August 1, 2014

SECURITIES ACT FILE NO. 2-14543 INVESTMENT COMPANY ACT FILE NO. 811-825

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [x]

PRE-EFFECTIVE AMENDMENT NO. __ [_]

POST-EFFECTIVE AMENDMENT NO. 82 [x]

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

AMENDMENT NO. 51 [x]

AMERICAN GROWTH FUND, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

1636 Logan Street, Denver, Colorado 80203

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE)

REGISTRANTS TELEPHONE NUMBER, INCLUDING AREA CODE (303) 626-0600

1636 Logan Street, Denver, CO 80203

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: as soon as practicable after

the effective date of the Registration Statement

[X] immediately upon filing pursuant to paragraph (b)

[_] on pursuant to paragraph (b)

[_] 60 days after filing pursuant to paragraph (a)(1)

[_] on November 30, 2010 Pursuant to paragraph (a)(1)

[_] 75 days after filing pursuant to paragraph (a)(2)

[_] on (date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

[_] this post-effective amendment designates a new effective Date for a previously filed post-effective amendment.

Class A AMRAX - Class B AMRBX - Class C AMRCX - Class D AMRGX

Prospectus - August 1, 2014

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus, and any representation to the contrary is a criminal offense.

Risk Return Summary

Investment Objectives/Goals

The Fund´s primary objective is growth of capital.

Fee Table

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the American Growth Fund. More information about these and other discounts is available from your financial professional and in How to Reduce your Sales Charge, page 11 of the Fund´s prospectus and under Distribution of Fund Shares, Page 15 of the Fund´s statement of additional information.

| Class A | Class B | Class C | Class D | |

| SHAREHOLDER FEES: (fees paid directly from your investment) | ||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.75% | None | None | 5.75% |

| Maximum deferred sales charge (load) as a percentage of original purchase price or redemption proceeds, whichever is lower | None(a) | 5% (b) | 1% (c) | None(a) |

| Maximum sales charge (load) imposed on reinvested dividends | None | None | None | None |

| Redemption Fees | None | None | None | None |

| Exchange Fee | None | None | None | None |

| Maximum Account Fee | None | None | None | None |

| Management Fees | 1.00% | 1.00% | 1.00% | 1.00% |

| Distribution and Service (12b-1) fees | 0.30% | 1.00% | 1.00% | None |

| Other Expenses | 3.62% | 3.67% | 3.63% | 3.63% |

| Total Annual Fund Operating Expenses | 4.92% | 5.67% | 5.63% | 4.63% |

(b) Contingent Deferred Sales Charge for the 1st 2 years is 5%, 3rd & 4th years - 4%, 5th yr. - 3%, 6th yr. - 2%, 7th yr. - 1%.

(c) For one year.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund´s operating expenses remain the same. Seven years after the date of purchase, Class C Shares automatically convert to Class A Shares. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class A | $1,039 | $1,968 | $2,898 | $5,231 |

| Class B | $1,065 | $2,084 | $3,088 | $5,287 |

| Class C | $661 | $1,673 | $2,771 | $5,456 |

| Class D | $1,012 | $1,891 | $2,777 | $5,020 |

| Class A | $1,039 | $1,968 | $2,898 | $5,231 |

| Class B | $565 | $1,684 | $2,788 | $5,287 |

| Class C | $561 | $1,673 | $2,771 | $5,456 |

| Class D | $1,012 | $1,891 | $2,777 | $5,020 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund´s performance. During the most recent fiscal year, the Fund´s portfolio turnover rate was 8% of the average value of its portfolio.

Page 2

Principal Investment Strategy

Investment Research Corporation (the "Adviser") manages the Fund using a growth style of investing. We use a consistent approach to build the Fund´s security portfolio which is made up primarily of common stocks and securities convertible into common stock. These securities are issued by large companies, and to a lesser extent, small and mid-sized companies. When a company´s fundamentals are strong, we believe earnings growth will follow.

Principal risks of investing in the Fund

The primary risks of investing in the Fund are:

~ Stock Market Risk - the value of an investment may fluctuate,

~ Industry and Security Risk - risks relating to an industry as a whole or a company´s prospects for business success,

~ Management Risk - risks that the Adviser´s assessment of a company´s growth prospects may not be accurate,

~ Liquidity Risk - a given security or asset may not be readily marketable,

~ Small Cap Risk - small cap stocks tend to have a high exposure to market fluctuations and failure,

~ Mid Cap Risk - mid cap stocks tend to have a greater exposure to market fluctuations and failure.

Loss of some or all of the money you invest is a risk of investing in the Fund.

Risk/Return Bar Chart and Table

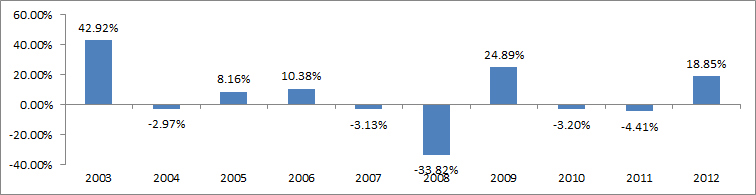

The bar chart and table are intended to provide you with an indication of the risks of investing in the Fund by showing changes in performance from year to year and by showing how the Fund´s average annual returns for 1, 5 and 10 years compare to those of the Standard and Poors 500. Past performance, before and after taxes, is not predictive of future performance. Sales load and account fees are not reflected in the chart. If the sales load and account fees were included, the returns would be less than those that are shown. Updated performance information for the Fund is available at the Fund´s web site (www.americangrowthfund.com) or toll free telephone number (800) 525-2406.

Best calendar quarter 06/03 26.21%. Worst calendar quarter 09/01 -30.42%. Year to date performance for the period ended 9/30/2012 was 16.92%.

| For the periods ended December 31, 2011 | One Year | Five Years | Ten Years |

| Class A Return before taxes | -4.60% | -6.15% | -2.81% |

| Class B Return before taxes | -5.53% | -6.76% | -3.53% |

| Class C Return before taxes | -5.56% | -6.84% | -3.54% |

| Class D Return before taxes | -4.41% | -5.83% | -2.53% |

| Class D Return after taxes on Distributions | -4.41% | -5.83% | -2.53% |

| Class D Return after taxes on Distributions and Sale of Fund Shares | -4.41% | -5.83% | -2.53% |

| Standard and Poors 500 | 2.12% | -0.25% | 2.92% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes;

Actual after-tax returns depend on an investor´s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts;

After-tax returns are shown for only Class D and after-tax returns for other Classes will vary.

The Investment Adviser

The investment adviser is Investment Research Corporation.

Page 3

Portfolio Manager

The Fund is managed by an Investment Committee made up of; Timothy Taggart, the Fund´s President who has acted in this capacity since April of 2011, and Robert Fleck, employee of the Adviser who has acted in this capacity since April of 2011.

Purchase and Sale of Fund Shares

You can purchase and sell your shares on any business day through your Financial Adviser, by mail by writing to: American Growth Fund, 1636 Logan Street, Denver, CO 80203, by wire if the purchase or sale is over $1,000 or by calling 800-525-2406 if the purchase or sale is $5,000 or less. When purchasing Fund shares there is no minimum initial or subsequent amount required.

Tax Consequences

Distributions from the Fund´s long-term capital gains are taxable as capital gains, while distributions from short-term capital gains and net investment income are generally taxable as ordinary income.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary´s Web site for more information.

Investment Objectives, Principal Investment Strategies, Related Risks, and Disclosure of Portfolio Holdings

What is the Fund´s investment objective?

The Fund´s investment objective, which is fundamental and cannot be changed without shareholder approval, is growth of capital. Income only becomes a Fund objective when it is in a temporary, defensive position.

How does the Fund implement its investment objective?

In attempting to achieve its investment objective, the Fund will typically invest at least 80% of its assets in common stocks and securities convertible into common stocks traded on national securities exchanges or over-the-counter.

