Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00242

| Natixis Funds Trust II |

(Exact name of Registrant as specified in charter)

| 399 Boylston Street, Boston, Massachusetts 02116 |

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

| Boston, Massachusetts 02116 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Table of Contents

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Table of Contents

SEMIANNUAL REPORT

June 30, 2012

ASG Diversifying Strategies Fund

ASG Global Alternatives Fund

ASG Managed Futures Strategy Fund

Loomis Sayles Absolute Strategies Fund

Loomis Sayles Multi-Asset Real Return Fund

Management Discussion and Investment Results page 1

Consolidated Portfolio of Investments page 33

Consolidated Financial Statements page 71

Table of Contents

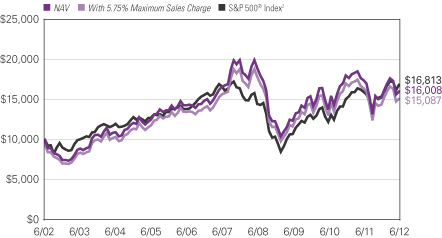

ASG DIVERSIFYING STRATEGIES FUND

Management Discussion

1 |

Table of Contents

would otherwise be too high. When the fund takes on a “long” exposure to a market, it profits as prices rise; when it takes on a “short” exposure, it profits as prices fall.

The fund’s negative return during the first half of the year was primarily attributable to currency losses in February and March (when anxiety about slowing Asian economies caused Asian-Pacific currencies to weaken relative to the dollar) and commodity losses in May (based on the sharp sell-off in energy and agricultural commodities). Fixed-income futures, including sovereign debt and short-term interest rate futures, contributed positively to performance. However, the losses in commodities and foreign currencies more than offset those gains. The contribution from equities was also negative, but only marginally so. Among equities, gains during January were more than offset by negative returns later in the first quarter, particularly during March, as stark divergence in global equity markets, triggered by concerns about a slowdown of economic activity in China and positive developments in the U.S., proved challenging for our equity relative-value signals. The equity correlation control mechanism contributed marginally positively overall. Fixed-income gains, mainly driven by episodes of flight to quality in April and May, were only partly offset by a yield spike in March and a return of risk appetite in June. Short-term interest rates remained low, so the contribution from money market positions was small.

The biggest positive contributors were Australian, British, and U.S. government bonds. Conversely, the biggest detractors from performance were the Japanese yen, the Australian and New Zealand dollars, along with the Japanese Topix Index.

The fund’s realized annualized volatility was 7.9%, consistent with its risk objectives and well within its targeted range. In order to help investors achieve diversification benefits in their overall portfolios, ASG Diversifying Strategies Fund seeks a low trailing 12-month correlation with global equity markets. The correlation of daily returns was -10% with the S&P 500® Index during the first half of the year and 0% for the trailing 12-month period.

Outlook

The outlook for global markets is cautiously positive following the latest European Summit. Investors are unsure whether the necessary fiscal and political reforms in the eurozone are feasible and can be implemented quickly enough to prevent further escalation of the crisis. Additional monetary easing by central banks globally and the extension of the U.S. Federal Reserve’s “Operation Twist” will likely buoy markets. However, the impending U.S. presidential election and the increased partisanship it brings to an already divided Congress will likely prevent Washington from addressing unemployment levels or the budget deficit, reducing the chance of a faster economic recovery. This, combined with the controversy of the reforms being attempted in Europe, may cause investors to remain somewhat cautious.

What You Should Know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 2

Table of Contents

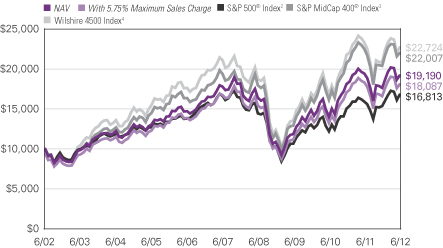

ASG DIVERSIFYING STRATEGIES FUND

Investment Results through June 30, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares5

August 3, 2009 (inception) through June 30, 2012

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges.

Expense Ratios

| Gross Expense Ratio (before fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.80% | Class C: 2.55% | Class Y: 1.55% | ||

| Net Expense Ratio (after fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.72% | Class C: 2.47% | Class Y: 1.47% | ||

| * | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 4/30/13. Contracts are reevaluated on an annual basis. |

3 |

Table of Contents

Average Annual Total Returns — June 30, 20125

| 6 Months | 1 Year | Since Inception | ||||||||||

| Class A (Inception 8/3/09) | ||||||||||||

| NAV | -5.33 | % | -5.33 | % | 2.39 | % | ||||||

| With 5.75% Maximum Sales Charge | -10.74 | -10.77 | 0.32 | |||||||||

| Class C (Inception 8/3/09) | ||||||||||||

| NAV | -5.70 | -6.04 | 1.60 | |||||||||

| With CDSC1 | -6.64 | -6.95 | 1.60 | |||||||||

| Class Y (Inception 8/3/09) | ||||||||||||

| NAV | -5.22 | -5.04 | 2.60 | |||||||||

| Comparative Performance | ||||||||||||

| 3-Month LIBOR2 | 0.28 | 0.39 | 0.37 | |||||||||

| HFRI Fund of Funds Composite Index3 | 0.99 | -4.49 | 1.70 | |||||||||

| Morningstar Multialternative Fund Avg.4 | 0.84 | -2.41 | 3.30 | |||||||||

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

Note: Portfolio summary tables previously included on this page can be found on the fund’s fact sheet available at ngam.natixis.com.

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | 3-Month LIBOR, or the London Interbank Offered Rate, represents the average rate a leading bank, for a given currency (in this case U.S. dollars), can obtain unsecured funding, and is representative of short-term interest rates. |

| 3 | HFRI Fund of Funds Composite Index is an unmanaged, equally-weighted hedge fund index including over 800 domestic and offshore funds of funds. Funds included within the index have either at least $50 million in assets under management or have been actively trading for at least twelve (12) months. Performance information is submitted by the funds of funds to the index provider, which does not audit the information submitted. The index is rebalanced monthly. Performance data is net of all fees charged by the hedge funds. Index returns are calculated three times each month and are subject to periodic recalculation by Hedge Fund Research, Inc. The funds do not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the HFRI Index returns reported by the funds may differ from the index returns for the same period published by others. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4

Table of Contents

ASG GLOBAL ALTERNATIVES FUND

Management Discussion

5 |

Table of Contents

typically makes extensive use of futures and forward contracts on global stock indexes, fixed-income securities, short-term interest rates, currencies and commodities. As market events unfold, these various market exposures result in a profit or loss for the fund.

