| (ASG Dynamic Allocation Fund) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investment Goal </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund seeks long-term capital appreciation. The secondary goal of the Fund is the protection of capital during unfavorable market conditions.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Fund Fees & Expenses </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 76 of the Prospectus, in Appendix A to the Prospectus and on page 121 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Shareholder Fees </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> (fees paid directly from your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Annual Fund Operating Expenses </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Example </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same, except that the example is based on the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement assuming that such waiver and/or reimbursement will only be in place through the date noted above and on the Total Annual Fund Operating Expenses for the remaining periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are not redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Portfolio Turnover </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 46% of the average value of its portfolio.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investments, Risks and Performance </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Strategies </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund tactically allocates its investments across a range of asset classes and global markets. Under normal market conditions, the Adviser will typically use a variety of derivative instruments, including equity, fixed-income and currency futures contracts and currency forward contracts, as well as exchange-traded funds ("ETFs") and money market and other short-term, high-quality securities, to achieve exposures to the following asset classes: (i) U.S. equity securities; (ii) foreign developed market equity securities; (iii) emerging market equity and fixed-income securities; (iv) U.S. fixed-income securities; and (v) foreign developed market fixed-income securities. Emerging markets are economies that the Adviser believes are not generally recognized to be fully developed markets, as measured by gross national income, financial market infrastructure, market capitalization and/or other factors. The Fund will typically obtain its target allocations through the use of long positions in futures and/or forward contracts, as well as investments in ETFs, which can provide exposure to certain asset classes that may not be readily available via futures contracts (e.g., domestic and international corporate bonds). The Fund may also hold short positions through the use of derivatives for hedging purposes. The Fund may obtain exposure to below investment grade fixed-income securities, also known as "junk bonds," through its investments in ETFs. Below investment grade fixed-income securities are rated below investment grade quality (i.e., none of the three major rating agencies (Moody's Investors Service, Inc., Fitch Investor Services, Inc. or S&P Global Ratings) have rated the securities in one of their respective top four ratings categories).

In deciding which investments to buy and sell, the Adviser uses a quantitative systematic approach which analyzes multiple time periods. The approach consists of overweighting and/or underweighting allocations to asset classes based on a number of factors, including momentum signals, changes in hedge fund positioning, and/or market volatility. For example, the Adviser may overweight an asset class that demonstrates increasing momentum and/or hedge fund exposure relative to other asset classes. In estimating changes in hedge fund positioning, the Adviser may use various approaches, including an analysis of the returns of hedge funds included in one or more commercially available databases selected by the Adviser (for example, the Lipper TASS hedge fund database). When determining allocations to asset classes, the Adviser will also take into consideration correlations between assets and the volatilities of these assets. The minimum exposure to each asset class may be as low as 0% of total assets.

The Adviser separately manages the Fund's investments in derivatives and ETFs (the "Dynamic Allocation Portion") and the Fund's investments in money market and other short-term, high-quality securities (the "Money Market Portion," described further below). The Dynamic Allocation Portion will obtain economic leverage through the use of derivative instruments. Leverage can vary over time based on market conditions and the net notional value of the Dynamic Allocation Portion's investment exposure will not exceed 200% of the Fund's total assets. The Fund's total investment exposure may be greater than 200% of the Fund's total assets because it includes exposures obtained through both the Dynamic Allocation Portion and the Money Market Portion. Because the Fund's investment exposure will often exceed its total assets, it will be subject to increased risk compared to funds that do not leverage their investment exposure. While this increased investment exposure may magnify the Fund's potential for gains, it will also magnify the potential for losses. For these reasons, the Fund is intended for long-term investors.

The Adviser will seek to manage the annualized volatility (a statistical measure of the variation of returns) of the Fund's overall portfolio as part of the investment approach. The Adviser will monitor the portfolio daily, and will generally seek an annualized volatility level of no greater than 20% (as measured by the standard deviation of the Fund's returns). The Fund's actual or realized volatility during certain periods or over time may significantly exceed 20% for various reasons, including changes in market levels of volatility and investments in instruments that are inherently volatile. This would increase the risk of investing in the Fund.

The Fund expects that, under normal market conditions, it will invest at least 40% of its total assets in the Money Market Portion. The Fund may invest less than this percentage in the Money Market Portion and the Adviser will determine the percentage of the Fund's assets that will be invested in the Money Market Portion at any time. The assets allocated to the Money Market Portion will be used primarily to provide collateral for the Fund's investments in derivatives and, secondarily, to provide the Fund with incremental income and liquidity. Although the Fund will invest a significant portion of its assets in money market instruments, the Fund is not a "money market" fund and the value of the Money Market Portion as well as the value of the Fund's shares may decrease. The Fund is not subject to the portfolio quality, maturity and net asset value requirements applicable to money market funds, and the Fund will not seek to maintain a stable net asset value. The Fund will concentrate its investments in the financial services industry, which means it will normally invest at least 25% of its total assets in securities and other obligations (for example, bank certificates of deposit, repurchase agreements and time deposits) of issuers in that industry.

