UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800, Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Susan McWhan Tobin, Esq.

Natixis Distribution, LLC

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2139

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

| (a) | The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

| Loomis Sayles High Income Fund |

| Loomis Sayles Investment Grade Bond Fund |

| Loomis Sayles Strategic Alpha Fund |

| Loomis Sayles Strategic Income Fund |

| 1 | |

| 21 | |

| 71 | |

| 94 |

| Managers |

| Matthew J. Eagan,

CFA® |

| Brian P.

Kennedy |

| Peter S. Sheehan* |

| Elaine M.

Stokes** |

| Todd P. Vandam,

CFA® |

| Loomis, Sayles & Company, L.P. |

| Symbols | |

| Class A |

NEFHX |

| Class C |

NEHCX |

| Class N |

LSHNX |

| Class Y |

NEHYX |

| * |

Effective June 30, 2023, Peter S. Sheehan serves as portfolio manager of the Fund. |

| ** |

Effective December 31, 2023, Elaine M. Stokes no longer serves as portfolio manager of the Fund. |

Investment Goal

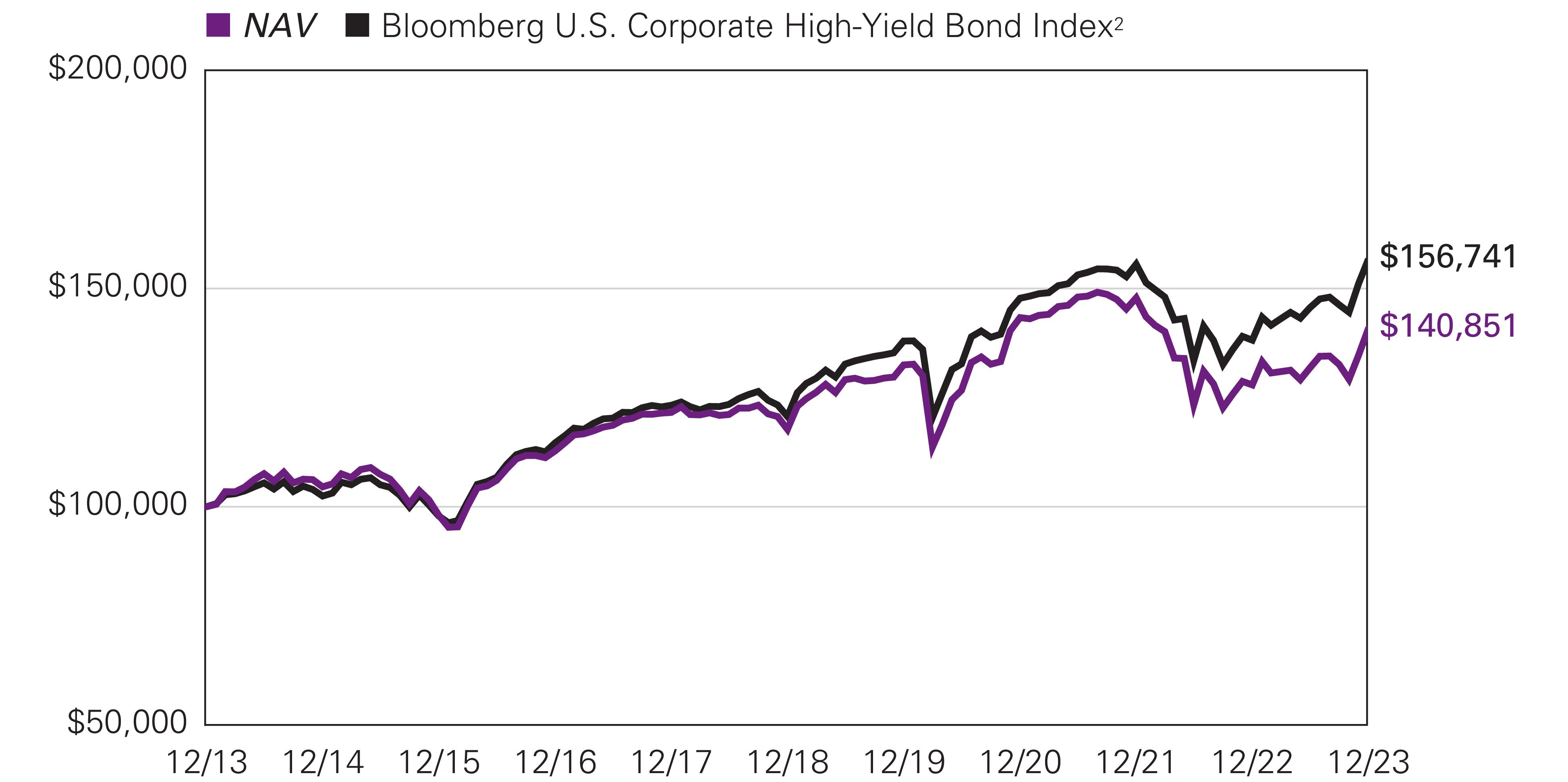

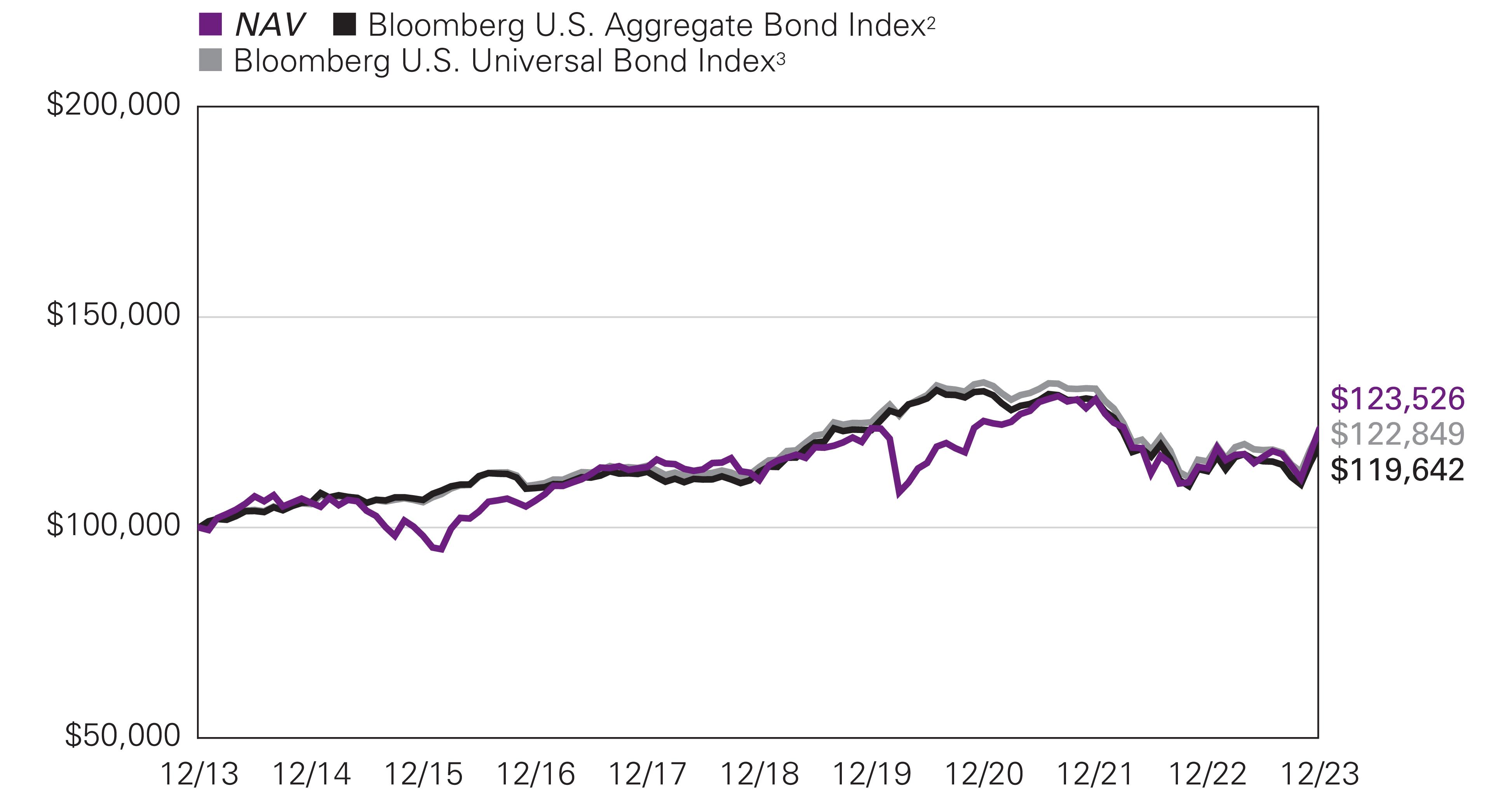

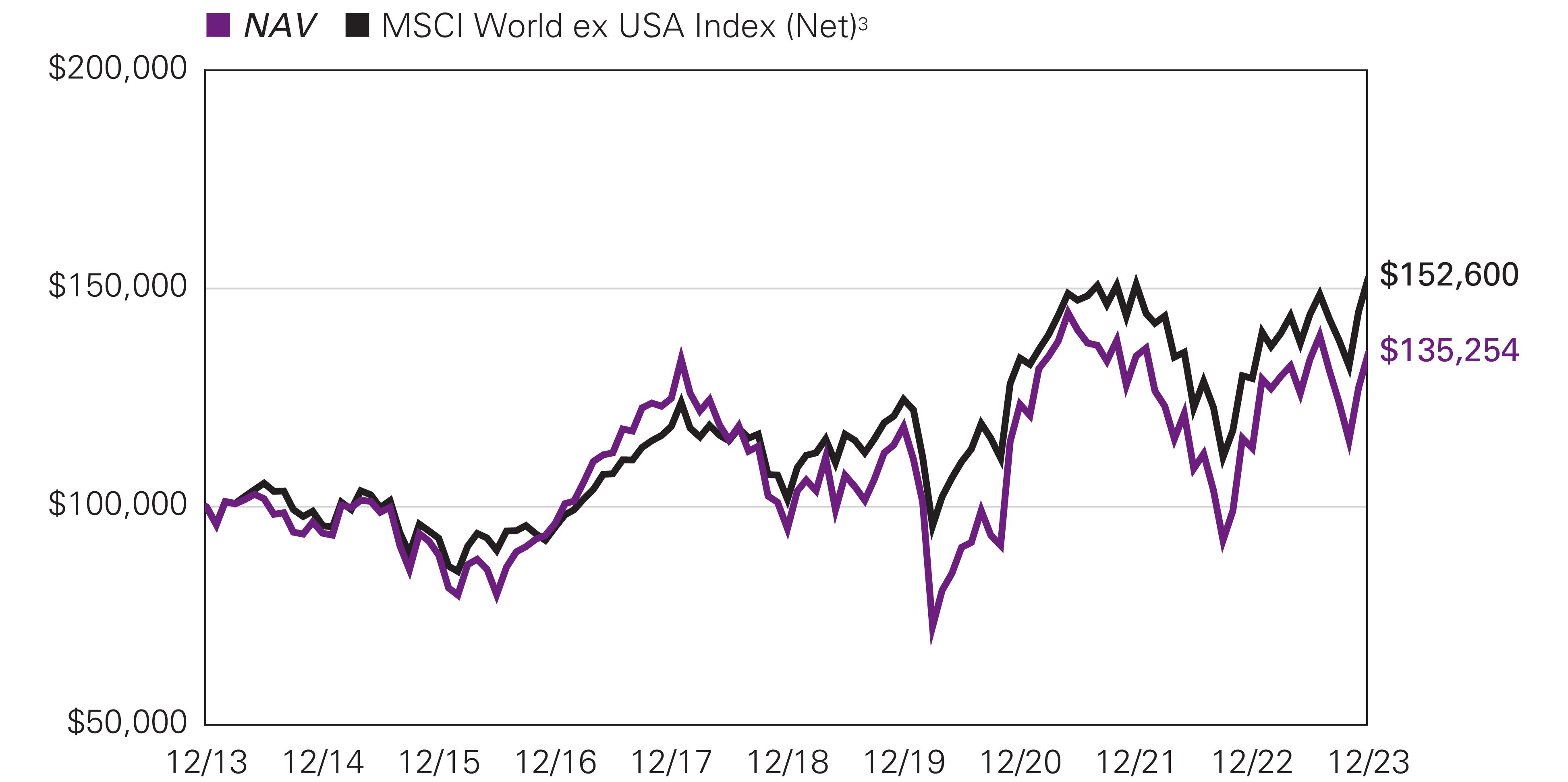

| Hypothetical Growth of $100,000 Investment in Class Y

Shares1 |

| December

31, 2013 through December 31, 2023 |

| |

1 Year |

5 Years |

10 Years |

Life of

Class N |

Expense Ratios3 | |

| |

Gross |

Net | ||||

| Class Y |

|

|

|

|

|

|

| NAV |

10.13 % |

3.65 % |

3.48 % |

— % |

0.89 % |

0.71 % |

| Class A |

|

|

|

|

|

|

| NAV |

9.53 |

3.33 |

3.18 |

— |

1.14 |

0.96 |

| With 4.25% Maximum Sales Charge |

4.74 |

2.42 |

2.72 |

— |

|

|

| Class C |

|

|

|

|

|

|

| NAV |

8.94 |

2.58 |

2.57 |

— |

1.89 |

1.71 |

| With CDSC4

|

7.94 |

2.58 |

2.57 |

— |

|

|

| Class N (Inception 11/30/16) |

|

|

|

|

|

|

| NAV |

9.85 |

3.64 |

— |

3.42 |

1.76 |

0.66 |

| Comparative Performance |

|

|

|

|

|

|

| Bloomberg U.S. Corporate High-Yield Bond

Index2 |

13.44 |

5.37 |

4.60 |

4.77 |

|

|

| 1 |

Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 2 |

Bloomberg U.S. Corporate High-Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities

are classified as high yield if the middle rating of Moody’s, Fitch, and

S&P is Ba1/BB+/BB+ or below, excluding emerging market debt. Bloomberg U.S. Corporate

High- Yield Bond Index was created in 1986, with history backfilled to July 1,

1983, and rolls up into the Bloomberg U.S. Universal and Global High-Yield Indices. |

| 3 |

Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in

the Financial Highlights section of this report under Ratios to Average Net

Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/25. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about

the Fund’s expense limitations. |

| 4 |

Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and

includes automatic conversion to Class A shares after eight years.

|

| Managers |

| Matthew J. Eagan,

CFA® |

| Brian P.

Kennedy |

| Elaine M.