During the reporting period, exposures to bonds, equities, and short-term interest rates contributed positively to fund performance, whereas commodities and foreign currencies detracted from returns. After beginning the year with gains in January and February, the fund incurred losses in March and May, whereas April and June were marginally positive. A stronger U.S. dollar against the Japanese yen resulted in negative performance in foreign currencies in February. Commodities contributed positively in January and February, but price declines in energy commodities and base metals in March and May more than offset earlier gains. Meanwhile, among equities, gains in the first quarter were nearly offset by negative returns during the market reversal in May. Fixed-income gains, mainly driven by episodes of flight to quality in April and May, were only partly offset by a yield spike in March and a return of risk appetite in June.

The biggest positive contributors during the first six months of 2012 were German and U.S. 10-year government bonds, along with natural gas. Conversely, the biggest detractors from performance were the Japanese yen, heating oil and nickel. The contribution from the fund’s money market positions was small.

As investors embraced risky assets during the start of the year and market volatility was generally subdued, the fund increased its risk taking in equities, foreign currencies, and commodities. When risk appetite waned later in the spring, the fund generally reduced its positions to compensate for increased market volatility. The fund’s realized volatility was 7.3%, which is in line with our risk management expectations.

Outlook

The outlook for global markets is cautiously positive following the latest European Summit. Investors are unsure whether the necessary fiscal and political reforms in the eurozone are feasible and can be implemented quickly enough to prevent further escalation of the crisis. Additional monetary easing by central banks globally and the extension of the U.S. Federal Reserve’s “Operation Twist” will likely buoy markets. However, the impending U.S. presidential election and the increased partisanship it brings to an already divided Congress will likely prevent Washington from addressing unemployment levels or the budget deficit, reducing the chance of a faster economic recovery. This, combined with the controversy of the reforms being attempted in Europe, may cause investors to remain somewhat cautious.

What You Should Know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 6

Table of Contents

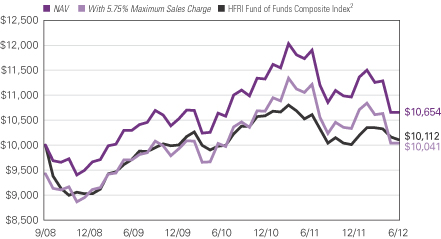

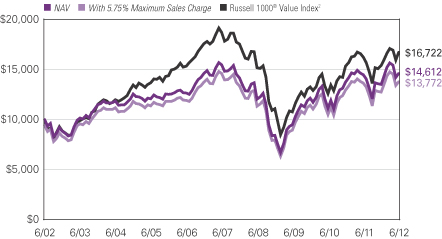

ASG GLOBAL ALTERNATIVES FUND

Investment Results through June 30, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares4

September 30, 2008 (inception) through June 30, 2012

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges.

Expense Ratios

| Gross Expense Ratio (before fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.61% | Class C: 2.36% | Class Y: 1.37% | ||

| Net Expense Ratio (after fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.61% | Class C: 2.36% | Class Y: 1.36% | ||

| * | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 4/30/13. Contracts are reevaluated on an annual basis. |

7 |

Table of Contents

Average Annual Total Returns — June 30, 20124

| 6 Months | 1 Year | Since Inception | ||||||||||

| Class A (Inception 9/30/08) | ||||||||||||

| NAV | -2.83 | % | -9.20 | % | 1.70 | % | ||||||

| With 5.75% Maximum Sales Charge | -8.45 | -14.42 | 0.10 | |||||||||

| Class C (Inception 9/30/08) | ||||||||||||

| NAV | -3.18 | -9.82 | 0.95 | |||||||||

| With CDSC1 | -4.15 | -10.73 | 0.95 | |||||||||

| Class Y (Inception 9/30/08) | ||||||||||||

| NAV | -2.71 | -8.96 | 1.96 | |||||||||

| Comparative Performance | ||||||||||||

| HFRI Fund of Funds Composite Index2 | 0.99 | -4.49 | 0.24 | |||||||||

| Morningstar Multialternative Fund Avg.3 | 0.84 | -2.41 | 1.45 | |||||||||

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

Note: Portfolio summary tables previously included on this page can be found on the fund’s fact sheet available at ngam.natixis.com.

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | HFRI Fund of Funds Composite Index is an unmanaged, equally-weighted hedge fund index including over 800 domestic and offshore funds of funds. Funds included within the index have either at least $50 million in assets under management or have been actively trading for at least twelve (12) months. Performance information is submitted by the funds of funds to the index provider, which does not audit the information submitted. The index is rebalanced monthly. Performance data is net of all fees charged by the hedge funds. Index returns are calculated three times each month and are subject to periodic recalculation by Hedge Fund Research, Inc. The funds do not expect to update the index returns provided if subsequent recalculations cause such returns to change. In addition, because of these recalculations, the HFRI Index returns reported by the funds may differ from the index returns for the same period published by others. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 8

Table of Contents

ASG MANAGED FUTURES STRATEGY FUND

Management Discussion

9 |

Table of Contents

The difference in performance between the fund and the benchmark was principally due to the fund’s diverse set of trend strategies and its risk management mechanism, which reduces target portfolio risk in the event of a drawdown. In general, the lower volatility helps mitigate the impact of continued losses, but at the cost of muting potential gains.

Strategies that followed fixed-income asset trends profited from the continued decline in bond yields. However, currency, equity and commodity returns from trend-following were negative, as long-term trends reversed across multiple asset classes. These long-term trend reversals led to the relative underperformance of our longer-term trend strategies and the relative outperformance of our shorter-term trend strategies. In particular, the fund’s long-term trend signals caused it to maintain significant long positions in equities and commodities during the first half of May, leading to relative underperformance when compared to funds that took short positions more rapidly in response to the downturn in those markets. This, combined with losses from currency trends during the first quarter, led to a majority of the losses experienced by the fund. Additionally, trend strategies designed to adapt to current market environments successfully navigated the volatile market conditions and outperformed even in the period’s challenging market climate, but strategies that had outperformed in the recent historical past underperformed in the first half of the year.

