Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Russell L. Kane, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: November 30

Date of reporting period: November 30, 2016

Table of Contents

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

ANNUAL REPORT

November 30, 2016

Loomis Sayles Dividend Income Fund

Loomis Sayles Global Growth Fund

Vaughan Nelson Select Fund

Portfolio Review page 1

Portfolio of Investments page 18

Financial Statements page 28

Notes to Financial Statements page 42

Table of Contents

LOOMIS SAYLES DIVIDEND INCOME FUND

| Managers: | Symbols: | |

| Arthur J. Barry, CFA® | Class A LSCAX | |

| Adam C. Liebhoff | Class C LSCCX | |

| Loomis, Sayles & Company, L.P. | Class Y LSCYX |

Investment Goal

The Fund’s investment goal is high total return through a combination of current income and capital appreciation.

Market Conditions

Throughout the 12-month period, volatility (as measured by the VIX Index) pervaded most areas of the market. In particular, volatility was most pronounced during the first quarter of 2016, following the UK’s late-June Brexit vote and prior to the November elections in the U.S. Additionally, interest rates recovered from post-Brexit lows to reach 52-week highs after the election of Donald Trump. Similarly, oil prices recovered, approaching 52-week highs toward the end of November on OPEC’s announcement of production cuts.

By traditional measures, the market’s valuation expanded toward the upper end of long-term ranges. However, adjusting for lack of earnings in the energy sector and the strong U.S. dollar, we believe U.S. equities seem reasonably valued given a broad lack of alternatives.

Performance Results

For the 12-month period ended November 30, 2016, Class A shares of the Loomis Sayles Dividend Income Fund returned 9.26% at net asset value. The fund outperformed its primary benchmark, the all-equity S&P 500® Index, which returned 8.06% for the period. The fund underperformed its secondary benchmark, the Russell 1000® Value Index, which returned 12.02%.

Explanation of Fund Performance

The fund’s outperformance was broad-based, as stock selection led to positive results in the real estate, information technology, consumer discretionary, consumer staples and materials sectors. Among individual holdings, Qualcomm, Chevron and International Paper were the largest contributors to performance.

Qualcomm, a wireless communications company, benefited from several factors, including better underlying performance in its licensing and chipset businesses and improving smartphone growth expectations. In addition, investors had a favorable view of the company’s offer for NXP Semiconductor, which would diversify Qualcomm away from smartphone chips and give it deeper reach into the emerging Internet of Things space.

Shares of Chevron have rallied with the rebound in oil prices. Additionally, the company is nearing the end of large capital investments and is beginning to harvest the free cash flow generated from these projects. As a result, investors have become more comfortable that

1 |

Table of Contents

the dividend payment is not only stable but also has a good probability of growing over the next few years.

International Paper, a container and packaging company, benefited from a reversal in sentiment toward containerboard volumes and from stabilization in pricing. The company also announced its acquisition of Weyerhaeuser’s Fluff Pulp business, which should drive solid earnings accretion.

Stock selection in the telecommunication services and energy sectors and an overweight in the healthcare sector weighed on relative performance. In terms of individual holdings, PBF Energy, Allergan and Vodafone were among the largest detractors.

PBF Energy, an independent refiner, was weak due to a confluence of refining headwinds and company-specific execution issues. On refining, elevated product inventories depressed crack spreads (the differential between the price of crude oil and the petroleum products derived from it) compared with 2015, particularly on the East Coast, where overflow product from Europe found its way to New York Harbor. Furthermore, in addition to having outsized exposure to the product-saturated East Coast, the company had trouble getting its newly acquired Torrance, California refinery up and running, which was a drain on cash and earnings.

Shares of Allergan, a specialty pharmaceutical company, declined due to the failed merger with Pfizer and a reset of earnings and cash flow expectations to more achievable stand-alone levels. The stock also struggled due to investor concerns surrounding pharmaceutical pricing and the U.S. presidential election.

Adverse foreign currency fluctuations hurt the shares of mobile company Vodafone Group. In particular, the substantial devaluation of the British pound following the U.K.’s Brexit vote was a main factor. For example, the U.S. shares underperformed the local U.K. shares by approximately 16%. Furthermore, the company announced higher capital spending plans than it previously communicated, causing its free cash flow outlook to decline.

The fixed-income portion of the Dividend Income Fund put forth positive returns during the course of the trailing year, primarily due to solid security selection.

Outlook

We believe stocks remain close to fairly valued and offer attractive longer-term return potential including dividends. Equities performed well even as interest rates increased significantly late in the period. We believe credit spreads (the difference in yield between Treasury and non-Treasury securities of similar maturity) remain fairly tight, and the president-elect’s tax platform seems likely to be implemented to a significant degree, making the earnings outlook better than we previously expected. Regardless of the direction of the markets, we continue to take a long-term, security-specific approach and, as always, view opportunities as defined by our reward-to-risk profiles.

| 2

Table of Contents

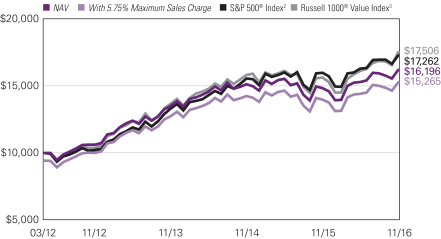

LOOMIS SAYLES DIVIDEND INCOME FUND

Hypothetical Growth of $10,000 Investment in Class A Shares4,5

March 30, 2012 (inception) through November 30, 2016

Top ten holdings (as of 11/30/2016)

| Security name | % of net assets |

|||||

| 1. | Wells Fargo & Co. | 3.35% | ||||

| 2. | Microsoft Corp. | 2.97% | ||||

| 3. | Pfizer, Inc. | 2.86% | ||||

| 4. | QUALCOMM, Inc. | 2.85% | ||||

| 5. | JPMorgan Chase & Co. | 2.84% | ||||

| 6. | Philip Morris International, Inc. | 2.80% | ||||

| 7. | GlaxoSmithKline PLC | 2.73% | ||||

| 8. | AbbVie, Inc. | 2.69% | ||||

| 9. | Dow Chemical Co. (The) | 2.65% | ||||

| 10. | BB&T Corp. | 2.61% | ||||

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

3 |

Table of Contents

Average Annual Total Returns — November 30, 20164,5

| Expense Ratios6 | ||||||||||||||||

| 1 Year | Life of Fund | Gross | Net | |||||||||||||

| Class A (Inception 3/30/2012) | ||||||||||||||||

| NAV | 9.26 | % | 10.88 | % | 1.60 | % | 1.10 | % | ||||||||

| With 5.75% Maximum Sales Charge | 2.99 | 9.48 | ||||||||||||||

| Class C (Inception 3/30/2012) | ||||||||||||||||

| NAV | 8.48 | 10.05 | 2.35 | 1.85 | ||||||||||||

| With CDSC1 | 7.54 | 10.05 | ||||||||||||||

| Class Y (Inception 3/30/2012) | ||||||||||||||||

| NAV | 9.53 | 11.15 | 1.32 | 0.85 | ||||||||||||

| Comparative Performance | ||||||||||||||||

| S&P 500® Index2 | 8.06 | 12.41 | ||||||||||||||

| Russell 1000® Value Index3 | 12.02 | 12.75 | ||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | The Fund revised its investment strategy on October 15, 2014 and July 18, 2016; performance may have been different had the current investment strategy been in place for all periods shown. |

| 6 | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 3/31/17. When an expense cap has not been exceeded, the fund may have similar expense ratios. |

| 4

Table of Contents

LOOMIS SAYLES GLOBAL GROWTH FUND

| Manager: | Symbols: | |

| Aziz V. Hamzaogullari, CFA® | Class A LSAGX | |

| Loomis, Sayles & Company, L.P. | Class C LSCGX | |

| Class Y LSGGX |

Investment Goal

The Fund’s investment goal is long-term growth of capital.

