|

|

Summary Prospectus |

|

Loomis Sayles Strategic Alpha Fund |

|

Ticker Symbol: Class A (LABAX), Class C (LABCX), Class N (LASNX), Class T* (LSATX) and Class Y (LASYX) |

| * | Class T shares of the Fund are not currently available for purchase. |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at www.icsdelivery.com/natixisfunds.

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at im.natixis.com/fund-documents. You can also get this information at no cost by calling 800-225-5478 or by sending an e-mail request to NatixisFunds@natixis.com. The Fund’s Prospectus and Statement of Additional Information, each dated May 1, 2019, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Goal

The Fund seeks to provide an attractive absolute total return, complemented by prudent investment management designed to manage risks and protect investor capital. The secondary goal of the Fund is to achieve these returns with relatively low volatility.

Fund Fees & Expenses

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section “How Sales Charges Are Calculated” on page 76 of the Prospectus, in Appendix A to the Prospectus and on page 121 in the section “Reduced Sales Charges” of the Statement of Additional Information (“SAI”).

Shareholder Fees

|

(fees paid directly from your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

4.25% |

None |

None |

2.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

None* |

1.00% |

None |

None |

None |

|

Redemption fees |

None |

None |

None |

None |

None |

| * | A 1.00% contingent deferred sales charge (“CDSC”) may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase. |

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Management fees |

0.60% |

0.60% |

0.60% |

0.60% |

0.60% |

|

Distribution and/or service (12b-1) fees |

0.25% |

1.00% |

0.00% |

0.25% |

0.00% |

|

Other expenses |

0.15% |

0.15% |

0.10% |

0.15%1 |

0.15% |

|

Total annual fund operating expenses |

1.00% |

1.75% |

0.70% |

1.00% |

0.75% |

|

Fee waiver and/or expense reimbursement2 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

1.00% |

1.75% |

0.70% |

1.00% |

0.75% |

| 1 | Other expenses are estimated for the current fiscal year. |

| 2 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund |

1

Fund Summary

| operating expenses to 1.00%, 1.75%, 0.70%, 1.00% and 0.75% of the Fund’s average daily net assets for Class A, Class C, Class N, Class T and Class Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through April 30, 2020 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Class A, Class C, Class N, Class T and Class Y shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fee/expense was waived/reimbursed. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

If shares are redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class A |

$ |

523 |

$ |

730 |

$ |

954 |

$ |

1,598 |

|

Class C |

$ |

278 |

$ |

551 |

$ |

949 |

$ |

2,062 |

|

Class N |

$ |

72 |

$ |

224 |

$ |

390 |

$ |

871 |

|

Class T |

$ |

349 |

$ |

560 |

$ |

789 |

$ |

1,444 |

|

Class Y |

$ |

77 |

$ |

240 |

$ |

417 |

$ |

930 |

|

If shares are not redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class C |

$ |

178 |

$ |

551 |

$ |

949 |

$ |

2,062 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 379% of the average value of its portfolio.

Investments, Risks and Performance

Principal Investment Strategies

The Fund has an absolute total return investment objective, which means that it is not managed relative to an index and that it attempts to achieve positive total returns over a full market cycle. The Fund intends to pursue its objective by utilizing a flexible investment approach that allocates investments across a global range of investment opportunities related to credit, currencies and interest rates, while employing risk management strategies to mitigate downside risk. The Fund may invest up to 100% of its total assets in below investment grade fixed-income securities (also known as “junk bonds”) and derivatives that have returns related to the returns on below investment grade fixed-income securities, although it is expected that, under normal market conditions, the Fund’s net exposure (i.e., long exposures obtained through direct investments in securities and in derivatives minus short exposures obtained through derivatives) to below investment grade fixed-income assets generally will not exceed 50% of the Fund’s total assets. Below investment-grade fixed-income securities are rated below investment-grade quality (i.e., none of the three major rating agencies (Moody’s Investors Service, Inc. (“Moody’s”), Fitch Investor Services, Inc. or S&P Global Ratings (“S&P”)) have rated the securities in one of their respective top four ratings categories). Under normal market conditions, the Fund also may invest up to 50% of its total assets in investments denominated in non-U.S. currencies and related derivatives, including up to 20% in investments denominated in emerging market currencies and related derivatives. The Fund expects that its exposure to these asset classes will often be obtained substantially through the use of derivative instruments. The Fund defines an “emerging market currency” as a currency of a country that carries a sovereign debt quality rating that is rated below investment grade by either S&P or Moody’s, or is unrated by both S&P and Moody’s. Currency positions that are intended to hedge the Fund’s non-U.S. currency exposure (i.e., currency positions that are not made for investment purposes) will offset positions in the same currency that are made for investment purposes when calculating the limitation on investments in non-U.S. and emerging market currency investments because the Fund believes that hedging a currency position is likely to negate some or all of the currency risk associated with the original currency position. The Fund does not have limits on the duration of its portfolio, and the Fund’s duration will change over time. The Fund also may invest in equity securities (including preferred stocks) as well as derivatives whose returns are linked to the returns of equity securities.

