SEC File Nos. 002-10811

811-00116

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM N-1A

Registration Statement

Under

the Securities Act of 1933

Post-Effective Amendment No. 122

and

Registration Statement

Under

The Investment Company Act of 1940

Amendment No. 46

__________________

THE INVESTMENT COMPANY OF AMERICA

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071-1406

(Address of Principal Executive Offices)

Registrant's telephone number, including area code:

(213) 486-9200

__________________

Vincent P. Corti, Secretary

The Investment Company of America

333 South Hope Street

Los Angeles, California 90071-1406

(Name and Address of Agent for Service)

__________________

Copies to:

Eric A.S. Richards

O'Melveny & Myers LLP

400 South Hope Street

Los Angeles, California 90071-2899

(Counsel for the Registrant)

__________________

Approximate date of proposed public offering:

It is proposed that this filing become effective on March 1, 2012, pursuant to paragraph (b) of rule 485.

|

|

The Investment

Company of America®

|

Prospectus

March 1, 2012

|

Class Ticker

|

|||

|

A AIVSX

B AICBX

C AICCX

F-1 AICFX

F-2 ICAFX

529-A CICAX

529-B CICBX

529-C CICCX

529-E CICEX

529-F-1 CICFX

R-1 RICAX

R-2 RICBX

R-3 RICCX

R-4 RICEX

R-5 RICFX

R-6 RICGX

|

||||

|

Table of contents

|

||||

|

Investment objectives

Fees and expenses of the fund

Principal investment strategies

Principal risks

Investment results

Management

Purchase and sale of fund shares

Tax information

Payments to broker-dealers and other financial intermediaries

Investment objectives, strategies and risks

Management and organization

|

1

1

3

3

4

6

7

7

7

8

11

|

Shareholder information

Purchase, exchange and sale of shares

How to sell shares

Distributions and taxes

Choosing a share class

Sales charges

Sales charge reductions and waivers

Rollovers from retirement plans to IRAs

Plans of distribution

Other compensation to dealers

Fund expenses

Financial highlights

|

14

15

19

22

23

24

26

29

29

30

30

32

|

|

|

The U.S. Securities and Exchange Commission has not approved or disapproved of these securities. Further, it has not determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

|

||||

[This page was intentionally left blank for this filing.]

Investment objectives

The fund’s investment objectives are to achieve long-term growth of capital and income.

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 26 of the prospectus and on page 57 of the fund’s statement of additional information.

|

Shareholder fees

(fees paid directly from your investment)

|

|||||||

|

Share classes

|

|||||||

|

A and

529-A

|

B and

529-B

|

C and

529-C

|

529-E

|

F-1, F-2

and

529-F-1

|

All R

share

classes

|

||

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

5.75%

|

none

|

none

|

none

|

none

|

none

|

|

|

Maximum deferred sales charge (load) (as a percentage of the amount redeemed)

|

1.00*

|

5.00%

|

1.00%

|

none

|

none

|

none

|

|

|

Maximum sales charge (load) imposed on reinvested dividends

|

none

|

none

|

none

|

none

|

none

|

none

|

|

|

Redemption or exchange fees

|

none

|

none

|

none

|

none

|

none

|

none

|

|

|

Maximum annual account fee

(529 share classes only)

|

$10

|

$10

|

$10

|

$10

|

$10

|

N/A

|

|

|

Annual fund operating expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

||||||||

|

Share classes

|

||||||||

|

A

|

B

|

C

|

F-1

|

F-2

|

529-A

|

529-B

|

529-C

|

|

|

Management fees

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

|

Distribution and/or service (12b-1) fees

|

0.23

|

1.00

|

1.00

|

0.25

|

none

|

0.22

|

1.00

|

0.99

|

|

Other expenses

|

0.14

|

0.14

|

0.18

|

0.17

|

0.16

|

0.24

|

0.26

|

0.26

|

|

Total annual fund operating expenses

|

0.61

|

1.38

|

1.42

|

0.66

|

0.40

|

0.70

|

1.50

|

1.49

|

|

529-E

|

529-F-1

|

R-1

|

R-2

|

R-3

|

R-4

|

R-5

|

R-6

|

|

|

Management fees

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

0.24%

|

|

Distribution and/or service (12b-1) fees

|

0.50

|

0.00

|

1.00

|

0.75

|

0.50

|

0.25

|

none

|

none

|

|

Other expenses

|

0.23

|

0.25

|

0.17

|

0.42

|

0.23

|

0.16

|

0.11

|

0.06

|

|

Total annual fund operating expenses

|

0.97

|

0.49

|

1.41

|

1.41

|

0.97

|

0.65

|

0.35

|

0.30

|

|

*

|

A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million or more made without an initial sales charge.

|

Page 1

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Share classes

|

1 year

|

3 years

|

5 years

|

10 years

|

|

A

|

$634

|

$759

|

$ 896

|

$1,293

|

|

B

|

640

|

837

|

955

|

1,447

|

|

C

|

245

|

449

|

776

|

1,702

|

|

F-1

|

67

|

211

|

368

|

822

|

|

F-2

|

41

|

128

|

224

|

505

|

|

529-A

|

662

|

825

|

1,001

|

1,501

|

|

529-B

|

672

|

913

|

1,076

|

1,676

|

|

529-C

|

271

|

510

|

870

|

1,879

|

|

529-E

|

119

|

348

|

594

|

1,293

|

|

529-F-1

|

70

|

197

|

333

|

723

|

|

R-1

|

144

|

446

|

771

|

1,691

|

|

R-2

|

144

|

446

|

771

|

1,691

|

|

R-3

|

99

|

309

|

536

|

1,190

|

|

R-4

|

66

|

208

|

362

|

810

|

|

R-5

|

36

|

113

|

197

|

443

|

|

R-6

|

31

|

97

|

169

|

381

|

For the share classes listed below, you would pay the following if you did not redeem your shares:

|

Share classes

|

1 year

|

3 years

|

5 years

|

10 years

|

|

B

|

$140

|

$437

|

$755

|

$1,447

|

|

C

|

145

|

449

|

776

|

1,702

|

|

529-B

|

172

|

513

|

876

|

1,676

|

|

529-C

|

171

|

510

|

870

|

1,879

|

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 28% of the average value of its portfolio.

