Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

| 399 Boylston Street, Boston, Massachusetts | 02116 | |

| (Address of principal executive offices) | (Zip code) |

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: November 30

Date of reporting period: November 30, 2015

Table of Contents

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

ANNUAL REPORT

November 30, 2015

Loomis Sayles Dividend Income Fund

Loomis Sayles Emerging Markets Opportunities Fund

Loomis Sayles Senior Floating Rate and Fixed Income Fund

Vaughan Nelson Select Fund

Portfolio Review page 1

Portfolio of Investments page 19

Financial Statements page 46

Notes to Financial Statements page 64

Table of Contents

LOOMIS SAYLES DIVIDEND INCOME FUND

| Managers: | Symbols: | |

| Arthur J. Barry, CFA® | Class A LSCAX | |

| Matthew J. Eagan, CFA® | Class C LSCCX | |

| Daniel J. Fuss, CFA®, CIC | Class Y LSCYX | |

| Adam C. Liebhoff | ||

| Elaine M. Stokes | ||

| Loomis, Sayles & Company, L.P. | ||

Objective:

The Fund’s investment goal is high total return through a combination of current income and capital appreciation.

Market Conditions

The U.S. large cap equity market generally outperformed most other global equity markets during the 12-month period. During the second half of the period, global stocks came under increasing pressure. Given mounting concerns about China’s growth, falling commodity prices and uncertainty around the timing of the Federal Reserve’s (the Fed) first interest rate increase, market volatility spiked in August and triggered a broad equity market correction. During that period, many benchmarks declined 10 percent or more for the first time since 2011. However, markets rebounded late in the period, coincident with lower volatility. Fixed income markets were similarly challenged during the 12-month period. For the first half, a strengthening U.S. dollar elevated investor concerns. During the second half, investor risk aversion rose due to volatile oil prices. Spreads (difference in yield between non-U.S. Treasury and Treasury securities of similar maturity) generally widened, particularly for lower-quality issues.

Performance Results

For the 12 months ended November 30, 2015, Class A shares of the Loomis Sayles Dividend Income Fund returned -1.89% at net asset value. The Fund underperformed its primary benchmark, the all-equity S&P 500® Index, which returned 2.75% for the period. The Fund also underperformed its secondary benchmark, the Russell 1000® Value Index, which returned -1.11%.

Explanation of Fund Performance

The Fund underperformed largely due to security selection in the fixed income allocation. Underperformance was primarily driven by security-specific risk; significant oil price volatility put pressure on energy-related holdings in the industrials sector. A specific energy sector convertible issue also weighed heavily on performance. Significant U.S. dollar appreciation during the reporting period caused bonds denominated in the Australian dollar and Mexican peso to detract from performance. Not surprisingly, equity allocations to the energy and materials sectors also detracted from absolute performance, given the pressure on commodities markets from declining oil prices. Additionally, a large underweight to and

1 |

Table of Contents

stock selection within the information technology sector dragged on relative performance. In terms of individual equity holdings, Tronox, a specialty chemical company, underperformed largely due to a softening titanium dioxide market. We exited the position during the summer. Qualcomm, a communications equipment maker, was also a main detractor. Investors’ confidence in the company’s ability to grow was soured by a number of factors, including worse-than-expected conditions in the company’s mobile chipset business, difficulties signing royalty contracts in China and a Korean regulatory investigation into its royalty business. In addition, Southcross Energy Partners, a natural gas utility, underperformed due to the continued decline in commodity prices and lower expected activity in the regions where its gathering, processing and pipeline networks are located. We sold the position in August.

On an absolute basis, the consumer discretionary, consumer staples, financials, industrials and utilities sectors contributed most to overall return. Security selection in the utilities, industrials, financials and consumer staples sectors contributed meaningfully to relative performance but not enough to offset individual stock underperformance in other sectors. On an individual basis, independent refiner PBF Energy was a leading contributor to performance due to strong operating fundamentals amid declining crude oil prices and increased demand for gasoline. PBF also made two attractive acquisitions that were well received by investors. In addition, Old Republic International, a property and casualty insurance holding company, was a main contributor. The company’s stock experienced significant price appreciation following strong earnings results released in October 2015. General Electric also performed well during the period, largely due to management’s historic decision to spin off the company’s financial services business. The combination of solid underlying fundamentals and a large capital return program propelled the company’s stock price to new highs.

Outlook

We expect S&P 500® earnings to resume growth in 2016 after a flat 2015. Profit margins should remain healthy, but we do not anticipate material expansion. We would be pleased with mid to high single-digit equity market returns over the next few years given high valuations, tepid global growth, US elections and geopolitical uncertainties. Importantly, major fundamental positives remain intact: stable-to-improving developed market growth, lower commodity prices, capped global inflation and continuing low interest rates.

| 2

Table of Contents

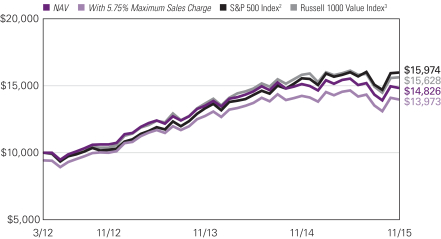

LOOMIS SAYLES DIVIDEND INCOME FUND

Growth of $10,000 Investment in Class A Shares4

March 30, 2012 (inception) through November 30, 2015

Average Annual Total Returns — November 30, 20154

| 1 Year | Life of Fund | |||||||

| Class A (Inception 3/30/2012) | ||||||||

| NAV | -1.89 | % | 11.33 | % | ||||

| With 5.75% Maximum Sales Charge | -7.50 | 9.55 | ||||||

| Class C (Inception 3/30/2012) | ||||||||

| NAV | -2.64 | 10.49 | ||||||

| With CDSC1 | -3.51 | 10.49 | ||||||

| Class Y (Inception 3/30/2012) | ||||||||

| NAV | -1.64 | 11.59 | ||||||

| Comparative Performance | ||||||||

| S&P 500® Index2 | 2.75 | 13.64 | ||||||

| Russell 1000® Value Index3 | -1.11 | 12.96 | ||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

3 |

Table of Contents

LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND

| Managers: | Symbols: | |

| Elisabeth Colleran, CFA® | Class A LEOAX | |

| Peter A. Frick, CFA® | Class C LEOCX | |

| Peter N. Marber | Class N LEONX | |

| David W. Rolley, CFA® | Class Y LEOYX | |

| Edgardo Sternberg | ||

| Loomis, Sayles & Company, L.P. | ||

Objective

The Fund seeks high total investment return through a combination of high current income and capital appreciation.

Market Conditions

Technical moves, U.S. dollar strength, falling commodity prices and risk-averse investor sentiment created a turbulent backdrop for emerging markets during the 12-month period. Quantitative easing (QE) policies from the European Central Bank (ECB) and Bank of Japan temporarily improved liquidity and investor sentiment for emerging market credit risk during the first half of the period. However, bond market liquidity fell and volatility increased in the second half, creating a more fragile environment for emerging markets.

Commodity prices continued to decline, albeit at a more muted pace as the period progressed. Net exporters of commodities, such as some Latin American countries and Russia, faced substantial price pressures as investors exited those markets. Meanwhile, slowing growth in China influenced conditions in the latter part of the period. Increased government intervention and weak exports triggered investor concerns, which were then exacerbated by weak demand and liquidity fears. The decision by the People’s Bank of China to devalue its currency triggered outflows from developing countries into developed markets. Investors generally interpreted the currency devaluation as a signal the Chinese economy was slowing faster than anticipated, spurring a selloff among risk assets that impacted most emerging markets.

The U.S. dollar rallied for most of the period, pressuring selected countries and currencies and hurting returns of local currency bonds in U.S.-dollar terms. However, easier local monetary policies and weakening currencies helped emerging market economies become better balanced in a world of lower commodity prices.