Specific assets that contributed positively included positions in Australian 10-year bond futures, Australian 3-year note futures, coffee futures, NASDAQ futures and EURIBOR futures. Conversely, positions that detracted from performance included the Japanese yen, the Australian dollar, the New Zealand dollar, the Swedish krona and the British pound.

We continued to scale portfolio positions to keep total portfolio risk at or below its target. As market volatility increased, positions were reduced, and as market volatility decreased, positions were increased. The fund’s realized annualized volatility during the period was 10.3%. The correlation of daily returns was 9% with the S&P 500® Index and 32% with the JP Morgan Global Bond Index. The money market position contributed only marginally to performance.

Outlook

The outlook for global markets is cautiously positive following the latest European Summit. Investors are unsure whether the necessary fiscal and political reforms in the eurozone are feasible and can be implemented quickly enough to prevent further escalation of the crisis. Additional monetary easing by central banks globally and the extension of the U.S. Federal Reserve’s “Operation Twist” will likely buoy markets. However, the impending U.S. presidential election and the increased partisanship it brings to an already divided Congress will likely prevent Washington from addressing unemployment levels or the budget deficit, reducing the chance of a faster economic recovery. This, combined with the controversy of the reforms being attempted in Europe, may cause investors to remain somewhat cautious.

What You Should Know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 10

Table of Contents

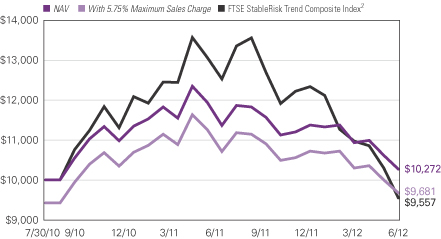

ASG MANAGED FUTURES STRATEGY FUND

Investment Results through June 30, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares4

July 30, 2010 (inception) through June 30, 2012

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges.

Expense Ratios

| Gross Expense Ratio (before fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.78% | Class C: 2.56% | Class Y: 1.56% | ||

| Net Expense Ratio (after fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.71% | Class C: 2.46% | Class Y: 1.46% | ||

| * | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 4/30/13. Contracts are reevaluated on an annual basis. |

11 |

Table of Contents

Average Annual Total Returns — June 30, 20124

| 6 Months | 1 Year | Since Inception | ||||||||||

| Class A (Inception 7/30/10) | ||||||||||||

| NAV | -9.69 | % | -9.63 | % | 1.40 | % | ||||||

| With 5.75% Maximum Sales Charge | -14.88 | -14.84 | -1.68 | |||||||||

| Class C (Inception 7/30/10) | ||||||||||||

| NAV | -10.07 | -10.37 | 0.59 | |||||||||

| With CDSC1 | -10.97 | -11.23 | 0.59 | |||||||||

| Class Y (Inception 7/30/10) |

||||||||||||

| NAV | -9.60 | -9.42 | 1.60 | |||||||||

| Comparative Performance | ||||||||||||

| FTSE StableRisk Trend Composite Index2 | -22.56 | -23.70 | -2.34 | |||||||||

| Morningstar Managed Futures Fund Avg.3 | -3.72 | -8.49 | -0.91 | |||||||||

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

Note: Portfolio summary tables previously included on this page can be found on the fund’s fact sheet available at ngam.natixis.com.

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | FTSE StableRisk Trend Composite Index is an unmanaged index based on a transparent trend-following strategy designed to provide long and/or short exposure to various asset classes at a targeted level of volatility. |

| 3 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 12

Table of Contents

LOOMIS SAYLES ABSOLUTE STRATEGIES FUND

Management Discussion

13 |

Table of Contents

bond holdings, specifically in consumer cyclical and technology, contributed to return, as these positions mirrored the equity market rally early in the period. Securitized assets also contributed positively to returns. The fund’s non-U.S.-dollar positions, particularly in the Mexican peso, euro and Australian dollar, benefited return.

During the period, the fund utilized a broad range of derivative instruments both for hedging and for investment purposes. We believe derivatives can be useful tools for expressing macroeconomic views, reducing overall market exposure and managing fund volatility. When contemplating the use of derivatives, we consider the expected relative risks and returns of such investments and their related costs.

Credit default swaps (CDS) and credit default swaps on indexes (CDX) helped us manage credit risk and reduced global and industry-specific credit exposure. Specifically, the fund used emerging market CDX to help protect against extreme market declines, and these positions contributed positively to the fund’s return. In addition, the fund held U.S. Treasury futures to manage interest rate risk. During the period, we sold these futures to reduce duration (price sensitivity to interest rate changes), which aided overall performance. The fund uses equity futures to hedge positions in convertible bonds and dividend-paying equities. Short positions in S&P 500® and Eurostoxx 50 futures aided performance, as these equity markets declined on negative news in Europe. Forward foreign currency contracts helped us manage the fund’s overall exposure to various currencies and generally contributed to overall performance.

Outlook

The developed world is struggling with strong deflationary headwinds, caused by significant slack in the economy and de-leveraging in the private sector. Government policy tools are somewhat limited by burdensome debt levels and large fiscal deficits, but aggressive monetary policy has so far been the most effective tool to reflate the global economy. Riskier assets have tended to perform well when strong monetary policies are announced and implemented. However, the risk rally has tended to fade as the monetary boost waned, and underlying deflationary conditions persist. This cycle is likely to continue until economic activity begins to normalize, which we do not expect to occur in the near term.

In this environment, we believe the global economy will grow slowly, with support from monetary authorities and lower commodity prices offsetting the headwinds from debt de-leveraging and low capacity utilization. However, we believe that market volatility will persist. In the developed world, the U.S. economy will probably continue its moderate growth path whereas Japan is likely to remain stagnant and Europe in recession. We believe that emerging markets will continue to be the world’s primary engine of economic growth, but even these economies are experiencing moderated growth. Given our macroeconomic views, we plan to position the fund in a relatively defensive manner unless we see strong policy actions from monetary authorities to reflate the economy.