Page 2

Principal investment strategies

The fund invests primarily in common stocks, most of which have a history of paying dividends. The fund’s investments are limited to securities of companies that are included on its eligible list. In light of the fund’s investment objectives and policies, securities are added to, or deleted from, the eligible list by the fund’s board of trustees after reviewing and acting upon the recommendations of the fund’s investment adviser. The investment adviser bases its recommendations on a number of factors, such as the fund’s investment objectives and policies, whether a company is considered a leader in its industry and a company’s dividend payment prospects. Although the fund focuses on investments in medium to larger capitalization companies, the fund’s investments are not limited to a particular capitalization size. In the selection of common stocks and other securities for investment, potential for capital appreciation and future dividends are given more weight than current yield.

The fund may invest up to 15% of its assets, at the time of purchase, in securities of issuers domiciled outside the United States.

The investment adviser uses a system of multiple portfolio counselors in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual counselors who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is through fundamental analysis, which may include meeting with company executives and employees, suppliers, customers and competitors. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline due to market conditions and other factors, including those directly involving the issuers of securities held by the fund.

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests.

Investing in growth-oriented stocks — Growth-oriented stocks may involve larger price swings and greater potential for loss than other types of investments.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations outside the United States, may lose value because of political, social, economic or market developments or instability in the countries or regions in which the issuer operates. These securities may also lose value due to changes

Page 3

in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different settlement and accounting practices and different regulatory, legal and reporting standards, and may be more difficult to value, than those in the United States.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

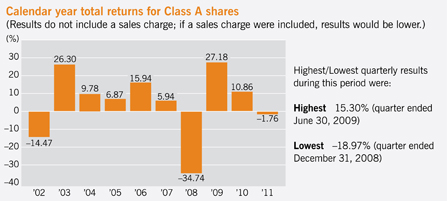

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Growth & Income Funds Index includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to the fund’s objective and/or strategies. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

Page 4

|

Average annual total returns

For the periods ended December 31, 2011 (with maximum sales charge):

|

|||||

|

Share class

|

Inception date

|

1 year

|

5 years

|

10 years

|

Lifetime

|

|

A − Before taxes

|

1/1/1934

|

–7.41%

|

–2.03%

|

2.87%

|

11.88%

|

|

− After taxes on distributions

|

–7.70

|

–2.53

|

2.19

|

N/A

|

|

|

− After taxes on distributions and sale of fund shares

|

–4.42

|

–1.73

|

2.36

|

N/A

|

|

|

Share classes (before taxes)

|

Inception date

|

1 year

|

5 years

|

10 years

|

Lifetime

|

|

B

|

3/15/2000

|

–7.34%

|

–1.97%

|

2.83%

|

2.54%

|

|

C

|

3/15/2001

|

–3.54

|

–1.67

|

2.62

|

2.46

|

|

F-1

|

3/15/2001

|

–1.84

|

–0.91

|

3.41

|

3.20

|

|

F-2

|

8/1/2008

|

–1.54

|

N/A

|

N/A

|

1.16

|

|

529-A

|

2/15/2002

|

–7.50

|

–2.11

|

N/A

|

3.05

|

|

529-B

|

2/15/2002

|

–7.44

|

–2.08

|

N/A

|

2.97

|

|

529-C

|

2/19/2002

|

–3.58

|

–1.72

|

N/A

|

2.98

|

|

529-E

|

3/1/2002

|

–2.15

|

–1.23

|

N/A

|

3.13

|

|

529-F-1

|

9/16/2002

|

–1.62

|

–0.74

|

N/A

|

5.53

|

|

R-1

|

6/6/2002

|

–2.55

|

–1.66

|

N/A

|

3.17

|

|

R-2

|

5/21/2002

|

–2.55

|

–1.70

|

N/A

|

2.77

|

|

R-3

|

6/4/2002

|

–2.11

|

–1.21

|

N/A

|

3.51

|

|

R-4

|

5/28/2002

|

–1.83

|

–0.91

|

N/A

|

3.58

|

|

R-5

|

5/15/2002

|

–1.50

|

–0.61

|

N/A

|

3.82

|

|

R-6

|

5/1/2009

|

–1.45

|

N/A

|

N/A

|

13.43

|

|

Indexes

|

1 year

|

5 years

|

10 years

|

Lifetime

(from Class A inception)

|

|

S&P 500 (reflects no deductions for sales charges, account fees, expenses or taxes)

|

2.09%

|

–0.25%

|

2.92%

|

10.55%

|

|

Lipper Growth & Income Funds Index (reflects no deductions for sales charges, account fees or taxes)

|

–1.82

|

–1.17

|

3.12

|

N/A

|

|

Class A annualized 30-day yield at December 31, 2011: 2.05%

(For current yield information, please call American FundsLine® at 800/325-3590.)

|

||||

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-deferred arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

Page 5

Management

Investment adviser Capital Research and Management Company

Portfolio counselors The individuals primarily responsible for the portfolio management of the fund are:

|

Portfolio counselor/

Fund title (if applicable)

|

Portfolio counselor

experience in this fund

|

Primary title

with investment adviser

|

|

James B. Lovelace

Vice Chairman of the Board

|

20 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Donald D. O’Neal

President and Trustee

|

20 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Joyce E. Gordon

Senior Vice President

|

11 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Christopher D. Buchbinder

Vice President

|

5 years

|

Senior Vice President –

Capital Research Global Investors

|

|

William L. Robbins

Vice President

|

5 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Eric S. Richter

|

4 years

|

Senior Vice President –

Capital Research Global Investors

|

|

C. Ross Sappenfield

|

12 years

|

Senior Vice President –

Capital Research Global Investors

|

Page 6

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50. For a payroll deduction retirement plan account, payroll deduction savings plan account or employer-sponsored 529 account, the minimum is $25 to establish, or add to, an account.

If you are a retail investor, you may sell (redeem) shares through your dealer or financial adviser or by writing to American Funds Service Company at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at 800/421-4225; faxing American Funds Service Company at 888/421-4351; or accessing our website at americanfunds.com. Please contact your plan administrator or recordkeeper in order to sell (redeem) shares from your retirement plan.

Tax information

Dividends and capital gain distributions you receive from the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-exempt or tax-deferred.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial adviser to recommend the fund over another investment. Ask your individual financial adviser or visit your financial intermediary’s website for more information.

