Document

File No. 812- ______

UNITED STATES OF AMERICA

BEFORE THE

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

Application for an Order under Section 6(c) of the Investment Company Act of 1940 (the “Act”) for an exemption from Sections 2(a)(32), 5(a)(1) and 22(d) of the Act and Rule 22c-1 under the Act, under Sections 6(c) and 17(b) of the Act for an exemption from Sections 17(a)(1) and 17(a)(2) of the Act, and under Section 12(d)(1)(J) of the Act for an exemption from Sections 12(d)(1)(A) and 12(d)(1)(B) of the Act.

__________________

In the matter of

American Century ETF Trust

American Century Investment Management, Inc.

4500 Main Street

Kansas City, MO 64111

__________________

Please send all communications, notices and orders to:

|

|

Charles A. Etherington American Century Investment Management, Inc. 4500 Main Street Kansas City, MO 64111 |

Page 1 of 87 sequentially numbered pages (including exhibits)

As filed with the U.S. Securities and Exchange Commission on February 2, 2018

TABLE OF CONTENTS

|

| | |

I. INTRODUCTION | 3 |

|

A. SUMMARY OF REQUEST | 3 |

|

B. STANDARDS FOR RELIEF TO BE GRANTED BY THE COMMISSION | 5 |

|

II. THE APPLICANTS | 7 |

|

A. THE TRUST | 7 |

|

B. THE INITIAL ADVISER | 8 |

|

C. THE INITIAL DISTRIBUTOR | 8 |

|

III. OPERATION OF THE FUNDS | 8 |

|

A. CAPITAL STRUCTURE AND VOTING RIGHTS: BOOK-ENTRY | 9 |

|

B. ROLES AND RESPONSIBILITIES | 10 |

|

C. EXCHANGE LISTING | 13 |

|

D. SALES AND REDEMPTION OF SHARES | 14 |

|

E. TRANSACTION FEES | 19 |

|

F. OPERATIONAL FEES AND EXPENSES | 20 |

|

G. SHAREHOLDER TRANSACTION AND DISTRIBUTION EXPENSES | 21 |

|

H. SHAREHOLDER REPORTS | 21 |

|

I. SALES AND MARKETING MATERIALS | 21 |

|

J. LIKELY PURCHASERS OF SHARES | 22 |

|

K. DISCLOSURE DOCUMENTS | 23 |

|

L. AVAILABILITY OF INFORMATION REGARDING THE FUNDS | 24 |

|

M. ARBITRAGE | 27 |

|

IV. IN SUPPORT OF THE APPLICATION | 27 |

|

V. REQUEST FOR ORDER | 31 |

|

A. SECTIONS 2(a)(32) AND 5(a)(1) OF THE ACT | 32 |

|

B. SECTION 22(d) OF THE ACT AND RULE 22c-1 UNDER THE ACT | 33 |

|

C. SECTION 17(a)(1) AND (a)(2) OF THE ACT | 35 |

|

D. SECTION 12(d)(1) OF THE ACT | 38 |

|

E. DISCUSSION OF PRECEDENT | 43 |

|

VI. CONDITIONS OF THIS APPLICATION | 45 |

|

A. ACTIVELY-MANAGED EXCHANGE-TRADED FUND RELIEF | 45 |

|

B. SECTION 12(d)(1) RELIEF | 45 |

|

VII. NAMES AND ADDRESSES | 48 |

|

VIII. AUTHORIZATIONS AND SIGNATURES | 50 |

|

Exhibit A | 53 |

|

Exhibit B | 56 |

|

Exhibit C | 57 |

|

Exhibit D | 66 |

|

Exhibit E | 77 |

|

Exhibit F | 82 |

|

A.SUMMARY OF REQUEST

In this application (this “Application”), the undersigned applicants, American Century ETF Trust (the “Trust”), American Century Investment Management, Inc. (the “Initial Adviser”), and Foreside Fund Services, LLC (the “Initial Distributor,” and together with the Trust and the Initial Adviser, the “Applicants”)1, apply for and request an order of the U.S. Securities and Exchange Commission (“Commission”) under Section 6(c) of the Investment Company Act of 1940 (the “Act”), for an exemption from Sections 2(a)(32), 5(a)(1), and 22(d) of the Act and Rule 22c-1 under the Act, under Sections 6(c) and 17(b) of the Act for an exemption from Sections 17(a)(1) and 17(a)(2) of the Act, and under Section 12(d)(1)(J) of the Act for an exemption from Sections 12(d)(1)(A) and 12(d)(1)(B) of the Act (the “Order”).

The requested Order would permit Applicants to operate actively managed exchange-traded funds (“ETFs”). To a very large extent, the Fund (defined below) will operate in the same manner as existing ETFs. The primary difference between the Fund and other ETFs is that (1) the constituents of the Creation Basket (defined below) and the Funds’ portfolio securities will not be publically disclosed each day, and (2) in connection with the creation and redemption of Creation Units (defined below), the delivery or receipt of any portfolio securities in-kind will be required to be effected through a confidential brokerage account (“Confidential Account”) with an agent (“AP Representative”), for the benefit of an “Authorized Participant,” which is generally a DTC Participant (defined below) that has executed a “Participant Agreement” with the Distributor (defined below) with respect to the creation and redemption of Creation Units and formed a Confidential Account for its benefit in accordance with the terms of the Participant Agreement. For purposes of creations or redemptions, all transactions will be effected through that Confidential Account, for the benefit of the Authorized Participant without disclosing the identity of such securities to the Authorized Participant. Each AP Representative will be given, before the commencement of trading each Business Day (defined below), both the holdings of the Fund and their relative weightings for that day. This information will permit an Authorized Participant to instruct the AP Representative to buy and sell positions in the portfolio securities to permit creations or redemptions. By not publicly disclosing the constituents of the Creation Basket (defined below) or the portfolio securities each day, the Funds are designed to protect the proprietary investment strategies of each Fund’s Adviser (defined below). In lieu of daily portfolio transparency, the Funds will disclose other data to the marketplace designed to provide adequate information to market participants to permit an arbitrage mechanism that will keep the trading price of the Shares at or close to their net asset value per share (“NAV”). This will include providing, on one second intervals throughout the trading day, a verified intraday indicative value (“VIIV”), which will be subject to board approved procedures and the oversight of the Fund’s chief compliance officer. This VIIV will be equally available to all investors and shareholders.

In all other respects, Applicants believe the requested Order is similar to other orders that have been issued by the Commission approving the operation of ETFs. Specifically,

_________________________

1 All existing entities that currently intend to rely on the Order are named as Applicants. Any other existing entity or future entity that relies on the Order will comply with the terms and conditions of the Order.

the requested Order would apply to actively-managed series of the Trust and would permit, among other things:

| |

• | issuance by a Fund of shares (“Shares”) in specified aggregations of individual Shares (each such specified aggregation of Shares a “Creation Unit”) by Authorized Participants on any day at the NAV; |

| |

• | redemption of Shares in Creation Units by an Authorized Participant through a Confidential Account with a AP Representative for the Authorized Participant that is contractually restricted from disclosing the Creation Basket (defined below) and the portfolio securities of the Fund; |

| |

• | secondary market transactions in Shares to be effected at negotiated market prices rather than at NAV on a national securities exchange as defined in Section 2(a)(26) of the Act (“Exchange”), such as NYSE Arca, Inc. (“NYSE Arca”), Cboe BZX Exchange, Inc. (“BZX”), and The Nasdaq Stock Market, LLC (“Nasdaq”); |

| |

• | certain affiliated persons of the Funds to deposit securities into, and receive securities from, such Funds, in connection with the purchase and redemption of aggregations of Shares of such investment company; |

| |

• | registered management investment companies and unit investment trusts (“UITs”) registered under the Act that are not advised or sponsored by an Adviser (defined below), and not part of the same “group of investment companies,” as defined in Section 12(d)(1)(G)(ii) of the Act as the Funds (such registered management investment companies are referred to as “Acquiring Management Companies,” such UITs are referred to as “Acquiring Trusts,” and Acquiring Management Companies and Acquiring Trusts are collectively referred to as “Acquiring Funds”), to acquire Shares beyond the limits of Section 12(d)(1)(A) and (B) of the Act; and |

| |

• | the Funds, and any principal underwriter for the Funds, and/or any broker dealer (“Broker”) registered under the Securities Exchange Act of 1934, as amended (“Exchange Act”), to sell Shares to Acquiring Funds beyond the limits of Section 12(d)(1)(B) of the Act. |

