0000005513FALSEDEF 14A00000055132022-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares00000055132021-01-012021-12-3100000055132020-01-012020-12-310000005513unm:FairValueOfStockAwardsGrantedMemberecd:PeoMember2022-01-012022-12-310000005513unm:FairValueOfStockAwardsGrantedMemberecd:PeoMember2021-01-012021-12-310000005513unm:FairValueOfStockAwardsGrantedMemberecd:PeoMember2020-01-012020-12-310000005513ecd:PeoMemberunm:ChangeInPensionFairValueMember2022-01-012022-12-310000005513ecd:PeoMemberunm:ChangeInPensionFairValueMember2021-01-012021-12-310000005513ecd:PeoMemberunm:ChangeInPensionFairValueMember2020-01-012020-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMemberecd:PeoMember2022-01-012022-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMemberecd:PeoMember2021-01-012021-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMemberecd:PeoMember2020-01-012020-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:PeoMember2022-01-012022-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:PeoMember2021-01-012021-12-310000005513unm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMemberecd:PeoMember2020-01-012020-12-310000005513ecd:PeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2022-01-012022-12-310000005513ecd:PeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2021-01-012021-12-310000005513ecd:PeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2020-01-012020-12-310000005513unm:PensionServiceCostMemberecd:PeoMember2022-01-012022-12-310000005513unm:PensionServiceCostMemberecd:PeoMember2021-01-012021-12-310000005513unm:PensionServiceCostMemberecd:PeoMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:FairValueOfStockAwardsGrantedMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:FairValueOfStockAwardsGrantedMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:FairValueOfStockAwardsGrantedMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:ChangeInPensionFairValueMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:ChangeInPensionFairValueMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:ChangeInPensionFairValueMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInCurrentYearMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:YearEndFairValueOfOutstandingAndUnvestedEquityAwardsGrantedInPriorYearsMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:VestingDateFairValueOfStockAwardsVestedInCurrentYearGrantedInPriorYearsMember2020-01-012020-12-310000005513ecd:NonPeoNeoMemberunm:PensionServiceCostMember2022-01-012022-12-310000005513ecd:NonPeoNeoMemberunm:PensionServiceCostMember2021-01-012021-12-310000005513ecd:NonPeoNeoMemberunm:PensionServiceCostMember2020-01-012020-12-31000000551312022-01-012022-12-31000000551322022-01-012022-12-31000000551332022-01-012022-12-31000000551342022-01-012022-12-31000000551352022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant X

Filed by a Party other than the Registrant

Check the appropriate box:

| | | | | | | | |

| | Preliminary Proxy Statement |

| | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| X | | Definitive Proxy Statement |

| | Definitive Additional Materials |

| | Soliciting Material under §240.14a-12 |

| | |

| UNUM GROUP |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| X | | No fee required |

| | Fee paid previously with preliminary materials |

| | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

| | | | | | | | | | | | | | |

NOTICE OF 2023 ANNUAL MEETING | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

We are furnishing proxy materials, including this proxy statement, in connection with the solicitation of proxies on behalf of the Board of Directors, to be voted at the 2023 Annual Meeting of Shareholders of Unum Group and at any adjournment or postponement thereof. Our proxy materials are first being mailed and made available electronically to shareholders on April 13, 2023.

| | |

| 2023 UNUM GROUP PROXY STATEMENT |

Our Purpose

Helping the working world thrive throughout life’s moments.TM

A Business for Good

In today’s economically volatile environment, financial protection benefits are more important than ever. As a Fortune 500 company and leading provider of workplace benefits, Unum helps millions of people gain access to essential disability, life, accident, critical illness, leave services, dental and vision benefits through the workplace. Employers of all sizes depend on us for the comprehensive benefits solutions they need to attract and support the people who keep their businesses growing. And their employees know they can count on us to be there during some of life’s most challenging times.

| | | | | | | | | | | | | | | | | | | | |

| OUR CORE OPERATIONS | | | | | | |

| Unum US | | | Colonial Life | | | Unum International |

| A market leader in group and individual disability benefits in the U.S., one of the largest providers of group life and voluntary workplace benefits, and a comprehensive dental and vision carrier. | | | A leading provider of voluntary worksite benefits, including disability, life, accident, critical illness, cancer, hospitalization, dental and vision coverage in the U.S. | | | Comprised of our European businesses. Unum UK is a leading provider of group income protection critical illness, life and dental coverages. Unum Poland provides group and individual life insurance. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Our Strategy

We appreciate that the market dynamics of workplace benefits are continuously evolving, and we remain diligent in engaging with our constituent groups to understand both current and future needs. Our strategy is to:

•Remain a market leader in employee benefits and workplace solutions for our customers.

•Be a destination for highly engaged employees.

•Make a positive impact in the communities where we live and work.

Through strong execution of these priorities, while managing both risk and operating expenses, we expect to deliver leading shareholder return and win in the market through:

•The best bundled administrative experience for employers.

•The best absence experience for companies and employees.

•The best and most productive sales force.

Success will also require us to show stable and predictable results in our Closed Block, particularly the long-term care business. We expect to achieve this through active and careful management with a sustained focus on creating value and increasing the predictability of outcomes. In turn, we can reduce overall risk and capital demands while serving the varied needs of our customers with care and compassion.

2023 UNUM GROUP PROXY STATEMENT

A LETTER FROM OUR BOARD OF DIRECTORS

April 13, 2023

Dear Fellow Shareholder:

At Unum, our purpose is a noble calling, and one that resonates in today's environment now more than ever. We're committed to helping the working world thrive throughout life’s moments, a promise we deliver on by protecting nearly 45 million people and their families across our businesses in the U.S., U.K. and Poland. That reach allowed Unum to pay almost $8 billion last year to help millions of individuals and their families through difficult times and partner with 181,000 companies to attract, protect and retain their employees.

As we reflect on 2022, it was a year of transition with Unum focused on recovering to pre-pandemic operating levels. Rising interest rates and wage growth became strong tailwinds for our business, and these dynamics converged to drive record earnings and strong growth. In 2022, Unum delivered after-tax adjusted operating income(1,2) of $1.25 billion from revenues of $12 billion. Across our core operations, premium growth – a key metric in our business – grew by 2.3%, while sales increased 15%. Efforts to transform our business continued as we accelerated investments in digital capabilities, new products and our people. Service levels remained high as customers adopted new digital tools and engaged with us on their own terms. In short, the operational agility and resiliency demonstrated by Unum and its people throughout 2022, and over the past several years, ensured the company continued delivering on the expectations of customers.

These results are a testament to the value of the company’s products and strong reputation. We believe that Unum's performance in 2022 illustrates a successful pivot to growth in a sustained manner after demonstrating a capacity to deliver in the difficult pandemic environment. Total shareholder return for the year was nearly 74%, ahead of the S&P 500, our industry benchmark and our proxy peer group. We are pleased that investors are beginning to recognize the value provided by Unum. Recent actions we've taken in our Closed Block of legacy policies we service and support, but no longer market, provide greater predictability and enhanced performance of our long-term care business. This includes plans to fully recognize the long-term care statutory reserve additions negotiated with the Maine Bureau of Insurance by year end 2023, three years ahead of schedule. Through this effort, we have added approximately $1.2 billion to these reserves since 2020 and we believe these additional contributions further increase our margin over our best estimate assumptions. We believe this and other actions we've taken will allow the ongoing strong financial and operational performance of our Unum- and Colonial Life-branded core businesses to be fully recognized by investors.

Unum's strong capital position provides the company significant financial flexibility to fund growth in meaningful ways. The recent launch of Unum Total Leave™ is a critical step in setting our leave management business on a sustainable growth path and has been well-received by the market. Platforms like Unum HR Connect® provide unique back-office capabilities that better integrate our offerings with our customers. Digital portals such as Colonial Life's Gathr™, make enrolling and managing benefits modern and intuitive. Streamlined processes and new digital tools also play an important role in driving greater efficiency and financial flexibility.

As a Board, we believe a key factor to Unum’s success is a strong leadership team and engaged employees, and the company made significant investments on the talent front in 2022. Effective leadership transitions gave highly talented individuals opportunities to run key parts of our business and demonstrated our deep bench strength. Significant investments in an increasingly competitive talent market retained critical staff and bolstered Unum as a dynamic and compelling place to work and grow a career. New inclusion and diversity leadership introduced a fresh approach and further supported our commitment to embed inclusion and diversity of thought into our strong work culture. These and other steps reinforce our goal that everyone at Unum remains well-equipped to achieve success.

(1) Non-GAAP financial measure, see Appendix A for reconciliation.

(2) In 2018, the Financial Accounting Standards Board issued Accounting Standard Update 2018-12, “Targeted Improvements to the Accounting for Long-Duration Contracts”. This update significantly amends the accounting and disclosure requirements for long-duration insurance contracts. We adopted this guidance effective January 1, 2023 with changes applied as of January 1, 2021. The discussion included herein does not include consideration of the impacts of this new accounting standard.

2023 UNUM GROUP PROXY STATEMENT

A LETTER FROM OUR BOARD OF DIRECTORS

Together, all of us at Unum recognize the obligations we have to all stakeholders to deliver on our commitments. This focus on doing the right thing is the essence of We Are Unum, a core set of values we strive to live up to every day, along with our Code of Conduct. These principles guide our advocacy for greater access to benefits to meet the growing need for financial protection in our society. They underpin our commitment to supporting our local communities and reducing the impact we have on the environment. They instill an unwavering customer focus and the importance of personal responsibility. Collectively, they represent a pledge to operate with integrity and compassion, and we're proud to have just been recognized for a third year as one of the World's Most Ethical Companies by Ethisphere, a nonprofit that defines and measures corporate ethical standards. Recognitions by these and other third-party organizations validate our commitment to cultivating a compelling and inclusive workplace.

The Board is committed to representing the interests of shareholders and driving Unum’s long-term success through good corporate governance. We take a thorough approach to governance that assesses performance and risk, demands regulatory compliance, provides insight on corporate strategy, and provides oversight of compensation, investment activity and other financial matters. We conduct a regular outreach and engagement program that enables us to receive valuable feedback from shareholders on a variety of topics. We also monitor Unum’s culture through feedback from employee engagement surveys, an ethics hotline and other processes so that the company remains true to its values.