Page 7

Investment objectives, strategies and risks

The fund’s investment objectives are to achieve long-term growth of capital and income. The fund strives to accomplish these objectives through extensive U.S. and global research, careful selection and broad diversification. The fund invests primarily in common stocks, most of which have a history of paying dividends. The fund’s investments are limited to securities of companies that are included on its eligible list. In light of the fund’s investment objectives and policies, securities are added to, or deleted from, the eligible list by the fund’s board of trustees after reviewing and acting upon the recommendations of the fund’s investment adviser. The investment adviser bases its recommendations on a number of factors, such as the fund’s investment objectives and policies, whether a company is considered a leader in its industry and a company’s dividend payment prospects. Although the fund focuses on investments in medium to larger capitalization companies, the fund’s investments are not limited to a particular capitalization size. In the selection of common stocks and other securities for investment, potential for capital appreciation and future dividends are given more weight than current yield.

Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

The prices of, and the income generated by, the common stocks and other securities held by the fund may decline in response to certain events taking place around the world, including those directly involving the issuers whose securities are owned by the fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency, interest rate and commodity price fluctuations.

The fund also invests in income-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds). Income provided by the fund may be reduced by changes in the dividend policies of the companies in which the fund invests and the capital resources available for dividend payments at such companies.

The growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) purchased by the fund may involve larger price swings and greater potential for loss than other types of investments.

The fund may invest up to 15% of its assets, at the time of purchase, in securities of issuers domiciled outside the United States. The prices of securities of issuers domiciled outside the United States or with significant operations outside the United States may decline due to conditions specific to the countries or regions in which the issuer is domiciled or operates, including political, social, economic or market changes or instability in such countries or regions. The securities of issuers domiciled in certain countries outside the United States may be more volatile, less liquid and/or more difficult to value than those of U.S. issuers. Issuers in countries outside the United States may also be subject to different tax and accounting policies and different auditing, reporting, legal and regulatory standards. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Issuers in countries outside the United States may also be subject to different government and legal systems that make it difficult for the fund to exercise its rights as a shareholder of the company. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. These investments may also be

Page 8

affected by changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries.

The fund may also invest in bonds and other debt securities. The prices of, and the income generated by, most bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities. For example, the prices of debt securities in the fund’s portfolio generally will decline when interest rates rise and increase when interest rates fall.

In addition, falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have higher rates of interest and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities.

The fund may also hold cash or money market instruments, including commercial paper and short-term securities issued by the U.S. government, its agencies and instrumentalities. The percentage of the fund invested in such holdings varies and depends on various factors, including market conditions and purchases and redemptions of fund shares. For temporary defensive purposes, the fund may invest without limitation in such instruments. The investment adviser may determine that it is appropriate to take such action in response to certain circumstances, such as periods of market turmoil. A larger percentage of such holdings could moderate the fund’s investment results in a period of rising market prices. A larger percentage of cash or money market instruments could reduce the magnitude of the fund’s loss in a period of falling market prices and provide liquidity to make additional investments or to meet redemptions.

The fund’s investment results will depend on the ability of the fund’s investment adviser to navigate the risks discussed above.

In addition to the investment strategies described above, the fund has other investment practices that are described in the statement of additional information, along with a description of certain of the risks associated with those practices.

Page 9

Fund comparative indexes The investment results table in this prospectus shows how the fund’s average annual total returns compare with various broad measures of market results. The Standard & Poor’s 500 Composite Index is a market capitalization weighted index based on the average weighted results of 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or taxes. The Lipper Growth & Income Funds Index is an equally weighted index of funds that combine a growth-of-earnings orientation and an income requirement for level and/or rising dividends. The results of the underlying funds in the index include the reinvestment of dividends and capital gain distributions, as well as brokerage commissions paid by the funds for portfolio transactions and other fund expenses, but do not reflect the effect of sales charges, account fees or taxes. This index was not in existence as of the date the fund became available; therefore, lifetime results are not shown.

Fund results All fund results in this prospectus reflect the reinvestment of dividends and capital gain distributions, if any. Unless otherwise noted, fund results reflect any fee waivers and/or expense reimbursements in effect during the periods presented.

Page 10

Management and organization

Investment adviser Capital Research and Management Company, an experienced investment management organization founded in 1931, serves as the investment adviser to the fund and other funds, including the American Funds. Capital Research and Management Company is a wholly owned subsidiary of The Capital Group Companies, Inc. and is located at 333 South Hope Street, Los Angeles, California 90071, and 6455 Irvine Center Drive, Irvine, California 92618. Capital Research and Management Company manages the investment portfolio and business affairs of the fund. The total management fee paid by the fund, as a percentage of average net assets, for the previous fiscal year appears in the Annual Fund Operating Expenses table under “Fees and expenses of the fund.” Please see the statement of additional information for further details. A discussion regarding the basis for approval of the fund’s Investment Advisory and Service Agreement by the fund’s board of trustees is contained in the fund’s semi-annual report to shareholders for the fiscal period ended June 30, 2011.

Capital Research and Management Company manages equity assets through two investment divisions, Capital World Investors and Capital Research Global Investors, and manages fixed-income assets through its Fixed Income division. Capital World Investors and Capital Research Global Investors make investment decisions on an independent basis.

Rather than remain as investment divisions, Capital World Investors and Capital Research Global Investors may be incorporated into wholly owned subsidiaries of Capital Research and Management Company. In that event, Capital Research and Management Company would continue to be the investment adviser, and day-to-day investment management of equity assets would continue to be carried out through one or both of these subsidiaries. Although not currently contemplated, Capital Research and Management Company could incorporate its Fixed Income division in the future and engage it to provide day-to-day investment management of fixed-income assets. Capital Research and Management Company and each of the funds it advises have applied to the U.S. Securities and Exchange Commission for an exemptive order that would give Capital Research and Management Company the authority to use, upon approval of the fund’s board, its management subsidiaries and affiliates to provide day-to-day investment management services to the fund, including making changes to the management subsidiaries and affiliates providing such services. The fund’s shareholders approved this arrangement at a meeting of the fund’s shareholders on November 24, 2009. There is no assurance that Capital Research and Management Company will incorporate its investment divisions or exercise any authority, if granted, under an exemptive order.

Portfolio holdings Portfolio holdings information for the fund is available on the American Funds website at americanfunds.com. A description of the fund’s policies and procedures regarding disclosure of information about its portfolio holdings is available in the statement of additional information.

