DELAWARE | 0-1088 | 38-1510762 |

(State or other | (Commission | (IRS Employer |

jurisdiction of | File Number) | Identification |

incorporation) | Number) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): [ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) [ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) [ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) [ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

KELLY SERVICES, INC. | ||

February 17, 2017 | ||

/s/ Olivier G. Thirot Olivier G. Thirot Senior Vice President and Chief Financial Officer (Principal Financial Officer) | ||

February 17, 2017 | ||

/s/ Laura S. Lockhart Laura S. Lockhart Vice President, Corporate Controller and Chief Accounting Officer (Principal Accounting Officer) | ||

Exhibit No. | Description |

99.1 | Revised financial information for year end January 1, 2017. |

99.2 | Revised presentation materials for year end January 1, 2017. |

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||

CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||||||||||

FOR THE 13 WEEKS ENDED JANUARY 1, 2017 AND 14 WEEKS ENDED JANUARY 3, 2016 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||

% | CC % | |||||||||||||||

2016 | 2015 | Change | Change | Change | ||||||||||||

Revenue from services | $ | 1,304.4 | $ | 1,461.6 | $ | (157.2 | ) | (10.8 | ) | % | (10.1 | ) | % | |||

Cost of services | 1,076.4 | 1,212.1 | (135.7 | ) | (11.2 | ) | ||||||||||

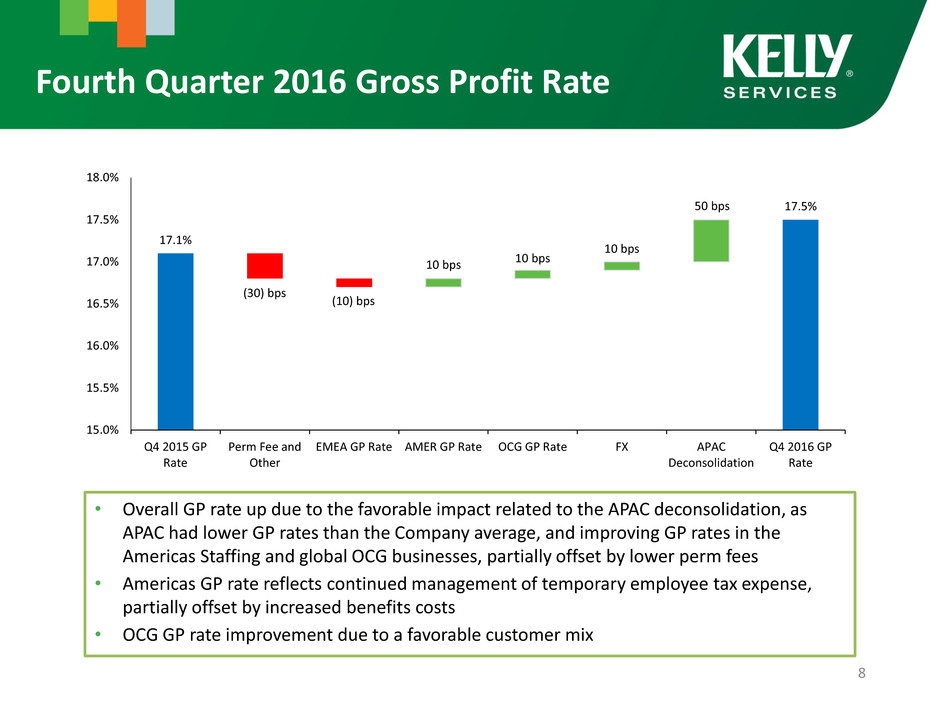

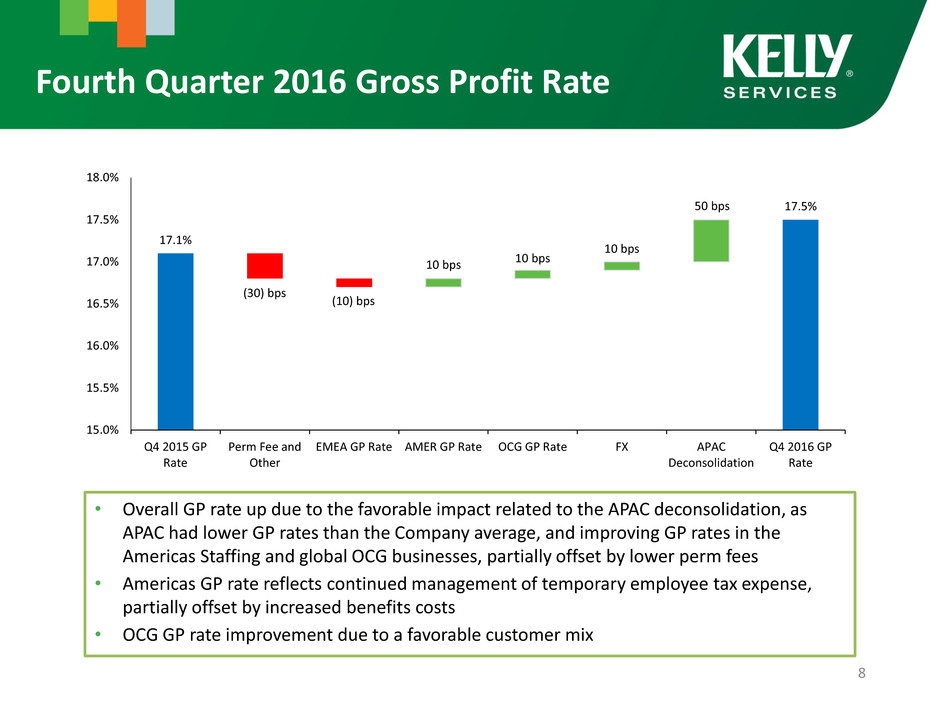

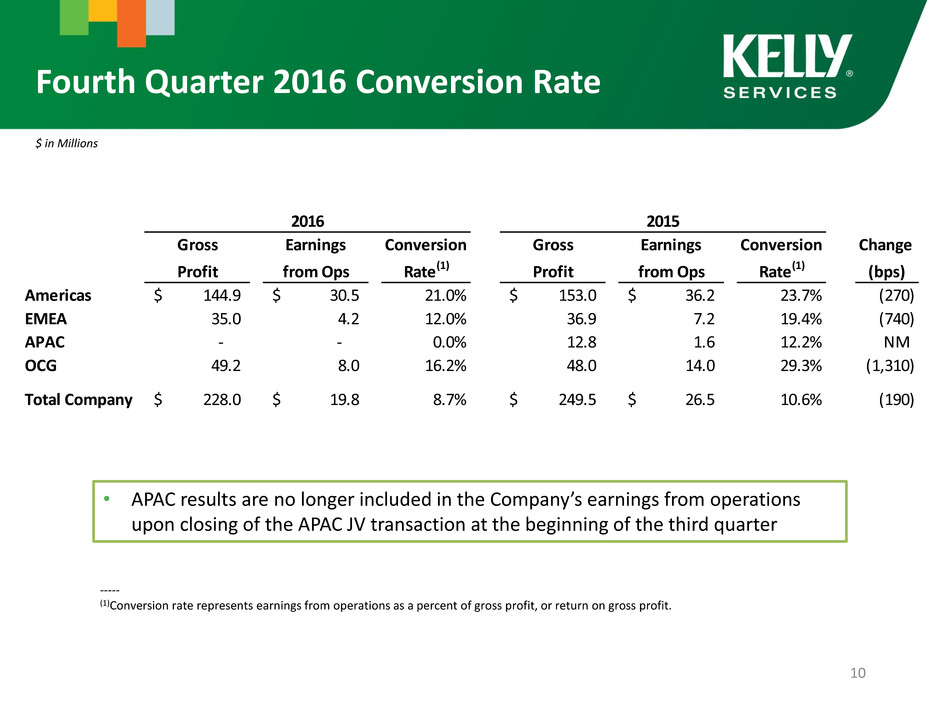

Gross profit | 228.0 | 249.5 | (21.5 | ) | (8.6 | ) | (8.1 | ) | ||||||||

Selling, general and administrative expenses | 208.2 | 223.0 | (14.8 | ) | (6.7 | ) | (6.2 | ) | ||||||||

Earnings from operations | 19.8 | 26.5 | (6.7 | ) | (25.2 | ) | ||||||||||

Other income (expense), net | 0.7 | (0.7 | ) | 1.4 | 204.1 | |||||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 20.5 | 25.8 | (5.3 | ) | (20.8 | ) | ||||||||||

Income tax expense (benefit) | 1.8 | (8.4 | ) | 10.2 | 121.4 | |||||||||||

Net earnings before equity in net earnings (loss) of affiliate | 18.7 | 34.2 | (15.5 | ) | (45.4 | ) | ||||||||||

Equity in net earnings (loss) of affiliate | 1.1 | — | 1.1 | NM | ||||||||||||

Net earnings | $ | 19.8 | $ | 34.2 | $ | (14.4 | ) | (42.0 | ) | % | ||||||

Basic earnings per share | $ | 0.51 | $ | 0.88 | $ | (0.37 | ) | (42.0 | ) | % | ||||||

