UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

INVESCO ADVANTAGE MUNICIPAL INCOME TRUST II

INVESCO BOND FUND

INVESCO CALIFORNIA VALUE MUNICIPAL INCOME TRUST

INVESCO HIGH INCOME 2024 TARGET TERM FUND

INVESCO HIGH INCOME TRUST II

INVESCO MUNICIPAL INCOME OPPORTUNITIES TRUST

INVESCO MUNICIPAL OPPORTUNITY TRUST

INVESCO MUNICIPAL TRUST

INVESCO PENNSYLVANIA VALUE MUNICIPAL INCOME TRUST

INVESCO QUALITY MUNICIPAL INCOME TRUST

INVESCO SENIOR INCOME TRUST

INVESCO TRUST FOR INVESTMENT GRADE MUNICIPALS

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

INVESCO VALUE MUNICIPAL INCOME TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) |

Title of each class of securities to which transaction applies:

| |||

| 2) |

Aggregate number of securities to which transaction applies:

| |||

| 3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) |

Proposed maximum aggregate value of transaction:

| |||

| 5) |

Total fee paid:

| |||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) |

Amount Previously Paid:

| |||

| 2) |

Form, Schedule or Registration Statement No.:

| |||

| 3) |

Filing Party:

| |||

| 4) |

Date Filed:

| |||

Invesco Advantage Municipal Income Trust II (VKI)

Invesco Bond Fund (VBF)

Invesco California Value Municipal Income Trust (VCV)

Invesco High Income 2024 Target Term Fund (IHTA)

Invesco High Income Trust II (VLT)

Invesco Municipal Income Opportunities Trust (OIA)

Invesco Municipal Opportunity Trust (VMO)

Invesco Municipal Trust (VKQ)

Invesco Pennsylvania Value Municipal Income Trust (VPV)

Invesco Quality Municipal Income Trust (IQI)

Invesco Senior Income Trust (VVR)

Invesco Trust for Investment Grade Municipals (VGM)

Invesco Trust for Investment Grade New York Municipals (VTN)

Invesco Value Municipal Income Trust (IIM)

11 Greenway Plaza

Houston, Texas 77046-1173

NOTICE OF JOINT ANNUAL MEETING AND JOINT SPECIAL MEETING OF SHAREHOLDERS

To Be Held August 29, 2024

Notice is hereby given to the holders of common shares of beneficial interest (the “Common Shares”) and, as applicable, the holders of preferred shares of beneficial interest (the “Preferred Shares”) of each Invesco closed-end fund listed above (each a “Fund” and together the “Funds”) that a separate Joint Annual Meeting and Joint Special Meeting of Shareholders of the Funds will be held at 11 Greenway Plaza, Houston, Texas 77046-1173, on August 29, 2024. The Joint Annual Meeting will be held at 1:00 p.m. Central Daylight Time (the “First Meeting”). The Joint Special Meeting will be held at 1:30 p.m. Central Daylight Time (the “Second Meeting”) (each a “Meeting” and collectively, the “Meetings”).

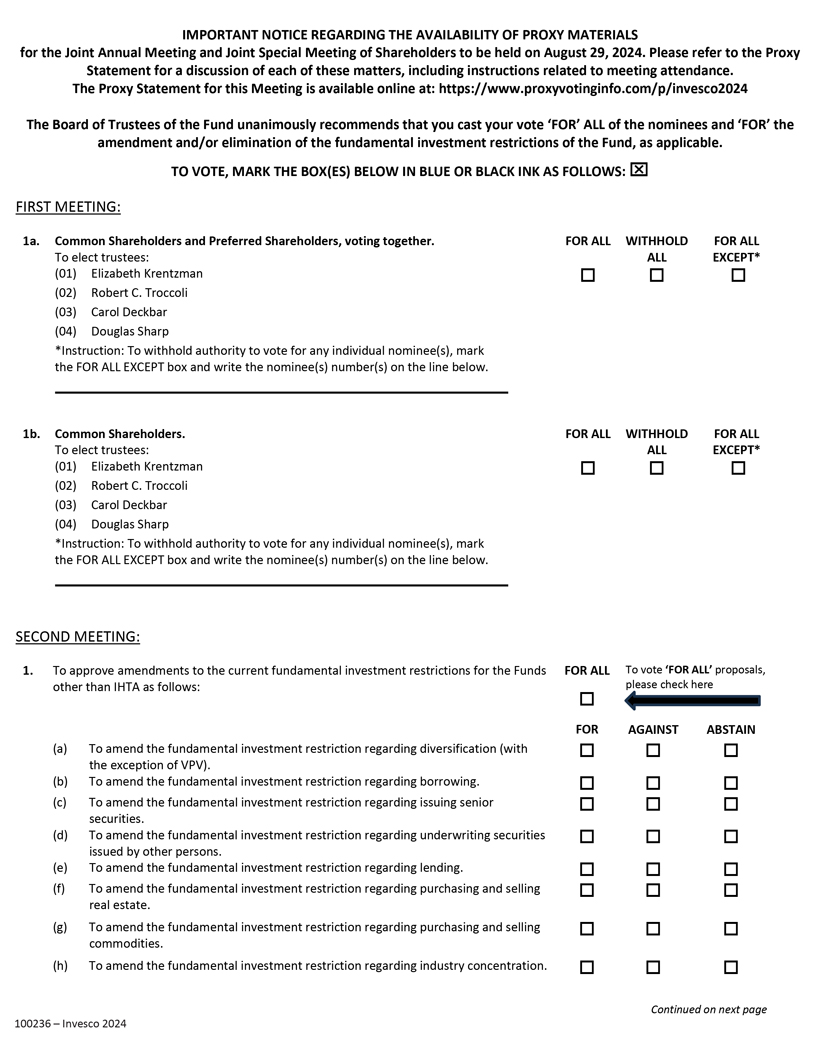

The First Meeting is to be held for the following purpose:

1. Proposal 1: To elect trustees in the following manner:

| Funds |

Trustee Nominees for Election | Shareholders Entitled to Vote | ||||

| Proposal 1(a) |

VKI, VCV, VMO, VKQ, VPV, IQI, VVR, VGM, VTN and IIM | Elizabeth Krentzman Robert C. Troccoli Carol Deckbar Douglas Sharp |

Common Shareholders and Preferred Shareholders, voting together | |||

| Proposal 1(b) |

VBF, OIA, VLT and IHTA |

Elizabeth Krentzman Robert C. Troccoli Carol Deckbar Douglas Sharp |

Common Shareholders | |||

Each elected trustee will serve for a three-year term or until a successor shall have been duly elected and qualified.

The Second Meeting is to be held for the following purposes:

1. Proposal 1: To approve amendments to the current fundamental investment restrictions required by the Investment Company Act of 1940, as amended (the “1940 Act”), for the Funds other than IHTA (the “Amending Funds”) (includes eight sub-proposals) as follows:

(a) To amend the fundamental investment restriction regarding diversification (with the exception of VPV);

(b) To amend the fundamental investment restriction regarding borrowing;

(c) To amend the fundamental investment restriction regarding issuing senior securities;

(d) To amend the fundamental investment restriction regarding underwriting securities issued by other persons;

(e) To amend the fundamental investment restriction regarding lending;

(f) To amend the fundamental investment restriction regarding purchasing and selling real estate;

(g) To amend the fundamental investment restriction regarding purchasing and selling commodities; and

(h) To amend the fundamental investment restriction regarding industry concentration.