Page 11

Multiple Portfolio Counselor System® Capital Research and Management Company uses a system of multiple portfolio counselors in managing mutual fund assets. Under this approach, the portfolio of a fund is divided into segments managed by individual counselors who decide how their respective segments will be invested. In addition, Capital Research and Management Company’s investment analysts may make investment decisions with respect to a portion of a fund’s portfolio. Investment decisions are subject to a fund’s objective(s), policies and restrictions and the oversight of the appropriate investment-related committees of Capital Research and Management Company and its investment divisions. The table below shows the investment experience and role in management of the fund for each of the fund’s primary portfolio counselors.

|

Portfolio counselor

|

Investment

experience

|

Experience

in this fund

|

Role in

management

of the fund

|

|

James B. Lovelace

|

Investment professional for 30 years, all with Capital Research and Management Company or affiliate

|

20 years

(plus 3 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

|

Donald D. O’Neal

|

Investment professional for 27 years, all with Capital Research and Management Company or affiliate

|

20 years

(plus 4 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

|

Joyce E. Gordon

|

Investment professional for 32 years, all with Capital Research and Management Company or affiliate

|

11 years

(plus 12 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

|

Christopher D. Buchbinder

|

Investment professional for 16 years, all with Capital Research and Management Company or affiliate

|

5 years

(plus 8 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

Page 12

|

Portfolio counselor

|

Investment

experience

|

Experience

in this fund

|

Role in

management

of the fund

|

|

William L. Robbins

|

Investment professional for 20 years in total;

18 years with Capital Research and Management Company or affiliate

|

5 years

(plus 8 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

|

Eric S. Richter

|

Investment professional for 20 years in total; 13 years with Capital Research and Management Company or affiliate

|

4 years

|

Serves as an equity portfolio counselor

|

|

C. Ross Sappenfield

|

Investment professional for 20 years, all with Capital Research and Management Company or affiliate

|

12 years

(plus 6 years of

prior experience

as an

investment analyst

for the fund)

|

Serves as an equity portfolio counselor

|

Information regarding the portfolio counselors’ compensation, their ownership of securities in the fund and other accounts they manage is in the statement of additional information.

Page 13

Certain privileges and/or services described on the following pages of this prospectus and in the statement of additional information may not be available to you, depending on your investment dealer or retirement plan recordkeeper. Please see your financial adviser, investment dealer or retirement plan recordkeeper for more information.

Shareholder information

Shareholder services American Funds Service Company®, the fund’s transfer agent, offers a wide range of services that you can use to alter your investment program should your needs or circumstances change. These services may be terminated or modified at any time upon 60 days’ written notice.

A more detailed description of policies and services is included in the fund’s statement of additional information and the owner’s guide sent to new American Funds shareholders entitled Welcome. Class 529 shareholders should also refer to the applicable program description for information on policies and services specifically relating to their account(s). These documents are available by writing to or calling American Funds Service Company.

Page 14

Unless otherwise noted, references to Class A, B, C or F-1 shares on the following pages also refer to the corresponding Class 529-A, 529-B, 529-C or 529-F-1 shares. References to Class F shares refer to both Class F-1 and F-2 shares and references to Class R shares refer to Class R-1, R-2, R-3, R-4, R-5 and R-6 shares.

Purchase, exchange and sale of shares

The fund’s transfer agent, on behalf of the fund and American Funds Distributors,® the fund’s distributor, is required by law to obtain certain personal information from you or any other person(s) acting on your behalf in order to verify your or such person’s identity. If you do not provide the information, the transfer agent may not be able to open your account. If the transfer agent is unable to verify your identity or that of any other person(s) authorized to act on your behalf, or believes it has identified potentially criminal activity, the fund and American Funds Distributors reserve the right to close your account or take such other action they deem reasonable or required by law.

When purchasing shares, you should designate the fund or funds in which you wish to invest. Subject to the exception below, if no fund is designated, your money will be held uninvested (without liability to the transfer agent for loss of income or appreciation pending receipt of proper instructions) until investment instructions are received, but for no more than three business days. Your investment will be made at the net asset value (plus any applicable sales charge in the case of Class A shares) next determined after investment instructions are received and accepted by the transfer agent. If investment instructions are not received, your money will be invested in Class A shares of American Funds Money Market Fund® on the third business day after receipt of your investment.

If the amount of your cash investment is $5,000 or less, no fund is designated, and you made a cash investment (excluding exchanges) within the last 16 months, your money will be invested in the same proportion and in the same fund or funds in which your last cash investment was made.

Different procedures may apply to certain group accounts.

Valuing shares The net asset value of each share class of the fund is the value of a single share of that class. The fund calculates the net asset value each day the New York Stock Exchange is open for trading as of approximately 4 p.m. New York time, the normal close of regular trading. The fund may also calculate its share price on days the New York Stock Exchange is closed when deemed prudent to do so by the fund’s officers. Assets are valued primarily on the basis of market quotations. However, the fund has adopted procedures for making “fair value” determinations if market quotations are not readily available or are not considered reliable. For example, if events occur between the close of markets outside the United States and the close of regular trading on the New York Stock Exchange that, in the opinion of the investment adviser, materially affect the value of any of the fund’s securities that principally trade in those international markets, those securities will be valued in accordance with fair value procedures. Use of these procedures is intended to result in more appropriate net asset values. In addition, such use is intended to reduce potential arbitrage opportunities otherwise available to short-term investors.

Because the fund may hold securities that are primarily listed on foreign exchanges that trade on weekends or days when the fund does not price its shares, the values of securities held in the fund may change on days when you will not be able to purchase or redeem fund shares.

Page 15

Your shares will be purchased at the net asset value (plus any applicable sales charge in the case of Class A shares) or sold at the net asset value next determined after American Funds Service Company receives your request, provided that your request contains all information and legal documentation necessary to process the transaction. A contingent deferred sales charge may apply at the time you sell certain Class A, B and C shares.

Purchase of Class A and C shares You may generally open an account and purchase Class A and C shares by contacting any financial adviser (who may impose transaction charges in addition to those described in this prospectus) authorized to sell the fund’s shares. You may purchase additional shares in various ways, including through your financial adviser and by mail, telephone, the Internet and bank wire.

