Table of Contents

As filed with the Securities and Exchange Commission on February 21, 2024

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

American General Life Insurance Company

(Exact Name of Registrant as specified in its charter)

| Texas | 6311 | 25-0598210 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2727-A Allen Parkway, Houston, Texas 77019

Telephone Number: (713) 522-1111

(Address, including zip code, and telephone number, including area code, of Principal Executive Offices)

Trina Sandoval, Esq.

American General Life Insurance Company

21650 Oxnard Street, Suite 750, Woodland Hills California 91367

(213) 218-1918

(Name, Address, including zip code, and telephone number, including area code, of Agent for Service)

Copies to:

Chip Lunde

Willkie Farr & Gallagher LLP

1875 K Street, N.W., Washington, DC 20006

(202) 303-1018

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

| Non-Accelerated Filer | ☒ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion Dated February 16, 2024

[COREBRIDGE RILA]

Single Purchase Payment Deferred Registered Index-Linked Annuity

issued by

American General Life Insurance Company

Prospectus Dated: [●]

This prospectus describes the [COREBRIDGE RILA] Contract and contains important information. Please read this prospectus carefully before investing and keep it for future reference.

The Contract is a single Purchase Payment deferred registered index-linked annuity contract issued by American General Life Insurance Company (“AGL”). The Contract is designed to help you accumulate funds for retirement or other long-term financial planning purposes on a tax-deferred basis.

Under the Contract, you may allocate your Purchase Payment to one or more of the “Strategy Account Option(s)” that credit returns based on the performance of a specific Index or Indices during a defined period of time (a “Term”) and/or the “Fixed Account Option,” a fixed interest investment option. Positive Index returns may be limited based on the applicable interest crediting method (the “Upside Parameter”), and your investment is subject to a downside parameter that provides limited downside protection from negative Index returns (the “Buffer”).

The Contract is available for use in connection with qualified and non-qualified annuities, including individual retirement accounts (“IRAs”), Roth IRAs and SEP IRAs. If you are considering funding an IRA with an annuity, you should know that an annuity does not provide any additional tax deferral treatment of earnings beyond the treatment provided by the IRA itself. You should fully discuss this decision with your financial representative.

If you are a new investor in the Contract, you may cancel your Contract within 10 days of receiving it without paying fees or penalties. In some states, this cancellation period may be longer. Upon cancellation, you will generally receive a full refund of the amount you paid with your application. The amount of the refund may vary according to state law. You should review this prospectus and consult with your financial representative for additional information about the specific cancellation terms that apply.

The Company offers several different annuity contracts to meet the diverse needs of our investors. Our contracts may provide different features, benefits, programs, and investment options offered at different fees and expenses. You should carefully consider, among other things, whether the features of the Contract and the related fees provide the most appropriate solution to help you meet your retirement savings goals.

These securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (“SEC”) nor any state securities commission, nor has the SEC passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. All obligations and guarantees under the Contract are subject to the creditworthiness and claims-paying ability of the Company.

Inquiries: If you have questions about your Contract, call your financial representative or contact us at American General Life Insurance Attn: Annuity Service Center, P.O. Box 15570, Amarillo, Texas 79105-5570. Telephone Number: (800) 445-7862 and website (www.corebridgefinancial.com/annuities).

Purchase Payments must be sent to a separate address than that listed above. Please see “PURCHASING A [COREBRIDGE RILA]” in this prospectus for the address to which you must send your Purchase Payment.

Table of Contents

| 1 | ||||

| 6 | ||||

| IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT |

7 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 28 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 38 |

| 38 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| Reduction or Elimination of Fees, Charges and Additional Amounts Credited |

45 | |||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 48 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| C-1 | ||||

| C-1 | ||||

| D-1 | ||||

| APPENDIX E: OPTIONAL RETURN OF PURCHASE PAYMENT DEATH BENEFIT EXAMPLES |

E-1 | |||

| F-1 | ||||

| G-1 |

Table of Contents

Accumulation Phase - The period during which you invest money in your Contract, from the Contract Issue Date until the Income Phase begins.

Allocation Account – A Strategy Account Option or the Fixed Account Option.

Annuity Service Center – American General Life Insurance Company, P.O. Box 15570, Amarillo, Texas 79105-5570. Telephone Number: (800) 445-7862.

Annuitant - The person on whose life we base annuity income payments after you begin the Income Phase.

Annuity Date - The date selected by you on which annuity income payments begin.

Beneficiary - The person you designate to receive any benefits under the Contract if you or, in the case of a non-natural Owner, the Annuitant dies. If your Contract is jointly owned, you and the joint Owner are each other’s primary Beneficiary.

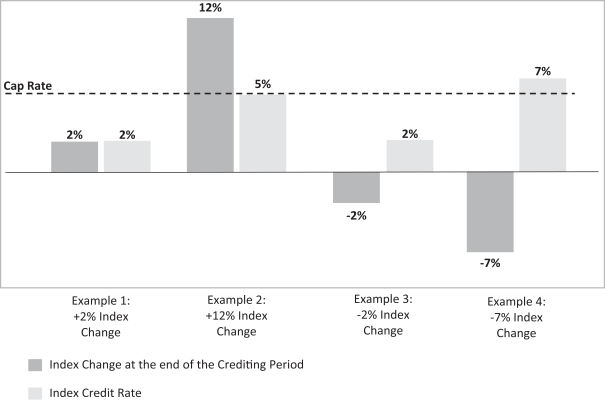

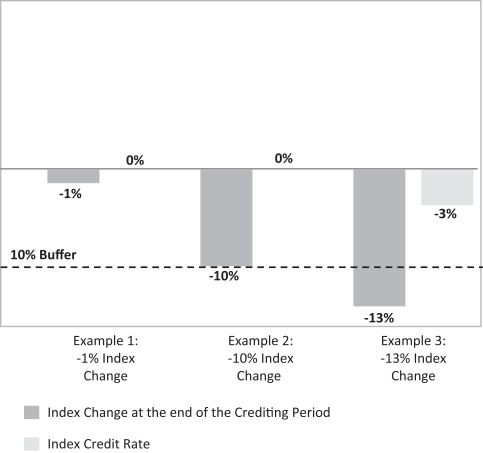

Buffer – The downside parameter that provides limited protection from negative Index performance. If negative Index performance exceeds the Buffer Rate, your negative Index performance will equal the negative Index Performance in excess of the Buffer Rate. If negative Index performance does not exceed the Buffer Rate, you will not incur a loss.

Buffer Rate – A percentage used to calculate the Index Credit Rate for a Strategy Account Option when the Index Change is negative.

Business Day – Each day the New York Stock Exchange (“NYSE”) is open for regular trading. Each Business Day ends when the NYSE closes each day which is typically 4:00 p.m. Eastern Time. If any transaction or event under a Contract is scheduled to occur on a day that is not a Business Day, such transaction or event will be processed using the applicable Index Value and will be deemed to occur on the next following Business Day unless otherwise specified.

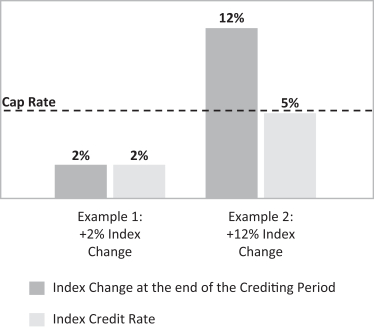

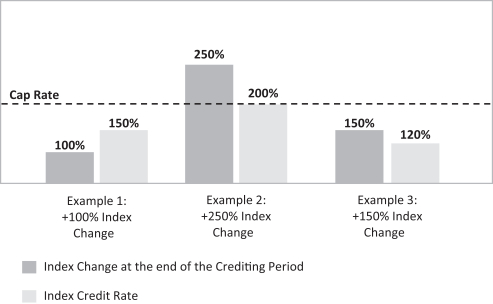

Cap – An Upside Parameter that allows you to participate in positive Index performance on the Term End Date up to and including the Cap Rate. If you select a Strategy Account Option with a Cap, and the positive Index performance meets or exceeds the Cap Rate, you will receive an Index Credit Rate equal to the Cap Rate.