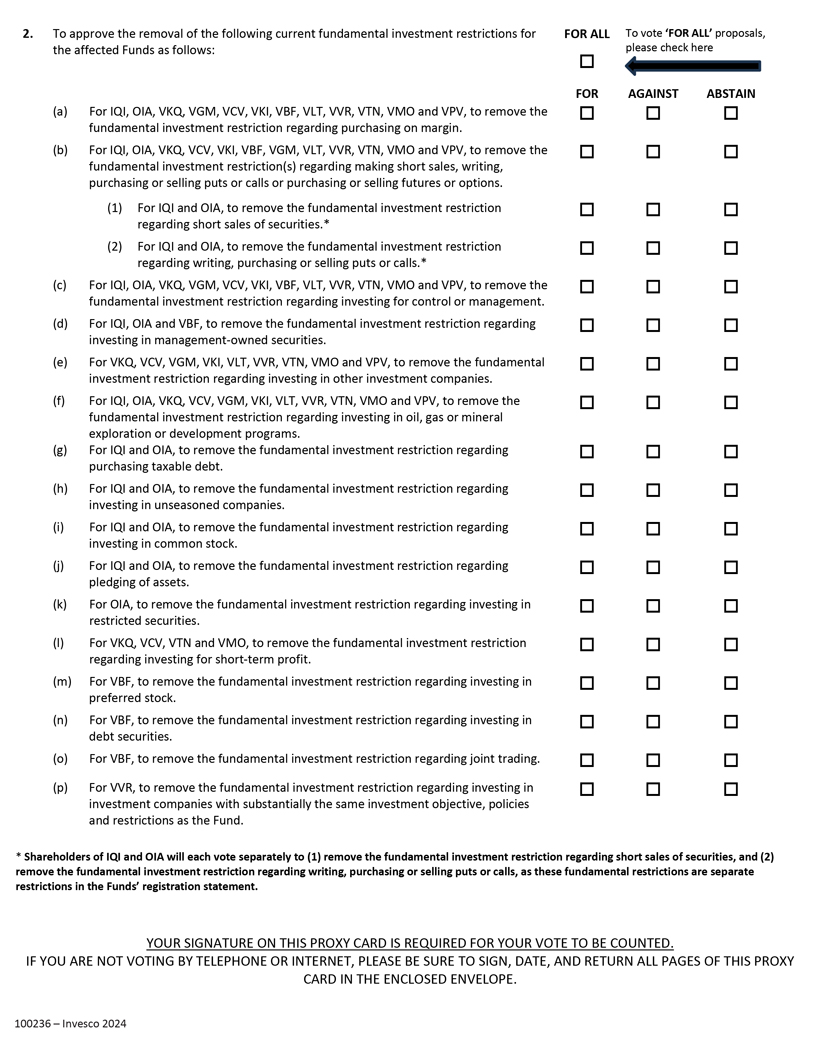

2. Proposal 2: To approve the removal of the following current fundamental investment restrictions not required by the federal securities laws for the affected Funds, as detailed below, (includes sixteen sub-proposals), as follows:

(a) For IQI, OIA, VKQ, VGM, VCV, VKI, VBF, VLT, VVR, VTN, VMO and VPV, to remove the fundamental investment restriction regarding purchasing on margin;

(b) For IQI, OIA, VKQ, VCV, VKI, VBF, VGM, VLT, VVR, VTN, VMO and VPV, to remove the fundamental investment restriction(s) regarding making short sales, writing, purchasing or selling puts or calls or purchasing or selling futures or options;

(c) For IQI, OIA, VKQ, VGM, VCV, VKI, VBF, VLT, VVR, VTN, VMO and VPV, to remove the fundamental investment restriction regarding investing for control or management;

(d) For IQI, OIA and VBF, to remove the fundamental investment restriction regarding investing in management-owned securities;

(e) For VKQ, VCV, VGM, VKI, VLT, VVR, VTN, VMO and VPV, to remove the fundamental investment restriction regarding investing in other investment companies;

(f) For IQI, OIA, VKQ, VCV, VGM, VKI, VLT, VVR, VTN, VMO and VPV, to remove the fundamental investment restriction regarding investing in oil, gas or mineral exploration or development programs;

(g) For IQI and OIA, to remove the fundamental investment restriction regarding purchasing taxable debt;

(h) For IQI and OIA, to remove the fundamental investment restriction regarding investing in unseasoned companies;

(i) For IQI and OIA, to remove the fundamental investment restriction regarding investing in common stock;

(j) For IQI and OIA, to remove the fundamental investment restriction regarding pledging of assets;

(k) For OIA, to remove the fundamental investment restriction regarding investing in restricted securities;

(l) For VKQ, VCV, VTN and VMO, to remove the fundamental investment restriction regarding investing for short-term profit;

(m) For VBF, to remove the fundamental investment restriction regarding investing in preferred stock;

(n) For VBF, to remove the fundamental investment restriction regarding investing in debt securities;

(o) For VBF, to remove the fundamental investment restriction regarding joint trading; and/or

(p) For VVR, to remove the fundamental investment restriction regarding investing in investment companies with substantially the same investment objective, policies and restrictions as the Fund.

In addition, any other business as may properly come before each Meeting or any adjournments thereof will be transacted at each Meeting.

Holders of record of the Common Shares and, where applicable, Preferred Shares, of each Fund on May 31, 2024 are entitled to notice of and to vote at each Meeting and any adjournments thereof.

THE BOARD OF TRUSTEES OF EACH FUND UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE FOR ALL OF THE NOMINEES TO THE BOARD OF TRUSTEES LISTED IN THE JOINT PROXY STATEMENT AND FOR THE AMENDMENT AND/OR ELIMINATION OF THE FUNDAMENTAL RESTRICTIONS OF THE FUNDS, AS APPLICABLE.

By order of the Board of Trustees,

Melanie Ringold

Senior Vice President,

Chief Legal Officer and Secretary

July 2, 2024

IT IS VERY IMPORTANT THAT YOUR SHARES BE REPRESENTED AT EACH MEETING IN PERSON OR BY PROXY. PLEASE PROMPTLY SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD(S) IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE

INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD(S), REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE MEETINGS.

If you attend the Meetings and wish to vote at the Meetings, you will be able to do so and your vote at the Meetings will revoke any proxy you may have submitted. Merely attending a Meeting, however, will not revoke a previously given proxy.

In order to avoid the additional expense of further solicitation, we ask that you mail your proxy card(s) or record your voting instructions by telephone or via the internet promptly.

Your vote is extremely important. No matter how many or how few shares you own, please send in your proxy card(s), or vote by telephone or the internet today.

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSALS

Below is a brief overview of the subject of the shareholder vote. Your vote is important, no matter how large or small your holdings may be. Please read the full text of this Joint Proxy Statement, which contains additional information about the Proposals and Sub-Proposals, and keep it for future reference.

PROPOSAL 1 OF THE FIRST MEETING: ELECTION OF TRUSTEES

WHAT IS THE ROLE OF THE BOARD OF TRUSTEES?

Each Fund is governed by a Board of Trustees, which has oversight responsibility for the management of the Fund’s business affairs. Trustees establish procedures and oversee and review the performance of the investment adviser, the distributor, and others who perform services for the Funds. Each of the Boards is comprised of the same Trustees.

WHO ARE THE TRUSTEE NOMINEES AND HOW WERE THEY SELECTED?

Shareholders are being asked to elect 4 Trustees (the “Trustee Nominees”) to the Board of each Fund. Each of the Trustee Nominees is currently a member of the Board of each Fund. Biographical information on each of the Trustee Nominees is provided in this Joint Proxy Statement under Proposal 1 of the First Meeting.

PROPOSAL 1 OF THE SECOND MEETING: AMENDMENT OF THE REQUIRED FUNDAMENTAL INVESTMENT RESTRICTIONS

WHAT ARE THESE REQUIRED FUNDAMENTAL INVESTMENT RESTRICTIONS?

Each Fund is subject to certain investment restrictions that are considered “fundamental” because they may only be changed with shareholder approval. The Funds (with the exception of IHTA) are proposing to amend their fundamental investment restrictions with respect to: (a) diversification (with the exception of VPV), (b) borrowing, (c) issuing senior securities, (d) underwriting securities issued by other persons, (e) lending, (f) purchasing and selling real estate, (g) purchasing and selling commodities, and (h) industry concentration.

WHAT WILL BE THE EFFECT OF THE AMENDMENTS TO THE FUNDS’ CURRENT REQUIRED FUNDAMENTAL INVESTMENT RESTRICTIONS?

The purpose of the proposed amendments is to update those restrictions that are more restrictive than is currently required and to standardize, to the extent practicable, each Fund’s fundamental investment restrictions with those of substantially all other Invesco funds. Certain proposed amendments would provide the Funds with additional flexibility to pursue various investments or strategies. To the extent that a Fund uses such flexibility in the future, the Fund may be subject to some additional costs and risks. Notwithstanding the foregoing, the Funds do not currently anticipate materially changing their investment strategies or risk profile if the proposed amendments to these fundamental investment restrictions are approved.

PROPOSAL 2 OF THE SECOND MEETING: REMOVAL OF CERTAIN NON-STANDARD FUNDAMENTAL INVESTMENT RESTRICTIONS

WHAT ARE THESE NON-STANDARD FUNDAMENTAL INVESTMENT RESTRICTIONS?

The Funds (with the exception of IHTA) are also subject to certain fundamental investment restrictions that were once imposed by state securities laws or other regulatory authorities that are now outdated or are no longer effective. For example, at the time many of the Funds were organized, investment companies were required to adopt investment policies in response to state “Blue Sky” laws and regulations limiting certain types of investment company practices and investments. These policies were preempted by the National Securities Markets Improvement Act of 1996 (“NSMIA”), which effectively removed the power of states to enforce the policies, and thereafter, investment companies were no longer required to comply with those state requirements.

