DEF 14AFALSE000005506700000550672022-01-022022-12-31iso4217:USDxbrli:pure00000550672021-01-032022-01-0100000550672019-12-292021-01-0200000550672022-12-31iso4217:USDxbrli:shares00000550672022-01-0100000550672021-01-020000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:PeoMember2022-01-022022-12-310000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMemberk:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMember2022-01-022022-12-310000055067k:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMemberk:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMember2022-01-022022-12-310000055067k:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:PeoMember2022-01-022022-12-310000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMemberk:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2022-01-022022-12-310000055067k:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMemberk:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMember2022-01-022022-12-310000055067k:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMemberk:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMember2022-01-022022-12-310000055067k:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:PeoMember2022-01-022022-12-310000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:NonPeoNeoMember2022-01-022022-12-310000055067ecd:PeoMember2022-01-022022-12-310000055067ecd:NonPeoNeoMember2022-01-022022-12-310000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:PeoMember2021-01-032022-01-010000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMemberk:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMember2021-01-032022-01-010000055067k:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMemberk:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMember2021-01-032022-01-010000055067k:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:PeoMember2021-01-032022-01-010000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMemberk:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2021-01-032022-01-010000055067k:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMemberk:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMember2021-01-032022-01-010000055067k:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMemberk:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMember2021-01-032022-01-010000055067k:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:PeoMember2021-01-032022-01-010000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:NonPeoNeoMember2021-01-032022-01-010000055067ecd:PeoMember2021-01-032022-01-010000055067ecd:NonPeoNeoMember2021-01-032022-01-010000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:PeoMember2019-12-292021-01-020000055067k:ValueOfStockAndOptionAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMemberk:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMember2019-12-292021-01-020000055067k:ChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMemberk:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMember2019-12-292021-01-020000055067k:PensionServiceCostAndImpactOfPensionPlanAdjustmentsMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:PeoMember2019-12-292021-01-020000055067k:YearEndValueOfAwardsGrantedInFiscalYearThatAreUnvestedAndOutstandingMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMemberk:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2019-12-292021-01-020000055067k:ChangeInFairValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMemberk:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMember2019-12-292021-01-020000055067k:FMVOfAwardsGrantedThisYearAndThatVestedThisYearMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMemberk:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMember2019-12-292021-01-020000055067k:ChangeInFairValueFromPriorYearEndOfPriorYearAwardsThatVestedThisYearMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:PeoMember2019-12-292021-01-020000055067k:PriorYearFairValueOfPriorYearAwardsThatFailedToVestThisYearMemberecd:NonPeoNeoMember2019-12-292021-01-020000055067ecd:PeoMember2019-12-292021-01-020000055067ecd:NonPeoNeoMember2019-12-292021-01-02000005506772022-01-022022-12-31000005506712022-01-022022-12-31000005506742022-01-022022-12-31000005506722022-01-022022-12-31000005506752022-01-022022-12-31000005506732022-01-022022-12-31000005506762022-01-022022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or §240.14a-12 |

KELLOGG COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ý | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Message from the Chairman and

Chief Executive Officer

KELLOGG COMPANY,

BATTLE CREEK,

MICHIGAN 49017-3534

Dear Shareowner:

On behalf of the Board of Directors, it is our pleasure to invite you to attend the 2023 Annual Meeting of Shareowners of Kellogg Company. The meeting will take place at 1:00 p.m. Eastern Time on April 28, 2023 and will be held entirely online via live webcast at www.virtualshareholdermeeting.com/K2023. There will not be an option to attend the meeting in person.

The following pages contain the formal Notice of the Annual Meeting and the Proxy Statement. Please review this material for information concerning the business to be conducted at the meeting and the nominees for election as Directors.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their shareowners on the Internet. We believe these rules allow us to provide our Shareowners with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting.

While you will not be able to attend the Annual Meeting at a physical location, we have designed the virtual Annual Meeting so that our Shareowners are given the same rights and opportunities to actively participate in the Annual Meeting as they would at an in-person meeting, using online tools to facilitate Shareowner access and participation. Attendance at the Annual Meeting will be limited to Shareowners only. You are entitled to participate in the Annual Meeting if you were a Shareowner as of the close of business on February 28, 2023, the record date, or hold a legal proxy for the meeting provided by your bank, broker, or nominee. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/K2023 (the “Annual Meeting Website”), you must enter the 16-digit control number found on your proxy card, voting instruction form or notice. You may vote your shares and submit your questions during the Annual Meeting by following the instructions available on the Annual Meeting Website during the meeting. If you do not have access to the Internet and are interested in attending, please contact Kellogg Investor Relations at (269) 961-2800, or (844) 986-0822 (US) or (303) 562-9302 (International).

If any Shareowner needs special assistance at the meeting, please contact Shareowner Services at (269) 961-2800 or by email at investor.relations@kellogg.com.

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares, and to do so as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. If you received a paper copy of the proxy or voting instruction card by mail, you may sign, date and mail the card in the envelope provided.

Sincerely,

| | | | | |

| |

Steve Cahillane Chairman, President and Chief Executive Officer March 2, 2023 |

One Kellogg Square

Battle Creek, Michigan 49017-3534

Notice of the Annual Meeting of Shareowners

Background

| | | | | | | | |

| | |

| Date and Time | Virtual Meeting | Record Date |

| | | |

| | | |

April 28, 2023 at 1:00 p.m. Eastern Time | Live webcast at

www.virtualshareholdermeeting.com/K2023 | Only Shareowners of record at the close of business on February 28, 2023 will receive notice of and be entitled to vote at the meeting or any adjournments. |

| | | |

Voting Items

| | | | | | | | |

| Proposal | Board Voting Recommendation |

| | |

1.To elect three Directors for a three-year term to expire at the 2026 Annual Meeting of Shareowners | | FOR each director nominee |

| | |

| | |

2.To vote on an advisory resolution to approve executive compensation | | FOR |

| | |

| | |

3.To hold an advisory vote on the frequency of holding an advisory vote on executive compensation | | ONE YEAR |

| | |

| | |

4.To ratify the Audit Committee's appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our 2023 fiscal year | | FOR |

| | |

| | |

5.To consider and act upon a Shareowner proposal requesting a civil rights, non-discrimination and return to merits audit, if properly presented at the meeting | | AGAINST |

| | |

| | |

6.To consider and act upon a Shareowner proposal requesting additional reporting on pay equity disclosure, if properly presented at the meeting | | AGAINST |

| | |

Shareowners will also take action upon any other matters that may properly come before the meeting, or any adjournments thereof.

The Annual Meeting will be virtual and will be held entirely online via live webcast at www.virtualshareholdermeeting.com/K2023. There will not be an option to attend the meeting in person.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on April 28, 2023: The Proxy Statement and 2022 Annual Report are available at https://investor.kelloggs.com/financials/sec-filings. On or about March 2, 2023, we are mailing either a Notice Regarding the Availability of Proxy Materials containing instructions on how to access this Proxy Statement and 2022 Annual Report online, or a printed copy of these proxy materials, as required by the rules of the Securities and Exchange Commission.

We look forward to the meeting.