Performance Results

For the 12-months ended November 30, 2015, Class A shares of the Loomis Sayles Emerging Markets Opportunities Fund returned -2.51% at net asset value. The Fund underperformed its benchmark, the Barclays EM USD Aggregate 10% Country Capped Index, which returned 0.18%.

| 4

Table of Contents

LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND

Explanation of Fund Performance

We express our investment views through specific strategies applied across the various market segments and instruments. When combined, these strategies constitute the Fund’s performance. For the 12-month period, our equity strategies detracted from performance. Specifically, out-of-benchmark exposure to emerging market equity exchange-traded funds (ETFs), equity options and equity index futures weighed on Fund performance. The continued decline in commodity prices, slowing growth in China and broad risk aversion triggered a selloff in global equities that hit emerging markets particularly hard. Additionally, our convertible strategy lost value primarily due to a specific holding. Our bank loan and derivative strategies, including interest rate futures and swaps and ETF options, also detracted from performance. Although our overall credit strategy was sound, selected names underperformed, particularly during the third quarter of 2015, mainly due to their heavy exposure to falling commodity markets.

Sovereign bonds contributed positively to performance. Specifically, long positions in U.S.-dollar-denominated Russian and Ukrainian sovereigns aided results as geopolitical tensions between Russia and Ukraine subsided. Some commodity price stability and the alleviation of Ukrainian sovereign default risk also supported the bonds. Meanwhile, emerging market corporate exposure across sectors contributed the most to performance despite the market volatility. In particular, financials, utilities, technology, media and telecommunications were the primary contributors to performance. On a country basis, commodity-linked names in Russia and Venezuela and financial names in Mexico added to return. While out-of-benchmark exposure to currency options proved useful, given the fluctuations in commodity prices and the U.S. dollar’s strength, the negative impact from ETF options overpowered the benefits from our currency option selection.

Outlook

We believe emerging markets will continue to be an area where idiosyncratic stories will take precedence over general themes. The fundamental backdrop for many emerging markets remains mixed, and depressed commodity prices are still stifling growth in many export-led economies. We remain generally constructive about emerging markets, as accommodative monetary policies, conservative behavior from corporate issuers and some positive market technical factors remain supportive. However, we expect that slow global growth, with few catalysts for acceleration, has the potential to trigger future liquidity concerns.

The delayed Federal Reserve (Fed) rate hike has delivered mixed results for emerging markets. It has reduced pressure on local rates, offering relief to countries facing decelerating growth. However, prolonged market uncertainty about the path for U.S. rates acts as a drag on emerging market investment. The Fed rate hike should reduce uncertainty and improve investor sentiment toward emerging markets.

5 |

Table of Contents

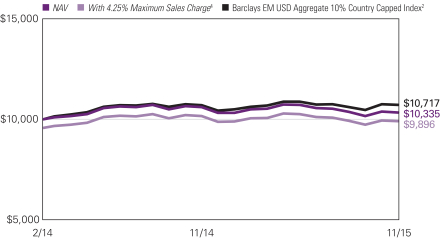

Growth of $10,000 Investment in Class A Shares3

February 10, 2014 (inception) through November 30, 2015

See notes to chart on page 7.

| 6

Table of Contents

LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND

Average Annual Total Returns — November 30, 20153

| 1 Year | Life of Fund | |||||||

| Class A (Inception 2/10/2014) | ||||||||

| NAV | -2.51 | %5 | 1.84 | % | ||||

| With 4.25% Maximum Sales Charge4 | -6.68 | -0.57 | ||||||

| Class C (Inception 2/10/2014) | ||||||||

| NAV | -3.30 | 0.95 | ||||||

| With CDSC1 | -4.24 | 0.95 | ||||||

| Class N (Inception 2/10/2014) | ||||||||

| NAV | -2.27 | 2.08 | ||||||

| Class Y (Inception 2/10/2014) | ||||||||

| NAV | -2.38 | 5 | 2.01 | |||||

| Comparative Performance | ||||||||

| Barclays EM USD Aggregate 10% Country Capped Index2 | 0.18 | 3.92 | ||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The Barclays EM USD Aggregate 10% Country Capped Index includes USD denominated debt from sovereign, quasi-sovereign, and corporate EM issuers. The index is broad-based in its coverage by sector and by country, and includes a 10% Country cap. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | The maximum sales charge on purchases of Class A shares was reduced from 4.50% to 4.25% on November 2, 2015. The Fund’s returns for Class A shares for all periods have been restated to reflect the current maximum applicable sales charge of 4.25%. |

| 5 | Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. The return presented in the table(s) is what an investor would have actually experienced. |

7 |

Table of Contents

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

| Managers: | Symbols: | |

| Kevin J. Perry | Class A LSFAX | |

| John R. Bell | Class C LSFCX | |

| Loomis, Sayles & Company, L.P. | Class Y LSFYX |

Objective:

The Fund seeks to provide a high level of current income.

Market Conditions

The bank loan market faced a challenging 12-month period ending November 30, 2015, as technical forces overwhelmed fundamentals and risk-aversion persisted. The period began on a difficult note, as continued concerns surrounding energy-related companies led to a risk-off sentiment that unsettled investors. Outflows from retail bank loan mutual funds noticeably slowed in January 2015, and although outflows generally persisted throughout the remainder of the period, the effect on the market was muted.

During the second quarter of 2015, collateralized loan obligation (CLO) formation, an important technical driver for the bank loan market, remained strong, topping $10 billion in April and June. Mounting concerns about Greece’s debt crisis in late June sparked volatility that continued into the third quarter of 2015. The bank loan market was less affected than the high yield bond market. Distressed bank loans posted outsized losses for the third quarter, while higher-rated loans fared better in the risk-averse environment. Technical conditions continued to influence the bank loan market more than fundamentals. CLO formation was more tepid during the last few months of the period, ranging between $5 and $7 billion from July through November.

Overall, new issuance was generally muted during the period, but the bank loan market continued to grow. As of November 30, 2015, the market value of the S&P/LSTA Leveraged Loan® Index stood at $870.6 billion.

Performance Results

For the 12-month period ended November 30, 2015, Class A shares of the Loomis Sayles Senior Floating Rate and Fixed Income Fund returned -1.33% at net asset value. The Fund underperformed its benchmark, the S&P/LSTA Leveraged Loan Index, which returned -0.89%.

Explanation of Fund Performance

The Fund’s bank loan exposure outpaced the benchmark, but the Fund’s allocation to high yield bonds weighed on relative results. Due to falling oil and commodity prices, the energy and metals and mining sectors lagged the broader bank loan and high yield indexes. Consequently, the Fund’s energy-related holdings and exposure to the metals and mining industry detracted the most from performance. We continued to analyze energy names, buying and selling on a credit-by-credit basis in light of our longer-term positive views on energy prices.

| 8

Table of Contents

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

We gradually reduced the Fund’s exposure to lower-rated loans in anticipation of greater market volatility surrounding a potential Federal Reserve (Fed) policy change. Nevertheless, we continued to focus on credit selection and generating a high level of current income rather than defensive tactics, given our fundamentally positive view of the U.S. loan market. Overall, we targeted a yield advantage relative to the benchmark in most market conditions, which aided the Fund’s performance. We made no significant shifts in our macroeconomic view during the period.

After subtracting cash held for the purpose of settling purchases, the Fund ended the period with approximately 84% of its portfolio invested in bank loans, 11% in bonds and 2% in cash equivalents. The Fund’s allocation to bonds remained relatively moderate and stable throughout the period, as few low-duration (less price sensitivity to interest rate changes) high yield bonds appeared competitive with bank loans. In the second quarter of 2015 we removed a modest level of leverage (borrowing capital at a lower interest rate relative to the interest rates on bank loans) initiated at the end of 2013, and we did not use leverage again during the reporting period.

Outlook

The Fed raised interest rates in December 2015, and additional rate increases appear likely, which may attract additional investors to the bank loan market. We also expect CLO formation to remain a positive technical driver for loan demand in 2016. We believe low levels of loan maturities through 2016 and 2017 should help keep default rates below historic averages. In our view, markets seem eager to embrace negative long-term views, particularly relative to slowing growth in China, recovering growth in Europe and other geopolitical risks. While we remain cautious, we are more positive on market fundamentals than the broad investor universe appears to be.