Cap Rate – A percentage used to calculate the Index Credit Rate if the Index Change is positive on the Term End Date for a Strategy Account Option with a Cap.

Cap Secure – An Upside Parameter that allows you to participate in positive Index performance up to and including the Cap Secure Rate measured each Contract Anniversary over a multi-year Term. If you select a Strategy Account Option with a Cap Secure, and Index performance on a Contract Anniversary meets or exceeds the Cap Secure Rate, the performance for the Strategy Account Option for that year will be limited to the Cap Secure Rate. While the performance for the Strategy Account Option based on the Cap Secure Rate will be calculated each Contract Anniversary, the Index Credit Rate is not applied until the Term End Date.

Cap Secure Rate – A percentage used to calculate the upside participation if the Index Change is positive measured at each Contract Anniversary over a multi-year Term for a Strategy Account Option with Cap Secure. A Cap Secure Rate is set for the entire multi-year Term and will not change throughout the Term or on any Contract Anniversary.

Cash Value – The total amount that is available for Withdrawal or Surrender. Your Cash Value is equal to the Contract Value after adjustment for any applicable fees, Withdrawal Charges and Market Value Adjustments. The Cash Value will never be less than the minimum required by law.

Company – American General Life Insurance Company (“AGL”), the insurer that issues the Contract. The terms “we,” “us” and “our” are also used to identify the Company.

Continuation Contribution – An amount by which the death benefit that would have been paid to the spousal Beneficiary upon the death of the original Owner exceeds the Contract Value as of the Good Order date. We will contribute this amount, if any, to the Contract Value upon spousal continuation.

1

Table of Contents

Continuing Spouse – The original Owner’s spouse, at the time of death, who elects to continue the Contract after the death of the original Owner.

Contract – The [Corebridge RILA].

Contract Anniversary – The same date, each subsequent year, as your Contract Issue Date. If your Contract Issue Date is February 29, your Contract Anniversary will be March 1 in a non-leap year.

Contract Issue Date – The Business Day we issue your Contract. The Contract Issue Date will generally be no later than two (2) Business Days after we receive your Purchase Payment and Contract application in Good Order. Contract Years and Contract Anniversaries are measured from this date.

Contract Value – The total amount attributable to your Contract. The Contract Value is the sum of all amounts invested in the Strategy Account Option(s) as well as the Fixed Account Option. If you invest in the Strategy Account Options, the Interim Value of those accounts will be used when determining your Contract Value on any day that is not a Term Start Date or Term End Date.

Contract Year – The 12-month period beginning on the Contract Issue Date and ending on each Contract Anniversary thereafter.

Dual Direction Buffer with Cap – An Upside Parameter that allows you to participate in positive Index performance on the Term End Date up to and including the Cap Rate, or the absolute value of any negative Index performance up to and including the Buffer Rate. The absolute value of a number is simply that number without regard to it being positive or negative. For example, the absolute value of -10 is 10. If the positive Index performance meets or exceeds the Cap Rate, you will receive an Index Credit Rate equal to the Cap Rate. If the absolute value of the negative Index performance exceeds the Buffer Rate, you will receive an Index Credit Rate equal to the negative Index performance in excess of the Buffer Rate.

Final Index Value – The Index Value on the Term End Date.

Fixed Account Option Minimum Withdrawal Value – The portion of the Minimum Withdrawal Value attributable to the Fixed Account Option. The Fixed Account Option Minimum Withdrawal Value is equal to the value of the Purchase Payment allocated to the Fixed Account Option multiplied by a Minimum Withdrawal Value percentage based on applicable state law increased proportionally for transfers into the Fixed Account Option and reduced proportionally for any Net Withdrawals or transfers from the Fixed Account Option; accumulated at the minimum non-forfeiture interest rate, which generally ranges from 0.15% to 3.00% depending on applicable state law.

Fixed Account Option – An investment option under the Contract in which you may invest money and earn a fixed rate of return.

Good Order – Fully and accurately completed form(s) and/or instructions as determined by us, including any necessary documentation, applicable to any transaction or request received by us.

Income Phase – The period starting upon annuitization during which we make annuity income payments to you.

Index – The reference index to which a Strategy Account Option is linked.

Index Change – For all Strategy Account Options other than Cap Secure and Trigger Secure, the percentage change in the Index Value between the Term Start Date and the Term End Date.

For Cap Secure and Trigger Secure, the percentage change in the Index Value between Contract Anniversaries during the Term.

Index Credit –The dollar amount of gain or loss reflected in your Strategy Account Option Value on the Term End Date. Index Credit may be positive, negative, or zero.

Index Credit Rate –

For all Strategy Account Options other than Cap Secure and Trigger Secure, a percentage gain or loss used to calculate your Strategy Account Option Value on the Term End Date.

For Cap Secure and Trigger Secure, a percentage gain or loss used to calculate your Strategy Account Option Value on the Term End Date based on the Index Change on each Contact Anniversary during the Term.

2

Table of Contents

The Index Credit Rate may be positive, negative, or zero.

Index Value – The value of an Index at the end of a day. The Index Value at the end of a day is the closing value of the Index for that day. The Index Value on any day that is not a Business Day is the value of the Index at the end of the previous Business Day. The Company relies on the Index Values reported by a third-party.

Initial Index Value – The Index Value on the Term Start Date.

Insurable Interest – Evidence that the Owner(s), Annuitant(s) or Beneficiary(ies) will suffer a financial loss at the death of the life that triggers the death benefit. Generally, we consider an interest insurable if a familial relationship and/or an economic interest exists. A familial relationship generally includes those persons related by blood or by law. An economic interest exists when the Owner has a lawful and substantial economic interest in having the life, health or bodily safety of the insured life preserved.

Interim Value – The value of a Strategy Account Option on any day during the Term other than the Term Start Date or Term End Date. This value is used to determine the amount available in the Strategy Account Option for Withdrawals, Surrenders, annuitization, death benefits and to pay fees and charges during the Term. If you exercise a Performance Lock, the “locked-in” gain or loss will be based on an Interim Value. The Interim Value is calculated at the end of the day.

Latest Annuity Date – The Contract Anniversary following your 95th birthday. The initial annuity income payment will be paid on the first Business Day of the month following the Latest Annuity Date.

Market Close – The close of the New York Stock Exchange on Business Days, usually at 4:00 p.m. Eastern Time.

Market Value Adjustment (MVA) – The adjustment that may be applied if you take a Withdrawal in excess of the penalty-free Withdrawal amount during the Withdrawal Charge Period.

Minimum Withdrawal Value – The minimum amount required to be paid to you on Surrender, payment of a death benefit or upon annuitization under the Contract required by applicable state law. The Minimum Withdrawal Value is equal to the sum of the Fixed Account Option Minimum Withdrawal Value and the Strategy Account Option Minimum Withdrawal Value(s).

Negative Adjustment – A proportional reduction in your Strategy Base if (i) a fee or charge is deducted from a Strategy Account Option on or before the Term End Date; or (ii) you take a Withdrawal (including, but not limited to, systematic Withdrawals under the Systematic Withdrawal Program, Withdrawals taken to satisfy the required minimum distributions under the Internal Revenue Code, or penalty-free Withdrawals) from a Strategy Account Option on or before the Term End Date. A Negative Adjustment could be greater than or less than the amount withdrawn and could significantly reduce your gains (if any) on the Term End Date (because the Index Credit Rate will be applied to a smaller Strategy Base).

Net Purchase Payment – A Purchase Payment that is reduced in the same proportion as the Contract Value is reduced by a Withdrawal on the date of such Withdrawal. A Net Purchase Payment is an on-going calculation. It does not represent a Contract Value.

Net Withdrawals – Withdrawals after adjustment for applicable Withdrawal Charges and MVAs.