Stokes* |

| Loomis, Sayles & Company, L.P. |

| Symbols | |

| Class A |

LIGRX |

| Class C |

LGBCX |

| Class N |

LGBNX |

| Class Y |

LSIIX |

| Admin Class |

LIGAX |

| * |

Effective December 31, 2023, Elaine M. Stokes no longer serves as portfolio manager of the Fund. |

Investment Goal

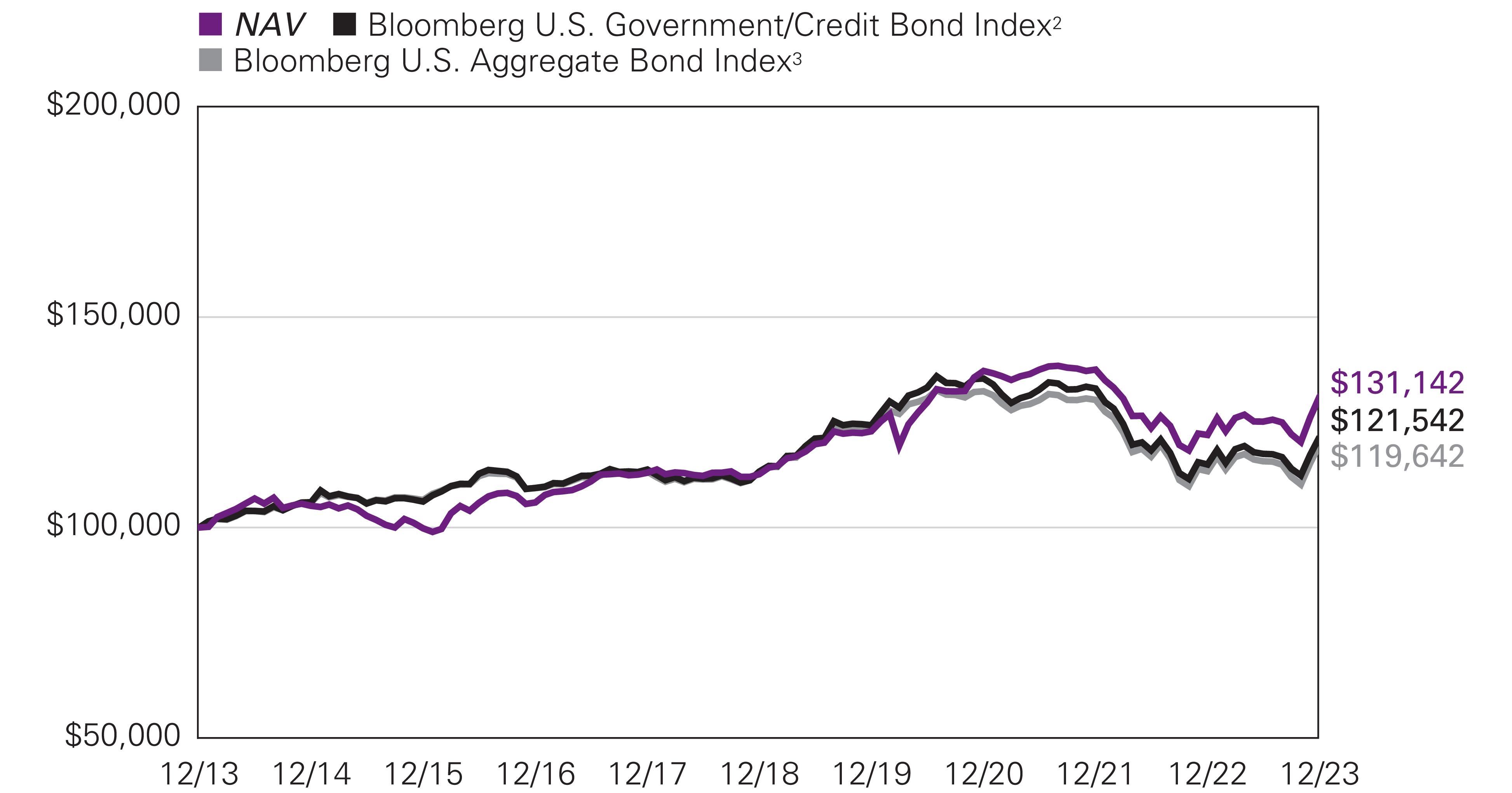

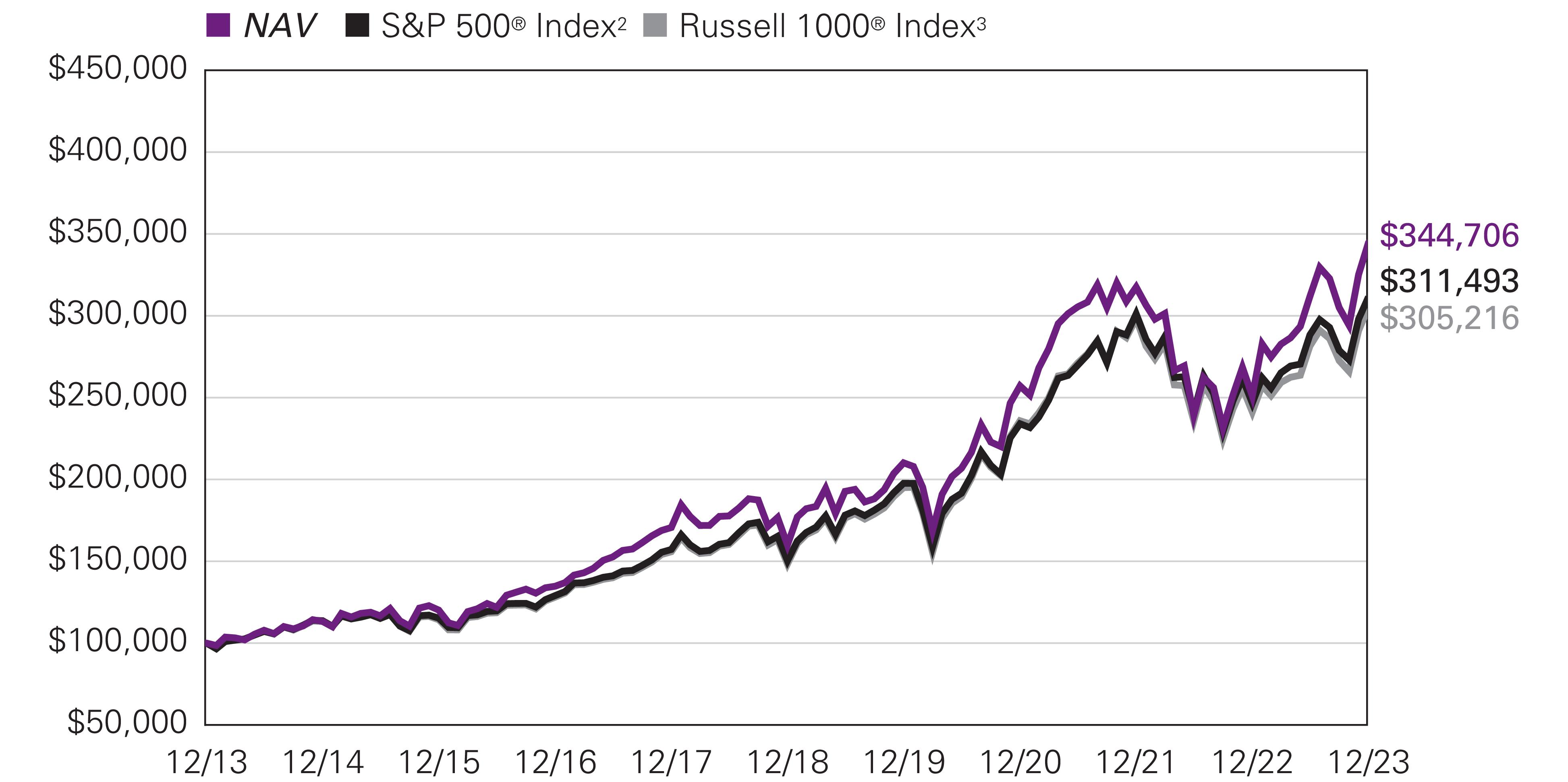

| Hypothetical Growth of $100,000 Investment in Class Y

Shares1 |

| December

31, 2013 through December 31, 2023 |

| |

1 Year |

5 Years |

10 Years |

Expense Ratios4 | |

| |

Gross |

Net | |||

| Class Y |

|

|

|

|

|

| NAV |

7.50 % |

3.08 % |

2.74 % |

0.55 % |

0.49 % |

| Class A |

|

|

|

|

|

| NAV |

7.34 |

2.84 |

2.50 |

0.80 |

0.74 |

| With 4.25% Maximum Sales Charge |

2.75 |

1.95 |

2.05 |

|

|

| Class C |

|

|

|

|

|

| NAV |

6.43 |

2.06 |

1.88 |

1.55 |

1.49 |

| With CDSC5 |

5.43 |

2.06 |

1.88 |

|

|

| Class N |

|

|

|

|

|

| NAV |

7.55 |

3.15 |

2.83 |

0.47 |

0.44 |

| Admin Class |

|

|

|

|

|

| NAV |

6.99 |

2.56 |

2.25 |

1.05 |

0.99 |

| Comparative Performance |

|

|

|

|

|

| Bloomberg U.S. Government/Credit Bond

Index2 |

5.72 |

1.41 |

1.97 |

|

|

| Bloomberg U.S. Aggregate Bond Index3

|

5.53 |

1.10 |

1.81 |

|

|

| 1 |

Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 2 |

Bloomberg U.S. Government/Credit Bond Index is the non-securitized component of the U.S. Aggregate Index. The U.S. Government/Credit Bond Index includes

investment grade, U.S. dollar-denominated, fixed rate Treasuries (i.e., public obligations of

the U.S. Treasury that have remaining maturities of more than one year),

government-related issues (i.e., agency, sovereign, supranational, and local authority debt),

and corporate securities. The U.S. Government/Credit Index was launched on January

1, 1979, with index history backfilled to 1973, and is a subset of the U.S. Aggregate Index. |

| 3 |

Bloomberg U.S. Aggregate Bond Index is a broad-based index that covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of

SEC- registered securities. The index includes bonds from the Treasury,

government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors. |

| 4 |

Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in

the Financial Highlights section of this report under Ratios to Average Net

Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/24. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about

the Fund’s expense limitations. |

| 5 |

Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and

includes automatic conversion to Class A shares after eight years.

|

| Managers |

| Matthew J. Eagan,

CFA® |

| Brian P.

Kennedy |

| Elaine M.

Stokes* |

| Todd P. Vandam,

CFA® |

| Loomis, Sayles & Company, L.P. |

| Symbols | |

| Class A |

LABAX |

| Class C |

LABCX |

| Class N |

LASNX |

| Class Y |

LASYX |

| * |

Effective December 31, 2023, Elaine M. Stokes no longer serves as portfolio manager of the Fund. |