Diluted earnings per share | $ | 0.51 | $ | 0.88 | $ | (0.37 | ) | (42.0 | ) | % | ||||||

STATISTICS: | ||||||||||||||||

Gross profit rate | 17.5 | % | 17.1 | % | 0.4 | pts. | ||||||||||

Selling, general and administrative expenses: | ||||||||||||||||

% of revenue | 16.0 | 15.3 | 0.7 | |||||||||||||

% of gross profit | 91.3 | 89.4 | 1.9 | |||||||||||||

% Return: | ||||||||||||||||

Earnings from operations | 1.5 | 1.8 | (0.3 | ) | ||||||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 1.6 | 1.8 | (0.2 | ) | ||||||||||||

Net earnings | 1.5 | 2.3 | (0.8 | ) | ||||||||||||

Effective income tax rate | 8.8 | % | (32.4 | ) | % | 41.2 | pts. | |||||||||

Average number of shares outstanding (millions): | ||||||||||||||||

Basic | 38.2 | 38.0 | ||||||||||||||

Diluted | 38.6 | 38.0 | ||||||||||||||

Shares adjusted for nonvested restricted awards (millions): | ||||||||||||||||

Basic | 38.9 | 38.9 | ||||||||||||||

Diluted | 39.2 | 38.9 | ||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||

CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||||||||||

FOR THE 52 WEEKS ENDED JANUARY 1, 2017 AND 53 WEEKS ENDED JANUARY 3, 2016 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||

% | CC % | |||||||||||||||

2016 | 2015 | Change | Change | Change | ||||||||||||

Revenue from services | $ | 5,276.8 | $ | 5,518.2 | $ | (241.4 | ) | (4.4 | ) | % | (3.2 | ) | % | |||

Cost of services | 4,370.5 | 4,597.9 | (227.4 | ) | (4.9 | ) | ||||||||||

Gross profit | 906.3 | 920.3 | (14.0 | ) | (1.5 | ) | (0.5 | ) | ||||||||

Selling, general and administrative expenses | 843.1 | 853.6 | (10.5 | ) | (1.2 | ) | (0.3 | ) | ||||||||

Earnings from operations | 63.2 | 66.7 | (3.5 | ) | (5.2 | ) | ||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | — | 87.2 | NM | ||||||||||||

Other expense, net | (0.7 | ) | (3.5 | ) | 2.8 | 80.6 | ||||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 149.7 | 63.2 | 86.5 | 136.8 | ||||||||||||

Income tax expense (benefit) | 30.0 | 8.7 | 21.3 | 245.1 | ||||||||||||

Net earnings before equity in net earnings (loss) of affiliate | 119.7 | 54.5 | 65.2 | 119.5 | ||||||||||||

Equity in net earnings (loss) of affiliate | 1.1 | (0.7 | ) | 1.8 | 251.9 | |||||||||||

Net earnings | $ | 120.8 | $ | 53.8 | $ | 67.0 | 124.5 | % | ||||||||

Basic earnings per share | $ | 3.10 | $ | 1.39 | $ | 1.71 | 123.0 | % | ||||||||

Diluted earnings per share | $ | 3.08 | $ | 1.39 | $ | 1.69 | 121.6 | % | ||||||||

