false--12-31FY2019000005125300.0100.2010.250.251150.31340.383950P12YP15YP23YP10YP5YP18YP23Y2350000066000000750000000.1250.1255000000005000000001285261371285261371066192021067872990.011250.06820.0640.01125P8Y52150000020170002011000505000158300050520007559000P3Y0000115159.54130.25159.54130.2521906935217388380

0000051253

2019-01-01

2019-12-31

0000051253

2019-06-30

0000051253

2020-02-26

0000051253

iff:A0.500SeniorNotesDue2021Member

2019-01-01

2019-12-31

0000051253

iff:A1.800SeniorNotesDue2026Member

2019-01-01

2019-12-31

0000051253

iff:A6.00TangibleEquityUnitsMember

2019-01-01

2019-12-31

0000051253

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0000051253

iff:A1.750SeniorNotesDue2024Member

2019-01-01

2019-12-31

0000051253

2017-01-01

2017-12-31

0000051253

2018-01-01

2018-12-31

0000051253

2018-12-31

0000051253

2019-12-31

0000051253

2017-12-31

0000051253

2016-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0000051253

us-gaap:RetainedEarningsMember

2018-12-31

0000051253

us-gaap:TreasuryStockMember

2019-01-01

2019-12-31

0000051253

us-gaap:TreasuryStockMember

2017-01-01

2017-12-31

0000051253

us-gaap:TreasuryStockMember

2017-12-31

0000051253

us-gaap:CommonStockMember

2016-12-31

0000051253

us-gaap:CommonStockMember

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201712Member

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201616Member

us-gaap:RetainedEarningsMember

2016-12-31

0000051253

us-gaap:TreasuryStockMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201712Member

2018-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201712Member

us-gaap:RetainedEarningsMember

2018-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2018-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2019-12-31

0000051253

us-gaap:TreasuryStockMember

2016-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:RetainedEarningsMember

2018-12-31

0000051253

us-gaap:CommonStockMember

2019-12-31

0000051253

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201616Member

us-gaap:RetainedEarningsMember

2017-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2016-12-31

0000051253

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0000051253

us-gaap:TreasuryStockMember

2019-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0000051253

us-gaap:AccountingStandardsUpdate201616Member

2017-12-31

0000051253

us-gaap:RetainedEarningsMember

2017-12-31

0000051253

us-gaap:RetainedEarningsMember

2019-12-31

0000051253

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0000051253

us-gaap:CommonStockMember

2017-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2017-12-31

0000051253

us-gaap:TreasuryStockMember

2018-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-01-01

2017-12-31

0000051253

us-gaap:RetainedEarningsMember

2016-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0000051253

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-12-31

0000051253

us-gaap:AccountingStandardsUpdate201602Member

2018-12-31

0000051253

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0000051253

us-gaap:NoncontrollingInterestMember

2016-12-31

0000051253

srt:MinimumMember

us-gaap:IntellectualPropertyMember

2019-01-01

2019-12-31

0000051253

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2018-01-01

2018-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2017-01-01

2017-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2017-12-31

0000051253

srt:MaximumMember

iff:BuildingsAndImprovementsMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

us-gaap:TradeNamesMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

us-gaap:TradeNamesMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

iff:BuildingsAndImprovementsMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

us-gaap:PatentsMember

2019-01-01

2019-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2019-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0000051253

iff:TradeAccountsReceivableWithFactoringAgreementsMember

2018-12-31

0000051253

srt:MinimumMember

iff:InformationTechnologyHardwareAndSoftwareMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

us-gaap:PatentsMember

2019-01-01

2019-12-31

0000051253

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:RetainedEarningsMember

2018-12-29

0000051253

srt:MaximumMember

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

iff:InformationTechnologyHardwareAndSoftwareMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

us-gaap:IntellectualPropertyMember

2019-01-01

2019-12-31

0000051253

2018-12-29

0000051253

srt:MinimumMember

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0000051253

iff:SharedITCorporateCostsMember

2017-01-01

2017-12-31

0000051253

iff:ScentMember

2017-01-01

2017-12-31

0000051253

iff:ScentMember

2018-01-01

2018-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2019-01-01

2019-12-31

0000051253

iff:SharedITCorporateCostsMember

2018-01-01

2018-12-31

0000051253

iff:TasteMember

2017-01-01

2017-12-31

0000051253

iff:ScentMember

2019-01-01

2019-12-31

0000051253

iff:SharedITCorporateCostsMember

2019-01-01

2019-12-31

0000051253

iff:TasteMember

2018-01-01

2018-12-31

0000051253

iff:TasteMember

2019-01-01

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2018-01-01

2018-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2018-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2017-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2017-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2018-01-01

2018-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2018-01-01

2018-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2018-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2017-01-01

2017-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2017-01-01

2017-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2015SeveranceInitiativesMember

2017-01-01

2017-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2015SeveranceInitiativesMember

2016-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2016-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2015SeveranceInitiativesMember

2017-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2016-12-31

0000051253

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2019SeveranceInitiativesMember

iff:ScentMember

2019-01-01

2019-12-31

0000051253

us-gaap:EMEAMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

srt:NorthAmericaMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2019SeveranceInitiativesMember

2019-01-01

2019-12-31

0000051253

srt:LatinAmericaMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

iff:A2017ProductivityProgramMember

2017-01-01

2017-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2019-01-01

2019-12-31

0000051253

iff:FixedAssetWriteDownMember

iff:FrutaromIntegrationInitiativeMember

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:FrutaromIntegrationInitiativeMember

2018-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2019SeveranceInitiativesMember

2018-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:FrutaromIntegrationInitiativeMember