Non-Qualified Contract – A contract purchased with after-tax dollars. In general, these contracts are not under any pension plan, specially sponsored program or individual retirement account (“IRA”).

Option Unit Value – The value, expressed as a percentage, of a hypothetical replicating portfolio of options used to calculate the Interim Value for each Strategy Account Option. The hypothetical replicating portfolio of options is determined by us for each Strategy Account Option and is used to estimate the fair value of the risk of loss and potential gain on the Term End Date. If we are unable to calculate the Option Unit Value on any day, we will use the last available Option Unit Value available to us. The Option Unit Value may be positive, negative or zero.

Owner – The person or entity (if a non-natural Owner) with an interest or title to this Contract. The terms “you” or “your” are also used to identify the Owner.

Participation and Cap – An Upside Parameter that allows you to participate in positive Index performance on the Term End Date at a percentage equal to the Participation Rate and up to and including the Cap Rate. If you select a Strategy Account Option with Participation and Cap, and the positive Index performance multiplied by the Participation Rate meets or exceeds the Cap Rate, you will receive an Index Credit Rate equal to the Cap Rate.

3

Table of Contents

Participation Rate – A percentage used as part of the calculation of the Index Credit Rate if the Index Change is positive on the Term End Date for a Strategy Account Option with Participation and Cap. The Participation Rate is multiplied by the positive Index performance as part of the calculation of the Index Credit Rate if the Index Change is positive.

Performance Lock – A feature offered for some Strategy Account Options that allows you to “lock-in” the Interim Value of a Strategy Account Option prior to the Term End Date. If you exercise the Performance Lock feature, your Interim Value on the Performance Lock Date will be “locked-in.”

Once Performance Lock occurs, you will no longer participate in Index performance for the remainder of the Term, and you will not receive an Index Credit on the Term End Date for that Strategy Account Option. The “locked-in” value will then be credited with the Performance Lock Fixed Rate from the Performance Lock Date until the next Contract Anniversary.

You may exercise Performance Lock for one, some, or all of your applicable Strategy Account Options. You may decide not to exercise a Performance Lock.

Performance Lock Date – If you exercise the Performance Lock for a Strategy Account Option, the date your Interim Value for that Strategy Account Option is locked-in.

Performance Lock Fixed Rate – A short-term fixed rate that is applied to Performance Lock amounts from the Performance Lock Date until the next Contract Anniversary. We may change the Performance Lock Fixed Rate at any time at our discretion, subject to an annual guaranteed minimum interest rate of 0.25%.

Purchase Payment – The money you give us to buy and invest in the Contract.

Purchase Payment Limit – The maximum Purchase Payment (without prior Company approval) is $2,000,000. We may choose to accept Purchase Payments in excess of $2,000,000 at our sole discretion.

Qualified Contract – A contract purchased with pretax dollars. These contracts are generally purchased under an IRA.

Renewal Notice – The notification we send to Owners at least [25] days before the Term End Date (or Contract Anniversary after a Performance Lock). Among other information, your Renewal Notice will, as applicable: (i) remind you of your opportunity to decide how your Contract Value should be re-invested; (ii) remind you of the Allocation Accounts that will be available for investment; (iii) provide the current Performance Lock Fixed Rate, the Fixed Account Option interest rate, and the Upside Parameter rates; and (iv) remind you to submit instructions to us prior to five (5) days before the Term End Date (or the next Contract Anniversary, after a Performance Lock).

Return of Purchase Payment Death Benefit – The minimum death benefit provided by the optional Return of Purchase Payment Death Benefit, which may be elected, for a fee, at the time you purchase the Contract. The Return of Purchase Payment Death Benefit will equal 100% of the Purchase Payment on the Contract Issue Date. The Return of Purchase Payment Death Benefit will be proportionately reduced by Withdrawals. If the Return of Purchase Payment Death Benefit has been elected, the Return of Purchase Payment Death Benefit is only payable upon the death of the Owner during the Accumulation Phase.

Strategy Account Option – An index-linked investment option under the Contract.

Strategy Account Option Minimum Withdrawal Value – The portion of the Minimum Withdrawal Value attributable to a Strategy Account Option. The Strategy Account Option Minimum Withdrawal Value on the Contract Issue Date is equal to the value of the Purchase Payment allocated to the Strategy Account Option multiplied by a Minimum Withdrawal Value percentage based on applicable state law. On any other day, the Strategy Account Option Minimum Withdrawal Value moves in proportion to the Strategy Account Option Value. Increases in Interim Value, positive Index Credits, and transfers to the Strategy Account Option will increase the Strategy Account Option Minimum Withdrawal Value. Decreases in Interim Value, negative Index Credits, Net Withdrawals, or applicable fees, and transfers out of the Strategy Account Option will decrease the Strategy Account Option Minimum Withdrawal Value.

Strategy Account Option Value – The value of your investment in a Strategy Account Option on any day during a Term.

Strategy Base – A value used to calculate Interim Value and Index Credits. The Strategy Base is equal to the Contract Value allocated to a Strategy Account Option on the Term Start Date and (i) reduced proportionally for Withdrawals and fees, if any, deducted from the Strategy Account Option since the Term Start Date; and (ii) increased proportionally to any applicable Interim Value increase at the time of a Continuation Contribution when there is a spousal continuation upon death of Owner.

4

Table of Contents

Surrender – A full Withdrawal of Cash Value and termination of the Contract.

Systematic Withdrawal Program – A program, for no additional charge, available during the Accumulation Phase where you may elect to receive periodic Withdrawals. Under the program, Withdrawals are taken proportionally from your Allocation Accounts and you may choose to take monthly, quarterly, semi-annual or annual Withdrawals from your Contract. Under this program, if a Withdrawal is scheduled for a day that does not exist in a given calendar month, it will occur on the last day of such month.

Term – The duration of an Allocation Account’s investment term, expressed in years. The Term is also the period during which the performance of a Strategy Account Option is linked to the performance of an Index. The Term begins on the Term Start Date and ends on the Term End Date.

Term End Date – The Contract Anniversary on the last day of the Term.

Term Start Date – The date the Purchase Payment or Contract Value are allocated to a new Term. The Term Start Date is the Contract Issue Date for the initial Term, and a Contract Anniversary for each subsequent Term.

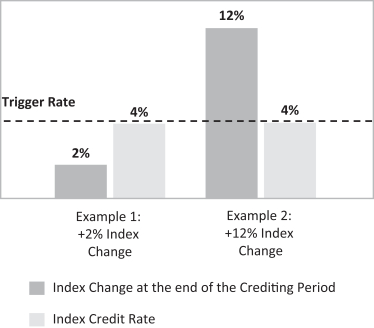

Trigger – An Upside Parameter that allows you to participate in positive Index performance on the Term End Date equal to the Trigger Rate. If you select a Strategy Account Option with a Trigger, and the Index performance on the Term End Date is greater than or equal to zero, you will receive an Index Credit Rate equal to the Trigger Rate. If Index performance exceeds the Trigger Rate, you will receive an Index Credit Rate equal to the Trigger Rate.

Trigger Rate – A percentage used to calculate the Index Credit Rate if the Index Change is greater than or equal to zero on the Term End Date for a Strategy Account Option with Trigger.

Trigger Secure – An Upside Parameter that allows you to participate in positive Index performance equal to the Trigger Secure Rate for the entire multi-year Term. If you select a Strategy Account Option with a Trigger Secure, and Index performance on a Contract Anniversary is greater than or equal to zero, the performance for the Strategy Account Option for that year will be the Trigger Secure Rate. While the performance for the Strategy Account Option based on the Trigger Secure Rate will be calculated each Contract Anniversary, the Index Credit Rate is not applied until the Term End Date.

Trigger Secure Rate – A percentage used to calculate the Index Credit Rate if the Index Change is greater than or equal to zero measured at each Contract Anniversary for a Strategy Account Option with Trigger Secure. The Trigger Secure Rate is set on the Term Start Date for the entire multi-year Term and will not change throughout the Term or on any Contract Anniversary.

