Form 10-K

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 29, 2012.

or

| ¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to .

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

94-1672743 |

| State or other jurisdiction of incorporation or organization |

|

(I.R.S. Employer Identification No.) |

|

|

| 2200 Mission College Boulevard, Santa Clara, California |

|

95054-1549 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (408) 765-8080

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value |

|

The NASDAQ Global Select Market* |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer x |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

|

Smaller reporting company ¨ |

|

|

|

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2012, based upon the closing price of the

common stock as reported by The NASDAQ Global Select Market* on such date, was

$133.5 billion

4,946 million shares of common stock outstanding as of February 8, 2013

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement related to its 2013

Annual Stockholders’ Meeting to be filed subsequently—Part III of this Form 10-K.

INTEL CORPORATION

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 29, 2012

INDEX

PART I

Company

Overview

We design and manufacture advanced integrated digital technology platforms. A platform consists of a microprocessor

and chipset, and may be enhanced by additional hardware, software, and services. We sell these platforms primarily to original equipment manufacturers (OEMs), original design manufacturers (ODMs), and industrial and communications equipment

manufacturers in the computing and communications industries. Our platforms are used in a wide range of applications, such as PCs (including Ultrabook™, detachable, and convertible systems), servers, tablets, smartphones, automobiles, automated factory systems, and medical devices. We also develop and sell software

and services primarily focused on security and technology integration. We were incorporated in California in 1968 and reincorporated in Delaware in 1989.

Company Strategy

Our goal is to be the preeminent computing solutions company that powers the

worldwide digital economy. Over time the number of devices connected to the Internet and each other has grown from hundreds of millions to billions, and the variety of devices also continues to increase. The combination of the proliferation of

mobile devices connecting to the Internet and a build-out of the cloud infrastructure that supports these devices is driving fundamental changes in the computing industry. As a result, we are transforming our primary focus from the design and

manufacture of semiconductor chips for PCs and servers to the delivery of solutions consisting of hardware and software platforms and supporting services across a wide range of computing devices. Examples of these solutions can be seen across the

computing continuum, from the teraflops of operations per second for high performance computing (HPC) to the milliwatts of energy-consumed by an embedded application. Additionally, computing is becoming an increasingly engaging, mobile, and personal

experience. End users value consistency across devices that connect seamlessly and securely to the Internet and to each other. We enable this experience by innovating around energy-efficient performance, connectivity, and security.

To succeed in this changing computing environment, we have the following key objectives:

| • |

|

strive to ensure that Intel®

technology remains the best choice for the PC as well as cloud computing and the data center; |

| • |

|

maximize and extend our manufacturing technology leadership;

|

| • |

|

expand platforms into adjacent market segments to bring compelling new System-on-Chip (SoC) solutions and user experiences to mobile form factors including

smartphones and tablets, as well as embedded and microserver applications; |

| • |

|

develop platforms that enable devices that connect to the Internet and to each other to create a continuum of personal user and computing experiences thereby

offering consumers a set of secure, consistent, engaging, and personalized computing experiences; and |

| • |

|

positively impact the world through our actions and the application of our energy-efficient technology. |

We use our core assets to meet these objectives. Our core assets include our silicon and process technology, our architecture and platforms, our global presence,

our strong relationships across the industry, and our brand recognition. We believe that applying these core assets to our key focus areas provides us with the scale, capacity, and global reach to establish new technologies and respond to

customers’ needs quickly. Our core assets and key focus areas include the following:

| • |

|

Silicon and Manufacturing Technology Leadership. We have long been a leader in silicon process technology and manufacturing, and we aim to

continue our lead through investment and innovation in this critical area. We drive a regular two-year upgrade cycle—introducing a new microarchitecture approximately every two years and ramping the next generation of silicon process technology

in the intervening years. We refer to this as our “tick-tock” technology development cadence. With our continued focus on silicon and manufacturing technology leadership, we entered into a series of agreements during the third quarter of

2012 with ASML Holding N.V. These agreements are intended to accelerate the development of 450-millimeter (450mm) wafer technology and extreme ultraviolet lithography (EUV). We expect larger silicon wafers and enhanced lithography technologies

with EUV to allow Moore’s Law to continue. Moore’s Law predicted that transistor density on integrated circuits would double about every two years. As part of these agreements, we made a $3.2 billion equity investment in ASML during

2012. We aim to have the best process technology, and unlike many semiconductor companies, we primarily manufacture our products in our own facilities. This in-house manufacturing capability allows us to optimize performance, shorten our time to

market, and scale new products more rapidly. We believe this competitive advantage will be extended in the future as the costs to build leading-edge fabrication facilities increase, and as fewer semiconductor companies will be able to combine

platform design and manufacturing. |

1

| • |

|

Architecture and Platforms. We are developing a wide range of solutions for devices that span the computing continuum and allow for computing

experiences from PCs (including Ultrabook, detachable, and convertible systems), tablets, and smartphones to in-vehicle infotainment systems and beyond. We believe that users want consistent computing experiences and interoperable devices and

that users and developers value consistency of architecture, which provides a common framework that allows for shortened time to market, with the ability to leverage technologies across multiple form factors. We believe that we can meet the needs of

users and developers to offer computing solutions across the computing continuum through our partnership with the industry on open, standards-based platform innovation around Intel® architecture. We continue to invest in improving Intel architecture to deliver increased value to our customers and expand the capabilities of the architecture in

adjacent market segments. For example, we focus on delivering improved energy-efficient performance, which involves balancing higher performance with lower power consumption. In addition, we are focusing on perceptual computing, which brings

exciting user experiences through devices that sense and perceive the user’s actions. |

| • |

|

Software and Services. We offer software and services that provide security solutions through a combination of hardware and software for

consumer, mobile, and corporate environments designed to protect systems from malicious virus attacks as well as loss of data. Additionally, we seek to enable and advance the computing ecosystem by providing development tools and support to help

software developers create software applications and operating systems that take advantage of our platforms. We seek to expedite growth in various market segments, such as the embedded market segment, through our software offerings. We continue to

collaborate with companies to develop software platforms optimized for our Intel processors and that support multiple hardware architectures and operating systems. |

| • |

|

Customer Orientation. Our strategy focuses on developing our next generation of products based on the needs and expectations of our customers.

