• | APAC Joint Venture completed |

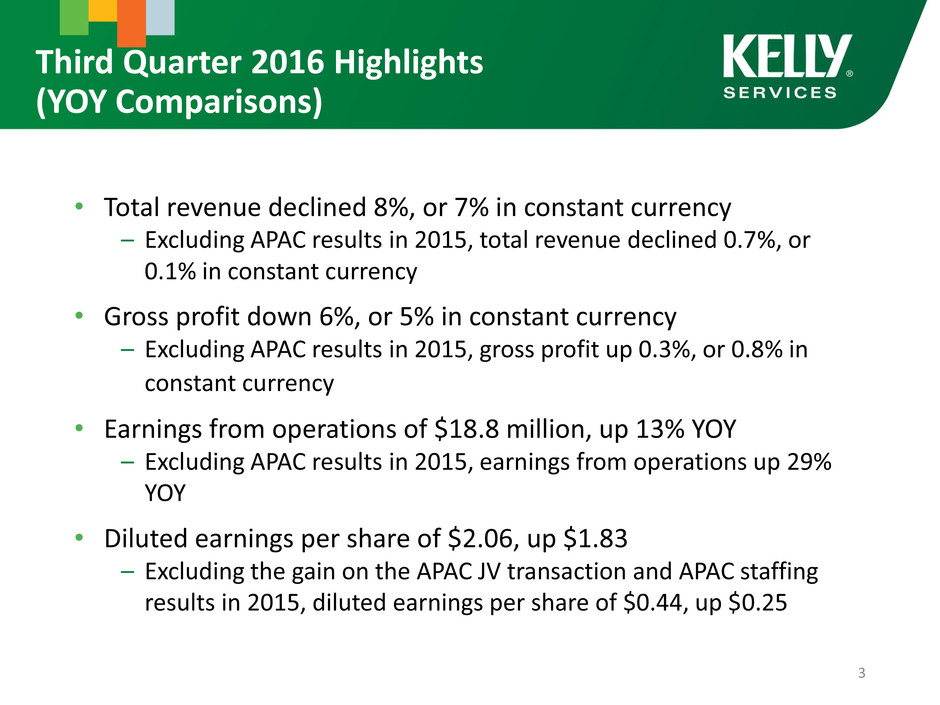

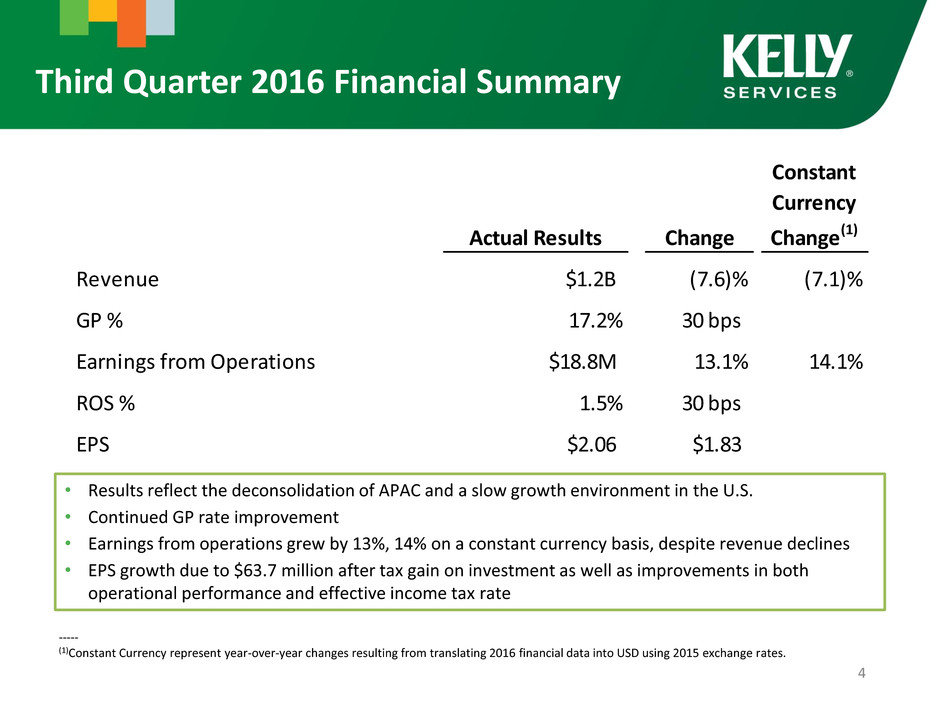

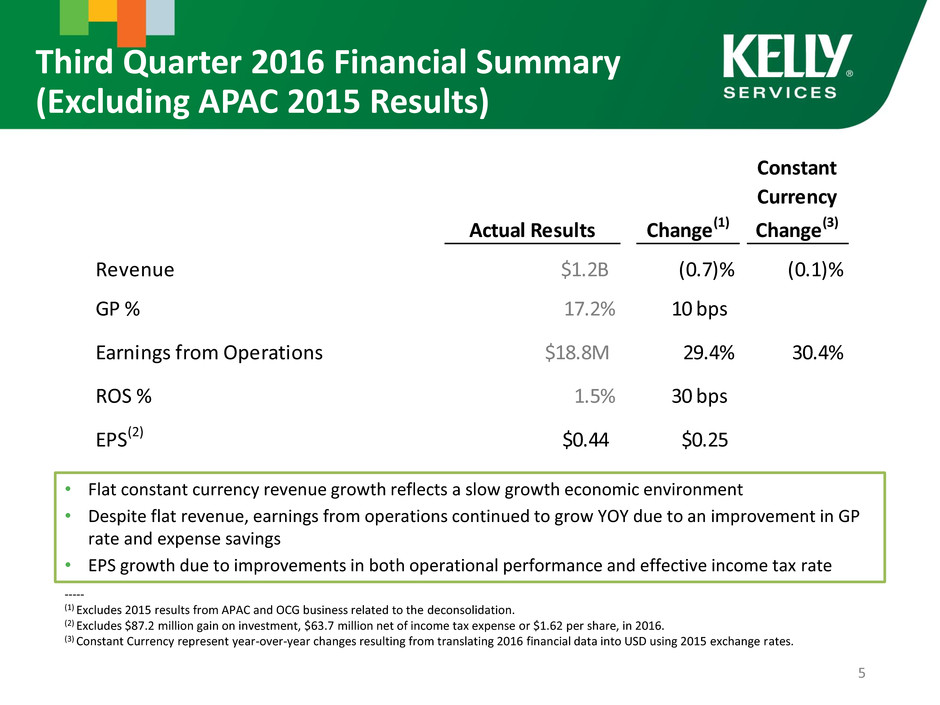

• | Total Revenue declines 8%; down 1% adjusted for APAC JV transaction |

• | Operating earnings increase 13%; up 29% adjusted for APAC JV transaction |

• | Earnings per share of $2.06 (Adjusted EPS of $0.44) versus $0.23 (Adjusted EPS of $0.19), a 132% increase on an adjusted basis |