STATISTICS: | ||||||||||||||||

Gross profit rate | 17.2 | % | 16.7 | % | 0.5 | pts. | ||||||||||

Selling, general and administrative expenses: | ||||||||||||||||

% of revenue | 16.0 | 15.5 | 0.5 | |||||||||||||

% of gross profit | 93.0 | 92.8 | 0.2 | |||||||||||||

% Return: | ||||||||||||||||

Earnings from operations | 1.2 | 1.2 | — | |||||||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 2.8 | 1.1 | 1.7 | |||||||||||||

Net earnings | 2.3 | 1.0 | 1.3 | |||||||||||||

Effective income tax rate | 20.0 | % | 13.7 | % | 6.3 | pts. | ||||||||||

Average number of shares outstanding (millions): | ||||||||||||||||

Basic | 38.1 | 37.8 | ||||||||||||||

Diluted | 38.4 | 37.9 | ||||||||||||||

Shares adjusted for nonvested restricted awards (millions): | ||||||||||||||||

Basic | 38.9 | 38.8 | ||||||||||||||

Diluted | 39.2 | 38.9 | ||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

Fourth Quarter | ||||||||||||||

2016 | 2015 | % | CC % | |||||||||||

(13 Wks) | (14 Wks) | Change | Change | |||||||||||

AMERICAS | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 660.4 | $ | 696.1 | (5.1 | ) | % | (4.7 | ) | % | ||||

Staffing fee-based income included in revenue from services | 3.3 | 3.7 | (11.6 | ) | (11.1 | ) | ||||||||

Gross profit | 106.5 | 110.0 | (3.2 | ) | (2.8 | ) | ||||||||

Gross profit rate | 16.1 | % | 15.8 | % | 0.3 | pts. | ||||||||

PT | ||||||||||||||

Revenue from services | $ | 228.8 | $ | 250.1 | (8.5 | ) | % | (8.5 | ) | % | ||||

Staffing fee-based income included in revenue from services | 4.2 | 4.5 | (6.2 | ) | (6.3 | ) | ||||||||

Gross profit | 38.4 | 43.0 | (10.6 | ) | (10.7 | ) | ||||||||

Gross profit rate | 16.8 | % | 17.2 | % | (0.4 | ) | pts. | |||||||

Total Americas | ||||||||||||||

Revenue from services | $ | 889.2 | $ | 946.2 | (6.0 | ) | % | (5.7 | ) | % | ||||

Staffing fee-based income included in revenue from services | 7.5 | 8.2 | (8.7 | ) | (8.5 | ) | ||||||||

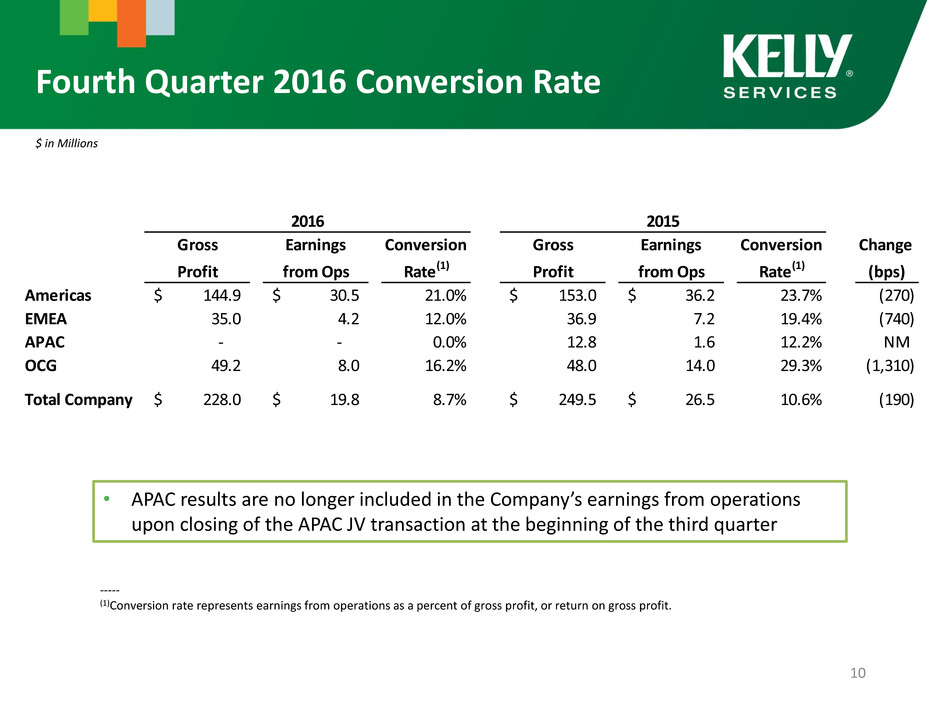

Gross profit | 144.9 | 153.0 | (5.3 | ) | (5.0 | ) | ||||||||

Total SG&A expenses | 114.4 | 116.8 | (2.0 | ) | (2.1 | ) | ||||||||

Earnings from operations | 30.5 | 36.2 | (15.7 | ) | ||||||||||

Gross profit rate | 16.3 | % | 16.2 | % | 0.1 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 12.9 | 12.3 | 0.6 | |||||||||||

% of gross profit | 79.0 | 76.3 | 2.7 | |||||||||||

Return on sales | 3.4 | 3.8 | (0.4 | ) | ||||||||||

EMEA | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 199.1 | $ | 200.5 | (0.7 | ) | % | 1.7 | % | |||||

Staffing fee-based income included in revenue from services | 3.1 | 3.3 | (6.3 | ) | (5.2 | ) | ||||||||

Gross profit | 26.4 | 27.5 | (4.0 | ) | (2.3 | ) | ||||||||

Gross profit rate | 13.3 | % | 13.7 | % | (0.4 | ) | pts. | |||||||

PT | ||||||||||||||

Revenue from services | $ | 42.4 | $ | 44.7 | (5.3 | ) | % | (3.2 | ) | % | ||||

Staffing fee-based income included in revenue from services | 2.4 | 2.4 | 1.9 | 3.6 | ||||||||||

Gross profit | 8.6 | 9.4 | (8.7 | ) | (7.1 | ) | ||||||||

Gross profit rate | 20.2 | % | 21.0 | % | (0.8 | ) | pts. | |||||||

Total EMEA | ||||||||||||||

Revenue from services | $ | 241.5 | $ | 245.2 | (1.5 | ) | % | 0.8 | % | |||||

Staffing fee-based income included in revenue from services | 5.5 | 5.7 | (2.9 | ) | (1.6 | ) | ||||||||