We perform our own extensive internal research to determine whether companies meet our growth criteria. From time to time we meet company management teams and other key staff face-to-face and tour corporate facilities and manufacturing plants to get a complete picture of a company before we invest.

We limit the amount of the Fund´s assets invested in any one industry and in any individual security. At the time of purchase we do not invest more than 5% of the Fund´s total assets in any one issuer nor do we invest more than 25% in any one industry. We also follow a rigorous selection process designed to identify undervalued securities before choosing securities for the portfolio.

Although the Fund will normally invest in large capitalization companies, the Fund may invest in companies of all sizes. Investment Research Corporation, the Fund´s investment adviser (the Adviser or IRC), will choose common stocks (or convertible securities) that it believes have a potential for capital appreciation because of existing or anticipated economic conditions or because the securities are considered undervalued or out of favor with investors or are expected to increase in price over the short-term. Convertible debt securities will be rated at least A by Moody´s Investor Service or Standard and Poors Ratings Services, or, if unrated, will be comparable quality in the opinion of the Adviser.

We maintain a long-term investment approach and focus on stocks we believe can appreciate over an extended time frame regardless of interim market fluctuations. Using the following disciplined approach, we look for companies having some or all of these characteristics:

~ Large capitalization companies, although on occasion the Fund may invest in small and mid-cap companies, if the Adviser believes it is in the best interests of the Fund. Large cap companies are generally companies with market capitalization exceeding $5 billion at the date of acquisition;

~ growth that is faster than the market as a whole and sustainable over the long term;

~ strong management team;

~ leading market positions and growing brand identities;

~ financial, marketing, and operating strength.

The Fund may invest in foreign securities in the form of American Depository Receipts.

The Fund emphasizes investments in common stocks with the potential for capital appreciation. These stocks generally pay regular dividends, although the Fund also may invest in non-dividend-paying companies if, in the opinion of an Adviser, they offer better prospects for capital appreciation.

Page 4

When the Adviser believes the securities the Fund holds may decline in value, the Fund may sell them and, if the Adviser believes market conditions warrant the Fund may assume a defensive position. While in a defensive position, the Fund may invest all or part of its assets in corporate bonds, debentures (both short and long term) or preferred stocks rated A or above by Moody´s Investors Service, Inc. or Standard and Poors (or, if unrated, of comparable quality in the opinion of the Adviser), United States Government securities, repurchase agreements meeting approved credit worthiness standards (e.g., whereby the underlying security is issued by the United States Government or any agency thereof), or retain funds in cash or cash equivalents. There is no maximum limit on the amount of fixed income securities in which the Fund may invest for temporary defensive purposes. If the Fund takes a temporary defensive position in attempting to respond to adverse market, economic, political or other conditions, it may not achieve its investment objective. The Fund´s performance could be lower during periods when it retains or invests its assets in these more defensive holdings.

A repurchase agreement is a contract under which the seller of a security agrees to buy it back at an agreed upon price and time in the future.

The Fund will enter into repurchase transactions only with parties who meet creditworthiness standards approved by the Fund´s board of directors.

The Fund may invest in foreign securities in the form of American Depository Receipts (ADRs) which represents ownership in the shares of a non-U.S. company that trades in U.S. financial markets. We typically invest only a small portion of the Fund´s portfolio in foreign corporations through ADRs. We do not invest directly in foreign securities. When we do purchase ADRs, they are generally denominated in U.S. dollars and traded on a U.S. exchange.

We limit exposure to illiquid securities.

Risks, How we strive to manage them.

Investing in any mutual fund involves risk, including the risk that you may receive little or no return on your investment, and the risk that you may lose part or all of the money you invest.

Stock Market risk is the risk that all or a majority of the securities in a certain market - such as the stock or bond market - will decline in value because of factors such as economic conditions, future expectations or investor confidence.

Industry and security risk is the risk that the value of securities in a particular industry or the value of an individual stock or bond will decline because of changing expectations for the performance of that industry or for the individual company issuing the stock or bond.

Management risk is the risk that the Adviser´s assessment of a company´s ability to increase earnings faster than the rest of the market is not correct, the securities in the portfolio may not increase in value, and could decrease in value.

Interest rate risk is the risk that as rates rise, the price of a fixed rate bond will fall.

Credit risk is the possibility that a bond´s issuer (or an entity that insures a bond) will be unable to make timely payments of interest and principal.

Foreign investment risk is the risk that foreign securities may be adversely affected by political instability, changes in currency exchange rates, foreign economic conditions or inadequate regulatory and accounting standards.

Liquidity risk is the possibility that securities cannot be readily sold, or can only be sold at a price lower than the price that the Fund has valued them.

Small Cap stocks tend to have a high risk exposure to market fluctuations and failure.

Mid Cap stocks also tend to have a greater risk exposure to market fluctuations and failure but normally not as much so as the Small Cap stocks.

Convertible Securities have the risk of loss of principal at maturity, however, this loss is limited to the value of the bond floor.

Before you invest in the Fund you should carefully evaluate the risks. Because of the nature of the Fund, you should consider the investment to be a long-term investment that typically provides the best results when held for a number of years.

Please see the Statement of Additional Information for further discussion of risks.

Portfolio Holdings

A description of the Fund´s policies and procedures with respect to the disclosure of the Fund´s portfolio securities is available in the Fund´s SAI which is available on the Fund´s website, www.americangrowthfund.com.

Annual Fund operating expenses

For the year ended July 31, 2012 the Fund paid $112,728 in administrative expenses and $135,895 in investment

Page 5

advisory fees. Distribution and service fees for the year ended July 31, 2012 for Class A were $12,988, for Class B were $7,590 and for Class C were $21,708. Directors fees for the year ended July 31, 2012 were $6,964. Other expenses totaled $68,834 which were $32,158 in office expenses, $15,980 in dues, fees and subscriptions and $20,696 in miscellaneous expenses. The Expense Ratio, which reflects the effect of expenses paid directly by the Fund, for the year ended July 31, 2012 for Class A was 4.92%, Class B was 5.67%, Class C was 5.63% and Class D was 4.63%.

Management, Organization, and Capital Structure

The Investment Adviser

Investment Research Corporation ("IRC") has been the Adviser for the Fund since its inception in 1958. IRC is located at 1636 Logan Street, Denver, CO 80203. The Fund offers four classes of shares; Class A, Class B, Class C and Class D shares of the Fund represent an identical interest in the investment portfolio. The Fund has an agreement to pay Investment Research Corporation an annual fee for its services based on a percentage of the Fund´s Class A, Class B, Class C, and Class D average net assets. Under the investment advisory contract with IRC, IRC receives annual compensation for investment advice on these classes, computed and paid monthly, equal to 1% of the first $30 million of the Fund´s Class A, Class B, Class C, and Class D average annual net assets and 0.75% of such assets in excess of $30 million. For the fiscal year ended July 31, 2012, this fee amounted to 1.00% of the average net assets on each of the Fund´s four classes. For the year ended July 31, 2012, under an agreement with IRC, the Fund was charged $112,728 for the costs and expenses related to employees of IRC who provided administrative, clerical and accounting services to the Fund. In addition, the Fund was charged $90,838 by an affiliated company of IRC for the rental of office space.

The Fund, and therefore, the Fund shareholders, pays the Fund´s operating expenses.

On September 23, 2010 an Investment Advisory Committee was formed with the purpose of offering investment advice to the senior portfolio manager of the Fund. The current members of the Investment Advisory Committee are Timothy Taggart and Robert Fleck. On September 20, 2012, the Board of Directors reviewed and approved the expenses reimbursed by the Fund to IRC as well as the Investment Advisory Agreement with IRC. A discussion regarding the basis for the Board of Directors approving the Investment Advisory Agreement is available in the Fund´s Annual Report to Shareholders for the year ended July, 31 2012.