By Order of the Board of Directors,

Gary Pilnick

Vice Chairman and Secretary

March 2, 2023

About Kellogg Company

Kellogg At a Glance

Kellogg Company (NYSE: K), founded in 1906, is engaged in the manufacture and marketing of snacks and convenience foods. Kellogg is a leading producer of cereal, crackers and savory snacks and frozen foods. Additional product offerings include toaster pastries, cereal bars, veggie foods, and noodles. Kellogg products are manufactured and marketed globally. Our beloved brands include Pringles®, Cheez-It®, Special K®, Kellogg's Frosted Flakes®, Pop-Tarts®, Kellogg's Corn Flakes®, Rice Krispies®, Eggo®, Mini-Wheats®, Kashi®, RXBAR®, MorningStar Farms® and more.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Over 1,000 products marketed in 180 Countries | 2022 Sales: ~$15.3B | World’s Leading cereal company |

| | | | | | | | |

| | | | | | | | |

World’s 2nd Largest savory snack company | A leading global plant-based foods company | Leading North American frozen foods company |

| | | | | | | | |

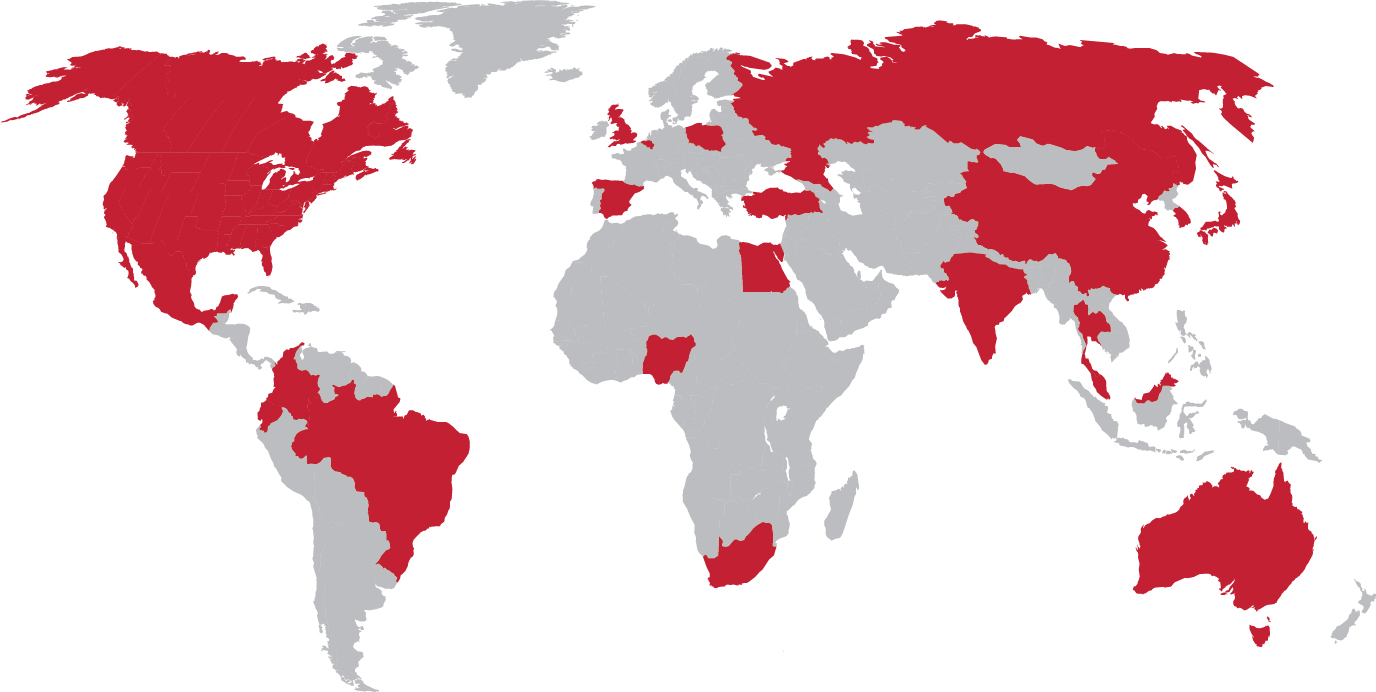

MANUFACTURING OPERATIONS ACROSS THE GLOBE:

| | |

| |

“I'll invest my money in people.” W.K. Kellogg – Founder of Kellogg Company |

| |

We Live Our Values

| | | | | |

| Our values are part of our DNA. They guide us, and we live them every day as we work with our customers, consumers, and business partners, in our communities and with each other. |

| | | | | | | | | | | | | | |

We Act with Integrity and

Show Respect | | We are All Accountable | | We Are Passionate About

What We Do |

| | | | | |

| | | | | |

We Have the Humility and

Hunger to Learn | | We Strive for Simplicity | | We Love Success |

| | | | | |

Our Business Employee Resource Groups

With eight established Business Employee Resource Groups (BERGs), we continue to be a workplace focused on inclusion at all levels.

| | | | | | | | | | | |

| | | |

| KVETS & SUPPORTERS | KELLOGG

MULTINATIONAL

EMPLOYEE RESOURCE

GROUP (KMERG) | KELLOGG’S YOUNG

PROFESSIONALS (YP) | KELLOGG AFRICAN

AMERICAN RESOURCE

GROUP (KAARG) |

| |

| | | |

WOMEN OF

KELLOGG (WOK) | HOLA (OUR LATINO RESOURCE GROUP) | KPride & Allies (KPA) (OUR BERG

FOR LGBTQ+ AND THEIR ALLIES) | KAPABLE (OUR BERG FOR

PEOPLE WITH DISABILITIES

AND THEIR SUPPORTERS) |

Select 2022 Recognition

| | | | | | | | | | | | | | |

| | | | |

| NATIONAL BUSINESS INCLUSION CONSORTIUM - BEST OF THE BEST (2022) | DIVERSITY INC. -

TOP 50 COMPANIES

FOR DIVERSITY (2022) | FORBES - AMERICA’S

BEST EMPLOYERS FOR

DIVERSITY (2022) | ETHISPHERE INSTITUTE -

WORLD'S MOST ETHICAL

COMPANIES (2022) | FORBES - AMERICA'S

BEST LARGE EMPLOYERS

(2022) |

| | | | | | | | | | | | | | |

| | | | |

FORTUNE - WORLD'S

MOST ADMIRED

COMPANIES (2022) | ACCESS TO NUTRITION INITIATIVE

(2022) | DOW JONES

SUSTAINABILITY

INDICES (2022) | NEWSWEEK - AMERICA'S

MOST RESPONSIBLE

COMPANIES (2022) | INTERBRAND'S, "BEST

GLOBAL BRANDS" (2022) |

Proxy Voting Roadmap

You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares at the 2023 Annual Meeting of Shareowners of Kellogg to be held at 1:00 p.m. Eastern Time on Friday, April 28, 2023, or any adjournments thereof. This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

| | | | | | | | |

| |

PROPOSAL 1 Election of Directors to Our Board | See further information beginning on page 10 |

| |

| |

| The Board recommends a vote FOR Stephanie Burns, Steve Cahillane, and La June Montgomery Tabron. |