After serving nine years on the Board, Francis Shammo has decided to step down at the end of his current term. We appreciate his many contributions to our discussions, including the perspective he added as a former chief financial officer.

As we look ahead, we recognize the important role Unum has in delivering the benefits and services people and companies count on every day. The resiliency of our nearly 11,000 employees, the strength of our franchise and our continued investments in growth, we believe, are positioning Unum well for the longer term.

Thank you for your continued support of the company.

2023 UNUM GROUP PROXY STATEMENT

NOTICE OF 2023 ANNUAL MEETING

Notice of 2023

Annual Meeting of Shareholders

DATE: Thursday, May 25, 2023

TIME: 9:30 a.m. Eastern Daylight Time

VIRTUAL MEETING SITE

The 2023 Annual Meeting of Shareholders of Unum Group (the "company") will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/UNM2023.

The Board of Directors (the "Board") has determined to hold a virtual-only Annual Meeting to facilitate shareholder attendance and participation by enabling shareholders to participate from any location and at no cost. We are committed to ensuring shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/UNM2023.

To attend the virtual meeting, you will need the 16-digit control number included on your Notice Regarding the Internet Availability of Proxy Materials ("Notice"), proxy card, voting instruction form, or legal proxy. The meeting webcast will begin promptly at 9:30 a.m. Eastern Daylight Time on May 25, 2023. We encourage you to access the meeting prior to the start time. Online check-in will begin approximately 15 minutes prior to the start time, and you should allow ample time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or during the meeting, please call the technical support number that will be posted on the virtual meeting log-in page. For further details, see "About the 2023 Annual Meeting" beginning on page 108.

WHO CAN VOTE

Shareholders of record of the company’s common stock (NYSE: UNM) at the close of business on March 27, 2023, are entitled to vote at the meeting and any adjournment or postponement of the meeting.

| | | | | | | | | | | | | | | | | |

| VOTING ITEMS | Pg. # |

þ | Election of the 11 Directors Named in this Proxy Statement | |

|

þ | Advisory Vote to Approve Executive Compensation | |

|

| þ | Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation | |

|

| þ | Ratification of Appointment of Independent Public Accounting Firm | |

|

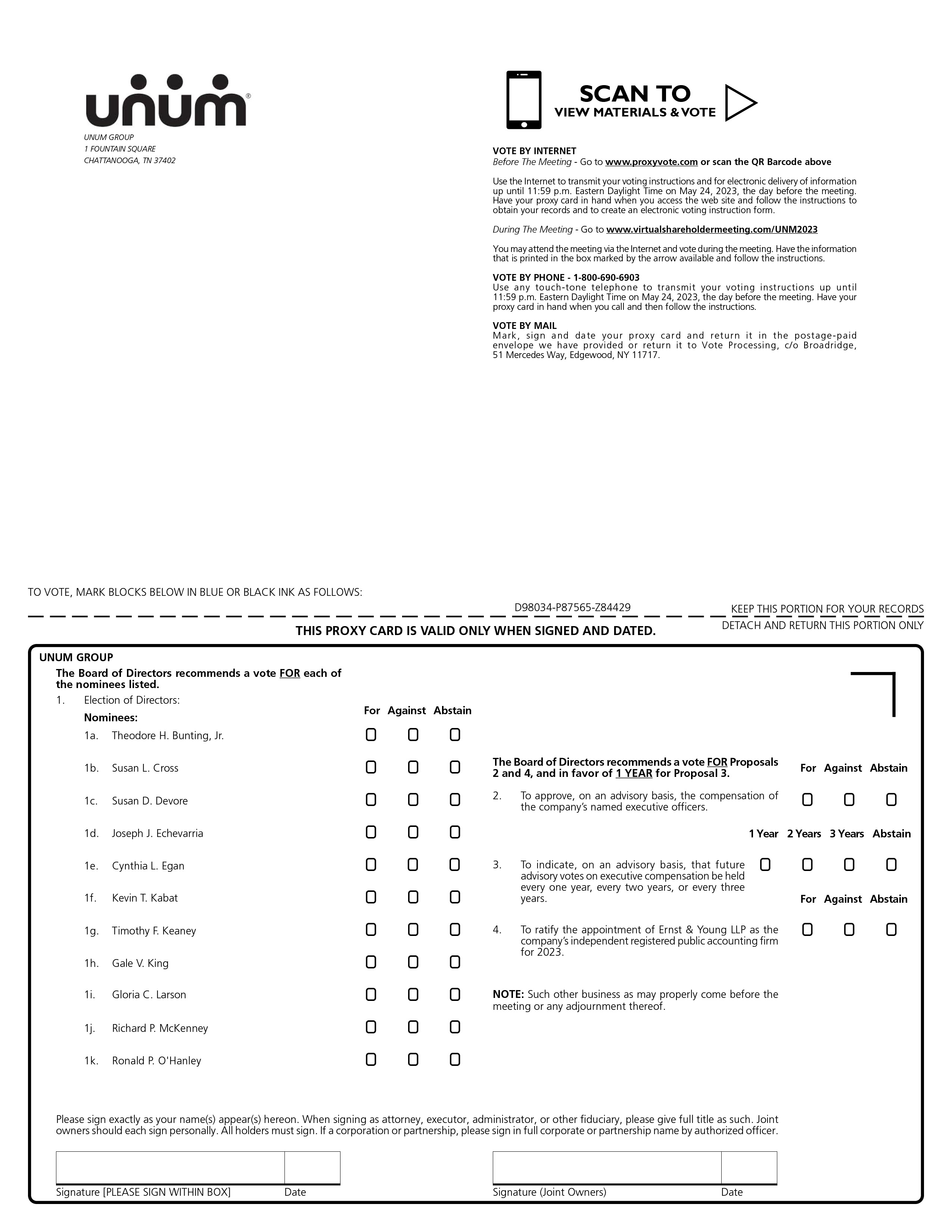

In addition to the voting items listed above, shareholders will transact any other business that may properly come before the meeting or any adjournment or postponement thereof. There will also be a report on the company's business. The Board unanimously recommends a vote "FOR" each of the director nominees in item 1, "FOR" items 2 and 4, and a vote in favor of a frequency of every "1 YEAR" for item 3.

HOW TO VOTE

Your vote is important. We encourage you to vote your shares as soon as possible, even if you plan to attend the meeting online. Many of our shareholders may vote by following the instructions below to vote via the internet, by telephone, or, if you have received a printed version of these proxy materials, by mail.

INTERNET

www.proxyvote.com (if in advance of meeting)

Deadline: 11:59 p.m. Eastern Daylight Time, May 24, 2023

You may also vote your shares during the meeting at www.virtualshareholdermeeting.com/UNM2023.

TELEPHONE

1-800-690-6903 or the telephone number on your voting instruction form

Deadline: 11:59 p.m. Eastern Daylight Time, May 24, 2023

MAIL

Vote Processing c/o Broadridge

51 Mercedes Way, Edgewood, NY 11717

Receipt due by close of business day on May 24, 2023

If the proxy materials you received do not have a 16-digit control number, you may vote by following the instructions on the Notice or voting instruction form that you received.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 25, 2023: The proxy statement and annual report to shareholders are available at www.proxyvote.com.

| | | | | | | | | | | |

| | | J. Paul Jullienne Vice President, Managing Counsel and Corporate Secretary April 13, 2023 |

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 1 |

A NOTE ABOUT NON-GAAP FINANCIAL MEASURES

A Note About Non-GAAP Financial Measures

In this proxy statement, we present certain measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States of America (GAAP), which we use for purposes of setting executive compensation and evaluating our performance. Non-GAAP financial measures exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP, which are set forth below:

| | | | | | | | | | | | | | | | | |

OPERATING RESULTS ($ in millions, except per share data) — GAAP FINANCIAL MEASURES |

| Year Ended December 31 |

| 2022 | | 2021 | | 2020 |

| Net Income | $1,314.2 | | $824.2 | | $793.0 |

Net Income per share* | $6.50 | | $4.02 | | $3.89 |

| Total Stockholders' Equity (book value) | $9,197.5 | | $11,416.4 | | $10,871.0 |

Total Stockholders' Equity (book value) per share | $46.51 | | $56.37 | | $53.37 |

| Return on Equity | 12.8 | % | | 7.4 | % | | 7.6 | % |

| *Assuming dilution | | | | | |

This proxy statement refers to the following non-GAAP financial measures, which we believe are helpful performance measures and indicators of revenue, profitability and underlying trends in our business:

| | | | | | | | | | | | | | | | | |

ADJUSTED OPERATING RESULTS ($ in millions, except per share data) — NON-GAAP FINANCIAL MEASURES |

| Year Ended December 31 |

| 2022 | | 2021 | | 2020 |

After-Tax Adjusted Operating Income (1) | $1,254.3 | | $890.7 | | $1,005.4 |

After-Tax Adjusted Operating Income per share | $6.21 | | $4.35 | | $4.93 |

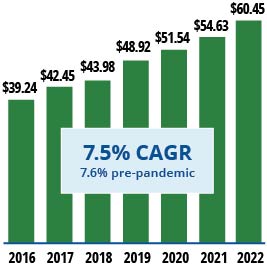

Book value, excluding AOCI (2) | $11,954.1 | | $11,062.3 | | $10,496.8 |

Book value, excluding AOCI, per share | $60.45 | | $54.63 | | $51.54 |

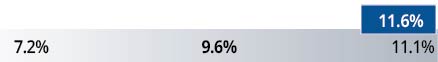

Adjusted Operating Return on Equity (3) | 11.6 | % | | 8.9 | % | | 10.7 | % |

Adjusted Operating Return on Equity (in core operations) | 17.4 | % | | 10.3 | % | | 14.1 | % |

(1)After-tax adjusted operating income is defined as net income adjusted to exclude after-tax investment gains or losses and the amortization of the cost of reinsurance as well as certain other items specified in the reconciliation of non-GAAP financial measures in Appendix A of this proxy statement. Investment gains or losses primarily include realized investment gains or losses, expected investment credit losses, and gains or losses on derivatives.

(2)We sometimes refer to book value, excluding accumulated other comprehensive income (AOCI), as "adjusted book value."