Applicants request that the Order apply to the new series identified and described in Exhibit B hereto and mentioned in Section II.A below (the “Initial Fund”) and any additional series of the Trust, and any other open-end management investment company or series thereof that seeks to rely upon the relief requested herein (“Future Funds” and together with the Initial Fund, “Funds”) that (1) invest primarily in U.S. listed, exchange traded equity securities and (2) operate as ETFs. In seeking to achieve its investment objective, each Fund would utilize an “active” management strategy for security selection and portfolio construction.2 Any Future Fund will (a) be advised by the Initial Adviser or an entity controlling, controlled by, or under common control with the Initial Adviser (each such entity or any successor thereto, an “Adviser”) and (b) comply with the terms and conditions of this Application. These Funds are designed to deliver improved efficiencies and flexibilities relative to mutual funds for both portfolio managers and investors that potentially include:

| |

• | Cost savings related to the elimination or reduction of transfer agency fees and the associated account maintenance expenses; |

| |

• | An alternative structure to what is currently available for professional active management; |

| |

• | Improved tax efficiency through the reduction in capital gains associated with the in-kind transfer of securities from the Fund to Authorized Participants and the accompanying cost-basis step up; |

| |

• | Increased Adviser flexibility associated with the reduction of embedded capital gains; |

| |

• | Ability for Adviser to implement proprietary investment strategies with less concern about “free riding” or “front running” to the detriment of Fund shareholders by other investors and/or managers; |

| |

• | Reduction of “cash drag” to the Fund attributable to the in-kind creation process; |

| |

• | Possibility for access to professional managers not currently available to retail investors in an ETF; |

| |

• | Investors’ real-time access to actively managed funds through the ability to transact at negotiated prices intraday on Exchanges; |

| |

• | Simplification of investor choice through the elimination of multiple share classes and a single price point for access; and |

| |

• | The potential to list options on the ETF may provide investors with additional tools for controlling risk. |

B.STANDARDS FOR RELIEF TO BE GRANTED BY THE COMMISSION

Applicants believe that the availability of a VIIV throughout the day, the ability of Authorized Participants to purchase and redeem Creation Units on any Business Day, and, as with all existing ETFs, the ability of market participants, transacting through an Authorized Participant, to purchase

_________________________

2 In order to implement each Fund’s investment strategy, the Adviser and any Sub-Adviser(s) of a Fund may review and change the securities, instruments or other assets or positions held by the Fund daily.

and redeem Creation Units on any Business Day, will permit the intraday trading of Shares to be at or near the Funds’ NAV without the need for daily disclosure of the Funds’ portfolio securities.

Applicants also believe the proposed operation of the Funds will bring significant advantages to investors that wish to invest in actively-managed funds. These advantages, as highlighted above, include: (i) the ability to purchase or sell Shares at a self-determined, real-time, market price on an intraday basis, on an Exchange; (ii) lower operational costs because there will be no need to maintain shareholder accounts; and (iii) enhanced tax efficiency, which will also have a positive impact on yields.3 Applicants further believe that the proposed operational structure of the Funds will permit an Adviser to manage the Funds using proprietary investment strategies with significantly less susceptibility to “front running” and “free riding” by other investors and/or managers which could otherwise harm, and result in substantial costs to, the Funds.

In light of these advantages, Applicants believe that (i) with respect to the relief requested pursuant to Section 6(c), the requested exemption for the proposed transactions is appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Act; (ii) with respect to the relief requested pursuant to Section 17(b), the proposed transactions are reasonable and fair and do not involve overreaching on the part of any person concerned; the proposed transactions are consistent with the policies of each Fund and will be consistent with the investment objectives and policies of each Acquiring Fund; and that the proposed transactions are consistent with the general purposes of the Act; and (iii) with respect to the relief requested under Section 12(d)(1)(J) of the Act, the requested exemption is consistent with the public interest and the protection of investors. The legislative history of Section 12(d)(1)(J) indicates that when granting relief under Section 12(d)(1)(J), the Commission should consider, among other things, “the extent to which a proposed arrangement is subject to conditions that are designed to address conflicts of interest and overreaching by a participant in the arrangement, so that the abuses that gave rise to the initial adoption of the Act’s restrictions against investment companies investing in other investment companies are not repeated.”4 Applicants believe that the conditions for relief, described at length herein, adequately address the concerns underlying Sections 12(d)(1)(A) and 12(d)(1)(B) of the Act and that a grant of relief would be consistent with Section 12(d)(1)(J) of the Act.

The relief requested by Applicants with respect to Sections 2(a)(32), 5(a)(1), 17(a)(1), 17(a)(2), and 22(d) of the Act and Rule 22c-1 thereunder will be referred to herein as “ETF Relief” and the relief requested with respect to Sections 12(d)(1)(A), 12(d)(1)(B) and 17(a)

_________________________

3Applicants note that the Funds will operate with the same in-kind creation and redemption process that has provided tax efficiency for existing traditional ETFs. In a creation, for either a traditional ETF or a Fund, a pro rata slice of a Fund’s portfolio, beneficially owned by an Authorized Participant or its customer, is contributed to the Fund in-kind, in exchange for a Creation Unit of Shares. In a redemption, again for either a traditional ETF or a Fund, a Creation Unit of Shares, beneficially owned by an Authorized Participant or its customer, will be submitted for redemption in exchange for a pro rata slice of the Fund’s current portfolio, transferred in-kind to the Authorized Participant.

4H.R. Rep. No. 622, 104th Cong., 2d Sess., at 43-44 (1996).

of the Act will be referred to herein as “12(d)(1) Relief.” The ETF Relief and 12(d)(1) Relief collectively, will be referred to herein as the “Relief.”

Because of the unique operational structure of the Funds, this Application addresses how that structure would address both (1) the issues raised by the Commission with respect to other actively managed ETFs and the issues raised by the Commission in a public notice related to an earlier application filed by the Precidian ETFs Trust, Precidian Funds LLC and Foreside Fund Services, LLC with respect to certain other actively managed ETFs.5

No form having been specifically prescribed for this Application, Applicants proceed under Rule 0‑2 of the General Rules and Regulations promulgated by the Commission under the Act.

A.THE TRUST

The Trust is a statutory trust organized under the laws of Delaware. The Trust has registered under the Act with the Commission as an open-end management investment company with multiple series and is overseen by a Board of Trustees (the “Board”). The Board will maintain the composition requirements of Section 10 of the Act. The Trust offers and sells, or will offer and sell, its securities pursuant to a registration statement on Form N-1A filed with the Commission under the Act and the Securities Act of 1933, as amended (“Securities Act”). The Trust may create Funds, each of which will operate pursuant to the terms and conditions stated in the Application.

Each Fund will primarily invest (or, for long-short strategies, take short positions) in securities that are listed on Exchanges, including common stocks, preferred stocks, ADRs,6 real estate investment trusts, and shares of other exchange-traded products, including ETFs, commodity pools, metals trusts, currency trusts and exchange-traded notes.7 Nonetheless, each Fund may also hold repurchase agreements, reverse repurchase agreements, government securities, cash and cash equivalents. Each Fund will adopt fundamental policies consistent with the Act, which will be disclosed in each Fund’s registration statement. The Initial Fund intends to maintain the required level of diversification, and conduct its operations so as to meet the regulated investment company (“RIC”) diversification requirements under the Internal Revenue Code of 1986, as amended (the “Code”).8

_________________________

5 Precidian ETFs Trust, et al. Investment Company Act Release No. 31300 (October 21, 2014).

6ADRs are issued by a U.S. financial institution (a “depositary”) and evidence ownership in a security or pool of securities issued by a foreign issuer that have been deposited with the depositary. Each ADR is registered under the Securities Act on Form F-6. ADRs in which a Fund may invest will trade on an Exchange.