IRC may use a portion of its base advisory fee to compensate third party advisors for assisting IRC in establishing relationships with other third party investment advisors and/or sub-manager programs and disseminating information concerning IRC to financial professionals.

The Fund and the Adviser have a Code of Ethics designed to ensure that the interests of Fund shareholders come before the interests of the people who manage the Fund. Among other provisions, the Code of Ethics prohibits portfolio managers and other investment personnel from buying securities in an initial public offering without prior written consent or from profiting from the purchase and sale of the same security within two calendar days. In addition, the Code of Ethics requires portfolio managers and other employees with access to information about the purchase or sale of securities by the Fund to obtain approval before executing personal trades in these specific securities. A copy of the Fund´s Code of Ethics can be obtained for free online at www.americangrowthfund.com or by calling us at 1-800-525-2406.

How is the Fund managed?

The daily operations of the Fund are managed by its officers subject to the overall supervision and control of the board of directors.

Portfolio Manager

The Fund is managed by an Investment Committee made up of; Timothy Taggart, the Fund´s Persident, who has acted in this capacity since April of 2011 and is the President of the Fund´s principal underwriter and distributor, World Capital Brokerage, Inc. ("WCB"), and Robert Fleck, employee of the Adviser who has acted in this capacity since April of 2011.

Since September 23, 2010, Mr. Taggart has been responsible for managing the Fund´s security portfolio through his positions with IRC, and the Fund´s Investment Advisory committee; and directing the distribution of Fund shares through his positions with WCB. For the years prior to that Mr. Taggart served on the Board of Directors for IRC, as Treasurer and Chief Complaince officer as well as on the Board of Directors for WCB as President and Chief Complaince Office.

Since Septembet 23, 2010, Mr. Fleck has been a member of the Investment Advisory Committee. For the years prior to that Mr. Fleck served as President and CEO of World Capital Advisors, LLC., a registered Investment Advisor.

Chief Compliance Officer

Michael L. Gaughan is the Fund´s Chief Compliance Officer (CCO). The Fund´s CCO insures that policies and guidelines, set forth by the CCO and the Board of Directors, that guard against violations of federal security laws, are adhered to. These policies and procedures are annually reviewed by the CCO and the Board of Directors to determine their adequacy and their effectiveness.

Page 6

Shareholder Information

Pricing of Fund Shares

The price you pay for shares will depend on when we receive your purchase order. If we or an authorized agent receive your order before the close of trading on the New York Stock Exchange on a business day, you will pay that day´s closing share price, which is based on the Fund´s net asset value. If we receive your order after the close of trading, you will pay the next business day´s price. A business day is any day that the New York Stock Exchange is open for business. Currently the Exchange is closed when the following holidays are observed: New Years Day, Martin Luther King, Jr.´s Birthday, Presidents Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving and Christmas. We reserve the right to reject any purchase order.

We determine the Fund´s net asset value (NAV) per share at the close of trading of the New York Stock Exchange each business day that the Exchange is open. We calculate this value by adding the market value of all the securities and assets in the Fund´s portfolio, deducting all liabilities, and dividing the resulting number by the shares outstanding. The result is the NAV per share. We price securities and other assets for which market quotations are available at their market value. We price debt securities on the basis of valuations provided to us by an independent pricing service that uses methods approved by our board of directors. Any debt securities that have a maturity of less than 60 days are priced at amortized cost. We price all other securities at their fair value if no bid and asked prices are quoted for such day or information as to New York or other approved exchange transactions is not readily available, using a method approved by the board of directors.

Purchase of Fund Shares

Through your financial adviser

Your financial adviser can handle all the details of purchasing shares, including opening an account.

Your adviser may charge a separate fee for this service.

By mail

Complete an investment application and mail it with your check, made payable to American Growth Fund, Inc. and class of shares you wish to purchase, to American Growth Fund, Inc., 1636 Logan Street, Denver CO, 80203. If you are making an initial purchase by mail, you must include a completed investment application (or an appropriate retirement plan application if you are opening a retirement account) with your check.

By wire

Ask your bank to wire the amount you want to invest to UMB Bank, NA, ABA #101000695 A/C #9871691527. Include your account number and the name of the Fund Class in which you want to invest. If you are making an initial purchase by wire, you must call Shareholder Services at 1-800-525-2406 so we can assign you an account number.

Please read the complete Prospectus before investing.

Special Services Available when Purchasing Fund Shares

To help make investing with us as easy as possible, and to help you build your investments, we offer the following special services.

Automatic Investing Plan - The Automatic Investing Plan allows you to make regular monthly investments directly from your bank account.

Direct Deposit - With Direct Deposit you can make additional investments through payroll deductions or recurring government or private payments, such as direct transfers from your bank account.

Dividend Reinvestment Plan - Through our Dividend Reinvestment Plan, you can have your distributions reinvested in your account. The shares that you purchase through the Dividend Reinvestment Plan are not subject to a front-end sales charge or to a contingent deferred sales charge. Under most circumstances, you may reinvest dividends only into like classes of shares.

Systematic Withdrawal Plan - Through our Systematic Withdrawal Plan you can arrange a regular monthly or quarterly payment from your account made to you or someone you designate. You may also have your withdrawals deposited directly to your bank account through our MoneyLine Direct Deposit Services.

Retirement Plans

In addition to being an appropriate investment for your Individual Retirement Account (IRA) and Roth IRA, shares in the Fund may be suitable for group retirement plans. You may establish your IRA account even if you are already a participant in an employer-sponsored retirement plan. For more information on how shares in the Fund can play an important role in your retirement planning or for details about group plans, please consult your financial adviser, or call 1-800-525-2406.

Page 7

How to Redeem Shares

Through your financial adviser

Your financial adviser can handle all the details of redeeming shares. Your adviser may charge a separate fee for this service.

By mail

You can redeem your shares (sell them back to the Fund) by mail by writing to: American Growth Fund, Inc., 1636 Logan Street, Denver, CO, 80203. All owners of the account must sign the request, and for redemptions of $5,000 or more, you must include a signature guarantee for each owner. Signature guarantees are also required when redemption proceeds are going to an address other than the address of record on an account. A signature guarantee is a certification by a bank, brokerage firm or other financial institution that a customer´s signature is valid; signature guarantees can be provided by members of the STAMP program (a program made up of members who are authorized to issue signature guarantees).

By wire

You can redeem $1,000 or more of your shares and have the proceeds deposited directly to your bank account the next business day after we receive your request. Bank information must be on file before you request a wire redemption.

By phone

You can redeem shares by phone. All shareholders must be on the call, redemption must be $5,000 or less and the proceeds must be sent to the address of record and made payable to all listed shareholders. Please remember that redemptions by check are restricted after an address change, unless a signature guaranteed letter requesting the redemption is submitted.

If you hold your shares in certificates, you must submit the certificates with your request to sell the shares. We recommend that you send your certificates by certified mail.

When you send us a properly completed request to redeem or exchange shares, you will receive the net asset value as determined on the business day we receive your request if we receive it before the close of the NYSE. We will deduct any applicable contingent deferred sales charges. We will send you a check, normally the next business day, but no later than seven days after we receive your request to sell your shares. If you recently purchased your shares by check, we will wait until your check has cleared, which can take up to 15 days, before we send your redemption proceeds.

If you are required to pay a contingent deferred sales charge when you redeem shares, the amount subject to the fee will be based on the shares´ net asset value when you purchased them or their net asset value when you redeem them, whichever is less. This arrangement assures that you will not pay a contingent deferred sales charge on any increase in the value of your shares. The redemption price for purposes of this formula will be the NAV of the shares you are actually redeeming.

Conversion of Class B Shares to Class A Shares. After approximately seven years (the Conversion Period), Class B shares will be converted automatically into Class A shares of the Fund. Class A shares are subject to an ongoing service fee of 0.25% of average net assets and are subject to a distribution fee of 0.05% of average net assets. Automatic conversion of Class B shares into Class A shares will occur at least once each month (on the Conversion Date) on the basis of the relative net asset values of the shares of the two classes on the Conversion Date, without the imposition of any sales load, fee or other charge. Conversion of Class B shares to Class A shares will not be deemed a purchase or sale of the shares for Federal income tax purposes.