In turn, our products help enable the design and development of new user experiences, form factors, and usage models for businesses and consumers. We offer platforms that

|

| |

|

incorporate various components and capabilities designed and configured to work together to provide an optimized solution that customers can easily integrate in their end products. Additionally,

we promote industry standards that we believe will yield innovation and improved technologies for users. |

| • |

|

Strategic Investments. We make investments in companies around the world that we believe will further our strategic objectives, support our key

business initiatives, and generate financial returns. Our investments—including those made through our Intel Capital program—generally focus on investing in companies and initiatives that we believe will stimulate growth in the digital

economy, create new business opportunities for Intel, and expand global markets for our products. Additionally, we plan to continue to purchase and license intellectual property to support our current and expanding business.

|

| • |

|

Stewardship. We are committed to developing energy-efficient technology solutions that can be used to address major global problems while

reducing our environmental impact. We are also committed to helping transform education globally through our technology, program, and policy leadership, as well as through funding by means of the Intel Foundation. In addition, we strive to cultivate

a work environment in which engaged, energized employees can thrive in their jobs and in their communities. |

Our

continued investment in developing our assets and execution in key focus areas is intended to help strengthen our competitive position as we enter and expand into adjacent market segments, such as smartphones and tablets. These market segments

change rapidly, and we need to adapt to this environment. A key characteristic of these adjacent market segments is low power consumption based on SoC products. We are making significant investments in this area with the accelerated development of

our SoC solutions based on the Intel® Atom™ microarchitecture. Additionally, we are building mobile reference designs to help the adoption of Intel architecture in these adjacent market segments. Examples

include our smartphone reference designs, which were launched by multiple global partners in 2012. We also believe that increased Internet traffic and the increased use of mobile and cloud computing create a need for an improved server

infrastructure, including server products optimized for energy-efficient performance.

2

Business Organization

As of December 29, 2012, we managed our business through the following operating segments:

For a description of our operating segments, see “Note 28: Operating Segment and Geographic Information,”

in Part II, Item 8 of this Form 10-K.

Products

Platforms

We offer platforms that incorporate various components and technologies,

including a microprocessor and chipset, or stand-alone SoC. Additionally, a platform may be enhanced by additional hardware, software, and services.

A microprocessor—the central processing unit (CPU) of a computer system—processes system data and controls other devices in the system. We offer microprocessors with one or multiple processor cores.

Multi-core microprocessors can enable improved multitasking and energy-efficient performance by distributing computing tasks across two or more cores. Our 2nd, 3rd, and expected-to-be-released 4th generation Intel®

Core™ (formerly code-named Haswell) processor families integrate graphics functionality onto the processor die. In

contrast, some of our previous-generation processors incorporated a separate graphics chip inside the processor package. We also offer graphics functionality as part of a separate chipset outside the processor package. Processor packages may also

integrate a memory controller.

A chipset sends data between the microprocessor and input, display, and storage devices, such as the keyboard, mouse,

monitor, hard drive or solid-state drive, and optical disc drives. Chipsets extend the audio, video, and other capabilities of many systems and perform essential logic functions, such as balancing the performance of the system and removing

bottlenecks. Some chipsets may also include graphics functionality or a memory controller, for use with our microprocessors that do not integrate those system components.

We offer and continue to develop SoC products that integrate our core processing functions with other system components, such as graphics, audio, and video, onto a single chip. SoC products are designed to reduce

total cost of ownership, provide improved performance due to higher integration and lower power consumption, and enable smaller form factors such as smartphones and tablets.

We also offer features designed to improve our platform capabilities. For example, we offer Intel® vPro™ technology, a computer

hardware-based security technology for the notebook and desktop market segments. This technology is designed to provide businesses with increased manageability, upgradeability, energy-efficient performance, and security while lowering the total cost

of ownership.

3

We offer a range of platforms based upon the following microprocessors:

McAfee

In 2011, we acquired McAfee, Inc. with the objective of improving the overall security of our platforms. McAfee offers software products that provide security solutions designed to protect systems in consumer,

mobile, and corporate environments from malicious virus attacks as well as loss of data. McAfee’s products include software solutions for end-point security, network and content security, risk and compliance, and consumer and mobile security.

Phone Components

In

addition to our Intel Atom processor-based products for the smartphone market segment, we offer components and platforms for mobile phones and connected devices. Our acquisition of the Wireless Solutions (WLS) business of

Infineon Technologies AG in 2011 has enabled us to offer a variety of mobile phone components, including baseband processors, radio frequency transceivers, and power management integrated

circuits. We also offer comprehensive mobile phone platforms, including Bluetooth* wireless technology and Global Positioning Systems (GPS) receivers, software solutions, customization, and essential interoperability tests. Our mobile phone

solutions based on multiple industry standards help enable mobile voice and high-speed data communications for a broad range of devices around the world.

Non-Volatile Memory Solutions

We offer NAND flash memory products primarily used in

solid-state drives (SSDs). Our NAND flash memory products are manufactured by IM Flash Technologies, LLC (IMFT).

4

Products and Product Strategy by Operating Segment

Our PC Client Group operating segment offers products that are incorporated in notebook (including Ultrabook, detachable,

and convertible systems) and desktop computers for consumers and businesses. In 2012 we introduced the 3rd generation

Intel®

Core™ processor family for use in notebook and desktop computers. These processors use 22-nanometer (nm) transistors

and our Tri-Gate transistor processor technology. Our Tri-Gate transistor technology extends Moore’s Law and is the world’s first 3-D Tri-Gate transistor on a production technology. These enhancements in combination can provide significant

power savings and performance gains when compared to previous-generation technologies.

Notebook

Our strategy for the notebook computing market segment is to offer notebook PC technologies designed to improve performance, battery life,

wireless connectivity, manageability and security, as well as to allow for the design of smaller, lighter, and thinner form factors. Additionally, we are collaborating with others in the industry to integrate a touch-based interface and recognition

features based on voice and gesture. In 2013, we expect to introduce our 4th generation Intel® Core™ processor family. We believe these processors will continue to deliver increasing levels of graphics performance and provide

OEMs and end users with more choice in selecting processors with more processor cores, graphics performance, or both.

In addition to offering notebook

PC technologies, we have worked with our customers to help them develop a new class of personal computing devices that includes Ultrabook, detachable, and convertible systems. These computers combine the energy-efficient performance and capabilities

of today’s notebooks and tablets with enhanced graphics and perceptual computing features in a thin, light, and customizable form factor that is highly responsive and secure, and that can seamlessly connect to the Internet and other enabled

devices. We believe the renewed innovation in the PC industry that we fostered with Ultrabook systems and expanded to other thin and light form factors will continue to blur the lines between tablets and notebooks so a consumer does not have to

choose between the two.

Desktop

Our strategy for the desktop computing market segment is to offer products that provide increased manageability, security, and energy-efficient performance while

lowering total cost of ownership for businesses. The desktop computing market segment includes all-in-one desktop products, which combine traditionally separate desktop components into one form factor. Additionally, all-in-one computers have

transformed into adaptable and flexible form factors that offer users increased customization and ease of use. For desktop consumers, we also focus on the design of products for high-end enthusiast PCs and mainstream PCs with rich audio and video

capabilities.