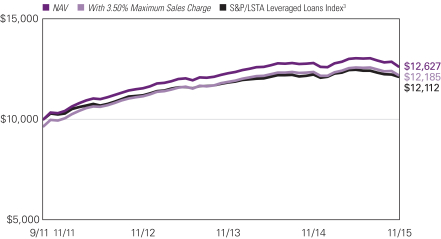

Growth of $10,000 Investment in Class A Shares4

September 30, 2011 (inception) through November 30, 2015

9 |

Table of Contents

Average Annual Total Returns — November 30, 20154

| 1 Year | Life of Fund | |||||||

| Class A (Inception 9/30/11) | ||||||||

| NAV | -1.33 | % | 5.76 | % | ||||

| With 3.50% Maximum Sales Charge | -4.81 | 4.85 | ||||||

| Class C (Inception 9/30/11) | ||||||||

| NAV | -2.06 | 4.99 | ||||||

| With CDSC2 | -2.99 | 4.99 | ||||||

| Class Y (Inception 9/30/11)1 | ||||||||

| NAV | -1.08 | 6.03 | ||||||

| Comparative Performance | ||||||||

| S&P / LSTA Leveraged Loan Index3 | -0.89 | 4.71 | ||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | 9/30/11 represents the date Class Y shares were first registered for public sale under the Securities Act of 1933. 9/16/11 represents commencement of operations for Class Y shares for accounting and financial reporting purposes only. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | S&P/LSTA Leveraged Loan Index reflects the market-weighted performance of institutional leveraged loans based upon real-time market weightings, spreads and interest payments. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 10

Table of Contents

VAUGHAN NELSON SELECT FUND

| Managers: | Symbols: | |

| Dennis G. Alff, CFA® | Class A VNSAX | |

| Chad D. Fargason, PhD | Class C VNSCX | |

| Chris D. Wallis, CFA® | Class Y VNSYX | |

| Scott J. Weber, CFA® | ||

| Vaughan Nelson Investment Management, L.P. | ||

Objective:

The Fund seeks long-term capital appreciation.

Market Conditions

During the past 12 months, deteriorating market breadth resulted in increased equity market volatility. Current volatility will likely continue as capital markets adjust to the shifts in central bank policy that are occurring globally. Specifically, the ongoing shift in U.S. monetary policy creates deflationary pressures as the dollar strengthens relative to those currencies whose monetary authorities are accelerating stimulative policies.

In typical business cycles, shifts in monetary policy that reduce liquidity occur when the economy is accelerating, profit margins are increasing and inflation expectations are rising. Unfortunately, none of these conditions are currently present in the United States, which is why we believe this market cycle will be materially different from market cycles experienced prior to the 2009 financial crisis.

Equity markets are digesting falling earnings growth estimates, declining profit margins and rising credit costs. The recent volatility is consistent with our view that with valuations stretched, near term earnings estimates declining and corporate borrowing rates likely beyond their cyclical lows, the market will present attractive investment opportunities.

Performance Results

For the 12 months ended November 30, 2015, Class A shares of the Vaughan Nelson Select Fund returned 3.31% at net asset value. The Fund outperformed its benchmark, the S&P 500® Index, which returned 2.75%.

Explanation of Fund Performance

Sector allocation drove the outperformance vs. the benchmark, while stock selection was a modest relative headwind. The sector allocation benefit resulted from our focus on company specific valuations and fundamentals as opposed to targeted sector exposure. Information technology and consumer staples contributed the most to both the Fund’s absolute and relative performance, while consumer discretionary and industrials were the biggest detractors.

Stock selection stood out as a positive driver in the information technology sector. Avago Technologies, Alphabet (formerly Google) and Microsoft were the largest contributors. Avago continued its strong fundamental performance on the back of increasing radio

11 |

Table of Contents

frequency content in mobile phones, solid execution in its enterprise businesses and effective capital deployment through mergers and acquisitions (announced acquisition of Broadcom). Alphabet was a strong contributor in 2015 as impressive growth in its core advertising business continued (search, mobile, YouTube) and management made overtures towards more disciplined capital allocation, expense management and enhanced transparency. Microsoft had a strong 2015, advancing its transition into a more enterprise focused IT organization with a unique combination of assets (public cloud, hybrid cloud, leading software applications).

Stock selection drove the positive performance in the consumer staples sector primarily due to the Fund’s position in Walgreens Boots Alliance. Walgreens had another strong year of performance as the new management team continued to implement improvements in operations and capital allocation.

Individual stocks that were meaningful contributors to performance from other sectors include UnitedHealth Group and American International Group.

Consumer discretionary and industrials were the sectors that detracted the most from performance. Fossil was the largest detractor in consumer discretionary and the Fund’s largest detractor overall in 2015. Fossil underperformed as its key category (watches) came under intense competitive pressure from emerging wearable technologies, as its biggest brand (Michael Kors) floundered, and as the overall retail environment remained anemic. The Fund exited the position as we lost conviction in our thesis and management’s ability to navigate the challenging environment. Cummins and Precision Castparts were the detractors in the industrials sector. Both companies were affected by a difficult global industrial environment compounded by slowing emerging markets growth and ongoing challenges in commodity-related investments.

The largest increases in weightings by sector were in information technology and healthcare. The increase in information technology was primarily due to new positions in Texas Instruments and Broadridge Financial, and the significant appreciation in positions such as Avago, Alphabet and Microsoft. The increase in healthcare was primarily due to new positions in Thermo Fisher and HCA Holdings, offset by exiting our position in Mallinckrodt.

The largest reductions in weightings by sector were in industrials and energy. The decline in industrials weighting was due to the sale of Precision Castparts and underperformance by Cummins. The reduction in the Fund’s energy exposure was due to the sale of positions in Schlumberger and Cabot Oil and Gas, which were slightly offset by a new position initiated in Marathon Petroleum late in the year.

Outlook

Given current valuations in the equity market, sluggish growth and the prospect of the Federal Reserve moving off its zero interest rate policy, the equity markets are likely to be volatile and could experience a further correction. We would view any correction as an opportunity to make attractive investments.

| 12

Table of Contents

VAUGHAN NELSON SELECT FUND

We expect market volatility to remain elevated during the short term as investors unwind trading positions that were preconditioned on higher levels of liquidity and lower levels of volatility. We expect the near term direction of U.S. equity markets will be dictated by the tug-of-war between an improving labor market, which will pressure corporate margins, and the potential reacceleration of top line growth as wages rise and the employment base expands. Preconditions for rising equity markets are stability in credit markets combined with abating deflationary forces from overseas markets. A shift to more accommodative U.S. fiscal and monetary policy could also positively impact equity markets.

We continue to seek investments in companies that have better pricing power, lower earnings variability, higher profitability and stronger balance sheets than the broader investment universe. We still do not favor any single industry or sector, and continue to look for companies with the characteristics noted above that trade at attractive valuations.

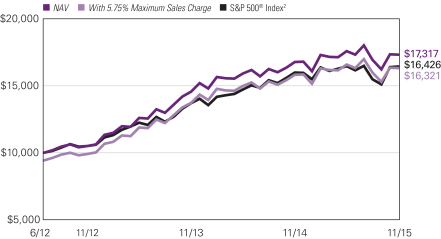

Growth of $10,000 Investment in Class A Shares3

June 29, 2012 (inception) through November 30, 2015

13 |

Table of Contents

Average Annual Total Returns — November 30, 20153

| 1 Year | Life of Fund | |||||||

| Class A (Inception 6/29/2012) | ||||||||

| NAV | 3.31 | % | 17.40 | % | ||||

| With 5.75% Maximum Sales Charge | -2.62 | 15.39 | ||||||

| Class C (Inception 6/29/2012) | ||||||||

| NAV | 2.52 | 16.55 | ||||||

| With CDSC1 | 1.52 | 16.55 | ||||||

| Class Y (Inception 6/29/2012) | ||||||||

| NAV | 3.56 | 17.72 | ||||||

| Comparative Performance | ||||||||

| S&P 500® Index2 | 2.75 | 15.65 | ||||||

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 14

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information, disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on Natixis Funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how Natixis Funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2015 is available from Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

15 |

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2015 through November 30, 2015. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| LOOMIS SAYLES DIVIDEND INCOME FUND | BEGINNING ACCOUNT VALUE 6/1/2015 |