Investment Goal

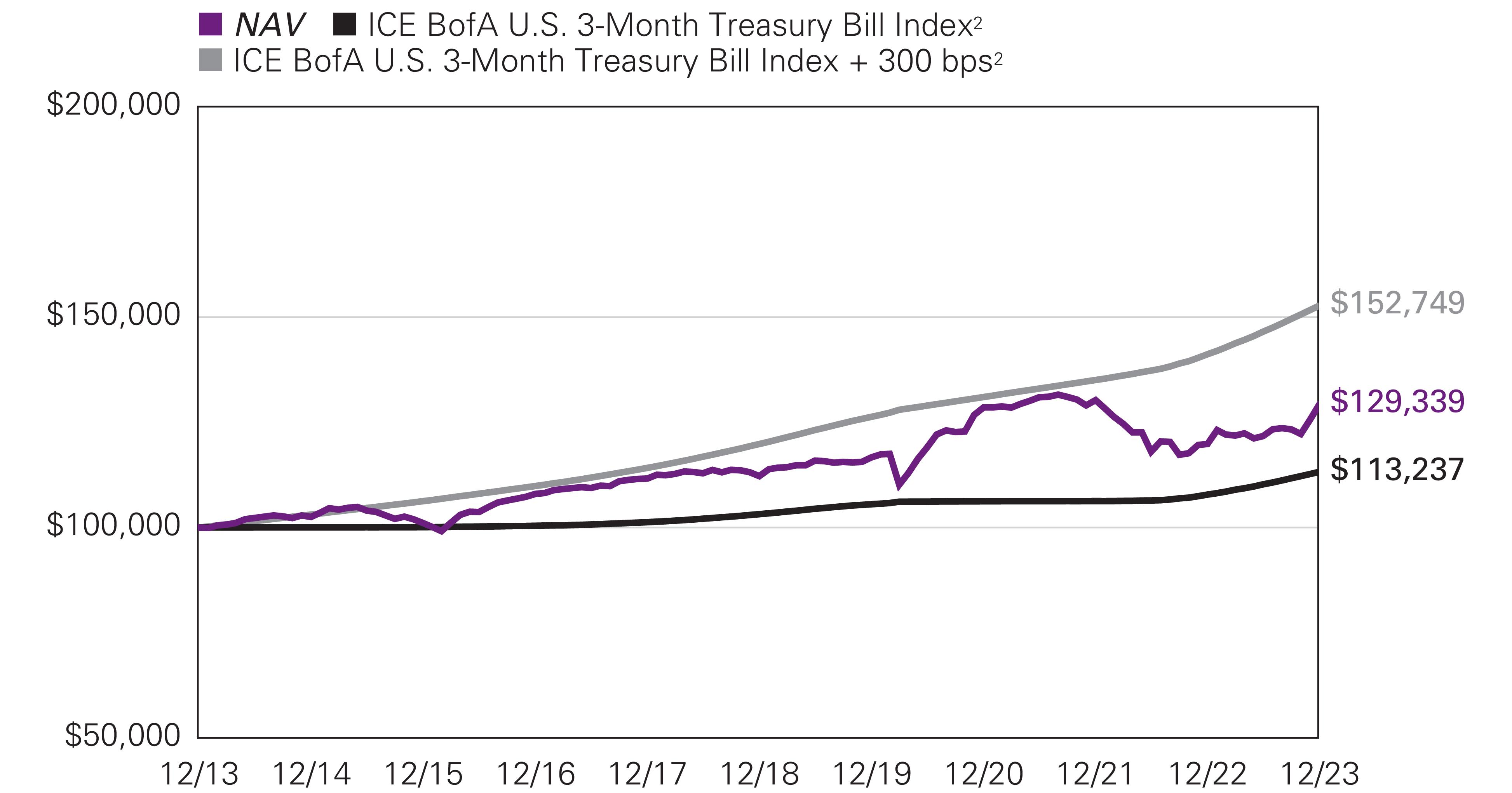

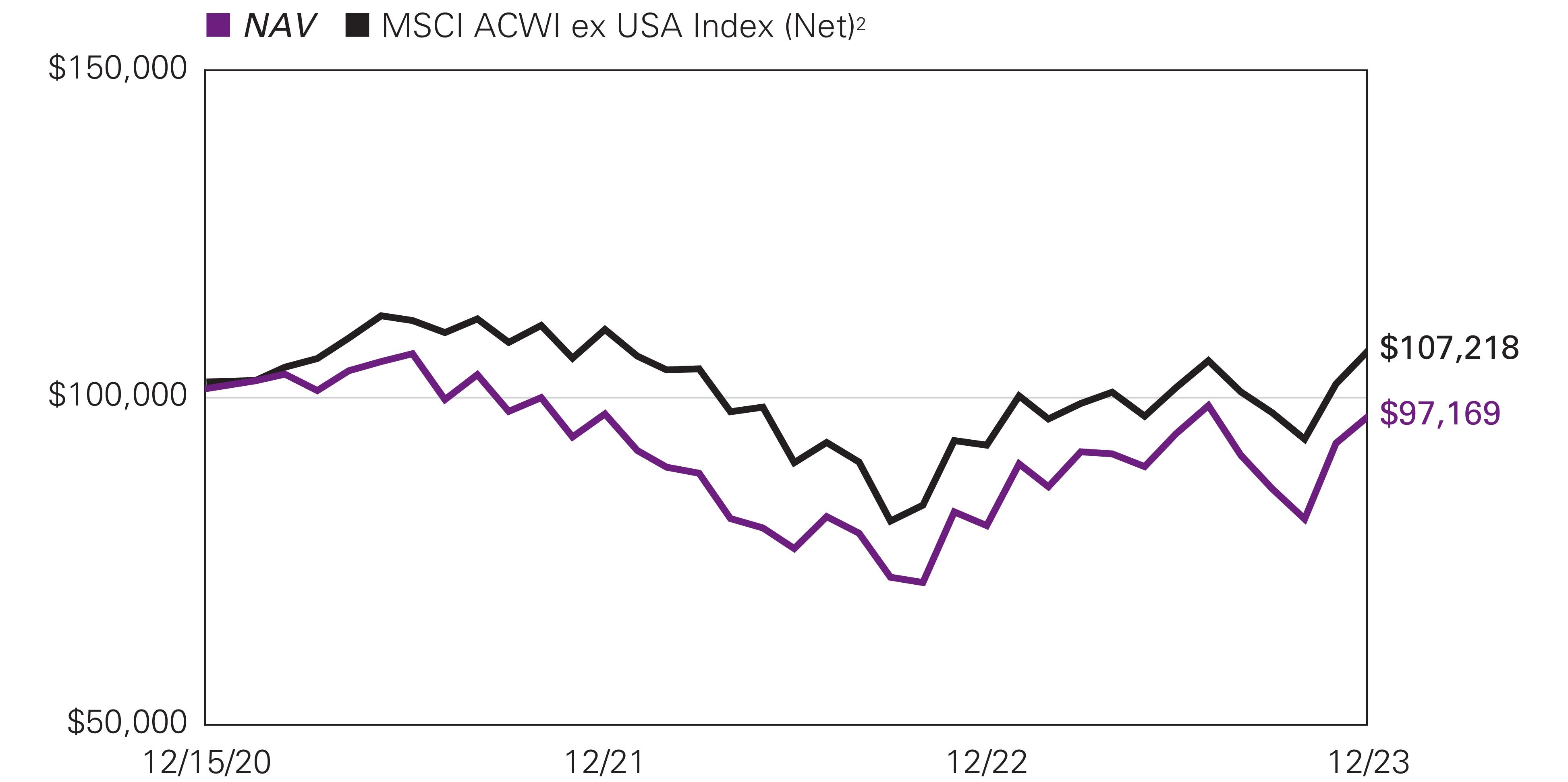

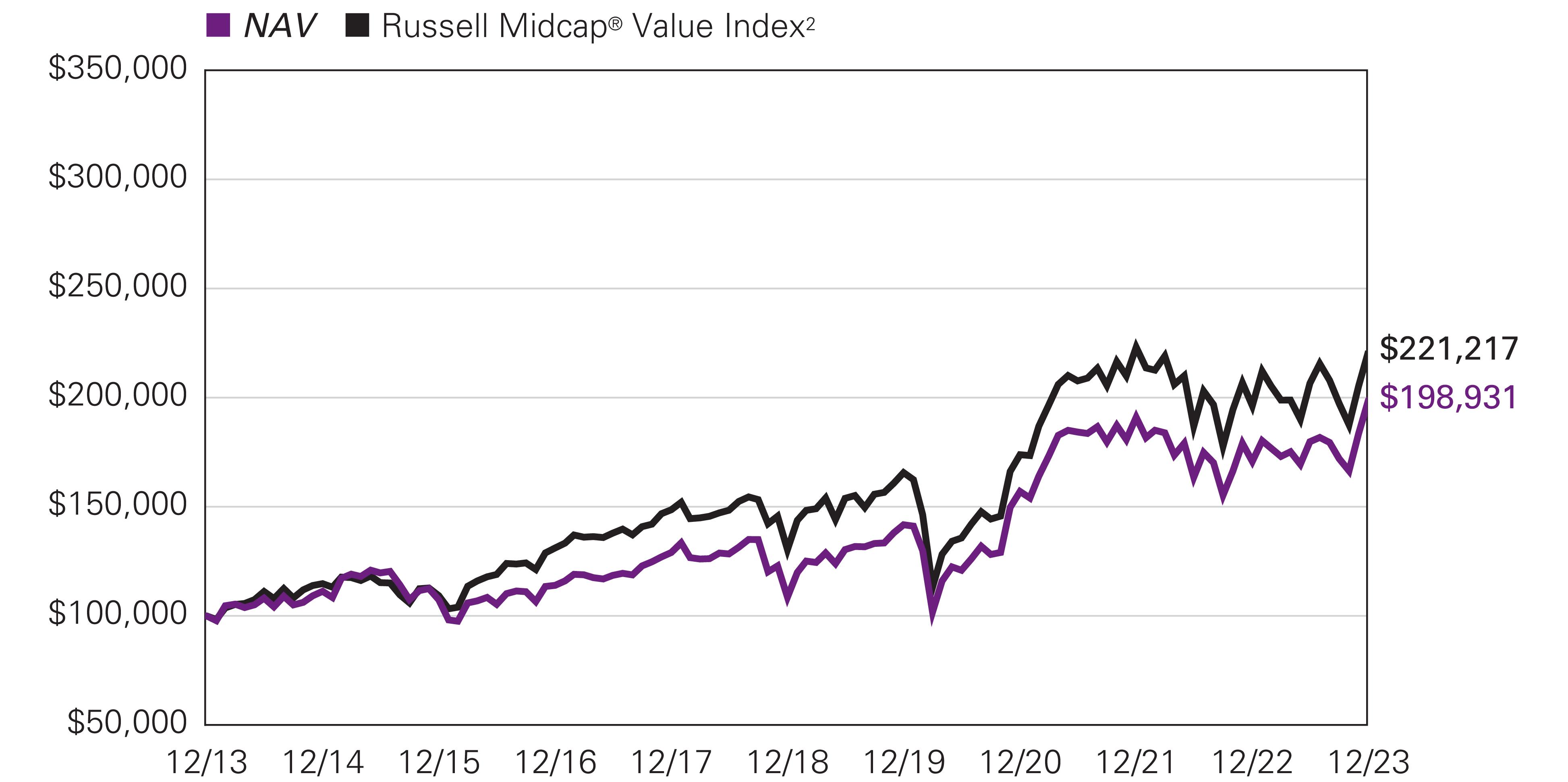

| Hypothetical Growth of $100,000 Investment in Class Y

Shares1 |

| December

31, 2013 through December 31, 2023 |

| |

1 Year |

5 Years |

10 Years |

Life of

Class N |

Expense Ratios3 | |

| |

Gross |

Net | ||||

| Class Y |

|

|

|

|

|

|

| NAV |

7.90 % |

2.88 % |

2.61 % |

— % |

0.75 % |

0.75 % |

| Class A |

|

|

|

|

|

|

| NAV |

7.70 |

2.60 |

2.35 |

— |

1.00 |

1.00 |

| With 4.25% Maximum Sales Charge |

3.08 |

1.71 |

1.90 |

— |

|

|

| Class C |

|

|

|

|

|

|

| NAV |

6.77 |

1.83 |

1.73 |

— |

1.75 |

1.75 |

| With CDSC4 |

5.77 |

1.83 |

1.73 |

— |

|

|

| Class N (Inception 5/1/17) |

|

|

|

|

|

|

| NAV |

7.94 |

2.92 |

— |

2.59 |

0.69 |

0.69 |

| Comparative Performance |

|

|

|

|

|

|

| ICE BofA U.S. 3-Month Treasury Bill Index2 |

5.01 |

1.88 |

1.25 |

1.79 |

|

|

| ICE BofA U.S. 3-Month Treasury Bill Index +300 basis

points2 |

8.01 |

4.88 |

4.25 |

4.78 |

|

|

| 1 |

Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 2 |

The ICE BofA U.S. 3-Month Treasury Bill Index is an unmanaged index that is comprised of a single U.S. Treasury issue with approximately three months to final

maturity, purchased at the beginning of each month and held for one full month.

ICE BofA U.S. 3-Month Treasury Bill Index +300 basis points

is created by adding 3.00% to the annual return of the ICE BofA 3-Month Treasury

Bill Index. |

| 3 |

Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in

the Financial Highlights section of this report under Ratios to Average Net

Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/24. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about

the Fund’s expense limitations. |

| 4 |

Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and

includes automatic conversion to Class A shares after eight years.

|

| Managers |

| Matthew J. Eagan,

CFA® |

| Brian P.

Kennedy |

| Elaine M.

Stokes* |

| Loomis, Sayles & Company, L.P. |

| Symbols | |

| Class A |

NEFZX |

| Class C |

NECZX |

| Class N |

NEZNX |

| Class Y |

NEZYX |

| Admin Class |

NEZAX |

| * |

Effective December 31, 2023, Elaine M. Stokes no longer serves as portfolio manager of the Fund. |

