intc-202309300000050863December 312023Q3FALSE97,12293,3864,2164,1374,2164,1370.130.730.621.4600000508632023-01-012023-09-3000000508632023-10-20xbrli:shares00000508632023-07-022023-09-30iso4217:USD00000508632022-07-032022-10-0100000508632021-12-262022-10-01iso4217:USDxbrli:shares00000508632023-09-3000000508632022-12-3100000508632021-12-2500000508632022-10-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-07-010000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-010000050863us-gaap:RetainedEarningsMember2023-07-010000050863us-gaap:NoncontrollingInterestMember2023-07-0100000508632023-07-010000050863us-gaap:RetainedEarningsMember2023-07-022023-09-300000050863us-gaap:NoncontrollingInterestMember2023-07-022023-09-300000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-022023-09-300000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-07-022023-09-300000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-09-300000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000050863us-gaap:RetainedEarningsMember2023-09-300000050863us-gaap:NoncontrollingInterestMember2023-09-300000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-07-020000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-020000050863us-gaap:RetainedEarningsMember2022-07-020000050863us-gaap:NoncontrollingInterestMember2022-07-0200000508632022-07-020000050863us-gaap:RetainedEarningsMember2022-07-032022-10-010000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-032022-10-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-07-032022-10-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-010000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-010000050863us-gaap:RetainedEarningsMember2022-10-010000050863us-gaap:NoncontrollingInterestMember2022-10-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-12-310000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000050863us-gaap:RetainedEarningsMember2022-12-310000050863us-gaap:NoncontrollingInterestMember2022-12-310000050863us-gaap:RetainedEarningsMember2023-01-012023-09-300000050863us-gaap:NoncontrollingInterestMember2023-01-012023-09-300000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-012023-09-300000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-12-250000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-250000050863us-gaap:RetainedEarningsMember2021-12-250000050863us-gaap:NoncontrollingInterestMember2021-12-250000050863us-gaap:RetainedEarningsMember2021-12-262022-10-010000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-262022-10-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-12-262022-10-010000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMemberintc:DesktopMember2023-07-022023-09-300000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMemberintc:DesktopMember2022-07-032022-10-010000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMemberintc:DesktopMember2023-01-012023-09-300000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMemberintc:DesktopMember2021-12-262022-10-010000050863intc:ClientComputingGroupMemberintc:NotebookMemberus-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863intc:ClientComputingGroupMemberintc:NotebookMemberus-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863intc:ClientComputingGroupMemberintc:NotebookMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863intc:ClientComputingGroupMemberintc:NotebookMemberus-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863intc:ClientComputingGroupMemberus-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863us-gaap:OperatingSegmentsMemberintc:DatacenterAndAIMember2023-07-022023-09-300000050863us-gaap:OperatingSegmentsMemberintc:DatacenterAndAIMember2022-07-032022-10-010000050863us-gaap:OperatingSegmentsMemberintc:DatacenterAndAIMember2023-01-012023-09-300000050863us-gaap:OperatingSegmentsMemberintc:DatacenterAndAIMember2021-12-262022-10-010000050863intc:NetworkAndEdgeMemberus-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863intc:NetworkAndEdgeMemberus-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863intc:NetworkAndEdgeMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863intc:NetworkAndEdgeMemberus-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863intc:MobileyeMemberus-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863intc:MobileyeMemberus-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863intc:MobileyeMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863intc:MobileyeMemberus-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863us-gaap:OperatingSegmentsMemberintc:IntelFoundryServicesMember2023-07-022023-09-300000050863us-gaap:OperatingSegmentsMemberintc:IntelFoundryServicesMember2022-07-032022-10-010000050863us-gaap:OperatingSegmentsMemberintc:IntelFoundryServicesMember2023-01-012023-09-300000050863us-gaap:OperatingSegmentsMemberintc:IntelFoundryServicesMember2021-12-262022-10-010000050863us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-07-022023-09-300000050863us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-07-032022-10-010000050863us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-012023-09-300000050863us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-12-262022-10-010000050863us-gaap:OperatingSegmentsMember2023-07-022023-09-300000050863us-gaap:OperatingSegmentsMember2022-07-032022-10-010000050863us-gaap:OperatingSegmentsMember2023-01-012023-09-300000050863us-gaap:OperatingSegmentsMember2021-12-262022-10-010000050863intc:ClientComputingGroupMember2023-07-022023-09-300000050863intc:ClientComputingGroupMember2022-07-032022-10-010000050863intc:ClientComputingGroupMember2023-01-012023-09-300000050863intc:ClientComputingGroupMember2021-12-262022-10-010000050863intc:DatacenterAndAIMember2023-07-022023-09-300000050863intc:DatacenterAndAIMember2022-07-032022-10-010000050863intc:DatacenterAndAIMember2023-01-012023-09-300000050863intc:DatacenterAndAIMember2021-12-262022-10-010000050863intc:NetworkAndEdgeMember2023-07-022023-09-300000050863intc:NetworkAndEdgeMember2022-07-032022-10-010000050863intc:NetworkAndEdgeMember2023-01-012023-09-300000050863intc:NetworkAndEdgeMember2021-12-262022-10-010000050863intc:MobileyeMember2023-07-022023-09-300000050863intc:MobileyeMember2022-07-032022-10-010000050863intc:MobileyeMember2023-01-012023-09-300000050863intc:MobileyeMember2021-12-262022-10-010000050863intc:IntelFoundryServicesMember2023-07-022023-09-300000050863intc:IntelFoundryServicesMember2022-07-032022-10-010000050863intc:IntelFoundryServicesMember2023-01-012023-09-300000050863intc:IntelFoundryServicesMember2021-12-262022-10-010000050863us-gaap:AllOtherSegmentsMember2023-07-022023-09-300000050863us-gaap:AllOtherSegmentsMember2022-07-032022-10-010000050863us-gaap:AllOtherSegmentsMember2023-01-012023-09-300000050863us-gaap:AllOtherSegmentsMember2021-12-262022-10-010000050863intc:ArizonaFabLLCMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-09-30xbrli:pure0000050863us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberintc:ArizonaFabLLCMember2023-01-012023-09-300000050863intc:ArizonaFabLLCMember2023-01-012023-09-300000050863intc:IntelCorporationAndBrookfieldAssetManagementMemberintc:SemiconductorCoInvestmentProgramConstructionCostsMember2023-09-300000050863us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300000050863us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310000050863intc:ArizonaFabLLCMember2023-09-300000