On February 9, 2023, The Interpublic Group of Companies, Inc. held a conference call to discuss its fourth-quarter and full-year 2022 results. CALL PARTICIPANTS IPG PARTICIPANTS Philippe Krakowsky Chief Executive Officer Ellen Johnson Executive Vice President, Chief Financial Officer Jerry Leshne Senior Vice President, Investor Relations ANALYST PARTICIPANTS David Karnovsky J.P.Morgan Lina Ghayor BNP Paribas Exane Steven Cahall Wells Fargo Michael Nathanson MoffettNathanson Tim Nollen Macquarie Jason B. Bazinet Citi

2 COMPANY PRESENTATION AND REMARKS Operator: Good morning, and welcome to the Interpublic Group fourth-quarter and full-year 2022 conference call. . . . I would now like to introduce Mr. Jerry Leshne, Senior Vice President of Investor Relations. Sir, you may begin. Jerry Leshne, Senior Vice President, Investor Relations: Good morning. Thank you for joining us. This morning, we are joined by our CEO, Philippe Krakowsky, and by Ellen Johnson, our CFO. We have posted our earnings release and our slide presentation on our website, interpublic.com. We will begin our call with prepared remarks to be followed by Q&A. We plan to conclude before market open at 9:30 Eastern time. During this call we will refer to certain non-GAAP measures. We believe that these measures provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. We will also refer to forward-looking statements about our Company. These are subject to the uncertainties and the cautionary statement that is included in our earnings release and the slide presentation, and further detailed in our 10-Q and other filings with the SEC. At this point, it is my pleasure to turn things over to Philippe Krakowsky. Philippe Krakowsky, Chief Executive Officer Thank you, Jerry, and thank you for joining us this morning. As usual, I'll start with a high-level view of our performance in the quarter and the full year, and our outlook on the year ahead. Ellen will then provide additional detail. And I'll conclude with updates on key developments at our agencies, to be followed by Q&A. We’re pleased to share another year of strong performance. Before turning to the numbers, I would like to once again thank our more than 58,000 colleagues around the world. Their dedication to our clients and to one another are exceptional. Along with their expertise spanning creative marketing services, technology and data management, that’s what continues to be at the heart of our performance. Turning to our results, for the full year, organic growth was 7%, and adjusted EBITA margin was 16.6%. Both are at the levels we shared with you in our last update in October. It’s worth noting that, a year ago at this time, we had looked ahead to full- year 5% organic growth, on top of very challenging multi-year comps, and performance

3 throughout the year drove consistent increases to that 7%. We grew in every world region and broadly across client sectors. Our three-year organic growth stack therefore stands at 14%, a level of performance that speaks to the strength and relevance of our offerings, particularly in services and sectors demanding precision and accountability. In our fourth quarter, organic net revenue growth was 3.8%, which brings three-year growth performance to 9.7%. That means that, as expected, growth slowed in the fourth quarter, consistent with global macroeconomic and geopolitical crosswinds which we are all aware of. Notwithstanding slowdowns across the global economy, and, with that, a broadly more cautious marketing and media environment, our growth continued in every world region during the fourth quarter. Overall U.S. organic growth was 2.4%, despite dilution from certain units in the portfolio, on top of a very strong 12.1% a year ago. Organic growth in our international markets was 6.1%, on top of 11.0% a year ago. By sector, growth in the fourth quarter was led by our clients in the auto & transportation sector, followed by the retail, our “other” sector of industrials and government, and healthcare. Going the other way, tech & telco, which for us is our second-largest client sector, began to show the impact of what I guess we could refer to as sector-specific issues, which we are forecasting will continue to present headwinds for us for at least the first half of 2023. Also in Q4, we felt the last of the late 2021 loss of a large food & beverage client, which will finish running off at the end of Q1 this year. Each of our operating segments grew organically in the quarter. In Media, Data & Engagement Solutions, organic growth was 5.0%, led by double-digit growth at IPG Mediabrands. Decreases at our digital specialists, which we have called out previously, weighed significantly on segment and group-wide growth in the quarter and the year. Our Integrated Advertising & Creativity Led Solutions segment grew 2.6%, paced again by IPG Health, which posted high-single-digit growth performance. Our segment of Specialized Communications & Experiential Solutions grew 3.5% organically, with leadership from the full range of our experiential and sports marketing offerings. Turning to profitability and expenses in the quarter, our teams continued their outstanding execution, effectively navigating today’s complicated economic environment. This, in turn, led to the strong fourth-quarter margin performance we are reporting today. We’ve been able to deliver this result while continuing to invest in our offerings and to take significant real estate actions in the quarter that will further our structural operating efficiencies going forward. Fourth-quarter net income was $297.2 million as reported. Our adjusted EBITA was $568.4 million, which is before a non-cash charge in the quarter for those real estate actions. Adjusted EBITA margin in the quarter was 22.3%. And that brings full-year adjusted EBITA to $1.57 billion and margin on net revenue to 16.6%. I think it’s worth reflecting on the fact that, at that margin level, we’ve successfully consolidated 260 basis points of margin improvement over the last three years, along with that very strong three-year growth stack that I mentioned earlier.

4 Fourth-quarter diluted earnings per share was $0.76 as reported, and was $1.02 as adjusted for the real estate restructuring charge, intangibles amortization, and the disposition of small, non-strategic businesses. In sum, our fourth quarter completes a year of strong financial performance across the key performance metrics of growth, adjusted EBITA, and earnings per share. During the quarter, we also closed the acquisition of RafterOne, a leading ecommerce implementation partner, which brings additional scale and capability to our offerings in an area of growth and strategic importance. Over the course of 2022, we also returned capital to shareholders in the amount of $777 million, between dividends and share repurchases. Given the continuing strength of our operating results and confidence in our strategic trajectory, our Board has once again raised IPG’s quarterly dividend, by 7%, to $0.31 per share. This marks our eleventh consecutive year of higher dividends, which, as you know, continued uninterrupted through the pandemic. Our Board also authorized an additional $350 million share repurchase program, on top of the $80 million remaining in our previous authorization. Turning the discussion to 2023, and our outlook for the year, there remains a meaningful degree of macroeconomic uncertainty. Visibility therefore is somewhat challenged. I think it’s fair to say that clients are approaching 2023 with equal parts conviction in the need to be in the market, as well as an increased level of conservatism. That’s not to say that they are any less focused on the need to drive for growth into the new year, or to invest in the transformation of their businesses. It’s just that we are seeing budgeting decision made with more deliberation. And it’s also fair to say that there’s significant variability within our client portfolio from client to client. We’re confident that the strongest growth areas of our business, such as consultative media services, healthcare marketing, experiential marketing, commerce, as well as data management and data sales, will continue to perform strongly despite the broader economic situation. We’re also confident in our operational rigor and flexible cost model. Our actions in the fourth quarter, to further reduce our occupied real estate footprint by nearly 7%, demonstrates our consistent and ongoing focus on identifying and acting on opportunities to re-think our business model and improve efficiency. Bringing all of those moving parts together, we expect organic net revenue growth for 2023 of 2% to 4%, on top of those industry-leading multi-year comparators, and further expansion of our operating EBITA margin to 16.7% for the full year. Our priorities for the year remain consistent. First, to build on IPG’s strategic differentiation. Which for us means a focus on the people, talent and capabilities that enable us to solve a broader set of business problems and which further our evolution to a higher-value solutions provider. As well as strong execution when it comes to integrating our agencies’ expertise through Open Architecture solutions. Second, to combine those client-focused offerings with operational excellence, which is always important, but never more so than in an uncertain economic climate. Delivering on these goals, and on our new financial targets, as well as on our long-standing