Upside Parameter – A feature of a Strategy Account Option that determines the extent to which a Strategy Account Option will participate in positive Index performance. The Upside Parameters are Cap, Cap Secure, Participation and Cap, Dual Direction with Buffer and Cap, Trigger, and Trigger Secure.

Withdrawal – The amount of Contract Value you withdraw from the Contract before adjustment for applicable Withdrawal Charges and MVAs. A Withdrawal includes, but is not limited to, one-time Withdrawals, systematic Withdrawals under the Systematic Withdrawal Program, Withdrawals taken to satisfy required minimum distributions under the Internal Revenue Code, penalty-free Withdrawal amounts, and Withdrawals under the Extended Care Waiver or the Terminal Illness Waiver.

Withdrawal Charge Period – The period during which we may apply a Withdrawal Charge and MVA to Withdrawals and Surrenders. The Withdrawal Charge Period begins on the Contract Issue Date and ends the day after the last day of the sixth Contract Year.

5

Table of Contents

The [Corebridge RILA] is a single purchase payment deferred registered index-linked annuity contract that is designed to help you invest on a tax-deferred basis, meet long-term financial goals, and plan for your retirement. This Contract may be appropriate for you if you have a long investment time horizon and the Contract’s terms and conditions are consistent with your financial goals. It is not intended for people whose liquidity needs require early or frequent withdrawals. You should discuss with your financial professional whether an index-linked annuity contract is appropriate for you.

An annuity is a contract between you (the Owner) and an insurance company (in this case, us), where the insurance company promises to pay you an income in the form of annuity income payments. Commencement of these payments is referred to as “annuitizing” your Contract. Prior to annuitizing, your Contract is in the Accumulation Phase and the earnings (if any) are generally tax deferred. Tax deferral means you are not taxed until you take money out of your annuity. Once your Contract is annuitized, your annuity switches to the Income Phase.

The Contract is a “single purchase payment” annuity because only one Purchase Payment is allowed under the Contract. We may agree to accept multiple payments as part of a single Purchase Payment subject to certain limitations outlined in this prospectus.

The Contract is “index-linked” because the value of each Strategy Account Option is linked to the performance of an Index. If you invest in one or more Strategy Account Options, the amount of money you accumulate under your Contract depends (at least in part) upon the performance of your Strategy Account Option(s). You could lose a significant amount of money that you allocate to the Strategy Account Option(s).

We guarantee that we will always offer at least one Strategy Account Option that is either currently offered or is similar to one that is currently offered. Please note the Index for that Strategy Account Option remains subject to our right of substitution.

The Contract includes a “Performance Lock” feature for certain Strategy Account Options. For all applicable Strategy Account Options you may exercise Performance Lock prior to the Term End Date, subject to certain limitations described in this prospectus. Once a Performance Lock occurs during a Term, the “locked-in” value of your investment in the Strategy Account Option will earn an annual rate with a daily credited interest at the Performance Lock Fixed Rate until the next Contract Anniversary. You should fully understand the operation and impact of the Performance Lock before choosing to exercise this feature. See “VALUING YOUR INVESTMENT IN A STRATEGY ACCOUNT OPTION - PERFORMANCE LOCK and RISK FACTORS – PERFORMANCE LOCK RISK.

The Contract has two phases: (1) the Accumulation Phase (savings) and (2) the Income Phase (income).

Accumulation Phase. During the Accumulation Phase, you invest the money under your Contract in one or more Allocation Account(s) to help you build assets on a tax-deferred basis.

Income Phase. When you are ready to receive guaranteed income under the Contract, you can switch to the Income Phase, at which time you will start to receive annuity income payments from us. This is also referred to as “annuitizing” your Contract. You generally decide when to annuitize your Contract, although there are restrictions on the earliest and latest times that your Contract may be annuitized. If you do not annuitize or Surrender your Contract before the Latest Annuity Date, your Contract will be automatically annuitized. Once your Contract is annuitized, you will no longer be able to Surrender, take Withdrawals of Contract Value and all other features and benefits of your Contract, including the death benefit, will terminate. You can choose from then available annuity income options, which may provide income for life, for an available time period, or a combination of both. There is no death benefit during the Income Phase. Annuity income payments may be payable after death if you select a period certain annuity income option.

6

Table of Contents

IMPORTANT INFORMATION YOU SHOULD CONSIDER ABOUT THE CONTRACT

| KEY FEATURES |

LOCATION IN PROSPECTUS | |||

| Purchase Payment | Your Purchase Payment must be at least $25,000.

Company approval is required before making a Purchase Payment in excess of $2,000,000. For purposes of this limit, the aggregate Purchase Payments are based on all contracts issued by AGL and/or The United States Life Insurance Company in the City of New York (“US Life”) to the same Owner and/or Annuitant.

After your Contract Issue Date, additional Purchase Payments are not allowed. |

Purchasing a [Corebridge RILA]-Allocation of Purchase Payment | ||

| Rate Lock | On your Contract Issue Date, we will apply the Fixed Account Option interest rates and Upside Parameter rates applicable to your Contract, for your initial Allocation Account elections.

The initial Upside Parameter rates applied on your Contract Issue Date are guaranteed for the length of the initial Term. The initial Fixed Account Option interest rate is guaranteed for one Contract Year. The initial interest rates and Upside Parameter rates are determined as follows:

If the Contract is issued within 60 days from the date the application was signed or the electronic order submission date, rates will be the better of the rates in effect on:

(1) the application-signed date or electronic order submission date, or

(2) the Contract Issue Date.

If the Contract Issue Date is not within the 60th day after the date the application is signed or the electronic order submission date, then rates will be those in effect on the Contract Issue Date.

Rate locks apply to all rates except guaranteed minimum interest rates and the Performance Lock Fixed Rate. |

Purchasing a [Corebridge RILA] – Rate Lock | ||

| Allocation Accounts | You can invest your Purchase Payment and Contract Value among the available Allocation Accounts under the Contract, which include the Strategy Account Options and the Fixed Account Option.

Strategy Account Option:

Strategy Account Option(s) apply an Index Credit Rate based on the performance of an Index over the Term. The Index Credit Rate may be positive, negative or zero. Positive returns may be limited based on the applicable Upside Parameter, and negative returns may be limited based on the Buffer, which provides limited protection from negative Index performance.

Fixed Account Option:

The Fixed Account Option credits a fixed rate of interest that is guaranteed for 1-year Terms, subject to the guaranteed minimum interest rate for the Fixed Account Option. |

Allocation Accounts | ||

| Indices | We currently offer the following reference Indices:

• [Index 1]

• [Index 2] |

The Indices | ||

| Strategy Account Option Terms | We currently offer 1-year, 3-year and 6-year Terms. | Allocation Accounts – Strategy Account Options | ||

7

Table of Contents

| Downside Parameter - the Buffer | The Buffer is a component of each Strategy Account Option that determines the Index Credit Rate that will be applied to your Strategy Account Option Value on the Term End Date (and the annual performance on each Contract Anniversary for Cap Secure and Trigger Secure Strategy Account Options) if the Index performance is negative. It provides a limited level of protection from loss. You will incur a loss if negative Index performance is greater than the Buffer Rate on the Term End Date (and on each Contract Anniversary for Cap Secure and Trigger Secure Strategy Account Options). For example, if the Index Change is negative 15% and your Buffer Rate is 10%, your Index Credit Rate would be negative 5% (for Cap Secure and Trigger Secure Strategy Account Options, the annual measured performance on that Contract Anniversary would be negative 5%).

For Dual Direction Buffer with Cap, the Buffer provides a gain equal to the absolute value of the negative Index Change, not limited by the Cap Rate, if the negative Index performance is up to and including the Buffer Rate. If the absolute value of the negative Index performance exceeds the Buffer Rate, your negative Index Credit Rate will equal the negative Index performance in excess of the Buffer Rate. For example, if the Index Change is negative 15% and your Buffer Rate is 10%, your Index Credit Rate would be negative 5%. However, if the Index Change is negative 8% and your Buffer Rate is 10%, your Index Credit Rate would be positive 8%.

