Pay vs Performance Disclosure

Unit_pure in Millions |

12 Months Ended |

|

Dec. 31, 2023

USD ($)

|

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

Dec. 31, 2020

USD ($)

|

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

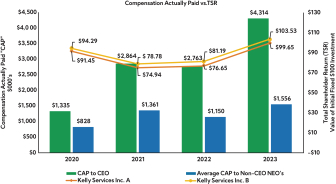

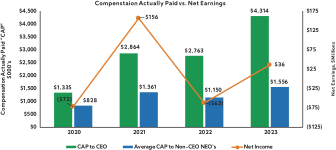

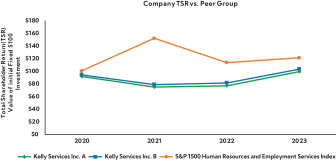

Pay vs. Performance The following table sets forth the compensation for our Chief Executive Officer (“CEO”) and the average compensation for our other non-CEO named executive officers (“NEOs”), both as reported in the Summary Compensation Table (“SCT”) and with certain adjustments to reflect the compensation actually paid (“CAP”) to such individuals, as defined under SEC rules, for the years 2023, 2022, 2021, and 2020. The table also provides information on our cumulative total shareholder return (“TSR”) for both our Class A and Class B Common Stock; the cumulative TSR of our peer group; Net Earnings; and the Company-Selected Measure (“CSM”), Non-GAAP Adjusted Earnings from Operations (“EFO”), over such years in accordance with SEC rules. Pay vs. Performance Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary

Compensation

Table Total to

CEO

(b) |

|

Compensation Actually Paid CEO (1)(2) (c) |

|

Average Summary Compensation Table Total for Non-CEO NEOs (d) |

|

Average Compensation Actually Paid to Non-CEO NEOs (1)(2) (e) |

|

Value of Initial Fixed $100

Investment Based On: |

|

Net

Earnings

(Loss) in

millions |

|

CSM:: Non-GAAP Adj EFO in millions (4) (j) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

$ |

4,163,424 |

|

|

|

$ |

4,313,597 |

|

|

|

$ |

1,407,120 |

|

|

|

$ |

1,555,635 |

|

|

|

$ |

99.65 |

|

|

|

$ |

103.53 |

|

|

|

$ |

121.22 |

|

|

|

|

$36.4 |

|

|

$69.1 |

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

$ |

3,535,281 |

|

|

|

$ |

2,762,629 |

|

|

|

$ |

1,331,744 |

|

|

|

$ |

1,150,597 |

|

|

|

$ |

76.65 |

|

|

|

$ |

81.19 |

|

|

|

$ |

113.87 |

|

|

|

|

($62.5 |

) |

|

$68.3 |

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

$ |

3,938,608 |

|

|

|

$ |

2,864,364 |

|

|

|

$ |

1,640,264 |

|

|

|

$ |

1,362,908 |

|

|

|

$ |

74.94 |

|

|

|

$ |

78.78 |

|

|

|

$ |

152.43 |

|

|

|

|

$156.1 |

|

|

$52.6 |

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

$ |

1,550,693 |

|

|

|

$ |

1,334,735 |

|

|

|

$ |

786,788 |

|

|

|

$ |

827,855 |

|

|

|

$ |

91.45 |

|

|

|

$ |

94.29 |

|

|

|

$ |

100.85 |

|

|

|

|

($72.0 |

) |

|

$44.3 |

|

| (1) |

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine compensation actually paid as reported in the Pay versus Performance Table. Compensation actually paid, generally, is calculated as Summary Compensation Table total compensation adjusted to include the fair market value of equity awards as of the end of the fiscal year for the applicable year or, if earlier, the vesting date (rather than the grant date). We do not offer pension plan benefits therefore, there was not a change in pension value for any of the years reflective in this table. To calculate CAP, the following amounts were deducted from and added to SCT total compensation: | CEO and Non-CEO NEOs SCT Total for CAP Reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Total |