2018-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2019-01-01

2019-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2019SeveranceInitiativesMember

2019-01-01

2019-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:FrutaromIntegrationInitiativeMember

2019-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2019SeveranceInitiativesMember

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2019SeveranceInitiativesMember

2018-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2017ProductivityProgramMember

2019-12-31

0000051253

iff:FixedAssetWriteDownMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:A2019SeveranceInitiativesMember

2019-12-31

0000051253

iff:FixedAssetWriteDownMember

iff:FrutaromIntegrationInitiativeMember

2018-12-31

0000051253

us-gaap:OtherRestructuringMember

iff:A2017ProductivityProgramMember

2019-12-31

0000051253

us-gaap:EmployeeSeveranceMember

iff:FrutaromIntegrationInitiativeMember

2019-12-31

0000051253

srt:AsiaMember

iff:FrutaromIntegrationInitiativeMember

2019-01-01

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

iff:ProductFormulaMember

2018-10-04

2018-10-04

0000051253

iff:FrutaromIndustriesLtd.Member

us-gaap:CustomerRelationshipsMember

2018-10-04

2018-10-04

0000051253

iff:FrutaromIndustriesLtd.Member

2018-10-04

2018-10-04

0000051253

iff:FrutaromIndustriesLtd.Member

us-gaap:AboveMarketLeasesMember

2019-01-01

2019-09-30

0000051253

iff:FrutaromIndustriesLtd.Member

us-gaap:TrademarksMember

2018-10-04

2018-10-04

0000051253

iff:PowderPureMember

2017-04-07

0000051253

iff:FragranceResourcesMember

2017-01-17

2017-01-17

0000051253

srt:RestatementAdjustmentMember

iff:FrutaromIndustriesLtd.Member

2019-09-30

0000051253

iff:PowderPureMember

2017-04-07

2017-04-07

0000051253

iff:PowderPureMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2017-04-07

2017-04-07

0000051253

iff:TheAdditiveAdvantageLLCMember

2018-12-07

0000051253

iff:PowderPureMember

us-gaap:TradeNamesMember

2017-04-07

2017-04-07

0000051253

srt:MaximumMember

iff:PowderPureMember

2017-04-07

0000051253

iff:FragranceResourcesMember

2017-01-17

0000051253

iff:TheAdditiveAdvantageLLCMember

2018-12-07

2018-12-07

0000051253

iff:PowderPureMember

us-gaap:TradeNamesMember

2017-04-07

0000051253

iff:WiburgCanadaMember

iff:FrutaromIndustriesLtd.Member

2019-06-30

0000051253

iff:MightyandLeagelMember

2019-03-31

0000051253

iff:NutritionBiosciencesIncMember

2019-12-15

0000051253

iff:FrutaromIndustriesLtd.Member

2018-10-04

0000051253

iff:NutritionBiosciencesIncMember

iff:SeniorUnsecuredTermLoanFacilitiesMember

us-gaap:UnsecuredDebtMember

2019-12-15

0000051253

iff:WiburgCanadaMember

2019-06-30

0000051253

iff:WiburgCanadaMember

2019-04-01

2019-06-30

0000051253

srt:MaximumMember

iff:MightyandLeagelMember

2019-03-31

0000051253

iff:MightyandLeagelMember

2019-01-01

2019-03-31

0000051253

iff:PowderPureMember

us-gaap:CustomerRelationshipsMember

2017-04-07

0000051253

iff:DuPontdeNemoursIncMember

iff:InternationalFlavorsFragrancesIncMember

iff:NutritionBiosciencesIncMember

2019-12-15

0000051253

iff:FragranceResourcesMember

us-gaap:TradeNamesMember

2017-01-17

2017-01-17

0000051253

srt:MinimumMember

iff:MightyandLeagelMember

2019-03-31

0000051253

srt:MinimumMember

iff:FragranceResourcesMember

us-gaap:CustomerRelationshipsMember

2017-01-17

2017-01-17

0000051253

iff:PowderPureMember

us-gaap:CustomerRelationshipsMember

2017-04-07

2017-04-07

0000051253

iff:FragranceResourcesMember

iff:TradeNamesandProprietaryTechnologyMember

2017-01-17

0000051253

iff:PowderPureMember

2019-01-01

2019-12-31

0000051253

iff:FragranceResourcesMember

us-gaap:CustomerRelationshipsMember

2017-01-17

0000051253

iff:NutritionBiosciencesIncMember

iff:ThreeHundredSixtyFourDaySeniorUnsecuredBridgeFacilityMember

us-gaap:UnsecuredDebtMember

2019-12-15

0000051253

srt:MaximumMember

iff:FragranceResourcesMember

us-gaap:CustomerRelationshipsMember

2017-01-17

2017-01-17

0000051253

iff:NutritionBiosciencesIncMember

iff:SeniorUnsecuredBridgeTermLoanMember

us-gaap:UnsecuredDebtMember

2019-12-15

0000051253

iff:FragranceResourcesMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2017-01-17