050863intc:ArizonaFabLLCMember2022-12-310000050863intc:ArizonaFabLLCMember2023-07-022023-09-300000050863intc:MobileyeMember2021-12-262022-12-310000050863intc:MobileyeMember2023-04-022023-07-010000050863intc:MobileyeMember2023-07-010000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMemberintc:MobileyeMember2023-04-022023-07-010000050863intc:MobileyeMember2023-09-300000050863intc:MobileyeMember2022-12-310000050863intc:MobileyeMember2023-07-022023-09-300000050863intc:MobileyeMember2023-01-012023-09-300000050863intc:IMSNanofabricationGmbHIMSMember2023-08-012023-08-310000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMemberintc:IMSNanofabricationGmbHIMSMember2023-08-012023-08-310000050863intc:IMSNanofabricationGmbHIMSMember2023-09-300000050863intc:IMSNanofabricationGmbHIMSMember2023-01-012023-09-300000050863intc:IMSNanofabricationGmbHIMSMember2023-07-022023-09-300000050863srt:ScenarioForecastMemberintc:IMSNanofabricationGmbHIMSMember2023-10-012023-12-300000050863intc:TaiwanSemiconductorManufacturingCompanyLtdTSMCMembersrt:ScenarioForecastMemberintc:IMSNanofabricationGmbHIMSMember2023-10-012023-12-300000050863intc:MachineryAndEquipmentCertainProductionAssetsMember2022-12-310000050863intc:MachineryAndEquipmentCertainProductionAssetsMember2023-01-010000050863us-gaap:ServiceLifeMember2023-07-022023-09-300000050863us-gaap:ServiceLifeMember2023-01-012023-09-300000050863us-gaap:ServiceLifeMember2023-09-300000050863intc:NANDMemoryBusinessMember2022-07-032022-10-010000050863intc:A2022RestructuringProgramMember2022-12-310000050863intc:A2022RestructuringProgramMember2023-01-012023-09-300000050863intc:A2022RestructuringProgramMember2023-09-300000050863intc:EcFineMember2023-07-022023-09-300000050863intc:EcFineMember2021-12-262022-04-020000050863intc:TowerSemiconductorLtdMember2022-04-020000050863intc:TowerSemiconductorLtdMember2023-07-022023-09-300000050863us-gaap:AvailableforsaleSecuritiesMember2023-09-300000050863us-gaap:AvailableforsaleSecuritiesMember2022-12-310000050863us-gaap:AvailableforsaleSecuritiesMember2023-07-022023-09-300000050863us-gaap:AvailableforsaleSecuritiesMember2023-01-012023-09-300000050863us-gaap:AvailableforsaleSecuritiesMember2022-07-032022-10-010000050863us-gaap:AvailableforsaleSecuritiesMember2021-12-262022-10-010000050863intc:McAfeeMember2023-07-022023-09-300000050863intc:NANDMemoryBusinessMember2020-10-192020-10-190000050863intc:NANDMemoryBusinessMember2021-12-292021-12-290000050863intc:NANDMemoryBusinessMember2023-09-300000050863intc:NANDMemoryBusinessMember2020-10-310000050863intc:NANDMemoryBusinessDivestitureMembersrt:AffiliatedEntityMember2023-09-300000050863intc:NANDMemoryBusinessDivestitureMembersrt:AffiliatedEntityMembersrt:ScenarioForecastMember2023-01-012023-12-300000050863intc:OregonandArizonaBondsMember2023-09-300000050863intc:OregonandArizonaBondsMembersrt:MinimumMember2023-09-300000050863srt:MaximumMemberintc:OregonandArizonaBondsMember2023-09-300000050863us-gaap:SeniorNotesMember2023-07-010000050863intc:VariableRateRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-04-022023-07-010000050863intc:VariableRateRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-07-010000050863intc:CreditFacilityAgreementMemberus-gaap:LineOfCreditMember2023-04-022023-07-010000050863intc:CreditFacilityAgreementMemberus-gaap:LineOfCreditMember2023-07-010000050863us-gaap:CommercialPaperMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentAssetsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentAssetsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentAssetsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2022-12-310000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-09-300000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000050863us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-09-300000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000050863us-gaap:FairValueMeasurementsNonrecurringMember2023-09-300000050863us-gaap:FairValueMeasurementsNonrecurringMember2022-12-310000050863us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310000050863us-gaap:ForeignExchangeContractMember2023-09-300000050863us-gaap:ForeignExchangeContractMember2022-12-310000050863us-gaap:InterestRateContractMember2023-09-300000050863us-gaap:InterestRateContractMember2022-12-310000050863us-gaap:OtherContractMember2023-09-300000050863us-gaap:OtherContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:OtherContractMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:OtherContractMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMemberus-gaap:OtherContractMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:OtherContractMember2022-12-310000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2023-09-300000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2023-09-300000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2022-12-310000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2022-12-310000050863us-gaap:OtherAssetsMember2023-09-300000050863us-gaap:OtherLiabilitiesMember2023-09-300000050863us-gaap:OtherAssetsMember2022-12-310000050863us-gaap:OtherLiabilitiesMember2022-12-310000050863us-gaap:ForeignExchangeContractMember2023-07-022023-09-300000050863us-gaap:ForeignExchangeContractMember2023-01-012023-09-300000050863us-gaap:ForeignExchangeContractMember2022-07-032022-10-010000050863us-gaap:ForeignExchangeContractMember2021-12-262022-10-010000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:FairValueHedgingMember2023-01-012023-09-300000050863us-gaap:InterestRateContractMember2023-07-022023-09-300000050863us-gaap:InterestRateContractMember2022-07-032022-10-010000050863us-gaap:InterestRateContractMember2023-01-012023-09-300000050863us-gaap:InterestRateContractMember2021-12-262022-10-010000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:LongTermDebtMember2023-09-300000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:LongTermDebtMember2022-12-310000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:LongTermDebtMember2023-01-012023-09-300000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:LongTermDebtMember2023-01-012023-07-010000050863us-gaap:NondesignatedMember2023-01-012023-09-300000050863us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-07-022023-09-300000050863us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-07-032022-10-010000050863us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-01-012023-09-300000050863us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-262022-10-010000050863us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-07-022023-09-300000050863us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-07-032022-10-010000050863us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-01-012023-09-300000050863us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2021-12-262022-10-010000050863us-gaap:NondesignatedMemberus-gaap:OtherContractMember2023-07-022023-09-300000050863us-gaap:NondesignatedMemberus-gaap:OtherContractMember2022-07-032022-10-010000050863us-gaap:NondesignatedMemberus-gaap:OtherContractMember2023-01-012023-09-300000050863us-gaap:NondesignatedMemberus-gaap:OtherContractMember2021-12-262022-10-010000050863us-gaap:NondesignatedMember2023-07-022023-09-300000050863us-gaap:NondesignatedMember2022-07-032022-10-010000050863us-gaap:NondesignatedMember2021-12-262022-10-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | | | | | | | |

| | ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended | September 30, 2023 |

or

| | | | | | | | |

| | ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number: 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | 94-1672743 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2200 Mission College Boulevard, | Santa Clara, | California | | 95054-1549 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 765-8080

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company | Emerging growth company |

☑

| | ¨ | | ¨ | | ☐ | ☐ |

| | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of October 20, 2023, the registrant had outstanding 4,216 million shares of common stock.

Table of Contents

Organization of Our Form 10-Q

The order and presentation of content in our Form 10-Q differs from the traditional SEC Form 10-Q format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-Q Cross-Reference Index" within Other Key Information for a cross-reference index to the traditional SEC Form 10-Q format.

We have defined certain terms and abbreviations used throughout our Form 10-Q in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details.

The preparation of our Consolidated Condensed Financial Statements is in conformity with US GAAP. Our Form 10-Q includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information. | | | | | | | | | | | |

| | | Page |

Forward-Looking Statements | |

Availability of Company Information | |

A Quarter in Review | |

Consolidated Condensed Financial Statements and Supplemental Details | |

| Consolidated Condensed Statements of Income | |

| Consolidated Condensed Statements of Comprehensive Income | |

| Consolidated Condensed Balance Sheets | |

| Consolidated Condensed Statements of Cash Flows | |

| Consolidated Condensed Statements of Stockholders' Equity | |

| Notes to Consolidated Condensed Financial Statements | |

| Key Terms | |

| | | |

Management's Discussion and Analysis (MD&A) | |

| | |

| | |

| Segment Trends and Results | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Consolidated Condensed Results of Operations | |

| Liquidity and Capital Resources | |

| | |

| | |

| Non-GAAP Financial Measures | |

| | | |

Other Key Information | |

| | |

| Form 8-K Disclosable Events | |

| Quantitative and Qualitative Disclosures About Market Risk | |

| Risk Factors | |

| Controls and Procedures | |

| | |

| Issuer Purchases of Equity Securities | |

| Rule 10b5-1 Trading Arrangements | |

| Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 | |

| Exhibits | |

| Form 10-Q Cross-Reference Index | |

Forward-Looking Statements

This Form 10-Q contains forward-looking statements that involve a number of risks and uncertainties. Words such as "accelerate", "achieve", "aim", "ambitions", "anticipate", "believe", "committed", "continue", "could", "designed", "estimate", "expect", "forecast", "future", "goals", "grow", "guidance", "intend", "likely", "may", "might", "milestones", "next generation", "objective", "on track", "opportunity", "outlook", "pending", "plan", "position", "potential", "possible", "predict", "progress", "ramp", "roadmap", "seeks", "should", "strive", "targets", "to be", "upcoming", "will", "would", and variations of such words and similar expressions are intended to identify such forward-looking statements, which may include statements regarding:

•our business plans and strategy and anticipated benefits therefrom, including with respect to our IDM 2.0 strategy, our partnership with Brookfield, the transition to an internal foundry model, updates to our reporting structure and our AI strategy;

•projections of our future financial performance, including future revenue, gross margins, capital expenditures, and cash flows;

•projected costs and yield trends;

•future cash requirements and the availability, uses, sufficiency, and cost of capital resources, and sources of funding, including future capital and R&D investments, credit rating expectations, and expected returns to stockholders, such as stock repurchases and dividends;

•future products, services and technologies, and the expected goals, timeline, ramps, progress, availability, production, regulation and benefits of such products, services and technologies, including future process nodes and packaging technology, product roadmaps, schedules, future product architectures, expectations regarding process performance, per-watt parity, and metrics and expectations regarding product and process leadership;

•investment plans, and impacts of investment plans, including in the US and abroad;

•internal and external manufacturing plans, including future internal manufacturing volumes, manufacturing expansion plans and the financing therefor, and external foundry usage;

•future production capacity and product supply;

•supply expectations, including regarding constraints, limitations, pricing, and industry shortages;

•plans and goals related to Intel’s foundry business, including with respect to anticipated customers, future manufacturing capacity and service, technology and IP offerings;

•expected timing and impact of acquisitions, divestitures, and other significant transactions, including the sale of our NAND memory business;

•expected completion and impacts of restructuring activities and cost-saving or efficiency initiatives, including those related to the 2022 Restructuring Program;

•future social and environmental performance goals, measures, strategies and results;

•our anticipated growth, future market share, and trends in our businesses and operations;

•projected growth and trends in markets relevant to our businesses;

•anticipated trends and impacts related to industry component, substrate, and foundry capacity utilization, shortages and constraints;

•expectations regarding government incentives;

•future technology trends and developments, such as AI;

•future macro environmental and economic conditions;

•future responses to and effects of COVID-19;

•geopolitical conditions;

•tax- and accounting-related expectations;

•expectations regarding our relationships with certain sanctioned parties; and

•other characterizations of future events or circumstances.

Such statements involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied, including:

•changes in demand for our products;

•changes in product mix;

•the complexity and fixed cost nature of our manufacturing operations;

•the high level of competition and rapid technological change in our industry;

•the significant upfront investments in R&D and our business, products, technologies, and manufacturing capabilities;

•vulnerability to new product development and manufacturing-related risks, including product defects or errata, particularly as we develop next generation products and implement next generation process technologies;

•risks associated with a highly complex global supply chain, including from disruptions, delays, trade tensions, or shortages;

•sales-related risks, including customer concentration and the use of distributors and other third parties;

•potential security vulnerabilities in our products;

•cybersecurity and privacy risks;

•investment and transaction risk;

•IP risks and risks associated with litigation and regulatory proceedings;

•evolving regulatory and legal requirements across many jurisdictions;

•geopolitical and international trade conditions, including the impacts of Russia's war on Ukraine, recent events in Israel and rising tensions between the US and China;

•our debt obligations and our ability to access sources of capital;

•risks of large scale global operations;

•macroeconomic conditions, including regional or global downturns or recessions;

•impacts of the COVID-19 or similar such pandemic;

•other risks and uncertainties described in this report, our 2022 Form 10-K and our other filings with the SEC.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-Q and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business.

Unless specifically indicated otherwise, the forward-looking statements in this Form 10-Q do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-Q are based on management's expectations as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable. We do not undertake, and expressly disclaim any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Availability of Company Information

We use our Investor Relations website, www.intc.com, as a routine channel for distribution of important, and often material, information about us, including our quarterly and annual earnings results and presentations, press releases, announcements, information about upcoming webcasts, analyst presentations, and investor days, archives of these events, financial information, corporate governance practices, and corporate responsibility information. We do not distribute our financial results via a news wire service. All such information is available on our Investor Relations website free of charge. Our Investor Relations website allows interested persons to sign up to automatically receive e-mail alerts when we post financial information and issue press releases, and to receive information about upcoming events. We encourage interested persons to follow our Investor Relations website in addition to our filings with the SEC to timely receive information about the company.

Intel, the Intel logo, Intel Core, and Intel Optane are trademarks of Intel Corporation or its subsidiaries in the US and/or other countries.

* Other names and brands may be claimed as the property of others.

