kamn-20211231000005438112/312021FYFALSEfalsehttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent00000543812021-01-012021-12-3100000543812021-07-02iso4217:USD00000543812022-01-28xbrli:shares00000543812021-12-3100000543812020-12-31iso4217:USDxbrli:shares00000543812020-01-012020-12-3100000543812019-01-012019-12-310000054381us-gaap:CommonStockMember2018-12-310000054381us-gaap:AdditionalPaidInCapitalMember2018-12-310000054381us-gaap:RetainedEarningsMember2018-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000054381us-gaap:TreasuryStockMember2018-12-3100000543812018-12-310000054381us-gaap:CommonStockMember2019-01-012019-12-310000054381us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000054381us-gaap:RetainedEarningsMember2019-01-012019-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000054381us-gaap:TreasuryStockMember2019-01-012019-12-310000054381us-gaap:CommonStockMember2019-12-310000054381us-gaap:AdditionalPaidInCapitalMember2019-12-310000054381us-gaap:RetainedEarningsMember2019-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000054381us-gaap:TreasuryStockMember2019-12-3100000543812019-12-310000054381us-gaap:CommonStockMember2020-01-012020-12-310000054381us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000054381us-gaap:RetainedEarningsMember2020-01-012020-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000054381us-gaap:TreasuryStockMember2020-01-012020-12-310000054381us-gaap:CommonStockMember2020-12-310000054381us-gaap:AdditionalPaidInCapitalMember2020-12-310000054381us-gaap:RetainedEarningsMember2020-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000054381us-gaap:TreasuryStockMember2020-12-310000054381us-gaap:CommonStockMember2021-01-012021-12-310000054381us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000054381us-gaap:TreasuryStockMember2021-01-012021-12-310000054381us-gaap:RetainedEarningsMember2021-01-012021-12-310000054381us-gaap:CommonStockMember2021-12-310000054381us-gaap:AdditionalPaidInCapitalMember2021-12-310000054381us-gaap:RetainedEarningsMember2021-12-310000054381us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000054381us-gaap:TreasuryStockMember2021-12-31kamn:segment0000054381kamn:U.K.CompositesMember2021-01-012021-12-3100000543812019-08-2600000543812018-01-012018-12-310000054381us-gaap:AccountsReceivableMember2021-01-012021-12-31kamn:Customers0000054381us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-31xbrli:pure0000054381us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000054381us-gaap:AccountsReceivableMember2020-01-012020-12-310000054381us-gaap:SalesMember2021-01-012021-12-310000054381us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000054381us-gaap:SalesRevenueNetMember2021-01-012021-12-310000054381us-gaap:SalesMember2020-01-012020-12-310000054381us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:GeographicDistributionForeignMember2021-01-012021-12-310000054381us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:GeographicDistributionForeignMember2020-01-012020-12-310000054381us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:GeographicDistributionForeignMember2019-01-012019-12-310000054381kamn:DistributionMember2019-01-012019-12-310000054381kamn:PerformanceobligationssatisfiedinpreviousperiodsMember2021-01-012021-12-310000054381kamn:PerformanceobligationssatisfiedinpreviousperiodsMember2020-01-012020-12-310000054381kamn:PerformanceobligationssatisfiedinpreviousperiodsMember2019-01-012019-12-3100000543812020-01-03kamn:Integer0000054381us-gaap:BuildingMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:BuildingMember2021-01-012021-12-310000054381srt:MinimumMemberus-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-01-012021-12-310000054381us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2021-01-012021-12-310000054381kamn:AerosystemsMember2020-10-020000054381kamn:AerosystemsMember2020-01-012020-12-310000054381kamn:U.K.CompositesMember2020-01-012020-12-310000054381kamn:CostOfSalesMemberMember2021-01-012021-12-310000054381kamn:CostOfSalesMemberMember2020-01-012020-12-310000054381kamn:CostOfSalesMemberMember2019-01-012019-12-3100000543812020-01-012021-12-310000054381kamn:U.K.CompositesMember2021-02-020000054381kamn:U.K.CompositesMember2020-01-012021-12-310000054381kamn:U.K.CompositesMember2021-12-310000054381kamn:DistributionMember2019-08-260000054381kamn:DistributionMember2019-08-262021-12-310000054381kamn:DistributionMember2021-01-012021-12-310000054381kamn:DistributionMember2020-01-012020-12-310000054381kamn:DistributionMember2019-01-012019-12-310000054381kamn:CashOutflowsMemberkamn:DistributionMember2019-08-262021-12-310000054381kamn:CashOutflowsMemberkamn:DistributionMember2021-01-012021-12-310000054381kamn:CashOutflowsMemberkamn:DistributionMember2020-01-012020-12-310000054381kamn:CashOutflowsMemberkamn:DistributionMember2019-01-012019-12-310000054381kamn:CashInflowsMemberkamn:DistributionMember2019-08-262021-12-310000054381kamn:CashInflowsMemberkamn:DistributionMember2021-01-012021-12-310000054381kamn:CashInflowsMemberkamn:DistributionMember2020-01-012020-12-310000054381kamn:CashInflowsMemberkamn:DistributionMember2019-01-012019-12-310000054381kamn:DistributionMember2019-08-262020-12-310000054381kamn:BalSealMember2020-01-030000054381kamn:BalSealMemberus-gaap:CustomerRelationshipsMember2020-01-030000054381srt:MinimumMemberkamn:BalSealMemberus-gaap:CustomerRelationshipsMember2020-01-032020-01-030000054381srt:MaximumMemberkamn:BalSealMemberus-gaap:CustomerRelationshipsMember2020-01-032020-01-030000054381us-gaap:TechnologyBasedIntangibleAssetsMemberkamn:BalSealMember2020-01-030000054381us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMemberkamn:BalSealMember2020-01-032020-01-030000054381srt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMemberkamn:BalSealMember2020-01-032020-01-030000054381kamn:BalSealMemberus-gaap:TradeNamesMember2020-01-030000054381kamn:BalSealMemberus-gaap:TradeNamesMember2020-01-032020-01-030000054381us-gaap:OrderOrProductionBacklogMemberkamn:BalSealMember2020-01-030000054381us-gaap:OrderOrProductionBacklogMemberkamn:BalSealMember2020-01-032020-01-030000054381kamn:BalSealMember2021-01-012021-12-310000054381kamn:BalSealMember2020-01-012020-12-310000054381kamn:BalSealMember2019-01-012019-12-310000054381kamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:StructuresMember2021-01-012021-12-310000054381kamn:StructuresMember2020-01-012020-12-310000054381kamn:StructuresMember2019-01-012019-12-310000054381us-gaap:CorporateMember2021-01-012021-12-310000054381us-gaap:CorporateMember2020-01-012020-12-310000054381us-gaap:CorporateMember2019-01-012019-12-310000054381kamn:OtherUnallocatedExpensesNetMember2021-01-012021-12-310000054381kamn:OtherUnallocatedExpensesNetMember2020-01-012020-12-310000054381kamn:OtherUnallocatedExpensesNetMember2019-01-012019-12-310000054381kamn:USGovernmentMember2021-01-012021-12-310000054381kamn:USGovernmentMember2020-01-012020-12-310000054381kamn:USGovernmentMember2019-01-012019-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMember2021-01-012021-12-310000054381kamn:MissileandBombFuzesMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:PrecisionProductsMemberkamn:MissileandBombFuzesMember2021-01-012021-12-310000054381kamn:MissileandBombFuzesMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:MissileandBombFuzesMember2021-01-012021-12-310000054381kamn:EngineeredProductsMemberkamn:CommercialAerospaceMember2021-01-012021-12-310000054381kamn:PrecisionProductsMemberkamn:CommercialAerospaceMember2021-01-012021-12-310000054381kamn:CommercialAerospaceMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:CommercialAerospaceMember2021-01-012021-12-310000054381kamn:MedicalMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:MedicalMemberkamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:MedicalMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:MedicalMember2021-01-012021-12-310000054381kamn:OtherMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:OtherMemberkamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:OtherMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:OtherMember2021-01-012021-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMember2020-01-012020-12-310000054381kamn:MissileandBombFuzesMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:PrecisionProductsMemberkamn:MissileandBombFuzesMember2020-01-012020-12-310000054381kamn:MissileandBombFuzesMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:MissileandBombFuzesMember2020-01-012020-12-310000054381kamn:EngineeredProductsMemberkamn:CommercialAerospaceMember2020-01-012020-12-310000054381kamn:PrecisionProductsMemberkamn:CommercialAerospaceMember2020-01-012020-12-310000054381kamn:CommercialAerospaceMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:CommercialAerospaceMember2020-01-012020-12-310000054381kamn:MedicalMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:MedicalMemberkamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:MedicalMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:MedicalMember2020-01-012020-12-310000054381kamn:OtherMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:OtherMemberkamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:OtherMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:OtherMember2020-01-012020-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:MilitaryandDefenseotherthanfuzesMember2019-01-012019-12-310000054381kamn:MissileandBombFuzesMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:PrecisionProductsMemberkamn:MissileandBombFuzesMember2019-01-012019-12-310000054381kamn:MissileandBombFuzesMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:MissileandBombFuzesMember2019-01-012019-12-310000054381kamn:EngineeredProductsMemberkamn:CommercialAerospaceMember2019-01-012019-12-310000054381kamn:PrecisionProductsMemberkamn:CommercialAerospaceMember2019-01-012019-12-310000054381kamn:CommercialAerospaceMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:CommercialAerospaceMember2019-01-012019-12-310000054381kamn:MedicalMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:MedicalMemberkamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:MedicalMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:MedicalMember2019-01-012019-12-310000054381kamn:OtherMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:OtherMemberkamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:OtherMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:OtherMember2019-01-012019-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:OriginalEquipmentManufacturerMember2021-01-012021-12-310000054381kamn:AftermarketMemberkamn:EngineeredProductsMember2021-01-012021-12-310000054381kamn:AftermarketMemberkamn:PrecisionProductsMember2021-01-012021-12-310000054381kamn:AftermarketMemberkamn:StructuresMember2021-01-012021-12-310000054381kamn:AftermarketMember2021-01-012021-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:OriginalEquipmentManufacturerMember2020-01-012020-12-310000054381kamn:AftermarketMemberkamn:EngineeredProductsMember2020-01-012020-12-310000054381kamn:AftermarketMemberkamn:PrecisionProductsMember2020-01-012020-12-310000054381kamn:AftermarketMemberkamn:StructuresMember2020-01-012020-12-310000054381kamn:AftermarketMember2020-01-012020-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:OriginalEquipmentManufacturerMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:OriginalEquipmentManufacturerMember2019-01-012019-12-310000054381kamn:AftermarketMemberkamn:EngineeredProductsMember2019-01-012019-12-310000054381kamn:AftermarketMemberkamn:PrecisionProductsMember2019-01-012019-12-310000054381kamn:AftermarketMemberkamn:StructuresMember2019-01-012019-12-310000054381kamn:AftermarketMember2019-01-012019-12-310000054381us-gaap:TimeAndMaterialsContractMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:TimeAndMaterialsContractMember2021-01-012021-12-310000054381us-gaap:FixedPriceContractMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:FixedPriceContractMember2021-01-012021-12-310000054381kamn:EngineeredProductsMember2021-12-310000054381kamn:EngineeredProductsMember2020-12-310000054381kamn:EngineeredProductsMember2019-12-310000054381kamn:PrecisionProductsMember2021-12-310000054381kamn:PrecisionProductsMember2020-12-310000054381kamn:PrecisionProductsMember2019-12-310000054381kamn:StructuresMember2021-12-310000054381kamn:StructuresMember2020-12-310000054381kamn:StructuresMember2019-12-310000054381us-gaap:CorporateMember2021-12-310000054381us-gaap:CorporateMember2020-12-310000054381us-gaap:CorporateMember2019-12-310000054381srt:NorthAmericaMember2021-01-012021-12-310000054381srt:NorthAmericaMember2020-01-012020-12-310000054381srt:NorthAmericaMember2019-01-012019-12-310000054381srt:EuropeMember2021-01-012021-12-310000054381srt:EuropeMember2020-01-012020-12-310000054381srt:EuropeMember2019-01-012019-12-310000054381us-gaap:MiddleEastMember2021-01-012021-12-310000054381us-gaap:MiddleEastMember2020-01-012020-12-310000054381us-gaap:MiddleEastMember2019-01-012019-12-310000054381srt:AsiaMember2021-01-012021-12-310000054381srt:AsiaMember2020-01-012020-12-310000054381srt:AsiaMember2019-01-012019-12-310000054381kamn:OceaniaDomain2021-01-012021-12-310000054381kamn:OceaniaDomain2020-01-012020-12-310000054381kamn:OceaniaDomain2019-01-012019-12-310000054381kamn:SegmentGeographicalGroupsOfCountriesGroupSixMember2021-01-012021-12-310000054381kamn:SegmentGeographicalGroupsOfCountriesGroupSixMember2020-01-012020-12-310000054381kamn:SegmentGeographicalGroupsOfCountriesGroupSixMember2019-01-012019-12-310000054381country:US2021-12-310000054381country:US2020-12-310000054381country:DE2021-12-310000054381country:DE2020-12-310000054381country:CZ2021-12-310000054381country:CZ2020-12-310000054381country:MX2021-12-310000054381country:MX2020-12-310000054381country:NL2021-12-310000054381country:NL2020-12-310000054381country:CH2021-12-310000054381country:CH2020-12-310000054381country:HK2021-12-310000054381country:HK2020-12-310000054381kamn:GAReductionEffortMember2021-01-012021-12-310000054381kamn:GAReductionEffortMember2020-01-012020-12-310000054381kamn:GAReductionEffortMember2019-01-012019-12-310000054381kamn:BalSealMember2021-01-012021-12-310000054381kamn:BalSealMember2020-01-012020-12-310000054381kamn:BalSealMember2019-01-012019-12-310000054381kamn:COVID19Member2021-01-012021-12-310000054381kamn:COVID19Member2020-01-012020-12-310000054381kamn:COVID19Member2019-01-012019-12-310000054381kamn:A2017AnnouncedRestructuringPlanMember2021-01-012021-12-310000054381kamn:A2017AnnouncedRestructuringPlanMember2020-01-012020-12-310000054381kamn:A2017AnnouncedRestructuringPlanMember2019-01-012019-12-310000054381kamn:U.K.CompositesMember2019-01-012019-12-310000054381us-gaap:TradeAccountsReceivableMember2021-12-310000054381us-gaap:TradeAccountsReceivableMember2020-12-310000054381kamn:USGovernmentMemberus-gaap:BilledRevenuesMemberkamn:ContractReceivablesMember2021-12-310000054381kamn:USGovernmentMemberus-gaap:BilledRevenuesMemberkamn:ContractReceivablesMember2020-12-310000054381us-gaap:UnbilledRevenuesMemberkamn:USGovernmentMemberkamn:ContractReceivablesMember2021-12-310000054381us-gaap:UnbilledRevenuesMemberkamn:USGovernmentMemberkamn:ContractReceivablesMember2020-12-310000054381kamn:CommercialAndOtherGovernmentMemberus-gaap:BilledRevenuesMemberkamn:ContractReceivablesMember2021-12-310000054381kamn:CommercialAndOtherGovernmentMemberus-gaap:BilledRevenuesMemberkamn:ContractReceivablesMember2020-12-310000054381kamn:CommercialAndOtherGovernmentMemberus-gaap:UnbilledRevenuesMemberkamn:ContractReceivablesMember2021-12-310000054381kamn:CommercialAndOtherGovernmentMemberus-gaap:UnbilledRevenuesMemberkamn:ContractReceivablesMember2020-12-310000054381kamn:ContractChangesNegotiatedSettlementsandClaimsMember2021-12-310000054381kamn:ContractChangesNegotiatedSettlementsandClaimsMember2020-12-310000054381kamn:CoststoFulfillMember2021-12-310000054381kamn:CoststoObtainMember2021-12-310000054381kamn:CoststoFulfillMember2020-12-310000054381kamn:CoststoObtainMember2020-12-310000054381us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381kamn:USGovernmentMember2021-12-310000054381kamn:USGovernmentMember2020-12-310000054381kamn:CommercialAndOtherGovernmentMember2021-12-310000054381kamn:CommercialAndOtherGovernmentMember2020-12-310000054381kamn:KMaxMember2021-12-310000054381kamn:KMaxMember2020-12-310000054381kamn:SH2GIMember2021-12-310000054381kamn:SH2GIMember2020-12-310000054381us-gaap:LandMember2021-12-310000054381us-gaap:LandMember2020-12-310000054381us-gaap:BuildingMember2021-12-310000054381us-gaap:BuildingMember2020-12-310000054381us-gaap:LeaseholdImprovementsMember2021-12-310000054381us-gaap:LeaseholdImprovementsMember2020-12-310000054381kamn:MachineryOfficeFurnitureAndEquipmentMember2021-12-310000054381kamn:MachineryOfficeFurnitureAndEquipmentMember2020-12-310000054381us-gaap:ConstructionInProgressMember2021-12-310000054381us-gaap:ConstructionInProgressMember2020-12-310000054381us-gaap:AssetsHeldUnderCapitalLeasesMember2020-12-310000054381us-gaap:AssetsHeldUnderCapitalLeasesMember2021-12-310000054381us-gaap:AssetsHeldUnderCapitalLeasesMember2021-01-012021-12-310000054381us-gaap:AssetsHeldUnderCapitalLeasesMember2020-01-012020-12-310000054381us-gaap:AssetsHeldUnderCapitalLeasesMember2019-01