Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

RAYONIER INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

| Corporate Headquarters |

April 4, 2011

Dear Shareholder:

You are cordially invited to attend our Annual Meeting of Shareholders on Thursday, May 19, 2011, at the Crowne Plaza Hotel, 1201 Riverplace Boulevard, Jacksonville, Florida, at 4:00 p.m. local time. In the following Notice of 2011 Annual Meeting and Proxy Statement, we describe the matters you will be asked to vote on at the meeting.

Once again, we are pleased to utilize the Securities and Exchange Commission rules allowing us to furnish our proxy materials to you over the Internet. We believe this allows us to provide the information you need in a more timely, efficient and cost-effective manner.

As always, your vote is very important. I urge you to vote on the Internet, by telephone or by mail in order to be certain that your shares are represented at the meeting, even if you plan to attend.

Sincerely yours,

LEE M. THOMAS

Chairman and Chief Executive Officer

Rayonier Inc. Ÿ 1301 Riverplace Boulevard Ÿ Jacksonville, FL 32207

Telephone (904) 357-9100 Ÿ Fax (904) 357-9101

Table of Contents

| Corporate Headquarters |

April 4, 2011

NOTICE OF 2011 ANNUAL MEETING

Notice is hereby given that the 2011 Annual Meeting of Shareholders of Rayonier Inc., a North Carolina corporation, will be held at the Crowne Plaza Hotel, 1201 Riverplace Boulevard, Jacksonville, Florida on Thursday, May 19, 2011 at 4:00 p.m. local time, for the purposes of:

| 1) | electing three Class II directors to terms expiring in 2014; |

| 2) | approving, in a non-binding vote, the compensation of our named executive officers as disclosed in the attached Proxy Statement; |

| 3) | recommending, in a non-binding vote, whether a non-binding shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years; |

| 4) | ratifying the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2011; |

| 5) | acting on one shareholder proposal described in the attached Proxy Statement; and |

| 6) | acting upon such other matters as may properly come before the meeting. |

All Rayonier shareholders of record at the close of business on March 21, 2011 are entitled to vote at the meeting.

We urge you to vote your shares over the Internet, by telephone or through the mail at your earliest convenience.

|

| W. EDWIN FRAZIER, III |

| Senior Vice President, Chief Administrative Officer and Corporate Secretary |

Rayonier Inc. Ÿ 1301 Riverplace Boulevard Ÿ Jacksonville, FL 32207

Telephone (904) 357-9100 Ÿ Fax (904) 357-9101

Table of Contents

| GENERAL INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING |

1 | |||

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting |

1 | |||

| 1 | ||||

| 7 | ||||

| 7 | ||||

| Information as to Nominees for Election to the Board of Directors |

8 | |||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| Compensation Committee Interlocks and Insider Participation; Processes and Procedures |

15 | |||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 23 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| Report of the Compensation and Management Development Committee |

30 | |||

| 30 | ||||

| 32 | ||||

Table of Contents

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| ITEM 4—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

47 | |||

| 47 | ||||

| 48 | ||||

| Information Regarding Independent Registered Public Accounting Firm |

48 | |||

| 49 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| A-1 | ||||

Table of Contents

PROXY STATEMENT

2011 Annual Meeting of Shareholders of Rayonier Inc.

Thursday, May 19, 2011

The 2011 Annual Meeting of Shareholders of Rayonier Inc. (the “Annual Meeting”) will be held on May 19, 2011, for the purposes set forth in the accompanying Notice of 2011 Annual Meeting. This Proxy Statement and the accompanying proxy card are furnished in connection with the solicitation by the Board of Directors of proxies to be used at the meeting and at any adjournment of the meeting. We will refer to your company in this Proxy Statement as “we”, “us”, “our”, the “Company” or “Rayonier”.

GENERAL INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

This year we are once again utilizing the Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to shareholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials (“Internet Notice”) by mail, you will not receive a printed copy of the proxy materials unless you specifically request one. The Internet Notice tells you how to access and review the Proxy Statement and our 2010 Annual Report to Shareholders (the “Annual Report”), which includes our 2010 Annual Report on Form 10-K, including financial statements, as well as how to submit your proxy over the Internet. If you received the Internet Notice and would still like to receive a printed copy of our proxy materials, simply follow the instructions for requesting these materials included in the Internet Notice.

The Internet Notice, these proxy solicitation materials and our Annual Report were first made available on the Internet and mailed to certain shareholders on or about April 4, 2011.

The Notice of 2011 Annual Meeting, this Proxy Statement and our Annual Report are available at www.ProxyVote.com.

| Q: | WHAT AM I VOTING ON? |

| A: | You are being asked by the Company to vote on five matters: (1) the election of three directors: Paul G. Boynton, Mark E. Gaumond and David W. Oskin (more information on each nominee is included beginning on page 8); (2) the approval, in a non-binding vote, of the compensation of our named executive officers as disclosed in this Proxy Statement (referred to herein as “Say on Pay”; beginning on page 45); (3) the recommendation, in a non-binding vote, of whether a non-binding shareholder vote to approve the compensation of our named executive officers as disclosed in the Company’s proxy statement should occur every one, two or three years (referred to herein as “Say When on Pay”; see page 46); (4) the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2011 (see page 47); and (5) one shareholder proposal (beginning on page 49). The Board of Directors recommends that you vote “FOR” each of the director nominees listed above, “ONE YEAR” for the Say When on Pay proposal, “AGAINST” the shareholder proposal and “FOR” each of the other proposals. |

| Q: | WHO IS ENTITLED TO VOTE? |

| A: | The record holder of each of the 81,089,562 shares of Rayonier common stock (“Common Shares”) outstanding at the close of business on March 21, 2011 is entitled to one vote for each share owned. |

1

Table of Contents

| Q: | WHY DID I RECEIVE A ONE-PAGE NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? |

| A: | As allowed under SEC rules, we are providing access to our proxy materials and the Annual Report over the Internet to all shareholders who have not previously indicated a preference to receive paper copies. The Internet Notice advised you of the website where you can access the proxy materials and the Annual Report, request a printed set of the proxy materials and the Annual Report if you would like, and submit your proxy over the Internet. |

| Q: | HOW DO I VOTE? |

| A: | You can vote in any one of the following ways: |

| • | You can vote on the Internet by following the “Vote by Internet” instructions on your Internet Notice or proxy card. |

| • | You can vote by telephone by following the “Vote by Phone” instructions on the www.ProxyVote.com website referred to in the Internet Notice. |

| • | If you receive hard-copies of the proxy solicitation materials, you can vote by mail by signing and dating your proxy card and mailing it in the provided prepaid envelope. If you mark your voting instructions on the proxy card, your shares will be voted as you instruct. If you return a signed and dated card but do not provide voting instructions, your shares will be voted in accordance with the recommendations of the Board of Directors. |

| • | You can vote in person at the Annual Meeting by delivering a completed proxy card or by completing a ballot available upon request at the meeting. However, if you hold your shares in a bank or brokerage account rather than in your own name, you must obtain a legal proxy from your stockbroker in order to vote at the meeting. |

Regardless of how you choose to vote, your vote is important and we encourage you to vote promptly.

| Q: | HOW DO I VOTE SHARES THAT I HOLD THROUGH AN EMPLOYEE BENEFIT PLAN SPONSORED BY THE COMPANY? |

| A: | If you hold shares of the Company through any of the following employee benefit plans, you vote them by following the instructions above. The employee benefit plans are: |

