Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

INTEL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ |

No fee required. | |

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title of each class of securities to which transaction applies:

| |

| (2) |

Aggregate number of securities to which transaction applies:

| |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) |

Proposed maximum aggregate value of transaction:

| |

| (5) |

Total fee paid:

| |

| ¨ |

Fee paid previously with preliminary materials:

| |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) |

Amount Previously Paid:

| |

| (2) |

Form, Schedule or Registration Statement No.:

| |

| (3) |

Filing Party:

| |

| (4) |

Date Filed:

| |

Table of Contents

Table of Contents

April 3, 2014

Dear Stockholder:

We look forward to your attendance virtually via the Internet, in person, or by proxy at our 2014 Annual Stockholders’ Meeting. We will hold the meeting at 8:30 a.m. Pacific Time on Thursday, May 22, 2014. If you attend the annual meeting via the Internet at www.intc.com, you will be able to vote and submit questions during the meeting by using the control number we have provided to you (either with the notice regarding the availability of these proxy materials or with a copy of these proxy materials). You may also attend the meeting in person at Intel Corporation, Building SC-12, 3600 Juliette Lane, Santa Clara, California 95054. If you plan to attend in person, please bring proof of Intel stock ownership and government-issued photo identification, as these will be required for admission.

We also are pleased to furnish proxy materials to stockholders primarily over the Internet. On April 3, 2014, we mailed our stockholders a Notice of Internet Availability containing instructions on how to access our 2014 Proxy Statement and 2013 Annual Report and to vote online. Internet distribution of our proxy materials expedites receipt by stockholders, lowers the cost of the annual meeting, and conserves natural resources. However, if you would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice of Internet Availability. If you received your annual meeting materials by mail, the notice of the annual meeting, proxy statement, and proxy card from our Board of Directors were enclosed. If you received your annual meeting materials via e-mail, the e-mail contained voting instructions and links to the online proxy statement and annual report, both of which are available at www.intc.com/annuals.cfm.

Please refer to the proxy statement for detailed information on each of the proposals and the annual meeting. Your vote is important, and we strongly urge all stockholders to vote their shares. For most items, including the election of directors, your shares will not be voted unless you provide voting instructions via the Internet, by telephone, or by returning a proxy card or voting instruction card. We encourage you to vote promptly, even if you plan to attend the annual meeting.

Sincerely yours,

Andy D. Bryant

Chairman of the Board

INTEL CORPORATION

2200 Mission College Blvd.

Santa Clara, CA 95054-1549

(408) 765-8080

Table of Contents

|

INTEL CORPORATION NOTICE OF 2014 ANNUAL STOCKHOLDERS’ MEETING |

| MEETING INFORMATION

|

HOW TO VOTE

n Please act as soon as possible to vote your shares, even if you plan to attend the annual meeting via the Internet or in person.

n Your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented at the meeting unless you have given your broker specific instructions to do so. We strongly encourage you to vote.

n You may vote via the Internet, by telephone, or, if you have received a printed version of these proxy materials, by mail.

n See “Additional Meeting Information” on page 72 of this proxy statement for more information. | |||||||

| Time and Date | 8:30 a.m. Pacific Time Thursday, May 22, 2014

|

|||||||

| Attend via Internet | Attend the annual meeting online, including to vote and/or submit questions, at www.intc.com

|

|||||||

| Attend in Person | Intel Corporation, Building

|

|||||||

| Record Date | March 24, 2014

|

|||||||

| ANNUAL MEETING AGENDA AND VOTING | ||||||||

| Proposal | Voting Recommendation of the Board | |||||||

| 1. | Election of the 10 directors named in this proxy statement

|

FOR EACH DIRECTOR NOMINEE | ||||||

| 2. | Ratification of selection of Ernst & Young LLP as our independent registered | FOR | ||||||

| public accounting firm for 2014

|

||||||||

| 3. | Advisory vote to approve executive compensation

|

FOR | ||||||

| ATTENDING THE ANNUAL MEETING | ||

| Attending and participating via the Internet

n www.intc.com; we encourage you to access the meeting online prior to its start time.

n Webcast starts at 8:30 a.m. Pacific Time.

n Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.intc.com.

n Stockholders may vote and submit questions while attending the meeting on the Internet.

n Webcast replay will be available until December 27, 2014.

|

Attending in person

n Doors open at 8:00 a.m. Pacific Time.

n Meeting starts at 8:30 a.m. Pacific Time.

n Proof of Intel Corporation stock ownership and government-issued photo identification will be required to attend the annual meeting.

n You do not need to attend the annual meeting to vote if you submitted your proxy in advance of the annual meeting.

n Security measures may include bag search, metal detector, and hand-wand search. The use of cameras is not allowed.

| |

Anyone can view the annual meeting live via the Internet at www.intc.com

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held

May 22, 2014:

The Notice of 2014 Annual Stockholders’ Meeting and Proxy Statement, and the 2013 Annual Report

and Form 10-K, are available at www.intc.com/annuals.cfm

Table of Contents

|

|

|

|

Table of Contents

2014 PROXY STATEMENT HIGHLIGHTS

This summary highlights information contained elsewhere in our proxy statement and does not contain all of the information that you should consider. We encourage you to read the entire proxy statement carefully before voting.

Board Nominees

| COMMITTEE MEMBERSHIPS | ||||||||||||||

| Name | Occupation | Independent | AC | CC | GNC | EC | FC | |||||||

| Charlene Barshefsky | Senior International Partner, | ¢ | ¢

C | |||||||||||

| Age: 63, Director Since: 2004 | WilmerHale | |||||||||||||

| Andy D. Bryant | Chairman of the Board of | ¢ | ||||||||||||

| Age: 63, Director Since: 2011 | Directors, Intel Corporation | |||||||||||||

| Susan L. Decker | Principal, Deck3 Ventures, LLC | ¢ LD |

¢ | ¢ Co |

¢ C |

|||||||||

| Age: 51, Director Since: 2006 | ||||||||||||||

| John J. Donahoe | President and CEO, | ¢ | ¢ | ¢ | ||||||||||

| Age: 53, Director Since: 2009 | eBay Inc. | |||||||||||||

| Reed E. Hundt | Principal, REH Advisors, LLC | ¢ | ¢ | ¢ | ¢ | |||||||||

| Age: 66, Director Since: 2001 | ||||||||||||||

| Brian M. Krzanich | CEO, Intel Corporation | ¢ | ¢ | |||||||||||

| Age: 53, Director Since: 2013 | ||||||||||||||

| James D. Plummer | Professor, Stanford University | ¢ | ¢ | ¢ | ||||||||||

| Age: 69, Director Since: 2005 | ||||||||||||||

| David S. Pottruck | Chairman and CEO, | ¢ | ¢ C |

¢ | ||||||||||

| Age: 65, Director Since: 1998 | Red Eagle Ventures, Inc. | |||||||||||||

| Frank D. Yeary | Executive Chairman, | ¢ | ¢ C |

¢ | ||||||||||

| Age: 50, Director Since: 2009 | CamberView Partners, LLC | |||||||||||||

| David B. Yoffie | Professor, | ¢ | ¢ | ¢ Co |

||||||||||

| Age: 59, Director Since: 1989 | Harvard Business School | |||||||||||||

| LD |

Independent Lead Director | AC |

Audit Committee | EC |

Executive Committee | |||||

| C |

Committee Chair | CC |

Compensation Committee | FC |

Finance Committee | |||||

| Co |

Committee Co-Chair | GNC |

Corporate Governance | |||||||

| and Nominating Committee |

LEADERSHIP TRANSITION

In 2012 and the first half of 2013, our Board of Directors devoted significant time and energy to implementing a successful senior management transition: Brian M. Krzanich was appointed Intel’s Chief Executive Officer (CEO), Renée J. James was appointed President, Stacy J. Smith as Chief Financial Officer (CFO) was made responsible for our acquisitions and equity investment organization, Paul S. Otellini retired as CEO and from the Board of Directors, and David Perlmutter (Executive Vice President and Chief Product Officer) announced his coming retirement from the company. The Compensation Committee made a deliberate decision to award Mr. Krzanich a compensation package valued at approximately the 25th percentile relative to CEOs in our peer group, and significantly below the former CEO’s annualized compensation. This package reflected the fact that Mr. Krzanich was new to his role and was an internal candidate, and, in the committee’s view, gives him an incentive to drive value in the future. Overall, total 2013 compensation for our listed officers was down year-over-year, as we followed through on our commitment to make the 2012 special retention awards a one-time action.