In addition, shares purchased through reinvestment of dividends and distributions on Class B shares also will convert automatically to Class A shares. The Conversion Date for dividend reinvestment shares will be calculated taking into account the length of time the shares underlying such reinvestment shares were outstanding. If at a Conversion Date the conversion of Class B shares to Class A shares of the Fund in a single account will result in less than $50 worth of Class B shares being left in the account, all of the Class B shares of the Fund held in the account on Conversion Date will be converted to Class A shares of the Fund.

Share certificates for Class B shares of the Fund to be converted must be delivered to the Transfer Agent at least one week prior to the Conversion Date applicable to those shares. In the event such certificates are not received by the Transfer Agent at least one week prior to the Conversion Date, the related Class B shares will convert to Class A shares on the next scheduled Conversion Date after such certificates are delivered.

Account Minimum

If you redeem shares and your account balance falls below a minimum of $250, and stays there for a period of 12 months or longer, the Fund may redeem your account after 30 days written notice to you.

Page 8

Dividends and Distributions

The Fund´s policy is to declare and pay income dividends and capital gains distributions to its shareholders in December of each calendar year unless the board of directors of the Fund determines that it is to the shareholders benefit to make distributions on a different basis.

Unless the shareholder on his or her application or in writing previously requests dividend and distribution payments in cash, income dividends and capital gains distributions will be reinvested in Fund shares of the same class, at their relative net asset values as of the business day next following the distribution record date. If no instructions are given on the application form, all income dividends and capital gains distributions will be reinvested.

The Fund intends to make distributions that may be taxed as ordinary income and capital gains (Capital gains may be taxable at different rates depending on the length of the time the Fund holds its assets).

We will send you a statement each year by January 31st detailing the amount and nature of all dividends and capital gains that you were paid for the prior year.

Distributions by the Fund, whether received in cash or reinvested in additional shares of the Fund, may be subject to federal income tax. Any capital gains may be taxable at different rates depending on the length of time the Fund held the assets. In addition, you may be subject to state and local taxes on distributions. An exchange of the Fund´s shares for shares of another fund will be treated as a sale of the Fund´s shares and any gain on the transaction may be subject to federal income tax.

Frequent Purchases and Redemptions of Fund Shares

The Fund is not designed to serve as vehicles for frequent trading in response to short-term fluctuations in the securities markets. Accordingly, purchases, including those that are part of exchange activity, that American Growth Fund, Inc. has determined could involve actual or potential harm to the Fund may be rejected. Frequent trading of a mutual fund´s shares may lead to increased costs to that fund and less efficient management of the fund´s portfolio, resulting in dilution of the value of the shares held by long-term shareholders.

The Fund´s Board of Directors has not adopted policies or procedures with respect to frequent purchases and redemptions by Fund shareholders. Due to the size of the Fund the Board feels that the Fund´s best interests are better served by allowing the Management of the Fund to monitor such trading activity. If at any time the Management of the Fund feels that a trade or an account is, or could, adversely affect the Fund´s performance through frequent purchasing and redeeming of Fund shares significantly increasing the costs of processing share purchase and/or redemption transactions, management reserves the right to reject the trade, suspend trading of the account(s) for a specified period of time, or both. Rejection of a trade and/or suspension(s) of trading activity will cause a letter to be promptly issued to the party(ies) involved.

The Fund has no agreement with any person(s) or corporate entity that would allow for frequent purchases and redemptions of Fund shares.

Distribution Arrangements

Sales Charges

You can choose from a number of share classes for the Fund. Because each share class has a different combination of sales charges, fees and other features, you should consult your financial adviser to determine which class best suits your investment goals and time frame. You may also consult the Fund´s Statement of Additional Information for more details.

Class A

Class A shares have an up-front sales charge of up to 5.75% that you pay when you buy shares.

The offering price for Class A shares includes the front-end sales charge.

If you invest $50,000 or more, your front-end sales charge will be reduced.

You may qualify for other reduced sales charges, as described in How to Reduce Your Sales Charge, and under certain circumstances the sales charge may be waived.

Class A shares are also subject to an annual 12b-1 fee no greater than 0.30% of average net assets, which is lower than the 12b-1 fee for Class B and Class C shares.

Class A shares generally are not subject to a contingent deferred sales charge unless they are sold in amounts of $1,000,000 or more at net asset value and are redeemed within one year of purchase.

Class B

Class B shares have no up-front sales charge, so the full amount of your purchase is invested in the Fund.

However, you will pay a contingent deferred sales charge if you redeem your shares within seven years after you buy them.

If you redeem Class B shares during the first two years after you buy them, the shares will be subject to a contingent deferred sales charge of 5%. The contingent deferred sales charge is 4% during the third and

Page 9

fourth years, 3% during the fifth year, 2% during the sixth year, and 1% during the seventh year.

Under certain circumstances the contingent deferred sales charge may be waived.

For approximately seven years after you buy your Class B shares, they are subject to annual 12b-1 fees no greater than 1% of average daily net assets, of which 0.25% are service fees paid to the Distributor, dealers or others for providing services and maintaining accounts.

Because of the higher 12b-1 fees, Class B shares have higher expenses and any dividends paid on these shares are lower than dividends on Class A shares.

Approximately seven years after you buy them, Class B shares automatically convert into Class A shares with a 12b-1 fee of no more than 0.30%. Conversions may occur as late as three months after the eighth anniversary of purchase, during which time Class B Shares higher 12b-1 fees apply.

Class C

Class C shares have no up-front sales charge, so the full amount of your purchase is invested in the Fund. However, you will pay a contingent deferred sales charge if you redeem your shares within 12 months after you buy them.

Under certain circumstances the contingent deferred sales charge may be waived.

Class C shares are subject to an annual 12b-1 fee which may not be greater than 1% of average daily net assets, of which 0.25% is service fees and 0.75% is distribution fees paid to the distributor, dealers or others for providing personal services and maintaining shareholder accounts.

Because of the higher 12b-1 fees, Class C shares have higher expenses and pay lower dividends than Class A shares.

Unlike Class B shares, Class C shares do not automatically convert into another class.

Class D

Class D shares are offered to investors who owned Class D shares as of March 1, 1996. They are also available to the Fund´s Adviser IRC, and the distributors, directors, certain institutional investors, corporations and accounts managed by specific types of fiduciaries. Additionally, IRC reserves the right to waive the front-end sales charge on purchases by IRC employees.

Class D shares have an up-front sales charge of 5.75% that you pay when you buy the shares. The offering price for Class D shares includes the front-end sales charge.

If you invest $50,000 or more, your front-end sales charge will be reduced.

You may qualify for other reduced sales charges, as described in How to Reduce Your Sales Charge, and under certain circumstances the sales charge may be waived.

Class D shares which are sold in amounts of $1,000,000 or more at net asset value and if redeemed within one year of purchase may be subject to a 1.0% contingent deferred sales charge.

The Fund´s directors have adopted separate 12b-1 plans for Class A, B, and C that allow each class to pay distribution fees for the sales and distributions of its shares. Because these fees are paid out of each Class´s assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges.

Class A and D Sales Charges

| Amount of purchase | Sales charge as % of offering price | Sales charge as % of amount invested | Dealers commission as % of offering price |

| Less than $50,000 | 5.75% | 6.10% | 5.00% |

| $50,000 but less than $100,000 | 4.50% | 4.71% | 3.75% |

| $100,000 but less than $250,000 | 3.50% | 3.63% | 2.75% |

| $250,000 but less than $500,000 | 2.50% | 2.56% | 2.00% |

| $500,000 but less than $1,000,000 | 2.00% | 2.04% | 1.60% |

| $1,000,000 and over* | 0.00% | 0.00% | 0.00% |

Page 10

* As shown above, there is no front-end sales charge when you purchase $1 million or more of Class A shares. However, if your financial adviser is paid a commission on your purchase, you may have to pay a limited contingent deferred sales charge of 1% if you redeem these shares within the first year.