Rayonier Investment and Savings Plan for Salaried Employees

Rayonier Inc. Savings Plan for Non-Bargaining Unit Hourly Employees at Certain Locations

Rayonier-Jesup Mill Savings Plan for Hourly Employees

Rayonier Inc.-Fernandina Mill Savings Plan for Hourly Employees

If you hold shares in any of these Company employee benefit plans and do not vote your shares or specify your voting instructions on your proxy card, the trustee of the employee benefit plans will vote your plan shares in the same proportion as the shares for which voting instructions have been received. To allow sufficient time for voting by the trustee, your voting instructions for employee benefit plan shares must be received by May 16, 2011.

| Q: | IS MY VOTE CONFIDENTIAL? |

| A: | Proxy cards, ballots and reports of Internet and telephone voting results that identify individual shareholders are mailed or returned directly to Broadridge Financial Services, Inc. (“Broadridge”), our vote tabulator, and handled in a manner that protects your privacy. Your vote will not be disclosed except: |

| • | as needed to permit Broadridge to tabulate and certify the vote; |

2

Table of Contents

| • | as required by law; |

| • | if we determine that a genuine dispute exists as to the accuracy or authenticity of a proxy, ballot or vote; or |

| • | in the event of a proxy contest where all parties to the contest do not agree to follow our confidentiality policy. |

| Q: | WHAT SHARES ARE COVERED BY MY INTERNET NOTICE OR PROXY CARD? |

| A: | You should have been provided an Internet Notice or proxy card for each account in which you own Common Shares either: |

| • | directly in your name as the shareholder of record, which includes shares purchased through any of our employee benefit plans; or |

| • | indirectly through a broker, bank or other holder of record. |

| Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE OR PROXY CARD? |

| A: | It means that you have multiple accounts in which you own Common Shares. Please vote all shares in each account for which you receive an Internet Notice or proxy card to ensure that all your shares are voted. However, for your convenience we recommend that you contact your broker, bank or our transfer agent to consolidate as many accounts as possible under a single name and address. Our transfer agent is The Bank of New York Mellon. All communications concerning shares you hold in your name, including address changes, name changes, requests to transfer shares and similar issues, can be handled by making a toll-free call to The Bank of New York Mellon at 1-800-659-0158. From outside the U.S. you may call The Bank of New York Mellon at 201-680-6685. |

| Q: | HOW CAN I CHANGE MY VOTE? |

| A: | You can revoke your proxy and change your vote by: |

| • | voting on the Internet or by telephone before 11:59 p.m. Eastern Daylight Time on the day before the Annual Meeting or, for employee benefit plan shares, the cut off date noted above (only your most recent Internet or telephone proxy is counted); |

| • | signing and submitting another proxy card with a later date at any time before the polls close at the Annual Meeting; |

| • | giving timely written notice of revocation of your proxy to our Corporate Secretary at 1301 Riverplace Boulevard, Suite 2300, Jacksonville, Florida 32207; or |

| • | voting again in person before the polls close at the Annual Meeting. |

| Q: | HOW MANY VOTES ARE NEEDED TO HOLD THE MEETING? |

| A: | In order to conduct the Annual Meeting, a majority of the Common Shares outstanding as of the close of business on March 21, 2011 must be present, either in person or represented by proxy. All shares voted pursuant to properly submitted proxies and ballots, as well as abstentions and shares voted on a discretionary basis by banks or brokers in the absence of voting instructions from their customers, will be counted as present and entitled to vote for purposes of satisfying this requirement. |

3

Table of Contents

| Q: | HOW MANY VOTES ARE NEEDED TO ELECT THE NOMINEES FOR DIRECTOR? |

| A: | The affirmative vote of a majority of the votes cast with respect to each nominee at the Annual Meeting is required to elect that nominee as a director. For this proposal, a majority of the votes cast means that the number of votes “FOR” a nominee must exceed the number of votes “AGAINST” a nominee. Abstentions will therefore not affect the outcome of director elections. |

Please note that under New York Stock Exchange (“NYSE”) rules, banks and brokers are not permitted to vote the uninstructed shares of their customers on a discretionary basis in the election of directors (referred to as “broker non-votes”). As a result, if you hold your shares through an account with a bank or broker and you do not instruct your bank or broker how to vote your shares in the election of directors, no votes will be cast on your behalf in the election of directors. Because broker non-votes will have no effect on the outcome of the vote, it is critical that you instruct your bank or broker if you want your vote to be counted in the election of directors.

| Q: | HOW MANY VOTES ARE NEEDED TO APPROVE THE “SAY ON PAY” PROPOSAL? |

| A: | The vote on the Say on Pay proposal is advisory only and non-binding on the Company or our Board of Directors. However, the proposal will be approved on a non-binding, advisory basis if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” it. Abstentions therefore will not affect the outcome of the proposal. |

Banks and brokers are not permitted to vote uninstructed shares for any company proposals relating to executive compensation, which includes this Say on Pay vote. As a result, if you hold your shares through an account with a bank or broker and you do not instruct your bank or broker how to vote your shares on the Say on Pay proposal, no votes will be cast on your behalf with regard to approval of the compensation of our named executive officers as disclosed in this Proxy Statement. Because broker non-votes will have no effect on the outcome of the vote, it is critical that you instruct your bank or broker if you want your vote to be counted in the approval of the Say on Pay proposal.

| Q: | HOW WILL MY RECOMMENDATION ON THE “SAY WHEN ON PAY” PROPOSAL BE RECORDED? |

| A: | The vote on the Say When on Pay proposal is advisory only and non-binding on the Company or our Board of Directors. However, the Company will report the results of the vote and will announce when the next Say on Pay proposal will be presented for a shareholder vote. |

Banks and brokers are not permitted to vote uninstructed shares for any company proposals relating to executive compensation, which includes this Say When on Pay vote. As a result, if you hold your shares through an account with a bank or broker and you do not instruct your bank or broker how to vote your shares on the Say When on Pay proposal, no votes will be cast on your behalf on the recommendation of whether a shareholder vote to approve the compensation of our named executive officers as disclosed in the Company’s proxy statement should occur every one, two or three years. Because broker non-votes will have no effect on the outcome of the vote, it is critical that you instruct your bank of broker if you want your vote to be counted in the recommendation of a frequency under the Say When on Pay proposal.

| Q: | HOW MANY VOTES ARE NEEDED TO APPROVE THE RATIFICATION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM? |

| A: | The proposal to ratify the appointment of the Company’s independent registered public accounting firm will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” it. Abstentions will therefore not affect the outcome of the proposal. Because brokerage firms and banks are |