|

|

|

|

5 |

Table of Contents

2014 PROXY STATEMENT HIGHLIGHTS

EXECUTIVE COMPENSATION AND INVESTOR OUTREACH

Intel’s Stockholder Outreach Process

Intel’s relationship with its stockholders is a critical part of our company’s success and we have a long tradition of transparency and responsiveness to stockholder perspectives. In connection with our 2013 Annual Stockholders’ Meeting, we heard concerns from some stockholders regarding certain aspects of our 2012 executive compensation program, primarily the design of compensation arrangements tied to our succession planning efforts. Accordingly, both before and after our 2013 Annual Stockholders’ Meeting, our directors and management contacted stockholders owning a significant percentage of our stock to discuss our executive compensation programs and the special equity awards granted to our executive officers in 2012 in connection with our succession planning efforts. In addition, following our 2013 Annual Stockholders’ Meeting, our Board of Directors and Compensation Committee conducted an in-depth analysis of our compensation program.

Changes to Our Executive Compensation Program

As a result of these discussions and the Compensation Committee’s review, in this proxy statement we have enhanced our disclosure of factors considered by the Compensation Committee in awarding elements of compensation. In addition, the Compensation Committee, with the support of our Board of Directors, has approved the following changes to our executive compensation program, effective for 2014:

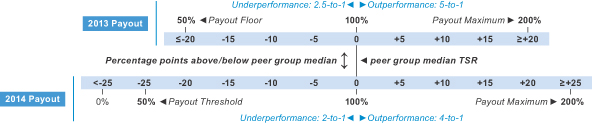

| n | We have revised our annual incentive cash plan for our executive officers so that it is based 50% on financial performance and 50% on operational performance. We have revised the financial component so that it is based on year-over-year absolute net income growth and net income growth relative to only a group of technology peer companies, and have narrowed the number of operational performance criteria. Through these changes, we have enhanced transparency and tied any payouts more directly to current-year performance. |

| n | We have revised the vesting formula applicable to our variable performance-based “outperformance” restricted stock units, so that no shares will vest or be issuable unless a threshold performance standard is achieved. This eliminates the former minimum payout of 50%. We also revised the payout formula so that it is less leveraged for above-average performance. |

| n | Because our OSUs are designed to incorporate the upside potential for superior stock price performance comparable to that of stock options while taking into account relative, not absolute, stock price performance, we have revised the mix of equity awards granted to our executive officers by eliminating the use of stock options and granting approximately 60% of the target value of annual equity awards in the form of OSUs and approximately 40% of the target value of annual equity awards in the form of restricted stock units (RSUs). |

In addition, recognizing that we are in a transition period with respect to our executive compensation programs, we are continuing our engagement efforts with stockholders in order to better understand their priorities and perspectives. Over the last several months of 2013, we pursued multiple avenues for stockholder engagement, including in-person meetings with stockholders representing approximately 15% of Intel’s outstanding voting shares, and teleconference meetings with stockholders representing another 8% of outstanding voting shares. We also sent a letter to the holders of over 50% of our shares summarizing the changes and updates being made to our compensation programs, and made this letter available to all our stockholders and other interested individuals by posting it on www.intc.com and submitting it to the SEC on Form 8-K. Intel participants in our stockholder engagement activities included our Corporate Secretary, Director of Executive Compensation, and Director of Investor Relations. During the meetings with stockholders, we also discussed governance topics and the results of our management succession process.

| 6 |

|

2014 PROXY STATEMENT |

|

Table of Contents

2014 PROXY STATEMENT HIGHLIGHTS

EXECUTIVE COMPENSATION HIGHLIGHTS FOR 2013

Intel has a long-standing commitment to pay-for-performance. We implement this commitment by providing a majority of compensation through arrangements that are designed to hold our executive officers accountable for business results and reward them for consistently strong corporate performance and creation of value for our stockholders. Our executive compensation program is periodically adjusted over time to ensure that it supports Intel’s business goals and promotes both current-year and long-term profitable growth of the company. Consistent with this, the majority of executive compensation is delivered through programs that link pay realized by executives with financial and operational results, and with total stockholder return (TSR).

| n | The majority of cash compensation is paid under our annual incentive cash plan with the annual payouts based on measures of relative financial performance, absolute financial performance, company performance relative to operational goals, and individual performance. |

| n | Equity awards (consisting in 2013 of variable performance-based OSUs, RSUs, and stock options) align compensation with the long-term interests of Intel’s stockholders by focusing our executive officers on both absolute and relative total stockholder return (TSR). Equity awards generally become fully vested between three and four years after the grant date, so that compensation realized under them reflects the long-term performance of Intel stock. |

| n | In setting executive officer compensation, the Compensation Committee evaluates individual performance reviews of our executive officers and compensation levels in a peer group, which for 2013 consisted of 13 technology companies and 10 other large companies. |

| n | Total compensation for each executive officer varies with both individual performance and Intel’s performance in achieving financial and non-financial objectives. Each executive officer’s compensation is designed to reward his or her contribution to Intel’s results. |

As noted above, our executive compensation program for 2013 represents a transitional year, both because of changes in our executive leadership and because of the changes being implemented in 2014. The following table shows the 2013 total direct compensation granted by the Compensation Committee to our Chief Executive Officer, Chief Financial Officer, and three additional executive officers serving at the end of 2013.

| Name and Principal Position |

Salary ($) |

Non-Equity Incentive Plan Compensation ($) |

Stock Awards ($) |

Option Awards ($) |

Total Direct Compensation ($) |

|||||||||||||||

| Brian M. Krzanich | 887,500 | 1,866,600 | 5,273,300 | 1,310,500 | 9,337,900 | |||||||||||||||

| CEO | ||||||||||||||||||||

| Renée J. James | 775,000 | 1,492,400 | 4,511,800 | 1,107,700 | 7,886,900 | |||||||||||||||

| President | ||||||||||||||||||||

| Andy Bryant | 760,000 | 1,222,400 | 3,451,000 | 894,500 | 6,327,900 | |||||||||||||||

| Chairman of the Board | ||||||||||||||||||||

| Stacy J. Smith | 650,000 | 1,093,100 | 3,711,000 | 894,500 | 6,348,600 | |||||||||||||||

| Executive Vice President and Chief Financial Officer |

||||||||||||||||||||

| Thomas M. Kilroy | 625,000 | 1,091,400 | 3,005,900 | 745,400 | 5,467,700 | |||||||||||||||

| Executive Vice President, General Manager, Sales and Marketing Group |

||||||||||||||||||||

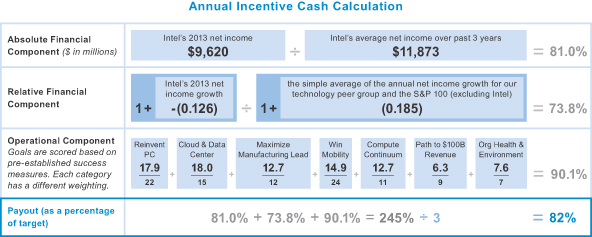

For 2013, our net income and operational performance resulted in an annual incentive cash payout at 82% of the annual incentive cash target amount under the annual incentive cash plan.

