Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

Natixis Funds Trust II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: November 30

Date of reporting period: November 30, 2014

Table of Contents

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

ANNUAL REPORT

November 30, 2014

Gateway International Fund

Loomis Sayles Dividend Income Fund

(formerly Loomis Sayles Capital Income Fund)

Loomis Sayles Emerging Markets Opportunities Fund

Loomis Sayles Senior Floating Rate and Fixed Income Fund

Vaughan Nelson Select Fund

Portfolio Review page 1

Portfolio of Investments page 20

Financial Statements page 55

Notes to Financial Statements page 79

Table of Contents

| Managers: | Symbols: | |

| Daniel M. Ashcraft, CFA® | Class A GAIAX | |

| Michael T. Buckius, CFA® | Class C GAICX | |

| Kenneth H. Toft, CFA® | Class Y GAIYX | |

| Gateway Investment Advisers, LLC |

Objective:

Over the long term, the Fund seeks to capture the majority of the returns associated with international developed market equity investments, while exposing investors to less risk than such investments generally.

Market Conditions

Over the 12-month period ended November 30, 2014, the international equity market moved up and down but ended essentially where it began. The key themes were a slowdown in Chinese economic growth, geopolitical uncertainty and the currency impact of strong monetary stimulus sponsored by certain foreign governments. Early in the period, foreign stock markets lost ground, due in part to evidence of slowing Chinese growth and concerns over rising tensions between Russia and the Ukraine. From February through the start of July, the markets advanced nicely as concerns lessened about the economic impact of geopolitical tension and Japan embarked on the third leg of its economic stimulus plan, dubbed “Abe-nomics” after the country’s prime minister. From its July peak through mid-October, stocks suffered a double digit decline, as Japan reported second quarter economic contraction, the European financial sector showed signs of deterioration and concern grew that Russian sanctions on Ukrainian trading partners could stifle already weakening global economic growth. In the final six weeks of the fiscal year, the international markets bounced back on announcements of expanding monetary stimulus programs from both the European Central Bank and the Bank of Japan. Currency losses had a significant impact on index returns in U.S. dollars, as the currency component of the MSCI EAFE Index lost 7.88% over the course of the fiscal year.

The CBOE EFA ETF Volatility Index (“VXEFA”), which measures the expected volatility of the iShares® MSCI EAFE Index Fund (“EFA”), was below its long-term average for much of the period. The VXEFA began the fiscal year at 14.37, declined to a low of 10.65 in late December, and rose to 22.49 during the first selloff of the year on February 3rd. It hit an ultimate peak of 26.48 at the October market bottom before declining to end the fiscal year at 14.66. The average level for the year was 15.19.

Performance Results

For the 12 months ended November 30, 2014, Class A shares of Gateway International Fund returned -2.24% at net asset value. The MSCI EAFE Index (Net) returned -0.02% in U.S. dollars for the same period.

1 |

Table of Contents

Explanation of Fund Performance

Despite a larger loss than the MSCI EAFE Index over the 12-month period, the Fund’s performance was consistent with expectations given its risk profile in each of the advancing and declining periods for the index. Gateway International Fund seeks to generate returns by selling at-the-money index ETF call options, which substitute less variable option premium for market price appreciation, and uses some of the cash flow to mitigate price declines in the portfolio by purchasing out-of-the-money index ETF put options. An option is described as being at-the-money when the price of the underlying instrument is the same as the strike price. Additionally, an option is described as being out-of-the-money when the price of the underlying instrument is above the strike price for a put option (an option to sell). During the most significant market advance from February 4th to July 3rd, the Fund had a return of 4.91%, underperforming the MSCI EAFE Index by 808 basis points. When the MSCI EAFE Index advances, the Fund’s index-tracking equity portfolio generates gains but the Fund’s return is limited to cash flow earned from written EFA call options less losses from purchased EFA put options. It is not unusual for the Fund to underperform during a period of above normal return for the MSCI EAFE Index — particularly when implied volatility is below average for much of the period.

During the most significant decline for the index, -13.60% from July 3rd to October 16th, the Fund lost 7.46% and outperformed the index by 614 basis points, as index call options written on EFA aided performance relative to the index. The Fund also experienced a small gain from index put options purchased on EFA during periods of decline. Over the last three weeks of October, the Fund had put protection on 80-95% of the portfolio. During this period, management made adjustments to the call and put portfolios to achieve a relative risk profile consistent with the Fund’s history. Put protection was restored to 100% by month-end as markets rallied and volatility declined.

Consistent with its objective, the measured risk of the Fund was low relative to the EFA, as its standard deviation for the period was 5.77%, versus 12.31% for the EFA.

The EFA options the Fund uses are U.S. dollar denominated, therefore the currency exposure of the Fund is less than that of the MSCI EAFE Index. As a result, the Fund’s currency losses were less than those of the index for the period.

Outlook

As the European Central Bank and the Bank of Japan expanded monetary stimulus programs, the U.S. Federal Reserve tapered its monetary stimulus. This de-synchronization of global central bank action may be an important factor affecting both international equity market volatility and currency volatility going forward. Coupled with ongoing geopolitical concerns, we believe that the international equity market environment will be one that demonstrates more volatility and one that is much more reactive to changes in market fundamentals as well as central bank actions.

| 2

Table of Contents

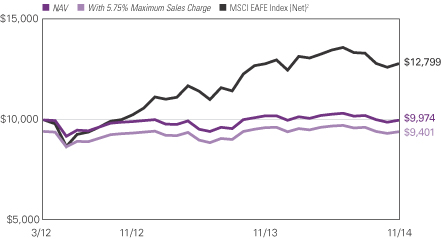

GATEWAY INTERNATIONAL FUND

Growth of $10,000 Investment in Class A Shares3

March 30, 2012 (inception) through November 30, 2014

Average Annual Total Returns — November 30, 20143

| 1 Year | Life of Fund | |||||||

| Class A (Inception 3/30/2012) |

||||||||

| NAV |

-2.24 | % | -0.10 | % | ||||

| With 5.75% Maximum Sales Charge |

-7.86 | -2.29 | ||||||

| Class C (Inception 3/30/2012) |

||||||||

| NAV |

-3.03 | -0.81 | ||||||

| With CDSC1 |

-3.99 | -0.81 | ||||||

| Class Y (Inception 3/30/2012) |

||||||||

| NAV |

-1.86 | 0.21 | ||||||

| Comparative Performance |

||||||||

| MSCI EAFE Index (Net)2 |

-0.02 | 9.71 | ||||||

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI EAFE Index (Net) (Europe, Australasia, Far East) is an unmanaged index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

3 |

Table of Contents

LOOMIS SAYLES DIVIDEND INCOME FUND

(formerly Loomis Sayles Capital Income Fund)

| Managers: | Symbols: | |

| Arthur J. Barry, CFA® | Class A LSCAX | |

| Matthew J. Eagan, CFA®* | Class C LSCCX | |

| Daniel J. Fuss, CFA®, CIC | Class Y LSCYX | |

| Warren N. Koontz, CFA®, CIC** | ||

| Adam C. Liebhoff*** | ||

| Elaine M. Stokes* | ||

| Loomis, Sayles & Company, L.P. | ||

| * | Matthew J. Eagan and Elaine M. Stokes became co-portfolio managers of the Fund effective October 15, 2014. |

| ** | Effective August 25, 2014 Warren Koontz no longer serves as co-portfolio manager of the Fund. |

| *** | Adam C. Liebhoff became a co-portfolio manager of the Fund effective September 12, 2014. |

Objective:

The Fund’s investment goal is high total return through a combination of current income and capital appreciation.

Market Conditions

During the 12 months that ended November 30, 2014, the United States remained a bright spot for equity investors from a total return perspective. Most S&P 500® Index sectors generated strong gains, with energy being the unsurprising laggard due to falling oil prices. The dividend yield on the index remained approximately 2.00%, as dividend increases kept pace with higher equity prices. As of the end of November, more than 80% of S&P 500® Index companies paid cash dividends, the highest number in several years.

Performance Results

For the 12-month period ended November 30, 2014, Class A shares of Loomis Sayles Dividend Income Fund returned 11.95% at net asset value. The Fund underperformed its primary benchmark, the S&P 500® Index, which returned 16.86% for the period. The Fund also underperformed its secondary benchmark, the Russell 1000® Value Index, which returned 15.62%.