4

Table of Contents

| permitted to vote on the ratification of the Company’s independent registered public accounting firm in the absence of instructions from their customers, we do not anticipate that there will be any broker non-votes with regard to the proposal. |

| Q: | HOW MANY VOTES ARE NEEDED TO APPROVE THE SHAREHOLDER PROPOSAL? |

| A: | The shareholder proposal will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” it. Abstentions and broker non-votes will therefore not affect the outcome. |

| Q: | WILL ANY OTHER MATTERS BE VOTED ON? |

| A: | We do not expect any other matters to be considered at the Annual Meeting. However, if a matter not listed on the Internet Notice or proxy card is legally and properly brought before the Annual Meeting, the proxies will vote on the matter in accordance with their judgment of what is in the best interest of our shareholders. Under the Company’s bylaws, all shareholder proposals must have been received by December 6, 2010 to be considered for inclusion in this Proxy Statement, and all other shareholder proposals and director nominations must have been received between January 21 and February 20, 2011 to be otherwise properly brought before the Annual Meeting. We have not received any other shareholder proposals or director nominations from shareholders to be acted upon at the Annual Meeting. |

| Q: | WHO WILL COUNT THE VOTES? |

| A: | Representatives of Broadridge will count the votes, however submitted. A Company representative will act as inspector of elections. |

| Q: | HOW WILL I LEARN THE RESULTS OF THE VOTING? |

| A: | We will announce the voting results of the proposals at the Annual Meeting and on a Form 8-K to be filed with the SEC no later than May 25, 2011. |

| Q: | WHO PAYS THE COST OF THIS PROXY SOLICITATION? |

| A: | The Company pays the costs of soliciting proxies and has retained Innisfree M&A Incorporated (“Innisfree”) to aid in the solicitation of proxies. For these services the Company will pay Innisfree a fee of $12,500, plus expenses. The Company will also reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of the Common Shares. Additionally, directors, officers and employees may solicit proxies on behalf of the Company by mail, telephone, facsimile, email and personal solicitation. Directors, officers and employees will not be paid additional compensation for such services. |

| Q: | WHEN ARE SHAREHOLDER PROPOSALS FOR THE 2012 ANNUAL MEETING OF SHAREHOLDERS DUE? |

| A: | For a shareholder proposal (other than a director nomination) to be considered for inclusion in the Company’s proxy statement for the 2012 Annual Meeting of Shareholders (the “2012 Annual Meeting”), the Company’s Corporate Secretary must receive the written proposal at our principal executive offices no later than the close of business on December 6, 2011. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in company-sponsored proxy materials. The submission of a proposal in accordance with these requirements does not guarantee that we will include the proposal in our proxy statement or on our proxy card. Proposals should be addressed to: |

Corporate Secretary

Rayonier Inc.

1301 Riverplace Boulevard, Suite 2300

Jacksonville, FL 32207

5

Table of Contents

For a shareholder proposal (including a director nomination) to be properly brought before the shareholders at the 2012 Annual Meeting outside of the Company’s proxy statement, the shareholder must provide the information required by the Company’s By-laws and give timely notice in accordance with such By-laws, which, in general, require that the notice be received by the Company’s Secretary: (i) no earlier than the close of business on January 20, 2012; and (ii) no later than the close of business on February 19, 2012.

If the date of the 2012 Annual Meeting is moved more than 30 days before or more than 60 days after May 19, 2012, then notice of a shareholder proposal that is not intended to be included in the Company’s Proxy Statement must be received no earlier than the close of business 120 days prior to the meeting and not later than the close of business on the later of: (a) 90 days prior to the meeting; and (b) 10 days after public announcement of the meeting date.

We strongly encourage any shareholder interested in submitting a proposal to contact our Corporate Secretary at (904) 357-9100 prior to submission in order to discuss the proposal.

6

Table of Contents

The Board of Directors is responsible for establishing overall corporate policy and for overseeing management and the ultimate performance of the Company. The Board reviews significant developments affecting the Company and acts on matters requiring Board approval. The Board held seven meetings during 2010.

Our Board currently consists of eleven directors divided into three classes (I, II and III) serving staggered three-year terms. The terms of the Class II directors, Paul G. Boynton, Mark E. Gaumond, Paul G. Kirk, Jr., David W. Oskin and Carl S. Sloane, will expire at the 2011 Annual Meeting, at which time Messrs. Kirk and Sloane will retire in accordance with the Board’s policy regarding mandatory retirement age. Messrs. Boynton, Gaumond and Oskin have been nominated for re-election for a term expiring in 2014.

The Board has no reason to believe that any nominee will be unable to serve as a director. If, however, a nominee should be unable to serve at the time of the Annual Meeting, Common Shares properly represented by valid proxies will be voted in connection with the election of a substitute nominee recommended by the Board. Alternatively, the Board may either allow the vacancy to remain unfilled until an appropriate candidate is located or may reduce the authorized number of directors to eliminate the unfilled seat.

If any incumbent nominee for director should fail to receive the required affirmative vote of the majority of the votes cast with regard to his election, under North Carolina law (the Company’s state of incorporation) the director would remain in office as a “holdover” director until his successor is elected and qualified or he resigns, retires or is otherwise removed. In such a situation, our Corporate Governance Principles require the director to tender his resignation to the Board. The Nominating and Corporate Governance Committee (the “Nominating Committee”) would then consider such resignation and make a recommendation to the Board as to whether to accept or reject the resignation. The Board is then required to make a determination and publicly disclose its decision and rationale within 90 days after receipt of the tendered resignation.

We believe the members of our Board of Directors have the proper mix of relevant experience and expertise given the Company’s businesses and REIT structure, together with a level of demonstrated integrity, judgment, leadership and collegiality, to effectively advise and oversee management in executing our strategy. There are no specific minimum qualifications for director nominees other than a maximum permitted age of 72. However, in identifying or evaluating potential nominees, it is the policy of our Nominating Committee to seek individuals who have the knowledge, experience, diversity and personal and professional integrity to be most effective, in conjunction with the other Board members, in collectively serving the long-term interests of our shareholders. These criteria for Board membership are periodically evaluated by the Nominating Committee taking into account the Company’s strategy, its geographic markets, regulatory environment and other relevant business factors, as well as changes in applicable laws or listing standards.

A biography of each member of Rayonier’s current Board of Directors, including the three nominees for election, is set forth below. Also included is a statement regarding each director’s or nominee’s individual qualifications for Board service.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE THREE NOMINEES NAMED BELOW FOR ELECTION TO THE BOARD OF DIRECTORS.

7

Table of Contents

Information as to Nominees for Election to the Board of Directors

Class II, Terms Expire in 2011

| PAUL G. BOYNTON, Age 46 |

Director Since 2011 |

Mr. Boynton is President and Chief Operating Officer of the Company, a position he has held since October 1, 2010. Previously he held a number of positions of increasing responsibility with Rayonier, including Senior Vice President, Performance Fibers from July 2002-January 2008, Senior Vice President, Performance Fibers and Wood Products from January 2008-November 2009 and Executive Vice President, Forest Resources and Real Estate from November 2009-October 2010. Mr. Boynton joined the Company as Director, Specialty Pulp Marketing and Sales in 1999. Prior to joining Rayonier, he held positions with 3M Corporation from 1990 to 1999, most recently as Global Brand Manager, 3M Home Care Division (a global manufacturer and marketer of cleaning tool products). Mr. Boynton serves on the Board of Directors of The Brink’s Company and is a director of the National Alliance of Forest Owners. He holds a B.S. in Mechanical Engineering from Iowa State University, an M.B.A. from the University of Iowa, and graduated from the Harvard University Graduate School of Business Advanced Management Program.

Mr. Boynton has direct operational experience leading each of our three core businesses and long-standing relationships with our major customers. We believe this history with Rayonier, together with his marketing and engineering background, make Mr. Boynton uniquely well suited to contribute to Board considerations of operational and strategic decisions across all of our business units.

| MARK E. GAUMOND, Age 60 |

Director Since 2010 |

Mr. Gaumond is the former Americas Senior Vice Chair – Markets of Ernst & Young (a global leader in assurance, tax, transaction and advisory services), a position he held from 2006-2010. Previously he served as Ernst & Young’s Managing Partner, San Francisco from 2003-2006 and as an audit partner on several major clients. Prior to joining Ernst & Young, Mr. Gaumond was a Managing Partner with Arthur Andersen from 1994-2002 and a partner in the firm’s audit practice from 1986-1994. Mr. Gaumond serves on the Board of Directors of Booz Allen Hamilton Holding Corporation and the Board of Trustees of the California Academy of Sciences. He holds a bachelor’s degree from Georgetown University and an MBA from the Leonard N. Stern School of Business, New York University. In addition, Mr. Gaumond is a member of The American Institute of Certified Public Accountants.