|

|

|

|

7 |

Table of Contents

2014 PROXY STATEMENT HIGHLIGHTS

CORPORATE GOVERNANCE AT INTEL

Intel understands that corporate governance practices change and evolve over time, and we seek to adopt and use practices that we believe will be of value to our stockholders and will positively aid in the governance of the company. Some of our governance practices include the following:

| n | Intel adopted “majority voting” in the election of directors in 2006. |

| n | Intel voluntarily implemented “say on pay” in 2009. |

| n | We have an active and empowered independent Lead Director. |

| n | Our directors are limited to service on four public company boards (three boards if also serving as a CEO). |

| n | Executives are subject to our long-standing policy prohibiting hedging Intel stock. |

| n | Compensation claw-back provisions apply to both our annual incentive cash plan and our equity incentive plan. |

| n | We have rigorous stock ownership guidelines for officers and non-management directors. |

| 8 |

|

2014 PROXY STATEMENT |

|

Table of Contents

PROPOSAL 1 n Election of Directors

INTEL CORPORATION

2200 Mission College Blvd.

Santa Clara, CA 95054-1549

Our Board of Directors solicits your proxy for the 2014 Annual Stockholders’ Meeting (and any postponement or adjournment of the meeting) for the matters set forth in “Annual Meeting Agenda and Voting.” We made this proxy statement available to stockholders beginning on April 3, 2014.

|

|

Election of Directors

Upon the recommendation of our Corporate Governance and Nominating Committee, our Board has nominated the 10 individuals listed below to serve as directors. Our nominees include eight independent directors, as defined in the rules for companies traded on The NASDAQ Global Select Market* (NASDAQ), and two Intel officers: Brian M. Krzanich, who became our CEO in May 2013, and Andy D. Bryant, who currently serves | |||

| as Chairman of the Board and previously served as our Executive Vice President and Chief Administrative Officer. Mr. Bryant became Chairman of the Board at the 2012 Annual Stockholders’ Meeting.

Each director’s term runs from the date of his or her election until our next annual stockholders’ meeting, or until his or her successor (if any) is elected or appointed. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the individuals named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. Alternatively, the Board may reduce the size of the Board, or the proxies may vote just for the remaining nominees, leaving a vacancy that the Board may fill at a later date. However, we have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Our Bylaws require that a director nominee will be elected only if he or she receives a majority of the votes cast with respect to his or her election in an uncontested election (that is, the number of shares voted “for” that nominee exceeds the number of votes cast “against” that nominee). Each of our director nominees currently serves on the Board. If a nominee who currently serves as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” Under our Bylaws and Corporate Governance Guidelines, each director submits an advance, contingent, irrevocable resignation that the Board may accept if stockholders do not re-elect that director. In that situation, our Corporate Governance and Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. Within 90 days from the date that the election results were certified, the Board would act on the Corporate Governance and Nominating Committee’s recommendation and publicly disclose its decision and the rationale behind it. | ||||

|

|

|

|

9 |

Table of Contents

PROPOSAL 1 n Election of Directors

RECOMMENDATION OF THE BOARD

The Board recommends that you vote “FOR” the election of each of the following nominees.

|

Ambassador Charlene Barshefsky has been a Senior International Partner

at Wilmer Cutler Pickering Hale and Dorr LLP (WilmerHale), a multinational law firm in Washington, D.C., since 2001. Prior to joining the law firm, Ambassador Barshefsky served as the United States Trade Representative, chief trade negotiator, and

principal trade | |||

| policy maker for the United States and a member of the President’s Cabinet from 1997 to 2001. Ambassador Barshefsky is also a director of American Express Company, Estée Lauder Companies, and Starwood Hotels & Resorts Worldwide.

Ambassador Barshefsky brings to the Board international experience acquired prior to, during, and after her tenure as a United States Trade Representative. As the chief trade negotiator for the United States, Ambassador Barshefsky headed an executive branch agency that operated worldwide in matters affecting international trade and commerce. Ambassador Barshefsky’s position as Senior International Partner at a multinational law firm brings to the Board continuing experience in dealing with foreign governments, focusing on market access and the regulation of business and investment. Through her government and private experience, Ambassador Barshefsky provides substantial expertise in doing business in China, where Intel has significant operations. As a director for other multinational companies, Ambassador Barshefsky also provides cross-board experience. | ||||

|

|

Andy D. Bryant has been Chairman of the Board of Directors of Intel

since May 2012. Mr. Bryant served as Vice Chairman of the Board of Directors of Intel from July 2011 to May 2012. Mr. Bryant joined Intel in 1981 as Controller for the Commercial Memory Systems Operation and in 1983 became Systems Group

Controller. In 1987, | |||

| he was promoted to Director of Finance, and in 1990 was appointed Vice President and Director of Finance of the Intel Products Group. Mr. Bryant became Chief Financial Officer (CFO) in February 1994, and was promoted to Senior Vice President in January 1999. In December 1999, he was promoted to Executive Vice President and his role expanded to Chief Financial and Enterprise Services Officer. In October 2007, Mr. Bryant was named Chief Administrative Officer (CAO), a position he held until January 2012. In 2009, Mr. Bryant’s responsibilities expanded to include the Technology and Manufacturing Group. Mr. Bryant serves on the board of directors of Columbia Sportswear and McKesson Corporation.

Mr. Bryant brings senior leadership, financial, strategic, and global expertise to the Board from his former service as CFO and CAO of Intel. Mr. Bryant has budgeting, accounting controls, and forecasting experience and expertise from his work in Intel Finance, as CFO and as CAO. Mr. Bryant has been responsible for manufacturing, human resources, information technology, and finance. Mr. Bryant has regularly attended Intel Board meetings for more than 18 years in his capacity as CFO and CAO, and has direct experience as a board member through his service on other public company boards. | ||||

|

|

Susan L. Decker has been Lead Director of Intel since May 2012. She has

been a Principal of Deck3 Ventures LLC, a consulting and advisory firm in Menlo Park, California, since 2009. From 2009 to 2010, she was an Entrepreneur-in-Residence at Harvard Business School. Prior to that, Ms. Decker served as President of Yahoo!

Inc., a global Internet company in Sunnyvale, California, | |||

| 10 |

|

2014 PROXY STATEMENT |

|

Table of Contents

PROPOSAL 1 n Election of Directors

| from 2007 to 2009; as Executive Vice President of the Advertiser and Publisher Group of Yahoo! from 2006 to 2007; and as Executive Vice President of Finance and Administration and CFO of Yahoo! from 2000 to 2007. Prior to joining Yahoo!, Ms. Decker was with the investment banking firm Donaldson, Lufkin & Jenrette for 14 years, most recently as the Global Director of Equity Research. Ms. Decker is also a member of the Berkshire Hathaway Inc. and Costco Wholesale Corporation boards of directors.

Ms. Decker’s experience as president of a global Internet company provides expertise in corporate leadership, financial management, and Internet technology. In her role as a CFO, Ms. Decker was responsible for finance, human resources, legal, and investor relations, and played a significant role in developing business strategy. This experience supports the Board in overseeing and advising on strategy and financial matters. Ms. Decker also provides brand marketing experience from her role as senior executive of Yahoo!’s Advertiser and Publisher Group. In addition, Ms. Decker’s 14 years as a financial analyst, service on audit committees of other public companies, and past service on the Financial Accounting Standards Advisory Council from 2000 to 2004 qualify her to offer valuable perspectives on Intel’s corporate planning, budgeting, and financial reporting. As a director for other multinational companies, Ms. Decker also provides cross-board experience. | ||||

|

|

John J. Donahoe has been President, CEO, and director of eBay Inc., a

global online marketplace in San Jose, California, since 2008. Mr. Donahoe joined eBay in 2005 as President of eBay Marketplaces, and was responsible for eBay’s global e-commerce businesses. In this role, he focused on expanding

eBay’s core business, | |||

| which accounts for a large percentage of the company’s revenue. Prior to joining eBay, Mr. Donahoe was the Worldwide Managing Director from 2000 to 2005 for Bain & Company, a global management consulting firm based in Boston, Massachusetts, where he oversaw Bain’s 30 offices and 3,000 employees.