Class B shares Class B and 529-B shares may not be purchased or acquired, except by exchange from Class B or 529-B shares of another fund in the American Funds family. Any other investment received by the fund that is intended for Class B or 529-B shares will instead be invested in Class A or 529-A shares and will be subject to any applicable sales charges.

Shareholders with investments in Class B and 529-B shares may continue to hold such shares until they convert to Class A or 529-A shares. However, no additional investments will be accepted in Class B or 529-B shares. Dividends and capital gain distributions may continue to be reinvested in Class B or 529-B shares until their conversion dates. In addition, shareholders invested in Class B or 529-B shares will be able to exchange those shares for Class B or 529-B shares of other American Funds offering Class B or 529-B shares until they convert.

Automatic conversion of Class B and C shares Class B shares automatically convert to Class A shares in the month of the eight-year anniversary of the original Class B share purchase date. Class C shares automatically convert to Class F-1 shares in the month of the 10-year anniversary of the purchase date; however, Class 529-C shares will not convert to Class 529-F-1 shares. The Internal Revenue Service currently takes the position that these automatic conversions are not taxable. Should its position change, the automatic conversion feature may be suspended. If this happens, you would have the option of converting your Class B, 529-B or C shares to the respective share classes at the anniversary dates described above. This exchange would be based on the relative net asset values of the two classes in question, without the imposition of a sales charge or fee, but you might face certain tax consequences as a result.

Purchase of Class F shares You may generally open an account and purchase Class F shares only through fee-based programs of investment dealers that have special agreements with the fund’s distributor, through certain registered investment advisers and through other intermediaries approved by the fund’s distributor. These intermediaries typically charge ongoing fees for services they provide. Intermediary fees are not paid by the fund and normally range from .75% to 1.50% of assets annually, depending on the services offered.

Purchase of Class 529 shares Class 529 shares may be purchased only through an account established with a 529 college savings plan managed by the American Funds organization. You may open this type of account and purchase Class 529 shares by contacting any financial adviser (who may impose transaction charges in addition to those described in this prospectus) authorized to sell such an account. You may purchase

Page 16

additional shares in various ways, including through your financial adviser and by mail, telephone, the Internet and bank wire.

Class 529-E shares may be purchased only by employees participating through an eligible employer plan.

Accounts holding Class 529 shares are subject to a $10 account setup fee and an annual $10 account maintenance fee.

Investors residing in any state may purchase Class 529 shares through an account established with a 529 college savings plan managed by the American Funds organization. Class 529-A, 529-B, 529-C and 529-F-1 shares are structured similarly to the corresponding Class A, B, C and F-1 shares. For example, the same initial sales charges apply to Class 529-A shares as to Class A shares.

Purchase of Class R shares Class R shares are generally available only to 401(k) plans, 457 plans, 403(b) plans, profit-sharing and money purchase pension plans, defined benefit plans and nonqualified deferred compensation plans. Class R shares also are generally available only to retirement plans where plan level or omnibus accounts are held on the books of the fund. Class R-5 and R-6 shares are generally available only to fee-based programs or through retirement plan intermediaries. In addition, Class R-6 shares are available for investment by American Funds Target Date Retirement Series,® and Class R-5 and R-6 shares are available to other registered investment companies approved by the fund’s investment adviser. Class R shares generally are not available to retail nonretirement accounts, traditional and Roth individual retirement accounts (IRAs), Coverdell Education Savings Accounts, SEPs, SARSEPs, SIMPLE IRAs and 529 college savings plans.

Purchases by employer-sponsored retirement plans Eligible retirement plans generally may open an account and purchase Class A or R shares by contacting any investment dealer (who may impose transaction charges in addition to those described in this prospectus) authorized to sell these classes of the fund’s shares. Some or all R share classes may not be available through certain investment dealers. Additional shares may be purchased through a plan’s administrator or recordkeeper.

Class A shares are generally not available for retirement plans using the PlanPremier® or Recordkeeper Direct® recordkeeping programs.

Employer-sponsored retirement plans that are eligible to purchase Class R shares may instead purchase Class A shares and pay the applicable Class A sales charge, provided that their recordkeepers can properly apply a sales charge on plan investments. These plans are not eligible to make initial purchases of $1 million or more in Class A shares and thereby invest in Class A shares without a sales charge, nor are they eligible to establish a statement of intention that qualifies them to purchase Class A shares without a sales charge. More information about statements of intention can be found under “Sales charge reductions and waivers” in this prospectus. Plans investing in Class A shares with a sales charge may purchase additional Class A shares in accordance with the sales charge table in this prospectus.

Employer-sponsored retirement plans that invested in Class A shares without any sales charge before April 1, 2004, and that continue to meet the eligibility requirements in effect as of that date for purchasing Class A shares at net asset value, may continue to purchase Class A shares without any initial or contingent deferred sales charge.

Page 17

A 403(b) plan may not invest in Class A or C shares, unless it was invested in Class A or C shares before January 1, 2009.

Purchase minimums and maximums Purchase minimums described in this prospectus may be waived in certain cases. In addition, the fund reserves the right to redeem the shares of any shareholder for their then current net asset value per share if the shareholder’s aggregate investment in the fund falls below the fund’s minimum initial investment amount. See the statement of additional information for details.

For accounts established with an automatic investment plan, the initial purchase minimum of $250 may be waived if the purchases (including purchases through exchanges from another fund) made under the plan are sufficient to reach $250 within five months of account establishment.

The effective purchase maximums for Class 529-A, 529-C, 529-E and 529-F-1 shares will reflect the maximum applicable contribution limits under state law. See the applicable program description for more information.

The purchase maximum for Class C shares is $500,000 per transaction. In addition, if you have significant American Funds holdings, you may not be eligible to invest in Class C or 529-C shares. Specifically, you may not purchase Class C or 529-C shares if you are eligible to purchase Class A or 529-A shares at the $1 million or more sales charge discount rate (that is, at net asset value). See “Sales charge reductions and waivers” in this prospectus and the statement of additional information for more details regarding sales charge discounts.

Exchange Generally, you may exchange your shares into shares of the same class of other American Funds without a sales charge. Class A, C or F-1 shares may generally be exchanged into the corresponding 529 share class without a sales charge. Class B shares may not be exchanged into Class 529-B shares. Exchanges from Class A, C or F-1 shares to the corresponding 529 share class, particularly in the case of Uniform Gifts to Minors Act or Uniform Transfers to Minors Act custodial accounts, may result in significant legal and tax consequences, as described in the applicable program description. Please consult your financial adviser before making such an exchange.