U.S. | 1 800 288-9626 |

International | 1 651 291-5254 |

ANALYST CONTACT: | MEDIA CONTACT: |

James Polehna | Jane Stehney |

(248) 244-4586 | (248) 244-5630 |

james_polehna@kellyservices.com | jane_stehney@kellyservices.com |

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||

CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||||||||||

FOR THE 13 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||

% | CC % | |||||||||||||||

2016 | 2015 | Change | Change | Change | ||||||||||||

Revenue from services | $ | 1,247.8 | $ | 1,351.0 | $ | (103.2 | ) | (7.6 | ) | % | (7.1 | ) | % | |||

Cost of services | 1,032.7 | 1,122.8 | (90.1 | ) | (8.0 | ) | ||||||||||

Gross profit | 215.1 | 228.2 | (13.1 | ) | (5.8 | ) | (5.3 | ) | ||||||||

Selling, general and administrative expenses | 196.3 | 211.6 | (15.3 | ) | (7.3 | ) | (6.9 | ) | ||||||||

Earnings from operations | 18.8 | 16.6 | 2.2 | 13.1 | ||||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | — | 87.2 | NM | ||||||||||||

Other expense, net | (0.4 | ) | — | (0.4 | ) | NM | ||||||||||

Earnings before taxes | 105.6 | 16.6 | 89.0 | NM | ||||||||||||

Income tax expense | 24.7 | 7.5 | 17.2 | 230.6 | ||||||||||||

Net earnings | $ | 80.9 | $ | 9.1 | $ | 71.8 | NM | % | ||||||||

Basic earnings per share | $ | 2.08 | $ | 0.23 | $ | 1.85 | NM | % | ||||||||

Diluted earnings per share | $ | 2.06 | $ | 0.23 | $ | 1.83 | NM | % | ||||||||

STATISTICS: | ||||||||||||||||

Gross profit rate | 17.2 | % | 16.9 | % | 0.3 | pts. | ||||||||||

Selling, general and administrative expenses: | ||||||||||||||||

% of revenue | 15.7 | 15.7 | — | |||||||||||||

% of gross profit | 91.3 | 92.7 | (1.4 | ) | ||||||||||||

% Return: | ||||||||||||||||

Earnings from operations | 1.5 | 1.2 | 0.3 | |||||||||||||

Earnings before taxes | 8.5 | 1.2 | 7.3 | |||||||||||||

Net earnings | 6.5 | 0.7 | 5.8 | |||||||||||||

Effective income tax rate | 23.4 | % | 45.2 | % | (21.8 | ) | pts. | |||||||||

Average number of shares outstanding (millions): | ||||||||||||||||

Basic | 38.1 | 37.9 | ||||||||||||||

Diluted | 38.4 | 37.9 | ||||||||||||||

Shares adjusted for nonvested restricted awards (millions): | ||||||||||||||||

Basic | 39.0 | 38.8 | ||||||||||||||

Diluted | 39.2 | 38.8 | ||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||

CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||||||||||

FOR THE 39 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||

% | CC % | |||||||||||||||

2016 | 2015 | Change | Change | Change | ||||||||||||

Revenue from services | $ | 3,972.4 | $ | 4,056.6 | $ | (84.2 | ) | (2.1 | ) | % | (0.7 | ) | % | |||

Cost of services | 3,294.1 | 3,385.8 | (91.7 | ) | (2.7 | ) | ||||||||||

Gross profit | 678.3 | 670.8 | 7.5 | 1.1 | 2.3 | |||||||||||

Selling, general and administrative expenses | 634.9 | 630.6 | 4.3 | 0.7 | 1.8 | |||||||||||

Earnings from operations | 43.4 | 40.2 | 3.2 | 7.9 | ||||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | — | 87.2 | NM | ||||||||||||