Please note that the above commentary may contain references to contributions to Fund performance from derivative instruments that differ from related amounts presented in the Fund’s Financial Statements. These differences, if any, result from the methodologies applied in determining performance contributions for these instruments.

| 14

Table of Contents

What You Should Know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

15 |

Table of Contents

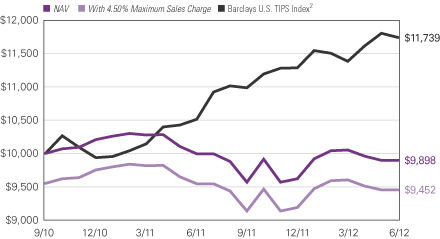

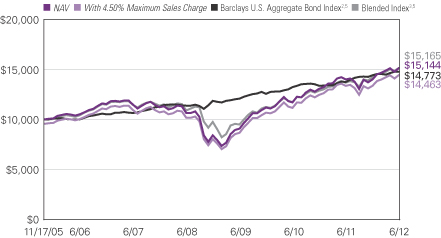

LOOMIS SAYLES ABSOLUTE STRATEGIES FUND

Investment Results through June 30, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares6

December 15, 2010 (inception) through June 30, 2012

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges.

Expense Ratios

| Gross Expense Ratio (before fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.17% | Class C: 1.91% | Class Y: 0.92% | ||

| Net Expense Ratio (after fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.17% | Class C: 1.91% | Class Y: 0.92% | ||

| * | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 4/30/13. Contracts are reevaluated on an annual basis. |

| 16

Table of Contents

Average Annual Total Returns — June 30, 20126

| 6 Months | 1 Year | Since Inception | ||||||||||

| Class A (Inception 12/15/10) | ||||||||||||

| NAV | 6.31 | % | 2.00 | % | 1.67 | % | ||||||

| With 4.50% Maximum Sales Charge | 1.53 | -2.60 | -1.32 | |||||||||

| Class C (Inception 12/15/10) | ||||||||||||

| NAV | 5.85 | 1.16 | 0.77 | |||||||||

| With CDSC1 | 4.85 | 0.18 | 0.77 | |||||||||

| Class Y (Inception 12/15/10) | ||||||||||||

| NAV | 6.49 | 2.21 | 1.87 | |||||||||

| Comparative Performance5 | ||||||||||||

| 3-Month LIBOR2 | 0.28 | 0.39 | 0.16 | |||||||||

| 3-Month LIBOR + 300 basis points3 | 1.79 | 3.43 | 1.67 | |||||||||

| Morningstar Nontraditional Bond Fund Avg.4 | 4.98 | 4.60 | 5.58 | |||||||||

|

|

|

|

|

|

|

|||||||

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

Note: Portfolio summary tables previously included on this page can be found on the fund’s fact sheet available at ngam.natixis.com.

NOTES TO CHARTS

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | 3-Month LIBOR, or the London Interbank Offered Rate, represents the average rate a leading bank, for a given currency (in this case U.S. dollars), can obtain unsecured funding, and is representative of short-term interest rates. |

| 3 | 3-Month LIBOR +300 basis points is created by adding 3.00% to the annual percentage change of the 3-Month LIBOR. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | The since-inception comparative performance figures shown are calculated from 12/31/10. |

| 6 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

17 |

Table of Contents

LOOMIS SAYLES MULTI-ASSET REAL RETURN FUND

Management Discussion

| 18

Table of Contents

Credit default swaps (CDS) and credit default swaps on indexes (CDX) helped manage credit risk and reduced global and industry-specific credit exposure and contributed modestly during the period. Positioning within sovereign CDS also aided performance. Short exposure in Turkey and Brazil benefited performance, as global growth expectations were revised lower. A short position within emerging market CDS in the latter half of the period was also positive.

U.S. Treasury yields moved significantly during the first half of the year, and efforts to manage interest rate risk with U.S. Treasury futures hurt performance. Commodity futures were used to gain exposure to commodities, notably precious metals, energy and agriculture holdings. Deflation concerns during the second quarter weighed on commodity markets, and the fund’s long commodity futures positions detracted as a result. We increased the fund’s hedge to commodity positions throughout the second quarter in an effort to manage risk. Equity future hedges weighed on returns when equities rallied early in the period, and the fund’s long equity positions pressured returns when risk fell out of favor in the second quarter. Overall, equity exposure had a muted effect on performance.

Outlook

The process of recognizing true asset values and writing off bad debt is ongoing in Europe, and our outlook for the euro remains bearish. Previous banking crises have shown that it can take around ten years to return to pre-crisis trend growth, and we are in year four of this crisis.

With ongoing challenges in Europe, disappointing U.S. economic growth and decelerating growth in China, market volatility and macroeconomic uncertainty have increased. We anticipate continued policy intervention through year-end and think markets will fluctuate between reflation hopes and deflation fears as policy actions surprise or disappoint. We plan to position the portfolio somewhat neutrally and use options to add upside and downside hedges.

We have a bias toward higher-quality credit, given what we view as strong corporate fundamentals. This position also provides modest duration exposure (price sensitivity to interest rate changes). Though deflationary risks persist, we recognize policy makers’ reflationary intentions and have used options to position the fund seeking to capture potential upside in riskier assets, including equities, currencies and interest rates. In our view, U.S. economic growth should remain above 1.5%, and consequently, we are comfortable taking long positions in higher-quality high yield. We plan to focus long positions in more U.S.-centric companies and continue to favor dividend-paying equities in Europe and the United States.

We expect to continue to monitor breakevens (the difference between yields on nominal government securities and inflation-protected securities of the same maturity) globally, as they tend to correlate strongly with equity performance. Commodity and commodity-currency performance can also serve as signs of global reflation and economic outlook.

Please note that the above commentary may contain references to contributions to Fund performance from derivative instruments that differ from related amounts presented in the Fund’s Financial Statements. These differences, if any, result from the methodologies applied in determining performance contributions for these instruments.

19 |

Table of Contents

What You Should Know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 20

Table of Contents

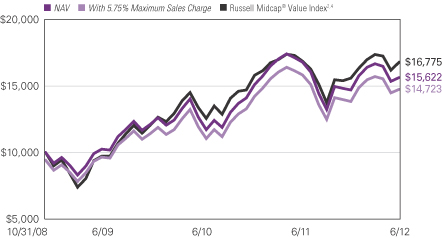

LOOMIS SAYLES MULTI-ASSET REAL RETURN FUND

Investment Results through June 30, 2012

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares5

September 30, 2010 (inception) through June 30, 2012

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com.