Gross profit | 35.0 | 36.9 | (5.2 | ) | (3.5 | ) | ||||||||

Total SG&A expenses | 30.8 | 29.7 | 3.5 | 6.0 | ||||||||||

Earnings from operations | 4.2 | 7.2 | (41.2 | ) | ||||||||||

Gross profit rate | 14.5 | % | 15.0 | % | (0.5 | ) | pts. | |||||||

Expense rates: | ||||||||||||||

% of revenue | 12.7 | 12.1 | 0.6 | |||||||||||

% of gross profit | 88.0 | 80.6 | 7.4 | |||||||||||

Return on sales | 1.7 | 2.9 | (1.2 | ) | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

Fourth Quarter | ||||||||||||||

2016 | 2015 | % | CC % | |||||||||||

(13 Wks) | (14 Wks) | Change | Change | |||||||||||

OCG | ||||||||||||||

Revenue from services | $ | 186.1 | $ | 187.5 | (0.7 | ) | % | (0.4 | ) | % | ||||

Gross profit | 49.2 | 48.0 | 2.4 | 2.9 | ||||||||||

Total SG&A expenses | 41.2 | 34.0 | 21.3 | 22.3 | ||||||||||

Earnings from operations | 8.0 | 14.0 | (43.3 | ) | ||||||||||

Gross profit rate | 26.4 | % | 25.6 | % | 0.8 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 22.1 | 18.1 | 4.0 | |||||||||||

% of gross profit | 83.8 | 70.7 | 13.1 | |||||||||||

Return on sales | 4.3 | 7.5 | (3.2 | ) | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

December Year to Date | ||||||||||||||

2016 | 2015 | % | CC % | |||||||||||

(52 Wks) | (53 Wks) | Change | Change | |||||||||||

AMERICAS | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 2,548.0 | $ | 2,604.3 | (2.2 | ) | % | (1.1 | ) | % | ||||

Staffing fee-based income included in revenue from services | 14.7 | 14.5 | 1.1 | 1.7 | ||||||||||

Gross profit | 402.4 | 400.3 | 0.5 | 1.3 | ||||||||||

Gross profit rate | 15.8 | % | 15.4 | % | 0.4 | pts. | ||||||||

PT | ||||||||||||||

Revenue from services | $ | 947.1 | $ | 971.9 | (2.6 | ) | % | (2.5 | ) | % | ||||

Staffing fee-based income included in revenue from services | 17.9 | 17.6 | 1.7 | 2.3 | ||||||||||

Gross profit | 162.7 | 165.0 | (1.4 | ) | (1.3 | ) | ||||||||

Gross profit rate | 17.2 | % | 17.0 | % | 0.2 | pts. | ||||||||

Total Americas | ||||||||||||||

Revenue from services | $ | 3,495.1 | $ | 3,576.2 | (2.3 | ) | % | (1.5 | ) | % | ||||

Staffing fee-based income included in revenue from services | 32.6 | 32.1 | 1.4 | 2.0 | ||||||||||

Gross profit | 565.1 | 565.3 | — | 0.6 | ||||||||||

SG&A expenses excluding restructuring charges | 454.9 | 456.6 | (0.4 | ) | 0.1 | |||||||||

Restructuring charges | 2.2 | — | NM | |||||||||||

Total SG&A expenses | 457.1 | 456.6 | 0.1 | 0.6 | ||||||||||

Earnings from operations | 108.0 | 108.7 | (0.6 | ) | ||||||||||

Earnings from operations excluding restructuring charges | 110.2 | 108.7 | 1.4 | |||||||||||

Gross profit rate | 16.2 | % | 15.8 | % | 0.4 | pts. | ||||||||

Expense rates (excluding restructuring charges): | ||||||||||||||

% of revenue | 13.0 | 12.8 | 0.2 | |||||||||||

% of gross profit | 80.5 | 80.8 | (0.3 | ) | ||||||||||

Return on sales (excluding restructuring charges) | 3.2 | 3.0 | 0.2 | |||||||||||

EMEA | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 769.3 | $ | 773.5 | (0.5 | ) | % | 2.1 | % | |||||

Staffing fee-based income included in revenue from services | 13.5 | 13.2 | 2.9 | 6.1 | ||||||||||

Gross profit | 103.9 | 106.6 | (2.6 | ) | (0.4 | ) | ||||||||

Gross profit rate | 13.5 | % | 13.8 | % | (0.3 | ) | pts. | |||||||

PT | ||||||||||||||

Revenue from services | $ | 168.8 | $ | 171.5 | (1.6 | ) | % | 0.7 | % | |||||

Staffing fee-based income included in revenue from services | 9.7 | 10.1 | (4.0 | ) | (0.8 | ) | ||||||||

Gross profit | 34.2 | 36.6 | (6.4 | ) | (4.2 | ) | ||||||||

Gross profit rate | 20.3 | % | 21.3 | % | (1.0 | ) | pts. | |||||||

Total EMEA | ||||||||||||||

Revenue from services | $ | 938.1 | $ | 945.0 | (0.7 | ) | % | 1.9 | % | |||||

Staffing fee-based income included in revenue from services | 23.2 | 23.3 | (0.1 | ) | 3.1 | |||||||||

Gross profit | 138.1 | 143.2 | (3.5 | ) | (1.4 | ) | ||||||||

SG&A expenses excluding restructuring charges | 123.7 | 129.2 | (4.2 | ) | (1.6 | ) | ||||||||

Restructuring charges | 1.2 | — | NM | |||||||||||

Total SG&A expenses | 124.9 | 129.2 | (3.3 | ) | (0.7 | ) | ||||||||

Earnings from operations | 13.2 | 14.0 | (5.9 | ) | ||||||||||

Earnings from operations excluding restructuring charges | 14.4 | 14.0 | 2.1 | |||||||||||

Gross profit rate | 14.7 | % | 15.2 | % | (0.5 | ) | pts. | |||||||

Expense rates (excluding restructuring charges): | ||||||||||||||

% of revenue | 13.2 | 13.7 | (0.5 | ) | ||||||||||

% of gross profit | 89.6 | 90.2 | (0.6 | ) | ||||||||||

Return on sales (excluding restructuring charges) | 1.5 | 1.5 | — | |||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