Explanation of Fund Performance

Stock selection was particularly strong for the Fund in the energy and information technology sectors. However, a relative overweight position in the weak energy sector and an underweight position in the strong technology sector contributed to the Fund’s lagging results versus the S&P 500® Index. The Fund’s relative weights in these sectors were driven by the availability of yield-oriented investments. In addition, stock selection in healthcare detracted from performance, primarily due to specific holdings in the pharmaceutical industry. The Fund’s fixed-income positions did not meaningfully contribute to overall performance.

| 4

Table of Contents

LOOMIS SAYLES DIVIDEND INCOME FUND

Primary detractors for the 12-month period included Royal Dutch Shell, American Eagle Outfitters and Transocean Partners. Royal Dutch Shell, an integrated energy company, trailed the market primarily due to falling oil prices. An increase in oil supply and a decision by the Organization of the Petroleum Exporting Countries (OPEC) to maintain production quotas led to the decline in oil prices. American Eagle Outfitters, a U.S. clothing retailer, continued to struggle in a highly competitive teen apparel space after announcing a weak second quarter and forward guidance. In addition, the unexplained firing of the company’s highly regarded CEO in January caused substantial pressure on the stock early in the year. We exited the name in June. In addition, Transocean Partners, an offshore driller, underperformed as falling oil prices clouded the long-term demand outlook for the drilling rigs that Transocean operates.

In terms of individual holdings, Eli Lilly, Apple and Microsoft were the largest positive contributors to Fund performance. Eli Lilly, a pharmaceutical company held in the Fund since November 2013, outperformed after a lackluster 2013 calendar year. The stock was a strong performer during 2014 as negative sentiment surrounding the stock dissipated. Apple outperformed due to a combination of several positive news items and data points. In particular, a strong earnings report (driven by iPhone sales), stabilizing gross margins, excitement around the company’s upcoming product launches and mean reversion from prior underperformance led to a strong 12-month gain. In addition, shares of Microsoft rose on a restructuring plan, announced in the third quarter, that was larger than Wall Street analysts anticipated. The plan, which will mainly address headcount and more closely align operations from its recently acquired Nokia Devices & Services business, has the potential to raise earnings per share (EPS) going forward.

Outlook

We believe there is pent up spending demand from the U.S. consumer. The job market is better, household balance sheets are improving and household income is showing slight gains. A stronger U.S. dollar and falling energy prices should contribute to an increase in consumer spending.

Although we are preparing for rising interest rates, we have tempered our yield expectations. Despite U.S. economic momentum, global factors, including sluggish growth outside the United States, low yields and geopolitical risks, are weighing on U.S. rates. At this point, our preference is to find equity investments offering higher yields due to lagging share prices. We believe these investments have the potential to provide ballast to the portfolio should interest rates begin to rise. As always, we will look for individual holdings that offer a risk/reward balance combined with yield.

5 |

Table of Contents

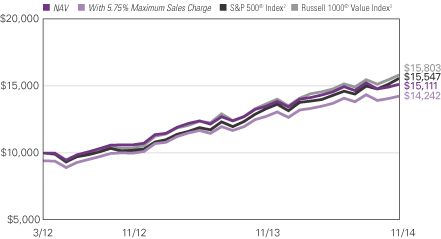

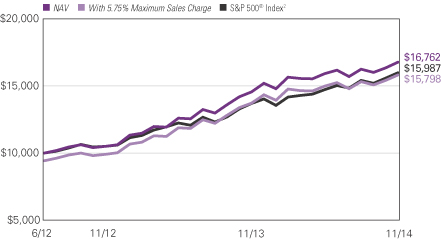

LOOMIS SAYLES DIVIDEND INCOME FUND

Growth of $10,000 Investment in Class A Shares4

March 30, 2012 (inception) through November 30, 2014

Average Annual Total Returns — November 30, 20144

| 1 Year | Life of Fund | |||||||

| Class A (Inception 3/30/2012) |

||||||||

| NAV |

11.95 | % | 16.72 | % | ||||

| With 5.75% Maximum Sales Charge |

5.48 | 14.16 | ||||||

| Class C (Inception 3/30/2012) |

||||||||

| NAV |

11.14 | 15.84 | ||||||

| With CDSC1 |

10.14 | 15.84 | ||||||

| Class Y (Inception 3/30/2012) |

||||||||

| NAV |

12.22 | 16.99 | ||||||

| Comparative Performance |

||||||||

| S&P 500® Index2 |

16.86 | 18.02 | ||||||

| Russell 1000® Value Index3 |

15.62 | 18.74 | ||||||

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6

Table of Contents

LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND

| Managers: | Symbols: | |||

| Elisabeth Colleran, CFA® | Class A | LEOAX | ||

| Peter A. Frick, CFA® | Class C | LEOCX | ||

| Peter N. Marber | Class N | LEONX | ||

| David W. Rolley, CFA® | Class Y | LEOYX | ||

| Edgardo Sternberg | ||||

| Loomis, Sayles & Company, L.P. | ||||

Objective

The Fund seeks high total investment return through a combination of current income and capital appreciation.

Market Conditions

Global growth concerns continued in 2014, as Europe and Japan struggled with deflationary pressures and anemic growth, while China continued to moderate its growth projections. Although the U.S. economy transitioned from recovery to expansion, other major developed markets sputtered, and geopolitical anxiety from conflicts in Russia/Ukraine and the Middle East intensified the cautious sentiment. Weaker global growth and disinflationary trends led to lower bond yields in developed markets. Central bank activity remained a principal factor influencing markets even as policies started to deviate regionally. The Federal Reserve (the Fed) and the Bank of England contemplated interest rate hikes while the Bank of Japan and European Central Bank (ECB) became increasingly more accommodative.

After a strong run during the first half of 2014, emerging market bonds came under pressure through the end of the period. An increase in market volatility and geopolitical risk led to a mixed and moderate selloff. Performance improved in October before cooling off once again in November. The economies of China, Brazil and Russia faced substantial headwinds during the period, and a quick recovery does not appear imminent. In particular, signs of disinflation emerged in China, and growth remained modestly below the robust figures of previous periods. The recent slide in oil prices significantly influenced emerging market performance. Net oil importers, such as Turkey and Indonesia, benefited from the lower prices, while net exporters, such as Venezuela, struggled.

Performance Results

For the period from the Fund’s inception on February 10, 2014, through its fiscal year end on November 30, 2014, Class A shares of Loomis Sayles Emerging Markets Opportunities Fund returned 6.00% at net asset value. The Fund underperformed its benchmark, the Barclays EM USD Aggregate 10% Country Capped Index, which returned 6.99%.

Explanation of Fund Performance

The Fund’s gains were largely driven by its allocation to hard currency bonds. In addition, issue selection in corporate sectors added value. However, yield curve (a curve that shows

7 |

Table of Contents

the relationship among bond yields across the maturity spectrum) positioning weighed on relative results. Small exposures to local emerging market currencies also detracted from relative return, as the U.S. dollar staged a strong rally.

An overall bias toward the short end of the U.S. dollar yield curve detracted from relative results, as rates fell broadly. The greatest downward pressure in yields was concentrated at the longest end of the curve, causing this portion of the curve to be the best-performing maturity bucket. Since the Fund was underweight in longer-maturity bonds in favor of shorter maturities, this positioning detracted from performance.

In addition, small exposures to the Ugandan shilling, Kenyan shilling and Zambian kwacha weighed on results. These out-of-benchmark positions were modest, but they detracted from relative results as the U.S. dollar staged a significant rally. Investors moved into the U.S. dollar in anticipation of further divergence among leading central bank policies and deflationary pressures in other hard currency blocs. Underweight exposure to sovereign issuers also contributed to the Fund’s underperformance, as this sector was one of the better performers during the period. More specifically, underweight exposure to Turkish and Indonesian hard currency issues detracted from results as the bonds performed well.

Holdings in the basic industrials, capital goods, communications, banking and technology sectors performed well versus the Fund’s benchmark. In addition, a cautious stance in bonds with exposure to Brazil, Russia and Ukraine aided return. An overweight position in consumer goods (cyclical and non-cyclical) also enhanced relative results. Furthermore, an underweight position in the government-owned sector added value. This segment underperformed corporates and sovereigns during most of the period. Interest rate futures were used to manage duration and contributed to results.

Outlook

The outlook for global growth remains cautious, as investors await the market’s reaction to activity of the leading central banks in 2015. U.S. growth remains on solid footing and should provide some support for emerging markets, provided the Fed’s rate hike strategy unfolds at a measured pace. We expect slow and gradual rate increases from the Fed, given subdued inflationary pressures, mild wage growth and ongoing concerns about weaker demand abroad.

