UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

_________________________

Filed by the Registrant | x |

Filed by a Party other than the Registrant | o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

KAMAN CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

_______________________________________________

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Title of each class of securities to which transaction applies: | |

(3) | Title of each class of securities to which transaction applies: | |

(4) | Title of each class of securities to which transaction applies: | |

(5) | Title of each class of securities to which transaction applies: | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Notice of Annual Meeting and

Proxy Statement

Annual Meeting of Shareholders

To be held on April 15, 2020

1332 BLUE HILLS AVENUE

BLOOMFIELD, CONNECTICUT 06002

NEAL J. KEATING

CHAIRMAN OF THE BOARD, PRESIDENT AND

CHIEF EXECUTIVE OFFICER

February 28, 2020

To Our Shareholders:

I would like to extend a personal invitation for you to join us at our Annual Meeting of Shareholders, which will be held on Wednesday, April 15, 2020, at 9:00 a.m., local time, at the corporate headquarters of the Company located at 1332 Blue Hills Avenue, Bloomfield, Connecticut. The meeting will be held in the cafeteria located in Building 19 on our Bloomfield campus. Appropriate signage will be in place directing you to the cafeteria the day of the meeting.

At this year’s meeting, you will be asked to (i) elect two directors for a term of one year expiring at the 2021 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; (ii) approve, on an advisory basis, the compensation of our named executive officers; and (iii) ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors. We will also discuss the financial performance of the Company during 2019.

Last year, we were fortunate to have approximately 94% of the Company's outstanding shares represented at the meeting, and we hope to have a similar turnout this year. You can vote your shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services appear in the Proxy Statement. If you are receiving a hard copy of the proxy materials, you can also vote your shares by marking your votes on the proxy card, signing and dating it and mailing it promptly using the envelope provided.

Your voice is important to us, and we encourage you to attend the meeting in person. If you are unable to attend, we urge you to vote your shares.

On behalf of our Board of Directors, we thank you for your continued support and we look forward to seeing you at the meeting.

Sincerely,

Neal J. Keating

Chairman of the Board, President and

Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD

April 15, 2020

The Annual Meeting of Shareholders of Kaman Corporation will be held at the corporate headquarters of the Company located at 1332 Blue Hills Avenue, Bloomfield, Connecticut, on Wednesday, April 15, 2020, at 9:00 a.m., local time, for the following purposes:

1. | To elect two directors for a term of one year; |

2. | To conduct an advisory vote to approve the compensation of the Company’s named executive officers; |

3. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm; and |

4. | To transact such other business as may properly come before the meeting. |

The close of business on February 7, 2020, has been fixed as the record date for determining the holders of Common Stock entitled to notice of, and to vote at, the Annual Meeting.

In connection with the Annual Meeting, we have prepared a meeting notice, a proxy statement and our annual report to shareholders, all of which provide important information that our shareholders will want to review before the Annual Meeting. On February 28, 2020, we mailed a Notice of Internet Availability of Proxy Materials instructing our shareholders how to access these materials online and how to submit proxies by telephone or the Internet. We use this online access format because it expedites the delivery of materials, reduces printing and postage costs and eliminates bulky paper documents from your files, creating a more efficient process for both shareholders and the Company.

If you receive the Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of these materials unless you specifically request one. The Notice of Internet Availability of Proxy Materials contains instructions on how to obtain a paper copy of the materials. If you receive paper copies of the materials, a proxy card will also be enclosed.

You may vote using the Internet, telephone or mail, or by attending the meeting and voting in person. If you plan to attend in person, you will need to provide proof of share ownership, such as an account or brokerage statement, and a form of personal identification in order to vote your shares.

All shareholders are cordially invited to attend the meeting.

Date: | February 28, 2020 | BY ORDER OF THE BOARD OF DIRECTORS | |

| |||

Richard S. Smith, Jr. | |||

Vice President, Deputy General Counsel, and Secretary | |||

____________________________

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 15, 2020: This Notice of Annual Meeting and Proxy Statement and the Company's Annual Report for the year ended December 31, 2019, are available free of charge on our website at www.kaman.com.

TABLE OF CONTENTS

Caption | Page | Caption | Page | |

Proxy Statement Summary | (i) | Recent Say-on-Pay Voting Results | 24 | |

General Information | 1 | Our Compensation Philosophy and Objectives | 25 | |

Information About Voting at the Annual Meeting | 1 | Our Compensation Program | 26 | |

Voting Rights and Outstanding Shares | 1 | 2019 Compensation for our NEOs | 27 | |

Submitting Your Proxy | 1 | Employment and Change in Control Arrangements | 36 | |

How to Submit Your Proxy if you are a "Beneficial Owner" | 1 | Stock Ownership Guidelines | 36 | |

How Your Proxy Will be Voted | 2 | Risk Assessment of Compensation Practices | 37 | |

How to Revoke Your Proxy | 2 | Short Sales, Hedging and Pledging | 37 | |

Quorum and Voting Requirements | 2 | Tax Considerations | 37 | |

Broker Non-Votes and Abstentions | 2 | Context of This Discussion | 38 | |

Board Voting Recommendations | 2 | Compensation Committee Report | 38 | |

Voting Results | 3 | Summary Compensation Table | 39 | |

Majority Voting Policy | 3 | Grants of Plan-Based Awards Table for Fiscal Year 2019 | 40 | |

Solicitation Costs | 3 | Outstanding Equity Awards at Fiscal Year 2019 Year-End | 41 | |

Householding of Proxies | 3 | Option Exercises and Stock Vested in Fiscal Year 2019 | 42 | |

Annual Report | 4 | Pension Benefits | 43 | |

Proposal 1 - Election of Two Directors for One-Year Terms | 4 | Non-Qualified Deferred Compensation Plan | 44 | |

Background | 4 | Securities Authorized for Issuance under Equity Compensation Plans | 45 | |

Board Recommendation | 4 | Post-Termination Payments and Benefits | 45 | |

Required Vote | 4 | Employment Agreements | 45 | |

Information about Nominees and Continuing Directors | 5 | Change in Control Agreements | 47 | |

Information about the Board of Directors and Corporate Governance | 8 | Equity Incentive Plans | 48 | |

Board Leadership Structure | 8 | Annual Cash Incentive Plans | 48 | |

Board Meetings and Committees | 8 | Coordination of Benefits | 48 | |

Annual Board and Committee Evaluations | 11 | Villani Retirement Agreement | 48 | |

Director Nominees | 11 | Assumptions Relating to Post-Termination Benefit Table | 49 | |

The Board's Role in Oversight of the Company's Risk Management Process | 12 | Coordination with Other Tables | 49 | |

Board and Committee Independence Requirements | 13 | Post-Termination Benefits Table | 50 | |

Specific Experience, Qualifications, Attributes and Skills of Current Board Members and Director Nominees | 13 | Pay Ratio Disclosure | 52 | |

Succession Planning | 14 | Proposal 2 - Advisory Vote to Approve Named Executive Officer Compensation | 53 | |

Shareholder Engagement | 15 | Proposal 3 - Ratification of Appointment of PwC | 54 | |

Environmental, Social and Governance Matters | 15 | Background | 54 | |

Communicating with our Board | 16 | Board Recommendation | 54 | |

Other Information about the Board's Structure and Composition | 16 | Required Vote | 54 | |

2019 Director Compensation | 17 | Principal Accounting Fees and Services | 55 | |

Code of Business Conduct and Other Governance Documents Available on the Company's Website | 18 | Audit Committee Preapproval Policy | 55 | |

Director Education | 19 | Audit Committee Report | 56 | |

Related Party Transactions | 19 | Shareholder Proposals for 2021 Annual Meeting | 57 | |

Security Ownership of Certain Beneficial Owners and Management | 20 | Annex I – Data Used by Compensation Consultant | I-1 | |

Stock Ownership of Directors and Executive Officers | 20 | |||

Beneficial Owners of More Than 5% of Common Stock | 21 | |||

Compensation Discussion and Analysis | 22 | |||

Introduction | 22 | |||

2019 Compensation Initiatives | 22 | |||

Kaman's Compensation and Benefits Best Practices | 24 | |||

PROXY STATEMENT SUMMARY

Date, Time and Place of Annual Meeting

The Annual Meeting is being held at 9:00 a.m., local time, on Wednesday, April 15, 2020, at the corporate headquarters of the Company located at 1332 Blue Hills Avenue, Bloomfield, Connecticut. The meeting will be held in the cafeteria located in Building 19 on our Bloomfield campus. Appropriate signage will be in place directing you to the cafeteria the day of the meeting.