|

|

$4,163,424 |

|

|

|

$1,407,120 |

|

|

|

$3,535,281 |

|

|

|

$1,331,744 |

|

|

|

$3,938,608 |

|

|

|

$1,640,264 |

|

|

|

$1,550,693 |

|

|

|

$786,788 |

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Stock Awards |

|

|

($2,160,522 |

) |

|

|

($555,116 |

) |

|

|

($1,811,085 |

) |

|

|

($524,293 |

) |

|

|

($2,734,149 |

) |

|

|

($974,762 |

) |

|

|

($839,987 |

) |

|

|

($326,162 |

) |

|

|

|

|

|

|

|

|

|

FYE value of unvested awards granted during current year |

|

|

$2,236,679 |

|

|

|

$617,264 |

|

|

|

$1,052,644 |

|

|

|

$334,843 |

|

|

|

$2,045,752 |

|

|

|

$789,365 |

|

|

|

$764,875 |

|

|

|

$405,599 |

|

|

|

|

|

|

|

|

|

|

Change in value of unvested awards from prior years |

|

|

$793,531 |

|

|

|

$239,143 |

|

|

|

$68,855 |

|

|

|

$24,517 |

|

|

|

($167,781 |

) |

|

|

($41,322 |

) |

|

|

($68,333 |

) |

|

|

($20,316 |

) |

|

|

|

|

|

|

|

|

|

Change in value of awards vesting during current year from the prior years |

|

|

$66,830 |

|

|

|

$20,763 |

|

|

|

$98,065 |

|

|

|

$22,069 |

|

|

|

$7,513 |

|

|

|

$2,122 |

|

|

|

($73,595 |

) |

|

|

($18,452 |

) |

|

|

|

|

|

|

|

|

|

Prior FYE value for awards not meeting performance requirements |

|

|

($812,048 |

) |

|

|

($183,487 |

) |

|

|

($191,086 |

) |

|

|

($41,686 |

) |

|

|

($227,577 |

) |

|

|

($53,637 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Dividends accrued on unvested stock awards |

|

|

$25,703 |

|

|

|

$9,948 |

|

|

|

$9,957 |

|

|

|

$3,404 |

|

|

|

$1,998 |

|

|

|

$877 |

|

|

|

$1,082 |

|

|

|

$399 |

|

|

|

|

|

|

|

|

|

|

Compensation Actually Paid |

|

|

$4,313,597 |

|

|

|

$1,555,635 |

|

|

|

$2,762,629 |

|

|

|

$1,150,597 |

|

|

|

$2,864,364 |

|

|

|

$1,362,908 |

|

|

|

$1,334,735 |

|

|

|

$827,855 |

|

| (2) |

Compensation for the non-principal executive officer (“CEO”) and average compensation for non-CEO named executive officers (“NEOs”) reflected in columns (c) and (e) represent the following individuals for the years shown: 2023 – Peter W. Quigley, Olivier G. Thirot, Daniel H. Malan, Vanessa P. Williams and Dinette Koolhaas, 2022 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Vanessa P. Williams, and Darren L. Simons, 2021 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Tammy L. Browning, and Timothy L. Dupree, 2020 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Tammy L. Browning, and Daniel H. Malan. |

| (3) |

As permitted by SEC rules, the peer group referenced for purpose of the TSR comparison is the group of companies included in the S&P 1500 Human Resources and Employment Services Index, which is the industry peer group used for purposes of item 201(e) of Regulation S-K as well as used in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. TSR is cumulative (assuming $100 was invested on December 31, 2019) for the measurement period ending December 31, 2019 and ending on December 31 of 2023, 2022, 2021, 2020, respectively. |

| (4) |

The following amounts are the reconciliation of the CSM, EFO (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