Mr. Donahoe brings senior leadership, strategic, and global expertise to the Board from his current position as CEO of a major Internet company and his prior work as a management consultant and leader of a global business consulting firm. In his role at eBay, Mr. Donahoe oversaw a number of strategic acquisitions, bringing business development and M&A experience to the Board. Mr. Donahoe also provides technical and brand marketing expertise from his role as a leader of global e-commerce businesses. | ||||

|

|

Reed E. Hundt has been a Principal of REH Advisors LLC, a strategic

advice firm in Washington, D.C., since 2009, and CEO of the Coalition for Green Capital, a non-profit organization based in Washington, D.C., that designs, develops, and implements green banks at the state, federal, and international level, since

2010. From 1998 to | |||

| 2009, Mr. Hundt was an independent advisor to McKinsey & Company, Inc., a worldwide management consulting firm in Washington, D.C., and Principal of Charles Ross Partners, LLC, a private investor and advisory service in Washington, D.C. Mr. Hundt served as Chairman of the U.S. Federal Communications Commission (FCC) from 1993 to 1997. From 1982 to 1993, Mr. Hundt was a partner with Latham & Watkins, an international law firm. Within the past five years, Mr. Hundt has served as a member of the boards of directors of Infinera Corporation and Data Domain, Inc.

As an advisor to and an investor in

telecommunications companies and other businesses on a worldwide basis, Mr. Hundt has significant global experience in communications technology and the communications business. Mr. Hundt also has significant government

experience from his service as Chairman of the FCC, where he helped negotiate the World Trade Organization Telecommunications Agreement, which opened markets in 69 countries to competition and reduced barriers to

international | ||||

|

|

|

|

11 |

Table of Contents

PROPOSAL 1 n Election of Directors

| investment. Mr. Hundt’s legal experience enables him to provide perspective and oversight on legal and compliance matters, and his board service with numerous other companies, including on their audit committees, provides cross-board experience and financial expertise. His work with a number of ventures involved in sustainable energy and the environment provides him with a unique perspective in overseeing Intel’s environmental and sustainability initiatives. | ||||

|

|

Brian M. Krzanich has been a director and CEO of Intel since May 2013.

Mr. Krzanich joined Intel in 1982. He became a corporate vice president in May 2006, serving until 2010 as Vice President and General Manager of Assembly and Test, where he was responsible for the implementation of the 0.13-micron

manufacturing | |||

| technology across Intel’s global factory network. He was Senior Vice President and General Manager of Manufacturing and Supply Chain from 2010 to 2012. He was appointed Executive Vice President and Chief Operating Officer in 2012, responsible for Intel’s global manufacturing, supply chain, human resources, and information technology operations. Mr. Krzanich holds a bachelor’s degree in chemistry from San Jose State University and has one patent for semiconductor processing. He is also a member of the board of directors of the Semiconductor Industry Association.

As our CEO and a senior executive officer with over 31 years of service with Intel, Mr. Krzanich brings to the Board significant senior leadership, manufacturing and operations, industry, technical, and global experience as well as a unique perspective of the company. As CEO, Mr. Krzanich is directly responsible for Intel’s strategy and operations. | ||||

|

|

James D. Plummer has been a Professor of Electrical Engineering at

Stanford University in Stanford, California, since 1978 and the Dean of Stanford’s School of Engineering since 1999. Dr. Plummer received his PhD in Electrical Engineering from Stanford University. Dr. Plummer has published more than

400 papers on | |||

| silicon devices and technology, has won numerous awards for his research, and is a member of the U.S. National Academy of Engineering. Dr. Plummer also directed the Stanford Nanofabrication Facility from 1994 to 2000. Dr. Plummer is a member of the boards of directors of Cadence Design Systems, Inc. and International Rectifier Corporation. Within the past five years, Dr. Plummer has served as a member of the board of directors of Leadis Technology, Inc.

As a scholar and educator in the field of integrated circuits, Dr. Plummer brings to the Board industry and technical experience directly related to Intel’s semiconductor research and development, and manufacturing. Dr. Plummer’s board service with other public companies, including on their audit committees, provides cross-board experience and financial expertise. | ||||

|

|

David S. Pottruck has been Chairman and CEO of Red Eagle Ventures,

Inc., a private equity firm in San Francisco, California, since 2005. Mr. Pottruck has also served as Co-Chairman of Hightower Advisors, a wealth-management company in Chicago, Illinois, since 2009 and in

2013 became Chair. Mr. Pottruck teaches in the MBA and Executive | |||

| Education programs of the Wharton School of Business of the University of Pennsylvania, and serves as a Senior Fellow in the Wharton School of Business Center for Leadership and Change Management. Prior to joining Red Eagle Ventures, Inc., Mr. Pottruck had a 20-year career at Charles Schwab Corporation that included service as President, CEO, and a member of the board.

| ||||

| 12 |

|

2014 PROXY STATEMENT |

|

Table of Contents

PROPOSAL 1 n Director Skills, Experience, and Background

|

|

|

|

13 |

Table of Contents

PROPOSAL 1 n Director Skills, Experience, and Background

| We believe that our employees around the world drive our business, and that a diverse employee population can better understand our customers’ needs. Our success with a diverse workforce informs our views about the value of a board of directors that has a mix of skills, experiences, and backgrounds. To learn more about Intel’s commitment to diversity, see:

n our Diversity web site at www.intel.com/content/www/us/en/company-overview/diversity-at-intel.html

n our Corporate Responsibility Report at www.intel.com/go/responsibility

n our Corporate Governance Guidelines at www.intel.com/go/governance

Listed below are the skills and experience that we consider important for our directors in light of our current business and structure. The directors’ biographies note each director’s relevant experience, qualifications, and skills relative to this list.

n Senior Leadership Experience. Directors who have served in senior leadership positions are important to us, as they have the experience and perspective to analyze, shape, and oversee the execution of important operational and policy issues. These directors’ insights and guidance, and their ability to assess and respond to situations encountered in serving on our Board, may be enhanced by leadership experience at businesses or organizations that operated on a global scale, faced significant competition, or involved technology or other rapidly evolving business models.

n Public Company Board Experience. Directors with public company board experience understand the dynamics and operation of a corporate board, the relationship of a board to the CEO and other management personnel, the importance of particular agenda and oversight issues, and how to oversee an ever-changing mix of strategic, operational, and compliance-related matters.

n Business Development and Mergers and Acquisitions (M&A) Experience. Directors with a background in business development and in M&A provide insight into developing and implementing strategies for growing our business. Useful experience in this area includes skills in assessing “make vs. buy” decisions, analyzing the “fit” of a proposed acquisition with a company’s strategy, the valuation of transactions, and assessing management’s plans for integration with existing operations.

n Financial Expertise. Knowledge of financial markets, financing and funding operations, and accounting and financial reporting processes is also important. This experience assists our directors in understanding, advising on, and overseeing Intel’s capital structure, financing and investing activities, as well as our financial reporting and internal controls.

n Industry and Technical Expertise. Because we are a technology, hardware, and software provider, education or experience in relevant technology is useful for understanding our research and development efforts, competing technologies, the products and processes we develop, our manufacturing and assembly and test operations, and the market segments in which we compete.