Investment Goal

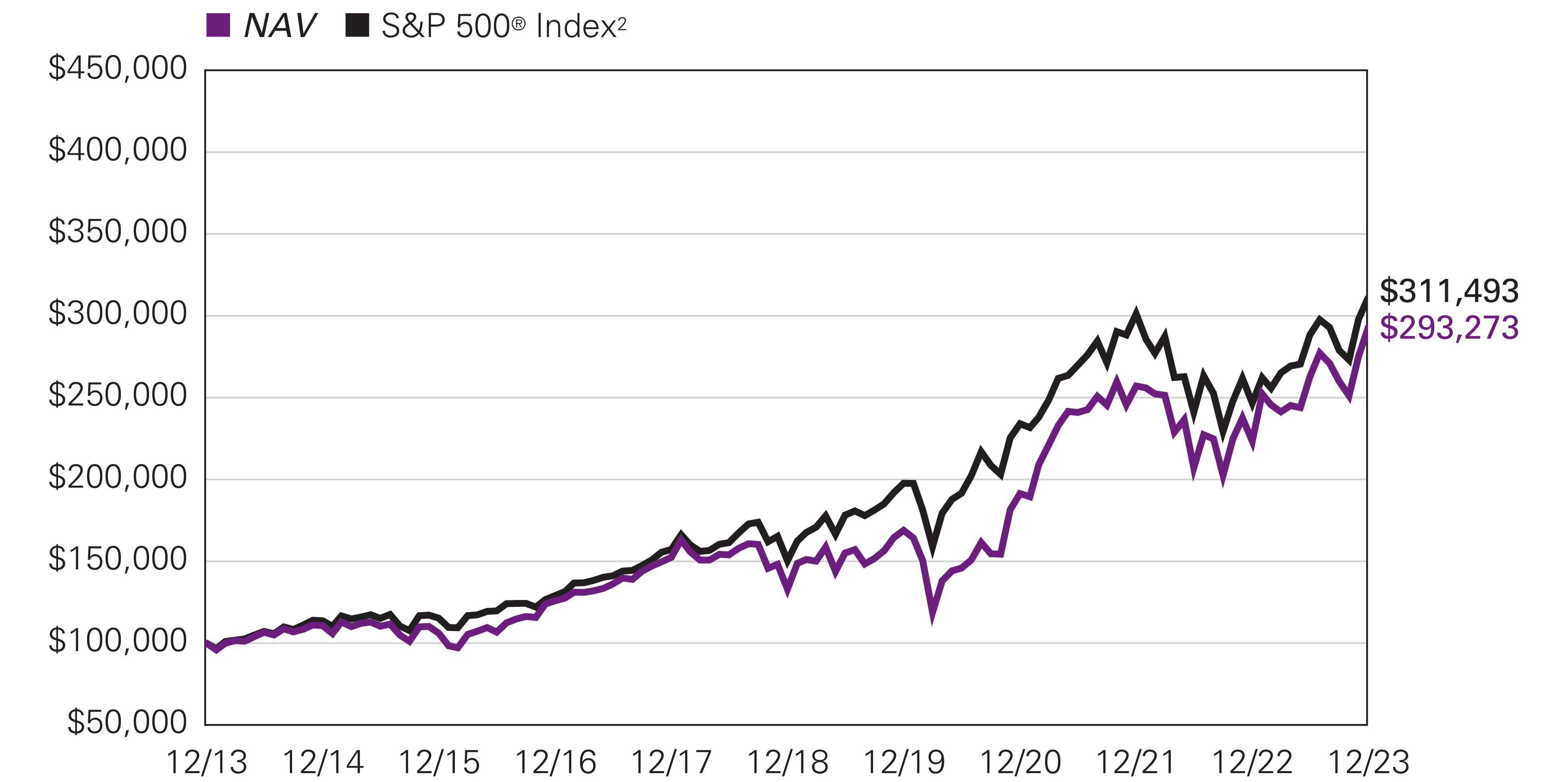

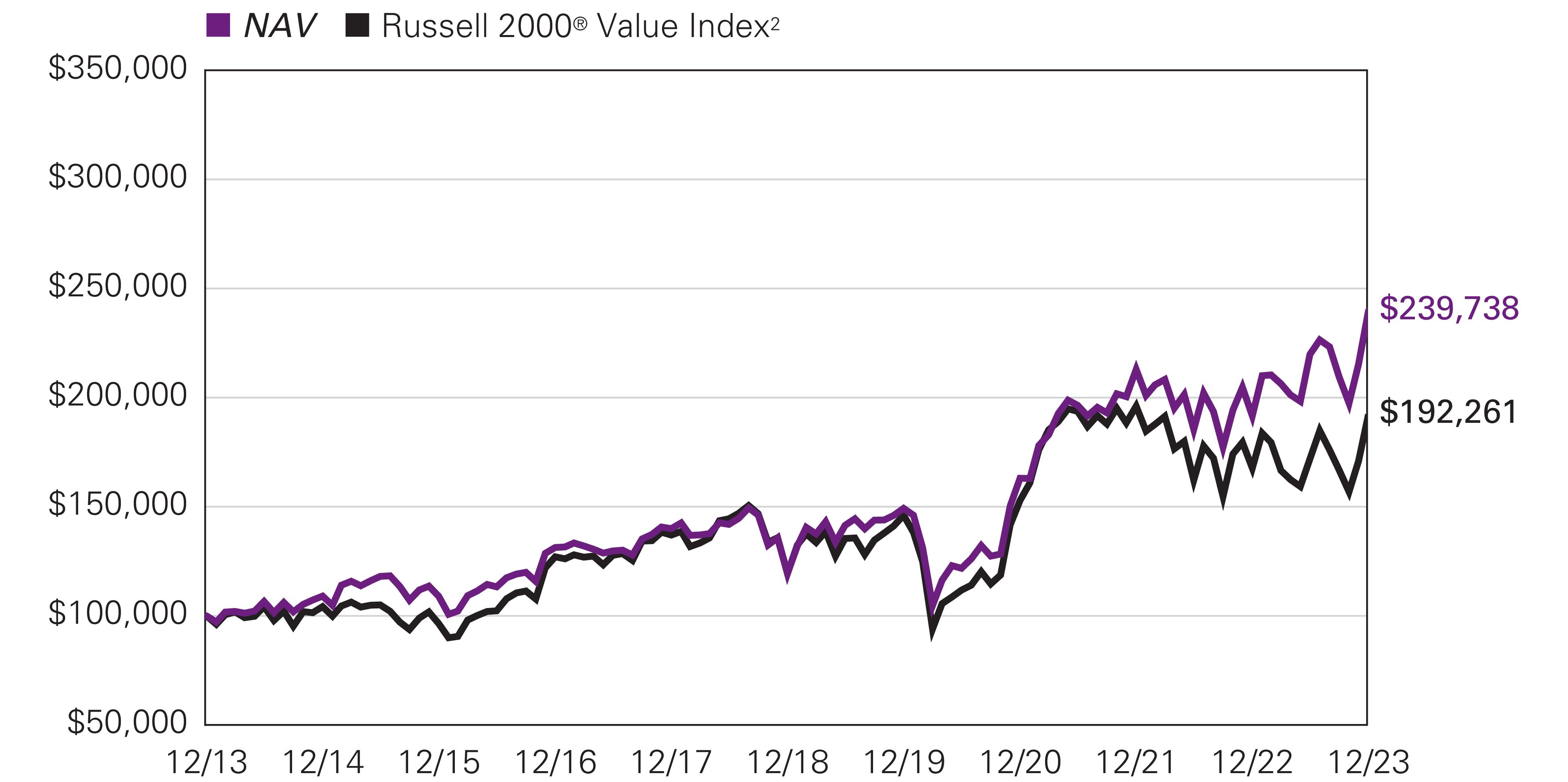

| Hypothetical Growth of $100,000 Investment in Class Y

Shares1 |

| December

31, 2013 through December 31, 2023 |

| |

1 Year |

5 Years |

10 Years |

Expense Ratios4 | |

| |

Gross |

Net | |||

| Class Y |

|

|

|

|

|

| NAV |

8.30 % |

2.11 % |

2.13 % |

0.72 % |

0.68 % |

| Class A |

|

|

|

|

|

| NAV |

8.02 |

1.86 |

1.88 |

0.97 |

0.93 |

| With 4.25% Maximum Sales Charge |

3.40 |

0.98 |

1.44 |

|

|

| Class C |

|

|

|

|

|

| NAV |

7.26 |

1.10 |

1.27 |

1.72 |

1.68 |

| With CDSC5

|

6.26 |

1.10 |

1.27 |

|

|

| Class N |

|

|

|

|

|

| NAV |

8.45 |

2.19 |

2.22 |

0.63 |

0.63 |

| Admin Class |

|

|

|

|

|

| NAV |

7.78 |

1.60 |

1.63 |

1.22 |

1.18 |

| Comparative Performance |

|

|

|

|

|

| Bloomberg U.S. Aggregate Bond Index2 |

5.53 |

1.10 |

1.81 |

|

|

| Bloomberg U.S. Universal Bond Index3 |

6.17 |

1.44 |

2.08 |

|

|

| 1 |

Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 2 |

Bloomberg U.S. Aggregate Bond Index is a broad-based index that covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of

SEC- registered securities. The index includes bonds from the Treasury,

government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors. |

| 3 |

Bloomberg U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the

Emerging Markets Index, and the non-ERISA portion of the CMBS Index. Municipal

debt, private placements, and non-dollar-denominated issues are excluded from the

Universal Bond Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index. |

| 4 |

Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in

the Financial Highlights section of this report under Ratios to Average Net

Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/25. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about

the Fund’s expense limitations. |

| 5 |

Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and

includes automatic conversion to Class A shares after eight years.

|

| Loomis Sayles High Income Fund |

Beginning

Account Value

7/1/2023 |

Ending

Account Value

12/31/2023 |

Expenses Paid

During Period* 7/1/2023 – 12/31/2023 |

| Class A |

|

|

|

| Actual |

$1,000.00 |

$1,064.20 |

$4.94 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,020.42 |

$4.84 |

| Class C |

|

|

|

| Actual |

$1,000.00 |

$1,062.70 |

$8.84 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,016.64 |

$8.64 |

| Class N |

|

|

|

| Actual |

$1,000.00 |

$1,065.80 |

$3.38 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.93 |

$3.31 |

| Class Y |

|

|

|

| Actual |

$1,000.00 |

$1,068.70 |

$3.65 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.68 |

$3.57

|

| * |

Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.95%, 1.70%, 0.65% and 0.70% for Class A, C,

N and Y, respectively, multiplied by the average account value over the period,

multiplied by the number of days in the most recent fiscal half–year (184), divided by 365 (to reflect the half–year period). |

| Loomis Sayles Investment Grade Bond

Fund |

Beginning

Account Value

7/1/2023 |

Ending

Account Value

12/31/2023 |

Expenses Paid

During Period

7/1/2023 – 12/31/2023* |

| Class A |

|

|

|

| Actual |

$1,000.00 |

$1,047.50 |

$3.82 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.48 |

$3.77 |

| Class C |

|

|

|

| Actual |

$1,000.00 |

$1,042.00 |

$7.67 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,017.69 |

$7.58 |

| Class N |

|

|

|

| Actual |

$1,000.00 |

$1,049.10 |

$2.27 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,022.99 |

$2.24 |

| Class Y |

|

|

|

| Actual |

$1,000.00 |

$1,047.80 |

$2.53 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,022.74 |

$2.50 |

| Admin Class |

|

|

|

| Actual |

$1,000.00 |

$1,045.20 |

$5.10 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,020.22 |

$5.04

|

| * |

Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.74, 1.49, 0.44, 0.49 and 0.99 for Class A,

C, N, Y and Admin Class, respectively, multiplied by the average account value

over the period, multiplied by the number of days in the most recent fiscal half–year (184), divided by 365 (to reflect the half–year period). |

| Loomis Sayles Strategic Alpha Fund

|

Beginning

Account Value

7/1/2023 |

Ending

Account Value

12/31/2023 |

Expenses Paid

During Period* 7/1/2023 – 12/31/2023 |

| Class A |

|

|

|

| Actual |

$1,000.00 |

$1,060.80 |

$5.19 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,020.16 |

$5.09 |

| Class C |

|

|

|

| Actual |

$1,000.00 |

$1,056.80 |

$9.07 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,016.38 |

$8.89 |

| Class N |

|

|

|

| Actual |

$1,000.00 |

$1,061.60 |

$3.64 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.68 |

$3.57 |

| Class Y |

|

|

|

| Actual |

$1,000.00 |

$1,062.50 |

$3.90 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.43 |

$3.82

|

| * |

Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.00%, 1.75%, 0.70% and 0.75% for Class A, C,

N and Y, respectively, multiplied by the average account value over the period,

multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| Loomis Sayles Strategic Income Fund

|

Beginning

Account Value

7/1/2023 |

Ending

Account Value

12/31/2023 |

Expenses Paid

During Period* 7/1/2023 – 12/31/2023 |

| Class A |

|

|

|

| Actual |

$1,000.00 |

$1,056.40 |

$4.82 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,020.52 |

$4.74 |

| Class C |

|

|

|

| Actual |

$1,000.00 |

$1,053.20 |

$8.69 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,016.74 |

$8.54 |

| Class N |

|

|

|

| Actual |

$1,000.00 |

$1,059.00 |

$3.27 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,022.03 |

$3.21 |

| Class Y |

|

|

|

| Actual |

$1,000.00 |

$1,057.80 |

$3.53 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,021.78 |

$3.47 |

| Admin Class |

|

|

|

| Actual |

$1,000.00 |

$1,055.30 |

$6.11 |

| Hypothetical (5% return before expenses) |

$1,000.00 |

$1,019.26 |

$6.01

|

| * |

Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.93, 1.68, 0.63, 0.68 and 1.18 for Class A,

C, N, Y and Admin Class, respectively, multiplied by the average account value

over the period, multiplied by the number of days in the most recent fiscal half–year (184), divided by 365 (to reflect the half–year period). |

| Principal

Amount |

Description |

Value (†) |

| Bonds and Notes — 92.8% of Net Assets | ||

| | ||

| | ||

| Non-Convertible Bonds — 89.0% | ||

| |

ABS Home Equity — 0.1% | |

| $102,943

|

DSLA Mortgage Loan Trust, Series 2005-AR5, Class 2A1A, 1 mo. USD SOFR + 0.774%, 6.130%, 9/19/2045(a) |

$54,100 |

| |

Aerospace & Defense — 1.4% | |

| 100,000 |

Bombardier, Inc., 6.000%, 2/15/2028(b) |

97,428 |

| 155,000 |

Bombardier, Inc., 7.125%, 6/15/2026(b) |

154,276 |

| 45,000 |

Bombardier, Inc., 8.750%, 11/15/2030(b) |

47,912 |

| 135,000 |

TransDigm, Inc., 6.750%, 8/15/2028(b) |

138,116 |

| 195,000 |

TransDigm, Inc., 6.875%, 12/15/2030(b) |

200,850 |

| |

|

638,582 |

| |

Airlines — 1.4% | |

| 70,000 |

Allegiant Travel Co., 7.250%, 8/15/2027(b) |

68,491 |

| 465,000 |

American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.750%, 4/20/2029(b) |

453,264 |

| 55,000 |

Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty Ltd., 5.750%, 1/20/2026(b) |

51,818 |

| 45,000 |

Spirit Loyalty Cayman Ltd./Spirit IP Cayman Ltd., 8.000%, 9/20/2025(b) |

32,363 |

| 20,000 |

Spirit Loyalty Cayman Ltd./Spirit IP Cayman Ltd., 8.000%, 9/20/2025(b) |

14,383 |

| |

|

620,319 |

| |

Automotive — 1.4% | |

| 15,000 |

Allison Transmission, Inc., 4.750%, 10/01/2027(b) |

14,494 |

| 55,000 |

American Axle & Manufacturing, Inc., 5.000%, 10/01/2029 |

48,590 |

| 85,000 |

Ford Motor Co., 3.250%, 2/12/2032 |

70,695 |

| 345,000 |

Ford Motor Credit Co. LLC, 2.300%, 2/10/2025 |

331,776 |

| 85,000 |

Wheel Pros, Inc., 6.500%, 5/15/2029(b) |

25,925 |

| 150,000 |

ZF North America Capital, Inc., 6.875%, 4/14/2028(b) |

155,943 |

| |

|

647,423 |

| |

Banking — 2.5% | |

| 365,000 |

Barclays PLC, (fixed rate to 6/27/2033, variable rate thereafter), 7.119%, 6/27/2034 |

388,990 |

| 235,000 |

Deutsche Bank AG, (fixed rate to 12/01/2027, variable rate thereafter), 4.875%, 12/01/2032 |

219,098 |

| 200,000 |

Intesa Sanpaolo SpA, 6.625%, 6/20/2033(b) |

204,947 |

| 335,000 |

UniCredit SpA, (fixed rate to 6/30/2030, variable rate thereafter), 5.459%, 6/30/2035(b) |

315,060 |

| |

|

1,128,095 |

| |

Brokerage — 0.6% | |

| 35,000 |

Coinbase Global, Inc., 3.375%, 10/01/2028(b) |

29,532 |

| 60,000 |

Coinbase Global, Inc., 3.625%, 10/01/2031(b) |

46,358 |

| 30,000 |

NFP Corp., 4.875%, 8/15/2028(b) |

29,689 |

| 80,000 |

NFP Corp., 6.875%, 8/15/2028(b) |

81,328 |

| 65,000 |

NFP Corp., 8.500%, 10/01/2031(b) |

70,454 |

| |

|

257,361 |

| |

Building Materials — 3.0% | |

| 25,000 |

ACProducts Holdings, Inc., 6.375%, 5/15/2029(b) |

18,508 |

| 115,000 |

Beacon Roofing Supply, Inc., 6.500%, 8/01/2030(b) |

117,584 |

| 90,000 |

Builders FirstSource, Inc., 4.250%, 2/01/2032(b) |

81,178 |

| 40,000 |

Builders FirstSource, Inc., 5.000%, 3/01/2030(b) |

38,626 |

| 45,000 |

Camelot Return Merger Sub, Inc., 8.750%, 8/01/2028(b) |

45,676 |

| 415,000 |

Cemex SAB de CV, 3.875%, 7/11/2031(b) |

371,162 |

| 60,000 |

Cornerstone Building Brands, Inc., 6.125%, 1/15/2029(b) |

49,200 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Building Materials — continued | |

| $190,000

|

Foundation Building Materials, Inc., 6.000%, 3/01/2029(b) |

$170,835

|

| 115,000 |

LBM Acquisition LLC, 6.250%, 1/15/2029(b) |

102,689 |

| 60,000 |

MIWD Holdco II LLC/MIWD Finance Corp., 5.500%, 2/01/2030(b) |

53,100 |

| 70,000 |

Patrick Industries, Inc., 4.750%, 5/01/2029(b) |

63,743 |

| 115,000 |

Specialty Building Products Holdings LLC/SBP Finance Corp., 6.375%, 9/30/2026(b) |