-012019-12-310000054381us-gaap:MeasurementInputLongTermRevenueGrowthRateMember2021-01-012021-12-310000054381us-gaap:MeasurementInputDiscountRateMember2021-01-012021-12-310000054381kamn:CustomerListsAndRelationshipsMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberkamn:CustomerListsAndRelationshipsMember2021-01-012021-12-310000054381kamn:CustomerListsAndRelationshipsMember2021-12-310000054381kamn:CustomerListsAndRelationshipsMember2020-12-310000054381us-gaap:DevelopedTechnologyRightsMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:DevelopedTechnologyRightsMember2021-01-012021-12-310000054381us-gaap:DevelopedTechnologyRightsMember2021-12-310000054381us-gaap:DevelopedTechnologyRightsMember2020-12-310000054381srt:MinimumMemberus-gaap:TrademarksAndTradeNamesMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:TrademarksAndTradeNamesMember2021-01-012021-12-310000054381us-gaap:TrademarksAndTradeNamesMember2021-12-310000054381us-gaap:TrademarksAndTradeNamesMember2020-12-310000054381us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:NoncompeteAgreementsMember2021-01-012021-12-310000054381us-gaap:NoncompeteAgreementsMember2021-12-310000054381us-gaap:NoncompeteAgreementsMember2020-12-310000054381us-gaap:PatentsMember2021-01-012021-12-310000054381us-gaap:PatentsMember2021-12-310000054381us-gaap:PatentsMember2020-12-310000054381kamn:AccrualsAndPayableAndOtherLongTermLiabiltiesMember2020-12-310000054381kamn:AccrualsAndPayableAndOtherLongTermLiabiltiesMember2019-12-310000054381kamn:AccrualsAndPayableAndOtherLongTermLiabiltiesMember2021-01-012021-12-310000054381kamn:AccrualsAndPayableAndOtherLongTermLiabiltiesMember2020-01-012020-12-310000054381kamn:AccrualsAndPayableAndOtherLongTermLiabiltiesMember2021-12-310000054381kamn:BloomfieldMember2008-08-310000054381kamn:BloomfieldMember2021-12-310000054381us-gaap:RevolvingCreditFacilityMember2021-12-310000054381us-gaap:RevolvingCreditFacilityMember2020-12-310000054381us-gaap:ConvertibleDebtMember2021-12-310000054381us-gaap:ConvertibleDebtMember2020-12-310000054381kamn:FinanceLeaseObligationsMember2021-12-310000054381kamn:FinanceLeaseObligationsMember2020-12-310000054381kamn:A2024NotesMember2017-05-240000054381kamn:A2024NotesMember2017-05-120000054381kamn:A2024NotesMember2019-09-270000054381kamn:A2024NotesMember2021-01-012021-12-310000054381kamn:A2024NotesMember2017-05-122017-05-120000054381kamn:A2024NotesMember2021-12-3100000543812017-05-122017-05-1200000543812017-05-240000054381kamn:A2024NotesMember2020-01-012020-12-310000054381kamn:A2024NotesMember2019-01-012019-12-310000054381kamn:A2024NotesMember2020-12-310000054381kamn:CreditAgreement2019Memberus-gaap:RevolvingCreditFacilityMember2019-12-130000054381kamn:CoLeadArrangersBankOfAmericaSecuritiesLlcJpMorganSecuritiesLlcAndRbsCitizensNAAndSyndicateOfLendersMemberkamn:CreditAgreement2015Memberus-gaap:RevolvingCreditFacilityMember2015-05-060000054381kamn:CreditAgreement2019Memberus-gaap:LineOfCreditMemberkamn:CollateralMemberOneMember2021-12-310000054381kamn:CollateralMemberTwoMemberkamn:CreditAgreement2019Memberus-gaap:LineOfCreditMember2021-12-310000054381kamn:CreditAgreement2019Memberus-gaap:RevolvingCreditFacilityMember2021-12-310000054381kamn:CreditAgreement2015Memberus-gaap:RevolvingCreditFacilityMember2020-12-310000054381us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-12-310000054381us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-12-310000054381us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMemberkamn:JPFMember2021-12-310000054381us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMemberkamn:JPFMember2020-12-310000054381us-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310000054381us-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310000054381us-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310000054381kamn:CreditAgreement2019Membersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310000054381srt:MaximumMemberkamn:CreditAgreement2019Memberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310000054381us-gaap:LetterOfCreditMemberkamn:CreditAgreement2019Membersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberus-gaap:LetterOfCreditMemberkamn:CreditAgreement2019Member2021-01-012021-12-310000054381kamn:CreditAgreement2019Member2021-12-310000054381kamn:CreditAgreement2019Member2020-12-310000054381kamn:CreditAgreement2019Member2021-01-012021-12-310000054381srt:MaximumMemberkamn:CreditAgreement2019Member2021-01-012021-12-310000054381kamn:CreditAgreement2019Membersrt:MinimumMember2021-01-012021-12-310000054381srt:ScenarioForecastMemberkamn:CreditAgreement2019Member2023-12-312024-03-290000054381us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000054381us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000054381us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310000054381us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310000054381us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000054381us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000054381us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000054381kamn:AccumulatedDefinedBenefitPlanSERPAmortizationofNetLossMember2021-01-012021-12-310000054381kamn:AccumulatedDefinedBenefitPlanSERPAmortizationofNetLossMember2020-01-012020-12-310000054381kamn:AccumulatedDefinedBenefitPlanSERPChangeinnetgainMember2021-01-012021-12-310000054381kamn:AccumulatedDefinedBenefitPlanSERPChangeinnetgainMember2020-01-012020-12-310000054381us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310000054381us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310000054381us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000054381us-gaap:GoodwillMember2021-01-012021-12-310000054381us-gaap:GoodwillMember2020-01-012020-12-310000054381us-gaap:GoodwillMember2019-01-012019-12-310000054381us-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310000054381us-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2020-01-012020-12-310000054381us-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2019-01-012019-12-310000054381kamn:EntityClassificationElectionMember2021-01-012021-12-310000054381kamn:EntityClassificationElectionMember2020-01-012020-12-310000054381kamn:EntityClassificationElectionMember2019-01-012019-12-310000054381kamn:ForeignDerivedIntangibleIncomeBenefitMember2021-01-012021-12-310000054381kamn:ForeignDerivedIntangibleIncomeBenefitMember2020-01-012020-12-310000054381kamn:ForeignDerivedIntangibleIncomeBenefitMember2019-01-012019-12-310000054381us-gaap:StockCompensationPlanMember2021-01-012021-12-310000054381us-gaap:StockCompensationPlanMember2020-01-012020-12-310000054381us-gaap:StockCompensationPlanMember2019-01-012019-12-310000054381kamn:CompensationMember2021-01-012021-12-310000054381kamn:CompensationMember2020-01-012020-12-310000054381kamn:CompensationMember2019-01-012019-12-310000054381us-gaap:AcquisitionRelatedCostsMember2021-01-012021-12-310000054381us-gaap:AcquisitionRelatedCostsMember2020-01-012020-12-310000054381us-gaap:AcquisitionRelatedCostsMember2019-01-012019-12-310000054381sic:Z88882021-01-012021-12-310000054381us-gaap:DomesticCountryMember2021-01-012021-12-310000054381sic:Z88882021-12-310000054381us-gaap:DomesticCountryMember2021-12-310000054381us-gaap:PensionCostsMember2021-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2020-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2019-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2021-01-012021-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2020-01-012020-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-01-012021-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2021-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000054381us-gaap:OtherPensionPlansDefinedBenefitMember2019-01-012019-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-01-012019-12-310000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-01-012021-10-290000054381us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-10-302021-12-310000054381us-gaap:CashAndCashEquivalentsMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2021-12-310000054381us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:CashAndCashEquivalentsMember2021-12-310000054381us-gaap:DerivativeMember2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:AssetsMember2021-12-310000054381us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AssetsMember2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:AssetsMember2021-12-310000054381us-gaap:FutureMember2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:LiabilityMember2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:LiabilityMember2021-12-310000054381us-gaap:FutureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:LiabilityMember2021-12-310000054381us-gaap:FixedIncomeSecuritiesMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2021-12-310000054381us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeSecuritiesMember2021-12-310000054381us-gaap:EquityFundsMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:EquityFundsMember2021-12-310000054381us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquityFundsMember2021-12-310000054381kamn:CommonTrustFundsMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberkamn:CommonTrustFundsMember2021-12-310000054381us-gaap:FairValueInputsLevel2Memberkamn:CommonTrustFundsMember2021-12-310000054381us-gaap:FairValueInputsLevel3Memberkamn:CommonTrustFundsMember2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkamn:CommonTrustFundsMember2021-12-310000054381us-gaap:EquitySecuritiesMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2021-12-310000054381us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMember2021-12-310000054381us-gaap:FairValueInputsLevel1Member2021-12-310000054381us-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FairValueInputsLevel3Member2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310000054381us-gaap:OtherIncomeMember2021-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:OtherIncomeMember2021-12-310000054381us-gaap:OtherIncomeMemberus-gaap:FairValueInputsLevel2Member2021-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherIncomeMember2021-12-310000054381us-gaap:CashAndCashEquivalentsMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2020-12-310000054381us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:CashAndCashEquivalentsMember2020-12-310000054381us-gaap:DerivativeMember2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:AssetsMember2020-12-310000054381us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AssetsMember2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:AssetsMember2020-12-310000054381us-gaap:FutureMember2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:LiabilityMember2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:LiabilityMember2020-12-310000054381us-gaap:FutureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:LiabilityMember2020-12-310000054381us-gaap:FixedIncomeSecuritiesMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2020-12-310000054381us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeSecuritiesMember2020-12-310000054381us-gaap:EquityFundsMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:EquityFundsMember2020-12-310000054381us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquityFundsMember2020-12-310000054381kamn:CommonTrustFundsMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberkamn:CommonTrustFundsMember2020-12-310000054381us-gaap:FairValueInputsLevel2Memberkamn:CommonTrustFundsMember2020-12-310000054381us-gaap:FairValueInputsLevel3Memberkamn:CommonTrustFundsMember2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkamn:CommonTrustFundsMember2020-12-310000054381us-gaap:EquitySecuritiesMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2020-12-310000054381us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:EquitySecuritiesMember2020-12-310000054381us-gaap:FairValueInputsLevel1Member2020-12-310000054381us-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FairValueInputsLevel3Member2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310000054381us-gaap:OtherIncomeMember2020-12-310000054381us-gaap:FairValueInputsLevel1Memberus-gaap:OtherIncomeMember2020-12-310000054381us-gaap:OtherIncomeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000054381us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherIncomeMember2020-12-310000054381us-gaap:SegmentContinuingOperationsMember2021-01-012021-12-310000054381us-gaap:SegmentContinuingOperationsMember2020-01-012020-12-310000054381us-gaap:SegmentContinuingOperationsMember2019-01-012019-12-310000054381us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-01-012020-12-310000054381us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-01-012021-12-310000054381us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2019-01-012019-12-310000054381kamn:OtherLiabiltiesMember2021-12-310000054381kamn:OtherLiabiltiesMember2020-12-310000054381kamn:OffsetAgreementMember2021-01-012021-12-310000054381kamn:OffsetAgreementMember2021-12-310000054381kamn:OffsetAgreementMember2018-01-150000054381kamn:NewHartfordMember2021-12-310000054381kamn:NewHartfordMember2021-01-012021-12-310000054381kamn:LiabiltiesOtherAccrualsAndPayablesMemberkamn:NewHartfordMember2021-12-310000054381kamn:BloomfieldMember2021-01-012021-12-310000054381kamn:LiabiltiesOtherAccrualsAndPayablesMemberkamn:BloomfieldMember2021-12-310000054381us-gaap:RealEstateMembersrt:MinimumMember2021-12-310000054381srt:MaximumMemberus-gaap:RealEstateMember2021-12-310000054381us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-12-310000054381srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2021-12-310000054381us-gaap:StockCompensationPlanMember2021-01-012021-12-310000054381us-gaap:StockCompensationPlanMember2020-01-012020-12-310000054381us-gaap:StockCompensationPlanMember2019-01-012019-12-310000054381us-gaap:EquitySecuritiesMember2021-01-012021-12-310000054381srt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMember2021-01-012021-12-310000054381kamn:RestructuringSeveranceMember2021-01-012021-12-310000054381kamn:RestructuringSeveranceMember2020-01-012020-12-310000054381kamn:RestructuringSeveranceMember2019-01-012019-12-310000054381us-gaap:SegmentDiscontinuedOperationsMember2019-01-012019-12-310000054381kamn:A2013ManagementIncentivePlanMember2013-04-170000054381kamn:A2013ManagementIncentivePlanMember2018-04-180000054381kamn:A2013ManagementIncentivePlanMember2021-12-310000054381kamn:LongtermIncentivePlanAwardsMemberkamn:A2013ManagementIncentivePlanMember2021-01-012021-12-310000054381kamn:LongtermIncentivePlanAwardsMemberkamn:A2013ManagementIncentivePlanMembersrt:MinimumMember2021-01-012021-12-310000054381srt:MaximumMemberkamn:LongtermIncentivePlanAwardsMemberkamn:A2013ManagementIncentivePlanMember2021-01-012021-12-310000054381us-gaap:EmployeeStockOptionMember2021-12-310000054381us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000054381us-gaap:RestrictedStockMemberkamn:PriorTo2021Member2021-12-310000054381us-gaap:RestrictedStockMemberkamn:PriorTo2021Member2021-01-012021-12-310000054381us-gaap:RestrictedStockMemberkamn:BeginningIn2021Member2021-12-310000054381us-gaap:RestrictedStockMemberkamn:BeginningIn2021Member2021-01-012021-12-310000054381us-gaap:EmployeeStockOptionMember2020-12-310000054381us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000054381us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000054381us-gaap:RestrictedStockMember2020-12-310000054381us-gaap:RestrictedStockMember2021-01-012021-12-310000054381us-gaap:RestrictedStockMember2021-12-310000054381us-gaap:RestrictedStockMember2020-01-012020-12-310000054381us-gaap:RestrictedStockMember2019-01-012019-12-310000054381us-gaap:PerformanceSharesMember2020-12-310000054381us-gaap:PerformanceSharesMember2021-01-012021-12-310000054381us-gaap:PerformanceSharesMember2021-12-310000054381kamn:NonqualifiedStockOptionsandRestrictedStockMember2021-01-012021-12-310000054381kamn:NonqualifiedStockOptionsandRestrictedStockMember2020-01-012020-12-310000054381kamn:NonqualifiedStockOptionsandRestrictedStockMember2019-01-012019-12-310000054381kamn:NonqualifiedStockOptionsandRestrictedStockMember2021-12-310000054381us-gaap:EmployeeStockMember2021-01-012021-12-310000054381us-gaap:EmployeeStockMember2021-12-310000054381us-gaap:EmployeeStockMembersrt:MinimumMember2021-12-310000054381srt:MaximumMemberus-gaap:EmployeeStockMember2021-12-310000054381us-gaap:EmployeeStockMember2020-01-012020-12-310000054381us-gaap:EmployeeStockMembersrt:MinimumMember2020-12-310000054381srt:MaximumMemberus-gaap:EmployeeStockMember2020-12-310000054381us-gaap:EmployeeStockMember2019-01-012019-12-310000054381us-gaap:EmployeeStockMembersrt:MinimumMember2019-12-310000054381srt:MaximumMemberus-gaap:EmployeeStockMember2019-12-310000054381us-gaap:AllowanceForCreditLossMember2020-12-310000054381us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000054381us-gaap:AllowanceForCreditLossMember2021-12-310000054381us-gaap:AllowanceForCreditLossMember2019-12-310000054381us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000054381us-gaap:AllowanceForCreditLossMember2018-12-310000054381us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310000054381us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended | December 31, 2021 |