The Adviser will only invest the assets of the Money Market Portion in high-quality securities which are denominated in U.S. dollars, and will select securities for investment based on various factors, including the security's maturity and rating. The Adviser will invest primarily in: (i) short-term obligations issued or guaranteed by the United States government, its agencies or instrumentalities; (ii) securities issued by foreign governments, their political subdivisions, agencies or instrumentalities; (iii) certificates of deposit, time deposits and bankers' acceptances issued by domestic banks, foreign branches of domestic banks, foreign subsidiaries of domestic banks and domestic and foreign branches of foreign banks; (iv) variable amount master demand notes; (v) participation interests in loans extended by banks to companies; (vi) commercial paper or similar debt obligations; and (vii) repurchase agreements.

The Fund expects to add commodities as an available asset class for investment at a future date. Although the Fund does not intend to invest in physical commodities directly, the Fund expects to obtain investment exposure to commodities and commodity-related derivatives by investing in a wholly-owned subsidiary expected to be organized under the laws of the Cayman Islands that will make commodity-related investments (the "Commodity Subsidiary"). The Fund anticipates registering the Commodity Subsidiary upon the attainment of approximately $100 million in assets under management. The maximum exposure to commodities will be 20% of total assets.

The Fund is non-diversified, which means that it may invest a greater percentage of its assets in a particular issuer and may invest in fewer issuers. Because the Fund may invest in the securities of a limited number of issuers, an investment in the Fund may involve a higher degree of risk than would be present in a diversified portfolio.

The Fund may engage in active and frequent trading of securities and other instruments. Effects of frequent trading may include high transaction costs, which may lower the Fund's return, and realization of greater short-term capital gains, distributions of which are taxable as ordinary income to taxable shareholders.

Trading costs and tax effects associated with frequent trading may adversely affect the Fund's performance. The Fund's trading in derivatives is active and frequent. Active and frequent trading of derivatives, like active and frequent trading of securities, will result in transaction costs which reduce fund returns.

The percentage limitations set forth herein are not investment restrictions and the Fund may exceed these limits from time to time.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Risks </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Allocation Risk: This is the risk that the Adviser's judgments about, and allocations between, asset classes and market exposures may adversely affect the Fund's performance. The allocation, as set forth above, may not be optimal in every market condition. You could lose money on your investment in the Fund as a result of this allocation. This risk can be increased by the use of derivatives to increase allocations to various market exposures. This is because derivatives can create investment leverage, which will magnify the impact to the Fund of its investment in any underperforming market exposure.

Below Investment Grade Fixed-Income Securities Risk: The Fund's investments in below investment grade fixed-income securities, also known as "junk bonds," may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk, credit/counterparty risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment grade fixed-income securities.

Commodity Risk: This is the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of physical commodities or commodity-linked derivative instruments may be affected by changes in overall market movements, commodity price volatility, changes in interest rates, currency fluctuations, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Commodity Subsidiary Risk: Investing in the Commodity Subsidiary will indirectly expose the Fund to the risks associated with the Commodity Subsidiary's investments, such as commodity risk. The Commodity Subsidiary will not be registered under the Investment Company Act of 1940 (the "1940 Act") and will not be subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund is organized and the Commodity Subsidiary is expected to be organized, respectively, could negatively affect the Fund and its shareholders.

Concentrated Investment Risk: The Fund is particularly vulnerable to events affecting companies in the financial services industry because the Fund concentrates its investments in securities and other obligations of issuers in such industry. Examples of risks affecting the financial services industry include changes in governmental regulation, issues relating to the availability and cost of capital, changes in interest rates and/or monetary policy and price competition. In addition, financial services companies are often more highly leveraged than other companies, making them inherently riskier. As a result, the Fund's shares may rise and fall in value more rapidly and to a greater extent than shares of a fund that does not concentrate or focus in a particular industry or economic sector.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivative transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter ("OTC") derivative transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivative transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains. This risk will be heightened to the extent the Fund enters into derivative transactions with a single counterparty (or affiliated counterparties that are part of the same organization), causing the Fund to have significant exposure to such counterparty.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest a significant portion of its assets in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including futures and forward contracts) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund's exposure to commodities markets, securities market values, interest rates or currency exchange rates. It is possible that the Fund's liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund's use of derivatives, such as futures, forward contracts, and other foreign currency transactions and commodity-linked derivatives involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward contracts and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund's derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund. There is a risk that the Adviser's use of derivatives, such as futures and forward contracts, to manage the Fund's volatility may be ineffective or may exacerbate losses, for example, if the derivative or the underlying assets decrease in value over time.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer's unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund's investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund's investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund's ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment, combined with the Federal Reserve Board's conclusion of its quantitative easing program and recent increases in interest rates, increases the likelihood of interest rates rising in the future.