7Although the Funds may invest in securities of companies of any capitalization, the Funds do not intend to invest in small capitalization companies listed on the Nasdaq Capital Market.

8Applicants also reserve the right to create Funds that will not operate as RICs.

B.THE INITIAL ADVISER

The Initial Adviser is a Delaware corporation that is a registered investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”). The Initial Adviser, or another Adviser, will serve as investment adviser to the Funds (the “Adviser”). Prior to relying on the relief requested herein, each Adviser will be registered with the Commission as an investment adviser under Section 203 of the Advisers Act. Subject to approval by the Board, an Adviser serves or will serve as the investment adviser to the Funds. The Adviser to each Fund may enter into sub-advisory agreements with one or more investment advisers, each of which will serve as a sub-adviser to a Fund (each a “Sub-Adviser” and, collectively, “Sub-Advisers”), with the consent of the Board and any necessary shareholder consent. Any Sub-Adviser to a Fund will either be registered with the Commission as an investment adviser, or not subject to registration, under Section 203 of the Advisers Act.

C. THE INITIAL DISTRIBUTOR

The Initial Distributor for the Funds, a Delaware limited liability company with its principal office and place of business at 3 Canal Plaza, Portland, Maine 04101, is a broker-dealer registered under the Exchange Act. Applicants request that the Order requested herein apply to any future distributor of the Funds, which also would be a registered broker-dealer under the Exchange Act and would comply with the terms and conditions of this Application (the Initial Distributor or any future distributor, the “Distributor”). The Distributor will be the principal underwriter of the Creation Units for the Funds and will distribute Creation Units of Shares on an agency basis. The Distributor of any Fund may be an affiliated person of the Adviser and/or Sub-Advisers. No Distributor is, or will be, affiliated with any Exchange on which Shares are listed.

III. OPERATION OF THE FUNDS

The orders granted to permit the operation of index-based ETFs (the “Index-Based ETF Orders”),9 have involved investment companies with portfolio securities selected to

_________________________

9See, e.g., Parker Global Strategies, LLC, Investment Company Act Release No. 32595 (April 5, 2017); Tortoise Index Solutions, LLC, et al. Investment Company Act Release No. 32579 (March 28, 2017); PowerShares Exchange-Traded Fund Trust. et al., Investment Company Act Release No. 25985 (March 28, 2003) (the “PowerShares Order”); UBS Global Asset Management (US) Inc., et al., Investment Company Act Release No. 25767 (October 11, 2002) (the “UBS Order”); ETF Advisors Trust, et al., Investment Company Act Release No. 25759 (September 27, 2002); Nuveen Exchange-Traded Index Trust, et al., Investment Company Act Release No. 25451 (March 4, 2002); In the Matter of Vanguard Index Funds. et al., Investment Company Act Release No. 24789 (December 12, 2000), as subsequently amended (the “Vanguard Order”); Barclays Global Fund Advisors, et al., Investment Company Act Release No. 24451 (May 12, 2000); Barclays Global Fund Advisors, et al., Investment Company Act Release No. 24452 (May 12, 2000), as subsequently amended; Select Sector SPDR Trust, Investment Company Act Release No. 23534 (November 13, 1998), as subsequently amended; The Foreign Fund, Inc., et al., Investment Company Act Release No. 21803 (March 6, 1996), as subsequently amended (the “Foreign Order”); CountryBaskets Index Fund, Inc., et al., Investment Company Act Release No. 21802 (March 5, 1996) (the “CountryBaskets Order”). In the Matter of Nasdaq-100 Trust, et al., Investment Company Act Release No. 23702 (February 22, 1999) (the “Nasdaq-100 Order”); MidCap SPDR Trust Series 1, Investment Company Act Release No. 20844 (January 18, 1995) (the “MidCap SPDR Order”); SPDR Trust Series I, Investment Company Act Release No. 19055 (October 26, 1992) (the “SPDR Order”) and SuperTrust Trust for

correspond to the price and yield performance of a particular securities index. The orders granted to investment companies with respect to the operation of actively-managed ETFs (the “Actively-Managed ETF Orders”)10 have permitted ETFs to hold an actively-managed portfolio that is fully transparent to market participants.

The relief requested herein is similar to the relief granted in the Actively-Managed ETF Orders, except that (1) the Funds will not make their holdings publicly available on a daily basis;11 and (2) the Funds will disseminate a verified intra-day indicative value each second throughout the trading day, rather than an intra-day indicative value in 15 second intervals throughout the trading day. Because the Funds will not disclose their current portfolio on a daily basis, there is one additional material difference in the operation of the Funds compared to existing ETFs - in connection with the purchase or redemption of Creation Units, the delivery of any portfolio securities in-kind will generally be effected through a Confidential Account with an AP Representative for the benefit of the purchasing or redeeming Authorized Participant without disclosing the identity of such securities to the Authorized Participant.

| |

A. | CAPITAL STRUCTURE AND VOTING RIGHTS: BOOK-ENTRY |

Each shareholder will have one vote per Share with respect to matters regarding the Trust or the Fund for which a shareholder vote is required, consistent with the requirements of the Act, the rules promulgated thereunder, and state laws applicable to Delaware statutory trusts.

Shares will be registered in book-entry form only and the Funds will not issue Share certificates. The Depository Trust Company, a limited purpose trust company organized under the laws of the State of New York (“DTC”), or its nominee, will be the record or registered owner of all outstanding Shares. Beneficial ownership of Shares will be shown on the records of DTC or

_________________________

Capital Market Fund, Inc. Shares, et al., Investment Company Act Release No. 17809 (October 19, 1990) (the “SuperTrust Order”).

10Spinnaker ETF Trust, et al., Investment Company Act Release No. 32601 (April 18, 2017);Nuveen Fund Advisors, LLC, et al., Investment Company Act Release No. 31705 (July 6, 2015); ETF Securities Advisors LLC, et al., Investment Company Act Release No. 31340 (November 19, 2014); Pacific Investment Management Company LLC and PIMCO ETF Trust, Investment Company Act Release No. 28993 (November 10, 2009) (the “PIMCO Order”); Grail Advisors, LLC and Grail Advisors ETF Trust, Investment Company Act Release No. 28604 (January 16, 2009) (the “Grail Order”); First Trust Advisors L.P. First Trust Portfolios L.P. and First Trust Exchange-Traded Fund III, Investment Company Act Release No. 28468 (October 27, 2008); WisdomTree Trust, et al., Investment Company Act Release No. 28471 (October 27, 2008) (“WisdomTree Order II”); Barclays Global Fund Advisors, et al., Investment Company Act Release No. 28173 (February 27, 2008) (the “BGFA Order”); Bear Stearns Asset Management, Inc., et al., Investment Company Act Release No. 28172 (February 27, 2008) (the “Bear Stearns Order”); PowerShares Capital Management LLC, et al., Investment Company Act Release No. 28171 (February 27, 2008) (the “PowerShares Active Order”); and WisdomTree Trust, et al., Investment Company Act Release No. 28174 (February 27, 2008) (the “WisdomTree Order I”).

11Each service provider that has access to the identity and weightings of securities in a Fund’s Creation Basket (defined below) or portfolio securities, such as the Fund’s custodian or pricing verification agent, shall be restricted contractually from disclosing that information to any other person, or using that information for any purpose other than providing services to the Fund. See also infra note 12 and accompanying text (regarding contractual obligations on AP Representatives).

DTC participants (“DTC Participants”). Shareholders will exercise their rights in such securities indirectly through the DTC and DTC Participants. The references herein to owners or holders of such Shares shall reflect the rights of persons holding an interest in such securities as they may indirectly exercise such rights through the DTC and DTC Participants, except as otherwise specified. No shareholder shall have the right to receive a certificate representing Shares. Delivery of all notices, statements, shareholder reports and other communications will be at the Funds’ expense through the customary practices and facilities of the DTC and DTC Participants.