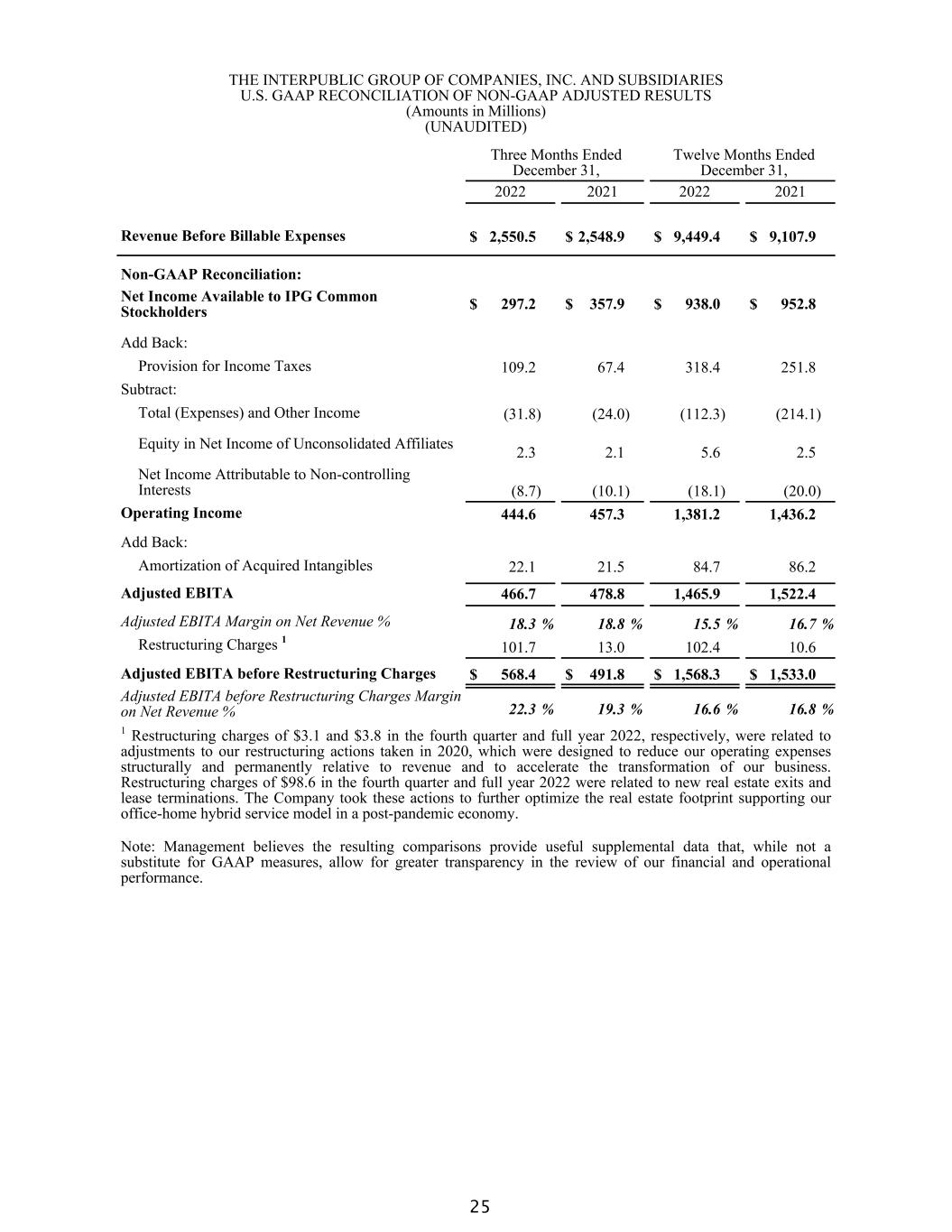

5 commitment to return of capital should lead to another year of value creation for all of our stakeholders. At this point, I’m going to hand things over to Ellen for a more in-depth view on our results. Ellen Johnson, Executive Vice President, Chief Financial Officer: Thank you. I hope that everyone is well. I would like to join Philippe and thank our people for their terrific accomplishments. As a reminder, my remarks will track to the presentation slides that accompany our webcast. Beginning on slide 2 of the presentation, fourth-quarter net revenue was essentially flat from a year ago, with organic growth of 3.8%. That brings organic growth for the year to 7.0%, and our three-year growth to 14.0%. Adjusted EBITA in the quarter, before a net restructuring charge, was $568.4 million, and margin on net revenue was 22.3%. Our restructuring charges in the quarter result from having identified further opportunities to optimize our real estate portfolio. We reduced our occupied real estate footprint by approximately 500,000 square feet, or 6.7%. The net charge in the quarter was $101.7 million, which we expect will result in $20 million of permanent expense savings, which will be realized as we move forward. There was no severance involved in these most recent actions. You will recall that, in 2020, we reduced our leased footprint by 1.7 million square feet, and this additional action builds on the recognition that, in the wake of the pandemic, our operating model has changed with respect to office space. While we will still continue to optimize our square footage in the normal course of our business, we do not anticipate additional restructuring charges. Our diluted earnings per share in the quarter was $0.76 as reported and $1.02 as adjusted to exclude the restructuring charge, the amortization of acquired intangibles, and a small non-operating loss from business dispositions. Our adjusted diluted EPS was $2.75 for the full year. We concluded the year in a strong financial position, with $2.5 billion of cash on the balance sheet, and with 1.6x gross financial debt-to-EBITDA, as defined in our credit facility. We repurchased 3.2 million shares in the fourth quarter, bringing our full-year repurchases to 10.3 million shares, returning $320 million to our shareholders in 2022. Our Board increased our quarterly dividend to $0.31, and authorized another $350 million repurchase program, in addition to the $80 million remaining on our prior authorization.

6 Turning to slide 3, you'll see our P&L for the quarter. I'll cover revenue and operating expenses in detail in the slides that follow. Turning to the fourth-quarter and full-year revenue on slide 4: • Our net revenue in the quarter was $2.55 billion, an increase of $1.6 million from a year ago. • Compared to Q4-21, the impact of the change in exchange rates was negative 3.9%. • Net acquisitions added 20 basis points. • Our organic net revenue increase was 3.8%, which, on the right-hand side of this slide, brings us to 7.0% for the full year. Further down this slide, we break out segment net revenue performance. Our Media, Data & Engagement Solutions segment grew 5.0% organically, on top of 11.9% in the fourth quarter of 2021. As you can see on this slide, the segment is comprised of IPG Mediabrands, Acxiom, Kinesso, and our digital specialist agencies. IPG Mediabrands grew at double-digit rates. As first noted on our third quarter call, R/GA and Huge are in the process of transitioning their business models and had soft performance which weighed significantly on the overall segment growth. That’s something we will not lap until the back half of this year. At the right-hand side of this slide, organic growth was 6.4% for the full year. Organic growth at our Integrated Advertising & Creativity Led Solutions segment was 2.6%, which was on top of 10.3% a year ago. As a reminder, the segment is comprised of IPG Health, McCann, MullenLowe, FCB, and our domestic integrated agencies. Our growth in the quarter was led by a strong increase at IPG Health, which grew in the high-single digits. For the year, the segment grew 7.1% organically. At our Specialized Communications & Experiential Solutions segment, organic growth was 3.5%, which compounds 15.2% in last year’s fourth quarter. The segment is comprised of Weber Shandwick, Golin, Jack Morton, Momentum, Octagon, and DXTRA Health. We were led by a high-single-digit increase in our experiential solutions. For the year, the SC&E segment increased 8.5% organically. Moving to slide 5, our revenue growth by region in the quarter: • The U.S., which was 63% of our fourth quarter net revenue, grew 2.4% organically, on top of 12.1% in last year’s fourth quarter. o We had notably strong growth at IPG Mediabrands, IPG Health, MRM. and Jack Morton in experiential. o Decreases at our digital specialist, R/GA and Huge, weighed on our U.S. growth rate by 160 basis points in the quarter. • International markets were 37% of our net revenue in the quarter, and increased 6.1% organically. You’ll recall that the same markets increased 11.0% a year ago. o In the U.K., organic growth in the quarter was 9.4%, led by notably strong performance in media, experiential and at MullenLowe.