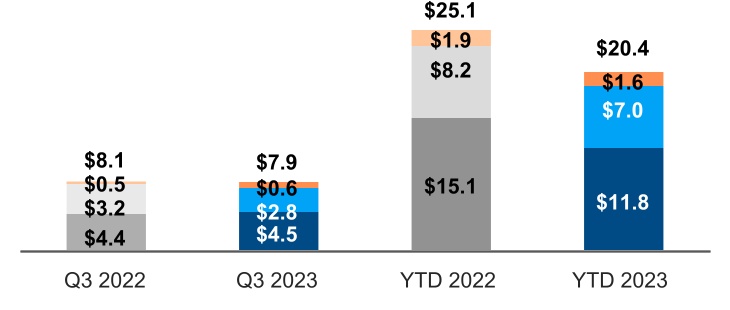

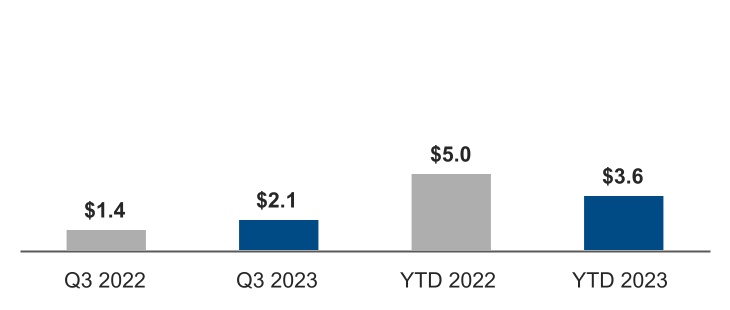

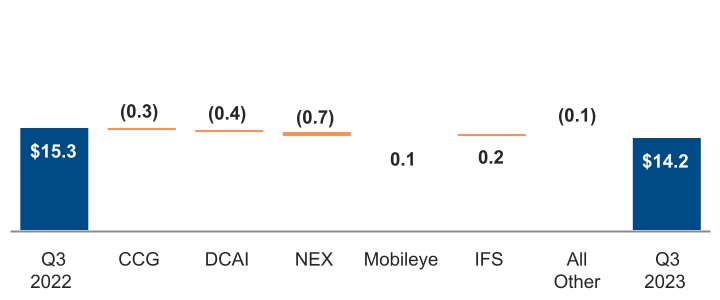

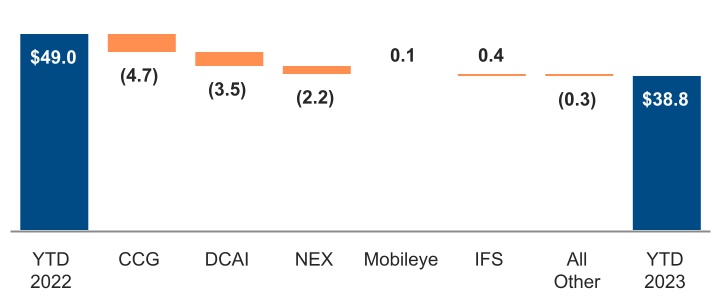

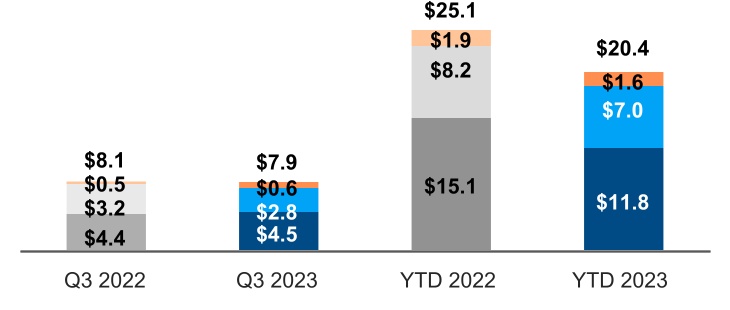

Total revenue of $14.2 billion was down $1.2 billion or 8% from Q3 2022, as CCG revenue decreased 3%, DCAI revenue decreased 10%, and NEX revenue decreased 32%. CCG revenue decreased due to lower desktop volume from lower demand across business market segments and lower notebook ASPs due to a higher mix of small core products combined with a higher mix of older generation products. This was partially offset by higher notebook volume, as customer inventory levels began to normalize and higher desktop ASPs due to an increased mix of product sales to the commercial and gaming market segments. DCAI revenue decreased due to lower server volume resulting from a softening CPU data center market, partially offset by higher ASPs from a lower mix of hyperscale customer-related revenue and a higher mix of high core count products. NEX revenue decreased as customers tempered purchases to reduce inventories and adjust to a lower demand environment across product lines.

| | | | | | | | | | | | | | | | | | | | |

| Revenue | | Gross Margin | | Diluted EPS attributable to Intel | | Cash Flows |

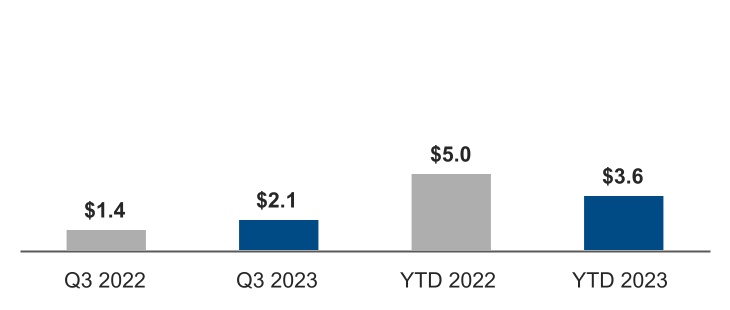

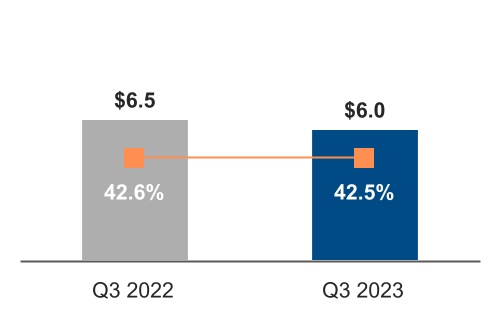

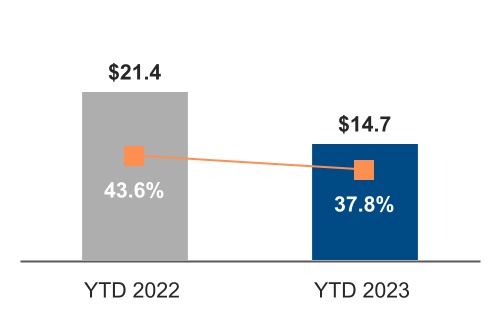

■ GAAP $B | | ■ GAAP ■ Non-GAAP | | ■ GAAP ■ Non-GAAP | | ■ Operating Cash Flow $B ■ Adjusted Free Cash Flow $B |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