| |

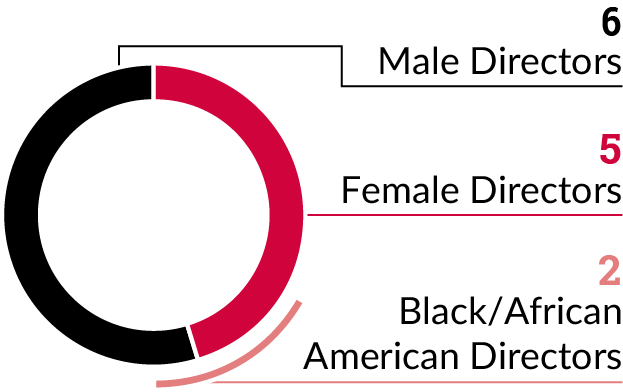

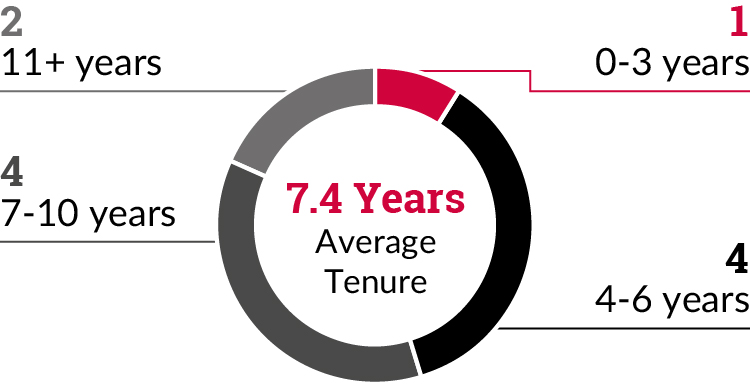

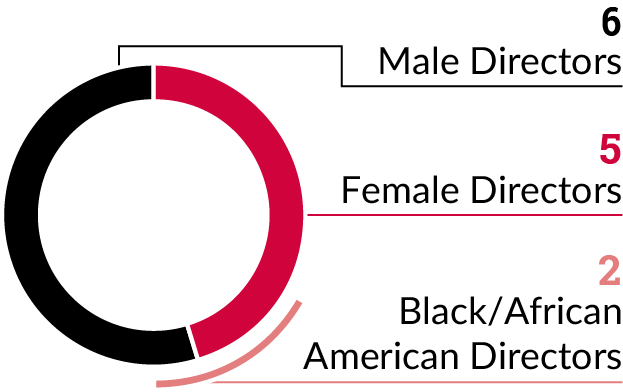

Board Demographics Following 2023 Annual Meeting

| | | | | |

| | |

| Diversity | ~ 45% of our Directors are women; ~ 55% of our Directors are men |

| |

| | |

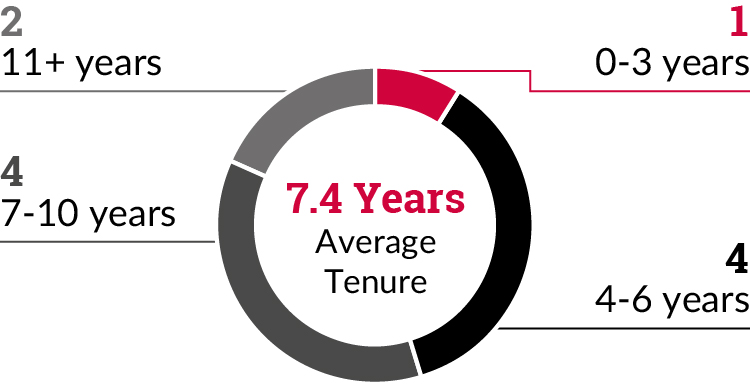

| Tenure | |

| |

| |

| Independence | •Designated Lead Director serves a variety of roles (see page 20) •Audit, Compensation and Talent Management, Nominating and Governance, Manufacturing, and Social Responsibility and Public Policy Committees are composed solely of independent Directors, each with a different Director serving as Committee chair |

| |

| | |

| Age | 63 years average age |

| |

| | |

| 2022 Meetings | •Held 12 Board meetings and 20 Board Committee meetings in 2022 |

| |

| | | | | | | | |

| |

PROPOSAL 2 Advisory Resolution to Approve

Executive Compensation | See further information beginning on page 35 |

| |

| |

| The Board recommends a vote FOR the resolution approving the compensation of the Company's Named Executive Officers. |

| |

Core Principles

The core principles that underpin our executive compensation program include the following:

•Pay for Performance

•Shareowner Alignment

•Values-Based

•Mitigating Risk

Our Pay is Closely Linked to Performance

As set forth in our core principles, Kellogg's compensation program is designed to have a significant portion of an NEO’s target compensation linked to our performance. We accomplish this by utilizing “performance-based” pay programs like our annual incentive plan and three-year stock unit plan ("Performance Stock Unit Plan," "PSU Plan," or "PSU"). The Performance Stock Unit Plan was formerly known as our “Executive Performance Plan” (or “EPP”). In 2022, the EPP was renamed the PSU Plan to reflect the expansion of the plan beyond the Company’s executives.

| | | | | | | | |

| |

PROPOSAL 3 Advisory Vote on Frequency of an Advisory Vote on Executive Compensation | See further information beginning on page 68 |

| |

| |

| The Board recommends a vote for the option of ONE YEAR as the frequency with which Shareowners are provided an advisory vote on executive compensation. |

| |

| | | | | | | | |

| |

PROPOSAL 4 Ratification of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm | See further information beginning on page 69 |

| |

| |

| The Board recommends a vote FOR the ratification of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm |

| |

PricewaterhouseCoopers LLP has been appointed by the Audit Committee, which is composed entirely of independent directors, to be the independent registered public accounting firm for the Company's fiscal year 2023.

| | | | | | | | |

| |

PROPOSAL 5 Shareowner Proposal Requesting a Civil Rights, Non-Discrimination and Return to Merits Audit | See further information beginning on page 72 |

| |

| |

| The Board recommends a vote AGAINST the Shareowner Proposal. |

| |

| | | | | | | | |

| |

PROPOSAL 6 Shareowner Proposal Requesting Additional Reporting on Pay Equity Disclosure | See further information beginning on page 75 |

| |

| |

| The Board recommends a vote AGAINST the Shareowner Proposal. |

| |

Contents

| | | | | |

| Board Voting Recommendation "FOR" | |

| Board Voting Recommendation "AGAINST" | |

Board and Corporate Governance

| | | | | | | | |

|

| PROPOSAL 1 |

| Election of Directors |

|

| |

| The Board recommends a vote FOR each director nominee. | |

| |

For more than 110 years, consumers have counted on Kellogg for great-tasting, high-quality and nutritious foods. These foods include snacks, such as crackers, savory snacks, toaster pastries, cereal bars and bites; and convenience foods, such as, ready-to-eat cereals, frozen waffles, veggie foods and noodles. Kellogg products are manufactured and marketed globally. As such, we believe that in order for our Board to effectively guide Kellogg to long-term sustainable, dependable performance, it should be composed of individuals with sophistication and experience in the many disciplines that impact our business. In order to best serve Kellogg and our Shareowners, we seek to have a Board, as a whole, that is competent in key corporate disciplines, including accounting and financial acumen, business judgment, crisis management, governance, leadership, people management, risk management, social responsibility and reputational issues, strategy and strategic planning. In addition, the Board desires to have specific knowledge related to Kellogg’s industry, such as expertise in branded consumer products and consumer dynamics, health and nutrition, innovation / research and development, international markets, manufacturing and supply chain, marketing, regulatory and government affairs, the retail environment, and sales and distribution.

The Nominating and Governance ("N&G") Committee considers a diverse slate of candidates when filling Board vacancies. The N&G Committee believes that all Directors must, at a minimum, meet the criteria set forth in the Board’s Code of Conduct and the Corporate Governance Guidelines, which specify, among other things, that the N&G Committee will consider criteria such as independence, diversity, age, skills and experience in the context of the needs of the Board. In addressing issues of diversity in particular, the N&G Committee considers a nominee’s differences in viewpoint, professional experience, background, education, skill, age, race, gender and national origin. The N&G Committee believes that diversity of backgrounds and viewpoints is a key attribute for a director nominee. The Committee seeks a diverse Board that is representative of our global business, Shareowners, consumers, customers, and employees. While diversity is a critical criteria in Board composition (demonstrated by the strong diversity of backgrounds of our Directors) and how the Board considers diversity when evaluating Board members is included in our publicly available Corporate Governance Guidelines, the N&G Committee has not established a formal policy regarding diversity. The N&G Committee also will consider a combination of factors for each director, including whether the nominee (1) has the ability to represent all Shareowners without a conflict of interest; (2) has the ability to work in and promote a productive environment; (3) has sufficient time and willingness to fulfill the substantial duties and responsibilities of a Director; (4) has demonstrated the high level of character and integrity that we expect; (5) possesses the broad professional and leadership experience and skills necessary to effectively respond to the complex issues encountered by a multi-national, publicly-traded company; (6) has the ability to apply sound and independent business judgment; and (7) has diverse attributes such as differences in background, qualifications and personal characteristics.

The N&G Committee has determined that all of our Directors meet the criteria and qualifications set forth in the Board’s Code of Conduct, the Corporate Governance Guidelines and the criteria set forth above for director nominees. Moreover, each Director possesses the following critical personal qualities and attributes that we believe are essential for the proper functioning of the Board to allow it to fulfill its duties for our Shareowners: accountability, ethical leadership, governance, integrity, risk management, and sound business judgment. In addition, our Directors have the mature confidence to assess and challenge the way things are done and recommend constructive solutions, a keen awareness of the business and social realities of the global environment in which Kellogg operates, the independence and high performance standards necessary to fulfill the Board’s oversight function, and the humility, professional maturity, and style to interface openly and constructively with other Directors. The N&G Committee conducts an annual review of Director commitment levels, and affirms that all directors are compliant at this time. Finally, while our Directors possess numerous qualities and experiences that make them effective fiduciaries for the Company, the Director biographies below include a non-exclusive list of other key experiences and qualifications that further qualify the individual to serve on the Board. These collective qualities, skills, experiences and attributes are essential to our Board’s ability to exercise its oversight function for Kellogg and its Shareowners, and guide the long-term sustainable, dependable performance of Kellogg.