Performance for other share classes will be greater or less than shown based on differences in fees and sales charges.

Expense Ratios

| Gross Expense Ratio (before fee waivers and/or expense reimbursements)* | ||||

| Class A: 2.01% | Class C: 2.62% | Class Y: 1.69% | ||

| Net Expense Ratio (after fee waivers and/or expense reimbursements)* | ||||

| Class A: 1.43% | Class C: 2.18% | Class Y: 1.18% | ||

| * | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 4/30/13. Contracts are reevaluated on an annual basis. |

21 |

Table of Contents

Average Annual Total Returns — June 30, 20125

| 6 Months | 1 Year | Since Inception | ||||||||||

| Class A (Inception 9/30/10) | ||||||||||||

| NAV | 2.89 | % | -0.94 | % | -0.58 | % | ||||||

| With 4.50% Maximum Sales Charge | -1.74 | -5.43 | -3.15 | |||||||||

| Class C (Inception 9/30/10) | ||||||||||||

| NAV | 2.58 | -1.65 | -1.28 | |||||||||

| With CDSC1 | 1.58 | -2.62 | -1.28 | |||||||||

| Class Y (Inception 9/30/10) | ||||||||||||

| NAV | 3.00 | -0.68 | -0.36 | |||||||||

| Comparative Performance | ||||||||||||

| Barclays U.S. TIPS Index2 | 4.04 | 11.66 | 11.76 | |||||||||

| CPI + 300 basis points3 | 3.21 | 4.74 | 5.97 | |||||||||

| Morningstar Conservative Allocation Fund Avg.4 | 4.51 | 2.34 | 5.55 | |||||||||

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit ngam.natixis.com. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Class Y shares are not available for purchase by all investors.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

Note: Portfolio summary tables previously included on this page can be found on the fund’s fact sheet available at ngam.natixis.com.

NOTES TO CHARTS

| 1 | Performance for Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index is an unmanaged index that tracks inflation protected securities issued by the U.S. Treasury. |

| 3 | CPI +300 basis points is created by adding 3.00% to the annual percentage change in the Consumer Price Index (CPI). The Consumer Price Index is an unmanaged index that represents the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. |

| 4 | Morningstar Fund Averages are the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 22

Table of Contents

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

Before investing, consider each fund’s investment objectives, risks, charges and expenses. Visit ngam.natixis.com or call 800-225-5478 for a prospectus and/or a summary prospectus, both of which contain this and other information. Read it carefully.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the funds voted proxies during the 12-month period ended June 30, 2012 is available on the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

23 |

Table of Contents

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from January 1, 2012 through June 30, 2012. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = $8.60) and multiply the result by the number in the Expenses Paid During Period column as shown for your Class.

The second line for the table of each class provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| 24

Table of Contents

| ASG DIVERSIFYING STRATEGIES FUND | BEGINNING ACCOUNT VALUE 1/1/2012 |

ENDING ACCOUNT VALUE 6/30/2012 |

EXPENSES PAID DURING PERIOD* 1/1/2012 – 6/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $946.70 | $8.37 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.26 | $8.67 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $943.00 | $11.98 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,012.53 | $12.41 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $947.80 | $7.17 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,017.50 | $7.42 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.73%, 2.48% and 1.48% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| ASG GLOBAL ALTERNATIVES FUND | BEGINNING ACCOUNT VALUE 1/1/2012 |

ENDING ACCOUNT VALUE 6/30/2012 |

EXPENSES PAID DURING PERIOD* 1/1/2012 – 6/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $971.70 | $7.89 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.86 | $8.07 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $968.20 | $11.55 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,013.13 | $11.81 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $972.90 | $6.67 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.10 | $6.82 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio, including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.61%, 2.36% and 1.36% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

25 |

Table of Contents

| ASG MANAGED FUTURES STRATEGY FUND |

BEGINNING ACCOUNT VALUE 1/1/2012 |

ENDING ACCOUNT VALUE 6/30/2012 |

EXPENSES PAID DURING PERIOD* 1/1/2012 – 6/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $903.10 | $8.19 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.26 | $8.67 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $899.30 | $11.71 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,012.53 | $12.41 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $904.00 | $7.01 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,017.50 | $7.42 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements) and interest expense: 1.73%, 2.48% and 1.48% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| LOOMIS SAYLES ABSOLUTE STRATEGIES FUND |

BEGINNING ACCOUNT VALUE 1/1/2012 |

ENDING ACCOUNT VALUE 6/30/2012 |

EXPENSES PAID DURING PERIOD* 1/1/2012 – 6/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $1,063.10 | $5.85 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,019.19 | $5.72 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $1,058.50 | $9.67 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,015.47 | $9.47 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $1,064.90 | $4.57 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,020.44 | $4.47 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.14%, 1.89% and 0.89% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| 26

Table of Contents

| LOOMIS SAYLES MULTI-ASSET REAL RETURN FUND |

BEGINNING ACCOUNT VALUE 1/1/2012 |

ENDING ACCOUNT VALUE 6/30/2012 |

EXPENSES PAID DURING PERIOD* 1/1/2012 – 6/30/2012 |

|||||||||

| Class A |

||||||||||||

| Actual |

$1,000.00 | $1,028.90 | $6.81 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.15 | $6.77 | |||||||||

| Class C |

||||||||||||

| Actual |

$1,000.00 | $1,025.80 | $10.58 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,014.42 | $10.52 | |||||||||

| Class Y |

||||||||||||

| Actual |

$1,000.00 | $1,030.00 | $5.55 | |||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,019.39 | $5.52 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement), including expenses of the Subsidiary (see Note 1 of Notes to Financial Statements): 1.35%, 2.10% and 1.10% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

27 |

Table of Contents

BOARD APPROVAL OF THE EXISTING ADVISORY AND SUB-ADVISORY AGREEMENTS

The Board of Trustees, including the Independent Trustees, considers matters bearing on each Fund’s advisory and sub-advisory agreements (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment advisers and sub-advisers (collectively, the “Advisers”) believe to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups and categories of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory and sub-advisory fees, if any, and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Advisers and to those of peer groups of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Advisers and (v) information obtained through the completion by the Advisers of a questionnaire distributed on behalf of the Trustees. The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) each Adviser’s financial results and/or financial condition, (ii) each Fund’s investment objectives and strategies and the size, education and experience of the Advisers’ respective investment staffs and their use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Advisers and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Advisers.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs

| 28

Table of Contents

showing each Fund’s performance and fee differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other representatives of the Advisers make periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board of Trustees most recently approved the continuation of the Agreements at their meeting held in June 2012. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Advisers and their affiliates to the Funds and the resources dedicated to the Funds by the Advisers and their affiliates.