Our Data Center Group operating segment offers products designed to provide

leading performance, energy efficiency, and virtualization technology for server, workstation, and storage platforms. We are also increasing our focus on products designed for high-performance computing, mission-critical computing, and cloud

computing services. The cloud computing market segment refers to servers and other products that enable on-demand network access to a shared pool of configurable software, services, and computing devices. Such products include the introduction in

2012 of our many-core Intel® Xeon Phi™ coprocessor with 60 or more high-performance, low-power Intel processor cores, as well as our server platform that incorporates our 32nm Intel®

Xeon® processors supporting as many as 10 cores for server platforms. The Intel Xeon Phi coprocessors are positioned to

boost the power of the world’s most advanced supercomputers, allowing for trillions of calculations per second, while the 32nm Intel Xeon processors provide faster throughput for cloud computing-based services. In the data storage market

segment, we introduced 64-bit Intel Atom microarchitecture-based SoC solutions to focus on the emerging market for highly dense, low-power server configurations. These products allow server rack space optimization and reduced energy costs with

microservers that require less than 10 watts per server node.

Our other Intel architecture operating segments offer products designed to

be used in the mobile communications, embedded, netbook, tablet, and smartphone market segments.

| • |

|

Our strategy for the mobile communications market segment, addressed by our Intel Mobile Communications (IMC) group, is to offer a portfolio of phone components

that covers a broad range of wireless connectivity options by combining Intel® WiFi technology with our 2G and 3G

technologies, while continuing our efforts to accelerate industry adoption of 4G LTE. These products feature low power consumption, innovative designs, and multi-standard platform solutions. |

| • |

|

Our strategy for the embedded market segment, addressed by our Intelligent Systems Group (ISG), is to drive Intel architecture as a solution for embedded

applications by delivering long life-cycle support, software and architectural scalability, and platform integration. |

| • |

|

Our strategy for the tablet market segment is to offer Intel architecture solutions optimized for multiple operating systems and application ecosystems, such as

our recent introduction of a platform for tablets that incorporates the Intel Atom processor. We are accelerating the process technology development for our Intel Atom processor product line to deliver increased battery life, performance, and

feature integration. |

| • |

|

Our strategy for the smartphone device market segment is to offer Intel Atom microarchitecture-based products that enable smartphones to deliver innovative

content and services. Such products include the introduction of a new platform for smartphones that incorporates the Intel Atom processor, which is designed to deliver increased performance and system responsiveness while also enabling longer

battery life. Additionally, we engage with and enable the supplier ecosystem by providing

|

5

| |

|

reference designs that showcase the advantages of Intel architecture in smartphone devices. |

Our software and services operating segments seek to create differentiated user experiences on Intel-based platforms. We differentiate by combining Intel platform features and enhanced software and

services. Our three primary initiatives are:

| • |

|

enabling platforms that can be used across multiple

|

| |

|

operating systems, applications, and services across all Intel products; |

| • |

|

optimizing features and performance by enabling the software ecosystem to quickly take advantage of new platform features and capabilities; and

|

| • |

|

delivering comprehensive solutions by using software, services, and hardware to enable a more secure online experience, such as our McAfee DeepSAFE* technology

platform, which provides additional security below the operating system of the platform. |

Revenue by Major Operating

Segment

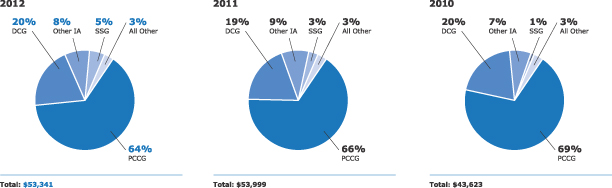

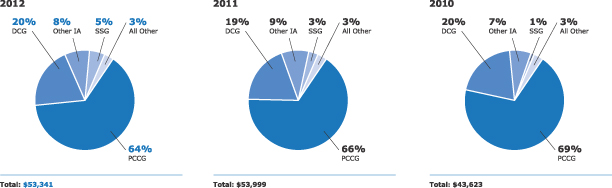

Net revenue for the PC Client Group (PCCG) operating segment, the Data Center Group (DCG) operating segment, the other Intel architecture

(Other IA) operating segments, and the software and services (SSG) operating segments is presented as a percentage of our consolidated net revenue. Other IA includes IMC, ISG, the Netbook Group, the Tablet Group, the Phone Group, and the Service

Provider Group operating segments. SSG includes McAfee, the Wind River Software Group, and the Software and Services Group operating segments. All Other consists primarily of revenue from the Non-Volatile Memory Solutions Group.

Percentage of Revenue by Major Operating Segment

(Dollars in Millions)

Revenue from sales of platforms presented as a percentage of our consolidated net revenue was as follows:

Percentage of Revenue by Principal Product from Reportable Segments

(Dollars in Millions)

6

Competition

The computing industry is evolving and as a result, so is our competitive landscape. Our platforms, based on Intel® architecture, are positioned to compete across the spectrum of Internet-connected computing devices, from the lowest-power portable devices to the most powerful data

center servers. New competitors are joining traditional competitors in our core PC and server business areas where we are a leading provider, while we face incumbent competitors in the adjacent market segments that we are pursuing, such as

smartphones and tablets. Competitors include Advanced Micro Devices, Inc. (AMD), International Business Machines (IBM), Oracle Corporation, as well as ARM* architecture licensees from ARM Limited, such as QUALCOMM Incorporated, NVIDIA

Corporation, Samsung Electronics Co., Ltd. and Texas Instruments Incorporated. The primary competitor for our McAfee family of security products and services is Symantec Corporation.

We face emerging business model competitors from OEMs that choose to vertically integrate their own proprietary semiconductor and software assets to some degree, such as Apple Inc. and Samsung. In doing so, these

OEMs may be attempting to offer greater differentiation in their products and increase their share of the profits for each finished product they sell. Unforeseen competitor acquisitions, collaborations or licensing scenarios (including injunctions

or other litigation outcomes) could also have a significant impact on our competitive position.

Our products primarily compete based on performance, energy efficiency, integration, innovative design, features,

price, quality, reliability, brand recognition and availability. One of our important competitive advantages is the combination of our network of manufacturing, assembly and test facilities with our global architecture design teams. This network

enables us to have more direct control over our processes, quality control, product cost, production timing, performance and manufacturing yield. The increased cost of constructing new fabrication facilities supporting smaller transistor geometries

and larger wafers has led to a smaller pool of companies that can afford to build and equip leading-edge manufacturing facilities. Most of our competitors rely on third-party foundries and subcontractors such as Taiwan Semiconductor Manufacturing

Company, Ltd. or GlobalFoundries Inc. for their manufacturing and assembly and test needs, creating, among other risks, the potential for supply constraints and limited process technology differentiation between competitors using the same foundry.

Manufacturing and Assembly and Test

As of December 29, 2012, 56% of our wafer fabrication, including microprocessors and chipsets, was conducted within the U.S. at our facilities in New Mexico, Arizona, Oregon, and Massachusetts. The remaining

44% of our wafer fabrication was conducted outside the U.S. at our facilities in Ireland, China, and Israel. Wafer fabrication conducted within and outside the U.S. is impacted by the timing of a facility’s transition to a newer process

technology, as well as a facility’s capacity utilization.