n Brand Marketing Expertise. Directors with brand marketing experience can provide expertise and guidance as we seek to maintain and expand brand and product awareness and enhance our reputation.

n Government Expertise. Directors who have served in government positions provide experience and insights that help us work constructively with governments around the world and address significant public policy issues, particularly as they relate to Intel’s operations and to public support for science, technology, engineering, and mathematics education.

n Global/International Expertise. Because we are a global organization with research and development, manufacturing, assembly and test facilities, and sales and other offices in many countries and the majority of our revenue comes from sales outside the United States, directors with global expertise can provide valuable business and cultural perspective regarding many important aspects of our business.

n Legal Expertise. Directors with a background in law can assist the Board in fulfilling its oversight responsibilities regarding Intel’s legal and regulatory compliance and its engagement with regulatory authorities. | ||||

| 14 |

|

2014 PROXY STATEMENT |

|

Table of Contents

Board Responsibilities and Structure

The Board oversees, counsels, and directs management in the long-term interests of the company and our stockholders. The Board’s responsibilities include:

| n | overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed; |

| n | planning for CEO succession and monitoring management’s succession planning for other executive officers; |

| n | reviewing and approving our major financial objectives, strategic and operating plans, and other significant actions; |

| n | selecting the CEO, evaluating CEO performance, and determining the compensation of the CEO and other executive officers; and |

| n | overseeing our processes for maintaining the integrity of our financial statements and other public disclosures, and our compliance with law and ethics. |

The Board and its committees met throughout the year on a set schedule, held special meetings, and acted by written consent from time to time as appropriate. At each of its Board meetings, the Board held sessions for the independent directors to meet without the CEO present. Officers regularly attend Board meetings to present information on our business and strategy, and Board members have access to our employees outside of Board meetings. Board members are encouraged and expected to make site visits on a worldwide basis to meet with local management; to attend Intel industry, analyst, and other major events; and to accept invitations to attend and speak at internal Intel meetings.

Board Leadership Structure. The Board has a general policy that the positions of Chairman of the Board and CEO should be held by separate individuals to aid in the Board’s oversight of management. This policy is in the Board’s published Guidelines on Significant Corporate Governance Issues, and it has been in effect since the company began operations. Sometimes the Board has chosen an independent director as Chairman, and sometimes it has chosen a senior executive as Chairman; since 1997 the Board has also elected an independent director to serve as Lead Director when the Chairman is a senior executive. Recent Chairmen have included Dr. Jane Shaw, an independent director who served as Chairman from 2009 until her retirement from the Board in May 2012; Dr. Craig R. Barrett, a former CEO of Intel, who served as Chairman from 2005 until 2009; and Dr. Andy Grove, a former CEO of Intel, who served as Chairman from 1997 until 2005.

Andy D. Bryant, the current Chairman, has been in that role since May 2012. He was first elected to the Board in 2011, when the Board designated him as Vice Chairman in anticipation of his becoming Chairman in 2012. Mr. Bryant had most recently been Executive Vice President and Chief Administrative Officer of Intel, with responsibility for the Technology and Manufacturing Group, Information Technology, Human Resources, and Finance. Mr. Bryant had previously been Intel’s Chief Financial Officer and has held various other positions at Intel. Mr. Bryant has attended and been a participant at Board meetings for more than 18 years in his positions as CFO and CAO.

The independent directors considered whether to elect an independent director as the next Chairman but decided that Mr. Bryant would be the right choice. The Board believes that Mr. Bryant’s extensive experience at Intel provides significant value and insight to the Board as it addresses technology, business, and leadership transitions. The independent members of the Board considered whether Mr. Bryant’s position as a senior executive officer might reduce or compromise his effectiveness as Chairman, and concluded that in their opinion this would not be the case. The Board and the Compensation Committee are responsible for determining Mr. Bryant’s performance reviews and compensation.

|

|

|

|

15 |

Table of Contents

CORPORATE GOVERNANCE n The Board’s Role in Risk Oversight at Intel

Ms. Decker has served as Lead Director since May 2012. The duties and responsibilities of the Lead Director, as set forth in our Bylaws and the Board’s Charter of the Lead Director, include:

| n | calling and presiding at meetings of the independent and non-employee directors of the Board of Directors and, in the absence of the Chairman, presiding at meetings of the Board; |

| n | approving the information, agenda, and meeting schedules for the Board of Directors’ and Board committee meetings; |

| n | serving as a liaison for consultation and direct communication with stockholders; |

| n | serving as principal liaison between the non-employee directors and the Chairman; and |

| n | approving the retention of advisors and consultants who report directly to the Board. |

The Board will continue to periodically assess its leadership structure and the potential advantages of having an independent Chairman.

The Board’s Role in Risk Oversight at Intel

One of the Board’s important functions is oversight of risk management at Intel. Risk is inherent in business, and the Board’s oversight, assessment, and decisions regarding risks occur in the context of and in conjunction with the other activities of the Board and its committees.

Defining Risk. The Board and management consider “risk” to be the possibility that an undesired event could occur that might adversely affect the achievement of our objectives. Risks vary in many ways, including the ability of the company to anticipate and understand the risk, the types of adverse impacts that could result if the undesired event occurs, the likelihood that an undesired event and a particular adverse impact would occur, and the ability of the company to control the risk and the potential adverse impacts. Examples of the types of risks faced by Intel include:

| n | macro-economic risks, such as inflation, reductions in economic growth, or recession; |

| n | political risks, such as restrictions on access to markets, confiscatory taxation, or expropriation of assets; |

| n | “event” risks, such as natural disasters; and |

| n | business-specific risks related to strategic position, operational execution, financial structure, legal and regulatory compliance, corporate governance, and environmental stewardship. |

Not all risks can be dealt with in the same way. Some risks may be easily perceived and controllable, while other risks are unknown; some risks can be avoided or mitigated by particular behavior, and some risks are unavoidable as a practical matter. In some cases, a higher degree of risk may be acceptable because of a greater perceived potential for reward. Intel seeks to align its voluntary risk-taking with company strategy, and Intel understands that its projects and processes may enhance the company’s business interests by encouraging innovation and appropriate levels of risk-taking.

Risk Assessment Processes. Management is responsible for identifying risk and risk controls related to significant business activities; mapping the risks to company strategy; and developing programs and recommendations to determine the sufficiency of risk identification, the balance of potential risk to potential reward, and the appropriate manner in which to control risk. The Board implements its risk oversight responsibilities by having management provide periodic briefing and informational sessions on the significant voluntary and involuntary risks that the company faces and how Intel is seeking to control risk if and when appropriate. In some cases, as with risks of new technology and risks related to product acceptance, risk oversight is addressed as part of the full Board’s regular interaction with the CEO and management. In other cases, a Board committee is assigned to oversee specific risk topics. For example, the Audit Committee oversees issues related to internal control over financial reporting, the Finance Committee oversees issues related to the company’s risk tolerance in cash-management investments, and the Compensation Committee oversees risks related to compensation programs, as discussed in greater detail below. Presentations and other information for the Board and Board committees generally identify and discuss relevant risk and risk control; and Board members assess and oversee risks in their review of

| 16 |

|

2014 PROXY STATEMENT |

|

Table of Contents

CORPORATE GOVERNANCE n The Board’s Role in Succession Planning

the related business, financial, and other activity of the company. The full Board also receives reports on enterprise risk management in which risk identification and risk mitigation and control are the primary topics.

