|

Summary Prospectus May 1, 2012 |

| Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at ngam.natixis.com/funddocuments. You can also get this information at no cost by calling 800-225-5478 or by sending an e-mail request to NatixisFunds@ngam.natixis.com. The Fund’s Prospectus and Statement of Additional Information, each dated May 1, 2012 are incorporated by reference into this Summary Prospectus. |

| Shareholder Fees(fees paid directly from your investment) | Class A | Class B | Class C | Class Y |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.75% | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) | None | 5.00% | 1.00% | None |

| Redemption fees | None | None | None | None |

| Annual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment) | Class A | Class B | Class C | Class Y |

| Management fees | 0.70% | 0.70% | 0.70% | 0.70% |

| Distribution and/or service (12b-1) fees | 0.25% | 1.00% | 1.00% | 0.00% |

| Other expenses |

| Fee/expense recovery1 | 0.01% | 0.01% | 0.01% | 0.01% |

| Remainder of other expenses | 0.34% | 0.34% | 0.34% | 0.34% |

| Total other expenses | 0.35% | 0.35% | 0.35% | 0.35% |

| Total annual fund operating expenses | 1.30% | 2.05% | 2.05% | 1.05% |

| Fee waiver and/or expense reimbursement1 | 0.00% | 0.00% | 0.00% | 0.00% |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement | 1.30% | 2.05% | 2.05% | 1.05% |

| | |

| 1 | |

| If shares are redeemed: | ||||

| 1 year | 3 years | 5 years | 10 years | |

| Class A | $700 | $963 | $1,247 | $2,053 |

| Class B | $708 | $943 | $1,303 | $2,187 |

| Class C | $308 | $643 | $1,103 | $2,379 |

| Class Y | $107 | $334 | $579 | $1,283 |

| If shares are not redeemed: | ||||

| 1 year | 3 years | 5 years | 10 years | |

| Class B | $208 | $643 | $1,103 | $2,187 |

| Class C | $208 | $643 | $1,103 | $2,379 |

| 1 | The Fund’s investment adviser has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 1.30%, 2.05%, 2.05% and 1.05% of the Fund’s average daily net assets for Class A, Class B, Class C and Class Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through April 30, 2013 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Fund’s investment adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below 1.30%, 2.05%, 2.05% and 1.05% of the Fund’s average daily net assets for Class A, Class B, Class C and Class Y shares, respectively. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

| | |

| 2 | |

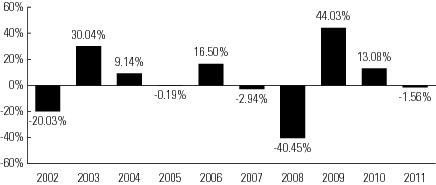

Equity Securities Risk: The value of the Fund’s investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds and preferred stock generally take precedence over the claims of those who own common stock. Focused Investment Risk: Because the Fund may invest in a small number of industries or securities, it may have more risk because the impact of a single economic, political or regulatory occurrence may have a greater adverse impact on the Fund’s net asset value. Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit and information risks. The Fund’s investments in foreign securities are subject to foreign currency fluctuations. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity. Management Risk: A strategy used by the Fund’s portfolio managers may fail to produce the intended result. Market Risk: The market value of a security will move up and down, sometimes rapidly and unpredictably, based upon a change in an issuer’s financial condition, as well as overall market and economic conditions. Risk/Return Bar Chart and Table The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual returns for the one-year, five-year and ten-year periods compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at ngam.natixis.com and/or by calling the Fund toll-free at 800-225-5478. The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund’s shares. A sales charge will reduce your return. Total Returns for Class A Shares

|

|

Highest Quarterly Return: Second Quarter 2009, 24.17% |

|

Lowest Quarterly Return: Fourth Quarter 2008, -27.03% |

| Average Annual Total Returns (for the periods ended December 31, 2011) |

Past 1 Year | Past 5 Years | Past 10 Years |

| Harris Associates Large Cap Value Fund Class A – Return Before Taxes |

-7.20% | -2.68% | 1.43% |

| Return After Taxes on Distributions | -7.28% | -2.78% | 1.37% |

| Return After Taxes on Distributions & Sale of Fund Shares | -4.56% | -2.27% | 1.22% |

| Class B – Return Before Taxes | -7.23% | -2.64% | 1.26% |

| Class C – Return Before Taxes | -3.25% | -2.25% | 1.26% |

| Class Y – Return Before Taxes | -1.40% | -1.20% | 2.40% |

| Russell 1000 Value Index | 0.39% | -2.64% | 3.89% |

| | |

| 3 | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.The Return After Taxes on Distributions & Sale of Fund Shares for the 1-year and 5-year periods exceeds the Return Before Taxes due to an assumed tax benefit from tax losses on a sale of Fund shares at the end of the measurement period. Management Investment Adviser NGAM Advisors, L.P. (“NGAM Advisors”) Subadviser Harris Associates L.P. Portfolio Managers Edward S. Loeb, CFA, Vice President and portfolio manager of Harris Associates, has served as co-manager of the Fund since 2002. Michael J. Mangan, CFA, portfolio manager of Harris Associates, has served as co-manager of the Fund since 2002. Diane L. Mustain, CFA, portfolio manager of Harris Associates, has served as co-manager of the Fund since 2005. Purchase and Sale of Fund Shares Class A and C Shares The following chart shows the investment minimums for various types of accounts:

| Type of Account | Minimum Initial Purchase |

Minimum Subsequent Purchase |

| Any account other than those listed below | $2,500 | $100 |

| For shareholders participating in Natixis Funds’ Investment Builder Program | $1,000 | $50 |

| For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) | $1,000 | $100 |

| Coverdell Education Savings Accounts | $500 | $100 |

- Other mutual funds, endowments, foundations, bank trust departments or trust companies.

- Wrap Fee Programs of certain broker-dealers, the advisers or NGAM Distribution, L.P. (the “Distributor”). Please consult your financial representative to determine if your wrap fee program is subject to additional or different conditions or fees.

- Retirement Plans such as 401(a), 401(k) or 457 plans.

- Certain Individual Retirement Accounts if the amounts invested represent rollover distributions from investments by any of the retirement plans invested in the Fund as set forth above.

- Registered Investment Advisers investing on behalf of clients in exchange for an advisory, management or consulting fee.

- Fund Trustees, former Fund trustees, employees of affiliates of the Natixis Funds and other

individuals who are affiliated with any Natixis Fund (this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those mentioned) and Natixis affiliate employee benefit plans.

| | |

| 4 | |

The Fund’s shares are available for purchase (and are redeemable on any business day) through your investment dealer, directly from the Fund by writing to the Fund at Natixis Funds, P.O. Box 219579, Kansas City, MO 64121-9579, by exchange, by wire, by internet at ngam.natixis.com, through the Automated Clearing House system, or, in the case of redemptions, by telephone at 800-225-5478 or by the Systematic Withdrawal Plan. Tax Information Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-exempt treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-exempt arrangement. Payments to Broker-Dealers and Other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

UHLC77-0512

| | |

| 5 | |

| Intentionally Left Blank |