Mr. Gaumond has 35 years of managerial, financial and accounting experience working extensively with senior management, audit committees and boards of directors of public companies, including several in the forest products industry. We believe Mr. Gaumond’s experience and financial expertise allow him to contribute strongly to our Board’s oversight of the Company’s overall financial performance, reporting and controls.

| DAVID W. OSKIN, Age 68 |

Director Since 2009 |

Mr. Oskin is President of Four Winds Ventures, LLC (a private investment and advisory company). He was the Executive Vice President of International Paper Company (a paper, packaging and forest products company) from 1996 to 2003. Previously Mr. Oskin was Chief Executive Officer of Carter Holt Harvey Limited (a New Zealand based forest products company) from 1992 to 1996 and Senior Vice President of International Paper from 1975 to 1992. Mr. Oskin is a director of Verso Paper Corp., Pacific Millennium Corporation, Samling Global Limited, and Big Earth Publishing LLC, and serves as Chair Emeritus of the Board of Trustees of Widener University. He holds bachelor and doctoral degrees from Widener University.

Mr. Oskin has long and extensive experience in the global forest products industry, having managed both manufacturing and timber operations, and also brings global public company board experience to Rayonier. We believe this industry experience is particularly well suited to assisting the Board in understanding the key drivers of our timber and performance fibers businesses.

8

Table of Contents

Information as to Other Directors

Class I, Terms Expire in 2013

| C. DAVID BROWN, II, Age 59 |

Director Since 2006 |

Mr. Brown is Chairman of Broad and Cassel (a law firm based in Orlando, Florida), a position he has held since 2000. Previously, he served as Managing Partner of the firm’s Orlando office from 1990. He joined the firm in 1980. Prior to joining Broad and Cassel, Mr. Brown was an associate with Rowland, Bowen and Thomas, P.A. and served as a First Lieutenant in the United States Air Force. Mr. Brown serves on the Board of Directors of CVS Caremark Corporation and the Board of Trustees for the University of Florida. He holds bachelor’s and juris doctorate degrees from the University of Florida.

Over a 33-year legal career, Mr. Brown has developed and demonstrated expertise in finance, environmental and land use issues, particularly in the State of Florida, as well as extensive experience in structuring complex real estate transactions. We believe his experience and expertise facilitate our Board’s discussions regarding our timberland and real estate assets, particularly in the Southeastern United States.

| JOHN E. BUSH, Age 58 |

Director Since 2008 |

Mr. Bush is President of Jeb Bush and Associates (a consulting firm). He served as the 43rd Governor of the State of Florida from January 1999 until January 2007. Prior to his election as Governor, Mr. Bush worked as a real estate executive and pursued other entrepreneurial ventures in Florida from 1981 to 1998, and served as Secretary of Commerce for the State of Florida from 1987 to 1988. He formed and serves as chairman of The Foundation for Florida’s Future, a non-profit public policy organization and the Foundation for Excellence in Education, a non-profit charitable organization. Mr. Bush serves on the Boards of Directors of Tenet Healthcare Corporation and Swisher Hygiene Inc. He holds a bachelor’s degree in Latin American affairs from the University of Texas at Austin.

In addition to his invaluable political experience in the State of Florida, Mr. Bush has expertise in the real estate industry and brings a unique understanding of global public policy issues. Given this background, we believe Mr. Bush brings a valuable perspective to our Board’s consideration of the issues facing our land holdings and global performance fibers business.

| LEE M. THOMAS, Age 66 |

Director Since 2006 |

Mr. Thomas is Chairman and Chief Executive Officer of the Company, positions he has held since July 1, 2007. He served as President and Chief Executive Officer from March 2007 to July 2007 and as a Director since March 2006. Prior to joining Rayonier, Mr. Thomas served as President of Georgia-Pacific Corporation (a global manufacturer and marketer of tissue, packaging, paper, building products and related chemicals), beginning in September 2002, and as its Chief Operating Officer from March 2003 to December 2005. Prior to becoming President and Chief Operating Officer, Mr. Thomas served in a number of management positions with Georgia-Pacific, including President-Building Products and Distribution, Executive Vice President-Consumer Products and Executive Vice President-Paper and Chemicals. Mr. Thomas previously served as chairman and chief executive officer of Law Companies Environmental Group Inc., as administrator of the U.S. Environmental Protection Agency, as executive deputy director of the Federal Emergency Management Agency, as director of the Division of Public Safety Programs-Office of the Governor of South Carolina and on the Board of Directors of the Federal Reserve Bank of Atlanta. Mr. Thomas serves on the Boards of Directors of Airgas, Inc. and Regal Entertainment Group. He holds a bachelor’s degree from the University of the South and an M.Ed. from the University of South Carolina.

Mr. Thomas has broad forest products industry experience, both domestic and international, along with an extensive knowledge of the environmental regulatory process and general political framework. We believe his industry and governmental experience and expertise are uniquely well suited to management of our core businesses and leadership of our Board.

9

Table of Contents

Class III, Terms Expire in 2012

| RICHARD D. KINCAID, Age 49 |

Director Since 2004 |

Mr. Kincaid is the President and Founder of the BeCause Foundation (a non-profit corporation that heightens awareness of complex social problems and promotes change through the power of film). He was the President, Chief Executive Officer and a trustee of Equity Office Properties Trust (an owner and manager of office buildings and, at the time, the largest U.S. real estate investment trust) until March 2007. He was named President in November 2002 and Chief Executive Officer in April 2003. Mr. Kincaid joined Equity Office Properties Trust as a Senior Vice President in 1996, was named Chief Financial Officer in 1997 and Executive Vice President and Chief Operating Officer in 2001. He previously served as Senior Vice President and Chief Financial Officer of Equity Office Holdings, L.L.C. (a predecessor of Equity Office Properties Trust), and was Senior Vice President of Equity Group Investments, Inc. (a private investment company). Mr. Kincaid serves on the Boards of Directors of Vail Resorts, Inc. and Strategic Hotels & Resorts, Inc. He is a graduate of Wichita State University and holds an MBA from the University of Texas.

Mr. Kincaid has significant financial expertise together with broad experience in the real estate industry and a deep understanding of the structural and strategic implications of REIT status. We believe his experience and expertise are particularly well suited to assist the Board in understanding the opportunities and challenges presented by our REIT structure, as well as overseeing the Board’s management of our real estate business and general financing decisions.

| V. LARKIN MARTIN, Age 47 |

Director Since 2007 |

Ms. Martin is the Managing Partner of Martin Farm and Vice President of The Albemarle Corporation (family businesses with interests in agriculture and timberland), positions she has held since 1990. She also served as Chairman of the Board of Directors of the Federal Reserve Bank of Atlanta from January 2007 until December 2008 and is a director and officer of Servico, Inc. and Cottonseed, LLC (operations involved in cotton ginning, warehousing and whole cottonseed sales). Ms. Martin is the immediate past Chairman of the Board of Directors of The Cotton Board and is a member of the President’s Advisory Council of the University of Alabama in Birmingham. She holds a bachelor’s degree from Vanderbilt University.