Please see “ALLOCATION ACCOUNTS” in this prospectus for further examples of the Buffer. |

Allocation Accounts – Strategy Account Options | ||

| Upside Parameters | An Upside Parameter is a component of each Strategy Account Option that determines the Index Credit Rate that will be applied to your Strategy Account Option Value on the Term End Date if the Index performance is positive (or greater than or equal to zero for Trigger). We currently offer the following Upside Parameters:

Cap: The Cap allows you to participate in positive Index performance on the Term End Date up to and including the Cap Rate. If you select a Strategy Account Option with a Cap, and Index performance exceeds the Cap Rate, you will receive the Cap Rate. For example, if the Index Change is 15% and your Cap Rate is 10%, you will receive an Index Credit Rate of 10% on the Term End Date.

Cap Secure: Cap Secure allows you to participate in positive Index performance each Contract Anniversary up to and including the Cap Secure Rate. The Cap Secure rate will remain the same for the entire multi-year Term. If you select a Strategy Account Option with a Cap Secure, and Index performance exceeds the Cap Secure Rate in any year, only the Cap Secure Rate will apply for that year. The Index Credit Rate is applied at the Term End Date based upon the values measured on each Contract Anniversary (including the Term End Date). For example, if the annual Index Change is 15% and your Cap Secure Rate is 8%, your adjusted annual Index performance is 8% on that Contract Anniversary. The adjusted annual Index performance on each Contract Anniversary within the multi-year term would be compounded to establish the Index Credit Rate on the Term End Date.

Participation and Cap: Participation and Cap allows you to participate in positive Index performance on the Term End Date at a percentage equal to the Participation Rate, up to a maximum of the Cap Rate. If Index performance multiplied by the Participation Rate exceeds the Cap Rate, you will receive the Cap Rate. For example, if the Index Change on the Term End Date is 40% and your Participation Rate is 150% and Cap Rate is 50%, we will first multiply the Participation Rate by the Index Change (150% x 40% = 60%) and then provide you with an Index Credit Rate that is the lesser of the resulting value and the Cap Rate, which in this case would be 50%.

Dual Direction Buffer with Cap: Dual Direction Buffer with Cap allows you to participate in positive Index performance on the Term End Date up to the Cap, or the absolute value of any negative Index performance up to and including the Buffer Rate. If the positive Index performance exceeds the Cap Rate, your positive Index performance will equal the Cap Rate. For example, if the Index Change is 11% and your Cap is 10%, your Index Credit Rate would be 10%. Since the Index Change was positive, the Buffer would not come into play. If the negative Index performance was within or equal to the Buffer Rate, you gain the absolute value of the negative Index performance. For example, if the Index Change is –10% and your Buffer Rate is 10%, your Index Credit Rate would be 10%. |

Allocation Accounts – Strategy Account Options | ||

8

Table of Contents

| Trigger: Trigger allows you to receive an Index Credit Rate equal to the Trigger Rate if Index performance is greater than or equal to zero on the Term End Date. If you select a Strategy Account option with a Trigger, and Index performance exceeds the Trigger Rate, you will receive the Trigger Rate. For example, if the Index Change is 2% and the Trigger Rate is 4%, your Index Credit Rate would be 4% because the Index Change was greater than zero. However, if the Index Change is 12% and the Trigger Rate is 4%, your Index Credit Rate would be 4% because the Index Change was greater than the Trigger Rate.

Trigger Secure: If you select a Strategy Account Option with a Trigger Secure, and Index performance is greater than or equal to zero for a Contract Year, only the Trigger Secure Rate will apply for that year. The Trigger Secure Rate is set on the Term Start Date and will remain the same for the entire multi-year Term. The Index Credit Rate is applied at the Term End Date based upon the values measured on each Contract Anniversary (including the Term End Date). For example, if the annual Index Change is 2% and the Trigger Secure Rate is 4%, your annual performance would be 4% on that Contract Anniversary because the Index Change was greater than zero. However, if the annual Index Change is 12% and the Trigger Secure Rate is 4%, your adjusted annual Index performance would still be 4% on that Contract Anniversary because the Index Change was greater than the Trigger Secure Rate. The performance on each Contract Anniversary within the multi-year Term would be compounded to establish the Index Credit Rate on the Term End Date.

Please see “ALLOCATION ACCOUNTS” in this prospectus for further examples of the Upside Parameters. |

||||

| Performance Lock | Performance Lock allows you to “lock-in” the Interim Value of a Strategy Account Option prior to the Term End Date. The Performance Lock feature may not be available on all Strategy Account Options. Once a Performance Lock occurs, the Strategy Account Option will earn an annual rate with daily credited interest at the Performance Lock Fixed Rate until the next Contract Anniversary. There are risks associated with the Performance Lock. Once a Performance Lock occurs, the value within the Strategy Account Option will no longer be tied to Index performance, and you will not receive an Index Credit Rate on the Term End Date. The locked-in value cannot be transferred to a new Allocation Account or a new Term in the same Strategy Account Option until the next Contract Anniversary. You may only exercise the Performance Lock once during a Term on the full amount allocated to an applicable Strategy Account Option, and the exercise is irrevocable. | Valuing Your Investment in A Strategy Account Option – Performance Lock | ||

| Contract Value/Cash Value | Contract Value. Prior to annuitization, your Contract Value represents the value of your investment in your Allocation Accounts, which may include the Fixed Account Option and one or more Strategy Account Option(s). If you invest in a Strategy Account Option, your Contract Value will reflect the Interim Values of your investment on any day other than the Term Start Date or the Term End Date.

On any day during the Accumulation Phase, your total Contract Value is equal to:

• Your Purchase Payment; minus

• Your total gross Withdrawals from the Contract (including any applicable amounts deducted for Withdrawal Charges and MVAs); plus

• Your accumulated gains on amounts allocated to Strategy Account Option(s); minus

• Your accumulated losses on amounts allocated to Strategy Account Option(s); plus

• Interest credited on amounts allocated to the Fixed Account Option; minus

• Amounts deducted for fees, charges, and taxes, if any.

Upon annuitization, you will no longer be able to take Withdrawals of Contract Value and all other features and benefits of your Contract will terminate, including your ability to Surrender your Contract.

Cash Value. Prior to annuitization, your Cash Value represents the total amount that is available for Withdrawal or Surrender. Your Cash Value is equal to the Contract Value after adjustment for any applicable Withdrawal Charges, fees, and MVA. Your Cash Value may be less than or equal to your Contract Value. Your Cash Value will never be less than the Minimum Withdrawal Value. Upon annuitization, your Contract does not have a Cash Value. |

Contract Value and Cash Value | ||

9

Table of Contents

| Death Benefit | Contract Value Death Benefit:

The Contract provides a Contract Value death benefit at no additional charge. The Contract Value death benefit is equal to the greater of the Contract Value or the Minimum Withdrawal Value on the Business Day we receive all required documentation in Good Order.

Optional Return of Purchase Payment Death Benefit:

For an additional fee, you may elect the Return of Purchase Payment Death Benefit which can provide greater protection for your Beneficiaries. You may only elect the Return of Purchase Payment Death Benefit at the time you purchase your Contract, and you cannot change your election thereafter at any time.

The fee for the Return of Purchase Payment Death Benefit is 0.20% (annually based on remaining Net Purchase Payments). The fee will be deducted proportionally from the Strategy Account Option(s) and charged on each Contract Anniversary. The fee is pro-rated upon death or Surrender. You may pay for the optional Return of Purchase Payment Death Benefit and your Beneficiary may never receive the benefit once you begin the Income Phase. The Return of Purchase Payment Death Benefit can only be elected prior to your 76th birthday.