Other expense, net | (1.4 | ) | (3.5 | ) | 2.1 | 61.2 | ||||||||||

Earnings before taxes | 129.2 | 36.7 | 92.5 | 252.3 | ||||||||||||

Income tax expense | 28.2 | 17.1 | 11.1 | 65.4 | ||||||||||||

Net earnings | $ | 101.0 | $ | 19.6 | $ | 81.4 | 414.7 | % | ||||||||

Basic earnings per share | $ | 2.59 | $ | 0.51 | $ | 2.08 | NM | % | ||||||||

Diluted earnings per share | $ | 2.58 | $ | 0.51 | $ | 2.07 | NM | % | ||||||||

STATISTICS: | ||||||||||||||||

Gross profit rate | 17.1 | % | 16.5 | % | 0.6 | pts. | ||||||||||

Selling, general and administrative expenses: | ||||||||||||||||

% of revenue | 16.0 | 15.5 | 0.5 | |||||||||||||

% of gross profit | 93.6 | 94.0 | (0.4 | ) | ||||||||||||

% Return: | ||||||||||||||||

Earnings from operations | 1.1 | 1.0 | 0.1 | |||||||||||||

Earnings before taxes | 3.3 | 0.9 | 2.4 | |||||||||||||

Net earnings | 2.5 | 0.5 | 2.0 | |||||||||||||

Effective income tax rate | 21.8 | % | 46.5 | % | (24.7 | ) | pts. | |||||||||

Average number of shares outstanding (millions): | ||||||||||||||||

Basic | 38.0 | 37.8 | ||||||||||||||

Diluted | 38.3 | 37.8 | ||||||||||||||

Shares adjusted for nonvested restricted awards (millions): | ||||||||||||||||

Basic | 39.0 | 38.8 | ||||||||||||||

Diluted | 39.2 | 38.8 | ||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

Third Quarter | ||||||||||||||

% | CC % | |||||||||||||

2016 | 2015 | Change | Change | |||||||||||

AMERICAS | ||||||||||||||

Commercial | ||||||||||||||

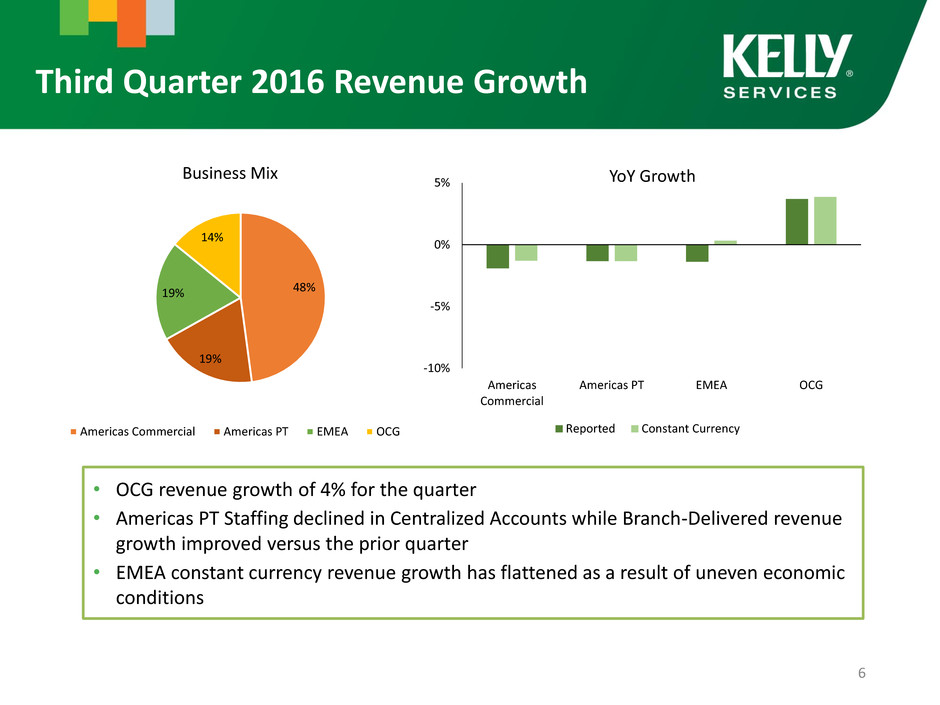

Revenue from services | $ | 603.7 | $ | 615.5 | (1.9 | ) | % | (1.3 | ) | % | ||||

Staffing fee-based income included in revenue from services | 4.2 | 3.8 | 10.0 | 10.1 | ||||||||||

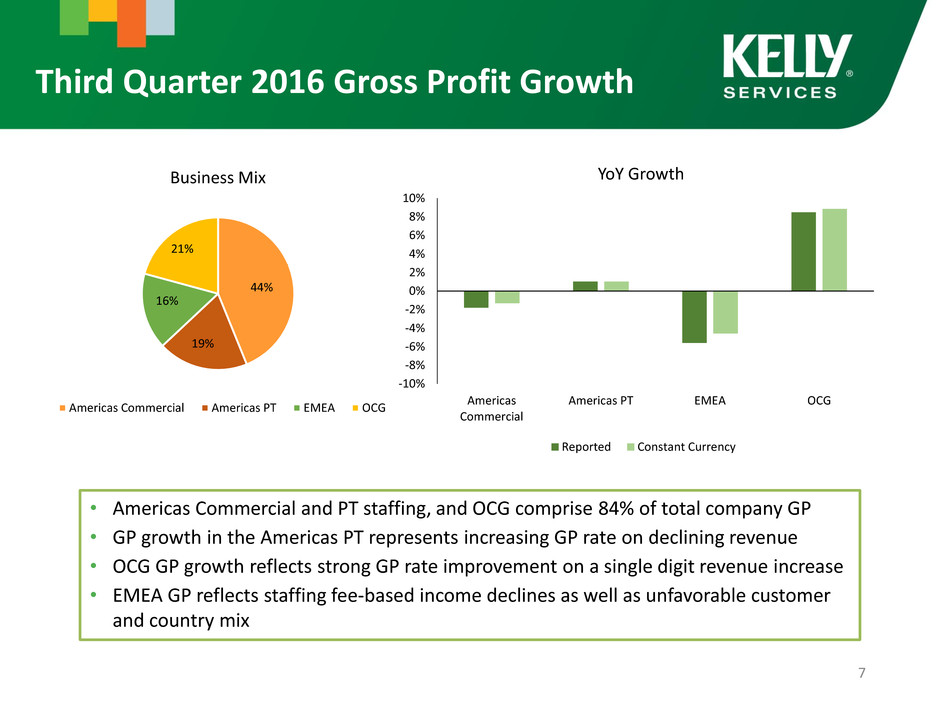

Gross profit | 94.9 | 96.6 | (1.8 | ) | (1.3 | ) | ||||||||

Gross profit rate | 15.7 | % | 15.7 | % | — | pts. | ||||||||

PT | ||||||||||||||

Revenue from services | $ | 239.6 | $ | 242.8 | (1.3 | ) | % | (1.3 | ) | % | ||||

Staffing fee-based income included in revenue from services | 4.4 | 4.7 | (6.9 | ) | (6.9 | ) | ||||||||