WHAT WILL BE THE EFFECT OF THE REMOVAL OF THE FUNDS’ CURRENT NON-STANDARD FUNDAMENTAL INVESTMENT RESTRICTIONS?

If the proposed removals are approved, it may be easier for the Funds to adapt to market or industry changes in the future because these restrictions would be eliminated. To the extent that a Fund uses this flexibility in the future, the Fund may be subject to some additional costs and risks. However, the Funds do not currently anticipate materially changing their investment strategies or risk profile if the proposed removals are approved.

VOTING PROCEDURES

HOW DO I VOTE IN PERSON?

If you do attend a Meeting, were the record owner of your shares on the Record Date, and wish to vote in person, we will provide you with a ballot prior to the vote. However, if you hold your shares in street name, you are required to obtain a “legal proxy” from your broker, bank or other nominee indicating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote. Please call the Funds at 1-800-952-3502 if you plan to attend a Meeting.

HOW DO I VOTE BY PROXY?

Whether you plan to attend a Meeting or not, we urge you to complete, sign and date the enclosed proxy card(s) and to return it promptly in the envelope provided. Returning the proxy card(s) will not affect your right to attend the Meetings or to vote at the Meetings if you choose to do so. If you properly complete and sign your proxy card(s) and send it to us in time to vote at the Meetings, your “proxy” (the individual(s) named on your proxy card(s)) will vote your shares as you have directed. If you sign your proxy card(s) but do not make specific choices, your proxy will vote your shares “FOR” each Nominee, Proposal or Sub-Proposal, as applicable, as recommended by the Board of your Fund, and in accordance with management’s recommendation on other matters.

Your proxy will have the authority to vote and act on your behalf at any adjournment or postponement of the Meeting. Shareholders may also transact any other business not currently contemplated that may properly come before the Meeting in the discretion of the proxies or their substitutes.

HOW DO I VOTE BY TELEPHONE OR THE INTERNET?

You may vote your shares by telephone or through a website established for that purpose by following the instructions that appear on the proxy card(s) accompanying this Joint Proxy Statement.

MAY I REVOKE MY VOTE?

If you authorize a proxy to vote for you, you may revoke the authorization at any time before it is exercised. You can do this in one of four ways:

| • | You may send in another duly executed proxy card bearing a later date, prior to a Meeting. |

| • | You may submit a proxy by telephone, via the internet, or via an alternative method of voting permitted by your broker, with a later date. |

| • | You may notify the Funds’ Secretary in writing before a Meeting that you have revoked your proxy. |

| • | You may vote in person at a Meeting, as set forth above under the heading, “How Do I Vote in Person? |

Invesco Advantage Municipal Income Trust II (VKI)

Invesco Bond Fund (VBF)

Invesco California Value Municipal Income Trust (VCV)

Invesco High Income 2024 Target Term Fund (IHTA)

Invesco High Income Trust II (VLT)

Invesco Municipal Income Opportunities Trust (OIA)

Invesco Municipal Opportunity Trust (VMO)

Invesco Municipal Trust (VKQ)

Invesco Pennsylvania Value Municipal Income Trust (VPV)

Invesco Quality Municipal Income Trust (IQI)

Invesco Senior Income Trust (VVR)

Invesco Trust for Investment Grade Municipals (VGM)

Invesco Trust for Investment Grade New York Municipals (VTN)

Invesco Value Municipal Income Trust (IIM)

11 Greenway Plaza

Houston, Texas 77046-1173

JOINT PROXY STATEMENT

FOR

JOINT ANNUAL MEETING AND JOINT SPECIAL MEETING OF SHAREHOLDERS

To be Held August 29, 2024

INTRODUCTION

This Joint Proxy Statement is being furnished in connection with the solicitation of proxies by the Boards of Trustees (the “Board”) of each fund listed above (each a “Fund” and together the “Funds”). The proxies are to be voted at (a) a Joint Annual Meeting of Shareholders of the Funds, and all adjournments thereof (the “First Meeting”), to be at 11 Greenway Plaza, Houston, Texas 77046-1173, on August 29, 2024, at 1:00 p.m. Central Daylight Time and (b) a Joint Special Meeting of Shareholders of the Funds, and all adjournments thereof (the “Second Meeting”), to be held at the same location, on August 29, 2024, at 1:30 p.m. Central Daylight Time (each a “Meeting” and collectively, the “Meetings”). The First Meeting will be an annual meeting for each Fund. The approximate mailing date of this Joint Proxy Statement and accompanying proxy card(s) is on or about July 3, 2024.

Participating in the Meetings are holders of common shares of beneficial interest (the “Common Shares”) and, where applicable, the holders of preferred shares of beneficial interest (the “Preferred Shares”) of each Fund as set forth in Annex A to this Joint Proxy Statement. The Common Shares and the Preferred Shares of the Funds are sometimes referred to herein collectively as the “Shares.” The Board has fixed May 31, 2024 as the record date (the “Record Date”) for the determination of holders of Shares of each Fund entitled to vote at each Meeting.

The Common Shares of each of the Funds are listed on the New York Stock Exchange (the “NYSE”). The NYSE ticker symbol of each Fund and the amount of Common Shares and Preferred Shares outstanding as of the Record Date are shown in Annex A to this Joint Proxy Statement. Each Fund is a closed-end fund organized as a Delaware statutory trust.

Each Meeting is scheduled as a joint meeting because the shareholders of the Funds are expected to consider and vote on similar matters.

If you have any questions about the information set forth in this Joint Proxy Statement, please contact our solicitor at 1-833-876-2299 or visit our website at www.invesco.com/us.

Important Notice Regarding the Availability of Proxy Materials for the Meetings

This Joint Proxy Statement and a copy of the proxy card(s) (together, the “Proxy Materials”) are available at https://www.proxyvotinginfo.com/p/invesco2024. The Proxy Materials will be available on the internet through the day of the Meetings.

Each Fund will furnish, without charge, a copy of its most recent annual report (and the most recent semiannual report succeeding the annual report, if any) to any shareholder upon request. Any such request should be directed to the Secretary of the respective Fund by calling 1-800-959-4246, or by writing to the Secretary of the respective Fund at 11 Greenway Plaza, Houston, Texas 77046-1173.

Only one copy of this proxy statement will be delivered to multiple shareholders sharing an address unless we have received contrary instructions from one or more of the shareholders. Upon request, we will deliver a separate copy of this proxy statement to a shareholder at a shared address to which a single copy of this proxy statement was delivered. Any shareholder who wishes to receive a separate proxy statement should contact their Fund at 1-833-876-2299.

Overview of the Proposals

The following summarizes the proposals concerning trustee elections to be presented at the First Meeting and the proposals concerning the fundamental restrictions of the Funds to be presented at the Second Meeting that the shareholders of each Fund, as applicable, are entitled to vote upon (collectively, the “Proposals”). The Board unanimously approved the Proposals and has determined that the Proposals are in the best interests of your Fund(s).

The First Meeting - Proposal 1: Election of Trustees (the “Election Proposal”)

The following table summarizes the proposal concerning trustee elections to be presented at the First Meeting and the shareholders entitled to vote.

| Funds |

Trustee Nominees for Election | Shareholders Entitled to Vote | ||||

| Proposal 1(a) | VKI, VCV, VMO, VKQ, VPV, IQI, VVR, VGM, VTN and IIM | Elizabeth Krentzman Robert C. Troccoli Carol Deckbar Douglas Sharp |

Common Shareholders and Preferred Shareholders, voting together | |||

| Proposal 1(b) | VBF, OIA, VLT and IHTA |

Elizabeth Krentzman Robert C. Troccoli Carol Deckbar Douglas Sharp |

Common Shareholders | |||

2

The Second Meeting - Proposal 1: Amendment of the Required Fundamental Investment Restrictions (the “Standard Restriction Proposal”)

The Standard Restriction Proposal contains eight sub-proposals to approve changes to the current fundamental investment restrictions (the “Required Fundamental Investment Restrictions”) for the Funds other than IHTA (the “Amending Funds”) to update and standardize the Required Fundamental Investment Restrictions. The Investment Company Act of 1940, as amended (the “1940 Act”) requires investment companies to adopt “fundamental” investment restrictions with respect to: (a) diversification, (b) borrowing, (c) issuing senior securities, (d) underwriting securities issued by other persons, (e) lending (f) purchasing and selling real estate, (g) purchasing and selling commodities, and (h) industry concentration. A “fundamental” investment restriction may be changed only if authorized by shareholder vote.

