| Label |

Element |

Value |

| INVESTMENT CO OF AMERICA® |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

INVESTMENT CO OF AMERICA®

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment objectives

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The fund’s investment objectives are to achieve long-term growth of capital and income.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses of the fund

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 26 of the prospectus and on page 61 of the fund’s statement of additional information.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the fiscal year ended December 31, 2015, the fund’s portfolio turnover rate was 30% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

30.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in American Funds.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 25,000

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same.

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

For the share classes listed to the right, you would pay the following if you did not redeem your shares:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal investment strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The fund invests primarily in common stocks, most of which have a history of paying dividends. The fund’s equity investments are limited to securities of companies that are included on its eligible list. Securities are added to, or deleted from, the eligible list based upon a number of factors, such as the fund’s investment objectives and policies, whether a company is deemed to be an established company of sufficient quality and a company’s dividend payment prospects. Although the fund focuses on investments in medium to larger capitalization companies, the fund’s investments are not limited to a particular capitalization size. In the selection of common stocks and other securities for investment, potential for capital appreciation and future dividends are given more weight than current yield.

The fund may invest up to 15% of its assets, at the time of purchase, in securities of issuers domiciled outside the United States.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is through fundamental analysis, which may include meeting with company executives and employees, suppliers, customers and competitors. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available for dividend payments at, the companies in which the fund invests.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Investment results

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Growth and Income Funds Index includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results.

|

|

| Performance Additional Market Index [Text] |

rr_PerformanceAdditionalMarketIndex |

The Lipper Growth and Income Funds Index includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

americanfunds.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past investment results (before and after taxes) are not predictive of future investment results.

|

|

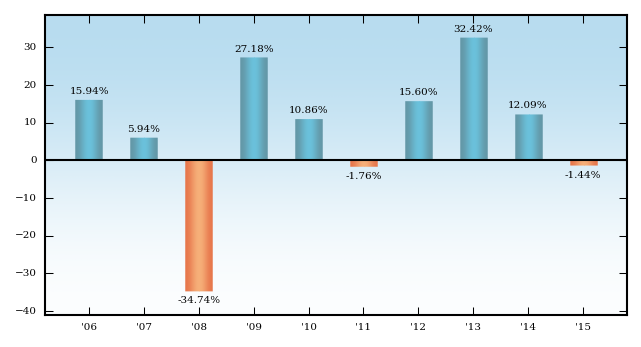

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar year total returns for Class A shares (Results do not include a sales charge; if a sales charge were included, results would be lower.)

|

|

| Bar Chart Narrative [Text Block] |

rr_BarChartNarrativeTextBlock |

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results.

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

(Results do not include a sales charge; if a sales charge were included, results would be lower.)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Highest/Lowest quarterly results during this period were:

Highest 15.30% (quarter ended June 30, 2009)

Lowest -18.97% (quarter ended December 31, 2008)

The fund's total return for the nine months ended September 30, 2016, was 11.17%.

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

total return for the nine months ended

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2016

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

11.17%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Highest

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

15.30%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Lowest

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(18.97%)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary.

|

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

|

|

| Caption |

rr_AverageAnnualReturnCaption |

Average annual total returns For the periods ended December 31, 2015 (with maximum sales charge):

|

|

| INVESTMENT CO OF AMERICA® | S&P 500 Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Label |

rr_AverageAnnualReturnLabel |

S&P 500 Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes)

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

1.38%

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

12.57%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

7.31%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

10.78%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jan. 01, 1934

|

|

| INVESTMENT CO OF AMERICA® | Lipper Growth and Income Funds Index (reflects no deductions for sales charges, account fees or U.S. federal income taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Label |

rr_AverageAnnualReturnLabel |

Lipper Growth and Income Funds Index (reflects no deductions for sales charges, account fees or U.S. federal income taxes)

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.61%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.00%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.50%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jan. 01, 1934

|

|

| INVESTMENT CO OF AMERICA® | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00%

|

[1] |

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.23%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.11%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.58%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

A contingent deferred sales charge of 1.00% applies on certain redemptions made within one year following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price and market value of shares being sold.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 631

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

750

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

880

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,259

|

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

15.94%

|

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

5.94%

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(34.74%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

27.18%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

10.86%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(1.76%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

15.60%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

32.42%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

12.09%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(1.44%)

|

|

| Label |

rr_AverageAnnualReturnLabel |

A Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(7.10%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.38%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.88%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

11.99%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jan. 01, 1934

|

|

| Thirty Day Yield Caption |

rr_ThirtyDayYieldCaption |

Class A annualized 30–day yield at June 30, 2016:

|

|

| Thirty Day Yield Phone |

rr_ThirtyDayYieldPhone |

(800) 325-3590

|

|

| Thirty Day Yield |

rr_ThirtyDayYield |

1.75%

|

|

| INVESTMENT CO OF AMERICA® | Class A | After Taxes on Distributions |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Label |

rr_AverageAnnualReturnLabel |

A After taxes on distributions

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(9.05%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