(3)Adjusted operating return on equity is calculated using after-tax adjusted operating income or loss and excludes from equity the unrealized gain or loss on securities and net gain or loss on hedges.

Investment gains or losses and unrealized gains or losses on securities and net gains on hedges depend on market conditions and do not necessarily relate to decisions regarding the underlying business of our company. We have exited a substantial portion of our Closed Block individual disability product line through the two phases of the reinsurance transaction that were executed in December 2020 and March 2021, respectively.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 2 |

A NOTE ABOUT NON-GAAP FINANCIAL MEASURES

As a result, we exclude the amortization of the cost of reinsurance that was recognized upon the exit of the business related to the ceded reserves for the cohort of policies on claim status. We believe that the exclusion of the amortization of the cost of reinsurance provides a better view of our results from our ongoing businesses. Book value per common share excluding AOCI, certain components of which tend to fluctuate depending on market conditions and general economic trends, is an important measure. We may at other times exclude certain other items from our discussion of financial ratios and metrics in order to enhance the understanding and comparability of our operational performance and the underlying fundamentals, but this exclusion is not an indication that similar items may not recur and does not replace the comparable GAAP financial measures in the determination of overall profitability.

For a reconciliation of the most directly comparable GAAP financial measures to the non-GAAP financial measures, refer to Appendix A of this proxy statement.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 3 |

FORWARD-LOOKING STATEMENTS AND WEBSITE REFERENCES

Forward-Looking Statements and Website References

Certain information contained in this proxy statement may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those not based on historical information, but rather relate to our outlook, future operations, strategies, financial results, goals (including environmental, human capital, and sustainability goals) or other developments. Forward-looking statements speak only as of the date made. Such statements involve risks and uncertainties and we can give no assurance that they will prove to be correct or that any plan, initiative, projection, goal, commitment, or expectation can or will be achieved. We undertake no obligation to update these statements, even if made available on our website or otherwise. Actual results or outcomes could differ materially from those included in the forward-looking statements. Factors that could cause actual results to differ materially from those included in the forward-looking statements are discussed in our annual report on Form 10-K for the year ended December 31, 2022 and subsequent Securities and Exchange Commission filings.

Website references throughout this proxy statement are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this proxy statement. In addition, historical, current, and forward-looking sustainability, environmental, social, governance and other-related statements may be based on standards of measurement and performance that are still developing or may change or be refined, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 4 |

Proxy Summary

This summary is intended to highlight certain key information contained in this proxy statement that we believe will assist your review of the four business items to be voted on at the 2023 Annual Meeting of Shareholders of Unum Group (the "2023 Annual Meeting"). As it is only a summary, we encourage you to review the full proxy statement, as well as our annual report on Form 10-K for the year ended December 31, 2022 (the "2022 Form 10-K"), for more complete information about these topics.

Voting Matters

| | | | | | | | | | | | | | | | | |

| Board's Recommendation | Page Reference |

| Item 1: Election of the 11 Directors Named in this Proxy Statement | FOR each nominee | |

Eleven director nominees are standing for election this year, each for a one-year term expiring at the 2024 Annual Meeting. Each director will hold office until his or her successor is duly elected and qualified or until his or her earlier death, resignation, disqualification, or removal from office. The Board and the Governance Committee believe each director nominee possesses the necessary skills and qualifications to provide effective oversight of the business. The director nominees are: |

| Director Nominee | Director Since | Independent | Committee Assignments |

Theodore H. Bunting, Jr. | 2013 | ✔ | Human Capital | Regulatory Compliance (Chair) |

Susan L. Cross | 2019 | ✔ | Audit | Risk and Finance |

Susan D. DeVore | 2018 | ✔ | Audit | Risk and Finance |

Joseph J. Echevarria | 2016 | ✔ | Governance | Risk and Finance (Chair) |

Cynthia L. Egan | 2014 | ✔ | Human Capital (Chair) | Regulatory Compliance |

Kevin T. Kabat, Board Chairman | 2008 | ✔ | Governance | Human Capital |

Timothy F. Keaney | 2012 | ✔ | Audit (Chair) | Risk and Finance |

| Gale V. King | 2022 | ✔ | Human Capital | Risk and Finance |

Gloria C. Larson | 2004 | ✔ | Governance (Chair) | Regulatory Compliance |

Richard P. McKenney, President and CEO | 2015 | — | — | |

Ronald P. O'Hanley | 2015 | ✔ | Governance | Human Capital |

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 5 |

| | | | | | | | | | | | | | |

| Board's Recommendation | Page Reference |

| Item 2: Advisory Vote to Approve Executive Compensation | FOR | |

We are seeking a non-binding advisory vote to approve the compensation of our named executive officers. We describe our compensation programs in the Compensation Discussion and Analysis section of this proxy statement. The Human Capital Committee believes these programs reward performance and align the long-term interests of management and shareholders. Although non-binding, the Human Capital Committee will take into account the outcome of the advisory vote and shareholder feedback when making future compensation decisions. |

| Item 3: Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation | 1 YEAR | |

We are seeking a non-binding advisory vote to determine whether shareholders believe we should hold future advisory votes to approve executive compensation, similar to Item 2 above, every one year, every two years, or every three years. |

Item 4: Ratification of Appointment of Independent Registered

Public Accounting Firm | FOR | |

The Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for 2023, and shareholders are being asked to ratify the appointment. |

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 6 |

Key Corporate Governance and Executive Compensation Items

2022 Say-on-Pay Vote and Shareholder Outreach

| | | | | |

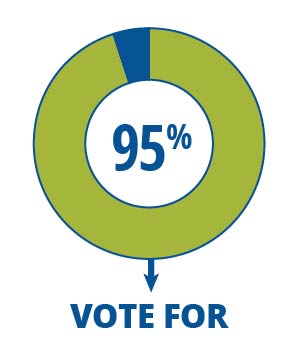

Our 2022 shareholder proposal to approve executive compensation received 95% support. In 2022, as in prior years, we invited our top shareholders, representing approximately 60% of our outstanding shares, to engage with us on business, governance, and compensation matters. Seven shareholders, representing approximately 25% of our outstanding shares, accepted our invitation for engagement, and we met with each of them. Another five shareholders, representing approximately 20% of our outstanding shares, responded that a meeting was not necessary. Our independent Human Capital Committee Chair joined three of the meetings. | |

During the 2022 outreach, we received specific feedback as follows:

•Positive commentary on the compensation disclosure in our proxy statement;

•Complimentary feedback for having a strong corporate governance profile, specifically Board diversity and independence;

•Recognition for integrating environmental, social and governance (ESG) factors into our investment decisions as well as signing the United Nations Principles for Responsible Investment; and

•Positive feedback on our ESG disclosure and a suggestion that we highlight specifics related to cybersecurity risk oversight (see page 38).

Through these discussions, we were also able to confirm that shareholders would like us to continue:

•Providing a CEO Compensation Summary in our proxy statement to help investors understand how the Committee approaches its CEO compensation decisions (see page 13); •Including Board demographics (specifically gender and ethnicity) in our Summary of Director Nominee Qualifications and Experience (see page 30); •Enhancing our ESG disclosures to enable better understanding of our corporate sustainability strategy, initiatives, and progress (see page 43); and •Emphasizing the company's commitment to creating a culture of belonging, including an expectation that all people leaders should embed inclusion and diversity into their performance goals and daily behaviors (see page 68). We also extended an invitation for engagement with two proxy advisory firms. Both firms declined a meeting indicating that they had no questions or overriding concerns with our corporate governance and executive compensation practices.

Overall, shareholders appreciated the opportunity to engage in these discussions. They also appreciated the company’s willingness to consider their input on both executive compensation and governance practices. We are committed to continuing our shareholder engagement efforts in the future.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 7 |

Corporate Governance and Executive Compensation Practices

| | | | | | | | | | | | | | |

| Executive Compensation Practices |

| ✔ | A pay-for-performance philosophy | | ✔ | Double-trigger provisions for severance and accelerated vesting of equity awards |

|

| ✔ | Annual say-on-pay votes | |

| ✔ | Restrictive covenants in our long-term incentive grant agreements |

| ✔ | Programs that mitigate undue risk taking in compensation | |

| ✔ | Clawback provisions |

| ✔ | Independent compensation consultant to the Human Capital Committee | |

| ✔ | A balance of short- and long-term incentives |

|

| ✔ | No golden parachute excise tax gross-ups | | ✔ | Robust stock ownership and retention requirements |

|

| ✔ | Limited perquisites | | ✔ | Relevant peer groups for benchmarking compensation |

|

| ✔ | No NEO employment agreements | | ✔ | In-depth performance assessments of executives |

|

| | | | | | | | | | | | | | |

| Board Practices |

| ✔ | All directors other than the CEO are independent, including the Board Chairman | | ✔ | High Board and committee meeting attendance by directors (average attendance of 99% in 2022) |

|

|

| ✔ | All Board committees fully independent | | ✔ | Limits on outside board and audit committee service |

|

| ✔ | Commitment to diversity at the Board level and within the enterprise | | | |

| |

| | | |

| | | | |

| | | | | | | | | | | | | | |

| Governance Practices |

| ✔ | Annual election of directors | | ✔ | No supermajority vote requirements |

|

| ✔ | Majority vote requirement for directors (in uncontested elections) | | ✔ | Anti-pledging and anti-hedging policies applicable to executives and directors |

|

| ✔ | Proxy access rights | |

| ✔ | Annual Board, committee, and individual director evaluations |

| ✔ | Shareholder right to call special meetings | |

| ✔ | Regular executive sessions of independent directors |

| ✔ | Annual, proactive shareholder engagement | |

| ✔ | No poison pill |

| ✔ | Independent Board chair | |

| ✔ | Board-level oversight of ESG |

| | |

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 8 |

Performance Highlights

Unum’s purpose is to help the working world thrive throughout life’s moments. We deliver on that commitment as a leading provider of financial protection benefits in the United States, United Kingdom and Poland. Through these benefits, we protect millions of working people and their families from the financial hardships that can occur in the event of illness, injury, or loss of life. Unum also offers services that help companies manage workplace wellbeing and regulatory challenges.