Ms. Martin has direct operating experience in the land-based businesses of agriculture and timberland management, particularly in the Southeastern United States, together with an understanding of national and regional financial markets. We believe this skill set allows Ms. Martin to add substantial value to Board discussions regarding our forest resources business and overall economic forces and trends impacting the Company.

| RONALD TOWNSEND, Age 69 |

Director Since 2001 |

Mr. Townsend is an independent communications consultant based in Jacksonville, Florida since 1997. He retired from Gannett Company (a diversified news and information company) in 1996 after serving 22 years in positions of increasing responsibility, most recently as President of Gannett Television Group. Mr. Townsend attended The City University of New York, Bernard Baruch.

Mr. Townsend brings significant experience in media and public relations issues to the Board and is familiar with public company board processes. We believe his background and expertise, including his political and civic activities in the Jacksonville, Florida area, provide the Board with a unique perspective on high-profile issues facing our core businesses.

Information as to Retiring Directors

| PAUL G. KIRK, JR., Age 73 |

Director Since 1994 |

Mr. Kirk is the Chairman, President and a director of Kirk & Associates, Inc. (a business advisory and consulting firm). He served as an interim United States Senator for Massachusetts from September 2009 until

10

Table of Contents

February 2010. He was a partner in the law firm of Sullivan & Worcester from 1977 to 1992 and is presently affiliated with the firm. He served as Chairman of the Democratic National Committee from 1985 to 1989. Mr. Kirk formerly served as Co-Chairman of the Commission on Presidential Debates, a Trustee of St. Sebastian’s School, Chairman of the Board of Directors of the John F. Kennedy Library Foundation, and Chairman of the Visiting Committee on Harvard Athletics. He currently serves on the Boards of Directors of The Hartford Financial Services Group, Inc. and Cedar Shopping Centers, Inc. and is a member of the Bloomberg Government Advisory Board. Mr. Kirk is a graduate of Harvard College and Harvard Law School.

Mr. Kirk has extensive political and public policy experience at the national level, along with legal and corporate governance expertise and an understanding of public company board processes. We believe this unique experience and skill set benefit our Board’s discussions of the many public policy issues impacting our businesses and strategy.

| CARL S. SLOANE, Age 74 |

Director Since 1997 |

Mr. Sloane served as Co-Chairman of AlixPartners Holdings and Questor Partners Holdings (providers of services and capital to underperforming and distressed companies) from June 2005 until October 2006. He is also Professor Emeritus, Harvard University Graduate School of Business Administration, and a Trustee of Beth Israel Deaconess Medical Center, a Harvard affiliated teaching hospital. Mr. Sloane was the Ernest L. Arbuckle Professor of Business Administration at Harvard from 1991 until his retirement in 2000. Prior to joining the Harvard faculty, he spent 30 years in management consulting, the last 20 with the firm he co-founded, Temple, Barker & Sloane, Inc., and its successor firm, Mercer Management Consulting, where he served as Chairman and Chief Executive. He was also a director of Brink’s Home Security Holdings, Inc. from 2008 to 2010 and a director of The Brink’s Company from 1998 to September 2008. He is a graduate of Harvard College and the Harvard University Graduate School of Business Administration.

With 30 years experience in management consulting before entering academia, Mr. Sloane has particular expertise in the areas of strategic planning and analysis, and is familiar with corporate governance and public company board processes. We believe his experience and expertise enhance the Board’s ongoing evaluation and oversight of the Company’s short- and long-term strategies.

Corporate Governance Principles

Our Board of Directors operates under a set of Corporate Governance Principles, which includes guidelines for determining director independence and consideration of potential director nominees. The Corporate Governance Principles can be found on the Company’s website at www.rayonier.com. The Board, through the Nominating Committee, regularly reviews developments in corporate governance and best practices and, as warranted, modifies the Corporate Governance Principles, committee charters and key practices.

The Company’s Common Shares are listed on the NYSE. In accordance with NYSE rules, the Board makes affirmative determinations annually as to the independence of each director and nominee for election as a director. To assist in making such determinations, the Board has adopted a set of Director Independence Standards which conform to or are more exacting than the independence requirements set forth in the NYSE listing standards. Our Director Independence Standards are appended to the Company’s Corporate Governance Principles, available at www.rayonier.com. In applying our Director Independence Standards, the Board considers all relevant facts and circumstances.

11

Table of Contents

Based on our Director Independence Standards, the Board has affirmatively determined that all persons who have served as directors of our Company at any time since January 1, 2010, other than Messrs. Thomas and Boynton, are independent.

The Nominating Committee, on behalf of the Board of Directors, annually reviews any transactions undertaken or relationship existing between the Company and other companies in connection with which any of our directors are affiliated. The Board determined that none of the transactions or relationships identified for 2010 were material to the Company, the other companies or the subject directors.

Committees of the Board of Directors

As indicated below, our Board of Directors has three standing committees, each of which operates under a written charter available on the Investor Relations section of the Company’s website at www.rayonier.com.

| Name of Committee and Members |

Functions of the Committee |

Number of Meetings in 2010 |

||||

| AUDIT: Richard D. Kincaid, Chair C. David Brown, II John E. Bush Mark E. Gaumond Paul G. Kirk, Jr. V. Larkin Martin |

This committee is responsible for advising the Board concerning the financial structure of the Company and oversight of our accounting and financial reporting policies, processes and systems of internal control, including: • financings; • risk management policies; • compliance with various REIT qualification tests; • investment policies; • performance of our pension and savings plans; • monitoring the independence and performance of our independent registered public accounting firm, with responsibility for such firm’s selection, evaluation, compensation and discharge; • approving, in advance, all of the audit and non-audit services provided to the Company by the independent registered public accounting firm; • facilitating open communication among the Board, senior management, internal audit and the independent registered public accounting firm; and • overseeing our enterprise risk management and legal compliance and ethics programs, including our Standard of Ethics and Code of Corporate Conduct. |

9 | ||||

| COMPENSATION AND MANAGEMENT DEVELOPMENT: Carl S. Sloane, Chair C. David Brown, II Richard D. Kincaid David W. Oskin Ronald Townsend |

This committee is responsible for overseeing the compensation and benefits of employees, including: • evaluating management performance, succession and development matters; • establishing executive compensation; • reviewing the Compensation Discussion and Analysis included in the annual Proxy Statement; • approving individual compensation actions for all senior executives other than our Chief Executive Officer; and • recommending compensation actions regarding our Chief Executive Officer for approval by our non-management directors. |

4 | ||||

12

Table of Contents

| Name of Committee and Members |

Functions of the Committee |

Number of Meetings in 2010 |

||||

| NOMINATING AND CORPORATE GOVERNANCE: Ronald Townsend, Chair John E. Bush Mark E. Gaumond Paul G. Kirk, Jr. V. Larkin Martin David W. Oskin Carl S. Sloane |

This committee is responsible for advising the Board with regard to board structure, composition and governance, including: • establishing criteria for Board nominees and identifying qualified individuals for nomination to become Board members, including considering potential nominees recommended by shareholders; • recommending the composition of Board committees; • overseeing processes to evaluate Board and committee effectiveness; • recommending director compensation and benefits programs to the Board; • overseeing our corporate governance structure and practices, including our Corporate Governance Principles; and • reviewing and approving changes to the charters of the other Board committees. |

8 | ||||

During 2010, the Board determined to dissolve its Finance Committee, which had been in place since 1998. The responsibilities previously delegated to the Finance Committee were either delegated to the Audit Committee or retained at the Board level.

On average, our directors attended 98 percent of the aggregate meetings of the Board of Directors and committees on which they served during 2010, and no director attended less than 75 percent of such meetings.