112,788 |

| 65,000 |

Standard Industries, Inc., 4.375%, 7/15/2030(b) |

59,695 |

| 65,000 |

Summit Materials LLC/Summit Materials Finance Corp., 7.250%, 1/15/2031(b) |

68,491 |

| |

|

1,353,275 |

| |

Cable Satellite — 12.0% | |

| 210,000 |

Altice Financing SA, 5.000%, 1/15/2028(b) |

190,357 |

| 240,000 |

CCO Holdings LLC/CCO Holdings Capital Corp., 4.250%, 2/01/2031(b) |

209,676 |

| 1,095,000 |

CCO Holdings LLC/CCO Holdings Capital Corp., 4.250%, 1/15/2034(b) |

889,827 |

| 140,000 |

CCO Holdings LLC/CCO Holdings Capital Corp., 4.500%, 6/01/2033(b) |

118,459 |

| 175,000 |

CCO Holdings LLC/CCO Holdings Capital Corp., 4.750%, 3/01/2030(b) |

159,909 |

| 200,000 |

CSC Holdings LLC, 3.375%, 2/15/2031(b) |

145,915 |

| 2,155,000 |

CSC Holdings LLC, 4.625%, 12/01/2030(b) |

1,297,569 |

| 405,000 |

CSC Holdings LLC, 5.000%, 11/15/2031(b) |

245,025 |

| 390,000 |

Directv Financing LLC/Directv Financing Co-Obligor, Inc., 5.875%, 8/15/2027(b) |

366,435 |

| 210,000 |

DISH DBS Corp., 5.125%, 6/01/2029 |

108,232 |

| 130,000 |

DISH DBS Corp., 5.250%, 12/01/2026(b) |

111,378 |

| 150,000 |

DISH DBS Corp., 5.750%, 12/01/2028(b) |

119,640 |

| 150,000 |

DISH DBS Corp., 7.375%, 7/01/2028 |

89,667 |

| 420,000 |

DISH DBS Corp., 7.750%, 7/01/2026 |

292,534 |

| 40,000 |

DISH Network Corp., 11.750%, 11/15/2027(b) |

41,754 |

| 135,000 |

Radiate Holdco LLC/Radiate Finance, Inc., 6.500%, 9/15/2028(b) |

66,148 |

| 260,000 |

Sirius XM Radio, Inc., 3.875%, 9/01/2031(b) |

222,426 |

| 85,000 |

Telesat Canada/Telesat LLC, 5.625%, 12/06/2026(b) |

52,127 |

| 80,000 |

Viasat, Inc., 6.500%, 7/15/2028(b) |

65,700 |

| 245,000 |

Virgin Media Secured Finance PLC, 5.500%, 5/15/2029(b) |

236,729 |

| 380,000 |

Ziggo Bond Co. BV, 6.000%, 1/15/2027(b) |

369,839 |

| |

|

5,399,346 |

| |

Chemicals — 1.4% | |

| 105,000 |

ASP Unifrax Holdings, Inc., 5.250%, 9/30/2028(b) |

75,821 |

| 200,000 |

Braskem Netherlands Finance BV, 8.500%, 1/12/2031(b) |

186,000 |

| 170,000 |

Hercules LLC, 6.500%, 6/30/2029 |

159,994 |

| 200,000 |

Olympus Water U.S. Holding Corp., 9.750%, 11/15/2028(b) |

212,278 |

| |

|

634,093 |

| |

Consumer Cyclical Services — 3.0% | |

| 245,000 |

ADT Security Corp., 4.125%, 8/01/2029(b) |

225,461 |

| 60,000 |

ANGI Group LLC, 3.875%, 8/15/2028(b) |

50,672 |

| 5,000 |

Arches Buyer, Inc., 4.250%, 6/01/2028(b) |

4,528 |

| 35,000 |

Arches Buyer, Inc., 6.125%, 12/01/2028(b) |

30,275 |

| 160,000 |

Realogy Group LLC/Realogy Co-Issuer Corp., 5.750%, 1/15/2029(b) |

124,346 |

| 885,000 |

Uber Technologies, Inc., 4.500%, 8/15/2029(b) |

844,261 |

| 65,000 |

VT Topco, Inc., 8.500%, 8/15/2030(b) |

67,624 |

| |

|

1,347,167 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Consumer Products — 1.0% | |

| $80,000

|

Coty, Inc./HFC Prestige Products, Inc./HFC Prestige International U.S. LLC, 4.750%, 1/15/2029(b) |

$76,305

|

| 100,000 |

Coty, Inc./HFC Prestige Products, Inc./HFC Prestige International U.S. LLC, 6.625%, 7/15/2030(b) |

102,731 |

| 205,000 |

Energizer Holdings, Inc., 4.375%, 3/31/2029(b) |

183,493 |

| 40,000 |

Prestige Brands, Inc., 3.750%, 4/01/2031(b) |

34,967 |

| 75,000 |

Tempur Sealy International, Inc., 3.875%, 10/15/2031(b) |

63,407 |

| |

|

460,903 |

| |

Diversified Manufacturing — 0.3% | |

| 80,000 |

Madison IAQ LLC, 5.875%, 6/30/2029(b) |

70,487 |

| 80,000 |

Resideo Funding, Inc., 4.000%, 9/01/2029(b) |

69,800 |

| |

|

140,287 |

| |

Electric — 0.7% | |

| 70,000 |

Calpine Corp., 4.500%, 2/15/2028(b) |

66,580 |

| 110,000 |

NRG Energy, Inc., 3.625%, 2/15/2031(b) |

94,510 |

| 4,000 |

NRG Energy, Inc., 3.875%, 2/15/2032(b) |

3,424 |

| 70,000 |

PG&E Corp., 5.000%, 7/01/2028 |

68,109 |

| 25,000 |

PG&E Corp., 5.250%, 7/01/2030 |

24,114 |

| 40,000 |

Talen Energy Supply LLC, 8.625%, 6/01/2030(b) |

42,501 |

| |

|

299,238 |

| |

Environmental — 0.7% | |

| 195,000 |

Covanta Holding Corp., 4.875%, 12/01/2029(b) |

170,370 |

| 105,000 |

GFL Environmental, Inc., 4.000%, 8/01/2028(b) |

97,061 |

| 40,000 |

GFL Environmental, Inc., 6.750%, 1/15/2031(b) |

41,211 |

| |

|

308,642 |

| |

Finance Companies — 6.0% | |

| 70,000 |

Aircastle Ltd., 6.500%, 7/18/2028(b) |

71,380 |

| 25,000 |

Blackstone Secured Lending Fund, 2.750%, 9/16/2026 |

22,873 |

| 110,000 |

Blackstone Secured Lending Fund, 3.625%, 1/15/2026 |

104,927 |

| 125,000 |

Blue Owl Capital Corp., 3.400%, 7/15/2026 |

116,211 |

| 80,437 |

Global Aircraft Leasing Co. Ltd., 7.250% PIK or 6.500% Cash, 9/15/2024(b)(c) |

75,611 |

| 80,000 |

Nationstar Mortgage Holdings, Inc., 5.000%, 2/01/2026(b) |

78,237 |

| 100,000 |

Nationstar Mortgage Holdings, Inc., 5.125%, 12/15/2030(b) |

90,413 |

| 265,000 |

Nationstar Mortgage Holdings, Inc., 5.750%, 11/15/2031(b) |

247,088 |

| 300,000 |

Navient Corp., 4.875%, 3/15/2028 |

278,716 |

| 120,000 |

Navient Corp., 5.500%, 3/15/2029 |

110,657 |

| 30,000 |

Navient Corp., 6.750%, 6/25/2025 |

30,358 |

| 210,000 |

OneMain Finance Corp., 3.500%, 1/15/2027 |

194,343 |

| 10,000 |

OneMain Finance Corp., 3.875%, 9/15/2028 |

8,848 |

| 75,000 |

OneMain Finance Corp., 4.000%, 9/15/2030 |

64,182 |

| 30,000 |

OneMain Finance Corp., 5.375%, 11/15/2029 |

28,092 |

| 145,000 |

OneMain Finance Corp., 7.125%, 3/15/2026 |

147,724 |

| 90,000 |

PennyMac Financial Services, Inc., 7.875%, 12/15/2029(b) |

92,643 |

| 115,000 |

Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/2025(b) |

105,512 |

| 40,000 |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 2.875%, 10/15/2026(b) |

36,900 |

| 15,000 |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 2.875%, 10/15/2026 |

13,838 |

| 75,000 |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 3.625%, 3/01/2029 |

67,881 |

| 20,000 |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 3.625%, 3/01/2029(b) |

18,102 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Finance Companies — continued | |

| $230,000

|

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 3.875%, 3/01/2031(b) |

$202,284

|

| 595,000 |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., 4.000%, 10/15/2033(b) |

505,469 |

| |

|

2,712,289 |

| |

Financial Other — 1.4% | |

| 210,000 |

Agile Group Holdings Ltd., 6.050%, 10/13/2025 |

25,332 |

| 175,600 |

CFLD Cayman Investment Ltd., 2.500%, 1/31/2031(b)(d) |

13,423 |

| 213,200 |

CFLD Cayman Investment Ltd., 2.500%, 1/31/2031(b)(d) |

5,511 |

| 21,792 |

CFLD Cayman Investment Ltd., Zero Coupon, 0.000%–27.988%, 1/31/2031(b)(e) |

142 |

| 200,000 |

China Aoyuan Group Ltd., 6.200%, 3/24/2026(f) |

3,500 |

| 200,000 |

China Evergrande Group, 8.750%, 6/28/2025(f) |

2,500 |

| 221,792 |

Easy Tactic Ltd., 7.500% PIK or 6.500% Cash, 7/11/2027(g) |

9,222 |

| 220,000 |

Fantasia Holdings Group Co. Ltd., 11.875%, 6/01/2023(f) |

5,500 |

| 5,000 |

Icahn Enterprises LP/Icahn Enterprises Finance Corp., 4.750%, 9/15/2024 |

4,969 |

| 495,000 |

Icahn Enterprises LP/Icahn Enterprises Finance Corp., 5.250%, 5/15/2027 |

444,621 |

| 5,000 |

Icahn Enterprises LP/Icahn Enterprises Finance Corp., 6.375%, 12/15/2025 |

4,909 |

| 200,000 |

Kaisa Group Holdings Ltd., 9.375%, 6/30/2024(f) |

6,478 |

| 200,000 |

Kaisa Group Holdings Ltd., 11.650%, 6/01/2026(f) |

5,750 |

| 400,000 |

Kaisa Group Holdings Ltd., 11.700%, 11/11/2025(f) |

12,920 |

| 200,000 |

Shimao Group Holdings Ltd., 6.125%, 2/21/2024(f) |

8,000 |

| 35,100 |

Sunac China Holdings Ltd., 6.000% PIK or 5.000% Cash, 9/30/2026(b)(h) |

4,293 |

| 35,100 |

Sunac China Holdings Ltd., 6.250% PIK or 5.250% Cash, 9/30/2027(b)(h) |

3,727 |

| 70,201 |

Sunac China Holdings Ltd., 6.500% PIK or 5.500% Cash, 9/30/2027(b)(h) |

6,553 |

| 105,302 |

Sunac China Holdings Ltd., 6.750% PIK or 5.750% Cash, 9/30/2028(b)(h) |

8,346 |

| 105,302 |

Sunac China Holdings Ltd., 7.000% PIK or 6.000% Cash, 9/30/2029(b)(h) |

7,824 |

| 49,473 |

Sunac China Holdings Ltd., 7.250% PIK or 6.250% Cash, 9/30/2030(b)(h) |

3,153 |

| 200,000 |

Times China Holdings Ltd., 6.200%, 3/22/2026(f) |

4,500 |

| 400,000 |

Yuzhou Group Holdings Co. Ltd., 6.350%, 1/13/2027(f) |

24,728 |

| 400,000 |

Zhenro Properties Group Ltd., 6.630%, 1/07/2026(f) |

3,764 |

| 200,000 |

Zhenro Properties Group Ltd., 6.700%, 8/04/2026(f) |

1,882 |

| |

|

621,547 |

| |

Food & Beverage — 0.8% | |

| 65,000 |

HLF Financing SARL LLC/Herbalife International, Inc., 4.875%, 6/01/2029(b) |

51,039 |

| 145,000 |

Lamb Weston Holdings, Inc., 4.375%, 1/31/2032(b) |

132,280 |

| 90,000 |

Post Holdings, Inc., 4.625%, 4/15/2030(b) |

82,786 |

| 35,000 |

Post Holdings, Inc., 5.750%, 3/01/2027(b) |

34,725 |

| 65,000 |

Simmons Foods, Inc./Simmons Prepared Foods, Inc./Simmons Pet Food, Inc./Simmons Feed, 4.625%, 3/01/2029(b) |

56,236 |

| |

|

357,066 |

| |

Gaming — 1.3% | |

| 65,000 |

Light & Wonder International, Inc., 7.000%, 5/15/2028(b) |

65,661 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Gaming — continued | |

| $40,000

|

Light & Wonder International, Inc., 7.500%, 9/01/2031(b) |

$41,722

|

| 200,000 |

Melco Resorts Finance Ltd., 5.375%, 12/04/2029(b) |

176,056 |

| 250,000 |

Wynn Macau Ltd., 5.125%, 12/15/2029(b) |

222,117 |

| 90,000 |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029(b) |

84,941 |

| |

|

590,497 |

| |

Government Owned - No Guarantee — 0.2% | |

| 125,000 |

Petroleos Mexicanos, 5.950%, 1/28/2031 |

99,813 |

| |

Health Care REITs — 0.2% | |

| 115,000 |

MPT Operating Partnership LP/MPT Finance Corp., 3.500%, 3/15/2031 |

71,901 |

| |

Health Insurance — 0.1% | |

| 15,000 |

Molina Healthcare, Inc., 3.875%, 11/15/2030(b) |

13,483 |

| 60,000 |

Molina Healthcare, Inc., 3.875%, 5/15/2032(b) |

52,426 |

| |

|

65,909 |

| |

Healthcare — 3.2% | |

| 25,000 |

AdaptHealth LLC, 4.625%, 8/01/2029(b) |

19,294 |

| 125,000 |

AdaptHealth LLC, 5.125%, 3/01/2030(b) |

97,509 |

| 220,000 |

Bausch & Lomb Escrow Corp., 8.375%, 10/01/2028(b) |

232,087 |

| 225,000 |

CHS/Community Health Systems, Inc., 5.250%, 5/15/2030(b) |

188,178 |

| 205,000 |

DaVita, Inc., 3.750%, 2/15/2031(b) |

168,377 |

| 100,000 |

Encompass Health Corp., 4.750%, 2/01/2030 |

94,173 |

| 20,000 |

Fortrea Holdings, Inc., 7.500%, 7/01/2030(b) |

20,539 |

| 80,000 |

Garden Spinco Corp., 8.625%, 7/20/2030(b) |

85,451 |

| 35,000 |

Hologic, Inc., 3.250%, 2/15/2029(b) |

31,732 |

| 180,000 |

LifePoint Health, Inc., 5.375%, 1/15/2029(b) |

133,102 |

| 105,000 |

Medline Borrower LP, 3.875%, 4/01/2029(b) |

94,935 |

| 60,000 |

RP Escrow Issuer LLC, 5.250%, 12/15/2025(b) |

48,006 |

| 160,000 |

Star Parent, Inc., 9.000%, 10/01/2030(b) |

168,616 |

| 50,000 |

U.S. Acute Care Solutions LLC, 6.375%, 3/01/2026(b) |

41,778 |

| |

|

1,423,777 |

| |

Home Construction — 0.2% | |

| 60,000 |

Brookfield Residential Properties, Inc./Brookfield Residential U.S. LLC, 4.875%, 2/15/2030(b) |