The proposed standardized Required Fundamental Investment Restrictions cover those areas for which the 1940 Act requires the Amending Funds to have fundamental investment restrictions described above and have substantially the same effect as the fundamental investment restrictions of the vast majority of funds within the Invesco Funds complex. The Board and Invesco Advisers, Inc. (the “Adviser” or “Invesco”), the investment adviser to each Amending Fund, believe that there are several advantages to revising and standardizing the Required Fundamental Investment Restrictions for the Amending Funds at this time. First, by obtaining shareholder approval to update and standardize the language of the Required Fundamental Investment Restrictions, the Funds may be able to minimize the costs and delays associated with obtaining future shareholder approval to revise fundamental investment restrictions that have become outdated or inappropriate. Second, updating the Required Fundamental Investment Restrictions will provide the Adviser with greater flexibility in managing an Amending Fund’s assets for the benefit of the Fund and its shareholders in a changing investment environment and will allow the Adviser to respond to market, industry, regulatory or technical changes and innovations by seeking Board, rather than shareholder, approval when necessary to revise certain investment policies or strategies. There may be additional risks associated with such increased flexibility, as described in “Second Meeting - Proposal 1” below. Additionally, the proposed standardized fundamental investment restrictions are expected to reduce administrative burdens by simplifying and making uniform the fundamental investment restrictions across the Invesco Funds complex, enabling the Amending Funds and their service providers to monitor portfolio compliance more efficiently across all Invesco funds and help avoid conflicts among restrictions whose language in some instances varies only slightly from one to another.

It is anticipated that the proposed changes to the fundamental investment restrictions will not materially change the way the Amending Funds are currently managed and operated. Although the proposed standardized Required Fundamental Investment Restrictions will give the Amending Funds greater flexibility to respond to possible future investment opportunities, at this time it is not anticipated that the changes, individually or in the aggregate, will result in a material change in the current level of investment risk associated with an investment in any of the Amending Funds. However, should the Adviser believe that the way any Amending Fund is managed in the future should be modified, the Adviser would continue to request approval by the Board of any such material modification and provide related notice to shareholders as deemed appropriate.

3

The Second Meeting — Proposal 2: Removal of Certain Non-Standard Fundamental Investment Restrictions (the “Non-Standard Restriction Proposal”)

The Non-Standard Restriction Proposal contains sixteen sub-proposals to approve the removal of the other current fundamental investment restrictions not required by federal securities laws (the “Non-Standard Restrictions”) for each affected Fund. Specifically, shareholders of each affected Fund are being asked to approve the removal of the various Non-Standard Restrictions of the affected Funds, as applicable, relating to the following investment activities:

(a) purchasing on margin; (b) making short sales, writing, purchasing or selling puts or calls or purchasing or selling futures or options; (c) investing for control or management; (d) investing in management-owned securities; (e) investing in other investment companies (f) investing in oil, gas or mineral exploration or development programs; (g) purchasing taxable debt; (h) investing in unseasoned companies; (i) investing in common stock; (j) pledging of assets; (k) investing in restricted securities; (l) investing for short-term profit; (m) investing in preferred stock; (n) investing in debt securities; (o) joint trading; and (p) investing in investment companies with substantially the same investment objective, policies and restrictions as the applicable Fund.

These Non-Standard Restrictions were adopted in the past by the respective affected Fund to reflect certain regulatory, business or industry conditions which are no longer in effect or relevant. As a result, many of these current Non-Standard Restrictions are outdated or inappropriate and unnecessarily limit the investment strategies available to the Adviser in managing the portfolios of the affected Funds. The removal of these Non-Standard Restrictions, as applicable, will provide the Adviser with greater flexibility in managing the portfolios of the affected Funds and may minimize the costs and delays associated with obtaining future shareholder approval to remove fundamental investment restrictions that have become outdated or inappropriate. There may be additional risks associated with such increased flexibility, as described in “Second Meeting - Proposal 2” below. Additionally, the removal of the Non-Standard Restrictions is expected to reduce administrative burdens by simplifying and making uniform the fundamental investment restrictions across the Invesco Funds complex, enabling the Amending Funds and their service providers to monitor portfolio compliance more efficiently across all Invesco funds.

It is anticipated that the removal of the Non-Standard Restrictions will not materially change the way the affected Funds are currently managed and operated. Although the removal of the Non-Standard Restrictions will give the affected Funds greater flexibility to respond to possible future investment opportunities, at this time it is not anticipated that the changes, individually or in the aggregate, will result in a material change in the current level of investment risk associated with an investment in any of the affected Funds. However, should the Adviser believe that the way any affected Fund is managed in the future should be modified, the Adviser would continue to request approval by the Board of any such material modification and provide related notice to shareholders as deemed appropriate.

Together, the Standard Restriction Proposal and the Non-Standard Restriction Proposal (together, the “Investment Restriction Proposals”) are intended to update the current fundamental investment restrictions of the Amending Funds and affected Funds, as

4

applicable (together, the “Updating Funds”), as set forth herein. Shareholders are being asked to vote separately on, and provide voting instructions separately with respect to, each applicable Sub-Proposal. No Sub-Proposal of the Investment Restrictions Proposals to amend or remove any fundamental investment restriction, as applicable, is contingent upon the approval of any other Sub-Proposal. As a result, it may be the case that certain Sub-Proposals for an Updating Fund will be amended or removed, as applicable, while others will not. If shareholders of an Updating Fund do not approve an applicable Sub-Proposal at the Second Meeting, the current fundamental investment restriction contained in that Sub-Proposal will remain in effect for that Updating Fund. If a Sub-Proposal is approved by shareholders at the Second Meeting, the proposed change to, or removal of, that fundamental investment restriction will take effect as soon as reasonably practicable.

The Investment Restriction Proposals are intended to, among other things, provide the Adviser with greater flexibility in managing the portfolios of the Updating Funds for the benefit of the Funds and their shareholders. However, if any or all of the Sub-Proposals are approved for an Updating Fund, unless otherwise disclosed in this Joint Proxy Statement, no material changes are expected to be made to an Updating Fund’s principal investment strategies, and the Updating Fund will continue to be managed subject to the applicable limitations imposed by the 1940 Act and the rules and interpretive guidance provided thereunder, as well as the Updating Fund’s investment objective, strategies and policies.

The Second Meeting – Summary of Proposals

The following table summarizes the Sub-Proposals regarding the Required Fundamental Investment Restrictions and the Non-Standard Restrictions to be presented at the Second Meeting and the Updating Funds with shareholders entitled to vote.

| Funds |

Sub-Proposal | |||

| Sub-Proposal 1(a)-(h) |

VKI, VCV, VMO, VKQ, VPV, IQI, VVR, VGM, VTN, IIM, VBF, OIA and VLT | To amend the fundamental investment restriction regarding: (a) diversification (for each Fund listed with the exception of VPV), (b) borrowing, (c) issuing senior securities, (d) underwriting, (e) lending, (f) purchasing and selling real estate, (g) purchasing and selling commodities, and (h) industry concentration | ||

| Sub-Proposal 2(a) |

IQI, OIA, VKQ, VGM, VCV, VKI, VBF, VLT, VVR, VTN, VMO and VPV | To remove the fundamental investment restriction regarding purchasing on margin | ||

| Sub-Proposal 2(b) |

IQI, OIA, VKQ, VCV, VKI, VBF, VGM, VLT, VVR, VTN, VMO and VPV | To remove the fundamental investment restriction regarding making short sales, writing, purchasing or selling puts or calls or purchasing or selling futures or options | ||

5

| Funds |

Sub-Proposal | |||

| Sub-Proposal 2(c) |

IQI, OIA, VKQ, VGM, VCV, VKI, VBF, VLT, VVR, VTN, VMO and VPV | To remove the fundamental investment restriction regarding investing for control or management | ||

| Sub-Proposal 2(d) |

IQI, OIA and VBF | To remove the fundamental investment restriction regarding investing in management-owned securities | ||

| Sub-Proposal 2(e) |

VKQ, VCV, VGM, VKI, VLT, VVR, VTN, VMO and VPV | To remove the fundamental investment restriction regarding investing in other investment companies | ||

| Sub-Proposal 2(f) |

IQI, OIA, VKQ, VCV, VGM, VKI, VLT, VVR, VTN, VMO and VPV | To remove the fundamental investment restriction regarding investing in oil, gas or mineral exploration or development programs | ||

| Sub-Proposal 2(g) |

IQI and OIA | To remove the fundamental investment restriction regarding purchasing taxable debt | ||

| Sub-Proposal 2(h) |

IQI and OIA | To remove the fundamental investment restriction regarding investing in unseasoned companies | ||

| Sub-Proposal 2(i) |

IQI and OIA | To remove the fundamental investment restriction regarding investing in common stock | ||

| Sub-Proposal 2(j) |

IQI and OIA | To remove the fundamental investment restriction regarding pledging of assets | ||

| Sub-Proposal 2(k) |

OIA | To remove the fundamental investment restriction regarding investing in restricted securities | ||

| Sub-Proposal 2(l) |

VKQ, VCV, VTN and VMO | To remove the fundamental investment restriction regarding investing for short-term profit | ||

| Sub-Proposal 2(m) |

VBF | To remove the fundamental investment restriction regarding investing in preferred stock | ||

| Sub-Proposal 2(n) |

VBF | To remove the fundamental investment restriction regarding investing in debt securities | ||