Non-Management Director Meetings and Lead Director

Our non-management directors met separately in five regularly scheduled meetings, chaired by the Lead Director, during 2010. The non-management directors elected Mr. Kirk to a two-year term as Lead Director in 2009. Following Mr. Kirk’s resignation in September 2009 to serve in the United States Senate, Mr. Townsend served as interim Lead Director until Mr. Kirk’s re-appointment to the Board effective March 1, 2010, at which time Mr. Kirk reassumed the Lead Director role. Upon the expiration of Mr. Kirk’s term in May 2011, the non-management directors will elect a new Lead Director to a two-year term.

Board Leadership Structure and Oversight of Risk

Lee Thomas has served as Chairman of the Board of Directors and Chief Executive Officer of the Company since 2007. We believe that given the Board and committee structure and governance processes discussed above, the appropriate leadership structure for our Company is to have a combined Chairman and Chief Executive Officer together with a Lead Director, elected by and from the independent Board members with clearly delineated and comprehensive duties, including:

| • | To act as intermediary between the non-management directors and the Chairman/CEO; |

| • | To suggest calling full Board meetings to the Chairman/CEO when appropriate; |

| • | To call meetings of the non-management directors; |

| • | To set the agenda for and lead meetings of the non-management directors; |

| • | To brief the Chairman/CEO on issues arising in the meetings of non-management directors; |

| • | To collaborate with the Chairman/CEO to set the agenda for Board meetings; and |

| • | To facilitate discussions among the non-management directors on key issues and concerns outside of Board meetings. |

13

Table of Contents

The combined Chairman and Chief Executive Officer role provides unambiguous reporting lines for management and allows the Company to communicate to customers, suppliers, shareholders, employees and other stakeholders with a single, consistent voice.

The Board oversees risk management at Rayonier by annually appointing the members of the Enterprise Risk Management (“ERM”) Committee, which consist of senior executives chaired by Mr. Thomas, who serves as the Company’s Chief Risk Officer. The ERM Committee in turn appoints the members of business unit and staff function level Risk Assessment and Management teams, which continually identify and assess the material risks facing their respective business or function and submit semi-annual reports to the ERM Committee. These reports form the basis for the ERM Committee’s annual risk assessment whereby risks are evaluated and categorized based on probability, potential impact and the Company’s tolerance for the risk type, and used to develop a list of enterprise-level material risks which are reported to the Audit Committee for review and evaluation of mitigation strategies. The Audit Committee then assigns on-going board level oversight responsibility for each material risk to either the full Board or the appropriate Board committee. The ERM Committee’s annual risk assessment with regard to the Company’s overall compensation policies and practices is approved by the Compensation and Management Development Committee (the “Compensation Committee”). In addition, the ERM Committee annually reports on the overall risk management program and the identified material risks to the full Board. We believe that these governance practices, including the interaction of the various committees with our Chairman and Chief Executive Officer, facilitate effective Board oversight of our significant risks, but have not affected our Board’s leadership structure.

Director Attendance at Annual Meeting of Shareholders

Directors are encouraged, but not required, to attend each Annual Meeting of Shareholders. At the 2010 Annual Meeting, nine of ten directors were in attendance.

Shareholders and other interested parties who would like to communicate their concerns to one or more members of the Board, a Board committee, the Lead Director or the independent non-management directors as a group may do so by writing to any such party at Rayonier, c/o Corporate Secretary, 1301 Riverplace Boulevard, Jacksonville, Florida 32207. All concerns received will be appropriately forwarded and, if deemed appropriate by the Corporate Secretary, may be accompanied by a report summarizing such concerns.

Potential director candidates may come to the attention of the Nominating Committee through current directors, management, shareholders and others. It is the policy of our Nominating Committee to consider director nominees submitted by shareholders based on the same criteria used in evaluating candidates for Board membership identified from any other source. The directions for shareholders to submit director nominations for the 2012 Annual Meeting are set forth beginning on page 5 under “When Are Shareholder Proposals for the 2012 Annual Meeting of Shareholders Due?” The Nominating Committee has from time to time utilized independent third-party search firms to identify potential director candidates. In 2010, Mr. Gaumond was identified by such a firm that also assisted with his evaluation for Board membership.

Our Nominating Committee has not adopted a formal diversity policy in connection with the consideration of director candidates or the selection of nominees. However, the Nominating Committee does utilize a skills-matrix to evaluate the specific personal and professional attributes of each director candidate versus those of the existing Board members to ensure diversity of experience and expertise among our directors. The Nominating Committee assesses such diversity through its annual review of Board structure and composition and review of the annual Board and committee performance evaluations.

14

Table of Contents

Our Board has adopted a written policy designed to minimize potential conflicts of interest in connection with Company transactions with related persons. Our policy defines a “Related Person” to include any director, executive officer or person owning more than 5% of the Company’s stock, any of their immediate family members and any entity with which any of the foregoing persons are employed or affiliated. A “Related Person Transaction” is defined as a transaction, arrangement or relationship in which the Company is a participant, the amount involved exceeds $120,000 and a Related Person has or will have a direct or indirect material interest.

To implement the policy, each year a Related Person list is compiled based on information obtained from our annual Director and Officer Questionnaires and, after review and consolidation by our Corporate Secretary, is provided to business unit, accounts payable, accounts receivable, financial, legal and communications managers and other persons responsible for purchasing or selling goods or services for the Company. Prior to entering into any transaction with a Related Person, the manager responsible for the potential transaction and/or the Related Person must provide notice to the Corporate Secretary setting out the facts and circumstances of the proposed transaction. If the Corporate Secretary determines that the transaction would constitute a Related Person Transaction, it is then submitted for consideration by the Nominating Committee, which will approve only those transactions determined to be in, or not inconsistent with, the best interests of the Company and its shareholders. In reviewing Related Person Transactions, the Nominating Committee will consider:

| • | the Related Person’s relationship to the Company and interest in any transaction with the Company; |

| • | the material terms of a transaction with the Company, including the type and amount; |

| • | the benefits to the Company of any proposed or actual transaction; |

| • | the availability of other sources of comparable products and services that are part of a transaction with the Company; and |

| • | if applicable, the impact on a director’s independence. |

In the event we become aware of a completed or ongoing Related Person Transaction that has not been previously approved, it is promptly submitted to the Nominating Committee for evaluation and, if deemed appropriate, ratification.

In addition, each year the persons and entities identified as Related Persons are matched against the Company’s accounts payable and accounts receivable records to determine whether any Related Person participated in a transaction with the Company, regardless of the amount involved. A report of all such transactions is prepared by the Corporate Secretary and reviewed with the Nominating Committee to determine if any would constitute a Related Person Transaction under our policy or would require proxy statement disclosure under SEC rules and regulations.

For 2010, no Related Person Transactions were submitted to the Nominating Committee for approval or ratification, and no transaction with any Related Person was identified as requiring proxy statement disclosure.

Standard of Ethics and Code of Corporate Conduct

The Company’s Standard of Ethics and Code of Corporate Conduct is available on the Company’s website at www.rayonier.com.

Compensation Committee Interlocks and Insider Participation; Processes and Procedures

Each of Messrs. Brown, Kincaid, Oskin, Sloane and Townsend served as a member of our Compensation Committee during the fiscal year ended December 31, 2010. No member of the Compensation Committee served as one of our officers or employees at any time during 2010 or had any related party transaction or relationship

15

Table of Contents

required to be disclosed in this Proxy Statement. None of our executive officers serve, or served during 2010, as a member of the board of directors or compensation committee of a public company with at least one of its executive officers serving on our Board or Compensation Committee.