Availability of Proxy Materials

Your proxy is being solicited for use at the Annual Meeting on behalf of the Board of Directors of the Company. On February 28, 2020, we mailed a Notice of Internet Availability of Proxy Materials to all shareholders of record as of February 7, 2020, the record date for the Meeting, advising that they could view all of the proxy materials online at www.envisionreports.com/KAMN, or request a paper copy of the proxy materials free of charge. You may request a paper or email copy of the materials using any of the following methods:

: | By Internet: Go to www.envisionreports.com/KAMN. Click "Cast Your Vote or Request Materials" and follow the instructions to log in and order a paper copy of the Meeting materials. |

( | By Phone: Call 1-866-641-4276 toll-free and follow the instructions to log in and order a paper copy of the Meeting materials. |

* | By Email: Send an email to investorvote@computershare.com with "Proxy Materials Kaman Corporation" in the subject line. Include in the message your full name and address, and state that you want a paper copy of the Meeting materials. |

All requests must include the control number set forth in the shaded area of the Notice of Internet Availability of Proxy Materials. To facilitate timely delivery, all requests must be received by April 5, 2020.

Eligibility to Vote

You can vote if you held shares of the Company’s Common Stock as of the close of business on February 7, 2020. Each share of Common Stock is entitled to one vote. As of February 7, 2020, there were 27,832,258 shares of Common Stock outstanding and eligible to vote.

How to Vote

You may vote by using any of the following methods:

: | By Internet: Go to www.envisionreports.com/KAMN. Have your Notice of Internet Availability of Proxy Materials or proxy card in hand when you go to the website. |

( | By Phone: Call 1-800-652-VOTE (8683) toll-free. Have your proxy card in hand when you call and then follow the instructions. |

+ | By Mail: If you requested a paper copy of the proxy materials, complete, sign and return your proxy card in the prepaid envelope. |

ó | In Person: Attend the Annual Meeting and vote in person. |

Revocation of Proxy

You may revoke your proxy at any time prior to its being counted at the Annual Meeting by:

ü | casting a new vote using the Internet or by telephone; |

ü | giving written notice to the Company’s Corporate Secretary or submitting a written proxy bearing a later date prior to the beginning of the Annual Meeting; or |

ü | attending the Annual Meeting and voting in person. |

(i)

Meeting Agenda and Voting Recommendations

Proposal | Matter | Board Recommendation | Page Reference | |||

1. | Election of Two Directors for One-Year Terms | "FOR" EACH NOMINEE | 4 | |||

2. | Advisory Vote to Approve Named Executive Officer Compensation | "FOR" | 53 | |||

3. | Ratification of Appointment of PwC | "FOR" | 54 | |||

Our Board of Directors

Committee Memberships | ||||||||||

Name | Age | Director Since | Occupation | Independent | Other Public Company Boards | A | CG | F | C | |

Directors Whose Terms Expire in 2020: | ||||||||||

Brian E. Barents† | 76 | 1996 | Former Executive Chairman and CEO of Aerion Corporation and Former President and CEO Galaxy Aerospace Co. and Learjet | Yes | 0 | M | M | |||

George E. Minnich | 70 | 2009 | Former Senior Vice President and CFO ITT Corporation | Yes | 2 | M | M | |||

Thomas W. Rabaut | 71 | 2008 | Operating Executive The Carlyle Group | Yes | 1 | M | M | |||

Class I Directors Whose Terms Expire in 2021: | ||||||||||

E. Reeves Callaway III | 72 | 1995 | President & CEO The Callaway Companies | Yes | 0 | M | M | |||

Karen M. Garrison | 71 | 2006 | Former President Pitney Bowes Business Services | Yes | 1 | C | M | |||

A. William Higgins | 61 | 2009 | President & CEO Albany International Corporation | Yes | 1 | M | C | |||

Class II Directors Whose Terms Expire in 2022: | ||||||||||

Neal J. Keating | 64 | 2007 | Chairman, President & CEO Kaman Corporation | No | 1 | |||||

Scott E. Kuechle | 60 | 2013 | Former Chief Financial Officer Goodrich Corporation | Yes | 0 | C | M | |||

Jennifer M. Pollino | 55 | 2015 | Executive Coach and Consultant & Former EVP, HR and Communications, Goodrich Corporation | Yes | 1 | M | C | |||

A = Audit Committee; CG = Corporate Governance Committee; F = Finance Committee; C = Compensation Committee. M = Member; C = Chair.

† Not standing for reelection at the Annual Meeting in accordance with the Company's mandatory retirement policy for directors.

(ii)

Corporate Governance Practices

As part of Kaman's commitment to high ethical standards, our Board follows sound governance practices, including the following:

Corporate Governance Practices | ||||

ü | Annual election of directors phasing in commencing with 2020 Annual Meeting | ü | The Board regularly assesses its performance through annual Board and committee self-evaluations | |

ü | Proxy access bylaw provisions allowing eligible long-term shareholders holding 3% or more of our outstanding shares to include nominations for directors in the Company’s proxy statement | ü | All directors attended at least 75% of 2019 meetings of the Board and the committees on which they served | |

ü | Majority voting for the election of directors, coupled with a robust director resignation policy | ü | Comprehensive Code of Conduct and Corporate Governance Principles | |

ü | Director mandatory retirement policy | ü | Stock ownership guidelines for directors and executive officers | |

ü | No shareholder rights plan or "poison pill" | ü | Policy prohibiting hedging, pledging and short selling of our stock | |

ü | All but one of the directors are independent; and all committees consist solely of independent directors | ü | Compensation "clawback" provisions in CEO/CFO employment agreements | |

ü | Lead Independent Director | ü | Strong pay-for-performance philosophy | |

ü | Regular executive sessions of independent directors | ü | Board participation in executive succession planning | |

2019 Compensation Initiatives and Highlights

Set forth below is a brief description of some of the most significant actions or events taken by the Compensation Committee during 2019 or otherwise affecting the determination of the 2019 compensation of our executive officers included in the Summary Compensation Table herein (our "Named Executive Officers" or "NEOs") and other members of our senior leadership team:

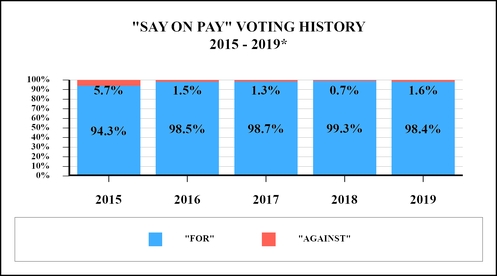

Listened to Shareholders' 2019 Say-on-Pay Vote | We discussed the results of the voting at the 2019 Annual Meeting with respect to the annual say-on-pay vote and considered the compensation-related aspects of the proxy advisory reports issued by Institutional Shareholder Services ("ISS") and Glass Lewis. |