B. ROLES AND RESPONSIBILITIES

Applicants believe that to investors, the Funds will be indistinguishable from existing ETFs given all of the similarities. Each Fund will (1) be quoted and traded on an Exchange, (2) be supported by Authorized Participants and Non-Authorized Participant Market Makers (defined below) to help mitigate potential premiums and discounts, and (3) provide investors with access to diversification and professional asset management. Applicants believe that investors will enjoy many of the same benefits that traditional ETFs offer. The proposed structure will also require no changes to existing broker-dealer trading systems, national quotation systems, reporting, and risk-management systems. With the exception of the roles described below, the roles and responsibilities of the Fund’s service providers, Authorized Participants, retail investors, and others will, for the most part, be identical to existing traditional ETFs.

1. Confidential Account

Each Authorized Participant will establish and maintain, a Confidential Account with an AP Representative for the benefit of the Authorized Participant in order to engage in: in-kind creation and redemption activity. Pursuant to a contract (the “Confidential Account Agreement”), the AP Representative will be restricted from disclosing the Creation Basket (defined below) or the portfolio securities of a Fund. In addition, the AP Representative will undertake an obligation not to use the identity of the portfolio securities for any purpose other than facilitating creations and redemptions for a Fund.12 The Confidential Account will enable Authorized Participants to transact in the underlying basket securities through their AP Representatives, enabling them to engage in in-kind creation or redemption activity without knowing the identity of those securities. As with all existing ETFs, each Authorized Participant will also be required to enter into a Participant Agreement with the Distributor.

For reporting purposes, the books and records of the Confidential Account will be maintained by the AP Representative and provided or made available to the appropriate regulatory agency as required. The Confidential Account will be liquidated daily, so that the account holds

_________________________

12Each Fund will identify one or more entities to enter into a contractual arrangement with the Fund to serve as an AP Representative. In selecting entities to serve as AP Representatives, a Fund will obtain, both initially and each year thereafter, representations from the entity related to the confidentiality of the Fund’s Creation Basket and portfolio securities, the effectiveness of information barriers, and the adequacy of insider trading policies and procedures. In addition, as a broker-dealer, Section 15(g) of the Exchange Act requires the AP Representative to establish, maintain, and enforce written policies and procedures reasonably designed to prevent the misuse of material, nonpublic information by the AP Representative or any person associated with the AP Representative.

no positions at the end of day. The Confidential Account Agreement, like any account agreement, will be negotiated between the parties and should be similar in cost to other brokerage arrangements.

2. AP Representative

Each Authorized Participant will enter into an agreement with an AP Representative to open a Confidential Account, for the benefit of the Authorized Participant. The AP Representative will serve as an agent between a Fund and each Authorized Participant and act as a broker-dealer on behalf of the Authorized Participant. Each day, the Custodian (defined below) will transmit the Fund’s Creation Basket (defined below) to each AP Representative and, acting on execution instructions from an Authorized Participant, the AP Representative may purchase or sell the securities currently held in a Fund’s portfolio for purposes of effecting in-kind creation and redemption activity during the day. Authorized Participants are responsible for all order instructions and associated profit and loss.

In the case of a creation, the Authorized Participant would enter into an irrevocable creation order with the Fund and then direct the AP Representative to purchase the necessary basket of portfolio securities. The AP Representative would then purchase the necessary securities in the Confidential Account. In purchasing the necessary securities, the AP Representative would be required, by the terms of the Confidential Account Agreement, to obfuscate the purchase by use of tactics such as breaking the purchase into multiple purchases and transacting in multiple marketplaces. Once the necessary basket of securities has been acquired, the purchased securities held in the Confidential Account would be contributed in-kind to the Fund.

Similarly, in the case of a redemption, the Authorized Participant would enter into an irrevocable redemption order, and then immediately instruct the AP Representative to sell the underlying basket of securities that it will receive in the redemption. As with the purchase of securities, the AP Representative would be required to obfuscate the sale of the portfolio securities it will receive as redemption proceeds using similar tactics. The positions in the underlying portfolio securities sold from the Confidential Account would be covered by the in-kind redemption proceeds received by the Confidential Account from the Fund.

3. Authorized Participants

Authorized Participants have the ability to facilitate efficient market making in the Shares, as well as add and decrease liquidity through the creation and redemption process. An Authorized Participant is generally (a) either a “Participating Party” or a DTC Participant and (b) in each case must have executed a Participant Agreement with the Distributor and a Confidential Account Agreement with the AP Representative. The term “Participating Party” means a broker-dealer or other participant in the Clearing Process through the Continuous Net Settlement (“CNS”) System of the National Securities Clearing Corporation (“NSCC”), a clearing agency registered with the Commission.

4. Non-Authorized Participant Market Makers

As with Authorized Participants, Non-Authorized Participant Market Makers have the ability to facilitate efficient market making in the Shares. However, Non-Authorized Participant Market Makers will not have the ability to create or redeem shares directly with a Fund. Rather, if a Non-Authorized Participant Market Maker wishes to create shares in a Fund, it will have to do so through an Authorized Participant.

5. Pricing Verification Agent

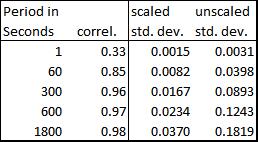

The Adviser, on behalf of each Fund, will employ a “Pricing Verification Agent,” who may also supply one or both of the two Calculation Engines (defined below), to compare for accuracy, in real-time, the indicative values being generated by the Calculation Engines. As the indicative values match, the Pricing Verification Agent will disseminate a VIIV every second during the regular trading day.

In the event that the prices from the Calculation Engines diverge by more than 25 basis points for 60 seconds, the Pricing Verification Agent will notify the Adviser of the Fund who will in turn request that the listing Exchange halt trading until such time as the prices come back in line. Applicants believe that a conservative threshold of 25 basis points,13 over a period of 60 seconds,14 strikes the right balance between the protection of investors from price distortions, and avoiding unnecessary disruptions to trading in order to ensure orderly markets.15

6. Independent Pricing Calculations

The Pricing Verification Agent, on behalf of each Fund, will utilize at least two separate calculation engines to calculate intra-day indicative values (“Calculation Engines”), based on the mid-point between the current national best bid and offer disseminated by the Consolidated Quotation System and UTP Plan Securities Information Processor,16 to provide the real-time value on a per share basis of each Fund’s holdings every second during regularly scheduled trading hours.17 The Custodian will provide, on a daily basis, the identities and quantities

_________________________

13For the period January 1, 2017, to October 31, 2017, the average bid/ask spread on actively managed equity ETFs traded on NYSE Arca, as a percentage, was 38 basis points. For the same period, the spread on all ETPs traded on NYSE Arca, as a percentage, was 54 basis points.

14While a 25 basis point deviation may not be material, a continuous deviation for sixty seconds could indicate an error in the feed or in a calculation engine.

15Applicants reserve the right to change these thresholds to the extent deemed appropriate and approved by a Fund’s Board.

16All SEC-registered exchanges and market centers send their trades and quotes to a central consolidator where the Consolidated Tape System (CTS) and Consolidated Quote System (CQS) data streams are produced and distributed worldwide. See https://www.ctaplan.com/index. Although there is only one source of market quotations, each Calculation Engine will receive the data directly and calculate an indicative value separately and independently from each other Calculation Engine.

17Applicants recognize that, for existing ETFs, professional traders at a broker-dealer, investment banker, or other institution can calculate their own indicative intraday value at fractions of a second. Applicants also recognize that most retail investors do not have the capability to make such calculations and so, for existing ETFs, those retail investors rely on the indicative intraday value disseminated every 15 seconds. Applicants believe that the

of portfolio securities that will form the basis for the Fund’s calculation of NAV at the end of the Business Day,18 plus any cash in the portfolio, to the Pricing Verification Agent for purposes of pricing.

It is anticipated that each Calculation Engine could be using some combination of different hardware, software and communications platforms to process the CQS data. Different hardware platforms’ operating systems could be receiving and calculating the CQS data inputs differently, potentially resulting in one Calculation Engine processing the indicative value in a different time slice than another Calculation Engine’s system, thus processing values in different sequences. The processing differences between different Calculation Engines are most likely in the sub-second range. Consequently, the frequency of occurrence of out of sequence values among different Calculation Engines due to differences in operating system environments should be minimal. Other factors that could result in sequencing that is not uniform among the different Calculation Engines are message gapping, internal system software design, and how the CQS data is transmitted to the Calculation Engine. While the expectation is that the separately calculated intraday indicative values will generally match, having dual streams of redundant data that must be compared by the Pricing Verification Agent will provide an additional check that the resulting VIIV is accurate.