Investments in Other Investment Companies Risk: The Fund will indirectly bear the management, service and other fees of any other investment companies, including ETFs, in which it invests in addition to its own expenses. In addition, investments in ETFs have unique characteristics, including, but not limited to, the expense structure and additional expenses associated with investing in ETFs.

Large Investor Risk: Ownership of shares of the Fund may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund's expenses.

Leverage Risk: Use of derivative instruments may involve leverage. Taking short positions in securities results in a form of leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on the fund's returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund's investments or in their capacity or willingness to transact may increase the Fund's exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund's investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to greater liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund's investments.

Management Risk: A strategy used by the Fund's portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services. The Adviser will attempt to reduce this risk by implementing various volatility management strategies and techniques. However, there is no guarantee that such strategies and techniques will produce the intended result.

Models and Data Risk: The Adviser utilizes various proprietary quantitative models to identify investment opportunities. There is a possibility that one or all of the quantitative models may fail to identify profitable opportunities at any time. Furthermore, the models may incorrectly identify opportunities and these misidentified opportunities may lead to substantial losses for the Fund. Models may be predictive in nature and such models may result in an incorrect assessment of future events. Data used in the construction of models may prove to be inaccurate or stale, which may result in losses for the Fund.

Non-Diversification Risk: Compared with other mutual funds, the Fund may invest a greater percentage of its assets in a particular issuer and may invest in fewer issuers. Therefore, the Fund may have more risk because changes in the value of a single security or the impact of a single economic, political or regulatory occurrence may have a greater adverse impact on the Fund's net asset value.

Short Exposure Risk: A short exposure through a derivative or short sale may present various risks, including credit/counterparty risk and leverage risk. If the value of the asset, asset class or index on which the Fund has obtained a short investment exposure increases, the Fund will incur a loss. Unlike a direct cash investment such as a stock, bond or ETF, where the potential loss is limited to the purchase price, the potential risk of loss from a short exposure is theoretically unlimited. The Fund may be unable to borrow securities in connection with a short sale or to enter into a short position at an advantageous time or price, which could limit its ability to obtain the desired short exposure. Moreover, there can be no assurance that securities necessary to cover (repurchase in order to close) a short position will be available for purchase.

U.S. Government Securities Risk: Investments in certain U.S. government securities may not be supported by the full faith and credit of the U.S. government. Accordingly, no assurance can be given that the U.S. government will provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. The maximum potential liability of the issuers of some U.S. government securities held by the Fund may greatly exceed their current resources, and it is possible that these issuers will not have the funds to meet their payment obligations in the future. In such a case, the Fund would have to look principally to the agency, instrumentality or sponsored enterprise issuing or guaranteeing the security for ultimate repayment, and the Fund may not be able to assert a claim against the U.S. government itself in the event the agency, instrumentality or sponsored enterprise does not meet its commitment. Concerns about the capacity of the U.S. government to meet its obligations may raise the interest rates payable on its securities, negatively impacting the price of such securities already held by the Fund.

Valuation Risk: This is the risk that the Fund has valued certain securities or positions at a higher price than the price at which they can be sold. This risk may be especially pronounced for investments, such as derivatives, that may be illiquid or may become illiquid.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Risk/Return Bar Chart and Table </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

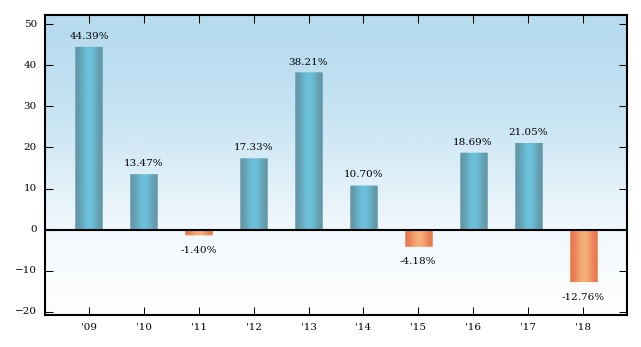

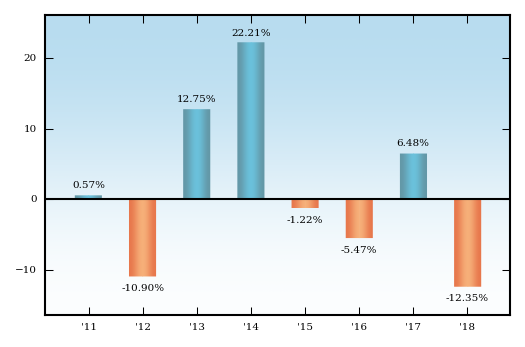

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year and life-of-fund periods compare to those of two broad measures of market performance. The Blended Index is an unmanaged, blended index composed of the following weights: 60% MSCI World Index (Net) and 40% Bloomberg Barclays U.S. Aggregate Bond Index. The two indices composing the Blended Index measure, respectively, the performance of global equity securities and global sovereign fixed-income securities. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Total Returns for Class Y Shares</b> </div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Highest Quarterly Return:

First Quarter 2017, 6.25%

Lowest Quarterly Return:

Fourth Quarter 2018, -9.89% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Average Annual Total Returns </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b> (for the periods ended December 31, 2018) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (ASG Global Alternatives Fund) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investment Goal </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund pursues an absolute return strategy that seeks to provide capital appreciation consistent with the risk-return characteristics of a diversified portfolio of hedge funds. The secondary goal of the Fund is to achieve these returns with less volatility than major equity indices.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Fund Fees & Expenses </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 76 of the Prospectus, in Appendix A to the Prospectus and on page 121 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Shareholder Fees </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> (fees paid directly from your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Annual Fund Operating Expenses </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Example </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same, except that the example is based on the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement assuming that such waiver and/or reimbursement will only be in place through the date noted above and on the Total Annual Fund Operating Expenses for the remaining periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are not redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Portfolio Turnover </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During its most recently ended fiscal year, the Fund's portfolio turnover rate was 59% of the average value of its portfolio.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investments, Risks and Performance </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Strategies </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund seeks to achieve long and short exposure to global equity, bond, currency and commodity markets through a wide range of derivative instruments and direct investments. Under normal market conditions, the Adviser typically will make extensive use of derivative instruments, in particular futures, forward contracts and swaps on global equity and fixed-income securities, securities indices (including both broad- and narrow-based securities indices), currencies, commodities and other instruments. These investments are intended to provide the Fund with risk and return characteristics similar to those of a diversified portfolio of hedge funds. The Fund may also make direct long and short investments in equity and fixed-income securities.

The Fund seeks to generate absolute returns over time rather than track the performance of any particular index of hedge fund returns. In selecting investments for the Fund, the Adviser uses quantitative models to estimate the market exposures that drive the aggregate returns of a diverse set of hedge funds. The Adviser seeks to capture these market exposures in the aggregate while adding value through dynamic allocation among market exposures and volatility management. These market exposures may include, for example, exposures to the returns of stocks, fixed-income securities (including U.S. and non-U.S. government securities, as well as corporate debt securities), currencies and commodities. In estimating these market exposures, the Adviser may use various approaches, including analyses of the returns of hedge funds included in one or more commercially available databases selected by the Adviser (for example, the Lipper TASS hedge fund database) and regulatory filings. The Fund may also directly employ various strategies commonly used by hedge funds that seek to profit from underlying risk factors, such as merger arbitrage and trend-following strategies. In a merger arbitrage strategy, the Adviser buys shares of target companies in corporate reorganizations and establishes short positions in shares of the acquiring companies. Trend-following strategies analyze markets over various time horizons to invest either long or short in assets whose values are rising or falling, respectively.

The Adviser will have great flexibility to allocate the Fund's exposure among various securities, indices, currencies, commodities and other instruments; the amount of the Fund's assets that may be allocated to various strategies and among investments is expected to vary over time. When buying and selling securities and other instruments for the Fund, the Adviser also may consider other factors, such as: (i) the Fund's obligations under its various derivative positions; (ii) portfolio rebalancing; (iii) redemption requests; (iv) yield management; (v) credit management; and (vi) volatility management. The Fund will not invest directly in hedge funds. The Fund may invest in non-U.S. securities and instruments and securities and instruments traded outside the United States, and expects to engage in non-U.S. currency transactions.

The Adviser currently targets an annualized volatility level of 9% or less (as measured by the standard deviation of the Fund's returns). The Fund's actual or realized volatility during certain periods or over time may materially exceed its target volatility for various reasons, including changes in market levels of volatility and because the Fund's portfolio may include instruments that are inherently volatile. This would increase the risk of investing in the Fund.