52,778 |

| 1,200,000 |

Corp. GEO SAB de CV, 8.875%, 3/27/2022(b)(f)(i) |

— |

| 50,000 |

Empire Communities Corp., 7.000%, 12/15/2025(b) |

49,750 |

| |

|

102,528 |

| |

Independent Energy — 5.1% | |

| 45,000 |

Antero Resources Corp., 5.375%, 3/01/2030(b) |

43,131 |

| 120,000 |

Ascent Resources Utica Holdings LLC/ARU Finance Corp., 7.000%, 11/01/2026(b) |

120,758 |

| 80,000 |

Baytex Energy Corp., 8.500%, 4/30/2030(b) |

82,793 |

| 135,000 |

Baytex Energy Corp., 8.750%, 4/01/2027(b) |

139,475 |

| 120,000 |

Chesapeake Energy Corp., 6.750%, 4/15/2029(b) |

121,116 |

| 155,000 |

Civitas Resources, Inc., 8.375%, 7/01/2028(b) |

161,811 |

| 50,000 |

Civitas Resources, Inc., 8.625%, 11/01/2030(b) |

53,036 |

| 75,000 |

Crescent Energy Finance LLC, 7.250%, 5/01/2026(b) |

75,462 |

| 105,000 |

Crescent Energy Finance LLC, 9.250%, 2/15/2028(b) |

108,945 |

| 45,000 |

Gulfport Energy Corp., 8.000%, 5/17/2026(b) |

45,488 |

| 170,000 |

Leviathan Bond Ltd., 6.750%, 6/30/2030(b) |

154,726 |

| 150,000 |

Matador Resources Co., 5.875%, 9/15/2026 |

148,755 |

| 40,000 |

MEG Energy Corp., 5.875%, 2/01/2029(b) |

38,866 |

| 60,000 |

Murphy Oil Corp., 5.875%, 12/01/2042 |

53,011 |

| 170,000 |

Northern Oil & Gas, Inc., 8.125%, 3/01/2028(b) |

172,125 |

| 60,000 |

Northern Oil & Gas, Inc., 8.750%, 6/15/2031(b) |

62,496 |

| 40,000 |

Permian Resources Operating LLC, 5.375%, 1/15/2026(b) |

39,474 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Independent Energy — continued | |

| $60,000

|

Permian Resources Operating LLC, 5.875%, 7/01/2029(b) |

$58,498

|

| 50,000 |

Permian Resources Operating LLC, 6.875%, 4/01/2027(b) |

49,966 |

| 90,000 |

Permian Resources Operating LLC, 7.000%, 1/15/2032(b) |

92,851 |

| 45,000 |

Range Resources Corp., 8.250%, 1/15/2029 |

46,574 |

| 230,000 |

Sitio Royalties Operating Partnership LP/Sitio Finance Corp., 7.875%, 11/01/2028(b) |

238,331 |

| 15,000 |

SM Energy Co., 5.625%, 6/01/2025 |

14,823 |

| 105,000 |

SM Energy Co., 6.750%, 9/15/2026 |

104,726 |

| 45,000 |

Southwestern Energy Co., 5.375%, 2/01/2029 |

43,915 |

| 50,000 |

Strathcona Resources Ltd., 6.875%, 8/01/2026(b) |

47,735 |

| |

|

2,318,887 |

| |

Industrial Other — 0.2% | |

| 60,000 |

Brundage-Bone Concrete Pumping Holdings, Inc., 6.000%, 2/01/2026(b) |

59,971 |

| 50,000 |

Installed Building Products, Inc., 5.750%, 2/01/2028(b) |

48,500 |

| |

|

108,471 |

| |

Leisure — 4.8% | |

| 295,000 |

Carnival Corp., 5.750%, 3/01/2027(b) |

287,753 |

| 185,000 |

Carnival Corp., 6.000%, 5/01/2029(b) |

178,008 |

| 15,000 |

Carnival Corp., 7.000%, 8/15/2029(b) |

15,662 |

| 70,000 |

Cinemark USA, Inc., 5.250%, 7/15/2028(b) |

64,218 |

| 410,000 |

NCL Corp. Ltd., 5.875%, 3/15/2026(b) |

400,635 |

| 10,000 |

NCL Corp. Ltd., 5.875%, 3/15/2026 |

9,772 |

| 90,000 |

NCL Corp. Ltd., 8.125%, 1/15/2029(b) |

94,012 |

| 70,000 |

NCL Finance Ltd., 6.125%, 3/15/2028(b) |

67,006 |

| 125,000 |

Royal Caribbean Cruises Ltd., 3.700%, 3/15/2028 |

115,235 |

| 170,000 |

Royal Caribbean Cruises Ltd., 4.250%, 7/01/2026(b) |

164,198 |

| 320,000 |

Royal Caribbean Cruises Ltd., 5.500%, 4/01/2028(b) |

315,923 |

| 30,000 |

Royal Caribbean Cruises Ltd., 11.625%, 8/15/2027(b) |

32,645 |

| 50,000 |

SeaWorld Parks & Entertainment, Inc., 5.250%, 8/15/2029(b) |

46,741 |

| 85,000 |

Speedway Motorsports LLC/Speedway Funding II, Inc., 4.875%, 11/01/2027(b) |

79,792 |

| 75,000 |

Viking Cruises Ltd., 5.875%, 9/15/2027(b) |

72,375 |

| 35,000 |

Viking Cruises Ltd., 7.000%, 2/15/2029(b) |

34,699 |

| 190,000 |

Viking Ocean Cruises Ship VII Ltd., 5.625%, 2/15/2029(b) |

185,250 |

| |

|

2,163,924 |

| |

Lodging — 1.8% | |

| 295,000 |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Escrow, Inc., 4.875%, 7/01/2031(b) |

261,135 |

| 110,000 |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Escrow, Inc., 5.000%, 6/01/2029(b) |

101,480 |

| 315,000 |

Marriott Ownership Resorts, Inc., 4.500%, 6/15/2029(b) |

277,581 |

| 185,000 |

Travel & Leisure Co., 4.500%, 12/01/2029(b) |

165,683 |

| 15,000 |

Travel & Leisure Co., 4.625%, 3/01/2030(b) |

13,415 |

| |

|

819,294 |

| |

Media Entertainment — 1.5% | |

| 310,000 |

Diamond Sports Group LLC/Diamond Sports Finance Co., 5.375%, 8/15/2026(b)(f) |

15,500 |

| 140,000 |

Diamond Sports Group LLC/Diamond Sports Finance Co., 6.625%, 8/15/2027(b)(f) |

7,000 |

| 295,000 |

iHeartCommunications, Inc., 4.750%, 1/15/2028(b) |

226,945 |

| 80,000 |

iHeartCommunications, Inc., 4.750%, 1/15/2028 |

61,545 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Media Entertainment — continued | |

| $60,000

|

Outfront Media Capital LLC/Outfront Media Capital Corp., 5.000%, 8/15/2027(b) |

$57,996

|

| 45,000 |

Outfront Media Capital LLC/Outfront Media Capital Corp., 7.375%, 2/15/2031(b) |

47,256 |

| 35,000 |

Playtika Holding Corp., 4.250%, 3/15/2029(b) |

30,539 |

| 260,000 |

Stagwell Global LLC, 5.625%, 8/15/2029(b) |

239,751 |

| |

|

686,532 |

| |

Metals & Mining — 3.3% | |

| 120,000 |

ATI, Inc., 4.875%, 10/01/2029 |

111,835 |

| 80,000 |

ATI, Inc., 7.250%, 8/15/2030 |

83,231 |

| 80,000 |

Commercial Metals Co., 4.125%, 1/15/2030 |

73,303 |

| 200,000 |

First Quantum Minerals Ltd., 6.875%, 3/01/2026(b) |

179,027 |

| 550,000 |

First Quantum Minerals Ltd., 6.875%, 10/15/2027(b) |

467,415 |

| 65,000 |

GrafTech Finance, Inc., 4.625%, 12/15/2028(b) |

43,089 |

| 70,000 |

GrafTech Global Enterprises, Inc., 9.875%, 12/15/2028(b) |

53,961 |

| 50,000 |

Mineral Resources Ltd., 8.000%, 11/01/2027(b) |

51,022 |

| 110,000 |

Mineral Resources Ltd., 8.125%, 5/01/2027(b) |

111,748 |

| 95,000 |

Mineral Resources Ltd., 9.250%, 10/01/2028(b) |

101,058 |

| 190,000 |

Novelis Corp., 4.750%, 1/30/2030(b) |

178,685 |

| 40,000 |

Volcan Cia Minera SAA, 4.375%, 2/11/2026(b) |

24,853 |

| |

|

1,479,227 |

| |

Midstream — 4.5% | |

| 85,000 |

Antero Midstream Partners LP/Antero Midstream Finance Corp., 5.375%, 6/15/2029(b) |

81,716 |

| 25,000 |

Antero Midstream Partners LP/Antero Midstream Finance Corp., 7.875%, 5/15/2026(b) |

25,606 |

| 80,000 |

Buckeye Partners LP, 5.600%, 10/15/2044 |

61,554 |

| 55,000 |

Buckeye Partners LP, 5.850%, 11/15/2043 |

44,556 |

| 65,000 |

Energy Transfer LP, 6.000%, 2/01/2029(b) |

65,584 |

| 125,000 |

Energy Transfer LP, Series A, 3 mo. USD LIBOR + 4.028%, 9.669%(a)(j) |

120,039 |

| 80,000 |

EnLink Midstream LLC, 6.500%, 9/01/2030(b) |

81,649 |

| 15,000 |

EnLink Midstream Partners LP, 5.050%, 4/01/2045 |

12,413 |

| 30,000 |

EnLink Midstream Partners LP, 5.450%, 6/01/2047 |

26,175 |

| 125,000 |

EnLink Midstream Partners LP, 5.600%, 4/01/2044 |

108,790 |

| 65,000 |

EQM Midstream Partners LP, 5.500%, 7/15/2028 |

64,404 |

| 105,000 |

EQM Midstream Partners LP, 6.500%, 7/01/2027(b) |

106,914 |

| 50,000 |

EQM Midstream Partners LP, 6.500%, 7/15/2048 |

51,235 |

| 55,000 |

EQM Midstream Partners LP, 7.500%, 6/01/2027(b) |

56,672 |

| 80,000 |

EQM Midstream Partners LP, 7.500%, 6/01/2030(b) |

86,002 |

| 80,000 |

Ferrellgas LP/Ferrellgas Finance Corp., 5.375%, 4/01/2026(b) |

78,291 |

| 200,000 |

Hess Midstream Operations LP, 4.250%, 2/15/2030(b) |

184,000 |

| 5,000 |

Hess Midstream Operations LP, 5.125%, 6/15/2028(b) |

4,824 |

| 30,000 |

Hess Midstream Operations LP, 5.625%, 2/15/2026(b) |

29,780 |

| 105,000 |

Kinetik Holdings LP, 5.875%, 6/15/2030(b) |

103,010 |

| 130,000 |

Kinetik Holdings LP, 6.625%, 12/15/2028(b) |

132,445 |

| 65,000 |

Suburban Propane Partners LP/Suburban Energy Finance Corp., 5.000%, 6/01/2031(b) |

58,928 |

| 50,000 |

Sunoco LP/Sunoco Finance Corp., 4.500%, 5/15/2029 |

46,446 |

| 225,000 |

Venture Global Calcasieu Pass LLC, 3.875%, 11/01/2033(b) |

190,676 |

| 130,000 |

Venture Global Calcasieu Pass LLC, 4.125%, 8/15/2031(b) |

114,531 |

| 110,000 |

Venture Global LNG, Inc., 8.375%, 6/01/2031(b) |

109,943 |

| |

|

2,046,183 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Non-Agency Commercial Mortgage-Backed Securities — 1.8% | |

| $94,077

|

CG-CCRE Commercial Mortgage Trust, Series 2014-FL2, Class COL1, 1 mo. USD SOFR + 3.614%, 8.976%, 11/15/2031(a)(b) |

$42,251

|

| 211,672 |

CG-CCRE Commercial Mortgage Trust, Series 2014-FL2, Class COL2, 1 mo. USD SOFR + 4.614%, 9.976%, 11/15/2031(a)(b) |

80,430 |

| 1,020,000 |

Credit Suisse Mortgage Trust, Series 2014-USA, Class E, 4.373%, 9/15/2037(b) |

479,341 |

| 380,000 |

Starwood Retail Property Trust, Series 2014-STAR, Class D, PRIME + 0.000%, 8.500%, 11/15/2027(a)(b)(d)(i) |

86,108 |

| 420,000 |

Starwood Retail Property Trust, Series 2014-STAR, Class E, PRIME + 0.000%, 8.500%, 11/15/2027(a)(b)(d)(i) |

21,000 |

| 60,000 |

Wells Fargo Commercial Mortgage Trust, Series 2016-C36, Class C, 4.118%, 11/15/2059(a) |

42,623 |

| 32,729 |

WFRBS Commercial Mortgage Trust, Series 2011-C3, Class D, 5.855%, 3/15/2044(a)(b) |

9,485 |

| 80,000 |

WFRBS Commercial Mortgage Trust, Series 2012-C10, Class C, 4.329%, 12/15/2045(a) |