$24.3 |

|

|

|

$14.8 |

|

|

|

$48.6 |

|

|

|

($93.6 |

) |

|

|

|

|

|

Gain on sale of assets |

|

|

|

|

|

|

(6.2 |

) (4) |

|

|

|

|

|

|

(32.1 |

) (8) |

|

|

|

|

|

Loss on disposal |

|

|

|

|

|

|

18.7 |

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill impairment charge |

|

|

|

|

|

|

41.0 |

(6) |

|

|

|

|

|

|

147.7 |

(9) |

|

|

|

|

|

Asset impairment charge |

|

|

2.4 |

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charge |

|

|

35.5 |

(2) |

|

|

|

|

|

|

4.0 |

(7) |

|

|

12.8 |

(10) |

|

|

|

|

|

Transaction costs |

|

|

6.9 |

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer dispute |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.5 |

(11) |

|

|

|

|

|

Adjusted |

|

|

$69.1 |

|

|

|

$68.3 |

|

|

|

$52.6 |

|

|

|

$44.3 |

|

| (1) |

Asset impairment charge in 2023 represents the impairment of assets related to an unoccupied existing office space lease |

| (2) |

Restructuring charges in 2023 represents costs related to a comprehensive transformation initiative that includes actions that will further streamline the Company’s operating model to enhance organizational efficiency and effectiveness |

| (3) |

Transaction costs, which includes employee termination costs, incurred in the fourth quarter of 2023 directly related to the sale of the EMEA staffing operations in the first quarter of 2024 |

| (4) |

Gain on sale of assets in 2022 is related to the sale of real property in the fourth quarter, under-utilized real property in the second quarter, and other real property sold in the first quarter of 2022 |

| (5) |

Loss on disposal in 2022 represents the write-off of the net assets of our Russian operations that were sold in the third quarter of 2022 |

| (6) |

Goodwill impairment charge in 2022 is the result of interim impairment tests the Company performed related to RocketPower due to triggering events caused by changes in market conditions |

| (7) |

Restructuring charges in 2021 represents severance costs as part of cost management actions designed to increase operational efficiencies with enterprise functions that provide centralize support to operating units |

| (8) |

Gain on sale of assets primarily represents the excess of proceeds over the cost of the headquarters properties sold during the first quarter of 2020 |

| (9) |

The goodwill impairment charge is a result of an interim impairment test the Company performed during the first quarter of 2020, due to a triggering event caused by a decline in the Company’s common stock price |

| (10) |

Restructuring charges in 2020 represents severance and lease terminations in preparation for a new operating model adopted in the third quarter of 2020 |

| (11) |

Customer dispute in 2020 represents a non-cash charge in Mexico to increase the reserve against a long-term receivable from a former customer based on an updated probability of loss assessment |

|

|

|

|

| Company Selected Measure Name |

EFO

|

|

|

|

| Named Executive Officers, Footnote |

Compensation for the non-principal executive officer (“CEO”) and average compensation for non-CEO named executive officers (“NEOs”) reflected in columns (c) and (e) represent the following individuals for the years shown: 2023 – Peter W. Quigley, Olivier G. Thirot, Daniel H. Malan, Vanessa P. Williams and Dinette Koolhaas, 2022 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Vanessa P. Williams, and Darren L. Simons, 2021 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Tammy L. Browning, and Timothy L. Dupree, 2020 – Peter W. Quigley, Olivier G. Thirot, Dinette Koolhaas, Tammy L. Browning, and Daniel H. Malan.

|

|

|

|

| Peer Group Issuers, Footnote |

As permitted by SEC rules, the peer group referenced for purpose of the TSR comparison is the group of companies included in the S&P 1500 Human Resources and Employment Services Index, which is the industry peer group used for purposes of item 201(e) of Regulation S-K as well as used in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. TSR is cumulative (assuming $100 was invested on December 31, 2019) for the measurement period ending December 31, 2019 and ending on December 31 of 2023, 2022, 2021, 2020, respectively.