Oversaw Compliance with CEO Pay Ratio Rules | We oversaw the Company’s compliance with the CEO pay ratio rules, and we considered the Company’s resulting 2019 CEO pay ratio. |

Approved Compensatory Matters Relating to the Sale of our Distribution business | We considered and approved a number of compensatory matters relating to the sale of our Distribution business and we commenced an ongoing assessment of our executive compensation program in light of the sale. |

Worked to Preserve the Deductibility of Grandfathered Compensation Arrangements | We assessed the eligibility of certain long-term performance awards granted prior to November 2, 2017, for "grandfathered" status under the Tax Cuts and Jobs Act of 2017, and worked with outside counsel to preserve, to the extent legally practicable, the deductibility of the awards. |

Reassessed the Adequacy of the Company's Hedging Practices and Policies | We reviewed and reassessed the adequacy of the Company's hedging practices and policies and reaffirmed the prohibition on hedging set forth in the Company's Insider Trading Policy. |

Continued the Increased Emphasis on TSR | We continued the increased emphasis of total shareholder return ("TSR") in the financial metrics relating to the long-term performance awards granted to our executive officers, including our Named Executive Officers. |

Continued to Incorporate Sub-Limits on LTIP Award Payouts | We continued to incorporate an additional sub-limit of 150% on the payouts that may be made in respect of any particular performance measure if the Company's adjusted performance for such measure is less than zero. |

Continued to Defer Base Salary Adjustments | We continued the practice of deferring the annual base salary adjustments for our senior executives from January 1 to July 1. |

(iii)

Key Governance Features of Our Executive Compensation Program

The following summary of specific features of our executive compensation program highlights our commitment to executive compensation practices that align the interests of our executives and shareholders:

What We Do: | What We Don't Do: | |||

ü | Independent Compensation Consultant – The Compensation Committee retains its own independent compensation consultant. | û | No Excessive Perquisites – We provide minimal perquisites to our NEOs. | |

ü | Pay for Performance – A significant portion of the compensation paid to our NEOs is in the form of at-risk variable compensation. | û | No Hedging – Directors and executive officers are prohibited from engaging in hedging activities with respect to their shares of Company stock. | |

ü | Multiple Performance Metrics – Variable compensation is based on more than one measure to encourage balanced incentives. | û | No Pledging – Directors and executive officers are prohibited from pledging their shares of Company stock. | |

ü | "Clawback" Provisions – Our CEO/CFO employment agreements provide for the recovery of compensation in the event of a mandatory restatement. | û | No Excise Tax Gross-ups – The employment and change in control agreements with our NEOs do not include any excise tax gross-up provisions. | |

ü | Award Caps – All of our variable compensation plans have caps on plan formulas. | û | No Re-Pricing of Underwater Stock Options – Our equity plans prohibit the re-pricing of underwater stock options. | |

ü | "Double Trigger" Vesting – All change in control agreements with our NEOs contain "double trigger" vesting provisions. | û | Limited Use of Time-Vested Restricted Stock – NEOs generally do not receive time-vested restricted stock. | |

ü | Independent Committees – The Compensation Committee, like all of our Board committees, is comprised solely of independent Directors. | û | No Further Accrual of Defined Benefit Pensions – We ceased further accrual of benefits under our qualified defined benefit pension plan and our supplemental employees' retirement plan. | |

ALL SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. EVEN IF YOU CANNOT ATTEND, PLEASE VOTE YOUR SHARES. | ||||

(iv)

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

KAMAN CORPORATION

__________

APRIL 15, 2020

__________

GENERAL INFORMATION

The Board of Directors (the "Board" or "board") of Kaman Corporation (the "Company" or "company") is soliciting proxies for use in connection with our annual meeting of shareholders (the "Meeting" or "Annual Meeting") to be held on Wednesday, April 15, 2020 (or at any adjournments or postponements thereof), at the time, place and for the purposes described in the accompanying Notice of Annual Meeting of Shareholders, dated February 28, 2020. We will conduct business at the Meeting only if shares representing a majority of all outstanding shares of Common Stock entitled to vote are either present in person or represented by proxy at the Meeting. We believe that the only matters to be brought before the Meeting are those referenced in this Proxy Statement. If any other matters are presented, the persons named as proxies may vote your shares in their discretion.

On February 28, 2020, we mailed a Notice of Internet Availability of Proxy Materials instructing our shareholders how to access this Proxy Statement and our Annual Report to Shareholders, and these materials were mailed to all shareholders who had previously requested paper copies. As of this date, all shareholders of record and all beneficial owners of shares of Common Stock had the ability to access the proxy materials relating to the Annual Meeting at a website referenced in the Notice of Internet Availability of Proxy Materials (www.edocumentview.com/KAMN). A shareholder will not receive a printed copy of these proxy materials unless the shareholder requests it by following the instructions set forth in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials explains how a shareholder may access and review the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also explains how a shareholder may submit a proxy via telephone or the Internet. Our proxy materials, whether in paper or electronic form, are available to all shareholders free of charge.

INFORMATION ABOUT VOTING AT THE ANNUAL MEETING

Voting Rights and Outstanding Shares

Only holders of record of the Company’s Common Stock at the close of business on February 7, 2020 (the "record date"), are entitled to notice of and to vote at the Annual Meeting. As of February 7, 2020, the Company had 27,832,258 shares of Common Stock outstanding, each of which is entitled to one vote on each matter properly brought before the Meeting. All votes will be counted by the Company’s transfer agent, Computershare Inc., who will be appointed as inspector of election for the Annual Meeting and who will separately tabulate the votes cast at the meeting, as well as the number of broker non-votes and abstentions.

Submitting Your Proxy

Before the Annual Meeting, you can appoint a proxy to vote your shares of Common Stock by following the instructions contained in the Notice of Internet Availability of Proxy Materials. You can do this by (i) using the Internet (www.envisionreports.com/KAMN), (ii) calling the toll-free telephone number (1-800-652-VOTE (8683)) or (iii) if you have a printed copy of our proxy materials, by completing, signing and dating the proxy card where indicated and mailing or otherwise returning the card to us prior to the beginning of the Annual Meeting. Voting using the Internet or telephone will be available until 1:00 a.m., Eastern Daylight Time, on Wednesday, April 15, 2020.

How to Submit Your Proxy if you are a "Beneficial Owner"

If your shares of Common Stock are held in the name of a bank or broker, you should follow the instructions on the form you receive from that firm. The availability of Internet or telephone voting will depend on that firm’s voting processes. If you choose not to vote by Internet or telephone, please return your proxy card, properly signed, and the shares represented will be voted in accordance with your directions. If you do not provide instructions to the bank or broker, that firm will only be able to vote your

- 1 -

shares with respect to "routine" matters. Under current broker voting regulations, the only routine matter to be voted upon at the Annual Meeting and the only matter for which brokers will have the discretion to vote is Proposal 3 (Ratification of Appointment of PwC). Your broker must have proper instructions from you in order to vote with respect to Proposal 1 (election of directors) and Proposal 2 (approval of executive compensation). Without proper instructions from you, the broker will not have the power to vote on those two proposals and this will be considered a "broker non-vote" for each such proposal. We recommend that you contact your broker to assure your shares are properly voted.