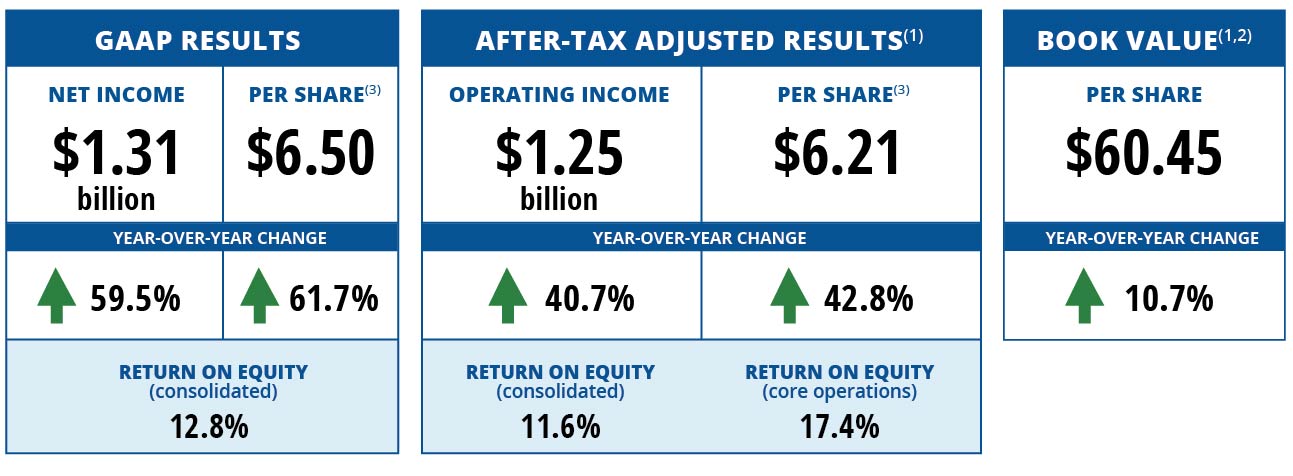

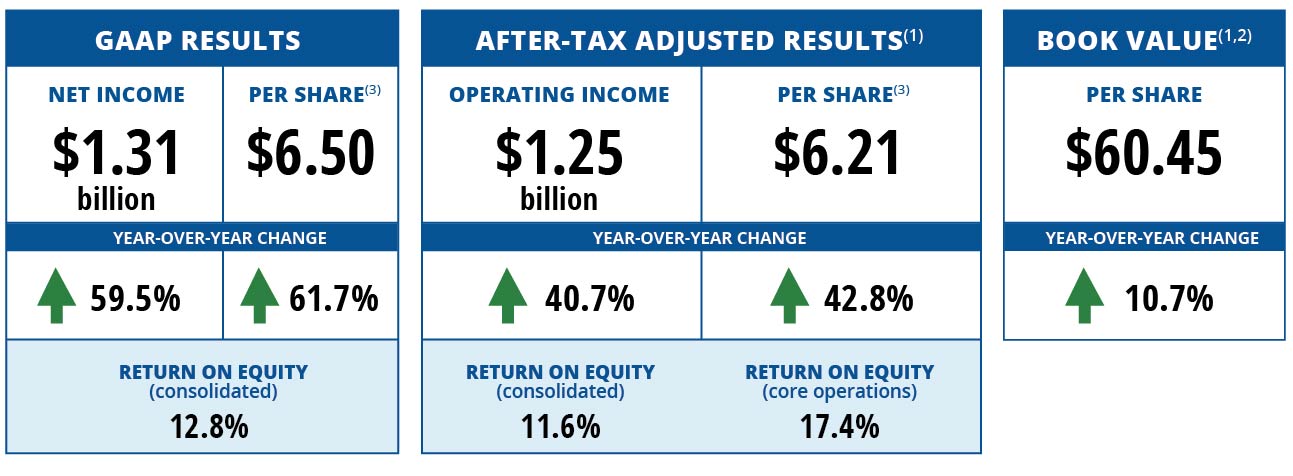

In 2022, Unum delivered record after-tax adjusted operating earnings of $1.25 billion as the company returned to pre-pandemic operating levels. Double-digit sales growth across our core operations and increased premium income highlighted the strong demand for our products and services, particularly in our group disability and leave management businesses. Claims experience returned to more normal levels as COVID-related group life and disability claims receded throughout the year. The introduction of new digital capabilities enhanced the enrollment, claims and leave experiences for customers while streamlining benefits administration for employers. Certain macro-economic trends during 2022, such as strong employment, wage inflation and rising interest rates, were also beneficial for our business.

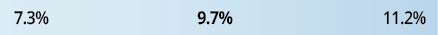

Below are key financial performance measures from 2022. Additional measures, including those we use for annual and long-term incentive decisions, can be found beginning on page 60. (1)After-tax adjusted operating results and book value per share, excluding AOCI, are non-GAAP financial measures. Information about the non-GAAP financial measures used in this proxy statement is set forth in “A Note About Non-GAAP Financial Measures” on page 2. For a reconciliation of the most directly comparable GAAP financial measures to the non-GAAP financial measures, refer to Appendix A of this proxy statement. (2)Excluding AOCI.

(3)Assuming dilution.

Operating Highlights

We delivered on our purpose of helping the working world thrive throughout life's moments in 2022. Unum paid nearly $8.0 billion in benefits to people facing illness, injury or loss of life. Satisfaction metrics measuring our interaction with customers and partners were high. We also remained focused on enhancing the experience of our customers through leveraging technology, improving processes and training employees.

We accelerated our digital transformation in response to evolving customer expectations by investing in technologies that allow us to rapidly address market needs and seize new opportunities. These technologies create new digital experiences for customers, automate and modernize business processes, track key metrics,

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 9 |

deliver new products and services to market faster, and improve customer satisfaction. By enhancing our digital capabilities, we strive to enrich the experience for our customers and enhance the effectiveness of our people.

Our well-diversified portfolio delivered consistent investment income. Due to the nature of our business, we invest in long-term securities focusing on asset liability management and sound risk management. In 2022, our portfolio performed well in a volatile interest rate environment and benefited from hedges, which were added to manage our reinvestment risk. As a United Nations Principles for Responsible Investment signatory, we are committed to expanded disclosure and an investment approach that more formally integrates ESG factors into our investment decisions.

Long-Term Care Performance

The same discipline that allows our core franchise to be successful also benefits our long-term care (LTC) business. LTC is part of our Closed Block that consists of policies that we continue to service and support, but no longer actively market. We manage this block with a combination of rate increases, risk management, tailored investment strategy and ongoing monitoring of emerging experience to inform updates to our reserve liability assumptions and prudent capital infusions.

Following an examination of one of our Maine-domiciled insurers, in 2020 the Maine Bureau of Insurance required us to establish additional LTC statutory reserves, permitting this to be done over a period of seven years. We view the additional statutory reserves as further increasing margin over our best estimate assumptions. In the last three years, LTC statutory reserves were increased by approximately $1.2 billion, and we plan on completing the recognition of these additional required reserves by the end of 2023, three years ahead of schedule.

Through these and other steps — including annual comprehensive adequacy reviews — we continue to take action designed to provide for the long-term stability of this block and promote transparency for our shareholders and customers.

Environmental, Social and Governance Matters

We provide a critical financial safety net for millions of people, a fact that drives us to deliver for those who count on us. This focus on doing the right thing guides our approach to sustainability and social responsibility. Unum has a long tradition of engaging with shareholders, customers, employees, suppliers and communities on a variety of ESG matters.

The Governance Committee of the Board provides oversight and guides the company's sustainability strategy and initiatives. In 2022, we continued to strengthen and mature our governance and disclosure of ESG matters, building on our most recent comprehensive sustainability assessment. This included evaluating additional emerging risks to our business, including climate change, as well as increased regulatory focus on ESG issues. We also updated our inclusion and diversity strategy and further refined our approach to integrating ESG factors into our investment decisions. In addition to these targeted efforts, we remained focused on providing meaningful opportunities for engagement with our key stakeholders on key ESG matters.

We recently developed a corporate sustainability strategic framework to help create long-term value for stakeholders by implementing business strategies that focus on social, environmental, governance, and economic dimensions of doing business. Our strategic framework focuses on three areas where we believe Unum can add both societal and business value:

•Inclusive products and services – We strive to ensure that the financial security provided by our products and practices contributes to more inclusive communities.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 10 |

•Responsible investments – Although we have long factored ESG considerations into a holistic assessment of risk when making investment decisions, we are taking steps to formalize and add transparency around the integration of ESG factors into our investment decisions. As part of our commitment, we have signed the United Nations Principles for Responsible Investment.

•Reducing environmental impact – We recognize that minimizing our environmental footprint serves all, while positioning the company for the impacts of climate change and enhancing our ability to engage and attract employees and customers.

A more comprehensive discussion of our efforts and progress is published annually in our ESG report, which is available at www.unum.com/about/responsibility. See page 43 for more information about ESG. Capital Generation for Shareholders

Because of our strong financial performance, we generated premium growth and strengthened our capital position in 2022, allowing us the opportunity to deploy capital in a number of ways.

•We invested in our people, products and technology to drive growth.

•We paid out more than $255 million in dividends, or $1.26 per share, in 2022.

•We purchased approximately $200 million worth of our shares in 2022.

Our credit ratings are reflective of a strong balance sheet, favorable operating results, and a highly respected brand in the employee benefits market.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 11 |

Total Shareholder Return

Unum delivered exceptional value to shareholders in 2022 as the company accelerated its recovery, returning to pre-pandemic operating levels and outpacing the performance of our peers. The company experienced increased demand for its products and services, highlighted by double-digit sales growth and strong persistency in our core operations. Record after-tax adjusted operating earnings per share illustrated Unum’s disciplined approach to pricing and balanced expense management, while our ability to generate substantial excess capital provided financial flexibility to invest in growth initiatives, fund long-term needs in our Closed Block segment and increase dividends for shareholders.

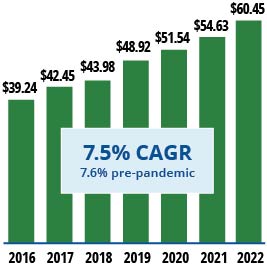

Total shareholder return (TSR) for 2022 was nearly 74%, which exceeded the S&P 500, our industry benchmark and our proxy peer group. This was a noteworthy improvement from the prior year and reflects the strength of our franchise, capital position and performance of our core operations. In 2022, Unum saw growth in book value per share (excluding AOCI) and premium income, a long-term trend that continued during the pandemic. Certain macro-economic factors, such as strong employment, wage inflation and rising interest rates, are beneficial for our business, and we believe will continue to drive greater recognition of our value to investors.