7. Each Fund’s Calculation of VIIV

The Trust’s Board has a responsibility to oversee the process of calculating an accurate VIIV and to make an affirmative determination, at least annually, that the procedures used to calculate the VIIV and maintain its accuracy are, in its reasonable business judgment, appropriate. These procedures and their continued effectiveness will be subject to the ongoing oversight of the Fund’s chief compliance officer. The specific methodology for calculating the VIIV will be disclosed on each Fund’s website. While each Fund will oversee the calculation of the VIIV, a Fund will utilize multiple Calculation Engines, one of which may be supplied by the Pricing Verification Agent. The Fund will not be responsible, and will expressly disclaim liability,19 for errors in the VIIV resulting from errors, omissions or interruptions of data provided by the CQS.

C. EXCHANGE LISTING

_________________________

dissemination of VIIV at one second intervals strikes a balance of providing all investors with useable information at a rate that can be processed by retail investors, does not provide so much information so as to allow market participants to accurately determine the constituents, and their weightings, of the portfolio, can be accurately calculated and disseminated, and still provides professional traders with per second data. Applicants believe that dissemination of the VIIV at one second intervals levels the informational playing field between institutional and retail investors. This effectively creates a level of “value transparency” to all investors that is currently unavailable for existing ETFs.

18Under accounting procedures followed by the Funds, trades made on the prior Business Day (T) will be booked and reflected in the NAV on the current Business Day (T+1). Thus, the VIIV calculated throughout the day will be based on the same portfolio as is used to calculate the NAV on that day.

19Limitations on liability shall be fully disclosed in each Fund’s registration statement.

Shares will be listed on an Exchange and will be traded in the secondary market in the same manner as other equity securities and ETFs. Except as permitted by the relief requested from Section 17(a), no promoter, Distributor or affiliated person of the Fund or any affiliated person of such person will be an Authorized Participant or make a market in Shares. Neither the Adviser nor the Distributor nor any other affiliated person of the Fund, the Adviser, its promoter or principal underwriter will maintain a secondary market in Shares (other than Authorized Participants who may be “affiliates” of a Fund pursuant to Section 2(a)(3)(A) and Section 2(a)(3)(C) of the Act solely as a consequence of beneficial ownership of 5% or more of the Fund’s voting shares). It is expected that each Exchange will appoint one or more market maker to provide liquidity for the Shares.20 As long as the Funds operate in reliance on the requested Order, the Shares will be listed on the Exchange.

D. SALES AND REDEMPTION OF SHARES

1.Creation Orders

a.General

The issuance of Shares will operate in a manner substantially identical to that of the ETFs that are the subject of prior Commission orders. Shares of each Fund will be issued in Creation Units of 5,000 or more Shares. The Funds will offer and sell Creation Units through the Distributor on a continuous basis at the NAV next determined after receipt of an order in proper form. Subject to approval by the Board, it is anticipated that the NAV of each Fund will be determined as of the close of regular trading on the NYSE on each day that the NYSE is open. A “Business Day” is defined as any day that the Trust is open for business, including as required by Section 22(e) of the Act. The Funds will sell and redeem Creation Units only on Business Days. Applicants anticipate that the price of a Share will range from $20 to $75, and that the price of a Creation Unit will range from $100,000 to $375,000.21

In order to keep costs low and permit each Fund to be as fully invested as possible, Shares will be purchased and redeemed in Creation Units and generally on an in-kind basis.

_________________________

20If Shares are listed on NYSE Arca, Nasdaq, BZX, or a similar electronic Exchange, one or more member firms of that Exchange will act as a market maker (“Market Maker”) and maintain a market for Shares trading on that Exchange. On Nasdaq and BZX, no particular Market Maker would be contractually obligated to make a market in Shares. However, the listing requirements on both Nasdaq and BZX stipulate that at least two market makers must be registered in Shares to maintain a listing. In addition, registered market makers are required to make a continuous two-sided market or subject themselves to regulatory sanctions. No market maker will be an affiliated person, or second-tier affiliate, of the Funds, except within Section 2(a)(3)(A) or (C) of the Act due solely to ownership of Shares as described below.

21Applicants may engage in share splits and reverse splits in order to keep the price of Shares generally within this range. By keeping the price of a Share in this range, it will dampen the impact of volatility in the prices of the underlying portfolio securities in a Fund, which has the effect of making it almost impossible to determine, based on changes in market prices, what securities are being held in the Fund’s portfolio. Ricky Alyn Cooper, PhD, Precidian’s Proposed ETF and the Possibility of Reverse Engineering (July 2015) (Attached as Exhibit C). See also, Ricky Alyn Cooper, PhD, Additional Research on the Ability to Reverse Engineer the Proposed Precidian ETF (August 2015) (Attached as Exhibit E).

Accordingly, except where the purchase or redemption will include cash under the limited circumstances specified below, purchasers will be required to purchase Creation Units by making an in-kind deposit of specified instruments (“Deposit Instruments”), and shareholders redeeming their Shares will receive an in-kind transfer of specified instruments (“Redemption Instruments”).22 On any given Business Day, the names and quantities of the instruments that constitute the Deposit Instruments and the names and quantities of the instruments that constitute the Redemption Instruments will be identical, and these instruments may be referred to, in the case of either a purchase or a redemption, as the “Creation Basket.” In addition, the Creation Basket will correspond pro rata to the positions in the Fund’s portfolio (including cash positions),23 except:

(a) for minor differences when rounding is necessary to eliminate fractional shares or lots that are not tradable round lots;24 or

(b) short positions and other positions that cannot be transferred in-kind25 will be excluded from the Creation Basket.26

If there is a difference between the NAV attributable to a Creation Unit and the aggregate market value of the Creation Basket exchanged for the Creation Unit, the party conveying instruments with the lower value will also pay to the other an amount in cash equal to that difference (“Balancing Amount”). A difference may occur where the market value of the Creation Basket changes relative to the NAV of the Fund for the reasons identified in clauses (a) and (b) above.

Purchases and redemptions of Creation Units may be made in whole or in part on a cash basis, rather than in-kind, solely under the following circumstances:

(a) to the extent there is a Balancing Amount, as described above;

_________________________

22The Funds must comply with the federal securities laws in accepting Deposit Instruments and satisfying redemptions with Redemption Instruments, including that the Deposit Instruments and Redemption Instruments are sold in transactions that would be exempt from registration under the Securities Act. In accepting Deposit Instruments and satisfying redemptions with Redemption Instruments that are restricted securities eligible for resale pursuant to Rule 144A under the Securities Act, the Funds will comply with the conditions of Rule 144A.

23The portfolio used for this purpose will be the same portfolio used to calculate the Fund’s NAV per Share for that Business Day.

24A tradable round lot for a security will be the standard unit of trading in that particular type of security in its primary market.

25This includes instruments that can be transferred in-kind only with the consent of the original counterparty to the extent the Fund does not intend to seek such consents.

26Because these instruments will be excluded from the Creation Basket, their value will be reflected in the determination of the Balancing Amount (defined below).