Stagnant growth in Europe and the potential for enhanced liquidity measures by the ECB could provide support to the higher yielding bonds of emerging markets. However, we believe some idiosyncratic stories will emerge, placing even more importance on credit and security selection. We do not believe the Russia/Ukraine crisis is over and believe it could plausibly spill into the broader markets, depending on the response of the United States and Europe. We suspect world demand for oil may catch up to excess supply in approximately 12 months, but we doubt oil price uncertainties will be resolved in the short term. The effects of lower oil costs should be relatively short lived, but we will closely monitor the potential distress experienced by Organization of the Petroleum Exporting Countries (OPEC) members.

| 8

Table of Contents

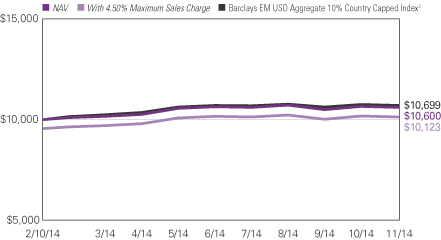

LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND

Growth of $10,000 Investment in Class A Shares3

February 10, 2014 (inception) through November 30, 2014

Total Returns — November 30, 20143

| Life of Fund |

||||

| Class A (Inception 2/10/2014) |

||||

| NAV |

6.00 | % | ||

| With 4.50% Maximum Sales Charge |

1.24 | |||

| Class C (Inception 2/10/2014) |

||||

| NAV |

5.20 | |||

| With CDSC1 |

4.20 | |||

| Class N (Inception 2/10/2014) |

||||

| NAV |

6.18 | |||

| Class Y (Inception 2/10/2014) |

||||

| NAV |

6.18 | |||

| Comparitive Performance | ||||

| Barclays EM USD Aggregate 10% Country Capped Index2 | 6.99 | |||

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The Barclays EM USD Aggregate 10% Country Capped Index includes USD denominated debt from sovereign, quasi-sovereign, and corporate EM issuers. The index is broad-based in its coverage by sector and by country, and includes a 10% Country cap. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

9 |

Table of Contents

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

| Managers: | Symbols: | |

| Kevin J. Perry | Class A LSFAX | |

| John R. Bell | Class C LSFCX | |

| Loomis, Sayles & Company, L.P. | Class Y LSFYX |

Objective:

The Fund seeks to provide a high level of current income.

Market Conditions

Bank loan market activity during the first quarter of 2014 was similar to most of 2013, with loan income constituting the majority of the returns earned and lower-rated loans continuing to drive performance. In April 2014, the 95-week streak of positive bank loan retail fund flows ended, and the long-anticipated default of TXU Energy occurred. The bank loan market quickly adjusted to the retail outflows, as collateralized loan obligations (CLOs) stepped in to fill the demand and exert their influence on the market. Overall, there was little bank loan price movement during the first half of 2014. Challenges emerged during the third quarter with bank loan-focused mutual funds and high yield funds that own bank loans experiencing retail outflows due to redemptions. Bank loan prices dropped slightly in October but regained some ground in November. During the last few months of the period, bank loan supply outpaced demand. The asset level of the S&P/LSTA Leveraged Loan® Index ended the period at a new high of $823 billion, an increase of 22% from the prior year.

Performance Results

For the 12-month period ended November 30, 2014, Class A shares of Loomis Sayles Senior Floating Rate and Fixed Income Fund returned 4.22% at net asset value. The Fund outperformed its benchmark, the S&P/LSTA Leveraged Loan® Index, which returned 3.37%.

Explanation of Fund Performance

As part of our general investment strategy, we did not make any significant tactical shifts during the 12-month period. Instead, we focused on credit selection and generating a high level of current income, reserving our tactical flexibility to manage exposures based on significant shifts in our macroeconomic view.

We targeted a yield advantage relative to the index in most market conditions, which helped the Fund’s performance even as retail outflows persisted during most of the period. Overall, the Fund’s bank loan returns were positive across all rating categories. In terms of sectors, the Fund’s allocations to technology and healthcare aided relative performance during the period, while oil-related holdings suffered due to falling oil prices.

After subtracting cash held for the purpose of settling purchases, the Fund ended the period with approximately 86% of its portfolio invested in bank loans, 11% in bonds and 3% in

| 10

Table of Contents

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

cash equivalents. The Fund’s allocation to bonds increased only two percentage points over the period, as few high yield bonds met the low duration (price sensitivity to interest rate changes), competitive return profile we seek for the Fund. We added some high yield bonds during periods of market weakness and sold some high yield bonds at yields below our expectations for bank loan benchmark returns.

We began using leverage (borrowing capital at a lower interest rate relative to the interest rates on bank loans) at the end of 2013, slightly increasing exposure during the third quarter of 2014. Overall, though, our use of leverage remained modest. We believe the cost of leverage is attractive given our market outlook, and we do not view this strategy as a significant driver of return.

Outlook

We believe overall market volatility is likely to increase if the Federal Reserve (the Fed) raises interest rates in 2015 to reflect a growing economy. Bank loans would not be immune to the resulting rate hike pressures, but they could benefit fundamentally (from a good economy) and technically (from demand related to rising rates) should the Fed move in that direction.

We expect CLO demand for bank loans to remain relatively strong even without Fed action. Such strength would reflect a history of strong returns with extremely low default rates, as well as a desire to finalize structures before new risk retention rules take effect in late 2016. Bank loan fund managers generally expect the default rate to remain relatively stable during the coming year. This expectation is largely due to the combination of a slow-growth macroeconomic environment, solid company fundamentals and low expected maturities (approximately $22.2 billion total for the remainder of 2014 and all of 2015 and 2016). However, exogenous shocks, such as political events or geopolitical unrest, may disrupt market expectations.

11 |

Table of Contents

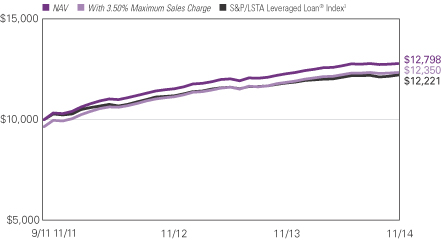

LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND

Growth of $10,000 Investment in Class A Shares4

September 30, 2011 (inception) through November 30, 2014

Average Annual Total Returns — November 30, 20144

| 1 Year | Life of Fund | |||||||

| Class A (Inception 9/30/11) | ||||||||

| NAV | 4.22 | % | 8.10 | % | ||||

| With 3.50% Maximum Sales Charge | 0.60 | 6.88 | ||||||

| Class C (Inception 9/30/11) | ||||||||

| NAV | 3.47 | 7.32 | ||||||

| With CDSC2 | 2.48 | 7.32 | ||||||

| Class Y (Inception 9/30/11)1 | ||||||||

| NAV | 4.49 | 8.38 | ||||||

| Comparative Performance | ||||||||

| S&P / LSTA Leveraged Loan® Index3 | 3.37 | 6.55 | ||||||

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | 9/30/11 represents the date Class Y shares were first registered for public sale under the Securities Act of 1933. 9/16/11 represents commencement of operations for Class Y shares for accounting and financial reporting purposes only. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | S&P/LSTA Leveraged Loan® Index reflects the market-weighted performance of institutional leveraged loans based upon real-time market weightings, spreads and interest payments. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 12

Table of Contents

VAUGHAN NELSON SELECT FUND

| Managers: | Symbols: | |

| Dennis G. Alff, CFA® | Class A VNSAX | |

| Chad D. Fargason, PhD | Class C VNSCX | |

| Chris D. Wallis, CFA® | Class Y VNSYX | |

| Scott J. Weber, CFA® | ||

| Vaughan Nelson Investment Management, L.P. | ||

Objective:

The Fund seeks long-term capital appreciation.

Market Conditions

The equity markets continued to advance even as the Federal Reserve (the Fed) ended its monthly bond-buying program known as quantitative easing, which began in 2009. While the Fed ended quantitative easing and planned to raise interest rates in 2015, the European Central Bank committed to easier monetary policy. The current market volatility and deteriorating market breadth may continue as capital markets adjust to global shifts in central bank policy and to escalating geopolitical tensions. We believe the market is discounting continued modest improvement in earnings growth and an inflationary environment where deflationary risks are modestly higher than inflationary risks. We continue to expect U.S. companies to face margin pressures as the Fed raises interest rates, as capital expenditures accelerate, and as rising operating costs challenge modest revenue growth.

