| Label |

Element |

Value |

| (Natixis Oakmark Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investment Goal

</b></div>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Fund Fees & Expenses

</b></div>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 83 of the Prospectus, in Appendix A to the Prospectus and on page 138 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Shareholder Fees

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> (fees paid directly from your investment) </b></div>

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Annual Fund Operating Expenses

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment) </b></div>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

April 30, 2020

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

A 1.00% contingent deferred sales charge ("CDSC") may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Example

</b></div>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same, except that the example for Class N is based on the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement assuming that such waiver and/or reimbursement will only be in place through the date noted above and on the Total Annual Fund Operating Expenses for the remaining periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are redeemed:</b></div>

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are not redeemed:</b></div>

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Portfolio Turnover

</b></div>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 39% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

39.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investments, Risks and Performance

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Strategies

</b></div>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Fund primarily invests in common stocks of U.S. companies. The Fund generally invests in securities of larger capitalization companies in any industry. Harris Associates L.P. ("Harris Associates") uses a value investment philosophy in selecting equity securities, including common stocks. This value investment philosophy is based upon the belief that, over time, a company's stock price converges with the company's intrinsic value. By "intrinsic value," Harris Associates means its estimate of the price a knowledgeable buyer would pay to acquire the entire business. Harris Associates believes that investing in securities priced significantly below what Harris Associates believes is a company's intrinsic value presents the best opportunity to achieve the Fund's investment objectives.

Harris Associates uses this value investment philosophy to identify companies that it believes have discounted stock prices compared to what Harris Associates believes are the companies' intrinsic values. In assessing such companies, Harris Associates looks for the following characteristics, although not all of the companies selected will have these attributes: (1) free cash flows and intelligent investment of excess cash; (2) earnings that are growing and are reasonably predictable; and (3) high level of company management ownership.

Once Harris Associates identifies a stock that it believes is selling at a significant discount to Harris Associates' estimate of intrinsic value and that the issuer has one or more of the additional qualities mentioned above, Harris Associates generally will consider buying that security for the Fund. Harris Associates usually sells a security when the price approaches its estimated value or the issuer's fundamentals change. Harris Associates monitors each holding and adjusts its price targets as warranted to reflect changes in the issuer's fundamentals. The Fund's portfolio typically holds 30 to 60 stocks.

|

|

| Risk [Heading] |

rr_RiskHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Risks

</b></div>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock.

Focused Investment Risk: Because the Fund may invest in a small number of industries or securities, it may have more risk because the impact of a single economic, political or regulatory occurrence may have a greater adverse impact on the Fund's net asset value.

Management Risk: A strategy used by the Fund's portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund.

|

|

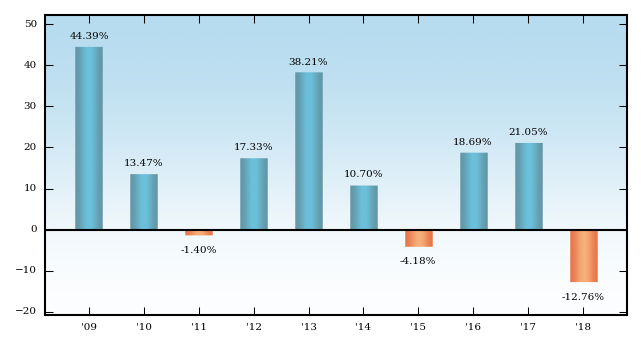

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Risk/Return Bar Chart and Table

</b></div>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year, and life-of-class periods compare to those of a broad measure of market performance. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;">

<b>Total Returns for Class Y Shares</b>

</div>

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarterly Return:

Second Quarter 2009, 24.26%

Lowest Quarterly Return:

Fourth Quarter 2018, -17.07%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Average Annual Total Returns </b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b> (for the periods ended December 31, 2018) </b></div>

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year, and life-of-class periods compare to those of a broad measure of market performance.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown for only one class of the Fund.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

im.natixis.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800-225-5478

|

|

| (Natixis Oakmark Fund) | S&P 500® Index |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(4.38%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

8.49%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

13.12%

|

|

| Life of Class N |

rr_AverageAnnualReturnSinceInception |

5.03%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 01, 2017

|

|

| (Natixis Oakmark Fund) | Class A |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.13%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.13%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 684

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

913

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,161

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,871

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(18.02%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.34%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

12.33%

|

|

| (Natixis Oakmark Fund) | Class C |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.88%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.88%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 291

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

591

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,016

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,201

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

191

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

591

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,016

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,201

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(14.40%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.80%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

12.16%

|

|

| (Natixis Oakmark Fund) | Class N |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

3.11%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

3.79%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

3.04%

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.75%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 77