Gross profit | 41.4 | 41.0 | 1.0 | 1.0 | ||||||||||

Gross profit rate | 17.3 | % | 16.9 | % | 0.4 | pts. | ||||||||

Total Americas | ||||||||||||||

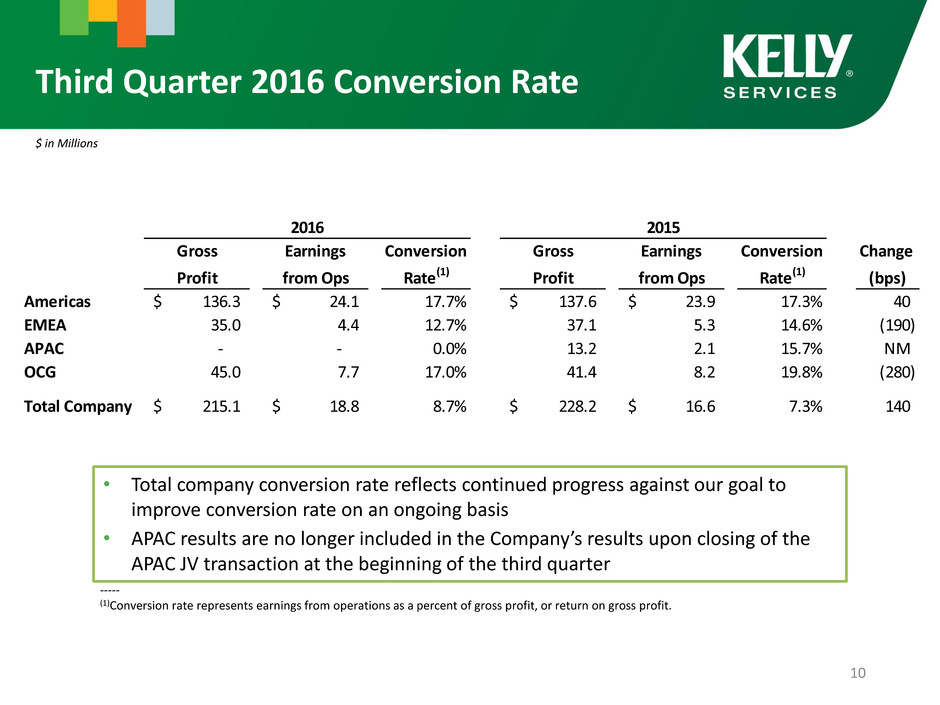

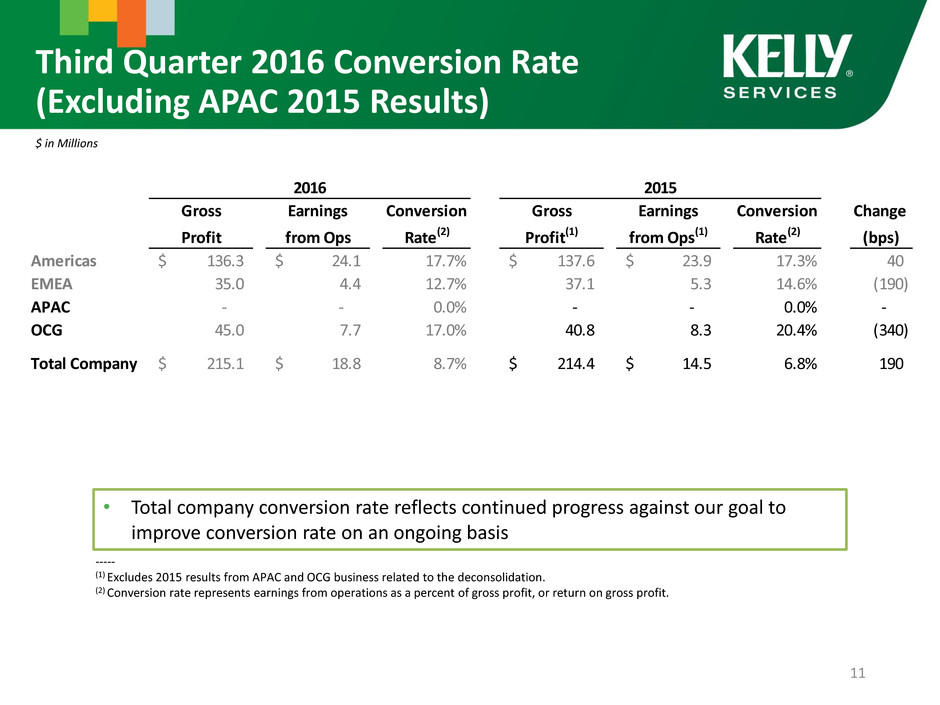

Revenue from services | $ | 843.3 | $ | 858.3 | (1.8 | ) | % | (1.3 | ) | % | ||||

Staffing fee-based income included in revenue from services | 8.6 | 8.5 | 0.6 | 0.7 | ||||||||||

Gross profit | 136.3 | 137.6 | (1.0 | ) | (0.6 | ) | ||||||||

Total SG&A expenses | 112.2 | 113.7 | (1.4 | ) | (1.2 | ) | ||||||||

Earnings from operations | 24.1 | 23.9 | 1.0 | |||||||||||

Gross profit rate | 16.2 | % | 16.0 | % | 0.2 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 13.3 | 13.2 | 0.1 | |||||||||||

% of gross profit | 82.3 | 82.7 | (0.4 | ) | ||||||||||

Return on sales | 2.9 | 2.8 | 0.1 | |||||||||||

EMEA | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 197.6 | $ | 199.0 | (0.8 | ) | % | 1.0 | % | |||||

Staffing fee-based income included in revenue from services | 3.3 | 3.2 | 5.0 | 6.7 | ||||||||||

Gross profit | 26.8 | 27.7 | (3.5 | ) | (2.5 | ) | ||||||||

Gross profit rate | 13.6 | % | 13.9 | % | (0.3 | ) | pts. | |||||||

PT | ||||||||||||||

Revenue from services | $ | 41.7 | $ | 43.6 | (4.3 | ) | % | (2.9 | ) | % | ||||

Staffing fee-based income included in revenue from services | 2.2 | 2.6 | (16.1 | ) | (14.4 | ) | ||||||||

Gross profit | 8.2 | 9.4 | (11.7 | ) | (10.6 | ) | ||||||||

Gross profit rate | 19.9 | % | 21.6 | % | (1.7 | ) | pts. | |||||||

Total EMEA | ||||||||||||||

Revenue from services | $ | 239.3 | $ | 242.6 | (1.4 | ) | % | 0.3 | % | |||||

Staffing fee-based income included in revenue from services | 5.5 | 5.8 | (4.6 | ) | (2.9 | ) | ||||||||

Gross profit | 35.0 | 37.1 | (5.6 | ) | (4.6 | ) | ||||||||

Total SG&A expenses | 30.6 | 31.8 | (3.5 | ) | (2.0 | ) | ||||||||

Earnings from operations | 4.4 | 5.3 | (17.8 | ) | ||||||||||

Gross profit rate | 14.7 | % | 15.3 | % | (0.6 | ) | pts. | |||||||

Expense rates: | ||||||||||||||

% of revenue | 12.8 | 13.1 | (0.3 | ) | ||||||||||

% of gross profit | 87.3 | 85.4 | 1.9 | |||||||||||

Return on sales | 1.9 | 2.2 | (0.3 | ) | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

Third Quarter | ||||||||||||||

% | CC % | |||||||||||||

2016 | 2015 | Change | Change | |||||||||||

OCG | ||||||||||||||

Revenue from services | $ | 178.2 | $ | 171.8 | 3.7 | % | 3.9 | % | ||||||

Gross profit | 45.0 | 41.4 | 8.5 | 8.9 | ||||||||||

Total SG&A expenses | 37.3 | 33.2 | 12.3 | 12.8 | ||||||||||

Earnings from operations | 7.7 | 8.2 | (7.0 | ) | ||||||||||

Gross profit rate | 25.2 | % | 24.1 | % | 1.1 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 20.9 | 19.3 | 1.6 | |||||||||||

% of gross profit | 83.0 | 80.2 | 2.8 | |||||||||||

Return on sales | 4.3 | 4.8 | (0.5 | ) | ||||||||||

Corporate | ||||||||||||||

Total SG&A expenses | $ | 17.4 | $ | 22.9 | (24.4 | ) | % | |||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