Market Conditions

Against a volatile backdrop, global equities advanced for the 12-month period, led by solid gains in the U.S. and emerging markets. Europe declined for the period, as economic growth and inflation remained weak. Japan advanced but underperformed the global equity market, as the nation continued to battle slow growth and threats of deflation.

Global stock markets struggled early in the period on fears of a U.S. recession, Federal Reserve (Fed) rate hikes, U.S. dollar strength, a currency devaluation in China, and falling oil and commodity prices. However, a rebound in oil and commodity prices in mid-February and an easing of Fed rate hike expectations helped restore investor optimism, and stocks generally advanced until the Brexit vote in late June rattled the financial markets worldwide. The selloff was short-lived, though, as the prospect of additional central bank stimulus lured investors back into stocks. Emerging market stocks rallied sharply following the Brexit vote, as investors expected developing markets to remain relatively immune from any Brexit-related weakness.

Volatility resurfaced late in the period, primarily due to anxiety ahead of the U.S. presidential election, continued economic weakness outside the U.S., and Fed rate hike uncertainty. However, U.S. stocks ended the period on an upbeat note, as Donald Trump’s surprising presidential election victory sparked a market rally. Expectations for the Trump administration to implement a pro-growth agenda drove U.S. stocks and the U.S. dollar higher.

Performance Results

For the period from March 31, 2016 (the fund’s inception date) through November 30, 2016 (the fund’s fiscal year-end), Class A shares of Loomis Sayles Global Growth Fund returned 5.30% at net asset value. The fund was in line with its benchmark, the MSCI ACWI (Net), which returned 5.33%.

Explanation of Fund Performance

The fund’s positions in ARM Holdings, Adidas and Qualcomm contributed to performance. Stock selection in the consumer discretionary, information technology, industrials and financials sectors, along with our weightings in information technology, contributed to relative performance. Among individual holdings, shares of UK-based ARM Holdings, the world’s leading semiconductor intellectual property (IP) supplier, were up

5 |

Table of Contents

approximately 40% in July on news of the all-cash acquisition by Softbank Group. Similar to our long-term thesis, Softbank recognized the fundamental drivers for ARM remain robust as it benefits from increased chip connectivity, complexity and chip architecture outsourcing. Softbank also highlighted ARM’s rich ecosystem and innovative culture, which have allowed ARM to take market share and become dominant in the markets it enters. Softbank’s willingness to pay a greater-than-40% premium to a share price already near an all-time high supported our assessment of ARM’s significant remaining upside potential. ARM Holdings became a privately held company when Softbank’s purchase became final on September 1, 2016, so the shares were effectively sold from the portfolio.

Germany-based Adidas, a leader in global sportswear, reported strong performance. Realignment of channel and brand management globally, along with new consumer-centric innovation and marketing, spurred strong demand across categories, and Adidas reported its best first and second fiscal quarters in more than a decade during the period. Representing more than 80% of sales, the Adidas brand posted double-digit revenue growth in strategic markets of Western Europe, North America, Greater China and Latin America. In the North America market, we believe Adidas took market share from Nike. The company recently decided to sell its golf hardware brands, including TaylorMade, with proceeds earmarked to strengthen the core business of sports footwear and apparel, which we believe is the right long-term strategy. Operating profit margins expanded, reflecting strong operating leverage. On October 1, 2016, new CEO Kasper Rorsted succeeded long-time CEO Herbert Hainer. One of two truly global sports footwear and apparel brands, we believe Adidas has sustainable competitive advantages, such as brand, scale and distribution.

Qualcomm, a U.S.-based chip designer and manufacturer, consistently reported better-than-expected results in its technology licensing (QTL) and chip manufacturing (QCT) businesses. Broad progress in obtaining new technology licensing agreements and catch-up payments from mobile device manufacturers in China powered revenue growth for the QTL business. However, Qualcomm initiated legal proceedings against Meizu, the only top-ten device maker yet to sign a licensing agreement. QTL margins were consistently 85% or better and generated approximately 80% of profits. The QCT business experienced strong performance and market share gains in China as it pushed new technologies to all price tiers and generated strong growth in non-mobile chips. Delivering on a priority for the year, QCT margins rose to 17% from more recent single-digit levels. We believe embedded market expectations for Qualcomm’s growth rate are below our estimates.

On the down side, positions in Novo Nordisk, Danone and Roche Holding were among the largest detractors. Stock selection in the healthcare, consumer staples and energy sectors, along with our weightings in the financials, consumer staples, energy, healthcare, industrials and consumer discretionary sectors, detracted from relative performance. In terms of individual holdings, Novo Nordisk, a Denmark-based diabetes-focused pharmaceutical company, reported fundamentally solid growth. Strong performance came from new-generation insulin therapy Tresiba and non-insulin anti-diabetic therapy Victoza. However, management issued lower-than-expected near-term guidance and meaningfully lowered longer-term operating profit growth to 5% from 10%, citing near-term pricing pressure in the U.S., which accounts for approximately 50% of the company’s

| 6

Table of Contents

LOOMIS SAYLES GLOBAL GROWTH FUND

sales. We continue to believe Novo’s competitive advantages of deep experience in diabetes care and therapeutic proteins, a robust infrastructure that took decades to build, efficient manufacturing techniques, a robust pipeline and economies of scale would be very difficult to replicate. As a result, we believe Novo Nordisk has an unmatched ability to engineer, formulate, develop and deliver value-added treatments for unmet patient needs.

Danone, a global manufacturer and distributor of fresh dairy and healthy nutrition products, reported solid growth and margin expansion early in the period. However, weakness in the France-based company’s water and early life nutrition in China led to recent softer results. Danone saw success in its U.S. fresh dairy division where it has become the leader across all segments of the yogurt market. Steps to restructure and simplify the company’s cost base and reintroduce blockbuster products led to progress in the European fresh dairy division, which had been affected by recession. In China, an economic-driven slowdown in the beverage industry led to near-term weak sales of Danone’s Mizone product, and we believe a distribution channel shift in China’s infant milk formula industry is also causing near-term disruptions. Danone announced the acquisition of WhiteWave Foods Company, a leader in plant-based drinking milk and organic milk. We believe WhiteWave will benefit from Danone’s advisory relationships with retailers and its global scale and distribution. Overall, we believe the company continues to execute well in difficult times and that market expectations for key variables, such as revenue and profit growth, are well below our estimates.

Roche, a Switzerland-based biopharmaceutical and diagnostics company, reported fundamentally sound performance, including steady growth from its leading cancer therapies Herceptin, Rituxan and Avastin, each of which grew sales in the mid-single digits and accounted for slightly more than half of pharmaceutical revenues. However, Lucentis, a treatment for eye diseases, has been ceding share to Regeneron’s Eylea. Roche’s pipeline, which is among the broadest in the industry, includes new submissions, approvals and potentially significant late-stage clinical products. The company remains solidly profitable, with operating margins holding relatively steady in the high 30% range. Earnings per share slightly exceeded expectations. We believe Roche continues to execute well operationally, redeploying the cash flows from its still growing but mature core franchise to support product extensions and innovation. We also believe the current market price embeds expectations for key revenue and cash flow growth drivers that are well below our long-term assumptions.