December Year to Date | ||||||||||||||

2016 | 2015 | % | CC % | |||||||||||

(52 Wks) | (53 Wks) | Change | Change | |||||||||||

OCG | ||||||||||||||

Revenue from services | $ | 706.4 | $ | 673.8 | 4.8 | % | 5.3 | % | ||||||

Gross profit | 179.3 | 160.6 | 11.6 | 12.3 | ||||||||||

Total SG&A expenses | 153.4 | 132.1 | 16.2 | 17.1 | ||||||||||

Earnings from operations | 25.9 | 28.5 | (9.7 | ) | ||||||||||

Gross profit rate | 25.4 | % | 23.8 | % | 1.6 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 21.7 | 19.6 | 2.1 | |||||||||||

% of gross profit | 85.6 | 82.2 | 3.4 | |||||||||||

Return on sales | 3.7 | 4.2 | (0.5 | ) | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||

CONSOLIDATED BALANCE SHEETS | |||||||

(UNAUDITED) | |||||||

(In millions of dollars) | |||||||

Jan. 1, 2017 | Jan. 3, 2016 | ||||||

Current Assets | |||||||

Cash and equivalents | $ | 29.6 | $ | 42.2 | |||

Trade accounts receivable, less allowances of | |||||||

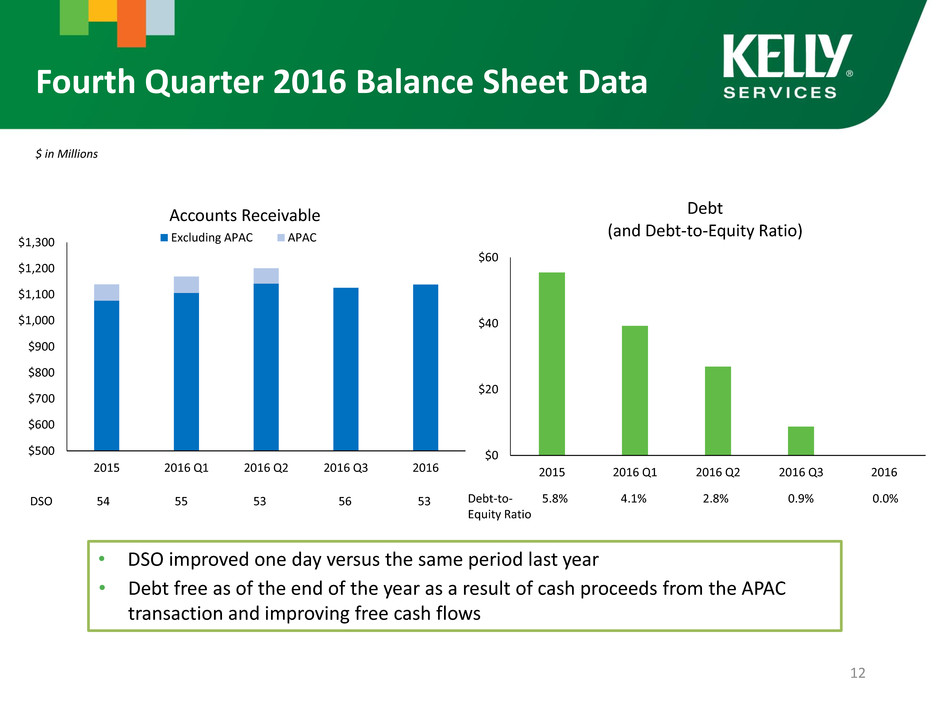

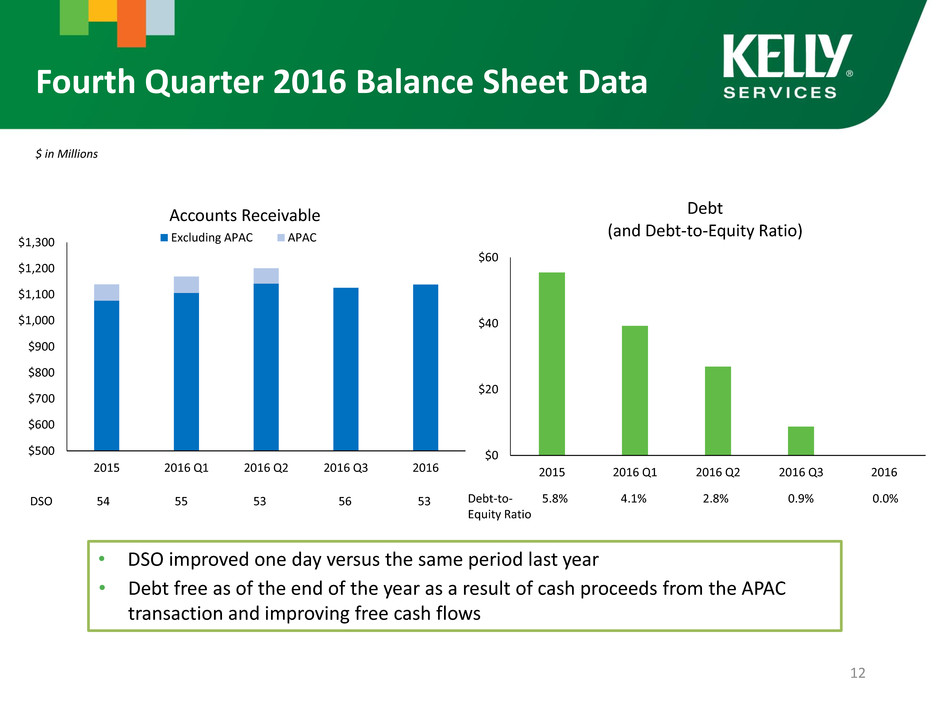

$12.5 and $10.5, respectively | 1,138.3 | 1,139.1 | |||||

Prepaid expenses and other current assets | 46.7 | 45.8 | |||||

Total current assets | 1,214.6 | 1,227.1 | |||||

Noncurrent Assets | |||||||

Property and equipment, net | 80.8 | 88.9 | |||||

Deferred taxes | 180.1 | 189.3 | |||||

Goodwill, net | 88.4 | 90.3 | |||||

Investment in equity affiliate | 114.8 | 9.4 | |||||

Other assets | 349.4 | 334.6 | |||||

Total noncurrent assets | 813.5 | 712.5 | |||||

Total Assets | $ | 2,028.1 | $ | 1,939.6 | |||

Current Liabilities | |||||||

Short-term borrowings | $ | — | $ | 55.5 | |||

Accounts payable and accrued liabilities | 455.1 | 405.5 | |||||

Accrued payroll and related taxes | 241.5 | 268.1 | |||||

Accrued insurance | 23.4 | 26.7 | |||||

Income and other taxes | 51.1 | 60.0 | |||||

Total current liabilities | 771.1 | 815.8 | |||||

Noncurrent Liabilities | |||||||

Accrued insurance | 45.5 | 40.0 | |||||

Accrued retirement benefits | 157.4 | 141.0 | |||||

Other long-term liabilities | 42.1 | 47.4 | |||||

Total noncurrent liabilities | 245.0 | 228.4 | |||||

Stockholders' Equity | |||||||

Common stock | 40.1 | 40.1 | |||||

Treasury stock | (39.0 | ) | (44.3 | ) | |||

Paid-in capital | 28.6 | 25.4 | |||||

Earnings invested in the business | 923.6 | 813.5 | |||||

Accumulated other comprehensive income | 58.7 | 60.7 | |||||

Total stockholders' equity | 1,012.0 | 895.4 | |||||

Total Liabilities and Stockholders' Equity | $ | 2,028.1 | $ | 1,939.6 | |||

STATISTICS: | |||||||

Working Capital | $ | 443.5 | $ | 411.3 | |||

Current Ratio | 1.6 | 1.5 | |||||

Debt-to-capital % | — | % | 5.8 | % | |||

Global Days Sales Outstanding | 53 | 54 | |||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||

FOR THE 52 WEEKS ENDED JANUARY 1, 2017 AND 53 WEEKS ENDED JANUARY 3, 2016 | ||||||

(UNAUDITED) | ||||||

(In millions of dollars) | ||||||

2016 | 2015 | |||||

Cash flows from operating activities: | ||||||

Net earnings | $ | 120.8 | $ | 53.8 | ||

Noncash adjustments: | ||||||