In selecting investments for the Fund, the Adviser develops long-term portfolio themes driven by macro-economic indicators. These include global economic trends, demographic trends and labor supply, analysis of global capital flows and assessments of geopolitical factors. The Adviser then develops shorter-term portfolio strategies based on factors including, but not limited to, economic, credit and Federal Reserve cycles, and top-down sector valuations and bottom-up security valuations. The Adviser seeks to actively manage risk, with a focus on managing the Fund’s exposure to credit, interest rate and currency risks in relation to the market. Additionally, the portfolio managers will use risk management tools, such as models that evaluate risk correlation to various market factors or asset classes, to seek to manage risk on an ongoing basis. The portfolio management team expects to actively evaluate each investment idea and

2

Fund Summary

to decide to buy or sell an investment based upon: (i) its return potential; (ii) its level of risk; and (iii) its fit within the team’s overall macro strategy, with the goal of continually optimizing the Fund’s portfolio.

The Adviser currently targets an annualized volatility range of 4% to 6% (as measured by the standard deviation of the Fund’s returns). The Fund’s actual or realized volatility during certain periods or over time may materially exceed or be lower than its target volatility range for various reasons, including changes in market levels of volatility and because the Fund’s portfolio may include instruments that are inherently volatile. This would increase the risk of investing in the Fund.

The Fund will pursue its investment goal by obtaining long investment exposures through investments in securities and derivatives and short investment exposures substantially through derivatives. A “long” investment exposure is an investment that rises in value with a rise in the value of an asset, asset class or index and declines in value with a decline in the value of that asset, asset class or index. A “short” investment exposure is an investment that rises in value with a decline in the value of an asset, asset class or index and declines in value with a rise in the value of that asset, asset class or index. The value of the Fund’s long and short investment exposures may, at times, each reach 100% of the assets invested in the Fund (excluding instruments primarily used for duration management or yield curve management and short-term investments (such as cash and money market instruments)), although these exposures may be higher or lower at any given time.

Fixed-Income Investments. In connection with its principal investment strategies, the Fund may invest in a broad range of U.S. and non-U.S. fixed-income securities, including, but not limited to, corporate bonds, municipal securities, U.S. and non-U.S. government securities (including their agencies, instrumentalities and sponsored entities), securities of supranational entities, emerging market securities, commercial and residential mortgage-backed securities, collateralized mortgage obligations, other mortgage-related securities (such as adjustable rate mortgage securities), asset-backed securities, collateralized loan obligations, bank loans, convertible bonds, securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”), real estate investment trusts (“REITs”), zero-coupon securities, step coupon securities, pay-in-kind (“PIK”) securities, inflation-linked bonds, variable and floating rate securities, private placements and commercial paper.

Non-U.S. Currency Investments. Under normal market conditions, the Fund may engage in a broad range of transactions involving non-U.S. and emerging market currencies, including, but not limited to, purchasing and selling forward currency exchange contracts in non-U.S. or emerging market currencies, investing in non-U.S. currency futures contracts, investing in options on non-U.S. currencies and non-U.S. currency futures, investing in cross-currency instruments (such as swaps), investing directly in non-U.S. currencies and investing in securities denominated in non-U.S. currencies. The Fund may engage in non-U.S. currency transactions for investment or for hedging purposes.