Outlook

Our investment process is characterized by bottom-up, fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The fund ended the quarter with overweight positions in the information technology, consumer staples, consumer discretionary and healthcare sectors and underweight positions in the financials, energy and industrials sectors. We did not own positions in the materials, real estate, telecommunication services and utilities sectors.

7 |

Table of Contents

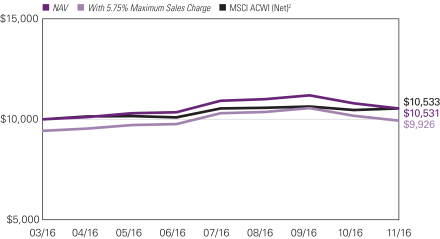

Hypothetical Growth of $10,000 Investment in Class A Shares3

March 31, 2016 (inception) through November 30, 2016

Top ten holdings (as of 11/30/2016)

| Security name | % of net assets |

|||||

| 1. | Alibaba Group Holding Ltd. | 5.50 | % | |||

| 2. | Oracle Corp. | 4.73 | % | |||

| 3. | Baidu, Inc. | 4.18 | % | |||

| 4. | Amazon.com, Inc. | 4.02 | % | |||

| 5. | Deere & Co. | 3.96 | % | |||

| 6. | QUALCOMM, Inc. | 3.87 | % | |||

| 7. | Novo Nordisk AS | 3.76 | % | |||

| 8. | Yum China Holdings, Inc. | 3.72 | % | |||

| 9. | Alphabet, Inc. | 3.70 | % | |||

| 10. | Facebook, Inc. | 3.66 | % | |||

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

See notes to chart on page 9.

| 8

Table of Contents

LOOMIS SAYLES GLOBAL GROWTH FUND

Total Returns — November 30, 20163

| Expense Ratios4 | ||||||||||||

| Life of Fund | Gross | Net | ||||||||||

| Class A (Inception 3/31/2016) | ||||||||||||

| NAV | 5.30 | % | 2.67 | % | 1.30 | % | ||||||

| With 5.75% Maximum Sales Charge | -0.75 | |||||||||||

| Class C (Inception 3/31/2016) | ||||||||||||

| NAV | 4.70 | 3.42 | 2.05 | |||||||||

| With CDSC1 | 3.70 | |||||||||||

| Class Y (Inception 3/31/2016) | ||||||||||||

| NAV | 5.50 | 2.42 | 1.05 | |||||||||

| Comparative Performance | ||||||||||||

| MSCI ACWI (Net)2 | 5.33 | |||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The MSCI ACWI (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 3/31/17. When an expense cap has not been exceeded, the fund may have similar expense ratios. |

9 |

Table of Contents

VAUGHAN NELSON SELECT FUND

| Managers: | Symbols: | |

| Dennis G. Alff, CFA® | Class A VNSAX | |

| Chad D. Fargason, PhD | Class C VNSCX | |

| Chris D. Wallis, CFA® | Class Y VNSYX | |

| Scott J. Weber, CFA® | ||

| Vaughan Nelson Investment Management, L.P. | ||

Investment Goal

The Fund seeks long-term capital appreciation.

Market Conditions

During the year, volatility remained elevated as the market digested the United Kingdom’s vote to leave the European Union (“Brexit”), Donald Trump’s successful campaign for President of the United States, and the Federal Reserve’s ability to raise interest rates. However, equity markets appreciated despite declining earnings expectations and deteriorating international economic conditions. We believe the incremental multiple expansion was driven by easy monetary conditions globally, by modest improvement in economic growth expectations throughout the year, and by foreign investors increasing portfolio allocations to U.S. equities post-Brexit.

Despite attractive gains in 2016, we believe equity markets might be in a state of unstable equilibrium given the significant structural changes that are occurring with central banks’ monetary policies and U.S. government deficits in addition to an escalating number of earnings headwinds. These include higher interest rates, a stronger U.S. dollar, rising healthcare costs, and wage inflation pressures. In fact, corporate earnings expectations declined for the fourth quarter of 2016 and for the full-year 2017, resulting in even richer valuation multiples as equity markets set new highs.

Performance Results

For the twelve months ended November 30, 2016, Class A shares of Vaughan Nelson Select Fund returned 5.91% at net asset value. The fund underperformed its benchmark, the S&P 500® Index, which returned 8.06%.

Explanation of Fund Performance

Stock selection was a positive contributor, but sector allocation weighed on returns versus the benchmark. Information technology and healthcare contributed the most to both the fund’s absolute and relative performance while cash, financials, and energy were the biggest detractors.

Financials was the sector that detracted the most from performance. American Express and American International Group (AIG) were the largest detractors in financials but were offset somewhat by the positive contribution from Citigroup. American Express underperformed largely due to the loss of its Costco portfolio, and the fund exited the position due to the increasingly competitive nature of the end market. AIG

| 10

Table of Contents

VAUGHAN NELSON SELECT FUND

underperformed due to softening fundamentals in the insurance market, and the fund exited the position as our confidence in management’s ability to execute their turnaround plan declined.

Marathon Petroleum was the largest detractor in energy and from the portfolio overall in 2016, other than cash. Marathon underperformed due to a weak refining environment that reduced its capital advantage and ability to invest in its midstream assets. The fund exited the position due to concerns surrounding the timing of the company’s investment in higher-value cash flow streams.

Michaels Companies was the primary detractor from other sectors amid a highly promotional and generally weaker end market that has weighed on same-store sales.

Stock selection stood out as a positive driver in the information technology sector. Broadcom Limited and Texas Instruments were the largest contributors. Broadcom continued its strong fundamental performance on the back of solid execution in its enterprise businesses and effective capital deployment through mergers and acquisitions. Texas Instruments was a strong contributor in 2016 as it continued to benefit from the long-term secular tailwind of increasing amounts of semiconductor content throughout the economy, particularly in industrial and automotive.

Stock selection drove the positive performance in the healthcare sector, primarily due to the fund’s position in UnitedHealth. UnitedHealth has benefited from its scale within the industry and the growth of its high-margin software and consultancy services. The healthcare sector’s performance was positive, despite Centene which was a detractor overall. This security was sold in November following the election, since changing or repealing the Affordable Care Act would likely have a negative impact on enrollment growth.

Individual stocks that were meaningful positive contributors to performance from other sectors include General Dynamics and Charter Communications.

The largest increase in weightings by sector was in consumer discretionary, driven primarily by the purchases of Michaels Companies and Charter Communications.

The largest reduction in weightings by sector was in information technology. The decline was due primarily to the sales of eBay and PayPal as well as profit taking in Microsoft.

Outlook

The U.S. presidential election has not caused us to change our view regarding portfolio positioning or the opportunity set. We still believe that there is little room for profit margins to improve and that interest rates cannot move materially higher without negative consequences. While we welcome a business-friendly administration, corporate tax reform, and more fiscal spending, we think that these conditions are necessary to hit next year’s earnings estimates anyway. From here, the biggest fundamental impact to the economy and to asset prices is likely a renewal of animal spirits.