The Trustees considered not only the advisory services provided by the Advisers to the Funds, but also the administrative services provided by NGAM Advisors, L.P. (“NGAM Advisors”) and its affiliates to the Funds.

For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Advisers. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of similarly categorized funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that also measured the performance of the Funds on a risk adjusted basis. The Board noted that, given the recent commencement of operations of each Fund, the Funds have a limited operating history upon which to evaluate their performance.

29 |

Table of Contents

With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement(s) relating to that Fund. In the case of each Fund that had performance that lagged that of a relevant peer group median and/or category median for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Agreements. These factors included one or more of the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Advisers that were reasonable and consistent with the Fund’s investment objective and policies; (2) that the Fund had a limited operating history; (3) that the Fund’s more recent performance, although lagging in certain periods, was competitive when compared to relevant performance benchmarks or peer groups; (4) that the Fund’s more recent performance, although lagging in certain periods, had shown improvement relative to its category; and (5) that although the Fund’s performance lagged that of its relevant peer group for certain periods, performance was stronger when compared to the Fund’s relevant performance benchmark. The Trustees also considered each Adviser’s performance and reputation generally, the performance of the fund family generally (as noted by certain financial publications), and the historical responsiveness of the Advisers to Trustee concerns about performance and the willingness of the Advisers to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Advisers supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Advisers and their affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory and sub-advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Advisers to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage and the greater regulatory costs associated with the management of mutual fund assets. In evaluating each Fund’s advisory and sub-advisory fees, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Advisers to offer competitive compensation. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. The Trustees noted that management had instituted an expense cap for each Fund, and they considered the amounts waived or reimbursed, if any, by the adviser under these caps. The Trustees noted that certain of the Funds had advisory fee rates that were above the median of a peer group of funds. In this regard, the Trustees considered the factors that management

| 30

Table of Contents

believed justified such relatively higher fees. These factors varied from Fund to Fund, but included one or more of the following: (1) that the Fund’s advisory fee rate was only slightly above its peer group median; (2) that although the Fund’s advisory fee rate was above its peer group median, it is subject to an expense cap, which resulted in the reduction of the advisory fee; (3) that management had proposed that advisory fee breakpoints be implemented for the Fund; (4) that the Fund’s net expense ratio was near, at, or below the median of a peer group of funds; (5) that the Fund’s investment discipline was capacity restrained and (6) that the relative difference in advisory fees in comparison to a median of a peer group of funds may be due, at least in part, to the Fund’s peer group consisting of funds with a broad range of advisory fees and of several peer group funds having significant assets.

The Trustees also considered the compensation directly or indirectly received by the Advisers and their affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Advisers’ and their affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the relevant Funds, the expense levels of the Funds, and whether the Advisers had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fees charged to each of the Funds were fair and reasonable, and that the costs of these services generally and the related profitability of the Advisers and their affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Advisers and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees noted that each of the Funds was subject to an expense cap. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the possible implementation of breakpoints or an expense cap for a fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees also noted that management had proposed the implementation of breakpoints for the ASG Global Alternatives Fund. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Advisers and their affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

31 |

Table of Contents

The Trustees also considered other factors, which included but were not limited to the following:

| · | The effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

| · | Whether each Fund has operated in accordance with its investment objectives and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Advisers. They also considered the compliance-related resources the Advisers and their affiliates were providing to the Funds. |

| · | The nature, quality, cost and extent of administrative and shareholder services performed by the Advisers and their affiliates, both under the Agreements and under separate agreements covering administrative services. |

| · | So-called “fallout benefits” to the Advisers, such as the engagement of affiliates of the Advisers to provide distribution, administrative and brokerage services to the Funds, the benefits of research made available to the Advisers by reason of brokerage commissions (if any) generated by the Funds’ securities transactions and the benefits to NGAM Advisors of being able to offer “alternative” products in the Natixis family of funds. The Trustees also considered the fact that NGAM Advisors’ parent company benefits from the retention of affiliated Advisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| · | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2013.

| 32

Table of Contents

Consolidated Portfolio of Investments – as of June 30, 2012 (Unaudited)

ASG Diversifying Strategies Fund

| Principal Amount |

Description | Value (†) | ||||||

| Short-Term Investments — 95.1% of Net Assets | ||||||||

| Certificates of Deposit — 60.1% | ||||||||

| $ | 6,300,000 | Royal Bank of Canada, 0.100%, 7/02/2012 | $ | 6,300,000 | ||||

| 10,000,000 | BNP Paribas, 0.120%, 7/02/2012 | 10,000,000 | ||||||

| 10,000,000 | Deutsche Bank AG, 0.400%, 7/02/2012 | 10,000,140 | ||||||

| 6,000,000 | Standard Chartered Bank (NY), 0.220%, 7/09/2012 | 6,000,036 | ||||||

| 9,000,000 | Standard Chartered Bank (NY), 0.540%, 7/13/2012 | 9,001,188 | ||||||

| 6,000,000 | Toronto Dominion Bank, 0.250%, 7/17/2012(b) | 6,000,420 | ||||||

| 7,000,000 | Canadian Imperial Bank of Commerce (NY), 0.335%, 7/25/2012(b)(c) | 7,000,021 | ||||||

| 12,000,000 | Mizuho Corporate Bank, 0.340%, 8/02/2012 | 12,001,128 | ||||||

| 5,000,000 | Toronto Dominion Bank, 0.200%, 8/06/2012(b) | 5,000,050 | ||||||

| 10,000,000 | National Australia Bank, 0.343%, 8/16/2012(c) | 9,999,630 | ||||||