(b) if, on a given Business Day, the Fund announces before the open of trading that all purchases, all redemptions or all purchases and redemptions on that day will be made entirely in cash;

(c) if, upon receiving a purchase or redemption order from an Authorized Participant, the Fund determines to require the purchase or redemption, as applicable, to be made entirely in cash;27

(d) if, on a given Business Day, the Fund requires all Authorized Participants purchasing or redeeming Shares on that day to deposit or receive (as applicable) cash in lieu of some or all of the Deposit Instruments or Redemption Instruments, respectively, solely because such instruments are not eligible for transfer through either the NSCC Process or DTC Process (each as defined below); or

(e) if the Fund permits an Authorized Participant to deposit or receive (as applicable) cash in lieu of some or all of the Deposit Instruments or Redemption Instruments, respectively, solely because: (i) such instruments are, in the case of the purchase of a Creation Unit, not available in sufficient quantity; or (ii) such instruments are not eligible for trading by an Authorized Participant or the investor on whose behalf the Authorized Participant is acting.28

The primary difference for the Funds, compared to the ETFs that are the subject of prior Commission orders, is that each Authorized Participant will be required to enter into a Confidential Account with an AP Representative and transact with each Fund through that Confidential Account.29 Therefore, before the commencement of trading on each Business Day, the AP Representative of each Authorized Participant will be provided, on a confidential basis, with a list of the names and quantities of the instruments comprising a Creation Basket, as well as the estimated Balancing Amount (if any), for that day. Each Creation Basket will apply until a new Creation Basket is provided on the following Business Day, and there will be no intra-day changes to a Creation Basket except to correct errors in that day’s Creation Basket. The instruments and cash that the purchaser is required to deliver in exchange for the Creation Units it is purchasing, as described in this Section III.D.1, may be referred to as the “Portfolio Deposit.”

b.Settlement Process

_________________________

27In determining whether a particular Fund will sell or redeem Creation Units entirely on a cash or in-kind basis, whether for a given day or a given order, the key consideration will be the benefit that would accrue to the Fund and its investors. Applicants do not currently anticipate the need to sell or redeem Creation Units entirely on a cash basis.

28A “custom order” is any purchase or redemption of Shares made in whole or in part on a cash basis in reliance on clause (e)(i) or (e)(ii).

29Transacting through a Confidential Account is fundamentally no different than transacting through any broker-dealer account, except that the AP Representative will be bound to keep the names and weights of the portfolio securities confidential.

All orders to purchase Creation Units must be placed with the Trust’s transfer agent (the “Transfer Agent”) or the Distributor by or through an Authorized Participant. Authorized Participants may be, but are not required to be, members of an Exchange. Investors may obtain a list of Authorized Participants from the Distributor. If an Authorized Participant places an order to purchase a Creation Unit, it will instruct the AP Representative to purchase securities comprising a Creation Basket for its Confidential Account and deliver those portfolio securities, as part of the Portfolio Deposit, to the Fund in-kind. Purchase orders must be in multiples of Creation Units. Purchase orders will be processed either through a manual clearing process or through an enhanced clearing process. The enhanced clearing process is available only to those DTC Participants that also are participants in the CNS System of the NSCC. The NSCC/CNS system has been enhanced specifically to effect purchases and redemptions of exchange-traded investment company securities, such as Creation Units of Shares. The enhanced clearing process (“NSCC Process”) simplifies the process of transferring a basket of securities between two parties by treating all of the securities that comprise the basket as a single unit. By contrast, the manual clearing process (“DTC Process”) involves a manual line-by-line movement of each securities position. Because the DTC Process involves the movement of hundreds of securities, while the NSCC Process involves the movement of one unitary basket, DTC will charge a Fund more than NSCC to settle a purchase or redemption of Creation Units.

All orders to purchase Creation Units, whether through the NSCC Process or the DTC Process, must be received by the Distributor no later than the scheduled closing time of the regular trading session on the NYSE (ordinarily 4:00 p.m. ET) (“Order Cut-Off Time”) when NAV is next computed by the Fund (“Transmittal Date”) in order for the purchaser to receive the NAV determined on the Transmittal Date. In the case of custom orders, the order must be received by the Distributor, no later than 3:00 p.m. ET, or such earlier time as may be designated by the Funds and disclosed to Authorized Participants. The Distributor will maintain a record of Creation Unit purchases and will send out confirmations of such purchases.

The Distributor will transmit all purchase orders to the relevant Fund. The Fund may reject any order that is not in proper form. In addition, a Fund, the Distributor or their agents on behalf of the Fund may reject any purchase order, if:

| |

• | the purchaser or group of related purchasers, upon obtaining the Shares so ordered, would own 80% or more of the outstanding Shares of a Fund; |

| |

• | the acceptance of the Creation Basket would have certain adverse tax consequences, such as causing the Fund to no longer meet the requirements of a RIC under the Code; |

| |

• | the acceptance of the purchase order would, in the opinion of the Trust, be unlawful; |

| |

• | the acceptance of the purchase order would otherwise, in the discretion of the Fund or the Adviser, have an adverse effect on the Fund or the shareholders of the Fund; or |

| |

• | there exist circumstances outside the control of the Fund that make it impossible to process purchases of Shares for all practical purposes. Examples of such circumstances include: acts of God or public service or utility problems such as fires, floods, extreme weather conditions and power outages resulting in telephone, telecopy and computer failures; market conditions or activities causing trading halts; systems failures involving computer or other information systems affecting the Fund, the Adviser, the Transfer Agent, the custodian to the Funds (the “Custodian”), the Distributor, DTC or any other participant in the purchase process, and similar extraordinary events. |

After a Fund has accepted a purchase order and received delivery of the Deposit Instruments and any cash payment, NSCC or DTC, as the case may be, will instruct the Fund to initiate “delivery” of the appropriate number of Shares to the book-entry account specified by the purchaser. The Distributor will furnish a Prospectus and a confirmation order to those Authorized Participants placing purchase orders.

2. Redemption

Just as Shares can be purchased from a Fund only in Creation Unit size aggregations, such Shares similarly may be redeemed only if tendered in Creation Units (except in the event a Fund is liquidated). To redeem, an investor must accumulate enough Shares to constitute a Creation Unit. Redemption requests must be placed by or through an Authorized Participant. As required by law, redemption requests in good order will receive the NAV next determined after the request is received in proper form.30 As with purchases, redemptions of Shares may be made either through the NSCC Process or through the DTC Process.

Redemptions of Creation Units for cash will occur as described above in Section III.D.1.a. through procedures that are analogous (in reverse) to those for purchases. All requests for redemption must be preceded or accompanied by an irrevocable commitment to deliver the requisite number of Shares of the relevant Fund, which delivery must be made to the Trust through, or outside, the NSCC Process, according to the procedures set forth in the Participant Agreement. Transmission of cash amounts, including the Transaction Fee, must be accomplished in a manner acceptable to the Trust and as specified in the Participant Agreement. An entity redeeming Shares in Creation Units outside the NSCC Process or entirely in cash may be required to pay a higher Transaction Fee than would have been charged had the redemption been effected through the NSCC Process.

Redemptions will occur primarily in-kind, although the AP Representative of an Authorized Participant may request to substitute cash for one or more positions and short positions will generally be settled in cash.31 The Participant Agreement signed by each Authorized

_________________________

30Consistent with the provisions of Section 22(e) of the Act and Rule 22e-2 under the Act, the right to redeem will not be suspended, nor payment upon redemption delayed, except as provided by Section 22(e) of the Act.

31It is anticipated that any portion of a Fund’s NAV attributable to short positions will be settled in cash, as securities sold short are not susceptible to in-kind settlement.

Participant will require establishment of a Confidential Account to receive distributions of Redemption Instruments in-kind upon redemption.32 The terms of the Confidential Account Agreement will provide that the AP Representative will not disclose, directly or indirectly, the identity of the Portfolio Deposit, the Redemption Instruments, or any other identifying information regarding the portfolio securities of a Fund, except as required by law.

After receipt of a redemption order, the Fund will instruct its Custodian to deliver the Redemption Instruments to the appropriate Confidential Account. In order to sell the Redemption Instruments, on that same day, the Authorized Participant will give the AP Representative instructions, that same day, to liquidate those securities. The AP Representative will then deliver the liquidation proceeds net of expenses, plus or minus any Cash Adjustment, to the Authorized Participant.33

3. Pricing of Shares

The secondary market price of Shares trading on an Exchange will be based on a current bid/ask market. The secondary market price of Shares of any Fund, like the price of all traded securities, is subject to factors such as supply and demand, as well as the current value of the portfolio securities held by a Fund. Shares available for purchase or sale on an intraday basis on an Exchange do not have a fixed relationship to the previous day’s NAV or the current day’s NAV. Therefore, prices on an Exchange may be below, at, or above the most recently calculated NAV of such Shares. The price at which Shares trade will be impacted by arbitrage opportunities created by the ability to purchase or redeem Creation Units at the current NAV, which is designed to ensure that Shares will not trade at a material premium or discount in relation to NAV. Applicants believe, because Authorized Participants and other market participants will have access to information that will permit them to determine when a Fund is trading at a price materially different from the current NAV, Shares will trade at prices that reflect the current value of the portfolio as with other ETFs.