September Year to Date | ||||||||||||||

% | CC % | |||||||||||||

2016 | 2015 | Change | Change | |||||||||||

AMERICAS | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 1,887.6 | $ | 1,908.2 | (1.1 | ) | % | 0.2 | % | |||||

Staffing fee-based income included in revenue from services | 11.4 | 10.8 | 5.5 | 6.1 | ||||||||||

Gross profit | 295.9 | 290.3 | 1.9 | 2.9 | ||||||||||

Gross profit rate | 15.7 | % | 15.2 | % | 0.5 | pts. | ||||||||

PT | ||||||||||||||

Revenue from services | $ | 718.3 | $ | 721.8 | (0.5 | ) | % | (0.4 | ) | % | ||||

Staffing fee-based income included in revenue from services | 13.7 | 13.1 | 4.4 | 5.2 | ||||||||||

Gross profit | 124.3 | 122.0 | 1.8 | 2.0 | ||||||||||

Gross profit rate | 17.3 | % | 16.9 | % | 0.4 | pts. | ||||||||

Total Americas | ||||||||||||||

Revenue from services | $ | 2,605.9 | $ | 2,630.0 | (0.9 | ) | % | — | % | |||||

Staffing fee-based income included in revenue from services | 25.1 | 23.9 | 4.9 | 5.6 | ||||||||||

Gross profit | 420.2 | 412.3 | 1.9 | 2.7 | ||||||||||

SG&A expenses excluding restructuring charges | 340.5 | 339.8 | 0.2 | 0.9 | ||||||||||

Restructuring charges | 2.2 | — | NM | |||||||||||

Total SG&A expenses | 342.7 | 339.8 | 0.8 | 1.5 | ||||||||||

Earnings from operations | 77.5 | 72.5 | 7.0 | |||||||||||

Earnings from operations excluding restructuring charges | 79.7 | 72.5 | 10.0 | |||||||||||

Gross profit rate | 16.1 | % | 15.7 | % | 0.4 | pts. | ||||||||

Expense rates (excluding restructuring charges): | ||||||||||||||

% of revenue | 13.1 | 12.9 | 0.2 | |||||||||||

% of gross profit | 81.0 | 82.4 | (1.4 | ) | ||||||||||

Return on sales (excluding restructuring charges) | 3.1 | 2.8 | 0.3 | |||||||||||

EMEA | ||||||||||||||

Commercial | ||||||||||||||

Revenue from services | $ | 570.2 | $ | 573.0 | (0.5 | ) | % | 2.3 | % | |||||

Staffing fee-based income included in revenue from services | 10.4 | 9.9 | 6.0 | 10.0 | ||||||||||

Gross profit | 77.5 | 79.1 | (2.1 | ) | 0.2 | |||||||||

Gross profit rate | 13.6 | % | 13.8 | % | (0.2 | ) | pts. | |||||||

PT | ||||||||||||||

Revenue from services | $ | 126.4 | $ | 126.8 | (0.3 | ) | % | 2.1 | % | |||||

Staffing fee-based income included in revenue from services | 7.3 | 7.7 | (5.8 | ) | (2.1 | ) | ||||||||

Gross profit | 25.6 | 27.2 | (5.7 | ) | (3.2 | ) | ||||||||

Gross profit rate | 20.3 | % | 21.5 | % | (1.2 | ) | pts. | |||||||

Total EMEA | ||||||||||||||

Revenue from services | $ | 696.6 | $ | 699.8 | (0.5 | ) | % | 2.2 | % | |||||

Staffing fee-based income included in revenue from services | 17.7 | 17.6 | 0.8 | 4.7 | ||||||||||

Gross profit | 103.1 | 106.3 | (3.0 | ) | (0.6 | ) | ||||||||

SG&A expenses excluding restructuring charges | 92.9 | 99.5 | (6.5 | ) | (3.8 | ) | ||||||||

Restructuring charges | 1.2 | — | NM | |||||||||||

Total SG&A expenses | 94.1 | 99.5 | (5.3 | ) | (2.7 | ) | ||||||||

Earnings from operations | 9.0 | 6.8 | 30.5 | |||||||||||

Earnings from operations excluding restructuring charges | 10.2 | 6.8 | 46.7 | |||||||||||

Gross profit rate | 14.8 | % | 15.2 | % | (0.4 | ) | pts. | |||||||

Expense rates (excluding restructuring charges): | ||||||||||||||

% of revenue | 13.4 | 14.2 | (0.8 | ) | ||||||||||

% of gross profit | 90.1 | 93.5 | (3.4 | ) | ||||||||||

Return on sales (excluding restructuring charges) | 1.5 | 1.0 | 0.5 | |||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||

(UNAUDITED) | ||||||||||||||

(In millions of dollars) | ||||||||||||||

September Year to Date | ||||||||||||||

% | CC % | |||||||||||||

2016 | 2015 | Change | Change | |||||||||||

OCG | ||||||||||||||

Revenue from services | $ | 520.3 | $ | 486.3 | 7.0 | % | 7.5 | % | ||||||

Gross profit | 130.1 | 112.6 | 15.5 | 16.3 | ||||||||||

Total SG&A expenses | 112.2 | 98.1 | 14.4 | 15.3 | ||||||||||

Earnings from operations | 17.9 | 14.5 | 22.8 | |||||||||||

Gross profit rate | 25.0 | % | 23.1 | % | 1.9 | pts. | ||||||||

Expense rates: | ||||||||||||||

% of revenue | 21.6 | 20.2 | 1.4 | |||||||||||

% of gross profit | 86.3 | 87.1 | (0.8 | ) | ||||||||||

Return on sales | 3.4 | 3.0 | 0.4 | |||||||||||

Corporate | ||||||||||||||

Total SG&A expenses | $ | 66.6 | $ | 61.1 | 8.8 | % | ||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||