The Return of Purchase Payment Death Benefit is the greatest of:

1. Contract Value less fees if applicable;

2. Minimum Withdrawal Value; or

3. Net Purchase Payments. |

Death Benefits | ||

| FEES AND CHARGES | ||||

| Withdrawal Charges | You may be subject to charges for early Withdrawals. If you withdraw money from your Contract within six (6) years following the Contract Issue Date, you may be assessed a Withdrawal Charge of up to 8%, as a percentage of the Contract Value withdrawn. Withdrawal Charges do not apply to certain Withdrawals including a Withdrawal up to the annual penalty-free Withdrawal amount equal to 10% of the previous Contract Anniversary Contract Value (and if withdrawn in the first Contract Year, the Purchase Payment amount).

For example, if you withdraw $100,000 in excess of the penalty-free Withdrawal amount during the Withdrawal Charge Period, you could be assessed a Withdrawal Charge of up to $8,000 if your Withdrawal Charge is 8%.

Withdrawals will also be subject to MVA during the Withdrawal Charge Period. The MVA reflects the change in market interest rates between the Contract Issue Date and the date of your Withdrawal which may increase or decrease your Withdrawal amount. |

Fees and Charges | ||

| Premium Taxes | Certain states charge the Company a tax on Purchase Payments that ranges from 0% to 3.5%. Some states assess this premium tax when the Contract is issued while other states only assess the tax upon annuitization. The Company may advance any tax amount due, but we will deduct such amount from your Contract Value only when and if you begin the Income Phase (annuitization). | Fees and Charges | ||

| RESTRICTIONS | ||||

| Investments | Transfer Restrictions. Contract Value allocated to a Strategy Account Option may only be transferred on the Term End Date. Contract Value allocated to the Fixed Account Option may not be transferred until the next Contract Anniversary. If you do not want to remain invested in the Fixed Account Option until the next Contract Anniversary, or in a Strategy Account Option until the Term End Date, your only options will be to take a Withdrawal from or Surrender the Contract, or exercise the Performance Lock feature (if available) and transfer your Strategy Account Option Value on the next Contract Anniversary. If you elect one of these options, the transaction will be based on the Interim Values of the Strategy Account Options. The Strategy Account Option Interim Value could be less than your investment in the Strategy Account Option even if the Index is performing positively. Withdrawals and Surrenders may be subject to Withdrawal Charges, MVA, any applicable fees, and taxes (including a 10% Federal tax penalty before age 591⁄2).

Performance Lock Restrictions. Manual Performance Lock is not allowed, and automatic Performance Lock settings cannot be changed, during the five (5) days prior to a Term End Date. Once you exercise Performance Lock, it cannot be revoked. |

Allocation Accounts Transfers between Allocation Accounts | ||

10

Table of Contents

| Investment Restrictions.

• Some Strategy Account Options may only be available on Contract Issue Date. On the Term End Date, you will only be able to invest in the Strategy Account Options available at that time.

• When allocating Contract Value on a Term End Date among the available Allocation Accounts, you may not invest in any Strategy Account Option that has a Term that extends beyond the Latest Annuity Date. If there is no eligible Strategy Account Option, only the Fixed Account Option will be available to you for investment.

Availability of Strategy Account Options and Indices. We reserve the right to add, replace or remove a Strategy Account Option or Index.

Certain Strategy Account Options and Indices may not be available through your financial representative. You may obtain information about the Strategy Account Options and Indices that are available to you by contacting your financial representative. |

||||

| TAXES | ||||

| Tax Implications | • You should consult with a tax professional to determine the tax implications of an investment in and payments received under the Contract.

• If you purchase the Contract through an IRA, there is no additional tax benefit under the Contract.

• Earnings under your Contract are taxed at ordinary income tax rates when withdrawn. You may have be subject to a tax penalty if you take a Withdrawal before age 591⁄2. |

Taxes | ||

| CONFLICTS OF INTEREST | ||||

| Investment Professional Compensation | Your financial representative may receive compensation for selling this Contract to you in the form of commissions, additional cash compensation, and/or non-cash compensation. We may share the revenue we earn on this Contract with your financial representative’s firm.

Revenue sharing arrangements and commissions may provide selling firms and/or their registered representatives with an incentive to favor sales of our contracts over other annuity contracts (or other investments) with respect to which a selling firm does not receive the same level of additional compensation. You should ask your financial representative about how they are compensated. |

Payments in Connection with Distribution of the Contract | ||

| Exchanges | Some financial representatives may have a financial incentive to offer you a new contract in place of the one you already own. You should exchange a contract you already own only if you determine, after comparing the features, fees, and risks of both contracts, that it is better for you to purchase the new contract rather than continue to own your existing contract. | Purchasing a [Corebridge RILA] – Exchange Offers | ||

11

Table of Contents

RISK OF LOSS. Annuities involve risks, including possible loss of principal. Your losses could be significant. This Contract is not a deposit or obligation of, or guaranteed or endorsed by, any bank. This Contract is not federally insured by the federal deposit insurance corporation, the federal reserve board, or any other agency.

SHORT-TERM INVESTMENT RISK. This Contract is not designed for short-term investing and may not be appropriate for an investor who needs ready access to cash in excess of the penalty-free Withdrawal Amount. The benefits of tax deferral and long-term income protections mean that this Contract is more beneficial to investors with a long investment time horizon.

WITHDRAWAL RISK. You should carefully consider the risks associated with Withdrawals under the Contract. Withdrawals may be subject to significant Withdrawal Charges and MVAs. If you make a Withdrawal prior to age 591⁄2, there may be adverse tax consequences, including a 10% Federal tax penalty. A Withdrawal may reduce the value of your standard and optional benefits. For instance, a Withdrawal will reduce the value of the death benefit. A Surrender will result in the termination of your Contract. We may defer payment of Withdrawals from the Fixed Account Option for up to six months when permitted by law.

In addition, Withdrawals during a Term could result in a greater reduction in your Contract Value than if you waited until the Term End Date. Withdrawals during a Term will proportionately reduce your Strategy Base, which could be significantly more than the dollar amount of your Withdrawal. The application of the Interim Value to Withdrawals taken prior to the Term End Date and proportional reductions to your Strategy Base, together with any Withdrawal Charges and the MVA, could significantly reduce your Contract Value and reduce any gains on the Term End Date.

OUR FINANCIAL STRENGTH AND CLAIMS-PAYING ABILITY RISK. Our General Account assets support the guarantees under the Contract and are subject to the claims of our creditors. Therefore, the guarantees under the Contract are subject to our financial strength and claims-paying ability. There is a risk that we may default on those guarantees. The assets in the Separate Account are subject to our creditors. You need to consider our financial strength and claims-paying ability in meeting the guarantees under the Contract. You may obtain information on our financial strength by reviewing our financial statements included in this prospectus. Additionally, information concerning our business and operations is set forth under “APPENDIX G: MANAGEMENT’S DISCUSSION & ANALYSIS AND STATUTORY FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULES.”

BUSINESS DISRUPTION RISK. Our business is vulnerable to disruptions from natural and man-made disasters and catastrophes, such as but not limited to hurricanes, windstorms, flooding, earthquakes, wildfires, solar storms, war or other military action, acts of terrorism, explosions and fires, pandemics (such as COVID-19) and other highly contagious diseases, mass torts and other catastrophes. A natural or man-made disaster or catastrophe may negatively affect the computer and other systems on which we rely, and may also interfere with our ability to receive, pickup and process mail, to calculate the Index Change or process other Contract-related transactions or have other possible negative impacts. While we have developed and put in place business continuity and disaster recovery plans to mitigate operational risks and potential losses related to business disruptions resulting from natural and man-made disasters and catastrophes, there can be no assurance that we, our agents, the Indices or our service providers will be able to successfully avoid negative impacts resulting from such disasters and catastrophes.