Our Amended Restated Certificate of Incorporation (the “Certificate of Incorporation”) and bylaws provide that the Board shall be composed of not less than seven and no more than fifteen Directors, divided into three classes as nearly equal in number as possible, and that each Director shall be elected for a term of three years with the term of one class expiring each year. The Board prefers approximately twelve members, but is willing to expand the Board in order to add outstanding candidates or to prepare for an orderly transition with respect to departures of Directors. As previously announced, on February 17, 2023, Richard W. Dreiling resigned from the Board of Directors. In connection with Mr. Dreiling's resignation, the size of the Board was reduced to eleven members.

Board and Corporate Governance

Three Directors have been nominated for re-election at the 2023 Annual Meeting to serve for a term ending at the 2026 Annual Meeting of Shareowners, and the proxies cannot be voted for a greater number of persons than the number of nominees named. There are currently eleven members of the Board.

The Board recommends that the Shareowners vote “FOR” the following nominees: Stephanie Burns, Steve Cahillane, and La June Montgomery Tabron. Each nominee was recommended for re-election by the N&G Committee for consideration by the Board and proposal to the Shareowners. If, before the Annual Meeting, any nominee becomes unable to serve, or chooses not to serve, the Board may nominate a substitute. If that happens, the persons named as proxies on the proxy card will vote for the substitute. Alternatively, the Board may either let the vacancy stay unfilled until an appropriate candidate is identified or reduce the size of the Board to eliminate the unfilled seat.

We have a balanced Board which individually possesses the leadership and character commensurate with the role of director, and which collectively possesses the mix of skills necessary to provide appropriate oversight of a company the size and complexity of Kellogg. In addition, the Board possesses a strong mix of experienced and newer Directors. The following skills have been identified by the Board as core competencies:

| | | | | | | | | | | |

Accounting and

Financial Acumen | Branded Consumer

Products / Consumer

Dynamics | Crisis Management | Health and Nutrition |

| | | |

Innovation /

Research and

Development | International and

Emerging Markets | People Management | Manufacturing and

Supply Chain |

| | | |

Marketing / Brand

Building | Regulatory /

Government | Retail Environment | Risk Management |

| | | | | | | | |

Sales and

Distribution | Social Responsibility | Strategy / Strategic

Planning |

Each of our Directors possesses many of these competencies. For purposes of this Proxy Statement, the Director biographies highlight approximately five of these competencies that each Director possesses.

Board and Corporate Governance

Nominees for Election for a Three-Year Term Expiring at the 2026 Annual Meeting

| | | | | | | | |

| | | |

| | STEPHANIE BURNS, Ph.D. | 68 Former Chief Executive Officer of Dow Corning Corporation Dr. Burns served as Chief Executive Officer of Dow Corning Corporation, a materials science company, from 2004 to 2011 and its Chairman from 2006 through 2011. She began her career with Dow Corning in 1983 and later became Dow Corning’s first director of women’s health. Dr. Burns was elected to the Dow Corning Board of Directors in 2001 and elected as President in 2003. Dr. Burns is a director of Corning Incorporated, a materials science technology company, and HP Inc., an information technology company. |

|

Director since February 2014 Committees Audit (Chair) Nominating and Governance Executive |

Core Competencies As a result of these professional and other experiences, Dr. Burns has been determined to be an “Audit Committee Financial Expert” under the SEC’s rules and regulations, and possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) accounting and financial acumen, crisis management, innovation / research and development, regulatory and government affairs and risk management. In addition, Dr. Burns has significant public company board experience (including specific experience in compensation, corporate relations, manufacturing, and social responsibility oversight). |

| | | | | | | | |

| | | |

| | STEVE CAHILLANE | 57 Chairman of the Board, President and Chief Executive Officer of Kellogg Company Mr. Cahillane has been Chairman of the Board of Kellogg Company since March 2018, and President and Chief Executive Officer since October 2017. He has also served as a Kellogg Director since October 2017. Prior to joining Kellogg, Mr. Cahillane served as Chief Executive Officer and President, and as a member of the board of directors, of Alphabet Holding Company, Inc., a holding company, and its wholly-owned operating subsidiary, The Nature’s Bounty Co., a health and wellness company, from September 2014. Prior to that, Mr. Cahillane served as Executive Vice President of The Coca-Cola Company, a beverage company, from February 2013 to February 2014 and President of Coca-Cola Americas, the global beverage maker’s largest business, with $25 billion in annual sales at that time, from January 2013 to February 2014. Mr. Cahillane served as President of various Coca-Cola operating groups from 2007 to 2012. Mr. Cahillane is a director of Colgate-Palmolive Company, a household and personal products company. He has also been a trustee of the W. K. Kellogg Foundation Trust since 2018. |

|

Director since October 2017 Committees Executive (Chair) |

Core Competencies As a result of these professional and other experiences, Mr. Cahillane possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) branded consumer products and consumer dynamics, health and nutrition, innovation / research and development, international and emerging markets, marketing / brand building, sales and distribution and strategy and strategic planning. |

Board and Corporate Governance

| | | | | | | | |

| | | |

| | LA JUNE MONTGOMERY TABRON | 60 President and CEO of the W.K. Kellogg Foundation Ms. Montgomery Tabron was elected President and CEO of the W.K. Kellogg Foundation effective January 2014. She is also a member of the Board of Trustees of the W.K. Kellogg Foundation since January 2014. During her 32 years with the W.K. Kellogg Foundation, she held various positions in finance, including Executive Vice President of Operations and Treasurer from March 2012 to December 2013, COO and Treasurer from January 2010 to February 2012, Vice President of Finance and Treasurer from September 2000 to December 2009, Assistant Vice President of Finance and Assistant Treasurer from September 1997 to September 2000, and Controller from May 1987 to September 1997. Ms. Montgomery Tabron has also been a trustee of the W.K. Kellogg Foundation Trust since 2014. |

|

Director since February 2014 Committees Social Responsibility and Public Policy (Chair) Manufacturing Executive |

Core Competencies As a result of these professional and other experiences, Ms. Montgomery Tabron possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) crisis management, health and nutrition, regulatory and government, social responsibility and strategy and strategic planning. In addition, Ms. Montgomery Tabron has significant private company board experience (including specific experience in social responsibility oversight). She also has a unique sense of shareowner perspectives. |

Board and Corporate Governance

Continuing Directors to Serve Until the 2024 Annual Meeting

| | | | | | | | |

| | | |

| | CARTER CAST | 59 Venture Partner at Pritzker Group Venture Capital Mr. Cast is currently a venture partner at Pritzker Group Venture Capital, a senior advisor at Pritzker Group Private Capital and is on faculty at Northwestern University’s Kellogg School of Management, where he is a clinical professor teaching entrepreneurship, innovation and marketing. Mr. Cast served as CEO of the online retail company, Hayneedle, Inc., from September 2007 until June 2011. Mr. Cast brings vast experience in the digital arena, previously helping to build and then lead Walmart.com, as its CEO. Prior to 2000, he led the launch of the Blue Nile brand, the leading online jewelry retailer and also served as the Chief Marketing Officer at eBay. He also has previously served as the Vice President of Product Marketing and Marketing Communications at Electronic Arts. Mr. Cast has significant leadership experience as well at other Fortune 500 companies, including PepsiCo where he was a marketing executive, and Frito-Lay where he managed its $1.5 billion tortilla chip category. |

|

Director since June 2017 Committees Manufacturing Social Responsibility and Public Policy |

Core Competencies As a result of these professional and other experiences, Mr. Cast possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) accounting and financial acumen, branded consumer products and consumer dynamics, retail environment (including the e-commerce channel / business model), risk management and social responsibility. |

| | | | | | | | |

| | | |

| | ZACK GUND | 52 Managing Partner of Coppermine Capital, LLC Mr. Zack Gund is currently a Managing Partner of Coppermine Capital, LLC, a private investment firm he founded in 2001. Mr. Gund makes investment decisions and oversees several portfolio companies across many different sectors. His work has spanned both the manufacturing and service industries, including food manufacturing. |

Core Competencies As a result of these professional and other experiences, Mr. Gund possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) accounting and financial acumen, crisis management, manufacturing and supply chain, strategy/strategic planning, and retail environment. He also has a unique sense of shareowner perspectives. |

Director since December 2014 Committees Manufacturing (Chair) Compensation and Talent Management Nominating and Governance Executive |