ENDING ACCOUNT VALUE 11/30/2015 |

EXPENSES PAID DURING PERIOD* 6/1/2015 – 11/30/2015 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $954.70 | $5.88 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.05 | $6.07 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $951.40 | $9.54 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.29 | $9.85 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $956.70 | $4.71 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.26 | $4.86 | |||||||||

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 1.20%, 1.95% and 0.95% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 16

Table of Contents

| LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND |

BEGINNING ACCOUNT VALUE 6/1/2015 |

ENDING ACCOUNT VALUE 11/30/2015** |

EXPENSES PAID DURING PERIOD* 6/1/2015 – 11/30/2015** |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $970.60 | $4.64 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.36 | $4.76 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $960.30 | $9.58 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.29 | $9.85 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $965.70 | $4.68 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.31 | $4.81 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $965.60 | $4.73 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.26 | $4.86 | |||||||||

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.94%, 1.95%, 0.95% and 0.96% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (183), divided by 365 (to reflect the half-year period). |

| ** | Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial statement purposes. Amounts expressed in the table include the effect of such adjustments. Prior to these adjustments, the Fund’s annualized expense ratios (after waiver/reimbursement) were 1.25%, 2.00%, 0.95% and 1.00% for Class A, C, N and Y, respectively. |

| LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND |

BEGINNING ACCOUNT VALUE 6/1/2015 |

ENDING ACCOUNT VALUE 11/30/2015 |

EXPENSES PAID DURING PERIOD* 6/1/2015 – 11/30/2015 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $969.10 | $5.18 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.80 | $5.32 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $966.50 | $8.87 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.04 | $9.10 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $970.40 | $3.95 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.06 | $4.05 | |||||||||

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 1.05%, 1.80% and 0.80% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

17 |

Table of Contents

| VAUGHAN NELSON SELECT FUND | BEGINNING ACCOUNT VALUE 6/1/2015 |

ENDING ACCOUNT VALUE 11/30/2015 |

EXPENSES PAID DURING PERIOD* 6/1/2015 – 11/30/2015 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $985.40 | $6.97 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.05 | $7.08 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $981.60 | $10.68 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.29 | $10.86 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $986.10 | $5.73 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.30 | $5.82 | |||||||||

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 1.40%, 2.15% and 1.15% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 18

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund

| Shares |

Description | Value (†) | ||||||

| Common Stocks — 79.5% of Net Assets | ||||||||

| Aerospace & Defense — 2.6% | ||||||||

| 3,765 | Honeywell International, Inc. | $ | 391,372 | |||||

| 1,480 | Northrop Grumman Corp. | 275,813 | ||||||

|

|

|

|||||||

| 667,185 | ||||||||

|

|

|

|||||||

| Automobiles — 3.3% | ||||||||

| 13,751 | General Motors Co.(b) | 497,786 | ||||||

| 6,909 | Harley-Davidson, Inc. | 337,989 | ||||||

|

|

|

|||||||

| 835,775 | ||||||||

|

|

|

|||||||

| Banks — 7.8% | ||||||||

| 11,905 | BB&T Corp. | 459,771 | ||||||

| 20,474 | Fifth Third Bancorp(b) | 423,198 | ||||||

| 10,129 | JPMorgan Chase & Co.(c) | 675,402 | ||||||

| 8,184 | Wells Fargo & Co. | 450,938 | ||||||

|

|

|

|||||||

| 2,009,309 | ||||||||

|

|

|

|||||||

| Beverages — 1.7% | ||||||||

| 4,353 | PepsiCo, Inc. | 435,997 | ||||||

|

|

|

|||||||

| Biotechnology — 2.3% | ||||||||

| 9,886 | AbbVie, Inc. | 574,871 | ||||||

|

|

|

|||||||

| Chemicals — 1.9% | ||||||||

| 7,353 | E.I. du Pont de Nemours & Co. | 495,151 | ||||||

|

|

|

|||||||

| Communications Equipment — 3.6% | ||||||||

| 17,854 | Cisco Systems, Inc. | 486,522 | ||||||

| 9,141 | QUALCOMM, Inc. | 445,989 | ||||||

|

|

|

|||||||

| 932,511 | ||||||||

|

|

|

|||||||

| Diversified Telecommunication Services — 2.1% | ||||||||

| 12,008 | Verizon Communications, Inc. | 545,764 | ||||||

|

|

|

|||||||

| Electric Utilities — 2.4% | ||||||||

| 2,000 | Entergy Corp. | 133,260 | ||||||

| 13,877 | PPL Corp. | 472,373 | ||||||

|

|

|

|||||||

| 605,633 | ||||||||

|

|

|

|||||||

| Electrical Equipment — 1.7% | ||||||||

| 7,584 | Eaton Corp. PLC(c) | 441,085 | ||||||

|

|

|

|||||||

| Energy Equipment & Services — 0.8% | ||||||||

| 5,592 | National Oilwell Varco, Inc. | 208,805 | ||||||

|

|

|

|||||||

| Food Products — 1.3% | ||||||||

| 3,691 | Hershey Co. (The) | 318,570 | ||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure — 2.0% | ||||||||

| 29,443 | SeaWorld Entertainment, Inc.(d) | 515,547 | ||||||

|

|

|

|||||||

| Industrial Conglomerates — 2.0% | ||||||||

| 17,047 | General Electric Co.(c) | 510,387 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

19 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund – (continued)

| Shares |

Description | Value (†) | ||||||

| Insurance — 3.2% | ||||||||

| 9,450 | MetLife, Inc. | $ | 482,800 | |||||

| 18,129 | Old Republic International Corp. | 343,726 | ||||||

|

|

|

|||||||

| 826,526 | ||||||||

|

|

|

|||||||

| Leisure Products — 1.4% | ||||||||

| 13,882 | Mattel, Inc. | 345,107 | ||||||

|

|

|

|||||||

| Media — 2.5% | ||||||||

| 5,832 | Omnicom Group, Inc. | 431,102 | ||||||

| 1,099 | Time Warner Cable, Inc. | 203,062 | ||||||

|

|

|

|||||||

| 634,164 | ||||||||

|

|

|

|||||||

| Multi-Utilities — 1.9% | ||||||||

| 9,312 | PG&E Corp. | 491,022 | ||||||

|

|

|

|||||||

| Multiline Retail — 1.1% | ||||||||

| 6,164 | Kohl’s Corp. | 290,509 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels — 6.3% | ||||||||

| 4,710 | Chevron Corp.(c) | 430,117 | ||||||

| 6,912 | Energy Transfer Partners LP | 264,108 | ||||||

| 11,496 | PBF Energy, Inc., Class A | 465,473 | ||||||

| 9,308 | Royal Dutch Shell PLC, ADR | 464,841 | ||||||

|

|

|

|||||||

| 1,624,539 | ||||||||

|

|

|

|||||||

| Pharmaceuticals — 9.6% | ||||||||

| 4,934 | Eli Lilly & Co.(c) | 404,785 | ||||||

| 10,944 | GlaxoSmithKline PLC, Sponsored ADR | 443,342 | ||||||

| 10,457 | Merck & Co., Inc.(b) | 554,326 | ||||||

| 20,704 | Pfizer, Inc.(c) | 678,470 | ||||||

| 8,578 | Sanofi, ADR | 379,319 | ||||||

|

|

|

|||||||

| 2,460,242 | ||||||||

|

|

|

|||||||

| REITs – Diversified — 2.5% | ||||||||

| 18,597 | Outfront Media, Inc. | 424,941 | ||||||

| 6,957 | Weyerhaeuser Co. | 223,807 | ||||||

|

|

|

|||||||

| 648,748 | ||||||||

|

|

|

|||||||

| REITs – Hotels — 3.3% | ||||||||

| 24,967 | Host Hotels & Resorts, Inc. | 414,452 | ||||||

| 8,099 | Ryman Hospitality Properties, Inc. | 440,100 | ||||||

|

|

|

|||||||

| 854,552 | ||||||||

|

|

|

|||||||

| Road & Rail — 1.9% | ||||||||

| 5,056 | Norfolk Southern Corp. | 480,623 | ||||||

|

|

|

|||||||

| Software — 3.9% | ||||||||

| 12,103 | Microsoft Corp. | 657,798 | ||||||

| 17,947 | Symantec Corp. | 351,402 | ||||||

|

|

|

|||||||

| 1,009,200 | ||||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals — 1.3% | ||||||||

| 2,757 | Apple, Inc. | 326,153 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 20