2017-01-17

0000051253

iff:NutritionBiosciencesIncMember

2019-12-15

2019-12-15

0000051253

iff:WiburgCanadaMember

2019-06-30

0000051253

iff:PowderPureMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2017-04-07

0000051253

iff:FrutaromIndustriesLtd.Member

2019-01-01

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2018-01-01

2018-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2019-09-30

0000051253

srt:MaximumMember

iff:FrutaromIndustriesLtd.Member

iff:ProductFormulaMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

iff:FrutaromIndustriesLtd.Member

us-gaap:AboveMarketLeasesMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

iff:FrutaromIndustriesLtd.Member

us-gaap:AboveMarketLeasesMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

iff:FrutaromIndustriesLtd.Member

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

us-gaap:TrademarksMember

2019-01-01

2019-12-31

0000051253

srt:MinimumMember

iff:FrutaromIndustriesLtd.Member

iff:ProductFormulaMember

2019-01-01

2019-12-31

0000051253

srt:MaximumMember

iff:FrutaromIndustriesLtd.Member

us-gaap:CustomerRelationshipsMember

2019-01-01

2019-12-31

0000051253

us-gaap:MachineryAndEquipmentMember

2018-12-31

0000051253

us-gaap:ConstructionInProgressMember

2019-12-31

0000051253

us-gaap:TechnologyEquipmentMember

2019-12-31

0000051253

us-gaap:BuildingAndBuildingImprovementsMember

2019-12-31

0000051253

us-gaap:ConstructionInProgressMember

2018-12-31

0000051253

us-gaap:MachineryAndEquipmentMember

2019-12-31

0000051253

us-gaap:BuildingAndBuildingImprovementsMember

2018-12-31

0000051253

us-gaap:LandMember

2018-12-31

0000051253

us-gaap:LandMember

2019-12-31

0000051253

us-gaap:TechnologyEquipmentMember

2018-12-31

0000051253

srt:MaximumMember

iff:InclusionsMember

2019-11-30

0000051253

iff:CashRestrictedStockUnitMember

2019-01-01

2019-12-31

0000051253

us-gaap:RestrictedStockMember

2019-01-01

2019-12-31

0000051253

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-12-31

0000051253

iff:LucasMeyersCosmeticsMember

2019-11-30

0000051253

srt:MinimumMember

iff:InclusionsMember

2019-11-30

0000051253

iff:IFFLegacyReportingUnitsMember

2019-11-30

0000051253

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-12-31

0000051253

us-gaap:CustomerRelationshipsMember

2018-12-31

0000051253

us-gaap:TrademarksAndTradeNamesMember

2019-12-31

0000051253

us-gaap:CustomerRelationshipsMember

2019-12-31

0000051253

us-gaap:OtherIntangibleAssetsMember

2019-12-31

0000051253

us-gaap:TrademarksAndTradeNamesMember

2018-12-31

0000051253

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-12-31

0000051253

us-gaap:OtherIntangibleAssetsMember

2018-12-31

0000051253

us-gaap:MeasurementInputDiscountRateMember

iff:NaturalProductSolutionsMember

2019-11-30

0000051253

us-gaap:MeasurementInputDiscountRateMember

iff:NaturalProductSolutionsMember

us-gaap:IncomeApproachValuationTechniqueMember

2019-11-30

0000051253

iff:MeasurementInputTerminalGrowthMember

iff:TasteMember

us-gaap:IncomeApproachValuationTechniqueMember

2019-11-30

0000051253

iff:MeasurementInputTerminalGrowthMember

iff:TasteMember

2019-11-30

0000051253

iff:MeasurementInputTerminalGrowthMember

iff:NaturalProductSolutionsMember

us-gaap:IncomeApproachValuationTechniqueMember

2019-11-30

0000051253

iff:TasteMember

2019-11-30

0000051253

us-gaap:MeasurementInputDiscountRateMember

iff:TasteMember

2019-11-30

0000051253

us-gaap:MeasurementInputDiscountRateMember

iff:TasteMember

us-gaap:IncomeApproachValuationTechniqueMember

2019-11-30

0000051253

iff:NaturalProductSolutionsMember

2019-11-30

0000051253

iff:MeasurementInputTerminalGrowthMember

iff:NaturalProductSolutionsMember

2019-11-30

0000051253

iff:UnallocatedMember

2018-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

2018-12-31

0000051253

iff:FragrancesMember

2019-12-31

0000051253

iff:FlavorsMember

2019-12-31

0000051253

iff:FlavorsMember

2018-12-31

0000051253

iff:FragrancesMember

2018-12-31

0000051253

iff:UnallocatedMember

2019-12-31

0000051253

us-gaap:EMEAMember

2019-12-31

0000051253

srt:AsiaMember

2019-12-31

0000051253

srt:LatinAmericaMember

2019-12-31

0000051253

srt:NorthAmericaMember

2019-12-31

0000051253

2018-09-17

2018-09-17

0000051253

2018-09-17

0000051253

iff:AmortizingNoteMember

2018-09-17

0000051253

iff:StockPurchaseContractMember

2018-09-17

2018-09-17

0000051253

iff:AmortizingNoteMember

2018-09-17

2018-09-17

0000051253

iff:StockPurchaseContractMember

2018-09-17

0000051253

iff:ConditionThreeMember

2019-12-31

0000051253

iff:ConditionOneMember

2019-12-31

0000051253

iff:ConditionTwoMember

srt:MaximumMember

2019-12-31

0000051253

iff:ConditionTwoMember

2019-12-31

0000051253

iff:ConditionTwoMember

srt:MinimumMember

2019-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

2019-12-31

0000051253

iff:TermLoanCreditAgreementMember

2019-12-31

0000051253