IRC will make payments to dealers in the amount of 0.25 of 1% per year of the average daily net asset value of outstanding Class D shares acquired after April 1, 1994 through such dealers (including shares acquired through reinvestment of dividends and distributions on such shares). These payments are made by IRC and not by the Class D shareholders of the Fund.

The Fund makes available free of charge on or though the Fund´s web site at www.americangrowthfund.com the information describing sales loads including deferred sales loads and a table of front end sales loads and each break point in the sales load as a percentage of both the offering price and the net amount invested. There is also a discussion on how to reduce your sales charge by using letter of intent, rights of accumulation plans, dividend reinvestment plans, withdrawal plans, exchange privileges, and waivers for particular classes of investors. This includes methods used to value accounts in order to determine whether a shareholder has met sales load breakpoints as well as and any other information that the shareholder might need to provide in order to obtain the break points.

The web site will also explain how to purchase shares including any special purchase plans or methods that may not be described in the prospectus or elsewhere in the SAI.

How to reduce your sales charge

We offer a number of ways to reduce or eliminate the sales charge on shares. Please refer to the Statement of Additional Information for detailed information and eligibility requirements. You can also get additional information from your financial adviser. You or your financial adviser must notify us at the time you purchase shares if you are eligible for any of these programs. In order to obtain a breakpoint discount, it is necessary at the time of purchase for a shareholder to inform the Fund or its intermediary of the existence of other eligible holdings.

Letter of intent

Through a Letter of Intent you agree to invest a certain amount in American Growth Fund over a 13-month period to qualify for reduced front-end sales charges.

Class A - Available

Class B and C - Although the Letter of Intent and Rights of Accumulation do not apply to the Purchase of Class B and C shares, you can combine your purchase of A shares with your purchase of B and C shares to fulfill your Letter of Intent or qualify for Rights of Accumulation.

Class D - Available

Rights of Accumulation

You can combine your holdings or purchases of all Classes in the Fund as well as the holdings and purchases of your spouse and children under 21 to qualify for reduced front-end sales charges.

Class A - Available

Class B and C - Although the Letter of Intent and Rights of Accumulation do not apply to the Purchase of Class B and C shares, you can combine your purchase of A shares with your purchase of B and C shares to fulfill your Letter of Intent or qualify for Rights of Accumulation.

Class D - Available

Reinvestment of redeemed shares

Up to 30 days after you redeem shares, you can reinvest the proceeds without paying a front-end sales charge.

Class A - Available

Class B and C - Not available

Class D - Available

SIMPLE IRA, SEP IRA, SAR/SEP, Prototype Profit Sharing, Pension, 401(k), SIMPLE 401(k), 403(b)(7)

These investment plans may qualify for reduced sales charges by combining the purchases of all members of the group. Members of these groups may also qualify to purchase shares without a front-end sales charge and a waiver of any contingent deferred sales charge.

Class A - Available

Class B and C - Not available

Class D - Available

Page 11

Financial Highlights

The financial highlight table is intended to help you understand the Fund´s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information for each of the five years in the period ended July 31, 2012 has been audited by Tait, Weller & Baker, LLP whose report, along with the Fund´s financial statements, are included in the annual report, which is available upon request by contacting the Fund at 800-525-2406 or on the Fund´s web site, www.americangrowthfund.com. The prior periods were audited by other auditors.

| Class A Year Ended July 31, |

| 2012 | 2011 | 2010 | 2009 | 2008 | |

| Per Share Operating Data: | |||||

| Net Asset Value, | |||||

| Beginning of Period | $2.62 | $2.55 | $2.49 | $2.99 | $3.44 |

| Income (loss) from investment operations: | |||||

| Net investment loss | (0.08) | (0.12) | (0.11) | (0.10) | (0.12) |

| Net realized and unrealized gain (loss) | 0.22 | 0.19 | 0.17 | (0.40) | (0.33) |

| Total income (loss) from investment operations | 0.14 | 0.07 | 0.06 | (0.50) | (0.45) |

| Net Asset Value, End of Period | $2.76 | $2.62 | $2.55 | $2.49 | $2.99 |

| Total Return at Net Asset Value1 | 5.3% | 2.8% | 2.4% | (16.7)% | (13.1)% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of period (in thousands) | $4,579 | $4,517 | $4,853 | $4,706 | $5,953 |

| Ratio to average net assets: | |||||

| Net investment loss | (3.11)% | (4.03)% | (3.99)% | (4.12)% | (3.37)% |

| Expenses | 4.92% | 4.99% | 4.80% | 5.11% | 4.08% |

| Portfolio Turnover Rate2 | 8% | 140% | 8% | 12% | 18% |

| Class B Year Ended July 31, |

| 2012 | 2011 | 2010 | 2009 | 2008 | |

| Per Share Operating Data: | |||||

| Net Asset Value, | |||||

| Beginning of Period | $2.34 | $2.29 | $2.25 | $2.72 | $3.16 |

| Income (loss) from investment operations: | |||||

| Net investment loss | (0.12) | (0.15) | (0.13) | (0.11) | (0.14) |

| Net realized and unrealized gain (loss) | 0.24 | 0.20 | 0.17 | (0.36) | (0.30) |

| Total income (loss) from investment operations | 0.12 | 0.05 | 0.04 | (0.47) | (0.44) |

| Net Asset Value, End of Period | $2.46 | $2.34 | $2.29 | $2.25 | $2.72 |

| Total Return at Net Asset Value1 | 5.1% | 2.2% | 1.8% | (17.3)% | (13.9)% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of period (in thousands) | $620 | $969 | $1,523 | $2,124 | $3,408 |

| Ratio to average net assets: | |||||

| Net investment loss | (3.87)% | (4.75)% | (4.70)% | (4.81)% | (4.05)% |

| Expenses | 5.67% | 5.71% | 5.51% | 5.79% | 4.77% |

| Portfolio Turnover Rate2 | 8% | 140% | 8% | 12% | 18% |

1. Assumes a hypothetical initial investment on the business day before the first day of the fiscal period with all dividends and distributions reinvested in additional shares on the reinvestment date and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in total returns.

2. The lesser of purchases and sales of portfolio securities for a period, divided by the monthly average of the market value of securities owned during the period. Securities with a maturity or expiration date at the time of acquisition of one year or less are excluded from the calculation. Purchases and sales of investment securities (other than short-term securities) for the year ended July 31, 2012, aggregated $1,122,514 and $3,180,947, respectively.