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund – (continued)

| Shares |

Description | Value (†) | ||||||

| Tobacco — 2.3% | ||||||||

| 6,782 | Philip Morris International, Inc.(c) | $ | 592,679 | |||||

|

|

|

|||||||

| Transportation Infrastructure — 1.1% | ||||||||

| 3,773 | Macquarie Infrastructure Corp. | 283,088 | ||||||

|

|

|

|||||||

| Wireless Telecommunication Services — 1.7% | ||||||||

| 13,045 | Vodafone Group PLC, Sponsored ADR | 437,790 | ||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $19,934,933) |

20,401,532 | |||||||

|

|

|

|||||||

| Principal Amount (‡) |

||||||||

| Bonds and Notes — 12.2% | ||||||||

| Non-Convertible Bonds — 11.5% | ||||||||

| Banking — 0.2% | ||||||||

| $ | 50,000 | Ally Financial, Inc., 4.625%, 3/30/2025 | 50,000 | |||||

|

|

|

|||||||

| Cable Satellite — 0.1% | ||||||||

| 40,000 | DISH DBS Corp., 5.875%, 11/15/2024 | 35,800 | ||||||

|

|

|

|||||||

| Chemicals — 0.3% | ||||||||

| 150,000 | Hexion, Inc., 9.200%, 3/15/2021(f)(g) | 48,840 | ||||||

| 65,000 | Hexion, Inc./Hexion Nova Scotia Finance ULC, 9.000%, 11/15/2020 | 22,750 | ||||||

|

|

|

|||||||

| 71,590 | ||||||||

|

|

|

|||||||

| Construction Machinery — 0.4% | ||||||||

| 95,000 | United Rentals North America, Inc., 5.500%, 7/15/2025 | 95,000 | ||||||

|

|

|

|||||||

| Consumer Cyclical Services — 0.2% | ||||||||

| 45,000 | ServiceMaster Co. LLC (The), 7.450%, 8/15/2027 | 45,225 | ||||||

|

|

|

|||||||

| Electric — 0.3% | ||||||||

| 100,000 | AES Corp. (The), 5.500%, 4/15/2025 | 89,875 | ||||||

|

|

|

|||||||

| Finance Companies — 1.1% | ||||||||

| 370,000 | Navient LLC, Series A, MTN, 5.625%, 8/01/2033(e) | 271,950 | ||||||

|

|

|

|||||||

| Healthcare — 1.2% | ||||||||

| 125,000 | HCA, Inc., 7.500%, 12/15/2023 | 138,125 | ||||||

| 150,000 | HCA, Inc., 7.500%, 11/06/2033 | 159,750 | ||||||

|

|

|

|||||||

| 297,875 | ||||||||

|

|

|

|||||||

| Home Construction — 0.6% | ||||||||

| 125,000 | PulteGroup, Inc., 6.000%, 2/15/2035 | 123,750 | ||||||

| 30,000 | PulteGroup, Inc., 6.375%, 5/15/2033 | 30,750 | ||||||

|

|

|

|||||||

| 154,500 | ||||||||

|

|

|

|||||||

| Independent Energy — 2.0% | ||||||||

| 50,000 | Chesapeake Energy Corp., 4.875%, 4/15/2022 | 21,156 | ||||||

| 75,000 | Halcon Resources Corp., 9.750%, 7/15/2020 | 23,625 | ||||||

| 20,000 | Noble Energy, Inc., 5.625%, 5/01/2021 | 20,200 | ||||||

| 95,000 | Noble Energy, Inc., 5.875%, 6/01/2022 | 95,339 | ||||||

| 50,000 | Noble Energy, Inc., 5.875%, 6/01/2024 | 50,125 | ||||||

See accompanying notes to financial statements.

21 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund – (continued)

| Principal Amount (‡) |

Description | Value (†) | ||||||

| Independent Energy — continued | ||||||||

| $ | 40,000 | QEP Resources, Inc., 5.250%, 5/01/2023 | $ | 35,700 | ||||

| 5,000 | QEP Resources, Inc., 5.375%, 10/01/2022 | 4,500 | ||||||

| 5,000 | QEP Resources, Inc., 6.875%, 3/01/2021 | 4,775 | ||||||

| 5,000 | Range Resources Corp., 5.000%, 8/15/2022 | 4,425 | ||||||

| 30,000 | Range Resources Corp., 5.000%, 3/15/2023 | 26,550 | ||||||

| 25,000 | Sanchez Energy Corp., 6.125%, 1/15/2023 | 17,187 | ||||||

| 15,000 | SM Energy Co., 5.000%, 1/15/2024 | 13,163 | ||||||

| 105,000 | SM Energy Co., 6.500%, 11/15/2021 | 102,112 | ||||||

| 50,000 | Whiting Petroleum Corp., 5.000%, 3/15/2019 | 47,000 | ||||||

| 50,000 | WPX Energy, Inc., 5.250%, 1/15/2017 | 49,500 | ||||||

|

|

|

|||||||

| 515,357 | ||||||||

|

|

|

|||||||

| Media Entertainment — 0.6% | ||||||||

| 185,000 | R.R. Donnelley & Sons Co., 6.000%, 4/01/2024 | 163,263 | ||||||

|

|

|

|||||||

| Metals & Mining — 0.5% | ||||||||

| 160,000 | Cliffs Natural Resources, Inc., 6.250%, 10/01/2040 | 38,400 | ||||||

| 200,000 | United States Steel Corp., 6.650%, 6/01/2037 | 82,940 | ||||||

|

|

|

|||||||

| 121,340 | ||||||||

|

|

|

|||||||

| Retailers — 1.0% | ||||||||

| 365,000 | J.C. Penney Corp., Inc., 6.375%, 10/15/2036 | 228,125 | ||||||

| 85,000 | Nine West Holdings, Inc., 6.125%, 11/15/2034 | 25,075 | ||||||

|

|

|

|||||||

| 253,200 | ||||||||

|

|

|

|||||||

| Supermarkets — 1.5% | ||||||||

| 400,000 | New Albertson’s, Inc., 8.000%, 5/01/2031 | 388,000 | ||||||

|

|

|

|||||||

| Transportation Services — 0.2% | ||||||||

| 75,000 | APL Ltd., 8.000%, 1/15/2024(e) | 57,000 | ||||||

|

|

|

|||||||

| Wireless — 0.7% | ||||||||

| 2,900,000 | America Movil SAB de CV, 8.460%, 12/18/2036, (MXN) | 168,937 | ||||||

|

|

|

|||||||

| Wirelines — 0.6% | ||||||||

| 45,000 | CenturyLink, Inc., 7.650%, 3/15/2042 | 36,225 | ||||||

| 10,000 | CenturyLink, Inc., Series P, 7.600%, 9/15/2039 | 8,050 | ||||||

| 10,000 | DIRECTV Holdings LLC/DIRECTV Financing Co., Inc., 3.950%, 1/15/2025 | 9,997 | ||||||

| 135,000 | Frontier Communications Corp., 6.875%, 1/15/2025 | 110,700 | ||||||

|

|

|

|||||||

| 164,972 | ||||||||

|

|

|

|||||||

| Total Non-Convertible Bonds (Identified Cost $3,446,733) |

2,943,884 | |||||||

|

|

|

|||||||

| Convertible Bonds — 0.7% | ||||||||

| Midstream — 0.7% | ||||||||

| 305,000 | Chesapeake Energy Corp., 2.500%, 5/15/2037 (Identified Cost $268,211) |