Risk Assessment in Compensation Programs. The Compensation Committee oversees management’s annual assessment of the company’s compensation programs. Based on that assessment, we have concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the company. Intel management assessed the company’s executive and broad-based compensation and benefits programs on a worldwide basis to determine whether the programs’ provisions and operations create undesired or unintentional material risk. This risk assessment process takes into account numerous compensation terms and practices that Intel maintains which aid in controlling risk, including the mix of cash, equity, and near- and long-term incentive programs, the use of multi-year vesting periods for equity awards, and a variety of performance criteria for incentive compensation, the claw-back provisions that apply to our annual incentive cash plan and equity plan, our stock ownership guidelines that apply broadly to executives and non-management directors and were expanded beginning in 2014 to our senior leaders, and the cap on the maximum equity incentive grant payouts for our top executives. This risk assessment process also included a review of program policies and practices, program analysis to identify risk and risk controls, and determinations as to the sufficiency of risk identification and risk control, the balance of potential risk to potential reward, and the significance of the programs and their risks to company strategy. Although we reviewed all significant compensation programs, we focused on programs with variable payout, in particular assessing the ability of participants to directly affect payouts, and the controls on such situations.

Based on the foregoing, we believe that our compensation policies and practices do not create inappropriate or unintended significant risk to the company as a whole. We also believe that our incentive compensation programs provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and Intel’s risk-management practices; and are supported by the Compensation Committee’s oversight of our executive compensation programs.

The Board’s Role in Succession Planning

As reflected in our Corporate Governance Guidelines, the Board’s primary responsibilities include planning for CEO succession and monitoring and advising on management’s succession planning for other executive officers. The Board’s goal is to have a long-term and continuing program for effective senior leadership development and succession. The Board also has contingency plans in place for emergencies such as the departure, death, or disability of the CEO or other executive officers. Following Mr. Otellini’s announcement in November 2012 of his intention to retire effective May 2013, the Board of Directors accelerated its process for selecting a new CEO. In May 2013, Intel announced that the Board of Directors had selected Brian M. Krzanich as CEO and Renée J. James as President, effective as of the retirement of Mr. Otellini as Intel’s CEO at the 2013 Annual Stockholders’ Meeting.

Director Independence and Transactions Considered in Independence Determinations

Director Independence. The Board has determined that each of the following non-employee directors qualifies as “independent” in accordance with the published listing requirements of NASDAQ: Ambassador Barshefsky, Ms. Decker, Mr. Donahoe, Mr. Hundt, Dr. Plummer, Mr. Pottruck, Mr. Yeary, and Dr. Yoffie. Because Mr. Krzanich and Mr. Bryant are employed by Intel, they do not qualify as independent.

The NASDAQ rules have objective tests and a subjective test for determining who is an “independent director.” Under the objective tests, a director cannot be considered independent if:

| n | the director is, or at any time during the past three years was, an employee of the company; |

|

|

|

|

17 |

Table of Contents

CORPORATE GOVERNANCE n Director Independence and Transactions Considered in Independence Determinations

| n | the director or a family member of the director accepted any compensation from the company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for Board or Board committee service); |

| n | a family member of the director is, or at any time during the past three years was, an executive officer of the company; |

| n | the director or a family member of the director is a partner in, a controlling stockholder of, or an executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceeded 5% of the recipient’s consolidated gross revenue for that year, or $200,000, whichever was greater (subject to certain exclusions); |

| n | the director or a family member of the director is employed as an executive officer of an entity for which at any time during the past three years, any of the executive officers of the company served on the compensation committee of such other entity; or |

| n | the director or a family member of the director is a current partner of the company’s outside auditor, or at any time during the past three years was a partner or employee of the company’s outside auditor, and who worked on the company’s audit. |

The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has not established categorical standards or guidelines to make these subjective determinations but considers all relevant facts and circumstances.

In addition to the Board-level standards for director independence, the directors who serve on the Audit Committee each satisfy standards established by the U.S. Securities and Exchange Commission (SEC), as no member of the Audit Committee accepts directly or indirectly any consulting, advisory, or other compensatory fee from the company other than their director compensation, or otherwise has an affiliate relationship with the company. Similarly, the members of the Compensation Committee each qualify as independent under NASDAQ standards. Under these standards, the Board considered that none of the members of the Compensation Committee accept directly or indirectly any consulting, advisory, or other compensatory fee from the company other than their director compensation, and that none have any affiliate relationships with the company or other relationships that would impair the director’s judgment as a member of the Compensation Committee.

Transactions Considered in Independence Determinations. In making its independence determinations, the Board considered transactions that occurred since the beginning of 2011 between Intel and entities associated with the independent directors or members of their immediate families.

All of the non-employee directors qualified as “independent” under the objective tests. In making its subjective determination that each non-employee director is independent, the Board reviewed and discussed additional information provided by the directors and the company with regard to each director’s business and personal activities as they may relate to Intel and Intel’s management. The Board considered the transactions in the context of the NASDAQ objective standards, the special standards established by the SEC and NASDAQ for members of audit and compensation committees, and the special SEC and U.S. Internal Revenue Service (IRS) standards for compensation committee members. Based on this review, as required by the NASDAQ rules, the Board made a subjective determination that, based on the nature of the director’s relationship with the entity and/or the amount involved, no relationships exist that, in the opinion of the Board, impair the directors’ independence. The Board’s independence determinations took into account the following transactions.

Business Relationships. Each of our non-employee directors or one of his or her immediate family members is, or was during the previous three fiscal years, a non-management director, trustee, advisor, or executive or served in a similar position at another entity that did business with Intel at some time during those years. The business relationships were ordinary course dealings as a supplier or purchaser of goods or services; licensing or research arrangements; facility, engineering, and equipment fees; or commercial

| 18 |

|

2014 PROXY STATEMENT |

|

Table of Contents

CORPORATE GOVERNANCE n Director Independence and Transactions Considered in Independence Determinations

paper or similar financing arrangements in which Intel or an affiliate participated as a creditor. Payments to or from each of these entities constituted less than the greater of $200,000 or 1% of both Intel’s and the recipient’s annual revenue, respectively, in each of the past three years, except as discussed below.

| n | Ambassador Barshefsky is a Partner at the law firm Wilmer Cutler Pickering Hale and Dorr LLP (WilmerHale). Ambassador Barshefsky does not provide any legal services to Intel, and she does not receive any compensation from the firm that are generated by or related to our payments to the firm. Intel engages a number of law firms, and has engaged WilmerHale in various significant matters since 1997, before Ambassador Barshefsky joined either the firm or Intel’s board. Recognizing that proxy advisory firms have questioned professional advisory relationships between companies and a director’s firm, the Board carefully reviewed the nature of Intel’s engagement of WilmerHale and the services rendered, including the expertise and relevant experience of the firm, the firm’s and specific partners’ knowledge of Intel and its business and past legal engagements, and the fees paid in such engagements, and determined that Ambassador Barshefsky’s service on Intel’s Board should not impair Intel’s ability to engage WilmerHale when Intel determines such engagements to be in the best interest of Intel and its stockholders. The Board is satisfied that WilmerHale, when engaged for legal work, is chosen by Intel’s legal group on the basis of the directly relevant factors of experience, expertise, and efficiency. The fees and expenses paid WilmerHale represented less than 5% of the firm’s annual revenue in each of the past three years, and represented less than 0.1% of Intel’s revenue in each year. After considering these fees and expenses and being briefed on the policies and procedures that WilmerHale has instituted to confirm that Ambassador Barshefsky has no professional involvement or financial interest in Intel’s dealings with the firm, the Board (with Ambassador Barshefsky recused) unanimously determined that Intel’s professional engagement of WilmerHale does not impair Ambassador Barshefsky’s independence. |

| n | Dr. Plummer is a member of the board of directors of Cadence Design Systems (Cadence), a company with which Intel engages in ordinary course business transactions. The Board carefully reviewed the nature of Intel’s transactions with Cadence, which primarily related to equipment rentals and leases, software support services, and technology contracts, and Dr. Plummer’s position as a non-management director at Cadence. The fees paid Cadence represented less than 5% of Cadence’s annual revenue in each of the past three years, and represented less than 0.15% of Intel’s revenue in each year. After considering these fees, the Board (with Dr. Plummer recused) unanimously determined that Intel’s business transactions with Cadence do not impair Dr. Plummer’s independence. |