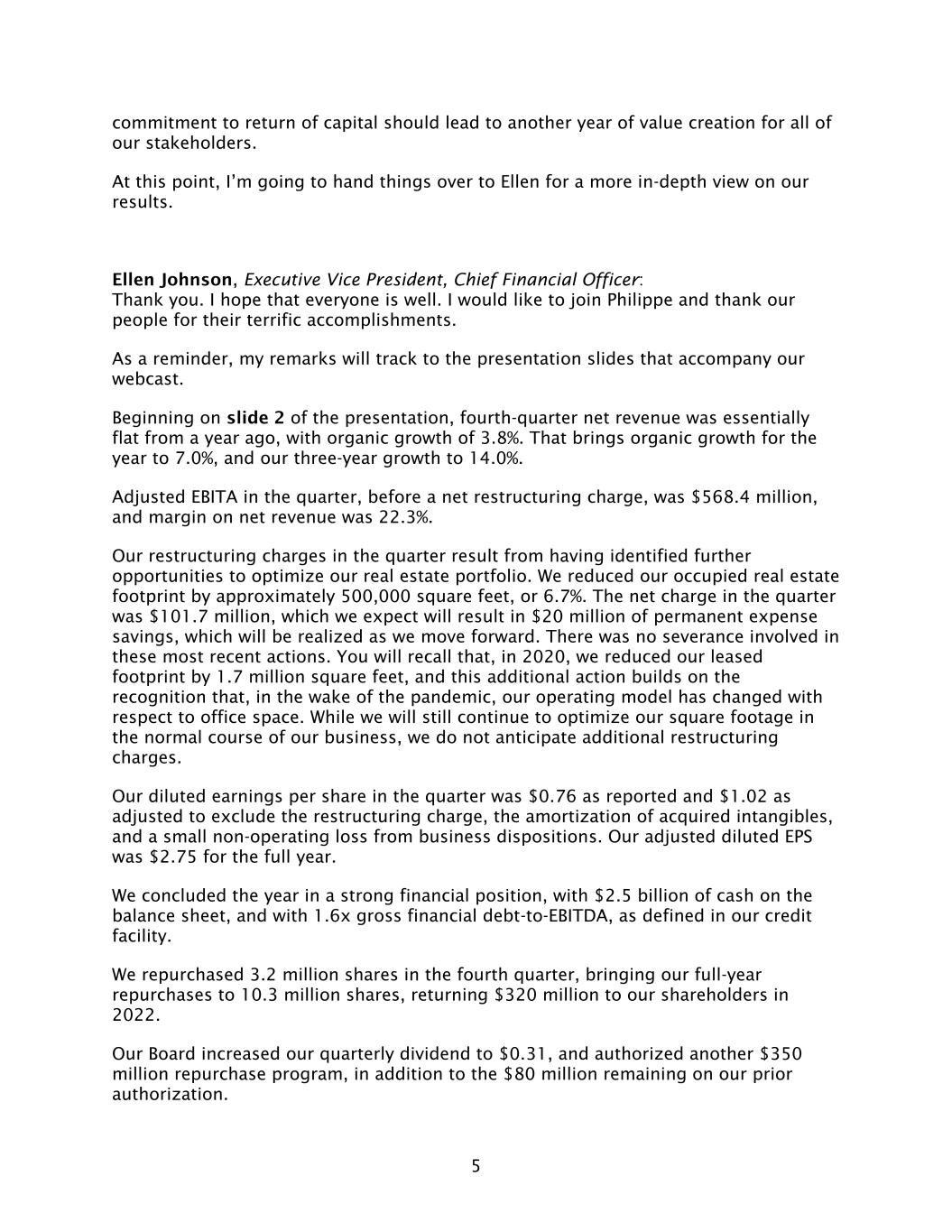

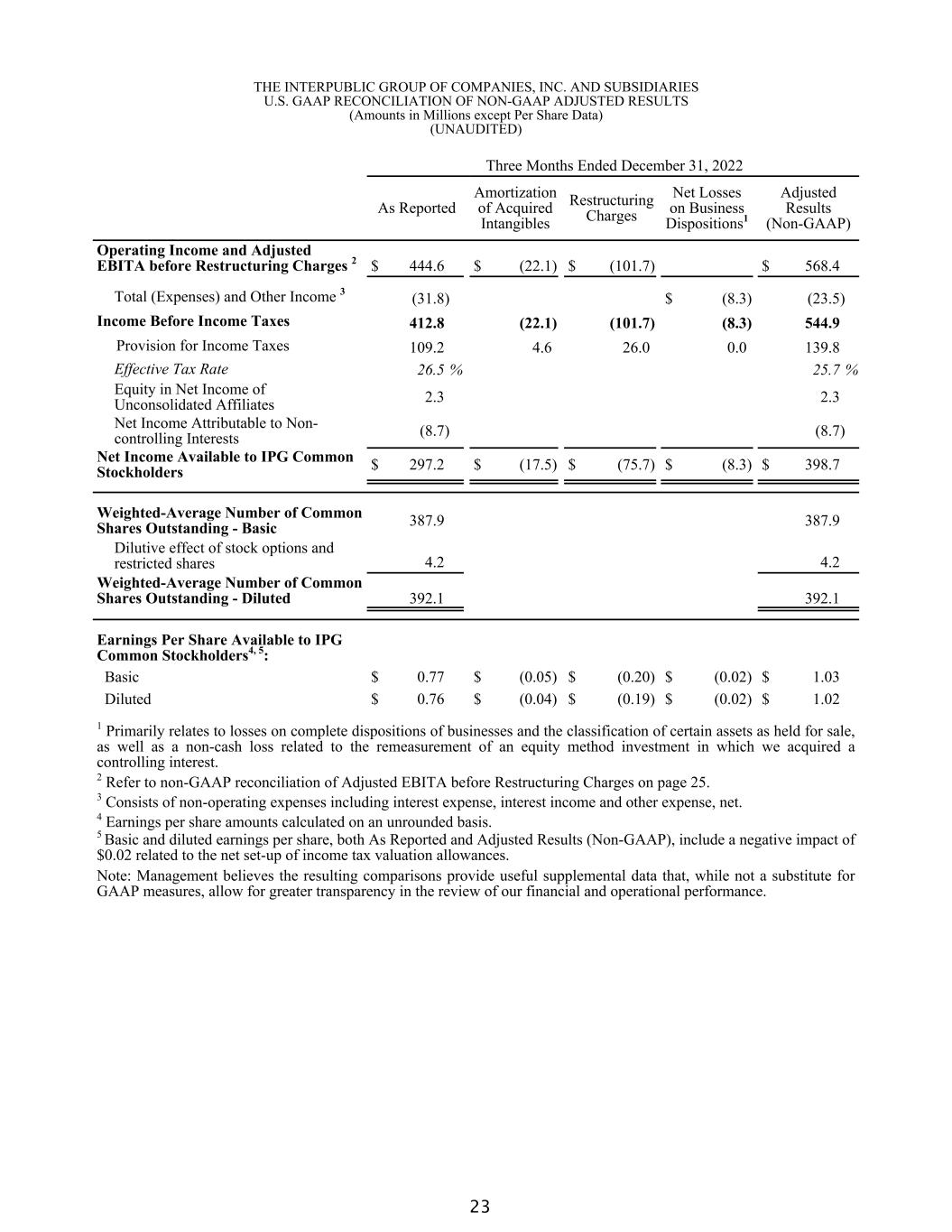

7 o Continental Europe grew 5.7% organically. We were led by very strong growth in Spain, while Germany and France were relatively flat year over year. o In AsiaPac, organic growth was 3.0% in the quarter, with strong results in Australia, Japan, and China, while India decreased. o In LatAm, we grew 5.8% organically, on top of 22.5% a year ago. o Our Other International Markets group, which consists of Canada, the Middle East and Africa, grew 6.9% organically, on top of 18.7% a year ago, which reflects notably strong growth in the Middle East, followed by Canada. Moving on to slide 6 and operating expenses in the quarter, our fully adjusted EBITA margin in the quarter was 22.3%, compared to 19.3% in 2021, an increase of 300 basis points. As you can see on this slide, we had operating leverage on each of our major cost lines: • Our ratio of salaries & related expenses as a percentage of net revenue was 61.0%, compared with 62.2% in last year’s fourth quarter. o Underneath that ratio, we de-levered on our expense for base pay, benefits & tax as headcount increased to support revenue growth. We ended the quarter with headcount of 58,400, an increase of 5% from a year ago. o Our expenses for temporary labor, performance-based incentive compensation, and severance were all notably lower than a year ago. • Our office & other direct expenses decreased as a percent of net revenue by 160 basis points to 13.5%. o That reflects leverage due to lower occupancy expenses. o We also reduced “all other” office & other direct expense compared to last year as a percent of net revenue, which reflects lower client services costs, consulting and employment-related expenses. • Our SG&A expense was 1.2% of net revenue, a decrease of 10 basis points. Turning to slide 7, we present detail on adjustments to our reported fourth-quarter results, in order to give you better transparency and a picture of comparable performance. This begins on the left-hand side with our reported results and steps through to adjusted EBITA excluding restructuring and our adjusted diluted EPS. • Our expense for the amortization of acquired intangibles, in the second column, was $22.1 million. • The real estate restructuring charges were $101.7 million, and the related tax benefit was $26.0 million. • Below operating expenses, our losses on the disposition of small, non-strategic businesses was $8.3 million, which is shown in column four.