54,494 |

| |

|

815,732 |

| |

Oil Field Services — 1.8% | |

| 60,000 |

Diamond Foreign Asset Co./Diamond Finance LLC, 8.500%, 10/01/2030(b) |

61,356 |

| 60,000 |

Nabors Industries, Inc., 9.125%, 1/31/2030(b) |

60,244 |

| 25,000 |

Oceaneering International, Inc., 6.000%, 2/01/2028(b) |

24,359 |

| 60,000 |

Solaris Midstream Holdings LLC, 7.625%, 4/01/2026(b) |

60,807 |

| 60,000 |

Transocean Aquila Ltd., 8.000%, 9/30/2028(b) |

60,898 |

| 333,750 |

Transocean Poseidon Ltd., 6.875%, 2/01/2027(b) |

332,093 |

| 25,000 |

Transocean Titan Financing Ltd., 8.375%, 2/01/2028(b) |

25,937 |

| 90,000 |

Transocean, Inc., 7.500%, 1/15/2026(b) |

88,755 |

| 90,000 |

Weatherford International Ltd., 8.625%, 4/30/2030(b) |

93,965 |

| |

|

808,414 |

| |

Other REITs — 0.7% | |

| 145,000 |

Service Properties Trust, 4.750%, 10/01/2026 |

135,303 |

| 40,000 |

Service Properties Trust, 7.500%, 9/15/2025 |

40,445 |

| 120,000 |

Service Properties Trust, 8.625%, 11/15/2031(b) |

125,692 |

| |

|

301,440 |

| |

Packaging — 0.2% | |

| 45,000 |

Graham Packaging Co., Inc., 7.125%, 8/15/2028(b) |

40,500 |

| 55,000 |

Sealed Air Corp./Sealed Air Corp. U.S., 6.125%, 2/01/2028(b) |

55,474 |

| |

|

95,974 |

| |

Pharmaceuticals — 4.8% | |

| 275,000 |

Bausch Health Cos., Inc., 4.875%, 6/01/2028(b) |

165,617 |

| 565,000 |

Bausch Health Cos., Inc., 5.250%, 1/30/2030(b) |

260,448 |

| 55,000 |

Bausch Health Cos., Inc., 6.125%, 2/01/2027(b) |

37,125 |

| 200,000 |

Cheplapharm Arzneimittel GmbH, 5.500%, 1/15/2028(b) |

189,876 |

| 270,000 |

Organon & Co./Organon Foreign Debt Co-Issuer BV, 5.125%, 4/30/2031(b) |

230,808 |

| 200,000 |

Perrigo Finance Unlimited Co., 4.650%, 6/15/2030 |

181,920 |

| 325,000 |

Teva Pharmaceutical Finance Co. LLC, 6.150%, 2/01/2036 |

311,022 |

| 195,000 |

Teva Pharmaceutical Finance Netherlands III BV, 3.150%, 10/01/2026 |

180,551 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Pharmaceuticals — continued | |

| $565,000

|

Teva Pharmaceutical Finance Netherlands III BV, 4.100%, 10/01/2046 |

$382,419

|

| 200,000 |

Teva Pharmaceutical Finance Netherlands III BV, 7.875%, 9/15/2029 |

215,552 |

| |

|

2,155,338 |

| |

Property & Casualty Insurance — 1.2% | |

| 40,000 |

Acrisure LLC/Acrisure Finance, Inc., 4.250%, 2/15/2029(b) |

36,118 |

| 70,000 |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 6.750%, 10/15/2027(b) |

69,753 |

| 100,000 |

AmWINS Group, Inc., 4.875%, 6/30/2029(b) |

91,323 |

| 55,000 |

AssuredPartners, Inc., 5.625%, 1/15/2029(b) |

51,345 |

| 65,000 |

BroadStreet Partners, Inc., 5.875%, 4/15/2029(b) |

60,674 |

| 145,000 |

HUB International Ltd., 7.250%, 6/15/2030(b) |

153,153 |

| 125,000 |

Liberty Mutual Group, Inc., 4.300%, 2/01/2061(b) |

82,593 |

| |

|

544,959 |

| |

Refining — 0.7% | |

| 125,000 |

CVR Energy, Inc., 5.250%, 2/15/2025(b) |

124,788 |

| 120,000 |

CVR Energy, Inc., 8.500%, 1/15/2029(b) |

119,400 |

| 5,000 |

HF Sinclair Corp., 5.000%, 2/01/2028(b) |

4,849 |

| 5,000 |

Parkland Corp., 4.500%, 10/01/2029(b) |

4,582 |

| 45,000 |

PBF Holding Co. LLC/PBF Finance Corp., 7.875%, 9/15/2030(b) |

45,832 |

| |

|

299,451 |

| |

Restaurants — 0.9% | |

| 330,000 |

1011778 BC ULC/New Red Finance, Inc., 3.875%, 1/15/2028(b) |

311,759 |

| 65,000 |

Papa John's International, Inc., 3.875%, 9/15/2029(b) |

57,497 |

| 15,000 |

Yum! Brands, Inc., 3.625%, 3/15/2031 |

13,527 |

| 35,000 |

Yum! Brands, Inc., 4.625%, 1/31/2032 |

32,728 |

| |

|

415,511 |

| |

Retailers — 1.5% | |

| 15,000 |

Asbury Automotive Group, Inc., 4.500%, 3/01/2028 |

14,246 |

| 90,000 |

Asbury Automotive Group, Inc., 4.625%, 11/15/2029(b) |

83,304 |

| 128,000 |

Asbury Automotive Group, Inc., 4.750%, 3/01/2030 |

119,485 |

| 25,000 |

Bath & Body Works, Inc., 5.250%, 2/01/2028 |

24,726 |

| 40,000 |

Bath & Body Works, Inc., 6.750%, 7/01/2036 |

40,253 |

| 55,000 |

Bath & Body Works, Inc., 6.875%, 11/01/2035 |

55,689 |

| 40,000 |

Ken Garff Automotive LLC, 4.875%, 9/15/2028(b) |

37,856 |

| 35,000 |

Lithia Motors, Inc., 4.375%, 1/15/2031(b) |

31,816 |

| 65,000 |

Michaels Cos., Inc., 7.875%, 5/01/2029(b) |

40,923 |

| 60,000 |

NMG Holding Co., Inc./Neiman Marcus Group LLC, 7.125%, 4/01/2026(b) |

57,657 |

| 85,000 |

Sonic Automotive, Inc., 4.625%, 11/15/2029(b) |

77,351 |

| 120,000 |

Sonic Automotive, Inc., 4.875%, 11/15/2031(b) |

106,962 |

| |

|

690,268 |

| |

Technology — 5.2% | |

| 70,000 |

Cloud Software Group, Inc., 6.500%, 3/31/2029(b) |

66,671 |

| 445,000 |

CommScope Technologies LLC, 5.000%, 3/15/2027(b) |

185,231 |

| 70,000 |

CommScope, Inc., 4.750%, 9/01/2029(b) |

46,998 |

| 50,000 |

CommScope, Inc., 6.000%, 3/01/2026(b) |

44,574 |

| 35,000 |

Dun & Bradstreet Corp., 5.000%, 12/15/2029(b) |

32,649 |

| 80,000 |

Elastic NV, 4.125%, 7/15/2029(b) |

73,460 |

| 60,000 |

Everi Holdings, Inc., 5.000%, 7/15/2029(b) |

54,464 |

| 160,000 |

GoTo Group, Inc., 5.500%, 9/01/2027(b) |

77,391 |

| 213,000 |

GTCR W-2 Merger Sub LLC, 7.500%, 1/15/2031(b) |

225,082 |

| 185,000 |

Iron Mountain, Inc., 4.500%, 2/15/2031(b) |

167,521 |

| 110,000 |

Iron Mountain, Inc., 4.875%, 9/15/2029(b) |

104,179 |

| 5,000 |

Iron Mountain, Inc., 5.250%, 7/15/2030(b) |

4,760 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Technology — continued | |

| $205,000

|

NCR Atleos Corp., 9.500%, 4/01/2029(b) |

$217,812

|

| 195,000 |

NCR Voyix Corp., 5.000%, 10/01/2028(b) |

184,327 |

| 55,000 |

NCR Voyix Corp., 5.125%, 4/15/2029(b) |

52,283 |

| 95,000 |

Neptune Bidco U.S., Inc., 9.290%, 4/15/2029(b) |

88,587 |

| 145,000 |

Newfold Digital Holdings Group, Inc., 11.750%, 10/15/2028(b) |

155,984 |

| 5,000 |

Paysafe Finance PLC/Paysafe Holdings U.S. Corp., 4.000%, 6/15/2029(b) |

4,412 |

| 70,000 |

Presidio Holdings, Inc., 8.250%, 2/01/2028(b) |

70,720 |

| 70,000 |

Rackspace Technology Global, Inc., 5.375%, 12/01/2028(b) |

25,130 |

| 60,000 |

Sabre Global, Inc., 11.250%, 12/15/2027(b) |

58,952 |

| 5,000 |

Seagate HDD Cayman, 4.091%, 6/01/2029 |

4,633 |

| 40,000 |

Seagate HDD Cayman, 4.875%, 6/01/2027 |

39,232 |

| 90,000 |

Seagate HDD Cayman, 8.250%, 12/15/2029(b) |

97,067 |

| 120,000 |

Sensata Technologies, Inc., 3.750%, 2/15/2031(b) |

105,688 |

| 50,000 |

Sensata Technologies, Inc., 4.375%, 2/15/2030(b) |

46,373 |

| 45,000 |

Western Digital Corp., 2.850%, 2/01/2029 |

38,739 |

| 70,000 |

Ziff Davis, Inc., 4.625%, 10/15/2030(b) |

64,220 |

| |

|

2,337,139 |

| |

Transportation Services — 0.7% | |

| 330,000 |

Rand Parent LLC, 8.500%, 2/15/2030(b) |

315,629 |

| |

Treasuries — 2.0% | |

| 900,000 |

U.S. Treasury Notes, 2.750%, 2/15/2024 |

897,162 |

| |

Wireless — 1.5% | |

| 230,000 |

Altice France SA, 5.125%, 1/15/2029(b) |

178,882 |

| 200,000 |

Altice France SA, 8.125%, 2/01/2027(b) |

184,366 |

| 330,000 |

SoftBank Group Corp., 4.625%, 7/06/2028 |

301,013 |

| |

|

664,261 |

| |

Wirelines — 1.9% | |

| 55,000 |

Cincinnati Bell Telephone Co. LLC, 6.300%, 12/01/2028 |

45,874 |

| 165,000 |

Frontier Communications Holdings LLC, 5.000%, 5/01/2028(b) |

152,489 |

| 215,000 |

Frontier Communications Holdings LLC, 5.875%, 10/15/2027(b) |

207,712 |

| 65,000 |

Level 3 Financing, Inc., 3.625%, 1/15/2029(b) |

27,300 |

| 95,000 |

Level 3 Financing, Inc., 4.250%, 7/01/2028(b) |

47,025 |

| 65,000 |

Lumen Technologies, Inc., 4.000%, 2/15/2027(b) |

41,949 |

| 225,000 |

Telecom Italia Capital SA, 6.375%, 11/15/2033 |

220,074 |

| 120,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 4.750%, 4/15/2028(b) |

103,428 |

| |

|

845,851 |

| |

Total Non-Convertible Bonds (Identified Cost $48,561,186) |

40,143,805 |

| | ||

| | ||

| Convertible Bonds — 3.8% | ||

| |

Airlines — 0.5% | |

| 215,000 |

Southwest Airlines Co., 1.250%, 5/01/2025 |

217,258 |

| |

Cable Satellite — 1.6% | |

| 1,265,000 |

DISH Network Corp., 3.375%, 8/15/2026 |

670,450 |

| 120,000 |

DISH Network Corp., Zero Coupon, 6.944%–33.530%, 12/15/2025(e) |

74,400 |

| |

|

744,850 |

| |

Consumer Cyclical Services — 0.1% | |

| 20,000 |

Zillow Group, Inc., 1.375%, 9/01/2026 |

27,260 |

| |

Financial Other — 0.0% | |

| 43,388 |

Sunac China Holdings Ltd., 7.800% PIK or 7.800% Cash, 9/30/2032(b)(h) |

3,254 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Gaming — 0.1% | |

| $40,000

|

Penn Entertainment, Inc., 2.750%, 5/15/2026 |

$51,800 |

| |

Healthcare — 0.3% | |

| 125,000 |

Envista Holdings Corp., 1.750%, 8/15/2028(b) |

113,750 |

| |

Independent Energy — 0.2% | |

| 90,000 |

Northern Oil & Gas, Inc., 3.625%, 4/15/2029 |

106,110 |

| |

Leisure — 0.2% | |

| 85,000 |

NCL Corp. Ltd., 1.125%, 2/15/2027 |

78,147 |

| |

Pharmaceuticals — 0.7% | |

| 325,000 |

BioMarin Pharmaceutical, Inc., 1.250%, 5/15/2027 |

333,742 |

| |

Technology — 0.1% | |

| 20,000 |

Wolfspeed, Inc., 0.250%, 2/15/2028 |

13,470 |

| 40,000 |

Wolfspeed, Inc., 1.875%, 12/01/2029 |

27,260 |

| |

|

40,730 |

| |

Total Convertible Bonds (Identified Cost $2,590,140) |

1,716,901 |

| |

Total Bonds and Notes (Identified Cost $51,151,326) |

41,860,706 |

| | ||

| | ||

| Senior Loans — 3.0% | ||

| |

Aerospace & Defense — 0.3% | |

| 155,000 |

TransDigm, Inc., 2023 Term Loan J, 3 mo. USD SOFR + 3.250%, 8.598%, 2/14/2031(a)(k) |

155,581 |

| |

Brokerage — 0.1% | |

| 64,834 |

Edelman Financial Center LLC, 2021 Term Loan B, 4/07/2028(l) |

64,875 |

| |

Chemicals — 0.2% | |

| 78,802 |

Chemours Co., 2023 USD Term Loan B, 1 mo. USD SOFR + 3.500%, 8.856%, 8/18/2028(a)(k) |

78,566 |

| |

Electric — 0.1% | |

| 28,855 |

Talen Energy Supply LLC, 2023 Term Loan B, 3 mo. USD SOFR + 4.500%, 9.869%, 5/17/2030(a)(k) |

28,975 |

| |

Food & Beverage — 0.2% | |

| 95,000 |

Chobani LLC, 2023 Incremental Term Loan, 3 mo. USD SOFR + 3.750%, 9.112%, 10/25/2027(a)(k) |

95,079 |

| |

Healthcare — 0.3% | |

| 17,000 |

IVC Acquisition Ltd., 2023 USD Term Loan B, 11/17/2028(l) |

17,014 |

| 126,820 |

Star Parent, Inc., Term Loan B, 3 mo. USD SOFR + 4.000%, 9.348%, 9/27/2030(a)(k) |