Under normal market conditions, it is expected that no more than 25% of the Fund's total assets will be dedicated to initial and variation margin payments relating to the Fund's derivative transactions. The gross notional value of the Fund's derivative investments, however, will generally exceed 25% of the Fund's assets, and may significantly exceed the total value of the Fund's assets. The Adviser will invest a portion of the Fund's assets, which may vary over time, in short-term, high-quality securities. Such investments will be used primarily to finance the Fund's investments in derivatives and, secondarily, to provide the Fund with incremental income and liquidity, and may include: (i) short-term obligations issued or guaranteed by the United States government, its agencies or instrumentalities; (ii) securities issued by foreign governments, their political subdivisions or agencies or instrumentalities; (iii) certificates of deposit, time deposits and bankers' acceptances issued by domestic banks, foreign branches of domestic banks, foreign subsidiaries of domestic banks, and domestic and foreign branches of foreign banks; (iv) variable amount master demand notes; (v) participation interests in loans extended by banks to companies; (vi) commercial paper or similar debt obligations; and (vii) repurchase agreements. The Adviser will select such investments based on various factors, including the security's maturity and credit rating.

Although the Fund does not intend to invest in physical commodities directly, the Fund expects to obtain investment exposure to commodities and commodity-related derivatives through a wholly-owned subsidiary organized under the laws of the Cayman Islands that will make commodity-related investments (the "Commodity Subsidiary"). Under normal market conditions, no more than 10% of the Fund's total assets will be dedicated to initial and variation margin payments relating to these transactions.

The Fund will concentrate its investments in the financial services industry, which means it will normally invest at least 25% of its total assets in securities and other obligations (for example, bank certificates of deposit) of issuers in such industry. The Fund may engage in active and frequent trading of securities and other instruments. Effects of frequent trading may include high transaction costs, which may lower the Fund's return, and realization of greater short-term capital gains, distributions of which are taxable as ordinary income to taxable shareholders. Trading costs and tax effects associated with frequent trading may adversely affect the Fund's performance. The Fund's trading in derivatives is active and frequent. Active and frequent trading of derivatives, like active and frequent trading of securities, will result in transaction costs which reduce fund returns.

The percentage limitations set forth herein are not investment restrictions and the Fund may exceed these limits from time to time.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Risks </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Allocation Risk: This is the risk that the Adviser's judgments about, and allocations between, asset classes and market exposures may adversely affect the Fund's performance. The allocation, as set forth above, may not be optimal in every market condition. You could lose money on your investment in the Fund as a result of this allocation. This risk can be increased by the use of derivatives to increase allocations to various market exposures. This is because derivatives can create investment leverage, which will magnify the impact to the Fund of its investment in any underperforming market exposure.

Commodity Risk: This is the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of physical commodities or commodity-linked derivative instruments may be affected by changes in overall market movements, commodity price volatility, changes in interest rates, currency fluctuations, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Commodity Subsidiary Risk: Investing in the Commodity Subsidiary will indirectly expose the Fund to the risks associated with the Commodity Subsidiary's investments, such as commodity risk. The Commodity Subsidiary is not registered under the Investment Company Act of 1940 (the "1940 Act") and is not subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Commodity Subsidiary, respectively, are organized, could negatively affect the Fund and its shareholders.

Concentrated Investment Risk: The Fund is particularly vulnerable to events affecting companies in the financial services industry because the Fund concentrates its investments in securities and other obligations of issuers in such industry. Examples of risks affecting the financial services industry include changes in governmental regulation, issues relating to the availability and cost of capital, changes in interest rates and/or monetary policy and price competition. In addition, financial services companies are often more highly leveraged than other companies, making them inherently riskier. As a result, the Fund's shares may rise and fall in value more rapidly and to a greater extent than shares of a fund that does not concentrate or focus in a particular industry or economic sector.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivative transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter ("OTC") derivative transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivative transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains. This risk will be heightened to the extent the Fund enters into derivative transactions with a single counterparty (or affiliated counterparties that are part of the same organization), causing the Fund to have significant exposure to such counterparty.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest a significant portion of its assets in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including futures, swaps, forward contracts, and other foreign currency transactions and commodity-linked derivatives) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund's exposure to commodities markets, securities market values, interest rates or currency exchange rates. It is possible that the Fund's liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund's use of derivatives, such as futures, swaps, forward contracts, and other foreign currency transactions and commodity-linked derivatives involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward contracts, swaps and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund's derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund. There is a risk that the Adviser's use of derivatives, such as futures and forward contracts, to manage the Fund's volatility may be ineffective or may exacerbate losses, for example, if the derivative or the underlying assets decrease in value over time.

Equity Securities Risk: The value of the Fund's investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer's bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund's investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Hedge Fund Risk: Hedge funds are typically unregulated private investment pools available only to sophisticated investors. They are often illiquid and highly leveraged. Although the Fund will not invest directly in hedge funds, because the Fund's investments are intended to provide exposure to the factors that drive hedge fund returns, an investment in the Fund will be subject to many of the same risks associated with an investment in a diversified portfolio of hedge funds. Therefore, the Fund's performance may be lower than the returns of the broader stock market and the Fund's net asset value may fluctuate substantially over time.