Board and Corporate Governance

| | | | | | | | |

| | | |

| | DON KNAUSS | LEAD DIRECTOR | 72 Former Chairman and CEO of The Clorox Company Mr. Knauss retired as Executive Chairman of the Board of The Clorox Company, a manufacturer and marketer of consumer and professional products. in July 2015. He had served as Chairman and CEO of The Clorox Company from 2006 to 2014. He was Executive Vice President of The Coca-Cola Company and President and COO for Coca-Cola North America from February 2004 until September 2006. Previously, he was President of the Retail Division of Coca-Cola North America from January 2003 through February 2004 and President and CEO of The Minute Maid Company, a division of The Coca-Cola Company, from January 2000 until January 2003 and President of Coca-Cola Southern Africa from March 1998 until January 2000. Prior to that, he held various positions in marketing and sales with PepsiCo, Inc. and Procter & Gamble, and served as an officer in the United States Marine Corps. In addition, Mr. Knauss is a director of McKesson Corporation and Target Corporation. |

|

Director since December 2007 Committees Nominating and Governance (Chair) Audit Compensation and Talent Management Executive |

Core Competencies As a result of these professional and other experiences, Mr. Knauss has been determined to be an “Audit Committee Financial Expert” under the SEC’s rules and regulations, and possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) accounting and financial acumen, crisis management, people management, retail environment, and branded consumer products/consumer dynamics. In addition, Mr. Knauss has significant public company board experience (including specific experience in auditing, manufacturing, and marketing oversight), which strongly positions him to serve as the Lead Director of Kellogg. |

| | | | | | | | |

| | | |

| | MIKE SCHLOTMAN | 65 Former Executive Vice President and Chief Financial Officer of Kroger Mr. Schlotman was the Executive Vice President and Chief Financial Officer of The Kroger Company, one of the world's largest food retailers, from September 2015 through December 2019. Before that, he was elected Senior Vice President and Chief Financial Officer in June 2003, and Group Vice President and Chief Financial Officer in January 2000. Prior to that he was elected Vice President and Corporate Controller in 1995, and served in various positions in corporate accounting after joining Kroger in 1985. |

| |

Director since October 2020 Committees Audit Social Responsibility and Public Policy | |

| Core Competencies As a result of these professional and other experiences, Mr. Schlotman possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) in accounting and financial acumen, crisis management, retail, regulatory and government, risk management and strategy and strategic planning. |

Board and Corporate Governance

Continuing Directors to Serve Until the 2025 Annual Meeting

| | | | | | | | |

| | | |

| | ROD GILLUM | 72 Principal in the Detroit law office of Jackson Lewis P.C. Mr. Gillum has served as a member of the Board of Trustees of the W.K. Kellogg Foundation since December 2006. He also served as board chair in 2012-2013 and co-trustee of the W.K. Kellogg Foundation Trust from March 2017 to February 2019. Mr. Gillum is a Principal in the Detroit law office of Jackson Lewis P.C. and co-leads the Firm’s Automotive Industry Team. His practice concentrates on corporate strategies related to crisis management, labor relations and legal risk avoidance. Prior to joining Jackson Lewis, Mr. Gillum was a senior leader at General Motors (GM), where he rose to become Secretary to the GM board of directors, and later Vice President, Corporate Responsibility & Diversity. As a co-leader of the Public Policy Center, based in North America, Europe, Asia, and Latin America, Mr. Gillum developed and coordinated global policy positions on safety, trade and government relations. He also chaired the General Motors Foundation. |

|

Director since February 2019 Committees Manufacturing Social Responsibility and Public Policy |

Core Competencies As a result of these and other experiences, Mr. Gillum possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) crisis management, regulatory and government, risk management, social responsibility and strategy and strategic management. |

| | | | | | | | |

| | | |

| | MARY LASCHINGER | 62 Former Chair of the Board and CEO of Veritiv Corporation Ms. Laschinger was the Chair of the Board and CEO of Veritiv Corporation, a business-to-business provider of packaging, publishing and hygiene products, from July 2014 to September 2020. Previously, Ms. Laschinger served as Senior Vice President of International Paper Company, a pulp and paper company, from 2007 to June 2014, and as President of the xpedx, International Paper’s former distribution business, from January 2010 to June 2014. Mary Laschinger became CEO in June 2014. She also served as President of the Europe, Middle East, Africa and Russia business at International Paper, Vice President and General Manager of International Paper’s Wood Products and Pulp businesses, as well as in other senior management roles in sales, marketing, manufacturing and supply chain at International Paper. Ms. Laschinger is a director of Newmont Corporation and Dollar Tree, Inc., and within the past five years, she has also served as a director of Veritiv Corporation. |

|

Director since October 2012 Committees Compensation and Talent Management (Chair) Nominating and Governance Executive |

Core Competencies As a result of these professional and other experiences, Ms. Laschinger possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) branded consumer products and consumer dynamics, crisis management, international and emerging markets, people management and sales and distribution. In addition, Ms. Laschinger has significant public company board experience. |

Board and Corporate Governance

| | | | | | | | |

| | | |

| | ERICA MANN | 64 Former President Consumer Health of Bayer Healthcare LLC Ms. Mann previously served as a member of the Board of Management of Bayer AG, a pharmaceutical and biotechnology company, from January 2016 to March 2018, and Bayer AG CH from January 2016 to March 2018. She was also President Consumer Health, Bayer Healthcare LLC from March 2011 to December 2015. Before joining Bayer HealthCare, Ms. Mann was President and General Manager of Pfizer Nutritional Health, a global business unit with operations in more than 80 countries, and served as a member of the Pfizer Senior Management Team from 2008 to 2011. Ms. Mann joined Pfizer upon its acquisition of Wyeth, where as Senior Vice President of Nutrition, she helped establish the shape and strategic direction of the new nutrition business unit. She also has significant experience at other Fortune 500 companies, including Ely Lilly & Company and Johnson & Johnson, and has held leadership positions in South Africa, Australia, New Zealand, Germany, Switzerland and the United States. Ms. Mann is a director of Perrigo Company plc, DSM, a global Nutrition, Health and Sustainable Living company, and Blackmores LTD, a leading Australian Natural Health company. |

|

Director since February 2019 Committees Audit Social Responsibility and Public Policy |

Core Competencies As a result of these and other experiences, Ms. Mann possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) accounting and financial acumen, health and nutrition, international and emerging markets, risk management, social responsibility and strategy and strategic planning. |

| | | | | | | | |

| | | |

| | CAROLYN TASTAD | 61 Former CEO, Health Care, Procter & Gamble Ms. Tastad served as the Chief Executive Officer, Health Care at The Procter & Gamble Company ("P&G"), a consumer goods corporation, leading the global Health Care business, responsible for sales, profit, selling, innovation, brand-building and supply across P&G’s Oral Care and Personal Health Care businesses, from August 2021 until her retirement in June 2022. Prior to August 2021, Ms. Tastad was the Group President, North America. Ms. Tastad began her work at P&G in 1983, and has significant acquisition integration experience and business model reinvention. She has led large multi-category regional businesses and smaller entrepreneurial global businesses, including responsibility for leading P&G’s selling organization across all sectors and all regions. Ms. Tastad also served as executive sponsor of P&G’s Gender Equality citizenship effort and led P&G’s Corporate Women’s Leadership Team. Ms. Tastad previously served in executive roles in the U.S., Canada, and Switzerland. |

|

Director since December 2015 Committees Compensation and Talent Management Manufacturing Nominating and Governance |

Core Competencies As a result of these professional and other experiences, Ms. Tastad possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) branded consumer products and consumer dynamics, international and emerging markets, marketing / brand building, people management, sales and distribution. |