Derivative Investments. For investment and hedging purposes, the Fund may invest substantially in a broad range of derivatives instruments and sometimes the majority of its investment returns will derive from its derivative investments. These derivative instruments include, but are not limited to, futures contracts (such as treasury futures and index futures), forward contracts, options (such as options on futures contracts, options on securities, interest rate/bond options, currency options, options on swaps and over-the-counter (“OTC”) options), warrants (such as non-U.S. currency warrants), swap transactions (such as interest rate swaps, total return swaps and index swaps) and structured notes (such as equity-linked notes). In addition, the Fund may invest in credit derivative products that may be used to manage default risk and credit exposure. Examples of such products include, but are not limited to, credit default swap index products (such as LCDX, CMBX and ABX index products), single name credit default swaps, loan credit default swaps and asset-backed credit default swaps. The Fund may, at times, invest substantially all of its assets in derivatives and securities used to support its obligations under those derivatives. The Fund’s strategy may be highly dependent on the use of derivatives, and to the extent that they become unavailable or unattractive the Fund may be unable to fully implement its investment strategy.

Equity Investments. In connection with its principal investment strategies, the Fund may invest in common stocks, preferred stocks and convertible preferred stocks.

The Fund is non-diversified, which means it may invest a greater portion of its assets in a particular issuer and may invest in fewer issuers. Because the Fund may invest in the securities of fewer issuers, an investment in the Fund may involve a higher degree of risk than would be present in a diversified portfolio.

The Fund expects to engage in active and frequent trading of securities and other instruments. Effects of frequent trading may include high transaction costs, which may lower the Fund’s return, and realization of greater short-term capital gains, distributions of which are taxable as ordinary income to taxable shareholders. Trading costs and tax effects associated with frequent trading may adversely affect the Fund’s performance.

The percentage limitations set forth herein are not investment restrictions and the Fund may exceed these limits from time to time. In addition, when calculating these exposures, the Fund may use the market value, the notional value, an adjusted notional value or some other measure of the value of a derivative in order to reflect what the Adviser believes to be the most accurate assessment of the Fund’s real economic exposure. The total notional value of the Fund’s derivative instruments may significantly exceed the total value of the Fund’s assets.

Although the Fund seeks positive total returns over time, the Fund’s investment returns may be volatile over short periods of time. The Fund may outperform the overall securities market during periods of flat or negative performance and may underperform during periods of strong market performance. There can be no assurance that the Fund’s returns over time or during any period will be positive.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

3

Fund Summary

Agency Securities Risk: Certain debt securities issued or guaranteed by agencies of the U.S. government are guaranteed as to the payment of principal and interest by the relevant entity but have not been backed by the full faith and credit of the U.S. government. Instead, they have been supported only by the discretionary authority of the U.S. government to purchase the agency’s obligations. An event affecting the guaranteeing entity could adversely affect the payment of principal or interest or both on the security and, therefore, these types of securities should be considered to be riskier than U.S. government securities.

Below Investment Grade Fixed-Income Securities Risk: The Fund’s investments in below investment grade fixed-income securities, also known as “junk bonds,” may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk, credit/counterparty risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment grade fixed-income securities.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivative transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter (“OTC”) derivative transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivative transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains. This risk will be heightened to the extent the Fund enters into derivative transactions with a single counterparty (or affiliated counterparties that are part of the same organization), causing the Fund to have significant exposure to such counterparty.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest a significant portion of its assets in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including futures contracts, forward contracts, options, warrants and swap transactions) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund’s exposure to securities markets values, interest rates or currency exchange rates. It is possible that the Fund’s liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund’s use of derivatives, such as futures, forward contracts, options, warrants, foreign currency transactions, swaps, credit default swaps and equity-linked and other structured notes, involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward contracts, swaps and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund. There is a risk that the Adviser’s use of derivatives, such as futures and forward contracts, to manage the Fund’s volatility may be ineffective or may exacerbate losses, for example, if the derivative and the underlying assets decrease in value over time. When used, derivatives may affect the amount, timing or character of distributions payable to, and thus taxes payable by, shareholders. Similarly, for accounting and performance reporting purposes, income and gain characteristics may be different than if the Fund held the underlying securities or assets directly.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer’s unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund’s investments in preferred stocks could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds generally take precedence over the claims of those who own preferred stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund’s investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Inflation/Deflation Risk: Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the present value of future payments. Deflation risk is the risk that prices throughout the economy decline over time (the opposite of inflation). Deflation may have an adverse effect on the creditworthiness of issuers and may make issuer default more likely, which may result in a decline in the value of the Fund’s portfolio. Because the Fund seeks positive returns that exceed the rate of inflation over time, if the portfolio managers’ inflation forecasts are incorrect, the Fund may be more severely impacted than other funds.