| 12,000,000 | ANZ Banking, 0.210%, 8/17/2012 | 12,001,632 | ||||||

| 6,000,000 | Canadian Imperial Bank of Commerce (NY), 0.390%, 8/24/2012(c) | 6,000,078 | ||||||

| 6,000,000 | Nordea Bank Finland (NY), 0.280%, 8/29/2012 | 6,000,612 | ||||||

| 13,000,000 | Svenska Handelsbanken (NY), 0.520%, 9/04/2012(b) | 13,005,304 | ||||||

| 10,000,000 | Bank of Montreal (IL), 0.190%, 9/18/2012 | 10,000,450 | ||||||

| 10,000,000 | Wells Fargo, 0.170%, 9/19/2012 | 9,995,730 | ||||||

| 10,000,000 | Bank of Nova Scotia (TX), 0.320%, 9/21/2012(b) | 10,002,330 | ||||||

| 10,000,000 | Societe Generale S.A., 0.345%, 9/28/2012(c) | 9,982,730 | ||||||

| 3,000,000 | Bank of Nova Scotia (TX), 0.335%, 12/21/2012(c) | 2,999,631 | ||||||

| 10,000,000 | Sumitomo Mitsui Trust (NY), 0.485%, 12/31/2012(c) | 9,998,210 | ||||||

| 5,000,000 | Westpac Banking Corp. (NY), 0.466%, 2/04/2013(c) | 4,999,165 | ||||||

|

|

|

|||||||

| 176,288,485 | ||||||||

|

|

|

|||||||

| Financial Company Commercial Paper — 23.2% | ||||||||

| 12,000,000 | ING (US) Funding LLC, 0.190%, 7/05/2012(d) | 11,999,747 | ||||||

| 7,000,000 | Nordea North America, Inc., 0.160%, 7/06/2012(d) | 6,999,825 | ||||||

| 12,000,000 | General Electric Capital Corp., 0.170%, 7/16/2012(d) | 11,999,316 | ||||||

| 10,000,000 | Overseas Chinese Banking Corp., 0.220%, 8/03/2012(d) | 9,998,210 | ||||||

| 14,000,000 | Nestle Capital Corporation, 0.180%, 8/28/2012(d) | 13,996,962 | ||||||

| 13,000,000 | United Overseas Funding Corp., 0.200%, 9/10/2012(d) | 12,992,460 | ||||||

|

|

|

|||||||

| 67,986,520 | ||||||||

|

|

|

|||||||

| Commercial Paper — 11.8% | ||||||||

| 8,800,000 | Louis Dreyfus Corp., (Credit Support: Barclays Bank), 0.380%, 7/02/2012(d) | 8,799,907 | ||||||

| 12,000,000 | Cofco Capital Corp., (Credit Support: Rabobank), 0.410%, 7/10/2012(d) | 11,998,770 | ||||||

| 14,000,000 | Private Export Funding Corp., 0.180%, 7/30/2012(d) | 13,997,704 | ||||||

|

|

|

|||||||

| 34,796,381 | ||||||||

|

|

|

|||||||

| Total Short-Term Investments (Identified Cost $279,085,307) |

279,071,386 | |||||||

|

|

|

|||||||

| Total Investments — 95.1% (Identified Cost $279,085,307)(a) |

279,071,386 | |||||||

| Other assets less liabilities — 4.9% | 14,470,978 | |||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 293,542,364 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

33 |

Table of Contents

Consolidated Portfolio of Investments – as of June 30, 2012 (Unaudited)

ASG Diversifying Strategies Fund – (continued)

| (†) | See Note 2 of Notes to Financial Statements. | |||||||

| (a) | Federal Tax Information: | |||||||

| At June 30, 2012, the net unrealized depreciation on short-term investments based on a cost of $279,085,307 for federal income tax purposes was as follows: | ||||||||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $ | 14,190 | ||||||

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (28,111 | ) | ||||||

|

|

|

|||||||

| Net unrealized depreciation | $ | (13,921 | ) | |||||

|

|

|

|||||||

| Only short-term obligations purchased with an original or remaining maturity of more than sixty days are valued at other than amortized cost. | ||||||||

| (b) | All or a portion of this security has been designated to cover the Fund’s obligations under open forward foreign currency and futures contracts. | |||||||

| (c) | Variable rate security. Rate as of June 30, 2012 is disclosed. | |||||||

| (d) | Interest rate represents discount rate at time of purchase; not a coupon rate. | |||||||

At June 30, 2012, the Fund had the following open forward foreign currency contracts:

| Contract to Buy/Sell1 |

Delivery Date |

Currency | Units | Notional Value |

Unrealized Appreciation (Depreciation) |

|||||||||||||

| Sell | 9/19/2012 | Australian Dollar | 6,800,000 | $ | 6,910,052 | $ | (201,369 | ) | ||||||||||

| Buy | 9/19/2012 | British Pound | 29,437,500 | 46,094,092 | 333,586 | |||||||||||||

| Sell | 9/19/2012 | British Pound | 31,500,000 | 49,323,614 | (499,338 | ) | ||||||||||||

| Buy | 9/19/2012 | Canadian Dollar | 4,000,000 | 3,922,122 | 28,696 | |||||||||||||

| Buy | 9/19/2012 | Canadian Dollar | 1,100,000 | 1,078,583 | (1,114 | ) | ||||||||||||

| Sell | 9/19/2012 | Canadian Dollar | 5,100,000 | 5,000,705 | (36,410 | ) | ||||||||||||

| Buy | 9/19/2012 | Euro | 6,750,000 | 8,548,476 | 124,243 | |||||||||||||

| Sell | 9/19/2012 | Euro | 2,375,000 | 3,007,797 | (23,213 | ) | ||||||||||||

| Buy | 9/19/2012 | Japanese Yen | 1,750,000,000 | 21,916,196 | (222,279 | ) | ||||||||||||

| Sell | 9/19/2012 | Japanese Yen | 2,012,500,000 | 25,203,626 | 180,360 | |||||||||||||

| Sell | 9/19/2012 | New Zealand Dollar | 17,000,000 | 13,536,903 | (210,568 | ) | ||||||||||||