Performance Results

For the 12-month period ended November 30, 2014, Class A shares of Vaughan Nelson Select Fund returned 15.31% at net asset value. The Fund underperformed its benchmark, the S&P 500® Index, which returned 16.86%.

Explanation of Fund Performance

Stock selection detracted modestly from results relative to the benchmark. However, our team’s focus on company specific valuations and fundamentals led to certain overweighted sector positions, which aided relative performance. Healthcare and industrials were the biggest contributors to relative performance by sector, while the information technology and consumer discretionary sectors were the biggest relative detractors.

In the healthcare sector, significant overweights relative to the index in UnitedHealth Group and Mallinckrodt and an out-of-index position in Valeant Pharmaceuticals were the most significant contributors. UnitedHealth benefits from being the industry leader in the managed care industry, which has a meaningful secular tailwind in the form of pricing power and moderating healthcare utilization trends. UnitedHealth’s performance stood out as concerns over headwinds from the Affordable Care Act abated. A new position in Mallinckrodt aided relative results as the company closed its acquisition of Questcor in August 2014. Following up on a strong 2013, Valeant Pharmaceuticals continued to be a strong performer as a result of the company’s consistent execution of mergers and acquisitions and cost cutting.

13 |

Table of Contents

In the industrials sector, the Fund had more exposure than the index to General Dynamics and an out-of-index position in Hertz Global Holdings, both of which were standout performers. General Dynamics was added to the portfolio in 2014. The company had a great year as its defense contracting business is near a trough from cuts in government spending, and growth in its private aviation business, Gulfstream, is accelerating with the economic expansion and new product introductions. Hertz Global Holdings contributed nicely to relative results as the company continued to benefit from industry consolidation and the announced spin off of its equipment rental business. We exited Hertz during the year.

Elsewhere in the portfolio, Avago Technologies, Harman International, Microsoft and Walgreen contributed solid gains to Fund performance.

Stock selection in information technology and consumer discretionary detracted from relative performance. An out-of-index position in Cabela’s in Consumer Discretionary was one of the largest detractors for the period. Cabela’s underperformed as same store sales failed to improve after several quarters of negative growth. We exited the position in 2014 as visibility into the company’s ability to execute its growth plan was clouded. An overweight in Symantec Corporation hurt relative performance in the information technology sector as CEO Steve Bennett was abruptly dismissed by the board. We exited the position as much of our investment thesis was predicated on Mr. Bennett’s ability to turn the company around.

During the period, exposure to healthcare increased on the substantial appreciation in UnitedHealth Group and new positions initiated in Mallinckrodt and Medtronic. In consumer staples, a new position in Anheuser-Busch InBev accounted for the entire increase in the Fund’s consumer staples weight. The Fund’s energy weight declined after we exited Oasis Petroleum, which underperformed and Phillips 66, which outperformed. The decrease in the Fund’s energy weight was partially offset by the addition of Cabot Oil & Gas. The Fund’s exposure to information technology declined on the sale of Symantec and a reduction in the portfolio’s weight in eBay. However, we view the change in the Fund’s technology weight as a net addition. We initiated a position in Priceline in 2014, which is included in the consumer discretionary sector but we view it as a technology company.

Outlook

Despite the potential for a correction in equity markets, we expect the credit market to remain supportive of equity values over the medium term and will welcome any correction as an opportunity to make attractive investments. Even without a broader equity market correction, we expect market breadth to continue to narrow. Companies can no longer rely on a recovery in consumption, lower interest rates, share repurchases and delayed capital expenditures to drive earnings growth. Going forward, we believe that companies will be required to increase capital expenditures, research and development and other operating costs in order to sustain or grow earnings. Further, a strengthening U.S. dollar is likely to affect top line sales growth, especially for the multinationals that generate a significant portion of their revenues outside of the United States. While the nature of the current bull market is changing, we believe certain individual stocks will perform well despite the increasing market headwinds. We continue to seek investments in companies that have better pricing power, lower earnings variability, higher profitability and stronger balance sheets than the broader investment universe. We do not favor any single industry or sector and continue to look for companies with the characteristics noted above that trade at attractive valuations.

| 14

Table of Contents

VAUGHAN NELSON SELECT FUND

Growth of $10,000 Investment in Class A Shares3

June 29, 2012 (inception) through November 30, 2014

Average Annual Total Returns — November 30, 20143

| 1 Year | Life of Fund | |||||||

| Class A (Inception 6/29/2012) |

||||||||

| NAV |

15.31 | % | 23.77 | % | ||||

| With 5.75% Maximum Sales Charge |

8.66 | 20.78 | ||||||

| Class C (Inception 6/29/2012) |

||||||||

| NAV |

14.54 | 22.89 | ||||||

| With CDSC1 |

13.54 | 22.89 | ||||||

| Class Y (Inception 6/29/2012) |

||||||||

| NAV |

15.66 | 24.11 | ||||||

| Comparative Performance |

||||||||

| S&P 500® Index2 |

16.86 | 21.45 | ||||||

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

15 |

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information, disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the Funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2014 is available from the Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

| 16

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2014 through November 30, 2014. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each Fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| GATEWAY INTERNATIONAL FUND | BEGINNING ACCOUNT VALUE 6/1/2014 |

ENDING ACCOUNT VALUE 11/30/2014 |

EXPENSES PAID DURING PERIOD* 6/1/2014 – 11/30/2014 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $969.80 | $6.67 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.30 | $6.83 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $965.40 | $10.35 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.54 | $10.61 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $970.00 | $5.43 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.55 | $5.57 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.35%, 2.10% and 1.10% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (183), divided by 365 (to reflect the half-year period). |

17 |

Table of Contents

| LOOMIS SAYLES DIVIDEND INCOME FUND (formerly Loomis Sayles Capital Income Fund) |

BEGINNING ACCOUNT VALUE 6/1/2014 |

ENDING ACCOUNT VALUE 11/30/2014 |

EXPENSES PAID DURING PERIOD* 6/1/2014 – 11/30/2014 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,037.90 | $6.13 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.05 | $6.07 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,034.00 | $9.94 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.29 | $9.85 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,039.20 | $4.86 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.31 | $4.81 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.20%, 1.95% and 0.95% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| LOOMIS SAYLES EMERGING MARKETS OPPORTUNITIES FUND |

BEGINNING ACCOUNT VALUE 6/1/2014 |

ENDING ACCOUNT VALUE 11/30/2014 |

EXPENSES PAID DURING PERIOD* 6/1/2014 – 11/30/2014 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,004.30 | $6.28 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.80 | $6.33 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,001.20 | $10.03 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.04 | $10.10 | |||||||||

| Class N | ||||||||||||

| Actual | $1,000.00 | $1,005.50 | $4.78 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.31 | $4.81 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,006.50 | $5.03 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.05 | $5.06 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.25%, 2.00%, 0.95% and 1.00% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (183), divided by 365 (to reflect the half-year period). |

| 18

Table of Contents

| LOOMIS SAYLES SENIOR FLOATING RATE AND FIXED INCOME FUND |

BEGINNING ACCOUNT VALUE 6/1/2014 |

ENDING ACCOUNT VALUE 11/30/2014 |

EXPENSES PAID DURING PERIOD* 6/1/2014 – 11/30/2014 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,009.20 | $5.54 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.55 | $5.57 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,005.50 | $9.30 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.79 | $9.35 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,010.50 | $4.28 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.81 | $4.31 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.10%, 1.85% and 0.85% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| VAUGHAN NELSON SELECT FUND | BEGINNING ACCOUNT VALUE 6/1/2014 |

ENDING ACCOUNT VALUE 11/30/2014 |

EXPENSES PAID DURING PERIOD* 6/1/2014 – 11/30/2014 |

|||||||||

| Class A | ||||||||||||

| Actual | $1,000.00 | $1,054.20 | $7.21 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.05 | $7.08 | |||||||||

| Class C | ||||||||||||

| Actual | $1,000.00 | $1,050.70 | $11.05 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.29 | $10.86 | |||||||||

| Class Y | ||||||||||||

| Actual | $1,000.00 | $1,055.50 | $5.93 | |||||||||

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.30 | $5.82 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.40%, 2.15% and 1.15% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