7.79%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

4.74%

|

|

| INVESTMENT CO OF AMERICA® | Class A | After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Label |

rr_AverageAnnualReturnLabel |

A After taxes on distributions and sale of fund shares

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(2.46%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

7.42%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

4.72%

|

|

| INVESTMENT CO OF AMERICA® | Class 529-A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00%

|

[1] |

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.22%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.69%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

A contingent deferred sales charge of 1.00% applies on certain redemptions made within one year following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price and market value of shares being sold.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 641

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

783

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

937

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,384

|

|

| Label |

rr_AverageAnnualReturnLabel |

529-A Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(7.22%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.27%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.78%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.07%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 15, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class B |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

5.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.10%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.34%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 636

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

825

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

934

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,404

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

136

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

425

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

734

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,404

|

|

| Label |

rr_AverageAnnualReturnLabel |

B Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(6.70%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.57%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.85%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

5.33%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 15, 2000

|

|

| INVESTMENT CO OF AMERICA® | Class 529-B |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

5.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.99%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.24%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.47%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 650

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

865

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,003

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,546

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

150

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

465

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

803

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,546

|

|

| Label |

rr_AverageAnnualReturnLabel |

529-B Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(6.82%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.43%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.73%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.01%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 15, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.39%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 242

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

440

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

761

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,669

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

142

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

440

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

761

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,669

|

|

| Label |

rr_AverageAnnualReturnLabel |

C Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(3.14%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.80%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.64%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

5.45%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 15, 2001

|

|

| INVESTMENT CO OF AMERICA® | Class 529-C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.99%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.46%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 249

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

462

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

797

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,746

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

149

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

462

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

797

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,746

|

|

| Label |

rr_AverageAnnualReturnLabel |

529-C Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(3.21%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.73%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.58%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

5.79%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Feb. 19, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class 529-E |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.93%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 95

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

296

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

515

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,143

|

|

| Label |

rr_AverageAnnualReturnLabel |

529-E Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.77%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.30%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.12%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.07%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 01, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class F-1 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.18%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.67%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 68

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

214

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

373

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 835

|

|

| Label |

rr_AverageAnnualReturnLabel |

F-1 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.53%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.61%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.45%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.01%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 15, 2001

|

|

| INVESTMENT CO OF AMERICA® | Class F-2 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.41%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 42

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

132

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

230

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 518

|

|

| Label |

rr_AverageAnnualReturnLabel |

F-2 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.26%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.92%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

8.03%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2008

|

|

| INVESTMENT CO OF AMERICA® | Class F-3 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.07%

|

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.31%

|

|

| Other Expenses, New Fund, Based on Estimates [Text] |

rr_OtherExpensesNewFundBasedOnEstimates |

Based on estimated amounts for the current fiscal year.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 32

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

100

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

174

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 393

|

|

| INVESTMENT CO OF AMERICA® | Class 529-F-1 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.47%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 48

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

151

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

263

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 591

|

|

| Label |

rr_AverageAnnualReturnLabel |

529-F-1 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.32%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.82%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.64%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

8.06%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Sep. 16, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-1 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.40%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 143

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

443

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

766

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,680

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-1 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(2.22%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.81%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.65%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.01%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jun. 06, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-2 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.42%

|

[3] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.41%

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Restated to reflect current fees.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 144

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

446

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

771

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,691

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-2 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(2.21%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

9.83%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.64%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

5.72%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 21, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-2E |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.60%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.30%

|

[3] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.14%

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Restated to reflect current fees.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 116

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

362

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

628

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,386

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-2E Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.83%)

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

(0.57%)

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 29, 2014

|

|

| INVESTMENT CO OF AMERICA® | Class R-3 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.21%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.95%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 97

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

303

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

525

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,166

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-3 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.79%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.29%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.13%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.40%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jun. 04, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-4 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.15%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.64%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 65

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

205

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

357

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 798

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-4 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.50%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.63%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.45%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.54%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 28, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-5 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.11%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.35%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 36

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

113

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

197

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 443

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-5 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.20%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

10.97%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.77%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

6.80%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 15, 2002

|

|

| INVESTMENT CO OF AMERICA® | Class R-5E |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.32%

|

[3] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.56%

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Restated to reflect current fees.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 57

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

179

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

313

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 701

|

|

| INVESTMENT CO OF AMERICA® | Class R-6 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption or exchange fees |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.24%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.06%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.30%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 31

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

97

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

169

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 381

|

|

| Label |

rr_AverageAnnualReturnLabel |

R-6 Before taxes

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(1.15%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

11.03%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

14.00%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

May 01, 2009

|

|

|

|