| | | | | |

| Commission File No. | 001-35419 |

| KAMAN CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Connecticut | | 06-0613548 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 1332 Blue Hills Avenue, | Bloomfield, | Connecticut | | | 06002 |

| (Address of principal executive offices) | | | (Zip Code) |

| | | | | | | | |

| Registrant's telephone number, including area code | (860) | 243-7100 |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock ($1 par value) | | KAMN | | New York Stock Exchange LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by checkmark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value on July 2, 2021, (the last business day of the Company’s most recently completed second quarter) of the voting and non-voting common stock held by non-affiliates of the registrant, computed by reference to the closing price of the stock, was approximately At January 28, 2022, there were shares of Common Stock outstanding.

Documents Incorporated Herein By Reference

Portions of our definitive proxy statement for our 2021 Annual Meeting of Shareholders are incorporated by reference into Part III of this Report.

Kaman Corporation

Index to Form 10-K

| | | | | | | | |

| Part I |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| Part II |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| | | |

| Part III |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| | | |

| Part IV |

| Item 15 | | |

| Item 16 | | |

PART I

ITEM 1.BUSINESS

GENERAL

Kaman Corporation, headquartered in Bloomfield, Connecticut, was incorporated in 1945. As used in this annual report, "the Company", "we", "us", "our" refer to the registrant and its consolidated subsidiaries. We are a diversified company that conducts business in the aerospace and defense, medical and industrial markets. In the fourth quarter of 2021, our Chief Operating Decision Maker ("CODM") established a new structure for the Company to better align our products and brands to support capital allocation plans, portfolio management and growth, which resulted in the introduction of three reportable segments: Engineered Products, Precision Products and Structures. The CODM reviews operating results for the purposes of allocating resources and assessing performance based on these three segments.

The Company's principal customers include the U.S. military, foreign allied militaries, Sikorsky Aircraft Corporation, The Boeing Company, Airbus, Lockheed Martin, Rolls-Royce, Raytheon and Bell Helicopter. The SH-2G aircraft is currently in service with the Egyptian Air Force and the New Zealand, Peruvian and Polish navies. Operations are conducted throughout the United States, as well as in manufacturing facilities located in Germany, the Czech Republic, Mexico and Singapore. Additionally, the Company maintains an investment in a joint venture in India. In the year ended December 31, 2021, two individual customers, the U.S. Government ("USG") and a Joint Programmable Fuze ("JPF") direct commercial sales ("DCS") customer, accounted for more than 10% of consolidated net sales. Sales to the U.S. Government were primarily made by the Engineered Products and Precision Products segments and sales to the JPF DCS customer were made by the Precision Products segment.

Engineered Products Segment

The Engineered Products segment serves the aerospace and defense, industrial and medical markets providing sophisticated, proprietary aircraft bearings and components; super precision, miniature ball bearings; and proprietary spring energized seals, springs and contacts.

Precision Products Segment

The Precision Products segment serves the aerospace and defense markets providing precision safe and arming solutions for missile and bomb systems for the U.S. and allied militaries; subcontract helicopter work; restoration, modification and support of our SH-2G Super Seasprite maritime helicopters; manufacture and support of our heavy lift K-MAX® manned helicopter, the K-MAX TITAN unmanned aerial system and the KARGO UAV unmanned aerial system, a purpose built autonomous medium lift logistics vehicle.

Structures Segment

The Structures segment serves the aerospace and defense and medical end markets providing sophisticated complex metallic and composite aerostructures for commercial, military and general aviation fixed and rotary wing aircraft, and medical imaging solutions.