With corporate margins near all-time highs, labor markets tight, and benefit costs on the rise, we do not believe top line growth will be sufficient to prevent further margin pressure.

11 |

Table of Contents

With monetary stimulus nearly exhausted, we believe fiscal stimulus will be necessary not only in the United States but internationally so that the macro imbalances can continue to adjust without creating excessive volatility. Our outlook has become more balanced, stock-specific, and not reflective of opportunities in specific industries, regions of the world, or broader market indices.

As it relates to the intermediate to long-term outlook, we believe we are entering the final stages of rebalancing the monetary bubble that has been accumulating in our financial markets for several decades. While the financial crisis was effective at eliminating excesses within our regulated banking systems, it pushed imbalances into the unregulated financial system and accentuated the imbalances that exist in international markets.

We continue to seek investments in companies that have better pricing power, lower earnings variability, higher profitability, and stronger balance sheets than the broader investment universe. We still do not favor any single industry or sector, and continue to look for companies with the characteristics noted above that trade at attractive valuations.

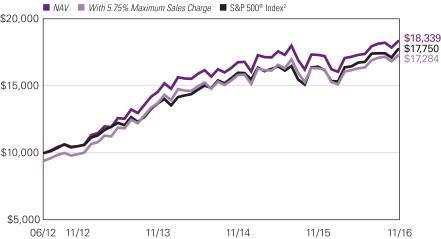

Hypothetical Growth of $10,000 Investment in Class A Shares3

June 29, 2012 (inception) through November 30, 2016

See notes to chart on page 14.

| 12

Table of Contents

VAUGHAN NELSON SELECT FUND

Top ten holdings (as of 11/30/2016)

| Security name | % of net assets |

|||||

| 1. | Alphabet, Inc. | 5.78% | ||||

| 2. | Walgreens Boots Alliance, Inc. | 5.62% | ||||

| 3. | General Dynamics Corp. | 5.19% | ||||

| 4. | UnitedHealth Group, Inc. | 5.15% | ||||

| 5. | Apple, Inc. | 4.95% | ||||

| 6. | Priceline Group, Inc. (The) | 4.83% | ||||

| 7. | Amsurg Corp. | 4.77% | ||||

| 8. | Citigroup, Inc. | 4.55% | ||||

| 9. | Charter Communications, Inc. | 4.54% | ||||

| 10. | Medtronic PLC | 4.40% | ||||

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

13 |

Table of Contents

Average Annual Total Returns — November 30, 20163

| Expense Ratios4 | ||||||||||||||||

| 1 Year | Life of Fund | Gross | Net | |||||||||||||

| Class A (Inception 6/29/2012) | ||||||||||||||||

| NAV | 5.91 | % | 14.70 | % | 1.54 | % | 1.44 | % | ||||||||

| With 5.75% Maximum Sales Charge | -0.16 | 13.17 | ||||||||||||||

| Class C (Inception 6/29/2012) | ||||||||||||||||

| NAV | 5.14 | 13.87 | 2.29 | 2.19 | ||||||||||||

| With CDSC1 | 4.14 | 13.87 | ||||||||||||||

| Class Y (Inception 6/29/2012) | ||||||||||||||||

| NAV | 6.22 | 15.01 | 1.29 | 1.19 | ||||||||||||

| Comparative Performance | ||||||||||||||||

| S&P 500® Index2 | 8.06 | 13.88 | ||||||||||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 3/31/17. When an expense cap has not been exceeded, the fund may have similar expense ratios. |

1680892.1.1

| 14

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information, disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on Natixis Funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how Natixis Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available from Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

15 |

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2016 through November 30, 2016. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| LOOMIS SAYLES DIVIDEND INCOME FUND | BEGINNING ACCOUNT VALUE 6/1/2016 |

ENDING ACCOUNT VALUE 11/30/2016 |

EXPENSES PAID DURING PERIOD* 6/1/2016 – 11/30/2016 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,059.40 | $5.77 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.40 | $5.65 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,055.90 | $9.61 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.65 | $9.42 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,061.70 | $4.43 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.70 | $4.34 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.12%, 1.87% and 0.86% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

| 16

Table of Contents

| LOOMIS SAYLES GLOBAL GROWTH FUND | BEGINNING ACCOUNT VALUE 6/1/2016 |

ENDING ACCOUNT VALUE 11/30/2016 |

EXPENSES PAID DURING PERIOD* 6/1/2016 – 11/30/2016 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,022.30 | $6.57 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.50 | $6.56 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,017.50 | $10.34 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.75 | $10.33 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,023.30 | $5.31 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.75 | $5.30 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.30%, 2.05% and 1.05% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

| VAUGHAN NELSON SELECT FUND | BEGINNING ACCOUNT VALUE 6/1/2016 |

ENDING ACCOUNT VALUE 11/30/2016 |

EXPENSES PAID DURING PERIOD* 6/1/2016 – 11/30/2016 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,059.20 | $6.74 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.45 | $6.61 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,055.40 | $10.59 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.70 | $10.38 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,061.00 | $5.46 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.70 | $5.35 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.31%, 2.06% and 1.06% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

17 |

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Dividend Income Fund

| Shares | Description | Value (†) | ||||||

| Common Stocks — 93.5% of Net Assets | ||||||||

| Aerospace & Defense — 2.0% | ||||||||

| 6,536 | United Technologies Corp. | $ | 704,058 | |||||

|

|

|

|||||||

| Automobiles — 3.2% | ||||||||

| 20,723 | General Motors Co. | 715,565 | ||||||

| 6,730 | Harley-Davidson, Inc. | 409,790 | ||||||

|

|

|

|||||||

| 1,125,355 | ||||||||

|

|

|

|||||||

| Banks — 10.2% | ||||||||

| 20,263 | BB&T Corp. | 916,901 | ||||||

| 18,265 | Fifth Third Bancorp | 475,255 | ||||||

| 12,409 | JPMorgan Chase & Co.(b) | 994,829 | ||||||

| 22,216 | Wells Fargo & Co. | 1,175,671 | ||||||

|

|

|

|||||||

| 3,562,656 | ||||||||

|

|

|

|||||||

| Beverages — 1.6% | ||||||||

| 5,759 | PepsiCo, Inc. | 576,476 | ||||||

|

|

|

|||||||

| Biotechnology — 2.7% | ||||||||

| 15,510 | AbbVie, Inc. | 943,008 | ||||||

|

|

|

|||||||

| Chemicals — 2.7% | ||||||||

| 16,700 | Dow Chemical Co. (The) | 930,524 | ||||||

|

|

|

|||||||

| Communications Equipment — 2.6% | ||||||||

| 30,485 | Cisco Systems, Inc. | 909,063 | ||||||

|

|

|

|||||||

| Containers & Packaging — 2.1% | ||||||||

| 15,470 | International Paper Co. | 753,698 | ||||||

|

|

|

|||||||

| Diversified Telecommunication Services — 2.3% | ||||||||

| 16,289 | Verizon Communications, Inc.(b) | 812,821 | ||||||

|

|

|

|||||||

| Electric Utilities — 5.8% | ||||||||

| 4,295 | Entergy Corp. | 295,195 | ||||||

| 15,391 | PG&E Corp. | 904,991 | ||||||

| 24,729 | PPL Corp. | 827,432 | ||||||

|

|

|

|||||||

| 2,027,618 | ||||||||

|

|

|

|||||||

| Electrical Equipment — 2.2% | ||||||||

| 11,433 | Eaton Corp. PLC(b) | 760,409 | ||||||

|

|

|

|||||||

| Food Products — 1.1% | ||||||||

| 4,118 | Hershey Co. (The) | 397,963 | ||||||

|

|

|

|||||||

| Independent Power & Renewable Electricity Producers — 1.2% | ||||||||

| 16,134 | NextEra Energy Partners LP | 413,192 | ||||||

|

|

|

|||||||

| Industrial Conglomerates — 2.1% | ||||||||

| 24,393 | General Electric Co.(b) | 750,329 | ||||||

|

|

|

|||||||

| Insurance — 3.8% | ||||||||

| 15,619 | MetLife, Inc. | 859,201 | ||||||

| 25,877 | Old Republic International Corp. | 462,422 | ||||||

|

|

|

|||||||

| 1,321,623 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 18

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Dividend Income Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Leisure Products — 1.1% | ||||||||