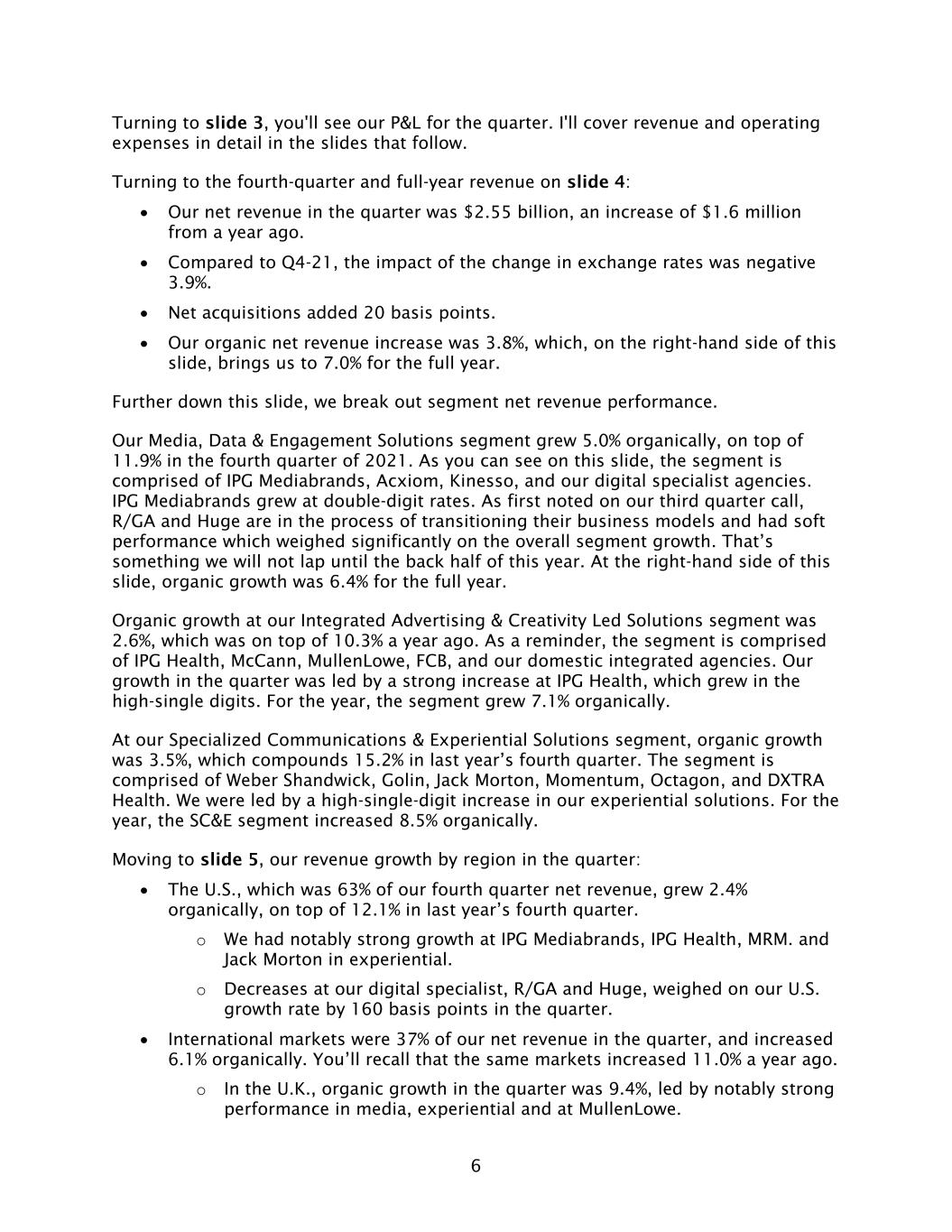

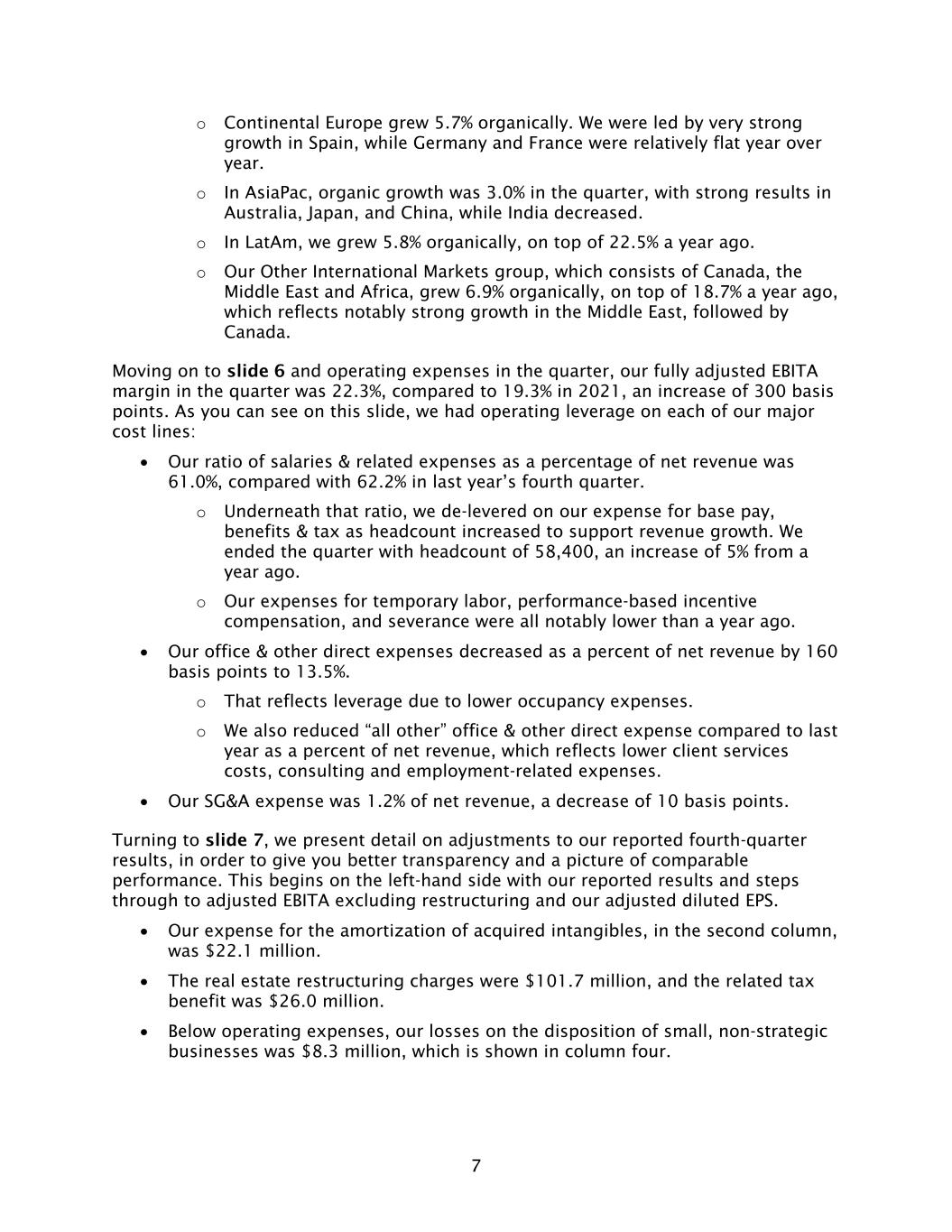

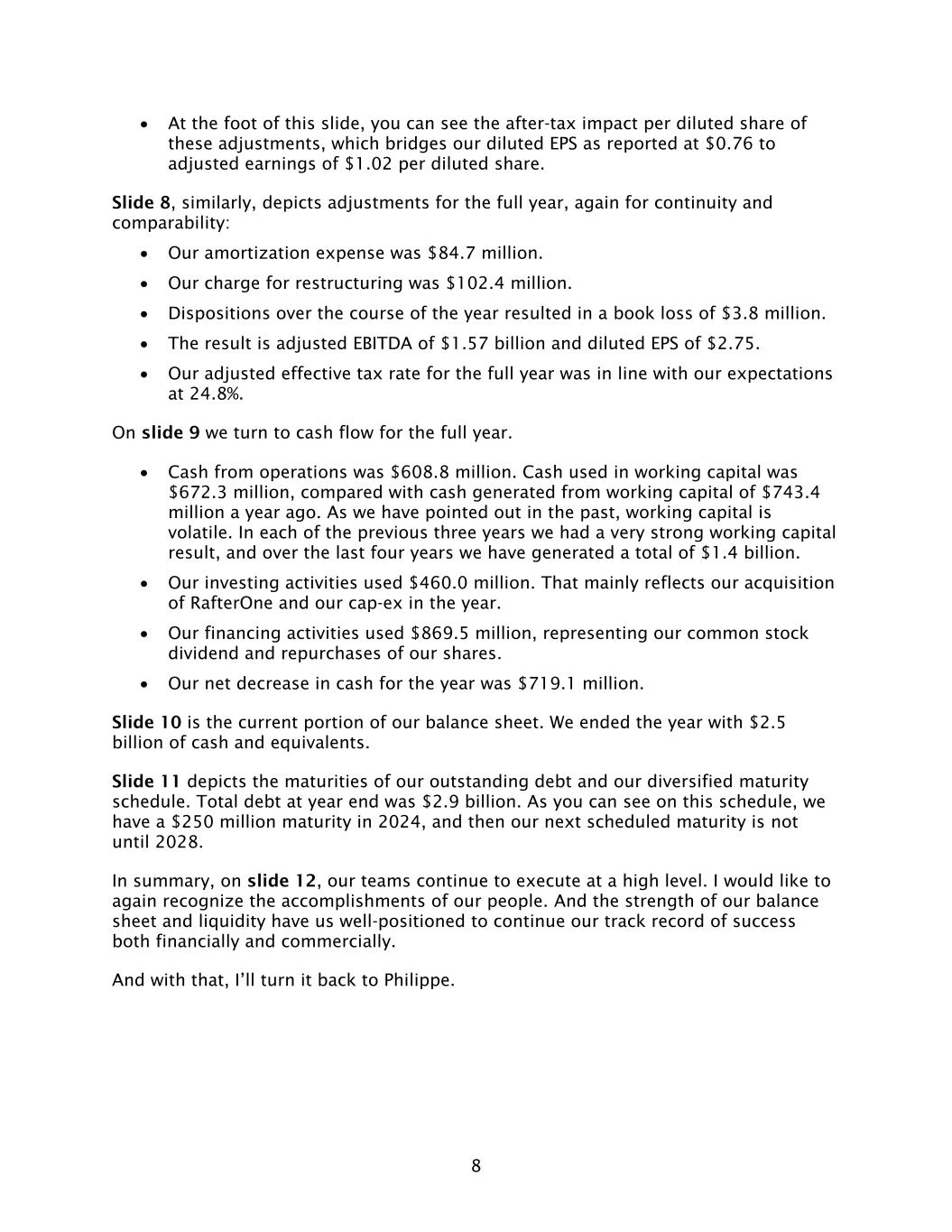

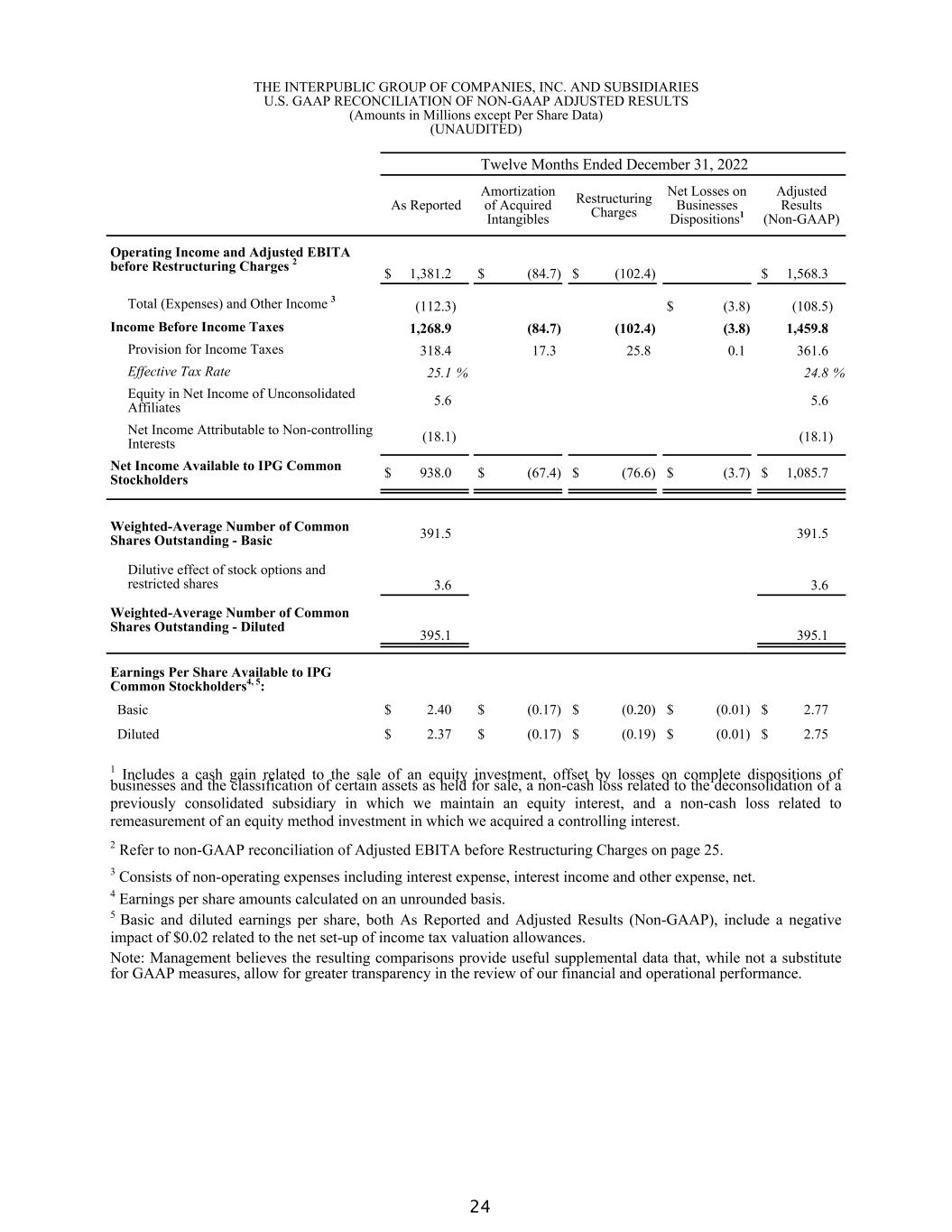

8 • At the foot of this slide, you can see the after-tax impact per diluted share of these adjustments, which bridges our diluted EPS as reported at $0.76 to adjusted earnings of $1.02 per diluted share. Slide 8, similarly, depicts adjustments for the full year, again for continuity and comparability: • Our amortization expense was $84.7 million. • Our charge for restructuring was $102.4 million. • Dispositions over the course of the year resulted in a book loss of $3.8 million. • The result is adjusted EBITDA of $1.57 billion and diluted EPS of $2.75. • Our adjusted effective tax rate for the full year was in line with our expectations at 24.8%. On slide 9 we turn to cash flow for the full year. • Cash from operations was $608.8 million. Cash used in working capital was $672.3 million, compared with cash generated from working capital of $743.4 million a year ago. As we have pointed out in the past, working capital is volatile. In each of the previous three years we had a very strong working capital result, and over the last four years we have generated a total of $1.4 billion. • Our investing activities used $460.0 million. That mainly reflects our acquisition of RafterOne and our cap-ex in the year. • Our financing activities used $869.5 million, representing our common stock dividend and repurchases of our shares. • Our net decrease in cash for the year was $719.1 million. Slide 10 is the current portion of our balance sheet. We ended the year with $2.5 billion of cash and equivalents. Slide 11 depicts the maturities of our outstanding debt and our diversified maturity schedule. Total debt at year end was $2.9 billion. As you can see on this schedule, we have a $250 million maturity in 2024, and then our next scheduled maturity is not until 2028. In summary, on slide 12, our teams continue to execute at a high level. I would like to again recognize the accomplishments of our people. And the strength of our balance sheet and liquidity have us well-positioned to continue our track record of success both financially and commercially. And with that, I’ll turn it back to Philippe.