19 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund

| Shares | Description | Value (†) | ||||||

| Common Stocks* — 97.5% of Net Assets | ||||||||

| Australia — 7.6% | ||||||||

| 7,734 | Amcor Ltd.(b) | $ | 79,934 | |||||

| 15,074 | Aurizon Holdings Ltd.(b) | 59,084 | ||||||

| 5,846 | Australia & New Zealand Banking Group Ltd.(c)(d) | 158,644 | ||||||

| 4,104 | BHP Billiton Ltd.(c)(d) | 106,466 | ||||||

| 8,286 | Brambles Ltd.(b) | 68,445 | ||||||

| 3,040 | Commonwealth Bank of Australia(c)(d) | 208,594 | ||||||

| 1,109 | CSL Ltd.(b) | 77,819 | ||||||

| 4,913 | National Australia Bank Ltd.(c)(d) | 136,162 | ||||||

| 3,876 | Newcrest Mining Ltd.(b)(e) | 33,635 | ||||||

| 2,348 | Orica Ltd.(b) | 36,280 | ||||||

| 5,088 | Origin Energy Ltd.(b) | 52,970 | ||||||

| 4,042 | QBE Insurance Group Ltd.(b) | 37,296 | ||||||

| 1,225 | Rio Tinto Ltd.(b) | 61,412 | ||||||

| 7,334 | Suncorp Group Ltd.(b) | 89,430 | ||||||

| 2,652 | Wesfarmers Ltd.(b) | 93,523 | ||||||

| 2,168 | Woodside Petroleum Ltd.(b) | 65,916 | ||||||

| 3,366 | Woolworths Ltd.(b) | 88,984 | ||||||

|

|

|

|||||||

| 1,454,594 | ||||||||

|

|

|

|||||||

| Euro Zone — 31.2% | ||||||||

| 1,686 | Accor S.A.(b) | 79,537 | ||||||

| 1,044 | Air Liquide S.A.(c)(d) | 131,530 | ||||||

| 1,382 | Airbus Group NV(b) | 84,244 | ||||||

| 991 | Allianz SE, (Registered)(c)(d) | 170,744 | ||||||

| 801 | Alstom S.A.(b)(e) | 28,107 | ||||||

| 1,652 | Anheuser-Busch InBev NV(c)(d) | 194,305 | ||||||

| 899 | ASML Holding NV(b) | 95,021 | ||||||

| 3,650 | AXA S.A.(b) | 88,219 | ||||||

| 17,001 | Banco Bilbao Vizcaya Argentaria S.A.(c)(d) | 182,708 | ||||||

| 30,471 | Banco Santander S.A.(c)(d) | 274,409 | ||||||

| 1,528 | BASF SE(c)(d) | 138,571 | ||||||

| 1,610 | Bayer AG, (Registered)(c)(d) | 242,219 | ||||||

| 951 | Bayerische Motoren Werke AG(b) | 108,713 | ||||||

| 1,326 | Belgacom S.A.(b) | 52,386 | ||||||

| 2,336 | BNP Paribas S.A.(c)(d) | 150,024 | ||||||

| 951 | Bouygues S.A.(b) | 35,779 | ||||||

| 346 | Casino Guichard Perrachon S.A.(b) | 33,347 | ||||||

| 151 | Continental AG(b) | 31,775 | ||||||

| 2,247 | Daimler AG, (Registered)(c)(d) | 189,548 | ||||||

| 1,322 | Danone(b) | 93,243 | ||||||

| 2,492 | Deutsche Bank AG, (Registered)(b) | 81,372 | ||||||

| 2,554 | Deutsche Post AG(b) | 84,738 | ||||||

| 6,633 | Deutsche Telekom AG(b) | 112,790 | ||||||

| 5,074 | E.ON AG(b) | 89,900 | ||||||

| 991 | Electricite de France S.A.(b) | 29,684 | ||||||

| 19,509 | Enel SpA(b) | 94,174 | ||||||

| 5,568 | ENI SpA(c)(d) | 110,927 | ||||||

See accompanying notes to financial statements.

| 20

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Euro Zone — continued | ||||||||

| 81,525 | Governor & Co. of the Bank of Ireland (The)(b)(e) | $ | 33,543 | |||||