As of December 29, 2012, we primarily

manufactured our products in wafer fabrication facilities at the following locations:

|

|

|

|

|

|

|

| Products |

|

Wafer Size |

|

Process Technology |

|

Locations |

| Microprocessors |

|

300mm |

|

22nm |

|

Israel, Arizona, Oregon |

| Microprocessors |

|

300mm |

|

32nm |

|

New Mexico |

| Microprocessors |

|

300mm |

|

45nm |

|

New Mexico |

| Chipsets and microprocessors |

|

300mm |

|

65nm |

|

China, Arizona, Ireland |

| Other products and chipsets |

|

300mm |

|

90nm |

|

Ireland |

| Chipsets and microprocessors |

|

200mm |

|

130nm |

|

Massachusetts |

As of December 29, 2012, most of our microprocessors were manufactured on 300mm wafers using our 22nm and 32nm

process technology. As we move to each succeeding generation of manufacturing process technology, we incur significant start-up costs to prepare each factory for manufacturing. However, continuing to advance our process technology provides benefits

that we believe justify these costs. The benefits of moving to each succeeding generation of manufacturing process technology can include using less space per transistor, reducing heat output from each

transistor, and increasing the number of integrated features on each chip. These advancements can result in microprocessors that are higher performing, consume less power, and cost less to

manufacture. In addition, with each shift to a new process technology, we are able to produce more microprocessors per square foot of our wafer fabrication facilities. The costs to develop our process technology are significantly less than adding

capacity by building additional wafer fabrication facilities using older process technology.

7

We use third-party manufacturing companies (foundries) to manufacture wafers for certain components, including

networking and communications products. In addition, we primarily use subcontractors to manufacture board-level products and systems, and smartphones. We purchase certain communications networking products and mobile phone components from external

vendors primarily in the Asia-Pacific region.

Following the manufacturing process, the majority of our components are subject to assembly and test. We

perform our components assembly and test at facilities in Malaysia, China, Costa Rica, and Vietnam. To augment capacity, we use subcontractors to perform assembly of certain products, primarily chipsets and networking and communications products. In

addition, we use subcontractors to perform assembly and test of our mobile phone components.

Our NAND flash memory products are manufactured by IMFT

and Micron Technology, Inc. using 20nm, 25nm, or 34nm process technology, and assembly and test of these products is performed by Micron and other external subcontractors. For further information, see “Note 10: Equity Method and Cost Method

Investments” in Part II, Item 8 of this Form 10-K.

Our employment practices are consistent with, and we expect our suppliers and

subcontractors to abide by, local country law. In addition, we impose a minimum employee age requirement as well as progressive Environmental, Health, and Safety (EHS) requirements, regardless of local law.

We have thousands of suppliers, including subcontractors, providing our various materials and service needs. We set expectations for supplier performance and

reinforce those expectations with periodic assessments. We communicate those expectations to our suppliers regularly and work with them to implement improvements when necessary. Where possible, we seek to have several sources of supply for all of

these materials and resources, but we may rely on a single or limited number of suppliers, or upon suppliers in a single country. In those cases, we develop and implement plans and actions to reduce the exposure that would result from a disruption

in supply. We have entered into long-term contracts with certain suppliers to ensure a portion of our silicon supply.

Our products are typically manufactured at multiple Intel facilities around the world or by subcontractors. However,

some products are manufactured in only one Intel or subcontractor facility, and we seek to implement action plans to reduce the exposure that would result from a disruption at any such facility. See “Risk Factors” in Part I, Item 1A

of this Form 10-K.

Research and Development

We are committed to investing in world-class technology development, particularly in the design and manufacture of integrated circuits. Research and development (R&D) expenditures were $10.1 billion in

2012 ($8.4 billion in 2011 and $6.6 billion in 2010).

Our R&D activities are directed toward developing the technology innovations that

we believe will deliver our next generation of products, which will in turn enable new form factors and usage models for businesses and consumers. Our R&D activities range from designing and developing new products and manufacturing processes to

researching future technologies and products.

As part of our R&D efforts, we plan to introduce a new microarchitecture for our

notebook, Ultrabook system, and Intel Xeon processors approximately every two years and ramp the next generation of silicon process technology in the intervening years. We refer to this as our “tick-tock” technology development cadence as

subsequently illustrated. In 2012, we started manufacturing products with our 4th generation Intel® Core™ microarchitecture, a new microarchitecture using our existing 22nm three-dimensional Tri-Gate transistor process technology

(22nm process technology). We are currently developing 14nm process technology, our next-generation process technology, and expect to begin manufacturing products using that technology in 2013. Our leadership in silicon technology has enabled us to

make Moore’s Law a reality.

8

Our leadership in silicon technology has also helped expand on the advances anticipated by Moore’s Law by

bringing new capabilities into silicon and producing new products optimized for a wider variety of applications. We have accelerated the Intel Atom processor-based SoC roadmap for smartphones, tablets, and other devices, from 32nm through 22nm to

14nm. We intend that Intel Atom processors will eventually be on the same process technology as our leading-edge products for both smartphones and tablets. We expect that this acceleration will result in a significant reduction in transistor

leakage, lower active power, and an increase in transistor density to enable more powerful smartphones and tablets with more features and longer battery life.

We focus our R&D efforts on advanced computing technologies, developing new microarchitectures, advancing our silicon manufacturing process technology, delivering the next generation of microprocessors and

chipsets, improving our platform initiatives, and developing software solutions and tools. Our R&D efforts are intended to enable new levels of performance and address areas such as energy efficiency, security, scalability for multi-core

architectures, system manageability, and ease of use. We continue to make significant R&D investments in the development of SoCs to enable growth in areas such as smartphones, tablets, and embedded applications. For example, we continue to build

smartphone and tablet reference designs to showcase the benefits of Intel architecture. In addition, we continue to make significant investments in wireless technologies, graphics, and HPC.

Our R&D model is based on a global organization that emphasizes a collaborative approach to identifying and

developing new technologies, leading standards initiatives, and influencing regulatory policies to accelerate the adoption of new technologies, including joint pathfinding conducted between researchers at Intel Labs and our business groups. We

centrally manage key cross-business group product initiatives to align and prioritize our R&D activities across these groups. In addition, we may augment our R&D activities by investing in companies or entering into agreements with companies

that have similar R&D focus areas, as well as directly purchasing or licensing technology applicable to our R&D initiatives. An example of augmenting our R&D activities is the series of agreements we entered into in the third quarter of

2012 with ASML. These agreements, in which Intel purchased ASML securities and agreed to provide R&D funding over five years, are intended to accelerate the development of 450mm wafer technology and EUV lithography. Additionally, in the second

quarter of 2012 we entered into agreements with Micron to modify our joint venture relationship, extending Intel and Micron’s NAND joint development program and expanding it to include emerging memory technologies. For further information, see

“Note 6: Available-for-Sale Investments and Cash Equivalents” and “Note 10: Equity Method and Cost Method Investments” in Part II, Item 8 of this Form 10-K.

Employees

As of December 29, 2012, we had 105,000 employees worldwide (100,100 as of

December 31, 2011), with approximately 51% of those employees located in the U.S. (52% as of December 31, 2011).