4

Fund Summary

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund’s investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. The value of zero-coupon and PIK bonds may be more sensitive to fluctuations in interest rates than other fixed-income securities. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment, combined with the Federal Reserve Board’s conclusion of its quantitative easing program and recent increases in interest rates, increases the likelihood of interest rates rising in the future.

Large Investor Risk: Ownership of shares of the Fund may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund’s expenses.

Leverage Risk: Use of derivative instruments may involve leverage. Taking short positions in securities also results in a form of leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on the fund’s returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund’s investments or in their capacity or willingness to transact may increase the Fund’s exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to greater liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund’s investments.

Management Risk: A strategy used by the Fund’s portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services. The Fund’s Adviser will attempt to reduce this risk by implementing various volatility management strategies and techniques. However, there is no guarantee that such strategies and techniques will produce the intended result.

Mortgage-Related and Asset-Backed Securities Risk: In addition to the risks associated with investments in fixed-income securities generally (for example, credit, liquidity and valuation risk), mortgage-related and asset-backed securities are subject to the risks of the mortgages and assets underlying the securities as well as prepayment risk, the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related or asset-backed security beyond the expected prepayment time, typically reducing the security’s value, which is called extension risk. The Fund also may incur a loss when there is a prepayment of securities that were purchased at a premium. The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets.

Non-Diversification Risk: Compared with other mutual funds, the Fund may invest a greater percentage of its assets in a particular issuer and may invest in fewer issuers. Therefore, the Fund may have more risk because changes in the value of a single security or the impact of a single economic, political or regulatory occurrence may have a greater adverse impact on the Fund’s net asset value.

Short Exposure Risk: A short exposure through a derivative may present various risks, including credit/counterparty risk and leverage risk. If the value of the asset, asset class or index on which the Fund has obtained a short investment exposure increases, the Fund will incur a loss. Unlike a direct cash investment such as a stock, bond or ETF, where the potential loss is limited to the purchase price, the potential risk of loss from a short exposure is theoretically unlimited. Moreover, there can be no assurance that securities necessary to cover (repurchase in order to close) a short position will be available for purchase.

Risk/Return Bar Chart and Table

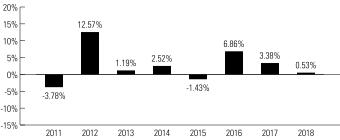

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual returns for the one-year, five-year, life-of-fund and life-of-class periods (as applicable) compare to those of two broad measures of market performance. The 3-Month LIBOR +300 basis points represents the average rate at which a leading bank, for a given currency (in this case, U.S. dollars), can obtain unsecured funding, and is representative of short-term interest rates. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund’s shares. A sales charge will reduce your return.

5

Fund Summary

Total Returns for Class Y Shares

|

|

Highest Quarterly Return: |

|

Average Annual Total Returns |

|

|

|

|

|

(for the periods ended December 31, 2018) |

Past 1 Year |

Past 5 Years |

Life of Fund |

Life of Class N |

|

Class Y - Return Before Taxes |

0.53% |

2.33% |

2.66% |

- |

|

Return After Taxes on Distributions |

-0.92% |

0.95% |

1.39% |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

0.33% |

1.17% |

1.51% |

- |

|

Class A - Return Before Taxes |

-3.88% |

1.20% |

1.88% |

- |

|

Class C - Return Before Taxes |

-1.39% |

1.31% |

1.64% |

- |

|

Class N - Return Before Taxes |

0.68% |

- |

- |

1.61% |

|

Class T - Return Before Taxes |

-2.08% |

1.57% |

2.10% |

- |

|

3-Month LIBOR |

2.08% |

0.86% |

0.67% |

1.72% |

|

3-Month LIBOR +300 basis points |

5.18% |

3.93% |

3.73% |

4.81% |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund’s other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

Management

Investment Adviser

Loomis, Sayles & Company, L.P.