| 12,635 | Mattel, Inc. | $ | 398,887 | |||||

|

|

|

|||||||

| Media — 0.9% | ||||||||

| 3,704 | Omnicom Group, Inc. | 322,026 | ||||||

|

|

|

|||||||

| Multiline Retail — 1.4% | ||||||||

| 9,295 | Kohl’s Corp. | 500,350 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels — 8.8% | ||||||||

| 7,861 | Chevron Corp.(b) | 876,973 | ||||||

| 10,420 | Energy Transfer Partners LP | 365,951 | ||||||

| 11,985 | MPLX LP | 393,707 | ||||||

| 21,701 | PBF Energy, Inc., Class A | 520,607 | ||||||

| 16,899 | Royal Dutch Shell PLC, B Shares, Sponsored ADR | 915,419 | ||||||

|

|

|

|||||||

| 3,072,657 | ||||||||

|

|

|

|||||||

| Pharmaceuticals — 9.2% | ||||||||

| 25,365 | GlaxoSmithKline PLC, Sponsored ADR | 958,543 | ||||||

| 12,179 | Merck & Co., Inc. | 745,233 | ||||||

| 31,199 | Pfizer, Inc.(b) | 1,002,736 | ||||||

| 12,930 | Sanofi, Sponsored ADR | 519,786 | ||||||

|

|

|

|||||||

| 3,226,298 | ||||||||

|

|

|

|||||||

| REITs – Diversified — 3.8% | ||||||||

| 28,098 | Outfront Media, Inc. | 708,351 | ||||||

| 20,387 | Weyerhaeuser Co. | 628,531 | ||||||

|

|

|

|||||||

| 1,336,882 | ||||||||

|

|

|

|||||||

| REITs – Hotels — 4.4% | ||||||||

| 42,267 | Host Hotels & Resorts, Inc. | 754,043 | ||||||

| 13,135 | Ryman Hospitality Properties, Inc. | 773,652 | ||||||

|

|

|

|||||||

| 1,527,695 | ||||||||

|

|

|

|||||||

| Road & Rail — 2.2% | ||||||||

| 7,100 | Norfolk Southern Corp. | 755,866 | ||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment — 2.8% | ||||||||

| 14,673 | QUALCOMM, Inc. | 999,671 | ||||||

|

|

|

|||||||

| Software — 3.0% | ||||||||

| 17,320 | Microsoft Corp. | 1,043,703 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals — 1.7% | ||||||||

| 5,432 | Apple, Inc. | 600,345 | ||||||

|

|

|

|||||||

| Tobacco — 4.9% | ||||||||

| 6,909 | British American Tobacco PLC, Sponsored ADR | 753,357 | ||||||

| 11,121 | Philip Morris International, Inc.(b) | 981,762 | ||||||

|

|

|

|||||||

| 1,735,119 | ||||||||

|

|

|

|||||||

| Transportation Infrastructure — 2.0% | ||||||||

| 8,662 | Macquarie Infrastructure Corp. | 709,764 | ||||||

|

|

|

|||||||

| Wireless Telecommunication Services — 1.7% | ||||||||

| 23,997 | Vodafone Group PLC, Sponsored ADR | 586,487 | ||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $30,533,464) |

32,804,543 | |||||||

|

|

|

|||||||

See accompanying notes to financial statements.

19 |

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Dividend Income Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Preferred Stocks — 4.0% | ||||||||

| Integrated Energy — 1.4% | ||||||||

| 7,222 | Hess Corp., 8.000% | $ | 484,380 | |||||

|

|

|

|||||||

| Pharmaceuticals — 2.6% | ||||||||

| 742 | Allergan PLC, Series A, 5.500% | 532,014 | ||||||

| 589 | Teva Pharmaceutical Industries Ltd., 7.000% | 388,681 | ||||||

|

|

|

|||||||

| 920,695 | ||||||||

|

|

|

|||||||

| Total Preferred Stocks (Identified Cost $1,659,250) |

1,405,075 | |||||||

|

|

|

|||||||

| Principal Amount |

||||||||

| Bonds and Notes — 1.5% | ||||||||

| Healthcare — 0.5% | ||||||||

| $ | 150,000 | HCA, Inc., 7.500%, 11/06/2033 | 159,000 | |||||

|

|

|

|||||||

| Independent Energy — 0.1% | ||||||||

| 50,000 | WPX Energy, Inc., 5.250%, 1/15/2017 | 50,062 | ||||||

|

|

|

|||||||

| Supermarkets — 0.8% | ||||||||

| 280,000 | New Albertson’s, Inc., 8.000%, 5/01/2031 | 266,700 | ||||||

|

|

|

|||||||

| Transportation Services — 0.1% | ||||||||

| 75,000 | APL Ltd., 8.000%, 1/15/2024(c)(d) | 46,875 | ||||||

|

|

|

|||||||

| Total Bonds and Notes (Identified Cost $486,248) |

522,637 | |||||||

|

|

|

|||||||

| Short-Term Investments — 1.1% | ||||||||

| 378,891 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2016 at 0.030% to be repurchased at $378,891 on 12/01/2016

collateralized by $395,000 U.S. Treasury Note, 2.000% due 8/15/2025 valued at $387,100 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $378,891) |

378,891 | ||||||

|

|

|

|||||||

| Total Investments — 100.1% (Identified Cost $33,057,853)(a) |

35,111,146 | |||||||

| Other assets less liabilities — (0.1)% | (24,136 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 35,087,010 | ||||||

|

|

|

|||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2016, the net unrealized appreciation on investments based on a cost of $33,230,948 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 3,004,285 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (1,124,087 | ) | ||||||

|

|

|

|||||||

| Net unrealized appreciation | $ | 1,880,198 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 20