| Buy | 9/19/2012 | Norwegian Krone | 48,000,000 | 8,046,110 | 130,770 | |||||||||||||

| Buy | 9/19/2012 | Norwegian Krone | 20,000,000 | 3,352,546 | (10,558 | ) | ||||||||||||

| Sell | 9/19/2012 | Norwegian Krone | 36,000,000 | 6,034,583 | (56,587 | ) | ||||||||||||

| Buy | 9/19/2012 | Singapore Dollar | 2,375,000 | 1,875,051 | 4,887 | |||||||||||||

| Sell | 9/19/2012 | Singapore Dollar | 8,000,000 | 6,315,960 | (57,347 | ) | ||||||||||||

| Sell | 9/19/2012 | Swedish Krona | 96,000,000 | 13,839,159 | (431,343 | ) | ||||||||||||

| Buy | 9/19/2012 | Swiss Franc | 875,000 | 923,715 | 10,825 | |||||||||||||

| Buy | 9/19/2012 | Turkish Lira | 900,000 | 489,574 | 8,317 | |||||||||||||

| Buy | 9/19/2012 | Turkish Lira | 4,500,000 | 2,447,872 | (892 | ) | ||||||||||||

| Sell | 9/19/2012 | Turkish Lira | 300,000 | 163,191 | (2,587 | ) | ||||||||||||

|

|

|

|||||||||||||||||

| Total | $ | (931,921 | ) | |||||||||||||||

|

|

|

|||||||||||||||||

1 Counterparty is UBS AG.

See accompanying notes to financial statements.

| 34

Table of Contents

Consolidated Portfolio of Investments – as of June 30, 2012 (Unaudited)

ASG Diversifying Strategies Fund – (continued)

At June 30, 2012, open futures contracts purchased were as follows:

| Financial Futures | Expiration Date |

Contracts | Notional Value |

Unrealized Appreciation (Depreciation) |

||||||||||||

| ASX SPI 200 | 9/20/2012 | 84 | $ | 8,719,909 | $ | (54,834 | ) | |||||||||

| CAC 40 | 7/20/2012 | 23 | 929,079 | 35,219 | ||||||||||||

| E-mini Dow | 9/21/2012 | 111 | 7,108,440 | 104,600 | ||||||||||||

| E-mini NASDAQ 100 | 9/21/2012 | 164 | 8,559,980 | 13,336 | ||||||||||||

| Euribor | 9/17/2012 | 1,089 | 342,792,270 | 130,837 | ||||||||||||

| Euro Schatz | 9/06/2012 | 1,494 | 208,908,013 | (533,351 | ) | |||||||||||

| EURO STOXX 50® | 9/21/2012 | 39 | 1,112,943 | 65,641 | ||||||||||||

| Eurodollar | 9/17/2012 | 1,036 | 257,756,800 | 126,437 | ||||||||||||

| FTSE JSE Top 40 | 9/20/2012 | 626 | 22,624,965 | (316,398 | ) | |||||||||||

| German Euro BOBL | 9/06/2012 | 334 | 53,210,774 | (600,264 | ) | |||||||||||

| German Euro Bund | 9/06/2012 | 659 | 117,505,524 | (2,246,894 | ) | |||||||||||

| Hang Seng | 7/30/2012 | 46 | 5,766,047 | 132,226 | ||||||||||||

| Mini-Russell 2000 | 9/21/2012 | 10 | 795,400 | 27,610 | ||||||||||||

| MSCI Taiwan | 7/30/2012 | 744 | 18,852,960 | 551,890 | ||||||||||||

| OMXS30 | 7/20/2012 | 296 | 4,402,056 | 53,311 | ||||||||||||

| S&P/TSX 60 | 9/20/2012 | 56 | 7,275,985 | 105,196 | ||||||||||||

| SGX CNX Nifty | 7/26/2012 | 186 | 1,969,554 | 112 | ||||||||||||

| Sterling | 9/19/2012 | 853 | 165,688,331 | 295,944 | ||||||||||||

| UK Long Gilt | 9/26/2012 | 91 | 16,975,527 | 29,287 | ||||||||||||

| 2 Year U.S. Treasury Note | 9/28/2012 | 1,520 | 334,685,000 | (142,500 | ) | |||||||||||

| 3 Year Australia Government Bond | 9/17/2012 | 377 | 42,595,432 | (171,422 | ) | |||||||||||

| 5 Year U.S. Treasury Note | 9/28/2012 | 664 | 82,315,250 | 160,813 | ||||||||||||

| 10 Year Japan Government Bond | 9/10/2012 | 25 | 44,939,639 | (61,425 | ) | |||||||||||

| 10 Year U.S. Treasury Note | 9/19/2012 | 643 | 85,760,125 | 196,625 | ||||||||||||

| 30 Year U.S. Treasury Bond | 9/19/2012 | 113 | 16,720,469 | 107,312 | ||||||||||||

|

|

|

|||||||||||||||

| Total | $ | (1,990,692 | ) | |||||||||||||

|

|

|

|||||||||||||||

| Commodity Futures2 | Expiration Date |

Contracts | Notional Value |

Unrealized Appreciation (Depreciation) |

||||||||||||

| Cocoa | 9/13/2012 | 1 | $ | 22,910 | $ | 1,130 | ||||||||||

| Corn | 12/14/2012 | 5 | 158,687 | 20,000 | ||||||||||||

| Gold | 8/29/2012 | 2 | 320,840 | 10,700 | ||||||||||||

| KC Wheat | 9/14/2012 | 1 | 37,800 | 38 | ||||||||||||

| Soybean | 11/14/2012 | 56 | 3,997,700 | 452,412 | ||||||||||||

| Soybean Meal | 12/14/2012 | 66 | 2,726,460 | 107,330 | ||||||||||||

| Soybean Oil | 12/14/2012 | 1 | 31,848 | 510 | ||||||||||||

| Wheat | 9/14/2012 | 4 | 151,450 | 1,000 | ||||||||||||

| Zinc | 9/19/2012 | 10 | 469,875 | (125 | ) | |||||||||||

|

|

|

|||||||||||||||

| Total | $ | 592,995 | ||||||||||||||

|

|

|

|||||||||||||||