9 Mr. Krakowsky: Thanks, Ellen. As you can see from our results, our strategy, talent and culture continue to drive innovation, creativity and collaboration that fuel our clients’ success in an increasingly digital economy. Over the past three years, we’ve organically added $1.2 billion dollars of revenue to our business, as well as increased adjusted EBITA by over $360 million since the start of 2020. Credit to our teams for those very strong results. Throughout this period, what we’re seeing play out are the accelerated technology- driven shifts in media and consumer behavior that our Company had anticipated and against which we had made significant investments. Our expertise in first-party data management, performance media, and accountable marketing solutions are all areas relevant to marketers looking to build their brands while also delivering business outcomes. Vital to our strong performance are our media, data, and healthcare offerings. These specialized assets have evolved their offerings to combine marketing services with emerging communications channels and technology, so as to help clients find new ways to identify and interact with individual consumers. As you saw in October, we continue to look for strategic areas of investment. With our RafterOne acquisition, we brought a talented and specialized team into the IPG network to architect and implement scaled Salesforce solutions that connect brands with customers through end-to-end commerce experiences in both B2B and B2C settings. The RafterOne team will help us deliver creative campaigns that work smarter for our clients by building meaningful relationships in digital marketing platforms. Enterprise marketing suites like Salesforce and Adobe form the foundation of so many brands’ marketing technology stacks, and our Company can serve as a bridge between those brands, their consumers, and these platforms, strengthening every touchpoint of the customer journey. We continue to invest in this important growth area and recently announced that we have brought on board our first Chief Commerce Strategy Officer. He joins us from Accenture, where he oversaw their omnichannel commerce practice. At IPG, he’ll connect our existing channel and platform expertise, including strong and scaled teams at MRM, RafterOne, Reprise Media, and IPG Platform Services, as well as others across our entire portfolio. And he’ll orchestrate how our Company supports clients as they build out commerce solutions and integrate them with the full breadth of their marketing programs. Turning now to the highlights of agency-level performance in Q4, as we’ve mentioned, results were once again led by our media, data and technology offerings. Media performed very strongly to close out a successful year. And during the quarter we saw a series of notable wins, including Celebrity Cruises at Mediahub,

10 EnergyAustralia, the retention of major client Merck and the addition of assignments on AWS at Initiative, and the onboarding of Moneysupermarket Group at UM, where earlier this week we also announced that we welcomed the new Global CEO to the agency. As we speak, IPG Mediabrands is also hosting their third annual Equity Upfront, which provides opportunities for clients and our agencies to engage directly with diverse-owned media partners, including Black, AAPI, Hispanic, and LGBTQIA-owned media, which is vital to establishing the kinds of partnerships that can change buying patterns in the industry. Acxiom continues to be a strong contributor to the performance of our media agencies, as well as others in the group who have incorporated audience-led methodologies into how they develop strategic insights and creative work. During the quarter, Acxiom brought in new logo wins and contract renewals in the automotive, CPG, financial services, insurance, retail, and travel & entertainment sectors. They were recognized as a “Leader” in the Snowflake Modern Marketing Stack Report and also launched a new integration with the customer data platform Tealium to enhance deterministic modeling capabilities. Turning to IPG Health, that network continued to deliver solid results for us in the quarter, compounding very strong trailing growth since we created the group approximately 15 months ago. While growing with nearly every existing client, IPG Health also focused on expanding its presence globally through some strategic alliances, notably in Europe. And the caliber of their creative work was honored at the 2022 MM+M Awards, where the network was named “Large Healthcare Network of the Year.” At our global advertising networks, we continued to see the benefit of our investment in strong, differentiated agency cultures, which are driving distinctive ideation and creativity. And we are seeing that recognized again and again in the industry. FCB won significant accolades during its first full year under its new leadership team. It was named as one of the 10 most innovative advertising agencies of 2022 by Fast Company. It was honored as the #2 network overall in Cannes, and it was once again named the Festival’s top ranked North American network, thanks to powerhouse offices in New York, Chicago, and Toronto, which it bears noting are all leaders in leveraging data to power audience insights and creativity. With a new CEO in place at the beginning of the fourth quarter, McCann saw new business wins with Smirnoff, which make it part of the Diageo roster, and Post Consumer Brands. McCann also launched work for recently won clients Converse and Prudential. Additionally, the agency was named Network of the Year at the 2022 Epica Awards for the fifth time in six years, and McCann New York won Epica’s Innovation Grand Prix for Mastercard’s Touch Card, the accessible card standard for blind and partially sighted people. More recently, McCann also announced a series of senior organizational changes, elevating key internal leaders and adding new executives to the agency. MullenLowe Group continued to secure new business, as it had throughout the year, with the addition of Ferrero International, Tetley Tea, National Highways in England, Lifestyle Fashion in India, and the Barcelona Football Club in Spain. We also announced

11 a new global CEO for MullenLowe, promoting a key female leader from within our organization who is known across the industry as a champion of creativity, a strong growth driver, and someone fully committed to diversity and inclusion. Among our domestic independent agencies, as part of the agency’s goal to help reshape our industry, The Martin Agency announced their commitment to hire a minimum of 50% directorial and editorial talent from underrepresented groups for all their video content production. At our earned and experiential agencies, performance was led by Octagon, Jack Morton and Momentum, all of which posted strong growth in the quarter. With more than three decades of World Cup experience, Octagon was very active with a range of clients at this year’s tournament. For example, with longtime client Budweiser, the agency ran a range of on-site activations in Doha, managed complex global influencer campaigns, and hosted nearly half a million consumers who are fans at viewing events around the world. Jack Morton continued to deliver outstanding performance and launched its sponsorship consulting practice, which it has dubbed Jack 39. And it continued to build out Jack X, which is their global experience innovation practice, which creates events that combine content with web 3.0 tech. Among our public relations firms during the quarter, Golin had several wins, including a product launch for a new alcohol brand, corporate communications work for a food products and services brand, and being named the influencer AOR for a household appliances manufacturer globally. Weber Shandwick announced new clients wins with HP in North America, and IKEA in the U.K. And the network also launched what it is calling Business & Society Futures, which is a C-Suite offering that combines public affairs, corporate affairs, as well as organizational design and consultancy. During the quarter, DXTRA Health posted strong gains, winning a large global oncology assignment for a major pharma client. And in addition, its leader was named to PRWeek's Health Influencer 30, which is the annual list of the most influential individuals in healthcare communications. At the holding company level, as you know, we have a long-standing commitment to ESG and DEI as key strategic priorities. And as you may have seen last week, we announced that IPG has been included on the Bloomberg Gender Equality Index for the fourth consecutive year and was recognized for the first time as a “Top-Rated ESG Performer” by Sustainalytics. We were also once again included on the FTSE4Good Index and Newsweek’s “America’s Most Responsible Companies 2023.” And Forbes featured us on both its “America’s Best Large Employers” list as well as the “World’s Top Female-Friendly Companies” for 2022. As a business in which human capital is vital to our success, our culture, including an intentional approach to ESG, has long been an important part of our strategy for attracting and retaining top talent, whether in strategic, creative, data analytics or engineering roles, or across a range of other skillsets that have become key to our evolving offerings. Looking ahead now, we believe IPG remains well-positioned for the future. Much of our growth in recent years, as well as in 2022, was fueled by disciplines that most actively

12 tap into our data and precision marketing capabilities, as well as our exceptional healthcare marketing offerings. These are growing parts of our portfolio that continue to develop into more structural and secular revenue streams. We know the world in which we live is increasingly digital and that more than ever clients need help from us in using audience-led thinking to solve for a widening set of business problems and opportunities. We’ve been leaders in this space, and 2023 will be a year in which we consolidate those gains and prepare to further evolve the way in which we deliver this expertise to marketers so as to elevate the value of the services and solutions we provide. In addition, we are confident that our commerce and our experiential disciplines, while not today figuring as large in our revenue mix, will continue to grow going forward. As stated earlier, despite the broader uncertainty that we are seeing at the macroeconomic level, we expect to deliver growth in 2023 of 2% to 4% on top of a very strong record that has compounded for a number of years. And, consistent with that level of growth, we foresee adjusted EBITA margin expansion to 16.7%. Of course another key area of value creation remains our strong balance sheet and liquidity, and our ongoing commitment to capital returns is clear in the actions that were announced by our Board today, which also speak to the confidence in our strategic position and future prospects. As part of our balanced approach to capital allocation, we will continue to further invest behind the growth of our businesses by developing our people and continuing to differentiate our offerings. This includes a disciplined approach to M&A, focusing on opportunities that are consistent with strategic growth areas, primarily commerce and performance media, business transformation, and consultancy. We thank our clients, our people and those of you on this call for your continued support. And with that, let’s open the floor for questions. * * * * *

13 QUESTIONS AND ANSWERS Operator: Thank you. . . . And our first question is from David Karnovsky with J.P.Morgan. You may go ahead. David Karnovsky, J.P.Morgan: Hi. Thank you. Philippe, you noted client uncertainty but a conviction to stay invested. I wanted to see if you could provide some insight into your conversations with marketers, how they manage that balance, and what factors are keeping them tipped into the side of remaining in the market? And then, just on the guide overall, that range is a little wider than we're used to seeing. Is that all due to the economy, and should we take it the macro is maybe the main driver in pushing you toward the lower or upper end? Philippe Krakowsky, Chief Executive Officer: Maybe I'll take them backwards if that's okay with you. I think if you think about our budgeting process, it’s bottoms up with our operators. We do, in fact, as you suggest, go client by client. We look at pipeline. And then, with our larger clients, obviously, we're able to engage with them directly. And I think what we're pointing out there is just that I think what's happening is that the caution that we're seeing is less a function of the specifics of what's going on right now. I think it's just the open-endedness, the concern about a potential downturn somewhere along the line as we get further into 2023. But again, if you go back to how we build the budget, that bottoms up look at clients, factor in the pipeline, clearly factor in a view of the macro, and we're going to have a geographic or a client or even a business mix that's specific to us. And then we did call out a couple of places, as you know. I think we're quite direct and clear about what's going on in the business, where we’re taking the business. So we call out a couple of places where some things require attention, and some things are having an impact as we look at the year ahead. So I would say, that that's how we got to the range. The fact that the range is broader than one would see in other years is reflective of that sense of uncertainty. I think you're seeing broader ranges when we know companies are going out there. And I would say we're comfortable at the midpoint of that range. Mr. Karnovsky: Okay. And maybe one for Ellen. I wanted to ask a question about the longer-term margin. So as IPG pushes to become more of a higher-value solutions partner, as you guys phrased it, how does that potentially impact your margin trajectory? Should we necessarily think higher-value services is translating to higher margins and additional higher growth? Or are there other kind of considerations like specialized labor that could also be issues that we should consider?