Depreciation and amortization | 21.3 | 22.3 | ||||

Provision for bad debts | 11.0 | 3.7 | ||||

Stock-based compensation | 8.0 | 6.1 | ||||

Gain on investment in TS Kelly Asia Pacific equity affiliate | (87.2 | ) | — | |||

Other, net | (3.9 | ) | (4.7 | ) | ||

Changes in operating assets and liabilities | (32.6 | ) | (57.7 | ) | ||

Net cash from operating activities | 37.4 | 23.5 | ||||

Cash flows from investing activities: | ||||||

Capital expenditures | (12.7 | ) | (16.9 | ) | ||

Net cash proceeds from investment in TS Kelly Asia Pacific equity affiliate | 23.3 | — | ||||

Investment in TS Kelly equity affiliate | — | (0.5 | ) | |||

Other investing activities | (0.3 | ) | (0.2 | ) | ||

Net cash from (used in) investing activities | 10.3 | (17.6 | ) | |||

Cash flows from financing activities: | ||||||

Net change in short-term borrowings | (55.9 | ) | (34.7 | ) | ||

Dividend payments | (10.7 | ) | (7.7 | ) | ||

Other financing activities | (0.3 | ) | 0.2 | |||

Net cash used in financing activities | (66.9 | ) | (42.2 | ) | ||

Effect of exchange rates on cash and equivalents | 6.6 | (4.6 | ) | |||

Net change in cash and equivalents | (12.6 | ) | (40.9 | ) | ||

Cash and equivalents at beginning of period | 42.2 | 83.1 | ||||

Cash and equivalents at end of period | $ | 29.6 | $ | 42.2 | ||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||

REVENUE FROM SERVICES | |||||||||||||

(UNAUDITED) | |||||||||||||

(In millions of dollars) | |||||||||||||

Fourth Quarter (Commercial, PT and OCG) | |||||||||||||

2016 | 2015 | % | CC % | ||||||||||

(13 Wks) | (14 Wks) | Change | Change | ||||||||||

Americas | |||||||||||||

United States | $ | 956.7 | $ | 998.8 | (4.2 | ) | % | (4.2 | ) | % | |||

Canada | 34.5 | 38.0 | (9.3 | ) | (9.7 | ) | |||||||

Mexico | 28.0 | 35.3 | (20.6 | ) | (6.1 | ) | |||||||

Puerto Rico | 18.3 | 24.7 | (25.8 | ) | (25.8 | ) | |||||||

Brazil | 13.3 | 8.7 | 52.2 | 29.4 | |||||||||

Total Americas | 1,050.8 | 1,105.5 | (5.0 | ) | (4.7 | ) | |||||||

EMEA | |||||||||||||

France | 61.1 | 65.6 | (6.8 | ) | (5.2 | ) | |||||||

Switzerland | 54.3 | 55.5 | (2.1 | ) | (1.0 | ) | |||||||

Portugal | 40.3 | 33.8 | 19.0 | 21.1 | |||||||||

Russia | 20.9 | 18.2 | 15.3 | 10.1 | |||||||||

United Kingdom | 18.5 | 26.7 | (31.0 | ) | (15.7 | ) | |||||||

Germany | 14.3 | 16.2 | (11.5 | ) | (10.0 | ) | |||||||

Italy | 14.2 | 14.5 | (2.1 | ) | (0.4 | ) | |||||||

Norway | 8.0 | 9.7 | (17.4 | ) | (18.7 | ) | |||||||

Other | 18.0 | 13.0 | 38.4 | 40.5 | |||||||||

Total EMEA | 249.6 | 253.2 | (1.4 | ) | 1.0 | ||||||||

APAC | |||||||||||||

Australia | 3.2 | 31.1 | (89.7 | ) | (90.1 | ) | |||||||

Singapore | 0.2 | 33.0 | (99.5 | ) | (99.5 | ) | |||||||

Malaysia | 0.1 | 14.1 | (98.6 | ) | (98.6 | ) | |||||||

New Zealand | — | 11.2 | (99.5 | ) | (99.6 | ) | |||||||

Other | 0.5 | 13.5 | (96.6 | ) | (96.5 | ) | |||||||

Total APAC | 4.0 | 102.9 | (96.0 | ) | (96.1 | ) | |||||||

Total Kelly Services, Inc. | $ | 1,304.4 | $ | 1,461.6 | (10.8 | ) | % | (10.1 | ) | % | |||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||