COMPENSATION DISCUSSION AND ANALYSIS

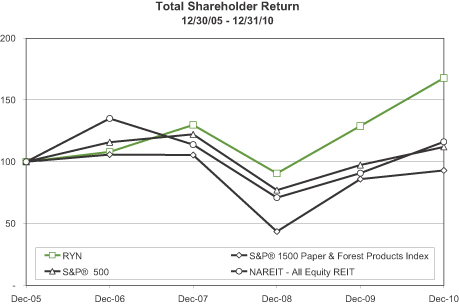

Our executive compensation philosophy, and the primary programs supporting that philosophy, are long-standing and tightly focused on tying the success of management and our shareholders. We believe our compensation programs have been an important part of our ability to attract and retain a talented management team and to consistently out-perform our competitors in the delivery of long-term value to shareholders.

In 2010, our shareholders enjoyed a 30% total return as we:

| • | Achieved record earnings, excluding gains from one-time special items; and |

| • | Increased our regular dividend by 8%, the fifth increase since our REIT conversion in 2004. |

Our 2010 results are discussed further beginning at page 25 (Results of Operations) of our 2010 Annual Report on Form 10-K.

16

Table of Contents

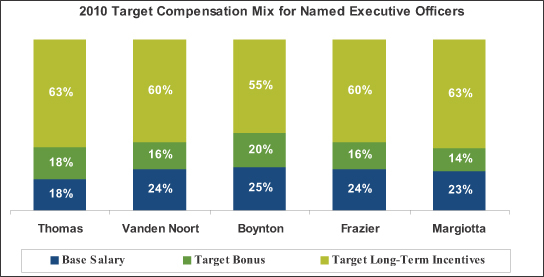

The cornerstone of our compensation philosophy is to provide a substantial majority of senior executive compensation in the form of “at risk” performance-based incentives. For 2010, the portion of total compensation for our named executive officers allocated to such incentives ranged between 75 and 81 percent.

The primary components of our “at risk” performance-based incentives are long-term stock-based awards. The ultimate value of these awards to the executive is dependent upon our performance in delivering value to shareholders both in absolute terms (through stock options) and relative to our peers (through performance shares). We believe that tying a majority of our senior executives’ compensation directly to our ability to deliver value to shareholders over a meaningful period of time properly aligns management interests with our investors, promotes an “ownership” mentality among our executives that fosters the long-term perspective necessary for sustained success, and minimizes the possibility that our incentive programs could promote excessive risk taking.

Annual stock-based award grants are made, and the exercise price for options is set, on the first trading day of the year to avoid any concern that awards are “timed” to take advantage of market fluctuations or Company announcements, and our plans do not allow “repricing” of stock options. All of our corporate officers, including all of the named executive officers, are subject to minimum share ownership requirements. The Compensation and Management Development Committee of our Board of Directors (referred to in this discussion as the “Committee”) receives a report at each regular meeting showing the current value of all Rayonier shares owned by each senior executive, as well as vested and unvested equity awards.

Short-term incentives for our executives consist of an annual cash bonus based on the Company’s performance against budgeted earnings and cash flow metrics and the Committee’s assessment of management’s performance in obtaining identified strategic objectives. We also provide a competitive base salary and benefit package.

Our executives do not have employment agreements and, with the exception of qualified pension benefits, all of their compensation and benefits are subject to modification or cancellation by the Committee. Perquisites provided to our executives are limited to annual physical examinations and reimbursement of tax and financial planning expenses, subject to an annual dollar cap.

As detailed in the following discussion and analysis, our executive compensation and benefit programs are closely managed by the Committee and our Board of Directors, are well aligned with our business strategies, and provide a powerful and consistent incentive to our management team to deliver above-market returns to our shareholders over the long-term.

17

Table of Contents

Named Executive Officers for 2010

Throughout this Proxy Statement, the following individuals are referred to as our “named executive officers”. Their compensation is disclosed in the tables following this discussion and analysis.

| • | Lee M. Thomas, our Chairman and Chief Executive Officer; |

| • | Hans E. Vanden Noort, our Senior Vice President and Chief Financial Officer; |

| • | Paul G. Boynton, our President and Chief Operating Officer; |

| • | W. Edwin Frazier, III, our Senior Vice President, Chief Administrative Officer and Corporate Secretary; and |

| • | Charles Margiotta, our Senior Vice President, Real Estate. |

While the focus of the following disclosure is on the compensation for our named executive officers, the types of compensation and benefits provided to them are generally similar to those provided to our other executives.

Roles of the Committee, Management and Advisors

The Committee has responsibility for establishing our compensation philosophy and for monitoring our adherence to it. The Committee reviews and approves compensation levels for all executive officers as well as all compensation, retirement, perquisite and benefit programs applicable to such officers.

The Committee establishes annual performance objectives for Mr. Thomas, evaluates his accomplishments and performance against those objectives, and, based on such evaluation, makes recommendations regarding his compensation level for approval by the independent members of our Board of Directors.

All of these functions are set forth in the Committee’s Charter, which appears on our website and is reviewed annually by the Committee.

The Committee’s work is accomplished through a series of meetings, following a regular calendar schedule to ensure that all major elements of compensation are appropriately considered and that compensation and benefit programs are properly designed, implemented and monitored. Special meetings are held as needed to address matters outside the regular compensation cycle.

Working with the Committee Chair, Mr. Frazier prepares an agenda and supporting materials for each meeting. Messrs. Thomas and Frazier generally attend Committee meetings by invitation, but are excused for executive sessions. The Committee invites other members of management to attend meetings as it deems necessary to cover issues within their specific areas of expertise or responsibility.

The Committee also seeks advice and assistance from compensation consultants and outside counsel to supplement their own knowledge and information provided by management. The Committee has engaged Exequity, LLP (“Exequity”) to provide advice, relevant market data and best practices to consider when making compensation decisions, including decisions involving Mr. Thomas and the programs applicable to senior executives generally. Exequity also provides the Committee meaningful input on program design features and the balance of pay among the various components of executive compensation. Total fees paid to Exequity for these services in 2010 were $56,156.

Our Compensation Philosophy and Objectives

Our compensation philosophy emphasizes “pay for performance” programs designed to reward superior financial performance and sustained increases in the value of our shareholders’ investment in Rayonier, while

18

Table of Contents

recognizing the need to maintain competitive base pay, retirement, healthcare, severance and other fixed compensation programs. Consistent with that philosophy, we seek to maintain compensation and benefits plans that will allow us to attract and retain highly qualified employees, while motivating and rewarding performance and effective risk management that leads to long-term enhancement of shareholder value.

Our policy for allocating value between long-term and current compensation is intended to ensure competitive base salaries and annual cash bonus opportunities, while providing strong incentives for our executives to focus on maximizing long-term value creation. We have no pre-established policy or target for the allocation between either cash and non-cash or short-term and long-term incentive compensation. However, our practice has been to pay a majority of the value of total compensation to our named executive officers in the form of long-term stock-based incentive compensation.

Our primary compensation programs for our named executive officers are designed to reflect their success, both individually and as a management team, in attaining key objectives as established by the Committee or our Board of Directors, and to provide rewards based on meaningful measures of performance. The Committee considers adjustments to our compensation program each year in light of past experience, changes in the competitive environment, regulatory requirements and other relevant factors. In addition, the Committee oversees a comprehensive evaluation of our executive compensation practices approximately every three years.