Index/Tracking Error Risk: Although the Fund does not seek to track any particular index, the Fund seeks to analyze the factors that drive hedge fund returns, as determined by reference to one or more indices. These indices may not provide an accurate representation of hedge fund returns generally, and the Adviser's strategy may not successfully identify or be able to replicate factors that drive returns. There is a risk that hedge fund return data provided by third party hedge fund index providers may be inaccurate or may not accurately reflect hedge fund returns due to survivorship bias, self-reporting bias or other biases.

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund's investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund's ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment, combined with the Federal Reserve Board's conclusion of its quantitative easing program and recent increases in interest rates, increases the likelihood of interest rates rising in the future.

Investments in Other Investment Companies Risk: The Fund will indirectly bear the management, service and other fees of any other investment companies, including ETFs, in which it invests in addition to its own expenses. In addition, investments in ETFs have unique characteristics, including, but not limited to, the expense structure and additional expenses associated with investing in ETFs.

Large Investor Risk: Ownership of shares of the Fund may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund's expenses.

Leverage Risk: Use of derivative instruments may involve leverage. Taking short positions in securities results in a form of leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on the fund's returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund's investments or in their capacity or willingness to transact may increase the Fund's exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund's investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to greater liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund's investments.

Management Risk: A strategy used by the Fund's portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund's investments, such as management performance, financial condition and demand for the issuers' goods and services. The Adviser will attempt to reduce this risk by implementing various volatility management strategies and techniques. However, there is no guarantee that such strategies and techniques will produce the intended result.

Models and Data Risk: The Adviser utilizes various proprietary quantitative models to identify investment opportunities. There is a possibility that one or all of the quantitative models may fail to identify profitable opportunities at any time. Furthermore, the models may incorrectly identify opportunities and these misidentified opportunities may lead to substantial losses for the Fund. Models may be predictive in nature and such models may result in an incorrect assessment of future events. Data used in the construction of models may prove to be inaccurate or stale, which may result in losses for the Fund.

Short Exposure Risk: A short exposure through a derivative or short sale may present various risks, including credit/counterparty risk and leverage risk. If the value of the asset, asset class or index on which the Fund has obtained a short investment exposure increases, the Fund will incur a loss. Unlike a direct cash investment such as a stock, bond or ETF, where the potential loss is limited to the purchase price, the potential risk of loss from a short exposure is theoretically unlimited. The Fund may be unable to borrow securities in connection with a short sale or to enter into a short position at an advantageous time or price, which could limit its ability to obtain the desired short exposure. Moreover, there can be no assurance that securities necessary to cover (repurchase in order to close) a short position will be available for purchase.

U.S. Government Securities Risk: Investments in certain U.S. government securities may not be supported by the full faith and credit of the U.S. government. Accordingly, no assurance can be given that the U.S. government will provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. The maximum potential liability of the issuers of some U.S. government securities held by the Fund may greatly exceed their current resources, and it is possible that these issuers will not have the funds to meet their payment obligations in the future. In such a case, the Fund would have to look principally to the agency, instrumentality or sponsored enterprise issuing or guaranteeing the security for ultimate repayment, and the Fund may not be able to assert a claim against the U.S. government itself in the event the agency, instrumentality or sponsored enterprise does not meet its commitment. Concerns about the capacity of the U.S. government to meet its obligations may raise the interest rates payable on its securities, negatively impacting the price of such securities already held by the Fund.

Valuation Risk: This is the risk that the Fund has valued certain securities or positions at a higher price than the price at which they can be sold. This risk may be especially pronounced for investments, such as derivatives, that may be illiquid or may become illiquid.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Risk/Return Bar Chart and Table </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