In addition to our core operations, our Closed Block segment primarily consists of long-term care (LTC) policies and older individual disability policies that Unum continues to service and support. After agreeing to increase LTC statutory reserves over a multi-year period starting in 2020, we accelerated these planned contributions over the last two years and expect to complete the recognition of these additional required reserves by the end of 2023, three years ahead of schedule. Through these and other steps, we continue to take action designed to provide for the long-term stability of this block and promote transparency for our shareholders and customers.

The pandemic highlighted the critical role and growing need for our products and services. We believe this, combined with our history of consistent execution and strategy of prioritizing funding of growth initiatives, makes Unum an excellent long-term investment.

| | | | | | | | | | | | | | | | | | | | |

| TOTAL SHAREHOLDER RETURN | | CORE OPERATIONS PREMIUM GROWTH (Billions) | BOOK VALUE PER SHARE (Excl AOCI) (1) |

| 1 Year | 3 Year | 5 Year | | | |

| Unum | 73.62% | 62.51% | (8.68)% | |

Proxy Peer Group | 5.36 | 25.08 | 24.59 | |

S&P 500 | (18.11) | 24.79 | 56.88 | |

S&P Life & Health Index (2) | 10.34 | 36.53 | 33.25 | |

(1) Non-GAAP financial measure, see Appendix A for reconciliation.

(2) S&P 500 Life & Health Insurance Sub Industry Index.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 12 |

2022 CEO Compensation Summary

Our approach to CEO compensation aligns directly with our overall executive compensation philosophy and structure as detailed in the Compensation Discussion and Analysis ("CD&A") section under "Compensation Program Structure". Richard P. McKenney serves as President and CEO of the company. Mr. McKenney's targeted total direct compensation consists of base pay plus short- and long-term incentives that are tied directly to performance goals. This structure is designed to support the long-term successes of the company and the interests of our shareholders.

Mr. McKenney is subject to robust stock ownership requirements, including a requirement to own six times his annual base salary in stock. This helps to ensure that the long-term value of his compensation directly aligns with shareholders.

At the beginning of 2022 following discussion with Mr. McKenney, the Board approved his performance goals for the year, which included:

•Business and financial objectives;

•Strategic objectives;

•Talent management initiatives;

•Goals for building a culture of inclusion and diversity; and

•Operational effectiveness and efficiency targets.

In addition to carefully reviewing a self-assessment prepared by Mr. McKenney, the Human Capital Committee (as used in this 2022 CEO Compensation Summary, the "Committee") and Board conduct a thorough evaluation of his performance against all objectives as well as a review of a number of professional and leadership characteristics and behaviors (see the "Individual Performance Evaluations" section of the CD&A).

As outlined in the "Performance Highlights" section above, Unum delivered record after-tax adjusted operating earnings of $1.25 billion as the company returned to pre-pandemic operating levels. Double-digit sales growth across our core operations and increased premium income highlighted the strong demand for our products and services, particularly in our group disability and leave management businesses.

The Committee and the Board recognized that Mr. McKenney guided the company through the year, delivering strong financial results. The Committee and the Board specifically highlighted Mr. McKenney's leadership in:

•Leading the company to record profitability, exceeding plan for nearly all operational and financial metrics;

•Strengthening the company's capital position to maximize financial flexibility while deploying capital to address key needs;

•Setting a clear tone for accountability and commitment to Unum's purpose of helping the working world thrive throughout life's moments;

•Deepening the company's commitment to sustainability and social responsibility through a variety of environmental, social, and governance and other programs that reflect the goals of the company, investors and other key stakeholders; and

•Driving a proactive change agenda focused on enhancing customer experiences, introducing new capabilities, and implementing a hybrid workplace.

The Board has full confidence in Mr. McKenney as CEO and believes the company is well-positioned for long-term success under his continued leadership.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 13 |

2022 Compensation Decisions

The CEO Compensation Summary table below depicts how the Committee views its decisions concerning Mr. McKenney’s compensation for 2022, compared to his 2021 compensation. It differs from the information presented in the Summary Compensation Table (the "SCT") required by the Securities and Exchange Commission as follows:

•The CEO Compensation Summary table treats equity awards similar to how annual incentive awards are treated in the SCT (which are based on the performance year to which the award relates). Therefore, the value of the long-term incentive (LTI) award granted in March 2023 based on performance in 2022 is shown as 2022 compensation. In contrast, the value of LTI awards reflected in the SCT is based on the year in which the equity awards are granted. As a result, 2022 compensation in the SCT includes the value of Mr. McKenney’s LTI award granted in 2022; and

•The SCT includes amounts reported in the "All Other Compensation" column. Although regularly monitored by the Committee, these amounts were not considered when it made annual performance-based compensation determinations for 2022 and are therefore not shown in the presentation below.

The CEO Compensation Summary table is not a substitute for the required SCT.

| | | | | | | | |

| CEO COMPENSATION SUMMARY |

| Component | 2021 | 2022 |

Base Salary | $1,050,000 | | $1,090,385 | |

Annual Incentive Payout | 2,646,000 | | 3,761,828 | |

Approved LTI Grant | 8,400,000 | | 9,000,000 | |

| Annual Compensation | $12,096,000 | | $13,852,213 | |

ANNUAL INCENTIVE

Mr. McKenney's 2022 annual incentive payout of $3,761,828 was calculated by applying the company performance achievement factor of 150% to his target award (see "Annual Incentive Results" in the CD&A section). Mr. McKenney's 2022 annual incentive award is an increase of $1,115,828 from his 2021 payout and was primarily driven by an increase in the year-over-year company performance achievement from 120% to 150% of the target award.

LONG-TERM INCENTIVE

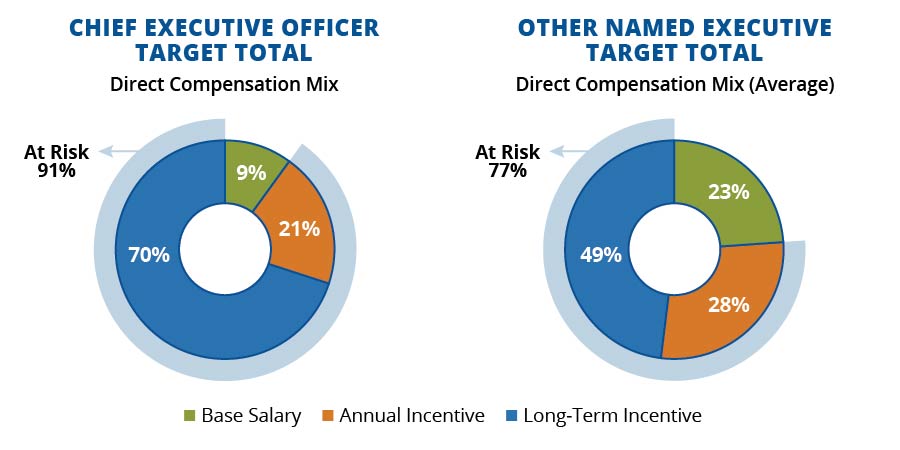

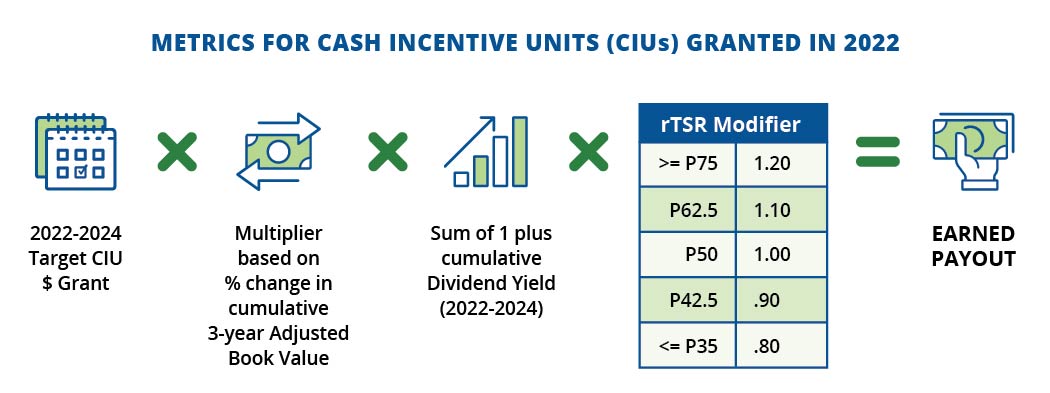

For 2022, 70% of Mr. McKenney's pay was in the form of long-term incentives (delivered through time-based restricted stock units (RSUs) and performance-based cash incentive units (CIUs)). The value of the RSUs is based on the company’s stock price while the value of his CIUs are based on growth in adjusted book value and dividends, further modified by relative total shareholder return (TSR). After consideration of Mr. McKenney's strategic leadership, his performance in 2022 and other considerations outlined above, the Committee awarded Mr. McKenney a LTI grant of $9,000,000 for 2022 performance. This award, which was granted in March 2023, is an increase of $600,000 over his award granted last year and reflects both his performance as outlined above as well as the performance of the company's stock, with TSR of nearly 74% during the year.

Our LTI program is designed to align the interests of management and long-term shareholders. For example, this impact can be seen in the vesting of Mr. McKenney's 2020-2022 performance share unit (PSU) award. Business goals were achieved at 150% of target over the three-year performance period, with relative TSR at the 87.5th percentile of the comparator group, resulting in a 20% increase for a final payout of 180% of target. The table below outlines the calculation of this award for the performance period ending December 31, 2022.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 14 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PERFORMANCE IMPACT ON 2020-2022 PSU AWARDS |

| 2020 Grant Date Value(1) | Target PSUs Granted | | Operating Performance Factor | | Adjusted Shares | | TSR Modifier | | Earned Shares | Accrued Cash Dividends | Value of Earned Shares and Cash Dividends(2) |

| | | |

| CEO | $3,185,008 | 136,637 | x | 150% | = | 204,956 | x | 120% | = | 245,946.6 | $889,097 | $11,418,071 |

(1)This amount was calculated by multiplying Mr. McKenney's target grant of 136,637 PSUs on the grant date, March 1, 2020, by $23.31, the closing stock price on the prior trading day, February 28, 2020.