Page 12

| Class C Year Ended July 31, |

| 2012 | 2011 | 2010 | 2009 | 2008 | |

| Per Share Operating Data: | |||||

| Net Asset Value, | |||||

| Beginning of Period | $2.33 | $2.28 | $2.24 | $2.72 | $3.15 |

| Income (loss) from investment operations: | |||||

| Net investment loss | (0.10) | (0.12) | (0.12) | (0.10) | (0.13) |

| Net realized and unrealized gain (loss) | 0.21 | 0.17 | 0.16 | (0.38) | (0.30) |

| Total income (loss) from investment operations | 0.11 | 0.05 | 0.04 | (0.48) | (0.43) |

| Net Asset Value, End of Period | $2.44 | $2.33 | $2.28 | $2.24 | $2.72 |

| Total Return at Net Asset Value1 | 4.7% | 2.2% | 1.8% | (17.7)% | (13.7)% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of period (in thousands) | $2,068 | $2,472 | $2,750 | $2,960 | $3,986 |

| Ratio to average net assets: | |||||

| Net investment loss | (3.83)% | (4.69)% | (4.70)% | (4.82)% | (4.07)% |

| Expenses | 5.63% | 5.68% | 5.50% | 5.81% | 4.78% |

| Portfolio Turnover Rate2 | 8% | 140% | 8% | 12% | 18% |

| Class D Year Ended July 31, |

| 2012 | 2011 | 2010 | 2009 | 2008 | |

| Per Share Operating Data: | |||||

| Net Asset Value, | |||||

| Beginning of Period | $2.72 | $2.64 | $2.57 | $3.08 | $3.54 |

| Income (loss) from investment operations: | |||||

| Net investment loss | (0.08) | (0.11) | (0.11) | (0.09) | (0.10) |

| Net realized and unrealized gain (loss) | 0.24 | 0.19 | 0.18 | (0.42) | (0.36) |

| Total income (loss) from investment operations | 0.16 | 0.08 | 0.07 | (0.51) | (0.46) |

| Net Asset Value, End of Period | $2.88 | $2.72 | $2.64 | $2.57 | $3.08 |

| Total Return at Net Asset Value1, | 5.9% | 3.0% | 2.7% | (16.6)% | (13.0)% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of period (in thousands) | $6,455 | $6,798 | $7,195 | $7,789 | $10,024 |

| Ratio to average net assets: | |||||

| Net investment loss | (2.84)% | (3.73)% | (3.69)% | (3.82)% | (3.06)% |

| Expenses | 4.63% | 4.69% | 4.50% | 4.81% | 3.78% |

| Portfolio Turnover Rate2 | 8% | 140% | 8% | 12% | 18% |

1. Assumes a hypothetical initial investment on the business day before the first day of the fiscal period with all dividends and distributions reinvested in additional shares on the reinvestment date and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in total returns.

2. The lesser of purchases and sales of portfolio securities for a period, divided by the monthly average of the market value of securities owned during the period. Securities with a maturity or expiration date at the time of acquisition of one year or less are excluded from the calculation. Purchases and sales of investment securities (other than short-term securities) for the year ended July 31, 2012, aggregated $1,122,514 and $3,180,947, respectively.

Page 13

Understanding the Financial Highlights

The tables on the preceding pages itemize what contributed to the changes in share price during the period. They also show the changes in share price for this period in comparison to changes over the last four fiscal periods.

On a per share basis, the tables include as appropriate:

~ share prices at the beginning of the period;

~ investment income and capital gains or losses;

~ distributions of income and capital gains paid to shareholders; and

~ share prices at the end of the period.

The tables also include some key statistics for the period as appropriate:

~ Total Return - the overall percentage of return of the Fund, assuming the reinvestment of all distributions

~ Expense Ratio - operating expenses as a percentage of average net assets;

~ Net Investment Income Ratio - net investment income as a percentage of average net assets; and

~ Portfolio Turnover - the percentage of the Fund´s buying and selling activity.

Proxy Voting

A discussion on Proxy Voting can be found on Page 5 of the Fund´s Statement of Additional Information. The Statement of Additional Information, as well as how the Fund issued votes for the year ended June 30, 2012, can be obtained by calling 800-525-2406 or by visiting the Fund´s web site at www.americangrowthfund.com.

Page 14

American Growth Fund, Inc.

1636 Logan Street

Denver, CO 80203

800.525.2406

303.626.0600

303.626.0614 Fax

DISTRIBUTOR

World Capital Brokerage, Inc.

1636 Logan Street

Denver, CO 80203

303.626.0631

888.742.0631

303.626.0614 Fax

INVESTMENT ADVISER

Investment Research Corporation

1636 Logan Street

Denver, CO 80203

303.626.0632

TRANSFER AGENT

Fund Services, Inc.

8730 Stony Point Parkway

Stony Point Bldg. III

Suite # 205

Richmond, Va. 23235

CUSTODIAN

UMB Bank NA Investment Services Group

928 Grand Blvd

Fifth Floor

Kansas City, MO 64106

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Tait, Weller & Baker LLP

1818 Market St.

Suite 2400

Philadelphia, PA 19103

Additional information about the Fund´s investments is available in American Growth Fund´s annual and semi-annual reports to shareholders. In American Growth Fund´s annual report, you will find a discussion of the market conditions and investment strategies that significantly affected the Fund´s performance during its last fiscal year.

You can find more detailed information about the Fund, including a description of the Fund´s policies and procedures with respect to the disclosure of the Fund´s portfolio securities, in the current Statement of Additional Information, which we have filed electronically with the Securities and Exchange Commission (SEC) and which is legally a part of this prospectus. If you want a free copy of the Statement of Additional Information, the annual or semi-annual report, or if you have any questions about investing in this Fund or shareholder inquiries, you can write to us at 1636 Logan Street, Denver, CO 80203, email us at info@americangrowthfund.com or view the annual, semi-annual and the statement of additional information online at www.americangrowthfund.com, or call us, toll-free, at 800-525-2406. Requests to mail or email the Statement of Additional Information, Annual Report or Semi Annual Report will be processed, without charge, within three business days of your request. You may also obtain additional information about the Fund from your financial adviser.

Information about the Fund (including the Fund´s Statement of Additional Information) can be reviewed and copied at the Commission´s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-551-8090. Reports and other information about the Fund are available on the EDGAR Database on the Commission´s Internet site at http://www.sec.gov. Copies of this information may be obtained, after paying a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the Commission´s Public Reference Section, Washington, D.C. 20549-1520.

Shareholder Service Center

Call the Shareholder Service Center Monday through Friday, 7:30 a.m. to 4:00 p.m. Mountain time at 800-525-2406.

~ For fund information; literature, price, and performance figures.

~ For information on existing regular investment accounts and retirement plan accounts including wire investments; wire redemptions; telephone redemptions and telephone exchanges.

Investment Company Act File #811-825

Page 15

1636 Logan Street, Denver, Colorado 80203

303-626-0600

Series One

Class A AMRAX - Class B AMRBX - Class C AMRCX - Class D AMRGX

STATEMENT OF ADDITIONAL INFORMATION

July 19, 2013

This Statement of Additional Information is not a prospectus. Prospective investors should read this Statement of Additional Information only in conjunction with the Prospectuses of Series One of American Growth Fund, Inc. (the "Fund") dated July 19, 2013. A copy of the Prospectus may be obtained at no cost by writing World Capital Brokerage, Inc. (the "Distributor"), 1636 Logan Street, Denver, Colorado 80203, or by calling 800-525-2406 or on the Fund´s web site, www.americangrowthfund.com.

A

ADDITIONAL INVESTMENT INFORMATION, 4

AUTOMATIC CASH WITHDRAWAL PLAN, 17

B

BOARD OF DIRECTORS, 9

BROKERAGE, 21

C

CALCULATION OF NET ASSET VALUE, 22

CLASSIFICATION, 3

CONTROL PERSONS AND PRINCIPAL HOLDERS OF SECURITIES, 11

D

DEALER REALLOWANCES, 12

DISCLOSUE OF PROTFOLIO HOLDINGS, 6

DISTRIBUTION OF SHARES, 13

DISTRIBUTION PLANS, 19

DIVIDENDS, DISTRIBUTIONS AND TAXES, 23

F

FUND HISTORY, 3

I

INDIVIDUAL RETIREMENT ACCOUNTS, 18

INVESTMENT ADVISORY AGREEMENT, 11

INVESTMENT STRATAGIES AND RISKS, 3

M

MANAGEMENT OF THE FUND, 6

O

OTHER INVESTMENT ADVICE, 12

OTHER SERVICE PROVIDERS, 13

P

PERFORMANCE DATA, 25

PORTFOLIO MANAGERS, 13

PORTFOLIO TURNOVER, 6

PRINCIPAL UNDERWRITER, 12

PROXY VOTING POLICIES, 10

R

RETIREMENT PLANS, 18

RULE 12b-1 PLANS, 12

S

SERVICE AGREEMENTS, 12

T

TEMPORARY DEFENSIVE POSITION, 6

FUND HISTORY

The Fund was established in August of 1958 as a diversified, open-end, management investment company organized and incorporated in the State of Maryland.