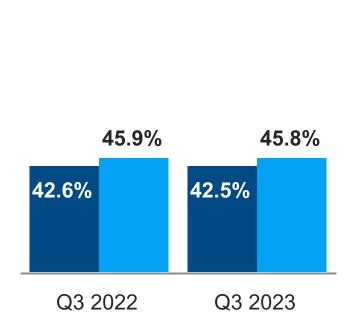

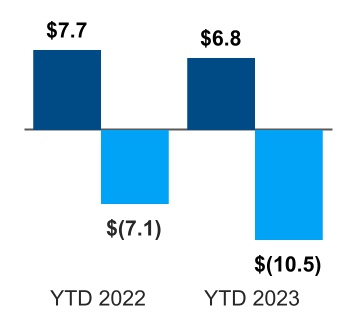

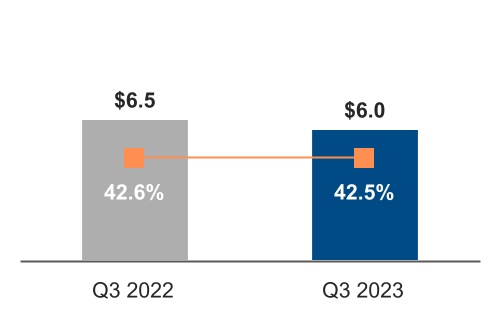

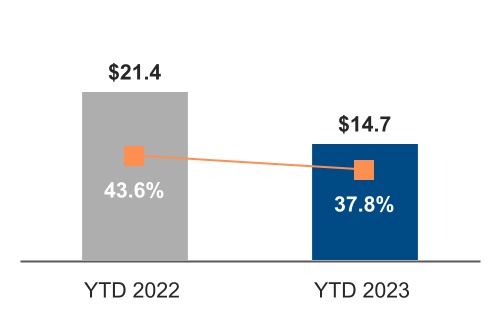

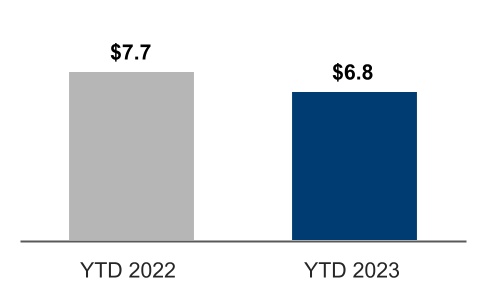

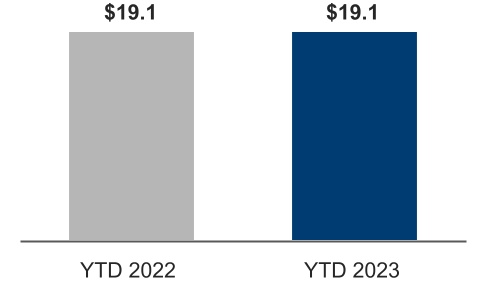

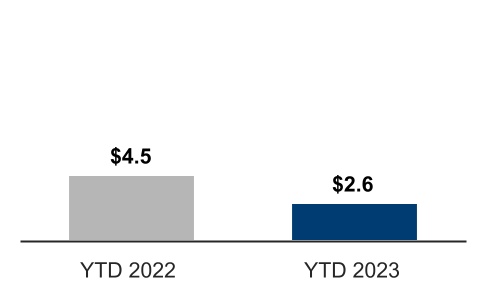

| $14.2B | | 42.5% | | 45.8% | | $0.07 | | $0.41 | | $6.8B | | $(10.5)B |

| GAAP | | GAAP | | non-GAAP1 | | GAAP | | non-GAAP1 | | GAAP | | non-GAAP1 |

| Revenue down $1.2B or 8% from Q3 2022 | | Gross margin down 0.1 ppt from Q3 2022 | | Gross margin down 0.1 ppt from Q3 2022 | | Diluted EPS attributable to Intel down $0.18 or 72% from Q3 2022 | | Diluted EPS attributable to Intel up $0.04 or 11% from Q3 2022 | | Operating cash flow down $0.9B or 12% from Q3 2022 | | Adjusted free cash flow down $3.4B or 48% from Q3 2022 |

| | | | | | | | | | | | |

Lower revenue in CCG, DCAI, and NEX. | | Lower GAAP gross margin from lower revenue, higher unit cost, partially offset by a decrease in period charges. | | Lower GAAP EPS attributable to Intel primarily from a lower tax benefit, partially offset by reduced operating expenses. | | Lower operating cash flow driven primarily by a net operating loss, partially offset by favorable changes in working capital and other adjustments. |

Key Developments

▪Our Ireland fab began high-volume production of Intel 4 technology. This is the first use of extreme ultraviolet (EUV) technology in high-volume manufacturing in Europe.

▪We announced our upcoming Intel® Core™ Ultra processors, featuring our first integrated neural processing unit, for power-efficient AI acceleration and local inference on the PC, which is expected to launch in Q4 2023.

▪We mutually agreed with Tower to terminate the agreement we entered into during the first quarter of 2022 to acquire Tower, due to our inability to obtain regulatory approval in a timely manner.

▪We announced a commercial agreement with Tower, where we will provide foundry services and manufacturing capacity through our New Mexico facility for 300mm advanced analog processing.

▪We received a $600 million grant from the State of Ohio to support the ongoing construction of our two chip factories in the state.

1 See "Non-GAAP Financial Measures" within MD&A.

| | | | | |

Consolidated Condensed Statements of Income | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

(In Millions, Except Per Share Amounts; Unaudited) | | Sep 30, 2023 | | Oct 1, 2022 | | Sep 30, 2023 | | Oct 1, 2022 |

| Net revenue | | $ | 14,158 | | | $ | 15,338 | | | $ | 38,822 | | | $ | 49,012 | |

| Cost of sales | | 8,140 | | | 8,803 | | | 24,158 | | | 27,646 | |

| Gross margin | | 6,018 | | | 6,535 | | | 14,664 | | | 21,366 | |

| Research and development | | 3,870 | | | 4,302 | | | 12,059 | | | 13,064 | |

| Marketing, general, and administrative | | 1,340 | | | 1,744 | | | 4,017 | | | 5,296 | |

| Restructuring and other charges | | 816 | | | 664 | | | 1,080 | | | (460) | |

| Operating expenses | | 6,026 | | | 6,710 | | | 17,156 | | | 17,900 | |

| Operating income (loss) | | (8) | | | (175) | | | (2,492) | | | 3,466 | |

| Gains (losses) on equity investments, net | | (191) | | | (151) | | | (46) | | | 4,082 | |

| Interest and other, net | | 147 | | | 138 | | | 512 | | | 1,016 | |

| Income (loss) before taxes | | (52) | | | (188) | | | (2,026) | | | 8,564 | |

| Provision for (benefit from) taxes | | (362) | | | (1,207) | | | (1,041) | | | (114) | |

| Net income (loss) | | 310 | | | 1,019 | | | (985) | | | 8,678 | |

| Less: Net income (loss) attributable to non-controlling interests | | 13 | | | — | | | (5) | | | — | |

| Net income (loss) attributable to Intel | | $ | 297 | | | $ | 1,019 | | | $ | (980) | | | $ | 8,678 | |

| Earnings (loss) per share attributable to Intel—basic | | $ | 0.07 | | | $ | 0.25 | | | $ | (0.23) | | | $ | 2.11 | |

| Earnings (loss) per share attributable to Intel—diluted | | $ | 0.07 | | | $ | 0.25 | | | $ | (0.23) | | | $ | 2.10 | |

| | | | | | | | |

| Weighted average shares of common stock outstanding: | | | | | | | | |

| Basic | | 4,202 | | | 4,118 | | | 4,180 | | | 4,104 | |

| Diluted | | 4,229 | | | 4,125 | | | 4,180 | | | 4,123 | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Income | 4 |

| | | | | |

Consolidated Condensed Statements of Comprehensive Income | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In Millions; Unaudited) | | Sep 30, 2023 | | Oct 1, 2022 | | Sep 30, 2023 | | Oct 1, 2022 |

| Net income (loss) | | $ | 310 | | | $ | 1,019 | | | $ | (985) | | | $ | 8,678 | |

| Changes in other comprehensive income (loss), net of tax: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net unrealized holding gains (losses) on derivatives | | (320) | | | (436) | | | (310) | | | (1,178) | |

| Actuarial valuation and other pension benefits (expenses), net | | 2 | | | 10 | | | 5 | | | 37 | |

| Translation adjustments and other | | 1 | | | — | | | 6 | | | (30) | |

| Other comprehensive income (loss) | | (317) | | | (426) | | | (299) | | | (1,171) | |

| Total comprehensive income (loss) | | (7) | | | 593 | | | (1,284) | | | 7,507 | |

| Less: comprehensive income (loss) attributable to non-controlling interests | | 13 | | | — | | | (5) | | | — | |

| Total comprehensive income (loss) attributable to Intel | | $ | (20) | | | $ | 593 | | | $ | (1,279) | | | $ | 7,507 | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Comprehensive Income | 5 |

| | | | | |

Consolidated Condensed Balance Sheets | |

| |

| | | | | | | | | | | | | | |

(In Millions; Unaudited) | | Sep 30, 2023 | | Dec 31, 2022 |

| | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 7,621 | | | $ | 11,144 | |

| Short-term investments | | 17,409 | | | 17,194 | |

| | | | |

| Accounts receivable, net | | 2,843 | | | 4,133 | |

| Inventories | | 11,466 | | | 13,224 | |

| | | | |

| Other current assets | | 4,472 | | | 4,712 | |

| Total current assets | | 43,811 | | | 50,407 | |

| | | | |

| Property, plant, and equipment, net of accumulated depreciation of $97,122 ($93,386 as of December 31, 2022) | | 93,352 | | | 80,860 | |