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

876

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,696

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 3,832

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(12.60%)

|

|

| Life of Class N |

rr_AverageAnnualReturnSinceInception |

0.55%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 01, 2017

|

|

| (Natixis Oakmark Fund) | Class T |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.20%

|

[4] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.13%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.13%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 362

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

600

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

857

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,590

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(15.17%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

5.06%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

12.72%

|

|

| (Natixis Oakmark Fund) | Class Y |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.68%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.88%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[2],[3] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.88%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 90

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

281

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

488

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,084

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

44.39%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

13.47%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(1.40%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

17.33%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

38.21%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

10.70%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(4.18%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

18.69%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

21.05%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(12.76%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarterly Return: Second Quarter 2009, 24.26%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

24.26%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarterly Return: Fourth Quarter 2018, -17.07%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(17.07%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2018

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(12.76%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

5.86%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

13.29%

|

|

| (Natixis Oakmark Fund) | Class Y | Return After Taxes on Distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(14.75%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.05%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

12.17%

|

|

| (Natixis Oakmark Fund) | Class Y | Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(6.10%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

4.43%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

11.08%

|

|

| (Vaughan Nelson Value Opportunity Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investment Goal

</b></div>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Fund Fees & Expenses

</b></div>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 83 of the Prospectus, in Appendix A to the Prospectus and on page 138 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Shareholder Fees

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> (fees paid directly from your investment) </b></div>

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Annual Fund Operating Expenses

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment) </b></div>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

April 30, 2020

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

A 1.00% contingent deferred sales charge ("CDSC") may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Example

</b></div>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are redeemed:</b></div>

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are not redeemed:</b></div>

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Portfolio Turnover

</b></div>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 44% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

44.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Investments, Risks and Performance

</b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Strategies

</b></div>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Fund will invest primarily in companies that, at the time of purchase, have market capitalizations either within the capitalization range of the Russell Midcap® Value Index, an unmanaged index that measures the performance of companies with lower price-to-book ratios and lower forecasted growth values within the broader Russell Midcap® Index, or of $15 billion or less. While the market capitalization range for the Russell Midcap® Value Index fluctuates, at December 31, 2018, it was $472.5 million to $33.6 billion. However, the Fund does not have any market capitalization limits and may invest in companies with smaller or larger capitalizations. Equity securities may take the form of stock in corporations, limited partnership interests, interests in limited liability companies, real estate investment trusts ("REITs") or other trusts and similar securities representing direct or indirect ownership interests in business organizations.

Vaughan Nelson Investment Management, L.P. ("Vaughan Nelson") invests in medium-capitalization companies with a focus on those companies meeting Vaughan Nelson's return expectations. Vaughan Nelson uses a bottom-up value oriented investment process in constructing the Fund's portfolio. Vaughan Nelson seeks companies with the following characteristics, although not all of the companies selected will have these attributes:

-

Companies earning a positive return on capital with stable-to-improving returns.

-

Companies valued at a discount to their asset value.

-

Companies with an attractive and sustainable dividend level.

In selecting investments for the Fund, Vaughan Nelson generally employs the following strategies:

-

Vaughan Nelson employs a value-driven investment philosophy that selects stocks selling at a relatively low value based on business fundamentals, economic margin analysis and discounted cash flow models. Vaughan Nelson selects companies that it believes are out of favor or misunderstood.

-

Vaughan Nelson narrows the investment universe by using value-driven screens to create a research universe of companies with market capitalizations between $1 billion and $20 billion.

-

Vaughan Nelson uses fundamental analysis to construct a portfolio that, in the opinion of Vaughan Nelson, is made up of quality companies with the potential to provide significant increases in share price over a three year period.

-

Vaughan Nelson will generally sell a security when it reaches Vaughan Nelson's price target or when the issuer shows a change in financial condition, competitive pressures, poor management decisions or internal or external forces reducing future expected returns from those expected at the time of investment.

The Fund may also:

-

Invest in convertible preferred stock and convertible debt securities.

-

Invest in foreign securities, including emerging markets securities.

-

Invest in other investment companies, to the extent permitted by the Investment Company Act of 1940.

-

Invest in REITs.

-

Invest in securities offered in initial public offerings ("IPOs") and securities issued pursuant to Rule 144A under the Securities Act of 1933 ("Rule 144A securities").

|

|

| Risk [Heading] |

rr_RiskHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Principal Investment Risks

</b></div>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer's unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Securities issued in IPOs tend to involve greater market risk than other equity securities due, in part, to public perception and the lack of publicly available information and trading history. Rule 144A securities may be less liquid than other equity securities. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock. Equity securities may take the form of stock in corporations, limited partnership interests, interests in limited liability companies, REITs or other trusts and other similar securities representing direct or indirect ownership interests in business organizations.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund's investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Investments in Other Investment Companies Risk: The Fund will indirectly bear the management, service and other fees of any other investment companies, including exchange-traded funds, in which it invests in addition to its own expenses.