Exchanges of shares from American Funds Money Market Fund initially purchased without a sales charge generally will be subject to the appropriate sales charge. For purposes of computing the contingent deferred sales charge on Class B and C shares, the length of time you have owned your shares will be measured from the date of original purchase and will not be affected by any permitted exchange.

Exchanges have the same tax consequences as ordinary sales and purchases. For example, to the extent you exchange shares held in a taxable account that are worth more now than what you paid for them, the gain will be subject to taxation.

See “Transactions by telephone, fax or the Internet” in this prospectus for information regarding electronic exchanges.

Please see the statement of additional information for details and limitations on moving investments in certain share classes to different share classes and on moving investments held in certain accounts to different accounts.

Page 18

How to sell shares

You may sell (redeem) shares in any of the following ways:

Employer-sponsored retirement plans

Shares held in eligible retirement plans may be sold through the plan’s administrator or recordkeeper.

Through your dealer or financial adviser (certain charges may apply)

• Shares held for you in your dealer’s name must be sold through the dealer.

|

|

• Generally, Class F shares must be sold through intermediaries such as dealers or financial advisers.

|

Writing to American Funds Service Company

• Requests must be signed by the registered shareholder(s).

• A signature guarantee is required if the redemption is:

— more than $75,000;

— made payable to someone other than the registered shareholder(s); or

|

|

— sent to an address other than the address of record or to an address of record that has been changed within the last 10 days.

|

|

|

• American Funds Service Company reserves the right to require signature guarantee(s) on any redemption.

|

|

|

• Additional documentation may be required for redemptions of shares held in corporate, partnership or fiduciary accounts.

|

Telephoning or faxing American Funds Service Company or using the Internet

|

·

|

Redemptions by telephone, fax or the Internet (including American FundsLine and americanfunds.com) are limited to $75,000 per American Funds shareholder each day.

|

|

·

|

Checks must be made payable to the registered shareholder.

|

|

·

|

Checks must be mailed to an address of record that has been used with the account for at least 10 days.

|

If you recently purchased shares and subsequently request a redemption of those shares, you will receive proceeds from the redemption once a sufficient period of time has passed to reasonably ensure that checks or drafts (including certified or cashier’s checks) for the shares purchased have cleared (normally 10 business days).

Although payment of redemptions normally will be in cash, the fund’s declaration of trust permits payment of the redemption price wholly or partly with portfolio securities or other fund assets under conditions and circumstances determined by the fund’s board of trustees.

Page 19

Transactions by telephone, fax or the Internet Generally, you are automatically eligible to redeem or exchange shares by telephone, fax or the Internet, unless you notify us in writing that you do not want any or all of these services. You may reinstate these services at any time.

Unless you decide not to have telephone, fax or Internet services on your account(s), you agree to hold the fund, American Funds Service Company, any of its affiliates or mutual funds managed by such affiliates, and each of their respective directors, trustees, officers, employees and agents harmless from any losses, expenses, costs or liabilities (including attorney fees) that may be incurred in connection with the exercise of these privileges, provided that American Funds Service Company employs reasonable procedures to confirm that the instructions received from any person with appropriate account information are genuine. If reasonable procedures are not employed, American Funds Service Company and/or the fund may be liable for losses due to unauthorized or fraudulent instructions.

Frequent trading of fund shares The fund and American Funds Distributors reserve the right to reject any purchase order for any reason. The fund is not designed to serve as a vehicle for frequent trading. Frequent trading of fund shares may lead to increased costs to the fund and less efficient management of the fund’s portfolio, potentially resulting in dilution of the value of the shares held by long-term shareholders. Accordingly, purchases, including those that are part of exchange activity that the fund or American Funds Distributors has determined could involve actual or potential harm to the fund, may be rejected.

The fund, through its transfer agent, American Funds Service Company, maintains surveillance procedures that are designed to detect frequent trading in fund shares. Under these procedures, various analytics are used to evaluate factors that may be indicative of frequent trading. For example, transactions in fund shares that exceed certain monetary thresholds may be scrutinized. American Funds Service Company also may review transactions that occur close in time to other transactions in the same account or in multiple accounts under common ownership or influence. Trading activity that is identified through these procedures or as a result of any other information available to the fund will be evaluated to determine whether such activity might constitute frequent trading. These procedures may be modified from time to time as appropriate to improve the detection of frequent trading, to facilitate monitoring for frequent trading in particular retirement plans or other accounts, and to comply with applicable laws.

In addition to the fund’s broad ability to restrict potentially harmful trading as described above, the fund’s board of trustees has adopted a “purchase blocking policy” under which any shareholder redeeming shares having a value of $5,000 or more from a fund will be precluded from investing in that fund for 30 calendar days after the redemption transaction. This policy also applies to redemptions and purchases that are part of exchange transactions. Under the fund’s purchase blocking policy, certain purchases will not be prevented and certain redemptions will not trigger a purchase block, such as purchases and redemptions of shares having a value of less than $5,000; transactions in Class 529 shares; purchases and redemptions resulting from reallocations by American Funds Target Date Retirement Series; retirement plan contributions, loans and distributions (including hardship withdrawals) identified as such on the retirement plan recordkeeper’s system; purchase transactions involving transfers of assets, rollovers, Roth IRA conversions and IRA recharacterizations, where the entity maintaining the

Page 20

shareholder account is able to identify the transaction as one of these types of transactions; and systematic redemptions and purchases, where the entity maintaining the shareholder account is able to identify the transaction as a systematic redemption or purchase. Generally, purchases and redemptions will not be considered “systematic” unless the transaction is pre-scheduled for a specific date.

The fund reserves the right to waive the purchase blocking policy with respect to specific shareholder accounts in those instances where American Funds Service Company determines that its surveillance procedures are adequate to detect frequent trading in fund shares.

American Funds Service Company will work with certain intermediaries (such as investment dealers holding shareholder accounts in street name, retirement plan recordkeepers, insurance company separate accounts and bank trust companies) to apply their own procedures, provided that American Funds Service Company believes the intermediary’s procedures are reasonably designed to enforce the frequent trading policies of the fund. You should refer to disclosures provided by the intermediaries with which you have an account to determine the specific trading restrictions that apply to you.