| 27,627 | Governor & Co. of the Bank of Ireland (The)(b)(e) | 11,337 | ||||||

| 9,153 | ING Groep NV(c)(d)(e) | 133,903 | ||||||

| 39,924 | Intesa Sanpaolo SpA(b) | 122,960 | ||||||

| 1,087 | Kone OYJ, Class B(b) | 50,066 | ||||||

| 977 | Koninklijke DSM NV(b) | 64,273 | ||||||

| 2,994 | Koninklijke Philips NV(b) | 90,170 | ||||||

| 1,468 | Legrand S.A.(b) | 77,015 | ||||||

| 453 | Linde AG(b) | 85,322 | ||||||

| 578 | LVMH Moet Hennessy Louis Vuitton S.A.(b) | 103,953 | ||||||

| 7,369 | Nokia OYJ(b) | 61,228 | ||||||

| 4,652 | Orange S.A.(b) | 82,035 | ||||||

| 722 | OSRAM Licht AG(b)(e) | 29,990 | ||||||

| 534 | Pernod-Ricard S.A.(b) | 63,316 | ||||||

| 1,674 | Sampo OYJ, A Shares(b) | 82,620 | ||||||

| 1,933 | Sanofi(c)(d) | 186,816 | ||||||

| 1,998 | SAP SE(c)(d) | 140,924 | ||||||

| 1,467 | Schneider Electric SE(b) | 119,771 | ||||||

| 1,720 | SCOR SE(b) | 53,709 | ||||||

| 1,948 | SES S.A.(b) | 72,553 | ||||||

| 1,576 | Siemens AG, (Registered)(c)(d) | 186,406 | ||||||

| 13,772 | Snam SpA(b) | 73,031 | ||||||

| 1,945 | Societe Generale S.A.(b) | 96,597 | ||||||

| 861 | Sodexo(b) | 86,905 | ||||||

| 48,700 | Telecom Italia SpA(b) | 43,173 | ||||||

| 10,197 | Telefonica S.A.(c)(d) | 163,572 | ||||||

| 944 | Thales S.A.(b) | 50,119 | ||||||

| 2,212 | ThyssenKrupp AG(b)(e) | 58,469 | ||||||

| 3,157 | Total S.A.(c)(d) | 176,288 | ||||||

| 831 | Umicore S.A.(b) | 33,786 | ||||||

| 8,666 | UniCredit SpA(b) | 64,052 | ||||||

| 3,257 | Unilever NV(c)(d) | 132,674 | ||||||

| 1,439 | Vinci S.A.(b) | 77,809 | ||||||

| 425 | Volkswagen AG(b) | 96,227 | ||||||

|

|

|

|||||||

| 6,012,626 | ||||||||

|

|

|

|||||||

| Hong Kong — 4.0% | ||||||||

| 30,556 | AIA Group Ltd.(b) | 176,186 | ||||||

| 69,205 | Bank of China Ltd., Class H(b) | 35,630 | ||||||

| 14,567 | CLP Holdings Ltd.(b) | 126,649 | ||||||

| 3,584 | CNOOC Ltd.(b) | 5,179 | ||||||

| 8,680 | Galaxy Entertainment Group Ltd.(b) | 59,152 | ||||||

| 4,059 | Hang Seng Bank Ltd.(b) | 67,594 | ||||||

| 4,256 | Hong Kong Exchanges & Clearing Ltd.(b) | 92,554 | ||||||

| 7,747 | Hutchison Whampoa Ltd.(b) | 96,973 | ||||||

| 2,284 | Tencent Holdings Ltd.(b) | 36,645 | ||||||

| 9,346 | Wharf Holdings Ltd. (The)(b) | 67,265 | ||||||

|

|

|

|||||||

| 763,827 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

21 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Japan — 20.4% | ||||||||

| 2,135 | Advantest Corp.(b) | $ | 25,578 | |||||

| 1,407 | Asahi Group Holdings Ltd.(b) | 43,872 | ||||||

| 5,800 | Astellas Pharma, Inc.(b) | 83,486 | ||||||

| 2,109 | Bridgestone Corp.(b) | 72,550 | ||||||

| 1,647 | Canon, Inc.(c)(d) | 52,612 | ||||||

| 2,120 | Coca-Cola West Co. Ltd.(b) | 29,060 | ||||||

| 1,386 | Credit Saison Co. Ltd.(b) | 25,945 | ||||||

| 2,611 | Daiichi Sankyo Co. Ltd.(b) | 38,542 | ||||||

| 836 | Daikin Industries Ltd.(b) | 55,499 | ||||||

| 1,770 | Denso Corp.(b) | 82,720 | ||||||

| 1,505 | Dentsu, Inc.(b) | 56,444 | ||||||

| 1,790 | Eisai Co. Ltd.(b) | 64,218 | ||||||

| 455 | FANUC Corp.(c)(d) | 76,823 | ||||||

| 154 | Fast Retailing Co. Ltd.(b) | 56,206 | ||||||

| 2,265 | FUJIFILM Holdings Corp.(b) | 74,911 | ||||||

| 1,444 | Hamamatsu Photonics KK(b) | 72,945 | ||||||

| 16,781 | Hankyu Hanshin Holdings, Inc.(b) | 92,198 | ||||||

| 2,084 | Hitachi Construction Machinery Co. Ltd.(b) | 45,021 | ||||||

| 11,589 | Hitachi Ltd.(b) | 89,540 | ||||||

| 2,640 | Honda Motor Co. Ltd.(c)(d) | 79,859 | ||||||

| 2,330 | Idemitsu Kosan Co. Ltd.(b) | 39,787 | ||||||

| 2,152 | Japan Tobacco, Inc.(b) | 69,010 | ||||||

| 1,245 | JGC Corp.(b) | 26,789 | ||||||

| 2,342 | JTEKT Corp.(b) | 38,875 | ||||||

| 6,125 | Kaneka Corp.(b) | 32,466 | ||||||

| 1,668 | Kao Corp.(b) | 61,776 | ||||||

| 1,204 | KDDI Corp.(c)(d) | 77,132 | ||||||

| 7,708 | Keikyu Corp.(b) | 58,907 | ||||||

| 2,766 | Komatsu Ltd.(b) | 65,473 | ||||||

| 1,538 | Konami Corp.(b) | 29,019 | ||||||

| 2,397 | Kurita Water Industries Ltd.(b) | 49,722 | ||||||

| 443 | Lawson, Inc.(b) | 27,297 | ||||||

| 4,659 | Mitsubishi Corp.(b) | 88,080 | ||||||

| 4,106 | Mitsubishi Estate Co. Ltd.(b) | 92,542 | ||||||

| 20,835 | Mitsubishi UFJ Financial Group, Inc.(b) | 120,041 | ||||||

| 10,517 | Mitsubishi UFJ Lease & Finance Co. Ltd.(b) | 49,628 | ||||||

| 4,790 | Mitsui & Co. Ltd.(b) | 66,086 | ||||||

| 3,304 | Mitsui Fudosan Co. Ltd.(b) | 95,621 | ||||||

| 12,148 | Nomura Holdings, Inc.(b) | 73,072 | ||||||

| 1,039 | NTT Data Corp.(d) | 39,650 | ||||||

| 4,615 | NTT DOCOMO, Inc.(b) | 72,046 | ||||||

| 5,410 | Panasonic Corp.(b) | 69,583 | ||||||

| 3,592 | Ricoh Co. Ltd.(b) | 38,963 | ||||||

| 1,217 | Secom Co. Ltd.(b) | 70,434 | ||||||

| 1,583 | Seven & I Holdings Co. Ltd.(b) | 59,009 | ||||||

| 1,207 | Shin-Etsu Chemical Co. Ltd.(c)(d) | 81,320 | ||||||

| 2,429 | Shionogi & Co. Ltd.(b) | 60,444 | ||||||

| 1,707 | Softbank Corp.(c)(d) | 113,763 | ||||||

See accompanying notes to financial statements.

| 22

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

| Shares | Description | Value (†) | ||||||

| Japan —continued | ||||||||

| 3,074 | Sony Corp.(b) | $ | 67,376 | |||||

| 2,242 | Sumitomo Corp.(b) | 23,927 | ||||||

| 1,794 | Sumitomo Metal Mining Co. Ltd.(b) | 27,471 | ||||||

| 1,932 | Sumitomo Realty & Development Co. Ltd.(b) | 66,837 | ||||||

| 1,672 | Suzuki Motor Corp.(b) | 52,710 | ||||||

| 4,182 | Taiyo Nippon Sanso Corp.(b) | 49,232 | ||||||

| 1,697 | Takeda Pharmaceutical Co. Ltd.(b) | 71,129 | ||||||

| 897 | TDK Corp.(b) | 54,092 | ||||||

| 2,200 | Terumo Corp.(b) | 50,059 | ||||||

| 645 | Tokyo Electron Ltd.(c)(d) | 44,968 | ||||||

| 1,375 | Toyo Suisan Kaisha Ltd.(b) | 46,578 | ||||||

| 4,413 | Toyota Motor Corp.(c)(d) | 271,412 | ||||||

| 1,801 | Toyota Tsusho Corp.(b) | 42,641 | ||||||

| 1,158 | Trend Micro, Inc.(b) | 35,193 | ||||||

| 1,826 | Yamato Holdings Co. Ltd.(b) | 41,336 | ||||||

|

|

|

|||||||

| 3,929,525 | ||||||||

|

|

|

|||||||

| Sweden — 3.6% | ||||||||

| 3,554 | Atlas Copco AB, Class A(b) | 102,504 | ||||||

| 1,992 | Hennes & Mauritz AB, Series B(b) | 85,313 | ||||||

| 1,666 | Hexagon AB, B Shares(b) | 52,939 | ||||||

| 7,343 | Nordea Bank AB(b) | 91,717 | ||||||

| 2,596 | Svenska Cellulosa AB SCA, B Shares(b) | 61,211 | ||||||

| 1,842 | Svenska Handelsbanken AB, A Shares(b) | 89,875 | ||||||

| 2,814 | Swedbank AB, A Shares(b) | 73,769 | ||||||

| 6,636 | Telefonaktiebolaget LM Ericsson, Class B(b) | 83,399 | ||||||

| 4,779 | Volvo AB, B Shares(b) | 52,260 | ||||||

|

|

|

|||||||

| 692,987 | ||||||||

|

|

|

|||||||

| Switzerland — 10.0% | ||||||||

| 5,204 | ABB Ltd., (Registered)(c)(d) | 116,858 | ||||||

| 852 | Aryzta AG(b) | 67,942 | ||||||

| 604 | Baloise Holding AG, (Registered)(b) | 78,812 | ||||||

| 2,830 | Credit Suisse Group AG, (Registered)(b) | 75,549 | ||||||

| 458 | Kuehne & Nagel International AG, (Registered)(b) | 61,833 | ||||||

| 4,920 | Nestle S.A., (Registered)(c)(d) | 369,262 | ||||||

| 3,815 | Novartis AG, (Registered)(c)(d) | 369,111 | ||||||

| 1,125 | Roche Holding AG(c)(d) | 336,820 | ||||||

| 425 | Schindler Holding AG(b) | 60,618 | ||||||

| 449 | Sonova Holding AG, (Registered)(b) | 67,932 | ||||||

| 146 | Sulzer AG, (Registered)(b) | 16,330 | ||||||

| 827 | Swatch Group AG (The), (Registered)(b) | 76,183 | ||||||

| 201 | Swiss Life Holding AG, (Registered)(b) | 46,038 | ||||||

| 1,834 | Transocean Ltd.(b) | 38,465 | ||||||

| 7,812 | UBS AG, (Registered)(b) | 140,520 | ||||||

|

|

|

|||||||

| 1,922,273 | ||||||||

|

|

|

|||||||

| United Kingdom — 20.7% | ||||||||

| 3,105 | Anglo American PLC(b) | 64,047 | ||||||

| 871 | Associated British Foods PLC(b) | 43,564 | ||||||

See accompanying notes to financial statements.