Charitable Contributions. Mr. Donahoe, Mr. Hundt, Dr. Plummer, Mr. Pottruck, Mr. Yeary, Dr. Yoffie, or one of their immediate family members is, or has each served during the previous three fiscal years, as an executive, professor, or other employee for one or more colleges or universities or as a director, executive, or employee of a charitable entity, that received matching or other charitable contributions from Intel during those years. Charitable contributions to each of these entities (including matching and discretionary contributions by Intel and the Intel Foundation) constituted less than $120,000 in each of the past three years, as discussed below.

| n | Mr. Donahoe is on the Board of Trustees of Dartmouth College. Intel Foundation contributed less than $10,000 in each of the past three years to match Intel employee charitable contributions to Dartmouth College, amounting to less than 0.001% of Dartmouth College’s annual revenue for each of the past three years. |

| n | Mr. Hundt is a member of the Advisory Board for the Yale School of Management, the graduate business school of Yale University. Intel Foundation contributed less than $10,000 in each of the past three years to match Intel employee charitable contributions to Yale University, amounting to less than 0.001% of Yale University’s consolidated annual revenue for each of the past three years. |

| n | Dr. Plummer is a Professor of Electrical Engineering and the Dean of the School of Engineering at Stanford University. Intel Foundation contributed less than $20,000 in each of the past three years to match Intel employee charitable contributions and employee volunteer hours under the Intel Involved Matching Grant Program. The Intel Foundation also contributed $20,000 in 2013 to support the university’s RISE (Raising Interest in Science and Engineering) Summer Internship Program for high school students and $20,000 in 2012 |

|

|

|

|

19 |

Table of Contents

CORPORATE GOVERNANCE n Director Attendance

| and $40,000 in 2011 to support the university’s science fair competitions, amounting to less than 0.001% of Stanford’s consolidated annual revenue for each of the past three years. |

| n | Mr. Pottruck is a Senior Fellow, Advisory Board Member, and Lecturer at the Wharton School of Business of the University of Pennsylvania. Intel Foundation contributed less than $5,000 in each of the past three years to match Intel employee charitable contributions to the University of Pennsylvania, amounting to less than 0.001% of the University of Pennsylvania’s consolidated annual revenue for each of the past three years. |

| n | Mr. Yeary was Vice Chancellor of the University of California, Berkeley from 2008 until 2012 and Trustee of the University of California, Berkeley Foundation from 2002 until 2012. Intel Foundation contributed less than $10,000 in each of the past three years to match Intel employee charitable contributions to the University of California, Berkeley and the University of California, Berkeley Foundation, amounting to less than 0.001% of the aggregate annual revenue of the University of California and University of California Campus Foundations for each of those years. |

| n | Dr. Yoffie is a Professor at Harvard Business School, the graduate business school of Harvard University. Intel Foundation contributed less than $5,000 in each of the past three years to match Intel employee charitable contributions to Harvard University, amounting to less than 0.001% of Harvard’s consolidated annual revenue for each of the past three years. |

The Board held 11 meetings in 2013. We expect each director to attend every meeting of the Board and the committees on which he or she serves, as well as the annual stockholders’ meeting. All directors attended at least 75% of the meetings of the Board and the committees on which they served in 2013 (held during the period in which the director served). Mr. Krzanich and seven directors then serving attended our 2013 Annual Stockholders’ Meeting.

Communications from Stockholders to Directors

The Board recommends that stockholders initiate communications with the Board, the Chairman, or any Board committee by writing to our Corporate Secretary. You can find the address in the “Other Matters” section of this proxy statement. This process assists the Board in reviewing and responding to stockholder communications. The Board has instructed our Corporate Secretary to review correspondence directed to the Board and, at his discretion, not to forward items that he deems to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration.

Corporate Governance Guidelines

Intel has long maintained a set of governance guidelines, titled the Board of Directors Guidelines on Significant Corporate Governance Issues. The Corporate Governance and Nominating Committee reviews the guidelines annually and recommends amendments to the Board as appropriate. The Board oversees administration and interpretation of, and compliance with, the guidelines and may amend, waive, suspend, or repeal any of the guidelines at any time, with or without public notice subject to legal requirements, as it determines necessary or appropriate in the exercise of the Board’s judgment in its role as fiduciary.

Investors may find these guidelines on our web site at www.intel.com/go/governance. Among other matters, they include the following items concerning the Board:

| n | Independent directors may not stand for re-election after age 72. |

| n | Directors may serve on up to three public company boards in addition to Intel’s. This limitation does not apply to not-for-profit and mutual fund boards. A director who is an active CEO of a public company is limited to service on two public company boards, in addition to Intel’s. |

| n | The CEO reports to the Board at least twice a year on succession planning and management development. |

| n | The Chairman of the Board or Lead Director manages an annual self-evaluation process for each director and for the Board as a whole. |

| 20 |

|

2014 PROXY STATEMENT |

|

Table of Contents

CORPORATE GOVERNANCE n Board Committees and Charters

| n | The Board’s policy is to obtain stockholder approval before adopting any “poison pill.” If the Board later repeals this policy and adopts a poison pill without prior stockholder approval, the Board will submit the poison pill to an advisory vote by Intel’s stockholders within 12 months. If Intel’s stockholders do not approve the Board’s action, the Board may elect to terminate, retain, or modify the poison pill in the exercise of its fiduciary responsibilities. |

In addition, the Board has adopted a policy that the company will not issue shares of preferred stock to prevent an unsolicited merger or acquisition.

The Board assigns responsibilities and delegates authority to its committees, and the committees regularly report on their activities and actions to the full Board. The Board has five standing committees: Audit, Compensation, Corporate Governance and Nominating, Executive, and Finance. Each committee can engage outside experts, advisors, and counsel to assist the committee in its work.

Each committee has a written charter approved by the Board. We post each charter on our web site at www.intc.com/corp_docs.cfm.

The following table identifies the current committee members. As discussed above, the Board has determined that each member of the Audit, Compensation, and Corporate Governance and Nominating Committees is an independent director in accordance with NASDAQ standards.

| Name | Audit | Compensation | Corporate Governance and Nominating |

Executive | Finance | |||||

| Charlene Barshefsky | ¢ Chair | |||||||||

| Andy D. Bryant | ¢ | |||||||||

| Susan L. Decker | ¢ | ¢ Co-Chair |

¢ Chair |

|||||||

| John J. Donahoe | ¢ | ¢ | ||||||||

| Reed E. Hundt | ¢ | ¢ | ¢ | |||||||

| Brian M. Krzanich | ¢ | |||||||||

| James D. Plummer | ¢ | ¢ | ||||||||

| David S. Pottruck | ¢ Chair |

¢ | ||||||||

| Frank D. Yeary | ¢ Chair |

¢ | ||||||||

| David B. Yoffie | ¢ | ¢ Co-Chair |

||||||||

| Number of Committee Meetings Held in 2013 | 8 | 6 | 4 | 2 | 1 |

Audit Committee

| n | Assists the Board in its general oversight of our financial reporting, financial risk assessment, internal controls, and audit functions. |

| n | Responsible for appointing and retaining our independent registered public accounting firm, managing its compensation, and overseeing its work. |