A discussion of 2021 developments is included in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Form 10-K.

WORKING CAPITAL

A discussion of our working capital is included in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources, in this Form 10-K.

Our working capital requirements are dependent on the nature and life cycles of the programs for which work is performed. New programs may initially require higher working capital to complete nonrecurring start-up activities and fund the purchase of inventory and equipment necessary to perform the work. Nonrecurring start-up costs on large and complex programs often take longer to recover, negatively impacting working capital in the short-term and producing a corresponding benefit in future periods. As these programs mature and efficiencies are gained in the production process, working capital requirements generally decrease.

Our credit agreement is a revolving credit facility which is available for additional working capital requirements and investment opportunities. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 14, Debt, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

PRINCIPAL PRODUCTS AND SERVICES

The following table sets forth the percentage contribution of each major product line to consolidated net sales for each of the three most recently completed years: | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, |

| | | 2021 | | 2020 | | 2019 |

| Sales | | | | | | |

| Defense | | 23.8 | % | | 23.0 | % | | 23.4 | % |

| Safe and Arm Devices | | 27.0 | % | | 31.7 | % | | 29.9 | % |

| Commercial, Business, & General Aviation | | 26.1 | % | | 28.1 | % | | 36.9 | % |

| Medical | | 12.2 | % | | 8.9 | % | | 3.8 | % |

| Industrial & Other | | 10.9 | % | | 8.3 | % | | 6.0 | % |

| Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

AVAILABILITY OF RAW MATERIALS

While we believe we have sufficient sources for the materials, components, services and supplies used in our manufacturing activities, we are highly dependent on the availability of essential materials, parts and subassemblies from our suppliers and subcontractors. The most important raw materials required for our products are aluminum (sheet, plate, forgings and extrusions), titanium, nickel, steel, copper, composites and adhesives. Many major components and product equipment items are procured from or subcontracted on a sole-source basis with a number of domestic and non-U.S. companies. Although alternative sources generally exist for these raw materials, qualification of the sources could take a year or more. We are dependent upon the ability of a large number of suppliers and subcontractors to meet performance specifications, quality standards and delivery schedules at anticipated costs. While we maintain an extensive qualification system to control risk associated with such reliance on third parties, failure of suppliers or subcontractors to meet commitments could adversely affect production schedules and contract profitability, while jeopardizing our ability to fulfill commitments to our customers. The current economy has put pressure on the supply chain and we have experienced some shortages in raw materials which have impacted our near term results; however, we do not foresee any near term unavailability of materials, components or supplies that would have a material adverse effect on our business. For further discussion of the possible effects of changes in the cost or availability of raw materials on our business, see Item 1A, Risk Factors, in this Form 10-K.

CLIMATE CHANGE

There have been no, and we do not expect there to be in the near term, material impacts on our business, financial condition or results of operations as a result of compliance with legislation or regulatory rules regarding climate change, from the known physical effects of climate change or as a result of supporting our Environmental, Social and Governance ("ESG") initiatives. For further information on our ESG initiatives, refer to Information about the Board of Directors and Corporate Governance section of the Proxy Statement. Increased regulation and other climate change concerns, however, could subject us to additional costs and restrictions, and we are not able to predict how such regulations or concerns would affect our business, operations or financial results.

INTELLECTUAL PROPERTY

We use patented and unpatented proprietary information, know-how and trade secrets to develop, maintain and enhance our competitive position, but we believe our continued success depends more on the knowledge, ability, experience and technological expertise of our employees than the legal protection that our patents and other proprietary rights may afford. Moreover, while we rely on a combination of patents, trademarks, copyrights, trade secrets, nondisclosure agreements, physical and information technology security systems, internal controls and compliance systems and other measures to protect our intellectual property, data and technology rights and that of third parties with which we are entrusted, our ability to protect and enforce our intellectual property, data and technology rights may be limited by a variety of factors and may be even more limited in certain countries outside the U.S., as may be our ability to prevent theft or compromise of our intellectual property, data and technology by competitors or third parties.

As of December 31, 2021, we held a total of 404 patents, 117 of which were U.S. patents and 287 of which were foreign patents. In addition, we have numerous U.S. and foreign patents pending. The Company believes the duration of its patents is adequate relative to the expected lives of its products.

Trademarks are also an important aspect of our business. The availability and duration of trademark registrations vary by country; however, trademarks are generally valid and may be renewed indefinitely as long as they are in use and registrations are maintained. We sell products under a number of registered trademarks that we own. Registered trademarks of the Company include KAflex®, KAron®, and K-MAX®. In all, we maintain 99 U.S. and foreign trademarks as of December 31, 2021.

BACKLOG

We anticipate that approximately 58% of our backlog at the end of 2021 will be performed in 2022. Approximately 57.8% of our backlog at the end of 2021 is related to USG contracts or subcontracts.

Total backlog at December 31, 2021, 2020 and 2019, and the portion of the backlog we expect to complete in 2022, is as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Backlog at December 31, 2021 | | 2021 Backlog to be completed in 2022 | | Total Backlog at December 31, 2020 | | Total Backlog at December 31, 2019 |

| In thousands | | | | | | | | |

| Engineered Products | | $ | 169,144 | | | $ | 150,647 | | | $ | 134,257 | | | $ | 134,532 | |

| Precision Products | | 180,082 | | | 138,382 | | | 293,261 | | | 439,336 | |

| Structures | | 351,697 | | | 120,304 | | | 203,718 | | | 233,002 | |

| Total | | $ | 700,923 | | | $ | 409,333 | | | $ | 631,236 | | | $ | 806,870 | |

Backlog related to uncompleted contracts for which we have recorded a provision for estimated losses was $1.2 million as of December 31, 2021. At December 31, 2021, there was no backlog related to firm but not yet funded orders. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 1, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, for further discussion.

REGULATORY MATTERS

Government Contracts

The USG, and other governments, may terminate any of our government contracts at their convenience or for default if we fail to meet specified performance measurements. If any of our government contracts were to be terminated for convenience, we generally would be entitled to receive payment for work completed and allowable termination or cancellation costs. If any of our government contracts were to be terminated for default, generally the USG would pay only for the work that has been accepted and can require us to pay the difference between the original contract price and the cost to re-procure the contract items, net of the work accepted from the original contract. The USG can also hold us liable for damages resulting from the default.

During 2021, approximately 94.7% of the work performed by the Company directly or indirectly for the USG was performed on a fixed-price basis and the balance was performed on a cost-reimbursement basis. Under a fixed-price contract, the price paid to the contractor is negotiated at the outset of the contract and is not generally subject to adjustment to reflect the actual costs incurred by the contractor in the performance of the contract. Cost reimbursement contracts provide for the reimbursement of allowable costs and an additional negotiated fee.

Compliance with Environmental Protection Laws

Our operations are subject to and affected by a variety of federal, state, local and non-U.S. environmental laws and regulations relating to the discharge, treatment, storage, disposal, investigation and remediation of certain materials, substances and wastes. We continually assess our compliance status and management of environmental matters in an effort to ensure our operations are in substantial compliance with all applicable environmental laws and regulations.

Operating and maintenance costs associated with environmental compliance and management of sites are a normal, recurring part of our operations. These costs often are generally allowable costs under our contracts with the USG. It is reasonably

possible that continued environmental compliance could have a material impact on our results of operations, financial condition or cash flows if more stringent clean-up standards are imposed, additional contamination is discovered and/or clean-up costs are higher than estimated.