9

Sales and Marketing

Customers

We sell our products primarily to OEMs and ODMs. ODMs provide design and/or

manufacturing services to branded and unbranded private-label resellers. In addition, we sell our products to other manufacturers, including makers of a wide range of industrial and communications equipment. Our customers also include those who buy

PC components and our other products through distributor, reseller, retail, and OEM channels throughout the world.

Our worldwide reseller sales channel

consists of thousands of indirect customers—systems builders that purchase Intel microprocessors and other products from our distributors. We have a boxed processor program that allows distributors to sell our microprocessors in small

quantities to these systems-builder customers; boxed processors are also available in direct retail outlets.

In 2012, Hewlett-Packard Company accounted

for 18% of our net revenue (19% in 2011 and 21% in 2010), Dell Inc. accounted for 14% of our net revenue (15% in 2011 and 17% in 2010), and Lenovo Group Limited accounted for 11% of our net revenue (9% in 2011 and 8% in 2010). No other customer

accounted for more than 10% of our net revenue during such periods. For information about revenue and operating income by operating segment, and revenue from unaffiliated customers by country, see “Note 28: Operating Segment and Geographic

Information” in Part II, Item 8 of this Form 10-K.

Sales Arrangements

Our products are sold through sales offices throughout the world. Sales of our products are typically made via purchase order acknowledgments that contain standard

terms and conditions covering matters such as pricing, payment terms, and warranties, as well as indemnities for issues specific to our products, such as patent and copyright indemnities. From time to time, we may enter into additional agreements

with customers covering, for example, changes from our standard terms and conditions, new product development and marketing, private-label branding, and other matters. Most of our sales are made using electronic and web-based processes that allow

the customer to review inventory availability and track the progress of specific goods ordered. Pricing on particular products may vary based on volumes ordered and other factors. We also offer discounts, rebates, and other incentives to customers

to increase acceptance of our products and technology.

Our products are typically shipped under terms that transfer title to the customer, even in arrangements for which

the recognition of revenue and related cost of sales is deferred. Our standard terms and conditions of sale typically provide that payment is due at a later date, generally 30 days after shipment or delivery. Our credit department sets accounts

receivable and shipping limits for individual customers to control credit risk to Intel arising from outstanding account balances. We assess credit risk through quantitative and qualitative analysis, and from this analysis, we establish credit

limits and determine whether we will use one or more credit support devices, such as a parent guarantee or standby letter of credit, or credit insurance. Credit losses may still be incurred due to bankruptcy, fraud, or other failure of the customer

to pay. For information about our allowance for doubtful receivables, see “Schedule II—Valuation and Qualifying Accounts” in Part IV of this Form 10-K.

Most of our sales to distributors are made under agreements allowing for price protection on unsold merchandise and a right of return on stipulated quantities of unsold merchandise. Under the price protection

program, we give distributors credits for the difference between the original price paid and the current price that we offer. On most products, there is no contractual limit on the amount of price protection, nor is there a limit on the time horizon

under which price protection is granted. The right of return granted generally consists of a stock rotation program in which distributors are able to exchange certain products based on the number of qualified purchases made by the distributor. We

have the option to grant credit for, repair, or replace defective products, and there is no contractual limit on the amount of credit that may be granted to a distributor for defective products.

Distribution

Distributors typically

handle a wide variety of products, including those that compete with our products, and fill orders for many customers. We also utilize third-party sales representatives who generally do not offer directly competitive products but may carry

complementary items manufactured by others. Sales representatives do not maintain a product inventory; instead, their customers place orders directly with us or through distributors. We have several distribution warehouses that are located in

proximity to key customers.

10

Backlog

Over time, our larger customers have generally moved to lean-inventory or just-in-time operations rather than maintaining larger inventories of our products. We have arrangements with these customers to seek to

quickly fill orders from regional warehouses. As a result, our manufacturing production is based on estimates and advance non-binding commitments from customers as to future purchases. Our order backlog as of any particular date is a mix of these

commitments and specific firm orders that are primarily made pursuant to standard purchase orders for delivery of products. Only a small portion of our orders is non-cancelable, and the dollar amount associated with the non-cancelable portion is not

significant.

Seasonal Trends

Historically, our platform sales have been higher in the second half of the year than in the first half of the year, accelerating in the third quarter and peaking in the fourth quarter; however, our sales have not

followed this trend over the past two years.

Marketing

Our corporate marketing objectives are to build a strong, well-known Intel corporate brand that connects with businesses and consumers, and to

offer a limited number of meaningful and valuable brands in our portfolio to aid businesses and consumers in making informed choices about technology purchases. The Intel® Core™ processor family and the Intel®

Atom™,

Intel®

Pentium®,

Intel®

Xeon®,

Intel® Xeon

Phi™ and

Intel®

Itanium® trademarks make up our processor brands.

We promote brand awareness and generate demand through our own direct marketing as well as through co-marketing programs. Our direct marketing activities include television, print, and Internet advertising, as well

as press relations and social media, consumer and trade events, and industry and consumer communications. We market to consumer and business audiences, and focus on building awareness and generating demand for new form factors such as Ultrabook

systems, and for increased performance, improved energy efficiency, and other capabilities such as Internet connectivity and security.

Purchases by customers often allow them to participate in cooperative advertising and marketing programs such as the Intel Inside® Program. This program broadens the reach of our brands beyond the scope of our own direct marketing. Through the Intel Inside® Program, certain customers are licensed to place Intel logos on computing devices containing our microprocessors and processor technologies, and to use

our brands in their marketing activities. The program includes a market development component that accrues funds based on purchases and partially reimburses the OEMs for marketing activities for

products featuring Intel brands, subject to the OEMs meeting defined criteria. These marketing activities primarily include television, print, and Internet marketing. We have also entered into joint marketing arrangements with certain customers.

Intellectual Property Rights and Licensing

Intellectual property (IP) that applies to our products and services includes patents, copyrights, trade secrets, trademarks, and maskwork rights. We maintain a program to protect our investment in technology by

attempting to ensure respect for our IP. The extent of the legal protection given to different types of IP varies under different countries’ legal systems. We intend to license our IP where we can obtain adequate consideration. See

“Competition” earlier in this section, “Risk Factors” in Part I, Item 1A, and “Note 27: Contingencies” in Part II, Item 8 of this Form 10-K.

We have obtained patents in the U.S. and other countries. While our patents are an important element of our success, our business as a whole is not significantly dependent on any one patent. Because of the fast

pace of innovation and product development, and the comparative pace of governments’ patenting processes, our products are often obsolete before the patents related to them expire; in some cases, our products may be obsolete before the patents

related to them are granted. As we expand our products into new industries, we also seek to extend our patent development efforts to patent such products. In addition to developing patents based on our own research and development efforts, we

purchase patents from third parties to supplement our patent portfolio. Established competitors in existing and new industries, as well as companies that purchase and enforce patents and other IP, may already have patents covering similar products.

There is no assurance that we will be able to obtain patents covering our own products, or that we will be able to obtain licenses from other companies on favorable terms or at all.