23 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

| Shares | Description | Value (†) | ||||||

| United Kingdom —continued | ||||||||

| 2,262 | AstraZeneca PLC(c)(d) | $ | 168,063 | |||||

| 7,033 | Aviva PLC(b) | 56,007 | ||||||

| 3,187 | Babcock International Group PLC(b) | 56,533 | ||||||

| 30,726 | Barclays PLC(b) | 117,402 | ||||||

| 4,998 | BG Group PLC(c)(d) | 70,286 | ||||||

| 4,156 | BHP Billiton PLC(c)(d) | 98,031 | ||||||

| 32,624 | BP PLC(c)(d) | 213,879 | ||||||

| 3,298 | British American Tobacco PLC(c)(d) | 195,251 | ||||||

| 21,198 | BT Group PLC(b) | 135,885 | ||||||

| 3,148 | Bunzl PLC(b) | 87,804 | ||||||

| 15,611 | Centrica PLC(b) | 69,437 | ||||||

| 944 | Croda International PLC(b) | 36,205 | ||||||

| 4,713 | Diageo PLC(c)(d) | 145,460 | ||||||

| 8,377 | GlaxoSmithKline PLC(c)(d) | 194,589 | ||||||

| 19,609 | Glencore PLC(b) | 98,064 | ||||||

| 30,425 | HSBC Holdings PLC(c)(d) | 303,138 | ||||||

| 112,195 | Lloyds Banking Group PLC(b)(e) | 140,973 | ||||||

| 5,747 | Meggitt PLC(b) | 45,150 | ||||||

| 11,619 | National Grid PLC(c)(d) | 168,927 | ||||||

| 728 | Next PLC(b) | 77,065 | ||||||

| 10,341 | Old Mutual PLC(b) | 32,340 | ||||||

| 5,802 | Prudential PLC(c)(d) | 140,218 | ||||||

| 1,390 | Reckitt Benckiser Group PLC(c)(d) | 114,009 | ||||||

| 2,115 | Rio Tinto PLC(c)(d) | 98,437 | ||||||

| 9,266 | Royal Dutch Shell PLC, A Shares(c)(d) | 308,721 | ||||||

| 1,810 | SABMiller PLC(b) | 100,668 | ||||||

| 1,360 | Shire PLC(b) | 97,064 | ||||||

| 3,352 | Standard Chartered PLC(b) | 49,071 | ||||||

| 17,778 | Tesco PLC(b) | 51,862 | ||||||

| 2,798 | Unilever PLC(c)(d) | 118,097 | ||||||

| 46,017 | Vodafone Group PLC(b) | 168,652 | ||||||

| 6,233 | WPP PLC(c)(d) | 130,495 | ||||||

|

|

|

|||||||

| 3,995,394 | ||||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $15,855,722) |

18,771,226 | |||||||

|

|

|

|||||||

| Purchased Options — 0.2% | ||||||||

| 49,800 | On iShares® MSCI EAFE ETF, Put expiring December 20, 2014 at 53.00 | 1,245 | ||||||

| 54,000 | On iShares® MSCI EAFE ETF, Put expiring December 20, 2014 at 54.00 | 2,970 | ||||||

| 50,000 | On iShares® MSCI EAFE ETF, Put expiring December 20, 2014 at 57.00 | 3,000 | ||||||

| 36,800 | On iShares® MSCI EAFE ETF, Put expiring January 17, 2015 at 55.00 | 3,680 | ||||||

| 45,000 | On iShares® MSCI EAFE ETF, Put expiring January 17, 2015 at 57.00 | 6,975 | ||||||

| 51,900 | On iShares® MSCI EAFE ETF, Put expiring January 17, 2015 at 58.00 | 10,120 | ||||||

| 49,800 | On iShares® MSCI EAFE ETF, Put expiring January 17, 2015 at 59.00 | 14,193 | ||||||

|

|

|

|||||||

| Total Purchased Options (Identified Cost $148,925) |

42,183 | |||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 24

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

| Principal Amount |

Description | Value (†) | ||||||

| Short-Term Investments — 2.5% | ||||||||

| $ | 487,882 | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/28/2014 at 0.010% to be repurchased at $487,882 on 12/01/2014 collateralized by $490,000 U.S. Treasury Note, 2.125% due 9/30/2021 valued at $497,963 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $487,882) |

$ | 487,882 | ||||

|

|

|

|||||||

| Total Investments — 100.2% (Identified Cost $16,492,529)(a) |

19,301,291 | |||||||

| Other assets less liabilities — (0.2)% | (42,849 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 19,258,442 | ||||||

|

|

|

|||||||

| Shares | ||||||||

| Written Options — (0.7%) | ||||||||

| 41,500 | On iShares® MSCI EAFE ETF, OTC Call expiring December 05, 2014 at 64.00(f) | $ | (12,018 | ) | ||||

| 27,400 | On iShares® MSCI EAFE ETF, OTC Call expiring December 05, 2014 at 62.50(f) | (41,715 | ) | |||||

| 45,900 | On iShares® MSCI EAFE ETF, OTC Call expiring December 12, 2014 at 64.00(f) | (21,876 | ) | |||||

| 40,900 | On iShares® MSCI EAFE ETF, OTC Call expiring December 12, 2014 at 65.00(f) | (5,115 | ) | |||||

| 46,600 | On iShares® MSCI EAFE ETF, OTC Call expiring December 20, 2014 at 64.00(f) | (14,294 | ) | |||||

| 39,500 | On iShares® MSCI EAFE ETF, OTC Call expiring January 17, 2015 at 65.00(f) | (13,810 | ) | |||||

| 45,700 | On iShares® MSCI EAFE ETF, OTC Call expiring February 20, 2015 at 65.00(f) | (30,679 | ) | |||||

|

|

|

|||||||

| Total Written Options (Premiums Received $169,256) |

$ | (139,507 | ) | |||||

|

|

|

|||||||

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| * | Common stocks are grouped by geographical regions that correspond to the markets underlying the iShares MSCI EAFE ETFs on which the Fund writes call options and buys put options. | |||||||

| (a) | Federal Tax Information: | |||||||

| At November 30, 2014, the net unrealized appreciation on investments based on a cost of $16,556,312 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 3,279,175 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (534,196 | ) | ||||||

|

|

|

|||||||

| Net unrealized appreciation | $ | 2,744,979 | ||||||

|

|

|

|||||||

| (b) | All of this security has been designated to cover the Fund’s obligations under open outstanding call options. | |||||||

| (c) | A portion of this security has been pledged as collateral for outstanding call options. | |||||||

| (d) | A portion of this security has been designated to cover the Fund’s obligations under open outstanding call options. | |||||||

| (e) | Non-income producing security. | |||||||

| (f) | Counterparty is UBS AG. | |||||||

| ETF | Exchange Traded Fund | |||||||

| OTC | Over-the-Counter | |||||||

See accompanying notes to financial statements.

25 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

Industry Summary at November 30, 2014

| Banks |

13.8 | % | ||

| Pharmaceuticals |

9.9 | |||

| Insurance |

5.5 | |||

| Oil, Gas & Consumable Fuels |

5.4 | |||

| Food Products |

4.5 | |||

| Automobiles |

4.1 | |||

| Chemicals |

3.6 | |||

| Metals & Mining |

3.4 | |||

| Diversified Telecommunication Services |

3.1 | |||

| Beverages |

3.0 | |||

| Machinery |

2.9 | |||

| Wireless Telecommunication Services |

2.2 | |||

| Other Investments, less than 2% each |

36.3 | |||

| Short-Term Investments |

2.5 | |||

|

|

|

|||

| Total Investments |

100.2 | |||

| Other assets less liabilities (including open written options) |

(0.2 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

Country of Risk Summary at November 30, 2014

| Japan |

20.4 | % | ||

| United Kingdom |

18.1 | |||

| Switzerland |

10.3 | |||

| France |

10.0 | |||

| Germany |

9.6 | |||

| Australia |

7.6 | |||

| Netherlands |

4.3 | |||

| Sweden |

3.6 | |||

| Hong Kong |

3.6 | |||

| Spain |

3.2 | |||

| Italy |

2.6 | |||

| Other Investments, less than 2% each |

4.4 | |||

| Short-Term Investments |

2.5 | |||

|

|

|

|||

| Total Investments |

100.2 | |||

| Other assets less liabilities (including open written options) |

(0.2 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

| 26

Table of Contents

Portfolio of Investments – as of November 30, 2014

Gateway International Fund – (continued)

Currency Exposure Summary at November 30, 2014

| Euro |

31.2 | % | ||

| British Pound |

20.7 | |||

| Japanese Yen |

20.4 | |||

| Swiss Franc |

10.0 | |||

| Australian Dollar |

7.6 | |||

| Hong Kong Dollar |

4.0 | |||

| Swedish Krona |

3.6 | |||

| United States Dollar |

2.7 | |||

|

|

|

|||

| Total Investments |

100.2 | |||

| Other assets less liabilities (including open written options) |

(0.2 | ) | ||

|

|

|

|||

| Net Assets |

100.0 | % | ||

|

|

|

See accompanying notes to financial statements.