Board and Corporate Governance

Corporate Governance

Board-Adopted Corporate Governance Guidelines

We operate under corporate governance principles and practices (the “Corporate Governance Guidelines”) that are designed to maximize long-term Shareowner value, align the interests of the Board and management with those of our Shareowners and promote high ethical conduct among our Directors and employees. The Corporate Governance Guidelines include the following:

| | | | | |

| |

| Board Independence | •A majority of the Directors, and all of the members of the Audit Committee, Compensation and Talent Management ("C&T") Committee, and N&G Committee, are required to meet the independence requirements of the New York Stock Exchange and the SEC. •One of the Directors is designated a Lead Director, who chairs executive session meetings of the independent, non-employee Directors (which are scheduled at each Board meeting), and may call any such meetings at any time, approves proposed meeting agendas and schedules, and establishes a method for Shareowners and other interested parties to communicate with the Board. See also "Board and Corporate Governance - Corporate Governance - Lead Director." •The Board and each Board Committee have the authority to hire independent legal, financial or other advisors as they may deem necessary, at the Company's expense. •The Corporate Governance Guidelines provide that non-employee Directors meet in executive session at least three times annually. As a general practice, the non-employee Directors are scheduled to meet in executive session at every Board and Committee meeting. •No Director shall serve as a director, officer or employee of a competitor. |

| |

| |

| Strategic Oversight | •Directors review the Company's strategy periodically during the year and dedicate at least one meeting per year to focus on a comprehensive strategic review, including the key elements of the Company's strategy. •Directors have direct and regular access to officers, employees, facilities, books and records of the Company and can initiate contact or meetings directly or through the CEO or Secretary. |

| |

| |

| Performance Assessments | •The Board and Board Committees conduct annual performance evaluations to assess whether the Board, its Committees, and the Directors are functioning effectively. •The independent members of the Board use the recommendations from the N&G Committee and C&T Committee to conduct an annual review of the CEO’s performance and determine the CEO’s compensation. |

| |

| |

| Succession Planning | •The Board periodically reviews CEO succession planning, and at least once per year. |

| |

| |

| Restrictions and Rules | •Non-employee Directors who change their principal responsibility or occupation from that held when they were elected shall offer their resignation for the Board to consider the continued appropriateness of Board membership under the circumstances. •No Director may be nominated for a new term if he or she would attain the age limit of seventy-two or older at the time of election, unless the Board determines that it is in the best interest of Kellogg to re-nominate the independent Director for additional terms due to his or her unique capabilities or special circumstances. •No Director should serve on more than three other public company boards, in addition to Kellogg (with consideration given to public company leadership roles and outside commitments). •All Directors are expected to comply with stock ownership guidelines for Directors, under which they are generally expected to hold at least five times their annual cash retainer in stock and stock equivalents. •Continuing education is provided to Directors consistent with our Board education policy. |

| |

Board Structure; Communication with the Board

The mix of experienced independent and management Directors that make up our Board, along with the independent role of our Lead Director and our independent Board Committee composition, benefits Kellogg and its Shareowners. The following section describes Kellogg’s Board leadership structure, the reasons why the structure is in place at this time, the roles of various positions, and related key governance practices.

Board and Corporate Governance

Independence; Board Mix

Our Board has an effective mix of independent and management Directors. It is composed of ten independent Directors and Mr. Cahillane, our CEO.

| | | | | | | | |

| Board Independence | Board Diversity | Tenure |

| | |

Director Demographics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stephanie Burns | Steve Cahillane | Carter Cast | Rod Gillum | Zack Gund | Don Knauss | Mary Laschinger | Erica Mann | La June Montgomery Tabron | Mike Schlotman | Carolyn Tastad |

| Independent | ☑ | | ☑ | ☑ | ☑ | ☑ | ☑ | ☑ | ☑ | ☑ | ☑ |

| Racially / Ethnically Diverse | | | | ☑ | | | | | ☑ | | |

| Male | | ☑ | ☑ | ☑ | ☑ | ☑ | | | | ☑ | |

| Female | ☑ | | | | | | ☑ | ☑ | ☑ | | ☑ |

| Years of Service | 9 | 6 | 6 | 4 | 8 | 15 | 11 | 4 | 9 | 2 | 7 |

Additionally, the diversity of the Board is reflected in the composition of the chairs of the Board's Committees, with three Committees chaired by female directors (including one Black/African American Director).

Committee Structure and Independence After 2023 Annual Meeting

In 2022, the Board had six standing Committees: (i) Audit, (ii) C&T, (iii) N&G, (iv) Manufacturing, (v) Social Responsibility and Public Policy ("SRPP"), and (vi) Executive. The Audit, C&T, N&G, Manufacturing, and SRPP Committees are composed solely of independent Directors, each with a different independent Director serving as Committee chair.

Board Leadership Structure

With respect to the roles of Chairman and CEO, the Corporate Governance Guidelines provide that the roles may be separated or combined, and the Board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. On March 15, 2018, the Chairman and CEO roles were combined, with the Board electing Mr. Cahillane as Chairman of the Board. At this time, the Board believes that combining the roles of Chairman and CEO, together with the separate, independent role of our Lead Director, is the most effective leadership structure for Kellogg for many reasons. In particular, the Board believes the combined role is appropriate because of:

•Mr. Cahillane’s extensive knowledge and experience in a variety of areas, including strategy and strategic planning, branded consumer products and consumer dynamics, and innovation and research and development acquired as a result of his professional and other experiences, gives him the insight necessary to combine the responsibilities of strategic development and execution along with management of day-to-day operations, and

•Mr. Cahillane’s knowledge of Kellogg's business, operations and risks acquired in his role as CEO gives him the insight to combine the responsibilities of strategic development along with management of day-to-day operations and execution.

We believe Don Knauss, fulfilling the Company's Lead Director role (as described below), provides the necessary independent voice on issues facing the company and ensures that key issues are brought to the Board's attention and that proper corporate governance is maintained.

Board and Corporate Governance

| | |

|

LEAD DIRECTOR Don Knauss, an independent Director and the Chairman of the N&G Committee, is currently our Lead Director. Mr. Knauss is an effective Lead Director for Kellogg due to, among other things: •independence; •board leadership experience as former CEO, Chairman and Executive Chairman of The Clorox Company; •strong strategic and financial acumen; •commitment to ethics; •extensive knowledge of the retail environment and branded consumer products; and •deep understanding of Kellogg and its business obtained while serving as a Kellogg Director. The independent Lead Director serves a variety of roles, including: •for every meeting, reviewing and approving Board agendas, meeting materials and schedules to confirm the appropriate Board and Committee topics are reviewed and sufficient time is allocated to each; •liaising between the Chairman and CEO and non-management Directors if and when necessary and appropriate (that said, each Director has direct and regular access to the Chairman and CEO); •presiding at the executive sessions of independent Directors and at all other meetings of the Board of Directors at which the Chairman of the Board is not present; •calling an executive session of independent Directors at every meeting consistent with the Corporate Governance Guidelines; •responsibility for leading the Board's annual evaluation process, including conducting private, individual reviews with each Director; and •facilitating succession planning for the Board, including by having the N&G Committee and the independent Directors regularly discuss and evaluate CEO succession plans. Mr. Knauss may be contacted at donald.knauss@kellogg.com. Any communications which Shareowners or interested parties may wish to send to the Board may be directly sent to Mr. Knauss at this e-mail address. |

|

Our Corporate Governance Guidelines provide the flexibility for our Board to modify our leadership structure as appropriate. We believe that Kellogg, like many U.S.-based companies, has been well-served by this flexible leadership structure.Board Self-Evaluation

Our Lead Director leads our annual process whereby the Board conducts an annual performance evaluation to assess the performance of the Board, its Committees, and the Directors, and to determine how to make the Board even more effective. The process includes detailed written survey materials as well as individual, private meetings between each Director and the Lead Director.

BOARD SELF-EVALUATION / CONTINUOUS IMPROVEMENT PROGRAM

Board and Corporate Governance

Company Strategy

Strategic planning and oversight of the Company’s business strategy is a key responsibility of the Board, and the Board has deep experience and expertise in the areas of strategy and strategic development. The Board believes that overseeing and monitoring strategy is a continuous process and takes a multi-step approach in exercising its responsibilities. Our entire Board discusses the strategic priorities of the Company, taking into consideration global economic, industry, consumer, environmental, social, governance, and other significant trends, as well as changes in the food industry and regulatory initiatives. The Board reviews the Company’s strategy periodically during the year, and dedicates at least one meeting each year to focus on a strategic review, including key elements of our strategy. Relevant strategic topics are also embedded in the work of Committees. The Board is uniquely positioned to provide the oversight required for the Company's strategy given the specific and diverse mix of skills, capabilities and core competencies relating to our long-term strategy and business model as well as their diverse perspectives, experiences and backgrounds (see “Board and Corporate Governance – Election of Directors”).