iff:AmortizingNoteMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

2019-12-31

0000051253

iff:SeniorNotesInTwoThousandSixteenMember

2016-03-14

2016-03-14

0000051253

iff:AmortizingNoteMember

iff:FrutaromIndustriesLtd.Member

2018-10-04

2018-10-04

0000051253

srt:MaximumMember

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

us-gaap:BaseRateMember

2018-06-06

2018-06-06

0000051253

iff:SeniorNotesInTwoThousandThirteenMember

2013-04-04

0000051253

srt:MaximumMember

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-06-06

2018-06-06

0000051253

iff:SeniorNotesInTwoThousandSixteenMember

2016-03-14

0000051253

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

us-gaap:BaseRateMember

2018-06-06

2018-06-06

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2018-06-06

0000051253

iff:SeniorNotesInTwoThousandSeventeenMember

2017-05-18

0000051253

us-gaap:CommercialPaperMember

2019-01-01

2019-12-31

0000051253

us-gaap:CommercialPaperMember

2018-01-01

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:UnsecuredDebtMember

2018-09-26

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2019-10-01

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

2018-09-25

0000051253

srt:MinimumMember

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

us-gaap:BaseRateMember

2018-06-06

2018-06-06

0000051253

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

us-gaap:BaseRateMember

2018-06-06

2018-06-06

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

2018-09-25

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2018-06-06

2018-06-06

0000051253

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-06-06

2018-06-06

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-09-26

0000051253

iff:TrancheBRevolvingCreditFacilityMember

iff:CitibankN.AMember

2018-06-06

0000051253

2016-03-14

2016-03-14

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-09-26

0000051253

iff:SeniorNotesInTwoThousandSeventeenMember

2017-05-18

2017-05-18

0000051253

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

2019-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2019-01-01

2019-03-31

0000051253

iff:SeniorNotesInTwoThousandThirteenMember

2013-04-03

2013-04-04

0000051253

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-06-06

2018-06-06

0000051253

us-gaap:RevolvingCreditFacilityMember

iff:CitibankN.AMember

2018-06-06

2018-06-06

0000051253

us-gaap:CommercialPaperMember

2019-12-31

0000051253

iff:TrancheARevolvingCreditFacilityMember

iff:CitibankN.AMember

2018-06-06

0000051253

srt:MinimumMember

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2018-06-06

2018-06-06

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2019-07-01

2019-09-30

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

2018-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

2018-12-31

0000051253

iff:DeferredRealizedGainsOnInterestRateSwapsMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

2019-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

2018-12-31

0000051253

iff:BankBorrowingsAndOverdraftsMember

2019-12-31

0000051253

iff:AmortizingNoteMember

2018-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2018-12-31

0000051253

iff:AmortizingNoteMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

2018-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:LoansPayableMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

2019-12-31

0000051253

iff:DeferredRealizedGainsOnInterestRateSwapsMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

2018-12-31

0000051253

iff:BankBorrowingsAndOverdraftsMember

2018-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

2018-12-31

0000051253

iff:RevolverBorrowingsMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-12-31

0000051253

srt:MinimumMember

iff:SeniorNotesInTwoThousandSevenMember

2019-12-31

0000051253

srt:MaximumMember

iff:SeniorNotesInTwoThousandSevenMember

2019-12-31

0000051253

us-gaap:CommercialPaperMember

2018-12-31

0000051253

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherLiabilitiesMember

2017-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherLiabilitiesMember

2018-12-31

0000051253

iff:TwoThousandEighteenToTwoThousandTwoThousandThirtySevenMember

2018-12-31

0000051253

us-gaap:OtherLiabilitiesMember

2019-12-31

0000051253

iff:TwoThousandEighteenToTwoThousandTwoThousandThirtySevenMember

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

iff:UnrecognizedTaxBenefitsOtherLiabilitiesMember

2019-12-31

0000051253

iff:IndefiniteMember

2019-12-31

0000051253

us-gaap:StateAndLocalJurisdictionMember

2019-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherCurrentLiabilitiesMember

2019-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherLiabilitiesMember

2019-12-31

0000051253

iff:FrutaromIndustriesLtd.Member

iff:UnrecognizedTaxBenefitsOtherCurrentLiabilitiesMember

2019-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherCurrentLiabilitiesMember

2017-12-31

0000051253

iff:UnrecognizedTaxBenefitsOtherCurrentLiabilitiesMember

2018-12-31

0000051253

iff:FlavorsMember

2017-01-01

2017-12-31

0000051253

iff:FragrancesMember

2017-01-01

2017-12-31

0000051253

iff:FlavorsMember

2018-01-01

2018-12-31

0000051253

iff:FragranceIngredientsMember

2018-01-01

2018-12-31

0000051253

iff:FragranceIngredientsMember

2019-01-01

2019-12-31

0000051253

iff:FragranceIngredientsMember

2017-01-01

2017-12-31

0000051253

iff:FragrancesMember

2018-01-01

2018-12-31

0000051253

iff:FragrancesMember

2019-01-01

2019-12-31

0000051253

iff:FlavorsMember

2019-01-01

2019-12-31

0000051253

srt:NorthAmericaMember

2019-01-01

2019-12-31

0000051253

srt:LatinAmericaMember

2018-01-01

2018-12-31

0000051253

srt:AsiaMember

2017-01-01

2017-12-31

0000051253

srt:LatinAmericaMember

2017-01-01

2017-12-31

0000051253

srt:NorthAmericaMember

2018-01-01

2018-12-31

0000051253

srt:AsiaMember

2018-01-01

2018-12-31

0000051253

srt:AsiaMember

2019-01-01

2019-12-31

0000051253

us-gaap:EMEAMember

2019-01-01

2019-12-31

0000051253

srt:NorthAmericaMember

2017-01-01

2017-12-31

0000051253

us-gaap:EMEAMember

2017-01-01

2017-12-31

0000051253

srt:LatinAmericaMember

2019-01-01

2019-12-31

0000051253

us-gaap:EMEAMember

2018-01-01

2018-12-31

0000051253

us-gaap:RestrictedStockMember

2017-01-01

2017-12-31

0000051253

us-gaap:RestrictedStockMember

2018-01-01

2018-12-31

0000051253

iff:EmployeeStockOptionAndRestrictedStockMember

2017-01-01

2017-12-31

0000051253

iff:StockPurchaseContractMember

2019-01-01

2019-12-31

0000051253

iff:StockPurchaseContractMember

2018-01-01

2018-12-31

0000051253

iff:EmployeeStockOptionAndRestrictedStockMember

2019-01-01

2019-12-31

0000051253

iff:EmployeeStockOptionAndRestrictedStockMember

2018-01-01

2018-12-31

0000051253

iff:StockPurchaseContractMember

2017-01-01

2017-12-31

0000051253

2017-11-01

0000051253

2012-12-31

0000051253

2017-10-31

0000051253

2015-08-31

0000051253

us-gaap:RestrictedStockUnitsRSUMember

2019-12-31

0000051253

us-gaap:RestrictedStockUnitsRSUMember

2018-12-31

0000051253

us-gaap:RestrictedStockUnitsRSUMember

2017-01-01

2017-12-31

0000051253

us-gaap:RestrictedStockUnitsRSUMember

2018-01-01

2018-12-31

0000051253

us-gaap:RestrictedStockMember

2018-12-31

0000051253

us-gaap:RestrictedStockMember

2019-12-31

0000051253

iff:EquityBasedAwardsMember

2018-01-01

2018-12-31

0000051253

iff:LiabilityBasedAwardsMember

2019-01-01

2019-12-31

0000051253

iff:EquityBasedAwardsMember

2017-01-01

2017-12-31

0000051253

iff:LiabilityBasedAwardsMember

2017-01-01

2017-12-31

0000051253

iff:LiabilityBasedAwardsMember

2018-01-01

2018-12-31

0000051253

iff:EquityBasedAwardsMember

2019-01-01

2019-12-31

0000051253

iff:CashRestrictedStockUnitMember

2018-12-31

0000051253

iff:CashRestrictedStockUnitMember

2019-12-31

0000051253

iff:StockOptionsAndSsarsMember

iff:RangeSixMember

2019-12-31

0000051253

iff:StockOptionsAndSsarsMember

iff:RangeSixMember

2019-01-01

2019-12-31

0000051253

us-gaap:StockAppreciationRightsSARSMember

2019-12-31

0000051253

us-gaap:StockAppreciationRightsSARSMember

2019-01-01

2019-12-31

0000051253

iff:TwoThousandEightToTwoThousandTenCycleMember

2019-01-01

2019-12-31

0000051253

iff:StockOptionsAndStockSettledAppreciationRightsMember

2017-12-31

0000051253

iff:TwoThousandTenPlanMember

2019-12-31

0000051253

iff:LongTermIncentivePlanMember

2019-01-01

2019-12-31

0000051253

us-gaap:StockAppreciationRightsSARSMember

2017-12-31

0000051253

iff:StockOptionsAndStockSettledAppreciationRightsMember

2019-12-31

0000051253

iff:TwoThousandTenToTwoThousandTwelveCycleMember

2018-03-01

2018-03-31

0000051253

iff:TwoThousandTenPlanMember

2019-01-01

2019-12-31

0000051253

iff:TwoThousandFourteenToTwoThousandSixteenCycleMember

2019-03-01

2019-03-31

0000051253

iff:TwoThousandTenToTwoThousandTwelveCycleMember

2016-03-01

2016-03-31

0000051253

iff:StockOptionsAndStockSettledAppreciationRightsMember

2018-12-31

0000051253

iff:StockOptionsAndSsarsMember

iff:RangeSevenMember

2019-12-31

0000051253

iff:StockOptionsAndSsarsMember

iff:RangeSevenMember

2019-01-01

2019-12-31

0000051253

iff:StockOptionsAndSsarsMember

2018-12-31

0000051253

iff:StockOptionsAndSsarsMember

2019-12-31

0000051253

iff:StockOptionsAndSsarsMember

2019-01-01

2019-12-31

0000051253

iff:FullThreeYearPeriodMember

2019-01-01

2019-12-31

0000051253

iff:EachTwelveMonthPeriodMember

2019-01-01

2019-12-31

0000051253

us-gaap:StockOptionMember

2018-01-01

2018-12-31

0000051253

us-gaap:StockAppreciationRightsSARSMember

2018-12-31

0000051253

us-gaap:StockOptionMember

2017-01-01

2017-12-31

0000051253

us-gaap:StockOptionMember

2019-01-01

2019-12-31

0000051253

us-gaap:CorporateAndOtherMember

2019-01-01

2019-12-31

0000051253

us-gaap:CorporateAndOtherMember

2018-01-01

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FlavorsMember

2019-01-01

2019-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FragrancesMember

2017-01-01

2017-12-31

0000051253

country:GB

us-gaap:CorporateAndOtherMember

2018-01-01

2018-12-31

0000051253

us-gaap:CorporateNonSegmentMember

2018-01-01

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

2019-01-01

2019-12-31

0000051253

iff:NutritionBiosciencesIncMember

us-gaap:CorporateAndOtherMember

2019-01-01

2019-12-31

0000051253

us-gaap:AcquisitionRelatedCostsMember

2018-01-01

2018-12-31

0000051253

us-gaap:CorporateAndOtherMember

2017-01-01

2017-12-31

0000051253

us-gaap:CorporateNonSegmentMember

2017-01-01

2017-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FragrancesMember

2018-01-01

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FrutaromIndustriesLtd.Member

2018-01-01

2018-12-31

0000051253

country:GB

us-gaap:CorporateAndOtherMember

2017-01-01

2017-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FragrancesMember

2019-01-01

2019-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FlavorsMember

2018-01-01

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

2017-01-01

2017-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FlavorsMember

2017-01-01

2017-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FrutaromIndustriesLtd.Member