6

| Funds |

Sub-Proposal | |||

| Sub-Proposal 2(o) |

VBF | To remove the fundamental investment restriction regarding joint trading | ||

| Sub-Proposal 2(p) |

VVR | To remove the fundamental investment restriction regarding investing in investment companies with substantially the same investment objective, policies and restrictions as the Fund | ||

Voting at the Meetings

Shareholders of a Fund on the Record Date are entitled to one vote per Share, and a proportionate fractional vote for each fractional Share, with respect to each applicable Proposal or Sub-Proposal, with no Share having cumulative voting rights. The voting requirement for passage of a particular Proposal depends on the nature of the Proposal. The voting requirement of each Proposal or Sub-Proposal is described below. A majority of the outstanding Shares of a Fund entitled to vote at a Meeting must be present at the Meeting or represented by proxy to have a quorum for such Fund to conduct business at the Meeting. Shareholders do not have rights of appraisal with respect to any matter to be acted upon at the Meetings.

If you intend to attend the Meetings in person and you are a record holder of a Fund’s Shares, in order to gain admission you must show photographic identification, such as your driver’s license. If you intend to attend the Meetings in person and you hold your Shares through a bank, broker or other custodian (i.e., in “street name”), in order to gain admission you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of Shares of a Fund, such as your voting instruction form (or a copy thereof) or a broker’s statement indicating ownership as of a recent date.

If you hold your Shares in “street name,” you will not be able to vote your Shares in person at either Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Meetings.

You may contact the Funds at 1-800-959-4246 to obtain directions to the site of the Meeting.

The Funds do not know of any business other than the Proposals that will, or are proposed to be, presented for consideration at the First Meeting and Second Meeting. If any other matters are properly presented, the persons named on the enclosed proxy card(s) shall vote proxies in accordance with their best judgment.

Required Vote

With respect to the Election Proposal for VKI, VCV, VMO, VKQ, VPV, IQI, VVR, VGM, VTN and IIM, holders of Common Shares and holders of Preferred Shares of each applicable Fund will vote together as a single class for the respective Nominees. The affirmative vote of a majority of the outstanding Shares of each such Fund present at the First Meeting or represented by proxy and entitled to vote is required to elect each Nominee for Trustee of such Fund designated to be elected by the holders of the Common Shares and the holders of Preferred Shares of such Fund, voting together as a single class.

7

With respect to the Election Proposal for VBF, OIA, VLT and IHTA, holders of Common Shares of each applicable Fund will vote for the respective Nominees. The affirmative vote of a majority of the outstanding Common Shares of each such Fund present at the First Meeting or represented by proxy and entitled to vote is required to elect each Nominee for Trustee of such Fund designated to be elected by the holders of the Common Shares of such Fund.

With respect to each of the Sub-Proposals in the Investment Restriction Proposals for each Fund, as applicable, holders of Common Shares and holders of Preferred Shares, as applicable, will vote together as a single class for each Sub-Proposal to amend or remove, as applicable, the respective current fundamental investment restriction. The affirmative vote of the lesser of (a) 67% or more of the shares present at the Second Meeting, if the holders of more than 50% of an Updating Fund’s outstanding shares are present or represented by proxy at the Second Meeting; or (b) more than 50% of an Updating Fund’s outstanding shares is required to amend or remove the fundamental restriction for the related affected Fund. This voting standard is often referred to as a “1940 Act Vote.” OIA, VBF and VLT currently do not have Preferred Shares outstanding.

The voting standards to approve the Nominees in the Election Proposal and each of the Sub-Proposals in the Investment Restriction Proposals differ because the applicable Funds’ governing documents specify that an affirmative vote of a majority of the outstanding shares of each such Fund present at the First Meeting or represented by proxy and entitled to vote is required to elect trustees, while the 1940 Act, in conjunction with the applicable Funds’ registration statements and governing documents, specify that a 1940 Act Vote is required for changes to fundamental investment restrictions, including the removal of such restrictions.

All Shares represented by properly executed proxies received prior to a Meeting will be voted at the Meeting in accordance with the instructions marked thereon. With respect to the First Meeting concerning the Election Proposal, proxies on which no vote is indicated will be voted “FOR” each Nominee. Proxies marked “WITHHOLD,” which is the equivalent of an abstention, will not be voted “FOR” the Nominee, but will be counted for purposes of determining whether a quorum is present, and will therefore have the same effect as a vote “AGAINST.”

With respect to the Second Meeting concerning each of the Sub-Proposals in the Investment Restriction Proposals for each Fund, if you sign your proxy card(s) but do not specify how to vote your shares (i.e., “FOR,” “AGAINST” OR “ABSTAIN”), your proxy will vote your shares “FOR” each Sub-Proposal, as recommended by the Board. Proxies marked “ABSTAIN” with respect to a Sub-Proposal will not be voted “FOR” the Sub-Proposal, but will be counted for purposes of determining whether a quorum is present, and will therefore have the same effect as a vote “AGAINST” the Sub-Proposal.

An unfavorable vote for a Nominee or Sub-Proposal by the shareholders of one Fund will not affect the election of the Nominee or implementation of such Sub-Proposal by another Fund if the Nominee or Sub-Proposal is approved by the shareholders of the other Fund. An unfavorable vote for a particular Nominee or Sub-Proposal by the shareholders of a Fund will not affect such Fund’s election of other Nominees or implementation of other

8

Sub-Proposals that receive a favorable vote. There is no cumulative voting with respect to the election of Trustees, the Sub-Proposals or any other matter.

Broker Non-Votes

Broker non-votes arise when shares are held by brokers or nominees, typically in “street name,” and (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter.

With respect to the Election Proposal, under the rules of the NYSE, brokers may vote at the First Meeting in their discretion on the election of trustees of a closed-end fund. Under the rules of the NYSE, beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their Shares voted by their brokers in favor of the Election Proposal. Broker-dealers and other financial intermediaries who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your shares without instruction. Because there are no proposals expected to come before the First Meeting for which brokers or nominees do not have discretionary voting power, the Funds do not anticipate receiving any broker non-votes for the First Meeting.

With respect to the Sub-Proposals of the Investment Restriction Proposals, broker non-votes at the Second Meeting will have the same effect as a vote against. Because the Second Meeting involves only non-routine matters, it is expected that broker-dealers, in the absence of specific authorization from their customers, will not have discretionary authority to vote any shares held beneficially by their customers, and therefore there are unlikely to be any broker non-votes at the Second Meeting.

We urge you to provide instructions to your broker or nominee to ensure that your votes may be counted at both Meetings.

Revoking a Proxy

Shareholders who execute proxies may revoke them at any time before they are voted by filing a written notice of revocation before a Meeting with the respective Fund, by delivering a duly executed proxy bearing a later date, by attending the Meeting and voting in person, by filing a revocation using any electronic, telephonic, computerized or other alternative means, or by written notice of the death or incapacity of the maker of the proxy received by the Fund prior to each Meeting. Shareholders who wish to vote at a Meeting and who hold their shares in “street name” through a brokerage or similar account should obtain a “legal proxy” from their broker in order to vote at the Meeting and follow the instructions detailed above.

Adjourning a Meeting

With respect to each Fund, the vote of the holders of one-third of the Shares cast whether or not a quorum is present, or the chair of the First Meeting in his or her discretion, will have the power to adjourn the First Meeting with regard to a particular proposal scheduled to be voted on at the First Meeting or to adjourn the First Meeting entirely from time to time without notice. With respect to each Fund, the vote of the holders of one-third

9

of the Shares cast whether or not a quorum is present, or the chair of the Second Meeting in his or her discretion, will have the power to adjourn the Second Meeting with regard to a particular proposal scheduled to be voted on at the Second Meeting or to adjourn the Second Meeting entirely from time to time without notice.

Provided a quorum is present, any business may be transacted at such adjourned meeting that might have been transacted at the Meeting as originally notified. A meeting may be adjourned from time to time without further notice to shareholders to a date not more than 120 days after the original meeting date for such meeting. In voting for the adjournment, the persons named as proxies may vote their proxies in favor of one or more adjournments of the First Meeting or Second Meeting, or the chair of the First Meeting or Second Meeting may call an adjournment, provided such persons determine that such adjournment is reasonable and in the best interests of shareholders and the Funds, based on a consideration of such factors as they may deem relevant.