2009 Strategic Review of Executive Compensation

Beginning in the fall of 2008 and throughout 2009, the Committee conducted a strategic review of our executive compensation programs focused on ensuring the programs are well designed and aligned with Rayonier’s business strategies, and that actual incentive compensation delivered to executives is appropriately correlated to returns delivered to shareholders. Working with its compensation consultant, the Committee:

| • | considered the degree of correlation between the Company’s historic financial performance and value creation with the levels of compensation targeted and received by the Company’s executives; |

| • | reviewed the compensation philosophies and incentive programs, historic levels of actual compensation earned, total shareholder return delivered and changes in market capitalization at Rayonier and peer companies; and |

| • | evaluated alternative program designs for annual bonus and performance-based equity incentive plans, including their anticipated impact on compensation expense and dilution. |

Changes implemented in late 2008 impacting 2009 compensation included raising the levels of relative total shareholder return performance required under the Performance Share Award Program (discussed below under “Long Term Incentive Compensation”) for all payouts from threshold up to the top quintile.

During 2009, the Committee implemented the following additional program design changes impacting 2010 compensation:

The Annual Corporate Bonus Program (discussed below under “Annual Bonus Awards”) was revised to:

| • | move to a true “corporate” program by eliminating the concept of business unit performance factors and “weighted” payout formulas for operations executives; and |

| • | provide the Committee with clear discretionary authority to adjust the overall bonus pool up or down for all participants other than the named executive officers, for whom the Committee’s authority remains limited to reducing the bonus pool. |

The Performance Share Award Program was revised to:

| • | eliminate use of a discount model to present value performance share awards; |

19

Table of Contents

| • | revise the payout scale to increase the payout for top-tier performance from 175% to 200% of target; |

| • | cap awards at target levels, regardless of relative performance, if absolute total shareholder return over the performance period is negative; |

| • | provide for accrual of dividends and interest over the performance period for any performance shares ultimately earned; and |

| • | replace Abitibi/Bowater Inc. in the peer group, due to its bankruptcy, with Domtar Corporation. |

The elimination of the historic present valuing of performance share awards resulted in a 24.7% reduction in the number of performance shares granted. The decisions to revise the payout scale and provide for the accrual of dividends with interest were a result of the Committee’s desire to nonetheless continue to provide a comparable award opportunity for top-tier performance (i.e., performance at or above the 80th percentile versus the peer companies) when compared to the 2009 Performance Share Program. Award opportunities for all levels of performance below top quintile were reduced for 2010, with payouts for “at target” performance 13% below 2009 levels.

How We Set Executive Compensation

The key elements of our executive compensation program are base salary, an annual cash bonus incentive, and long-term stock-based incentive compensation. Consistent with our compensation philosophy, we strive to use long-term incentive compensation, rather than base salary or annual cash bonuses, to provide executives with an above-median compensation opportunity if they can, over time, drive increases in shareholder value and outperform our peers on a relative total shareholder return basis.

The Committee evaluates and balances each of the primary components of executive compensation at Rayonier. The role of each such component is discussed separately below, together with other factors considered in the setting of executive compensation.

Setting Base Salary

We provide cash base salaries to meet competitive market demands based on each executive’s position, skills and experience. Each year, the Committee reviews the base salary of our Chief Executive Officer and each of his direct reports, including all of our named executive officers. In making adjustments (or, in the case of our Chief Executive Officer, recommendations for adjustment) to base salary levels, the Committee considers:

| • | the executive’s level of responsibilities; |

| • | the executive’s experience and breadth of knowledge; |

| • | the executive’s individual performance as assessed through annual performance reviews; |

| • | the executive’s role in management continuity and development plans; |

| • | the perceived retention risk; and |

| • | internal pay equity factors. |

Setting Annual Bonus Opportunities

We also provide cash compensation in the form of annual bonus incentives, which are funded based on the Company’s financial performance against key budgeted financial metrics, and the attainment of identified strategic objectives. This is accomplished each year by the Committee adopting an Annual Corporate Bonus Program under the Rayonier Non-Equity Incentive Plan (the “Bonus Plan”), which was approved by our shareholders in 2008.

20

Table of Contents

Setting Long-Term Incentive Compensation

We provide non-cash compensation to reward superior long-term performance in delivering value to our shareholders in both absolute terms (through stock options) and as compared to our peers (through performance shares). The Rayonier Incentive Stock Plan (the “Stock Plan”), which was approved by our shareholders in 2008, allows the Committee the flexibility to award long-term compensation incentives through a variety of equity-based awards. The Committee has historically chosen to award primarily stock options and performance shares. The Committee’s objective in granting such awards is to provide a strong incentive to our executives to focus on the ongoing creation of shareholder value by offering above-median compensation opportunities for superior performance. These award opportunities allow us to offer a competitive overall compensation package, and also further opportunities for share ownership by our executives in order to increase their proprietary interest in Rayonier and, as a result, their interest in our long-term success and commitment to creating shareholder value. The three-year vesting and payment periods for our stock-based awards also provide a retention incentive for our executives.

Internal Pay Equity Factors

By “internal pay equity” we mean seeing that relative pay differences among our executives are consistent with different job levels and responsibilities. Mr. Thomas, for example, holds the dual responsibilities of Chairman and Chief Executive Officer. As a result, the Committee believes that he currently has substantially more responsibility and impact on shareholder value than any other named executive officer. Therefore, the Committee sets his total compensation level appreciably higher in relationship to that of other named executive officers, but at a level the Committee believes is appropriate and reflective of current market practice.

Other Considerations in Setting Equity-Based Awards

In order to keep the Committee informed of the proprietary interests of the named executive officers in Rayonier, at every regular meeting the Committee is provided a report on the number and current value of Rayonier shares and equity-based awards held by each of our senior executives. The Committee, however, does not take into account market fluctuations in the value of executives’ share ownership or outstanding awards when setting annual long-term incentive award levels. Decisions on equity grants are based solely on our compensation and retention objectives and our established measurements of the value of these awards.

We set the exercise price for stock options based on the closing price of Rayonier stock as of the award grant date. Accordingly, we do not backdate stock options or grant options retroactively. We make annual option grants on the first trading day of the year, and do not coordinate grants of options so that they are made before the announcement of favorable information, or after the announcement of unfavorable information.

Tax Considerations—Section 162(m)

Section 162(m) of the Internal Revenue Code (the “Tax Code”) precludes a public corporation from taking a deduction for compensation in excess of $1 million for its named executive officers unless certain criteria are satisfied. The Committee considers the anticipated tax treatment to Rayonier and the named executive officers in its review and establishment of compensation programs and payments. However, deductibility of compensation is only one factor that the Committee takes into account in setting executive compensation terms and levels and, in an appropriate case, would not preclude an award that is not deductible.

Use of Peer Group and Other Compensation Data

Given the diversity of our businesses and our REIT structure, we compete with companies across multiple industries for top executive-level talent. As such, the Committee generally expects that over time the total compensation levels for our executives will be at or above the median level of compensation paid to similarly

21

Table of Contents

situated executives of comparably-sized general industry companies. The Committee periodically reviews surveys of outside compensation practices provided by their compensation consultant in order to determine if our compensation levels and mix of components are competitive or might require rebalancing. The Committee does not benchmark any individual executive’s compensation level to the median or to certain amounts or percentages of compensation, but consistent with our emphasis on providing “pay for performance”, we generally expect our base salary and annual bonus opportunities to be at or below median levels, and our long-term incentive award opportunities to be above median. Of course, variations from these general expectations may occur based on the expertise and experience level of a given executive as well as individual, company and market factors.