No secondary sales will be made to broker-dealers at a concession by the Distributor or by a Fund. Transactions involving the sale of Shares on an Exchange will be subject to customary brokerage fees or commissions and charges.

_________________________

32The terms of the Confidential Account will be set forth as an exhibit to the Participant Agreement, which will be signed by each Authorized Participant. The Authorized Participant will be free to choose an AP Representative for its Confidential Account from a list of banks and trust companies that have signed confidentiality agreements with the Trust. The Authorized Participant will be free to negotiate account fees and brokerage charges with its selected AP Representative. The Authorized Participant will be responsible to pay all fees and expenses charged by the AP Representative of its Confidential Account.

33All income, gain or loss realized by a Confidential Account will be directly attributed to the Authorized Participant for that Confidential Account. In a redemption, the Authorized Participant will have a basis in the distributed securities equal to the fair market value at the time of the distribution and any gain or loss realized on the sale of those Shares will be taxable income to the Authorized Participant.

Applicants believe that the existence of a continuous trading market on an Exchange for Shares, together with the publication by the Exchange of the current VIIV of the Funds as described below, will be a key feature of the Trust.

E. TRANSACTION FEES

Each Fund may recoup the settlement costs charged by NSCC and DTC by imposing a “Transaction Fee” on Authorized Participants who purchase or redeem Creation Units. For this reason, Authorized Participants purchasing or redeeming Shares through the DTC Process generally will pay a higher Transaction Fee than will investors doing so through the NSCC Process. The Transaction Fee will be borne only by purchasers and redeemers of Creation Units and will be limited to amounts that have been determined appropriate by the Adviser to defray the transaction expenses that will be incurred by a Fund when an investor purchases or redeems Creation Units. Transaction Fees will be limited to amounts that have been determined by the Adviser to be appropriate and will take into account transaction costs associated with the relevant purchase and redemption of Creation Units. The purpose of the Transaction Fee is to protect the existing shareholders of the Funds from the dilutive costs associated with the purchase and redemption of Creation Units. Transaction Fees will differ for each Fund, depending on the transaction expenses related to each Fund’s portfolio securities. Where a Fund permits an in-kind purchaser or redeemer to deposit or receive cash in lieu of one or more Deposit Instruments or Redemption Instruments, the purchaser or redeemer may be assessed a higher Transaction Fee to offset the cost of buying or selling those particular Deposit Instruments or Redemption Instruments.

From time to time and for such periods as the Adviser in its sole discretion may determine, the Transaction Fees for the purchase or redemption of Shares may be increased, decreased, waived, or otherwise modified, not to exceed amounts approved by the Board. In all cases, such Transaction Fees will be limited in accordance with then-existing requirements of the Commission applicable to management investment companies offering redeemable securities.

F. OPERATIONAL FEES AND EXPENSES

All expenses incurred in the operation of the Funds will be borne by the Trusts and allocated among the Trust’s various Funds, except to the extent specifically assumed by the Adviser, or Sub-Adviser(s), if any, the Fund’s administrator or sub-administrator(s), if any, or some other party. Operational fees and expenses incurred by the Trusts that are directly attributable to a specific Fund will be allocated and charged to that Fund. Such expenses may include, but will not be limited to, the following: investment advisory fees, fund accounting and administration fees, custody fees, brokerage commissions, registration fees of the Commission, Exchange listing fees, fees of the securities lending agent, if any, and other costs properly payable by each Fund. Common expenses and expenses that are not readily attributable to a specific Fund will be allocated on a pro rata basis or in such other manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of each Fund. Such expenses may include, but will not be limited to, the following: fees and expenses of the Trustees of the Fund who are not “interested persons” (as defined in Section 2(a)(19) of the Act) of the Trust

(“Independent Trustees”),34 legal and audit fees, administration and accounting fees, costs of preparing, printing and mailing statements of additional information (“SAIs”), semi-annual and annual reports, proxy statements and other documents required for regulatory purposes and for distribution to existing shareholders, transfer agent fees and insurance premiums. All operational fees and expenses incurred by the Trust will be accrued and allocated to each respective Fund on a daily basis, except to the extent expenses are specifically assumed by the Adviser or another party. The Transfer Agent and Custodian will provide certain administrative, fund accounting, transfer agent and custodial services to each Fund for aggregate fees based on a percentage of the average daily net assets of the respective Fund or other basis, out of which they will be expected to pay any fees to sub-transfer agents or sub-custodians, if any. The Adviser, the Transfer Agent, the dividend disbursing agent, the Custodian or any other service provider for the Funds may agree to cap expenses or to make full or partial fee waivers for a specified or indefinite period of time with respect to one or more of the Funds.

G. SHAREHOLDER TRANSACTION AND DISTRIBUTION EXPENSES

No sales charges for purchases of Shares of any Fund will be imposed.35 As indicated above, each Fund may charge a Transaction Fee in connection with the purchase and redemption of Creation Units of its Shares.36

H. SHAREHOLDER REPORTS

With each distribution, the Trust will furnish to the DTC Participants for distribution to beneficial owners of Shares of each Fund a statement setting forth the amount being distributed, expressed as a dollar amount per Share. Beneficial owners also will receive annually notification as to the tax status of the Fund’s distributions.

As required under applicable rules and regulations, after the end of each fiscal year, the Trust will furnish to the DTC Participants, for distribution to each person who was a beneficial owner of Shares at the end of the fiscal year, an annual report of the Trust containing financial statements audited by independent accountants of nationally recognized standing and such other information as may be required by applicable laws, rules and regulations. Copies of annual and semi-annual shareholder reports will also be provided to the DTC Participants for distribution to beneficial owners of Shares.

_________________________

34For ease of reference, throughout this Application, the term “Independent Trustees” will be used with respect to investment companies that are organized as trusts or corporations.

35Each Fund may, however, implement a distribution plan pursuant to Rule 12b-1 under the Act.

36Investors purchasing and selling Shares in the secondary market may incur customary brokerage commissions.

I. SALES AND MARKETING MATERIALS

Applicants will take such steps as may be necessary to avoid confusion in the public’s mind between the Trust and its Funds and a traditional “open-end investment company” or “mutual fund.”

The Trust will not be advertised or marketed or otherwise “held out” as a traditional open-end investment company or a mutual fund. To that end, the designation of the Trust and the Funds in all marketing materials will be limited to the terms “actively-managed exchange-traded fund,” “investment company,” “fund” and “trust” without reference to an “open-end fund” or a “mutual fund,” except to compare and contrast the Trust and the Funds with traditional mutual funds. All marketing materials that describe the features or method of obtaining, buying or selling Creation Units, or Shares traded on an Exchange, or that refer to redeemability, will prominently disclose that Shares are not individually redeemable shares and will disclose that the owners of Shares may acquire those Shares from the Fund, or tender those Shares for redemption to the Fund, in Creation Units only.

Each Fund will prominently disclose in its prospectus and on its website that, unlike other actively managed ETFs, the Fund does not disclose its portfolio holdings each day, but instead publishes a VIIV each second during normal trading hours of the NYSE. Each Fund will describe in plain English where an investor can get access to the VIIV, that the methodology for calculating the VIIV is available on the Fund’s web site, and that the VIIV is intended to provide investors and other market participants with a highly correlated per share value of the underlying portfolio that can be compared to the current market price. Each Fund will further disclose that, (1) although the VIIV is intended to provide investors with enough information to allow for an effective arbitrage mechanism that will keep the market price of the Fund at or close to the underlying NAV of the Fund, there is a risk that market prices will vary significantly from the underlying NAV of the Fund; (2) ETFs trading on the basis of a published VIIV is new, and there is a risk that Shares may trade at a wider bid/ask spread than other ETFs, (3) market participants may attempt to use the VIIV to calculate with a high degree of certainty (“reverse engineer”) a Fund’s trading strategy, which if successful, could increase opportunities for certain predatory trading practices, such as front-running, that may have the potential to harm Fund shareholders; and (4) the Funds are new, and there is a risk that the Funds might perform differently than other ETFs during periods of market disruption.37

J. LIKELY PURCHASERS OF SHARES

Applicants expect that there will be several categories of market participants who will be interested in purchasing Creation Units of the Funds. One is the institutional investor that desires to keep a portion of its portfolio invested in a professionally managed, diversified portfolio of securities and finds the Shares a cost effective means to do so. The other likely institutional

_________________________

37Once a Fund has been in continuous operation for a period of three years, Applicants may reconsider the appropriateness of such risk disclosure. To that end, Applicants reserve the right to revise or remove such risk disclosure to the extent that such action is deemed appropriate and approved by a Fund’s Board.