While the Board and its Committees oversee strategy and strategic planning, management is charged with executing the business strategy. To monitor performance against the Company’s strategic goals, the Board receives regular updates and actively engages in dialogue with our Company’s senior leaders. The Board’s discussions are enhanced with first-hand experiences, such as visits to specific markets and interaction with key retailers, which provide Directors an opportunity to experience strategy execution.

The Board’s oversight and management’s execution of business strategy are intended to help promote the creation of long-term shareowner value in a sustainable manner, with a focus on assessing both opportunities available to us and risks that we may encounter.

Board and Corporate Governance

Board Oversight of Enterprise Risk

The Board, both directly and indirectly through its Committees, utilizes our Enterprise Risk Management (“ERM”) process to assist in fulfilling its oversight of the Company's risks. While risk oversight is a full Board responsibility, the responsibility for monitoring the ERM process has been delegated to the Audit Committee. As such, one of the leaders of the ERM process is the Vice President, Internal Audit, who reports to the Chair of the Audit Committee.

Annually, the Audit Committee reviews an assessment of the Company’s enterprise risks and the allocation of risk oversight among the Board and its Committees. Due to the dynamic nature of risk and the business environment generally, at every Audit Committee meeting, the Company provides a status report on key enterprise risks where responsible senior leaders provide in-depth reviews. Key enterprise risks are also reviewed with and discussed in other Committee meetings. Board and Committee agendas are updated throughout the year so that emerging enterprise risks may be reviewed and discussed at the relevant times. This process facilitates the Board’s ability to fulfill its oversight responsibilities of Kellogg’s risks in a timely and effective manner.

| | | | | | | | |

| | |

| RISK ASSESSMENT | |

| | |

| | |

The risk assessment process is global in nature and has been developed to identify and assess Kellogg’s current and emerging risks, including the nature, probability and implications of the risk, as well as to identify steps to mitigate and manage each risk (including how ERM is integrated into the Company’s internal audit plan). Many of our key business leaders, functional heads and other managers from across the globe provide perspective and input in a targeted and strategic manner to develop the Company’s holistic views on enterprise risks. The centerpiece of the enterprise risk assessment is the distillation of this review into key enterprise risks which includes the potential magnitude, likelihood and velocity of each risk. As part of the process for assessing each risk, management identifies the following: •the nature of the risk •the senior executive responsible for managing the risk •the potential impact of the risk •management’s approach to manage the risk •Board or Committee accountability The results of the risk assessment are then integrated into the Board’s processes. |

| | |

| | | | | | | | |

| | |

| BOARD OF DIRECTORS | |

| | |

| | |

•Receives updates on business operations, financial results, long-range plans and key enterprise risks, including current status and action items, during regularly scheduled meetings •Advises management on shaping corporate purpose, values and strategy •The full Board reviews the results of the annual enterprise risk assessment and periodic updates on status of key risks, which includes consideration of potential impacts •Oversight responsibility for each risk is allocated among the full Board and its Committees, and specific Board and Committee agendas are developed accordingly |

| | |

| | | | | | | | |

| | |

| AUDIT COMMITTEE | |

| | |

| | |

•Reviews and considers the annual audit risk assessment, which identifies risks related to our internal control over financial reporting and informs our internal and external audit plans •Receives updates on the key enterprise risks •Reviews the ERM process and results of the annual risk assessment •Monitors independence of our independent auditor, including establishing policies for hiring of any current or former employees of our independent auditor •Reviews the use of new accounting principles •Reviews the use of non-GAAP measures in our earnings releases and SEC filings •Considers the impact of risk on our financial position and the adequacy of our risk-related internal controls •Oversees cybersecurity and receives regular updates on cybersecurity matters, which includes a review of potential digital threats and vulnerabilities, cybersecurity priorities, and our cybersecurity framework •Receives quarterly updates on litigation matters and developments •Reviews the ethics and compliance and litigation management programs •Coordinates with the Vice President, Internal Audit, who reports to the Chair of the Committee |

| | |

Board and Corporate Governance

| | | | | | | | |

| | |

| NOMINATING AND GOVERNANCE COMMITTEE | |

| | |

| | |

•Conducts an annual review of our corporate governance policies and practices •Oversees corporate governance, receiving regular updates on emerging corporate governance issues and trends •Oversees annual self-evaluation process for the Board and each of its committees •Oversees succession planning and refreshment efforts for the Board •Reviews, approves and oversees any proposed transactions involving a related party |

| | |

| | | | | | | | |

| | |

| COMPENSATION AND TALENT MANAGEMENT COMMITTEE | |

| | |

| | |

•Assesses annually whether our compensation plans, policies and practices encourage excessive or inappropriate risk taking by employees •Evaluates our executive compensation programs to ensure they adequately tie to company performance •Reviews risks related to talent acquisition, retention and development •Monitors progress toward internal ED&I goals |

| | |

| | | | | | | | |

| | |

| MANUFACTURING COMMITTEE | |

| | |

| | |

•Oversees food quality and safety, manufacturing operations and people and labor strategies, including reviewing policies, programs and practices and providing strategic advice •Reviews global food safety and people safety performance reports, including results of regulatory audits, as well as supply chain financial performance •Oversees contingency planning, commodity purchasing and hedging programs and people utilization and union and non-union strategies |

| | |

| | | | | | | | |

| | |

| SOCIAL RESPONSIBILITY AND PUBLIC POLICY COMMITTEE | |

| | |

| | |

•Oversees our corporate responsibility strategy and risks related to our reputation, including receiving reports from the SVP of Global Corporate Affairs •Oversees our sustainability efforts and climate policy •Assists the Board in monitoring climate and sourcing, sustainable packaging and nutrition |

| | |

| | | | | | | | |

| | |

| MANAGEMENT | |

| | |

| | |

•Conducts a formal risk assessment of Kellogg's business annually, including assessing probability, magnitude, velocity, potential economic and reputational impacts, and developing mitigation actions and monitoring plans •Evaluates the completeness of the identified Enterprise Risks •Key risks are reviewed and monitored and mitigation plans developed by designated senior leaders responsible for day-to-day risk management |

| | |

Board and Corporate Governance

Majority Voting for Directors; Director Resignation Policy

Our bylaws contain a majority voting standard for the election of Directors in an uncontested election (that is, an election where the number of nominees is equal to the number of seats open). In an uncontested election, each nominee must be elected by the vote of a majority of the votes cast. A “majority of the votes cast” means the number of votes cast “for” a director’s election must exceed the number of votes cast “against” (excluding abstentions). No Director will be nominated for election or otherwise be eligible for service on the Board unless and until such candidate has delivered an irrevocable resignation to the N&G Committee that would be effective upon (i) such Director’s failure to receive the required vote in an election of Directors and (ii) the Board’s acceptance of the resignation. If a Director fails to achieve the required vote in an uncontested election, the N&G Committee would promptly consider the resignation and recommend to the Board the action to be taken on the offered resignation. The Board would act on the N&G Committee’s recommendation no later than 90 days following the date of the Shareowners’ meeting where the election occurred. The Director whose resignation is under consideration shall not participate in the recommendation of the N&G Committee or deliberations of the Board with respect to his or her nomination. Following the Board’s decision, Kellogg would promptly disclose in a current report on Form 8-K the decision whether to accept the resignation as tendered. To the extent that a resignation is accepted, the N&G Committee would recommend to the Board whether to fill such vacancy or vacancies or to reduce the size of the Board.

Director Independence

The Board has determined that all current Directors (other than Mr. Cahillane) are independent based on the following standards: (a) no entity (other than a charitable entity) of which such a Director is an employee in any position or any immediate family member (as defined) is an executive officer, made payments to, or received payments from, Kellogg and its subsidiaries in any of the 2022, 2021, or 2020 fiscal years in excess of the greater of (1) $1,000,000 or (2) two percent of that entity’s annual consolidated gross revenues; (b) no such Director, or any immediate family member employed as an executive officer of Kellogg or its subsidiaries, received in any twelve month period within the last three years more than $120,000 per year in direct compensation from Kellogg or its subsidiaries, other than Director and Committee fees and pension or other forms of deferred compensation for prior service not contingent in any way on continued service; (c) Kellogg did not employ such Director in any position, or any immediate family member as an executive officer, during the past three years; (d) no such Director was a current partner or employee of a firm that is Kellogg’s internal or external auditor (“Auditor”), no immediate family member of such Director was a current partner of the Auditor or an employee of the Auditor who personally worked on our audit, and no Director or immediate family member of such Director was during the past three years a partner or employee of the Auditor and personally worked on our audit within that time; (e) no such Director or immediate family member served as an executive officer of another company during the past three years at the same time as a current executive officer of Kellogg served on the compensation committee of such company; and (f) no other material relationship exists between any such Director and Kellogg or our subsidiaries.