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Dividend Income Fund – (continued)

| (b) | Security (or a portion thereof) has been pledged as collateral for potential derivative contracts. | |||||||

| (c) | Illiquid security. (Unaudited) | |||||||

| (d) | Securities classified as fair valued pursuant to the Fund’s pricing policies and procedures. At November 30, 2016, the value of this security amounted to $46,875 or 0.1% of net assets. See Note 2 of Notes to Financial Statements. | |||||||

| ADR | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |||||||

| REITs | Real Estate Investment Trusts |

Industry Summary at November 30, 2016

| Pharmaceuticals |

11.8 | % | ||

| Banks |

10.2 | |||

| Oil, Gas & Consumable Fuels |

8.8 | |||

| Electric Utilities |

5.8 | |||

| Tobacco |

4.9 | |||

| REITs - Hotels |

4.4 | |||

| REITs - Diversified |

3.8 | |||

| Insurance |

3.8 | |||

| Automobiles |

3.2 | |||

| Software |

3.0 | |||

| Semiconductors & Semiconductor Equipment |

2.8 | |||

| Biotechnology |

2.7 | |||

| Chemicals |

2.7 | |||

| Communications Equipment |

2.6 | |||

| Diversified Telecommunication Services |

2.3 | |||

| Electrical Equipment |

2.2 | |||

| Road & Rail |

2.2 | |||

| Containers & Packaging |

2.1 | |||

| Industrial Conglomerates |

2.1 | |||

| Transportation Infrastructure |

2.0 | |||

| Aerospace & Defense |

2.0 | |||

| Other Investments, less than 2% each |

13.6 | |||

| Short-Term Investments |

1.1 | |||

|

|

|

|||

| Total Investments |

100.1 | |||

| Other assets less liabilities |

(0.1 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

21 |

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Global Growth Fund

| Shares | Description | Value (†) | ||||||

| Common Stocks — 100.1% of Net Assets | ||||||||

| Argentina — 2.9% | ||||||||

| 1,839 | MercadoLibre, Inc. | $ | 290,231 | |||||

|

|

|

|||||||

| Brazil — 1.8% | ||||||||

| 21,180 | Companhia Brasileira de Meios de Pagamento | 185,759 | ||||||

|

|

|

|||||||

| China — 9.7% | ||||||||

| 5,855 | Alibaba Group Holding Ltd., Sponsored ADR(b) | 550,487 | ||||||

| 2,505 | Baidu, Inc., Sponsored ADR(b) | 418,210 | ||||||

|

|

|

|||||||

| 968,697 | ||||||||

|

|

|

|||||||

| Denmark — 3.8% | ||||||||

| 11,165 | Novo Nordisk AS, Class B | 376,038 | ||||||

|

|

|

|||||||

| France — 5.9% | ||||||||

| 5,378 | Danone | 336,851 | ||||||

| 2,354 | Sodexo S.A. | 257,105 | ||||||

|

|

|

|||||||

| 593,956 | ||||||||

|

|

|

|||||||

| Germany — 2.3% | ||||||||

| 1,569 | Adidas AG | 231,166 | ||||||

|

|

|

|||||||

| Ireland — 2.9% | ||||||||

| 15,168 | Experian PLC | 285,903 | ||||||

|

|

|

|||||||

| Italy — 1.4% | ||||||||

| 38,800 | Prada SpA | 137,257 | ||||||

|

|

|

|||||||

| Sweden — 1.4% | ||||||||

| 17,102 | Elekta AB, Class B | 141,156 | ||||||

|

|

|

|||||||

| Switzerland — 7.7% | ||||||||

| 3,098 | Nestle S.A., (Registered) | 208,491 | ||||||

| 3,746 | Novartis AG, (Registered) | 258,181 | ||||||

| 1,383 | Roche Holding AG | 307,816 | ||||||

|

|

|

|||||||

| 774,488 | ||||||||

|

|

|

|||||||

| United Kingdom — 3.2% | ||||||||

| 6,352 | Diageo PLC | 158,817 | ||||||

| 4,114 | Unilever NV | 164,024 | ||||||

|

|

|

|||||||

| 322,841 | ||||||||

|

|

|

|||||||

| United States — 57.1% | ||||||||

| 477 | Alphabet, Inc., Class A(b) | 370,095 | ||||||

| 536 | Amazon.com, Inc.(b) | 402,306 | ||||||

| 3,382 | American Express Co. | 243,639 | ||||||

| 6,447 | Coca-Cola Co. (The) | 260,136 | ||||||

| 3,498 | Colgate-Palmolive Co. | 228,175 | ||||||

| 755 | Core Laboratories NV | 84,379 | ||||||

| 3,954 | Deere & Co. | 396,191 | ||||||

| 3,297 | Expeditors International of Washington, Inc. | 173,884 | ||||||

| 3,091 | Facebook, Inc., Class A(b) | 366,036 | ||||||

| 4,331 | Microsoft Corp. | 260,986 | ||||||

| 11,795 | Oracle Corp. | 474,041 | ||||||

| 3,681 | Procter & Gamble Co. (The) | 303,535 | ||||||

See accompanying notes to financial statements.

| 22

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Global Growth Fund – (continued)

| Shares | Description | Value (†) | ||||||

| United States — continued | ||||||||

| 5,687 | QUALCOMM, Inc. | $ | 387,455 | |||||

| 4,210 | Schlumberger Ltd. | 353,850 | ||||||

| 4,309 | SEI Investments Co. | 203,299 | ||||||

| 4,645 | Shire PLC | 270,519 | ||||||

| 4,688 | Visa, Inc., Class A | 362,476 | ||||||

| 13,241 | Yum China Holdings, Inc.(b) | 372,337 | ||||||

| 3,229 | Yum! Brands, Inc. | 204,686 | ||||||

|

|

|

|||||||

| 5,718,025 | ||||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $9,870,150) |

10,025,517 | |||||||

|

|

|

|||||||

| Total Investments — 100.1% (Identified Cost $9,870,150)(a) |

10,025,517 | |||||||

| Other assets less liabilities — (0.1)% | (13,410 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 10,012,107 | ||||||

|

|

|

|||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2016, the net unrealized appreciation on investments based on a cost of $9,883,594 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 552,431 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (410,508 | ) | ||||||

|

|

|

|||||||

| Net unrealized appreciation | $ | 141,923 | ||||||

|

|

|

|||||||

| (b) | Non-income producing security. | |||||||

| ADR | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |||||||

See accompanying notes to financial statements.

23 |

Table of Contents

Portfolio of Investments – as of November 30, 2016

Loomis Sayles Global Growth Fund – (continued)