CYBERSECURITY RISK. We rely heavily on interconnected computer systems and digital data to conduct our annuity business activities. Because our annuity business is highly dependent upon the effective operation of our computer systems and those of our business partners and service providers, our business is vulnerable to physical disruptions and utility outages, and susceptible to operational and information security risks resulting from information systems failure (e.g., hardware and software malfunctions) and cyber-attacks. These risks include, among other things, the theft, misuse, corruption, disclosure and destruction of sensitive business data, including personal information, maintained on our or our business partners’ or service providers’ systems, interference with or denial of service attacks on websites and other operational disruptions and unauthorized release of confidential customer information. Such systems failures and cyber-attacks affecting us, any third-party administrator, the Index or Index issuers, intermediaries and other affiliated or third-party service providers, as well as our distribution partners, may adversely affect us and your Contract Value. For instance, systems failures and cyber-attacks may interfere with our processing of contract transactions, including the processing of orders from our website, impact our ability to calculate the Index Change, cause the release and possible destruction of confidential

12

Table of Contents

customer or business information, impede order processing, subject us and/or our service providers, distribution partners and other intermediaries to regulatory fines and enforcement action, litigation risks and financial losses and/or cause reputational damage. Cyber security risks may also impact the issuers of securities that comprise the Indices, which may cause the securities making up the Index to lose value. There may be an increased risk of cyber-attacks during periods of geo-political or military conflict. Despite our implementation of policies and procedures, which we believe to be reasonable, that address physical, administrative and technical safeguards and controls and other preventative actions to protect customer information and reduce the risk of cyber-incident, there can be no assurance that we or our distribution partners, the Indices or our service providers will avoid cyber-attacks or information security breaches in the future that may affect your Contract and/or personal information.

ALLOCATION ACCOUNT AVAILABILITY RISK. We reserve the right to add, remove and replace Allocation Accounts as available investment options. There is no guarantee that an Allocation Account you select for investment will always be available in the future or available with the same rates.

There is no guarantee that any Strategy Account Option will always be available in the future. However, we will always offer at least one Strategy Account Option that is either currently offered or is similar to one that is currently offered. Please note the Index for that Strategy Account Option remains subject to our right of substitution. See “INDEX SUBSTITUTION RISK”.

If we remove an Allocation Account, it will be closed such that no transfers will be allowed into that Allocation Account. If you are currently invested in an Allocation Account and it is removed, you may remain in that Allocation Account until the Term End Date.

LIQUIDITY RISK. This Contract may be appropriate if you are looking for retirement income or you want to meet other long-term financial objectives. The Contract is not designed to be a short-term investment and may not be appropriate for you if you intend to take early or frequent Withdrawals.

| • | Transfer Limitations. The Contract restricts transfers between investment options, which will limit your ability to transfer your Contract Value in response to changes in market conditions or your personal circumstances. You may transfer Contract Value invested in an Allocation Account only on the Term End Date for that Allocation Account (or on the next Contract Anniversary after a Performance Lock occurs). |

| • | Withdrawal and Surrender Consequences. You may take a Withdrawal or Surrender at any time during the Accumulation Phase; however, there may be significant risks and negative consequences associated with any such Withdrawal or Surrender, including potential Withdrawal Charges and MVAs, taxes and tax penalties, and negative impacts to the value of your investment. See “WITHDRAWAL RISK.” |

| • | Interim Values. There may be long periods of time when you can only perform a transaction under the Contract that is based on one or more Interim Values. For as long as you have multiple ongoing Terms for Strategy Account Options, there may be no time that any such transaction can be performed without the application of at least one Interim Value. See “INTERIM VALUE RISK.” |

| • | Taxes. Income taxes and certain tax restrictions may apply to any Withdrawal or Surrender. If taken before age 591⁄2, a Withdrawal or Surrender may also be subject to a 10% federal tax penalty. |

| • | Delays in Payment. We generally make payment of any amount due from the Contract within seven (7) days from the date we receive all required information in Good Order. When permitted by law, however, we may defer payment of any Withdrawal or Surrender proceeds for up to six (6) months from the date we receive your request. |

INDEX RISK. Strategy Account Option Value(s) will be impacted by the performance of the reference Index. Although you will not directly invest in the reference Index, you are indirectly exposed to the investment risks associated with an Index, such as market, equity and issuer risks. The following risks related to Index performance apply when you invest in a Strategy Account Option:

| • | Negative Index Performance Could Result in Loss. The performance of any Index may fluctuate, sometimes rapidly and unpredictably. Both short-term and sustained negative Index performance, over one or multiple Terms, may cause you to lose principal or previous earnings. The historical performance of an Index does not guarantee future results. It is impossible to predict whether an Index will perform positively or negatively over the course of a Term or multiple Terms. |

13

Table of Contents

| • | Index Change Calculations. We calculate Index Changes by comparing the value of the Index between two specific points in time, which means the performance of the Index may be negative or flat even if the Index performed positively for certain time periods between those two specific points in time. This is true even for Strategy Account Options with multi-year Terms. |

| • | Dividends Excluded from Index Values. Index Values do not include income from any dividends or other distributions paid by a market index’s component companies. If dividends and other distributions were included, the Index performance would be higher. |

| • | No Rights in the Index. You are not investing directly in the Index, and you have no rights with respect to the Index, the Index provider, or any aspect of the Index or any companies whose securities comprise the Index. |

| • | Evolving and Uncertain Economic Environment. In recent years, the financial markets have experienced periods of significant volatility and negative returns, contributing to an uncertain and evolving economic environment. The performance of the markets has been impacted by several interrelating factors such as, but not limited to, the COVID-19 pandemic, geopolitical turmoil, rising inflation, changes in interest rates, and actions by governmental authorities. It is not possible to predict future performance of the markets. Depending on your individual circumstances, you may experience (perhaps significant) negative returns under the Contract. You should consult with a financial professional about how market conditions may impact your investment decisions under the Contract. |

| • | Exposure to Investment Risks. When you invest in a Strategy Account Option, you are indirectly exposed to the investment risks that could cause the stocks or other instruments that comprise the Index to decrease in value. The Indices are subject to a variety of investment risks, many of which are complicated and interrelated and all of which may adversely impact Index performance. If you invest in a Strategy Account Option with an Index that exposes you to higher investment risks, your risk of loss may be higher depending on the level of the Strategy Account Option’s downside protection. |

| • | Market Risk. Each Index could decrease in value over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Negative fluctuations in the value of an Index may be significant and unpredictable. |

| • | Equity Risk. Each Index is comprised of equity securities or other assets considered to represent a particular market or sector. Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. Equity securities may underperform in comparison to the general financial markets, a particular market segment, or other asset classes. |

| • | Issuer Risk. The performance of each Index depends on the performance of individual securities that make-up the Index. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. |

UPSIDE PARAMETER AND BUFFER RISK. Each Strategy Account Option has an applicable Upside Parameter and Buffer for determining the Index Credit Rate applied to your Strategy Account Option Value. Each Strategy Account Options has an Upside Parameter that provides either a Cap, Cap Secure, Participation and Cap, Dual Direction Buffer with Cap, Trigger, or Trigger Secure and downside protection in the form of a Buffer (including the Dual Direction Buffer with Cap).

| • | Upside Parameter Risk. If you invest Contract Value in a Strategy Account Option, the highest possible Index Credit Rate that you may achieve is limited by the applicable Upside Parameter. Because of these limits, the Index Credit Rate for a Strategy Account Option may be less than the positive Index Change. The Upside Parameters may therefore limit the positive Index Credit Rate, if any, that may be applied to your Contract Value for a given Term. |

The Upside Parameters benefit us because they limit the amount of positive interest that we may be obligated to credit for any Term. We set the Upside Parameter rates each Term in our discretion, however, they will never be less than the minimum rates set forth in this prospectus. You bear the risk that we will not set the Upside Parameter rates higher than these minimums.