2019-01-01

2019-12-31

0000051253

iff:NutritionBiosciencesIncMember

us-gaap:CorporateAndOtherMember

2018-01-01

2018-12-31

0000051253

us-gaap:AcquisitionRelatedCostsMember

2019-01-01

2019-12-31

0000051253

us-gaap:CorporateNonSegmentMember

2019-01-01

2019-12-31

0000051253

iff:NutritionBiosciencesIncMember

us-gaap:CorporateAndOtherMember

2017-01-01

2017-12-31

0000051253

us-gaap:OperatingSegmentsMember

2018-01-01

2018-12-31

0000051253

country:GB

us-gaap:CorporateAndOtherMember

2019-01-01

2019-12-31

0000051253

us-gaap:AcquisitionRelatedCostsMember

2017-01-01

2017-12-31

0000051253

us-gaap:CustomerConcentrationRiskMember

2018-01-01

2018-12-31

0000051253

us-gaap:CustomerConcentrationRiskMember

2017-01-01

2017-12-31

0000051253

us-gaap:NonUsMember

2019-01-01

2019-12-31

0000051253

us-gaap:CustomerConcentrationRiskMember

2019-01-01

2019-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FrutaromIndustriesLtd.Member

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FragrancesMember

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FlavorsMember

2019-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FlavorsMember

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FragrancesMember

2019-12-31

0000051253

us-gaap:CorporateNonSegmentMember

2018-12-31

0000051253

us-gaap:OperatingSegmentsMember

iff:FrutaromIndustriesLtd.Member

2019-12-31

0000051253

us-gaap:CorporateNonSegmentMember

2019-12-31

0000051253

us-gaap:GeographicDistributionDomesticMember

2019-01-01

2019-12-31

0000051253

us-gaap:GeographicDistributionForeignMember

2018-01-01

2018-12-31

0000051253

us-gaap:GeographicDistributionDomesticMember

2017-01-01

2017-12-31

0000051253

us-gaap:GeographicDistributionForeignMember

2017-01-01

2017-12-31

0000051253

us-gaap:GeographicDistributionForeignMember

2019-01-01

2019-12-31

0000051253

us-gaap:GeographicDistributionDomesticMember

2018-01-01

2018-12-31

0000051253

country:NL

2019-12-31

0000051253

country:SG

2018-12-31

0000051253

country:NL

2018-12-31

0000051253

iff:OtherCountriesMember

2019-12-31

0000051253

country:US

2019-12-31

0000051253

country:CN

2018-12-31

0000051253

country:US

2018-12-31

0000051253

iff:OtherCountriesMember

2018-12-31

0000051253

country:CN

2019-12-31

0000051253

country:SG

2019-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2017-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2018-01-01

2018-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2019-01-01

2019-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel2Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel3Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel1Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel3Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel2Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel1Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2017-01-01

2017-12-31

0000051253

us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember

2019-12-31

0000051253

us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember

2018-12-31

0000051253

us-gaap:LiabilityMember

2018-12-31

0000051253

us-gaap:LiabilityMember

2019-12-31

0000051253

iff:ExpenseMember

2018-01-01

2018-12-31

0000051253

us-gaap:LiabilityMember

2018-01-01

2018-12-31

0000051253

iff:ExpenseMember

2019-01-01

2019-12-31

0000051253

us-gaap:LiabilityMember

2019-01-01

2019-12-31

0000051253

iff:ExpenseMember

2019-12-31

0000051253

iff:ExpenseMember

2018-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:ForeignPlanMember

us-gaap:PensionPlansDefinedBenefitMember

2019-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:ForeignPlanMember

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel2Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel3Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel2Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel1Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel1Member

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

us-gaap:FairValueInputsLevel3Member

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:FixedIncomeSecuritiesMember

iff:GovernmentAndGovernmentAgencyBondsMember

country:US

us-gaap:PensionPlansDefinedBenefitMember

2018-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2018-12-31

0000051253

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000051253

us-gaap:ForeignExchangeContractMember

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

2018-12-31

0000051253

us-gaap:NondesignatedMember

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

us-gaap:InterestExpenseMember

iff:DealContingentSwapsMember

2019-01-01

2019-12-31

0000051253

iff:ForeignCurrencyContractsMember

us-gaap:NondesignatedMember

2018-01-01

2018-12-31

0000051253

iff:ForeignCurrencyContractsMember

us-gaap:NondesignatedMember

iff:OtherIncomeExpenseNetMember

iff:DealContingentSwapsMember

2019-01-01

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

us-gaap:InterestExpenseMember

iff:DealContingentSwapsMember

2018-01-01

2018-12-31

0000051253

iff:ForeignCurrencyContractsMember

us-gaap:NondesignatedMember

iff:OtherIncomeExpenseNetMember

iff:DealContingentSwapsMember

2018-01-01

2018-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:OtherNonoperatingIncomeExpenseMember

2018-01-01

2018-12-31

0000051253

iff:ForeignCurrencyContractsMember

us-gaap:NondesignatedMember

2019-01-01

2019-12-31

0000051253

iff:AmortizingNoteMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:AmortizingNoteMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:AmortizingNoteMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:AmortizingNoteMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyThreeMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortySevenMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandTwentyEightMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentyOneMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandFortyEightMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNotesDueTwoThousandTwentySixMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:TermLoanCreditAgreementMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-12-31

0000051253

iff:SeniorNotesEuroNoteDueTwoThousandTwentyFourMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2018-12-31

