; and energy-related components for the oil and gas industry, as well as power generation. The Company’s wear and metallurgical powders are used by producers and suppliers in equipment-intensive operations such as road construction, mining, quarrying, and oil and gas exploration, refining, production and supply.

Throughout Management's Discussion and Analysis of Financial Condition and Results of Operations (the MD&A), we refer to measures used by management to evaluate performance. We also refer to a number of financial measures that are not defined under accounting principles generally accepted in the United States of America (U.S. GAAP), including organic sales growth, constant currency regional sales growth (decline) and constant currency end market sales growth (decline). The explanation at the end of the MD&A provides the definition of these non-GAAP financial measures as well as details on their use and a reconciliation to the most directly comparable GAAP financial measures.

Our sales of $2,012.5 million for the year ended June 30, 2022 increased 9 percent year-over-year, reflecting 11 percent organic sales growth, partially offset by a 2 percent unfavorable currency exchange effect.

Operating income was $218.1 million in 2022 compared to $102.2 million in the prior year. The increase in operating income was due primarily to organic sales growth, restructuring and related charges of $4 million compared to $40 million in the prior year, favorable pricing in excess of raw material costs, lower incentive compensation costs, favorable product mix and approximately $14 million of incremental simplification/modernization benefits, partially offset by higher raw material costs of approximately $49 million, certain manufacturing inefficiencies including higher depreciation and approximately $25 million due to the restoration of salaries and other cost-control measures that were taken in the prior year. Operating margin in 2022 was 10.8 percent compared to 5.5 percent in the prior year. In 2022, the Metal Cutting and Infrastructure segments had operating margins of 9.9 percent and 12.6 percent, respectively.

In July 2021, the Board of Directors of the Company approved a share repurchase program authorizing the Company to purchase up to $200 million of the Company's common stock over a three-year period. During 2022, the Company repurchased a total of 2.7 million shares of common stock for $85 million.

On March 11, 2020, the World Health Organization declared the Coronavirus Disease 2019 (COVID-19) a pandemic bringing significant uncertainty in our end markets and operations. Since then, national, regional and local governments have taken steps at various times during the course of the continuing pandemic to limit the spread of the virus through stay-at-home, social distancing, and various other orders and guidelines. Although some jurisdictions have relaxed these measures, particularly as more and more people are vaccinated, others have not or have reinstated them at times when COVID-19 cases are surging or new variants emerge. The imposition of these measures, including the lockdowns in China, has created significant operating constraints on our business. Throughout the pandemic we have deployed safety protocols and processes to keep our employees safe while continuing to serve our customers, based on the guidance provided by the U.S. Centers for Disease Control and other relevant authorities. Late in the March quarter of 2022, our manufacturing and distribution operations in Shanghai were affected by COVID-19 lockdowns and have since reopened. The extent to which the ongoing COVID-19 pandemic may continue to affect our business, operating results or financial condition in the future will depend on a number of factors, including the duration and spread of the pandemic, the emergence and spread of more contagious or virulent strains of the virus, travel restrictions, business and workforce disruptions associated with the pandemic, including the availability of critical materials and resources, the success of preventative measures to contain or mitigate the spread of the virus and emerging variants, and the effectiveness of the distribution and acceptance of COVID-19 vaccines.

18

Russia's invasion of Ukraine in February 2022 has resulted in the imposition of economic sanctions on Russia by the United States, Canada, the European Union and other countries. We are monitoring and evaluating the broader economic impact, including the sanctions imposed, the potential for additional sanctions and any responses from Russia, including limiting the supply of natural gas and other resources to Europe, which could directly affect the Company's operations, business partners, customers or supply chain. To date, the conflict between Russia and Ukraine has not had a material impact on the Company's financial condition or results of operations. During the March quarter of 2022, the Company ceased operations in Russia and subsequently decided to liquidate its legal entity in Russia. Total charges of $2.7 million were recorded in 2022 related to liquidation activities, the expected risk of loss related to accounts receivables and the impairment of inventory associated with the Company's Russian and Ukrainian operations.

The Company's cost structure benefited from its simplification/modernization initiative including the FY21 Restructuring Actions which have resulted in annualized savings of $71.0 million and pre-tax charges of $86.4 million inception to date. We recorded $4.2 million of pre-tax restructuring and related charges in 2022.

We reported earnings per diluted share (EPS) of $1.72 for 2022. EPS for the year was unfavorably affected by restructuring and related charges of $0.03 per share and charges related to Russian and Ukrainian operations of $0.03 per share. EPS in the prior year of $0.65 was unfavorably affected by restructuring and related charges of $0.40 per share, the effects from the early extinguishment of debt of $0.08 per share and the partial annuitization of the Canadian pension plans of $0.02 per share, partially offset by a discrete tax benefit of $0.11 per share.

We generated cash flow from operating activities of $181.4 million in 2022 compared to $235.7 million during the prior year. Capital expenditures were $96.9 million and $127.3 million during 2022 and 2021, respectively. During 2022, the Company returned a total of $152 million to the shareholders through $85.4 million in share repurchases under the three-year share repurchase program and $66.6 million in dividends. In 2021, the Company returned $66.7 million to shareholders through dividends.

For a discussion related to the results of operations, changes in financial condition and liquidity and capital resources for fiscal 2020 refer to Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in our fiscal 2021 Annual Report on Form 10-K, which was filed with the United States Securities and Exchange Commission on August 10, 2021.

RESULTS OF CONTINUING OPERATIONS

SALES Sales in 2022 were $2,012.5 million, a 9 percent increase from $1,841.4 million in 2021. The increase was primarily due to organic sales growth of 11 percent, partially offset by a 2 percent unfavorable currency exchange effect.

Our sales growth (decline) by end market and region are as follows:

| 2022 | ||||||||

| (in percentages) | As Reported | Constant Currency | ||||||

| End market sales growth (decline): | ||||||||

| Aerospace | 21% | 23% | ||||||