195,200 | ||||||

|

|

|

|||||||

| Total Bonds and Notes (Identified Cost $3,714,944) |

3,139,084 | |||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 22

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund – (continued)

| Shares |

Description | Value (†) | ||||||

| Preferred Stocks — 3.1% | ||||||||

| Consumer Non-Cyclical Services — 1.3% | ||||||||

| 5,642 | Tyson Foods, Inc., 4.750% | $ | 323,004 | |||||

|

|

|

|||||||

| Pharmaceuticals — 1.8% | ||||||||

| 453 | Allergan PLC, Series A, 5.500% | 474,436 | ||||||

|

|

|

|||||||

| Total Preferred Stocks (Identified Cost $726,806) |

797,440 | |||||||

|

|

|

|||||||

| Principal Amount (‡) |

||||||||

| Short-Term Investments — 4.8% | ||||||||

| $ | 1,230,010 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2015 at 0.010% to be repurchased at $1,230,010 on 12/01/2015 collateralized by $1,245,000 U.S. Treasury

Note, 2.000% due 5/31/2021 valued at $1,257,450 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $1,230,010) |

1,230,010 | |||||

|

|

|

|||||||

| Total Investments — 99.6% (Identified Cost $25,606,693)(a) |

25,568,066 | |||||||

| Other assets less liabilities — 0.4% | 92,322 | |||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 25,660,388 | ||||||

|

|

|

|||||||

| Shares | ||||||||

| Written Options — (0.0%) | ||||||||

| Options on Securities — (0.0%) | ||||||||

| 1,500 | Hershey Co. (The), Put expiring December 18, 2015 at 85 | $ | (1,358 | ) | ||||

| 2,000 | Mattel, Inc., Call expiring December 18, 2015 at 27 | (200 | ) | |||||

| 2,000 | Norfolk Southern Corp., Call expiring December 18, 2015 at 95 | (5,750 | ) | |||||

|

|

|

|||||||

| Total Written Options (Premiums Received $4,468) |

$ | (7,308 | ) | |||||

|

|

|

|||||||

| (‡) | Principal Amount stated in U.S. dollars unless otherwise noted. | |||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2015, the net unrealized depreciation on investments based on a cost of $25,641,850 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 1,880,804 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (1,954,588 | ) | ||||||

|

|

|

|||||||

| Net unrealized depreciation | $ | (73,784 | ) | |||||

|

|

|

|||||||

| (b) | All of this security has been designated to cover the Fund’s obligations under outstanding options. | |||||||

| (c) | A portion of this security has been pledged as collateral for outstanding options. | |||||||

See accompanying notes to financial statements.

23 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Dividend Income Fund – (continued)

| (d) | A portion of this security has been designated to cover the Fund’s obligations under outstanding options. | |||||

| (e) | Illiquid security. At November 30, 2015, the value of these securities amounted to $328,950 or 1.3% of net assets. Illiquid securities are deemed to be fair valued pursuant to the Fund’s pricing policies and procedures. See Note 2 of Notes to Financial Statements. | |||||

| (f) | Illiquid security. At November 30, 2015, the value of this security amounted to $48,840 or 0.2% of net assets. | |||||

| (g) | Fair valued by the Fund’s adviser. At November 30, 2015, the value of this security amounted to $48,840 or 0.2% of net assets. See Note 2 of Notes to Financial Statements. | |||||

| ADR | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |||||

| MTN | Medium Term Note | |||||

| REITs | Real Estate Investment Trusts | |||||

| MXN | Mexican Peso | |||||

Industry Summary at November 30, 2015

| Pharmaceuticals |

11.4 | % | ||

| Banks |

7.8 | |||

| Oil, Gas & Consumable Fuels |

6.3 | |||

| Software |

3.9 | |||

| Communications Equipment |

3.6 | |||

| REITs - Hotels |

3.3 | |||

| Automobiles |

3.3 | |||

| Insurance |

3.2 | |||

| Aerospace & Defense |

2.6 | |||

| REITs - Diversified |

2.5 | |||

| Media |

2.5 | |||

| Electric Utilities |

2.4 | |||

| Tobacco |

2.3 | |||

| Biotechnology |

2.3 | |||

| Chemicals |

2.2 | |||

| Diversified Telecommunication Services |

2.1 | |||

| Hotels, Restaurants & Leisure |

2.0 | |||

| Independent Energy |

2.0 | |||

| Industrial Conglomerates |

2.0 | |||

| Other Investments, less than 2% each |

27.1 | |||

| Short-Term Investments |

4.8 | |||

|

|

|

|||

| Total Investments |

99.6 | |||

| Other assets less liabilities (including open written options) |

0.4 | |||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

| 24

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund

| Principal Amount |

Description | Value (†) | ||||||

| Bonds and Notes — 85.6% of Net Assets | ||||||||

| Argentina — 1.4% | ||||||||

| $ | 150,000 | Argentina Bonar Bonds, Series X, 7.000%, 4/17/2017 | $ | 147,054 | ||||

| 200,000 | YPF S.A., 8.750%, 4/04/2024, 144A | 197,500 | ||||||

|

|

|

|||||||

| 344,554 | ||||||||

|

|

|

|||||||

| Barbados — 0.9% | ||||||||

| 200,000 | Columbus International, Inc., 7.375%, 3/30/2021, 144A | 210,750 | ||||||

|

|

|

|||||||

| Brazil — 5.2% | ||||||||

| 135,000 | Banco do Brasil S.A., 6.000%, 1/22/2020, 144A | 139,641 | ||||||

| 235,000 | Banco Santander Brasil S.A., 4.625%, 2/13/2017(b) | 238,408 | ||||||

| 250,000 | Itau Unibanco Holding S.A., EMTN, 2.850%, 5/26/2018 | 236,250 | ||||||

| 600,000 | Petrobras Global Finance BV, 5.375%, 1/27/2021(b) | 478,320 | ||||||

| 200,000 | Tupy Overseas S.A., 6.625%, 7/17/2024, 144A | 185,500 | ||||||

|

|

|

|||||||

| 1,278,119 | ||||||||

|

|

|

|||||||

| Chile — 2.7% | ||||||||

| 200,000 | Cencosud S.A., 5.150%, 2/12/2025, 144A | 195,837 | ||||||

| 250,000 | Latam Airlines Pass Through Trust, Series 2015-1, Class B, 4.500%, 8/15/2025, 144A |

232,225 | ||||||

| 240,000 | VTR Finance BV, 6.875%, 1/15/2024 | 230,592 | ||||||

|

|

|

|||||||

| 658,654 | ||||||||

|

|

|

|||||||

| China — 7.0% | ||||||||

| 215,000 | Baidu, Inc., 3.500%, 11/28/2022(b) | 212,165 | ||||||

| 270,000 | Bestgain Real Estate Ltd., 2.625%, 3/13/2018(b) | 268,058 | ||||||

| 250,000 | China Resources Gas Group Ltd., 4.500%, 4/05/2022, 144A(b) | 260,368 | ||||||

| 280,000 | CNOOC Finance 2013 Ltd., 3.000%, 5/09/2023(b) | 266,413 | ||||||

| 255,000 | Country Garden Holdings Co. Ltd., 7.250%, 4/04/2021, 144A | 264,804 | ||||||

| 225,000 | ENN Energy Holdings Ltd., 6.000%, 5/13/2021, 144A(b) | 246,754 | ||||||

| 200,000 | Tencent Holdings Ltd., 3.375%, 5/02/2019, 144A | 203,813 | ||||||

|

|

|

|||||||

| 1,722,375 | ||||||||

|

|

|

|||||||

| Colombia — 2.4% | ||||||||

| 235,000 | Empresa de Energia de Bogota S.A. E.S.P., 6.125%, 11/10/2021(b) | 243,812 | ||||||

| 260,000 | Oleoducto Central S.A., 4.000%, 5/07/2021, 144A(b) | 252,200 | ||||||

| 275,000 | Pacific Exploration and Production Corp., 5.375%, 1/26/2019, 144A | 88,000 | ||||||

|

|

|

|||||||

| 584,012 | ||||||||

|

|

|

|||||||

| Croatia — 1.7% | ||||||||

| 200,000 | Agrokor d.d., 8.875%, 2/01/2020 | 215,360 | ||||||

| 200,000 | Hrvatska Elektroprivreda, 5.875%, 10/23/2022, 144A | 204,750 | ||||||

|

|

|

|||||||

| 420,110 | ||||||||

|

|

|

|||||||

| Dominican Republic — 1.2% | ||||||||

| 295,000 | Dominican Republic International Bond, 5.500%, 1/27/2025, 144A | 289,100 | ||||||

|

|

|

|||||||

| Guatemala — 0.9% | ||||||||

| 225,000 | Central American Bottling Corp., 6.750%, 2/09/2022 | 228,375 | ||||||

|

|

|

|||||||

| Hong Kong — 1.9% | ||||||||

| 265,000 | PCCW-HKT Capital No. 5 Ltd., 3.750%, 3/08/2023(b) | 265,885 | ||||||

See accompanying notes to financial statements.