(2)The PSU achievement was certified by the Committee on February 20, 2023. Given this date was not a trading day, the shares were valued based on the prior trading day's closing stock price of $42.81 (February 17, 2023).

2023 Compensation

In February 2023, the Committee with its consultant, Pay Governance LLC, reviewed Mr. McKenney's total targeted compensation relative to proxy peers. After considering his experience, his performance in the CEO role, and the leadership that he has shown during his almost eight years in the role, the Committee decided to increase his annual incentive target from 230% to 250% and his long-term incentive target opportunity from $8.4 million to $9.5 million. These decisions reflect Mr. McKenney's strong leadership and strategic positioning of the company. With these adjustments, Mr. McKenney's targeted total direct compensation is positioned between the 50th and 75th percentile of our proxy peer group, which the Committee believes is appropriate given his tenure and performance in the job.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 15 |

Corporate Governance

Board Overview

The Board of Directors is elected by shareholders to oversee their interests in the long-term health and overall success of the company's business and financial strength. In addition, the Board has responsibility to the company's policyholders, employees, and business partners and to the communities in which the company operates, all of which are essential to the company's success. The Board oversees the CEO and other senior management, who are responsible for carrying out the company's day-to-day operations in a responsible and ethical manner. The Board and its committees meet regularly to review and discuss the company's strategy, business, performance, ethics, risk tolerance, human capital engagement, and culture, as well as important issues that it faces. These discussions take place with management and, as appropriate, with outside advisers who provide independent expertise, perspectives and insights. In addition, the independent members of the Board and its committees hold regular executive sessions without management present. Board members are also in ongoing communication with each other and with management between meetings.

Board Composition and Refreshment

The Board believes a critical component of its effectiveness in serving the long-term interests of shareholders is to ensure its membership remains diverse, possessing a variety of backgrounds, experiences and skill sets from which to draw. Fresh views and ideas help the Board to maintain a broad perspective and forward-looking vision capable of anticipating and adapting to the rapid pace of change, just as experience and continuity provide necessary context and stability for important decisions. With that in mind, the Governance Committee reviews the composition of the Board with the goal of maintaining an appropriate balance of experiences, skills, tenure and diversity. This is an ongoing, year-round evaluation process. Most recently, Gale King joined the Board in 2022 as a result of the Board's commitment to this ongoing process. Additionally, Mr. Shammo's decision to not stand for re-election at the 2023 Annual Meeting will further inform the Governance Committee's discussions and process surrounding the composition of the Board and its committees.

The Board is committed to effective Board succession planning and refreshment, including having honest and difficult conversations with individual directors when necessary. These conversations may arise in connection with the Board evaluation process, succession planning or consideration of the annual slate of Board nominees. As a result of these processes, directors may decide (for personal or professional reasons) or be asked (for reasons such as evolving needs for Board composition or directors' availability to make sufficient contributions to the Board) not to stand for re-election at the next Annual Meeting. It is expected these refreshment practices will continue in the future. While some companies have tenure limits on Board service, we believe our balanced approach delivers the right mix of directors with new ideas and perspectives along with those possessing deep knowledge of the company.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 16 |

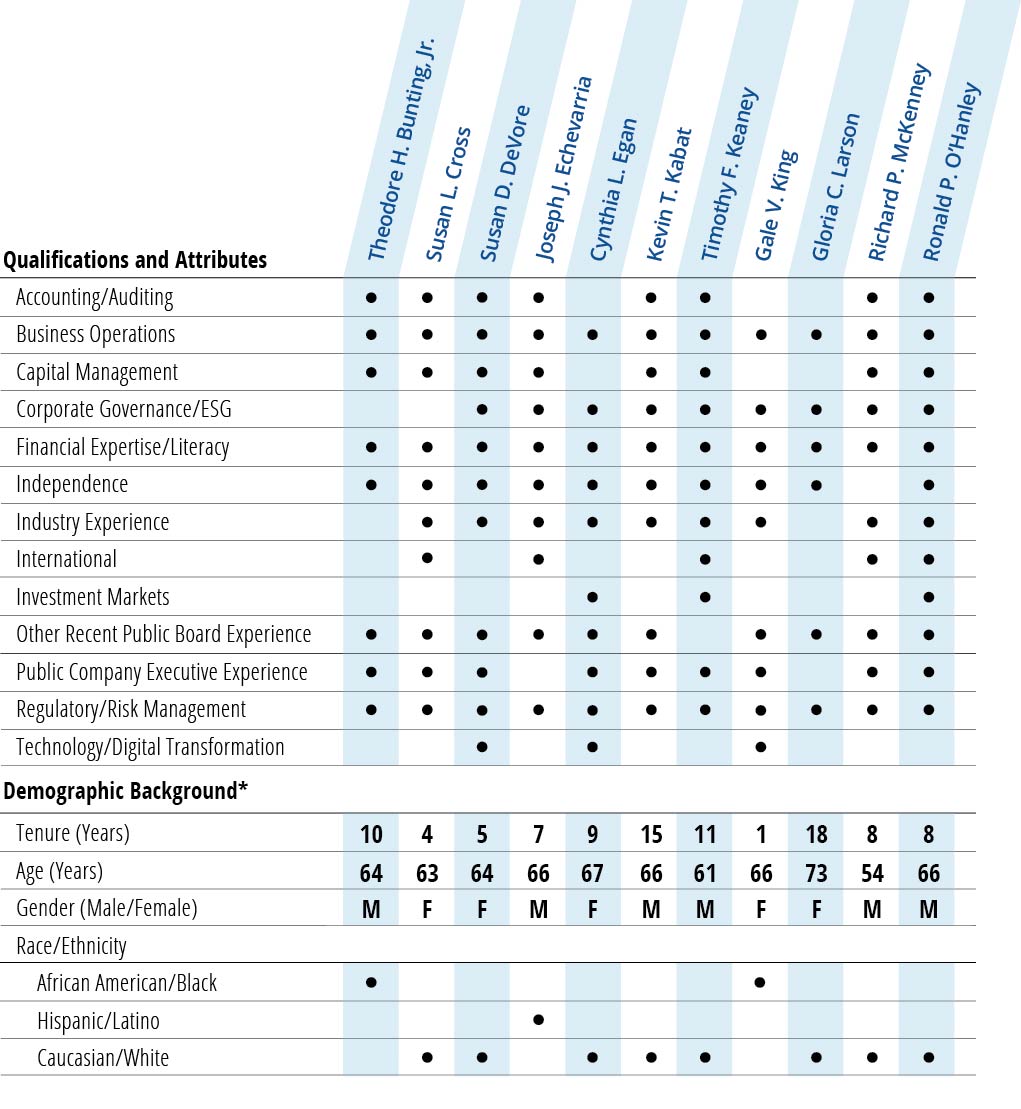

Board Qualifications

The Board strives to maintain independence of thought and diverse professional experience among its membership. The Board and the Governance Committee look for directors who have qualifications and attributes in key areas relevant to Unum, and that align with both our short- and long-term business strategies. These qualifications and attributes are evaluated on an annual basis and adjusted as needed so that they continue to serve the best interests of the company. The table below summarizes the qualifications and attributes that are important to Unum and addresses how the composition of our Board, as a whole, meets these needs.

| | | | | | | | |

Qualifications

and Attributes | Relevance to Unum | Board Composition* |

| Accounting/Auditing | We operate in a complex financial and regulatory environment with disclosure requirements, detailed business processes and internal controls. | |

| Business Operations | We have significant operations focused on customer service, claims management, sales, marketing and various back-house functions. | |

| Capital Management | We allocate capital in various ways to run our operations, grow our core businesses and return value to shareholders. | |

| Corporate Governance/ESG | As a public company and responsible corporate citizen, we expect effective oversight and transparency, and our stakeholders demand it. | |

| Financial Expertise/Literacy | Our business involves complex financial transactions and reporting requirements. | |

| Independence | Independent directors have no material relationships with us and are essential in providing unbiased oversight. | |

| Industry Experience | Experience in the insurance and financial services industry provides a relevant understanding of our business, strategy, and marketplace dynamics. | |

| International | With global operations in several countries and prospects for further expansion, international experience helps us understand opportunities and challenges. | |

| Investment Markets | We manage a large and long-term investment portfolio to uphold our promises to pay the future claims of our policyholders. | |

| Recent Public Board Experience | We value individuals who understand public company reporting responsibilities and have experience with the issues commonly faced by public companies. | |

| Public Company Executive Experience | Experience leading a large, widely-held organization provides practical insights on need for transparency, accountability, and integrity. | |

| Regulatory/Risk Management | A complex regulatory and risk environment requires us to develop policies and procedures that effectively manage compliance and risk. | |

| Technology/Digital Transformation | We rely on technology to manage customer data, deliver products and services to the market, pay claims, and enhance the customer experience. | |

*Includes only the 11 director nominees named in this proxy statement.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 17 |

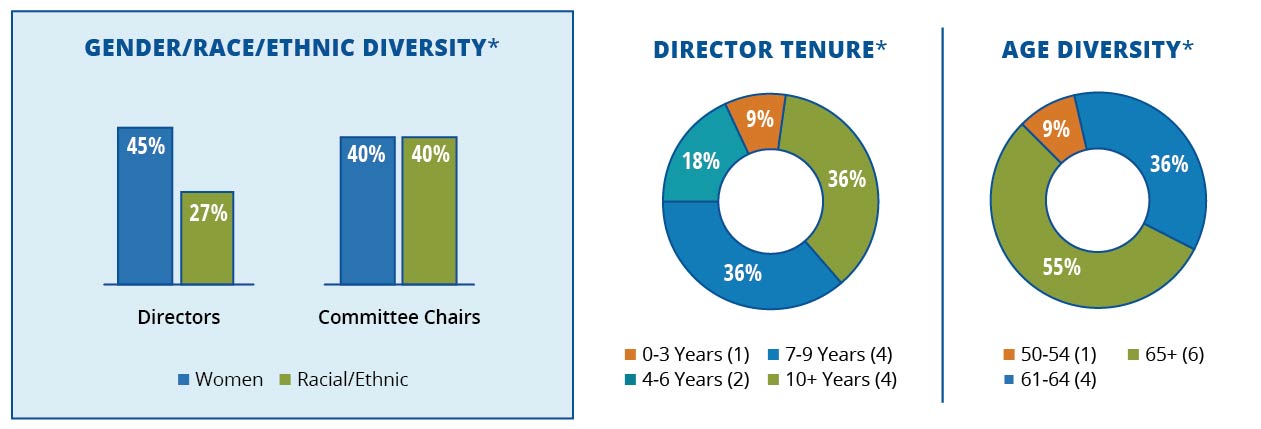

Board Tenure

Directors with varied tenure contribute to a range of perspectives and allow us to transition knowledge and experience from longer-serving members to those newer to our Board. We have a mix of new and long-standing directors, with our 11 director nominees averaging 8.8 years of service on the Board as of the 2023 Annual Meeting.