0000051253

iff:SeniorNotesDueTwoThousandandTwentyMember

us-gaap:CarryingReportedAmountFairValueDisclosureMember

2018-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:CashFlowHedgingMember

2019-01-01

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:CashFlowHedgingMember

us-gaap:InterestExpenseMember

2018-01-01

2018-12-31

0000051253

iff:EuroSeniorNotes2016Member

us-gaap:NetInvestmentHedgingMember

2018-01-01

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:CashFlowHedgingMember

2018-01-01

2018-12-31

0000051253

iff:EuroSeniorNotes2016Member

us-gaap:NetInvestmentHedgingMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:NetInvestmentHedgingMember

2018-01-01

2018-12-31

0000051253

iff:SeniorNotesMaturing2021through2026Member

us-gaap:NetInvestmentHedgingMember

2018-01-01

2018-12-31

0000051253

iff:SeniorNotesMaturing2021through2026Member

us-gaap:NetInvestmentHedgingMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

us-gaap:CostOfSalesMember

2018-01-01

2018-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:NetInvestmentHedgingMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

us-gaap:CostOfSalesMember

2019-01-01

2019-12-31

0000051253

us-gaap:ForwardContractsMember

2018-12-31

0000051253

us-gaap:ForwardContractsMember

2019-12-31

0000051253

us-gaap:CurrencySwapMember

2019-12-31

0000051253

us-gaap:CurrencySwapMember

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

2017-01-01

2017-03-31

0000051253

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2018-10-01

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

2017-05-18

2017-05-18

0000051253

iff:ForeignCurrencyContractAndInterestRateSwapMember

2019-12-31

0000051253

us-gaap:CurrencySwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000051253

us-gaap:InterestRateSwapMember

2017-03-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2019-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

2019-12-31

0000051253

us-gaap:ForeignExchangeContractMember

2019-12-31

0000051253

us-gaap:DesignatedAsHedgingInstrumentMember

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

2019-12-31

0000051253

us-gaap:NondesignatedMember

2019-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember

2019-01-01

2019-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-01-01

2017-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-01-01

2019-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-01-01

2018-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-01-01

2019-12-31

0000051253

us-gaap:InterestRateSwapMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember

2017-01-01

2017-12-31

0000051253

us-gaap:ForeignExchangeContractMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember

2019-01-01

2019-12-31

0000051253

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember

2018-01-01

2018-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2019-01-01

2019-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2019-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2019-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2018-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2018-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2017-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2017-01-01

2017-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2017-12-31

0000051253

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2017-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2016-12-31

0000051253

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2016-12-31

0000051253

us-gaap:AccumulatedTranslationAdjustmentMember

2018-01-01

2018-12-31

0000051253

2019-01-01

2019-03-31

0000051253

iff:ZhejiangIngredientsPlantMember

2019-03-31

2019-03-31

0000051253

iff:PledgedAssetsMember

2019-01-01

2019-12-31

0000051253

iff:ZhejiangChinaMember

iff:ZhejiangIngredientsPlantMember

2019-12-31

0000051253

2018-10-01

2018-12-31

0000051253

srt:MinimumMember

2019-12-31

0000051253

us-gaap:ForeignCountryMember

country:BR

2019-10-01

2019-12-31

0000051253

country:CN

iff:ZhejiangIngredientsPlantMember

2019-12-31

0000051253

srt:MaximumMember

2019-12-31

0000051253

iff:HangzhouChinaMember

2019-10-01

2019-12-31

0000051253

us-gaap:DamagesFromProductDefectsMember

2019-12-31

0000051253

iff:GuangzhouChinaMember

iff:TasteMember

2019-12-31

0000051253

iff:BankGuaranteesAndStandbyLettersOfCreditMember

2019-01-01

2019-12-31

0000051253

iff:GuangzhouChinaMember

iff:ScentMember

2019-12-31

0000051253

iff:ZhejiangIngredientsPlantMember

2017-10-01

2017-12-31

0000051253

iff:BankGuaranteesMember

2019-01-01

2019-12-31

0000051253

iff:NutritionBiosciencesIncMember

2019-12-31

0000051253

iff:RedeemableNoncontrollingInterestMember

2017-12-31

0000051253

iff:RedeemableNoncontrollingInterestMember

2019-01-01

2019-12-31

0000051253

iff:RedeemableNoncontrollingInterestMember

2018-01-01

2018-12-31

0000051253

iff:RedeemableNoncontrollingInterestMember

2019-12-31

0000051253

iff:RedeemableNoncontrollingInterestMember

2018-12-31

0000051253

srt:MinimumMember

iff:SeniorUnsecuredTermLoanFacilitiesMember

us-gaap:UnsecuredDebtMember

us-gaap:SubsequentEventMember

2020-01-17

2020-01-17

0000051253

srt:MaximumMember

iff:SeniorUnsecuredTermLoanFacilitiesMember

us-gaap:UnsecuredDebtMember

us-gaap:SubsequentEventMember

2020-01-17

2020-01-17

0000051253

srt:MinimumMember

iff:ThreeHundredSixtyFourDaySeniorUnsecuredBridgeFacilityMember

us-gaap:UnsecuredDebtMember

us-gaap:SubsequentEventMember

2020-01-17

2020-01-17

0000051253

srt:MaximumMember

iff:ThreeHundredSixtyFourDaySeniorUnsecuredBridgeFacilityMember

us-gaap:UnsecuredDebtMember

us-gaap:SubsequentEventMember

2020-01-17

2020-01-17

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2017-01-01

2017-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2018-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2018-01-01

2018-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2017-01-01

2017-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2018-01-01

2018-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2016-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2019-01-01

2019-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2018-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2019-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2019-01-01

2019-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2017-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2019-12-31

0000051253

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2017-12-31

0000051253

us-gaap:AllowanceForCreditLossMember

2016-12-31

0000051253

us-gaap:ScenarioAdjustmentMember

2018-12-31

0000051253

us-gaap:ScenarioAdjustmentMember

2017-12-31

iso4217:USD

xbrli:shares

xbrli:pure

iff:entity

iso4217:EUR

iso4217:USD

iff:Facility

iff:Position

xbrli:shares

iff:segment

iff:category

iff:Customer

iff:swap

iff:Agreement

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

| | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 1-4858

INTERNATIONAL FLAVORS & FRAGRANCES INC.