How Your Proxy will be Voted

All properly submitted proxies received prior to the Annual Meeting will be voted in accordance with their terms. If a proxy is returned signed, but without instructions for voting, the shares of Common Stock it represents will be voted as recommended by the Board of Directors. If a proxy is returned improperly marked, the Common Stock it represents will be counted as present for purposes of determining a quorum but will be treated as an abstention for voting purposes. Unsigned proxies will not be counted for any purpose.

How to Revoke Your Proxy

Whichever voting method you choose, a properly submitted proxy may be revoked at any time before it is counted at the Annual Meeting. You may revoke your previously submitted proxy by (i) timely casting a new vote using the Internet or by telephone; (ii) giving written notice to the Company’s Corporate Secretary or submitting a written proxy bearing a later date prior to the beginning of the Annual Meeting; or (iii) attending the Annual Meeting and voting in person. If you submit a later dated proxy, it will have the effect of revoking any proxy that you submitted previously and will constitute a revocation of all previously granted authority to vote for every proposal included on any previously submitted proxy. If you plan to revoke a proxy for shares of Common Stock that are held in the name of a bank or broker, please be sure to contact your bank or broker to ensure that your revocation has been properly processed, or if you plan to revoke a proxy for such shares by voting in person at the Annual Meeting, be sure to bring personal identification and a statement from your bank or broker that shows your ownership of such shares.

Attendance at the Annual Meeting will not by itself revoke a proxy. Written revocations or later-dated proxies should be hand-delivered to the Corporate Secretary at the Annual Meeting or sent to Kaman Corporation, Corporate Headquarters, 1332 Blue Hills Avenue, Bloomfield, Connecticut 06002, Attention: Corporate Secretary. In order to be effective, all written revocations or later-dated proxies must be received before the voting is conducted at the Annual Meeting.

Quorum and Voting Requirements

Under Connecticut law, our shareholders may take action on a matter at the Annual Meeting only if a quorum exists with respect to that matter. With respect to each proposal, a majority of the votes entitled to be cast on the matter will constitute a quorum for action on that matter. For this purpose, only shares of Common Stock held as of the record date by those present at the Annual Meeting or for which proxies are properly provided by telephone, Internet or in writing and returned to the Company as provided herein will be considered to be represented at the Annual Meeting.

Assuming the presence of a quorum, directors will be elected (Proposal 1) only if the number of votes cast "FOR" each director nominee exceeds the number of votes cast "AGAINST" such director nominee, and each of the other proposals (Proposals 2 and 3) will be approved only if the number of votes cast "FOR" each such other proposal exceeds the number of votes cast "AGAINST" that proposal. Our Board has adopted a majority voting policy, described in more detail below, that would apply in the event that one or more director nominees who are standing for reelection do not receive the favorable vote of a majority of the votes cast. See "Majority Voting Policy."

Broker Non-Votes and Abstentions

All shares of Common Stock represented at the Annual Meeting will be counted for quorum purposes, including broker non-votes and abstentions. However, broker non-votes and proxies marked to abstain from voting with respect to any item to be voted upon at the Annual Meeting (including the election of any particular director nominee) are not considered for purposes of determining the tally of votes cast "FOR" or "AGAINST" the item and, therefore, will have no effect on the outcome of the voting with regard to the election of directors or the approval of any proposal requiring that the number of votes cast "FOR" such proposal exceeds the number of votes cast "AGAINST" that proposal.

Board Voting Recommendations

The Board of Directors recommends that shareholders vote "FOR" the election of all director nominees, "FOR" Proposal 2 (Advisory Vote to Approve Executive Compensation), and "FOR" Proposal 3 (Ratification of Appointment of PwC). The Board does not know of any matters to be presented for consideration at the Meeting other than the matters described in those Proposals and the Notice of Annual Meeting of Shareholders. However, if other matters are presented, the persons named in the proxy intend to vote on such matters in accordance with their judgment.

- 2 -

Voting Results

We will file a Current Report on Form 8-K containing the final voting results with the Securities and Exchange Commission (the "SEC") within four business days of the Annual Meeting or, if final results are not available at that time, within four business days of the date on which final voting results become available.

Majority Voting Policy

The Board has adopted a majority voting policy (set forth in the Company's Corporate Governance Principles which are available at http://www.kaman.com by clicking on the "Governance" link) that addresses certain circumstances when a director nominee does not receive a majority of the votes cast with respect to that director’s re-election. Briefly, in an uncontested election for directors (one in which the number of nominees does not exceed the number of directors to be elected) at a properly called and held meeting of shareholders, any director nominee running for re-election who does not receive a majority of the votes cast shall promptly tender his or her resignation once the shareholder vote has been certified by the Company’s tabulation agent. A "majority of the votes cast" means that the number of shares voted "FOR" a director’s election exceeds fifty percent (50%) of the number of votes cast with respect to that director’s election. For this purpose, "votes cast" include votes “FOR” and “AGAINST”, but exclude abstentions and broker non-votes with respect to that director’s election.

The Corporate Governance Committee will thereafter recommend to the Board whether to accept or reject that resignation and, depending on the recommendation, whether or not a resulting vacancy should be filled. The Board will then act, taking into account the committee’s recommendation. The Board will publicly disclose its decision and the rationale therefor in a press release to be disseminated in the customary manner, together with the filing of a Current Report on Form 8-K with the SEC. This process shall be completed within ninety (90) days after the shareholder vote certification. A director who has tendered his or her resignation shall not participate in the Corporate Governance Committee’s determination process and/or the Board’s action regarding the matter.

In determining whether or not to accept a director’s resignation for failure to secure a majority of the votes cast, the Corporate Governance Committee and the Board will consider the matter in light of the best interests of the Company and its shareholders and may consider any information they believe is relevant and appropriate, including the following:

• | the director’s qualifications in light of the overall composition of the Board; |

• | the director’s past and anticipated future contributions to the Board; |

• | the stated reasons, if any, for the "AGAINST" votes and the underlying cause for the "AGAINST" votes if it otherwise can be addressed; and |

• | the potential adverse consequences of accepting the resignation, including the failure to comply with any applicable rule or regulation (including applicable stock exchange rules or federal securities laws) or triggering of defaults or other adverse consequences under material contracts or the acceleration of change in control provisions and other rights in employment agreements, if applicable. |

If the Board accepts the resignation, it may, in its sole discretion, (a) fill the resulting vacancy with any other qualified person, or (b) reduce the number of directors constituting the full Board to equal the number of remaining directors. If the Board elects to fill the resulting vacancy on the Board, the term of the director so elected shall expire at the next annual meeting of shareholders at which directors are to be elected.

If the Board does not accept the resignation, the director will continue to serve until the annual meeting for the year in which such director’s term expires and until such director’s successor shall be duly elected and shall qualify, subject, however, to prior death, resignation, retirement, disqualification or removal from office.

Solicitation Costs

The Company pays the cost of preparing, printing and mailing proxy material, as well as the cost of any required solicitation of proxies. The solicitation will be made by mail and Internet and may also include participation of the Company’s officers and employees personally or by telephone, facsimile or Internet, without additional compensation. The Company has engaged Georgeson Inc. to assist with the solicitation of proxies and expects to pay approximately $8,500 for these services, plus expenses. The Company may also be required to reimburse brokers, dealers, banks, voting trustees or their nominees for reasonable expenses in sending proxies, proxy material and annual reports to beneficial owners.