The Board has determined that Ms. Decker and Mr. Yeary both qualify as “audit committee financial experts” under SEC rules and that each Audit Committee member is sufficiently proficient in reading and understanding the company’s financial statements to serve on the Audit Committee. The responsibilities and activities of the Audit Committee are described in detail in “Report of the Audit Committee” in this proxy statement and the Audit Committee’s charter.

|

|

|

|

21 |

Table of Contents

CORPORATE GOVERNANCE n Board Committees and Charters

Compensation Committee

| n | Reviews and determines salaries, performance-based incentives, and other matters related to the compensation of our executive officers. |

| n | Administers our equity plans, including reviewing and granting equity awards to our executive officers. |

| n | Reviews and determines other compensation policies, handles many compensation-related matters, and makes recommendations to the Board and to management on employee compensation and benefit plans. |

| n | Makes recommendations to the Board on stockholder proposals about compensation matters. |

| n | Administers the employee stock purchase plan. |

The Compensation Committee is responsible for determining executive compensation, while the Corporate Governance and Nominating Committee recommends to the full Board the compensation for non-employee directors. The Compensation Committee can designate one or more of its members to perform duties on its behalf, subject to reporting to or ratification by the Compensation Committee, and can delegate to other Board members, or an officer or officers of the company, the authority to review and grant stock-based compensation for employees who are not executive officers.

The Compensation Committee retains an independent executive compensation consultant, Farient Advisors LLC, to provide input, analysis, and advice about Intel’s executive compensation philosophy, peer groups, pay positioning (by pay component and in total), compensation design, equity usage and allocation, and risk assessment under Intel’s compensation programs. Farient Advisors reports directly to the Compensation Committee and interacts with management at the committee’s direction. Farient Advisors did not perform work for Intel in 2013 except under its engagement by the Compensation Committee, and it provided the committee with a report covering factors specified in SEC rules regarding potential conflicts of interest arising from the consultant’s work. Based on this report and its discussions with Farient Advisors, the committee determined that Farient Advisors’ work in 2013 did not raise any conflicts of interest.

The CEO makes recommendations to the Compensation Committee on the base salary, annual incentive cash targets, and equity awards for all executive officers other than himself and the Chairman of the Board. These recommendations are based on his assessment of each executive officer’s performance during the year and his review of compensation surveys. For more information on the responsibilities and activities of the Compensation Committee, including the processes for determining executive compensation, see “Compensation Discussion and Analysis,” “Report of the Compensation Committee,” and “Executive Compensation” in this proxy statement, and the Compensation Committee’s charter (available at www.intc.com/corp_docs.cfm).

Corporate Governance and Nominating Committee

| n | Reviews matters of corporate governance and corporate responsibility, such as environmental, sustainability, workplace, political contributions, and stakeholder issues, and periodically reports on these matters to the Board. |

| n | Annually reviews and assesses the effectiveness of the Board’s Corporate Governance Guidelines, recommends to the Board proposed revisions to the Guidelines and committee charters, and reviews the poison pill policy. |

| n | Makes recommendations to the Board regarding the size and composition of the Board and its committees. |

| n | Reviews all stockholder proposals and recommends actions on such proposals. |

| n | Advises the Board on compensation for our non-employee directors. |

The Corporate Governance and Nominating Committee also establishes procedures for Board nominations and recommends candidates for election to the Board. Consideration of new Board candidates typically involves a series of internal discussions, review of candidate information, and interviews with selected candidates. In screening director candidates, the committee considers the diversity of skills, experience, and background of the Board as a whole and, based on that analysis, determines whether it would strengthen the Board to add a director with a certain type of background, experience, personal

| 22 |

|

2014 PROXY STATEMENT |

|

Table of Contents

CORPORATE GOVERNANCE n Board Committees and Charters

characteristics, or skills. In connection with this process, the committee also seeks input from Intel’s head of Global Diversity and Inclusion. In addition to candidates nominated by Board members, the committee considers candidates proposed by stockholders and evaluates them using the same criteria. A stockholder who wishes to suggest a candidate for the committee’s consideration should send the candidate’s name and qualifications to our Corporate Secretary. The Corporate Secretary’s contact information can be found in this proxy statement under the heading “Other Matters; Communicating with Us.”

Executive Committee

| n | Exercises the authority of the Board between Board meetings, except as limited by applicable law. |

Finance Committee

| n | Advises the Board on capital structure decisions, including the issuance of debt and equity securities; banking arrangements, including the investment of corporate cash; and management of the corporate debt structure. |

| n | Reviews and approves finance and other cash-management transactions. |

The Finance Committee also oversees and appoints the members of the Retirement Plans Investment Policy Committee, which sets the investment policies and chooses investment managers for our U.S. retirement plans. Mr. Pottruck is chairman of the Retirement Plans Investment Policy Committee, whose other members are Intel employees.

|

|

|

|

23 |

Table of Contents

The general policy of the Board is that compensation for independent directors should be a mix of cash and equity, with the majority of compensation provided in the form of equity. The Corporate Governance and Nominating Committee, consisting solely of independent directors, has the primary responsibility for reviewing director compensation and considering any changes in how we compensate our independent directors. The Board reviews the committee’s recommendations and determines the amount of director compensation.

Intel’s Legal department, our Corporate Secretary, and the Compensation and Benefits Group in the Human Resources department support the committee in recommending director compensation and creating director compensation programs. In addition, the committee can engage outside advisors, experts, and others to assist the committee. The director peer group is the same as the peer group used in 2013 to set executive compensation and consisted of 13 technology companies and 10 companies in Standard & Poor’s S&P 100* Index (S&P 100), as described in detail below under “Compensation Discussion and Analysis; External Competitive Considerations for 2013.” The committee targets cash and equity compensation at the average of the peer group.

For 2013, annual compensation for non-employee directors consisted of the following elements:

| Board Fees | ||

| Cash retainer |

$80,000 | |

| Variable performance-based restricted stock units, which we refer to as “outperformance” restricted stock units (OSUs) | Targeted value of approximately $110,000 | |

| Restricted stock units (RSUs) |

Targeted value of approximately $110,000 | |

| Committee Fees | ||

| Audit Committee chair |

$25,000 | |

| Compensation Committee chair |

$20,000 | |

| Corporate Governance and Nominating Committee chair |

$15,000 | |

| Non-chair Audit Committee member |

$10,000 | |

| Non-chair Compensation Committee member |

$10,000 | |

| Lead Director Fee | ||

| Additional cash retainer |

$20,000 | |

Intel does not pay its management directors for Board service in addition to their regular employee compensation.

Director Compensation for Fiscal Year 2013

The following table details the compensation of Intel’s non-employee directors for the 2013 fiscal year.

Director Compensation for Fiscal Year 2013 Table

| Name | Fees Earned or Paid in |

Stock Awards1 ($) |

Change in Pension Value and Non-Qualified Deferred Compensation Earnings2 ($) |

All Other Compensation3 ($) |

|

Total ($) |

| |||||

| Charlene Barshefsky4 | 90,000 | 214,900 | — | — | 304,900 | |||||||

| Susan L. Decker | 135,000 | 214,900 | — | 5,000 | 354,900 | |||||||

| John J. Donahoe5 | — | 298,000 | — | — | 298,000 | |||||||

| Reed E. Hundt | 95,000 | 214,900 | — | — | 309,900 | |||||||

| James D. Plummer | 90,000 | 214,900 | — | 5,000 | 309,900 | |||||||

| David S. Pottruck | 110,000(6) | 214,900 | — | — | 324,900 | |||||||

| Frank D. Yeary | 105,000 | 214,900 | — | — | 319,900 | |||||||

| David B. Yoffie | 105,000 | 214,900 | — | 4,000 | 323,900 |

| 24 |

|

2014 PROXY STATEMENT |

|

Table of Contents

DIRECTOR COMPENSATION