REVENUE FROM SERVICES | |||||||||||||

(UNAUDITED) | |||||||||||||

(In millions of dollars) | |||||||||||||

December Year to Date (Commercial, PT and OCG) | |||||||||||||

2016 | 2015 | % | CC % | ||||||||||

(52 Wks) | (53 Wks) | Change | Change | ||||||||||

Americas | |||||||||||||

United States | $ | 3,722.5 | $ | 3,705.2 | 0.5 | % | 0.5 | % | |||||

Canada | 139.7 | 160.2 | (12.8 | ) | (9.9 | ) | |||||||

Mexico | 107.6 | 130.5 | (17.6 | ) | (2.8 | ) | |||||||

Puerto Rico | 84.2 | 99.9 | (15.7 | ) | (15.7 | ) | |||||||

Brazil | 46.8 | 42.9 | 9.1 | 19.3 | |||||||||

Total Americas | 4,100.8 | 4,138.7 | (0.9 | ) | (0.2 | ) | |||||||

EMEA | |||||||||||||

France | 239.7 | 246.0 | (2.5 | ) | (2.1 | ) | |||||||

Switzerland | 210.5 | 216.2 | (2.6 | ) | (0.3 | ) | |||||||

Portugal | 151.9 | 132.5 | 14.6 | 15.0 | |||||||||

United Kingdom | 84.7 | 105.1 | (19.5 | ) | (9.3 | ) | |||||||

Russia | 69.9 | 75.6 | (7.6 | ) | 0.7 | ||||||||

Germany | 59.6 | 59.3 | 0.5 | 0.9 | |||||||||

Italy | 56.3 | 54.0 | 4.2 | 4.5 | |||||||||

Norway | 32.4 | 39.2 | (17.2 | ) | (13.5 | ) | |||||||

Other | 63.9 | 45.8 | 39.4 | 40.2 | |||||||||

Total EMEA | 968.9 | 973.7 | (0.5 | ) | 2.1 | ||||||||

APAC | |||||||||||||

Australia | 67.4 | 123.2 | (45.3 | ) | (42.3 | ) | |||||||

Singapore | 65.1 | 129.9 | (49.9 | ) | (48.8 | ) | |||||||

Malaysia | 27.9 | 59.5 | (53.1 | ) | (47.3 | ) | |||||||

New Zealand | 19.3 | 41.4 | (53.3 | ) | (48.8 | ) | |||||||

Other | 27.4 | 51.8 | (46.9 | ) | (43.4 | ) | |||||||

Total APAC | 207.1 | 405.8 | (48.9 | ) | (45.9 | ) | |||||||

Total Kelly Services, Inc. | $ | 5,276.8 | $ | 5,518.2 | (4.4 | ) | % | (3.2 | ) | % | |||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||

RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||

FOR THE 13 WEEKS ENDED JANUARY 1, 2017 AND 14 WEEKS ENDED JANUARY 3, 2016 | |||||||||||||

(UNAUDITED) | |||||||||||||

(In millions of dollars except per share data) | |||||||||||||

2016 | 2015 | ||||||||||||

As Reported | Adjusted Earnings | % Change | CC % Change | ||||||||||

Revenue from services | $ | 1,304.4 | $ | 1,362.6 | (4.3 | ) | % | (3.6 | ) | % | |||

Cost of services | 1,076.4 | 1,126.6 | (4.5 | ) | |||||||||

Gross profit | 228.0 | 236.0 | (3.4 | ) | (2.9 | ) | |||||||

SG&A expenses | 208.2 | 211.3 | (1.5 | ) | (1.0 | ) | |||||||

Earnings from operations | 19.8 | 24.7 | (19.6 | ) | |||||||||

Other income (expense), net | 0.7 | (0.6 | ) | 226.9 | |||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 20.5 | 24.1 | (15.1 | ) | |||||||||

Inc. tax expense (benefit)* | 1.8 | (8.7 | ) | 120.6 | |||||||||

Net earnings before equity in net earnings (loss) of affiliate | 18.7 | 32.8 | (43.1 | ) | |||||||||

Equity in net earnings (loss) of affiliate | 1.1 | — | NM | ||||||||||

Net earnings | $ | 19.8 | $ | 32.8 | (39.6 | ) | % | ||||||

Earnings per share: | |||||||||||||

Basic | $ | 0.51 | $ | 0.84 | (39.3 | ) | % | ||||||

Diluted | $ | 0.51 | $ | 0.84 | (39.3 | ) | % | ||||||

* Income tax benefit for the fourth quarter of 2015 includes $13.9 million related to the retroactive reinstatement of work opportunity credits for the entire year. | |||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||

RECONCILIATION OF NON-GAAP MEASURES | ||||||||||

FOR THE 13 WEEKS ENDED JANUARY 1, 2017 AND 14 WEEKS ENDED JANUARY 3, 2016 | ||||||||||

(UNAUDITED) | ||||||||||

(In millions of dollars except per share data) | ||||||||||

2015 | ||||||||||

As Reported | Disposal of APAC Businesses (Note 2) | Adjusted Earnings | ||||||||

Revenue from services | $ | 1,461.6 | $ | (99.0 | ) | $ | 1,362.6 | |||

Cost of services | 1,212.1 | (85.5 | ) | 1,126.6 | ||||||

Gross profit | 249.5 | (13.5 | ) | 236.0 | ||||||

SG&A expenses | 223.0 | (11.7 | ) | 211.3 | ||||||

Earnings from operations | 26.5 | (1.8 | ) | 24.7 | ||||||

Other (expense) income, net | (0.7 | ) | 0.1 | (0.6 | ) | |||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 25.8 | (1.7 | ) | 24.1 | ||||||

Inc. tax expense (benefit) | (8.4 | ) | (0.3 | ) | (8.7 | ) | ||||

Net earnings before equity in net earnings (loss) of affiliate | 34.2 | (1.4 | ) | 32.8 | ||||||