The software that we distribute, including software embedded in our component-level and platform products, is entitled to copyright and other IP protection. To distinguish our products from our competitors’

products, we have obtained trademarks and trade names for our products, and we maintain cooperative advertising programs with customers to promote our brands and to identify products containing genuine Intel components. We also protect details about

our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage.

11

In the first quarter of 2011, we entered into a long-term patent cross-license agreement with NVIDIA. Under the

agreement, we received a license to all of NVIDIA’s patents with a capture period that runs through March 2017 while NVIDIA products are licensed under our patents with the same capture period, subject to exclusions for x86 products, certain

chipsets, and certain flash memory technology products.

Compliance with Environmental, Health, and Safety Regulations

Our compliance efforts focus on monitoring regulatory and resource trends and setting company-wide performance targets for key resources and

emissions. These targets address several parameters, including product design; chemical, energy, and water use; waste recycling; the source of certain minerals used in our products; climate change; and emissions.

As a company, we focus on reducing natural resource use, the solid and chemical waste by-products of our manufacturing processes, and the environmental impact of

our products. We currently use a variety of materials in our manufacturing process that have the potential to adversely impact the environment and are subject to a variety of EHS laws and regulations. Over the past several years, we have

significantly reduced the use of lead and halogenated flame retardants in our products and manufacturing processes.

We work with the U.S. Environmental

Protection Agency (EPA), non-governmental organizations (NGOs), OEMs, and retailers to help manage e-waste (including electronic products nearing the end of their useful lives) and to promote recycling. The European Union requires producers of

certain electrical and electronic equipment to develop programs that let consumers return products for recycling. Many states in the U.S. have similar e-waste take-back laws. Although these laws are typically targeted at the end electronic

product and not the component products that we manufacture, the inconsistency of many e-waste take-back laws and the lack of local e-waste management options in many areas pose a challenge for our compliance efforts.

We are an industry leader in our efforts to build ethical sourcing of minerals for our products, including “conflict minerals” coming out of central

Africa. In 2013, Intel will continue to work to establish a “conflict-free” supply chain for our company and our industry. In 2012, Intel verified, after reasonable inquiry, that the tantalum we use in our microprocessors is

“conflict-free,” and our goal for the end of 2013 is to manufacture the world’s first verified, “conflict-free” microprocessor.

We seek to reduce our global greenhouse gas emissions by investing in energy conservation projects in our factories and working with suppliers to improve energy

efficiency. We take a holistic approach to power management, addressing the

challenge at the silicon, package, circuit, micro-architecture, macro architecture, platform, and software levels. We recognize that climate change may cause general economic risk. For further

information on the risks of climate change, see “Risk Factors” in Part I, Item 1A of this Form 10-K. We see a potential for higher energy costs driven by climate change regulations. This could include items applied to utility

companies that are passed along to customers, such as carbon taxes or costs associated with obtaining permits for our U.S. manufacturing operations, emission cap and trade programs, or renewable portfolio standards.

We are committed to sustainability and take a leadership position in promoting voluntary environmental initiatives and working proactively with governments,

environmental groups, and industry to promote global environmental sustainability. We believe that technology will be fundamental to finding solutions to the world’s environmental challenges, and we are joining forces with industry, business,

and governments to find and promote ways that technology can be used as a tool to combat climate change.

We have been purchasing wind power and other

forms of renewable energy at some of our major sites for several years. We purchase renewable energy certificates under a multi-year contract. This purchase has placed Intel at the top of the EPA’s Green Power Partnership for the past four

years and is intended to help stimulate the market for green power, leading to additional generating capacity and, ultimately, lower costs.

Distribution of Company Information

Our Internet address is www.intel.com. We publish

voluntary reports on our web site that outline our performance with respect to corporate responsibility, including EHS compliance.

We use

our Investor Relations web site, www.intc.com, as a routine channel for distribution of important information, including news releases, analyst presentations, and financial information. We post filings as soon as reasonably

practicable after they are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC), including our annual and quarterly reports on Forms 10-K and 10-Q and current reports on Form 8-K; our proxy statements; and

any amendments to those reports or statements. All such postings and filings are available on our Investor Relations web site free of charge. In addition, our Investor Relations web site allows interested persons to sign up to automatically

receive e-mail alerts when we post news releases and financial information. The SEC’s web site, www.sec.gov, contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. The content on any web site referred to in this Form 10-K is not incorporated by reference in this Form 10-K unless expressly noted.

12

Executive Officers of the Registrant

The following sets forth certain information with regard to our executive officers as of February 19, 2013 (ages are as of December 29, 2012):