Householding of Proxies

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for proxy materials with respect to two or more shareholders sharing the same address by delivering a single set of proxy materials addressed to those shareholders. This process, which is commonly referred to as "householding," potentially provides extra convenience for shareholders and cost savings for companies. We and some brokers household proxy materials, delivering a single set of proxy materials to multiple shareholders sharing an address unless contrary instructions have been received from the affected

- 3 -

shareholders. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent.

If, at any time, (i) you no longer wish to participate in householding and would prefer to receive a separate set of proxy materials in the future or (ii) you and another shareholder sharing the same address wish to participate in householding and prefer to receive a single copy of our proxy materials, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. You can notify us by sending a written request to the Corporate Secretary, Kaman Corporation, 1332 Blue Hills Avenue, Bloomfield, Connecticut 06002, or calling 860-243-6319. We undertake to deliver promptly upon written or oral request at the preceding address or phone number a separate copy of the proxy materials to any shareholder at a shared address to which a single copy of the proxy materials was delivered.

Annual Report

Upon a shareholder’s written request, the Company will provide, free of charge, a copy of its Annual Report to Shareholders, which includes the Company’s Annual Report on Form 10-K with financial statements and financial statement schedules for the year ended December 31, 2019.

PROPOSAL 1

ELECTION OF TWO DIRECTORS FOR ONE-YEAR TERMS

Background

In accordance with the Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws (the "Bylaws"), each director elected prior to the annual meeting of shareholders held in 2020 holds office until the annual meeting to be held in the third year following the year of his or her respective election and until his or her successor shall be elected and shall qualify, unless he or she dies, resigns, retires or is removed from office. Each director elected at each annual meeting of shareholders commencing with the 2020 Annual Meeting holds office for a term of one year, expiring at the next annual meeting of shareholders and until his or her respective successor is duly elected and qualified. Each director also holds office subject to the Company’s majority voting policy, which is described on page 3. The following two individuals, each of whom is currently a director and whose term expires at the Annual Meeting, are nominated for election at the Annual Meeting for one-year terms that will expire at the annual meeting to be held in 2021: George E. Minnich and Thomas W. Rabaut.

Brian E. Barents, a current director whose term of office expires at the Annual Meeting, is not standing for re-election in accordance with the Company's mandatory retirement policy for directors, which is discussed more fully below. See "Mandatory Retirement." During his twenty-four year tenure on the Board, Mr. Barents served the Company and its shareholders faithfully and with distinction, and the Board wishes to express its gratitude to Mr. Barents for his dedicated leadership, wise counsel and many important and lasting contributions to the Company.

Board Recommendation

The Board of Directors unanimously recommends that shareholders vote "FOR" all nominees.

Required Vote

In an uncontested election, directors are elected by the affirmative vote of a majority of the "votes cast" with respect to each such director nominee. "Votes cast" include votes "FOR" and "AGAINST" a nominee but exclude broker non-votes and abstentions, which, therefore, do not affect the outcome of the voting. Our Board has supplemented the voting requirement with a majority voting policy which is described in more detail above. See "INFORMATION ABOUT VOTING AT THE ANNUAL MEETING – Majority Voting Policy."

- 4 -

Information About Nominees and Continuing Directors

Set forth below is information about each of the two director nominees, as well as the six other directors whose terms continue after the Annual Meeting, including the name, age, and professional experience during the last five years of each individual and the qualifications, attributes and skills the Board believes qualify each individual for service on the Board. None of the organizations listed as business affiliates of the directors is an affiliate of the Company.

Director Nominees for Election at the 2020 Annual Meeting

George E. Minnich | |

| Mr. Minnich, 70, has been a director since 2009. He served as Senior Vice President and Chief Financial Officer of ITT Corporation, then a $9 billion commercial and defense conglomerate, from 2005 until his retirement in 2007. Prior to that, he served for 12 years in several senior finance positions at United Technologies Corporation, including Vice President and Chief Financial Officer of Otis Elevator Company and of Carrier Corporation. As a Certified Public Accountant, he also held various increasingly senior positions with PricewaterhouseCoopers (then Price Waterhouse) from 1971 to 1993, culminating in Audit Partner from 1984 to 1993. He also serves as a director of AGCO Corporation, a manufacturer and distributor of agricultural equipment, and Belden Inc., a manufacturer of high-speed electronic cables, connectivity and networking products. Mr. Minnich earned a Bachelor of Science degree in Accounting from Albright College. He provides the Board with extensive financial and accounting experience gained over a career spanning more than thirty-five years. This experience was important to the Board in connection with his initial election as a means to provide additional depth of capability to the Board's Audit Committee. Mr. Minnich’s senior-level operational background also provides the Board with additional perspectives regarding the aerospace industry, defense contracting, international sales and acquisitions. |

Thomas W. Rabaut | |

| Mr. Rabaut, 71, has been a director since 2008. He currently serves as an Operating Executive with The Carlyle Group, a global private equity firm, with which he has been affiliated since January 2007. From June 2005 to January 2007, he was President of the Land & Armaments Operating Group of BAE Systems, a global leader in the design, development and production of military systems. From January 1994 to June 2005, he served as the President and Chief Executive Officer of United Defense Industries, Inc., which was acquired by BAE Systems in 2005. Mr. Rabaut is a graduate of the U.S. Military Academy and he served five years in the United States Army. He is currently Vice Chairman of the Association of the United States Army (AUSA), and he also serves as a director of Allison Transmission Holdings, Inc., a manufacturer of fully-automatic transmissions for medium-and heavy-duty commercial vehicles, medium- and heavy-tactical U.S. military vehicles and hybrid-propulsion systems for transit buses (where he serves as Lead Director), and a number of other privately held companies. He previously served as a director of Cytec Industries, Inc., a supplier of advanced composite products. The Board believes that these positions demonstrate an extensive history of senior executive leadership positions in the defense and aerospace industries. His professional and Board experience provide the Board with additional perspectives about the aerospace industry, defense markets, international markets, and acquisitions from both commercial and defense-related standpoints, as well as market and sales trends. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE | ||||

- 5 -

Class I Directors Whose Terms Expire in 2021

E. Reeves Callaway III | |

| Mr. Callaway, 72, has been a director since 1995. He is the founder, President, Chief Executive Officer and a director of The Callaway Companies, an engineering services firm in the high technology composites industry that has presence in the United States and Europe. Mr. Callaway provides the Board with senior executive insight into the conduct of the composites business, global operations and marketing and sales trends. As a sitting CEO, Mr. Callaway provides the Board with important insights and perspectives as an executive leading another company. |

Karen M. Garrison | |

| Ms. Garrison, 71, has been a director since 2006, and she currently serves as the Board's Lead Independent Director. She is the retired President of Pitney Bowes Business Services, having served in that position from 1999 until her retirement in 2004. In her 27 years with Pitney Bowes and its subsidiary, the Dictaphone Corporation, Ms. Garrison held a series of positions with increasing responsibilities, including Vice President of Operations, and Vice President of Finance and Chief Financial Officer. She also serves as a director of SP Plus Corporation (formerly, Standard Parking Corporation), a national provider of parking facility management services (where she serves as non-executive Chairman of the Board), and she previously served as a director of Tenet Healthcare Corporation, one of the largest investor-owned health care delivery systems in the nation, and North Fork Bank, a regional bank holding company that was acquired by Capital One Financial Corporation in 2006. The Board believes these positions demonstrate an extensive history of senior executive and oversight roles which provide operational insight, particularly with regard to acquisitions, human resources, information technologies, government contracting and distribution. The Board also values Ms. Garrison's extensive experience in finance and accounting, from her Bachelor of Science degree in Accounting from Rollins College and Master of Business Administration from Florida Institute of Technology to progressively senior roles as Controller, Worldwide Controller, Vice President - Finance and Chief Financial Officer over a ten-year period during her tenure at Pitney Bowes and its subsidiary, Dictaphone Corporation. |