14 Ellen Johnson, Executive Vice President, Chief Financial Officer: Sure. Thank you for the question. Very optimistic about the opportunity to increase our margins going forward. And I would point to we have a long track record of doing so. I mean if you look at the past couple of years, we've increased our margins 250 basis points since 2019. So, I think it's a combination of several factors. One, as you point out, I think high- value services is a continued opportunity for us, but also I think we have a good track record of translating growth profitably into margin expansion. We manage our costs in a very disciplined way, and we're continuously looking at opportunities on business transformation. We have a large portion of our revenue in shared services. We manage our real estate portfolio centrally. So, put all those things together, I do think that there is opportunity for margin expansion as we move ahead. Mr. Krakowsky: And one just quick add there, David, is just that across the senior teams, whether it's corporate or any of the units, our incentives are fully aligned to that objective. So, the plan is modestly more heavily weighted to margin than revenue. And so, to our mind, that ensures that where there's growth, there's profitable growth. And that when we're in a circumstance that’s got more uncertainty, we're still able to, as Ellen said, make good on that consistent record of where there's growth, we've demonstrated that we can convert it to incremental profit. Mr. Karnovsky: Great. Thank you. Operator: Thank you. The next question is from Lina Ghayor with BNP Paribas. You may go ahead. Philippe Krakowsky, Chief Executive Officer: Hey, Lina. Lina Ghayor, BNP Paribas Exane: Hi, good morning, Phillipe, Ellen and Jerry. Thank you for taking my questions. I have three, please. The first one is on the guidance. Could you elaborate a tiny bit more on the guidance regarding the impact of inflation on the revenue? And more generally, what shape do you expect the growth to be, for example, H1 versus H2? The second one, perhaps for Ellen, on wage inflation: how much was wage inflation in '22? And what have you taken for 2023 in your assumptions? And lastly, Philippe, just to come back on your point at the beginning of your remarks: could you comment on the performance by sector? I think you mentioned telecoms. Could you elaborate? And, more generally, what is the attitude of your clients by sector ahead of ’23? Thank you.

15 Mr. Krakowsky: Sure. That's a lot. So, I guess there are two inflation questions. I will take the — so in terms of inflation vis-à-vis our growth, yes, the majority of our contracts have written into them the ability to, as the world changes, sort of go back to clients and talk about the costs of the services that we provide to them. That's not something that triggers automatically. It requires that you enter into a conversation or, ultimately, negotiation with clients. So, if I were to talk about what's gone into our thinking and how we build the forecast that leads to the guidance, revenue growth is primarily from growing scope with our existing clients. And we definitely believe that there is, that the primary avenue for growth, the most, the one that we are most keen on, is growth with existing clients. So, deepen the relationship, bring additional services. Then, secondarily, clearly you have the opportunity to add when there are new business opportunities and pitches. So, I think that that's really what has baked into it, and then, as we've discussed, we're beginning to, in some instances, be able to go to clients with some of these services that are new services based on the data and the technology part of what we've been building. So, I think that's one part of the question. And then, Ellen, I'll let Ellen take the costs as it bakes into our business and then the second part, and then I'll come back for your third piece on sectors. Ellen Johnson, Executive Vice President, Chief Financial Officer: So as far as inflation on our cost base, we've been very transparent that there's been modest inflation in the salary line, but ones that we feel are very manageable and that will not take us off the growth trajectory on our margins and at — more deter us from expanding them accordingly. So that was factored into our guidance for '23 and going forward. Mr. Krakowsky: And then on sectors, though, auto & transportation is strong, and we see it continuing. Healthcare, financial services for us, given the mix of clients that we've got in retail, that has continued to be a place where we've got quite progressive, modern clients. And then the other category, as I mentioned, I think the — a lot of the headlines and a lot of the sector-specific issues that we're seeing in tech are manifesting in conversations with clients. And there what we're seeing is clients either taking reductions or being — not committing for a full year. So I think, as we said, what we saw there was something that is — we're seeing the impact. The duration on that is, perhaps, open-ended. And then food & beverage for us, we'll have the runoff of a very large industry consolidation that took place at the holding company level in late ’21. And as we said, it impacted Q4 most heavily, but we'll still see some impact. So, in terms of the revenue deltas, it's definitely, for us, the items that we've identified for you, which we are addressing, are definitely going to impact first half, whether it's the digital agencies and where they are in their cycle of transformation as the macro becomes a bit more challenged, and then some of these client items. So, for us, it's

16 definitely a stronger back half is very much where and how we've gotten to that guidance. Ms. Ghayor: Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. The next question is from Steve Cahall with Wells Fargo. You may go ahead. Steven Cahall, Wells Fargo: Thank you. Good morning. Maybe just a follow-up on that theme a little bit first. So, Philippe, can you give us an idea of what the net new business impact is for 2023? It sounds like it's probably modestly negative. So I just want to make sure I'm piecing all that together. And I'd love to include some components of this question, which is, how does healthcare set up from a growth-rate perspective in 2023, since that's such a big part of the revenue mix? And R/GA and Huge, it sounds like those will be dragged this year. Historically, they've kind of been some real superstar agencies for IPG. So, how do you think about the journey of these digitally native agencies? Is it still an area of investment? And how do they fit in the portfolio going forward? Philippe Krakowsky, Chief Executive Officer: Sure. Look, I think you're right. They're premium providers. It's a largely project-based business, which is, I think, both of those a premium provider of uncertain macro project-based business. Again, projects showed up in Q4 for us at a very solid level, I'd say in line with overall Q4 growth. Experiential was strong, PR was maybe a bit below the segment growth, but the digital projects that you would see at those very high-end agencies were definitely not at the levels; they were weak. And so, I think that every three to five years, these agencies need to kind of reinvent and reconfigure, because they are, to your point, at the leading edge .But I think that in the current environment, that's where we find ourselves with them. P.S. they're also probably more exposed to tech than many of our businesses. So, we've seen client attrition and lower growth there. And Huge has a pretty clear line-of-sight into what their new value proposition is. And that'll be going in the market probably towards the end of the first quarter here. So, they also had been — because of the strength that you call out, tying them more into, whether it's Open Architecture or whether it's the kind of the overall data stack that we've built, is clearly something that we need to focus on. So maybe that long-term success and a measure of independence is something that is going to need to be addressed.

17 And then on the question around new business, again, we now see new business in the big media pitches. And then in some of the more traditional parts of the business, probably the creative ad agencies and, to some degree, PR. We don't see the new business within health very much. And then a lot of what's going on, as I said, has become project-specific. So I'd say, we are going into the year exactly, as you said, with a modest headwind. And then — was there one piece of the question that I'm forgetting at this point? Oh, and then health: I think we see health at scale now, having put these assets together and, as we said, trailing very, very strong performance, doing high single-digit in the quarter. That's probably consistent with what they did for the year, and that's consistent with the expectation that we have for them as we go into '23. Mr. Cahall: Great. And then maybe just a short follow-up for Ellen. Working capital was a big use in '22. I think it was favorable in '21. I know the timing of the year can be a strange line to draw in the sand, but should we expect it to then be back to probably a benefit in '23? Thank you. Ellen Johnson, Executive Vice President, Chief Financial Officer: So, as we've pointed out, working capital is volatile. Whether we get paid on the 31st or the 1st, when you print your balance sheet and cash flow makes a big difference. It is something that we spend a lot of time and have a lot of discipline around and carefully manage. And if you go back over the past four years, I think we've generated $1.4 billion in working capital. So, I would expect, going forward, it will normalize, but you're right: in anyone year, you can get an aberration. Mr. Cahall: Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question is from Michael Nathanson with MoffettNathanson. You may go ahead. Michael Nathanson, MoffettNathanson: Thank you. Good morning, Philippe. Philippe Krakowsky, Chief Executive Officer: How are you? Mr. Nathanson: I believe there were — I'm good. How are you? Mr. Krakowsky: I’m alright.

18 Mr. Nathanson: Cool. Philippe, I want to ask you about the RafterOne acquisition. Mr. Krakowsky: Yes. Mr. Nathanson: I believe it's the biggest deal since Acxiom. If you go back to the history of the Company, it's probably one of the biggest deals we've seen, right? So can you talk a little bit more about the necessity to do it, the multiples, the skillsets? And whether or not like this is the beginning and, it’s not like it’s cheap, but it's like the beginning of maybe more tuck-in acquisitions like that? And then, Ellen, given the FX volatility, what's your thinking on the year ahead for FX? And any impact from acquisitions and investment to revenue this year from FX? Mr. Krakowsky: So I think that's a really — I mean, that's very apt observation. I can definitely speak to RafterOne and what it is about them and why. To our mind, a very strong asset in a very specific space that is growing very fast. Obviously, Salesforce is a platform that means a lot more to more of our clients. So they're ascendant. And then for the dollars that go into a major Salesforce implementation, there's a multiple, there's a $4 or $5 that goes to the service provider. So that's a — there's a large service economy around that. And we're very strong in Adobe. And to us, we were building that Salesforce capability, started working with this company as a partner, got to know them. And it was actually preemptive on our part, because I don't know that their ownership was, their owners were, necessarily thinking that this was a moment in time at which they would trade the asset. But from where we sit, tech implementation, direct-to-consumer work, the internal platform services group that we've created so that we are bringing bigger presence into those kinds of engagement. So, I think, Salesforce, I mean RafterOne, is 500 experts. I think, 800 or 900 certifications, and both B2B and B2C expertise. But I think what you said that's very accurate is that we're a bigger company by a fair bit as of the last three years. So, you used to think of us as doing tuck-ins, and they were quite small, and they were much more sort of agency-like. And to our mind, I think we want to concentrate that buying power and then focus on these areas where what you've got is sort of a hybrid of marketing expertise, some measure of creativity against an emerging channel. And then some piece of what they do, which brings some technology expertise. So, I think you probably will see us do fewer, and, scale-wise, they'll have gotten bigger. What tuck-in means will be I think more like this. Mr. Nathanson: Okay. Thanks. Ellen Johnson, Executive Vice President, Chief Financial Officer: And with regards to FX, '22 was a larger impact in what we typically see. It was negative 3% on revenue growth and actually 20 basis points on margin. For the most part, our revenue and expenses, if you look historically, are pretty well-matched. And