25 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund – (continued)

| Principal Amount |

Description | Value (†) | ||||||

| Hong Kong — continued | ||||||||

| $ | 200,000 | Swire Pacific MTN Financing Ltd., EMTN, 4.500%, 10/09/2023 | $ | 213,779 | ||||

|

|

|

|||||||

| 479,664 | ||||||||

|

|

|

|||||||

| Hungary — 1.6% | ||||||||

| 400,000 | Magyar Export-Import Bank Zrt, 4.000%, 1/30/2020, 144A | 405,831 | ||||||

|

|

|

|||||||

| India — 3.6% | ||||||||

| 260,000 | Bharti Airtel International BV, 5.350%, 5/20/2024, 144A(b) | 274,511 | ||||||

| 220,000 | NTPC Ltd., EMTN, 5.625%, 7/14/2021(b) | 241,079 | ||||||

| 250,000 | Reliance Industries Ltd., 4.125%, 1/28/2025, 144A(b) | 247,905 | ||||||

| 200,000 | Rolta Americas LLC, 8.875%, 7/24/2019, 144A | 111,250 | ||||||

|

|

|

|||||||

| 874,745 | ||||||||

|

|

|

|||||||

| Indonesia — 3.8% | ||||||||

| 200,000 | Listrindo Capital BV, 6.950%, 2/21/2019, 144A | 206,141 | ||||||

| 340,000 | Pelabuhan Indonesia III PT, 4.875%, 10/01/2024, 144A(b) | 325,550 | ||||||

| 215,000 | Pertamina Persero PT, EMTN, 4.300%, 5/20/2023(b) | 198,747 | ||||||

| 200,000 | TBG Global Pte Ltd., 4.625%, 4/03/2018 | 196,750 | ||||||

|

|

|

|||||||

| 927,188 | ||||||||

|

|

|

|||||||

| Israel — 1.0% | ||||||||

| 230,000 | Israel Electric Corp. Ltd., 5.625%, 6/21/2018, 144A(b) | 243,312 | ||||||

|

|

|

|||||||

| Jamaica — 1.9% | ||||||||

| 250,000 | Digicel Ltd., 6.000%, 4/15/2021, 144A | 223,125 | ||||||

| 255,000 | Jamaica Government International Bond, 6.750%, 4/28/2028 | 257,550 | ||||||

|

|

|

|||||||

| 480,675 | ||||||||

|

|

|

|||||||

| Korea — 4.1% | ||||||||

| 240,000 | GS Caltex Corp., 3.250%, 10/01/2018, 144A(b) | 243,522 | ||||||

| 230,000 | Korea Gas Corp., 4.250%, 11/02/2020(b) | 248,562 | ||||||

| 200,000 | Lotte Shopping Co. Ltd., 3.375%, 5/09/2017(b) | 203,538 | ||||||

| 275,000 | Woori Bank, 5.875%, 4/13/2021(b) | 310,598 | ||||||

|

|

|

|||||||

| 1,006,220 | ||||||||

|

|

|

|||||||

| Luxembourg — 0.9% | ||||||||

| 240,000 | Altice Luxembourg S.A., 7.750%, 5/15/2022, 144A | 224,400 | ||||||

|

|

|

|||||||

| Malaysia — 1.3% | ||||||||

| 200,000 | Malayan Banking Bhd, EMTN, (fixed rate to 9/20/2017, variable rate thereafter), 3.250%, 9/20/2022(b) | 200,026 | ||||||

| 100,000 | Petronas Capital Ltd., 7.875%, 5/22/2022, 144A(b) | 125,591 | ||||||

|

|

|

|||||||

| 325,617 | ||||||||

|

|

|

|||||||

| Mexico — 7.9% | ||||||||

| 250,000 | Alfa SAB de CV, 5.250%, 3/25/2024, 144A(b) | 257,500 | ||||||

| 225,000 | BBVA Bancomer S.A., 6.750%, 9/30/2022(b) | 247,275 | ||||||

| 254,593 | Fermaca Enterprises S de RL de CV, 6.375%, 3/30/2038, 144A(b) | 241,863 | ||||||

| 255,000 | Fresnillo PLC, 5.500%, 11/13/2023, 144A(b) | 262,523 | ||||||

| 250,000 | Grupo KUO SAB de CV, 6.250%, 12/04/2022 | 241,250 | ||||||

| 250,000 | Nemak SAB de CV, 5.500%, 2/28/2023, 144A | 253,000 | ||||||

| 235,000 | Office Depot de Mexico S.A. de CV, 6.875%, 9/20/2020, 144A | 239,700 | ||||||

See accompanying notes to financial statements.

| 26

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund – (continued)

| Principal Amount |

Description | Value (†) | ||||||

| Mexico — continued | ||||||||

| $ | 200,000 | Unifin Financiera S.A.P.I. de CV SOFOM ENR, 6.250%, 7/22/2019, 144A | $ | 192,500 | ||||

|

|

|

|||||||

| 1,935,611 | ||||||||

|

|

|

|||||||

| Morocco — 0.9% | ||||||||

| 225,000 | OCP S.A., 5.625%, 4/25/2024, 144A(b) | 228,375 | ||||||

|

|

|

|||||||

| Panama — 0.8% | ||||||||

| 140,000 | Panama Government International Bond, 8.875%, 9/30/2027 | 195,300 | ||||||

|

|

|

|||||||

| Paraguay — 0.9% | ||||||||

| 240,000 | Telefonica Celular del Paraguay S.A., 6.750%, 12/13/2022 | 225,300 | ||||||

|

|

|

|||||||

| Peru — 2.6% | ||||||||

| 190,000 | InRetail Consumer, 5.250%, 10/10/2021, 144A | 190,513 | ||||||

| 280,000 | Southern Copper Corp., 3.875%, 4/23/2025(b) | 253,715 | ||||||

| 195,000 | Union Andina de Cementos SAA, 5.875%, 10/30/2021, 144A | 191,831 | ||||||

|

|

|

|||||||

| 636,059 | ||||||||

|

|

|

|||||||

| Philippines — 2.0% | ||||||||

| 240,000 | Philippine Government International Bond, 4.200%, 1/21/2024(b) | 261,512 | ||||||

| 205,000 | Power Sector Assets and Liabilities Management Corp., 7.250%, 5/27/2019(b) | 237,288 | ||||||

|

|

|

|||||||

| 498,800 | ||||||||

|

|

|

|||||||

| Qatar — 1.3% | ||||||||

| 285,000 | Ooredoo International Finance Ltd., 4.750%, 2/16/2021, 144A(b) | 312,217 | ||||||

|

|

|

|||||||

| Russia — 7.5% | ||||||||

| 265,000 | Gazprom OAO Via Gaz Capital S.A., 3.850%, 2/06/2020, 144A | 249,762 | ||||||

| 420,000 | Gazprom OAO Via Gaz Capital S.A., 4.950%, 2/06/2028(b) | 370,717 | ||||||

| 245,000 | MMC Norilsk Nickel OJSC via MMC Finance Ltd., 5.550%, 10/28/2020 | 246,838 | ||||||

| 400,000 | Russian Foreign Bond-Eurobond, 4.500%, 4/04/2022(b) | 411,520 | ||||||

| 255,850 | Russian Foreign Bond-Eurobond, 7.500%, 3/31/2030 | 303,950 | ||||||

| 260,000 | VimpelCom Holdings BV, 6.255%, 3/01/2017 | 267,150 | ||||||

|

|

|

|||||||

| 1,849,937 | ||||||||

|

|

|

|||||||

| Singapore — 1.2% | ||||||||

| 300,000 | BOC Aviation Pte Ltd., 3.000%, 3/30/2020, 144A(b) | 296,212 | ||||||

|

|

|

|||||||

| South Africa — 1.6% | ||||||||

| 200,000 | Eskom Holdings SOC Ltd., 6.750%, 8/06/2023, 144A | 189,040 | ||||||

| 200,000 | Myriad International Holdings BV, 5.500%, 7/21/2025, 144A | 199,804 | ||||||