Board Diversity

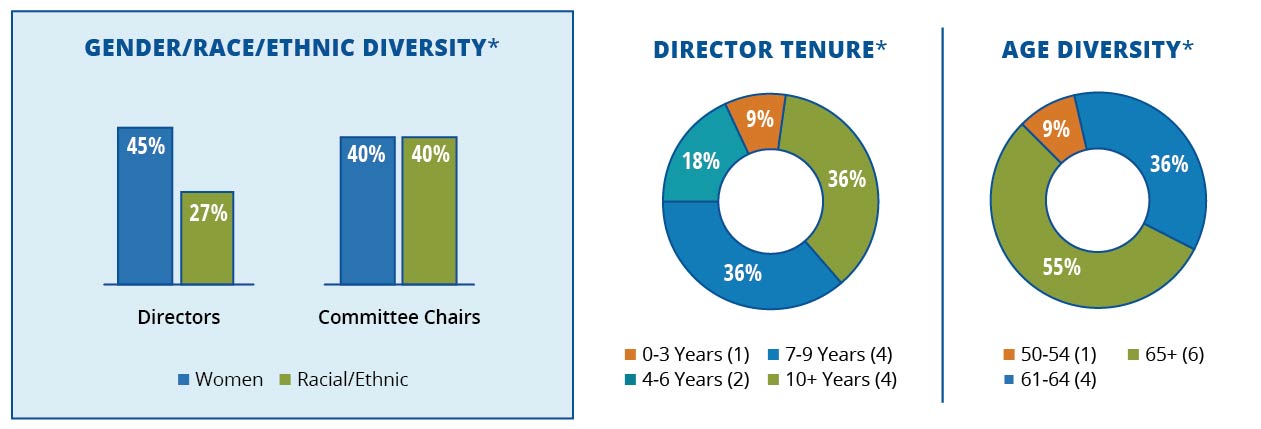

Our Board is comprised of members with a range of backgrounds and overall experience. More than half of our 11 director nominees are women or represent a minority group.

Although the Board does not have a specific diversity policy, it recognizes diverse representation on the Board with respect to gender, race, ethnicity, and age, including in positions of leadership, serves to improve dialogue, decision-making, and culture in the boardroom. Our Governance Committee focuses on advancing continued diversity on the Board during refreshment activities by requiring that candidate pools include diverse individuals, including women, who meet the recruitment criteria. From the candidate pools, our Governance Committee selects director candidates based on their qualifications and attributes as addressed below. Our director nominees range from 54 to 73 years of age, with the average age being 64.5 years, as of the 2023 Annual Meeting.

*Includes only the 11 director nominees named in this proxy statement. Tenure and age for director nominees is calculated as of the 2023 Annual Meeting. Tenure is rounded to the nearest year and calculated from date of first election.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 18 |

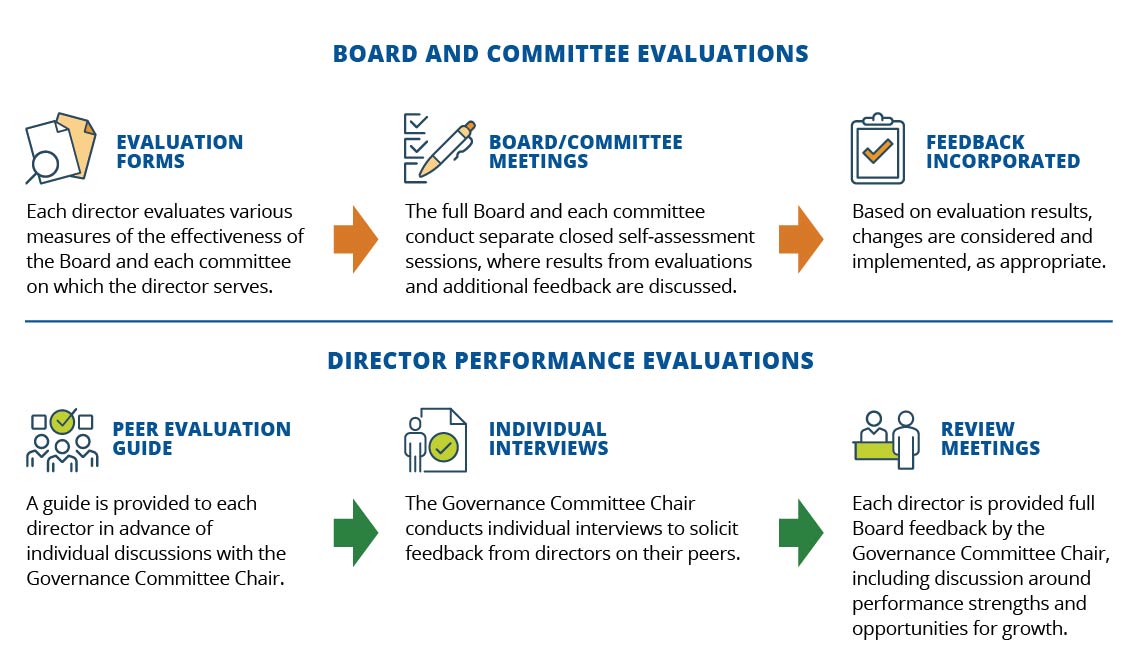

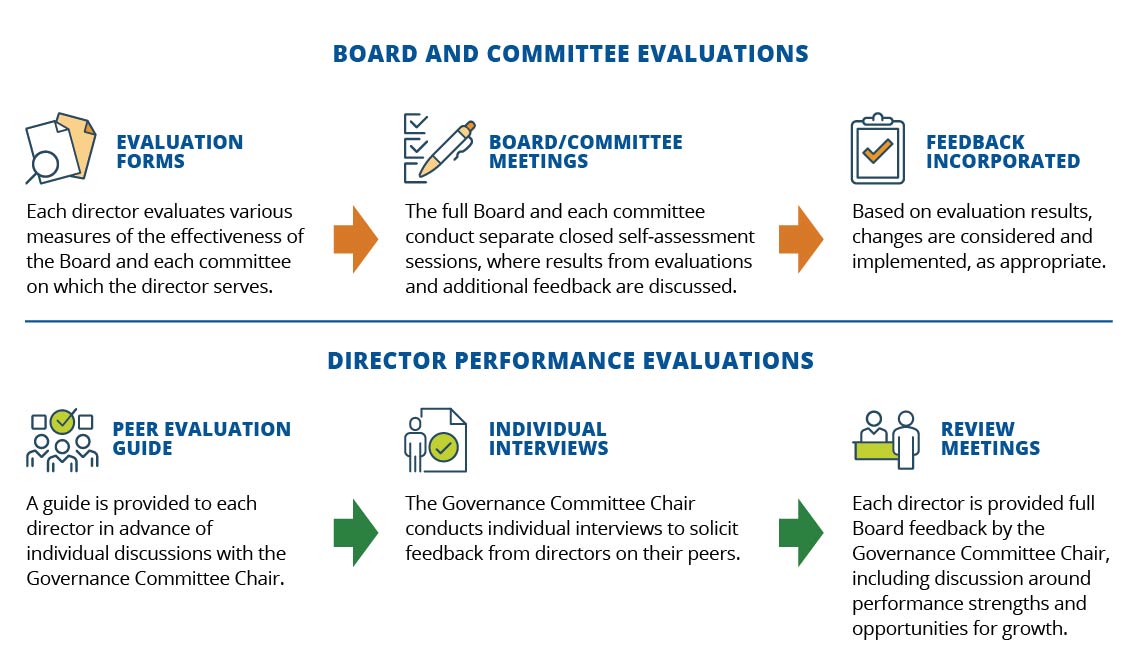

Board Evaluation Process

A healthy and vigorous Board evaluation process is an essential part of good corporate governance. A thorough evaluation process helps us achieve the right balance of perspectives, experiences and skill sets needed for prudent oversight of the company, including execution on corporate strategy, while also considering the best interests of our shareholders. At Unum, this evaluation process includes annual evaluations of the Board, each committee, and individual directors.

The Governance Committee establishes and oversees the evaluation process, which focuses on identifying areas where Board, committee and director performance is most effective, as well as opportunities for further development or enhancement. Each year, the Governance Committee reviews the format and effectiveness of the evaluation process in identifying actionable feedback, recommending changes in process as appropriate. Determining whether to engage a third-party facilitator is also part of the review.

The evaluation process is conducted in two phases. The first phase focuses on the evaluation of the effectiveness of each committee and the Board as a whole. Directors complete questionnaires evaluating the Board and the committees on which they serve across a variety of topics, including culture, composition, structure and engagement. In recent years, Board members have provided feedback regarding corporate strategy, risk management programs, Board composition and structure, succession plans, future agenda items, meeting materials and director education. The second phase involves interviewing individual directors to collect feedback on peer directors' performance. This phase is led by the Governance Committee Chair in advance and in anticipation of the nomination process, with key messages delivered to each director. This two-phased approach has generated robust discussions at all levels of the Board, and resulted in changes that have improved Board efficiency and effectiveness. For example, in recent years, these discussions have led to enhancements to Board diversity, meeting materials, director on-boarding, executive sessions, and Board member engagement.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 19 |

Director Independence

Our corporate governance guidelines provide that a majority of the Board will be independent. For a director to be considered independent, the Board must determine the director has no material relationship with our company, and the director must meet the requirements for independence under the listing standards of the New York Stock Exchange (NYSE). The Board has also determined certain categories of relationships are not considered to be material relationships that would impair a director’s independence. These independence standards are listed in our corporate governance guidelines, which are available on our investor relations website under the "Governance" heading at www.investors.unum.com.