19 so going forward, we're expecting, based on what the rates are today, a flat impact on revenue and a de minimis impact on margin. Mr. Nathanson: Ellen, can I follow up? I remember asking you when you started about that question about margin. Why was there a drag on margin from FX this year? I think you answered previously there wasn't much difference. So what happened this year on margin that didn't happen in the past? Ms. Johnson: It was more of an impact of what happened in the currency markets. If you look at'22, the currency markets moved more than they historically do. But for the very vast majority of our businesses, revenue expenses are matched by currency, and we — that was probably the largest impact we've seen in a very long time. And we do not expect that type of impact at all going forward. Mr. Nathanson: Okay. Thanks. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question is from Tim Nollen with Macquarie. You may go ahead. Tim Nollen, Macquarie: Hi, thanks very much. Could I ask a couple of cost-related questions, please? If my math is right, your $20 million in real estate savings equates to about 30 basis points of margin. Is that the kind of scope of upside we could expect in 2023? And, maybe an offset to that, or maybe a boon to that, I don't know, would be any comments you can make on staff. I heard your comment on managing the staff cost inflation versus the revenue growth. It sounds like you guys maybe net-net might still be hiring rather than reducing staff, and there's a lot of talent now available from all these layoffs at lots of other companies. I'm just wondering what you could tell us about your expectations in terms of staffing levels and growth in cost this year. Thanks. Ellen Johnson, Executive Vice President, Chief Financial Officer: Sure. Maybe I'll start with your second question first. We always — hiring always lags revenue growth. And so we are forecasting growth for next year, and underneath growth, we will hire responsibly in a disciplined fashion. Conversely, when we have contractions, we take actions. As far as the real estate, I think your math is a little bit aggressive on the 30 basis points. And the $20 million that we noted on the call will happen over more than one year. You need to sublease some of the properties in order to realize the full benefit. But we're very optimistic about the numbers we put out there. We feel really good that

20 we've taken another look and really have been able to optimize our real estate portfolio. Like I mentioned, it's a very centralized process, and the way we manage it here. And we've really taken the learnings that we've had over the last couple of years and then applied it in a way to become more efficient. Mr. Nollen: Great. Thanks a lot. Philippe Krakowsky, Chief Executive Officer: Thank you. Operator: Thank you. Our next question is from Jason Bazinet with Citi. You may go ahead. Jason B. Bazinet, Citi:, i Hi, a quick question just in terms of the macro — how's it going? — in terms of the macro uncertainty, is there anything that you would call out in terms of either higher or lower risk profile as it relates to account reviews? It just doesn't seem like it's been as active as I would have thought. But I'd love any color that you have. Philippe Krakowsky, Chief Executive Officer: That's an interesting question, and a fair one. Because we've all been assuming that there was going to be a backlog, going all the way back to pandemic. Understandable that there were fewer, but everybody sort of waited for the floodgates to open. And I think '21 was -— there was just a great deal of opportunity, growing with your existing clients, doing more of the kind of new services that we have been building for some period of time. The word is that there likely will be — as I said, scale reviews these days tend to come in media and then to some extent in healthcare. But at the moment it's more kind of in the murmurs than the reality. But we'll obviously all know. I mean, there — our folks on the ground at agencies, our growth leader here at the center, are all saying that they believe that it will begin to pick up steam. But right now, I don't have a ton of hard data that says that's the case. Mr. Bazinet: Okay. Thank you very much. Mr. Krakowsky: Please. Operator: Thank you. And that was our last question. I will now turn it back to Philippe for any final thoughts.

21 Philippe Krakowsky, Chief Executive Officer: Thank you, Sue. Thank you all for the time and the interest. We're looking forward to the year. We've got a lot of work to do, and we'll keep you posted as we go. Thanks again. Operator: Thank you. And that does conclude today’s conference. Thank you all for participating. You may disconnect at this time.

22 Cautionary Statement This transcript contains forward-looking statements. Statements in this transcript that are not historical facts, including statements regarding guidance, goals, intentions, and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements, and are subject to change based on a number of factors, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other filings with the Securities and Exchange Commission ("SEC"). Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward- looking statement. Such factors include, but are not limited to, the following: • the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition; • our ability to attract new clients and retain existing clients; • our ability to retain and attract key employees; • the impacts of the COVID-19 pandemic, including potential developments like the emergence of more transmissible or virulent coronavirus variants, and associated mitigation measures, such as restrictions on businesses, social activities and travel, on the economy, our clients and demand for our services; • risks associated with the effects of global, national and regional economic conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates; • the economic or business impact of military or political conflict in key markets; • risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy; • potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments; • developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy; and • the impact on our operations of general or directed cybersecurity events. Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended December 31, 2022 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Business Dispositions1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges 2 $ 444.6 $ (22.1) $ (101.7) $ 568.4 Total (Expenses) and Other Income 3 (31.8) $ (8.3) (23.5) Income Before Income Taxes 412.8 (22.1) (101.7) (8.3) 544.9 Provision for Income Taxes 109.2 4.6 26.0 0.0 139.8 Effective Tax Rate 26.5 % 25.7 % Equity in Net Income of Unconsolidated Affiliates 2.3 2.3 Net Income Attributable to Non- controlling Interests (8.7) (8.7) Net Income Available to IPG Common Stockholders $ 297.2 $ (17.5) $ (75.7) $ (8.3) $ 398.7 Weighted-Average Number of Common Shares Outstanding - Basic 387.9 387.9 Dilutive effect of stock options and restricted shares 4.2 4.2 Weighted-Average Number of Common Shares Outstanding - Diluted 392.1 392.1 Earnings Per Share Available to IPG Common Stockholders4, 5: Basic $ 0.77 $ (0.05) $ (0.20) $ (0.02) $ 1.03 Diluted $ 0.76 $ (0.04) $ (0.19) $ (0.02) $ 1.02 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a non-cash loss related to the remeasurement of an equity method investment in which we acquired a controlling interest. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 25. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts calculated on an unrounded basis. 5 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), include a negative impact of $0.02 related to the net set-up of income tax valuation allowances. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. 23

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Twelve Months Ended December 31, 2022 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Businesses Dispositions1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges 2 $ 1,381.2 $ (84.7) $ (102.4) $ 1,568.3 Total (Expenses) and Other Income 3 (112.3) $ (3.8) (108.5) Income Before Income Taxes 1,268.9 (84.7) (102.4) (3.8) 1,459.8 Provision for Income Taxes 318.4 17.3 25.8 0.1 361.6 Effective Tax Rate 25.1 % 24.8 % Equity in Net Income of Unconsolidated Affiliates 5.6 5.6 Net Income Attributable to Non-controlling Interests (18.1) (18.1) Net Income Available to IPG Common Stockholders $ 938.0 $ (67.4) $ (76.6) $ (3.7) $ 1,085.7 Weighted-Average Number of Common Shares Outstanding - Basic 391.5 391.5 Dilutive effect of stock options and restricted shares 3.6 3.6 Weighted-Average Number of Common Shares Outstanding - Diluted 395.1 395.1 Earnings Per Share Available to IPG Common Stockholders4, 5: Basic $ 2.40 $ (0.17) $ (0.20) $ (0.01) $ 2.77 Diluted $ 2.37 $ (0.17) $ (0.19) $ (0.01) $ 2.75 1 Includes a cash gain related to the sale of an equity investment, offset by losses on complete dispositions of businesses and the classification of certain assets as held for sale, a non-cash loss related to the deconsolidation of a previously consolidated subsidiary in which we maintain an equity interest, and a non-cash loss related to remeasurement of an equity method investment in which we acquired a controlling interest. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 25. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts calculated on an unrounded basis. 5 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), include a negative impact of $0.02 related to the net set-up of income tax valuation allowances. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. 24

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions) (UNAUDITED) Three Months Ended December 31, Twelve Months Ended December 31, 2022 2021 2022 2021 Revenue Before Billable Expenses $ 2,550.5 $ 2,548.9 $ 9,449.4 $ 9,107.9 Non-GAAP Reconciliation: Net Income Available to IPG Common Stockholders $ 297.2 $ 357.9 $ 938.0 $ 952.8 Add Back: Provision for Income Taxes 109.2 67.4 318.4 251.8 Subtract: Total (Expenses) and Other Income (31.8) (24.0) (112.3) (214.1) Equity in Net Income of Unconsolidated Affiliates 2.3 2.1 5.6 2.5 Net Income Attributable to Non-controlling Interests (8.7) (10.1) (18.1) (20.0) Operating Income 444.6 457.3 1,381.2 1,436.2 Add Back: Amortization of Acquired Intangibles 22.1 21.5 84.7 86.2 Adjusted EBITA 466.7 478.8 1,465.9 1,522.4 Adjusted EBITA Margin on Net Revenue % 18.3 % 18.8 % 15.5 % 16.7 % Restructuring Charges 1 101.7 13.0 102.4 10.6 Adjusted EBITA before Restructuring Charges $ 568.4 $ 491.8 $ 1,568.3 $ 1,533.0 Adjusted EBITA before Restructuring Charges Margin on Net Revenue % 22.3 % 19.3 % 16.6 % 16.8 % 1 Restructuring charges of $3.1 and $3.8 in the fourth quarter and full year 2022, respectively, were related to adjustments to our restructuring actions taken in 2020, which were designed to reduce our operating expenses structurally and permanently relative to revenue and to accelerate the transformation of our business. Restructuring charges of $98.6 in the fourth quarter and full year 2022 were related to new real estate exits and lease terminations. The Company took these actions to further optimize the real estate footprint supporting our office-home hybrid service model in a post-pandemic economy. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. 25