The Board also considers from time to time commercial ordinary-course transactions as it assesses independence status. The Board has concluded that these transactions did not impair Director independence for a variety of reasons including that the amounts in question were considerably under the thresholds set forth in our independence standards and the relationships were not deemed material.

Related Person Transactions

The Board has adopted a written policy relating to the N&G Committee’s review and approval of transactions with related persons that are required to be disclosed in proxy statements by SEC regulations, which are commonly referred to as “related person transactions.” A “related person” is defined under the applicable SEC regulation and includes our Directors, executive officers and 5% or more beneficial owners of our common stock. The Secretary administers procedures adopted by the Board with respect to related person transactions and the N&G Committee reviews and approves all such transactions. At times, it may be advisable to initiate a transaction before the N&G Committee has evaluated it or a transaction may begin before discovery of a related person’s participation. In such instances, management consults with the Chair of the N&G Committee to determine the appropriate course of action. Approval of a related person transaction requires the affirmative vote of the majority of disinterested Directors on the N&G Committee. In approving any related person transaction, the N&G Committee must determine that the transaction is fair and reasonable to Kellogg. The N&G Committee periodically reports on its activities to the Board. The written policy relating to the N&G Committee’s review and approval of related person transactions is available on our website under the “Investor Relations” tab, at the “Governance” link.

There were no related person transactions since January 1, 2022 that require reporting under the SEC disclosure rules.

Board and Corporate Governance

Shareowner Recommendations for Director Nominees

The N&G Committee will consider Shareowner nominations for membership on the Board. For the 2024 Annual Meeting of Shareowners, nominations may be submitted to the Office of the Secretary, Kellogg Company, One Kellogg Square, Battle Creek, Michigan 49017-3534, which will forward them to the Chairman of the N&G Committee. Recommendations must be in writing and we must receive the recommendation not earlier than November 3, 2023 and not later than December 3, 2023. Recommendations must also include certain other requirements specified in our Bylaws.

When filling a vacancy on the Board, the N&G Committee identifies the desired skills and experience of a new Director and nominates individuals who it believes can strengthen the Board’s capabilities and further diversify the collective experience represented by the then-current Directors. The N&G Committee may, as it has done in the past, engage third parties to assist in the search and provide recommendations. Also, Directors are generally asked to recommend candidates for the position. The candidates would be evaluated based on the process outlined in the Corporate Governance Guidelines and the N&G Committee charter, and the same process would be used for all candidates, including candidates recommended by Shareowners. For more information, see “Board and Committee Membership-Nominating and Governance Committee.”

Shareowner Nomination of Director Candidates for Inclusion in Proxy Statement for Annual Meeting

Our Bylaws permit a Shareowner, or a group of up to 20 Shareowners, owning 3% or more of the Company’s outstanding common stock continuously for at least three years to nominate and include in our proxy materials director candidates constituting up to the greater of two individuals or 20% of the Board, provided that the Shareowner(s) and the nominee(s) satisfy the requirements specified in our Bylaws. For the 2024 Annual Meeting of Shareowners, nominations may be submitted to the Office of the Secretary, Kellogg Company, One Kellogg Square, Battle Creek, Michigan 49017-3534. Any such nomination must be received by us not earlier than October 4, 2023 and not later than November 3, 2023. Any such nomination must meet the other requirements set forth in our Bylaws.

In addition to satisfying the requirements of our Bylaws, including the notice deadlines set out above and therein, to comply with the universal proxy rules, Shareowners who intend to solicit proxies in support of Director nominees, other than the Company’s nominees, must also comply with the additional requirements of Rule 14a-19 under the Exchange Act.

Attendance at Annual Meetings

All incumbent Directors are expected to attend the Annual Meeting of Shareowners. All of our Directors attended the 2022 Annual Meeting of Shareowners.

Code of Conduct/Code of Ethics

We have adopted the Code of Conduct for Kellogg Company Directors and the Global Code of Ethics for Kellogg Company employees (including the CEO, CFO, other named executive officers, and Corporate Controller). Any amendments to, or waivers of, the Global Code of Ethics applicable to our Directors or executive officers will be posted on www.kelloggcompany.com. There were no waivers of the Global Code of Ethics in 2022.

Availability of Corporate Governance Documents

Copies of the Corporate Governance Guidelines, the Charters of the Audit, C&T, and N&G Committees of the Board, the Code of Conduct for Kellogg Company Directors, and Global Code of Ethics for Kellogg Company employees can be found on the Kellogg Company website at www.kelloggcompany.com under “Investor Relations,” then “Environmental, Social & Governance.” Shareowners may also request a free copy of these documents from: Kellogg Company Consumer Affairs, P.O. Box CAMB, Battle Creek, Michigan 49016 (phone: (800) 962-1413), the Investor Relations Department at that same address (phone: (269) 961-2800) or investor.relations@kellogg.com.

Board and Corporate Governance

Board and Committee Membership

The Board routinely reviews Board composition to ensure that it has the right balance of skills to fulfill its oversight obligations for Shareowners. As part of that process, the N&G Committee and the Board consider current tenure and potential retirements.

The Board had the following standing Committees in 2022: (i) Audit; (ii) C&T; (iii) N&G; (iv) Manufacturing; (v) SRPP; and (vi) Executive.

The Board held 12 meetings in 2022. All of the incumbent Directors attended at least 75% of the total number of meetings of the Board and of all Board Committees of which the Directors were members during 2022 that were held while such Directors were on the Board.

The table below provides 2022 membership and meeting information for each Board Committee (other than Executive) as of December 31, 2022 (the last day of fiscal year 2022):

| | | | | | | | | | | | | | | | | |

Name(3) | Audit | Compensation

and Talent

Management | Nominating and

Governance | Manufacturing | Social

Responsibility and

Public Policy |

| Stephanie Burns | Chair | | | | |

Steve Cahillane(1) | | | | | |

| Carter Cast | | | | | |

Rick Dreiling(2) | | | | | |

| Rod Gillum | | | | | |

| Zack Gund | | | | Chair | |

| Don Knauss | | | Chair | | |

| Mary Laschinger | | Chair | | | |

| Erica Mann | | | | | |

| La June Montgomery Tabron | | | | | Chair |

Mike Schlotman | | | | | |

| Carolyn Tastad | | | | | |

| 2022 Meetings Held | 6 | 5 | 3 | 3 | 3 |

(1)Mr. Cahillane is not a formal member of any Board Committee (other than Executive) and attends meetings for each Committee, as appropriate.

(2)Mr. Dreiling resigned from the Board and all Board Committees on which he served effective February 17, 2023.

The Board also has an Executive Committee made up of the CEO and Committee Chairs, which held no meetings in 2022.

Each of the Board Committees may form and delegate authority to subcommittees when it deems appropriate.

Board and Corporate Governance

Audit Committee

| | | | | | | | | | | |

| | | | |

Stephanie Burns (Chair) Erica Mann | Don Knauss

| Mike Schlotman | 2022 Meetings Held: 6 |

| | | |

Pursuant to a written charter, the Audit Committee’s responsibilities include the following.

•The Committee assists the Board in monitoring the following:

–the integrity of the financial statements of the Company;

–the independence and performance of the Company’s independent registered public accounting firm;

–the performance of the Company’s internal audit function;

–the Company’s ERM process and key risks;

–compliance by the Company with legal and regulatory requirements; and

–other related matters.

•The Committee, or its Chair, pre-approves all audit, audit-related, internal control-related and permitted non-audit engagements and services by the independent registered public accounting firm and their affiliates.

•The Committee discusses and/or reviews specified matters with, and receives specified information or assurances from, Kellogg management and the independent registered public accounting firm.