If American Funds Service Company identifies any activity that may constitute frequent trading, it reserves the right to contact the intermediary and request that the intermediary either provide information regarding an account owner’s transactions or restrict the account owner’s trading. If American Funds Service Company is not satisfied that the intermediary has taken appropriate action, American Funds Service Company may terminate the intermediary’s ability to transact in fund shares.

There is no guarantee that all instances of frequent trading in fund shares will be prevented.

Notwithstanding the fund’s surveillance procedures and purchase blocking policy, all transactions in fund shares remain subject to the right of the fund and American Funds Distributors to restrict potentially abusive trading generally (including the types of transactions described above that will not be prevented or trigger a block under the purchase blocking policy). See the statement of additional information for more information about how American Funds Service Company may address other potentially abusive trading activity in the American Funds.

Page 21

Distributions and taxes

Dividends and distributions The fund intends to distribute dividends to you, usually in March, June, September and December.

Capital gains, if any, are usually distributed in December. When a dividend or capital gain is distributed, the net asset value per share is reduced by the amount of the payment.

You may elect to reinvest dividends and/or capital gain distributions to purchase additional shares of this fund or other American Funds, or you may elect to receive them in cash. Dividends and capital gain distributions for 529 share classes and retirement plan shareholders will be reinvested automatically.

Taxes on dividends and distributions For federal tax purposes, dividends and distributions of short-term capital gains are taxable as ordinary income. Some or all of your dividends may be eligible for a reduced tax rate if you meet a holding period requirement. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains. Any dividends or capital gain distributions you receive from the fund will normally be taxable to you when made, regardless of whether you reinvest dividends or capital gain distributions or receive them in cash.

Dividends and capital gain distributions that are automatically reinvested in a tax-favored retirement or education savings account do not result in federal or state income tax at the time of reinvestment.

Taxes on transactions Your redemptions, including exchanges, may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment is the difference between the cost of your shares, including any sales charges, and the amount you receive when you sell them.

Exchanges within a tax-favored retirement plan account will not result in a capital gain or loss for federal or state income tax purposes. With limited exceptions, distributions from a retirement plan account are taxable as ordinary income.

Shareholder fees Fees borne directly by the fund normally have the effect of reducing a shareholder’s taxable income on distributions. By contrast, fees paid directly to advisers by a fund shareholder for ongoing advice are deductible for income tax purposes only to the extent that they (combined with certain other qualifying expenses) exceed 2% of such shareholder’s adjusted gross income.

Please see your tax adviser for more information. Holders of Class 529 shares should refer to the applicable program description for more information regarding the tax consequences of selling Class 529 shares.

Page 22

Choosing a share class

The fund offers different classes of shares through this prospectus. The services or share classes available to you may vary depending upon how you wish to purchase shares of the fund.

Each share class represents an investment in the same portfolio of securities, but each class has its own sales charge and expense structure, allowing you to choose the class that best fits your situation. When you purchase shares of the fund for an individual-type account, you should choose a share class. If none is chosen, your investment will be made in Class A shares or, in the case of a 529 plan investment, Class 529-A shares.

Factors you should consider when choosing a class of shares include:

|

·

|

how long you expect to own the shares;

|

|

·

|

how much you intend to invest;

|

|

·

|

total expenses associated with owning shares of each class;

|

|

·

|

whether you qualify for any reduction or waiver of sales charges (for example, Class A or 529-A shares may be a less expensive option over time, particularly if you qualify for a sales charge reduction or waiver);

|

|

·

|

whether you plan to take any distributions in the near future (for example, the contingent deferred sales charge will not be waived if you sell your Class 529-B or 529-C shares to cover higher education expenses); and

|

|

·

|

availability of share classes:

|

|

—

|

Class B and 529-B shares may not be purchased or acquired except by exchange from Class B or 529-B shares of another fund in the American Funds family;

|

|

—

|

Class C shares are not available to retirement plans that do not currently invest in such shares and that are eligible to invest in Class R shares, including employer-sponsored retirement plans such as defined benefit plans, 401(k) plans, 457 plans, 403(b) plans, and money purchase pension and profit-sharing plans;

|

|

—

|

Class F and 529-F-1 shares are generally available only to fee-based programs of investment dealers that have special agreements with the fund’s distributor, to certain registered investment advisers and to other intermediaries approved by the fund’s distributor; and

|

|

—

|

Class R shares are generally available only to 401(k) plans, 457 plans, 403(b) plans, profit-sharing and money purchase pension plans, defined benefit plans and nonqualified deferred compensation plans.

|

Each investor’s financial considerations are different. You should speak with your financial adviser to help you decide which share class is best for you.

Page 23

Sales charges

Class A shares The initial sales charge you pay each time you buy Class A shares differs depending upon the amount you invest and may be reduced or eliminated for larger purchases as indicated below. The “offering price,” the price you pay to buy shares, includes any applicable sales charge, which will be deducted directly from your investment. Shares acquired through reinvestment of dividends or capital gain distributions are not subject to an initial sales charge.

|

Sales charge as a percentage of:

|

|||

|

Investment

|

Offering price

|

Net amount

invested

|

Dealer commission

as a percentage

of offering price

|

|

Less than $25,000

|

5.75%

|

6.10%

|

5.00%

|

|

$25,000 but less than $50,000

|

5.00

|

5.26

|

4.25

|

|

$50,000 but less than $100,000

|

4.50

|

4.71

|

3.75

|

|

$100,000 but less than $250,000

|

3.50

|

3.63

|

2.75

|

|

$250,000 but less than $500,000

|

2.50

|

2.56

|

2.00

|

|

$500,000 but less than $750,000

|

2.00

|

2.04

|

1.60

|

|

$750,000 but less than $1 million

|

1.50

|

1.52

|

1.20

|

|

$1 million or more and certain other investments described below

|

none

|

none

|

see below

|

The sales charge, expressed as a percentage of the offering price or the net amount invested, may be higher or lower than the percentages described in the table above due to rounding. This is because the dollar amount of the sales charge is determined by subtracting the net asset value of the shares purchased from the offering price, which is calculated to two decimal places using standard rounding criteria. The impact of rounding will vary with the size of the investment and the net asset value of the shares. Similarly, any contingent deferred sales charge paid by you on investments in Class A shares may be higher or lower than the 1% charge described below due to rounding.