A. William Higgins | |

| Mr. Higgins, 61, has been a director since 2009. He has been the President and Chief Executive Officer of Albany International Corp., a global advanced textiles and materials processing company, since January 2020, serving on its board of directors since 2016 and as chairman of its board of directors from February 2019 until January 2020. He is the former Chairman, CEO and President of CIRCOR International, Inc., a global diversified manufacturing company, having served in those positions from March 2008 until his retirement in December 2012. He had previously served as the Chief Operating Officer and an Executive Vice President of CIRCOR. Prior to joining CIRCOR in 2005, he spent thirteen years in a variety of senior management positions with Honeywell International and Allied Signal. He also previously served as a director of Bristow Group Inc, a leading provider of industrial aviation services. Bristow Group Inc. filed for bankruptcy protection in May 2019, successfully emerging from bankruptcy in October 2019. Leslie Controls, Inc., a wholly owned subsidiary of CIRCOR and an entity for which Mr. Higgins served as a director and Vice President, filed for bankruptcy protection in July 2010 in order to eliminate certain asbestos litigation liabilities. The subsidiary successfully emerged from bankruptcy the following year. Mr. Higgins’ professional background provides the Board with additional perspective on talent development, international operations and global strategic development, lean manufacturing and continuous improvement processes, the defense industry, acquisitions, and the aerospace market. In addition, his experience at Honeywell International and Allied Signal provide him with a strong background in the aerospace industry. |

- 6 -

Class II Directors Whose Terms Expire in 2022

Neal J. Keating | |

| Mr. Keating, 64, has been a director since September 2007, when he was appointed President and Chief Operating Officer of the Company. In January 2008, he was appointed Chief Executive Officer and, in March 2008, he was appointed to the additional position of Chairman. Prior to joining the Company, Mr. Keating served as Chief Operating Officer at Hughes Supply, then a $5.4 billion wholesale distributor that was acquired by Home Depot in 2006. Prior to that, he held senior positions at GKN Aerospace, an aerospace subsidiary of GKN, plc, and Rockwell Collins, Commercial Systems, and was a board member for GKN, plc and AgustaWestland. He is also a director of Hubbell Incorporated, an international manufacturer of electrical and electronic products. The Board believes that these positions demonstrate an extensive history of senior executive leadership and Board participation in the Company's business, with an emphasis on international operations and acquisitions. The Board also believes that Mr. Keating's combined role of CEO and Chairman provides the Company's shareholders with the benefits of Board leadership by an executive with an extensive professional background, as well as day-to-day knowledge of the Company's businesses and markets, strategic plan execution, and future needs. |

Scott E. Kuechle | |

| Mr. Kuechle, 60, has been a director since 2013. He is a former Chief Financial Officer of Goodrich Corporation, a worldwide supplier of aerospace components, systems and services to the commercial and general aviation airplane market that was acquired by United Technologies Corporation in 2012. Mr. Kuechle served as CFO of Goodrich from August 2005 until his retirement in July 2012. He had previously served as Vice President and Controller from 2004-2005 and Vice President and Treasurer from 1998-2004 and in various other financial leadership roles during his 29-year tenure with Goodrich. He also previously served as a director of Esterline Corporation, a specialty manufacturer serving the global aerospace and defense markets, and Wesco Aircraft Holdings, Inc., a provider of comprehensive supply chain management services to the global aerospace industry. Mr. Kuechle's extensive background and experience within the aerospace and defense industry, coupled with his financial expertise and past experience as a Chief Financial Officer, provide the Board with a powerful skill-set upon which to draw as the Company continues to execute on its strategic plan. This type of expertise and experience was particularly important to the Board as a means of providing additional depth of capability to the Audit Committee, to which he was appointed upon his election to the Board. Mr. Kuechle’s background also provides the Board with additional perspective on international operations, financial management, acquisitions, and other finance-related matters. |

Jennifer M. Pollino | |

| Ms. Pollino, 55, has been a director since 2015. She currently serves as an executive coach and consultant with JMPollino LLC, a leadership development, talent management and succession planning firm she founded upon her retirement from Goodrich Corporation in July 2012. She previously served as Executive Vice President, Human Resources and Communications, at Goodrich from February 2005 until July 2012, when Goodrich was acquired by United Technologies Corporation. Prior to that, she served as President and General Manager of the Aircraft Wheels & Brakes Division of Goodrich from September 2002 to February 2005, as President and General Manager of the Turbomachinery Products Division of Goodrich from December 2001 to August 2002, and in various other positions of increasing responsibility during her 20-year tenure with Goodrich. She also serves as a director of Crane Co., a diversified manufacturer of highly engineered industrial products, and she previously served as a director of Wesco Aircraft Holdings, Inc., a provider of comprehensive supply chain management services to the global aerospace industry. The Board believes these positions demonstrate an extensive history of senior executive and oversight roles which provide operational insight, particularly with regard to human resources, government contracting and distribution. The Board also values her prior experience in finance and accounting gained as Vice President-Finance and Controller of two other Goodrich divisions, the Controller of a savings and loan association, a field accounting officer with the Resolution Trust Corporation, and a Certified Public Accountant. |

- 7 -

INFORMATION ABOUT THE BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE

The Board is elected by our shareholders to oversee their interests as owners of the Company. The Board is the ultimate decision-making authority for the Company, except for those matters that are reserved for, or shared with, our shareholders. The Board appoints and oversees the Company’s senior management, which is responsible for conducting the Company’s day-to-day business operations.

Board Leadership Structure

Our Bylaws and Corporate Governance Principles provide the Board with the flexibility to select and revise its leadership structure on the basis of the best interests of the Company and its shareholders at any given point in time. The Board evaluates this structure in connection with the annual appointments to the positions of Chairman of the Board ("Chairman") and Chief Executive Officer ("CEO"). The Board believes that it is currently in the best interests of the Company and its shareholders to combine the Chairman and CEO roles and to appoint a Lead Independent Director annually. In this way, the Company’s shareholders have the benefit of Board leadership by Mr. Keating, an executive with extensive day-to-day knowledge of the Company’s operations, strategic plan execution and future needs, as well as a Lead Independent Director who provides Board member leadership. In arriving at its determination, the Board has also considered the fact that the Board consists entirely of independent directors (other than Mr. Keating), all having diverse professional and other Board experience.

The current Lead Independent Director is Karen M. Garrison. The Lead Independent Director position has existed since 2002. The roles and responsibilities of the Lead Independent Director currently include the following:

• | membership on the Corporate Governance Committee; |

• | chair of the Board’s executive sessions and of Board meetings at which the Chairman is not in attendance; |

• | review and approval of all Board and committee meeting agendas; |

• | liaison between the Chairman and the independent directors, which includes facilitating communications and assisting in the resolution of conflicts, if any, between the independent directors and the Company’s management; |

• | providing counsel to the Chairman and CEO, including provision of appropriate feedback regarding effectiveness of Board meetings, and otherwise as needed or requested; and |

• | such other responsibilities as the Board delegates. |

In performing these responsibilities, the Lead Independent Director is expected to consult with the chairpersons of the Board committees, as appropriate, and solicit their participation in order to avoid the appearance of diluting the authority or responsibility of the Board committees and their chairpersons.