Industry Summary at November 30, 2016

| Internet Software & Services |

20.0 | % | ||

| Pharmaceuticals |

9.4 | |||

| Hotels, Restaurants & Leisure |

8.4 | |||

| Software |

7.3 | |||

| IT Services |

5.4 | |||

| Food Products |

5.4 | |||

| Household Products |

5.3 | |||

| Energy Equipment & Services |

4.4 | |||

| Beverages |

4.2 | |||

| Internet & Direct Marketing Retail |

4.0 | |||

| Machinery |

4.0 | |||

| Semiconductors & Semiconductor Equipment |

3.9 | |||

| Textiles, Apparel & Luxury Goods |

3.7 | |||

| Professional Services |

2.9 | |||

| Biotechnology |

2.7 | |||

| Consumer Finance |

2.4 | |||

| Capital Markets |

2.0 | |||

| Other Investments, less than 2% each |

4.7 | |||

|

|

|

|||

| Total Investments |

100.1 | |||

| Other assets less liabilities |

(0.1 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

Currency Exposure Summary at November 30, 2016

| United States Dollar |

67.0 | % | ||

| Euro |

9.8 | |||

| Swiss Franc |

7.7 | |||

| British Pound |

7.2 | |||

| Danish Krone |

3.8 | |||

| Other, less than 2% each |

4.6 | |||

|

|

|

|||

| Total Investments |

100.1 | |||

| Other assets less liabilities |

(0.1 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

| 24

Table of Contents

Portfolio of Investments – as of November 30, 2016

Vaughan Nelson Select Fund

| Shares | Description | Value (†) | ||||||

| Common Stocks — 90.4% of Net Assets | ||||||||

| Aerospace & Defense — 5.2% | ||||||||

| 39,225 | General Dynamics Corp. | $ | 6,878,104 | |||||

|

|

|

|||||||

| Auto Components — 2.8% | ||||||||

| 57,725 | Delphi Automotive PLC | 3,694,400 | ||||||

|

|

|

|||||||

| Banks — 7.1% | ||||||||

| 106,925 | Citigroup, Inc. | 6,029,501 | ||||||

| 63,500 | Wells Fargo & Co. | 3,360,420 | ||||||

|

|

|

|||||||

| 9,389,921 | ||||||||

|

|

|

|||||||

| Capital Markets — 1.8% | ||||||||

| 23,025 | Moody’s Corp. | 2,314,013 | ||||||

|

|

|

|||||||

| Diversified Financial Services — 2.4% | ||||||||

| 20,375 | Berkshire Hathaway, Inc., Class B(b) | 3,207,840 | ||||||

|

|

|

|||||||

| Food & Staples Retailing — 5.6% | ||||||||

| 87,925 | Walgreens Boots Alliance, Inc. | 7,449,885 | ||||||

|

|

|

|||||||

| Health Care Equipment & Supplies — 4.4% | ||||||||

| 79,900 | Medtronic PLC | 5,833,499 | ||||||

|

|

|

|||||||

| Health Care Providers & Services — 10.9% | ||||||||

| 92,825 | Amsurg Corp.(b) | 6,323,239 | ||||||

| 18,900 | HCA Holdings, Inc.(b) | 1,339,821 | ||||||

| 43,125 | UnitedHealth Group, Inc. | 6,827,550 | ||||||

|

|

|

|||||||

| 14,490,610 | ||||||||

|

|

|

|||||||

| Industrial Conglomerates — 3.8% | ||||||||

| 44,675 | Honeywell International, Inc. | 5,090,269 | ||||||

|

|

|

|||||||

| Insurance — 1.9% | ||||||||

| 50,800 | Arthur J. Gallagher & Co. | 2,557,780 | ||||||

|

|

|

|||||||

| Internet & Direct Marketing Retail — 4.8% | ||||||||

| 4,260 | Priceline Group, Inc. (The)(b) | 6,405,677 | ||||||

|

|

|

|||||||

| Internet Software & Services — 6.6% | ||||||||

| 1,400 | Alphabet, Inc., Class A(b) | 1,086,232 | ||||||

| 10,110 | Alphabet, Inc., Class C(b) | 7,663,784 | ||||||

|

|

|

|||||||

| 8,750,016 | ||||||||

|

|

|

|||||||

| IT Services — 3.4% | ||||||||

| 49,400 | Broadridge Financial Solutions, Inc. | 3,198,156 | ||||||

| 12,700 | MasterCard, Inc., Class A | 1,297,940 | ||||||

|

|

|

|||||||

| 4,496,096 | ||||||||

|

|

|

|||||||

| Life Sciences Tools & Services — 2.6% | ||||||||

| 24,700 | Thermo Fisher Scientific, Inc. | 3,460,717 | ||||||

|

|

|

|||||||

| Media — 4.5% | ||||||||

| 21,868 | Charter Communications, Inc., Class A(b) | 6,020,479 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels — 2.6% | ||||||||

| 131,775 | Enterprise Products Partners LP | 3,416,926 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

25 |

Table of Contents

Portfolio of Investments – as of November 30, 2016

Vaughan Nelson Select Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Semiconductors & Semiconductor Equipment — 6.2% | ||||||||

| 21,525 | Broadcom Ltd. | $ | 3,669,797 | |||||

| 61,975 | Texas Instruments, Inc. | 4,581,812 | ||||||

|

|

|

|||||||

| 8,251,609 | ||||||||

|

|

|

|||||||

| Software — 4.4% | ||||||||

| 95,750 | Microsoft Corp. | 5,769,895 | ||||||

|

|

|

|||||||

| Specialty Retail — 4.4% | ||||||||

| 238,800 | Michaels Cos., Inc. (The)(b) | 5,821,944 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals — 5.0% | ||||||||

| 59,325 | Apple, Inc. | 6,556,599 | ||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $105,232,945) |

119,856,279 | |||||||

|

|

|

|||||||

| Principal Amount |

||||||||

| Short-Term Investments — 10.6% | ||||||||

| $ | 14,033,310 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2016 at 0.030% to be repurchased at $14,033,322 on 12/01/2016 collateralized by $14,555,000 U.S. Treasury Note, 2.000% due 2/15/2025 valued at $14,318,481 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $14,033,310) | 14,033,310 | |||||

|

|

|

|||||||

| Total Investments — 101.0% (Identified Cost $119,266,255)(a) |

133,889,589 | |||||||

| Other assets less liabilities — (1.0)% | (1,371,575 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 132,518,014 | ||||||

|

|

|

|||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2016, the net unrealized appreciation on investments based on a cost of $119,372,454 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 15,682,099 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (1,164,964 | ) | ||||||

|

|

|

|||||||

| Net unrealized appreciation | $ | 14,517,135 | ||||||

|

|

|

|||||||

| (b) | Non-income producing security. | |||||||

See accompanying notes to financial statements.

| 26

Table of Contents

Portfolio of Investments – as of November 30, 2016

Vaughan Nelson Select Fund – (continued)

Industry Summary at November 30, 2016

| Health Care Providers & Services |

10.9 | % | ||

| Banks |

7.1 | |||

| Internet Software & Services |

6.6 | |||

| Semiconductors & Semiconductor Equipment |

6.2 | |||

| Food & Staples Retailing |

5.6 | |||

| Aerospace & Defense |

5.2 | |||

| Technology Hardware, Storage & Peripherals |

5.0 | |||

| Internet & Direct Marketing Retail |

4.8 | |||

| Media |

4.5 | |||

| Health Care Equipment & Supplies |

4.4 | |||

| Specialty Retail |

4.4 | |||

| Software |

4.4 | |||

| Industrial Conglomerates |

3.8 | |||

| IT Services |

3.4 | |||

| Auto Components |

2.8 | |||

| Life Sciences Tools & Services |

2.6 | |||

| Oil, Gas & Consumable Fuels |

2.6 | |||

| Diversified Financial Services |

2.4 | |||

| Other Investments, less than 2% each |

3.7 | |||

| Short-Term Investments |

10.6 | |||

|

|

|

|||

| Total Investments |

101.0 | |||

| Other assets less liabilities |

(1.0 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

27 |

Table of Contents

Statements of Assets and Liabilities

November 30, 2016

| Loomis Sayles Dividend Income Fund |

Loomis Sayles Global Growth Fund |

Vaughan Nelson Select Fund |

||||||||||

| ASSETS |

| |||||||||||

| Investments at cost |

$ | 32,678,962 | $ | 9,870,150 | $ | 105,232,945 | ||||||

| Repurchase agreement(s) at cost |

378,891 | — | 14,033,310 | |||||||||

| Net unrealized appreciation |

2,053,293 | 155,367 | 14,623,334 | |||||||||

|

|

|

|

|

|

|

|||||||

| Investments at value |

35,111,146 | 10,025,517 | 133,889,589 | |||||||||

| Receivable for Fund shares sold |

66,344 | — | 128,172 | |||||||||

| Receivable for securities sold |

— | 55,835 | — | |||||||||

| Dividends and interest receivable |

150,068 | 10,377 | 195,709 | |||||||||

| Tax reclaims receivable |

2,473 | 3,427 | 8,537 | |||||||||

| Prepaid expenses (Note 7) |

89 | 21 | 324 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL ASSETS |

35,330,120 | 10,095,177 | 134,222,331 | |||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES |

| |||||||||||

| Payable for securities purchased |

— | — | 1,296,348 | |||||||||

| Payable for Fund shares redeemed |

128,466 | 9,478 | 230,407 | |||||||||

| Management fees payable (Note 6) |

4,426 | 6,150 | 70,193 | |||||||||

| Deferred Trustees’ fees (Note 6) |

41,084 | 6,579 | 39,411 | |||||||||

| Administrative fees payable (Note 6) |

1,271 | 374 | 4,745 | |||||||||

| Payable to distributor (Note 6d) |

129 | 2 | 591 | |||||||||

| Other accounts payable and accrued expenses |

67,734 | 60,487 | 62,622 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES |