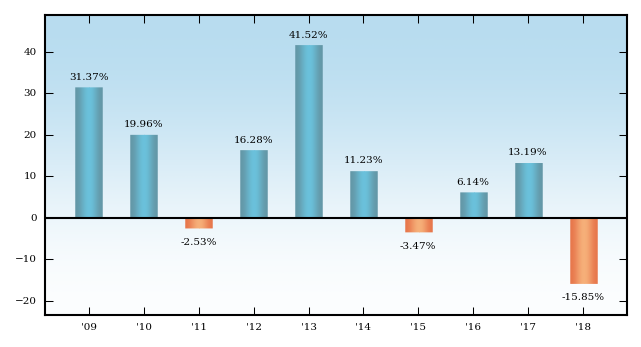

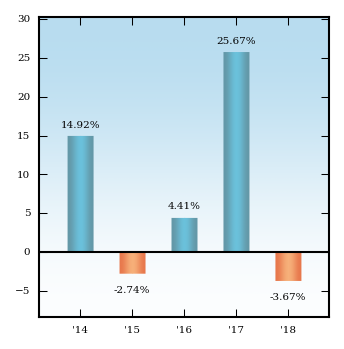

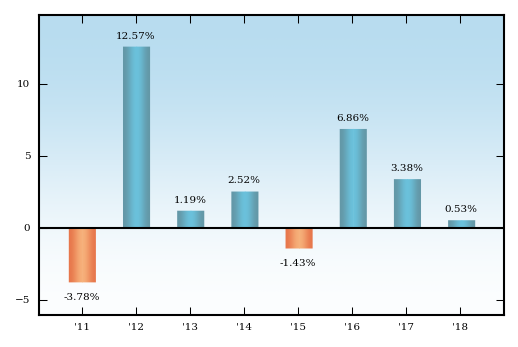

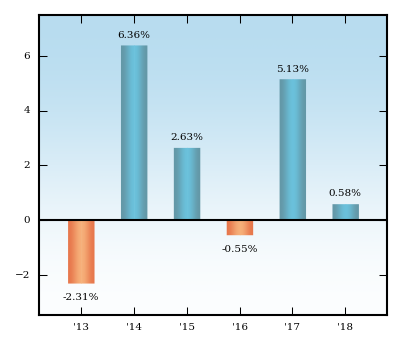

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of a broad measure of market performance. The Barclay Fund of Funds Index is a measure of the average return of all funds of funds in the Barclay database. The Fund's past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund's shares. A sales charge will reduce your return.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Total Returns for Class Y Shares</b> </div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Highest Quarterly Return:

Third Quarter 2010, 7.23%

Lowest Quarterly Return:

First Quarter 2016, -8.36% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b>Average Annual Total Returns </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"> <b> (for the periods ended December 31, 2018) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund's other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period.The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for the Fund's fees, expenses or taxes, but does reflect the management fees and other expenses of both the funds of funds in the index and the hedge funds in which those funds of funds invest.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (ASG Managed Futures Strategy Fund) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investment Goal </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund pursues an absolute return strategy that seeks to provide capital appreciation.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Fund Fees & Expenses </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section "How Sales Charges Are Calculated" on page 76 of the Prospectus, in Appendix A to the Prospectus and on page 121 in the section "Reduced Sales Charges" of the Statement of Additional Information ("SAI").

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Shareholder Fees </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> (fees paid directly from your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Annual Fund Operating Expenses </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>(expenses that you pay each year as a percentage of the value of your investment) </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Example </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b>If shares are not redeemed:</b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Portfolio Turnover </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. Due to the short-term nature of the Fund's investment portfolio, the Fund does not calculate a portfolio turnover rate.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Investments, Risks and Performance </b></div> <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Strategies </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Fund seeks to generate positive absolute returns over time. Under normal market conditions, the Adviser typically will make extensive use of a variety of derivative instruments, including futures and forward contracts, to capture the exposures suggested by its absolute return strategy while also seeking to add value through volatility management. These market exposures, which are expected to change over time, may include, for example, exposures to the returns of U.S. and non-U.S. equity and fixed-income securities indices (including both broad- and narrow-based securities indices), currencies and commodities. The Adviser will have great flexibility to allocate the Fund's derivatives exposure among various securities, indices, currencies, commodities and other instruments; the amount of the Fund's assets that may be allocated to derivative strategies and among these various instruments is expected to vary over time. The Adviser uses proprietary quantitative models to identify price trends in equity, fixed-income, currency and commodity instruments across time periods of various lengths. The Adviser believes that asset prices may show persistent trending behavior due to a number of behavioral biases among market participants as well as certain risk-management policies that will identify assets to purchase in upward-trending markets and identify assets to sell in downward-trending markets. The Adviser believes that following trends across a widely diversified set of assets, combined with active risk management, may allow it to earn a positive expected return over time. The Fund may have both "short" and "long" exposures within an asset class based upon the Adviser's analysis of multiple time horizons to identify trends in a particular asset class. A "short" exposure will benefit when the underlying asset class decreases in price. A "long" exposure will benefit when the underlying asset class increases in price. The Adviser will scale the notional exposure of the Fund's futures and currency forward positions with the objective of targeting a relatively stable level of annualized volatility for the Fund's overall portfolio. The Adviser currently targets an annualized volatility level of 17% or less (as measured by the standard deviation of the Fund's returns). The Fund's actual or realized volatility during certain periods or over time may materially exceed its target volatility for various reasons, including changes in market levels of volatility and because the Fund's portfolio may include instruments that are inherently volatile. This would increase the risk of investing in the Fund.