Board Meetings and Committees

The Board met 10 times in 2019 and its committees met a total of 26 times. Each director attended 75% or more of the aggregate of all meetings of the Board and committees on which he or she served during 2019. The Company's Corporate Governance Principles provide that directors are strongly encouraged to attend each annual meeting of shareholders, and all directors then in office attended the 2019 Annual Meeting, except for Ms. Pollino who was traveling outside of the country on that date. All current directors whose terms extend beyond the Annual Meeting are expected to attend the 2020 Annual Meeting.

The Board maintains the following standing committees: Corporate Governance, Audit, Compensation, and Finance. Each committee has a charter that has been approved by the Board. The complete text of each committee charter is available on the Company’s website located at www.kaman.com by clicking on the "Governance" link followed by the "Documents & Downloads" link. Each committee and the Board periodically, but not less than annually, review and revise the committee charters, as appropriate.

- 8 -

The following table describes the current members of each committee and the number of meetings held during 2019. Unless otherwise noted, each director served on the committees noted for the entire year.

Board Member | Audit Committee(3) | Corporate Governance Committee(3) | Finance Committee(3) | Compensation Committee(3) | ||||

Brian E. Barents | X | — | — | X | ||||

E. Reeves Callaway III | — | — | X | X | ||||

Karen M. Garrison(1) | — | Chair | X | — | ||||

A. William Higgins | — | X | Chair | — | ||||

Neal J. Keating(2) | — | — | — | — | ||||

Scott E. Kuechle | Chair | X | — | — | ||||

George E. Minnich | X | — | — | X | ||||

Jennifer M. Pollino | — | X | — | Chair | ||||

Thomas W. Rabaut | X | — | X | — | ||||

Number of Meetings | 8 | 6 | 6 | 6 | ||||

(1) | Lead Independent Director. |

(2) | Not an independent director. |

(3) | All appointments shown in the table became effective as of April 17, 2019, but did not reflect any change from the prior year, except that effective as of such date: (a) Ms. Pollino was appointed Chair of the Compensation Committee and a member of the Corporate Governance Committee and removed as a member of the Audit Committee, and (b) Mr. Barents was appointed a member of the Audit Committee and removed as a member of the Finance Committee. |

Corporate Governance Committee

Under its charter, the Corporate Governance Committee consists of the chairpersons of the standing committees and the Lead Independent Director, if the Lead Independent Director is not already a committee chairperson. The committee assists the Board in fulfilling its corporate governance responsibilities and serves as the Board’s nominating committee. These corporate governance responsibilities include board and committee organization and function, membership, compensation, and annual performance evaluation; annual goals development and evaluation for the CEO with participation by the Compensation Committee and the Board in executive session; succession planning; development and periodic review of governance policies and principles; monitoring director compliance with stock ownership guidelines; consideration and recommendation of shareholder proposals; establishment of selection criteria for, and review and recommendation of, new Board members; and administration of the Company’s majority voting policy for director elections. In addition, on November 18, 2019, the committee's Charter was amended to vest the committee with oversight of the Company's environmental, social and governance (“ESG”) strategy, initiatives and policies and to direct that the Committee receive updates on significant corporate ESG activities.

Audit Committee

The Audit Committee is responsible for assisting the Board in fulfilling its responsibility to oversee the Company’s financial reporting and accounting policies and procedures, its system of internal accounting and financial controls, the internal audit function and the annual independent audit of the Company’s financial statements. The committee is also responsible for overseeing the performance, qualifications and independence of the Company’s independent registered public accounting firm (which reports directly to the committee) as well as the performance of the internal audit department. The committee reviews the Company’s business risk assessment framework and identifies principal business risks confronting the Company (including, without limitation, business interruption, crisis management and cyber-security issues) and periodically discusses those risks and exposures with the independent auditor and management, including the internal chief audit executive (however, this committee is not the only Board committee that reviews such business risks), and pre-approves all auditing services and permitted non-audit services to be performed by its independent auditor (which approval authority has been delegated to the committee’s chairperson for certain immaterial items that may arise between meetings, subject to ratification at the committee’s next meeting).

The Audit Committee also oversees the development, operation and material findings of the Company’s legal and ethical compliance program, and in connection therewith, reviews and discusses with the Chief Ethics and Compliance Officer any particular compliance matters that are reasonably likely to have a material adverse effect on the Company’s business, financial condition, results of operations or cash flows, or otherwise relate to material noncompliance with applicable laws and regulations or material inquiries received from regulators or government agencies. Periodically, but not less than annually, the Audit Committee receives a report from the Chief Ethics and Compliance Officer relating to (i) the implementation and effectiveness of the Company’s legal and ethical compliance program and adherence to the Company’s Code of Business Conduct; (ii) all significant compliance investigations undertaken in the past year; (iii) all significant retaliation claims, lawsuits alleging retaliation, settlements of retaliation claims, and reports of alleged retaliation received through the Company’s compliance program in the past year; and (iv) all significant sexual harassment claims, lawsuits alleging sexual harassment, settlements of sexual harassment claims, and reports of alleged sexual harassment received through the Company’s compliance program in the past year.

- 9 -

The Audit Committee has also established a policy for the Company’s hiring of current or former employees of the independent auditor to ensure that the auditor’s independence under applicable SEC rules and accounting standards is not impaired. The committee has also established, and monitors management’s operation of, procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, auditing or other matters, as well as the confidential, anonymous submission by the Company’s employees of concerns regarding questionable accounting, auditing or other matters. The committee meets regularly in separate executive sessions with representatives of the independent auditor, the Company's Chief Audit Executive, the Company's Chief Ethics & Compliance Officer and the Company's General Counsel.

The Audit Committee Charter provides that a committee member may not simultaneously serve on the audit committees of more than three companies whose stock is publicly traded (including this committee) unless the Board has provided its consent. No determination to grant such consent is currently required.

Scott E. Kuechle, George E. Minnich and Thomas W. Rabaut each has been determined to be an "audit committee financial expert," within the meaning of Item 407(d)(5) of Regulation S-K.

Compensation Committee

The Compensation Committee (formerly known as the "Personnel & Compensation Committee") reviews and approves the terms of, as well as oversees, the Company's executive compensation strategies (including the plans and policies to execute those strategies), administers its equity plans (including the review and approval of equity grants to executive officers) and annually reviews and approves compensation decisions relating to executive officers, including those for the CEO and the other Named Executive Officers. The committee considers the CEO's recommendations when determining the compensation of the other executive officers, but the CEO has no role in determining his own compensation (although as part of the annual CEO evaluation process, he prepares a self-assessment for review by the Corporate Governance Committee, which shares that evaluation with this committee). The committee then submits its determinations regarding proposed CEO compensation at an executive session of the Board for consideration and approval.

The Compensation Committee also monitors management's compliance with stock ownership guidelines adopted from time to time by the Board; reviews and approves employment, severance, change in control and termination arrangements for all executive officers and periodically reviews the Company's policies and procedures for management development.

During each of the last fifteen years, the committee has directly engaged Geoffrey A. Wiegman, founder and president of Wiegman Associates LLC, an independent compensation consulting firm, to assist the committee in fulfilling its responsibilities (Mr. Wiegman is sometimes referred to in this proxy statement as the "independent compensation consultant"). The independent compensation consultant attends each committee meeting, including executive sessions. He advises the committee on marketplace trends in executive compensation and evaluates proposals for compensation programs and executive officer compensation decisions. He has also provided services to the Corporate Governance Committee in connection with its evaluation of director compensation. Although he interacts with Company management in his capacity as an advisor to the committee, he is directly accountable to the committee. The committee has assessed the independence of Mr. Wiegman as required under applicable SEC and NYSE rules and has determined that the work of the independent compensation consultant does not raise any conflict of interest. The committee also has the authority to obtain advice and assistance from external legal, accounting or other advisers.