| Equity investments | | 5,700 | | | 5,912 | |

| | | | |

| Goodwill | | 27,591 | | | 27,591 | |

| Identified intangible assets, net | | 4,970 | | | 6,018 | |

| Other long-term assets | | 13,413 | | | 11,315 | |

| Total assets | | $ | 188,837 | | | $ | 182,103 | |

| | | | |

| Liabilities and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Short-term debt | | $ | 2,288 | | | $ | 4,367 | |

| Accounts payable | | 8,669 | | | 9,595 | |

| Accrued compensation and benefits | | 3,115 | | | 4,084 | |

| | | | |

| | | | |

| Income taxes payable | | 2,112 | | | 2,251 | |

| Other accrued liabilities | | 12,430 | | | 11,858 | |

| Total current liabilities | | 28,614 | | | 32,155 | |

| | | | |

| Debt | | 46,591 | | | 37,684 | |

| | | | |

| | | | |

| | | | |

| Other long-term liabilities | | 7,946 | | | 8,978 | |

| Contingencies (Note 13) | | | | |

| | | | |

| Stockholders’ equity: | | | | |

| | | | |

| Common stock and capital in excess of par value, 4,216 issued and outstanding (4,137 issued and outstanding as of December 31, 2022) | | 35,653 | | | 31,580 | |

| Accumulated other comprehensive income (loss) | | (861) | | | (562) | |

| Retained earnings | | 67,021 | | | 70,405 | |

| Total Intel stockholders' equity | | 101,813 | | | 101,423 | |

| Non-controlling interests | | 3,873 | | | 1,863 | |

| Total stockholders' equity | | 105,686 | | | 103,286 | |

| Total liabilities and stockholders’ equity | | $ | 188,837 | | | $ | 182,103 | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Balance Sheets | 6 |

| | | | | |

Consolidated Condensed Statements of Cash Flows | |

| |

| | | | | | | | | | | | | | |

| | Nine Months Ended |

(In Millions; Unaudited) | | Sep 30, 2023 | | Oct 1, 2022 |

| | | | |

| Cash and cash equivalents, beginning of period | | $ | 11,144 | | | $ | 4,827 | |

| Cash flows provided by (used for) operating activities: | | | | |

| Net income (loss) | | (985) | | | 8,678 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Depreciation | | 5,753 | | | 8,309 | |

| Share-based compensation | | 2,433 | | | 2,392 | |

| | | | |

| Restructuring and other charges | | 718 | | | 665 | |

| Amortization of intangibles | | 1,336 | | | 1,439 | |

| (Gains) losses on equity investments, net | | 47 | | | (4,075) | |

| (Gains) losses on divestitures | | — | | | (1,072) | |

| | | | |

| | | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | 1,290 | | | 1,991 | |

| Inventories | | 1,758 | | | (2,043) | |

| Accounts payable | | (1,082) | | | (485) | |

| Accrued compensation and benefits | | (1,171) | | | (1,912) | |

| | | | |

| Income taxes | | (2,676) | | | (4,062) | |

| Other assets and liabilities | | (574) | | | (2,095) | |

| Total adjustments | | 7,832 | | | (948) | |

| Net cash provided by (used for) operating activities | | 6,847 | | | 7,730 | |

| Cash flows provided by (used for) investing activities: | | | | |

| Additions to property, plant, and equipment | | (19,054) | | | (19,145) | |

| | | | |

| | | | |

| | | | |

| Purchases of short-term investments | | (37,287) | | | (31,669) | |

| Maturities and sales of short-term investments | | 36,725 | | | 35,129 | |

| | | | |

| | | | |

| | | | |

| Sales of equity investments | | 375 | | | 4,880 | |

| | | | |

| | | | |

| | | | |

| Proceeds from divestitures | | — | | | 6,579 | |

| Other investing | | 518 | | | (2,764) | |

| Net cash used for investing activities | | (18,723) | | | (6,990) | |

| Cash flows provided by (used for) financing activities: | | | | |

| Repayment of commercial paper | | (3,944) | | | — | |

| | | | |

| | | | |

| Payments on finance leases | | (96) | | | (341) | |

| Partner contributions | | 1,106 | | | — | |

| Proceeds from sales of subsidiary shares | | 2,423 | | | — | |

| Issuance of long-term debt, net of issuance costs | | 11,391 | | | 6,103 | |

| Repayment of debt | | (423) | | | (3,088) | |

| | | | |

| | | | |

| | | | |

| | | | |

| Payment of dividends to stockholders | | (2,561) | | | (4,488) | |

| | | | |

| | | | |

| | | | |

| Other financing | | 457 | | | 776 | |

| Net cash provided by (used for) financing activities | | 8,353 | | | (1,038) | |

| | | | |

| Net increase (decrease) in cash and cash equivalents | | (3,523) | | | (298) | |

| Cash and cash equivalents, end of period | | $ | 7,621 | | | $ | 4,529 | |

| | | | |

| Supplemental disclosures: | | | | |

| Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | | $ | 5,234 | | | $ | 3,386 | |

| | | | |

| | | | |

| Cash paid during the period for: | | | | |

| Interest, net of capitalized interest | | $ | 968 | | | $ | 315 | |

| Income taxes, net of refunds | | $ | 1,649 | | | $ | 3,960 | |

| | | | |

| | | | |

| | | | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Cash Flows | 7 |

| | | | | |

Consolidated Condensed Statements of Stockholders' Equity | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions, Except Per Share Amounts; Unaudited) | | Common Stock and Capital in Excess of Par Value | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Non-Controlling Interests | | Total |

| Shares | | Amount | | | | |

| Three Months Ended | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Balance as of July 1, 2023 | | 4,188 | | | $ | 34,330 | | | $ | (544) | | | $ | 67,231 | | | $ | 3,454 | | | $ | 104,471 | |

| | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | 297 | | | 13 | | | 310 | |

| Other comprehensive income (loss) | | — | | | — | | | (317) | | | — | | | — | | | (317) | |

| Net proceeds from sales of subsidiary shares and partner contributions | | — | | | 388 | | | — | | | — | | | 371 | | | 759 | |

| Employee equity incentive plans and other | | 33 | | | 372 | | | — | | | — | | | — | | | 372 | |

| Share-based compensation | | — | | | 737 | | | — | | | — | | | 35 | | | 772 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Restricted stock unit withholdings | | (5) | | | (174) | | | — | | | 18 | | | — | | | (156) | |

| Cash dividends declared ($0.13 per share) | | — | | | — | | | — | | | (525) | | | — | | | (525) | |

| Balance as of September 30, 2023 | | 4,216 | | | $ | 35,653 | | | $ | (861) | | | $ | 67,021 | | | $ | 3,873 | | | $ | 105,686 | |

| | | | | | | | | | | | |

| Balance as of July 2, 2022 | | 4,106 | | | $ | 29,858 | | | $ | (1,625) | | | $ | 72,985 | | | $ | — | | | $ | 101,218 | |

| | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | 1,019 | | | — | | | 1,019 | |

| Other comprehensive income (loss) | | — | | | — | | | (426) | | | — | | | — | | | (426) | |

| | | | | | | | | | | | |

| Employee equity incentive plans and other | | 24 | | | 399 | | | — | | | — | | | — | | | 399 | |

| Share-based compensation | | — | | | 793 | | | — | | | — | | | — | | | 793 | |

| Restricted stock unit withholdings | | (3) | | | (138) | | | — | | | 32 | | | — | | | (106) | |