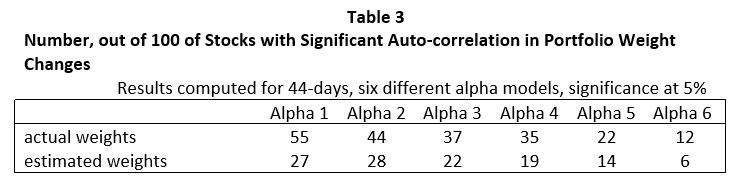

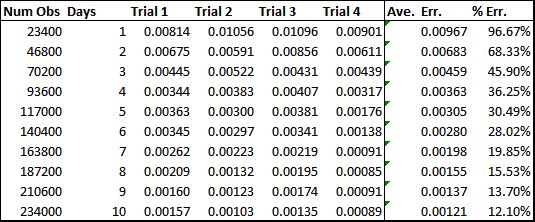

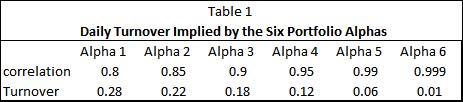

investor is the arbitrageur, who stands ready to take advantage of any slight premium or discount in the market price of Shares of a Fund on an Exchange versus the aggregate value of the portfolio securities held by such Fund. Applicants do not expect that arbitrageurs will hold positions in Shares for any length of time unless the positions are appropriately hedged. Applicants believe that arbitrageurs will purchase or redeem Creation Units of a Fund in pursuit of arbitrage profit, and in so doing will enhance the liquidity of the secondary market as well as keep the market price of Shares close to their NAV. Institutional investors may also wish to purchase or redeem Creation Units of a Fund to take advantage of the potential arbitrage opportunities in much the same manner as arbitrageurs. Because arbitrageurs are expected to be able to construct a very good hedge portfolio for any position they take in Shares,38 and evaluate profit and loss on their position, Applicants believe that there will be Authorized Participants and Non-Authorized Participant Market Makers that will seek to make a market in Shares.39 Applicants also believe that market makers and other liquidity providers will employ risk-management techniques such as “statistical arbitrage,” including correlation hedging, beta hedging, and dispersion trading,40 which is currently used throughout the financial services industry, to make efficient markets in exchange-traded products.

In the above examples, purchasers of Shares in Creation Units may hold such Shares or sell them into the secondary market. Applicants expect that secondary market purchasers of Shares will include both institutional investors and retail investors for whom such Shares provide a useful, retail-priced, exchange-traded mechanism for investing in securities. Applicants believe that investors will value the ability to transact in shares of a professionally managed portfolio of securities, at a self-determined, real-time market price, rather than at an uncertain price determined at the market close, as is currently the standard for mutual funds.

_________________________

38Given the one second VIIV, a sophisticated regression analysis allows for “the construction of very good hedge portfolios.” Lawrence R. Glosten, PhD, Analysis of the Ability to determine the Portfolio Underlying an Actively Managed ETF (June 2017)(Attached as Exhibit F);

39Examples of typical ETF strategies that may be employed by Authorized Participants and Non-Authorized Participant Market Makers with respect to the Funds include, but are no way limited to, spread trading, pairs trading, statistical arbitrage, bona fide arbitrage, cash equitization, alpha generation, momentum trading and dispersion trading among others. Consequently, Applicants believe that the universe of potential Authorized Participants and Non-Authorized Participant Market Makers will be sufficient to support the Funds.

40Statistical arbitrage enables a trader to construct an accurate proxy for another instrument, allowing it to hedge the other instrument or buy or sell the instrument when it is cheap or expensive in relation to the proxy. Statistical analysis permits traders to discover correlations based purely on trading data without regard to other fundamental drivers. These correlations are a function of differentials, over time, between one instrument or group of instruments and one or more other instruments. Once the nature of these price deviations have been quantified, a universe of securities is searched in an effort to, in the case of a hedging strategy, minimize the differential. Once a suitable hedging proxy has been identified, a trader can minimize portfolio risk by executing the hedging basket. The trader then can monitor the performance of this hedge throughout the trade period making correction where warranted. In the case of correlation hedging, the analysis seeks to find a proxy that matches the pricing behavior of the Fund. In the case of beta hedging, the analysis seeks to determine the relationship between the price movement over time of the Fund and that of another stock.

K. DISCLOSURE DOCUMENTS

Section 5(b)(2) of the Securities Act makes it unlawful to carry or cause to be carried through interstate commerce any security for the purpose of sale or delivery after sale unless accompanied or preceded by a statutory prospectus. Although Section 4(a)(3) of the Securities Act excepts certain transactions by dealers from the provisions of Section 5 of the Securities Act,41 Section 24(d) of the Act disallows such exemption for transactions in redeemable securities issued by a unit investment trust or an open-end management company if any other security of the same class is currently being offered or sold by the issuer or by or through an underwriter in a public distribution. Applicants also note that Section 24(d) of the Act provides that the exemption provided by Section 4(a)(3) of the Securities Act shall not apply to any transaction in a redeemable security issued by an open-end management investment company.

Because Creation Units will be redeemable, will be issued by an open-end management company and will be continually in distribution, the above provisions require the delivery of a statutory or summary prospectus prior to or at the time of the confirmation of each secondary market sale involving a dealer.

The Distributor will coordinate the distribution of Prospectuses to broker-dealers. It will be the responsibility of the broker-dealers to ensure that a Prospectus is provided for every secondary market purchase of Shares.42

L. AVAILABILITY OF INFORMATION REGARDING THE FUNDS

1.Information on Each Fund’s Website

Each Fund’s website (“Website”), which will be publicly available before the offering of Shares, will include the Fund’s Prospectus, SAI, and summary prospectus, if used, and after the offering of Shares commences, additional quantitative information that is updated on a daily basis, including, for each Fund, the prior Business Day’s NAV and the market closing price or mid-point of the bid/ask spread at the time of calculation of such NAV (“Bid/Ask Price”), and a calculation of the premium or discount of the market closing price or Bid/Ask Price against such NAV. The Website and information will be publicly available at no charge.

_________________________

41Applicants note that Prospectus delivery is not required in certain instances, including purchases of Shares by an investor who has previously been delivered a Prospectus (until such Prospectus is supplemented or otherwise updated) and unsolicited brokers’ transactions in Shares (pursuant to Section 4(4) of the Securities Act). Also, firms that do incur a Prospectus-delivery obligation with respect to Shares will be reminded that under Securities Act Rule 153, a Prospectus-delivery obligation under Section 5(b)(2) of the Securities Act owed to a member of an Exchange in connection with a Sale on such Exchange, is satisfied by the fact that the Prospectus and SAI (as defined below) are available at such Exchange upon request.

42To the extent that a Fund is using a summary prospectus pursuant to Rule 498 under the Securities Act, the summary prospectus may be used to meet the prospectus delivery requirements.

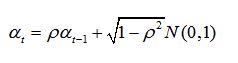

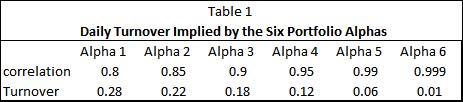

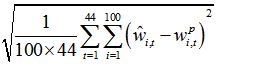

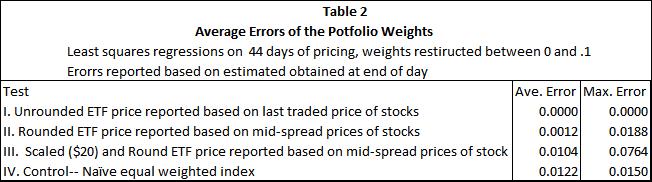

2.Verified Intraday Indicative Value