CONSOLIDATED BALANCE SHEETS | ||||||||||

(UNAUDITED) | ||||||||||

(In millions of dollars) | ||||||||||

October 2, 2016 | Jan. 3, 2016 | September 27, 2015 | ||||||||

Current Assets | ||||||||||

Cash and equivalents | $ | 27.6 | $ | 42.2 | $ | 44.9 | ||||

Trade accounts receivable, less allowances of | ||||||||||

$11.1, $10.5 and $9.7, respectively | 1,125.8 | 1,139.1 | 1,160.3 | |||||||

Prepaid expenses and other current assets | 53.0 | 45.8 | 49.0 | |||||||

Deferred taxes | — | — | 35.0 | |||||||

Total current assets | 1,206.4 | 1,227.1 | 1,289.2 | |||||||

Noncurrent Assets | ||||||||||

Property and equipment, net | 80.5 | 88.9 | 88.3 | |||||||

Noncurrent deferred taxes | 179.8 | 189.3 | 140.8 | |||||||

Goodwill, net | 88.4 | 90.3 | 90.3 | |||||||

Investment in equity affiliate | 113.6 | 9.4 | 9.4 | |||||||

Other assets | 370.6 | 334.6 | 331.9 | |||||||

Total noncurrent assets | 832.9 | 712.5 | 660.7 | |||||||

Total Assets | $ | 2,039.3 | $ | 1,939.6 | $ | 1,949.9 | ||||

Current Liabilities | ||||||||||

Short-term borrowings | $ | 8.7 | $ | 55.5 | $ | 76.8 | ||||

Accounts payable and accrued liabilities | 408.7 | 405.5 | 385.2 | |||||||

Accrued payroll and related taxes | 276.9 | 268.1 | 312.8 | |||||||

Accrued insurance | 26.8 | 26.7 | 25.9 | |||||||

Income and other taxes | 56.9 | 60.0 | 59.5 | |||||||

Total current liabilities | 778.0 | 815.8 | 860.2 | |||||||

Noncurrent Liabilities | ||||||||||

Accrued insurance | 40.2 | 40.0 | 42.2 | |||||||

Accrued retirement benefits | 153.9 | 141.0 | 139.5 | |||||||

Other long-term liabilities | 50.7 | 47.4 | 48.4 | |||||||

Total noncurrent liabilities | 244.8 | 228.4 | 230.1 | |||||||

Stockholders' Equity | ||||||||||

Common stock | 40.1 | 40.1 | 40.1 | |||||||

Treasury stock | (39.1 | ) | (44.3 | ) | (46.9 | ) | ||||

Paid-in capital | 26.2 | 25.4 | 26.7 | |||||||

Earnings invested in the business | 906.8 | 813.5 | 781.3 | |||||||

Accumulated other comprehensive income | 82.5 | 60.7 | 58.4 | |||||||

Total stockholders' equity | 1,016.5 | 895.4 | 859.6 | |||||||

Total Liabilities and Stockholders' Equity | $ | 2,039.3 | $ | 1,939.6 | $ | 1,949.9 | ||||

STATISTICS: | ||||||||||

Working Capital | $ | 428.4 | $ | 411.3 | $ | 429.0 | ||||

Current Ratio | 1.6 | 1.5 | 1.5 | |||||||

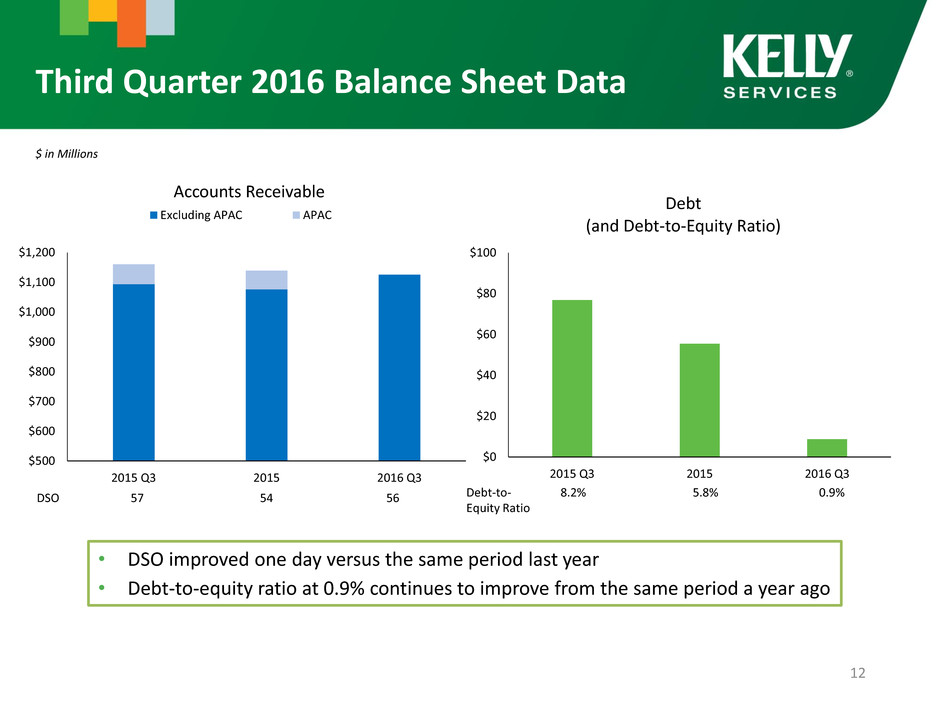

Debt-to-capital % | 0.9 | % | 5.8 | % | 8.2 | % | ||||

Global Days Sales Outstanding | 56 | 54 | 57 | |||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||

FOR THE 39 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | ||||||

(UNAUDITED) | ||||||

(In millions of dollars) | ||||||

2016 | 2015 | |||||

Cash flows from operating activities: | ||||||

Net earnings | $ | 101.0 | $ | 19.6 | ||

Noncash adjustments: | ||||||

Depreciation and amortization | 16.0 | 16.6 | ||||

Provision for bad debts | 6.1 | 3.3 | ||||

Stock-based compensation | 5.5 | 4.6 | ||||

Gain on investment in TS Kelly Asia Pacific equity affiliate | (87.2 | ) | — | |||

Other, net | (2.2 | ) | (0.7 | ) | ||

Changes in operating assets and liabilities | (13.1 | ) | (44.9 | ) | ||

Net cash from (used in) operating activities | 26.1 | (1.5 | ) | |||

Cash flows from investing activities: | ||||||

Capital expenditures | (7.8 | ) | (12.3 | ) | ||

Net cash proceeds from investment in TS Kelly Asia Pacific equity affiliate | 18.8 | — | ||||

Investment in TS Kelly equity affiliate | — | (0.5 | ) | |||

Other investing activities | (0.4 | ) | (0.4 | ) | ||

Net cash from (used in) investing activities | 10.6 | (13.2 | ) | |||

Cash flows from financing activities: | ||||||

Net change in short-term borrowings | (47.8 | ) | (13.8 | ) | ||

Dividend payments | (7.7 | ) | (5.7 | ) | ||

Other financing activities | 0.4 | 0.2 | ||||

Net cash used in financing activities | (55.1 | ) | (19.3 | ) | ||

Effect of exchange rates on cash and equivalents | 3.8 | (4.2 | ) | |||

Net change in cash and equivalents | (14.6 | ) | (38.2 | ) | ||

Cash and equivalents at beginning of period | 42.2 | 83.1 | ||||

Cash and equivalents at end of period | $ | 27.6 | $ | 44.9 | ||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||