| Cash dividends declared ($0.73 per share) | | — | | | — | | | — | | | (3,012) | | | — | | | (3,012) | |

| Balance as of October 1, 2022 | | 4,127 | | | $ | 30,912 | | | $ | (2,051) | | | $ | 71,024 | | | $ | — | | | $ | 99,885 | |

| | | | | | | | | | | | |

| Nine Months Ended | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Balance as of December 31, 2022 | | 4,137 | | | $ | 31,580 | | | $ | (562) | | | $ | 70,405 | | | $ | 1,863 | | | $ | 103,286 | |

| | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | (980) | | | (5) | | | (985) | |

| Other comprehensive income (loss) | | — | | | — | | | (299) | | | — | | | — | | | (299) | |

| Net proceeds from sales of subsidiary shares and partner contributions | | — | | | 1,254 | | | — | | | — | | | 1,912 | | | 3,166 | |

| Employee equity incentive plans and other | | 91 | | | 1,037 | | | — | | | — | | | — | | | 1,037 | |

| Share-based compensation | | — | | | 2,330 | | | — | | | — | | | 103 | | | 2,433 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Restricted stock unit withholdings | | (12) | | | (548) | | | — | | | 157 | | | — | | | (391) | |

| Cash dividends declared ($0.62 per share) | | — | | | — | | | — | | | (2,561) | | | — | | | (2,561) | |

| Balance as of September 30, 2023 | | 4,216 | | | $ | 35,653 | | | $ | (861) | | | $ | 67,021 | | | $ | 3,873 | | | $ | 105,686 | |

| | | | | | | | | | | | |

| Balance as of December 25, 2021 | | 4,070 | | | $ | 28,006 | | | $ | (880) | | | $ | 68,265 | | | $ | — | | | $ | 95,391 | |

| | | | | | | | | | | | |

| Net income (loss) | | — | | | — | | | — | | | 8,678 | | | — | | | 8,678 | |

| Other comprehensive income (loss) | | — | | | — | | | (1,171) | | | — | | | — | | | (1,171) | |

| Employee equity incentive plans and other | | 66 | | | 1,000 | | | — | | | — | | | — | | | 1,000 | |

| Share-based compensation | | — | | | 2,392 | | | — | | | — | | | — | | | 2,392 | |

| Restricted stock unit withholdings | | (9) | | | (486) | | | — | | | 79 | | | — | | | (407) | |

| Cash dividends declared ($1.46 per share) | | — | | | — | | | — | | | (5,998) | | | — | | | (5,998) | |

| Balance as of October 1, 2022 | | 4,127 | | | $ | 30,912 | | | $ | (2,051) | | | $ | 71,024 | | | $ | — | | | $ | 99,885 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Stockholders' Equity | 8 |

| | | | | |

Notes to Consolidated Condensed Financial Statements | |

| |

| | | | | |

| Note 1 : | Basis of Presentation |

We prepared our interim Consolidated Condensed Financial Statements that accompany these notes in conformity with US GAAP, consistent in all material respects with those applied in our 2022 Form 10-K.

We have a 52- or 53-week fiscal year that ends on the last Saturday in December. Fiscal year 2023 is a 52-week fiscal year; fiscal 2022 was a 53-week fiscal year, with the extra week included in the first quarter of 2022.

We have made estimates and judgments affecting the amounts reported in our Consolidated Condensed Financial Statements and the accompanying notes. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, and reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This report should be read in conjunction with the Consolidated Financial Statements in our 2022 Form 10-K where we include additional information on our critical accounting estimates, policies, and the methods and assumptions used in our estimates.

| | | | | |

| Note 2 : | Operating Segments |

We previously announced the organizational change to integrate AXG into CCG and DCAI. This change is intended to drive a more effective go-to-market capability and to accelerate the scale of these businesses, while also reducing costs. As a result, we modified our segment reporting in the first quarter of 2023 to align to this and certain other business reorganizations. All prior-period segment data has been retrospectively adjusted to reflect the way our CODM internally receives information and manages and monitors our operating segment performance starting in fiscal year 2023.

We manage our business through the following operating segments:

▪Client Computing (CCG)

▪Data Center and AI (DCAI)

▪Network and Edge (NEX)

▪Mobileye

▪Intel Foundry Services (IFS)

We derive a substantial majority of our revenue from our principal products that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone SoC, or a multichip package, which is based on Intel® architecture.

CCG, DCAI and NEX are our reportable operating segments. Mobileye and IFS do not qualify as reportable operating segments; however, we have elected to disclose the results of these non-reportable operating segments. When we enter into federal contracts, they are aligned to the sponsoring operating segment.

We have sales and marketing, manufacturing, engineering, finance, and administration groups. Expenses for these groups are generally allocated to the operating segments.

We have an "all other" category that includes revenue, expenses, and charges such as:

▪results of operations from non-reportable segments not otherwise presented, and from start-up businesses that support our initiatives;

▪historical results of operations from divested businesses;

▪amounts included within restructuring and other charges;

▪employee benefits, compensation, impairment charges, and other expenses not allocated to the operating segments; and

▪acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill.

The CODM, who is our CEO, allocates resources to and assesses the performance of each operating segment using information about the operating segment's revenue and operating income (loss). The CODM does not evaluate operating segments using discrete asset information, and we do not identify or allocate assets by operating segments. Based on the interchangeable nature of our manufacturing and assembly and test assets, most of the related depreciation expense is not directly identifiable within our operating segments, as it is included in overhead cost pools and subsequently absorbed into inventory as each product passes through our manufacturing process. Because our products are then sold across multiple operating segments, it is impracticable to determine the total depreciation expense included as a component of each operating segment's operating income (loss) results. We do not allocate gains and losses from equity investments, interest and other income, share-based compensation, or taxes to our operating segments. Although the CODM uses operating income (loss) to evaluate the segments, operating costs included in one segment may benefit other segments. The accounting policies for segment reporting are the same as for Intel as a whole. There have been no changes to our segment accounting policies disclosed in our 2022 Form 10-K except for the organizational change described above.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 9 |

Net revenue and operating income (loss) for each period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

(In Millions) | | Sep 30, 2023 | | Oct 1, 2022 | | Sep 30, 2023 | | Oct 1, 2022 |

| Net revenue: | | | | | | | | |

| Client Computing | | | | | | | | |

| Desktop | | $ | 2,753 | | | $ | 3,222 | | | $ | 7,002 | | | $ | 8,152 | |

| Notebook | | 4,503 | | | 4,408 | | | 11,806 | | | 15,118 | |

| Other | | 611 | | | 498 | | | 1,606 | | | 1,858 | |

| | 7,867 | | | 8,128 | | | 20,414 | | | 25,128 | |

| | | | | | | | |

| Data Center and AI | | 3,814 | | | 4,255 | | | 11,536 | | | 15,024 | |

| Network and Edge | | 1,450 | | | 2,133 | | | 4,303 | | | 6,483 | |

| Mobileye | | 530 | | | 450 | | | 1,442 | | | 1,304 | |

| Intel Foundry Services | | 311 | | | 78 | | | 661 | | | 291 | |

| All other | | 186 | | | 294 | | | 466 | | | 782 | |

| Total net revenue | | $ | 14,158 | | | $ | 15,338 | | | $ | 38,822 | | | $ | 49,012 | |

| | | | | | | | |

| Operating income (loss): | | | | | | | | |

| Client Computing | | $ | 2,073 | | | $ | 1,447 | | | $ | 3,632 | | | $ | 5,045 | |

| Data Center and AI | | 71 | | | (139) | | | (608) | | | 1,174 | |

| Network and Edge | | 17 | | | 197 | | | (470) | | | 907 | |

| Mobileye | | 170 | | | 142 | | | 422 | | | 480 | |

| Intel Foundry Services | | (86) | | | (90) | | | (369) | | | (247) | |

| All other | | (2,253) | | | (1,732) | | | (5,099) | | | (3,893) | |

| Total operating income (loss) | | $ | (8) | | | $ | (175) | | | $ | (2,492) | | | $ | 3,466 | |