|

|

|

|

| PEO Total Compensation Amount |

$ 4,163,424

|

$ 3,535,281

|

$ 3,938,608

|

$ 1,550,693

|

| PEO Actually Paid Compensation Amount |

$ 4,313,597

|

2,762,629

|

2,864,364

|

1,334,735

|

| Adjustment To PEO Compensation, Footnote |

CEO and Non-CEO NEOs SCT Total for CAP Reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Total |

|

|

$4,163,424 |

|

|

|

$1,407,120 |

|

|

|

$3,535,281 |

|

|

|

$1,331,744 |

|

|

|

$3,938,608 |

|

|

|

$1,640,264 |

|

|

|

$1,550,693 |

|

|

|

$786,788 |

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Stock Awards |

|

|

($2,160,522 |

) |

|

|

($555,116 |

) |

|

|

($1,811,085 |

) |

|

|

($524,293 |

) |

|

|

($2,734,149 |

) |

|

|

($974,762 |

) |

|

|

($839,987 |

) |

|

|

($326,162 |

) |

|

|

|

|

|

|

|

|

|

FYE value of unvested awards granted during current year |

|

|

$2,236,679 |

|

|

|

$617,264 |

|

|

|

$1,052,644 |

|

|

|

$334,843 |

|

|

|

$2,045,752 |

|

|

|

$789,365 |

|

|

|

$764,875 |

|

|

|

$405,599 |

|

|

|

|

|

|

|

|

|

|

Change in value of unvested awards from prior years |

|

|

$793,531 |

|

|

|

$239,143 |

|

|

|

$68,855 |

|

|

|

$24,517 |

|

|

|

($167,781 |

) |

|

|

($41,322 |

) |

|

|

($68,333 |

) |

|

|

($20,316 |

) |

|

|

|

|

|

|

|

|

|

Change in value of awards vesting during current year from the prior years |

|

|

$66,830 |

|

|

|

$20,763 |

|

|

|

$98,065 |

|

|

|

$22,069 |

|

|

|

$7,513 |

|

|

|

$2,122 |

|

|

|

($73,595 |

) |

|

|

($18,452 |

) |

|

|

|

|

|

|

|

|

|

Prior FYE value for awards not meeting performance requirements |

|

|

($812,048 |

) |

|

|

($183,487 |

) |

|

|

($191,086 |

) |

|

|

($41,686 |

) |

|

|

($227,577 |

) |

|

|

($53,637 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Dividends accrued on unvested stock awards |

|

|

$25,703 |

|

|

|

$9,948 |

|

|

|

$9,957 |

|

|

|

$3,404 |

|

|

|

$1,998 |

|

|

|

$877 |

|

|

|

$1,082 |

|

|

|

$399 |

|

|

|

|

|

|

|

|

|

|

Compensation Actually Paid |

|

|

$4,313,597 |

|

|

|

$1,555,635 |

|

|

|

$2,762,629 |

|

|

|

$1,150,597 |

|

|

|

$2,864,364 |

|

|

|

$1,362,908 |

|

|

|

$1,334,735 |

|

|

|

$827,855 |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,407,120

|

1,331,744

|

1,640,264

|

786,788

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,555,635

|

1,150,597

|

1,362,908

|

827,855

|

| Adjustment to Non-PEO NEO Compensation Footnote |

CEO and Non-CEO NEOs SCT Total for CAP Reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Total |