THE BOARD OF EACH FUND UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE FOR ALL OF THE NOMINEES IN THE ELECTION PROPOSAL AND FOR THE AMENDMENTS AND/OR REMOVALS OF THE FUNDAMENTAL RESTRICTIONS OF THE FUNDS, AS APPLICABLE, IN THE INVESTMENT RESTRICTION PROPOSALS.

Investment Adviser of the Funds

The investment adviser for each Fund is Invesco Advisers, Inc. (“Invesco” or the “Adviser”). The Adviser is a wholly owned subsidiary of Invesco Ltd. The Adviser is located at 1331 Spring Street, NW, Suite 2500, Atlanta, Georgia 30309. The Adviser, as successor in interest to multiple investment advisers, has been an investment adviser since 1976.

Sub-Advisers of the Funds

The Adviser has entered into a sub-advisory agreement with certain affiliates to serve as sub-advisers to each Fund (except IHTA), pursuant to which these affiliated sub-advisers may be appointed by the Adviser from time to time to provide discretionary investment management services, investment advice, and/or order execution services to the Funds. The affiliated sub-advisers, each of which is a registered investment adviser under the Investment Advisers Act of 1940 are Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc., and Invesco Canada Ltd. (each a “Sub-Adviser” and collectively, the “Sub-Advisers”). Each Sub-Adviser is an indirect wholly owned subsidiary of Invesco Ltd.

Other Service Providers of the Funds

Administration Services

Each Fund has entered into a master administrative services agreement with the Adviser, pursuant to which the Adviser performs or arranges for the provision of accounting

10

and other administrative services to each Fund which are not required to be performed by the Adviser under its investment advisory agreement with each Fund. Pursuant to a subcontract for administrative services with the Adviser, State Street Bank and Trust Company performs certain administrative functions for the Funds. State Street Bank and Trust Company is located at 225 Franklin Street, Boston, Massachusetts 02110-2801. Invesco Senior Income Trust has also entered into an additional administration agreement with the Adviser. Each Fund has also entered into a support services agreement with Invesco Investment Services, Inc. The principal business address of Invesco Investment Services, Inc. is 11 Greenway Plaza, Houston, Texas 77046-1173.

Custodian and Transfer Agents

The custodian for each Fund is State Street Bank and Trust Company, located at 225 Franklin Street, Boston, Massachusetts 02110-2801. The transfer agent for the Common Shares for each Fund is Computershare Trust Company, N.A., located at 250 Royall Street, Canton, MA 02021. The transfer agent for the Preferred Shares for the applicable Funds is Deutsche Bank Trust Company Americas, Trust & Agency Services, located at 1 Columbus Circle, 17th Floor, Mail Stop: NYC01-1710, New York, NY 10019.

11

FIRST MEETING – PROPOSAL 1

ELECTION OF TRUSTEES PROPOSAL (THE “ELECTION PROPOSAL”)

At the First Meeting, with respect to each of Invesco Bond Fund, Invesco Municipal Income Opportunities Trust, Invesco High Income 2024 Target Term Fund and Invesco High Income Trust II, holders of Common Shares will vote with respect to the election of Elizabeth Krentzman, Robert C. Troccoli, Carol Deckbar and Douglas Sharp.

At the First Meeting, with respect to each of Invesco Advantage Municipal Income Trust II, Invesco California Value Municipal Income Trust, Invesco Municipal Opportunity Trust, Invesco Municipal Trust, Invesco Pennsylvania Value Municipal Income Trust, Invesco Quality Municipal Income Trust, Invesco Senior Income Trust, Invesco Trust for Investment Grade Municipals, Invesco Trust for Investment Grade New York Municipals and Invesco Value Municipal Income Trust, holders of Common Shares and holders of Preferred Shares of each of these Funds will vote together with respect to the election of Elizabeth Krentzman, Robert C. Troccoli, Carol Deckbar and Douglas Sharp.

All Nominees have consented to being named in this Joint Proxy Statement and have agreed to serve if elected. Carol Deckbar was initially identified during a search process for potential candidates that was undertaken by the independent trustees with the assistance of a third-party search firm and was recommended for consideration as a nominee for Trustee by the independent trustees. Douglas Sharp was recommended for consideration as a nominee for Trustee by Invesco management. Robert C. Troccoli and Elizabeth Krentzman were previously elected by shareholders in 2021. Carol Deckbar and Douglas Sharp are being nominated for election to the Board of each Fund by shareholders for the first time.

If elected at the First Meeting, each Trustee will serve until the later of such Fund’s Annual Meeting of Shareholders in 2027 or until his or her successor has been duly elected and qualified. As in the past, only one class of Trustees is being submitted to shareholders of each Fund for election at the First Meeting. Each Fund’s Amended and Restated Agreement and Declaration of Trust (each, a “Declaration of Trust”) provides that the Board shall be divided into three classes. For each Fund, only one class of Trustees is elected at each annual meeting, so that the regular term of only one class of Trustees will expire annually and any particular Trustee stands for election only once in each three-year period. The foregoing is subject to the provisions of the 1940 Act, applicable Delaware state law, each Fund’s Declaration of Trust and each Fund’s Bylaws.

In the case of any vacancy on the Board, each Fund’s Declaration of Trust provides that the size of the Board shall be automatically reduced by the number of vacancies unless or until the Board by resolution expressly maintains or increases the size of the Board. In the case of a vacancy arising from a Board resolution to maintain or increase the size of the Board, the remaining Trustees may fill such vacancy or add additional Board members, as the case may be, by appointing a replacement meeting the Trustee qualifications outlined in each Funds’ Declaration of Trust to serve for the remainder of the term of the Board position previously vacated.

12

The following table indicates all current Trustees in each such class and the period for which each class currently serves:

|

Class I1 |

Class II2 |

Class III3 | ||

| Cynthia Hostetler |

Beth Ann Brown |

Carol Deckbar | ||

| Eli Jones |

Anthony J. LaCava, Jr. |

Elizabeth Krentzman | ||

| Prema Mathai-Davis |

Joel W. Motley |

Robert C. Troccoli | ||

| Daniel S. Vandivort |

Teresa M. Ressel |

Douglas Sharp | ||

| James “Jim” Liddy |

Jeffrey Kupor |

| 1 | Serving until the 2025 Annual Meeting or until their successors have been duly elected and qualified. |

| 2 | Serving until the 2026 Annual Meeting or until their successors have been duly elected and qualified. |

| 3 | Currently up for election at the First Meeting. |

Information Regarding the Trustees

The business and affairs of the Funds are managed under the direction of the Board. This section of this Joint Proxy Statement provides you with information regarding each incumbent Trustee that is proposed to serve on the Board. Trustees of the Funds generally serve three-year terms or until their successors are duly elected and qualified. The tables below list the Trustees, their principal occupations, other directorships held by them during the past five years, and any affiliations with the Adviser or its affiliates. If all of the Trustees are elected at the First Meeting, the Board will be composed of 14 Trustees, including 12 Trustees who are not “interested persons” of the Funds, as that term is defined in the 1940 Act (collectively, the “Independent Trustees” and each an “Independent Trustee”).

As used in this Joint Proxy Statement, the term “Invesco Fund Complex” includes each of the open-end and closed-end registered investment companies advised primarily by the Adviser as of the Record Date. As of the date of this Joint Proxy Statement, there were 164 funds in the Invesco Fund Complex.

The mailing address of each Trustee is 11 Greenway Plaza, Houston, Texas 77046-1173.

13

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Interested Trustee |

||||||||

| Jeffrey H. Kupor1 — 1968 Trustee |

† | Senior Managing Director and General Counsel, Invesco Ltd.; Trustee, Invesco Foundation, Inc.; Director, Invesco Advisers, Inc.; Executive Vice President, Invesco Asset Management (Bermuda), Ltd. Invesco Investments (Bermuda) Ltd.; and Vice President, Invesco Group Services, Inc.