(Exact name of registrant as specified in its charter)

|

| |

New York | 13-1432060 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

521 West 57th Street, New York, NY 10019-2960

Registrant’s telephone number, including area code (212) 765-5500

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | | | |

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, par value 12 1/2¢ per share | | IFF | | New York Stock Exchange |

6.00% Tangible Equity Units | | IFFT | | New York Stock Exchange |

0.500% Senior Notes due 2021 | | IFF 21 | | New York Stock Exchange |

1.750% Senior Notes due 2024 | | IFF 24 | | New York Stock Exchange |

1.800% Senior Notes due 2026 | | IFF 26 | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | þ | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the voting stock held by non-affiliates of the Registrant was $15,491,883,187 as of June 30, 2019.

As of February 26, 2020, there were 106,802,194 shares of the registrant’s common stock, par value 12 1/2¢ per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2020 Annual Meeting of Shareholders (the “IFF 2020 Proxy Statement”) are incorporated by reference in Part III of this Form 10-K.

INTERNATIONAL FLAVORS & FRAGRANCES INC.

TABLE OF CONTENTS

|

| | |

| | PAGE |

| PART I | |

ITEM 1. | | |

| | |

ITEM 1A. | | |

| | |

ITEM 1B. | | |

| | |

ITEM 2. | | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| | |

| PART II | |

ITEM 5. | | |

| | |

ITEM 6. | | |

| | |

ITEM 7. | | |

| | |

ITEM 7A. | | |

| | |

ITEM 8. | | |

| | |

ITEM 9. | | |

| | |

ITEM 9A. | | |

| | |

ITEM 9B. | | |

| | |

| PART III | |

ITEM 10. | | |

| | |

ITEM 11. | | |

| | |

ITEM 12. | | |

| | |

ITEM 13. | | |

| | |

ITEM 14. | | |

| | |

| PART IV | |

ITEM 15. | | |

| | |

ITEM 16. | | |

| | |

| |

PART I

In this report, we use the terms “IFF,” “the Company,” “we,” “us” and “our” to refer to International Flavors & Fragrances Inc. and its subsidiaries.

We are a leading innovator of sensory experiences that move the world. Our creative capabilities, global footprint, regulatory and technological know-how provide us a competitive advantage in meeting the demands of our global, regional and local customers around the world. The 2018 acquisition of Frutarom solidified our position as an industry leader across an expanded portfolio of products, resulting in a broader customer base across small, mid-sized and large companies and an expansion to new adjacencies that provides a platform for significant cross-selling opportunities.

Our product portfolio covers taste, scent and complementary adjacent products, and we have over 128,000 individual products that are provided to customers in approximately 200 countries. Our global manufacturing footprint allows us to optimize our supply chain and support our global and regional customers. As of December 31, 2019, we had 104 manufacturing facilities and 82 creative centers and application laboratories located in 44 different countries. We currently anticipate that we will continue to optimize our global facilities footprint as we seek opportunities to efficiently and cost-effectively deliver value to our global and regional customers.

Sales in 2019 were approximately $5.1 billion which, management believes, makes us the second largest company in the taste, scent, nutrition and specialty ingredient industry. During the past few years, we have diversified our customer base and leveraged our technical expertise to significantly expand our global small and mid-sized customer base through acquisitions, including, Frutarom, and the development of Tastepoint. Based on 2019 sales, of our approximately 38,000 customers, approximately 35% are global consumer products companies and approximately 65% are small and mid-sized companies. During 2019, our 25 largest customers accounted for 38% of our sales. In 2019, no customer accounted for more than 10% of sales.

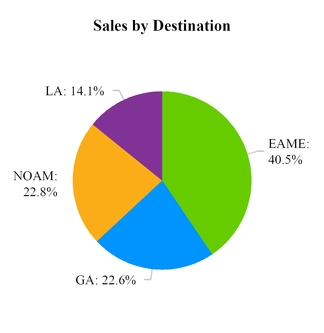

Our business is geographically diverse, with sales in the U.S. representing approximately 20% of sales in 2019. No other country represents more than 6% of sales. We believe that more significant future growth potential for taste and scent, and for our business, exists in the emerging markets (which we classify as all markets except North America, Japan, Australia, and Western, Southern and Northern Europe). As a result, we intend to continue to build on our multi-decade experience in the emerging markets. As our customers seek to grow their businesses in emerging markets, we provide them the ability to leverage our long-standing international presence and extensive market knowledge to help drive their brands in these markets.

For the periods presented in this Form 10-K, our business was organized in three segments: Taste, Scent and Frutarom. Beginning in the first quarter of fiscal year 2020, we are operating our business across two segments, Taste and Scent. As part of this new operating model, nearly all of the former Frutarom business segment was combined with the Taste segment. The financial results presented in this Form 10-K reflect the Taste, Scent and legacy Frutarom business segments prior to the realignment.

Vision 2021 and Frutarom Integration Initiative

Following the acquisition of Frutarom, we developed a new strategy, Vision 2021, targeting accelerated revenue and profitability growth. Vision 2021 has four "pillars":