Equity in net earnings (loss) of affiliate | — | — | — | |||||||

Net earnings | $ | 34.2 | $ | (1.4 | ) | $ | 32.8 | |||

Earnings per share: | ||||||||||

Basic | $ | 0.88 | $ | (0.04 | ) | $ | 0.84 | |||

Diluted | $ | 0.88 | $ | (0.04 | ) | $ | 0.84 | |||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES | ||||||||||||||||||||||

FOR THE 52 WEEKS ENDED JANUARY 1, 2017 AND 53 WEEKS ENDED JANUARY 3, 2016 | ||||||||||||||||||||||

(UNAUDITED) | ||||||||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||||||||

2016 | 2015 | |||||||||||||||||||||

As Reported | Gain on Investment in Equity Affiliate (Note 1) | Restructuring Charges (Note 3) | Adjusted Earnings | Adjusted Earnings | % Change | CC % Change | ||||||||||||||||

Revenue from services | $ | 5,276.8 | $ | — | $ | — | $ | 5,276.8 | $ | 5,325.2 | (0.9 | ) | % | 0.3 | % | |||||||

Cost of services | 4,370.5 | — | — | 4,370.5 | 4,432.2 | (1.4 | ) | |||||||||||||||

Gross profit | 906.3 | — | — | 906.3 | 893.0 | 1.5 | 2.5 | |||||||||||||||

SG&A expenses | 843.1 | — | (3.4 | ) | 839.7 | 830.2 | 1.1 | 2.5 | ||||||||||||||

Earnings from operations | 63.2 | — | 3.4 | 66.6 | 62.8 | 6.2 | ||||||||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | (87.2 | ) | — | — | — | NM | |||||||||||||||

Other expense, net | (0.7 | ) | — | — | (0.7 | ) | (3.3 | ) | 79.4 | |||||||||||||

Earnings before taxes and equity in net earnings (loss) of affiliate | 149.7 | (87.2 | ) | 3.4 | 65.9 | 59.5 | 10.9 | |||||||||||||||

Inc. tax expense (benefit) | 30.0 | (23.5 | ) | 1.2 | 7.7 | 8.0 | (3.6 | ) | ||||||||||||||

Net earnings before equity in net earnings (loss) of affiliate | 119.7 | (63.7 | ) | 2.2 | 58.2 | 51.5 | 13.1 | |||||||||||||||

Equity in net earnings (loss) of affiliate | 1.1 | — | — | 1.1 | (0.7 | ) | NM | |||||||||||||||

Net earnings | $ | 120.8 | $ | (63.7 | ) | $ | 2.2 | $ | 59.3 | $ | 50.8 | 16.9 | % | |||||||||

Earnings per share: | ||||||||||||||||||||||

Basic | $ | 3.10 | $ | (1.64 | ) | $ | 0.06 | $ | 1.53 | $ | 1.31 | 16.8 | % | |||||||||

Diluted | $ | 3.08 | $ | (1.62 | ) | $ | 0.06 | $ | 1.52 | $ | 1.31 | 16.0 | % | |||||||||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | ||||||||||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||

RECONCILIATION OF NON-GAAP MEASURES | ||||||||||

FOR THE 52 WEEKS ENDED JANUARY 1, 2017 AND 53 WEEKS ENDED JANUARY 3, 2016 | ||||||||||

(UNAUDITED) | ||||||||||

(In millions of dollars except per share data) | ||||||||||

2015 | ||||||||||

As Reported | Disposal of APAC Businesses (Note 2) | Adjusted Earnings | ||||||||

Revenue from services | $ | 5,518.2 | $ | (193.0 | ) | $ | 5,325.2 | |||

Cost of services | 4,597.9 | (165.7 | ) | 4,432.2 | ||||||

Gross profit | 920.3 | (27.3 | ) | 893.0 | ||||||

SG&A expenses | 853.6 | (23.4 | ) | 830.2 | ||||||

Earnings from operations | 66.7 | (3.9 | ) | 62.8 | ||||||

Other (expense) income, net | (3.5 | ) | 0.2 | (3.3 | ) | |||||

Earnings from operations before taxes and equity in net earnings (loss) of affiliate | 63.2 | (3.7 | ) | 59.5 | ||||||

Inc. tax expense (benefit) | 8.7 | (0.7 | ) | 8.0 | ||||||

Net earnings before equity in net earnings (loss) of affiliate | 54.5 | (3.0 | ) | 51.5 | ||||||

Equity in net earnings (loss) of affiliate | (0.7 | ) | — | (0.7 | ) | |||||

Net earnings | $ | 53.8 | $ | (3.0 | ) | $ | 50.8 | |||

Earnings per share: | ||||||||||

Basic | $ | 1.39 | $ | (0.08 | ) | $ | 1.31 | |||

Diluted | $ | 1.39 | $ | (0.08 | ) | $ | 1.31 | |||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | ||||||||||

[D2/I7V&++Z_2VF?!S+4BF1O8/IE?)3'#&S892Q#^W=N_&8_S@MSLR?\

MO\'\5?QAKZGZ/D\I>L@OVT\210$! 0$! 0$! 0$! 0$%O-7T]._9+/%&[KM>

M\ _.LQ$STA&;1'64GPM1?ON#^E;]:QM;P.*OB?"U'^^X/Z5OUK.UO XJ^)\*

MT?[[@_I6_6FUO!CBKXGPM1?ONG_I6_6FUO!GCKX@NU$?\;I_Z5OUIPV\&..O

MB?"M'^^X/Z5OUIM;P9XJ^)\*T?[Z@_I6_6FUO!GBCQ/A6C_?4']*WZTVMX,<

M5?$^%J/]]P?TK?K3:W@<5?$^%:/]]0?TK?K3:W@<5?$^%:/]]0?TK?K3:W@<

M5?$^%J/]]P?TK?K3:W@<5?$^%:/]]P?TK?K6-K>#''7Q/A:B_?=/_2M^M9VM

MX,\=?%-%LB([EA>G'U?$K8P>,JLW.&$D9M.0M^)Y.;,-[78)CSCP1B56C?(&5#2-Y+NBQLB

MHTT,CH2.T.