CLASSIFICATION

The American Growth Fund is a diversified, open-end management investment company.

INVESTMENT STRATAGIES

In attempting to achieve its investment objective, the Fund will typically invest at least 80% of its assets in common stocks and securities convertible into common stocks traded on national securities exchanges or over-the-counter.

We perform our own extensive internal research to determine whether companies meet our growth criteria. From time to time we meet company management teams and other key staff face-to-face and tour corporate facilities and manufacturing plants to get a complete picture of a company before we invest.

We limit the amount of the Fund´s assets invested in any one industry and in any individual security. At the time of purchase we do not invest more than 5% of the Fund´s total assets in any one issuer nor do we invest more than 25% in any one industry. We also follow a rigorous selection process designed to identify undervalued securities before choosing securities for the portfolio.

Although the Fund will normally invest in large capitalization companies, the Fund may invest in companies of all sizes. Investment Research Corporation, the Fund´s investment adviser (the Adviser or IRC), will choose common stocks (or convertible securities) that it believes have a potential for capital appreciation because of existing or anticipated economic conditions or because the securities are considered undervalued or out of favor with investors or are expected to increase in price over the short-term. Convertible debt securities will be rated at least A by Moody´s Investor Service or Standard and Poors Ratings Services, or, if unrated, will be comparable quality in the opinion of the Adviser.

We maintain a long-term investment approach and focus on stocks we believe can appreciate over an extended time frame regardless of interim market fluctuations. Using the following disciplined approach, we look for companies having some or all of these characteristics:

~ Large capitalization companies, although on occasion the Fund may invest in small and mid-cap companies, if the Adviser believes it is in the best interests of the Fund. Large cap companies are generally companies with market capitalization exceeding $5 billion at the date of acquisition;

~ growth that is faster than the market as a whole and sustainable over the long term;

~ strong management team;

~ leading market positions and growing brand identities;

~ financial, marketing, and operating strength.

The Fund emphasizes investments in common stocks with the potential for capital appreciation. These stocks generally pay regular dividends, although the Fund also may invest in non-dividend-paying companies if, in the opinion of an Adviser, they offer better prospects for capital appreciation.

When the Adviser believes the securities the Fund holds may decline in value, the Fund may sell them and, if the Adviser believes market conditions warrant the Fund may assume a defensive position. While in a defensive position, the Fund may invest all or part of its assets in corporate bonds, debentures (both short and long term) or preferred stocks rated A or above by Mood´y Investors Service, Inc. or Standard and Poors (or, if unrated, of comparable quality in the opinion of the Adviser), United States Government securities, repurchase agreements meeting approved credit worthiness standards (eg, whereby the underlying security is issued by the United States Government or any agency thereof), or retain funds in cash or cash equivalents. There is no maximum limit on the amount of fixed income securities in which the Fund may invest for temporary defensive purposes. If the Fund takes a temporary defensive position in attempting to respond to adverse market, economic, political or other conditions, it may not achieve its investment objective. The Fund´s performance could be lower during periods when it retains or invests its assets in these more defensive holdings.

A repurchase agreement is a contract under which the seller of a security agrees to buy it back at an agreed upon price and time in the future.

The Fund will enter into repurchase transactions only with parties who meet creditworthiness standards approved by the Fund´s board of directors.

The Fund may invest in foreign securities in the form of American Depository Receipts (ADRs) which represents ownership in the shares of a non-U.S. company that trades in U.S. financial markets. We typically invest only a small portion of the Fund´s portfolio in foreign corporations through ADRs. We do not invest directly in foreign securities. When we do purchase ADRs, they are generally denominated in U.S. dollars and traded on a U.S. exchange.

We limit exposure to illiquid securities.

INVESTMENT RISKS

The primary risks of investing in the Fund are:

Stock Market risk is the risk that all or a majority of the securities in a certain market - such as the stock or bond market - will decline in value because of factors such as economic conditions, future expectations or investor confidence.

Industry and security risk is the risk that the value of securities in a particular industry or the value of an individual stock or bond will decline because of changing expectations for the performance of that industry or for the individual company issuing the stock or bond.

Management risk is the risk that the Adviser´s assessment of a company´s ability to increase earnings faster than the rest of the market is not correct, the securities in the portfolio may not increase in value, and could decrease in value.

Interest rate risk is the risk that as rates rise, the price of a fixed rate bond will fall.

Credit risk is the possibility that a bond´s issuer (or an entity that insures a bond) will be unable to make timely payments of interest and principal.

Foreign investment risk is the risk that foreign securities may be adversely affected by political instability, changes in currency exchange rates, foreign economic conditions or inadequate regulatory and accounting standards.

Liquidity risk is the possibility that securities cannot be readily sold, or can only be sold at a price lower than the price that the Fund has valued them.

Small Cap stocks tend to have a high risk exposure to market fluctuations and failure.

Mid Cap stocks also tend to have a greater risk exposure to market fluctuations and failure but normally not as much so as the Small Cap stocks.

Convertible Securities have the risk of loss of principal at maturity, however, this loss is limited to the value of the bond floor.

Before you invest in the Fund you should carefully evaluate the risks. Because of the nature of the Fund, you should consider the investment to be a long-term investment that typically provides the best results when held for a number of years.

Loss of some or all of the money you invest is a risk of investing in the Fund.

ADDITIONAL INVESTMENT INFORMATION

The following information supplements the information in the American Growth Fund, Inc. (the "Fund") Prospectuses under the heading Principal Investment Strategy.

The Fund is subject to certain restrictions on its investment policies, including the following:

1. No securities may be purchased on margin, the Fund may not sell securities short, and will not participate in a joint or joint and several basis with others in any securities trading account.

2. Not more than 5% of the value of the assets of the Fund at the time of investment may be invested in securities of any one issuer other than securities issued by the United States government.

3. Not more than 10% of any class of voting securities or other securities of any one issuer may be held in the portfolio of the Fund.

4. The Fund cannot act as an underwriter of securities of other issuers.

5. The Fund cannot borrow money except from a bank as a temporary measure for extraordinary or emergency purposes, and then only in an amount not to exceed 10% of its total assets taken at cost, or mortgage or pledge any of its assets.

6. The Fund cannot make or purchase loans to any person including real estate mortgage

loans, other than through the purchase of a portion of publicly distributed debt securities pursuant to the investment policy of the Fund.

7. The Fund cannot issue senior securities or purchase the securities of another investment company or investment trust except in the open market where no profit to a sponsor or dealer, other than the customary brokers commission, results from such purchase (but the total of such investment shall not exceed 10% of the net assets of the Fund), or except when such purchase is part of a plan of merger or consolidation. The Fund may purchase securities of other investment companies in the open market if the purchase involves only customary broker´s commissions and only if immediately thereafter (i) no more than 3% of the voting securities of any one investment company are owned by the Fund, (ii) no more than 5% of the value of the total assets of the Fund would be invested in any one investment company, and (iii) no more than 10% of the value of the total assets of the Fund would be invested in the securities of such investment companies. Should the Fund purchase securities of other investment companies, the Fund´s shareholders may incur additional management and distribution fees.

8. The Fund cannot invest in the securities of issuers which have been in operation for less than three years if such purchase at the time thereof would cause more than 5% of the net assets of the Fund to be so invested, and in any event, any such investments must be limited to utility or pipeline companies.

9. The Fund cannot invest in companies for the purpose of exercising management or control.

10. The Fund cannot deal in real estate, commodities or commodity contracts.

11. In applying its restrictions on concentration of investments in any one industry, the Fund uses industry classifications based, where applicable, on Bridge Information Systems, Reuters, the S&P Stock Guide published by Standard & Poors, the O´Neil Database published by William O´Neil & Co., Inc., information obtained from Value Line, Bloomberg L.P. and Moody´s International, and/or the prospectus of the issuing company, and/or other recognized classification resources. Selection of an appropriate industry classification resource will be made by management in the exercise of its reasonable discretion. The Fund will not concentrate its investments in any particular industry nor will it purchase a security if, as a result of such purchase, more than 25% of its assets will be invested in a particular industry.