Portfolio Managers

Matthew J. Eagan, CFA®, Executive Vice President of the Adviser, has served as co-portfolio manager of the Fund since 2010.

Kevin P. Kearns, Vice President of the Adviser, has served as co-portfolio manager of the Fund since 2010.

Todd P. Vandam, CFA®, Vice President of the Adviser, has served as co-portfolio manager of the Fund since 2010.

Purchase and Sale of Fund Shares

Class A and C Shares

The following chart shows the investment minimums for various types of accounts:

6

Fund Summary

|

Type of Account |

Minimum Initial Purchase |

Minimum Subsequent Purchase | ||

|

Any account other than those listed below |

$ |

2,500 |

$ |

50 |

|

For shareholders participating in Natixis Funds’ Investment Builder Program |

$ |

1,000 |

$ |

50 |

|

For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

1,000 |

$ |

50 |

|

Coverdell Education Savings Accounts using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

500 |

$ |

50 |

There is no initial or subsequent investment minimum for:

• Fee Based Programs (such as wrap accounts) where an advisory fee is paid to the broker-dealer or other financial intermediary. Please consult your financial representative to determine if your fee based program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

Class N Shares

Class N shares of the Fund are subject to a $1,000,000 initial investment minimum. There is no initial investment minimum for Certain Retirement Plans and funds of funds that are distributed by Natixis Distribution, L.P. (the “Distributor”). Sub-accounts held within an omnibus account, where the omnibus account has at least $1,000,000, are not required to meet the investment minimum. There is no subsequent investment minimum for these shares. In its sole discretion, the Distributor may waive the investment minimum requirement for accounts as to which the Distributor reasonably believes will have enough assets to exceed the investment minimum requirement within a relatively short period of time following the establishment date of such accounts in Class N. If, after two years, an account’s value does not exceed the investment minimum requirement, the Distributor and the Fund reserve the right to redeem such account.

Class T Shares

Class T shares of the Fund are not currently available for purchase.

Class T shares of the Fund may only be purchased by investors who are investing through an authorized third party, such as a broker-dealer or other financial intermediary, that has entered into a selling agreement with Natixis Distribution, L.P. Investors may not hold Class T shares directly with the Fund. Class T shares are subject to a minimum initial investment of $2,500 and a minimum subsequent investment of $50. Not all financial intermediaries make Class T shares available to their clients.

Class Y Shares

Class Y shares of the Fund are generally subject to a minimum initial investment of $100,000 and a minimum subsequent investment of $50, except there is no minimum initial or subsequent investment for:

• Fee Based Programs (such as wrap accounts) where an advisory fee is paid to the broker-dealer or other financial intermediary. Please consult your financial representative to determine if your fee based program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Certain Individual Retirement Accounts if the amounts invested represent rollover distributions from investments by any of the retirement plans invested in the Fund.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

• Fund Trustees, former Fund trustees, employees of affiliates of the Natixis Funds and other individuals who are affiliated with any Natixis Fund

(this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those

mentioned) and Natixis affiliate employee benefit plans.

At the discretion of Natixis Advisors, L.P., clients of Natixis Advisors, L.P. and its affiliates may purchase Class Y shares of the Fund below the stated minimums.

Due to operational limitations at your financial intermediary, certain fee based programs, retirement plans, individual retirement

accounts and accounts of registered investment advisers may be subject to the investment minimums described

above.

The Fund’s shares are available for purchase and are redeemable on any business day through your

investment dealer, directly from the Fund by writing to the Fund at Natixis Funds, P.O. Box 219579, Kansas City, MO

64121-9579, by exchange, by wire, by internet at im.natixis.com (certain restrictions may apply), through the

Automated Clearing House system, or, in the case of redemptions, by telephone at 800-225-5478 or by the Systematic Withdrawal Plan.

7

Tax Information

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

|

|

ULA77-0519 |