Under normal market conditions, it is expected that no more than 25% of the Fund's total assets will be dedicated to initial and variation margin payments relating to the Fund's derivative transactions. The gross notional value of the Fund's derivative investments, however, will generally exceed 25% of the Fund's total assets, and may significantly exceed the total value of the Fund's assets. The Fund expects that under normal market conditions it will invest at least 75% of its total assets in money market and other short-term, high-quality securities (such as bankers' acceptances, certificates of deposit, commercial paper, loan participations, repurchase agreements and time deposits) (the "Money Market Portion"), although the Fund may invest less than this percentage. The Adviser will determine the percentage of the Fund's assets that will be invested in the Money Market Portion at any time. The assets allocated to the Money Market Portion will be used primarily to support the Fund's investments in derivatives and, secondarily, to provide the Fund with incremental income and liquidity. Although the Fund will invest a significant portion of its assets in money market instruments, the Fund is not a "money market" fund and the value of the Money Market Portion as well as the value of the Fund's shares may decrease. The Fund is not subject to the portfolio quality, maturity and net asset value requirements applicable to money market funds, and the Fund will not seek to maintain a stable net asset value. The Fund will concentrate its investments in the financial services industry, which means it will normally invest at least 25% of its total assets in securities and other obligations (for example, bank certificates of deposit, repurchase agreements and time deposits) of issuers in such industry.

The Adviser will only invest the assets of the Money Market Portion in high-quality securities which are denominated in U.S. dollars, and will select securities for investment based on various factors, including the security's maturity and rating. The Adviser will invest primarily in: (i) short-term obligations issued or guaranteed by the United States government, its agencies or instrumentalities ("U.S. Government Obligations"); (ii) securities issued by foreign governments, their political subdivisions, agencies or instrumentalities; (iii) certificates of deposit, time deposits and bankers' acceptances issued by domestic banks, foreign branches of domestic banks, foreign subsidiaries of domestic banks and domestic and foreign branches of foreign banks; (iv) variable amount master demand notes; (v) participation interests in loans extended by banks to companies; (vi) commercial paper or similar debt obligations; and (vii) repurchase agreements.

Although the Fund does not intend to invest in physical commodities directly, the Fund expects to obtain investment exposure to commodities and commodity-related derivatives by investing in a wholly-owned subsidiary organized under the laws of the Cayman Islands that will make commodity-related investments (the "Commodity Subsidiary"). Under normal market conditions, no more than 10% of the Fund's total assets will be dedicated to initial and variation margin payments relating to these transactions.

Although the Fund seeks positive absolute returns over time, it is likely that the Fund's investment returns may be volatile over short periods of time. The Fund may outperform the overall securities market during periods of flat or negative market performance and may underperform during periods of strong market performance. There can be no assurance that the Fund's returns over time or during any period will be positive or that the Fund will outperform the overall security markets over time or during any particular period.

The Fund may engage in active and frequent trading of securities and other instruments. Effects of frequent trading may include high transaction costs, which may lower the Fund's return, and realization of greater short-term capital gains, distributions of which are taxable as ordinary income to taxable shareholders. Trading costs and tax effects associated with frequent trading may adversely affect the Fund's performance. Due to the short-term nature of the Fund's investment portfolio, the Fund does not calculate a portfolio turnover rate. The Fund's trading in derivatives is active and frequent. Active and frequent trading of derivatives, like active and frequent trading of securities, will result in transaction costs which reduce fund returns.

The percentage limitations set forth herein are not investment restrictions and the Fund may exceed these limits from time to time.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <div style="font-size:10pt;padding-top:5pt;padding-bottom:0;padding-left:0;"><b> Principal Investment Risks </b></div> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

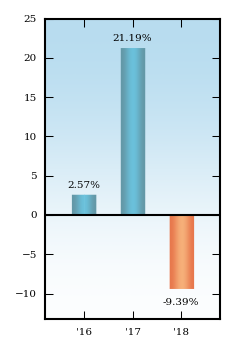

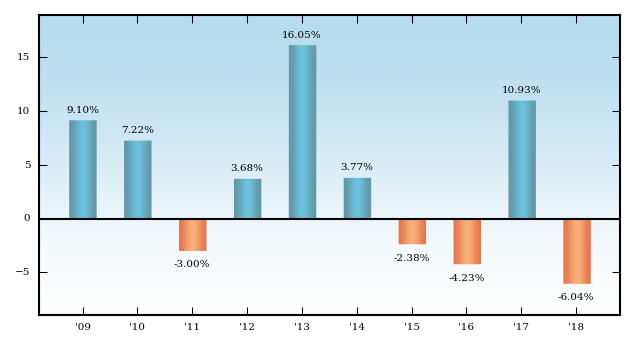

Allocation Risk: This is the risk that the Adviser's judgments about, and allocations between, asset classes and market exposures may adversely affect the Fund's performance. The allocation, as set forth above, may not be optimal in every market condition. You could lose money on your investment in the Fund as a result of this allocation. This risk can be increased by the use of derivatives to increase allocations to various market exposures. This is because derivatives can create investment leverage, which will magnify the impact to the Fund of its investment in any underperforming market exposure.