In the second quarter of 2022, we initiated the wind-down of our Intel® Optane™ memory business, which is part of our DCAI operating segment, resulting in an inventory impairment of $559 million in Cost of sales on the Consolidated Condensed Statements of Income in the first nine months of 2022. The impairment charge was recognized as a Corporate charge in the "all other" category presented above.

| | | | | |

| Note 3 : | Non-Controlling Interests |

Semiconductor Co-Investment Program

In 2022, we closed a transaction with Brookfield Asset Management (Brookfield) resulting in the formation of Arizona Fab LLC (Arizona Fab), a VIE for which we and Brookfield own 51% and 49%, respectively. Because we are the primary beneficiary of the VIE, we fully consolidate the results of Arizona Fab into our consolidated financial statements. Generally, contributions will be made to, and distributions will be received from, Arizona Fab based on both parties' proportional ownership. We will be sole operator and majority owner of two new chip factories that will be constructed by Arizona Fab, and we will have the right to purchase 100% of the related factory output. Once production commences, we will be required to operate Arizona Fab at minimum production levels measured in wafer starts per week and will be required to limit excess inventory held on site or we will be subject to certain penalties.

We have an unrecognized commitment to fund our respective share of the total construction costs of Arizona Fab of $29.0 billion.

As of September 30, 2023, a substantial majority of the assets of Arizona Fab consisted of property, plant, and equipment. The assets held by Arizona Fab, which can be used only to settle obligations of the VIE and are not available to us, were $4.0 billion as of September 30, 2023 ($1.8 billion as of December 31, 2022).

Non-controlling interest in Arizona Fab was $2.0 billion as of September 30, 2023 ($874 million as of December 31, 2022). Net loss attributable to non-controlling interest in Arizona Fab was $3 million in the third quarter of 2023 and $12 million in the first nine months of 2023; there was no net income (loss) attributable to non-controlling interest in the first nine months of 2022.

Mobileye

In 2022, Mobileye completed its IPO and certain other equity financing transactions that resulted in net proceeds of $1.0 billion. During the second quarter of 2023, we converted $38.5 million of Class B shares into Class A shares, representing 5% of Mobileye’s outstanding capital stock, and subsequently sold the Class A shares for $42 per share as part of a secondary offering. We received net proceeds of $1.6 billion and increased our capital in excess of par value by $663 million, net of tax, as a result of the secondary offering. We continue to consolidate the results of Mobileye into our consolidated financial statements.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 10 |

As of September 30, 2023, Intel held approximately 88% (94% as of December 31, 2022) of the outstanding equity interest in Mobileye. Non-controlling interest in Mobileye was $1.8 billion as of September 30, 2023 ($1.0 billion as of December 31, 2022). Net income attributable to non-controlling interest in Mobileye was $6 million in the third quarter of 2023 and $3 million of net loss in the first nine months of 2023; there was no net income (loss) attributable to non-controlling interest in the first nine months of 2022.

IMS Nanofabrication

In August 2023, we closed an agreement to sell a 20% minority stake in our IMS Nanofabrication GmbH (IMS) business, a business within our IFS operating segment, to Bain Capital Special Situations (Bain Capital). Net proceeds resulting from the sale were $849 million and our capital in excess of par value increased by $591 million, net of tax. We continue to consolidate the results of IMS into our consolidated financial statements.

Non-controlling interest in IMS was $109 million as of September 30, 2023. Net income attributable to the non-controlling interest in IMS was $10 million in the third quarter of 2023 and in the first nine months of 2023.

In September 2023, we signed agreements to sell an additional 12.5% minority stake in our IMS business, including 10% to Taiwan Semiconductor Manufacturing Company, Ltd. (TSMC), which are expected to close in the fourth quarter of 2023.

| | | | | |

| Note 4 : | Earnings (Loss) Per Share |

We computed basic earnings (loss) per share of common stock based on the weighted average number of shares of common stock outstanding during the period. We computed diluted earnings (loss) per share of common stock based on the weighted average number of shares of common stock outstanding plus potentially dilutive shares of common stock outstanding during the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| (In Millions, Except Per Share Amounts) | | Sep 30, 2023 | | Oct 1, 2022 | | Sep 30, 2023 | | Oct 1, 2022 |

| Net income (loss) | | $ | 310 | | | $ | 1,019 | | | $ | (985) | | | $ | 8,678 | |

| Less: Net income (loss) attributable to non-controlling interests | | 13 | | | — | | | (5) | | | — | |

| Net income (loss) attributable to Intel | | 297 | | | 1,019 | | | (980) | | | 8,678 | |

| Weighted average shares of common stock outstanding—basic | | 4,202 | | | 4,118 | | | 4,180 | | | 4,104 | |

| Dilutive effect of employee equity incentive plans | | 27 | | | 7 | | | — | | | 19 | |

| | | | | | | | |

| Weighted average shares of common stock outstanding—diluted | | 4,229 | | | 4,125 | | | 4,180 | | | 4,123 | |

Earnings (loss) per share attributable to Intel—basic

| | $ | 0.07 | | | $ | 0.25 | | | $ | (0.23) | | | $ | 2.11 | |

Earnings (loss) per share attributable to Intel—diluted

| | $ | 0.07 | | | $ | 0.25 | | | $ | (0.23) | | | $ | 2.10 | |

Potentially dilutive shares of common stock from employee equity incentive plans are determined by applying the treasury stock method to the assumed exercise of outstanding stock options, the assumed vesting of outstanding RSUs, and the assumed issuance of common stock under the stock purchase plan. Securities that were anti-dilutive were insignificant and were excluded from the computation of diluted earnings per share in all periods presented.

Due to our net loss in the nine months ended September 30, 2023, the assumed exercise of outstanding stock options, the assumed vesting of outstanding RSUs, and the assumed issuance of common stock under the stock purchase plan had an anti-dilutive effect on diluted loss per share for the period and were excluded.

| | | | | |

| Note 5 : | Other Financial Statement Details |

Accounts Receivable

We sell certain of our accounts receivable on a non-recourse basis to third-party financial institutions. We record these transactions as sales of receivables and present cash proceeds as cash provided by operating activities in the Consolidated Condensed Statements of Cash Flows. Accounts receivable sold under non-recourse factoring arrangements were $1.5 billion during the first nine months of 2023. After the sale of our accounts receivable, we expect to collect payment from the customers and remit it to the third-party financial institution.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 11 |

Inventories

| | | | | | | | | | | | | | |

(In Millions) | | Sep 30, 2023 | | Dec 31, 2022 |

Raw materials | | $ | 1,278 | | | $ | 1,517 | |

Work in process | | 6,266 | | | 7,565 | |

Finished goods | | 3,922 | | | 4,142 | |

| Total inventories | | $ | 11,466 | | | $ | 13,224 | |

Property, Plant, and Equipment