The Governance Committee reviews information about the directors’ relationships and affiliations that are germane to an assessment of their independence and makes recommendations to the Board as to the independence of the directors. In making independence determinations, the Board considers all relevant facts and circumstances. In this regard, the Board considered that each of the non-employee directors, or one of their immediate family members, is or was during the last three fiscal years a director, trustee, advisor, or executive or served in a similar position at another business that had dealings with our company during those years. In each case, these have been ordinary course dealings (e.g., where the other business obtains insurance policies from us or we acquire, dispose or receive interest on security investments or make payments for trustee, depository and commercial banking business relationships) involving amounts less than 1% of both our and the other business’ consolidated gross revenues for such fiscal year or in which the director's interest arose only from his or her position as a director of the other business. None of our non-employee directors, or any of their immediate family members, is or was during the last three fiscal years, a director, executive, or employee of a charitable organization or university that received contributions from us (other than non-discretionary matching contributions) in excess of $120,000 in any one fiscal year.

Based on a review of the findings and recommendations of the Governance Committee and applying the standards described above, the Board has determined Mr. Bunting, Ms. Cross, Ms. DeVore, Mr. Echevarria, Ms. Egan, Mr. Kabat, Mr. Keaney, Ms. King, Ms. Larson, Mr. O’Hanley and Mr. Shammo are independent directors.

Mr. McKenney, our President and CEO, is not an independent director.

Process for Selecting and Nominating Directors

Director Nominee and Selection

The Governance Committee is responsible for identifying and evaluating director candidates and recommending to the Board a slate of nominees for election at each Annual Meeting. The Governance Committee periodically engages a third-party search firm to assist with recruitment efforts. During these times, the firm has been asked to identify candidates who meet the criteria of our search, provide requested background and other relevant information regarding candidates, and coordinate arrangements for interviews as necessary. Nominees may also be suggested by directors, management, or shareholders.

Shareholders may recommend director candidates for consideration by the Governance Committee by providing the same information that would be required to nominate a director candidate, as described on page 113 in the section titled "Shareholder proposals and nominations for our 2024 Annual Meeting". Submissions must be made in writing to the Corporate Secretary at Unum Group, 1 Fountain Square, Chattanooga, Tennessee 37402. The Governance Committee’s policy is to consider candidates recommended by shareholders in the same manner as other candidates.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 20 |

Our corporate governance guidelines specify the following criteria to be used in evaluating the candidacy of a prospective nominee:

•Reputation for high ethical conduct, integrity, sound judgment, and accountability;

•Current knowledge and experience in one or more key areas identified in the corporate governance guidelines;

•Ability to commit sufficient time to the Board and its committees;

•Collegial effectiveness; and

•Diversity, whether in viewpoints, gender, race, ethnicity, age, professional experience or other demographics.

The core qualifications and attributes sought in any particular candidate depend on the current and future needs of the Board based on an assessment of the composition of the Board and the mix of qualifications and attributes currently represented. In addition, the Governance Committee considers other specific qualifications that may be desired or required of nominees, including their independence and ability to satisfy specific requirements for committees. As part of the director selection and nomination process, the Governance Committee assesses the effectiveness of its Board membership criteria.

In determining whether to recommend a director for re-election, the Governance Committee also considers the director’s ability to commit the time and attention appropriate for effective Board service; past attendance at meetings; contributions to the Board and committees on which the director serves; the skills, experience and background that the director brings to the Board relative to the Board’s needs and existing composition; and the results of the most recent Board, committee and individual director evaluations.

Annual Election of Directors

Directors are elected each year at the Annual Meeting for a one-year term expiring at the next Annual Meeting. Directors hold office until their successors are elected, or until their earlier death, resignation, disqualification, or removal from office. Other than requiring retirement from the Board at the next Annual Meeting after a director reaches age 75, there are no term limits. However, the Governance Committee evaluates the qualifications and performance of each incumbent director before recommending the nomination of that director for an additional term.

Majority Voting Standard

Our bylaws provide that, in an election of directors where the number of nominees does not exceed the number of directors to be elected (an "uncontested election"), each nominee must receive a majority of the votes cast with respect to that nominee to be elected as a director (i.e., the number of shares voted "for" a nominee must exceed the number voted "against" that nominee). If an incumbent director is not re-elected under this majority voting standard, the Board must decide whether to accept or reject the director's offer of resignation which was previously delivered to the company pursuant to the Board's advance contingent director resignation policy. The Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. If the director submitting the resignation is a member of the Governance Committee, that director will not participate in the Governance Committee’s recommendation to the Board. The Board will act on the Governance Committee’s recommendation and publicly disclose its decision and rationale within 90 days from the date of the certification of the election results. The director in question will not participate in the Board's decision.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 21 |

Limits on Board and Audit Committee Service

While we recognize that Board members benefit from service on the boards of other companies and such service is encouraged, the Board believes it is critical that directors be able to dedicate sufficient time to their service on our Board. To that end, except for our CEO, no director may serve on more than three public company boards in addition to our Board, or on more than two audit committees of public companies in addition to our Audit Committee. The company's CEO may not serve on more than one public company board in addition to our Board.

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 22 |

INFORMATION ABOUT THE BOARD OF DIRECTORS

Information about the Board of Directors

Below are brief biographies for each of our current directors and descriptions of the directors’ key qualifications, skills, and experiences that contribute to the Board’s effectiveness as a whole.

Director Nominees

| | | | | | | | | | | | | | |

Director since 2013 Age: 64 at Annual Meeting

Independent Director

COMMITTEES •Human Capital •Regulatory Compliance (Chair) | | Theodore H. Bunting, Jr. | | |

| | | |

| Mr. Bunting retired as the Group President, Utility Operations of Entergy Corporation, an integrated energy company, where he previously served as Senior Vice President and Chief Accounting Officer. He has extensive financial, accounting and operational experience as a senior executive with a public company in a regulated industry. Mr. Bunting has experience as a director at other publicly traded companies and is also a certified public accountant. |

| CAREER EXPERIENCE | | QUALIFICATIONS |

| Entergy Corporation Group President, Utility Operations (2012-2017) Sr. Vice President and Chief Accounting Officer (2007-2012) Numerous other executive roles (joined Entergy in 1983) | | •Accounting/Auditing •Business Operations •Capital Management •Financial Expertise/Literacy •Other Recent Public Company Board Experience •Public Company Executive Experience •Regulatory/Risk Management |

| | |

| PUBLIC COMPANY BOARD EXPERIENCE | |

|

| The Hanover Insurance Group, Inc., since 2020 NiSource Inc., since 2018 Prior board service: Infrastructure and Energy Alternatives, Inc. (2021-2022) | |

|

| | | | | | | | | | | | | | |

Director since 2019 Age: 63 at Annual Meeting

Independent Director

COMMITTEES •Audit •Risk and Finance | | Susan L. Cross | | |

| | | |

| Ms. Cross is the former Executive Vice President and Global Chief Actuary of XL Group Ltd (now AXA XL), a global insurance and reinsurance company. She previously held various chief actuarial positions for operational segments of XL. Ms. Cross brings more than three decades of financial, actuarial, insurance and risk experience as a senior executive with an international company in a regulated industry. She is a director of another publicly traded company, and she also qualifies as an audit committee financial expert under SEC regulations. |

| CAREER EXPERIENCE | | QUALIFICATIONS |

| XL Group Ltd. Executive Vice President and Global Chief Actuary (2008–2018) Senior Vice President and Chief Actuary, XL Group (2006–2008) XL Reinsurance (2000–2006) XL America (1999–2000) Significant consulting experience with Willis Towers Watson in the U.S. and Bermuda | | •Accounting/Auditing •Business Operations •Capital Management •Financial Expertise/Literacy •Industry Experience •International •Other Recent Public Company Board Experience •Public Company Executive Experience •Regulatory/Risk Management |

| PUBLIC COMPANY BOARD EXPERIENCE | |

| |

| Enstar Group Limited, since 2020 | |

| | | | | | | | |

2023 UNUM GROUP PROXY STATEMENT | 23 |

INFORMATION ABOUT THE BOARD OF DIRECTORS

| | | | | | | | | | | | | | |

Director since 2018 Age: 64 at Annual Meeting

Independent Director

COMMITTEES •Audit •Risk and Finance | | Susan D. DeVore | | |

| | | |

| Ms. DeVore retired as the Chief Executive Officer of Premier, Inc., a leading health care improvement company, after serving in that role from 2013 to May 2021. She previously served as President of Premier from 2013 to April 2019, and before that served as President and Chief Executive Officer for its predecessor company, Premier Healthcare Solutions, Inc. She also previously served as the Chief Operating Officer for a number of affiliated Premier entities. Prior to joining Premier, Ms. DeVore had two decades of finance, strategy and health care consulting experience. She also qualifies as an audit committee financial expert under SEC regulations. |

| CAREER EXPERIENCE | | QUALIFICATIONS |

| Premier, Inc. CEO (2013 - May 2021) President (2013–April 2019) Premier Healthcare Solutions, Inc. President and CEO (2009–2013) COO (2006–2009) Significant consulting experience with Ernst & Young LLP, including service as a Partner, Executive Committee member and Senior Healthcare Industry Management Practice Leader | | •Accounting/Auditing •Business Operations •Capital Management •Corporate Governance/ESG •Financial Expertise/Literacy •Industry Experience •Other Recent Public Company Board Experience •Public Company Executive Experience •Regulatory/Risk Management •Technology/Digital Transformation |

| | PUBLIC COMPANY BOARD EXPERIENCE | |

| | Elevance Health, Inc., since 2021 Prior board service: Premier, Inc. (2013-2021) | |

| | | | |

| | | | | | | | | | | | | | |

Director since 2016 Age: 66 at Annual Meeting

Independent Director

COMMITTEES •Governance •Risk and Finance (Chair) | | Joseph J. Echevarria | | |

| | | |