Compensation Committee Interlocks and Insider Participation

As noted above, each member of the Compensation Committee is "independent" under the NYSE and SEC rules applicable to compensation committee members and otherwise in accordance with the Compensation Committee's charter and our Corporate Governance Principles. In addition, no member of the Compensation Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the Board of Directors or Compensation Committee of any other company that employs a member of our Board or the Compensation Committee. All members of the Compensation Committee are "non-employee directors" as defined in SEC Rule 16b-3(b)(3).

Finance Committee

The Finance Committee assists the Board in fulfilling its responsibilities concerning matters of a material financial nature, including the Company’s strategies, policies and financial condition, insurance-related risk management programs, financing agreements, dividend policy, significant derivative instrument or foreign currency positions, and administration of tax-qualified defined contribution and defined benefit plans. The committee’s responsibilities also include review of the Company’s annual business plan and long range planning strategies; all forms of major debt issuances; the financial aspects of proposed acquisitions or divestitures that exceed transaction levels for which the Board has delegated authority to management; material capital expenditures; methods of financing; and the Company’s relationship with its lenders. Finally, the committee reviews and approves the Company’s policies and procedures on hedging, swaps, security-based swaps, derivatives, foreign currency exchange risk and debt and interest rate risk and, not less than annually, reviews and approves, on a general or a case-by-case basis, the Company’s decision to enter into swaps and other derivative transactions that are exempt from exchange-execution and clearance under the

- 10 -

"end-user exception" set forth in the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") and any applicable regulations established by the Commodity Futures Trading Commission.

Annual Board and Committee Evaluations

The Board recognizes that a thorough, constructive self-evaluation process enhances its effectiveness and is an essential element of good corporate governance. Accordingly, the Corporate Governance Committee oversees an annual self-evaluation process to ensure that the full Board and each of its committees conducts a thorough self-assessment of its performance and solicits feedback for improvement. In addition, the Board and its committees meet regularly in executive session throughout the year to consider areas that may warrant additional focus and attention. The Corporate Governance Committee reviews and reassesses the format and effectiveness of the evaluation process each year and makes changes when considered necessary or appropriate.

In recent years, the Board and committee evaluations have alternated between the use of detailed written questionnaires and one-on-one interviews. When one-on-one interviews are conducted at the Board level, the committees generally conduct their self-evaluations utilizing detailed written surveys; and when one-on-one interviews are conducted at the committee level, the Board generally conducts its self-evaluation utilizing a detailed written survey. In this manner, one-on-one interviews are conducted each year, alternating between the Board and committee levels.

During 2019, the Board evaluation was conducted through the use of personal interviews, and the committee evaluations were conducted through the use of detailed written surveys. The results of the surveys and the interviews were aggregated, summarized and presented to the Board and each committee for discussion in executive session. These discussions generally noted the experience and contributions of the directors and the high functioning nature of the Board and its committees, but also identified several areas for enhanced emphasis and focus that will be addressed during the coming year.

Director Nominees

General. The Board is responsible for selecting its own members and recommending them for election by the shareholders. The Board delegates the screening process involved to the Corporate Governance Committee, which consults with the Chairman and CEO, after which it provides recommendations to the Board. The Corporate Governance Committee will also consider director candidates recommended by shareholders. While the Corporate Governance Committee does not have specific minimum qualifications for potential directors, its policy is that all candidates, including those recommended by shareholders, will be evaluated on the same basis. The committee utilizes a nationally recognized third-party consultant to assist in identifying potential candidates. The consultant is provided with the committee’s assessment of the skill-sets and experience required in the context of current Board composition and identifies potential candidates for introduction to the committee. Thereafter, consideration of any such individuals is the responsibility of the committee in consultation with the CEO.

Advance Notice Bylaw Provisions. Under our Bylaws, only individuals nominated in accordance with certain procedures are eligible for election as directors of the Company (except for the rights of preferred shareholders, of which there currently are none). Generally, nominations are made by the Board of Directors or any shareholder (i) who is a shareholder of record on the date of the giving of written notice in respect of the nomination for director and on the record date for the determination of shareholders entitled to notice of and to vote at a meeting where directors are to be elected, and (ii) who provides advance written notice, all of the foregoing in accordance with the Bylaws.

In addition to any other applicable requirements, for a nomination to be properly made by a shareholder, such shareholder must have given timely notice therefor in proper written form to the Secretary of the Company. To be timely, a shareholder's written notice to the Secretary of the Company must be delivered to or mailed and received at the principal executive offices of the Company, in the case of: (i) an annual meeting, not less than ninety (90) days nor more than one hundred twenty (120) days prior to the first anniversary of the date of the immediately preceding year's annual meeting; provided, however, that if the date of the annual meeting is advanced more than twenty-five (25) days prior to or delayed by more than twenty-five (25) days after the anniversary of the preceding year's annual meeting, to be timely, notice by the shareholder must be so received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the annual meeting is mailed or public disclosure of the date of the annual meeting is first given or made (which for this purpose shall include any and all filings of the Company made with the SEC), whichever first occurs; and (ii) a special meeting called for the purpose of electing directors, not later than the close of business on the tenth (10th) day following the day on which notice of the date of the special meeting is mailed or public disclosure of the date of the special meeting is first given or made (which for this purpose shall include any and all filings of the Company made with the SEC).

A shareholder’s written notice of a proposed nomination must describe (i) the name, age, business address and residence address of the nominee, (ii) the principal occupation or employment of the nominee, (iii) (A) the class or series and number of all shares of stock of the Company that are owned beneficially or of record by such nominee and any affiliates of such nominee, (B) the name of each nominee holder of all shares of stock of the Company owned beneficially but not of record by such nominee or any affiliates of such nominee, and the number of such shares of stock of the Company held by each such nominee holder, (C) whether and the extent to which any derivative instrument, swap, option, warrant, short interest, hedge, profit interest or other

- 11 -

transaction has been entered into by or on behalf of such nominee, or any affiliates of such nominee, with respect to stock of the Company and (D) whether and the extent to which any other transaction, agreement, arrangement or understanding (including any short position or any borrowing or lending of shares of stock of the Company) has been made by or on behalf of such nominee, or any affiliates of such nominee, the effect or intent of any of the foregoing being to mitigate loss to, or to manage risk or benefit of stock price changes for, such nominee, or any affiliates of such nominee, or to increase or decrease the voting power or pecuniary or economic interest of such nominee, or any affiliates of such nominee, with respect to stock of the Company (the "Ownership Information"), and (iv) any other information relating to the nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the "Exchange Act"). The shareholder giving the notice, and the beneficial owner, if any, on whose behalf the nomination is being made must also provide (i) the name and address of the shareholder making the nomination, (ii) the Ownership Information, (iii) a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such shareholder, (iv) a description of any material interest of such person or any affiliates of such person in the nomination, including any anticipated benefit therefrom to such person or any affiliates of such person, (v) a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the persons identified in its notice, and (vi) any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and its rules and regulations. The written notice must be accompanied by a written consent of each proposed nominee to being named or referred to as a nominee and to serving as a director if elected and the completed and signed written representation and agreement required by Section 2(b) of Article III of the Bylaws. The Board may require any proposed nominee to furnish such other information (which may include meetings to discuss the furnished information) as it may reasonably require to determine the eligibility of such proposed nominee to serve as a director.