|

|

$4,163,424 |

|

|

|

$1,407,120 |

|

|

|

$3,535,281 |

|

|

|

$1,331,744 |

|

|

|

$3,938,608 |

|

|

|

$1,640,264 |

|

|

|

$1,550,693 |

|

|

|

$786,788 |

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Stock Awards |

|

|

($2,160,522 |

) |

|

|

($555,116 |

) |

|

|

($1,811,085 |

) |

|

|

($524,293 |

) |

|

|

($2,734,149 |

) |

|

|

($974,762 |

) |

|

|

($839,987 |

) |

|

|

($326,162 |

) |

|

|

|

|

|

|

|

|

|

FYE value of unvested awards granted during current year |

|

|

$2,236,679 |

|

|

|

$617,264 |

|

|

|

$1,052,644 |

|

|

|

$334,843 |

|

|

|

$2,045,752 |

|

|

|

$789,365 |

|

|

|

$764,875 |

|

|

|

$405,599 |

|

|

|

|

|

|

|

|

|

|

Change in value of unvested awards from prior years |

|

|

$793,531 |

|

|

|

$239,143 |

|

|

|

$68,855 |

|

|

|

$24,517 |

|

|

|

($167,781 |

) |

|

|

($41,322 |

) |

|

|

($68,333 |

) |

|

|

($20,316 |

) |

|

|

|

|

|

|

|

|

|

Change in value of awards vesting during current year from the prior years |

|

|

$66,830 |

|

|

|

$20,763 |

|

|

|

$98,065 |

|

|

|

$22,069 |

|

|

|

$7,513 |

|

|

|

$2,122 |

|

|

|

($73,595 |

) |

|

|

($18,452 |

) |

|

|

|

|

|

|

|

|

|

Prior FYE value for awards not meeting performance requirements |

|

|

($812,048 |

) |

|

|

($183,487 |

) |

|

|

($191,086 |

) |

|

|

($41,686 |

) |

|

|

($227,577 |

) |

|

|

($53,637 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Dividends accrued on unvested stock awards |

|

|

$25,703 |

|

|

|

$9,948 |

|

|

|

$9,957 |

|

|

|

$3,404 |

|

|

|

$1,998 |

|

|

|

$877 |

|

|

|

$1,082 |

|

|

|

$399 |

|

|

|

|

|

|

|

|

|

|

Compensation Actually Paid |

|

|

$4,313,597 |

|

|

|

$1,555,635 |

|

|

|

$2,762,629 |

|

|

|

$1,150,597 |

|

|

|

$2,864,364 |

|

|

|

$1,362,908 |

|

|

|

$1,334,735 |

|

|

|

$827,855 |

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

| Tabular List, Table |

As discussed in the CD&A section of this Proxy Statement, the five items listed below represent the most important financial measures we used to determine CAP for FY 2023.

|

|

|

Most Important Performance Measures |

|

|

Adjusted EFO |

Gross Profit |

EBITDA Margin |

Revenue Growth |

Stock Price |

|

|

|

|

| Peer Group Total Shareholder Return Amount |

$ 121.22

|

113.87

|

152.43

|

100.85

|

| Net Income (Loss) |

$ 36,400,000

|

$ (62,500,000)

|

$ 156,100,000

|

$ (72,000,000)

|

| Company Selected Measure Amount |

69.1

|

68.3

|

52.6

|

44.3

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Adjusted EFO

|

|

|

|

| Non-GAAP Measure Description |

| (4) |

The following amounts are the reconciliation of the CSM, EFO (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

$24.3 |

|

|

|

$14.8 |

|

|

|

$48.6 |

|

|

|

($93.6 |

) |

|

|

|

|

|

Gain on sale of assets |

|

|

|

|

|

|

(6.2 |

) (4) |

|

|

|

|

|

|

(32.1 |

) (8) |

|

|

|

|

|

Loss on disposal |

|

|

|

|

|

|

18.7 |

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill impairment charge |

|

|

|

|

|

|

41.0 |

(6) |

|

|

|

|

|

|

147.7 |

(9) |

|

|

|

|

|

Asset impairment charge |

|

|

2.4 |

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charge |

|

|

35.5 |

(2) |

|

|

|

|

|

|

4.0 |

(7) |

|

|

12.8 |

(10) |

|

|

|

|

|

Transaction costs |

|

|

6.9 |

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer dispute |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.5 |