27 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Loomis Sayles Dividend Income Fund*

| Shares | Description | Value (†) | ||||||

| Common Stocks — 79.9% of Net Assets | ||||||||

| Aerospace & Defense — 1.2% | ||||||||

| 2,781 | Northrop Grumman Corp. | $ | 391,926 | |||||

|

|

|

|||||||

| Automobiles — 1.8% | ||||||||

| 16,753 | General Motors Co. | 560,053 | ||||||

|

|

|

|||||||

| Banks — 7.3% | ||||||||

| 27,242 | Fifth Third Bancorp | 548,109 | ||||||

| 13,127 | JPMorgan Chase & Co. | 789,720 | ||||||

| 5,337 | PNC Financial Services Group, Inc. (The) | 466,827 | ||||||

| 9,474 | Wells Fargo & Co. | 516,144 | ||||||

|

|

|

|||||||

| 2,320,800 | ||||||||

|

|

|

|||||||

| Beverages — 1.8% | ||||||||

| 5,614 | PepsiCo, Inc. | 561,961 | ||||||

|

|

|

|||||||

| Capital Markets — 1.3% | ||||||||

| 12,758 | Federated Investors, Inc., Class B | 401,112 | ||||||

|

|

|

|||||||

| Chemicals — 2.9% | ||||||||

| 6,686 | E.I. du Pont de Nemours & Co. | 477,380 | ||||||

| 19,324 | Tronox Ltd., Class A | 435,756 | ||||||

|

|

|

|||||||

| 913,136 | ||||||||

|

|

|

|||||||

| Communications Equipment — 1.7% | ||||||||

| 19,332 | Cisco Systems, Inc. | 534,336 | ||||||

|

|

|

|||||||

| Diversified Consumer Services — 1.5% | ||||||||

| 13,920 | H&R Block, Inc. | 468,269 | ||||||

|

|

|

|||||||

| Diversified Telecommunication Services — 1.8% | ||||||||

| 11,642 | Verizon Communications, Inc. | 588,969 | ||||||

|

|

|

|||||||

| Electric Utilities — 1.6% | ||||||||

| 10,187 | Northeast Utilities | 515,870 | ||||||

|

|

|

|||||||

| Electrical Equipment — 3.3% | ||||||||

| 19,404 | ABB Ltd., Sponsored ADR | 435,038 | ||||||

| 9,241 | Eaton Corp. PLC | 626,817 | ||||||

|

|

|

|||||||

| 1,061,855 | ||||||||

|

|

|

|||||||

| Energy Equipment & Services — 1.7% | ||||||||

| 4,474 | National Oilwell Varco, Inc. | 299,937 | ||||||

| 15,974 | Transocean Partners LLC | 250,472 | ||||||

|

|

|

|||||||

| 550,409 | ||||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure — 1.3% | ||||||||

| 25,407 | SeaWorld Entertainment, Inc. | 424,043 | ||||||

|

|

|

|||||||

| Industrial Conglomerates — 1.6% | ||||||||

| 18,707 | General Electric Co. | 495,548 | ||||||

|

|

|

|||||||

| Insurance — 3.8% | ||||||||

| 19,000 | FNF Group | 615,600 | ||||||

| 10,747 | MetLife, Inc. | 597,641 | ||||||

|

|

|

|||||||

| 1,213,241 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

| 28

Table of Contents

Portfolio of Investments – as of November 30, 2014

Loomis Sayles Dividend Income Fund* – (continued)

| Shares | Description | Value (†) | ||||||

| Media — 2.7% | ||||||||

| 6,850 | Omnicom Group, Inc. | $ | 529,300 | |||||

| 2,251 | Time Warner Cable, Inc. | 336,029 | ||||||

|

|

|

|||||||

| 865,329 | ||||||||

|

|

|

|||||||

| Multi-Utilities — 1.4% | ||||||||

| 8,602 | PG&E Corp. | 434,401 | ||||||

|

|

|

|||||||

| Multiline Retail — 1.2% | ||||||||

| 6,275 | Kohl’s Corp.(b) | 374,116 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels — 7.1% | ||||||||

| 5,162 | Chevron Corp.(c) | 561,987 | ||||||

| 4,272 | HollyFrontier Corp. | 174,383 | ||||||

| 15,597 | PBF Energy, Inc., Class A | 440,771 | ||||||

| 11,129 | Regency Energy Partners LP(d) | 317,065 | ||||||

| 7,638 | Royal Dutch Shell PLC, ADR | 530,383 | ||||||

| 14,023 | Southcross Energy Partners LP(d) | 244,561 | ||||||

|

|

|

|||||||

| 2,269,150 | ||||||||

|

|

|

|||||||

| Pharmaceuticals — 14.1% | ||||||||

| 8,864 | AbbVie, Inc. | 613,389 | ||||||

| 8,239 | Bristol-Myers Squibb Co. | 486,513 | ||||||

| 11,097 | Eli Lilly & Co.(c) | 755,928 | ||||||

| 12,094 | GlaxoSmithKline PLC, Sponsored ADR | 561,766 | ||||||

| 10,686 | Merck & Co., Inc. | 645,434 | ||||||

| 25,968 | Pfizer, Inc.(c) | 808,903 | ||||||

| 12,806 | Sanofi, ADR | 618,402 | ||||||

|

|

|

|||||||

| 4,490,335 | ||||||||

|

|

|

|||||||

| REITs – Diversified — 2.6% | ||||||||

| 17,623 | Outfront Media, Inc. | 476,878 | ||||||

| 9,790 | Weyerhaeuser Co.(b) | 345,685 | ||||||

|

|

|

|||||||

| 822,563 | ||||||||

|

|

|

|||||||

| REITs – Hotels — 1.7% | ||||||||

| 10,135 | Ryman Hospitality Properties, Inc. | 527,831 | ||||||

|

|

|

|||||||

| REITs – Office Property — 1.5% | ||||||||

| 18,800 | Columbia Property Trust, Inc. | 473,760 | ||||||

|

|

|

|||||||

| REITs – Shopping Centers — 1.3% | ||||||||

| 24,058 | Washington Prime Group, Inc. | 414,519 | ||||||

|

|

|

|||||||

| Road & Rail — 1.6% | ||||||||

| 4,591 | Norfolk Southern Corp. | 512,539 | ||||||

|

|

|

|||||||

| Software — 3.8% | ||||||||

| 13,488 | Microsoft Corp. | 644,861 | ||||||

| 21,867 | Symantec Corp. | 570,510 | ||||||

|

|

|

|||||||

| 1,215,371 | ||||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals — 1.7% | ||||||||

| 4,492 | Apple, Inc. | 534,234 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

29 |

Table of Contents

Portfolio of Investments – as of November 30, 2014

Loomis Sayles Dividend Income Fund* – (continued)

| Shares | Description | Value (†) | ||||||

| Tobacco — 1.8% | ||||||||

| 6,789 | Philip Morris International, Inc. | $ | 590,168 | |||||

|

|

|

|||||||

| Transportation Infrastructure — 1.0% | ||||||||

| 4,597 | Macquarie Infrastructure Co. LLC | 323,169 | ||||||

|

|

|

|||||||

| Wireless Telecommunication Services — 1.8% | ||||||||

| 15,895 | Vodafone Group PLC, Sponsored ADR | 580,962 | ||||||

|

|

|

|||||||

| Total Common Stocks (Identified Cost $22,154,757) |

25,429,975 | |||||||

|

|

|

|||||||

| Principal Amount (‡) |

||||||||

| Bonds and Notes — 13.6% | ||||||||

| Non-Convertible Bonds — 12.7% | ||||||||

| Banking — 2.3% | ||||||||

| $ | 300,000 | BNP Paribas S.A., (fixed rate to 6/25/2037, variable rate thereafter), 7.195%, 144A(e) | 348,000 | |||||

| 100,000 | Morgan Stanley, 8.000%, 5/09/2017, (AUD) | 93,449 | ||||||

| 280,000 | Royal Bank of Scotland Group PLC, 4.700%, 7/03/2018 | 292,352 | ||||||

|

|

|

|||||||

| 733,801 | ||||||||

|

|

|

|||||||

| Chemicals — 0.6% | ||||||||

| 65,000 | Hexion U.S. Finance Corp./Hexion Nova Scotia Finance ULC, 9.000%, 11/15/2020 | 52,975 | ||||||

| 150,000 | Momentive Specialty Chemicals, Inc., 9.200%, 3/15/2021(f) | 139,500 | ||||||

|

|

|

|||||||