| • | Buffer Risk. The Buffer provides only limited protection against negative Index performance. When you invest Contract Value in a Strategy Account Option, you bear the risk that negative Index performance may cause the Index Credit Rate to be negative even after the application of the Buffer. This would result in a negative Index Credit Rate and reduce your Strategy Account Option Value. Additionally, the Buffer provides downside protection only on the Term End Date, so your exposure to negative Index performance during a Term is greatest before the Term End Date. |

| • | Cap Secure and Trigger Secure Risk. For Cap Secure and Trigger Secure, since the gain or loss is established on the Term End Date based on Index performance on each Contract Anniversary, losses can accumulate so that you could lose a percentage in excess of the Buffer Rate in multiple years of the Term. |

14

Table of Contents

| • | Dual Direction Buffer with Cap Rate Risk. For a Dual Direction Buffer with Cap Strategy Account Option, you should note that, because the absolute value of any negative Index Change up to the Buffer Rate will be credited as a positive rate of interest, a negative Index Change on the Term End Date that is slightly below or slightly above the Buffer Rate can result in very different Index Credit Rates. For example, for a Dual Direction Buffer with Cap Strategy Account Option with a 10% Buffer, if the negative Index Change is –10.00%, the Index Credit Rate will be 10%; whereas if the negative Index Change is -10.01%, the Index Credit Rate will be -0.01%. |

PERFORMANCE LOCK RISK. You may exercise the Performance Lock, if available, prior to the end of the Term End Date. If you exercise Performance Lock, your Interim Value for that Strategy Account Option on the Performance Lock Date is “locked-in” and will then earn an annual rate of interest credited daily at the Performance Lock Fixed Rate until the next Contract Anniversary.

Performance Lock is subject to the following risks:

| • | If you exercise Performance Lock, you will be locking-in an Interim Value for the applicable Strategy Account Option. Interim Values may be unfavorable to you. See “INTERIM VALUE RISK.” |

| • | If you lock-in an Interim Value that is lower than the amount you invested in that Strategy Account Option on the Term Start Date, you may be locking-in a loss. It is possible that you would have realized less loss or no loss if you exercised the Performance Lock at a different time or not at all. |

| • | On the Performance Lock Date, your Strategy Account Option Value will begin earning an annual rate with daily credited interest at the Performance Lock Fixed Rate until the next Contract Anniversary. Therefore, between the Performance Lock Date and the next Contract Anniversary, the value within the Strategy Account Option will no longer be tied to Index performance, and you will not receive an Index Credit Rate. The sooner after the Term Start Date a Performance Lock occurs the longer you will forego participating in Index performance. |

| • | If you exercise Performance Lock manually, we will “lock-in” the next calculated Interim Value after we receive your request in Good Order. You won’t know the locked-in Interim Value in advance. The locked-in Interim Value may be lower or higher than the Interim Value that was calculated on the last day before you submitted your request. When you exercise Performance Lock automatically, you will not know the locked-in Interim Value in advance, and the locked-in Interim Value will be triggered by the target Interim Value gain you have instructed us to lock in. |

| • | We will not provide advice or notify you regarding whether you should exercise the Performance Lock or the best time to do so. We will not warn you if you exercise the Performance Lock at a time that may not be beneficial to you. We are not responsible for any losses related to your decision whether or not to exercise the Performance Lock. There may not be a best time to exercise the Performance Lock during a Term. |

See “VALUING YOUR INVESTMENT IN A STRATEGY ACCOUNT OPTION – PERFORMANCE LOCK.”

INDEX SUBSTITUTION RISK. During a Term, if an Index is discontinued or if the calculation of the Index is substantially changed by the Index provider, or if Index Values should become unavailable for any reason, we may substitute the Index with a new Index, once we obtain all necessary regulatory approvals. We will notify you of any such substitution in writing.

If we substitute an Index, we will select a new Index that we determine in our judgment is comparable to the original Index. You will have no right to reject the substitution of an Index. The performance of the new Index may differ significantly from the performance of the original Index. If we substitute the Index for a Strategy Account Option in which you are invested, your investment in the Contract is subject to the same terms and conditions as any other investment in a Strategy Account Option under the Contract. For example, you may not be permitted to transfer Contract Value prior to the Term End Date if an Index substitution occurs.

See “VALUING YOUR INVESTMENT IN A STRATEGY ACCOUNT OPTION – INDEX SUBSTITUTIONS.”

AVAILABILITY BY SELLING BROKER-DEALER. The availability of the Strategy Account Option, Indices, and the optional Return of Purchase Payment Death Benefit described in this prospectus may vary by selling broker-dealer firm. For example, a firm may choose not to offer certain Strategy Account Options that are described in this prospectus. Only those Strategy Account Options and death benefit available through your firm will be part of your Contract and will be described in your firm’s marketing materials. You should ask your financial representative for details about the specific Strategy Account Options and the death benefit available under your Contract.

15

Table of Contents

INTERIM VALUE RISK. On any day during a Term, other than the Term Start Date and Term End Date, we determine the Strategy Account Option Value for each Strategy Account Option by calculating its Interim Value. We calculate your Interim Value based on the value of a hypothetical portfolio of financial instruments designed to replicate the Strategy Account Option Value if it were held until the Term End Date. Such value could be less than your investment in the Strategy Account Option even if the Index is performing positively. This means that even if the Index Change is positive, it is possible that the Interim Value may not have increased.

If you choose to allocate your Purchase Payment to a Strategy Account Option, an Index Credit will not be credited to your Contract Value until the Term End Date. This means that an Index Credit will not be credited to any amounts withdrawn prior to the Term End Date. This includes Contract Value applied to pay a death benefit or to begin an annuity income option. Except for the Term Start Date and the Term End Date, your Interim Value is the amount available for Withdrawals, Surrenders, annuitization and death benefits. You should consider the risk that it could be less than your original investment even when the applicable Index is performing positively.

PURCHASING A [COREBRIDGE RILA]

When you purchase an annuity, a Contract exists between you and the Company. You are the Owner of the Contract.

Maximum Issue Age

We will not issue a Contract to anyone age 86 or older on the Contract Issue Date (age 76 or older with optional Return of Purchase Payment Death Benefit). In general, we will not issue a Qualified Contract to anyone who is age 72 or older, unless it is shown that the minimum distribution required by the IRS is being made. See “TAXES.”

Joint Ownership

A Non-Qualified Contract may be jointly owned by a spouse or non-spouse. Joint Owners possess an equal and undivided interest in the Contract. The age of the older Owner is used to determine the availability of most age driven benefits. The addition of a joint Owner after the Contract has been issued is contingent upon prior review and approval by the Company. We will not issue a Qualified Contract with joint Owners, in accordance with tax law.

Spouse

Your spouse (as determined for federal tax law purposes) may jointly own the Contract. In certain states, domestic or civil union partners (“Domestic Partners”) qualify for treatment as, or are equal to, spouses under state law.

Non-Spouse

In certain states, we may issue the Contract to non-spousal joint owners. Non-spousal joint Owners and Domestic Partners should consult with their tax adviser and/or financial representative as, they may not be able to fully benefit from certain benefits and features of the Contract such as spousal continuation of the death benefit.

See “APPENDIX F: STATE VARIATIONS” for a list of states that require that benefits and features be made to domestic or civil union partners.

Non-Natural Ownership

A trust, corporation or other non-natural entity may only own this Contract if such entity has sufficiently demonstrated an Insurable Interest in the Annuitant selected. At its sole discretion, the Company reserves the right to decline to issue this Contract to certain entities. We apply various considerations including, but not limited to, estate planning, tax consequences, and the propriety of this Contract as an investment consistent with a non-natural Owner’s organizational documentation. For more information on non-natural ownership, see “TAXES.” You should consult with your tax and/or legal adviser in connection with non-natural ownership of this Contract.

Assignment of the Contract/Change of Ownership

You may assign this Contract before the Income Phase begins. We will not be bound by any assignment until we receive and process your written request at our Annuity Service Center, and you have received confirmation.

16

Table of Contents

| • | Your rights and those of any other person with rights under this Contract will be subject to the assignment. |