125,181 |

| |

|

142,195 |

| |

Leisure — 0.6% | |

| 180,424 |

Carnival Corp., 2021 Incremental Term Loan B, 1 mo. USD SOFR + 3.250%, 8.720%, 10/18/2028(a)(k) |

180,500 |

| 72,751 |

Carnival Corp., 2023 Term Loan B, 1 mo. USD SOFR + 3.000%, 8.357%, 8/08/2027(a)(k) |

72,811 |

| |

|

253,311 |

| |

Media Entertainment — 0.2% | |

| 112,327 |

MH Sub I LLC, 2023 Term Loan, 1 mo. USD SOFR + 4.250%, 9.606%, 5/03/2028(a)(k) |

110,252 |

| |

Property & Casualty Insurance — 0.5% | |

| 47,373 |

Acrisure LLC, 2020 Term Loan B, 2/15/2027(a)(k) |

47,212 |

| 77,186 |

Acrisure LLC, 2020 Term Loan B, 2/15/2027(l) |

76,924 |

| 15,994 |

AssuredPartners, Inc., 2023 Term Loan B4, 2/12/2027(l) |

16,023 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

Property & Casualty Insurance — continued | |

| $13,545

|

USI, Inc., 2023 Acquisition Term Loan, 3 mo. USD SOFR + 3.250%, 8.598%, 9/27/2030(a)(k) |

$13,549

|

| 55,579 |

USI, Inc., 2023 Term Loan B, 3 mo. USD SOFR + 3.000%, 8.348%, 11/22/2029(a)(k) |

55,623 |

| |

|

209,331 |

| |

Technology — 0.3% | |

| 55,000 |

Iron Mountain, Inc., 2023 Term Loan B, 1/31/2031(l) |

54,966 |

| 103,859 |

Neptune Bidco U.S., Inc., 2022 USD Term Loan B, 3 mo. USD SOFR + 5.000%, 10.507%, 4/11/2029(a)(k) |

94,641 |

| |

|

149,607 |

| |

Transportation Services — 0.2% | |

| 79,244 |

PODS LLC, 2021 Term Loan B, 1 mo. USD SOFR + 3.000%, 8.470%, 3/31/2028(l) |

77,433 |

| |

Total Senior Loans (Identified Cost $1,355,497) |

1,365,205 |

| | ||

| | ||

| Collateralized Loan Obligations — 1.1% | ||

| 250,000 |

Battalion CLO XVI Ltd., Series 2019-16A, Class ER, 3 mo. USD SOFR + 6.862%, 12.277%, 12/19/2032(a)(b) |

232,080 |

| 250,000 |

NYACK Park CLO Ltd., Series 2021-1A, Class E, 3 mo. USD SOFR + 6.362%, 11.777%, 10/20/2034(a)(b) |

237,209 |

| |

Total Collateralized Loan Obligations (Identified Cost $500,000) |

469,289 |

| Shares |

|

|

| Preferred Stocks — 0.3% | ||

| | ||

| | ||

| Convertible Preferred Stock — 0.3% | ||

| |

Technology — 0.3% | |

| 3,738 |

Clarivate PLC, Series A, 5.250% (Identified Cost $169,212) |

143,165 |

| | ||

| | ||

| Common Stocks— 0.1% | ||

| |

Energy Equipment & Services — 0.0% | |

| 10,149 |

McDermott International Ltd.(d) |

913 |

| |

Media — 0.0% | |

| 9,786 |

iHeartMedia, Inc., Class A(d) |

26,129 |

| |

Oil, Gas & Consumable Fuels — 0.1% | |

| 3,650 |

Battalion Oil Corp.(d) |

35,077 |

| |

Total Common Stocks (Identified Cost $841,517) |

62,119 |

| | ||

| | ||

| Warrants — 0.0% | ||

| 20,319 |

McDermott International Ltd., Tranche A, Expiration on 5/1/2024, (d)(i) |

— |

| 22,577 |

McDermott International Ltd., Tranche B, Expiration on 5/1/2024, (d)(i) |

— |

| |

Total Warrants (Identified Cost $31,517) |

— |

| | ||

| | ||

| Other Investments — 0.0% | ||

| |

Aircraft ABS — 0.0% | |

| 100 |

ECAF I Blocker, Ltd.(i)(m) (Identified Cost $1,000,000) |

— |

| Principal

Amount |

Description |

Value (†) |

| Short-Term Investments — 3.3% | ||

| $911,604

|

Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/29/2023 at 2.500% to be repurchased at $911,857 on 1/02/2024 collateralized by $913,300 U.S. Treasury Note, 4.125% due 9/30/2027 valued at $929,842 including accrued interest (Note 2 of Notes to Financial Statements) |

$911,604

|

| 580,000 |

U.S. Treasury Bills, 5.170%–5.237%, 4/09/2024(n)(o) |

571,796 |

| |

Total Short-Term Investments (Identified Cost $1,483,307) |

1,483,400 |

| |

Total Investments — 100.6% (Identified Cost $56,532,376) |

45,383,884 |

| |

Other assets less liabilities — (0.6)% |

(276,900 ) |

| |

Net Assets — 100.0% |

$45,106,984 |

| (†) |

See Note 2 of Notes to Financial Statements. |

| (a)

|

Variable rate security. Rate as of December 31, 2023 is disclosed.

Issuers comprised of various lots with differing coupon rates have

been aggregated for the purpose of presentation in the Portfolio of

Investments and show a weighted average rate. Certain variable

rate securities are not based on a published reference rate and

spread, rather are determined by the issuer or agent and are based

on current market conditions. These securities may not indicate a

reference rate and/or spread in their description. |

| (b)

|

All or a portion of these securities are exempt from registration

under Rule 144A of the Securities Act of 1933. These securities may

be resold in transactions exempt from registration, normally to

qualified institutional buyers. At December 31, 2023, the value of

Rule 144A holdings amounted to $32,057,040 or 71.1% of net assets. |

| (c)

|

Payment-in-kind security for which the issuer, at each interest

payment date, may make interest payments in cash and/or

additional principal. For the period ended December 31, 2023,

interest payments were made in cash. |

| (d)

|

Non-income producing security. |

| (e)

|

Interest rate represents annualized yield at time of purchase; not a

coupon rate. The Fund’s investment in this security is comprised of

various lots with differing annualized yields. |

| (f)

|

The issuer is in default with respect to interest and/or principal

payments. Income is not being accrued. |

| (g)

|

Payment–in–kind security for which the issuer, at each interest

payment date, may make interest payments in cash and/or

additional principal. For the period ended December 31, 2023,

interest payments were made in principal. |

| (h)

|

Payment–in–kind security for which the issuer, at each interest

payment date, may make interest payments in cash and/or

additional principal. No payments were received during the period. |

| (i)

|

Level 3 security. Value has been determined using significant

unobservable inputs. See Note 3 of Notes to Financial Statements. |

| (j)

|

Perpetual bond with no specified maturity date. |

| (k)

|

Stated interest rate has been determined in accordance with the

provisions of the loan agreement and is subject to a minimum

benchmark floor rate which may range from 0.00% to 2.50%, to

which the spread is added. |

| (l)

|

Position is unsettled. Contract rate was not determined at

December 31, 2023 and does not take effect until settlement date.

Maturity date is not finalized until settlement date. |

| (m)

|

Securities subject to restriction on resale. At December 31, 2023,

the restricted securities held by the Fund are as follows: |

| |

Acquisition Date |

Acquisition Cost |

Value |

% of Net Assets |

| ECAF I Blocker, Ltd. |

6/18/2015 |

$1,000,000

|

$—

|

0.0% |

| (n)

|

The Fund's investment in U.S. Government/Agency securities is

comprised of various lots with differing discount rates. These

separate investments, which have the same maturity date, have

been aggregated for the purpose of presentation in the Portfolio of

Investments. |

| (o)

|

Interest rate represents discount rate at time of purchase; not a

coupon rate. |

| ABS

|

Asset-Backed Securities |

| LIBOR

|

London Interbank Offered Rate |

| PIK

|

Payment-in-Kind |

| REITs

|

Real

Estate Investment Trusts |

| SOFR

|

Secured Overnight Financing Rate |

| Sell Protection |

| Reference Obligation |

(Pay)/

Receive

Fixed Rate |

Expiration

Date |

Implied

Credit

Spread^ |

Notional

Value(‡) |

Unamortized

Up Front Premium

Paid/(Received) |

Market

Value |

Unrealized Appreciation

(Depreciation) |

| CDX.NA.HY* .S41 |

5.00 % |

12/20/2028 |

3.56 % |

420,750 |

$(4,921

) |

$25,242 |

$30,163 |

| (‡) |

Notional value stated in U.S. dollars unless otherwise noted. |

| ^ |

Implied credit spreads, represented in absolute terms, serve as an indicator of the current status of the payment/performance risk and represent the likelihood or

risk of default for the credit derivative. The implied credit spread of a

particular reference entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the reference entity’s credit soundness and a greater

likelihood or risk of default or other credit event occurring as defined under the

terms of the agreement. |

| * |

CDX.NA.HY is an index composed of North American high yield credit default swaps. |

| Cable Satellite |

13.6 % |

| Finance Companies |

6.0 |

| Technology |

5.9 |

| Leisure |

5.6 |

| Pharmaceuticals |

5.5 |

| Independent Energy |

5.3 |

| Midstream |

4.5 |

| Healthcare |

3.8 |

| Metals & Mining |

3.3 |

| Consumer Cyclical Services |

3.1 |

| Building Materials |

3.0 |

| Banking |

2.5 |

| Treasuries |

2.0 |

| Other Investments, less than 2% each |

32.1 |

| Collateralized Loan Obligations |

1.1 |

| Short-Term Investments |

3.3 |

| Total Investments |

100.6 |

| Other assets less liabilities (including swap

agreements) |

(0.6 ) |

| Net Assets |

100.0 % |

| Principal

Amount |

Description |

Value (†) |

| Bonds and Notes — 74.9% of Net Assets | ||

| | ||

| | ||

| Non-Convertible Bonds — 73.4% | ||

| |

ABS Car Loan — 3.7% | |

| $3,200,000

|

American Credit Acceptance Receivables Trust, Series 2022-1, Class D, 2.460%, 3/13/2028(a) |

$3,078,234

|

| 1,785,000 |

American Credit Acceptance Receivables Trust, Series 2022-4, Class C, 7.860%, 2/15/2029(a) |

1,807,170 |

| 13,370,000 |

American Credit Acceptance Receivables Trust, Series 2023-2, Class C, 5.960%, 8/13/2029(a) |

13,349,715 |

| 4,795,000 |

American Credit Acceptance Receivables Trust, Series 2023-3, Class D, 6.820%, 10/12/2029(a) |

4,883,645 |

| 11,365,000 |

American Credit Acceptance Receivables Trust, Series 2023-4, Class D, 7.650%, 9/12/2030(a) |

11,714,304 |

| 10,244,793 |

AmeriCredit Automobile Receivables Trust, Series 2019-2, Class D, 2.990%, 6/18/2025 |

10,229,496 |

| 1,395,000 |

AmeriCredit Automobile Receivables Trust, Series 2020-2, Class D, 2.130%, 3/18/2026 |

1,345,895 |

| 5,500,000 |

Avis Budget Rental Car Funding AESOP LLC, Series 2018-2A, Class D, 3.040%, 3/20/2025(a) |

5,444,686 |

| 8,910,000 |

Avis Budget Rental Car Funding AESOP LLC, Series 2020-2A, Class A, 2.020%, 2/20/2027(a) |

8,311,615 |

| 7,500,000 |

Avis Budget Rental Car Funding AESOP LLC, Series 2021-2A, Class D, 4.080%, 2/20/2028(a) |

6,601,125 |

| 7,985,000 |

Avis Budget Rental Car Funding AESOP LLC, Series 2023-4A, Class C, 7.240%, 6/20/2029(a) |

8,153,682 |

| 2,810,000 |

Avis Budget Rental Car Funding AESOP LLC, Series 2023-8A, Class C, 7.340%, 2/20/2030(a) |

2,866,365 |

| 21,010,000 |

Bridgecrest Lending Auto Securitization Trust, Series 2023-1, Class D, 7.840%, 8/15/2029 |

21,816,853 |

| 2,550,000 |

CarMax Auto Owner Trust, Series 2021-3, Class D, 1.500%, 1/18/2028 |

2,352,594 |

| 1,100,000 |

CarMax Auto Owner Trust, Series 2022-1, Class D, 2.470%, 7/17/2028 |

1,008,788 |

| 11,965,000 |

CarMax Auto Owner Trust, Series 2023-1, Class D, 6.270%, 11/15/2029 |

11,928,042 |

| 1,540,000 |

CarMax Auto Owner Trust, Series 2023-2, Class D, 6.550%, 10/15/2029 |

1,549,774 |

| 3,035,000 |

CarMax Auto Owner Trust, Series 2023-4, Class D, 7.160%, 4/15/2030 |

3,121,179 |

| 1,595,000 |

Carvana Auto Receivables Trust, Series 2023-N1, Class D, 6.690%, 7/10/2029(a) |

1,596,434 |

| 1,860,000 |

Carvana Auto Receivables Trust, Series 2023-N4, Class D, 7.220%, 2/11/2030(a) |

1,900,512 |

| 275,000 |

Credit Acceptance Auto Loan Trust, Series 2020-3A, Class C, 2.280%, 2/15/2030(a) |

272,867 |

| 2,970,000 |

Credit Acceptance Auto Loan Trust, Series 2023-1A, Class C, 7.710%, 7/15/2033(a) |

3,048,625 |

| 4,835,000 |

Credit Acceptance Auto Loan Trust, Series 2023-2A, Class C, 7.150%, 9/15/2033(a) |

4,881,450 |

| 2,035,000 |

Credit Acceptance Auto Loan Trust, Series 2023-3A, Class C, 7.620%, 12/15/2033(a) |

2,090,291 |

| 10,500,000 |

DT Auto Owner Trust, Series 2022-1A, Class D, 3.400%, 12/15/2027(a) |

10,002,352 |

| 9,695,000 |

DT Auto Owner Trust, Series 2023-1A, Class D, 6.440%, 11/15/2028(a) |

9,695,421 |

| 10,700,000 |

DT Auto Owner Trust, Series 2023-2A, Class D, 6.620%, 2/15/2029(a) |

10,735,041 |

| Principal

Amount |

Description |

Value (†) |

| | ||

| |

ABS Car Loan — continued | |

| $7,695,000

|

DT Auto Owner Trust, Series 2023-3A, Class D, 7.120%, 5/15/2029(a) |

$7,871,870

|

| 7,410,000 |

Exeter Automobile Receivables Trust, Series 2021-1A, Class D, 1.080%, 11/16/2026 |

7,168,387 |