Formerly: Head of Legal of the Americas, Invesco Ltd.; Senior Vice President and Secretary, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Secretary, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.); Vice President and Secretary, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.); Senior Vice President, Chief Legal Officer and Secretary, The Invesco Funds; Secretary and General Counsel, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Secretary and General Counsel, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.) and Chief Legal Officer, Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, |

164 | None | ||||

14

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust; Secretary and Vice President, Harbourview Asset Management Corporation; Secretary and Vice President, Oppenheimer Funds, Inc. and Invesco Managed Accounts, LLC; Secretary and Senior Vice President, OFI Global Institutional, Inc.; Secretary and Vice President, OFI SteelPath, Inc.; Secretary and Vice President, Oppenheimer Acquisition Corp.; Secretary and Vice President, Shareholder Services, Inc.; Secretary and Vice President, Trinity Investment Management Corporation, Senior Vice President, Invesco Distributors, Inc.; Secretary and Vice President, Jemstep, Inc.; Head of Legal, Worldwide Institutional, Invesco Ltd.; Secretary and General Counsel, INVESCO Private Capital Investments, Inc.; Senior Vice President, Secretary and General Counsel, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.); Assistant Secretary, INVESCO Asset Management (Bermuda) |

15

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Ltd.; Secretary and General Counsel, Invesco Private Capital, Inc.; Assistant Secretary and General Counsel, INVESCO Realty, Inc.; Secretary and General Counsel, Invesco Senior Secured Management, Inc.; Secretary, Sovereign G./P. Holdings Inc.; Secretary, Invesco Indexing LLC; and Secretary, W.L. Ross & Co., LLC | ||||||||

| Douglas Sharp1 — 1974 Trustee |

† | Senior Managing Director and Head of Americas & EMEA, Invesco Ltd.

Formerly: Director and Chairman Invesco UK Limited; and Director, Chairman and Chief Executive, Invesco Fund Managers Limited. |

164 | None | ||||

| Independent Trustees |

||||||||

| Beth Ann Brown — 1968 Trustee (2019) and Chair (2022) |

† | Independent Consultant

Formerly: Head of Intermediary Distribution, Managing Director, Strategic Relations, Managing Director, Head of National Accounts, Senior Vice President, National Account Manager and Senior Vice President, Key Account Manager, Columbia Management Investment Advisers LLC; and Vice President, Key Account Manager, Liberty Funds Distributor, Inc. |

164 | Director, Board of Directors of Caron Engineering Inc.; Formerly: Advisor, Board of Advisors of Caron Engineering Inc.; President and Director, Acton Shapleigh Youth Conservation Corps (non-profit); President and Director of Grahamtastic Connection (non-profit); and Trustee of certain Oppenheimer Funds | ||||

16

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Carol Deckbar – 1962 Trustee |

† | Formerly: Executive Vice President and Chief Product Officer, TIAA Financial Services; Executive Vice President and Principal, College Retirement Equities Fund at TIAA; Executive Vice President and Head of Institutional Investments and Endowment Services, TIAA | 164 | Formerly: Board Member, TIAA Asset Management, Inc.; and Board Member, TH Real Estate Group Holdings Company | ||||

| Cynthia Hostetler — 1962 Trustee |

† | Non-Executive Director and Trustee of a number of public and private business corporations

Formerly: Director, Aberdeen Investment Funds (4 portfolios); Director, Artio Global Investment LLC (mutual fund complex); Director, Edgen Group, Inc. (specialized energy and infrastructure products distributor); Director, Genesee & Wyoming, Inc. (railroads); Head of Investment Funds and Private Equity, Overseas Private Investment Corporation; President, First Manhattan Bancorporation, Inc.; and Attorney, Simpson Thacher & Bartlett LLP |

164 | Resideo Technologies (smart home technology); Vulcan Materials Company (construction materials company); Trilinc Global Impact Fund; Investment Company Institute (professional organization); and Independent Directors Council (professional organization) | ||||

| Eli Jones — 1961 Trustee |

† | Professor and Dean Emeritus, Mays Business School at Texas A&M University

Formerly: Dean of Mays Business School at Texas A&M University; Professor and Dean, Walton College of Business, University of Arkansas and E.J. Ourso College of Business, Louisiana State University; and Director, Arvest Bank |

164 | Insperity, Inc. (formerly known as Administaff) (human resources provider); Board Member of the regional board, First Financial Bank Texas; and Board Member, First Financial Bankshares, Inc. Texas | ||||

17

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Elizabeth Krentzman — 1959 Trustee |

† | Formerly: Principal and Chief Regulatory Advisor for Asset Management Services and U.S. Mutual Fund Leader of Deloitte & Touche LLP; General Counsel of the Investment Company Institute (trade association); National Director of the Investment Management Regulatory Consulting Practice, Principal, Director and Senior Manager of Deloitte & Touche LLP; Assistant Director of the Division of Investment Management – Office of Disclosure and Investment Adviser Regulation of the U.S. Securities and Exchange Commission and various positions with the Division of Investment Management – Office of Regulatory Policy of the U.S. Securities and Exchange Commission; and Associate at Ropes & Gray LLP | 164 | Formerly: Member of the Cartica Funds Board of Directors (private investment funds); Trustee of the University of Florida National Board Foundation; Member of the University of Florida Law Center Association, Inc. Board of Trustees, Audit Committee, and Membership Committee; and Trustee of certain Oppenheimer Funds | ||||

| Anthony J. LaCava, Jr. — 1956 Trustee |

† | Formerly: Director and Member of the Audit Committee, Blue Hills Bank (publicly traded financial institution) and Managing Partner, KPMG LLP | 164 | Member and Chairman of the Bentley University, Business School Advisory Council Formerly: Board Member and Chair of the Audit and Finance Committee and Nominating Committee, KPMG LLP | ||||

18

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| James “Jim” Liddy – 1959 Trustee |

† | Formerly: Chairman, Global Financial Services, Americas and Retired Partner, KPMG LLP | 164 | Director and Treasurer, Gulfside Place Condominium Association, Inc. and Non-Executive Director, Kellenberg Memorial High School | ||||

| Prema Mathai-Davis — 1950 Trustee |

† | Formerly: Co-Founder & Partner of Quantalytics Research, LLC, (a FinTech Investment Research Platform for the Self-Directed Investor); Trustee of YWCA Retirement Fund; CEO of YWCA of the USA; Board member of the NY Metropolitan Transportation Authority; Commissioner of the NYC Department of Aging; and Board member of Johns Hopkins Bioethics Institute | 164 | Member of Board of Positive Planet US (non-profit) and HealthCare Chaplaincy Network (non-profit) | ||||

| Joel W. Motley — 1952 Trustee |

† | Director of Office of Finance, Federal Home Loan Bank System; Managing Director of Carmona Motley Inc. (privately held financial advisor); Member of the Council on Foreign Relations and its Finance and Budget Committee; Chairman Emeritus of Board of Human Rights Watch and Member of its Investment Committee; Member of Investment Committee and Board of Historic Hudson Valley (non-profit cultural organization); and Member of the Vestry and the Investment Committee of Trinity Church Wall Street. | 164 | Member of Board of Blue Ocean Acquisition Corp; Member of Board of Trust for Mutual Understanding (non-profit promoting the arts and environment); Member of Board of Greenwall Foundation (bioethics research foundation) and its Investment Committee; Member of Board | ||||

19

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Formerly: Managing Director of Public Capital Advisors, LLC (privately held financial advisor); Managing Director of Carmona Motley Hoffman, Inc. (privately held financial advisor); and Director of Columbia Equity Financial Corp. (privately held financial advisor). | of Friends of the LRC (non-profit legal advocacy); Board Member and Investment Committee Member of Pulitzer Center for Crisis Reporting (non-profit journalism); and Trustee of certain Oppenheimer Funds | |||||||

| Teresa M. Ressel — 1962 Trustee |

† | Non-executive director and trustee of a number of public and private business corporations

Formerly: Chief Executive Officer, UBS Securities LLC (investment banking); Group Chief Operating Officer, UBS AG Americas (investment banking); Sr. Management Team Olayan America, The Olayan Group (international investor/commercial/industrial); and Assistant Secretary for Management & Budget and Designated Chief Financial Officer, U.S. Department of Treasury |

164 | None | ||||

| Robert C. Troccoli — 1949 Trustee |

† | Formerly: Adjunct Professor, University of Denver – Daniels College of Business; and Managing Partner, KPMG LLP | 164 | None | ||||

| Daniel S. Vandivort — 1954 Trustee |

† | President, Flyway Advisory Services LLC (consulting and property management) and Member, Investment Committee of Historic Charleston Foundation. | 164 | Formerly: Trustee and Governance Chair, Oppenheimer Funds; Treasurer, Chairman of the | ||||

20

| Name, Year of Birth and Position(s) Held with the Funds |

Trustee Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Invesco Fund Complex Overseen by Trustee |

Other Held by During At Least 5 Years | ||||

| Formerly: President and Chief Investment Officer, previously Head of Fixed Income, Weiss Peck and Greer/Robeco Investment Management; Trustee and Chair, Weiss Peck and Greer Funds Board; and various capacities at CS First Boston including Head of Fixed Income at First Boston Asset Management. | Audit and Finance Committee, Huntington Disease Foundation of America. |

| (1) | Mr. Kupor and Mr. Sharp are considered interested persons (within the meaning of Section 2(a)(19) of the 1940 Act) of the Funds because they are officers of the Adviser to the Funds, and officers of Invesco Ltd., ultimate parent of the Adviser. |

| † | Each Trustee generally serves a three-year term from the date of election. Each Trustee currently serving on the Board has served as a Trustee of each respective Fund since the year shown below: |

| Kupor | Sharp | Brown | Deckbar | Hostetler | Jones | Krentzman | LaCava, Jr. | |||||||||||||||||||||||||

| VKI |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VBF |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VCV |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| IHTA |