243,110 | 83,070 | 1,704,317 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS |

$ | 35,087,010 | $ | 10,012,107 | $ | 132,518,014 | ||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS CONSIST OF: |

| |||||||||||

| Paid-in capital |

$ | 33,201,644 | $ | 9,627,379 | $ | 117,465,401 | ||||||

| Undistributed (Distributions in excess of) net investment income |

(41,084 | ) | 38,448 | 246,555 | ||||||||

| Accumulated net realized gain (loss) on investments, options written, short sales and foreign currency transactions |

(126,843 | ) | 191,193 | 182,724 | ||||||||

| Net unrealized appreciation on investments, options written and foreign currency translations |

2,053,293 | 155,087 | 14,623,334 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET ASSETS |

$ | 35,087,010 | $ | 10,012,107 | $ | 132,518,014 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to financial statements.

| 28

Table of Contents

Statements of Assets and Liabilities (continued)

November 30, 2016

| Loomis Sayles Dividend Income Fund |

Loomis Sayles Global Growth Fund |

Vaughan Nelson Select Fund |

||||||||||

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE: |

||||||||||||

| Class A shares: |

| |||||||||||

| Net assets |

$ | 14,236,351 | $ | 194,668 | $ | 20,501,841 | ||||||

|

|

|

|

|

|

|

|||||||

| Shares of beneficial interest |

1,330,073 | 18,482 | 1,332,646 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value and redemption price per share |

$ | 10.70 | $ | 10.53 | $ | 15.38 | ||||||

|

|

|

|

|

|

|

|||||||

| Offering price per share (100/94.25 of net asset value) (Note 1) |

$ | 11.35 | $ | 11.17 | $ | 16.32 | ||||||

|

|

|

|

|

|

|

|||||||

| Class C shares: (redemption price per share is equal to net asset value less any applicable contingent deferred sales charge) (Note 1) |

||||||||||||

| Net assets |

$ | 5,505,462 | $ | 24,611 | $ | 7,692,624 | ||||||

|

|

|

|

|

|

|

|||||||

| Shares of beneficial interest |

516,947 | 2,350 | 517,336 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value and offering price per share |

$ | 10.65 | $ | 10.47 | $ | 14.87 | ||||||

|

|

|

|

|

|

|

|||||||

| Class Y shares: |

| |||||||||||

| Net assets |

$ | 15,345,197 | $ | 9,792,828 | $ | 104,323,549 | ||||||

|

|

|

|

|

|

|

|||||||

| Shares of beneficial interest |

1,432,651 | 927,838 | 6,740,655 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value, offering and redemption price per share |

$ | 10.71 | $ | 10.55 | $ | 15.48 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to financial statements.

29 |

Table of Contents

Statements of Operations

For the Year Ended November 30, 2016

| Loomis Sayles Dividend Income Fund |

Loomis Sayles Global Growth Fund(a) |

Vaughan Nelson Select Fund |

||||||||||

| INVESTMENT INCOME |

||||||||||||

| Interest |

$ | 123,746 | $ | 54 | $ | 11,516 | ||||||

| Dividends |

1,299,125 | 92,882 | 1,712,571 | |||||||||

| Less net foreign taxes withheld |

(9,495 | ) | (4,697 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| 1,413,376 | 88,239 | 1,724,087 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Expenses |

||||||||||||

| Management fees (Note 6) |

185,564 | 47,321 | 965,843 | |||||||||

| Service and distribution fees (Note 6) |

79,498 | 331 | 122,492 | |||||||||

| Administrative fees (Note 6) |

13,702 | 2,624 | 50,337 | |||||||||

| Trustees’ fees and expenses (Note 6) |

20,174 | 12,948 | 21,965 | |||||||||

| Transfer agent fees and expenses (Note 6) |

25,016 | 2,323 | 68,559 | |||||||||

| Audit and tax services fees |

52,417 | 31,131 | 42,322 | |||||||||

| Custodian fees and expenses |

8,542 | 23,221 | 5,439 | |||||||||

| Legal fees |

480 | 88 | 1,826 | |||||||||

| Registration fees |

58,111 | 22,929 | 68,308 | |||||||||

| Shareholder reporting expenses |

14,568 | 778 | 30,558 | |||||||||

| Dividend expenses on securities sold short (Note 2) |

— | — | 3,473 | |||||||||

| Miscellaneous expenses (Note 7) |

10,401 | 7,202 | 15,717 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

468,473 | 150,896 | 1,396,839 | |||||||||

| Less waiver and/or expense reimbursement (Note 6) |

(109,507 | ) | (88,415 | ) | (34,582 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net expenses |

358,966 | 62,481 | 1,362,257 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net investment income |

1,054,410 | 25,758 | 361,830 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, OPTIONS WRITTEN, SHORT SALES AND FOREIGN CURRENCY TRANSACTIONS |

||||||||||||

| Net realized gain (loss) on: |

||||||||||||

| Investments |

(311,419 | ) | 191,193 | 2,408,742 | ||||||||

| Options written |

75,153 | — | 28,382 | |||||||||

| Short sales |

— | — | (205,764 | ) | ||||||||

| Foreign currency transactions |

(497 | ) | (2,928 | ) | — | |||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||||||

| Investments |

2,091,920 | 155,367 | 4,866,123 | |||||||||

| Options written |

2,840 | — | — | |||||||||

| Foreign currency translations |

75 | (280 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net realized and unrealized gain on investments, options written, short sales and foreign currency transactions |

1,858,072 | 343,352 | 7,097,483 | |||||||||

|

|

|

|

|

|

|

|||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 2,912,482 | $ | 369,110 | $ | 7,459,313 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | From commencement of operations on March 31, 2016 through November 30, 2016. |

See accompanying notes to financial statements.

| 30

Table of Contents

Statements of Changes in Net Assets

| Loomis Sayles Dividend Income Fund |

||||||||

| Year Ended November 30, 2016 |

Year Ended November 30, 2015 |

|||||||

| FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 1,054,410 | $ | 802,734 | ||||

| Net realized gain (loss) on investments, options written, short sales and foreign currency transactions |

(236,763 | ) | 2,575,880 | |||||

| Net change in unrealized appreciation (depreciation) on investments, options written and foreign currency translations |

2,094,835 | (3,560,452 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

2,912,482 | (181,838 | ) | |||||