|

|

|

|||||||

| 388,844 | ||||||||

|

|

|

|||||||

| Thailand — 0.9% | ||||||||

| 205,000 | PTT Global Chemical PCL, 4.250%, 9/19/2022(b) | 210,670 | ||||||

|

|

|

|||||||

| Turkey — 4.8% | ||||||||

| 200,000 | Akbank TAS, 4.000%, 1/24/2020, 144A(b) | 194,000 | ||||||

| 240,000 | Coca-Cola Icecek AS, 4.750%, 10/01/2018, 144A(b) | 247,440 | ||||||

| 200,000 | Export Credit Bank of Turkey, 5.000%, 9/23/2021, 144A | 198,450 | ||||||

| 275,000 | TC Ziraat Bankasi AS, 4.250%, 7/03/2019, 144A(b) | 272,877 | ||||||

| 265,000 | Turk Telekomunikasyon AS, 3.750%, 6/19/2019, 144A(b) | 261,025 | ||||||

|

|

|

|||||||

| 1,173,792 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

27 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund – (continued)

| Principal Amount |

Description | Value (†) | ||||||

| Ukraine — 0.7% | ||||||||

| $ | 901 | Ukraine Government International Bond, 7.750%, 9/01/2019, 144A | $ | 879 | ||||

| 161,000 | Ukraine Government International Bond, 7.750%, 9/01/2020, 144A | 155,397 | ||||||

| 40,000 | Ukraine Government International Bond, (fixed rate to 5/31/2021, variable rate thereafter), Zero Coupon, 5/31/2040, 144A | 18,608 | ||||||

|

|

|

|||||||

| 174,884 | ||||||||

|

|

|

|||||||

| United Arab Emirates — 4.7% | ||||||||

| 325,000 | Abu Dhabi National Energy Co. PJSC, 3.625%, 1/12/2023(b) | 311,187 | ||||||

| 275,000 | Dolphin Energy Ltd., 5.500%, 12/15/2021, 144A(b) | 304,729 | ||||||

| 230,000 | DP World Ltd., 3.250%, 5/18/2020, 144A | 227,130 | ||||||

| 260,000 | Dubai Electricity & Water Authority, 7.375%, 10/21/2020, 144A(b) | 308,646 | ||||||

|

|

|

|||||||

| 1,151,692 | ||||||||

|

|

|

|||||||

| United States — 2.2% | ||||||||

| 315,000 | Flextronics International Ltd., 4.750%, 6/15/2025, 144A(b) | 303,367 | ||||||

| 260,000 | Kosmos Energy Ltd., 7.875%, 8/01/2021, 144A | 226,850 | ||||||

|

|

|

|||||||

| 530,217 | ||||||||

|

|

|

|||||||

| Uruguay — 0.7% | ||||||||

| 200,000 | ACI Airport Sudamerica S.A., 6.875%, 11/29/2032, 144A | 173,000 | ||||||

|

|

|

|||||||

| Venezuela — 1.4% | ||||||||

| 395,000 | Petroleos de Venezuela S.A., 5.500%, 4/12/2037 | 145,518 | ||||||

| 220,000 | Petroleos de Venezuela S.A., 6.000%, 11/15/2026 | 79,200 | ||||||

| 240,000 | Venezuela Government International Bond, 12.750%, 8/23/2022 | 118,800 | ||||||

|

|

|

|||||||

| 343,518 | ||||||||

|

|

|

|||||||

| Total Bonds and Notes (Identified Cost $21,462,619) |

21,028,129 | |||||||

|

|

|

|||||||

| Senior Loans — 1.3% | ||||||||

| Trinidad and Tobago — 1.0% | ||||||||

| 254,363 | Methanol Holdings (Trinidad) Ltd., Term Loan B, 4.250%, 6/30/2022(c) | 237,829 | ||||||

|

|

|

|||||||

| Brazil — 0.3% | ||||||||

| 83,000 | Gol LuxCo S.A., 1st Lien Term Loan, 6.500%, 8/31/2020(c) | 80,925 | ||||||

|

|

|

|||||||

| Total Senior Loans (Identified Cost $334,154) |

318,754 | |||||||

|

|

|

|||||||

| Shares/Units of Currency (††) |

||||||||

| Purchased Options — 0.0% | ||||||||

| Options on Securities — 0.0% | ||||||||

| 20,000 | iShares® MSCI Brazil Capped ETF, Call expiring December 18, 2015 at 25.0000 |

3,300 | ||||||

| 110,000 | iShares® MSCI Emerging Markets ETF, Call expiring January 15, 2016 at 38.0000 |

5,500 | ||||||

|

|

|

|||||||

| 8,800 | ||||||||

|

|

|

|||||||

| Over-the-Counter Options on Currency — 0.0% | ||||||||

| 500,000 | KRW Put, expiring December 04, 2015 at 1201.1000(d) | 54 | ||||||

| 1,000,000 | MXN Put, expiring December 04, 2015 at 16.9000(d) | 514 | ||||||

See accompanying notes to financial statements.

| 28

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund – (continued)

| Shares/Units of Currency (††) |

Description |

Value (†) |

||||||

| Over-the-Counter Options on Currency — continued | ||||||||

| 500,000 | MYR Put, expiring December 04, 2015 at 4.3175(e) | $ | 1,224 | |||||

|

|

|

|||||||

| 1,792 | ||||||||

|

|

|

|||||||

| Total Purchased Options (Identified Cost $96,336) |

10,592 | |||||||

|

|

|

|||||||

| Principal Amount |

||||||||

| Short-Term Investments — 12.1% | ||||||||

| $ | 2,966,794 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/2015 at 0.010% to be repurchased at $2,966,795 on 12/01/2015 collateralized by $3,000,000 U.S. Treasury Note, 2.000% due 5/31/2021 valued at $3,030,000 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $2,966,794) | 2,966,794 | |||||

|

|

|

|||||||

| Total Investments — 99.0% (Identified Cost $24,859,903)(a) |

24,324,269 | |||||||

| Other assets less liabilities — 1.0% | 234,395 | |||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 24,558,664 | ||||||

|

|

|

|||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (††) | Options on securities are expressed as shares. Options on currency are expressed as units of currency. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2015, the net unrealized depreciation on investments based on a cost of $24,976,785 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 306,944 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (959,460 | ) | ||||||

|

|

|

|||||||

| Net unrealized depreciation | $ | (652,516 | ) | |||||

|

|

|

|||||||

| (b) | All of this security has been designated to cover the Fund’s obligations under open forward foreign currency contracts, futures contracts or swap agreements. | |||||||

| (c) | Variable rate security. Rate as of November 30, 2015 is disclosed. | |||||||

| (d) | Counterparty is Bank of America, N.A. | |||||||

| (e) | Counterparty is Credit Suisse International. | |||||||

| 144A | All or a portion of these securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2015, the value of Rule 144A holdings amounted to $11,799,618 or 48.0% of net assets. | |||||||

| EMTN | Euro Medium Term Note | |||||||

See accompanying notes to financial statements.

29 |

Table of Contents

Portfolio of Investments – as of November 30, 2015

Loomis Sayles Emerging Markets Opportunities Fund – (continued)

| ETF | Exchange-Traded Fund | |||||

| OJSC | Open Joint-Stock Company | |||||

| PJSC | Private Joint-Stock Company | |||||

| KRW | South Korean Won | |||||

| MXN | Mexican Peso | |||||

| MYR | Malaysian Ringgit | |||||

At November 30, 2015, the Fund had the following open bilateral credit default swap agreements:

| Sell Protection | ||||||||||||||||||||||||||||||||

| Counterparty | Reference Obligation |

(Pay)/ Receive Fixed Rate |

Expiration Date |

Implied Credit Spread^ |

Notional Value(‡) |

Unamortized Up Front Premium Paid/ (Received) |