2024 | 2024 | 2019 | 2024 | 2017 | 2017 | 2019 | 2019 | ||||||||||||||||||||||||

| VLT |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| OIA |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VMO |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VKQ |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VPV |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| IQI |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VVR |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VGM |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| VTN |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

| IIM |

2024 | 2024 | 2019 | 2024 | 2017 | 2016 | 2019 | 2019 | ||||||||||||||||||||||||

21

| Liddy | Mathai- Davis |

Motley | Ressel | Troccoli | Vandivort | |||||||||||||||||||

| VKI |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VBF |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VCV |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| IHTA |

2024 | 2017 | 2019 | 2017 | 2017 | 2019 | ||||||||||||||||||

| VLT |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| OIA |

2024 | 2010 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VMO |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VKQ |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VPV |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| IQI |

2024 | 2010 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VVR |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VGM |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| VTN |

2024 | 2014 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

| IIM |

2024 | 2010 | 2019 | 2017 | 2016 | 2019 | ||||||||||||||||||

Board Meetings

In addition to regularly scheduled meetings each year, the Board holds special meetings and/or conference calls to discuss specific matters that may require action prior to the next regular meeting. The Board met eight times during the fiscal year ended February 29, 2024 (nine times for VVR) and each independent Trustee attended at least 75% of the aggregate of: (i) all regular meetings of the Board during which time such independent Trustee served and (ii) all meetings of the committees of the Board on which the Trustee served. Trustees are encouraged to attend regular shareholder meetings, but the Board has no set policy requiring Board member attendance at such meetings.

Board Leadership Structure

The Board has appointed an Independent Trustee to serve in the role of Chair. The Chair’s primary role is to preside at meetings of the Board and act as a liaison with the Adviser and other service providers, officers, attorneys and other Trustees between meetings. The Chair also participates in the preparation of the agenda for the meetings of the Board, is active with mutual fund industry organizations, and may perform such other functions as may be requested by the Board from time to time. Except for any duties specified pursuant to each Fund’s Declaration of Trust or Bylaws, the appointment, designation or identification of a Trustee as the Chair of the Board, a member or chair of a committee of the Trustees, an expert on any topic or in any area (including an audit committee financial expert), or the lead Independent Trustee, shall not impose on that person any standard of care or liability that is greater than that imposed on that person as a Trustee in the absence of that appointment, designation or identification, and no Trustee who has special skills or expertise, or is appointed, designated or identified as aforesaid, shall be held to a higher standard of care by virtue thereof.

The Board believes that its leadership structure, including having an Independent Trustee as Chair, allows for effective communication between the Trustees and management, among the Trustees and among the Independent Trustees. The existing Board structure, including its committee structure as discussed below, provides the Independent Trustees with effective control over Board governance while also allowing them to receive and benefit

22

from insight from the interested Trustee who is an active officer of the Funds’ investment adviser. The Board’s leadership structure promotes dialogue and debate, which the Board believes allows for the proper consideration of matters deemed important to the Funds and their shareholders and results in effective decision-making.

Board Qualifications and Experience

Interested Trustees.

Jeffrey H. Kupor, Trustee

Jeffrey Kupor has been a member of the Board of Trustees of the Invesco Funds since 2024. Mr. Kupor is Senior Managing Director and General Counsel at Invesco Ltd.

Mr. Kupor joined Invesco Ltd. in 2002 and has held a number of legal roles, including, most recently, Head of Legal, Americas, in which role he was responsible for legal support for Invesco’s Americas business. Prior to joining the firm, he practiced law at Fulbright & Jaworski LLP (now known as Norton Rose Fulbright), specializing in complex commercial and securities litigation. He also served as the general counsel of a publicly traded communication services company.

Mr. Kupor earned a BS degree in economics from the Wharton School at the University of Pennsylvania and a JD from the Boalt Hall School of Law (now known as Berkeley Law) at the University of California at Berkeley.

The Board believes that Mr. Kupor’s current and past positions with the Invesco complex along with his legal background and experience as an executive in the investment management area benefits the Funds.

Douglas Sharp, Trustee

Douglas Sharp has been a member of the Board of Trustees of the Invesco Funds since 2024. Mr. Sharp is Senior Managing Director, Head of Americas & EMEA (Europe, the Middle East, and Africa) at Invesco Ltd. He also served as Director and Chairman of the Board of Invesco UK Limited (Invesco’s European subsidiary board) and as Director, Chairman and Chief Executive of Invesco Fund Managers Limited.

Mr. Sharp joined Invesco Ltd. in 2008 and has served in multiple leadership roles across the company, including his previous role as Head of EMEA. Prior to that, he ran Invesco Ltd.’s EMEA retail business and served as head of strategy and business planning and as chief administrative officer for Invesco Ltd.’s US institutional business. Before joining the firm, he was with the strategy consulting firm McKinsey & Co., where he served clients in the financial services, energy, and logistics sectors.

The Board believes that Mr. Sharp’s current and past positions within the Invesco complex along with his experience in the investment management business benefits the Funds.

23

Independent Trustees

Beth Ann Brown, Trustee and Chair

Beth Ann Brown has been a member of the Board of Trustees of the Invesco Funds since 2019 and Chair since 2022. From 2016 to 2019, Ms. Brown served on the boards of certain investment companies in the Oppenheimer Funds complex.

Ms. Brown has served as Director of Caron Engineering, Inc. since 2018 and as an Independent Consultant since 2012.

Previously, Ms. Brown served in various capacities at Columbia Management Investment Advisers LLC, including Head of Intermediary Distribution, Managing Director, Strategic Relations and Managing Director, Head of National Accounts. She also served as Senior Vice President, National Account Manager from 2002-2004 and Senior Vice President, Key Account Manager from 1999 to 2002 of Liberty Funds Distributor, Inc. From 2013 through 2022, she served as Director, Vice President (through 2019) and President (2019-2022) of Grahamtastic Connection, a non-profit organization.

From 2014 to 2017, Ms. Brown served on the Board of Advisors of Caron Engineering Inc. and also served as President and Director of Acton Shapleigh Youth Conservation Corps, a non–profit organization, from 2012 to 2015.

The Board believes that Ms. Brown’s experience in financial services and investment management and as a director of other investment companies benefits the Funds.

Carol Deckbar, Trustee

Carol Deckbar has been a member of the Board of Trustees of the Invesco Funds since 2024. Ms. Deckbar previously served as Executive Vice President and Chief Product Officer at Teachers Insurance and Annuity Association (TIAA) Financial Services from 2019 to 2021. She also served as Executive Vice President and Principal of College Retirement Equities Fund at TIAA from 2014 to 2021. Ms. Deckbar served in various other capacities at TIAA since joining in 2007, including Executive Vice President and Head of Institutional Investments and Endowment Services from 2016 to 2019.

Prior to joining TIAA, Ms. Deckbar was a Senior Vice President of AMSOUTH Bank from 2002 to 2006, and before that she served as Senior Vice President, Managing Director, for Bank of America Capital Management from 1999 to 2002. She began her asset management career with the Evergreen Funds where she served as Senior Vice President, Managing Director from 1991 to 1998.

From 2019 to 2020, Ms. Deckbar served as Chairman of the TIAA Retirement Plan Investments Committee and as an Executive Sponsor at Advance, a council for the advancement of women. She has also held various memberships, including at Investment Company Institute, from 2017 to 2019, Fortune 400 Most Powerful Women Network, from 2012 to 2015, and Mutual Fund Education Alliance, from 2010 to 2015.

24

The Board believes that Ms. Deckbar’s experience in financial services and investment management benefits the Funds.

Cynthia Hostetler, Trustee

Cynthia Hostetler has been a member of the Board of Trustees of the Invesco Funds since 2017.

Ms. Hostetler is currently a member of the board of directors of the Vulcan Materials Company, a public company engaged in the production and distribution of construction materials, Trilinc Global Impact Fund LLC, a publicly registered non-traded limited liability company that invests in a diversified portfolio of private debt instruments, and Resideo Technologies, Inc., a public company that manufactures and distributes smart home security products and solutions worldwide. Ms. Hostetler also serves on the board of governors of the Investment Company Institute and is a member of the governing council of the Independent Directors Council, both of which are professional organizations in the investment management industry.