|

|

|

| Andy D. Bryant, age 62 |

| • 2012 – present, |

|

Chairman of the Board |

| • 2011 – 2012, |

|

Vice Chairman of the Board, Executive VP,

Technology, Manufacturing and Enterprise Services, Chief

Administrative Officer |

| • 2009 – 2011, |

|

Executive VP, Technology, Manufacturing, and

Enterprise Services, Chief Administrative Officer |

| • 2007 – 2009, |

|

Executive VP, Finance and Enterprise Services,

Chief Administrative Officer |

| • 2001 – 2007, |

|

Executive VP, Chief Financial and Enterprise Services Officer |

| •

Member of Intel Corporation Board of Directors |

| •

Member of Columbia Sportswear Company Board of Directors |

| •

Member of McKesson Corporation Board of Directors |

| •

Joined Intel 1981 |

|

| William M. Holt, age 60 |

| • 2013 – present, |

|

Executive VP, GM, Technology and Manufacturing

Group |

| • 2006 – 2013, |

|

Senior VP, GM, Technology and Manufacturing

Group |

| • 2005 – 2006, |

|

VP, Co-GM, Technology and Manufacturing

Group |

| •

Joined Intel 1974 |

|

| Renee J. James, age 48 |

| • 2012 – present, |

|

Executive VP, GM, Software and Services

Group |

| • 2005 – 2012, |

|

Senior VP, GM, Software and Services

Group |

| • 2002 – 2005, |

|

VP, Developer Programs |

| •

Member of VMware, Inc. Board of Directors |

| •

Member of Vodafone Group plc Board of Directors |

| •

Joined Intel 1988 |

|

| Thomas M. Kilroy, age 55 |

| • 2013 – present, |

|

Executive VP, GM, Sales and Marketing Group |

| • 2010 – 2013, |

|

Senior VP, GM, Sales and Marketing Group |

| • 2009 – 2010, |

|

VP, GM, Sales and Marketing Group |

| • 2005 – 2009, |

|

VP, GM, Digital Enterprise Group |

| •

Joined Intel 1990 |

|

| Brian M. Krzanich, age 52 |

| • 2012 – present, |

|

Executive VP, Chief Operating Officer |

| • 2010 – 2012, |

|

Senior VP, GM, Manufacturing and Supply

Chain |

| • 2006 – 2010, |

|

VP, GM, Assembly and Test |

| •

Joined Intel 1982 |

|

|

|

| A. Douglas Melamed, age 67 |

| • 2009 – present, |

|

Senior VP, General Counsel |

| • 2001 – 2009, |

|

Partner, Wilmer Cutler Pickering Hale and Dorr

LLP |

| • Joined

Intel 2009 |

|

| Paul S. Otellini, age 62 |

| • 2005 – present, |

|

President, Chief Executive Officer |

| • Member

of Intel Corporation Board of Directors |

| • Member

of Google, Inc. Board of Directors |

| • Joined

Intel 1974 |

|

| David Perlmutter, age 59 |

| • 2012 – present, |

|

Executive VP, GM, Intel Architecture Group, Chief Product Officer |

| • 2009 – 2012, |

|

Executive VP, GM, Intel Architecture Group |

| • 2007 – 2009, |

|

Executive VP, GM, Mobility Group |

| • 2005 – 2007, |

|

Senior VP, GM, Mobility Group |

| • Joined

Intel 1980 |

|

| Stacy J. Smith, age 50 |

| • 2012 – present, |

|

Executive VP, Chief Financial Officer, Director of

Corporate Strategy |

| • 2010 – 2012, |

|

Senior VP, Chief Financial Officer |

| • 2007 – 2010, |

|

VP, Chief Financial Officer |

| • 2006 – 2007, |

|

VP, Assistant Chief Financial Officer |

| • 2004 – 2006, |

|

VP, Finance and Enterprise Services, Chief

Information Officer |

| • Member

of Autodesk, Inc. Board of Directors |

| • Member

of Gevo, Inc. Board of Directors |

| • Joined

Intel 1988 |

|

| Arvind Sodhani, age 58 |

| • 2007 – present, |

|

Executive VP of Intel, President of Intel

Capital |

| • 2005 – 2007, |

|

Senior VP of Intel, President of Intel Capital |

| • Member

of SMART Technologies, Inc. Board of Directors |

| • Joined

Intel 1981 |

13

Changes

in product demand may harm our financial results and are hard to predict.

If product demand decreases, our revenue and profit could be harmed.

Important factors that could cause demand for our products to decrease include changes in:

| • |

|

business conditions, including downturns in the computing industry, regional economies, and the overall economy; |

| • |

|

consumer confidence or income levels caused by changes in market conditions, including changes in government borrowing, taxation, or spending policies; the

credit market; or expected inflation, employment, and energy or other commodity prices; |

| • |

|

the level of customers’ inventories; |

| • |

|

competitive and pricing pressures, including actions taken by competitors; |

| • |

|

customer product needs; |

| • |

|

market acceptance of our products and maturing product cycles; and |

| • |

|

the technology supply chain, including supply constraints caused by natural disasters or other events. |

Our operations have high costs—including costs related to facility construction and equipment, R&D, and employment and training of a highly skilled

workforce—that are either fixed or difficult to reduce in the short term. At the same time, demand for our products is highly variable. If product demand decreases or we fail to forecast demand accurately, we could be required to write off

inventory or record excess capacity charges, which would lower our gross margin. Our manufacturing or assembly and test capacity could be underutilized, and we may be required to write down our long-lived assets, which would increase our expenses.

Factory-planning decisions may shorten the useful lives of facilities and equipment and cause us to accelerate depreciation. If product demand increases, we may be unable to add capacity fast enough to meet market demand. These changes in product

demand, and changes in our customers’ product needs, could negatively affect our competitive position and may reduce our revenue, increase our costs, lower our gross margin percentage, or require us to write down our assets.

We operate in highly competitive industries, and our failure to anticipate and respond to technological and market developments could harm

our ability to compete.

We operate in highly competitive industries that experience rapid technological and market developments, changes in

industry standards, changes in customer needs, and frequent product introductions and improvements. If we are unable to

anticipate and respond to these developments, we may weaken our competitive position, and our products or technologies may be uncompetitive or obsolete. As computing market segments emerge, such

as smartphones, tablets, and consumer electronics devices, we face new sources of competition and customers with different needs than customers in our PC business. Some of our competitors in these market segments are pursuing a vertical integration

strategy, incorporating their SoC solutions into the smartphones and tablets they offer, which could make it less likely that they will adopt our SoC solutions. To be successful, we need to cultivate new industry relationships in these market

segments. As the number and variety of Internet-connected devices increase, we need to improve the cost, connectivity, energy efficiency, and security of our platforms to succeed in these market segments. And we need to expand our software

capabilities to provide customers with comprehensive computing solutions.

To compete successfully, we must maintain a successful R&D effort,

develop new products and production processes, and improve our existing products and processes ahead of competitors. Our R&D efforts are critical to our success and are aimed at solving complex problems, and we do not expect all of our projects

to be successful. We may be unable to develop and market new products successfully, and the products we invest in and develop may not be well received by customers. Additionally, the products and technologies offered by others may affect demand for

our products. These types of events could negatively affect our competitive position and may reduce revenue, increase costs, lower gross margin percentage, or require us to impair our assets.

Changes in the mix of products sold may harm our financial results.

Because of the wide

price differences of platform average selling prices among our data center, PC client, and other Intel architecture platforms, a change in the mix of platforms among these market segments may impact our revenue and gross margin. For example, our PC

client platforms that are incorporated in notebook and desktop computers tend to have lower average selling prices and gross margin than our data center platforms that are incorporated in servers, workstations and storage products. Therefore, if

there is less demand for our data center platforms, and a resulting mix shift to our PC client platforms, our gross margins and revenue would decrease. Also, more recently introduced products tend to have higher costs because of initial development

costs and lower production volumes relative to the previous product generation, which can impact gross margin.

14

Our global operations subject us to risks that may harm our results of operations and financial

condition.

We have sales offices, R&D, manufacturing, assembly and test facilities, and other facilities in many countries, and some

business activities may be concentrated in one or more geographic areas. As a result, our ability to manufacture, assemble and test, design, develop, or sell products may be affected by:

| • |

|

security concerns, such as armed conflict and civil or military unrest, crime, political instability, and terrorist activity; |

| • |

|

natural disasters and health concerns; |

| • |

|

inefficient and limited infrastructure and disruptions, such as supply chain interruptions and large-scale outages or interruptions of service from utilities,

transportation, or telecommunications providers; |

| • |

|

restrictions on our operations by governments seeking to support local industries, nationalization of our operations, and restrictions on our ability to

repatriate earnings; |

| • |

|

differing employment practices and labor issues; and |

| • |

|

local business and cultural factors that differ from our normal standards and practices, including business practices that we are prohibited from engaging in by

the Foreign Corrupt Practices Act (FCPA) and other anti-corruption laws and regulations. |

Legal and regulatory requirements differ

among jurisdictions worldwide. Violations of these laws and regulations could result in fines; criminal sanctions against us, our officers, or our employees; prohibitions on the conduct of our business; and damage to our reputation. Although we have

policies, controls, and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Although most of our sales occur in U.S. dollars, expenses such as payroll, utilities, tax, and marketing expenses may be paid in local currencies. We also conduct

certain investing and financing activities in local currencies. Our hedging programs reduce, but do not eliminate, the impact of currency exchange rate movements; therefore, changes in exchange rates could harm our results of operations and

financial condition. Changes in tariff and import regulations and in U.S. and non-U.S. monetary policies may harm our results of operations and financial condition by increasing our expenses and reducing revenue. Differing tax rates in various

jurisdictions could harm our results of operations and financial condition by increasing our overall tax rate.