Liquidity Risk:

Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund's investments or in their capacity or willingness to transact may increase the Fund's exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund's investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to greater liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Liquidity issues may also make it difficult to value the Fund's investments.

Management Risk: A strategy used by the Fund's portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services.

REITs Risk: Investments in the real estate industry, including REITs, are particularly sensitive to economic downturns and are sensitive to factors such as changes in real estate values, property taxes and tax laws, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents and the management skill and creditworthiness of the issuer. Companies in the real estate industry also may be subject to liabilities under environmental and hazardous waste laws. In addition, the value of a REIT is affected by changes in the value of the properties owned by the REIT or mortgage loans held by the REIT. REITs are also subject to default and prepayment risk. Many REITs are highly leveraged, increasing their risk. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund.

Small- and Mid-Capitalization Companies Risk: Compared to large-capitalization companies, small- and mid-capitalization companies are more likely to have limited product lines, markets or financial resources. Stocks of these companies often trade less frequently and in limited volume and their prices may fluctuate more than stocks of large-capitalization companies. As a result, it may be relatively more difficult for the Fund to buy and sell securities of small- and mid-capitalization companies.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund.

|

|

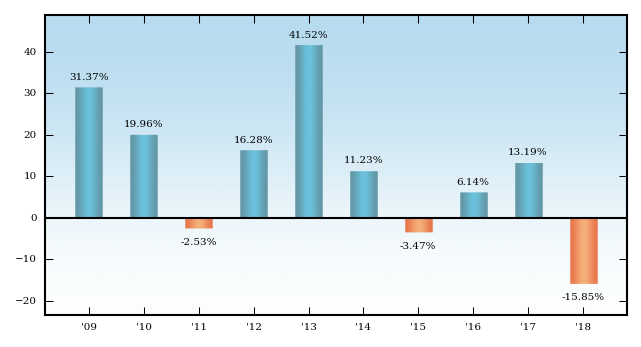

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>

Risk/Return Bar Chart and Table

</b></div>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, life-of-fund and life-of-class periods (as applicable) compare to those of a broad measure of market performance. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;">

<b>Total Returns for Class Y Shares</b>

</div>

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest Quarterly Return:

Third Quarter 2009, 21.36%

Lowest Quarterly Return:

Third Quarter 2011, -21.12%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Average Annual Total Returns </b></div>

<div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b> (for the periods ended December 31, 2018) </b></div>

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

Index performance reflects no deduction for fees, expenses or taxes.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, life-of-fund and life-of-class periods (as applicable) compare to those of a broad measure of market performance.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown for only one class of the Fund.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

im.natixis.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800-225-5478

|

|

| (Vaughan Nelson Value Opportunity Fund) | Russell MidCap® Value Index |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(12.29%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

5.44%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

13.03%

|

|

| Life of Class N |

rr_AverageAnnualReturnSinceInception |

7.74%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 01, 2013

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class A |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.21%

|

[5] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.45%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.45%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 714

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,007

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,322

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 2,210

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(20.92%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

0.20%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

9.68%

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class C |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.18%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.21%

|

[5] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

2.19%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

2.19%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 322

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

685

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,175

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,524

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

222

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

685

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,175

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,524

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(17.47%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

0.64%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

9.52%

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class N |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.08%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.21%

|

[5] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.09%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.09%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 111

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

347

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

601

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,329

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(15.78%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

1.73%

|

|

| Life of Class N |

rr_AverageAnnualReturnSinceInception |

5.56%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 01, 2013

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class T |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

[4] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.21%

|

[5] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.45%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.45%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 394

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

697

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,022

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,942

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(18.20%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

0.88%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.06%

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class Y |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Redemption fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.21%

|

[5] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.20%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[6] |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.20%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 122

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

381

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

660

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,455

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

31.37%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

19.96%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(2.53%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

16.28%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

41.52%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

11.23%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(3.47%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

6.14%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

13.19%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(15.85%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest Quarterly Return: Third Quarter 2009, 21.36%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

21.36%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2009

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest Quarterly Return: Third Quarter 2011, -21.12%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(21.12%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(15.85%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

1.66%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

10.62%

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class Y | Return After Taxes on Distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(17.62%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

0.46%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

9.61%

|

|

| (Vaughan Nelson Value Opportunity Fund) | Class Y | Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Past 1 Year |

rr_AverageAnnualReturnYear01 |

(8.08%)

|

|

| Past 5 Years |

rr_AverageAnnualReturnYear05 |

1.29%

|

|

| Past 10 Years |

rr_AverageAnnualReturnYear10 |

8.75%

|

|

|

|