See Environmental Matters in Item 3, Legal Proceedings and Note 19, Commitments and Contingencies, in the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, for further discussion of our environmental matters.

With respect to all other matters that may currently be pending, in the opinion of management, based on our analysis of relevant facts and circumstances, we do not believe that compliance with relevant environmental protection laws is likely to have a material adverse effect upon our capital expenditures, earnings or competitive position. In arriving at this conclusion, we have taken into consideration site-specific information available regarding total costs of any work to be performed and the extent of work previously performed. If we are identified as a “potentially responsible party” ("PRP") by environmental authorities at a particular site, we, using information available to us, will also review and consider a number of other factors, including: (i) the financial resources of other PRPs involved in each site and their proportionate share of the total volume of waste at the site; (ii) the existence of insurance, if any, and the financial viability of the insurers; and (iii) the success others have had in receiving reimbursement for similar costs under similar insurance policies issued during the periods applicable to each site.

International Operations

Our international sales are subject to U.S. and non-U.S. governmental regulations and procurement policies and practices, including regulations relating to import-export control, investment, exchange controls and repatriation of earnings. International sales are also subject to varying currency, political and economic risks.

COMPETITION

The Company operates in a highly competitive environment with many other organizations, some of which are substantially larger than us and have greater financial strength and more extensive resources. We compete for composite and metallic aerostructures subcontracts, and helicopter sales and structures, bearings, springs, seals and contacts and components business on the basis of price and/or quality; product endurance and special performance characteristics; proprietary knowledge; the quality of our products and services; the availability of facilities, equipment and personnel to perform contracts; and the reputation of our business. Competitors for our business include small machine shops and offshore manufacturing facilities. We compete for advanced technology fuzing business primarily on the basis of technical competence, product quality and price, and also on the basis of our experience as a developer and manufacturer of fuzes for particular weapon types and the availability of our facilities, equipment and personnel. We are also affected by the political and economic circumstances of our potential foreign customers and, in certain situations, the relationships of those foreign customers with the USG, the USG's perceptions of those foreign customers, such as our Middle Eastern customers, and the ability to obtain necessary export approvals, licenses or authorizations from the USG.

HUMAN CAPITAL

The Company employs a global workforce focused on serving its customers and creating solutions to meet their needs. We consider our employees to be the most valuable resource for current and future success and we seek to provide a work environment that fosters growth, encourages self-development and provides meaningful work. How we manage our human capital is critical to how we deliver on our strategy and create sustained growth and value for our shareholders. Kaman Corporation is a place where people who want to make a difference come to work.

Employee Demographics

As of December 31, 2021, we employed 2,846 individuals. Of these employees, approximately 75% are employed in the United States and 25% are employed internationally. Within the United States, 64% of the employees are non-exempt and 36% are exempt.

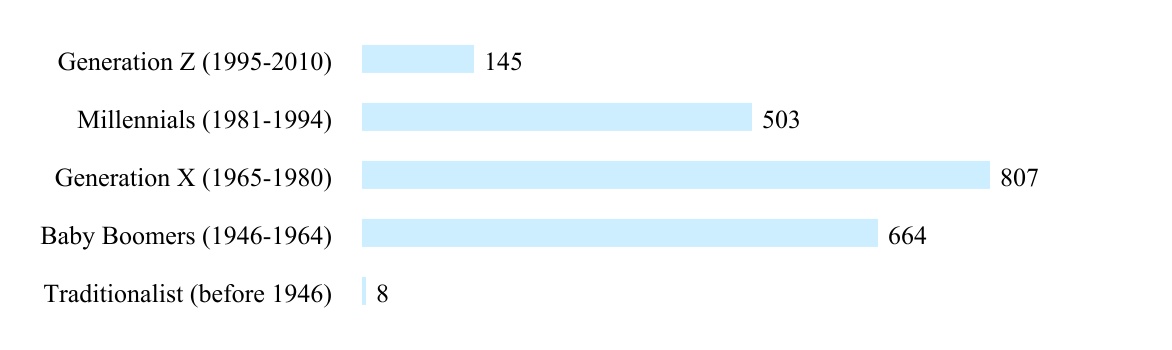

The Company's average age of U.S. employees is 49. U.S. headcount by generation at December 31, 2021 is as follows:

Values

The Company’s core values are Respect, Excellence, Accountability, Creativity and Honor ("REACH"):

•Respect - Employees value people, their skills and their perspectives.

•Excellence - Employees do their best, giving full attention to the quality of every job, outcome and relationship. The highest level of customer service is provided to customers, both externally and internally.

•Accountability - Employees accept responsibility for their actions and work to achieve desired results.

•Creativity - Employees take on every challenge with a spirit of discovery and ingenuity, offering new ideas and resources.

•Honor - Employees behave with integrity.

Our employees are committed to these values, which define how employees behave, treat others and operate.

Business Ethics

The Company's Code of Conduct ("Code") is a statement of the principles and standards that the Company expects the Kaman community to follow. Each officer, director and employee is required to use good ethical judgement when conducting business and comply with applicable laws, rules and regulations. The Code describes what is appropriate behavior and guides ethical business decisions that maintain a commitment to integrity. Failure to comply with the Code and applicable laws can have severe consequences for both individuals involved and the Company, including disciplinary action, civil penalties or criminal prosecution under certain circumstances.

The Company has designated Compliance Officers who are responsible for the following:

•Distributing of the Code to the Kaman community;

•Educating and training personnel on the Code;

•Obtaining written acknowledgments from employees, officers, directors, agents, contractors, suppliers and customers that they have read, understand and will comply with the Code as a condition of their association with the Company;

•Investigating reported Code violations and implementing remedial actions when a violation has been confirmed; and

•Reporting Code submissions to the Company's Chief Compliance Officers.

Talent Acquisition

An important component of the Company’s Human Capital strategy is acquiring new talent. The Company strives to attract top talent with diverse backgrounds and experiences who align with the commitment of driving a culture of innovation.

The foundation of the talent acquisition strategy is the commitment to being an Equal Opportunity Employer. Qualified applicants receive consideration for employment without regard for race, color, religion, sex, sexual orientation, gender identity, national origin, disability, protected veteran status or any other protected class. The Company provides reasonable accommodations for qualified individuals with disabilities and disabled veterans in job application procedures and processes. The Company fully provides equal opportunity for all.

The Company uses a number of programs to ensure it attracts and hires top talent to develop as future leaders of the organization. The Kaman Internship Program is designed to provide meaningful work experiences and professional development for students. The goal of this program is to ensure a mutual benefit to both the students engaging in the internship

and the Company with a pipeline of future employees. The Kaman Early Career Rotational Program is designed to provide prospective Leadership Development Candidates, if selected, with the opportunity to develop leadership skills and learn key organizational processes across multiple business functions. The Early Career Rotational Program is 18 to 24 months in duration and consists of rotations through Operations, Program Management, Engineering, Quality and Supply Chain Management. The Campus Champions Program is designed to engage universities and military organizations through hands-on involvement in a variety of interactive activities including participation in recruitment drives and meeting with faculty, alumni, students, student organizations and veterans’ organizations. This program allows the Company to explore opportunities to strengthen its relationships and develop mutually beneficial partnerships with these institutions.

Talent Development

In addition to acquiring new talent, the Company focuses on growing and developing its existing talent. The Company makes significant investments in enhancing its employees’ skill levels and providing professional opportunities for career development and advancement. The Company’s leadership team utilizes a robust succession planning program for identifying the next generation of leaders to ensure that the organization is prepared to fill critical roles with employees who are prepared to support the strategy of the business and respond to the needs of key stakeholders.