12. The Fund cannot invest in puts, calls, straddles, spreads or any combination thereof.

The foregoing policies can be changed only by approval of a majority of the outstanding shares of the Fund, which means the lesser of (i) 67% of the shares represented at a meeting at which more than 50% of the outstanding shares are present in person or by proxy, or (ii) more than 50% of the outstanding shares.

When the Fund makes temporary investments in U.S. Government securities, it ordinarily

will purchase U.S. Treasury Bills, Notes, or Bonds. The Fund may make temporary investments in repurchase agreements where the underlying security is issued or guaranteed by the U.S. Government or an agency thereof. The Fund will not invest more than 10% of its assets in repurchase agreements maturing in more than seven days, or securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale. The Fund will not invest in real estate limited partnership interests, other than interests in readily marketable real estate investment trusts. The Fund will not invest in oil, gas or mineral leases, or invest more than 5% of its net assets in warrants or rights, valued at the lower of cost or market, nor more than 2% of its net assets in warrants or rights (valued on the same basis) which are not listed on the New York or American Stock Exchanges.

TEMPORARY DEFENSIVE POSITION

If the Fund invests in fixed-income securities, for temporary defensive purposes, these securities generally are U.S. government obligations. If corporate fixed-income securities are used, the securities normally are rated A or higher by Moody´s Investor Service, Inc. (Moody´s) or A or higher by Standard & Poors (S&P). There is no maximum limit on the amount of fixed income securities in which the Fund may invest for temporary defensive purposes.

PORTFOLIO TURNOVER

The Fund experienced a portfolio turnover rate of 8% for the year ended July 31, 2012. This higher then normal rate was in response to market behavior.

DISCLOSUE OF PORTFOLIO HOLDINGS

Disclosures of portfolio holdings are made on a case by case basis by Timothy E. Taggart, President. Considerations for disclosing portfolio holdings include, but are not limited to, the person or group making the request, the frequency of requests, timing of requests, compensation received, and if the disclosure of such information is in the best interest of the Fund´s shareholders. In deciding if the request is within the shareholders´ best interest Mr. Taggart will weigh any possible conflicts between the shareholders and the investment adviser, principal underwriter and any affiliated person of such entity. Mr. Taggart may elect to place restrictions on the use of such information including a requirement that the information be kept confidential or prohibitions on trading based on said information. Restrictions on such use may also include procedures to monitor the use of the information. All instances of the release of such information will be reviewed quarterly by the Board of Directors.

Currently the Fund has no ongoing arrangements or commitment to release portfolio holdings to any individual or group.

MANAGEMENT OF THE FUND

The day-to-day operations of the Fund are managed by its officers subject to the overall supervision and control of the board of directors. The Fund´s Audit Committee meets quarterly and is responsible for reviewing the financial statements of the Fund. The

following information about the interested directors2 the Fund includes their principal occupations for the past five years:

| Name, Address, and Age | Position(s) Held with Fund | Term of Office1 and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director for the Past Five Years |

| Timothy E. Taggart (58), 1636 Logan Street, Denver, CO | President, Director and Treasurer | Since April 2004 | Principal financial and accounting officer, employee of Adviser since 1983. See below for affiliation with Distributor. | 1 | Director of World Capital Brokerage, Inc. and Investment Research Corporation |

| John Pasco III (63), 8730 Stony Point Parkway, Suite 205, Richmond, VA | Director and Audit Committee Member | Since December 2006 | Mr. Pasco is Treasurer of Commonwealth Shareholder Services, Inc., a mutual fund administrator; President of First Dominion Capital Corp., a Broker Dealer; President of Fund Services, Inc., a transfer and disbursing agent; President and Treasurer of Commonwealth Capital Management, Inc., a Registered Investment Adviser; President of Commonwealth Capital Management, LLC, a Registered Investment Advisor; President of Commonwealth Fund Accounting, Inc.; and President and Director of The World Insurance Trust, a registered investment company. | 1 | Director of Commonwealth Shareholder Services, Inc., Director of First Dominion Capital Corp., Director of Fund Services, Inc., Director of Commonwealth Fund Accounting, Inc. |

The following information about the non-interested directors, officers and advisors of the Fund includes their principal occupations for the past five years:

| Name, Address, and Age | Position(s) Held with Fund | Term of Office1 and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director for the Past Five Years |

| Eddie R. Bush (71), 1400 W. 122nd Ave., Suite 100, Westminster, Colorado | Director and Audit Committee Member (financial expert) | Since September 1987 | Certified Public Accountant | 1 | None |

| Harold Rosen (83), 1 Middle Road, Englewood, CO | Director | Since December 1995 | Owner of Bi-Rite Furniture Stores. | 1 | None |

| Dr. Brian Brody (57)*, 6901 S. Pierce St. Suite #100M, Littleton, CO | Director | Since June 2008 | Doctor of Professional Psychology | 1 | None |

| Michael L. Gaughan (45), 2001 Avenue D, Scottsbluff, NE | Chief Complaince Officer and Secretary | Since September 2004 | Employee of the Fund since 1995. | N/A | World Capital Brokerage, Inc. and Investment Research Corporation |

| Patricia A. Blum (54), 1636 Logan Street, Denver, CO | Vice President | Since June 2013 | Employee of the Fund since 2001. | N/A | N/A |

1. Trustees and officers of the fund serve until their resignation, removal or retirement.

2. Timothy Taggart is an "interested person of the Fund as defined by the Investment Company Act of 1940 because of the following positions which he holds.

Timothy E. Taggart is the President, Treasurer and a Director of World Capital Brokerage, Inc. and is the President, Treasurer and a Director of Investment Research Corporation.

John Pasco III is an "interested person of the Fund as defined by the Investment Company Act of 1940 because of the following position which he holds.

John Pasco III is the Treasurer and a director of Director of Commonwealth Shareholder Services, Inc., the Fund´s administrator. President and Director of Fund Services, Inc., the Fund´s transfer agent. President and Director of Commonwealth Fund Accounting, Inc., the Fund´s accounting service agent.

Timothy E. Taggart is president and a director of the Distributor and the president and a director of Investment Research Corporation.

None of the above named persons received any retirement benefits or other form of deferred compensation from the Fund. There are no other funds that together with the Fund constitute a Fund Complex.

As of November 2, 2012, all officers and directors as a group (a total of 7) owned directly 353,004 of its shares or 7.35% of shares outstanding. Together, directly and indirectly, all the officers and directors as a group owned 374,341 shares or 7.80% of all shares outstanding.

As of November 2, 2012, officers, directors and members of the advisory board and their relatives owned of record and beneficially Fund shares with net asset value of approximately $1,122,901 representing approximately 8.18% of the total net assets of the Fund.

BOARD OF DIRECTORS

The management of the Fund believes that the business experience and educational background of the Fund´s Directors and Officers set forth above make these individuals well qualified to serve the Fund in the positions that they hold. Specifically, Fund management believes that:

Timothy E. Taggart, President and Director, has held his securities license since 1987. His knowledge of the securities industry is vast as owner and president of World Capital Brokerage, Inc., a registered Broker Dealer, and owner and president of Investment Research Corporation, a registered Investment Advisor. Mr. Taggart is also a member of the Investment Committee and a FINRA Arbitrator.

John Pasco III, Director and Audit Committee Member, has extensive experience in the Securities industry as Treasurer and a Director of a mutual fund administrator, President and a Director of a FINRA Registered Broker Dealer, President and a Director of a mutual fund transfer and disbursing agent, President of two SEC Registered Investment Advisers, President and Director of an accounting firm, President and a Director of a registered investment company of World Funds, Inc.