(11) |

|

|

|

|

|

Adjusted |

|

|

$69.1 |

|

|

|

$68.3 |

|

|

|

$52.6 |

|

|

|

$44.3 |

|

| (1) |

Asset impairment charge in 2023 represents the impairment of assets related to an unoccupied existing office space lease |

| (2) |

Restructuring charges in 2023 represents costs related to a comprehensive transformation initiative that includes actions that will further streamline the Company’s operating model to enhance organizational efficiency and effectiveness |

| (3) |

Transaction costs, which includes employee termination costs, incurred in the fourth quarter of 2023 directly related to the sale of the EMEA staffing operations in the first quarter of 2024 |

| (4) |

Gain on sale of assets in 2022 is related to the sale of real property in the fourth quarter, under-utilized real property in the second quarter, and other real property sold in the first quarter of 2022 |

| (5) |

Loss on disposal in 2022 represents the write-off of the net assets of our Russian operations that were sold in the third quarter of 2022 |

| (6) |

Goodwill impairment charge in 2022 is the result of interim impairment tests the Company performed related to RocketPower due to triggering events caused by changes in market conditions |

| (7) |

Restructuring charges in 2021 represents severance costs as part of cost management actions designed to increase operational efficiencies with enterprise functions that provide centralize support to operating units |

| (8) |

Gain on sale of assets primarily represents the excess of proceeds over the cost of the headquarters properties sold during the first quarter of 2020 |

| (9) |

The goodwill impairment charge is a result of an interim impairment test the Company performed during the first quarter of 2020, due to a triggering event caused by a decline in the Company’s common stock price |

| (10) |

Restructuring charges in 2020 represents severance and lease terminations in preparation for a new operating model adopted in the third quarter of 2020 |

| (11) |

Customer dispute in 2020 represents a non-cash charge in Mexico to increase the reserve against a long-term receivable from a former customer based on an updated probability of loss assessment |

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Gross Profit

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

EBITDA Margin

|

|

|

|

| Measure:: 4 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Revenue Growth

|

|

|

|

| Measure:: 5 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Stock Price

|

|

|

|

| Class A [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Total Shareholder Return Amount |

$ 99.65

|

$ 76.65

|

$ 74.94

|

$ 91.45

|

| Class B [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Total Shareholder Return Amount |

103.53

|

81.19

|

78.78

|

94.29

|

| PEO | Summary Compensation Table Stock Awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(2,160,522)

|

(1,811,085)

|

(2,734,149)

|

(839,987)

|

| PEO | FYE value of unvested awards granted during current year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

2,236,679

|

1,052,644

|

2,045,752

|

764,875

|

| PEO | Change in value of unvested awards from prior years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

793,531

|

68,855

|

(167,781)

|

(68,333)

|

| PEO | Change in value of awards vesting during current year from the prior years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

66,830

|

98,065

|

7,513

|

(73,595)

|

| PEO | Prior FYE value for awards not meeting performance requirements [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(812,048)

|

(191,086)

|

(227,577)

|

0

|

| PEO | Dividends accrued on unvested stock awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

25,703

|

9,957

|

1,998

|

1,082

|

| Non-PEO NEO | Summary Compensation Table Stock Awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(555,116)

|

(524,293)

|

(974,762)

|

(326,162)

|

| Non-PEO NEO | FYE value of unvested awards granted during current year [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

617,264

|

334,843

|

789,365

|

405,599

|

| Non-PEO NEO | Change in value of unvested awards from prior years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

239,143

|

24,517

|

(41,322)

|

(20,316)

|

| Non-PEO NEO | Change in value of awards vesting during current year from the prior years [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

20,763

|

22,069

|

2,122

|

(18,452)

|

| Non-PEO NEO | Prior FYE value for awards not meeting performance requirements [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(183,487)

|

(41,686)

|

(53,637)

|

0

|

| Non-PEO NEO | Dividends accrued on unvested stock awards [Member] |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 9,948

|

$ 3,404

|

$ 877

|

$ 399

|