Except as provided below, investments in Class A shares of $1 million or more may be subject to a 1% contingent deferred sales charge if the shares are sold within one year of purchase. The contingent deferred sales charge is based on the original purchase cost or the current market value of the shares being sold, whichever is less.

Class A share purchases not subject to sales charges The following investments are not subject to any initial or contingent deferred sales charge if American Funds Service Company is properly notified of the nature of the investment:

|

·

|

investments in Class A shares made by endowments or foundations with $50 million or more in assets;

|

|

·

|

investments made by accounts that are part of certain qualified fee-based programs and that purchased Class A shares before the discontinuation of the relevant investment dealer’s load-waived Class A share program with the American Funds; and

|

|

·

|

certain rollover investments from retirement plans to IRAs (see “Rollovers from retirement plans to IRAs” in this prospectus for more information).

|

The distributor may pay dealers a commission of up to 1% on investments made in Class A shares with no initial sales charge. The fund may reimburse the distributor for these payments through its plans of distribution (see “Plans of distribution” in this prospectus).

Page 24

Transfers from certain 529 plans to plans managed by the American Funds organization will be made with no sales charge. No commission will be paid to the dealer on such a transfer. Please see the statement of additional information for more information.

Certain other investors may qualify to purchase shares without a sales charge, such as employees of investment dealers and registered investment advisers authorized to sell American Funds and employees of The Capital Group Companies, Inc. and its affiliates. Please see the statement of additional information for further details.

Class B and C shares For Class B shares, a contingent deferred sales charge may be applied to shares you sell within six years of purchase, as shown in the table below. The contingent deferred sales charge is eliminated six years after purchase.

|

Contingent deferred sales charge on Class B shares

|

|||||||

|

Year of redemption:

|

1

|

2

|

3

|

4

|

5

|

6

|

7+

|

|

Contingent deferred sales charge:

|

5%

|

4%

|

4%

|

3%

|

2%

|

1%

|

0%

|

Class C shares are sold without any initial sales charge. American Funds Distributors pays 1% of the amount invested to dealers who sell Class C shares. A contingent deferred sales charge of 1% applies if Class C shares are sold within one year of purchase. The contingent deferred sales charge is eliminated one year after purchase.

Any contingent deferred sales charge paid by you on sales of Class B or C shares, expressed as a percentage of the applicable redemption amount, may be higher or lower than the percentages described above due to rounding.

Class 529-E and Class F shares Class 529-E and Class F shares are sold without any initial or contingent deferred sales charge.

Class R shares Class R shares are sold without any initial or contingent deferred sales charge. The distributor will pay dealers annually asset-based compensation of up to 1.00% for sales of Class R-1 shares, up to .75% for Class R-2 shares, up to .50% for Class R-3 shares and up to .25% for Class R-4 shares. No dealer compensation is paid from fund assets on sales of Class R-5 or R-6 shares. The fund may reimburse the distributor for these payments through its plans of distribution.

See “Plans of distribution” in this prospectus for ongoing compensation paid to your dealer or financial adviser for all share classes.

Contingent deferred sales charges Shares acquired through reinvestment of dividends or capital gain distributions are not subject to a contingent deferred sales charge. In addition, the contingent deferred sales charge may be waived in certain circumstances. See “Contingent deferred sales charge waivers” in this prospectus. The contingent deferred sales charge is based on the original purchase cost or the current market value of the shares being sold, whichever is less. For purposes of determining the contingent deferred sales charge, if you sell only some of your shares, shares that are not subject to any contingent deferred sales charge will be sold first, followed by shares that you have owned the longest.

Page 25

Sales charge reductions and waivers

To receive a reduction in your Class A initial sales charge, you must let your financial adviser or American Funds Service Company know at the time you purchase shares that you qualify for such a reduction. If you do not let your adviser or American Funds Service Company know that you are eligible for a reduction, you may not receive a sales charge discount to which you are otherwise entitled. In order to determine your eligibility to receive a sales charge discount, it may be necessary for you to provide your adviser or American Funds Service Company with information and records (including account statements) of all relevant accounts invested in the American Funds.

In addition to the information in this prospectus, you may obtain more information about share classes, sales charges and sales charge reductions and waivers through a link on the home page of the American Funds website at americanfunds.com, from the statement of additional information or from your financial adviser.

Reducing your Class A initial sales charge Consistent with the policies described in this prospectus, you and your “immediate family” (your spouse — or equivalent if recognized under local law — and your children under the age of 21) may combine all of your American Funds investments to reduce Class A sales charges. In addition, two or more retirement plans of an employer or an employer’s affiliates may combine all of their American Funds investments to reduce Class A sales charges. Certain investments in the American Funds Target Date Retirement Series may also be combined for this purpose. Please see the American Funds Target Date Retirement Series prospectus for further information. However, for this purpose, investments representing direct purchases of American Funds Money Market Fund are excluded. Following are different ways that you may qualify for a reduced Class A sales charge:

Aggregating accounts To receive a reduced Class A sales charge, investments made by you and your immediate family (see above) may be aggregated if made for your own account(s) and/or certain other accounts, such as:

|

·

|

trust accounts established by the above individuals (please see the statement of additional information for details regarding aggregation of trust accounts where the person(s) who established the trust is/are deceased);

|

|

·

|

solely controlled business accounts; and

|

|

·

|

single-participant retirement plans.

|

Investments made through employer-sponsored retirement plan accounts will not be aggregated with individual-type accounts.

Concurrent purchases You may combine simultaneous purchases (including, upon your request, purchases for gifts) of any class of shares of two or more American Funds (excluding American Funds Money Market Fund) to qualify for a reduced Class A sales charge.

Rights of accumulation You may take into account your accumulated holdings in all share classes of the American Funds (excluding American Funds Money Market Fund) to determine the initial sales charge you pay on each purchase of Class A shares. Subject to your investment dealer’s capabilities, your accumulated holdings will be calculated as the higher of (a) the current value of your existing holdings (as of the day prior to your additional American Funds investment) or (b) the amount you invested (including reinvested dividends and capital gains, but excluding capital appreciation) less any withdrawals. Please see the statement of additional information for further

Page 26

details. You should retain any records necessary to substantiate the historical amounts you have invested.

If you make a gift of shares, upon your request you may purchase the shares at the sales charge discount allowed under rights of accumulation of all of your American Funds accounts.