We maintain a program of insurance

coverage for a variety of property, casualty, and other risks. We place our insurance coverage with multiple carriers in numerous jurisdictions. However, one or more of our insurance providers may be

unable or unwilling to pay a claim. The types and amounts of insurance we obtain vary depending on availability, cost, and decisions with respect to risk retention. The policies have deductibles

and exclusions that result in us retaining a level of self-insurance. Losses not covered by insurance may be large, which could harm our results of operations and financial condition.

Failure to meet our production targets, resulting in undersupply or oversupply of products, may harm our business and results of operations.

Production of integrated circuits is a complex process. Disruptions in this process can result from errors; difficulties in our development and implementation of

new processes; defects in materials; disruptions in our supply of materials or resources; and disruptions at our fabrication and assembly and test facilities due to accidents, maintenance issues, or unsafe working conditions—all of which could

affect the timing of production ramps and yields. We may not be successful or efficient in developing or implementing new production processes. Production issues may result in our failure to meet or increase production as desired, resulting in

higher costs or large decreases in yields, which could affect our ability to produce sufficient volume to meet product demand. The unavailability or reduced availability of products could make it more difficult to deliver computing platforms. The

occurrence of these events could harm our business and results of operations.

We may have difficulties obtaining the resources or

products we need for manufacturing, assembling and testing our products, or operating other aspects of our business, which could harm our ability to meet demand and increase our costs.

We have thousands of suppliers providing materials that we use in production and other aspects of our business, and where possible, we seek to have several sources of supply for all of those materials. However, we

may rely on a single or a limited number of suppliers, or upon suppliers in a single location, for these materials. The inability of suppliers to deliver adequate supplies of production materials or other supplies could disrupt our production

processes or make it more difficult for us to implement our business strategy. Production could be disrupted by the unavailability of resources used in production, such as water, silicon, electricity, gases, and other materials. Future environmental

regulations could restrict the supply or increase the cost of materials that we use in our business and make it more difficult to obtain permits to build or modify manufacturing capacity to meet demand. The unavailability or reduced availability of

materials or resources may require us to reduce production or incur additional costs. The occurrence of these events could harm our business and results of operations.

15

Costs related to product defects and errata may harm our results of operations and business.

Costs of product defects and errata (deviations from published specifications) due to, for example, problems in our design and manufacturing

processes, could include:

| • |

|

writing off the value of inventory; |

| • |

|

disposing of products that cannot be fixed; |

| • |

|

recalling products that have been shipped; |

| • |

|

providing product replacements or modifications; and |

| • |

|

defending against litigation. |

These costs

could be large and may increase expenses and lower gross margin. Our reputation with customers or end users could be damaged as a result of product defects and errata, and product demand could be reduced. The announcement of product defects and

errata could cause customers to purchase products from competitors as a result of possible shortages of Intel components or for other reasons. These factors could harm our business and financial results.

Third parties might attempt to breach our network security and our products and services, which could damage our reputation and financial

results.

We regularly face attempts by others to gain unauthorized access through the Internet or to introduce malicious software to our IT

systems. Additionally, malicious hackers may attempt to gain unauthorized access and corrupt the processes of hardware and software products that we manufacture and services we provide. These attempts might be the result of industrial or other

espionage or actions by hackers seeking to harm our company, our products and services, or users of our products and services. Due to the widespread use of our products and due to the high profile of our McAfee subsidiary, we or our products

and services are a frequent target of computer hackers and organizations that intend to sabotage, take control of, or otherwise corrupt our manufacturing or other processes, products and services. We are also a target of malicious attackers who

attempt to gain access to our network or data centers or those of our customers or end users, steal proprietary information related to our business, products, employees and customers, or interrupt our systems and services or those of our customers

or others. We believe such attempts are increasing in number and in technical sophistication. These attacks are sometimes successful; and in some instances we, our customers and the users of our products and services might be unaware of an incident

or its magnitude and effects. We seek to detect and investigate such attempts and incidents and to prevent their recurrence where practicable through changes to our internal processes and tools and/or changes or patches to our products and services,

but in some cases preventive and remedial action might not be successful. Such attacks,

whether successful or unsuccessful, could result in our incurring costs related to, for example, rebuilding internal systems, reduced inventory value, providing modifications to our products

and services, defending against litigation, responding to regulatory inquiries or actions, paying damages, or taking other remedial steps with respect to third parties. Publicity about vulnerabilities and attempted or successful incursions

could damage our reputation with customers or users and reduce demand for our products and services.

We may be subject to theft,

loss or misuse of personal data about us or our customers or other third parties, which could increase our expenses, damage our reputation or result in litigation.

Global privacy legislation, enforcement, and policy activity are rapidly expanding and creating a complex compliance environment. The theft, loss, or misuse of personal data collected, used, stored, or transferred

by us to run our business could result in increased security costs or costs related to defending legal claims. Costs to comply with and implement privacy-related and data protection measures could be significant. Our failure to comply with federal,

state, or international privacy-related or data protection laws and regulations could result in proceedings against us by governmental entities or others.

Third parties may claim infringement of IP rights, which could harm our business.

We

may face IP rights infringement claims from individuals and companies, including those who have acquired patent portfolios to assert claims against other companies. We are engaged in a number of litigation matters involving IP rights. Claims that

our products or processes infringe the IP rights of others could cause us to incur large costs to respond to, defend, and resolve the claims, and they may divert the efforts and attention of management and technical personnel. As a result of IP

rights infringement claims, we could:

| • |

|

pay infringement claims; |

| • |

|

stop manufacturing, using, or selling products or technology subject to infringement claims; |

| • |

|

develop other products or technology not subject to infringement claims, which could be time-consuming, costly or impossible; or |

| • |

|

license technology from the party claiming infringement, which license may not be available on commercially reasonable terms. |

These actions could harm our competitive position, result in expenses, or require us to impair our assets. If we alter or stop production of affected items, our

revenue could be harmed.

16

We may be unable to enforce or protect our IP rights, which may harm our ability to compete and

may harm our business.

Our ability to enforce our patents, copyrights, software licenses, and other IP rights is subject to general litigation

risks, as well as uncertainty as to the enforceability of our IP rights in various countries. When we seek to enforce our rights, we are often subject to claims that the IP rights are invalid, not enforceable, or licensed to the opposing party. Our

assertion of IP rights often results in the other party seeking to assert claims against us, which could harm our business. Governments may adopt regulations—and governments or courts may render decisions—requiring compulsory licensing of

IP rights, or governments may require products to meet standards that serve to favor local companies. Our inability to enforce our IP rights under these circumstances may harm our competitive position and business.