REVENUE FROM SERVICES | |||||||||||||

(UNAUDITED) | |||||||||||||

(In millions of dollars) | |||||||||||||

Third Quarter (Commercial, PT and OCG) | |||||||||||||

% | CC % | ||||||||||||

2016 | 2015 | Change | Change | ||||||||||

Americas | |||||||||||||

United States | $ | 900.3 | $ | 899.8 | 0.1 | % | 0.1 | % | |||||

Canada | 34.9 | 37.9 | (7.8 | ) | (8.5 | ) | |||||||

Mexico | 27.6 | 31.3 | (12.3 | ) | 0.4 | ||||||||

Puerto Rico | 20.9 | 23.8 | (12.2 | ) | (12.2 | ) | |||||||

Brazil | 13.3 | 10.4 | 27.9 | 28.1 | |||||||||

Total Americas | 997.0 | 1,003.2 | (0.6 | ) | (0.3 | ) | |||||||

EMEA | |||||||||||||

France | 60.8 | 63.1 | (3.7 | ) | (4.1 | ) | |||||||

Switzerland | 55.0 | 58.0 | (5.2 | ) | (3.9 | ) | |||||||

Portugal | 39.2 | 33.5 | 16.9 | 16.5 | |||||||||

United Kingdom | 19.5 | 27.7 | (29.3 | ) | (16.4 | ) | |||||||

Russia | 18.4 | 17.0 | 7.9 | 11.2 | |||||||||

Germany | 14.2 | 15.4 | (7.7 | ) | (8.1 | ) | |||||||

Italy | 13.6 | 14.0 | (2.8 | ) | (3.1 | ) | |||||||

Norway | 8.4 | 10.1 | (17.3 | ) | (15.9 | ) | |||||||

Other | 17.4 | 11.5 | 50.8 | 50.3 | |||||||||

Total EMEA | 246.5 | 250.3 | (1.5 | ) | 0.2 | ||||||||

APAC | |||||||||||||

Australia | 3.6 | 28.8 | (87.5 | ) | (88.0 | ) | |||||||

Singapore | 0.1 | 32.6 | (99.7 | ) | (99.7 | ) | |||||||

New Zealand | 0.1 | 9.4 | (99.1 | ) | (99.2 | ) | |||||||

Malaysia | 0.1 | 14.0 | (99.5 | ) | (99.5 | ) | |||||||

Other | 0.4 | 12.7 | (96.5 | ) | (96.4 | ) | |||||||

Total APAC | 4.3 | 97.5 | (95.6 | ) | (95.7 | ) | |||||||

Total Kelly Services, Inc. | $ | 1,247.8 | $ | 1,351.0 | (7.6 | ) | % | (7.1 | ) | % | |||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||

REVENUE FROM SERVICES | |||||||||||||

(UNAUDITED) | |||||||||||||

(In millions of dollars) | |||||||||||||

September Year to Date (Commercial, PT and OCG) | |||||||||||||

% | CC % | ||||||||||||

2016 | 2015 | Change | Change | ||||||||||

Americas | |||||||||||||

United States | $ | 2,765.8 | $ | 2,706.4 | 2.2 | % | 2.2 | % | |||||

Canada | 105.2 | 122.2 | (13.9 | ) | (9.9 | ) | |||||||

Mexico | 79.6 | 95.2 | (16.4 | ) | (1.6 | ) | |||||||

Puerto Rico | 65.9 | 75.2 | (12.4 | ) | (12.4 | ) | |||||||

Brazil | 33.5 | 34.2 | (1.8 | ) | 16.7 | ||||||||

Total Americas | 3,050.0 | 3,033.2 | 0.6 | 1.4 | |||||||||

EMEA | |||||||||||||

France | 178.6 | 180.4 | (1.0 | ) | (1.0 | ) | |||||||

Switzerland | 156.2 | 160.7 | (2.8 | ) | (0.1 | ) | |||||||

Portugal | 111.6 | 98.7 | 13.1 | 13.0 | |||||||||

United Kingdom | 66.2 | 78.4 | (15.5 | ) | (7.2 | ) | |||||||

Russia | 49.0 | 57.4 | (14.8 | ) | (2.2 | ) | |||||||

Germany | 45.3 | 43.1 | 5.0 | 5.0 | |||||||||

Italy | 42.1 | 39.5 | 6.5 | 6.3 | |||||||||

Norway | 24.4 | 29.5 | (17.2 | ) | (11.8 | ) | |||||||

Other | 45.9 | 32.8 | 39.8 | 40.1 | |||||||||

Total EMEA | 719.3 | 720.5 | (0.2 | ) | 2.5 | ||||||||

APAC | |||||||||||||

Singapore | 64.9 | 96.9 | (33.0 | ) | (31.6 | ) | |||||||

Australia | 64.2 | 92.1 | (30.3 | ) | (26.2 | ) | |||||||

Malaysia | 27.8 | 45.4 | (38.9 | ) | (31.4 | ) | |||||||

New Zealand | 19.3 | 30.2 | (36.1 | ) | (29.8 | ) | |||||||

Other | 26.9 | 38.3 | (29.5 | ) | (24.7 | ) | |||||||

Total APAC | 203.1 | 302.9 | (32.9 | ) | (28.9 | ) | |||||||

Total Kelly Services, Inc. | $ | 3,972.4 | $ | 4,056.6 | (2.1 | ) | % | (0.7 | ) | % | |||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||||||

FOR THE 13 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | |||||||||||||||||||

(UNAUDITED) | |||||||||||||||||||

(In millions of dollars except per share data) | |||||||||||||||||||

2016 | 2015 | ||||||||||||||||||

As Reported | Gain on Investment in Equity Affiliate (Note 1) | Adjusted Earnings | Adjusted Earnings | % Change | CC % Change | ||||||||||||||

Revenue from services | $ | 1,247.8 | $ | — | $ | 1,247.8 | $ | 1,257.0 | (0.7 | ) | % | (0.1 | ) | % | |||||