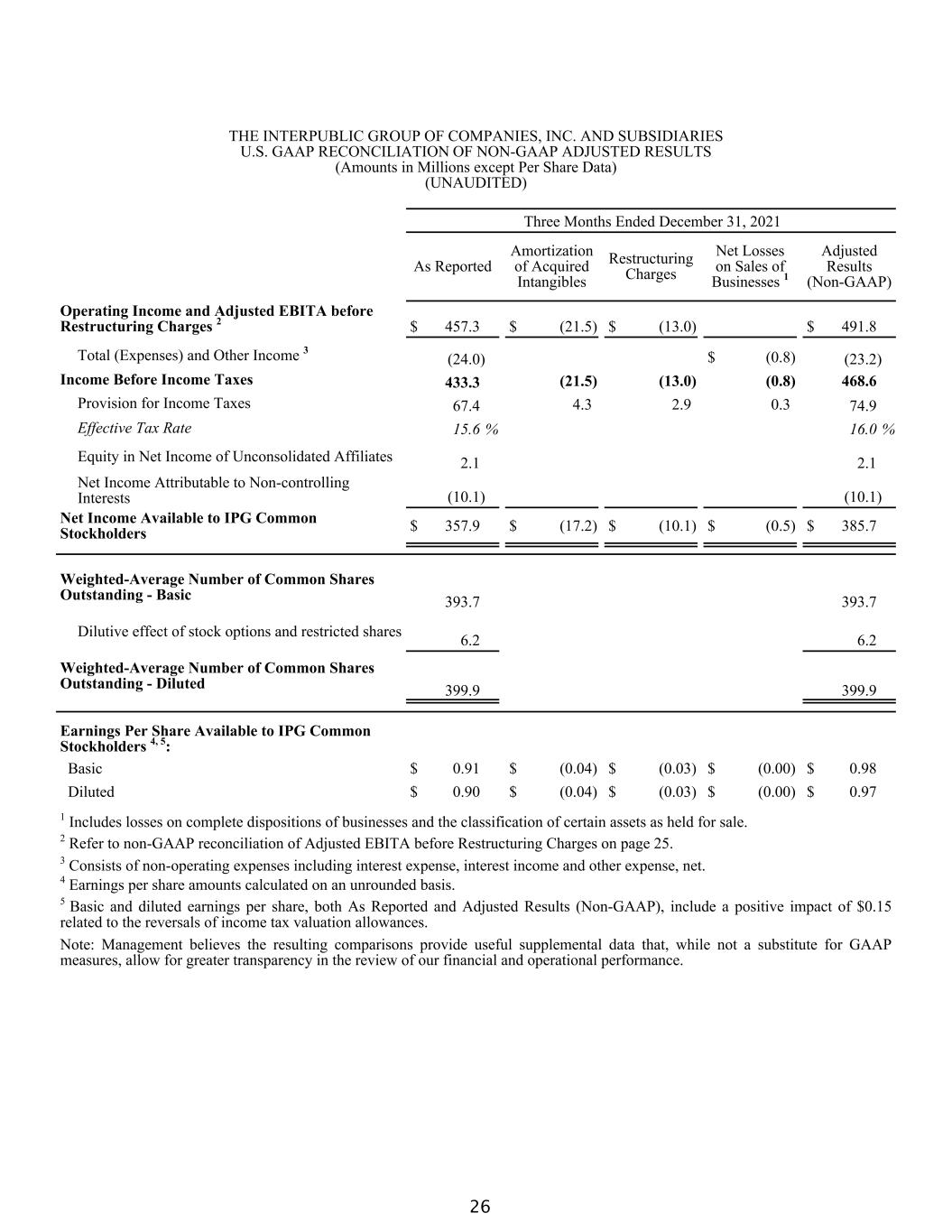

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended December 31, 2021 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses 1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges 2 $ 457.3 $ (21.5) $ (13.0) $ 491.8 Total (Expenses) and Other Income 3 (24.0) $ (0.8) (23.2) Income Before Income Taxes 433.3 (21.5) (13.0) (0.8) 468.6 Provision for Income Taxes 67.4 4.3 2.9 0.3 74.9 Effective Tax Rate 15.6 % 16.0 % Equity in Net Income of Unconsolidated Affiliates 2.1 2.1 Net Income Attributable to Non-controlling Interests (10.1) (10.1) Net Income Available to IPG Common Stockholders $ 357.9 $ (17.2) $ (10.1) $ (0.5) $ 385.7 Weighted-Average Number of Common Shares Outstanding - Basic 393.7 393.7 Dilutive effect of stock options and restricted shares 6.2 6.2 Weighted-Average Number of Common Shares Outstanding - Diluted 399.9 399.9 Earnings Per Share Available to IPG Common Stockholders 4, 5: Basic $ 0.91 $ (0.04) $ (0.03) $ (0.00) $ 0.98 Diluted $ 0.90 $ (0.04) $ (0.03) $ (0.00) $ 0.97 1 Includes losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 25. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts calculated on an unrounded basis. 5 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), include a positive impact of $0.15 related to the reversals of income tax valuation allowances. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. 26

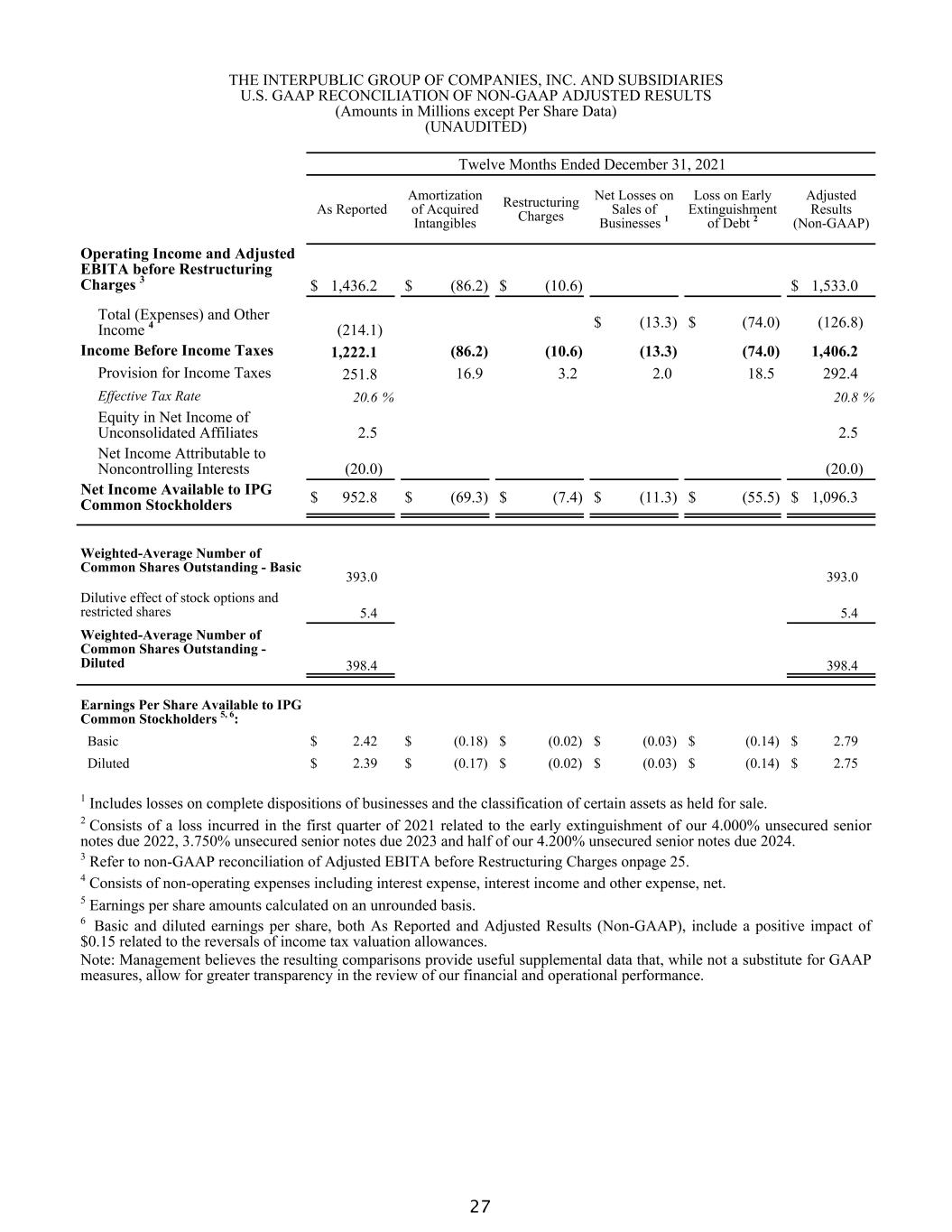

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Twelve Months Ended December 31, 2021 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses 1 Loss on Early Extinguishment of Debt 2 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges 3 $ 1,436.2 $ (86.2) $ (10.6) $ 1,533.0 Total (Expenses) and Other Income 4 (214.1) $ (13.3) $ (74.0) (126.8) Income Before Income Taxes 1,222.1 (86.2) (10.6) (13.3) (74.0) 1,406.2 Provision for Income Taxes 251.8 16.9 3.2 2.0 18.5 292.4 Effective Tax Rate 20.6 % 20.8 % Equity in Net Income of Unconsolidated Affiliates 2.5 2.5 Net Income Attributable to Noncontrolling Interests (20.0) (20.0) Net Income Available to IPG Common Stockholders $ 952.8 $ (69.3) $ (7.4) $ (11.3) $ (55.5) $ 1,096.3 Weighted-Average Number of Common Shares Outstanding - Basic 393.0 393.0 Dilutive effect of stock options and restricted shares 5.4 5.4 Weighted-Average Number of Common Shares Outstanding - Diluted 398.4 398.4 Earnings Per Share Available to IPG Common Stockholders 5, 6: Basic $ 2.42 $ (0.18) $ (0.02) $ (0.03) $ (0.14) $ 2.79 Diluted $ 2.39 $ (0.17) $ (0.02) $ (0.03) $ (0.14) $ 2.75 1 Includes losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Consists of a loss incurred in the first quarter of 2021 related to the early extinguishment of our 4.000% unsecured senior notes due 2022, 3.750% unsecured senior notes due 2023 and half of our 4.200% unsecured senior notes due 2024. 3 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 25. 4 Consists of non-operating expenses including interest expense, interest income and other expense, net. 5 Earnings per share amounts calculated on an unrounded basis. 6 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), include a positive impact of $0.15 related to the reversals of income tax valuation allowances. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. 27