Training and employee learning opportunities are offered to employees, which allow the Company to efficiently develop its staff and meet legal and compliance training requirements. Over seven thousand webinar courses were completed in 2021, along with hundreds of health, wellness and leadership training sessions delivered to the employee population.

The Company uses several mechanisms to support the development of current employees for future leadership roles. First, the company has evolved its coaching strategy to adjust to the effects of the COVID-19 pandemic by creating a model that embraces virtual employee coaching. Second, the Women in Leadership Program develops capabilities of female leaders through a process of learning and personal discovery so they can make stronger contributions within their careers and the organizations in which they work. With the use of a leadership assessment tool, management discovers the strengths and opportunities for its participants and creates actions plans to help improve their performance. Professional networking and mentoring helps prepare the female leaders for larger roles in the organization. As of December 31, 2021, 76% and 24% of the Company's management positions were held by men and women, respectively. This compares to the Company's overall U.S. population comprised of 69% males and 31% females.

The Company executed an All-Employee Engagement Survey in 2021. The survey was an opportunity for employees to offer open, honest and confidential feedback as it was administered by a third-party organization. It was launched to support continuous improvement and help shape and strengthen the Company’s culture, teamwork and overall work environment. The survey is used as a tool to measure and improve engagement and satisfaction while helping us discover areas and topics where we may need more dialogue and conversation. Action plans have been implemented to address the focus areas of training and development, inclusive culture and belonging and communication.

The Company also conducts annual performance appraisals with all employees. Feedback is used to support continuous improvement. Individual, annual goal setting activities align to the overall company and business unit strategies and objectives.

Diversity & Inclusion

The Company views diversity as a competitive advantage and integral to future success. Diversity helps create an innovative workforce, while inclusion ensures the Company has the right culture, processes, policies, and practices to ensure employees feel valued and included.

Women Advocating Leadership at Kaman ("WALK") is a program that is designed to support the advancement of Kaman’s strategic diversity goals by implementing specific business initiatives that increase the global representation of women in leadership roles. WALK’s long-term objectives include hiring; retaining and promoting more women; supporting the change in Kaman’s culture of being more accepting of women in leadership roles; providing women with equal access to development opportunities; and creating a life balance and family-friendly culture.

The Company also seeks opportunities to recruit and hire skilled veterans as well as engage in partnerships and support programs that allow the Company to give back to the veteran community. The Company has a multitude of recognition programs to show its appreciation for their service to the United States. An employee resource group is dedicated to veteran employees which supports community engagement as well as professional development activities.

Total Rewards

The Company focuses on paying its employees fairly and competitively. The Company strives to provide competitive pay opportunities which reward its employees for achieving and exceeding objectives that create long-term value for shareholders. Management aims to have all compensation programs, processes and decisions be transparent and easy to understand. Providing equitable and competitive pay enhances the Company's ability to attract and retain strong, innovative talent.

Providing comprehensive, competitive and affordable benefits is important to the Company's attraction and retention strategy. The Company offers the following:

Health Benefits

The Company offers various medical plan options and provides employees with a cost comparison tool to assist employees with their decision. The options for pharmacy, dental and vision care coverage are also provided for employees. In addition to insurance benefits, Kaman’s Chronic Condition Management programs provides valuable resources to support employees and their family members dealing with a chronic condition, such as diabetes or cancer.

Wealth Benefits

The Kaman Corporation 401(k) Plan provides employees with a tax advantageous way to save for retirement. Contributions up to the first 5% in pre-tax and/or Roth accounts are matched, and matching contributions vest after three years of service. Additionally, the Company offers an Employee Stock Purchase Plan, Health Savings Accounts for those in a high deductible health plan, Flexible Spending Accounts for both health care and dependent care, life and accidental death and dismemberment insurance, disability benefits and voluntary accident and critical illness insurance.

Wellness Benefits

The Fit for Life Wellness program provides all employees with opportunities to participate in company-wide events, webinars and local wellness challenges focused on living a healthy lifestyle. Kaman Work-Life Solutions is available to all employees and their household members who need help dealing with issues affecting their personal or professional lives. This resource connects employees with individuals who can help them with an array of issues such as locating child care programs and individual counseling.

The Company recognizes the need to support its employees’ work-life balance. The Paid Parental Leaves of Absence better enables employees to care for and bond with a newborn, newly adopted, or newly placed foster child during the six-month period immediately following the event. Eligible employees receive three weeks of parental leave at 100% of base pay, inclusive of shift premiums, if applicable. This benefit is offered in addition to short-term disability benefits already provided for pregnancy and childbirth to women at the organization.

The Company’s approach to remote work aligns with its wellness and retention strategies as well as its response to the COVID-19 pandemic. The Company has implemented a Work from Home policy recognizing it as a strategic imperative to attract and retain employees as well as address how both current and potential employees view work in light of the global pandemic.

Health & Safety

The Company continues to diligently monitor and respond to the challenges faced by the Company and its employees navigating through the COVID-19 pandemic. The Company's employees have worked to keep the Company operational and meet customer requirements throughout the pandemic, while respecting the recommendations of local governments and regulatory agencies.

The Company's first priority continues to be the health and safety of employees and their families. As the COVID-19 global pandemic evolved, the Company enforced practical precautions, including global travel restrictions and enforcing quarantine periods as appropriate. A number of initiatives were implemented across the Company to ensure employees are safe, including an increase in communications and outreach to the workforce. Additionally, best practices for hygiene and preventing the spread of germs continue. The increased frequency of cleaning and disinfecting common areas has been maintained and our leadership teams have responded to local business needs and priorities to ensure safe operations and minimal business disruptions.

At the onset of the pandemic, a remote work strategy was implemented where appropriate, which the Company has evolved into a formal Work from Home policy. For those employees returning to work in the Company’s offices, a formal Return to Office process was implemented to ensure those returning were trained on the Company’s enhanced health and safety protocols. In addition, the process focuses on employee re-acclimation. Enhanced resources have been provided to help all employees manage the stress and anxiety of the current situation.

Corporate Responsibility

The Company is a strong supporter of education, including meritorious children of its employees, students pursuing engineering degrees, museums with educational programs and various local education programs across the country. The Company also financially supports charitable and civic organizations such as art councils, boy and girl scouts, food pantries, health organizations and veterans' organizations. Additionally, employees volunteer their time to give back to the communities in which they live and work.

AVAILABLE INFORMATION

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements and other information with the SEC.

We make available, free of charge on our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, proxy statements, and current reports on Form 8-K as well as amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act, together with Section 16 insider beneficial stock ownership reports, as soon as reasonably practicable after we electronically file these documents with, or furnish them to, the SEC. These documents are posted on our website at www.kaman.com — select the “Investors” link, then the "Financial Information" link and then view under “SEC Filings”.

We also make available, free of charge on our website, our Certificate of Incorporation, By–Laws, Governance Principles and all Board of Directors' standing Committee Charters (Audit, Corporate Governance, Compensation and Finance). These documents are posted on our website at www.kaman.com — select the “Investors” link, then the "Corporate Governance" link and then view under "Documents and Downloads".

The information contained on our website is not intended to be, and shall not be deemed to be, incorporated into this Form 10-K or any other filing under the Exchange Act or the Securities Act of 1933, as amended.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The Company’s executive officers as of the date of this report are as follows: | | | | | | | | | | | |

| Name | Age | Position | Prior Experience |