Cost of services | 1,032.7 | — | 1,032.7 | 1,042.6 | (1.0 | ) | |||||||||||||

Gross profit | 215.1 | — | 215.1 | 214.4 | 0.3 | 0.8 | |||||||||||||

SG&A expenses | 196.3 | — | 196.3 | 199.9 | (1.8 | ) | (1.4 | ) | |||||||||||

Earnings from operations | 18.8 | — | 18.8 | 14.5 | 29.4 | ||||||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | (87.2 | ) | — | — | — | |||||||||||||

Other (expense) income, net | (0.4 | ) | — | (0.4 | ) | 0.1 | NM | ||||||||||||

Earnings before taxes | 105.6 | (87.2 | ) | 18.4 | 14.6 | 26.7 | |||||||||||||

Inc. tax expense (benefit) | 24.7 | (23.5 | ) | 1.2 | 7.1 | (83.1 | ) | ||||||||||||

Net earnings | $ | 80.9 | $ | (63.7 | ) | $ | 17.2 | $ | 7.5 | 130.7 | % | ||||||||

Earnings per share: | |||||||||||||||||||

Basic | $ | 2.08 | $ | (1.63 | ) | $ | 0.44 | $ | 0.19 | 131.6 | % | ||||||||

Diluted | $ | 2.06 | $ | (1.62 | ) | $ | 0.44 | $ | 0.19 | 131.6 | % | ||||||||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | |||||||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||

RECONCILIATION OF NON-GAAP MEASURES | ||||||||||

FOR THE 13 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | ||||||||||

(UNAUDITED) | ||||||||||

(In millions of dollars except per share data) | ||||||||||

2015 | ||||||||||

As Reported | Disposal of APAC Businesses (Note 2) | Adjusted Earnings | ||||||||

Revenue from services | $ | 1,351.0 | $ | (94.0 | ) | $ | 1,257.0 | |||

Cost of services | 1,122.8 | (80.2 | ) | 1,042.6 | ||||||

Gross profit | 228.2 | (13.8 | ) | 214.4 | ||||||

SG&A expenses | 211.6 | (11.7 | ) | 199.9 | ||||||

Earnings from operations | 16.6 | (2.1 | ) | 14.5 | ||||||

Other income, net | — | 0.1 | 0.1 | |||||||

Earnings before taxes | 16.6 | (2.0 | ) | 14.6 | ||||||

Inc. tax expense (benefit) | 7.5 | (0.4 | ) | 7.1 | ||||||

Net earnings | $ | 9.1 | $ | (1.6 | ) | $ | 7.5 | |||

Earnings per share: | ||||||||||

Basic | $ | 0.23 | $ | (0.04 | ) | $ | 0.19 | |||

Diluted | $ | 0.23 | $ | (0.04 | ) | $ | 0.19 | |||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | ||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES | ||||||||||||||||||||||

FOR THE 39 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | ||||||||||||||||||||||

(UNAUDITED) | ||||||||||||||||||||||

(In millions of dollars except per share data) | ||||||||||||||||||||||

2016 | 2015 | |||||||||||||||||||||

As Reported | Gain on Investment in Equity Affiliate (Note 1) | Restructuring Charges (Note 3) | Adjusted Earnings | Adjusted Earnings | % Change | CC % Change | ||||||||||||||||

Revenue from services | $ | 3,972.4 | $ | — | $ | — | $ | 3,972.4 | $ | 3,962.6 | 0.2 | % | 1.7 | % | ||||||||

Cost of services | 3,294.1 | — | — | 3,294.1 | 3,305.6 | (0.3 | ) | |||||||||||||||

Gross profit | 678.3 | — | — | 678.3 | 657.0 | 3.2 | 4.5 | |||||||||||||||

SG&A expenses | 634.9 | — | (3.4 | ) | 631.5 | 618.9 | 2.0 | 3.2 | ||||||||||||||

Earnings from operations | 43.4 | — | 3.4 | 46.8 | 38.1 | 22.8 | ||||||||||||||||

Gain on investment in TS Kelly Asia Pacific | 87.2 | (87.2 | ) | — | — | — | — | |||||||||||||||

Other expense, net | (1.4 | ) | — | — | (1.4 | ) | (3.4 | ) | 60.3 | |||||||||||||

Earnings before taxes | 129.2 | (87.2 | ) | 3.4 | 45.4 | 34.7 | 31.1 | |||||||||||||||

Inc. tax expense (benefit) | 28.2 | (23.5 | ) | 0.9 | 5.6 | 16.7 | (66.6 | ) | ||||||||||||||

Net earnings | $ | 101.0 | $ | (63.7 | ) | $ | 2.5 | $ | 39.8 | $ | 18.0 | 121.5 | % | |||||||||

Earnings per share: | ||||||||||||||||||||||

Basic | $ | 2.59 | $ | (1.63 | ) | $ | 0.07 | $ | 1.02 | $ | 0.46 | 121.7 | % | |||||||||

Diluted | $ | 2.58 | $ | (1.63 | ) | $ | 0.07 | $ | 1.02 | $ | 0.46 | 121.7 | % | |||||||||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | ||||||||||||||||||||||

KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||

RECONCILIATION OF NON-GAAP MEASURES | |||||||||||

FOR THE 39 WEEKS ENDED OCTOBER 2, 2016 AND SEPTEMBER 27, 2015 | |||||||||||

(UNAUDITED) | |||||||||||

(In millions of dollars except per share data) | |||||||||||

2015 | |||||||||||

As Reported | Disposal of APAC Businesses (Note 2) | Adjusted Earnings | |||||||||

Revenue from services | $ | 4,056.6 | $ | (94.0 | ) | $ | 3,962.6 | ||||

Cost of services | 3,385.8 | (80.2 | ) | 3,305.6 | |||||||

Gross profit | 670.8 | (13.8 | ) | 657.0 | |||||||

SG&A expenses | 630.6 | (11.7 | ) | 618.9 | |||||||

Earnings from operations | 40.2 | (2.1 | ) | 38.1 | |||||||

Other (expense) income, net | (3.5 | ) | 0.1 | (3.4 | ) | ||||||

Earnings before taxes | 36.7 | (2.0 | ) | 34.7 | |||||||

Inc. tax expense (benefit) | 17.1 | (0.4 | ) | 16.7 | |||||||

Net earnings | $ | 19.6 | $ | (1.6 | ) | $ | 18.0 | ||||

Earnings per share: | |||||||||||

Basic | $ | 0.51 | $ | (0.04 | ) | $ | 0.46 | ||||

Diluted | $ | 0.51 | $ | (0.04 | ) | $ | 0.46 | ||||

Note: Earnings per share amounts for each quarter are required to be computed independently and may not equal the amounts computed for the total year. | |||||||||||